Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - H&E Equipment Services, Inc. | d392185d8k.htm |

| EX-99.1 - PRESS RELEASE - H&E Equipment Services, Inc. | d392185dex991.htm |

Exhibit 99.2

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

Statements included herein contain forward-looking statements within the meaning of the federal securities laws. Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements. Forward-looking statements include statements preceded by, followed by or that include the words “may,” “could,” “would,” “should,” “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,” “project,” “intend,” “foresee” and similar expressions. These statements include, among others, statements regarding our expected business outlook, anticipated financial and operating results, our business strategy and means to implement the strategy, our objectives, the amount and timing of capital expenditures, the likelihood of our success in expanding our business, financing plans, budgets, working capital needs and sources of liquidity. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We believe that these risks and uncertainties include, but are not limited to, those described in the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2011. These factors should not be construed as exhaustive and should be read with the other cautionary statements contained herein and in our filings with the SEC.

Forward-looking statements are only predictions and are not guarantees of performance. These statements are based on our management’s beliefs and assumptions, which in turn are based on currently available information. Important assumptions relating to the forward-looking statements include, among others, assumptions regarding demand for our products, the expansion of product offerings geographically or through new marketing applications, the timing and cost of planned capital expenditures, competitive conditions and general economic conditions. These assumptions could prove inaccurate. Forward-looking statements also involve known and unknown risks and uncertainties, which could cause actual results to differ materially from those contained in any forward-looking statement. In addition, even if our actual results are consistent with the forward-looking statements contained herein, those results may not be indicative of results or developments in subsequent periods. Many of these factors are beyond our ability to control or predict. Such factors include, but are not limited to, the following:

| • | general economic conditions and construction and industrial activity in the markets where we operate in North America, as well as the depth and duration of the recent macroeconomic downturn and related decreases in construction and industrial activities, which may significantly affect our revenues and operating results; |

| • | the impact of conditions in the global credit markets and their effect on construction spending and the economy in general; |

| • | relationships with equipment suppliers; |

| • | increased maintenance and repair costs as we age our fleet and decreases in our equipment’s residual value; |

| • | our substantial indebtedness; |

| • | risks associated with the special cash dividend we plan to pay to our stockholders, subject to the approval of our board of directors, using the proceeds of this offering together with borrowings under the Credit Facility; |

1

| • | risks associated with the expansion of our business; |

| • | competitive pressures; |

| • | political events that could impact the worldwide economy; |

| • | our possible inability to integrate any businesses we acquire; |

| • | compliance with laws and regulations, including those relating to environmental matters and corporate governance matters; and |

| • | other factors discussed from time to time in our filings with the SEC, including factors discussed under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2011. |

Any forward-looking statements which we make herein speak only as of the date of such statement. Except as required by applicable law, including the securities laws of the United States and the rules and regulations of the SEC, we are under no obligation to publicly update or revise any forward-looking statements, whether as a result of any new information, future events or otherwise. Potential investors and other readers are urged to consider the above mentioned factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results or performance. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data.

2

SUMMARY

Unless the context otherwise requires, references to (i) “H&E” and the “Company” refer solely to H&E Equipment Services, Inc. and not its subsidiaries; and (ii) “we,” “our,” and “us” refer to H&E Equipment Services, Inc. and its subsidiaries on a consolidated basis. The term “guarantors” refers to certain of H&E’s’ subsidiaries that guarantee, as described herein, the obligations of H&E under the Notes.

“EBITDA” and “Adjusted EBITDA” are defined and discussed in note 5 under the caption “— Summary Historical Financial Data.”

Our Company

We are one of the largest integrated equipment services companies in the United States focused on heavy construction and industrial equipment. We rent, sell and provide parts and service support for four core categories of specialized equipment: (1) hi-lift or aerial work platform equipment; (2) cranes; (3) earthmoving equipment; and (4) industrial lift trucks. We engage in five principal business activities in these equipment categories:

| • | equipment rentals; |

| • | new equipment sales; |

| • | used equipment sales; |

| • | parts sales; and |

| • | repair and maintenance services. |

3

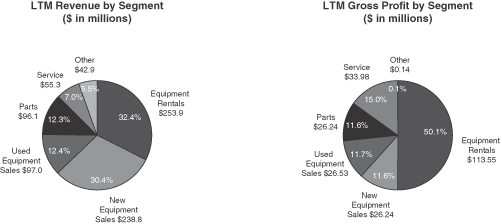

By providing rental, sales, parts, repair and maintenance functions under one roof, we offer our customers a one-stop solution for their equipment needs. This full-service approach provides us with (1) multiple points of customer contact; (2) cross-selling opportunities among our rental, new and used equipment sales, parts sales and services operations; (3) an effective method to manage our rental fleet through efficient maintenance and profitable distribution of used equipment; and (4) a mix of business activities that enables us to operate effectively throughout economic cycles. We believe that the operating experience and extensive infrastructure we have developed throughout our history as an integrated services company provide us with a competitive advantage over rental-focused companies and equipment distributors. In addition, our focus on four core categories of heavy construction and industrial equipment enables us to offer specialized knowledge and support to our customers. For the twelve months ended June 30, 2012, we generated total revenues, gross profit and EBITDA of approximately $784.0 million, $226.7 million and $174.2 million, respectively. The pie charts below illustrate a breakdown of our revenues and gross profit for the twelve months ended June 30, 2012 by business segment:

Products and Services

Equipment Rentals. We rent our heavy construction and industrial equipment to our customers on a daily, weekly and monthly basis. We have a well-maintained rental fleet that, at June 30, 2012, consisted of 19,453 pieces of equipment having an original acquisition cost (which we define as the cost originally paid to manufacturers or the original amount financed under operating leases) of approximately $809.3 million and an average age of approximately 40.4 months. Our rental business creates cross-selling opportunities for us in sales and service support activities.

New Equipment Sales. We sell new heavy construction and industrial equipment in all four core equipment categories, and are a leading U.S. distributor for nationally recognized suppliers including JLG Industries, Gehl, Genie Industries (Terex), Komatsu and Doosan/Bobcat. In addition, we are a major distributor of Grove and Manitowoc crane equipment. Our new equipment sales operation is a source of new customers for our parts sales and service support activities, as well as for used equipment sales.

Used Equipment Sales. We sell used equipment primarily from our rental fleet, as well as inventoried equipment that we acquire through trade-ins from our customers and selective purchases of high-quality used equipment. For the twelve months ended June 30, 2012, approximately 83.6% of our

4

used equipment sales revenues were derived from sales of rental fleet equipment. Used equipment sales, like new equipment sales, generate parts and service business for us.

Parts Sales. We sell new and used parts to customers and also provide parts to our own rental fleet. We maintain an extensive in-house parts inventory in order to provide timely parts and service support to our customers as well as to our own rental fleet. In addition, our parts operations enable us to maintain a high-quality rental fleet and provide additional product support to our end users.

Service Support. We provide maintenance and repair services for our customers’ owned equipment and to our own rental fleet. In addition to repair and maintenance on an as-needed or scheduled basis, we provide ongoing preventative maintenance services and warranty repairs for our customers. We devote significant resources to training our technical service employees and over time, we have built a full-scale services infrastructure that we believe would be difficult for companies without the requisite resources and lead time to effectively replicate.

