Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Monarch Financial Holdings, Inc. | d413377d8k.htm |

Investor Presentation

As of June 30, 2012

September 11-12, 2012

Exhibit 99.1 |

Page 2

Forward-Looking Statements

Certain information contained in this discussion may include

“forward-looking statements” within the meaning

of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as

amended. These forward-looking statements relate to

the Company’s future operations and are generally identified by

phrases such as “the Company expects,” “the Company

believes” or words of similar import. Although the

Company believes that its expectations with respect to the

forward-looking statements are based upon reliable

assumptions within the bounds of its knowledge of its business and

operations, there can be no assurance that actual results,

performance or achievements of the Company will not differ

materially from any future results, performance or

achievements expressed or implied by such forward-looking

statements. For details on factors that could affect

expectations, see the Company’s most recently issued Annual

Report on Form 10-K, as filed with the Securities and

Exchange Commission.

|

Page 3

Brad E. Schwartz

Chief Executive Officer

E. Neal Crawford, Jr.

President

Introduction |

Page 4

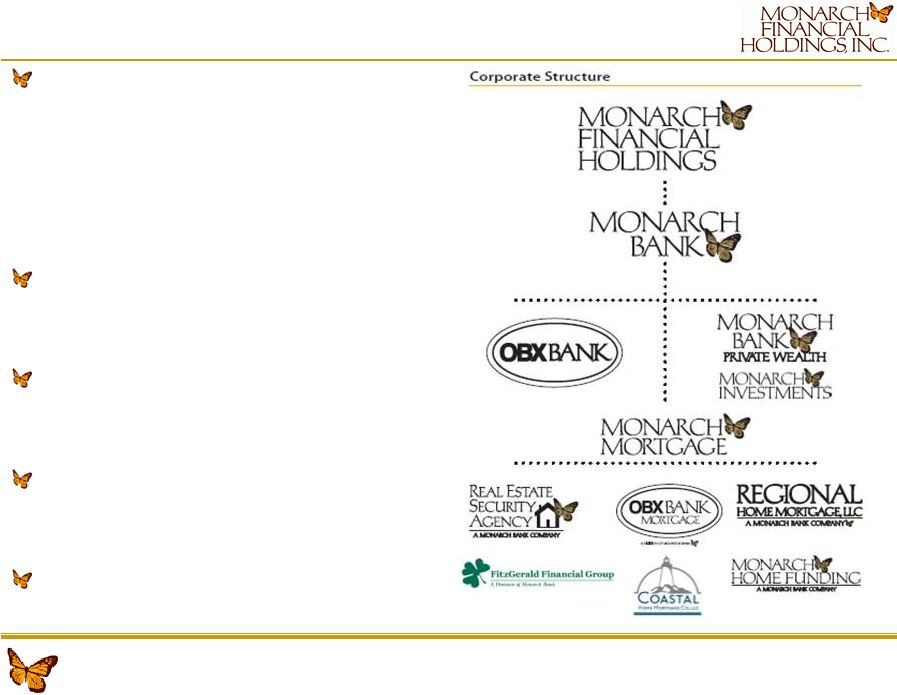

Corporate Profile

Monarch Financial Holdings is a growing

financial services company headquartered in

Chesapeake, Virginia

–

$995 million in assets

–

$626 million in loans held for investment

–

$282 million in loans held for sale

–

$853 million in deposits

Monarch Bank was founded in 1998, profitable

in

15

month

of

operation,

and

now

has

11

offices in Hampton Roads

OBX Bank, a division of Monarch Bank,

opened in May 2007 to serve the local needs of

the Outer Banks with two offices

Monarch Mortgage drives significant non-

interest income through retail residential

mortgage origination

Monarch Bank Private Wealth recently

formed to capture investment and trust

business using Raymond James Financial

th |

Page 5

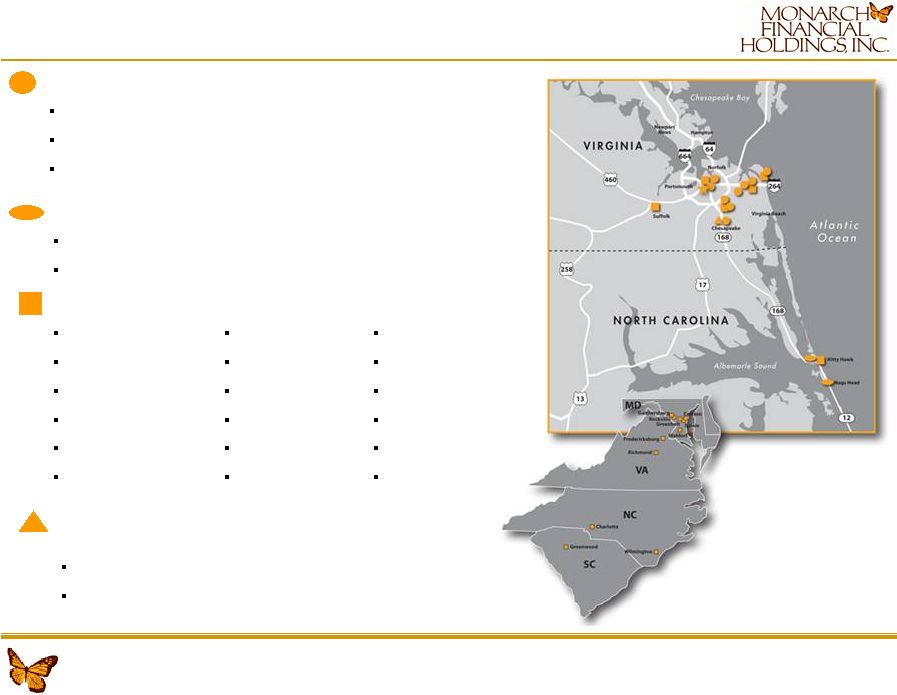

Monarch Franchise

OBX Bank Offices:

Kitty Hawk, NC

Nags Head, NC

Monarch Investments/ Monarch Bank

Private Wealth:

Chesapeake, VA

Williamsburg, VA (NEW)

Monarch Bank Offices:

Chesapeake, VA (2)

Suffolk, VA (NEW)

Norfolk, VA (2)

Williamsburg, VA (NEW)

Virginia Beach, VA (5)

Monarch Mortgage Offices:

Chesapeake, VA (2)

Norfolk, VA (2)

Virginia Beach, VA (2)

Richmond, VA (2)

Fredericksburg, VA

Fairfax, VA (2)

Bowie, MD

Crofton, MD

Gaithersburg, MD

Greenbelt, MD

Rockville, MD (2)

Towson, MD

Waldorf, MD

Annapolis,MD

Charlotte, NC (2)

Kitty Hawk, NC

Wilmington, NC (2)

