Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AXIALL CORP/DE/ | d467723d8k.htm |

| EX-99.3 - EX-99.3 - AXIALL CORP/DE/ | d467723dex993.htm |

| EX-99.2 - EX-99.2 - AXIALL CORP/DE/ | d467723dex992.htm |

| EX-99.1 - EX-99.1 - AXIALL CORP/DE/ | d467723dex991.htm |

Exhibit 99.4

CERTAIN INFORMATION EXCERPTED FROM THE COMPANY’S PRELIMINARY OFFERING MEMORANDUM AND DISCLOSED PURSUANT TO REGULATION FD

CAUTIONARY STATEMENTS ON FORWARD-LOOKING STATEMENTS

In various places herein there are statements relating to future events and our intentions, beliefs, expectations, and predictions for the future. Any such statements other than statements of historical fact are forward-looking statements. Words or phrases such as “will likely result,” “are expected to,” “will continue,” “is anticipated,” “we believe,” “we expect,” “estimate,” “project,” “may,” “will,” “intend,” “plan,” “believe,” “target,” “forecast,” “would” or “could” (including the negative variations thereof) or similar terminology used in connection with any discussion of future plans, actions or events, including with respect to the Transactions (as defined below), generally identify forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding expected benefits of the Transactions, integration plans and expected synergies therefrom, the expected timing of consummation of the Transactions, and our anticipated future financial and operating performance and results, including its estimates for growth. These statements are based on the current expectations of our management. There are a number of risks and uncertainties that could cause our actual results to differ materially from the forward-looking statements included herein. These risks and uncertainties, include:

| • | PPG being unable to obtain any remaining regulatory approvals required to complete the Transactions, or such required approvals delaying the Transactions or resulting in the imposition of conditions that could have a material adverse effect on us or causing the companies to abandon the Transactions; |

| • | other conditions to the closing of the Transactions not being satisfied; |

| • | a material adverse change, event or occurrence affecting Georgia Gulf or the PPG Chlor-alkali and Derivatives Business prior to the closing of the Transactions delaying the Transactions or causing the companies to abandon the Transactions; |

| • | problems arising in successfully integrating the PPG Chlor-alkali and Derivatives Business and Georgia Gulf, which may result in us not operating as effectively and efficiently as expected; |

| • | the possibility that the Transactions may involve other unexpected costs, liabilities or delays; |

| • | the businesses of each respective company being negatively impacted as a result of uncertainty surrounding the Transactions; |

| • | disruptions from the Transactions harming relationships with customers, employees or suppliers; and |

| • | uncertainties regarding (1) future prices, (2) industry capacity levels and demand for our products, (3) raw materials and energy costs and availability, feedstock availability and prices, (4) changes in governmental and environmental regulations, the adoption of new laws or regulations that may make it more difficult or expensive to operate Georgia Gulf’s businesses or manufacture its products before the Transactions or to operate our businesses or manufacture its products after the Transactions, (5) Georgia Gulf’s ability to generate sufficient cash flows from its businesses before the Transactions or our ability to generate sufficient cash flows from its businesses after the Transactions, (6) future economic conditions in the specific industries to which our products are sold and (7) global economic conditions. |

In light of these risks, uncertainties, assumptions and other factors, the forward-looking statements discussed herein may not occur. Other unknown or unpredictable factors could also have a material adverse effect on our actual future results, performance, or achievements. For a further discussion of these and other risks and uncertainties, see the section entitled “Risk Factors.” As a result of the foregoing, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this document. We undertake, and expressly disclaim, any duty to update any forward-looking statement whether as a result of new information, future events, or changes in its respective expectations, except as required by law.

1

HELPFUL INFORMATION

| • | “Additional Agreements” means the Employee Matters Agreement, the Tax Matters Agreement, the Shared Facilities, Services and Supply Agreement, the Transition Services Agreement, the Servitude Agreement, the Electric Generation, Distribution and Transmission Facilities Lease, the Chlorine, Liquid Caustic Soda and Hydrochloric Acid Sales Agreements and the Real Property Agreement; |

| • | “ASC” means the Financial Accounting Standards Board Accounting Standards Codification; |

| • | “Chlorine, Liquid Caustic Soda and Hydrochloric Acid Sales Agreements” means those certain agreements to be entered into at the date of the Separation between PPG and Georgia Gulf; |

| • | “Chlorine Sales Agreement Amendment” means the Amendment, dated as of July 18, 2012, to the Chlorine Sales Contract, dated as of January 1, 1985, as amended, between PPG and a subsidiary of Georgia Gulf; |

| • | “Code” means the Internal Revenue Code of 1986, as amended; |

| • | “Combined Company,” “we,” “us” and “our” refer to Georgia Gulf Corporation and its consolidated subsidiaries, including Splitco and its consolidated subsidiaries, upon the consummation of the Merger; |

| • | “Debt Exchange” means the transfer of all or a portion of the notes offered hereby by PPG on the closing date of the Merger to the initial purchasers or their affiliates that are acting as selling securityholders in the offering in satisfaction of all or a portion of the PPG Debt held by affiliates of the initial purchasers as described in the section entitled “Description of Certain Other Indebtedness—Debt Exchange”; |

| • | “Distribution” means the distribution by PPG of its shares of Splitco common stock to the holders of shares of PPG common stock by way of an exchange offer and, with respect to any shares of Splitco common stock that are not subscribed for in the exchange offer, a pro rata distribution to the holders of shares of PPG common stock; |

| • | “Distribution Tax Opinion” means an opinion from Wachtell, Lipton, Rosen & Katz, tax counsel to PPG, substantially to the effect that (i) the Distribution will be treated as satisfying the business purpose requirement described in Treasury Regulation § 1.355-2(b)(1), (ii) the Distribution will not be treated as being used principally as a device for the distribution of earnings and profits of PPG or Splitco or both under Section 355(a)(1)(B) of the Code, (iii) the stock of Splitco distributed in the Distribution will not be treated as other “qualified property” by reason of the application of Section 355(e)(1) of the Code; and (iv) the Splitco securities will constitute “securities” for purposes of the application of Section 361(a) of the Code; |

| • | “The Electric Generation, Distribution and Transmission Facilities Lease” means the Generation, Distribution and Transmission Facilities Lease to be entered into at the date of the Separation between PPG and Splitco; |

| • | “Employee Matters Agreement” means the Employee Matters Agreement, dated as of July 18, 2012, by and among Georgia Gulf, PPG and Splitco; |

| • | “Exchange Act” means the Securities Exchange Act of 1934, as amended; |

| • | “GAAP” means generally accepted accounting principles in the United States; |

| • | “Georgia Gulf” refers to Georgia Gulf Corporation and its consolidated subsidiaries prior to the consummation of the Merger; |

| • | “Georgia Gulf common stock” means the common stock, par value $0.01 per share, of Georgia Gulf; |

| • | “Georgia Gulf Group” means Georgia Gulf and each of its consolidated subsidiaries prior to the consummation of the Merger; |

2

| • | “Group” means the Georgia Gulf Group, PPG Group, or Splitco Group, as the case may be; |

| • | “Master Terminal Agreement” means the Master Terminal Agreement to be entered into at the date of the Separation between PPG and Splitco; |

| • | “Merger” means the combination of Georgia Gulf’s business and the PPG Chlor-alkali and Derivatives Business through the merger of Merger Sub with and into Splitco, whereby the separate corporate existence of Merger Sub will cease and Splitco will continue as the surviving company and as a wholly-owned subsidiary of Georgia Gulf, as contemplated by the Merger Agreement; |

| • | “Merger Agreement” means the Agreement and Plan of Merger, dated as of July 18, 2012, by and among PPG, Splitco, Georgia Gulf and Merger Sub, as amended by Amendment No. 1 to the Merger Agreement, dated as of August 31, 2012; |

| • | “Merger Sub” means Grizzly Acquisition Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of Georgia Gulf, and, unless the context otherwise requires, its subsidiaries; |

| • | “Monroeville Shared Facilities Agreement” means the Monroeville Shared Facilities Agreement to be entered into at the date of the Separation, between PPG and Splitco; |

| • | “NYSE” means the New York Stock Exchange; |

| • | “PPG” means PPG Industries, Inc., a Pennsylvania corporation, and, unless stated otherwise or the context otherwise requires, its subsidiaries, other than Splitco and any of its subsidiaries; |