In addition to our principal business activities mentioned above, we provide ancillary equipment support activities including transportation, hauling, parts shipping and loss damage waivers.

Our Competitive Strengths

Integrated Platform of Products and Services. We believe that our operating experience and the extensive infrastructure we have developed through years of operating as an integrated equipment services company provide us with a competitive advantage over rental-focused companies and equipment distributors. Key strengths of our integrated equipment services platform include:

| • | ability to strengthen customer relationships by providing a full-range of products and services; |

| • | purchasing power gained through purchases for our new equipment sales and rental operations; |

| • | high quality rental fleet supported by our strong product support capabilities; |

| • | established retail sales network resulting in profitable disposal of our used equipment; and |

| • | mix of business activities that enables us to effectively operate through economic cycles. |

Complementary, High Margin Parts and Service Operations. Our parts and service businesses allow us to maintain our rental fleet in excellent condition and to offer our customers high-quality rental equipment. Our after-market parts and service businesses together provide us with a high-margin revenue source that has proven to be relatively stable throughout a range of economic cycles.

Specialized, High-Quality Equipment Fleet. Our focus on four core types of heavy construction and industrial equipment allows us to better provide the specialized knowledge and support that our customers demand when renting and purchasing equipment. These four types of equipment are attractive because they have a long useful life, high residual value and generally strong industry demand.

Well-Developed Infrastructure. We have built an infrastructure that included a network of 64 full-service facilities as of July 27, 2012, and a workforce that, as of June 30, 2012, included a highly-skilled group of approximately 531 service technicians and an aggregate of 212 sales people in our

5

specialized rental and equipment sales forces. We believe that our well-developed infrastructure helps us to better serve large multi-regional customers than our historically rental-focused competitors and provides an advantage when competing for lucrative fleet and project management business.

Leading Distributor for Suppliers. We are a leading U.S. distributor for nationally-recognized equipment suppliers, including JLG Industries, Gehl, Genie Industries (Terex), Komatsu and Doosan/Bobcat. In addition, we are a major distributor of Grove and Manitowoc crane equipment. These relationships improve our ability to negotiate equipment acquisition pricing and allow us to purchase parts at wholesale costs.

Customized Information Technology Systems. Our information systems allow us to actively manage our business and our rental fleet. We have a customer relationship management system that provides our sales force with real-time access to customer and sales information. In addition, our enterprise resource planning system implemented in 2010 expanded our ability to provide more timely and meaningful information to manage our business.

Experienced Management Team. Our senior management team is led by John M. Engquist, our President and Chief Executive Officer, who has approximately 37 years of industry experience. Our senior and regional managers have an average of approximately 23 years of industry experience. Our branch managers have extensive knowledge and industry experience as well.

Our Business Strategy

Our business strategy includes, among other things, leveraging our integrated business model, managing the life cycle of our rental equipment, further developing our parts and services operations and selectively entering new markets and pursuing acquisitions. However, the timing and extent to which we implement these various aspects of our strategy depend on a variety of factors, many of which are outside our control, such as general economic conditions and construction activity in the United States.

Leverage Our Integrated Business Model. We intend to continue to actively leverage our integrated business model to offer a one-stop solution to our customers’ varied needs with respect to the four categories of heavy construction and industrial equipment on which we focus. We will continue to cross-sell our services to expand and deepen our customer relationships. We believe that our integrated equipment services model provides us with a strong platform for growth and enables us to effectively operate through economic cycles.

Managing the Life Cycle of Our Rental Equipment. We actively manage the size, quality, age and composition of our rental fleet, employing a “cradle through grave” approach. During the life of our rental equipment, we (1) aggressively negotiate on purchase price; (2) use our customized information technology systems to closely monitor and analyze, among other things, time utilization (equipment usage based on customer demand), rental rate trends and targets and equipment demand; (3) continuously adjust our fleet mix and pricing; (4) maintain fleet quality through regional quality control managers and our on-site parts and services support; and (5) dispose of rental equipment through our retail sales force. This allows us to purchase our rental equipment at competitive prices, optimally utilize our fleet, cost-effectively maintain our equipment quality and maximize the value of our equipment at the end of its useful life.

6

Grow Our Parts and Service Operations. Our strong parts and services operations are keystones of our integrated equipment services platform and together provide us with a relatively stable high-margin revenue source. Our parts and service operations help us develop strong, ongoing customer relationships, attract new customers and maintain a high quality rental fleet. We intend to further grow this product support side of our business and further penetrate our customer base.

Enter Carefully Selected New Markets. We intend to continue our strategy of selectively expanding our network to solidify our presence in attractive and contiguous regions where we operate. We look to add new locations in those markets that offer attractive growth opportunities, high demand for construction and heavy equipment, and contiguity to our existing markets.

Make Selective Acquisitions. The equipment industry is fragmented and includes a large number of relatively small, independent businesses servicing discrete local markets. Some of these businesses may represent attractive acquisition candidates. We intend to evaluate and pursue, on an opportunistic basis, acquisitions which meet our selection criteria, including favorable financing terms, with the objective of increasing our revenues, improving our profitability, entering additional attractive markets and strengthening our competitive position.

Industry Background

Although there has been some consolidation within the industry, including the recent acquisition of Rental Services Corporation by United Rentals, the U.S. construction equipment distribution industry remains highly fragmented and consists mainly of a small number of multi-location regional or national operators and a large number of relatively small, independent businesses serving discrete local markets. The industry is driven by a broad range of economic factors including total U.S. non-residential construction trends, construction machinery demand, and demand for rental equipment and has been adversely affected by the recent economic downturn and the related decline in construction and industrial activities. Construction equipment is largely distributed to end users through two channels: equipment rental companies and equipment dealers. Examples of rental equipment companies include United Rentals/Rental Service Corporation, Sunbelt Rentals and Hertz Equipment Rental. Examples of equipment dealers include Finning and Toromont. Unlike many of these companies, which principally focus on one channel of distribution, we operate substantially in both channels. As an integrated equipment services company, we rent, sell and provide parts and service support. Although many of the historically pure equipment rental companies also provide parts and service support to customers, their service offerings are typically limited and may prove difficult to expand due to the infrastructure, training and resources necessary to develop the breadth of offerings and depth of specialized equipment knowledge that our service and sales staff provides.

Transactions

We will use the aggregate proceeds from the Notes together with borrowings under the Credit Facility (as defined below) to repurchase or redeem all of our outstanding 8 3/8% senior unsecured notes due 2016 (the “Existing Senior Notes”), to pay related fees and expenses and for general corporate purposes. We also currently expect to pay a special cash dividend to our stockholders, subject to the approval of our board of directors. See “Use of Proceeds” for more detailed sources and uses information.