Greenwood, SC |

Our

senior

management

team

consists

of

18

officers

who

have

over

504

years

of

combined

experience and over 28 years experience on average in the financial

services industry –

11% Directors and Executive Management ownership

Page 6

Experienced Management Team

* Serves as a director on the holding company board

Years

Name

Position

Experience

Brad E. Schwartz (50) *

Chief Executive Officer

28

E. Neal Crawford (50)*

President

27

Denys Diaz

Executive Vice President & Chief Information Officer

20

Lynette P. Harris

Executive Vice President & Chief Financial Officer

30

Andrew N. Lock

Executive Vice President & Chief Risk Officer

20

William T. Morrison (50)*

CEO, Monarch Mortgage

28

Barry A. Mathias

Market President

41

David W. McGlaughon

Market President

32

W. Craig Reilly

Market President

15

Adam Goldblatt

Market President

32

W. Craig Reilly

Market President

15

Jeremy R. Starkey

Senior Vice President

21

James K. Ferber

President

30

Jack Lane

President

20

Bernie Ngo

Market President/Managing

Director

29

Patrick Faulkner

Managing Director

26

Mary A. Anderson

Senior Vice President

26

Barbara N. Lane

Executive Vice President

42

Nancy B. Porter

Senior Vice President

22

Norfolk

Suffolk

Virginia Beach

Commercial Real Estate Group

Real Estate Finance Group

Monarch Mortgage

Williamsburg/Private Wealth

Private Wealth

Human Resources

Facilities

Marketing and Training

Chesapeake

OBX Bank |

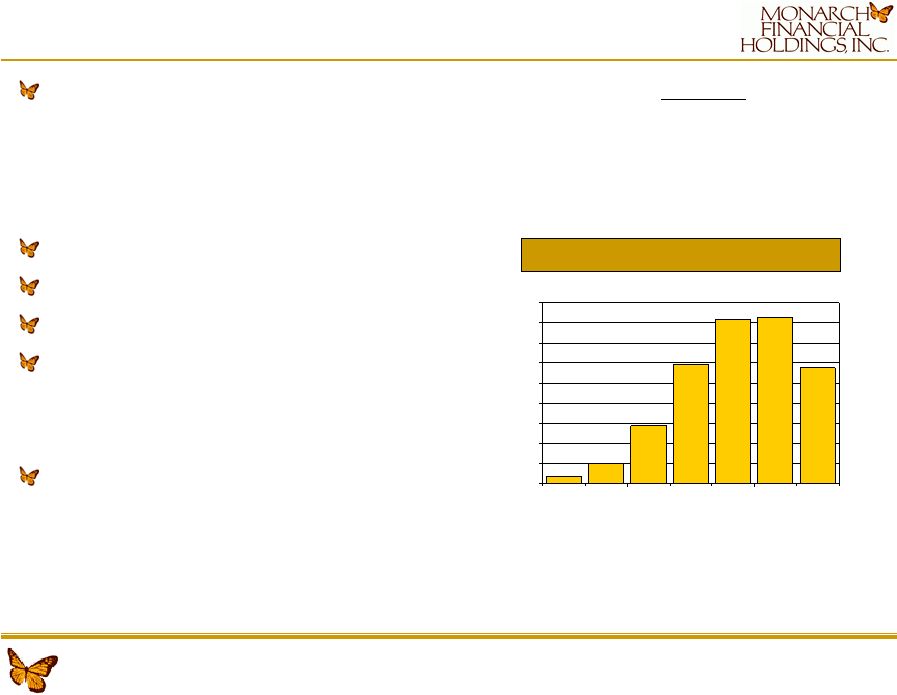

$1,153

$1,656

$75

$200

$577

$1,630

$1,186

$0.00

$200.00

$400.00

$600.00

$800.00

$1,000.00

$1,200.00

$1,400.00

$1,600.00

$1,800.00

2006

2007

2008

2009

2010

2011

Q2-12

Page 7

Monarch Mortgage

Monarch

Mortgage,

headquartered

in

Virginia

Beach,

was

founded

in

May

2007

–

Originates permanent residential mortgage loans primarily sold,

servicing released, into the secondary market

–

Focus on loan quality, offering only products with a proven liquid

market and multiple reliable buyers

Strong risk management and bank oversight

Experienced and proven management team

Minimal legacy loan issues

Monarch Mortgage operates 27 locations

–

7 in core banking markets

–

20 in mortgage only markets

Significant origination capabilities:

–

$1.6 Billion closed in 2011, $1.1 Billion through June 2012

–

Primary focus on purchase market, 52% of closings YTD 2012

Mortgage Originations |

Publicly traded on Nasdaq Capital Market under MNRK, MNRKP

Formed Monarch Financial Holdings, Inc. as one bank holding company

in 2006 with 6,029,475 common shares now outstanding

Issued $14.7 Million in TARP Capital in December 2008 as an

abundance of caution during financial crisis. Repaid TARP

Capital in full in December 2009

Issued $20 Million of Non-cumulative Convertible Preferred in

2009 •

800,000 shares at $25 per share with a 7.80% rate

•

Can force convert if common stock trades at $10.40 to 2.5 million

shares •

Can redeem beginning in December 2012

Began

common stock dividends in 2010 ($0.14 in 2010, $0.16 in 2011, $0.14

YTD 2012 with one quarter remaining).

Page 8

Capital Events |

Outside Recognition

Bauer top 5-STAR bank rating, since 2009

KBW

Honor

Roll

Award

winner

2011

(top

40

banks

in

USA)

and

2012

(top

45

banks

in

USA).

One

of

two

banks

in

Virginia

to

win

both

years.

BB&T Capital Markets/Scott and Stringfellow

“Buy” recommendation

Recognized as “Rising 20”

top growth company in Hampton Roads (2X)

Recognized

by

Inside

Business

as

one

of

the

“Best

Places

to

Work”

in

Hampton Roads in 2007, 2009, 2011, 2012)

|

Page 10

Our

“Smart

Growth”

Business

Strategy

Continue to Grow

Banking

Franchises

Grow Core

Deposits

Maintain Risk

Management

Focus

Grow Non-

Interest Income

Lines of Business

Maintain

Financial

Discipline

Use Market Presidents and advisory boards for product and service

delivery in existing and potential expansion markets such as

the Peninsula, Williamsburg, and Richmond, the I-64

pathway. Organic and Acquisition growth

opportunities. Continue to conservatively underwrite loans

with strong committee structure and aggressively manage

problem assets. Maintain strong risk management focus

with mortgage origination business. Private Banking/Cash

Management Group focused on core deposit generation

and

service

of

business

deposits,

focused

on

checking

account

growth. Focus on office repositioning and franchise

growth. Target of $50 million or more per

office. Build and maintain sustainable revenue and net income

sources incremental to our spread income through significant

residential mortgage

origination and investment management income activities with bottom

line mentality. Continue to look for acquisition

opportunities. Deliver high performance shareholder returns

through strict adherence to risk management and pricing

philosophy. Remain a shareholder return focused

company. |

Page 11

Financial Highlights

2012 -

2007

($ in millions)

Q2 2012

2011

2010

2007

CAGR

Balance Sheet:

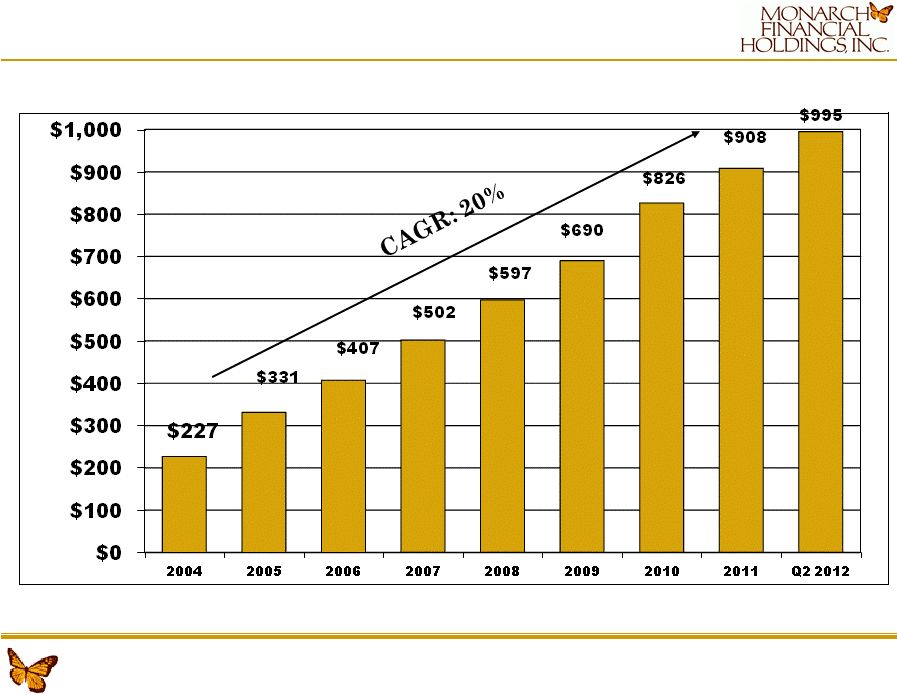

Total Assets

$995.2

$908.7

$825.6

$502.4

14.7%

Loans, HFI

626.4

607.6

558.9

419.2

8.4%

Total Deposits

853.4

740.0

705.7

389.7

17.0%

Stockholders Equity

81.2

76.8

71.7

36.5

17.3%

Tangible Book Value per Share

$9.89

$9.17

$8.40

$7.10

6.85%

Income Statement:

Net Interest Income

$19.0

$33.6

$30.5

$16.1

18.7%

Non-Interest Income

38.3

54.7

53.5

8.5

55.2%

Pre-Tax Pre-Provision Income

11.9

17.3

18.4

5.8

32.6%

Net Income

5.6

7.1

5.9

3.2

28.4%

Basic Earnings per Share

$0.75

$0.93

$0.77

$0.66

23.1%

Diluted Earnings per Share

$0.62

$0.84

$0.75

$0.63

17.6%

Return on Equity

13.63%

9.66%

8.59%

8.86%

Performance:

Net Interest Margin

4.43%

4.51%

4.22%

4.29%

NPAs & 90 PD / Total Assets

0.85%

0.85%

1.30%

0.10%

Loan Loss Reserves / Loans, HFI

1.71%

1.63%

1.62%

0.95%

Equity /Assets

8.36%

9.16%

8.67%

8.59%

Banking Offices

12

11

11

9

Basic Shares Outstanding

6,029,475

5,999,989

5,715,532

4,814,738

Preferred Shares Outstanding

800,000

800,000

800,000

0 |

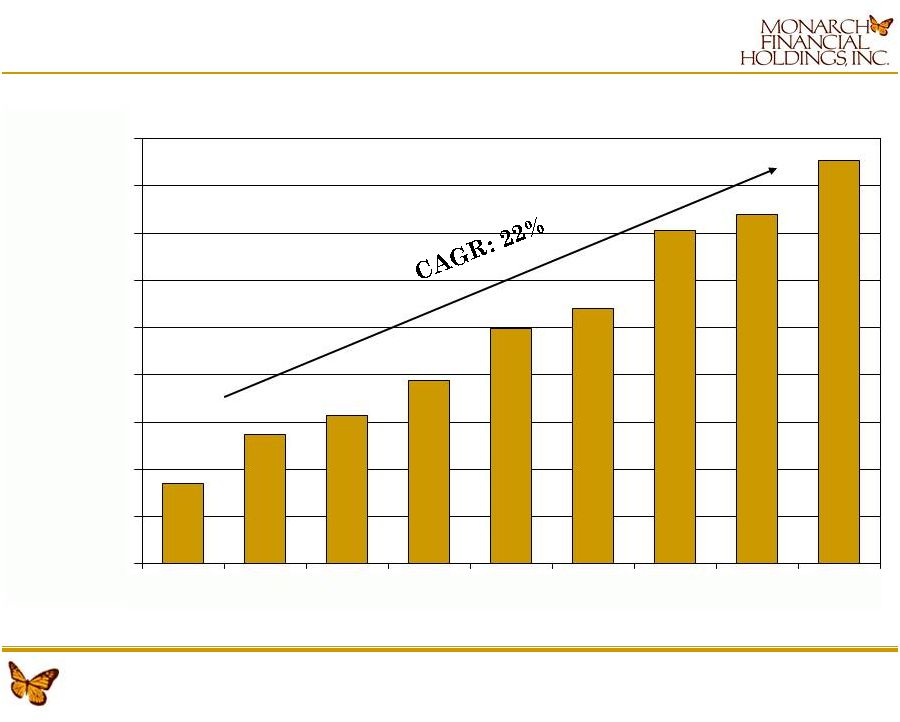

Page 12

Strong

Balance

Sheet

Growth

–

Total

Assets |

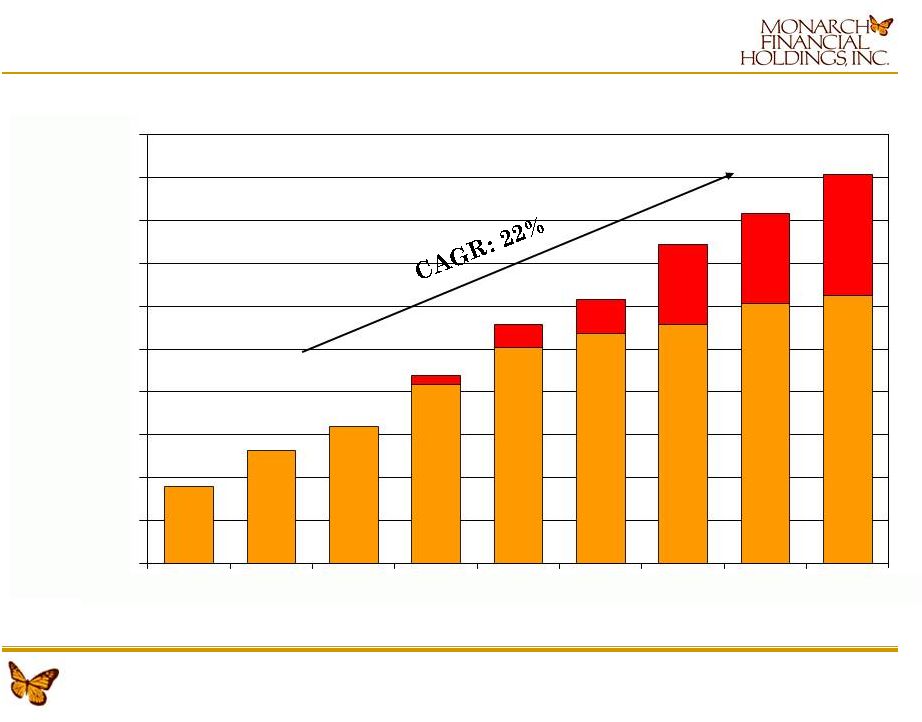

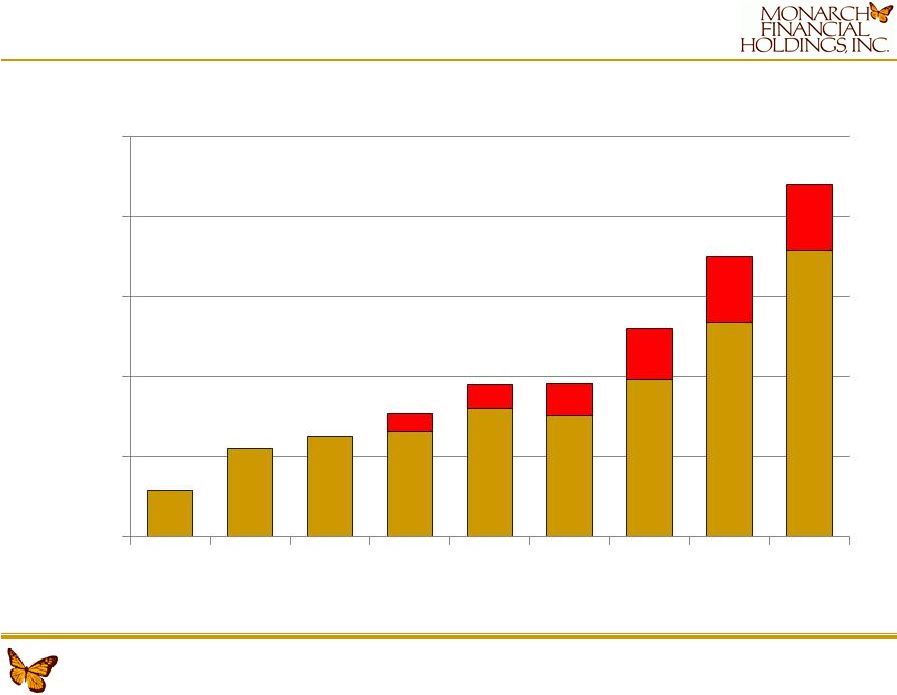

Page 13

Strong

Balance

Sheet

Growth

–

Loans

$179

$263

$321

$419

$505

$538

$559

$607

$626

$19

$54

$79

$186

$211

$282

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

$1,000

2004

2005

2006

2007

2008

2009

2010

2011

Q2 2012 |

Page 14

Significant controls in place to actively monitor and manage real

estate exposure –

Centralized real estate and construction underwriting and

monitoring –

Centralized

Commercial

Real

Estate

Group

with

CRE

loan

brokerage

capacity

Mortgage loans held for sale provide additional spread income and

average 30 to 45 days on the balance sheet

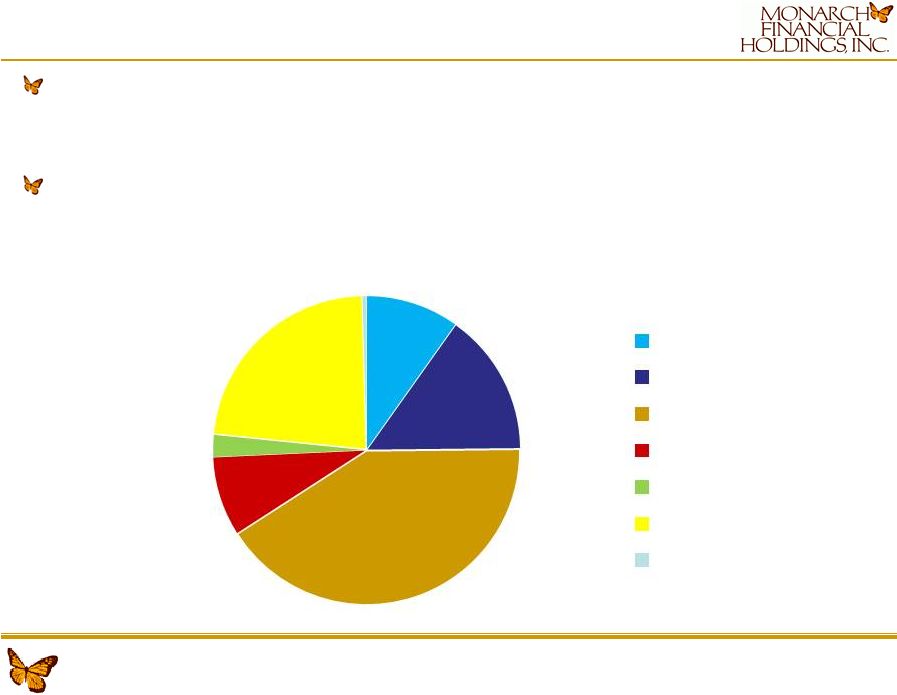

Diversified Loan Portfolio

10%

15%

41%

8%

2%

23%

1%

Commercial

RE Construction

RE Residential

RE Heloc

RE Multifamily

RE Commercial

Consumer |

Page 15

Strong

Balance

Sheet

Growth

-

Deposits

$171

$273

$314

$389

$498

$540

$706

$740

$853

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

