Attached files

| file | filename |

|---|---|

| 8-K - CAPSTEAD MORTGAGE CORP 8-K 9-26-2013 - CAPSTEAD MORTGAGE CORP | form8k.htm |

Exhibit 99.1

CAPSTEAD Information as of June 30, 2013 Investor Presentation

Safe Harbor Statement - Private Securities Litigation Reform Act of 1995 Cautionary Statement Concerning Forward-looking Statements This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance or achievements, and may contain the words “believe,” “anticipate,” “expect,” “estimate,” “intend,” “will be,” “will likely continue,” “will likely result,” or words or phrases of similar meaning. Forward-looking statements are based largely on the expectations of management and are subject to a number of risks and uncertainties including, but not limited to, the following: In addition to the above considerations, actual results and liquidity are affected by other risks and uncertainties which could cause actual results to be significantly different from those expressed or implied by any forward-looking statements included herein. It is not possible to identify all of the risks, uncertainties and other factors that may affect future results. In light of these risks and uncertainties, the forward-looking events and circumstances discussed herein may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements. Forward-looking statements speak only as of the date the statement is made and the Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Accordingly, readers of this document are cautioned not to place undue reliance on any forward-looking statements included herein. changes in general economic conditions; fluctuations in interest rates and levels of mortgage prepayments; the effectiveness of risk management strategies; the impact of differing levels of leverage employed; liquidity of secondary markets and credit markets; the availability of financing at reasonable levels and terms to support investing on a leveraged basis; the availability of new investment capital; the availability of suitable qualifying investments from both an investment return and regulatory perspective; changes in legislation or regulation affecting Fannie Mae and Freddie Mac (together, the “GSEs”) and similar federal government agencies and related guarantees; deterioration in credit quality and ratings of existing or future issuances of GSE or Ginnie Mae Securities; changes in legislation or regulation affecting exemptions for mortgage REITs from regulation under the Investment Company Act of 1940; and increases in costs and other general competitive factors. 2

Company Summary Proven Strategy Experienced Management Team Aligned with Stockholders Overview of Capstead Mortgage Corporation Founded in 1985, Capstead is the oldest publicly-traded Agency mortgage REIT. At June 30, 2013, we had a residential ARM securities portfolio of $13.81 billion, supported by long-term investment capital of $1.50 billion levered 8.44 times.* Our five-year compound annual total return of 17.2% exceeded the Russell 2000 Index and the NAREIT Mortgage REIT Index.** We invest exclusively in residential adjustable-rate mortgage (ARM) securities issued and guaranteed by Fannie Mae, Freddie Mac or Ginnie Mae. Agency-guaranteed mortgage securities are considered to have little, if any, credit risk. Our focus on short-duration ARM securities augmented with 2-year interest rate swap agreements differentiates us from our peers because ARM securities reset to more current interest rates within a relatively short period of time. This allows for the recovery of financing spreads diminished during periods of rising interest rates and smaller fluctuations in portfolio values from changes in interest rates compared to fixed-rate mortgage securities. With this strategy, Capstead is recognized as the most defensively-positioned Agency mortgage REIT from an interest rate risk perspective. Our prudently leveraged portfolio provides financial flexibility to manage changing market conditions. Our top four executive officers have over 85 years of combined mortgage finance industry experience, including over 80 years at Capstead. We are self-managed with low operating costs and a focus on performance-based compensation for our executive officers. This structure greatly enhances the alignment of management interests with those of our stockholders. 3 * Long-term investment capital includes stockholders’ equity and unsecured borrowings, net of investments in related unconsolidated affiliates. ** Compound annual growth rate is based on cumulative total returns assuming an investment in Capstead was made June 30, 2008 and dividends were reinvested.

Market Snapshot (dollars in thousands, except per share amounts) 4 On September 12, 2013 declared a $0.31 third quarter dividend; unchanged from the first and second quarters.