On August 6, 2012, we commenced a tender offer for any and all of our Existing Senior Notes. In connection with the tender offer, we have solicited consents to amend the indenture governing the

7

Existing Senior Notes to eliminate substantially all of the restrictive covenants, reporting requirements and certain events of default. Under the terms of the tender offer, the total consideration for tendered notes equals $1,031.67 for every $1,000 principal amount of Existing Senior Notes tendered. The total consideration includes a consent payment of $10.00 per $1,000 principal amount of Existing Senior Notes tendered prior to the consent deadline. This Exhibit 99.2 is not an offer to purchase, or the solicitation of an offer to sell, the Existing Senior Notes. The tender offer and consent solicitation is made only by and pursuant to the terms of the Offer to Purchase and Consent Solicitation Statement of the Company, dated August 6, 2012, and the related Letter of Transmittal and Consent, as the same may be amended or supplemented. The tender offer is subject to the satisfaction or waiver of various conditions, including the issuance of the Notes, entry into an amendment to the Credit Facility and other customary conditions. We may amend, extend or terminate the tender offer and consent solicitation in our sole discretion. At any time and from time to time before, during and after the expiration of the tender offer, we may purchase or offer to purchase the Existing Senior Notes through open market purchases, privately negotiated transactions, tender offer, exchange offers, redemptions or otherwise. We currently intend to redeem any and all Existing Senior Notes that remain outstanding following consummation of the tender offer. This Exhibit 99.2 does not constitute a notice of redemption.

We currently expect to use a portion of the proceeds from the sale of the Notes to pay during 2012 a special cash dividend of approximately $246 million in the aggregate to our stockholders of record on the record date determined by our board of directors. However, whether we will declare a special dividend, and, if so, the timing, amount and nature of any such special cash dividend, will be subject to approval by our board of directors. Any such approval will depend on a variety of factors, including our ability both to complete the sale of the Notes and to enter into an amendment to our Credit Facility on terms acceptable to us; our financial results, cash requirements and financial condition; our ability to pay dividends under applicable state law; and any other factors deemed relevant by our board of directors. If for any reason our board of directors does not approve a special cash dividend in the currently anticipated amount of approximately $246 million, we may use the proceeds from the sale of the Notes to fund a special cash dividend of a smaller amount, or we may elect not to declare any special cash dividend.

Concurrently with the offering of the Notes, we intend to enter into an amendment to our credit facility with General Electric Capital Corporation as agents and the lenders named therein (the “Credit Facility”). As amended, the Credit Facility will provide for aggregate revolving loan commitments of $402.5 million. As of June 30, 2012, after giving effect to the Transactions, we would have had $281.0 million of availability under the Credit Facility, as amended, net of $6.5 million of outstanding letters of credit. We refer to the offering of the Notes, our entering into the amendment to the Credit Facility, the repurchase or redemption of our Existing Senior Notes and the potential declaration and payment of a special cash dividend collectively as the “Transactions.” See “Description of Other Indebtedness” for a summary of the proposed terms of the amendment to the Credit Facility.

8

Summary Historical Financial Data

The following tables set forth, for the periods and dates indicated, our summary historical financial data. The summary historical consolidated financial data for our fiscal years ended December 31, 2009, 2010 and 2011 have been derived from our audited consolidated financial statements. The summary historical financial data for the six months ended June 30, 2011 and 2012 have been derived from our unaudited condensed consolidated financial statements. The unaudited condensed consolidated financial statements have been prepared on the same basis as our audited consolidated financial statements and, in the opinion of our management, reflect all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the results for those periods. The results for any interim period are not necessarily indicative of the results that may be expected for a full year. The historical results included here are not necessarily indicative of future performance or results of operations.

9

You should read this information in conjunction with “Selected Financial Data” and the accompanying “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2011 and “Financial Statements” and the accompanying “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2012.

| For the Year Ended December 31, |

For the Six Months Ended June 30, |

|||||||||||||||||||

| 2009 | 2010 | 2011 | 2011 | 2012 | ||||||||||||||||

| (Amounts in thousands) | (Unaudited) | |||||||||||||||||||

| Statement of operations data(1): | ||||||||||||||||||||

| Revenues: | ||||||||||||||||||||

| Equipment rentals | 191,512 | 177,970 | $ | 228,038 | $ | 104,250 | $ | 130,133 | ||||||||||||

| New equipment sales | 208,916 | 167,303 | 220,211 | 87,086 | 105,701 | |||||||||||||||

| Used equipment sales | 86,982 | 62,286 | 85,347 | 38,483 | 50,110 | |||||||||||||||

| Parts sales | 100,500 | 86,686 | 94,511 | 46,519 | 48,103 | |||||||||||||||

| Services revenues | 58,730 | 49,629 | 53,954 | 25,881 | 27,179 | |||||||||||||||

| Other | 33,092 | 30,280 | 38,490 | 17,024 | 21,463 | |||||||||||||||

| Total revenues | 679,732 | 574,154 | 720,551 | 319,243 | 382,689 | |||||||||||||||

| Cost of revenues: | ||||||||||||||||||||

| Rental depreciation | 87,902 | 78,583 | 86,781 | 42,070 | 47,577 | |||||||||||||||

| Rental expense | 42,086 | 40,194 | 46,599 | 22,308 | 23,796 | |||||||||||||||

| New equipment sales | 183,885 | 150,665 | 196,152 | 77,148 | 93,578 | |||||||||||||||

| Used equipment sales | 70,305 | 48,269 | 65,042 | 29,620 | 35,027 | |||||||||||||||

| Parts sales | 72,786 | 63,902 | 69,222 | 34,101 | 34,734 | |||||||||||||||

| Services revenues | 21,825 | 18,751 | 21,024 | 10,048 | 10,292 | |||||||||||||||

| Other | 35,445 | 37,851 | 43,028 | 21,037 | 20,799 | |||||||||||||||

| Total cost of revenues | 514,234 | 438,215 | 527,848 | 236,332 | 265,803 | |||||||||||||||

| Gross profit (loss): | ||||||||||||||||||||

| Equipment rentals | 61,524 | 59,193 | 94,658 | 39,872 | 58,760 | |||||||||||||||

| New equipment sales | 25,031 | 16,638 | 24,059 | 9,938 | 12,123 | |||||||||||||||

| Used equipment sales | 16,677 | 14,017 | 20,305 | 8,863 | 15,083 | |||||||||||||||

| Parts sales | 27,714 | 22,784 | 25,289 | 12,418 | 13,369 | |||||||||||||||

| Services revenues | 36,905 | 30,878 | 32,930 | 15,833 | 16,887 | |||||||||||||||

| Other | (2,353 | ) | (7,571 | ) | (4,538 | ) | (4,013 | ) | 664 | |||||||||||

| Total gross profit | 165,498 | 135,939 | 192,703 | 82,911 | 116,886 | |||||||||||||||

| Selling, general and administrative expenses(2) | 144,460 | 148,277 | 153,354 | 75,639 | 82,102 | |||||||||||||||

| Impairment of goodwill and intangible assets(3) | 8,972 | — | — | — | — | |||||||||||||||

| Gain from sales of property and equipment, net | 533 | 443 | 793 | 149 | 964 | |||||||||||||||

| Income (loss) from operations | 12,599 | (11,895 | ) | 40,142 | 7,421 | 35,748 | ||||||||||||||

| Other income (expense): | ||||||||||||||||||||

| Interest expense(4) | (31,339 | ) | (29,076 | ) | (28,727 | ) | (14,385 | ) | (13,843 | ) | ||||||||||

| Other, net | 619 | 591 | 726 | 508 | 508 | |||||||||||||||

| Total other expense, net | (30,720 | ) | (28,485 | ) | (28,001 | ) | (13,877 | ) | (13,335 | ) | ||||||||||

| Income (loss) before income taxes | (18,121 | ) | (40,380 | ) | 12,141 | (6,456 | ) | 22,413 | ||||||||||||

| Income tax provision (benefit) | (6,178 | ) | (14,920 | ) | 3,215 | (2,672 | ) | 7,990 | ||||||||||||

| Net income (loss) | $ | (11,943 | ) | $ | (25,460 | ) | $8,926 | $(3,784 | ) | $14,423 | ||||||||||

