Attached files

| file | filename |

|---|---|

| EX-99.1 - JOINT PRESS RELEASE - HERITAGE FINANCIAL CORP /WA/ | d412181dex991.htm |

| 8-K - FORM 8-K - HERITAGE FINANCIAL CORP /WA/ | d412181d8k.htm |

Acquisition

of

Northwest

Commercial

Bank

September

2012

Heritage

Financial

Corporation

Exhibit 99.2 |

2

This presentation includes forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995, which can be

identified by words such as “may,” “expected,”

“anticipate,”

“continue,”

or other comparable words. In addition, all

statements other than statements of historical facts that address activities

that Heritage Financial Corporation (“HFWA”) expects or

anticipates will or may occur in the future are forward-looking

statements. Readers are encouraged to read the SEC reports of HFWA,

particularly its Form 10-K for the fiscal year ended December 31, 2011, for

meaningful cautionary language discussing why actual results may vary

materially from those anticipated by management. Specific risks in this

presentation include whether Northwest Commercial Bank (“NCB”)

shareholders approve the merger, whether the companies receive

regulatory approval for the merger, whether the conditions to closing are satisfied,

the timing of the closing and management’s ability to effectively

integrate the companies, whether the companies have accurately predicted

acquisition and consolidation expenses, the timing and amount of savings

from consolidation, and the expected earnings contributions of both

companies. Forward Looking Statement |

3

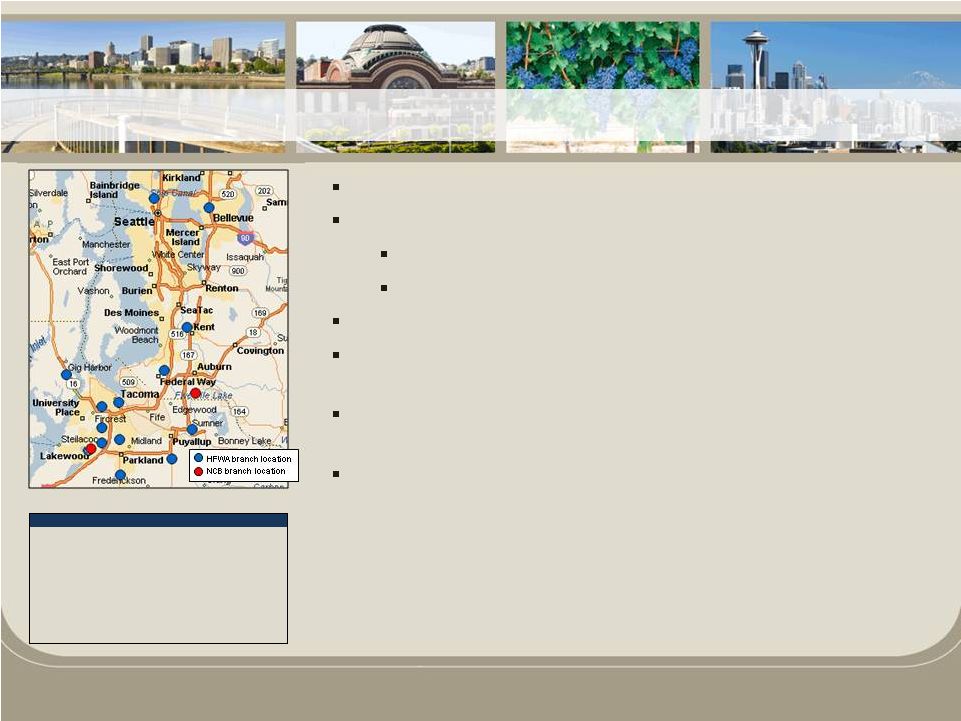

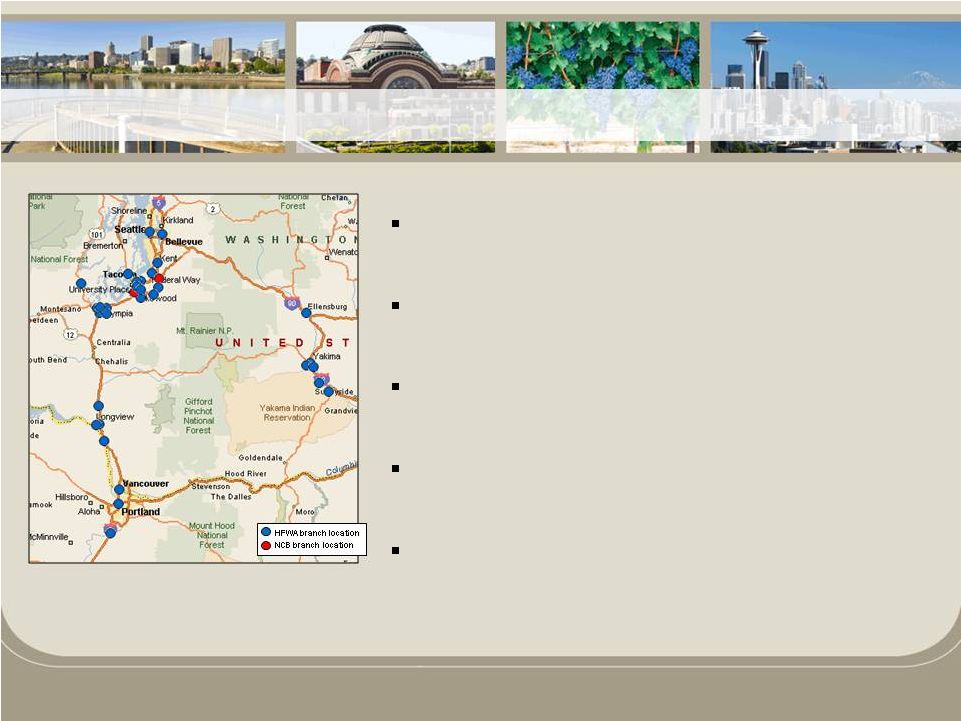

NCB will be merged into Heritage Bank

Fill-in footprint in Puget Sound Region

Expansion into the Auburn market

Consolidation of Lakewood branches

Fits HFWA’s overall growth strategy in the Pacific Northwest

