Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HERITAGE FINANCIAL CORP /WA/ | d500587d8k.htm |

| EX-2.1 - EX-2.1 - HERITAGE FINANCIAL CORP /WA/ | d500587dex21.htm |

| EX-99.1 - EX-99.1 - HERITAGE FINANCIAL CORP /WA/ | d500587dex991.htm |

Acquisition of

Valley Community Bancshares, Inc.

March 12, 2013

INVESTOR PRESENTATION

Heritage Financial Corporation |

Forward-Looking Statements

Forward-Looking Statements

This presentation includes forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995, which can

be

identified

by

words

such

as

“may,”

“expected,”

“anticipate,”

“continue,”

or

other

comparable

words.

In

addition,

all

statements

other than statements of historical facts that address activities that Heritage

Financial Corporation (“HFWA”) expects or anticipates will or

may occur in the future are forward-looking statements. Readers are

encouraged to read the Securities and Exchange Commission (“SEC”)

reports of HFWA, particularly its Form 10-K for the fiscal year ended

December 31, 2012, for meaningful cautionary language discussing why

actual results may vary materially from those anticipated by management.

Specific risks in this presentation include whether Valley

Community

Bancshares,

Inc.

(“Valley”)

shareholders

approve

the

merger,

whether

the

companies

receive

regulatory

approval

for

the

merger, whether the conditions to closing are satisfied, the timing of the

closing and management’s ability to effectively integrate the

companies, whether the companies have accurately predicted acquisition and

consolidation expenses, the timing and amount of savings from

consolidation, and the expected earnings contributions of both companies.

HFWA will file a registration statement and other relevant documents concerning

the transaction with the SEC and appropriate state and federal banking

authorities as soon as practical. HFWA and Valley will prepare a proxy statement/prospectus and other relevant

documents concerning the proposed transaction for the Valley shareholders.

Investors are urged to read such proxy statement/prospectus and

registration statements regarding the proposed transaction as they become available and any other relevant documents filed with the

SEC,

as

well

as

any

amendments

or

supplements

to

those

documents

because

they

will

contain

important

information.

You

will

be

able

to

obtain a free copy of the registration statement, as well as other filings

including the proxy statement/prospectus at the SEC’s internet site

(http://sec.gov). The documents can also be obtained, without charge, by

directing a written request to either Heritage Financial

Corporation,

P.O.

Box

1578,

Olympia,

WA,

98501,

Attention:

Brian

Vance,

or

Valley

Community

Bancshares,

Inc.,

1307

East

Main,

Puyallup WA 98372, Attention: David Brown. HFWA and Valley and their respective

directors and executive officers may be deemed to be participants in the

solicitation of proxies from the Valley shareholders in connection with the merger. Information about the directors and