| • | “PPG Chlor-alkali and Derivatives Business” means substantially all of the assets and liabilities of the business of PPG relating to the production of chlorine, caustic soda and related chemicals as further described in the section entitled “Business” and to be transferred to Splitco pursuant to the terms and conditions contained in the Separation Agreement; |

| • | “PPG common stock” means the common stock, par value $1.66 2/3 per share, of PPG; |

| • | “PPG Debt” means the senior unsecured bridge loans in the amount of $688.0 million incurred by PPG on January 3, 2013 pursuant to that certain 180-day credit agreement among PPG, the lenders from time to time party thereto and Barclays Bank plc, as administrative agent; |

| • | “PPG Group” means PPG and each of its consolidated subsidiaries which, after consummation of the Merger, will not include the PPG Chlor-alkali and Derivatives Business; |

| • | “PPG shareholders” means the holders of PPG common stock; |

| • | “Private Letter Ruling” means a Private Letter Ruling from the IRS substantially to the effect that (i) the Distribution, together with certain related transactions, will qualify as a “reorganization” within the meaning of Section 368(a)(1)(D) of the Code and (ii) PPG will not recognize gain or loss for U.S. federal income tax purposes in connection with the receipt of the notes offered hereby or the consummation of the Debt Exchange; |

| • | “Real Property Agreement” means the Real Property Agreement to be entered into at the date of the Separation, between PPG and Eagle Natrium LLC; |

| • | “SEC” means the United States Securities and Exchange Commission; |

| • | “Securities Act” means the Securities Act of 1933, as amended; |

| • | “Separation” means the transfer by PPG of the assets and liabilities related to the PPG Chlor-alkali and Derivatives Business, including certain subsidiaries of PPG, to Splitco; |

| • | “Separation Agreement” means the Separation Agreement, dated as of July 18, 2012, between PPG and Splitco; |

| • | “Servitude Agreement” means the Servitude Agreement to be entered into at the date of the Separation between PPG and Splitco; |

3

| • | “Shared Facilities, Services and Supply Agreement” means the Shared Facilities, Services and Supply Agreement to be entered into at the date of the Separation between PPG and Splitco; |

| • | “Special Distribution” means the distribution to be made in connection with the Transactions by Splitco to PPG consisting of (1) the cash proceeds of approximately $212.0 million from the Term Facility and (2) all or a portion of the notes offered hereby; |

| • | “Splitco” means Eagle Spinco Inc., a Delaware corporation, and, prior to the Merger, a wholly-owned subsidiary of PPG, and, unless stated otherwise or the context otherwise requires, its subsidiaries; |

| • | “Splitco common stock” means the common stock, par value $0.001 per share, of Splitco; |

| • | “Splitco Group” means Splitco and each of its consolidated subsidiaries (including, after consummation of the Merger, Georgia Gulf and each of its subsidiaries); |

| • | “Tax Matters Agreement” means the Tax Matters Agreement to be entered into at the date of the Separation by and among Georgia Gulf, PPG and Splitco; |

| • | “TCI” means Taiwan Chlorine Industries, Ltd., a joint venture between PPG and China Petrochemical Development Corporation. |

| • | “TCI Interests” means the shares of TCI owned by PPG as of the date of the Merger Agreement, which represent a 60 percent interest in TCI; |

| • | “Term Facility” means the approximately $212.0 million in new bank debt to be incurred by Splitco under a senior secured term loan facility, which debt will be obligations of Splitco and its subsidiaries and, upon consummation of the Transactions, guaranteed by Georgia Gulf and each of its existing and future domestic subsidiaries (other than certain excluded subsidiaries) (the amount of the Term Facility is subject to adjustment in certain circumstances and may (1) increase or decrease based on the working capital adjustment contained in the Merger Agreement or (2) decrease by an amount equal to $12.0 million plus the amount of any net proceeds from this offering of notes used to fund the Special Distribution in the event the TCI Interests are not owned by Splitco immediately prior to the consummation of the Merger); |

| • | “Transactions” means the transactions contemplated by the Merger Agreement and the Separation Agreement, which provide for, among other things, the Separation, the Term Facility, the notes offered hereby, the Debt Exchange, the Distribution and the Merger, as described in the section entitled “The Transactions”; and |

| • | “Transition Services Agreement” means the Transition Services Agreement to be entered into at the date of the Separation between PPG and Splitco. |

4

Overview

The Combined Company

After the consummation of the Merger, Georgia Gulf will own and operate the PPG Chlor-alkali and Derivatives Business through Splitco, which will be Georgia Gulf’s wholly-owned subsidiary, while continuing its current businesses. Georgia Gulf will manage the PPG Chlor-alkali and Derivatives Business as part of Georgia Gulf’s integrated chain of electrovinyl and compound products within its chlorovinyls segment.

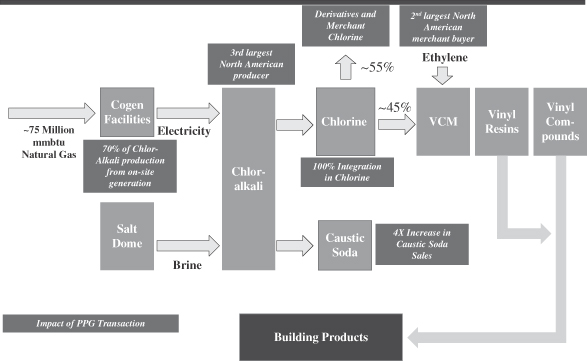

The combination of the PPG Chlor-alkali and Derivatives Business with Georgia Gulf’s existing business is intended to make Georgia Gulf an integrated leader across the chlorovinyls chain. Based on industry data from IHS, Inc. (formerly known as CMAI), Georgia Gulf anticipates that the Transactions will create: (1) the third largest chlorine producer in North America; (2) the second largest vinyl chloride monomer (“VCM”) producer in North America; (3) the fourth largest polyvinyl chloride (“PVC”) producer in North America; and (4) one of the lowest-cost chlor-alkali producers in the world due to Georgia Gulf’s access to low-cost North American natural gas, with the electricity and steam requirements of approximately 70% of its chlor-alkali capacity provided by company-owned natural gas fired cogeneration. On a historical combined basis, for the twelve months ended September 30, 2012, we would have generated net sales of approximately $4.9 billion, and Adjusted EBITDA of approximately $645 million. For the definition of Adjusted EBITDA and a reconciliation of net income to Adjusted EBITDA, see footnote 2 in the section entitled “Summary Historical and Pro Forma Financial Data—Summary Unaudited Historical Combined and Pro Forma Condensed Combined Financial Information of Georgia Gulf and the PPG Chlor-alkali and Derivatives Business.”

The following chart illustrates our chlorovinyls and building and home improvement products integration on a pro forma basis after giving effect to the Transactions.

Georgia Gulf

Georgia Gulf Corporation is a leading, integrated North American manufacturer and international marketer of chemicals and building products. Georgia Gulf, headquartered in Atlanta, Georgia, has manufacturing facilities located throughout North America to provide industry-leading service to customers.

5

Georgia Gulf operates through three reportable segments: (1) chlorovinyls; (2) building products; and (3) aromatics.

| • | Chlorovinyls: Georgia Gulf’s chlorovinyls segment produces a highly integrated chain of electrovinyl and compound products, which includes chlorine, caustic soda, VCM, vinyl resins, vinyl compounds and compound additives. As of September 30, 2012, Georgia Gulf is one of the largest producers of VCM, vinyl resins, and vinyl compounds by total annual production capacity by product in North America; |

| • | Building Products: Georgia Gulf’s building products segment is comprised of window and door profiles and mouldings products and outdoor building products. Georgia Gulf manufactures extruded vinyl window and door profiles as well as interior and exterior mouldings. Georgia Gulf also manufactures outdoor building products, which include siding, pipe and pipe fittings and deck products. In addition, Georgia Gulf operates distribution centers, some of which are co-located with manufacturing plants. |

| • | Aromatics: Georgia Gulf’s aromatics segment produces an integrated chain of products, which include cumene and the co-products phenol and acetone. As of September 30, 2012, Georgia Gulf operates the world’s largest cumene plant by total annual production capacity. |

For the year ended December 31, 2011 and the nine months ended September 30, 2012, Georgia Gulf generated $3,222.9 million and $2,541.1 million in net sales, respectively. For the year ended December 31, 2011 and the nine months ended September 30, 2012, Georgia Gulf generated $222.9 million and $236.5 million in Adjusted EBITDA, respectively.

