Attached files

| file | filename |

|---|---|

| EX-21 - EXHIBIT 21 - AXIALL CORP/DE/ | a2196967zex-21.htm |

| EX-23 - EXHIBIT 23 - AXIALL CORP/DE/ | a2196967zex-23.htm |

| EX-32 - EXHIBIT 32 - AXIALL CORP/DE/ | a2196967zex-32.htm |

| EX-31 - EXHIBIT 31 - AXIALL CORP/DE/ | a2196967zex-31.htm |

| EX-4.4 - EXHIBIT 4.4 - AXIALL CORP/DE/ | a2196967zex-4_4.htm |

| EX-10.1 - EXHIBIT 10.1 - AXIALL CORP/DE/ | a2196967zex-10_1.htm |

| EX-10.27 - EXHIBIT 10.27 - AXIALL CORP/DE/ | a2196967zex-10_27.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS PART I

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2009

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 1-9753

GEORGIA GULF CORPORATION

(Exact name of registrant as specified in its charter)

| DELAWARE (State or other jurisdiction of incorporation or organization) |

58-1563799 (I.R.S. Employer Identification No.) |

|

115 Perimeter Center Place, Suite 460, Atlanta, Georgia (Address of principal executive offices) |

30346 (Zip Code) |

|

Registrant's telephone number, including area code: (770) 395-4500 |

||

Securities registered pursuant to Section 12(b) of the Act: |

||

Title of each class

|

Name of each exchange on which registered

|

|

|---|---|---|

| Common Stock, $0.01 par value | New York Stock Exchange, Inc. |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer o Non-accelerated filer ý Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

Aggregate market value of the common stock held by non-affiliates of the registrant, computed using the closing price on the New York Stock Exchange for the registrant's common stock on June 30, 2009 was $22,162,928.

Indicate the number of shares outstanding of the registrant's common stock as of the latest practicable date.

Class

|

Outstanding at March 5, 2010

|

|

|---|---|---|

| Common Stock, $0.01 par value | 33,722,121 shares |

DOCUMENTS INCORPORATED BY REFERENCE

(To the Extent Indicated Herein)

Proxy Statement for the Annual Meeting of Stockholders to be held on May 18, 2010, in Part III of this Form 10-K.

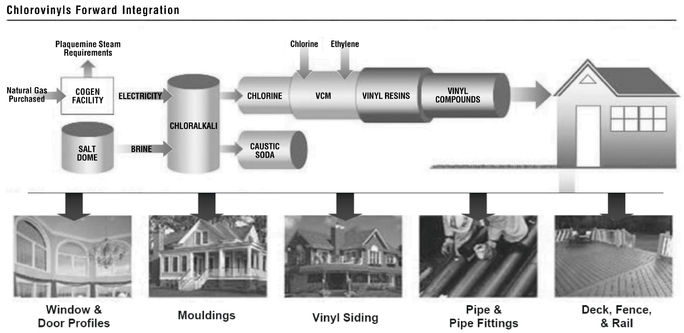

General

Georgia Gulf Corporation is a leading North American manufacturer and international marketer of two integrated chemical product lines, chlorovinyls and aromatics. Our primary chlorovinyls products are chlorine, caustic soda, ethylene dichloride ("EDC"), vinyl chloride monomer ("VCM"), vinyl resins, vinyl compounds and compound additives; and our aromatics products are cumene, phenol and acetone. On October 3, 2006, we completed the acquisition of Royal Group Technologies Limited, which was subsequently renamed Royal Group, Inc. ("Royal Group"), a leading North American manufacturer and marketer of vinyl-based building and home improvement products. Royal Group's core businesses now consist of five product lines: (i) window and door profiles; (ii) mouldings; (iii) siding; (iv) pipe and pipe fittings; and (v) deck, fence and rail products.

The Royal Group acquisition furthered our chlorovinyls forward integration strategy by providing a growth platform that leverages Georgia Gulf's vinyl resins and vinyl compounds formulation expertise, which we have refined over the last 20 years, with Royal Group's experience and innovative product development. We believe the acquisition will allow us to strengthen our competitive position through further penetration of Royal Group's markets. The following chart illustrates our chlorovinyls and building and home improvement products integration.

Recapitalization

We completed the acquisition of all of the outstanding common stock of Royal Group in 2006 for a total purchase price, including assumed debt and debt retired in conjunction with the closing, of approximately $1.5 billion. The acquisition was financed entirely with new debt, including $500.0 million in aggregate principal amount of new senior notes, $200.0 million in aggregate principal amount of new senior subordinated notes and $800.0 million principal amount of floating interest rate term debt under a new senior secured credit facility.

Demand for our building and home improvement products declined during 2008 as compared to 2007 primarily as a result of U.S. housing starts decreasing by about 33 percent according to a report furnished

1

jointly by the U.S. Census Bureau and the U.S. Department of Housing and Urban Development in January 2009. Similarly, in 2008 our chlorovinyls segment experienced decreased demand compared to 2007, primarily as a result of a continued weakness in the U.S. residential housing market.

As a result of the significant impact of the recession on the residential construction industry, we were required to obtain numerous waivers and amendments of certain restrictive covenants that required us to maintain certain financial ratios under our senior secured credit facility. In early 2009, we began to take actions to recapitalize our company.

On March 31, 2009, we commenced private exchange offers for our outstanding 7.125 percent senior notes due 2013 (the "2013 notes"), 9.5 percent senior notes due 2014 (the "2014 notes"), and 10.75 percent senior subordinated notes due 2016 (the "2016 notes" and collectively with the 2013 notes and 2014 notes, the "notes") and, in conjunction with the private exchange offers, withheld payment of $34.5 million of interest due April 15, 2009 for the 2014 and 2016 notes. After numerous extensions and amendments of the exchange offers and additional waivers and amendments under our senior secured credit facility, on July 29, 2009, we consummated our private exchange of equity for approximately $736.0 million (principal amount), or 92.0 percent, in aggregate principal amount of the notes. The $736.0 million was comprised of $91.0 million of the $100 million of 2013 notes, $486.8 million of the $500 million of 2014 notes, and $158.1 million of the $200 million of 2016 notes. An aggregate of approximately 30.2 million shares of convertible preferred stock and approximately 1.3 million shares of common stock were issued in exchange for the tendered notes after giving effect to a 1-for-25 reverse stock split, which reduced the outstanding common shares, before the issuance of common shares in the debt exchange, to approximately 1.4 million shares. In preparation and prior to this debt for equity exchange, we executed a 1-for-25 reverse stock split. In September 2009, following an amendment of our charter to increase our authorized shares of common stock to 100 million shares, approximately 30.2 million convertible preferred shares converted to an equal number of common shares. After giving effect to the debt exchange at December 31, 2009, we had outstanding $9.0 million of the 2013 notes, $13.2 million of the 2014 notes and $41.4 million of the 2016 notes. This debt for equity exchange was a troubled debt restructuring and thus an extinguishment of the notes for which we recognized a net gain of $400.8 million, or approximately $16.61 per share.

