Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CYS Investments, Inc. | d388659d8k.htm |

| EX-1.1 - UNDERWRITING AGREEMENT - CYS Investments, Inc. | d388659dex11.htm |

| EX-3.1 - ARTICLES SUPPLEMENTARY - CYS Investments, Inc. | d388659dex31.htm |

| EX-8.1 - OPINION OF HUNTON & WILLIAMS LLP - CYS Investments, Inc. | d388659dex81.htm |

| EX-5.1 - OPINION OF VENABLE LLP - CYS Investments, Inc. | d388659dex51.htm |

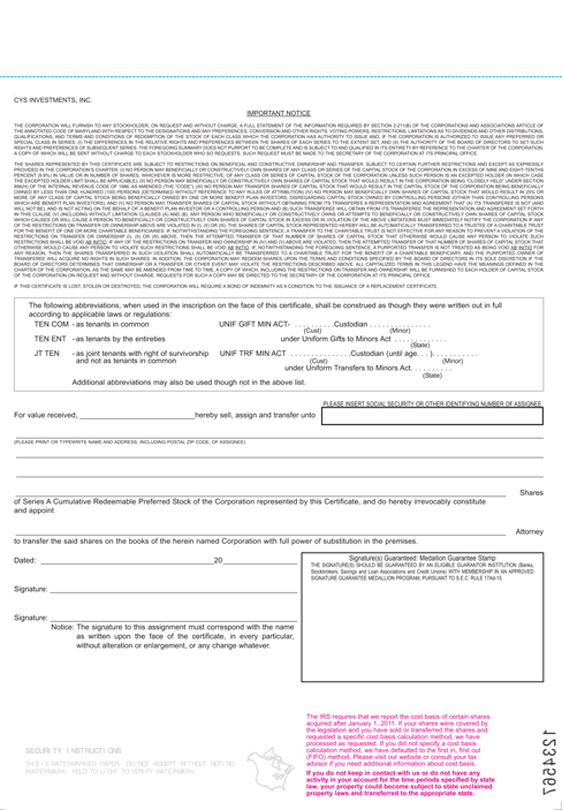

Exhibit 4.1

016570| 003590|127C|RESTRICTED||4|057-423 7.75% Series A Cumulative Redeemable Preferred Stock PAR VALUE $0.01 PER SHARE Certificate Number ZQ 000000 7.75% Series A Cumulative Redeemable Preferred Stock THIS CERTIFICATE IS TRANSFERABLE IN CANTON, MA AND NEW YORK, NY CYS INVESTMENTS, INC. INCORPORATED UNDER THE LAWS OF THE STATE OF MARYLAND THIS CERTIFIES THAT is the owner of CUSIP 12673A207 SEE REVERSE FOR IMPORTANT NOTICE ON TRANSFER RESTRICTIONS AND OTHER INFORMATION Shares * * 0 0 0 0 0 0 * * * * * * * * * 0 0 0 0 0 0 * * * * * * * * * 0 0 0 0 0 0 * * * * * * * * * 0 0 0 0 0 0 * * * * * * * * * 0 0 0 0 0 0 * * ** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample MR. **** Mr. Alexander SAMPLE David Sample **** Mr. Alexander David &Sample MRS. **** Mr. Alexander David SAMPLE Sample **** Mr. Alexander David & Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander MR. David Sample SAMPLE **** Mr. Alexander David Sample & **** Mr. Alexander MRS. David Sample **** SAMPLE Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Alexander David Sample **** Mr. Sample **** Mr. Sample **000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****

000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****

000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****

000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****

000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****0000

00**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000

**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**

Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****0000 ***ZERO***00**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**

Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**

Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**

Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**

Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**

Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**

Shares****000000**Shares****000000**Shares****000000**Shares****000000**Shares****000000**S FULLY PAID AND NONASSESSABLE SHARES OF 7.75% SERIES A CUMULATIVE REDEEMABLE PREFERRED STOCK, LIQUIDATION PREFERENCE $25.00 PER SHARE, OF CYS Investments, Inc. (the “Corporation”) transferable on the books of the Corporation by the holder hereof in person or by its duly authorized attorney, upon surrender of this Certificate properly endorsed. This Certificate and the shares represented hereby are issued and shall be held subject to all of the provisions of the charter of the Corporation (the “Charter”) and the Bylaws of the Corporation, and any amendments thereto. This Certificate is not valid unless countersigned and registered by the Transfer Agent and Registrar. IN WITNESS WHEREOF, the Corporation has caused this Certificate to be executed on its behalf by its duly authorized officers. Chief Executive Officer Secretary DATED <<Month Day, Year>> COUNTERSIGNED AND REGISTERED: COMPUTERSHARE TRUST COMPANY, N.A. TRANSFER AGENT AND REGISTRAR, By AUTHORIZED SIGNATURE PO BOX 43004, Providence, RI 02940-3004 MR A SAMPLE DESIGNATION (IF ANY) ADD 1 ADD 2 ADD 3 ADD 4 CUSIP XXXXXX XX X Holder ID XXXXXXXXXX Insurance Value 00.1,000,000 Number of Shares 123456 DTC 12345678901234512345678 Certificate Numbers Num/No Denom. Total. 1234567890/1234567890 111 1234567890/1234567890 222 1234567890/1234567890 333 1234567890/1234567890 444 1234567890/1234567890 555 1234567890/1234567890 666 Total Transaction 7