10

| For the Year Ended December 31, |

For the Six Months Ended June 30, |

|||||||||||||||||||

| 2009 | 2010 | 2011 | 2011 | 2012 | ||||||||||||||||

| (Amounts in thousands, except for ratios) |

||||||||||||||||||||

| Other financial data: |

||||||||||||||||||||

| EBITDA(5) |

$112,511 | $80,962 | $140,266 | $56,493 | $90,421 | |||||||||||||||

| Adjusted EBITDA(5) |

121,483 | 80,962 | 140,266 | 56,493 | 90,421 | |||||||||||||||

| Depreciation and amortization(6) |

99,293 | 92,266 | 99,398 | 48,564 | 54,165 | |||||||||||||||

| Total capital expenditures (gross)(7) |

45,539 | 107,179 | 174,024 | 85,920 | 164,774 | |||||||||||||||

| Total capital expenditures (net)(8) |

(26,877 | ) | 58,947 | 109,284 | 58,773 | 118,848 | ||||||||||||||

| Ratio of earnings to fixed charges |

— | — | 1.4x | — | 2.4x | |||||||||||||||

| As of June 30, 2012 | ||||||||

| Actual | As Adjusted(10) | |||||||

| (Amounts in thousands) | ||||||||

| (Unaudited) | ||||||||

| Balance sheet data: |

||||||||

| Cash |

$3,692 | $3,692 | ||||||

| Rental equipment, net |

518,425 | 518,425 | ||||||

| Goodwill(3) |

33,046 | 33,046 | ||||||

| Deferred financing costs, net |

5,754 | 13,559 | ||||||

| Intangible assets, net |

17 | 17 | ||||||

| Total assets |

859,140 | 866,945 | ||||||

| Total debt(9) |

323,790 | 597,504 | ||||||

| Stockholders’ Equity |

279,422 | 23,413 | ||||||

| Selected financial data and ratios: | Twelve Months Ended June 30, 2012 |

|||

| (Amounts in thousands, except for ratios) |

||||

| Pro forma interest expense(11) |

$ | 45,536 | ||

| Pro forma net income(11) |

16,220 | |||

| Adjusted EBITDA(5) |

174,194 | |||

| Ratio of Adjusted EBITDA to pro forma interest expense |

3.8x | |||

| Ratio of As Adjusted total debt to Adjusted EBITDA |

3.4x | |||

| (1) | See note 17 to the audited consolidated financial statements discussing segment information. |

| (2) | Stock-based compensation expense included in selling, general and administrative expenses for the years ended December 31, 2011, 2010 and 2009 totaled $1.3 million, $1.0 million and $0.7 million, respectively. |

| (3) | As more fully described in note 2 to the audited consolidated financial statements, and in connection with our annual impairment test, we recorded in 2009 a non-cash goodwill impairment of approximately $9.0 million, or $5.5 million after tax, related to our Equipment Rentals Component 1 reporting unit. |

| (4) | Interest expense is comprised of cash-pay interest (interest recorded on debt and other obligations requiring periodic cash payments) and non-cash pay interest comprised of amortization of deferred financing costs and accretion of loan discounts. |

| (5) | We define EBITDA as net income (loss) before interest expense, income taxes, depreciation and amortization. We define Adjusted EBITDA for the year ended December 31, 2009 as EBITDA adjusted for the $9.0 million goodwill impairment charge recorded in the fourth quarter of 2009. We use EBITDA and Adjusted EBITDA in our business operations to, among other things, evaluate the performance of our business, develop budgets and measure our performance against those budgets. We also believe that analysts and investors use EBITDA and Adjusted EBITDA as supplemental measures to evaluate a company’s overall operating performance. However, EBITDA and Adjusted EBITDA have material limitations as an analytical tool and you should not consider them in isolation, or as substitutes for analysis of our results as reported under GAAP. We consider them useful tools to assist us in evaluating performance because they eliminate items related to capital structure, taxes and non-cash charges. The items that we have eliminated in determining EBITDA for the periods presented are interest expense, income taxes, depreciation of fixed assets (which includes rental equipment and property and equipment), and amortization of intangible assets |

11

| and, in the case of Adjusted EBITDA, any goodwill and intangible asset impairment charges and the other items described above applicable to the particular period. However, some of these eliminated items are significant to our business. For example, (i) interest expense is a necessary element of our costs and ability to generate revenue because we incur a significant amount of interest expense related to our outstanding indebtedness; (ii) payment of income taxes is a necessary element of our costs; and (iii) depreciation is a necessary element of our costs and ability to generate revenue because rental equipment is the single largest component of our total assets and we recognize a significant amount of depreciation expense over the estimated useful life of this equipment. Any measure that eliminates components of our capital structure and costs associated with carrying significant amounts of fixed assets on our consolidated balance sheet has material limitations as a performance measure. In light of the foregoing limitations, we do not rely solely on EBITDA and Adjusted EBITDA as performance measures and also consider our GAAP results. EBITDA and Adjusted EBITDA are not measurements of our financial performance under GAAP and should not be considered alternatives to net income (loss), operating income (loss) or any other measures derived in accordance with GAAP. Because EBITDA and Adjusted EBITDA are not calculated in the same manner by all companies, they may not be comparable to other similarly titled measures used by other companies. |

Set forth below is a reconciliation of net income (loss) to EBITDA and Adjusted EBITDA for the periods presented.

| For the Year Ended December 31, | For the Six Months Ended June 30, |

|||||||||||||||||||

| 2009 | 2010 | 2011 | 2011 | 2012 | ||||||||||||||||

| (Amounts in thousands) | (Unaudited) | |||||||||||||||||||

| Net income (loss) |

$ | (11,943 | ) | $ | (25,460 | ) | $8,926 | $(3,784 | ) | $14,423 | ||||||||||

| Income tax provision (benefit) |

(6,178 | ) | (14,920 | ) | 3,215 | (2,672 | ) | 7,990 | ||||||||||||

| Interest expense |

31,339 | 29,076 | 28,727 | 14,385 | 13,843 | |||||||||||||||

| Depreciation and amortization(6) |

99,293 | 92,266 | 99,398 | 48,564 | 54,165 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA |

112,511 | 80,962 | 140,266 | 56,493 | 90,421 | |||||||||||||||

| Impairment of goodwill |

8,972 | — | — | — | — | |||||||||||||||

| Adjusted EBITDA |

$ | 121,483 | $ | 80,962 | $ | 140,266 | $ | 56,493 | $ | 90,421 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (6) | Excludes amortization of deferred financing costs and accretion of loan discounts, which are both included in interest expense. |

| (7) | Total capital expenditures (gross) include rental equipment purchases, assets transferred from new and used inventory to rental fleet and property and equipment purchases. |

| (8) | Total capital expenditures (net) include rental equipment purchases, assets transferred from new and used inventory to rental fleet and property and equipment purchases less proceeds from the sale of these assets. |

| (9) | Total debt represents the amounts outstanding, as applicable for the periods presented, under the Credit Facility, Existing Senior Notes, notes payable and capital leases, as well as the Notes. |

| (10) | The amounts shown in the “As Adjusted” column give pro forma effect to the Transactions as if they had occurred on June 30, 2012 and assume that all of our Existing Senior Notes will be tendered and purchased in the tender offer and assume the amount of the tender offer price and fees described above under “Summary—Transactions.” Amounts will depend upon the amount of Existing Senior Notes actually tendered and purchased, and the actual amount of the tender offer consideration. In addition, amounts will depend upon the amount of cash on hand that is available at the time, and we may borrow more or less under the Credit Facility depending upon the amount of cash available. See “Use of Proceeds” discussion for further information. To the extent that any Existing Senior Notes are not tendered, the amount of our total debt may increase. |

| (11) | Pro forma interest expense and pro forma net income give effect to the Transactions as if they had occurred on July 1, 2011. |

12

RISK FACTORS

Risks Related to the Notes

Our substantial indebtedness could adversely affect our financial condition.