The PPG Chlor-alkali and Derivatives Business

The PPG Chlor-alkali and Derivatives Business is a producer and supplier of chlor-alkali and derivative products, including chlorine, caustic soda, VCM, chlorinated solvents, calcium hypochlorite, ethylene dichloride (“EDC”), muriatic acid (also called hydrochloric acid or “HCL”) and phosgene derivatives. Most of these products are sold directly to manufacturing companies in the chemical processing, plastics, paper, minerals, metals, agricultural products and water treatment industries.

With sales, marketing, customer service, logistics, production planning, finance and research and development based in Monroeville, Pennsylvania, the PPG Chlor-alkali and Derivatives Business owns and operates plants in Lake Charles, Louisiana; Natrium, West Virginia; La Porte, Texas; Longview, Washington; Beauharnois, Quebec, Canada; and, through the TCI Interests, Kaohsiung, Taiwan. Except for the Monroeville facility, which houses the PPG Chlor-alkali and Derivatives Business’s management, customer service and research and development operations as well as certain other PPG operations, each of these facilities will be transferred to Splitco prior to the Distribution.

For the year ended December 31, 2011 and the nine months ended September 30, 2012, the PPG Chlor-alkali and Derivatives Business generated net sales of $1,741.0 million and $1,292.0 million, respectively. For the year ended December 31, 2011 and the nine months ended September 30, 2012, the PPG Chlor-alkali and Derivatives Business generated $396.0 million and $311.0 million in Adjusted EBITDA, respectively.

Our Strengths

Leading global chemicals and building products company

The Merger creates a leading global chemicals and building products company with a broad portfolio of downstream products and approximately $4.9 billion in net sales on a historical combined basis for the twelve months ended September 30, 2012.

6

We believe that as a leading integrated chemicals and building products company we will benefit from significant integration and scale, a broad portfolio of downstream products, as well as the regional advantage of low-cost North American natural gas. We expect that the Merger will allow us to expand our manufacturing footprint significantly through the addition of production plants in Lake Charles, Louisiana; Natrium, West Virginia; La Porte, Texas; Longview, Washington; Beauharnois, Quebec; and, through our expected ownership of the TCI Interests, Kaohsiung, Taiwan.

Leading market positions with diversified products

We believe that the combination of Georgia Gulf and the PPG Chlor-alkali and Derivatives Business will significantly increase integration across our chlorovinyls chain. On a pro forma basis after giving effect to the Transactions, we anticipate we will be: (1) the third largest chlorine producer in the North America, (2) the second largest VCM producer in North America, (3) the fourth largest PVC producer in North America, and (4) one of the lowest-cost chlor-alkali producers in the world due to our access to low-cost North American natural gas, with the electricity and steam requirements of approximately 70% of our chlor-alkali capacity provided by company-owned natural gas fired cogeneration.

Our broad range of vinyl resin grades and flexible and rigid vinyl compounds strengthens our competitive position. In our aromatics segment, we are a leading North American producer of cumene, phenol and acetone. Our cumene manufacturing facility located in Pasadena, Texas, along the Houston ship channel has nameplate annual capacity of two billion pounds and is the largest in the world based on capacity. We are fully backward integrated in relation to our cumene needs for the production of phenol and acetone. In our vinyl-based home improvement and building products segments, window, door and mouldings products and outdoor building products, we are one of the largest extruders of window and door profiles in North America. We believe we are the third largest manufacturer and marketer of vinyl siding in North America and the second largest manufacturer of pipe and pipe fittings in Canada based on production capacity. We market and sell our high-quality home improvement and building products under our Royal Building Products and Exterior Portfolio brands, which are well-recognized in the industry for product innovation and quality. Our leadership position enables us to effectively meet customers’ volume and product grade requirements.

Low cost producer of commodity chemicals

We own and operate highly integrated chemical manufacturing facilities located within close proximity to major water and rail access, our customer base and suppliers of raw materials. Our operations at these facilities include the production of chlorine, caustic soda, VCM, vinyl resins and compounds, cumene and phenol and acetone. In addition, we have numerous manufacturing facilities and distribution centers for our building and home improvement products to facilitate prompt and cost-effective delivery to our customers. We believe our vertical integration, world-scale manufacturing facilities, operating efficiencies and facility locations and the productivity of our employees provide us with a competitive cost position in the primary markets we serve. The large scale and level of operational integration of our facilities enhances our control over production costs and capacity utilization rates, as compared to our less integrated competitors.

We believe the Merger will significantly increase our level of backward integration into chlorine and caustic soda. In addition, we expect to achieve approximately $115.0 million in annualized cost synergies relating to improved procurement and logistics, operating rate optimization and reduction in general and administrative expenses. We believe the Merger will allow for greater scale and ability to capitalize on globally advantaged, low-cost North American natural gas and provide a foundation for future growth.

Expertise in product formulation and innovation

Over the past 20 years, we have developed specific vinyl resins and compound formulations for many products, including many of the vinyl-based home improvement and building products we manufacture and

7

market under the Royal Building Products and Exterior Portfolio brands. This expertise has allowed us to develop competitively priced vinyl resins and compounds, which we believe our customers have used to improve manufacturing efficiencies and to produce differentiated products based on quality and other performance characteristics. We believe that coupling this expertise with our experiences and innovation in development of vinyl-based home improvement and building products will allow us to further penetrate the building products markets in North America and create opportunities for new product development.

Experienced management team

Following the Merger, we will be led by Georgia Gulf’s existing management team, together with senior management additions from the PPG Chlor-alkali and Derivatives Business. The board of directors of Georgia Gulf will consist of the eight existing Georgia Gulf board members and three members to be designated by PPG, including Michael H. McGarry, who is currently an executive vice president of PPG with responsibility for the PPG Chlor-alkali and Derivatives Business through the consummation of the Merger, and will remain with PPG after the Merger.

Our Strategies

Integration and product portfolio diversification

A key element of Georgia Gulf’s strategy has been to increase its level of integration in chlorovinyls. As a result of the Merger, we expect that our combined chlorine and caustic production capacity will increase by nearly 400 percent over Georgia Gulf’s existing stand-alone production capacity. In addition, we believe we will have significant additional operational flexibility due to the integration of four North American chlorine and caustic production facilities from the PPG Chlor-alkali and Derivatives Business. Accordingly, we believe we will be able to satisfy all of our internal chlorine-based product requirements with improved operating rates through the business cycle. We expect that the combination with the PPG Chlor-alkali and Derivatives Business will reduce the potential for negative impacts from any planned or unplanned production outages by adding the capability to serve both internal needs and external customers from five North American production facilities, as compared to Georgia Gulf’s current ability to meet those needs from a single site. Additionally, we expect that we will have a more diverse portfolio of chlorine-based products with increased scale in caustic sales and the addition of HCL, calcium hypochlorite and chlorinated solvents from the PPG Chlor-alkali and Derivatives Business. We also plan to continue to explore further opportunities to vertically integrate our operations and broaden our portfolio offerings.

Operational efficiencies and cost savings

The combination with the PPG Chlor-alkali and Derivatives Business increases our size, economies of scale and total capabilities, which we believe should allow us to continue to improve our cost structure and increase profitability. We expect to achieve approximately $115.0 million in annualized cost synergies relating to improved procurement and logistics, operating rate optimization and reduction in general and administrative expenses. In addition, we believe our increased size and scale will allow us to secure ethylene supply on more favorable terms while increased vertical integration enhances our operating rate throughout the cycle. The close geographic proximity and existing operational integration of the PPG Chlor-alkali and Derivatives Business Lake Charles production facility with our Lake Charles VCM production facility should increase the achievability of a meaningful portion of our expected synergies.

Focus on organic growth in domestic and export markets

We believe we are well-positioned for the future as natural gas positions North American chlor-alkali producers at the low end of the global cost curve. This position, combined with our favorable Gulf Coast logistics, should allow us to effectively compete in global export markets. We believe North American housing, remodeling and construction markets will continue to recover from historically depressed levels. Additionally, we believe we are well positioned to participate in North American ethylene expansion based on our increased size and scale.