The IRS requires that we report the cost basis of certain shares acquired after January 1, 2011. If your shares were covered by the legislation and you have sold or transferred the shares and requested a specific cost basis calculation method, we have processed as requested. If you did not specify a cost basis calculation method, we have defaulted to the first in, first out (FIFO) method. Please visit our website or consult your tax advisor if you need additional information about cost basis. If you do not keep in contact with us or do not have any activity in your account for the time periods specified by state law, your property could become subject to state unclaimed property laws and transferred to the appropriate state. The following abbreviations, when used in the inscription on the face of this certificate, shall be construed as though they were written out in full according to applicable laws or regulations: TEN COM - as tenants in common UNIF GIFT MIN ACT- . . . . . . . . . .Custodian . . . . . . . . . . . . . . . TEN ENT - as tenants by the entireties under Uniform Gifts to Minors Act . . . . . . . . . . . . . JT TEN - as joint tenants with right of survivorship UNIF TRF MIN ACT . . . . . . . . . . . . . . .Custodian (until age. . . ). . . . . . . . . . . and not as tenants in common (Cust) (Minor) under Uniform Transfers to Minors Act. . . . . . . . . . (State) Additional abbreviations may also be used though not in the above list. For value received, hereby sell, assign and transfer unto Shares Attorney Dated: 20 Signature: Signature: Notice: The signature to this assignment must correspond with the name as written upon the face of the certificate, in every particular, without alteration or enlargement, or any change whatever. (Cust) (Minor) (State) PLEASE INSERT SOCIAL SECURITY OR OTHER IDENTIFYING NUMBER OF ASSIGNEE (PLEASE PRINT OR TYPEWRITE NAME AND ADDRESS, INCLUDING POSTAL ZIP CODE, OF ASSIGNEE) of Series A Cumulative Redeemable Preferred Stock of the Corporation represented by this Certificate, and do hereby irrevocably constitute and appoint to transfer the said shares on the books of the herein named Corporation with full power of substitution in the premises. .CYS INVESTMENTS, INC. IMPORTANT NOTICE THE CORPORATION WILL FURNISH TO ANY STOCKHOLDER, ON REQUEST AND WITHOUT CHARGE, A FULL STATEMENT OF THE INFORMATION REQUIRED BY SECTION 2-211(B) OF THE CORPORATIONS AND ASSOCIATIONS ARTICLE OF THE ANNOTATED CODE OF MARYLAND WITH RESPECT TO THE DESIGNATIONS AND ANY PREFERENCES, CONVERSION AND OTHER RIGHTS, VOTING POWERS, RESTRICTIONS, LIMITATIONS AS TO DIVIDENDS AND OTHER DISTRIBUTIONS, QUALIFICATIONS, AND TERMS AND CONDITIONS OF REDEMPTION OF THE STOCK OF EACH CLASS WHICH THE CORPORATION HAS AUTHORITY TO ISSUE AND, IF THE CORPORATION IS AUTHORIZED TO ISSUE ANY PREFERRED OR SPECIAL CLASS IN SERIES, (I) THE DIFFERENCES IN THE RELATIVE RIGHTS AND PREFERENCES BETWEEN THE SHARES OF EACH SERIES TO THE EXTENT SET, AND (II) THE AUTHORITY OF THE BOARD OF DIRECTORS TO SET SUCH RIGHTS AND PREFERENCES OF SUBSEQUENT SERIES. THE FOREGOING SUMMARY DOES NOT PURPORT TO BE COMPLETE AND IS SUBJECT TO AND QUALIFIED IN ITS ENTIRETY BY REFERENCE TO THE CHARTER OF THE CORPORATION, A COPY OF WHICH WILL BE SENT WITHOUT CHARGE TO EACH STOCKHOLDER WHO SO REQUESTS. SUCH REQUEST MUST BE MADE TO THE SECRETARY OF THE CORPORATION AT ITS PRINCIPAL OFFICE. THE SHARES REPRESENTED BY THIS CERTIFICATE ARE SUBJECT TO RESTRICTIONS ON BENEFICIAL AND CONSTRUCTIVE OWNERSHIP AND TRANSFER. SUBJECT TO CERTAIN FURTHER RESTRICTIONS AND EXCEPT AS EXPRESSLY PROVIDED IN THE CORPORATION’S CHARTER, (I) NO PERSON MAY BENEFICIALLY OR CONSTRUCTIVELY OWN SHARES OF ANY CLASS OR SERIES OF THE CAPITAL STOCK OF THE CORPORATION IN EXCESS OF NINE AND EIGHT-TENTHS PERCENT (9.8%) IN VALUE OR IN NUMBER OF SHARES, WHICHEVER IS MORE RESTRICTIVE, OF ANY CLASS OR SERIES OF CAPITAL STOCK OF THE CORPORATION UNLESS SUCH PERSON IS AN EXCEPTED HOLDER (IN WHICH CASE THE EXCEPTED HOLDER LIMIT SHALL