After giving effect to the offering of the Notes and the amendment of the Credit Facility, we will have a significant amount of indebtedness. On June 30, 2012, after giving effect to the offering of the Notes and the amendment of the Credit Facility, we would have had total indebtedness of $597.5 million (including $480.0 million of senior unsecured debt under the Notes and $115.0 million under the Credit Facility). As of June 30, 2012, after giving effect to the Transactions, we would have had $281.0 million of availability under the Credit Facility, as amended, net of $6.5 million of outstanding letters of credit.

Our substantial indebtedness could have important consequences to you. For example, it could:

| • | increase our vulnerability to general adverse economic and industry conditions; |

| • | require us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures and other general corporate purposes; |

| • | limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

| • | place us at a competitive disadvantage compared to our competitors that have less debt; and |

| • | limit our ability to obtain additional financing for working capital, capital expenditures, acquisitions or general corporate purposes. |

We expect to use cash flow from operations and borrowings under our Credit Facility to meet our current and future financial obligations, including funding our operations, debt service and capital expenditures. Our ability to make these payments depends on our future performance, which will be affected by financial, business, economic and other factors, many of which we cannot control. Our business may not generate sufficient cash flow from operations in the future, which could result in our being unable to repay indebtedness, or to fund other liquidity needs. If we do not have enough capital, we may be forced to reduce or delay our business activities and capital expenditures, sell assets, obtain additional debt or equity capital or restructure or refinance all or a portion of our debt, including the Notes and our credit facility, on or before maturity. We cannot make any assurances that we will be able to accomplish any of these alternatives on terms acceptable to us, or at all. In addition, the terms of existing or future indebtedness, including the agreements for governing the Notes offered hereby and the proposed amendment to our credit facility, respectively, may limit our ability to pursue any of these alternatives.

We may not be able to generate sufficient cash to service all of our indebtedness, including the Notes, and may be forced to take other actions to satisfy our obligations under our indebtedness, which may not be successful.

Our ability to make scheduled payments or to refinance our debt obligations depends on our financial and operating performance, which is subject to prevailing economic and competitive conditions and to certain financial, business and other factors beyond our control. We cannot assure

13

you that we will maintain a level of cash flows from operating activities sufficient to permit us to pay the principal, premium, if any, and interest on our indebtedness, including the Notes. In the absence of such operating results and resources, we could face substantial liquidity problems and might be required to dispose of material assets or operations to meet our debt service and other obligations. The indenture that will govern the Notes will restrict our ability to dispose of assets and use the proceeds from the disposition. We may not be able to consummate those dispositions or to obtain the proceeds which we could realize from such dispositions. Any proceeds we do receive from a disposition may not be adequate to meet any debt service obligations then due. In addition, we currently intend to use a portion of the proceeds from the offering of the Notes together with borrowings under the Credit Facility to pay a special cash dividend to our stockholders, subject to the approval of our board of directors. The payment of such dividend will decrease our available cash.

If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to reduce or delay capital expenditures, sell assets or operations, seek additional capital or restructure or refinance our indebtedness, including the Notes. We cannot assure you that we would be able to take any of these actions, that these actions would be successful and permit us to meet our scheduled debt service obligations or that these actions would be permitted under the terms of our existing or future debt agreements, including the Credit Facility or the indenture that will govern the Notes.

If we cannot make scheduled payments on our debt, we will be in default and, as a result:

| • | our debt holders could declare all outstanding principal and interest to be due and payable; |

| • | the lenders under the Credit Facility could terminate their commitments to lend us money and foreclose against the assets securing our borrowings; and |

| • | we could be forced into bankruptcy or liquidation, which could result in your losing your investment in the Notes. |

Despite current indebtedness levels, we may still be able to incur more indebtedness, which could further exacerbate the risks described above.

We and our subsidiaries may be able to incur substantial additional indebtedness in the future. The terms of the agreements governing the Credit Facility and the Notes, respectively, will not fully prohibit us from doing so. If we incur any additional indebtedness that ranks equally with the Notes, the holders of that debt will be entitled to share ratably with you in any proceeds distributed in connection with any insolvency, liquidation, reorganization, dissolution or other winding-up of us. This may have the effect of reducing the amount of proceeds paid to you.

Additionally, our Credit Facility, as amended, will provide revolving commitments of up to $402.5 million in the aggregate. As of June 30, 2012, after giving effect to the Transactions, we would have had $281.0 million of availability under the Credit Facility, as amended, net of $6.5 million of outstanding letters of credit. All of those borrowings would be secured indebtedness. If new debt is added to our current debt levels, the risks that we now face relating to our substantial indebtedness could intensify. The subsidiaries that will guarantee the Notes will also be guarantors under the Credit Facility.

14

The agreements governing the Credit Facility and the Notes restrict our ability to engage in some business and financial transactions.

The agreements governing the Credit Facility and the Notes, respectively, will among other things, restrict our ability to:

| • | incur more debt; |

| • | pay dividends and make distributions; |

| • | issue preferred stock of subsidiaries; |

| • | make investments; |

| • | repurchase stock; |

| • | create liens; |

| • | enter into transactions with affiliates; |

| • | enter into sale and lease-back transactions; |

| • | merge or consolidate; and |

| • | transfer and sell assets. |

Our ability to borrow under the Credit Facility will depend upon compliance with these covenants. Events beyond our control could affect our ability to meet these covenants. In addition, the Credit Facility will require us to meet certain financial conditions tests.

Events beyond our control can affect our ability to meet these financial conditions tests and to comply with other provisions governing the Credit Facility and the Notes. Our failure to comply with obligations under the agreements governing the Credit Facility and the Notes may result in an event of default under the agreements governing the Credit Facility or the Notes, respectively. A default, if not cured or waived, may permit acceleration of this indebtedness and our other indebtedness. We may not have funds available to remedy these defaults. If our indebtedness is accelerated, we may not have sufficient funds available to pay the accelerated indebtedness and may not have the ability to refinance the accelerated indebtedness on terms favorable to us or at all.

Variable rate indebtedness subjects us to interest rate risk, which could cause our debt service obligations to increase significantly.

Borrowings under the Credit Facility are at variable rates of interest and expose us to interest rate risk. As such, our results of operations are sensitive to movements in interest rates. There are many economic factors outside our control that have in the past and may, in the future, impact rates of interest including publicly announced indices that underlie the interest obligations related to a certain portion of our debt. Factors that impact interest rates include governmental monetary policies, inflation, recession, changes in unemployment, the money supply, international disorder and instability in domestic and foreign financial markets. If interest rates increase, our debt service obligations on the variable rate indebtedness would increase even though the amount borrowed remained the same, and our results of operations would be adversely impacted. Such increases in interest rates could have a material adverse effect on our financial conditions and results of operations.