8

We believe that increased chlorine production capacity will create new opportunities for organic growth that were not available on a stand-alone basis. Historically, we have been limited in our ability to organically grow our VCM and PVC businesses due to lack of chlorine integration. We plan to use approximately 60% of chlorine production capacity internally. We expect that this excess production capacity will allow us to sell the remainder on the merchant market or expand production of VCM and PVC or other downstream growth opportunities. We believe we are well-positioned to capitalize on these increased opportunities, particularly due to the cost advantaged position of North American natural gas position and the proximity of our VCM and PVC production facilities to large Gulf Coast ports.

Enhance cash flow and credit profile

We believe the Merger will allow us to significantly enhance our cash flow from operations and Adjusted EBITDA and maintain a strong credit profile. We believe the enhanced cash flow from operations will allow us greater financial flexibility than we would have on a standalone basis, even after taking into account the additional indebtedness incurred in connection with the Transactions. We believe we will have a strong capital structure as a result of the Merger, and we plan to use our cash flow from operations to improve our credit profile and invest in our integrated businesses.

Leverage our competitive strengths

We plan to continue to strengthen our competitive position through further focus on integration across the product chain, seek to optimize our world-scale facilities, seek to maximize our operating efficiencies and seek to increase the productivity of our employees. In addition, we plan to continue leveraging our wide breadth of multiple complementary products by identifying and pursuing cross-selling opportunities.

Transaction Rationale

The Transactions combine two complementary businesses. Key benefits of the Transactions include:

Creates Global Chemicals and Building Products Leader with Increased Scale

| • | The combination of Georgia Gulf and the PPG Chlor-alkali and Derivatives Business is expected to result in the creation of a Fortune 500 company with approximately $4.9 billion in net sales on a historical combined basis for the twelve months ended September 30, 2012, and a broad portfolio of leading positions in downstream chemicals and building products. |

| • | We anticipate we will be the third largest chlor-alkali producer and second largest VCM producer in North America. |

| • | We believe the Transactions materially increase scale for future growth opportunities while maintaining a conservative capital structure. |

Enhanced Vertical Integration with Significant U.S. Natural Gas Driven Chlor-alkali Production

| • | We expect full vertical chlorine integration into vinyl will enhance operating rates throughout the business cycle. |

| • | The large scale and level of operational integration of our facilities enhances our control over production costs and capacity utilization rates, as compared to our less integrated competitors. |

| • | We expect the electricity and steam requirements of approximately 70% of our chlor-alkali capacity to be provided by company-owned natural gas fired cogeneration, which we anticipate will make us one of the lowest cost integrated chlor-alkali producers in the world. |

9

| • | We expect that the Transactions will allow for greater scale and ability to capitalize on globally advantaged, low-cost North American natural gas and provide a foundation for future growth. |

Significant Cost Synergies and Well-Positioned to Capitalize on Growth Opportunities

| • | We believe the combination of Georgia Gulf and the PPG Chlor-alkali and Derivatives Business will result in significant run-rate cost synergies of approximately $115.0 million annually. |

| • | The combination of Georgia Gulf and the PPG Chlor-alkali and Derivatives Business is expected to result in lower procurement and logistics cost from savings of combined ethylene and natural gas purchases as well as freight and terminal optimization. |

| • | As a result of the Transactions, we expect reduced overhead charges and information technology savings. |

| • | The close geographic proximity and existing operational integration of the PPG Chlor-alkali and Derivatives Business’s Lake Charles production facility with Georgia Gulf’s Lake Charles production facility should increase the achievability of a meaningful portion of our expected synergies. |

Financially Compelling

| • | We believe the Combined Company will have a better credit profile and balance sheet, stronger operating cash flow, and greater financial flexibility than either of the two businesses independently. |

Recent Developments

Based on operating data and preliminary financial data currently available, Georgia Gulf estimates that on a standalone basis:

| • | Georgia Gulf’s net sales for the fiscal year ended December 31, 2012 will be approximately $3.3 billion; |

| • | Georgia Gulf’s cash and cash equivalents as of December 31, 2012 will be approximately $200 million; |

| • | Georgia Gulf’s total debt position as of December 31, 2012 will be approximately $448 million, including no cash drawn under the ABL Revolver (as defined herein). |

In addition, Georgia Gulf expects to exceed its previously provided full year guidance for Adjusted EBITDA. For the fiscal year ended December 31, 2012, Georgia Gulf now expects its Adjusted EBITDA on a standalone basis to be between $330 million and $340 million(1).

| (1) | Adjusted EBITDA is a non-GAAP financial measure. Georgia Gulf has generally provided reconciliations of the historical non-GAAP measures included herein to the most directly comparable GAAP measures in the section of this offering memorandum entitled “Selected Pro Forma and Historical Financial Data—Selected Historical Consolidated Financial Data of Georgia Gulf.” However, Georgia Gulf has not provided a reconciliation of this forward-looking non-GAAP financial measure to the directly comparable GAAP measure because, due primarily to the timing of the closing of Georgia Gulf’s financial records for the fiscal year ended December 31, 2012, it does not currently have sufficient data to accurately provide this reconciliation to net income without unreasonable efforts. Georgia Gulf believes the probable significance of its providing this forward-looking non-GAAP financial measure without a reconciliation to net income is that investors and analysts will have certain information that Georgia Gulf believes to be useful and meaningful regarding its expected results for the fiscal year ended December 31, 2012, but that such investors and analysts will not have all of Georgia Gulf’s expected financial results on a GAAP basis. As a result, investors and analysts may be unable to accurately compare Georgia Gulf’s expected results to its historical results or the results or expected results of other companies who may have treated such matters differently. Georgia Gulf management believes that, given the inherent uncertainty of forward-looking statements, its investors and analysts will be able to understand and appropriately take into account the limitations in the information Georgia Gulf has provided. Investors are cautioned that until Georgia Gulf’s financial records are closed for the fiscal year, it cannot predict the occurrence, timing or amount of all non-GAAP items that it excludes from Adjusted EBITDA. As a result, the actual effect of these items, when determined could potentially be significant to the calculation of Adjusted EBITDA for the fiscal year ended December 31, 2012. |

10

Georgia Gulf has not finalized its financial statement closing process for the fiscal year ended December 31, 2012. As a result, these estimates for net sales, cash, debt and Adjusted EBITDA are based on preliminary estimates and are subject to risks and uncertainties, including, among others, changes in connection with year-end adjustments. There can be no assurance that Georgia Gulf’s actual net sales, cash, debt and Adjusted EBITDA for the fiscal year ended December 31, 2012 will fall within the ranges set forth above or that this preliminary financial data is indicative of future performance. Any variation between Georgia Gulf’s actual results and the preliminary financial data set forth above may be material. Accordingly, investors should exercise caution in relying on the preliminary financial data contained herein and should not draw any inferences from this information regarding financial or operating data that is not discussed herein. This preliminary financial data has been prepared by, and is the responsibility of, Georgia Gulf management. Georgia Gulf’s independent auditors, Ernst & Young LLP, have not audited, reviewed, compiled or performed any procedures with respect to this preliminary financial data. Accordingly, Ernst & Young LLP does not express an opinion or any other form of assurance with respect thereto.

Summary Historical and Pro Forma Financial Data

The following summary combined financial data of the PPG Chlor-alkali and Derivatives Business and summary consolidated financial data of Georgia Gulf are being provided to help you in your analysis of the financial aspects of the Transactions. You should read this information in conjunction with the sections entitled “Business” and “Selected Pro Forma and Historical Financial Data,” each included elsewhere herein.