2004

2005

2006

2007

2008

2009

2010

2011

Q2 2012 |

Checking Account Focus = Record Growth

-

50

100

150

200

250

2004

2005

2006

2007

2008

2009

2010

2011

Q2

2012

29

56

63

66

80

76

98

134

179

11

15

20

32

41

41 |

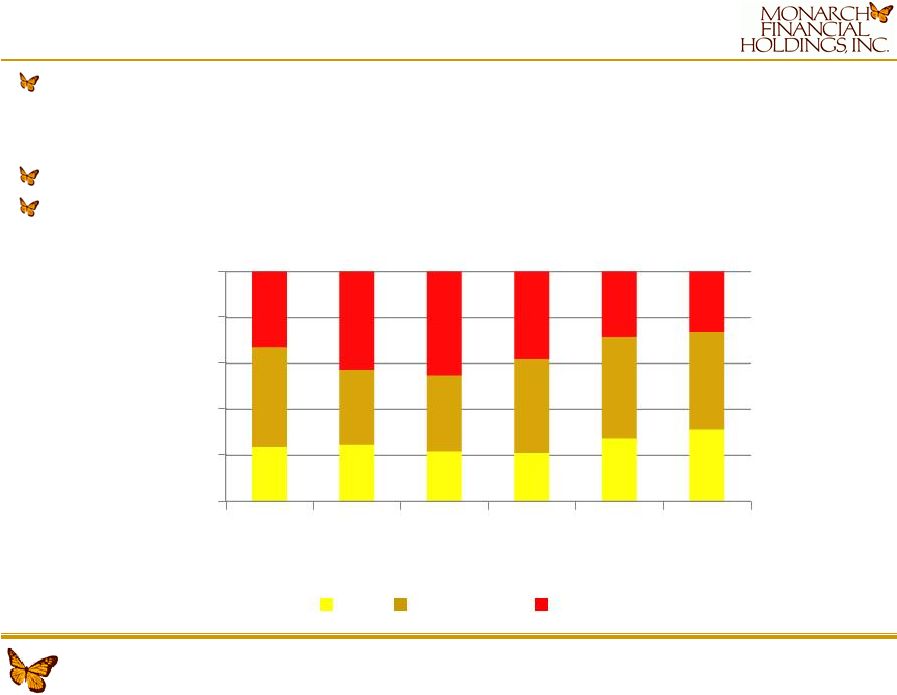

Page 17

Core Deposits Mix

Core deposit mix is vital to funding our loan growth and preserving

our net interest margin –

Built a Cash Management Team to rival larger competitors

–

Goal sell and service large DDA relationships

26% DDA growth YTD in 2012

We utilize FHLB and brokered deposits for mortgage loan

funding 0%

20%

40%

60%

80%

100%

2007

2008

2009

2010

2011

Q2

2012

CK

SAV/MM

TD

24%

25%

22%

21%

27%

31%

43%

33%

33%

41%

44%

43%

33%

43%

45%

38%

29%

26% |

Branch

Deposits

2011

Count

in Market

Market Share (%)

Avg. Per

Rank

Institution

(#)

($M)

2011

2007

Branch

1

Wells Fargo & Company (CA)

54

$ 5,006

23.00%

21.84%

$ 92,703

2

SunTrust Banks, Inc. (GA)

42

$ 3,340

15.36%

14.19%

$ 79,523

3

TowneBank (VA)

24

$ 3,017

13.87%

10.00%

$ 125,708

4

BB&T Corporation (NC)

54

$ 2,817

12.95%

14.00%

$ 52,166

5

Bank of America Corporation (NC)

45

$ 2,167

9.97%

13.54%

$ 48,155

6

Commonwealth Bankshares, Inc. (VA)

19

$

890 4.09%

2.99%

$ 46,842

7

Hampton Roads Bankshares, Inc. (VA)

26

$

682 3.14%

2.12%

$ 26,230

8

Old Point Financial Corporation (VA)

23

$

680 3.14%

3.25%

$ 29,565

9

Monarch Financial Holdings, Inc. (VA)