On December 22, 2009, we refinanced our senior secured credit facility and our $175.0 million asset securitization agreement. At the time of the refinancing, our senior secured credit facility was comprised of a $300.0 million revolving credit facility and a $347.7 million Term Loan B. We replaced the senior secured credit facility and asset securitization facility with a four-year term secured asset—based revolving credit facility that provides for a maximum of $300 million of revolving credit (including credit in the form of letters of credit and swingline loans) through December 2013, subject to borrowing base availability and other terms and conditions (the "ABL Revolver") and the issuance of $500.0 million in principal amount of our 9.0 percent senior secured notes. The borrowing base under the ABL Revolver is equal to specified percentages of our eligible accounts receivable and inventories, less a fixed $15 million availability reserve and other reserves reasonably determined by the co-collateral agents. The borrowings under the ABL Revolver are secured by substantially all of our assets.

The $500.0 million of senior secured 9.0 percent notes are due in 2017. The 9.0 percent notes are secured by substantially all of our assets and contain certain restrictive covenants including restrictions on debt incurrence, granting of liens, dividends, acquisitions and investments.

Our new capital structure significantly reduces our interest expense to approximately $70 million to $80 million annually from approximately $130 million in recent years and substantially eliminates quarterly maintenance covenants that were part of our debt agreements under our previous capital structure. However, we cannot be certain that our annual interest expense will always fall within a range of $70 million to $80 million, as the borrowings under our ABL Revolver are subject to variable interest rates, and thus, could increase substantially over time.

2

Segment Information

We operate through four reportable segments: chlorovinyls; window and door profiles and mouldings products; outdoor building products; and aromatics. These four reportable segments reflect the organization used by our management for purposes of allocating resources and assessing performance. The chlorovinyls segment is a highly integrated chain of products, which includes chlorine, caustic soda, EDC, VCM and vinyl resins, vinyl compounds and compound additives. Through the Royal Group acquisition, we acquired manufacturing facilities for vinyl-based building and home improvement products. Our vinyl-based building and home improvement products are primarily marketed under the Royal Group brand names, and are managed within two reportable segments, window and door profiles and mouldings; and outdoor building products, which includes the manufacturing of siding, pipe and pipe fittings and deck, fence, and rail products. The aromatics segment includes cumene and the co-products phenol, acetone and alpha methyl styrene ("AMS").

Reportable Segments

|

Key Products | |

|---|---|---|

Chlorovinyls |

Chlorine/Caustic Soda | |

|

EDC | |

|

VCM | |

|

Vinyl Resins | |

|

Vinyl Compounds | |

|

Compound Additives | |

Window and Door Profiles and Mouldings |

Window and Door Profiles |

|

|

Mouldings | |

Outdoor Building Products |

Siding |

|

|

Pipe and Pipe Fittings | |

|

Deck, Fence and Rail | |

Aromatics |

Cumene |

|

|

Phenol/Acetone | |

|

AMS |

For selected financial information concerning our four reportable segments and our domestic and international sales, see Note 19 of the Notes to the Consolidated Financial Statements included in Item 8.

Plant Closings and Temporary Plant Idlings

In May 2009, we announced plans to consolidate two plants in our window and door profiles and mouldings segment. As part of this plan, our window and door profiles plant in McCarran, Nevada was closed in November 2009 and one of our window and door profiles manufacturing plants in Vaughan, Ontario was closed in December 2009.

The phenol industry suffered from industry-wide supply and demand imbalance primarily as a result of capacity that was brought online in 1999 and 2000. Rather than continue running both of our phenol/acetone plants of our aromatics segment at lower capacity utilization rates, management temporarily idled the Pasadena, Texas phenol/acetone plant in the second quarter of 2002. Subsequently, we have been able to continue to meet all of our customers' needs with phenol/acetone production from our Plaquemine, Louisiana plant. We intend to restart the Pasadena, Texas phenol/acetone plant when market conditions warrant. The net book value of our idled Pasadena, Texas phenol/acetone plant was approximately $0.7 million as of December 31, 2009 and is included in property, plant and equipment on our consolidated balance sheet.

3

Products and Markets

Chlorovinyls

The chlorovinyls segment is a highly integrated chain of products, which includes chlorine, caustic soda, EDC, VCM, vinyl resins, vinyl compounds and compound additives. We have leading market positions in our key chemical products. In North America, we are one of the largest producers of VCM, vinyl resins, and vinyl compounds. The following table shows our total annual production capacities as of December 31, 2009, in our chlorovinyls product line:

Product Line

|

Capacity | |||

|---|---|---|---|---|

Vinyl Compounds |

1.3 billion pounds | |||

Vinyl Resins |

2.7 billion pounds | |||

VCM |

3.0 billion pounds | |||

Caustic Soda |

500,000 tons | |||

Chlorine |

450,000 tons | |||

Compound Additives |

162 million pounds | |||

Plasticizers |

22 million pounds | |||

Vinyl Compounds and Compound Additives. Vinyl compounds are formulated to provide specific end-use properties that allow them to be processed directly into finished products. We produce flexible and rigid compounds, which are used in many different applications, including wire and cable insulation and jacketing, electrical outlet boxes and pipe fittings, window and furniture profiles and food-grade and general-purpose bottles. We also supply chlorinated vinyl compounds, or CPVC, to the extrusion and injection molding markets, mainly for production of hot water pipe and pipe fittings.

We have four vinyl compound facilities located in Aberdeen, Gallman, Madison and Prairie, Mississippi. As a result of the Royal Group acquisition, we acquired several vinyl compound manufacturing facilities in Vaughan, Ontario and a compound additives manufacturing facility located in Bradford, Ontario. Additionally, certain Royal Group extrusion plants contain compounding facilities. Substantially all of the vinyl compounds produced by Royal Group are used internally in Royal Group's extrusion operations. The additives plant produces lubricants, stabilizers, impact modifiers and process aids used in the production of compounds, which are part of the typical compound formulations. The majority of our additives are consumed internally.

Vinyl Resins. Vinyl resins are among the most widely used plastics in the world today, and we supply numerous grades of vinyl resins to a broad number of end-use markets. During 2009, approximately 69 percent of Georgia Gulf's vinyl resins production was sold into the merchant market where our vinyl resins were used in a wide variety of flexible and rigid vinyl end-use applications. In 2009, the largest end-uses of our products were for pipe and pipe fittings, siding and window profiles. Approximately 31 percent of our vinyl resins are used internally in the manufacture of our vinyl compounds and vinyl building products.

VCM. During 2009, we used about 99 percent of our VCM production in the manufacture of vinyl resins in our PVC manufacturing operations. VCM production not used internally is sold to other vinyl resins producers in domestic and international markets.

Chlor-alkali Products. All of the chlorine we produce is used internally in the production of VCM. As a co-product of chlorine, caustic soda further diversifies our revenue base. We sell substantially all of our caustic soda domestically and overseas to customers in numerous industries, with the pulp and paper, chemical and alumina industries constituting our largest markets. Other markets for our caustic soda include soap and detergents and the water treatment industries.

4

Window and Door Profiles and Mouldings

In our window and door profiles and mouldings segment, we currently operate 11 manufacturing facilities located in Canada and the U.S. In addition we operate distribution centers, some of which are co-located with manufacturing plants. The window and door profiles and mouldings segment consists of extruded vinyl window and door profiles as well as interior and exterior mouldings, in which we have leading market positions.