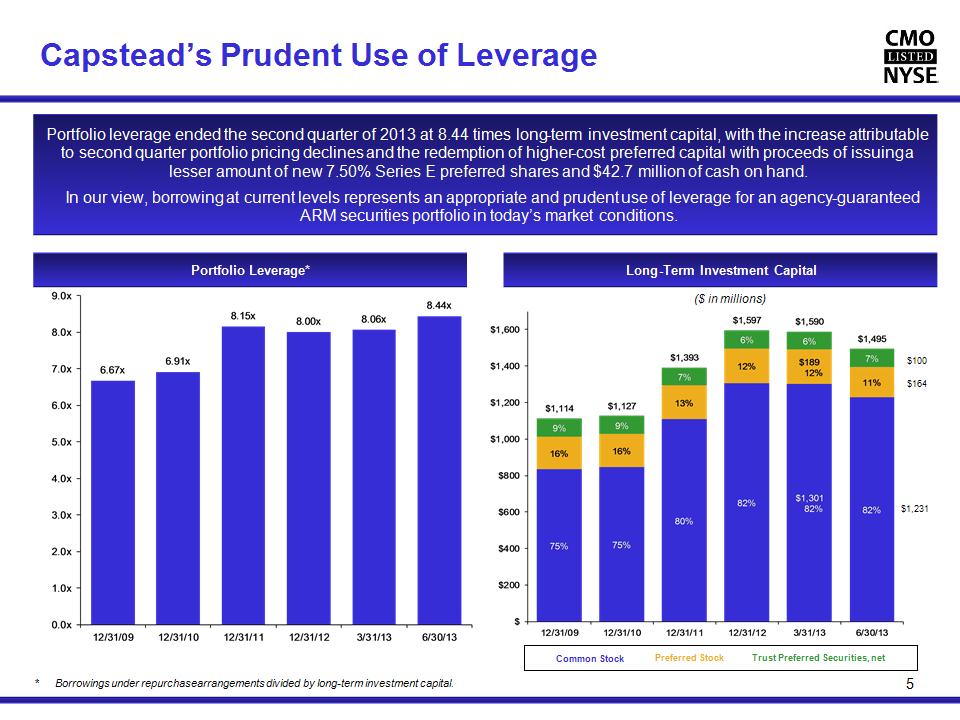

Capstead’s Prudent Use of Leverage 5 ** Borrowings under repurchase arrangements divided by long-term investment capital. ($ in millions) Portfolio Leverage* Long-Term Investment Capital $100 $164 $1,231 Common Stock Preferred Stock Trust Preferred Securities, net Portfolio leverage ended the second quarter of 2013 at 8.44 times long-term investment capital, with the increase attributable to second quarter portfolio pricing declines and the redemption of higher-cost preferred capital with proceeds of issuing a lesser amount of new 7.50% Series E preferred shares and $42.7 million of cash on hand. In our view, borrowing at current levels represents an appropriate and prudent use of leverage for an agency-guaranteed ARM securities portfolio in today’s market conditions.

Capstead’s Proven Short-Duration Investment Strategy 6 As of June 30, 2013 As of June 30, 2013 Low risk agency-guaranteed residential ARM securities financed primarily with 30-90 day “repo” borrowings, augmented with two-year interest rate swap agreements for hedging purposes. Residential ARM Securities Portfolio Repurchase Arrangements & Similar Borrowings Total: $12.62 billion** * Based on fair market value as of the indicated balance sheet date (unaudited). ** Excludes forward-starting interest rate swap positions. Total: $13.80 billion* Most of our securities are backed by well-seasoned mortgage loans with coupon interest rates that reset at least annually or begin doing so after an initial fixed-rate period of five years or less. We have long-term relationships with numerous repo counterparties. As of June 30, 2013, we had borrowings outstanding with 24 counterparties. Second quarter 2013 repo borrowing rates averaged 39 basis points, down from 41 basis points during the first quarter of 2013 (a blended rate of 0.53% after considering currently-paying interest rate swaps). During the second quarter we increased our portfolio financing-related swap positions by a net $400 million notional amount to $6.70 billion, and in the process lengthened average maturities by two months to 20 months. We accomplished this through the addition of $1.10 billion notional amount of forward-starting swaps with average fixed rates of 0.46% and average maturities of 31 months which improved our ability to manage further increases in market interest rates at a reasonable cost. The duration of our investment portfolio and related borrowings (adjusted for swap positions) was approximately 11½ months and 10½ months, respectively, at June 30, 2013. This resulted in a net duration gap of approximately one month. Duration is a measure of market price sensitivity to interest rate movements. Longer-to-Reset ARMs $5.98 Billion Current-Reset ARMs $7.82 Billion Borrowings with rates effectively fixed by Currently-Paying Interest Rate Swaps $3.70 Billion Remaining Borrowings $8.92 Billion Forward-starting Interest Rate Swap Positions $3.00 Billion 24%