11

$

656 3.02%

1.83%

$ 59,636

10

Farmers Bank

5

$

374 1.72%

1.50%

$ 74,800

Greater Hampton Roads MSA

384

$ 21,749

100.00%

100.00%

Page 18

Deposit

Market

Share

–

Greater

Hampton

Roads

Ranked #9 with $656 million or 3.02% deposit market share

–

Top five institutions had 72.23% of deposits in the market

–

CAGR 24% past five years in Hampton Roads MSA

–

Based on expected 2012 deposits we could take the #6 spot in market

share |

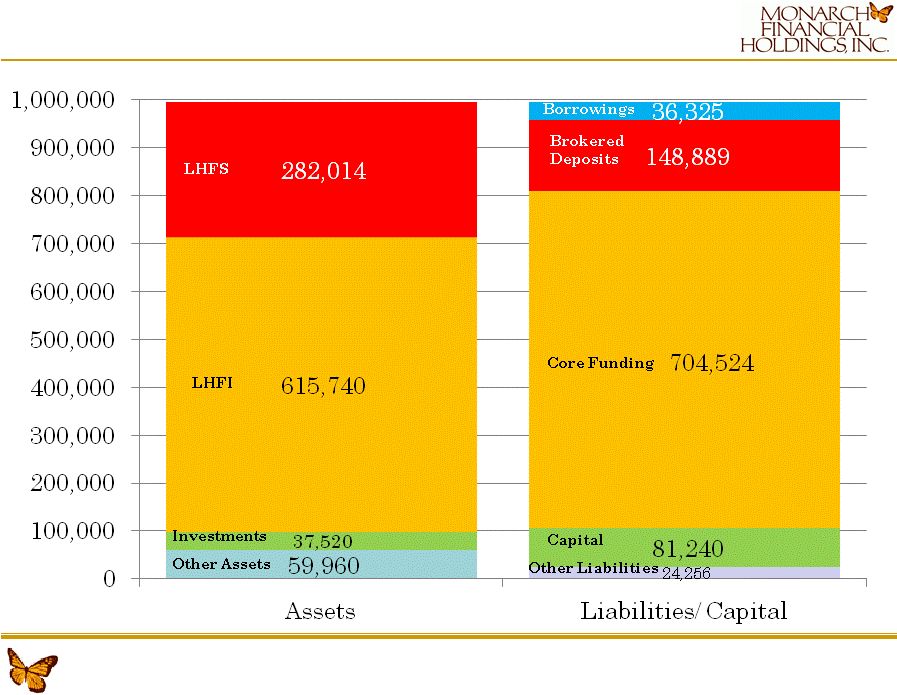

Page 19

Balance Sheet 6/30/2012 |

Page 20

2009 –

2012 Have Been Record Years

First Quarter 2009–

Record YOY 1

st

Quarter profits

Second Quarter 2009 –

Record YOY 2

nd

Quarter profits

Third Quarter 2009 –

Record YOY 3

rd

Quarter profits

Fourth Quarter 2009 –

Record YOY 4

th

Quarter profits

First Quarter 2010 –

Record YOY 1

st

Quarter profits

Second Quarter 2010 –

Record YOY 2

nd

Quarter profits

Third Quarter 2010 –

Record YOY 3

rd

Quarter profits

Fourth Quarter 2010 –

Record YOY 4

th

Quarter profits

First Quarter 2011 –

Record YOY 1

st

Quarter profits

Second Quarter 2011 –

Record YOY 2

nd

Quarter profits

Third Quarter 2011 –

Record YOY 3

rd

Quarter profits

Fourth Quarter 2011 –

Record YOY 4

th

Quarter profits

First Quarter 2012 –

Record YOY 1

st

Quarter profits

Second Quarter 2012 –

Record YOY 2

nd

Quarter profits |

Page 21

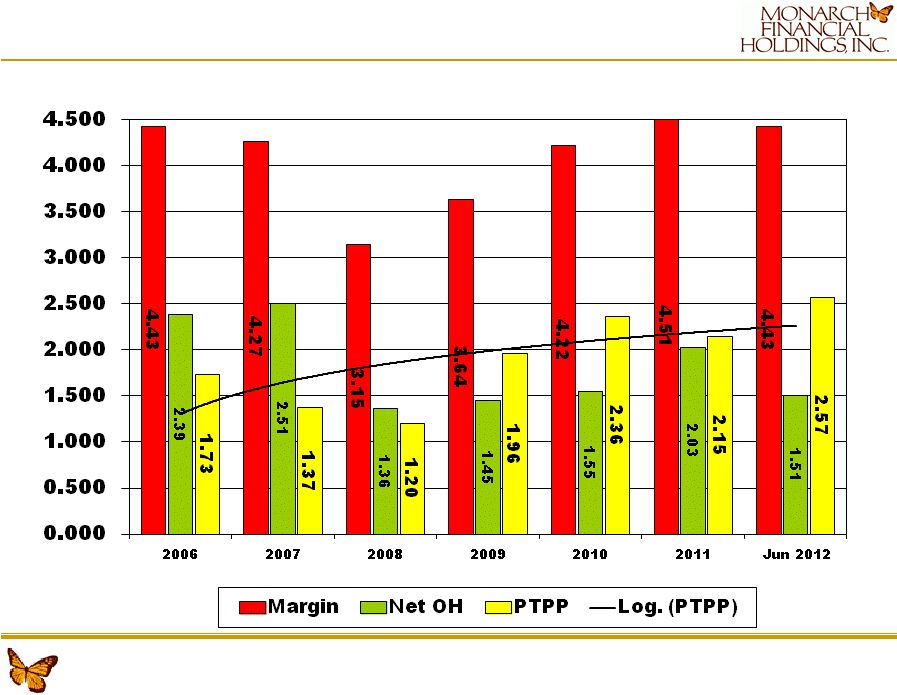

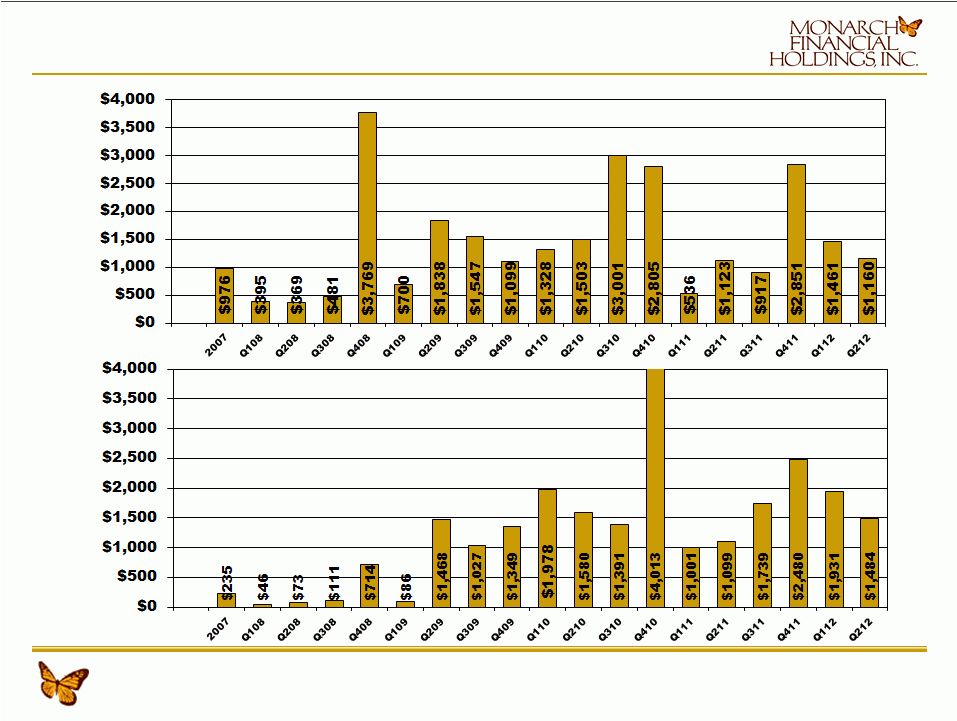

Profitability Performance Trends |

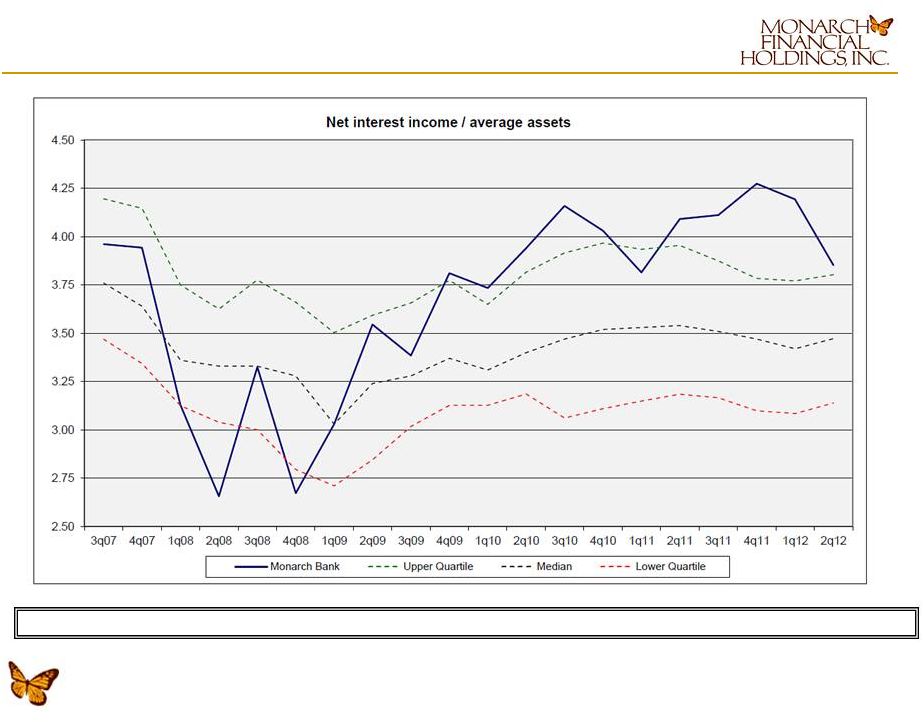

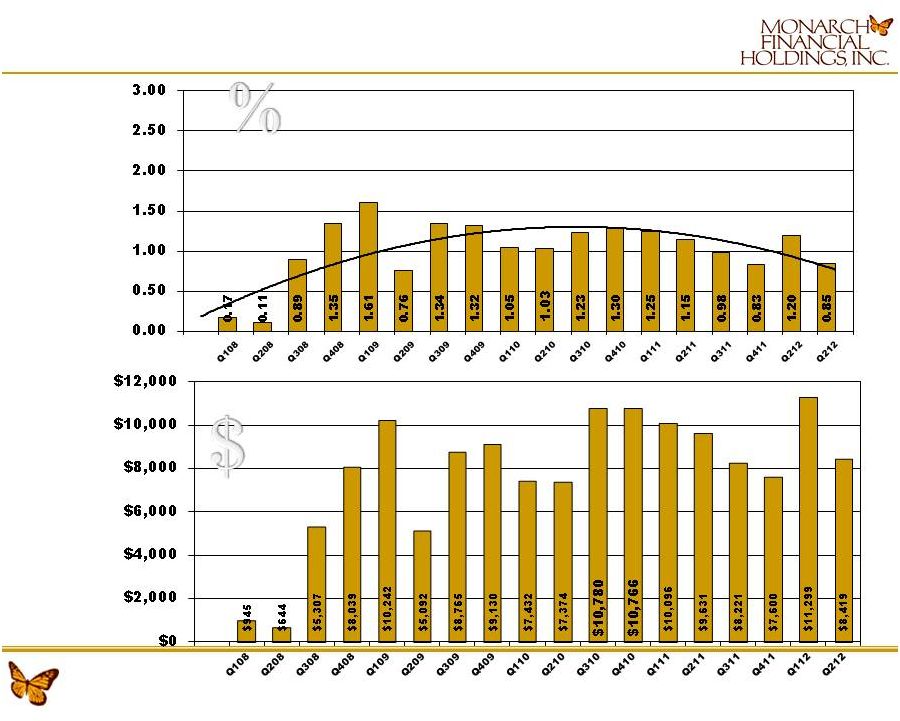

Page 22

Net

Interest

Income

–

Peer

Comparison

Bank

Only

–

FFIEC

Information |

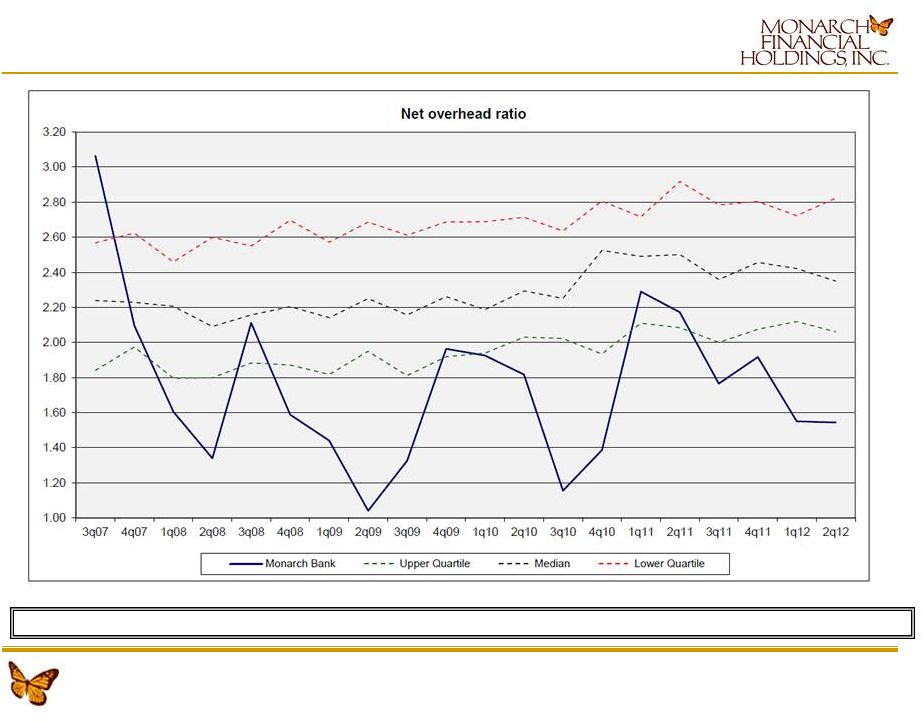

Page 23

Net

Overhead

–

Peer

Comparison

Bank only –

FFIEC Information |

Page 24

Non-Interest Income Growth

Our strategy involves building and maintaining sustainable revenue

and net income sources in addition to traditional banking

spread income –

Monarch

Mortgage:

underwrites

permanent