Window and Door Profiles. Our window and door profiles products represent the largest portion of revenues within our building and home improvement products lines. We manufacture and extrude vinyl window profiles including frames, sashes, trim and other components, as well as vinyl patio door components and fabricated patio doors, which are sold primarily to window and door fabricators. Our sales are primarily to the custom segment of the vinyl window profile market with the profile design customized to a window fabricator's specific requirements.

Mouldings. We manufacture and market extruded decorative mouldings and millwork. Our decorative trim products are used for interior mouldings, such as crown, base and chair rail. For exterior mouldings, our products are used in applications such as brick mouldings, and as components used in the fabrication of doors, windows and spas. This product line includes a series of offerings, such as bendable trim and paintable/stainable trim.

Outdoor Building Products

In our outdoor building products segment, our continuing operations include 11 manufacturing facilities, which produce siding, pipe and pipe fittings, deck, fence and rail, and fabricated aluminum products. In addition, we operate distribution centers, some of which are co-located with manufacturing plants and 21 of which are free-standing facilities.

Siding. We manufacture vinyl siding, and we also offer a wide range of complementary accessories including vinyl soffit, aluminum soffit, fascia and trim and molded vent mounts and exterior shutters. We have a broad product offering of vinyl siding styles, including a premium vinyl siding that includes rich, dark, color-fast shades as well as a siding system, which enables siding panels to withstand harsh wind conditions.

Pipe and Pipe Fittings. We manufacture pipe and pipe fittings for the municipal and electrical markets, as well as pipe for plumbing applications. Our municipal pipe and pipe fittings product lines are used in potable water applications as well as for storm and sewer applications. Our plumbing lines are used in residential and industrial applications to move storm and sanitary wastewater from the building to the municipal sewer at the property line. This product line is primarily targeted at drain, waste and vent applications. Electrical, pipe, conduit and fittings are available in a wide variety of sizes and configurations, to meet the needs of both commercial and residential applications.

Deck, Fence and Rail. We manufacture vinyl deck, fence and rail products that are used for both the do-it-yourself ("D-I-Y") and professionally installed segments of the market. Products directed at the D-I-Y segment such as D-I-Y fencing are made in pre-built sections designed for quick and easy installation, and are sold through big-box home improvement retail stores. We offer many different fence styles for the professional installer. We also offer decorative columns and rail to complement our fence products. Royal Group's deck, fence and rail product lines are positioned as a lower-maintenance alternative to conventional wood and metal products.

5

Aromatics

The aromatics segment is also integrated and includes cumene and the co-products phenol and acetone. We operate the world's largest cumene plant.

The following table shows our total annual production capacities as of December 31, 2009 in our aromatics product line:

Product Line

|

Capacity | |

|---|---|---|

Phenol* |

660 million pounds | |

Acetone* |

408 million pounds | |

Cumene |

2.0 billion pounds |

- *

- Capacity includes our plant in Pasadena (160 million pounds of phenol and 100 million pounds of acetone), which has been temporarily idled.

Cumene. Cumene is used as an intermediate to make phenol and acetone. About 31 percent of our cumene was consumed internally during 2009 to produce phenol and acetone. Cumene production not used internally is sold to other phenol and acetone manufacturers in domestic and international markets, and is sold as an additive in gasoline blending.

Phenol. Our phenol is sold to a broad base of customers who are producers of a variety of phenolic resins, engineering plastics and specialty chemicals. Phenolic resins are used as adhesives for wood products such as plywood and Oriented Strand Board, or OSB. Engineering plastics are used in compact discs, digital video discs, automobiles, household appliances, electronics and protective coating applications. We also sell phenol for use in insulation, electrical parts, oil additives and chemical intermediates. In 2009, the largest sales segment of our phenol was the chemical/specialty chemical sector.

Acetone. As a co-product of phenol, acetone further diversifies our revenue base. Acetone is a chemical used primarily in the production of acrylic resins, engineering plastics and industrial solvents. We sell the majority of our acetone into the acrylic resins market, where it is used in the manufacture of various plastics and coatings used for signage, automotive parts, household appliances, paints and industrial coatings. Other uses range from solvents for automotive and industrial applications to pharmaceuticals and cosmetics.

Production, Raw Materials and Facilities

Our operations are highly vertically integrated as a result of our production of some of the key raw materials and intermediates used in the manufacture of our products. Our operational integration enhances our control over production costs and capacity utilization rates, as compared to our non-integrated competitors.

Chemical Products. In our chlorovinyls segment, we produce chlorine and its co-product caustic soda by electrolysis of salt brine. We produce VCM by reacting purchased ethylene with chlorine, which is both produced internally and purchased from third parties; our internal production of VCM slightly exceeds our internal demand requirements. We produce vinyl resins by polymerization of VCM in a batch reactor process. We formulate our vinyl compounds by blending our vinyl resins with various additives such as plasticizers, impact modifiers, stabilizers and pigments, most of which are purchased. We also have the capacity to produce EDC, an intermediate in the manufacture of VCM, for external sales. In our aromatics segment, we produce cumene utilizing benzene and refinery grade propylene ("propylene") purchased from third parties. Cumene is then oxidized to produce cumene hydroperoxide, which is split into the co-products phenol and acetone.

6

The significant raw materials we purchase from third parties include ethylene, benzene, natural gas, propylene, compound additives and chlorine. The majority of our purchases of ethylene and chlorine are made under long-term supply agreements, and we purchase natural gas, benzene and propylene in both the open market and under long-term contracts. We believe we have reliable sources of supply for our raw materials under normal market conditions. We cannot, however, predict the likelihood or impact of any future raw material shortages. Any shortages could have a material adverse impact on our results of operations.

Plaquemine, Louisiana Facilities. Our operations at these facilities include the production of chlorine, caustic soda, VCM, vinyl resins, phenol and acetone. We have a long-term lease on a nearby salt dome with reserves in excess of twenty years from which we supply our salt brine requirements. We use all of our chlorine production in the manufacture of VCM at this facility, and we sell substantially all of our caustic soda production externally. All of the ethylene requirements for our VCM production are supplied by pipeline. Most of our Plaquemine VCM production is consumed on-site in our vinyl resins production or shipped to our other vinyl resins facilities with the remainder sold to third parties. We manufacture a significant portion of our vinyl resins production at this facility. As part of a modernization project at this facility completed in 2007, we increased our vinyl resins production capacity by approximately 450 million pounds annually. Our cumene requirements for the production of phenol and its co-product acetone are shipped from our Pasadena, Texas facility by dedicated barges.

Our 250-megawatt cogeneration facility supplies all of the electricity and steam needs at our Plaquemine facilities. We also own an on-site air separation unit operated by a third party that provides all of the Plaquemine facility's nitrogen and oxygen gas requirements.

Lake Charles, Louisiana Facilities. We produce VCM at our Lake Charles, Louisiana facility and through our manufacturing joint venture, PHH Monomers, LLC, which is located in close proximity to our Lake Charles VCM facility. PHH Monomers is a joint venture with PPG Industries, Inc. that entitles us to 50 percent of the VCM production. Virtually all of the chlorine and ethylene needs of our Lake Charles VCM facility and PHH Monomers facility are supplied by pipeline. VCM from these facilities supplies our Aberdeen, Mississippi facility. On occasion, a small portion of VCM produced at the Lake Charles facilities is sold on spot sales to third parties.