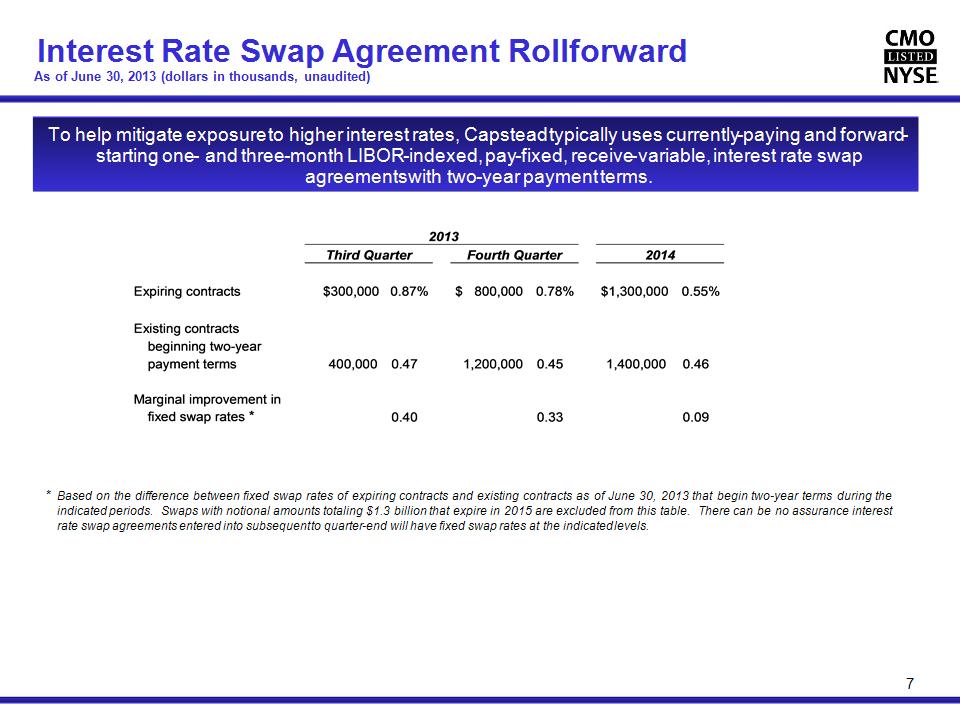

Interest Rate Swap Agreement Rollforward As of June 30, 2013 (dollars in thousands, unaudited) 7 To help mitigate exposure to higher interest rates, Capstead typically uses currently-paying and forward-starting one- and three-month LIBOR-indexed, pay-fixed, receive-variable, interest rate swap agreements with two-year payment terms. * Based on the difference between fixed swap rates of expiring contracts and existing contracts as of June 30, 2013 that begin two-year terms during the indicated periods. Swaps with notional amounts totaling $1.3 billion that expire in 2015 are excluded from this table. There can be no assurance interest rate swap agreements entered into subsequent to quarter-end will have fixed swap rates at the indicated levels.

Financing Spread Analysis As of June 30, 2013 (unaudited) 8

ARM versus Fixed-Rate Prepayment Speeds 9 Overall prepayment speeds for agency-guaranteed mortgage securities have declined during the 3rd quarter, largely due to sharp increases in mortgage interest rates. However, as can be seen in the graph below, speeds for agency-guaranteed ARM securities increased during the 2nd quarter and have since lagged declines for 30-year fixed-rate securities. As a result, average ARM speeds were little changed quarter-over-quarter. While our prepay experience will differ from published agency ARM speeds due to portfolio composition including seasoning, it is reasonable to conclude that our 3rd quarter results have not benefited from declining speeds. What is very positive for our future quarterly results is that September ARM speeds were back at levels last experienced in March and appear to be trending lower, in line with declines already experienced with 30-year fixed-rate speeds. Published Agency MBS Prepayment Speeds (in CPR) Avg. 1st Qtr ARM CPR: 23.1% Avg. 2nd Qtr ARM CPR: 26.0% Avg. 3rd Qtr ARM CPR: 25.8%