executive officers of Valley and the interests of these participants may be

obtained by reading the proxy statement/prospectus regarding the

proposed transaction when it becomes available. 2

|

•

Effective use of capital

•

In line with 2013 strategic objective to seek acquisitions within the current

footprint •

Further

enhances

the

franchise

branch

network

in

the

Puget

Sound

Region

–

Complements recent Northwest Commercial Bank acquisition

–

Notable increase in Pierce and King County deposit market share

•

Attractive loan and deposit portfolio mix

–

87% commercial real estate and commercial & industrial loans

–

77% in non-maturity deposits

•

Valley Bank has a consistent and proven track record

–

Asset quality metrics among the strongest in the Pacific Northwest

–

Sustained and strong earnings

•

Financially attractive deal pricing and structure with conservative modeling

assumptions –

Accretive to earnings in first full year following close

–

Significant cost savings to be realized

•

This

transaction

marks

HFWA’s

4

th

acquisition

in

the

past

3

years

Source: Company documents & SNL Financial

3

Transaction Highlights |

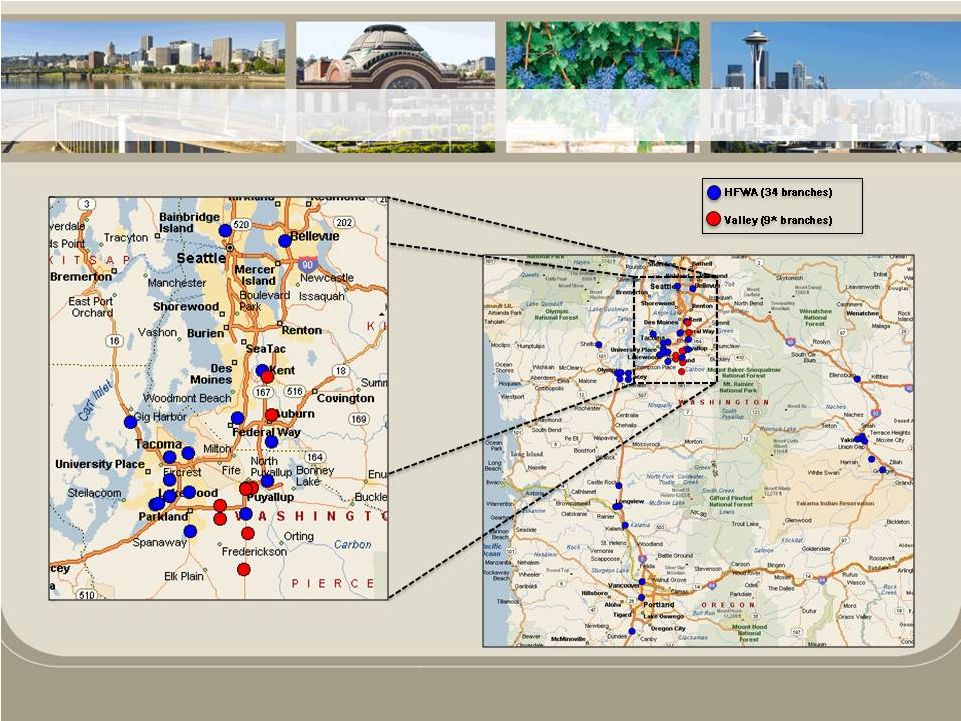

*1 location is a drive-up facility only

Source: Company documents, SNL Financial & Microsoft MapPoint.

4

Expanding Pacific Northwest Franchise |

Transaction Value:

Approximately $44.2 million (including cash out of stock options)

Offer Price Per Share:

$39.00

Consideration Mix:

50% of Valley shares exchanged for $19.50 cash

50% of Valley shares exchanged for 1.3611 HFWA shares

Stock Option Treatment:

In-the-money stock options cashed out (approximately $232

thousand) Board Representation:

One Valley Board member will join the Board of HFWA

Exchange Ratio:

Fixed exchange ratio

Collars:

A 20% collar above and below HFWA’s stock price of $14.33

Walk-away Provision:

If HFWA’s stock price drops below $11.46 HFWA has the option to fill with

cash or stock or walk-away Termination Fee:

$1.76 million

Required Approvals:

Customary regulatory approvals and Valley shareholder approval

Expected

Closing

:

Q3 2013

Source: Company documents, SNL Financial & Microsoft MapPoint.

5

Transaction Overview |

Purchase

Accounting

Adjustments

(pre-tax):

•

Estimated credit mark of 2.0% or ~$279 thousand

•

Estimated $1.5 million mark-up on real estate and other assets

•

Estimated core deposit intangible equaling 1.0% of Valley’s core deposits

(1)

Other Financial Impacts:

•

Estimated cost savings of between 45% and 50%

–

Phased-in 50% in 2013 and 100% in 2014

–

Assumes consolidation of four branches

•

Estimated after-tax deal related expenses of $2.0 million

(1)

Core deposits represent total deposits less total certificates

of deposit.

6

Transaction Financial Impact |

•

Valley Bank has a history of strong and stable profitability with an average

ROAA of 0.97% over the past 5 years

•

Strong

asset

quality

has

been

maintained

throughout

the

economic

recession

•

Attractive low-cost funding mix (total cost of funds was 0.17% as of

12/31/2012) Note: Consolidated Valley Community Bancshares, Inc.

financials not publicly available. *1 location is a drive-up facility

only FTE = Full-time employees

Source: SNL Financial & Valley Bank call report data.