Attractive NCB loan portfolio mix, which is 76% Commercial

Real Estate and Commercial & Industrial loans

Deposit base with 18% non-interest bearing demand

deposits

Financially attractive deal pricing and structure with

conservative modeling assumptions

Source: SNL Financial, NCB regulatory call report data, as of 6/30/2012

NCB Financial Overview (6/30/2012):

Total Assets ($000s)

72,153

$

Total Loans ($000s)

52,697

$

Total Deposits ($000s)

63,206

$

Total Equity ($000s)

8,373

$

Tangible Common Equity ($000s)

6,321

$

Loans / Deposits (%)

83.4%

Date Established

7/29/2002

# of Branches

2

Expanding Pacific Northwest Franchise |

4

Consideration Mix at Closing

100% cash

Purchase Price Per

Common Share

$5.50

Aggregate Deal Value at Closing

(Common Shareholders)

$3.0 million

Earn-Out/Contingent Consideration

Approximately $1.8 million based

on sale of certain OREO assets

Earn-Out Period

Prior to 12/31/2013

Required Approvals

Customary regulatory approvals and

approval of NCB shareholders

Anticipated Closing

Q4 2012

Due Diligence

Comprehensive due diligence completed, including

preliminary

3

rd

party

fair

value

assessment

EPS Impact

Immediately accretive

(excluding one-time deal costs)

Tangible Book Value

Per Share Impact

Less than 2.00% dilution

Transaction Overview |

5

Deal Value /

Tangible Book Value*

47%

Preliminary Loan

Fair Value Adjustment

Approximately -8.0%

Potential contingent cash consideration based on proceeds from sale of certain

OREO assets prior to 12/31/2013

HFWA will establish a contingent liability on day-1 for potential

earn-out consideration NCB’s $2.0 million of TARP preferred

securities held by U.S. Treasury will be redeemed prior to closing

* Consideration at closing, exclusive of potential contingent consideration.