* Net WAC, or weighted average coupon, is the weighted average interest rate of the mortgage loans underlying the indicated investments, net of servicing and other fees, as of June 30, 2013. Net WAC is expressed as a percentage calculated on an annualized basis on the unpaid principal balance of the mortgage loans underlying these investments. Fully indexed WAC represents the weighted average coupon upon one or more resets using interest rate indexes and net margins in effect as of June 30, 2013. Gross WAC is the weighted average interest rate of the mortgage loans underlying the indicated investments, including servicing and other fees paid by borrowers, as of June 30, 2013. NOTE: Excludes $8 million of fixed-rate investments. Key Elements of Capstead’s ARM Portfolio As of June 30, 2013 (dollars in thousands, unaudited) 10

Capstead’s Stockholder Friendly Structure 11 * Expressed as a percentage of average long-term investment capital (LTIC). ** Incentive compensation is currently based on a 10% participation in returns on LTIC in excess of benchmark returns (greater of 10% or the average 10-year Treasury rate plus 2.0%), capped at 50 basis points of LTIC and subject to Compensation Committee discretion. Self-managed with low operating costs. Our board of directors requires management to hold a significant amount of CMO stock based on a multiple of each executive’s base salary. As of February 25, 2013 our directors and executive officers beneficially owned 1.8% of our common shares. Pay structure is variable through compensation elements that focus on “pay for performance.” Management is incented to grow the Company by raising capital when it is accretive to book value and earnings rather than for the purpose of increasing compensation or external management fees. Bottom line: our management prospers when our stockholders prosper.

CAPSTEAD Appendix CAPSTEAD 12

Capstead’s Second Quarter 2013 Highlights Completed offering of $170 million face amount of 7.50% Series E perpetual preferred shares using proceeds and cash on hand to redeem higher-cost perpetual preferred shares Generated core earnings of $0.27 per diluted common share (excluding certain one-time effects of the preferred capital transactions) Book value ended the second quarter at $12.80 per common share, lower by 2.1% due to the preferred capital transactions, and 3.8% due to portfolio pricing changes net of hedges as well as other operational factors Realized financing spreads on residential mortgage investments of 1.00% and incurred operating costs as a percentage of average long-term investment capital of 0.68% Fully replaced portfolio runoff and did not sell any assets while maintaining $13.8 billion agency-guaranteed adjustable-rate mortgage (“ARM”) portfolio with leverage ending the second quarter at 8.44 times long-term investment capital Comments from our July 24, 2013 earnings press release: “We are very pleased to have completed the preferred capital transactions this quarter which eliminated substantially higher-cost preferred capital in favor of a smaller amount of new lower-cost perpetual preferred capital that can be redeemed any time after five years from issuance. The 2.1%, or $0.28, decrease in book value per common share resulting from these transactions will be fully recovered in approximately three years through reduced preferred dividend requirements of nearly $0.09 per diluted common share on an annualized basis. “The second quarter was also notable for an abrupt shift in the market to significantly higher long-term interest rates in large part due to concerns regarding the timing of the Federal Reserve reducing and ultimately ending its bond buying program. While we are not immune to this volatility, pricing for our portfolio of short-duration and well-seasoned ARM securities has held up reasonably well compared to pricing for longer duration ARM or fixed-rate mortgage securities. Consequently, we experienced a relatively modest book value decline through quarter-end of 3.8%, or $0.52 per common share, related to our portfolio net of interest rate hedges and other operational factors. “By replacing portfolio runoff and not selling any assets this quarter, we maintained the size of our portfolio at $13.81 billion. In doing so we increased our portfolio leverage to 8.44 to one, which we believe represents an appropriate and prudent use of leverage considering the characteristics of our portfolio. We did experience higher quarter over quarter mortgage prepayment levels resulting in an additional $5.3 million in investment premium amortization due largely to low mortgage interest rates available to homeowners during much of the quarter. But with the recent transition to substantially higher prevailing mortgage interest rates, we anticipate mortgage prepayment rates will decline considerably beginning in August, lessening investment premium amortization levels to the benefit of future earnings. “We continue to see modest declines in market rates for our borrowings under repurchase arrangements, which averaged 39 basis points during the second quarter before considering swap positions, and ended the quarter averaging 37 basis points. This compares to average rates of 41 basis points during the first quarter and 45 basis points during the fourth quarter of 2012. We also anticipate continued improvement in overall borrowing rates during the third and fourth quarters as higher-rate swaps continue to mature and are replaced with forward-starting swaps entered into prior to quarter-end with significantly lower rates. During the second quarter we increased our portfolio financing-related swap positions by a net $400 million notional amount to $6.70 billion, and in the process lengthened average maturities by two months to 20 months. We accomplished this through the addition of $1.10 billion notional amount of forward-starting swaps with average fixed rates of 0.46% and average maturities of 31 months which improved our ability to manage further increases in market interest rates at a reasonable cost . “In summary, the preferred capital transactions we executed during the second quarter significantly reduced the cost of our preferred capital to the benefit of future earnings and the relative performance of our investment portfolio against a backdrop of sharply higher long-term interest rates also bodes well for future results. We remain confident in our investment strategy of managing a conservatively leveraged portfolio of agency-guaranteed residential ARM securities that can produce attractive risk-adjusted returns over the long term while reducing, but not eliminating, sensitivity to changes in interest rates. With this strategy, Capstead is widely recognized as the most defensively-positioned residential mortgage REIT from an interest rate and credit risk perspective.” 13