Summary Unaudited Historical Combined and Pro Forma Condensed Combined Financial Information of Georgia Gulf and the PPG Chlor-alkali and Derivatives Business

The following summary unaudited historical combined and pro forma condensed combined financial information of Georgia Gulf and the PPG Chlor-alkali and Derivatives Business is being presented for illustrative purposes only. The following summary unaudited historical combined and pro forma condensed combined financial data assumes that the PPG Chlor-alkali and Derivatives Business had been owned by Georgia Gulf for all periods, and at the date presented. Georgia Gulf and the PPG Chlor-alkali and Derivatives Business may have performed differently had they actually been combined for all periods or on the date presented. The following summary unaudited historical combined and pro forma condensed combined financial data may not be indicative of the results or financial condition that would have been achieved had Georgia Gulf and the PPG Chlor-alkali and Derivatives Business been combined other than during the periods or on the date presented or of the actual future results or financial condition of Georgia Gulf to be achieved following the Transactions.

| Twelve Months Ended September 30, 2012 (Historical Combined)(1) |

As of and for

the Nine Months Ended September 30, 2012 (Pro Forma) |

For the

Year Ended December 31, 2011 (Pro Forma) |

||||||||||

| (In millions) | ||||||||||||

| Results of Operations: |

||||||||||||

| Net sales |

$ | 4,908 | $ | 3,794 | $ | 4,876 | ||||||

| Operating costs and expenses: |

||||||||||||

| Cost of sales |

4,062 | 3,109 | 4,134 | |||||||||

| Selling, general and administrative |

314 | 294 | 360 | |||||||||

| Long-lived asset impairment charges |

8 | — | 8 | |||||||||

| Transaction related costs, Restructuring and other, net |

30 | 11 | 3 | |||||||||

| Other charges |

9 | 8 | 10 | |||||||||

| Other earnings |

(15 | ) | (13 | ) | (27 | ) | ||||||

| (Gains) on sale of assets |

(19 | ) | (19 | ) | (1 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Total operating costs and expenses |

4,389 | 3,390 | 4,487 | |||||||||

|

|

|

|

|

|

|

|||||||

| Operating income |

519 | 404 | 388 | |||||||||

| Interest expense, net |

(59 | ) | (87 | ) | (123 | ) | ||||||

| Loss on redemption and other debt costs |

(4 | ) | — | (5 | ) | |||||||

| Foreign exchange loss |

(1 | ) | (1 | ) | (1 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Income before income taxes |

455 | 316 | 260 | |||||||||

| Provision for income taxes |

135 | 96 | 57 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net income |

320 | 220 | 203 | |||||||||

|

|

|

|

|

|

|

|||||||

| Less: net income attributable to noncontrolling interest |

14 | 8 | 10 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net income attributable to controlling shareholders |

$ | 306 | $ | 212 | $ | 193 | ||||||

|

|

|

|

|

|

|

|||||||

11

| Twelve Months Ended September 30, 2012 (Historical Combined)(1) |

As of and for

the Nine Months Ended September 30, 2012 (Pro Forma) |

For the

Year Ended December 31, 2011 (Pro Forma) |

||||||||||

| (In millions) | ||||||||||||

| Financial Highlights: |

||||||||||||

| Total assets |

$ | 5,381 | ||||||||||

| Total liabilities |

3,104 | |||||||||||

| Other Selected Data: |

||||||||||||

| Adjusted EBITDA(2) |

$ | 645 | $ | 561 | $ | 637 | ||||||

| Capital expenditures |

$ | 140 | $ | 89 | $ | 130 | ||||||

| (1) | The summary unaudited historical combined financial information of Georgia Gulf and the PPG Chlor-alkali and Derivatives Business for the twelve months ended September 30, 2012 has been prepared on a basis different from, and are not directly comparable to, such pro forma condensed combined financial information for the nine months ended September 30, 2012 and the year ended December 31, 2011. The summary unaudited historical combined financial information of Georgia Gulf and the PPG Chlor-alkali and Derivatives Business for the twelve months ended September 30, 2012 has been derived from the combination of Georgia Gulf’s unaudited condensed consolidated financial statements for the last quarter of 2011, as derived from Georgia Gulf’s audited consolidated financial statements for the year ended December 31, 2011, and Georgia Gulf’s unaudited condensed consolidated financial statements for the nine months ended September 30, 2012, along with the combination of the PPG Chlor-alkali and Derivatives Business’s unaudited condensed combined financial statements for the last quarter of 2011, as derived from the PPG Chlor-alkali and Derivatives Business’s audited combined financial statements for the year ended December 31, 2011, and the PPG Chlor-alkali and Derivatives Business’s unaudited condensed combined financial statements for the nine months ended September 30, 2012. |

| (2) | In addition to evaluating financial condition and results of operations in accordance with GAAP, management of Georgia Gulf also reviews and evaluates certain alternative financial measures not prepared in accordance with GAAP. Non-GAAP measures do not have definitions under GAAP and may be defined differently by and not be comparable to, similarly titled measures used by other companies. As a result, management of Georgia Gulf considers and evaluates non-GAAP measures in connection with a review of the most directly comparable measure calculated in accordance with GAAP. Management of Georgia Gulf cautions investors not to place undue reliance on such non-GAAP measures, but also to consider them with the most directly comparable GAAP measure. |

In this document, Georgia Gulf supplements its financial information prepared in accordance with GAAP with Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization, cash and non-cash restructuring and certain other costs related to financial restructuring and business improvement initiatives, gains or losses on substantial modification of debt and sales of certain assets, certain purchase accounting and certain non-income tax reserve adjustments, professional fees related to a previously disclosed and withdrawn unsolicited offer and the Merger, goodwill, intangibles, and other long-lived asset impairments, and interest expense related to OMERS lease financing obligations) because Georgia Gulf believes investors commonly use Adjusted EBITDA as a main component of valuing cyclical companies such as Georgia Gulf. Adjusted EBITDA is not a measurement of financial performance under GAAP and should not be considered as an alternative to net income (loss) as a measure of performance or to cash provided by operating activities as a measure of liquidity. In addition, Georgia Gulf’s calculation of Adjusted EBITDA may be different from the calculation used by other companies and, therefore, comparability may be limited.

12

A reconciliation of Adjusted EBITDA to net income (loss) determined in accordance with GAAP is provided below:

| Twelve Months Ended September 30, 2012 | ||||||||||||

| Historical | ||||||||||||

| (in millions) | Georgia Gulf | PPG Chlor- alkali and Derivatives Business |

Historical Combined |

|||||||||

| Net income |

$ | 85.0 | $ | 235.0 | $ | 320.0 | ||||||

| Net income attributable to non-controlling interests |

— | (14.0 | ) | (14.0 | ) | |||||||

| Provision for income taxes |

20.3 | 115.0 | 135.3 | |||||||||

| Interest income |

(0.3 | ) | — | (0.3 | ) | |||||||

| Loss on redemption and other debt costs |

3.8 | — | 3.8 | |||||||||

| Interest expense |

59.2 | — | 59.2 | |||||||||

| Depreciation and amortization expense(b) |

91.2 | 42.0 | 133.2 | |||||||||

| Long-lived asset impairment charges |

8.3 | — | 8.3 | |||||||||

| Transaction related costs, restructuring and other, net |

28.7 | 1.0 | 29.7 | |||||||||

| (Gains) on sale of assets(c) |

(19.2 | ) | — | (19.2 | ) | |||||||

| Other(d) |

(11.2 | ) | — | (11.2 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Adjusted EBITDA |

$ | 265.8 | $ | 379.0 | $ | 644.8 | ||||||

|

|

|

|

|

|

|

|||||||

| Nine Months Ended September 30, 2012 | ||||||||||||||||||||

| Historical | Pro Forma Adjustments(a) | |||||||||||||||||||

| (in millions) | Georgia Gulf | PPG Chlor- alkali and Derivatives Business |

Acquisition Adjustments |

Financing Adjustments |

Pro

Forma Condensed Combined |

|||||||||||||||

| Net income |

$ | 88.3 | $ | 193.0 | $ | (34.4 | ) | $ | (26.9 | ) | $ | 220.0 | ||||||||

| Net income attributable to non-controlling interests |

— | (10.0 | ) | 2.1 | — | (7.9 | ) | |||||||||||||

| (Benefit) provision for income taxes |

38.1 | 95.0 | (20.7 | ) | (16.1 | ) | 96.3 | |||||||||||||

| Interest income |

(0.2 | ) | — | — | — | (0.2 | ) | |||||||||||||

| Interest expense |

43.8 | — | — | 43.0 | 86.8 | |||||||||||||||

| Depreciation and amortization expense(b) |

68.0 | 32.0 | 82.4 | — | 182.4 | |||||||||||||||

| Transaction related costs, restructuring and other, net |

26.4 | 1.0 | (16.3 | ) | — | 11.1 | ||||||||||||||

| (Gains) on sale of assets(c) |

(19.3 | ) | — | — | — | (19.3 | ) | |||||||||||||

| Other(d) |

(8.6 | ) | — | — | — | (8.6 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | 236.5 | $ | 311.0 | $ | 13.1 | $ | — | $ | 560.6 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