15

Risks Related to Our Business

Our business could be adversely affected by declines in construction and industrial activities, or a downturn in the economy in general, which could lead to decreased demand for equipment, depressed equipment rental rates and lower sales prices, resulting in a decline in our revenues, gross margins and operating results.

Our equipment is principally used in connection with construction and industrial activities. Consequently, a downturn in construction or industrial activities, or the economy in general, may lead to a decrease in the demand for equipment or depress rental rates and the sales prices for our equipment. Our business may also be negatively impacted, either temporarily or long-term, by:

| • | a reduction in spending levels by customers; |

| • | unfavorable credit markets affecting end-user access to capital; |

| • | adverse changes in federal and local government infrastructure spending; |

| • | an increase in the cost of construction materials; |

| • | adverse weather conditions which may affect a particular region; |

| • | an increase in interest rates; or |

| • | terrorism or hostilities involving the United States. |

Weakness or deterioration in the non-residential construction and industrial sectors caused by these or other factors could have a material adverse effect on our financial position, results of operations and cash flows in the future and may also have a material adverse effect on residual values realized on the disposition of our rental fleet. Most recently, the economic downturn and related economic uncertainty, combined with weakness in the construction industry and a decrease in industrial activity, resulted in a significant decrease during fiscal years 2009 and 2010 in the demand for our new and used equipment and depressed equipment rental rates, which resulted in decreased revenues and lower gross margins realized on our equipment rentals and on the sale of our new and used inventory during those periods.

The inability to forecast trends accurately may have an adverse impact on our business and financial condition.

An economic downturn or economic uncertainty makes it difficult for us to forecast trends, which may have an adverse impact on our business and financial condition. The recent economic downturn — which included, among other things, significant reductions in available capital and liquidity from banks and other providers of credit, substantial reductions and/or fluctuations in equity and currency values worldwide and concerns that the worldwide economy may enter into a prolonged recessionary period — limited our ability, as well as the ability of our customers and our suppliers, to accurately forecast future product demand trends. Uncertainty regarding future product demand could cause us to maintain excess equipment inventory and increase our equipment inventory carrying costs. Alternatively, this forecasting difficulty could cause a shortage of equipment for sale or rental that could result in an inability to satisfy demand for our products and a loss of market shares.

16

Unfavorable conditions or disruptions in the capital and credit markets may adversely impact business conditions and the availability of credit.

Disruptions in the global capital and credit markets as a result of an economic downturn, economic uncertainty, changing or increased regulation, reduced alternatives or failures of significant financial institutions could adversely affect our customers’ ability to access capital and could adversely affect our access to liquidity needed for business in the future. Additionally, unfavorable market conditions may depress demand for our products and services or make it difficult for our customers to obtain financing and credit on reasonable terms. Unfavorable market conditions also may cause more of our customers to be unable to meet their payment obligations to us, increasing delinquencies and credit losses. If we are unable to manage credit risk adequately, or if a large number of customers should have financial difficulties at the same time, our credit losses could increase above historical levels and our operating results would be adversely affected. Delinquencies and credit losses generally can be expected to increase during economic slowdowns or recessions. Moreover, our suppliers may be adversely impacted by unfavorable capital and credit markets, causing disruption or delay of product availability. These events could negatively impact our business, financial position, results of operations and cash flows.

In addition, if the financial institutions that have extended line of credit commitments to us are adversely affected by the conditions of the capital and credit markets, they may be unable to fund borrowings under those credit commitments, which could have an adverse impact on our financial condition and our ability to borrow funds, if needed, for working capital, acquisitions, capital expenditures and other corporate purposes.

Our business could be hurt if we are unable to obtain additional capital as required, resulting in a decrease in our revenues and profitability.

The cash that we generate from our business, together with cash that we may borrow under the Credit Facility, may not be sufficient to fund our capital requirements. We may require additional financing to obtain capital for, among other purposes, purchasing equipment, completing acquisitions, establishing new locations and refinancing existing indebtedness. Any additional indebtedness that we incur will make us more vulnerable to economic downturns and limit our ability to withstand competitive pressures. Moreover, we may not be able to obtain additional capital on acceptable terms, if at all. If we are unable to obtain sufficient additional financing in the future, our business could be adversely affected by reducing our ability to increase revenues and profitability.

Our revenue and operating results may fluctuate, which could result in a decline in our profitability and make it more difficult for us to grow our business.

Our revenue and operating results have historically varied from quarter to quarter. Periods of decline could result in an overall decline in profitability and make it more difficult for us to make payments on our indebtedness and grow our business. We expect our quarterly results to continue to fluctuate in the future due to a number of factors, including:

| • | general economic conditions in the markets where we operate; |

| • | the cyclical nature of our customers’ business, particularly our construction customers; |

| • | seasonal sales and rental patterns of our construction customers, with sales and rental activity tending to be lower in the winter months; |

17

| • | severe weather and seismic conditions temporarily affecting the regions where we operate; |

| • | changes in corporate spending for plants and facilities or changes in government spending for infrastructure projects; |

| • | the effectiveness of integrating acquired businesses and new start-up locations; and |

| • | timing of acquisitions and new location openings and related costs. |

In addition, we incur various costs when integrating newly acquired businesses or opening new start-up locations, and the profitability of a new location is generally expected to be lower in the initial months of operation.

We are subject to competition, which may have a material adverse effect on our business by reducing our ability to increase or maintain revenues or profitability.

The equipment rental and retail distribution industries are highly competitive and the equipment rental industry is highly fragmented. Many of the markets in which we operate are served by numerous competitors, ranging from national and multi-regional equipment rental companies to small, independent businesses with a limited number of locations. We generally compete on the basis of availability, quality, reliability, delivery and price. Some of our competitors have significantly greater financial, marketing and other resources than we do, and may be able to reduce rental rates or sales prices. The recent market downturn and increased competitive pressures in 2009 and 2010 caused us to significantly reduce our rates to maintain market share, resulting in lower operating margins and profitability. We may encounter increased competition from existing competitors or new market entrants in the future, which could have a material adverse effect on our business, financial condition and results of operations.

We purchase a significant amount of our equipment from a limited number of manufacturers. Termination of one or more of our relationships with any of those manufacturers could have a material adverse effect on our business, as we may be unable to obtain adequate or timely rental and sales equipment.

We purchase most of our rental and sales equipment from leading, nationally-known original equipment manufacturers (“OEMs”). For the year ended December 31, 2011, we purchased approximately 64% of our rental and sales equipment from three manufacturers (Grove/Manitowoc, Komatsu and Genie Industries (Terex)). Although we believe that we have alternative sources of supply for the rental and sales equipment we purchase in each of our core product categories, termination of one or more of our relationships with any of these major suppliers could have a material adverse effect on our business, financial condition or results of operations if we were unable to obtain adequate or timely rental and sales equipment.

Our suppliers of new equipment may appoint additional distributors, sell directly or unilaterally terminate our distribution agreements, which could have a material adverse effect on our business due to a reduction of, or inability to increase, our revenues.