Overview:

Headquarters:

Year Established (BHC / Bank):

Number of Branches:

FTE:

Assets / FTE ($000s):

Puyallup, WA

1998 / 1972

9*

67

$3,615

Balance Sheet & Capital

Assets ($000s):

Deposits ($000s):

Gross Loans:

Loans / Deposits:

Securities / Assets:

TCE / TA:

Tier 1 Leverage Ratio:

$242,220

$212,501

$125,085

58.9%

25.9%

11.7%

11.2%

Profitability (FYE 2012)

ROAA:

ROAE:

Net Interest Margin:

Cost of Interest-Bearing Deposits:

Efficiency Ratio:

0.78%

6.57%

3.68%

0.25%

69.82%

Asset Quality

NPAs / Assets:

NPAs / (Loans + OREO):

Reserves / Loans:

Reserves / NPAs:

NCOs / Avg. Loans:

1.00%

1.93%

1.78%

91.94%

0.04%

7

Overview of Valley Bank |

8

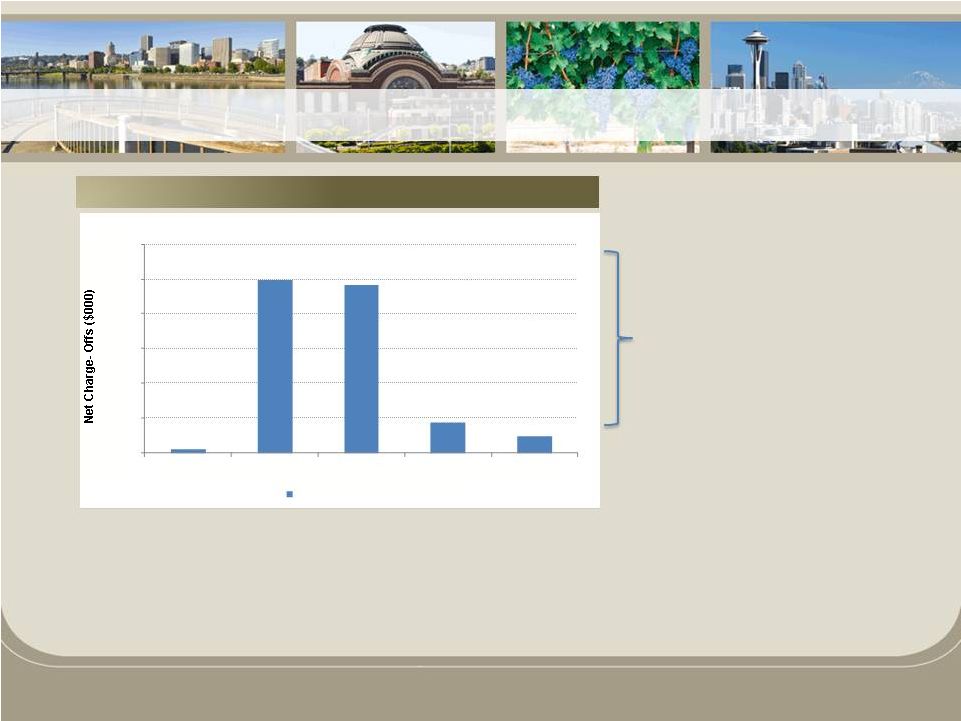

Strong Asset Quality

•

Valley has maintained strong asset quality throughout the economic downturn,

despite being located in a region that was not immune to the

recession Valley Net Charge-Off History

Cumulative net charge-offs since 2008

total $1.1 million

$0

$100

$200

$300

$400

$500

$600

2008

2009

2010

2011

2012

Net Charge-Offs per Year |

9

Note: Pro forma deposit market share assumes no branch consolidations

Source: SNL Financial; deposit data as of 6/30/2012.