13

| Year Ended December 31, 2011 | ||||||||||||||||||||

| Historical | Pro Forma Adjustments(a) | |||||||||||||||||||

| (in millions) | Georgia Gulf | PPG Chlor- alkali and Derivatives Business |

Acquisition Adjustments |

Financing Adjustments |

Pro

Forma Condensed Combined |

|||||||||||||||

| Net income |

$ | 57.8 | $ | 246.0 | $ | (65.2 | ) | $ | (35.8 | ) | $ | 202.8 | ||||||||

| Net income attributable to non-controlling interests |

— | (13.0 | ) | 3.0 | — | (10.0 | ) | |||||||||||||

| (Benefit) provision for income taxes |

(4.3 | ) | 122.0 | (39.1 | ) | (21.5 | ) | 57.1 | ||||||||||||

| Interest income |

(0.3 | ) | — | — | — | (0.3 | ) | |||||||||||||

| Loss on redemption and other debt costs |

4.9 | — | — | — | 4.9 | |||||||||||||||

| Interest expense |

65.7 | — | — | 57.3 | 123.0 | |||||||||||||||

| Depreciation and amortization expense(b) |

101.5 | 41.0 | 109.8 | — | 252.3 | |||||||||||||||

| Long-lived asset impairment charges |

8.3 | — | — | — | 8.3 | |||||||||||||||

| Restructuring costs |

3.3 | — | — | — | 3.3 | |||||||||||||||

| (Gains) on sale of assets(c) |

(1.2 | ) | — | — | — | (1.2 | ) | |||||||||||||

| Other(d) |

(12.8 | ) | — | 9.3 | — | (3.5 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | 222.9 | $ | 396.0 | $ | 17.8 | $ | — | $ | 636.7 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (a) | See Notes 2 and 3 to the Unaudited Pro Forma Condensed Combined Financial Statements for a discussion of the various pro forma adjustments. |

| (b) | The following is a reconciliation of the acquisition adjustments made to depreciation in Note 2, “Acquisition Adjustments” in the Unaudited Pro Forma Condensed Combined Financial Statements to the acquisition adjustments made to depreciation contained in this reconciliation of Adjusted EBITDA: |

| Twelve

Months Ended September 30, 2012 |

Nine

Months Ended September 30, 2012 |

Year Ended December 31, 2011 |

||||||||||

| (in millions) |

||||||||||||

| An increase in depreciation expense resulting from an increase in the value of the PPG Chlor-alkali and Derivatives Business’s property, plant and equipment |

$ | 38.2 | $ | 28.7 | $ | 38.2 | ||||||

| An increase in amortization expense resulting from adjustments to intangible assets |

71.6 | 53.7 | 71.6 | |||||||||

|

|

|

|

|

|

|

|||||||

| Depreciation and amortization expense pro forma acquisition adjustment included in the reconciliation of Adjusted EBITDA to net income (loss) determined in accordance with GAAP |

$ | 109.8 | $ | 82.4 | $ | 109.8 | ||||||

|

|

|

|

|

|

|

|||||||

| (c) | (Gains) on sale of assets for Georgia Gulf for the nine months ended September 30, 2012 primarily consists of a $17.4 million gain on the sale of our air separation plant in Plaquemine, Louisiana. Concurrent with the sale, we entered into a long-term supply agreement with the purchaser to supply the Plaquemine facility with the products made by the air separation unit at market prices. The remaining gain in the nine months ended September 30, 2012 and the year ended December 31, 2011 primarily relate to the sale of equipment and real estate related to a previously shut down plant. |

| (d) | “Other” for Georgia Gulf for the nine months ended September 30, 2012 consists of $3.0 million of loan cost amortization and $5.5 million of OMERS lease financing obligations interest. For the year ended December 31, 2011, “Other” for Georgia Gulf consists of $4.1 million in loan cost amortization, $7.4 million of OMERS lease financing obligations interest and a $4.4 million reversal of non-income tax reserves, partially offset by $3.0 million in acquisition costs and inventory purchase accounting adjustments. For the year ended December 31, 2011, “Other” in the Acquisition Adjustments column consists of $9.3 million inventory purchase accounting adjustment. |

14

Summary Historical Combined Financial Data of the PPG Chlor-alkali and Derivatives Business

Splitco, is a newly formed, direct wholly-owned subsidiary of PPG that was organized specifically for the purpose of effecting the Separation. The following summary historical combined financial data of the PPG Chlor-alkali and Derivatives Business for the years ended December 31, 2011, December 31, 2010 and December 31, 2009 and as of December 31, 2011 and December 31, 2010 has been derived from the audited combined financial statements of the PPG Chlor-alkali and Derivatives Business. The following summary historical condensed combined financial data of the PPG Chlor-alkali and Derivatives Business for the nine-month periods ended September 30, 2012 and September 30, 2011, and as of September 30, 2012, September 30, 2011 and December 31, 2009, has been derived from the unaudited condensed combined financial statements of the PPG Chlor-alkali and Derivatives Business, but is not necessarily indicative of the results or the financial condition to be expected for the remainder of the year or any future date or period. The management of the PPG Chlor-alkali and Derivatives Business believes that the unaudited condensed combined financial statements reflect all normal and recurring adjustments necessary for a fair presentation of the results as of and for the interim periods presented.

| Nine Months Ended September 30, |

Year Ended December 31, | |||||||||||||||||||

| 2012 | 2011 | 2011 | 2010 | 2009 | ||||||||||||||||

| (In Millions) | ||||||||||||||||||||

| Statement of Income Data: |

||||||||||||||||||||

| Net sales |

$ | 1,292 | $ | 1,340 | $ | 1,741 | $ | 1,441 | $ | 1,282 | ||||||||||

| Cost of sales, exclusive of depreciation and amortization |

884 | 927 | 1,224 | 1,117 | 1,001 | |||||||||||||||

| Selling, general and administrative |

91 | 91 | 123 | 102 | 100 | |||||||||||||||

| Depreciation and amortization |

32 | 31 | 41 | 39 | 40 | |||||||||||||||

| Research and development—net |

1 | 1 | 2 | 2 | 2 | |||||||||||||||

| Business restructuring |

1 | — | — | — | 6 | |||||||||||||||

| Other charges |

8 | 9 | 10 | 11 | 9 | |||||||||||||||

| Other earnings |

(13 | ) | (25 | ) | (27 | ) | (7 | ) | (12 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before income taxes |

288 | 306 | 368 | 177 | 136 | |||||||||||||||

| Income tax expense |

95 | 102 | 122 | 65 | 43 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income attributable to the controlling and noncontrolling interests |

193 | 204 | 246 | 112 | 93 | |||||||||||||||

| Less: Net income attributable to noncontrolling interests |

(10 | ) | (9 | ) | (13 | ) | (7 | ) | (5 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (attributable to the PPG Chlor-alkali and Derivatives Business) |

$ | 183 | $ | 195 | $ | 233 | $ | 105 | $ | 88 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance Sheet Data (at end of period): |

||||||||||||||||||||

| Total assets |

$ | 786 | $ | 718 | $ | 734 | $ | 621 | $ | 601 | ||||||||||

| Working capital |

176 | 131 | 119 | 81 | 77 | |||||||||||||||

| Other long-term obligations |

318 | 274 | 320 | 268 | 264 | |||||||||||||||

| Total Parent company shareholders’ equity |

241 | 222 | 181 | 132 | 130 | |||||||||||||||

| Cash Flow Data: |

||||||||||||||||||||

| Cash from operating activities |

$ | 172 | $ | 191 | $ | 276 | $ | 142 | $ | 133 | ||||||||||

| Cash used for investing activities |

$ | (31 | ) | $ | (56 | ) | $ | (86 | ) | $ | (43 | ) | $ | (22 | ) | |||||

| Cash used for financing activities |

$ | (153 | ) | $ | (131 | ) | $ | (174 | ) | $ | (95 | ) | $ | (123 | ) | |||||

15

Summary Historical Consolidated Financial Data of Georgia Gulf

The following summary historical consolidated financial data of Georgia Gulf for the years ended December 31, 2011, 2010 and 2009, and as of such dates, has been derived from Georgia Gulf’s audited consolidated financial statements as of and for the years ended December 31, 2011, 2010 and 2009. The following summary historical consolidated financial data as of and for the nine month periods ended September 30, 2012 and 2011 has been derived from the unaudited condensed consolidated financial statements of Georgia Gulf and is not necessarily indicative of the results or financial condition to be expected for the remainder of the year or for any future period. Georgia Gulf’s management believes that the unaudited condensed consolidated financial statements reflect all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of the results and the financial condition as of and for the interim periods presented.