We are a distributor of new equipment and parts supplied by leading, nationally-known OEMs. Under our distribution agreements with these OEMs, manufacturers retain the right to appoint additional dealers and sell directly to national accounts and government agencies. We have both written and oral distribution agreements with our new equipment suppliers. Under our oral agreements with the OEMs, we operate under our established course of dealing with the supplier and are subject to

18

the applicable state law regarding such relationship. In most instances, the OEM’s may appoint additional distributors, elect to sell to customers directly or unilaterally terminate their distribution agreements with us at any time without cause. Any such actions could have a material adverse effect on our business, financial condition and results of operations due to a reduction of, or an inability to increase, our revenues.

The cost of new equipment that we sell or purchase for use in our rental fleet may increase and therefore we may spend more for such equipment. In some cases, we may not be able to procure new equipment on a timely basis due to supplier constraints.

The cost of new equipment from manufacturers that we sell or purchase for use in our rental fleet may increase as a result of increased raw material costs, including increases in the cost of steel, which is a primary material used in most of the equipment we use. These increases could materially impact our financial condition or results of operations in future periods if we are not able to pass such cost increases through to our customers.

Our rental fleet is subject to residual value risk upon disposition.

The market value of any given piece of rental equipment could be less than its depreciated value at the time it is sold. The market value of used rental equipment depends on several factors, including:

| • | the market price for new equipment of a like kind; |

| • | wear and tear on the equipment relative to its age; |

| • | the time of year that it is sold (prices are generally higher during the construction season); |

| • | worldwide and domestic demands for used equipment; |

| • | the supply of used equipment on the market; and |

| • | general economic conditions. |

We include in operating income the difference between the sales price and the depreciated value of an item of equipment sold. Although for the year ended December 31, 2011 we sold used equipment from our rental fleet at an average selling price of approximately 141.9% of net book value, we cannot assure you that used equipment selling prices will not decline. Any significant decline in the selling prices for used equipment could have a material adverse affect on our business, financial condition, results of operations or cash flows.

We incur maintenance and repair costs associated with our rental fleet equipment that could have a material adverse effect on our business in the event these costs are greater than anticipated.

As our fleet of rental equipment ages, the cost of maintaining such equipment, if not replaced within a certain period of time, generally increases. Determining the optimal age for our rental fleet equipment is subjective and requires considerable estimates by management. We have made estimates regarding the relationship between the age of our rental fleet equipment, and the maintenance and repair costs, and the market value of used equipment. Our future operating results could be adversely affected because our maintenance and repair costs may be higher than estimated and market values of used equipment may fluctuate.

19

Fluctuations in fuel costs or reduced supplies of fuel could harm our business.

We could be adversely affected by limitations on fuel supplies or significant increases in fuel prices that result in higher costs to us of transporting equipment from one branch to another branch or one region to another region. A significant or protracted disruption of fuel supplies could have a material adverse effect on our financial condition and results of operations.

We may not be able to facilitate our growth strategy by identifying or completing transactions with attractive acquisition candidates, which could impede our revenues and profitability. Future acquisitions may result in significant transaction expenses and may involve significant costs. We may experience integration and consolidation risks associated with future acquisitions.

From time to time, we may selectively identify attractive acquisition candidates. We cannot assure you that we will be able to identify attractive acquisition candidates or complete the acquisition of any identified candidates at favorable prices and upon advantageous terms and conditions, including financing alternatives. We expect to face competition for acquisition candidates, which may limit the number of acquisition opportunities and lead to higher acquisition costs. We may not have the financial resources necessary to consummate any acquisitions or the ability to obtain the necessary funds on satisfactory terms. Any future acquisitions may result in significant transaction expenses and risks associated with entering new markets. We may also be subject to claims by third parties related to the operations of these businesses prior to our acquisition and by sellers under the terms of our acquisition agreements.

We may not have sufficient management, financial and other resources to integrate and consolidate any future acquisitions. Any significant diversion of management’s attention or any major difficulties encountered in the integration of the businesses we acquire could have a material adverse effect on our business, financial condition or results of operations, which could decrease our profitability and make it more difficult for us to grow our business. Furthermore, general economic conditions or unfavorable global capital and credit markets could affect the timing and extent to which we successfully acquire new businesses, which could impede our revenues and profitability.

We may not be able to facilitate our growth strategy by identifying and opening attractive start-up locations, which could impede our revenues and profitability.

An important element of our growth strategy is to selectively identify and implement start-up locations in order to add new customers. The success of our growth strategy depends, in part, on identifying strategic start-up locations.

We also cannot assure you that we will be able to identify attractive start-up locations. Opening start-up locations may involve significant costs and limit our ability to expand our operations. Start-up locations may involve risks associated with entering new markets and we may face significant competition.

We may not have sufficient management, financial and other resources to successfully operate new locations. Any significant diversion of management’s attention or any major difficulties encountered in the locations that we open in the future could have a material adverse effect on our business, financial condition or results of operations, which could decrease our profitability and make it more difficult for us to grow our business. Furthermore, general economic conditions or unfavorable global capital and credit markets could affect the timing and extent to which we open new start-up locations, which could impede our revenues and profitability.

20

We are dependent on key personnel. A loss of key personnel could have a material adverse effect on our business, which could result in a decline in our revenues and profitability.

Our senior and regional managers have an average of approximately 23 years of industry experience. Our branch managers have extensive knowledge and industry experience as well. Our success is dependent, in part, on the experience and skills of our management team. Competition for top management talent within our industry is generally significant. If we are unable to fill and keep filled all of our senior management positions, or if we lose the services of any key member of our senior management team and are unable to find a suitable replacement in a timely manner, we may be challenged to effectively manage our business and execute our strategy.

Disruptions in our information technology systems, including our customer relationship management system, could adversely affect our operating results by limiting our capacity to effectively monitor and control our operations.

Our information technology systems facilitate our ability to monitor and control our operations and adjust to changing market conditions. Any disruption in any of these systems, including our customer management system, or the failure of any of these systems to operate as expected could, depending on the magnitude of the problem, adversely affect our operating results by limiting our capacity to effectively monitor and control our operations and adjust to changing market conditions.

If the Company fails to maintain an effective system of internal controls, the Company may not be able to accurately report financial results or prevent fraud.

Effective internal controls are necessary to provide reliable financial reports and to assist in the effective prevention of fraud. Any inability to provide reliable financial reports or prevent fraud could harm our business. We must annually evaluate our internal procedures to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, which requires management and auditors to assess the effectiveness of our internal controls. If we fail to remedy or maintain the adequacy of our internal controls, as such standards are modified, supplemented or amended from time to time, we could be subject to regulatory scrutiny, civil or criminal penalties or shareholder litigation.

In addition, failure to maintain effective internal controls could result in financial statements that do not accurately reflect our financial condition or results of operations. There can be no assurance that we will be able to maintain a system of internal controls that fully complies with the requirements of the Sarbanes-Oxley Act of 2002 or that our management and independent registered public accounting firm will continue to conclude that our internal controls are effective.

We are exposed to various risks related to legal proceedings or claims that could adversely affect our operating results. The nature of our business exposes us to various liability claims, which may exceed the level of our insurance coverage and thereby not fully protect us.