Pierce County

King County

2012

Rank

Institution (ST)

2012

Number of

Branches

2012

Total

Deposits in

Market

($000)

2012

Total

Market

Share

(%)

1

Columbia Banking System Inc. (WA)

22

1,541,409

17.65

2

KeyCorp (OH)

28

1,295,122

14.83

3

Bank of America Corp. (NC)

19

1,285,820

14.73

4

Wells Fargo & Co. (CA)

14

1,183,766

13.56

5

JPMorgan Chase & Co. (NY)

19

629,834

7.21

Pro Forma

17

574,316

6.58

6

U.S. Bancorp (MN)

23

493,981

5.66

7

Heritage Financial Corp. (WA)

10

403,116

4.62

8

Umpqua Holdings Corp. (OR)

11

313,600

3.59

9

Mitsubishi UFJ Finl Grp Inc

8

190,715

2.18

10

Valley Community Bcshs Inc (WA)

7

171,200

1.96

11

Timberland Bancorp Inc. (WA)

5

158,660

1.82

12

HomeStreet Inc. (WA)

2

120,214

1.38

13

Commencement Bank (WA)

1

115,369

1.32

14

Washington Federal Inc. (WA)

4

103,533

1.19

15

Sunwest Bank (CA)

2

101,708

1.16

Total For Institutions In Market

199

8,731,311

2012

Rank

Institution (ST)

2012

Number of

Branches

2012

Total

Deposits in

Market

($000)

2012

Total

Market

Share

(%)

1

Bank of America Corp. (NC)

92

17,079,370

29.76

2

Wells Fargo & Co. (CA)

62

7,642,973

13.32

3

U.S. Bancorp (MN)

57

7,171,379

12.49

4

JPMorgan Chase & Co. (NY)

83

5,559,521

9.69

5

KeyCorp (OH)

66

5,110,206

8.90

6

Washington Federal Inc. (WA)

30

2,592,770

4.52

7

Mitsubishi UFJ Finl Grp Inc

14

1,462,637

2.55

8

HomeStreet Inc. (WA)

11

1,059,585

1.85

9

HSBC

4

864,531

1.51

10

East West Bancorp Inc. (CA)

4

857,261

1.49

11

W.T.B. Financial Corp. (WA)

2

829,135

1.44

12

Sterling Financial Corp. (WA)

18

790,448

1.38

13

First Financial Northwest Inc (WA)

1

748,600

1.30

14

Zions Bancorp. (UT)

1

725,563

1.26

15

Columbia Banking System Inc. (WA)

14

683,910

1.19

25

Pro Forma

7

135,162

0.34

30

Heritage Financial Corp. (WA)

5

96,060

0.17

41

Valley Community Bcshs Inc (WA)