| (In millions) | As of and for the Nine Months Ended September 30, |

As of and for the Year Ended December 31, |

||||||||||||||||||

| 2012 | 2011 | 2011 | 2010 | 2009 | ||||||||||||||||

| Results of Operations: |

||||||||||||||||||||

| Net sales |

$ | 2,541 | $ | 2,549 | $ | 3,223 | $ | 2,818 | $ | 1,990 | ||||||||||

| Cost of sales |

2,210 | 2,292 | 2,920 | 2,544 | 1,779 | |||||||||||||||

| Selling, general and administrative expenses |

153 | 130 | 168 | 160 | 183 | |||||||||||||||

| Long-lived asset impairment charges |

— | — | 8 | — | 22 | |||||||||||||||

| Transaction related costs, restructuring and other, net |

26 | 1 | 3 | — | 7 | |||||||||||||||

| (Gains) on sale of assets |

(19 | ) | (1 | ) | (1 | ) | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income (loss) |

171 | 127 | 125 | 114 | (1 | ) | ||||||||||||||

| Interest expense |

(44 | ) | (50 | ) | (65 | ) | (69 | ) | (131 | ) | ||||||||||

| Loss on redemption and other debt costs |

— | (1 | ) | (5 | ) | — | (43 | ) | ||||||||||||

| Gain on debt exchange(1) |

— | — | — | — | 401 | |||||||||||||||

| Foreign exchange loss |

(1 | ) | (1 | ) | (1 | ) | (1 | ) | (1 | ) | ||||||||||

| Interest income |

— | — | — | — | 1 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income from operations before taxes |

126 | 75 | 54 | 44 | 226 | |||||||||||||||

| Provision (benefit) for income taxes |

38 | 14 | (4 | ) | 1 | 95 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

$ | 88 | $ | 61 | $ | 58 | $ | 43 | $ | 131 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance Sheet Data: |

||||||||||||||||||||

| Net working capital(2) |

$ | 448 | $ | 407 | $ | 385 | $ | 400 | $ | 341 | ||||||||||

| Property, plant and equipment, net |

637 | 641 | 641 | 653 | 688 | |||||||||||||||

| Total assets |

1,801 | 1,835 | 1,644 | 1,666 | 1,605 | |||||||||||||||

| Total debt |

498 | 592 | 497 | 578 | 633 | |||||||||||||||

| Lease financing obligation |

114 | 108 | 110 | 112 | 106 | |||||||||||||||

| Cash Flow Data: |

||||||||||||||||||||

| Net cash provided by operating activities |

66 | 20 | 187 | 184 | 1 | |||||||||||||||

| Net cash (used in) investing activities |

(32 | ) | (115 | ) | (137 | ) | (45 | ) | (26 | ) | ||||||||||

| Net cash (used in) provided by financing activities |

(5 | ) | 16 | (86 | ) | (56 | ) | (29 | ) | |||||||||||

| Other Selected Data: |

||||||||||||||||||||

| Adjusted EBITDA(3) |

$ | 237 | $ | 194 | $ | 223 | $ | 201 | $ | 155 | ||||||||||

| Depreciation and amortization |

68 | 78 | 102 | 100 | 117 | |||||||||||||||

| Capital expenditures |

56 | 44 | 66 | 46 | 30 | |||||||||||||||

| Acquisition, net of cash acquired |

— | 71 | 71 | — | — | |||||||||||||||

| Maintenance expenditures |

129 | 107 | 109 | 137 | 104 | |||||||||||||||

16

| (1) | Reflects gain recognized from the extinguishment of certain outstanding notes that were exchanged in connection with Georgia Gulf’s private debt for equity exchange offers consummated on July 29, 2009. |

| (2) | Net working capital means current assets less current liabilities. |

| (3) | Georgia Gulf supplements its financial statements prepared in accordance with GAAP with Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization, cash and non-cash restructuring charges and certain other charges, if any, related to financial restructuring and business improvement initiatives, gains (loss) on substantial modification of debt and sales of certain assets, certain purchase accounting and certain non-income tax reserve adjustments, professional fees related to a previously disclosed and withdrawn unsolicited offer to acquire Georgia Gulf and the Merger, goodwill, intangibles, and other long-lived asset impairments, and interest expense related to the OMERS sale-leaseback transaction) because investors commonly use Adjusted EBITDA as a main component of valuation analysis of cyclical companies such as Georgia Gulf. Adjusted EBITDA is not a measurement of financial performance under GAAP and should not be considered as an alternative to net income (loss) as a measure of performance or to cash provided by operating activities as a measure of liquidity. In addition, Georgia Gulf’s calculation of Adjusted EBITDA may be different from the calculation used by other companies and, therefore, comparability may be limited. A reconciliation of Adjusted EBITDA to net income (loss) determined in accordance with GAAP is provided below: |

| Nine Months Ended September 30, |

Year Ended December 31, | |||||||||||||||||||

| (in millions) | 2012 | 2011 | 2011 | 2010 | 2009 | |||||||||||||||

| Net income |

$ | 88 | $ | 61 | $ | 58 | $ | 43 | $ | 131 | ||||||||||

| (Benefit) provision for income taxes |

38 | 14 | (4 | ) | 1 | 95 | ||||||||||||||

| Interest income |

— | — | — | — | (1 | ) | ||||||||||||||

| Gain on debt exchange(a) |

— | — | — | — | (401 | ) | ||||||||||||||

| Loss on redemption and other debt costs |

— | — | 5 | — | 43 | |||||||||||||||

| Interest expense |

44 | 50 | 65 | 69 | 131 | |||||||||||||||

| Depreciation and amortization expense |

68 | 78 | 102 | 100 | 118 | |||||||||||||||

| Long-lived asset impairment charges |

— | — | 8 | — | 22 | |||||||||||||||

| Restructuring costs |

26 | 1 | 3 | — | 7 | |||||||||||||||

| (Gains) on sale of assets |

(19 | ) | (1 | ) | (1 | ) | — | — | ||||||||||||

| Other (b) |

(8 | ) | (9 | ) | (13 | ) | (12 | ) | 10 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | 237 | $ | 194 | $ | 223 | $ | 201 | $ | 155 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (a) | Reflects gain recognized from the extinguishment of certain outstanding notes that were exchanged in connection with Georgia Gulf’s private debt for equity exchange offers consummated on July 29, 2009. |

| (b) | Other for all periods includes loan cost amortization, which is included in both the depreciation and amortization expense line item and interest expense line item above, and lease financing obligation interest. Other for the period ended September 30, 2011 also includes a $4.4 million reversal of non-income tax reserves, partially offset by $3.0 million acquisition costs and inventory purchase accounting adjustment. Other for the year ended December 31, 2011 also includes $3.0 million acquisition costs and inventory purchase accounting adjustment, partially offset by $4.4 million reversal of non-income tax reserves. Other for the year ended December 31, 2009 also includes $13.9 million of equity compensation related to the 2009 equity and performance incentive plan, $13.1 million of operational and financial restructuring consulting fees, partially offset by $9.6 million of loan cost amortization. |

17

You should carefully consider each of the following risks and all of the other information contained or incorporated herein in connection with any evaluation of Georgia Gulf. Some of the risks described below relate principally to the business and the industry in which we will operate after the Transactions, while others relate principally to the Transactions. The remaining risks relate principally to the offering of the notes. The risks described below are not the only risks that we face following the consummation of the Transactions. Additional risks and uncertainties not currently known or that are currently deemed to be immaterial may also materially and adversely affect our business operations and financial condition. In such a case, you may lose all or part of your investment in the notes.