We are a party to lawsuits in the normal course of our business. Litigation in general can be expensive, lengthy and disruptive to normal business operations. Moreover, the results of complex legal proceedings are difficult to predict. Responding to lawsuits brought against us, or legal actions that we may initiate, can often be expensive and time-consuming. Unfavorable outcomes from these claims and/or lawsuits could adversely affect our business, results of operations or financial condition, and we could incur substantial monetary liability and/or be required to change our business practices.

21

Our business exposes us to claims for personal injury, death or property damage resulting from the use of the equipment we rent or sell and from injuries caused in motor vehicle accidents in which our delivery and service personnel are involved and other employee related matters. Additionally, we could be subject to potential litigation associated with compliance with various laws and governmental regulations at the federal, state or local levels, such as those relating to the protection of persons with disabilities, employment, health, safety, security and other regulations under which we operate.

We carry comprehensive insurance, subject to deductibles, at levels we believe are sufficient to cover existing and future claims made during the respective policy periods. However, we may be exposed to multiple claims that do not exceed our deductibles, and, as a result, we could incur significant out-of-pocket costs that could adversely affect our financial condition and results of operations. In addition, the cost of such insurance policies may increase significantly upon renewal of those policies as a result of general rate increases for the type of insurance we carry as well as our historical experience and experience in our industry. Although we have not experienced any material losses that were not covered by insurance, our existing or future claims may exceed the coverage level of our insurance, and such insurance may not continue to be available on economically reasonable terms, or at all. If we are required to pay significantly higher premiums for insurance, are not able to maintain insurance coverage at affordable rates or if we must pay amounts in excess of claims covered by our insurance, we could experience higher costs that could adversely affect our financial condition and results of operations.

Our future operating results and financial position could be negatively affected by impairment charges to our goodwill, intangible assets or other long-lived assets.

When we acquire a business, we record goodwill as the excess of the consideration transferred plus the fair value of any non-controlling interest in the acquiree at the acquisition date over the fair values of the identifiable net assets acquired. At December 31, 2011, we had goodwill of approximately $34.0 million. In accordance with Accounting Standards Codification 350, Intangibles–Goodwill and Other, we test goodwill for impairment on October 1 of each year, and on an interim date if factors or indicators become apparent that would require an interim test. In connection with our annual impairment test as of October 1, 2009, and as further discussed in note 2 to our audited consolidated financial statements included elsewhere in this offering memorandum, we recorded a non-cash goodwill impairment of $9.0 million.

If economic conditions deteriorate and result in significant declines in the Company’s stock price, or if there are significant downward revisions in the present value of our estimated future cash flows, additional impairments to one or more reporting units could occur in future periods, and such impairments could be material. A downward revision in the present value of estimated future cash flows could be caused by a number of factors, including, among others, adverse changes in the business climate, negative industry or economic trends, decline in performance in our industry sector, or a decline in market multiples for competitors. Our estimates regarding future cash flows are inherently uncertain and changes in our underlying assumptions and the impact of market conditions on those assumptions could materially affect the determination of fair value and/or goodwill impairment. Future events and changing market conditions may impact our assumptions as to revenues, costs or other factors that may result in changes in our estimates of future cash flows. We can provide no assurance that a material impairment charge will not occur in a future period. Such a charge could negatively affect our results of operations and financial position. We will continue to monitor the recoverability of the carrying value of our goodwill and other long-lived assets

22

(see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies and Estimates” included elsewhere in our Annual Report on Form 10-K for the year ended December 31, 2011).

Labor disputes could disrupt our ability to serve our customers and/or lead to higher labor costs.

As of June 30, 2012, we have approximately 67 employees in Utah, a significant territory in our geographic footprint, who are covered by collective bargaining agreements and approximately 1,603 employees who are not represented by unions or covered by collective bargaining agreements. Various unions periodically seek to organize certain of our nonunion employees. Union organizing efforts or collective bargaining negotiations could potentially lead to work stoppages and/or slowdowns or strikes by certain of our employees, which could adversely affect our ability to serve our customers. Further, settlement of actual or threatened labor disputes or an increase in the number of our employees covered by collective bargaining agreements can have unknown effects on our labor costs, productivity and flexibility.

We have operations throughout the United States, which exposes us to multiple state and local regulations. Changes in applicable law, regulations or requirements, or our material failure to comply with any of them, can increase our costs and have other negative impacts on our business.

Our 64 branch locations in the United States are located in 21 different states, which exposes us to a host of different state and local regulations. These laws and requirements address multiple aspects of our operations, such as worker safety, consumer rights, privacy, employee benefits and more, and can often have different requirements in different jurisdictions. Changes in these requirements, or any material failure by our branches to comply with them, can increase our costs, affect our reputation, limit our business, drain management time and attention and generally otherwise impact our operations in adverse ways.

We could be adversely affected by environmental and safety requirements, which could force us to increase significant capital and other operational costs and may subject us to unanticipated liabilities.

Our operations, like those of other companies engaged in similar businesses, require the handling, use, storage and disposal of certain regulated materials. As a result, we are subject to the requirements of federal, state and local environmental and occupational health and safety laws and regulations. We may not be in complete compliance with all such requirements at all times. We are subject to potentially significant civil or criminal fines or penalties if we fail to comply with any of these requirements. We have made and will continue to make capital and other expenditures in order to comply with these laws and regulations. However, the requirements of these laws and regulations are complex, change frequently, and could become more stringent in the future. It is possible that these requirements will change or that liabilities will arise in the future in a manner that could have a material adverse effect on our business, financial condition and results of operations.

Environmental laws also impose obligations and liability for the cleanup of properties affected by hazardous substance spills or releases. These liabilities can be imposed on the parties generating or disposing of such substances or operator of the affected property, often without regard to whether the owner or operator knew of, or was responsible for, the presence of hazardous substances. Accordingly, we may become liable, either contractually or by operation of law, for remediation costs even if a contaminated property is not presently owned or operated by us, or if the contamination was caused by

23

third parties during or prior to our ownership or operation of the property. Given the nature of our operations (which involve the use of petroleum products, solvents and other hazardous substances for fueling and maintaining our equipment and vehicles), there can be no assurance that prior site assessments or investigations have identified all potential instances of soil or groundwater contamination. Future events, such as changes in existing laws or policies or their enforcement, or the discovery of currently unknown contamination, may give rise to additional remediation liabilities which may be material.

Hurricanes, other adverse weather events, national or regional catastrophes or natural disasters could negatively affect our local economies or disrupt our operations, which could have an adverse effect on our business or results of operations.

Our market areas in the Gulf Coast and Mid-Atlantic regions of the United States are susceptible to hurricanes. Such weather events can disrupt our operations, result in damage to our properties and negatively affect the local economies in which we operate. Future hurricanes could result in damage to certain of our facilities and the equipment located at such facilities, or equipment on rent with customers in those areas. In addition, climate change could lead to an increase in intensity or occurrence of hurricanes or other adverse weather events. Future occurrences of these events, as well as regional or national catastrophes or natural disasters, and their effects may adversely impact our business or results of operations.

24

USE OF PROCEEDS

We will use the proceeds from the offering of the Notes, together with borrowings under the Credit Facility:

| • | to retire all of our Existing Senior Notes; |

| • | to pay redemption or tender premiums and accrued interest associated with repaying our Existing Senior Notes; |

| • | to pay a special cash dividend to our stockholders of record on a record date determined by our board of directors, subject to the approval of our board of directors; |

| • | to pay fees and expenses related to the Transactions; and |

| • | for general corporate purposes. |