Tangible book value as of 6/30/2012

Transaction Pricing & Additional Details |

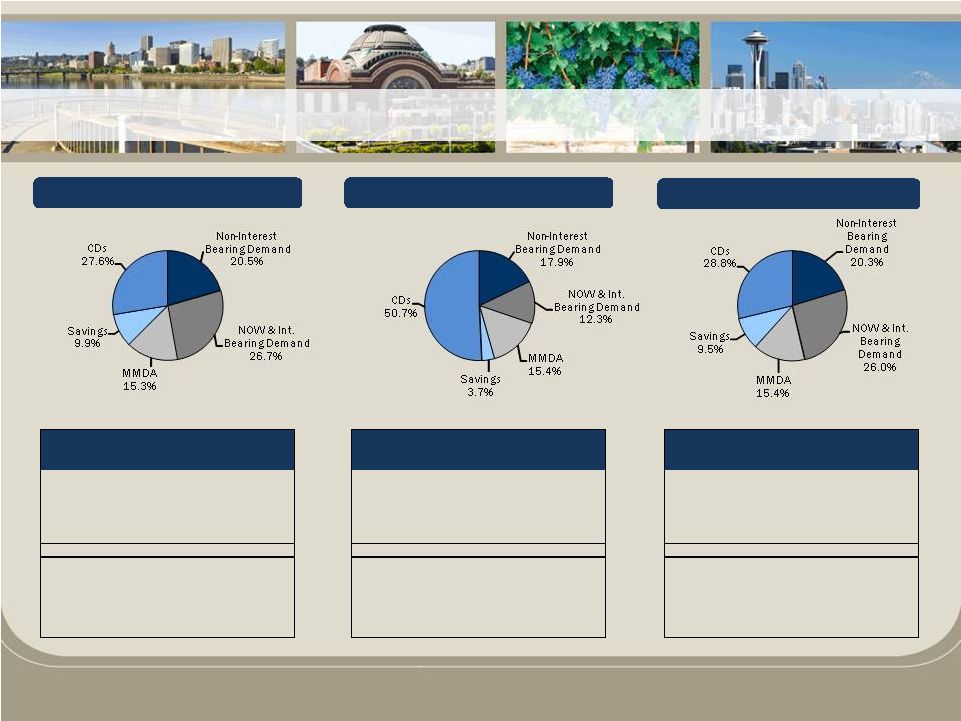

Balance

($000s)

% of

Total

Deposits

Non-Interest Bearing Demand

239,058

$

20.3%

NOW & Int. Bearing Demand

305,594

$

26.0%

MMDA

180,646

$

15.4%

Savings

112,240

$

9.5%

CDs

339,014

$

28.8%

Total Deposits

1,176,552

$

100.0%

Int. Bearing Deposits

937,494

$

79.7%

Non-CDs

837,538

$

71.2%

Cost of Deposits

0.44%

Cost of Interest Bearing Deposits

0.55%

Balance

($000s)

% of

Total

Deposits

Non-Interest Bearing Demand

11,292

$

17.9%

NOW & Int. Bearing Demand

7,848

$

12.3%

MMDA

9,737

$

15.4%

Savings

2,309

$

3.7%

CDs

32,020

$

50.7%

Total Deposits

63,206

$

100.0%

Int. Bearing Deposits

51,914

$

82.1%

Non-CDs

31,186

$

49.3%

Cost of Deposits

0.79%

Cost of Interest Bearing Deposits

0.96%

Balance

($000s)

% of

Total

Deposits

Non-Interest Bearing Demand

227,766

$

20.5%

NOW & Int. Bearing Demand

297,746

$

26.7%

MMDA

170,909

$

15.3%

Savings

109,931

$

9.9%

CDs

306,994

$

27.6%

Total Deposits

1,113,346

$

100.0%

Int. Bearing Deposits

885,580

$

79.5%

Non-CDs

806,352

$

72.4%

Cost of Deposits

0.42%

Cost of Interest Bearing Deposits

0.53%

6

HFWA

NCB

Pro-Forma

Source: HFWA 10-Q and SNL Financial, NCB regulatory call report data, as of

6/30/2012 Note: Pro-Forma does not include purchase accounting or

merger related adjustments Pro-Forma Deposit Mix (6/30/2012)

|

7

HFWA

NCB

Pro-Forma

Source: HFWA 10-Q and SNL Financial, NCB regulatory call report data, as of

6/30/2012 Note: Pro-Forma does not include purchase accounting or

merger related adjustments * Loans acquired in FDIC-assisted

transactions Pro-Forma Loan Mix (6/30/2012)

C & I

32.2%

CRE -

OO

21.7%

CRE -

NOO &

Multi.

29.6%

1-

4 Fam.

4.8%

Constr. (1 -

4)

2.7%

Constr. & Land

(Other)

5.4%

Consumer &

Other

3.6%

C & I

27.1%

CRE -

OO

30.3%

CRE -

NOO &

Multi.

21.8%

1-4 Fam.

11.1%

Constr. (1 -

4)

1.2%

Constr. & Land

(Other)

4.8%

Consumer &

Other

3.7%

C & I

32.5%

CRE -

OO

21.2%

CRE -

NOO &

Multi.

30.1%

1-

4 Fam.

4.4%

Constr. (1 -

4)

2.8%

Constr. & Land

(Other)

5.4%

Consumer &

Other

3.6%

Balance

($000s)

% of

Total

Loans

Commercial & Industrial

278,194

$

32.5%

Owner-Occupied CRE

180,982

$

21.2%

Non-Own. Occ. CRE & Multifam.