Aberdeen, Mississippi Facility. We produce vinyl resins at our Aberdeen, Mississippi facility from VCM supplied by railcar from our various VCM facilities. In addition, the Aberdeen facility produces plasticizers, which are consumed internally for flexible vinyl compound production.

Vinyl Compounds and Compound Additives Facilities. We operate compound facilities in Aberdeen, Gallman, Madison and Prairie, Mississippi and Vaughan, Ontario. We also produce vinyl compounds in certain of our extrusion plants. All of these vinyl compound facilities are supplied from our vinyl resins facilities by railcar, truck or in the case of Aberdeen, pipeline. Additionally, we produce some of our compound additives at our Bradford, Ontario facility and purchase the remainder from various sources at market prices.

Pasadena, Texas Facilities. At our Pasadena, Texas facilities we have the capability to produce cumene, phenol and acetone. We produce cumene utilizing purchased benzene and propylene. Our cumene facility is integrated by pipeline with our phenol and acetone facility at Pasadena. Currently, due to the temporary idling of phenol and acetone production at Pasadena (discussed above), all of the cumene production at this facility is either shipped to the Plaquemine phenol and acetone facility or sold to third parties. We purchase propylene and benzene at market prices from various suppliers delivered by multiple transportation modes to our cumene facility. A portion of the benzene is supplied under contracts at market prices, and the propylene is provided from numerous refineries at market prices. Based on current industry capacity, we believe we have adequate access to benzene and propylene under normal conditions.

7

Building and Home Improvement Products. In our building and home improvement product lines, we produce vinyl window and door profiles, mouldings, siding, pipe and pipe fittings, and deck, fence and rail products. The principal raw material we use in production is vinyl resin, which is blended with other compound additives to form vinyl compounds, which are then extruded or injection molded. We believe internal production of vinyl resins, compounds and most compound additives by our chlorovinyls segment assures quality and facilitates efficient production of our vinyl-based products. Additives assist in processing vinyl resins efficiently and can be used to make the resulting product flexible or rigid, to add color or texture or other desired properties. For example, UV inhibitors may be added to protect an exterior product from sun damage, which could cause fading.

Extrusion is a process by which vinyl compounds are heated until they melt and then forced through a uniquely shaped opening, referred to as a die, to form various shapes and thickness. For example, when producing decking, a slip resistant design may be embossed onto the planks. Variations in extrusion are used to give products other desired qualities. For example, in producing mouldings and some deck products, we use cellular extrusion, which involves the process of encapsulating air bubbles in the vinyl extrusion, which reduces weight and cost. As the extruded product leaves the die, it is immediately cooled resulting in resolidification of the vinyl into a product matching the die pattern. Cooling is accomplished by using water and/or air.

We also produce some pipe fittings through injection molding. These products are produced by heating vinyl compounds until they melt and then injecting them under pressure into a hollow mold to create three dimensional parts.

Facilities. We operate numerous manufacturing facilities in Canada and the U.S. to produce our building and home improvement products. Vinyl resins and vinyl compounds as well as compound additives from the plants operated by our chlorovinyls segment are supplied to our facilities by truck or rail. We also purchase additional additives from various sources at market prices. The other principal cost to produce these products is electricity to power our facilities.

Operation of numerous manufacturing facilities located strategically near customers, such as is the case in our window and door profiles division, facilitates marketing and customer support and also minimizes transportation costs. Transportation costs limit sales of pipe from our facilities. Because our pipe plants are located in Ontario and British Columbia, sales of our pipe are concentrated within the northeastern and northwestern portions of Canada and the U.S. Our building and home improvement products are delivered primarily by truck.

Seasonality

Operating income for all four of our reportable segments is affected by the seasonality of the construction industry, which experiences its highest level of activity during the spring and summer months. Therefore, our second and third quarter operating results are typically the strongest. Our first and fourth quarter operating results usually reflect a decrease in construction activity due to colder weather and holidays.

Inventory Practices and Product Returns

In our chlorovinyls business, by the nature of our products, we do not maintain significant inventories and product returns are insignificant.

As is typical for the industry, in our home improvement and building products business, we maintain stocks of inventories in most of our product lines. We generally build additional inventory in advance of the peak construction season to assure product availability.

8

Generally, our home improvement and building products may be returned only if defective. However, in certain circumstances, we may allow the return of products as a customer accommodation, such as in the case of a change in product lines.

Sales and Marketing

No single customer accounted for more than 6 percent of our consolidated revenues for the years ended December 31, 2009, 2008, and 2007. In addition to our domestic sales, we export some of our products.

Chemical Products. Our sales and marketing program is aimed at supporting our existing customers and expanding and diversifying our customer base. In our chemicals business, we have a dedicated sales force organized by product line and region. In addition, we use distributors to market products to smaller customers. We have a product development and technical service staff that primarily supports our vinyl resins and vinyl compounds businesses. This staff works closely with customers to qualify existing Georgia Gulf products for use by our customers.

Building and Home Improvement Products. In our building products business, sales and marketing activities vary by product line and distribution channel. Our window and door profiles are primarily sold by our dedicated sales force and supported by marketing support activities that may include brochure development for window fabricators, technical advisory and design services for fabricators and advertising directed at installers suggesting that they look for windows fabricated with Royal Group profiles. Our mouldings products are distributed primarily by our dedicated sales force to independent dealers, fabricators, distributors and home centers, who resell the products directly to builders, installers or homeowners. The majority of our vinyl siding and accessories sales are in North America, where products are distributed through independent building product distributors, who are solicited primarily by Royal Group's dedicated sales force. In Canada, vinyl siding and accessories are distributed through company-owned as well as independent building product distributors. These distributors generally sell to professional building product installers in North America. Sales of pipe and pipe fittings are generally sold through municipal and electrical distributors. Our sales and technical staff work with end use customers to provide technical information to promote the use of our PVC pipe and fitting products. The majority of pipe and pipe fitting sales occur in Canada, where products are sold nationally through pipe distributors to contractors. In the United States, we sell our pipe fittings nationally, but sell our pipe only in the Northeast and Northwest due to close proximity to Canadian manufacturing plants and higher costs associated with shipping to other regions. Deck, fence and rail products are sold through retail home improvement stores, and are also sold to professionals through distributors. The sales force for these products is primarily company employees. Royal Group engages in advertising programs primarily directed at trade professionals that are intended to develop awareness and interest in its products. In addition, Royal Group displays its products at a series of national and regional trade shows.

Competition

We experience competition from numerous manufacturers in our chlorovinyls, aromatics and building and home improvement products businesses. We compete on a variety of factors including price, product quality, delivery and technical service.

In our chemicals business, we face competition from numerous manufacturers of chemicals and vinyl resins and compounds. In our building and home improvement products business, we face competition for each of our products from other manufacturers of vinyl products as well as numerous manufacturers of traditional building materials. We believe that our vinyl building and home improvement products are preferred by builders and homeowners because of their durability and ease of installation and maintenance as compared to traditional building materials. In the window and door profile market, we face competition from manufacturers of wood, aluminum and fiberglass products. In the siding market, we face competition

9

from manufacturers of cement, brick, wood, stucco, stone, concrete and aluminum products. We face competition from manufacturers of concrete and metal products in the pipe and pipe fittings market. Similarly, we face competition from manufacturers of composite materials, wood and metal products in the deck, fence and rail markets. In addition, competition for certain price sensitive products from countries such as China is increasing.