2

39,102

0.07

Total For Institutions In Market

557

57,396,911

In-Market Deposit Franchise Expansion |

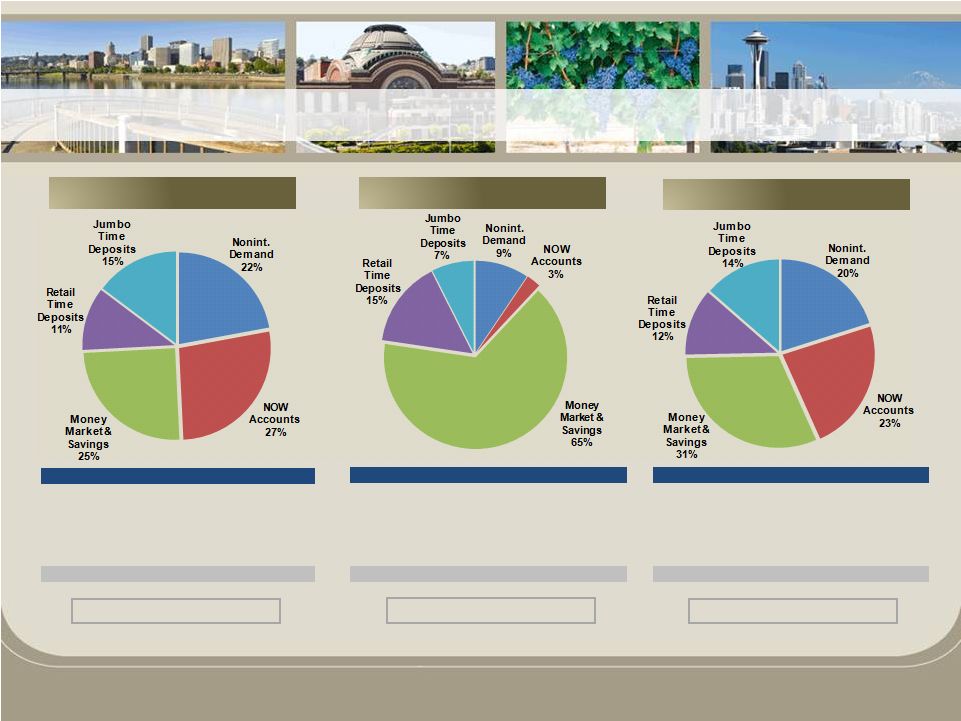

Note: Excludes pro forma impact of Northwest Commercial Bank on 1/9/2013.

(1)

Service utilized by Valley internally reclassifies certain money market

accounts to demand accounts (demand deposits ~25% of total deposits)

Source: Company filings & SNL Financial; data for the quarter ended

12/31/2012. HFWA

Valley

Pro Forma

Cost of Total Deposits: 0.34%

Cost of Total Deposits : 0.17%

Cost of Total Deposits : 0.31%

10

Pro Forma Deposit Composition

Deposit Composition ($000)

Amount

% of Total

Noninterest Demand

$247,048

22.1

%

NOW Accounts

303,487

27.1

Money Market & Savings

278,509

24.9

Retail Time Deposits

124,039

11.1

Jumbo Time Deposits

164,888

14.7

Total Deposits

$1,117,971

100.0

%

Deposit Composition ($000)

Amount

% of Total

Noninterest Demand

$20,104

9.5

%

NOW Accounts

5,371

2.5

Money Market & Savings

138,866

65.3

Retail Time Deposits

32,379

15.2

Jumbo Time Deposits

15,781

7.4

Total Deposits

$212,501

100.0

%

Deposit Composition ($000)