257,263

$

30.1%

1 -

4 Family Residential

37,752

$

4.4%

Construction (1 -

4 Family)

24,132

$

2.8%

Construction & Land (Other)

46,457

$

5.4%

Consumer & Other

30,749

$

3.6%

Total Originated Loans

855,529

$

100.0%

Net Deferred Loan Fees

(1,896)

$

Plus: Acquired Loans*

178,270

$

Gross Loans

1,031,903

$

Yield on Loans

6.63%

Gross Loans / Deposits (%)

92.7%

Balance

($000s)

% of

Total

Loans

Commercial & Industrial

14,311

$

27.1%

Owner-Occupied CRE

16,051

$

30.3%

Non-Own. Occ. CRE & Multifam.

11,496

$

21.8%

1 -

4 Family Residential

5,844

$

11.1%

Construction (1 -

4 Family)

649

$

1.2%

Construction & Land (Other)

2,527

$

4.8%

Consumer & Other

1,943

$

3.7%

Total Originated Loans

52,821

$

100.0%

Net Deferred Loan Fees

(124)

$

Plus: Acquired Loans*

-

$

Gross Loans

52,697

$

Yield on Loans

5.94%

Gross Loans / Deposits (%)

83.4%

Balance

($000s)

% of

Total

Loans

Commercial & Industrial

292,505

$

32.2%

Owner-Occupied CRE

197,033

$

21.7%

Non-Own. Occ. CRE & Multifam.

268,759

$

29.6%

1 -

4 Family Residential

43,596

$

4.8%

Construction (1 -

4 Family)

24,781

$

2.7%

Construction & Land (Other)

48,984

$

5.4%

Consumer & Other

32,692

$

3.6%

Total Originated Loans

908,350

$

100.0%

Net Deferred Loan Fees

(2,020)

$

Plus: Acquired Loans*

178,270

$

Gross Loans

1,084,600

$

Yield on Loans

6.59%

Gross Loans / Deposits (%)

92.2% |

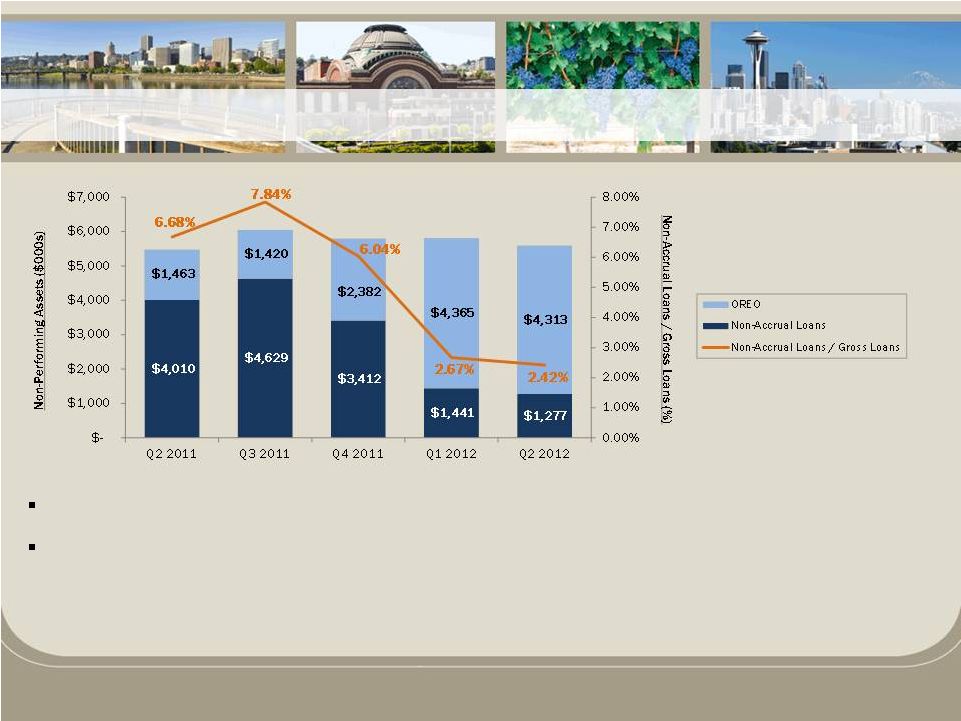

8

Significant credit resolution over the last twelve months, resulting with

migration to OREO Currently 22.8% of total non-performing assets from

non-accrual loans and 77.2% from OREO Source: SNL Financial, NCB

regulatory call report data Note: Non-performing assets excludes

restructured loans NCB -

Meaningful Credit Progress |

9

Fits into HFWA’s acquisition strategy to enhance

Pacific Northwest footprint

Financially attractive deal pricing and structure with

conservative modeling assumptions

HFWA tangible common equity to tangible assets

estimated to be 13.2% post closing

HFWA management team will continue to prudently

evaluate future acquisition opportunities

Continue strategy to build one of the premier

banking franchises in the Pacific Northwest

Concluding Thoughts |