prime

residential

mortgage

loans

to

be

sold

in the secondary market

–

Real

Estate

Security

Agency:

residential

and

commercial

title

and

settlement

–

Monarch

Capital:

provides

commercial

mortgage

brokerage

services

(in

mortgage

#’s)

–

Monarch

Bank

Private

Wealth

(NEW):

provides

investment,

trust,

financial

planning

* Operating Revenue defined as non-interest income plus

net-interest income Non-Interest Income

($ in 000s)

2008

2009

2010

2011

YTD 2012

Mortgage banking income

$18,080

$32,477

$50,506

$51,362

$36,736

Investment and insurance commissions

1,278

749

290

250

31

Service charges and fees

1,370

1,502

1,637

1,630

882

Title company income

230

309

599

618

283

Other

455

597

472

885

388

Total Non-Interest Income

$21,413

$35,634

$53,503

$54,745

$38,320

Non-Interest Income / Operating Revenue

55.1%

61.7%

63.7%

63.1%

63.6% |

Page 25

Our Risk Management Focus Pays Off

All loans are risk rated with those ratings reviewed by an

independent third-party loan review service

Always enjoyed healthy relationship with our regulators, the

Richmond FRB and Virginia SCC Mortgage operations risks are

managed daily through a senior management team at Monarch

Mortgage along with oversight from Monarch Bank senior

management –

Duties include authority and oversight of underwriting and

regulatory compliance –

All correspondents and products are approved by our Board of

Directors to ensure no inappropriate products with excessive

risk are sold –

William Morrison, Monarch Mortgage CEO, previously served as a chief

credit officer for a local community bank

Other than credit risk our banking risk includes interest rate risk,

which we manage through our active Asset/Liability Management

Committee The credit risk within the company is overseen by our

Chief Risk Officer All loans are reviewed and loan

relationships that exceed $1,500,000 are approved by either a

management loan committee or a board of directors’