In all businesses, we believe that we are well-positioned to compete as a result of integrated product lines and the operational efficiency of our plants and, in the case of our chemical plants, the proximity of our facilities near major water and/or rail transportation terminals. We also believe that for many of our extruded products, our ability to produce our dies internally is a competitive advantage over producers who must rely on third parties. For example, we believe our ability to produce our own dies generally results in our responding more quickly and efficiently to the customer. Finally, we believe the breadth of our extruded building and home improvement product lines to be a source of competitive advantage.

Environmental Regulation

Our operations are subject to increasingly stringent federal, state and local laws and regulations relating to environmental quality. These regulations, which are enforced principally by the United States Environmental Protection Agency ("USEPA") and comparable state agencies and Canadian federal and provincial agencies, govern the management of solid hazardous waste, emissions into the air and discharges into surface and underground waters, and the manufacture of chemical substances. In addition to the matters involving environmental regulation above and the matters discussed in Item 3 "Legal Proceedings," we have the following potential environmental issues.

In the first quarter of 2007, the USEPA informed us of possible noncompliance at our Aberdeen, Mississippi facility with certain provisions of the Toxic Substances Control Act. Subsequently, we discovered possible non-compliance involving our Plaquemine, Louisiana and Pasadena, Texas facilities, which were then disclosed. We expect that all of these disclosures will be resolved in one settlement agreement with USEPA. While the penalties, if any, for such noncompliance may exceed $100,000, we do not expect that any penalties will have a material effect on our financial position, results of operations, or cash flows.

There are several serious environmental issues concerning the VCM facility at Lake Charles, Louisiana we acquired from CONDEA Vista Company ("CONDEA Vista" is now Sasol North America, Inc.) on November 12, 1999. Substantial investigation of the groundwater at the site has been conducted, and groundwater contamination was first identified in 1981. Groundwater remediation through the installation of groundwater recovery wells began in 1984. The site currently contains an extensive network of monitoring wells and recovery wells. Investigation to determine the full extent of the contamination is ongoing. It is possible that offsite groundwater recovery will be required, in addition to groundwater monitoring. Soil remediation could also be required.

Investigations are currently underway by federal environmental authorities concerning contamination of an estuary near the Lake Charles VCM facility we acquired known as the Calcasieu Estuary. It is likely that this estuary will be listed as a Superfund site and will be the subject of a natural resource damage recovery claim. It is estimated that there are about 200 potentially responsible parties ("PRPs") associated with the estuary contamination. CONDEA Vista is included among these parties with respect to its Lake Charles facilities, including the VCM facility we acquired. The estimated cost for investigation and remediation of the estuary is unknown and could be quite costly. Also, Superfund statutes may impose joint and several liabilities for the cost of investigations and remedial actions on any company that generated the waste, arranged for disposal of the waste, transported the waste to the disposal site, selected the disposal site, or presently or formerly owned, leased or operated the disposal site or a site otherwise contaminated by hazardous substances. Any or all of the responsible parties may be required to bear all of the costs of cleanup regardless of fault, legality of the original disposal or ownership of the disposal site.

10

Currently, we discharge our wastewater to CONDEA Vista, which has a permit to discharge treated wastewater into the estuary.

CONDEA Vista has agreed to retain responsibility for substantially all environmental liabilities and remediation activity relating to the vinyls business we acquired from it, including the Lake Charles, Louisiana VCM facility. For all matters of environmental contamination that were currently known at the time of acquisition (November 1999), we may make a claim for indemnification at any time. For environmental matters that were then unknown, we must generally have made such claims for indemnification before November 12, 2009. No such material claims were made.

At our Lake Charles VCM facility, CONDEA Vista continued to conduct the ongoing remediation at its expense until November 12, 2009. We are now responsible for remediation costs up to about $150,000 of expense per year, as well as costs in any year in excess of this annual amount up to an aggregate one-time amount of about $2.3 million. As part of our ongoing assessment of our environmental contingencies, we determined these remediation costs to be probable and estimable and therefore maintained a $2.2 million accrual in non-current liabilities at December 31, 2009.

As for employee and independent contractor exposure claims, CONDEA Vista is responsible for exposures before November 12, 2009, and we are responsible for exposures after November 12, 2009, on a pro rata basis determined by years of employment or service before and after November 12, 1999, by any claimant.

In May 2008, our corporate management was informed that further efforts to remediate a spill of styrene reducer at our Royal Mouldings facility in Atkins, Virginia would be necessary. The spill was the result of a supply line rupture from an external holding tank. As a result of this spill, the facility entered into a voluntary remediation agreement with the Virginia Department of Environmental Quality ("VDEQ") in August 2003 and began implementing the terms of the voluntary agreement shortly thereafter. In August 2007, the facility submitted a report on the progress of the remediation to the VDEQ. Subsequently, the VDEQ responded by indicating that continued remediation of the area impacted by the spill is required. While the additional remediation costs may exceed $100,000, we do not expect such costs will have a material effect on our financial position, results of operations or cash flows.

We believe that we are in material compliance with all current environmental laws and regulations. We estimate that any expenses incurred in maintaining compliance with these requirements will not materially affect earnings or cause us to exceed our level of anticipated capital expenditures. However, there can be no assurance that regulatory requirements will not change, and it is not possible to accurately predict the aggregate cost of compliance resulting from any such changes.

Although we are not aware of any significant environmental liabilities associated with Royal Group, should any arise, we would have no third party indemnities for environmental liabilities, including liabilities resulting from Royal Group's operations prior to our acquisition of the company.

Employees

As of December 31, 2009 and 2008, we had 3,489 and 4,463, respectively, full-time employees. The decrease in number of employees represents part of management's continuing cost reduction strategy. We employ approximately 444 employees under collective bargaining agreements that expire at various times from 2010 through 2014. We believe our relationships with our employees are good.

11

Available Information

We make available free of charge on our website at www.ggc.com our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) of the Securities Exchange Act of 1934 as soon as reasonably practicable after we electronically file such materials with, or furnish them to, the Securities and Exchange Commission ("SEC").

Our business, financial condition and results of operations may be adversely affected by the risks described below as well as the other risks described in this Annual Report on Form 10-K.

The chemical industry is cyclical and volatile, experiencing alternating periods of tight supply and overcapacity, and the building products industry is also cyclical. This cyclicality adversely impacts our capacity utilization and causes fluctuations in our results of operations.

Our historical operating results for our chemical businesses have tended to reflect the cyclical and volatile nature of the chemical industry. Historically, periods of tight supply have resulted in increased prices and profit margins and have been followed by periods of substantial capacity addition, resulting in oversupply and declining prices and profit margins. A number of our chemical products are highly dependent on markets that are particularly cyclical, such as the building and construction, paper and pulp, and automotive markets. As a result of changes in demand for our products, our operating rates and earnings fluctuate significantly, not only from year to year but also from quarter to quarter, depending on factors such as feedstock costs, transportation costs, and supply and demand for the product produced at the facility during that period. As a result, individual facilities may operate below or above rated capacities in any period. We may idle a facility for an extended period of time because an oversupply of a certain product or a lack of demand for that product makes production uneconomical. Facility shutdown and subsequent restart expenses may adversely affect quarterly results when these events occur. In addition, a temporary shutdown may become permanent, resulting in a write-down or write-off of the related assets. Capacity expansions or the announcement of these expansions have generally led to a decline in the pricing of our chemical products in the affected product line. We cannot assure that future growth in product demand will be sufficient to utilize any additional capacity.