Risks Related to Our Business

The chemicals industry is cyclical, seasonal and volatile, experiencing alternating periods of tight supply and overcapacity, and the building products industry is also cyclical and seasonal. This cyclicality adversely impacts our capacity utilization and causes fluctuations in our results of operations.

Georgia Gulf’s historical operating results for its chemical businesses have tended to reflect the cyclical and volatile nature of the chemicals industry. We expect to continue to be subject to cyclicality and volatility following the consummation of the Transactions. Historically, periods of tight supply of commodity chemicals have resulted in increased prices and profit margins thereon, and have been followed by periods of substantial capacity increase, resulting in oversupply and declining prices and profit margins for those products. A number of our chemical products are and will remain highly dependent on markets that are particularly cyclical, such as the building and construction, paper and pulp, and automotive markets. The chlor-alkali industry is also cyclical, both as a result of changes in demand for each of chlorine and caustic soda and as a result of changes in manufacturing capacity, and prices for both products respond rapidly to changes in supply and demand conditions in the industry. The chlor-alkali industry experiences its highest level of activity during the spring and summer months. The first and fourth quarter demand in the chlor-alkali industry usually reflects a decrease in construction and water treatment activity due mainly to weather patterns in those periods. As a result of changes in demand for our products, our operating rates and earnings fluctuate significantly, not only from year to year, but also from quarter to quarter, depending on factors such as feedstock costs, transportation costs, and supply and demand for the product produced at the facility during that period. In order to compensate for changes in demand, Georgia Gulf has historically operated individual facilities below or above rated capacities in any period, and we expect to continue this practice in the future. We may idle a facility for an extended period of time because an oversupply of a certain product or a lack of demand for that product makes production uneconomical. Facility shutdown and subsequent restart expenses may adversely affect periodic results when these events occur. In addition, a temporary shutdown may become permanent, resulting in a write-down or write-off of the related assets. Industry-wide capacity expansions or the announcement of such expansions have generally led to a decline in the pricing of our chemical products in the affected product line. Following the completion of the Transactions, we expect that we may be required to take similar actions in the future in response to cyclical conditions. We cannot provide any assurances that future growth in product demand will be sufficient to utilize any additional capacity.

In addition, the cyclical and seasonal nature of the building products industry, which is significantly affected by changes in national and local economic and other conditions such as employment levels, demographic trends, availability of financing, interest rates and consumer confidence, could negatively affect the demand for and pricing of our building products. For example, if interest rates increase, the ability of prospective buyers to finance purchases of home improvement products and invest in new real estate could be adversely affected, which, in turn, could adversely affect our financial performance. In response to the significant decline in the market for Georgia Gulf’s building and home improvement products beginning in 2008, Georgia Gulf closed facilities and sold certain businesses and assets and we continue to monitor cost control initiatives. In the near-term, it is unclear whether demand for these products will return and stabilize or whether demand for our building products will further decline.

18

Our operations and assets are and will continue to be subject to extensive environmental, health and safety laws and regulations; the costs associated with compliance with these regulations could materially adversely affect our financial condition and results of operations, and the failure to comply could expose us to material liabilities.

Our operations and assets are, and are expected to continue to be, subject to extensive environmental, health and safety regulation, including laws and regulations related to air emissions, water discharges, waste disposal and remediation of contaminated sites, at both the national and local levels in the U.S. We are also subject to similar laws and regulations in Canada and, after consummation of the Transactions, expect to be subject to similar regulations in other jurisdictions. The nature of the chemical and building products industries exposes, and is expected to continue to expose, us to risks of liability under these laws and regulations due to the production, storage, use, transportation and sale of materials that can cause contamination or personal injury, including, in the case of commodity chemicals, potential releases into the environment. Environmental laws may have a significant effect on the costs of use, transportation and storage of raw materials and finished products, as well as the costs of the storage and disposal of wastes. We have and will continue to incur substantial operating and capital costs to comply with environmental laws and regulations. In addition, we may incur substantial costs, including fines, damages, criminal or civil sanctions and remediation costs, or experience interruptions in its operations for violations arising under these laws and regulations.

For example, some environmental laws, such as the federal Superfund statute, impose joint and several liability for the cost of investigations and remedial actions on any company that generated, arranged for disposal of or transported waste to a disposal site, or selected or presently or formerly owned or operated a disposal site or a site otherwise contaminated by hazardous substances. A number of environmental liabilities have been associated with our facilities at Lake Charles, Louisiana that Georgia Gulf acquired as part of its acquisition of the vinyls business of CONDEA Vista Company (“CONDEA Vista,” which is now known as Sasol North America, Inc.) and which may be designated as Superfund sites. Although CONDEA Vista retained financial responsibility for certain environmental liabilities that relate to the acquired facilities that arose before the closing of the acquisition in November 1999, there can be no assurance that CONDEA Vista will be able to satisfy its obligations in this regard, particularly in light of the long period of time in which environmental liabilities may arise under the environmental laws. If CONDEA Vista fails to fulfill its obligations regarding these environmental liabilities, then we could be held responsible. Furthermore, we are severally responsible for, and do not have indemnification for, any environmental liabilities arising from certain other acquisitions, including several liabilities resulting from Royal Group’s operations prior to Georgia Gulf’s acquisition of that company.

In connection with the consummation of the Transactions, we will acquire a significant additional number of properties and amount of assets, which could materially increase our compliance costs and exposure to liabilities. The properties and assets associated with the PPG Chlor-alkali and Derivatives Business are subject to similar environmental health and safety laws and regulations, as are the properties and assets of Georgia Gulf, which could require or result in significant additional capital expenditures in future periods. For example, the PPG Chlor-alkali and Derivatives Business could be responsible for, and is engaged in discussing with various parties regarding an allocation of costs relating to certain environmental remediation plans at the Calcasieu River Estuary in Lake Charles, Louisiana. These costs could be material and, if incurred, would be expected to be incurred following the consummation of the Transactions. Further, PPG has recently settled with the Louisiana Department of Environmental Quality alleged violations of PPG’s Lake Charles facility’s air permit relating to the PPG Chlor-alkali and Derivatives Business. The settlement calls for a cash payment of $400,000 and the performance of Beneficial Environmental Projects expected to cost $220,000. In connection with the Transactions, this settlement is a liability of the PPG Chlor-alkali and Derivatives Business.

Separately, the PPG Chlor-alkali and Derivatives Business’s facility in Natrium, West Virginia is subject to a number of environmental uncertainties. This facility discharges wastewater into the Ohio River pursuant to a permit issued by the West Virginia Department of Environmental Protection. Because it discharges into the Ohio River, this facility’s permit terms must conform to pollution control standards for the Ohio River set by the Ohio

19

River Valley Water Sanitation Commission (“ORSANCO”). ORSANCO has adopted certain pollution control standards that prohibit, as of October 16, 2013, the use of a “mixing zone” as used by, among others, the PPG Chlor-alkali and Derivatives Business, to meet certain water quality standards. PPG, on behalf of the PPG Chlor-alkali and Derivatives Business, submitted a request for a variance from this prohibition and to allow for the continued use of a mixing zone for mercury for the life of the permit, and for any subsequent permits. On October 12, 2012, ORSANCO granted PPG’s request for a variance which will allow the PPG Chlor-alkali and Derivatives Business to continue to have a mixing zone for its discharge of mercury for a five-year period after ORSANCO’s prohibition on mixing zones takes effect on October 16, 2013. In addition, this facility operates a coal-fired power plant that it is currently anticipated may require capital expenditures in the range of $15-30 million in order to remain in compliance with the requirements of certain final regulations expected to be issued by the United States Environmental Protection Agency (the “EPA”) in 2012 relating to emissions standards for large and small boilers and incinerators that burn solid waste, known as Boiler maximum achievable control technology (“MACT”) regulations. No assurances as to the timing or content of the Boiler MACT regulations can be provided, and any final regulations may require the incurrence of significant additional costs beyond those currently anticipated.

As of September 30, 2012, the PPG Chlor-alkali and Derivatives Business had reserves for environmental contingencies totaling approximately $33 million of which $5 million was classified as a current liability.

For additional information on the potential environmental liabilities associated with the properties and assets of the PPG Chlor-alkali and Derivatives Business, including the expected timing and costs of actions related thereto, see the section entitled “Business—Environmental Regulation” and “—Legal Proceedings.”