loan committee |

Aggressive Provision & Charge-off History

|

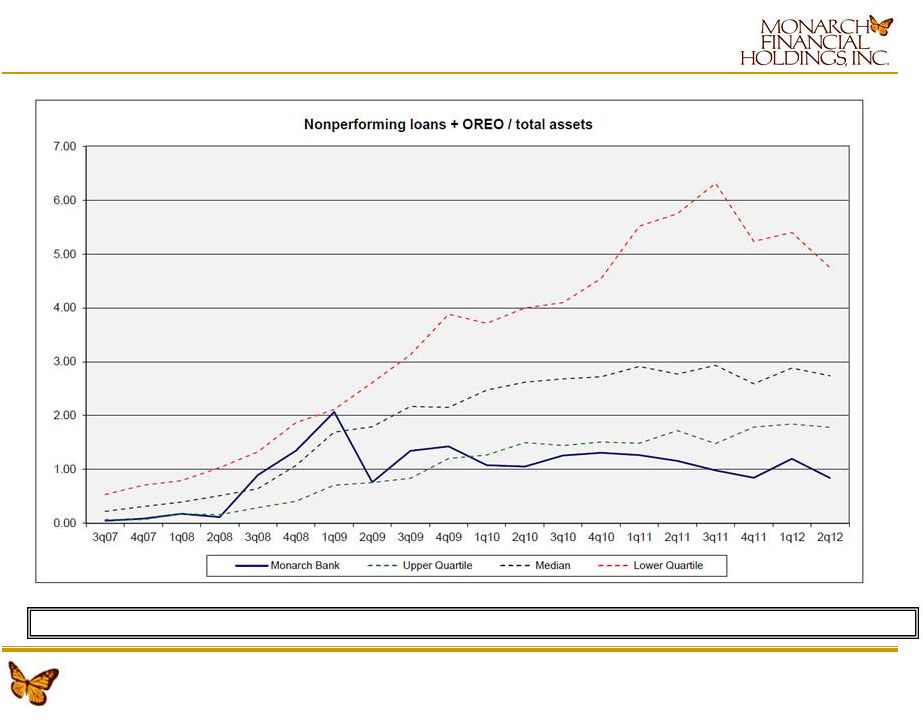

Non-Performing

Assets

VA Q212 Median 2.49% |

Non-Performing

Assets

–

Compared

to

Peers

Non-Performing Assets includes loans & debt securities past due 90 days or more

and those placed on non-accrual status, and non-investment OREO. |

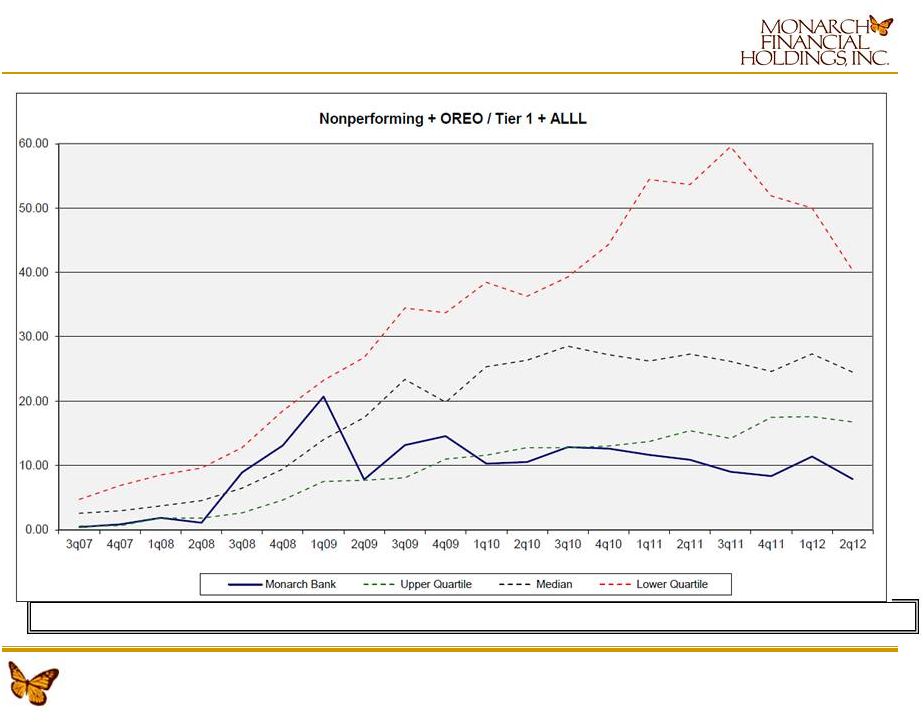

Our

Texas

Ratio

–

Compared

to

Peers

The Texas Ratio is defined as non-current loans & debt securities plus

non-investment OREO divided by tangible equity plus loan loss reserves. |

High performing, diversified financial services company

Attractive franchise in one of the best demographic markets in the

country Strong, highly experienced senior management team and

bankers Conservative underwriting culture with better than

peer asset quality Significant

mortgage

operations

with

focus

on

growing

additional

non-

interest income lines of business

Outperform peers through disciplined growth and risk

management Continue to take advantage of market dysfunction

through client and employee acquisition growth

Page 30

Why Invest in Monarch? |

|

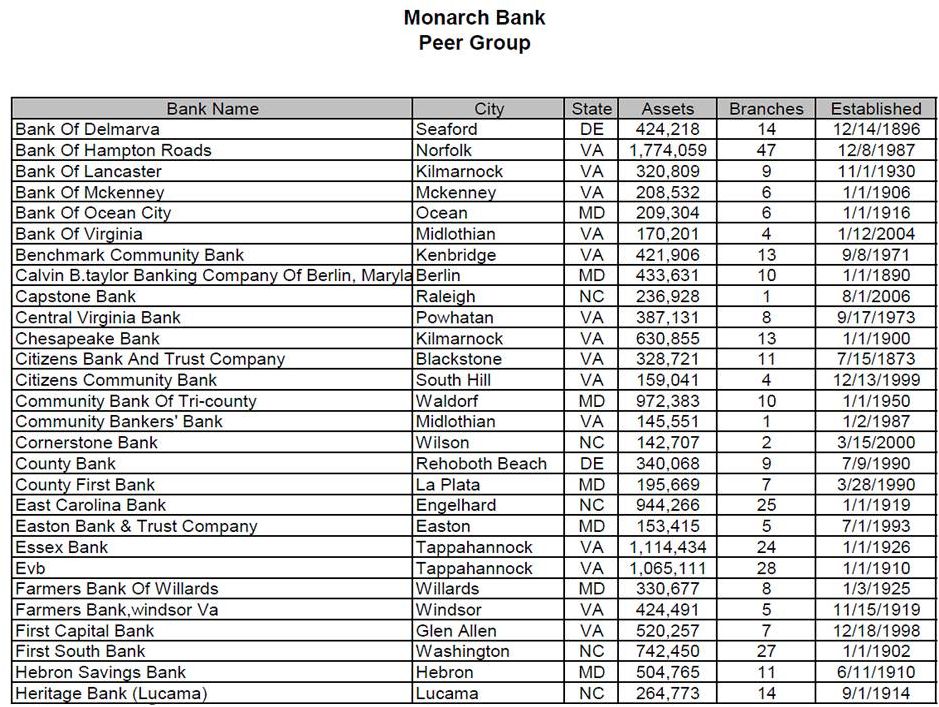

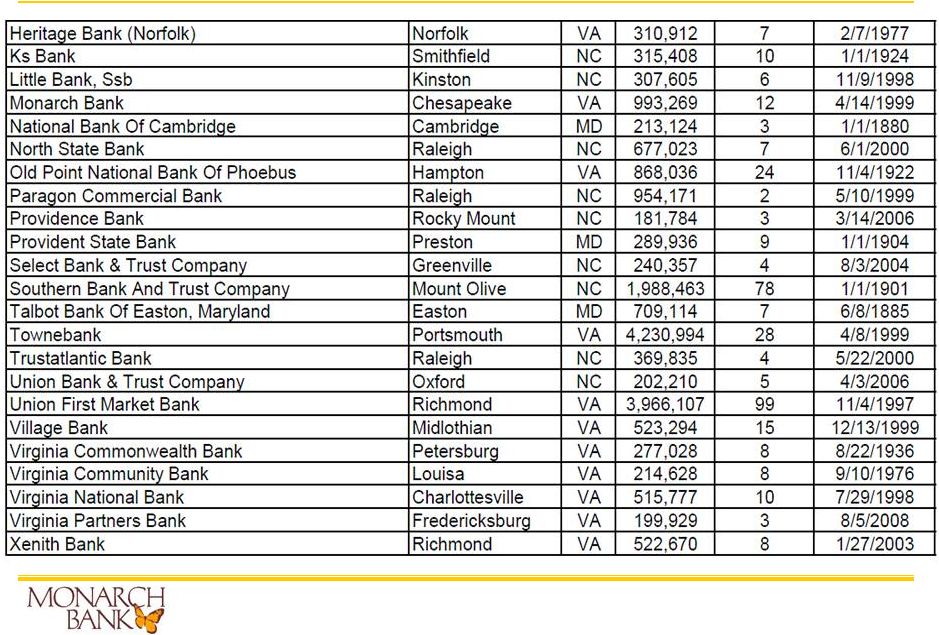

Peer

Group (continued) Page 32

|

Thank You |