In addition, the building products industry is cyclical and seasonal and is significantly affected by changes in national and local economic and other conditions such as employment levels, demographic trends, availability of financing, interest rates and consumer confidence, which factors could negatively affect the demand for and pricing of our building products. For example, if interest rates increase, the ability of prospective buyers to finance purchases of home improvement products and invest in new real estate could be adversely affected, which, in turn, could adversely affect our financial performance. In response to the recent significant decline in the market for our building and home improvement products, we have closed facilities and sold certain businesses and assets. We are continuing to take further actions and implement cost control initiatives; however, it is uncertain as to when demand will return, or whether demand for our products will decline further, and when these businesses will return to profitability.

Our substantial level of indebtedness could adversely affect our financial condition and prevent us from fulfilling our obligations under our senior secured notes and our other indebtedness or force us to take other actions to satisfy these obligations.

We have substantial indebtedness which requires significant interest payments, including interest payments of approximately $63 million in 2010, based on interest rates in effect at December 31, 2009. As of December 31, 2009, we had total indebtedness of $739.0 million, including $500.0 million outstanding under our 9.0 percent notes, $56.5 million drawn under the new asset-based revolving credit facility that

12

provides for a maximum of $300 million of revolving credit, subject to borrowing base availability and other terms and conditions (the "ABL Revolver"), $106.4 million of lease financing obligations, $22.1 million of senior unsecured notes, $41.4 million of senior subordinated notes and $15.9 million of other debt. As of December 31, 2009, we had $134.5 million of undrawn availability under our new ABL Revolver, after giving effect to $45.2 million of outstanding letters of credit. Our high level of indebtedness could have important consequences. For example, it could:

- •

- make it more difficult for us to satisfy our obligations, exposing us to the risk of default, which could result in a

foreclosure on our assets, which, in turn, would negatively affect our ability to operate as a going concern;

- •

- require us to dedicate a substantial portion of our cash flow from operations to interest and principal payments on our

indebtedness, reducing the availability of our cash flow for other purposes, such as capital expenditures, acquisitions, dividends and working capital;

- •

- limit our flexibility in planning for, or reacting to, changes in our business and the industries in which we operate;

- •

- increase our vulnerability to general adverse economic and industry conditions;

- •

- place us at a disadvantage compared to our competitors that have less debt;

- •

- expose us to fluctuations in the interest rate environment because the interest rates on borrowings under our new ABL

Revolver are variable;

- •

- increase our cost of borrowing; and

- •

- limit our ability to borrow additional funds.

If our cash flows are insufficient to fund our debt service obligations, we may be forced to sell assets, seek additional capital or restructure or refinance our indebtedness. These alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations. In addition, the terms of existing or future debt agreements, including our new ABL Revolver and the indenture relating to our 9.0 percent notes may restrict us from pursuing any of these alternatives. However, if we satisfy the various restrictive conditions in our debt agreements that address our ability to incur additional indebtedness, and we incur additional new debt, the risks associated with our high level of indebtedness could intensify.

Our new ABL Revolver and the indenture governing the 9.0 percent notes impose significant operating and financial restrictions on us and our subsidiaries, which may prevent us from capitalizing on business opportunities and taking some actions.

The agreements that govern the terms of our debt, including our new ABL Revolver and the indenture that governs the 9.0 percent notes, impose significant operating and financial restrictions on us. These restrictions limit our ability to, among other things:

- •

- incur additional indebtedness;

- •

- incur liens;

- •

- make investments and sell assets, including the stock of subsidiaries;

- •

- pay dividends and make other distributions;

- •

- purchase our stock;

- •

- engage in business activities unrelated to our current business;

- •

- enter into transactions with affiliates; or

- •

- consolidate, merge or sell all or substantially all of our assets.

13

As a result of these covenants and restrictions, we will be limited in how we conduct our business and we may be unable to raise additional debt or equity financing to compete effectively or to take advantage of new business opportunities. The terms of any future indebtedness we may incur could include more restrictive covenants. A breach of any of these covenants could result in a default in respect of the related indebtedness. If a default occurs, the relevant lenders could elect to declare the indebtedness, together with accrued interest and other fees, to be due and payable immediately and proceed against any collateral securing that indebtedness.

Furthermore, there are limitations on our ability to incur the full $300.0 million of commitments under our new ABL Revolver. Borrowings under our new ABL Revolver are limited by a specified borrowing base consisting of a percentage of eligible accounts receivable and inventory, less customary reserves. In addition, if our availability under the ABL Revolver falls below a certain amount, we will be subject to a minimum fixed charge maintenance covenant, which will require us to maintain a fixed charge coverage ratio of at least 1.1 to 1.0. Our ability to meet the required fixed charge coverage ratio can be affected by events beyond our control, and we cannot assure you we will meet this ratio. A breach of any of these covenants could result in a default under our new ABL Revolver.

A further deterioration in business conditions, or material interruption in our operations, could cause us to default on our indebtedness, which could result in loss of our sources of liquidity, or an acceleration of our principal indebtedness.

We principally operate in the North American chemicals and building products markets, which have suffered a substantial decline as a result of the severe downturn in the U.S. housing industry and the general worldwide recession resulting in a reduced demand for our products. In response principally to our resulting weakened financial condition, in July 2009, we completed equity-for-debt exchanges, which substantially reduced our debt and relieved us of certain covenant obligations and we obtained amendments to the financial covenants in our senior secured credit agreement. In December 2009 we entered into a new ABL Revolver because, among other things, it does not require compliance with maximum leverage ratios. While we believe that we should be able to meet the covenants under the new ABL Revolver, we may be unable to do so, particularly if business conditions further deteriorate to a material degree, or we suffer significant interruption of our operations. Further, deteriorating business conditions could result in declines in our accounts receivable and inventories thereby lowering the availability of borrowings under the ABL Revolver. In any of these events, we would need to seek an amendment to, or a waiver or refinancing of, our new ABL Revolver, although there can be no assurance that we could do so, and even if we do, it is likely that such relief would significantly increase our costs through additional fees or increased rates and may only last for a specified period, potentially necessitating additional amendments, waivers or refinancing in the future. In the event we do not maintain compliance with the covenants under the new ABL Revolver, our lenders under such facility could cease making loans to us and accelerate and declare due all outstanding loans under the facility.

Natural gas, electricity, fuel and raw materials costs, and other external factors beyond our control, as well as downturns in the home repair and remodeling and new home construction sectors of the economy, can cause wide fluctuations in our margins.

The cost of our natural gas, electricity, fuel and raw materials, and other costs, may not correlate with changes in the prices we receive for our products, either in the direction of the price change or in absolute magnitude. Natural gas and raw materials costs represent a substantial part of our manufacturing costs, and energy costs, in particular electricity and fuel, represent a component of the costs to manufacture building products. Most of the raw materials we use are commodities and the price of each can fluctuate widely for a variety of reasons, including changes in availability because of major capacity additions or significant facility operating problems. Other external factors beyond our control can cause volatility in raw materials prices, demand for our products, product prices, sales volumes and margins. These factors

14

include general economic conditions, the level of business activity in the industries that use our products, competitors' actions, international events and circumstances, and governmental regulation in the United States and abroad. These factors can also magnify the impact of economic cycles on our business. While we attempt to pass through price increases in energy costs and raw materials, we have been unsuccessful in doing so in some circumstances in the past and there can be no assurance that we can do so in the future.