BE APPLICABLE); (II) NO PERSON MAY BENEFICIALLY OR CONSTRUCTIVELY OWN SHARES OF CAPITAL STOCK THAT WOULD RESULT IN THE CORPORATION BEING “CLOSELY HELD” UNDER SECTION 856(H) OF THE INTERNAL REVENUE CODE OF 1986, AS AMENDED (THE “CODE”); (III) NO PERSON MAY TRANSFER SHARES OF CAPITAL STOCK THAT WOULD RESULT IN THE CAPITAL STOCK OF THE CORPORATION BEING BENEFICIALLY OWNED BY LESS THAN ONE HUNDRED (100) PERSONS (DETERMINED WITHOUT REFERENCE TO ANY RULES OF ATTRIBUTION) (IV) NO PERSON MAY BENEFICIALLY OWN SHARES OF CAPITAL STOCK THAT WOULD RESULT IN 25% OR MORE OF ANY CLASS OF CAPITAL STOCK BEING BENEFICIALLY OWNED BY ONE OR MORE BENEFIT PLAN INVESTORS, DISREGARDING CAPITAL STOCK OWNED BY CONTROLLING PERSONS (OTHER THAN CONTROLLING PERSONS WHICH ARE BENEFIT PLAN INVESTORS); AND (V) NO PERSON MAY TRANSFER SHARES OF CAPITAL STOCK WITHOUT OBTAINING FROM ITS TRANSFEREE A REPRESENTATION AND AGREEMENT THAT (A) ITS TRANSFEREE IS NOT (AND WILL NOT BE), AND IS NOT ACTING ON THE BEHALF OF, A BENEFIT PLAN INVESTOR OR A CONTROLLING PERSON AND (B) SUCH TRANSFEREE WILL OBTAIN FROM ITS TRANSFEREE THE REPRESENTATION AND AGREEMENT SET FORTH IN THIS CLAUSE (V) (INCLUDING WITHOUT LIMITATION CLAUSES (A) AND (B). ANY PERSON WHO BENEFICIALLY OR CONSTRUCTIVELY OWNS OR ATTEMPTS TO BENEFICIALLY OR CONSTRUCTIVELY OWN SHARES OF CAPITAL STOCK WHICH CAUSES OR WILL CAUSE A PERSON TO BENEFICIALLY OR CONSTRUCTIVELY OWN SHARES OF CAPITAL STOCK IN EXCESS OR IN VIOLATION OF THE ABOVE LIMITATIONS MUST IMMEDIATELY NOTIFY THE CORPORATION IF ANY OF THE RESTRICTIONS ON TRANSFER OR OWNERSHIP ABOVE ARE VIOLATED IN (I), (II) OR (III), THE SHARES OF CAPITAL STOCK REPRESENTED HEREBY WILL BE AUTOMATICALLY TRANSFERRED TO A TRUSTEE OF A CHARITABLE TRUST FOR THE BENEFIT OF ONE OR MORE CHARITABLE BENEFICIARIES. IF, NOTWITHSTANDING THE FOREGOING SENTENCE, A TRANSFER TO THE CHARITABLE TRUST IS NOT EFFECTIVE FOR ANY REASON TO PREVENT A VIOLATION OF THE RESTRICTIONS ON TRANSFER OR OWNERSHIP (I), (II) OR (III) ABOVE, THEN THE ATTEMPTED TRANSFER OF THAT NUMBER OF SHARES OF CAPITAL STOCK THAT OTHERWISE WOULD CAUSE ANY PERSON TO VIOLATE SUCH RESTRICTIONS SHALL BE VOID AB INITIO. IF ANY OF THE RESTRICTIONS ON TRANSFER AND OWNERSHIP IN (IV) AND (V) ABOVE ARE VIOLATED, THEN THE ATTEMPTED TRANSFER OF THAT NUMBER OF SHARES OF CAPITAL STOCK THAT OTHERWISE WOULD CAUSE ANY PERSON TO VIOLATE SUCH RESTRICTIONS SHALL BE VOID AB INITIO. IF, NOTWITHSTANDING THE FOREGOING SENTENCE, A PURPORTED TRANSFER IS NOT TREATED AS BEING VOID AB INITIO FOR ANY REASON, THEN THE SHARES TRANSFERRED IN SUCH VIOLATION SHALL AUTOMATICALLY BE TRANSFERRED TO A CHARITABLE TRUST FOR THE BENEFIT OF A CHARITABLE BENEFICIARY, AND THE PURPORTED OWNER OF TRANSFEREE WILL ACQUIRE NO RIGHTS IN SUCH SHARES. IN ADDITION, THE CORPORATION MAY REDEEM SHARES UPON THE TERMS AND CONDITIONS SPECIFIED BY THE BOARD OF DIRECTORS IN ITS SOLE DISCRETION IF THE BOARD OF DIRECTORS DETERMINES THAT OWNERSHIP OR A TRANSFER OR OTHER EVENT MAY VIOLATE THE RESTRICTIONS DESCRIBED ABOVE. ALL CAPITALIZED TERMS IN THIS LEGEND HAVE THE MEANINGS DEFINED IN THE CHARTER OF THE CORPORATION, AS THE SAME MAY BE AMENDED FROM TIME TO TIME, A COPY OF WHICH, INCLUDING THE RESTRICTIONS ON TRANSFER AND OWNERSHIP, WILL BE FURNISHED TO EACH HOLDER OF CAPITAL STOCK OF THE CORPORATION ON REQUEST AND WITHOUT CHARGE. REQUESTS FOR SUCH A COPY MAY BE DIRECTED TO THE SECRETARY OF THE CORPORATION AT ITS PRINCIPAL OFFICE. IF THIS CERTIFICATE IS LOST, STOLEN OR DESTROYED, THE CORPORATION WILL REQUIRE A BOND OF INDEMNITY AS A CONDITION TO THE ISSUANCE OF A REPLACEMENT CERTIFICATE. Signature(s) Guaranteed: Medallion Guarantee Stamp THE SIGNATURE(S) SHOULD BE GUARANTEED BY AN ELIGIBLE GUARANTOR INSTITUTION (Banks, Stockbrokers, Savings and Loan Associations and Credit Unions) WITH MEMBERSHIP IN AN APPROVED SIGNATURE GUARANTEE MEDALLION PROGRAM, PURSUANT TO S.E.C. RULE 17Ad-15. SECURITY | INSTRUCTIONS THIS IS WATERMARK PAPER, DO NOT ACCEPT WITHOUT NOTING WATERMARK. HOLD TO LIGHT TO VARIFY WATERMARK.