Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ANALOGIC CORP | d463306d8k.htm |

| EX-2.1 - ARRANGEMENT AGREEMENT - ANALOGIC CORP | d463306dex21.htm |

| EX-99.1 - PRESS RELEASE - ANALOGIC CORP | d463306dex991.htm |

Innovative Solutions for Life

–

Analogic Confidential

Ultrasonix Acquisition

January 8, 2013

Nasdaq: ALOG

3D Trajectory Drives Shareholder Value

Exhibit 99.2 |

Innovative Solutions for Life

Safe Harbor

2

Any statements about future expectations, plans, and prospects for the Company, including

statements containing the words “believes,”

“anticipates,”

“plans,”

“expects,”

and similar expressions, constitute

forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995. Actual results may differ materially from those indicated by such

forward-looking statements as a result of various important factors, including

risks relating to product development and commercialization, limited demand for the

Company’s products, risks associated with competition, uncertainties associated with regulatory agency

approvals, competitive pricing pressures, downturns in the economy, the risk of potential

intellectual property litigation, and other factors discussed in our most recent

quarterly or annual report filed with the Securities and Exchange Commission. In

addition, the forward-looking statements included in this presentation represent

the Company’s views as of the date of this document. While the Company anticipates

that subsequent events and developments will cause the Company’s views to change, the

Company specifically disclaims any obligation to update these forward-looking

statements. These forward-looking statements should not be relied upon as

representing the Company’s views as of any later date. |

Innovative Solutions for Life

Deal

Structure

Deal

Structure

Analogic to Acquire Ultrasonix

3

•

Targeted late February 2013

•

Accelerates ALOG’s expansion in fast growing point of care and emerging

markets •

Complementary sales channel adds scale to ALOG’s U.S. direct channel and

China presence •

Complementary technology and product portfolio

•

Significant revenue and operational synergies

Strategic

Rationale

Strategic

Rationale

•

Adds $16-18M revenue in FY13; combined Ultrasound Business grows double digit

going forward •

Neutral to

non-GAAP operating margin and EPS in FY13

•

Accretive to GAAP and non-GAAP operating margin and EPS in FY14

•

Revenue year ended December 31, 2011 was 34.5 MM $CDN, with positive operating

income •

20%+ growth in US Direct and China; estimated global revenue of approx. 37MM $CDN

in CY 2012 •

Analogic

will

acquire

all

outstanding

equity

of

Ultrasonix

for

$83M

in

cash

•

Funded through available cash on balance sheet

Ultrasonix

Financial

Profile

Ultrasonix

Financial

Profile

Expected

Financial

Impact on

ALOG

Expected

Financial

Impact on

ALOG

Closing

Closing |

Innovative Solutions for Life

Ultrasonix Overview

4

•

Ultrasonix is a privately held Ultrasound manufacturer based in Vancouver,

Canada •

Founded in 2000;

approximately 130 employees

•

More than 5,000 ultrasound systems installed worldwide

•

Focus on fast growing point of care markets in developed countries and general

imaging in emerging markets •

Direct sales force in North America with distribution network in 65 countries

•

Unique GPS technology for needle guidance; intuitive graphical user interface

|

Innovative Solutions for Life

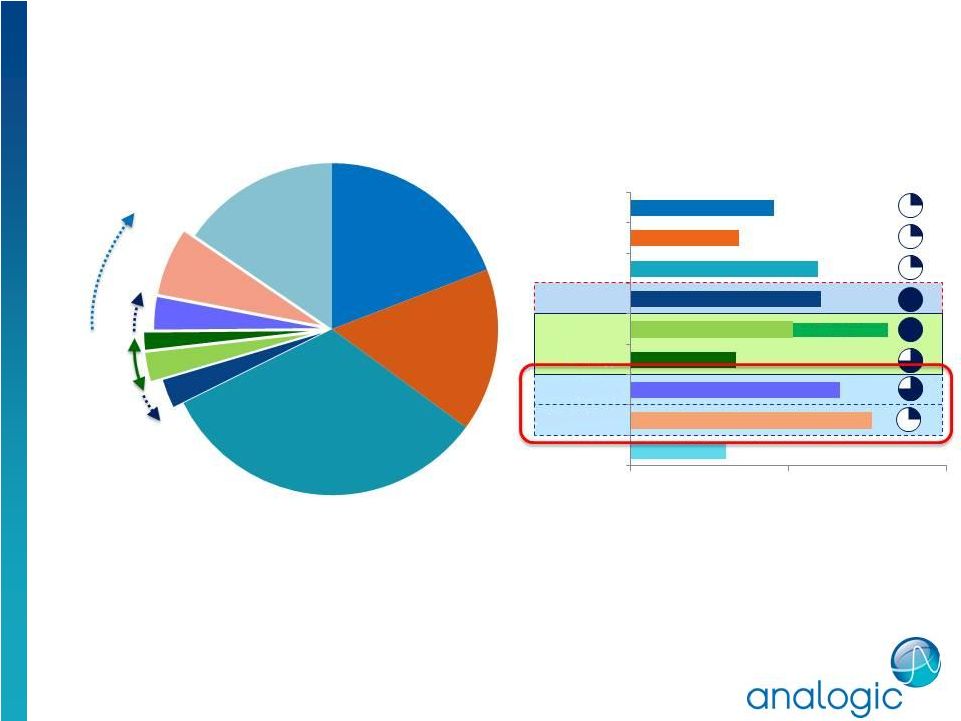

Ultrasonix Accelerates our Planned Expansion into Point-of-Care

5

Use of U/S for

Procedure

Guidance

Global Ultrasound Market 2011, $5.3B

Revenue Growth Rate by Application (’11-’16)

Core Markets

Organic

Growth

Organic

Growth

Ultrasonix

1

POC –

Point of care

2

IR: Interventional Radiology

Source: Klein, InMedica

1

1

2

2

Robotic

Cardiology

19%

OB/GYN

16%

Radiology / General

Imaging

33%

IR

3%

Rest of POC

6%

Other

15%

Surgery 3%

Urology 2%

Anesthesia 3%

Other

Rest of POC

Anesthesia

Urology

Surgery

IR

Radiology

OB/GYN

Cardiology

0%

5%

10%

3 |