Additionally, our business is impacted by changes in the North American home repair and remodeling sectors, as well as the new construction sector, which may be significantly affected by changes in economic and other conditions such as gross domestic product levels, employment levels, demographic trends, consumer confidence, increases in interest rates and availability of consumer financing for home repair and remodeling projects as well as availability of financing for new home purchases. These factors can lower the demand for and pricing of our products, which could cause our net sales and net income to decrease and require us to recognize additional impairments of our assets.

The industries in which we compete are highly competitive, with some of our competitors having greater financial and other resources than we have; competition may adversely affect our results of operations.

The commodity chemical industry is highly competitive. Many of our competitors are larger and have greater financial and other resources and less debt than us. Moreover, barriers to entry, other than capital availability, are low in most product segments of our commodity chemical business. Capacity additions or technological advances by existing or future competitors also create greater competition, particularly in pricing. We cannot provide assurance that we will have access to the financing necessary to upgrade our facilities in response to technological advances or other competitive developments.

In addition, we compete with other national and international manufacturers of vinyl-based building and home improvement products. Some of these companies are larger and have greater financial resources and less debt than us. Accordingly, these competitors may be better able to withstand changes in conditions within the industries in which we operate and may have significantly greater operating and financial flexibility than us. Some of these competitors, who compete with our building product lines, may also be able to compete more aggressively in pricing and could take a greater share of sales and cause us to lose business from our customers. Many of our competitors have operated in the building products industry for a long time. Additionally, our building products face competition from alternative materials: wood, metal, fiber cement and masonry in siding, wood and aluminum in windows and iron and cement in pipe and fittings. An increase in competition from other vinyl exterior building products manufacturers and alternative building materials could cause us to lose customers and lead to decreases in net sales. To the extent we lose customers in the renovation and remodeling markets, we must market to the new home construction market, which historically has experienced more fluctuations in demand.

Extensive environmental, health and safety laws and regulations impact our operations and assets; compliance with these regulations could adversely affect our results of operations.

Our operations on and ownership of real property are subject to extensive environmental, health and safety regulation, including laws and regulations related to air emissions, water discharges, waste disposal and remediation of contaminated sites, at both the national and local levels in the U.S. We are also subject to similar regulations in Canada. The nature of the chemical and building products industries exposes us to risks of liability under these laws and regulations due to the production, storage, use, transportation and sale of materials that can cause contamination or personal injury, including, in the case of commodity chemicals, potential releases into the environment. Environmental laws may have a significant effect on the costs of use, transportation and storage of raw materials and finished products, as well as the costs of the storage and disposal of wastes. We have and must continue to incur operating and capital costs to comply with environmental laws and regulations. In addition, we may incur substantial costs, including fines, damages, criminal or civil sanctions and remediation costs, or experience interruptions in our operations for violations arising under these laws.

15

Also, some environmental laws, such as the federal Superfund statute, may impose joint and several liability for the cost of investigations and remedial actions on any company that generated the waste, arranged for disposal of the waste, transported the waste to the disposal site, selected the disposal site, or presently or formerly owned, leased or operated the disposal site or a site otherwise contaminated by hazardous substances. Any or all of the responsible parties may be required to bear all of the costs of cleanup, regardless of fault, legality of the original disposal or ownership of the disposal site. A number of environmental liabilities have been associated with the facilities at Lake Charles, Louisiana that we acquired as part of the acquisition of the vinyls business of CONDEA Vista Company ("CONDEA Vista," which is now known as Sasol North America, Inc.) and which may be designated as Superfund sites. Although CONDEA Vista retained financial responsibility for certain environmental liabilities that relate to the facilities that we acquired from it and that arose before the closing of our acquisition of the vinyls business of CONDEA Vista in November 1999, there can be no assurance that CONDEA Vista will be able to satisfy its obligations in this regard, particularly in light of the long period of time in which environmental liabilities may arise under the environmental laws. If CONDEA Vista fails to fulfill its obligation regarding its environmental liabilities, then we could be held responsible. Furthermore, any environmental liabilities relating to Royal Group will not have the benefit of any third party indemnification, including liabilities resulting from Royal Group's operations prior to our acquisition of the company.

Our policy is to accrue costs relating to environmental matters when it is probable that these costs will be required and can be reasonably estimated. However, estimated costs for future environmental compliance and remediation may be too low or we may not be able to quantify the potential costs. We expect to be continually subjected to increasingly stringent environmental and health and safety laws and regulations. It is difficult to predict the future interpretation and development of these laws and regulations or their impact on our future earnings and operations. We anticipate continued compliance will require increased capital expenditures and increased operating costs. Any increase in these costs could adversely affect our financial performance.

Concerns related to climate change are continuing to grow leading to efforts to limit greenhouse gas ("GHG") emissions. In the fourth quarter of 2009, the EPA issued rules requiring reporting of GHG emissions in the U.S. beginning in 2010. In addition, the United States Congress is considering legislation which may require companies such as Georgia Gulf to restrict or control GHG emissions. Also, the United States has recently engaged in discussions under the United Nations Framework Convention on Climate Change at Copenhagen. Such discussions may result in international treaties requiring additional controls on GHG emissions. Our non-U.S. manufacturing facilities are all in Canada which has adopted the Kyoto Protocol which seeks the reduction of GHG emissions. The cost impact of such legislation, regulation or international negotiations would depend on the specific requirements enacted and cannot be determined at this time. For example, the impact of proposed legislation relating to GHG emissions would depend on factors such as the specific GHG limits imposed and the timing of the implementation of these requirements. The EPA regulatory requirement to report GHG emissions may result in the need to install or modify monitoring equipment at certain of our U.S. manufacturing facilities to monitor GHG emissions.

16

The potential impact of these and related future international, legislative or regulatory actions on our operations cannot be predicted at this time but could be significant. Such impacts would include the potential for significant compliance costs, including capital expenditures, and could result in operating restrictions. Any increase in the costs related to these initiatives could adversely affect our financial performance.

The heightened interest in climate change issues could have the potential to affect business operations. There is a potential for indirect consequences of climate change regulation on business trends. In addition, some have alleged an association with changes in weather patterns on climate change. The Company may, in the future, be required to expend money to defend claims based on the alleged association of climate change with changes in weather patterns.

Hazards associated with manufacturing may occur, which could adversely affect our results of operations.

Hazards associated with chemical manufacturing as well as building products manufacturing, and the related use, storage and transportation of raw materials, products and wastes may occur in our operations. These hazards could lead to an interruption or suspension of operations and have an adverse effect on the productivity and profitability of a particular manufacturing facility or on our operations as a whole. These hazards include:

- •

- pipeline and storage tank leaks and ruptures;

- •

- explosions and fires;

- •

- inclement weather and natural disasters;

- •

- mechanical failure;

- •

- unscheduled downtime;

- •

- labor difficulties;

- •

- transportation interruptions;

- •

- remediation complications;

- •

- terrorist acts; and

- •

- chemical spills and other discharges or releases of toxic or hazardous substances or gases.