Amount

% of Total

Noninterest Demand

$267,152

20.1

%

NOW Accounts

308,858

23.2

Money Market & Savings

417,375

31.4

Retail Time Deposits

156,418

11.8

Jumbo Time Deposits

180,669

13.6

Total Deposits

$1,330,472

100.0

%

(1) |

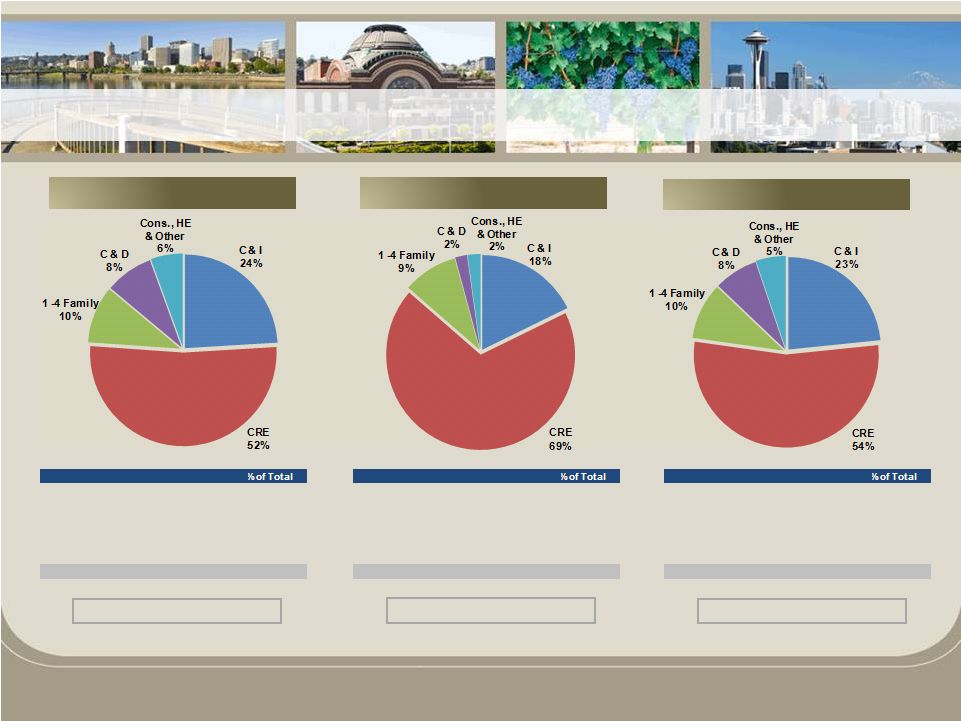

Note: Excludes pro forma impact of Northwest Commercial Bank on 1/9/2013.

*Loans acquired in FDIC-assisted transactions

Source: Company filings & SNL Financial; data for the quarter ended

12/31/2012. HFWA

Valley

Pro Forma

Yield on Loans and Leases: 6.22%

Yield on Loans and Leases: 5.40%

Yield on Loans and Leases: 6.13%

11

Loan Composition ($000)

Amount

Commercial & Industrial

$247,429

24.1

%

Commercial Real Estate

535,397

52.1

1-4 Family Residential

102,298

9.9

C&D

86,246

8.4

Cons, HE & Other

57,244

5.6

Gross Loans & Leases

$1,028,614

100.0

%

Loan Composition ($000)

Amount

Commercial & Industrial

$22,239

17.8

%

Commercial Real Estate

85,912

68.6

1-4 Family Residential

11,753

9.4

C&D

2,538

2.0

Cons, HE & Other

2,758

2.2

Gross Loans & Leases

$125,200

100.0

%

Loan Composition ($000)

Amount

Commercial & Industrial

$269,668

23.4

%

Commercial Real Estate

621,309

53.8

1-4 Family Residential

114,051

9.9

C&D

88,784

7.7

Cons, HE & Other

60,002

5.2

Gross Loans & Leases

$1,153,814

100.0

%

Pro Forma Loan Composition |

Note:

Impact includes completed acquisition of Northwest Commercial Bank on 1/9/2013.

(1)

Based on internal earnings estimates

(2)

Incremental

tangible

book

value

earnback

represents

the

number

of

years

to

eliminate

tangible

book

value

dilution

at

closing

utilizing

just

the

incremental

earnings

realized

through

the

merger

(it

ignores

HFWA

stand

alone

earnings)

(3)

Static tangible book value earnback represents the number of years to eliminate

tangible book value dilution at closing utilizing combined pro forma earnings

Earnings Accretion & Return

(1)

:

2014 EPS Accretion:

2015 EPS Accretion:

IRR:

Tangible Book Value Earnback Period:

> 19%

> 24%

> 16%

<4.5 years, using incremental earnings

(2)

<1.5 years, on static basis

(3)

Capital Ratios:

TCE / TA:

Leverage Ratio:

Tier 1 Ratio:

Total Risk-Based Capital Ratio:

13.9%

13.6%

18.7%

19.9%

11.7%

11.2%

20.3%

21.6%

11.7%

11.7%

16.4%

17.7%

Pro

Forma

12

Pro Forma Financial Impact |

•

Accretive to earnings in the first full year after closing

•

A continuing and consistent execution of our growth and

acquisition strategies within existing geographic footprint

•

Drives growth, efficiency and scale strategies

•

A continuation of our capital leveraging strategies

•

Expected cost saves complements our strategic branch

efficiency plans

•

Increased size and scale favorably positions the

company for further acquisitions and growth strategies

13

Investment Value |

Heritage Financial Corporation |