Capstead’s Quarterly Income Statements (dollars in thousands, except per share amounts, unaudited) 14 * With the issuance of our new 7.50% Series E preferred shares, and subsequent redemption of our existing preferred shares, cash dividends paid on preferred shares will be reduced to a quarterly run-rate of $3.2 million for an annualized reduction in perpetual preferred dividends of $8.3 million, or nearly $0.09 per common share. Second quarter 2013 net income available to common stockholders reflects a short-term preferred capital “overhang” associated with the timing difference between the May 13, 2013 issuance of our Series E preferred shares and the June 13, 2013 redemption of our existing preferred shares. Second quarter net income available to common stockholders also reflects a one-time charge of $19.9 million associated with the payment of Series A and B redemption preference premiums. Core earnings per common share, a non-GAAP financial measure, excludes the effects of the capital overhang and the redemption preference premiums paid.

Capstead’s Comparative Balance Sheets (dollars in thousands, except per share amounts, unaudited) 15

Capstead’s Annual Income Statements – Five Years Ended 2012 (dollars in thousands, except per share amounts, unaudited) 16

Experienced Management Team 17 Over 85 years of combined mortgage finance industry experience, including over 80 years at Capstead. Andrew F. Jacobs – President and Chief Executive Officer, Director Has served as president and chief executive officer since 2003 and has held various executive positions at Capstead since 1988 Certified Public Accountant (“CPA”), member of the Executive Board of the National Association of Real Estate Investment Trusts (“NAREIT”), chairman of NAREIT’s Council of Mortgage REITs, member of the Executive Committee of the Chancellors Council of the University of Texas System, the Executive Council of the Real Estate Finance and Investment Center at the University of Texas at Austin, the American Institute of Certified Public Accountants (“AICPA”), and the Financial Executives International (“FEI”) Phillip A. Reinsch – Executive Vice President and Chief Financial Officer, Secretary Has held various financial accounting and reporting positions at Capstead since 1993 Formerly employed by Ernst & Young LLP as an audit senior manager focusing on mortgage banking and asset securitization CPA, Member AICPA, FEI Robert A. Spears – Executive Vice President, Director of Residential Mortgage Investments Has served in asset and liability management positions at Capstead since 1994 Formerly Vice President of secondary marketing with NationsBanc Mortgage Corporation Michael W. Brown – Senior Vice President, Asset and Liability Management, Treasurer Has served in asset and liability management positions at Capstead since 1994 MBA, Southern Methodist University, Dallas, Texas