These hazards may cause personal injury and loss of life, severe damage to or destruction of property and equipment, and environmental damage, any of which could lead to claims or liability under the environmental laws. Additionally, individuals could seek damages for alleged personal injury or property damage due to exposure to chemicals at our facilities or to chemicals otherwise owned, controlled or manufactured by us. We are also subject to present and future claims with respect to workplace exposure, workers' compensation and other matters. Although we maintain property, business interruption and casualty insurance of the types and in the amounts that we believe are customary for the industry, we are not fully insured against all potential hazards incident to our business.

We face potential product liability claims relating to the production and manufacture of building products.

We are exposed to product liability risk and the risk of negative publicity if our building products do not meet customer expectations. Although we maintain insurance for products liability claims, the amount and scope of such insurance may not be adequate to cover a products liability claim that is successfully asserted against us. In addition, product liability insurance could become more expensive and difficult to maintain and, in the future, may not be available to us on commercially reasonable terms or at all. There can be no assurance that we will be able to obtain or maintain adequate insurance coverage against possible products liability claims at commercially reasonable levels, or at all.

17

We rely heavily on third party transportation, which subjects us to risks that we cannot control; these risks may adversely affect our operations.

We rely heavily on railroads, barges and other shipping companies to transport raw materials to our manufacturing facilities and to ship finished product to customers. These transport operations are subject to various hazards, including extreme weather conditions, work stoppages and operating hazards, as well as interstate transportation regulations. If we are delayed or unable to ship finished product or unable to obtain raw materials as a result of these transportation companies' failure to operate properly, or if there were significant changes in the cost of these services, we may not be able to arrange efficient alternatives and timely means to obtain raw materials or ship our goods, which could result in an adverse effect on our revenues and costs of operations.

We rely on a limited number of outside suppliers for specified feedstocks and services, and due to our overall financial condition, including our debt level, our key suppliers may require more onerous terms for trade credit.

We obtain a significant portion of our raw materials from a few key suppliers. If any of these suppliers is unable to meet its obligations under present supply agreements, we may be forced to pay higher prices to obtain the necessary raw materials. Any interruption of supply or any price increase of raw materials could have an adverse effect on our business and results of operations. In connection with our acquisition of the vinyls business of CONDEA Vista in 1999, we entered into agreements with CONDEA Vista to provide specified feedstocks for the Lake Charles facility. This facility is dependent upon CONDEA Vista's infrastructure for services such as wastewater and ground water treatment, site remediation, and fire water supply. Any failure of CONDEA Vista to perform its obligations under those agreements could adversely affect the operation of the affected facilities and our results of operations. The agreements relating to these feedstocks and services had initial terms of one to ten years. Most of these agreements have been automatically renewed, but may be terminated by CONDEA Vista after specified notice periods. If we were required to obtain an alternate source for these feedstocks or services, we may not be able to obtain pricing on as favorable terms. Additionally, we may be forced to pay additional transportation costs or to invest in capital projects for pipelines or alternate facilities to accommodate railcar or other delivery or to replace other services.

While we believe that our relationships with our key suppliers are strong, any vendor may choose, subject to existing contracts, to modify our relationship due to general economic concerns or concerns relating to the vendor or us, at any time. Any significant change in the terms that we have with our key suppliers could adversely affect our financial condition and liquidity, as could significant additional requirements from our suppliers that we provide them additional security in the form of prepayments or with letters of credit.

Operation on multiple ERP information systems may negatively impact operations

We are highly dependent on our information systems infrastructure in order to process orders, track inventory, ship products in a timely manner, prepare invoices to our customers, maintain regulatory compliance and otherwise carry on our business in the ordinary course. We currently operate on multiple Enterprise Resource Planning, or ERP, information systems, which complicate our processing, reporting and analysis of business transactions and other information. Since we must process and reconcile our information from multiple systems, the chance of errors is increased and we may incur additional costs. Inconsistencies in the information from multiple ERP systems could adversely impact our ability to manage our business efficiently and may result in heightened risk to our ability to maintain our books and records and comply with regulatory requirements.

Further, from time to time we may transition a portion of our operations from one of our ERP systems to another.

18

The transition to a different ERP system involves numerous risks, including:

- •

- diversion of management's attention away from normal daily business operations;

- •

- increased demand on our operations support personnel;

- •

- initial dependence on unfamiliar systems while training personnel to use new systems; and

- •

- increased operating expenses resulting from training, conversion and transition support activities.

We may pursue dispositions, asset acquisitions, and joint ventures, and other transactions that may impact our results of operations, including difficulties in integrating any acquired business operations, which may result in our failure to realize expected cost savings and operational efficiencies.

We may enter into agreements to dispose of certain assets. However, we cannot assure you that we will be able to dispose of these assets at any anticipated prices, or at all, or that any such sale will occur during any anticipated time frame. In addition, we may engage in additional business combinations, purchases or sales of assets, or contractual arrangements or joint ventures. To the extent permitted under our debt agreements, some of these transactions may be financed by additional borrowings by us. The integration of any business we acquire may be disruptive to our business and may result in a significant diversion of management attention and operational resources. Additionally, we may suffer a loss of key employees, customers or suppliers, loss of revenues, increases in costs or other difficulties. If the expected efficiencies and synergies of the transactions are not fully realized, our results of operations could be adversely affected, at least in the short term, because of the costs associated with such transactions. Other transactions may advance future cash flows from some of our businesses, thereby yielding increased short-term liquidity, but consequently resulting in lower cash flows from these operations over the longer term.

Our participation in joint ventures exposes us to risks of shared control.

We own a 50 percent interest in a manufacturing joint venture, the remainder of which is controlled by PPG Industries, Inc., which also supplies chlorine to the facility operated by the joint venture. We also have other joint ventures, such as Royal Group's strategic joint venture arrangements with several customers. We may enter into additional joint ventures in the future. The nature of a joint venture requires us to share control with unaffiliated third parties. If our joint venture partners do not fulfill their obligations, the affected joint venture may not be able to operate according to its business plan. In that case, our operations may be adversely affected or we may be required to increase our level of commitment to the joint venture. Also, differences in views among joint venture participants may result in delayed decisions or failure to agree on major issues. Any differences in our views or problems with respect to the operations of our joint ventures could have a material adverse effect on our business, financial condition, results of operations or cash flows.

Fluctuations in foreign currency exchange and interest rates could affect our consolidated financial results.

We earn revenues, pay expenses, own assets and incur liabilities in countries using currencies other than the U.S. dollar, principally the Canadian dollar. Because our consolidated financial statements are presented in U.S. dollars, we must translate revenues and expenses into U.S. dollars at the average exchange rate during each reporting period, as well as assets and liabilities into U.S. dollars at exchange rates in effect at the end of each reporting period. Therefore, increases or decreases in the value of the U.S. dollar against other major currencies will affect our net revenues, operating income and the value of balance sheet items denominated in foreign currencies. Because of the geographic diversity of our operations, weaknesses in various currencies might occur in one or many of such currencies over time. From time to time, we may use derivative financial instruments to further reduce our net exposure to currency exchange rate fluctuations. However, we cannot assure you that fluctuations in foreign currency

19

exchange rates, particularly the strengthening of the U.S. dollar against major currencies, would not materially affect our financial results.