Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - CYS Investments, Inc. | Financial_Report.xls |

| EX-12.1 - EXHIBIT 12.1 - CYS Investments, Inc. | a20141231ex121.htm |

| EX-31.2 - EXHIBIT 31.2 - CYS Investments, Inc. | a20141231ex312.htm |

| EX-31.1 - EXHIBIT 31.1 - CYS Investments, Inc. | a20141231ex311.htm |

| EX-32.2 - EXHIBIT 32.2 - CYS Investments, Inc. | a20141231ex322.htm |

| EX-32.1 - EXHIBIT 32.1 - CYS Investments, Inc. | a20141231ex321.htm |

| EX-23.1 - EXHIBIT 23.1 - CYS Investments, Inc. | a20141231ex231.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________________________

FORM 10-K

________________________________________________________________

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to .

Commission file number 001-33740

________________________________________________________________

CYS Investments, Inc.

________________________________________________________________

(Exact name of registrant as specified in its charter)

Maryland | 20-4072657 | |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |

890 Winter Street, Suite 200 Waltham, Massachusetts | 02451 | |

(Address of principal executive offices) | (Zip Code) | |

(617) 639-0440

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common stock, $0.01 par value | New York Stock Exchange | |

7.75% Series A Cumulative Redeemable Preferred Stock, $25.00 Liquidation Preference | New York Stock Exchange | |

7.50% Series B Cumulative Redeemable Preferred Stock, $25.00 Liquidation Preference | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. Check one:

Large accelerated filer | x | Accelerated filer | ¨ |

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was approximately $1,447,594,625 based on the closing price on the New York Stock Exchange as of June 30, 2014.

Number of the registrant’s common stock outstanding as of January 31, 2015: 161,871,080

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement with respect to its 2015 Annual Meeting of Stockholders to be filed not later than 120 days after the end of the registrant’s fiscal year are incorporated by reference into Part II, Item 5 and III hereof as noted therein.

CYS INVESTMENTS, INC.

INDEX

Item No. | Form 10-K Report Page | |||

PART I | ||||

PART II | ||||

PART III | ||||

PART IV | ||||

PART I

Item 1. Business

In this Annual Report on Form 10-K, we refer to CYS Investments, Inc. as “we,” “us,” “our company,” or “our,” unless we specifically state otherwise or the context indicates otherwise. In addition, the following define certain of the commonly used terms in this report: RMBS refers to whole-pool residential mortgage pass-through securities collateralized by residential mortgage loans; agency securities or Agency RMBS refers to our RMBS that are issued or guaranteed by a federally chartered corporation, such as the Federal National Mortgage Association (“Fannie Mae”) or the Federal Home Loan Mortgage Corporation (“Freddie Mac”), or an agency of the U.S. government, such as the Government National Mortgage Association (“Ginnie Mae”); ARMs refers to adjustable-rate residential mortgage loans that typically have interest rates that adjust monthly to an increment over a specified interest rate index; and Hybrid ARMs refers to hybrid adjustable-rate residential mortgage loans that have interest rates that are fixed for a specified period of time and, thereafter, generally adjust annually to an increment over a specified interest rate index.

Forward Looking Statements

When used in this Annual Report on Form 10-K, in future filings with the Securities and Exchange Commission (“SEC”) or in press releases or other written or oral communications, statements which are not historical in nature, including those containing words such as “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “may” or similar expressions, are intended to identify “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and, as such, may involve known and unknown risks, uncertainties and assumptions. The forward-looking statements we make in this Annual Report on Form 10-K include, but are not limited to, statements about the following:

• | the effect of movements in interest rates on our assets and liabilities (including our hedging instruments) and our net income; |

• | our investment, financing and hedging strategies; |

• | the effect of U.S. government actions on interest rates and the housing and credit markets; |

• | the effect of actual or proposed actions of the U.S. Federal Reserve (the "Fed") with respect to monetary policy, interest rates, inflation or unemployment; |

• | the supply of Agency RMBS; |

• | the effect of increased prepayment rates on the value of our assets; |

• | our ability to convert our assets into cash or extend the financing terms related to our assets; |

• | the effect of widening credit spreads or shifts in the yield curve on the value of our assets and investment strategy; |

• | the types of indebtedness we may incur; |

• | our ability to quantify risks based on historical experience; |

• | our ability to be taxed as a real estate investment trust (“REIT”) and to maintain an exemption from registration under the Investment Company Act of 1940, as amended (the “Investment Company Act”); |

• | the tax limitations of capital loss carryforwards and other built in losses; |

• | our assessment of counterparty risk and/or the rise of counterparty defaults; |

• | our ability to meet short-term liquidity requirements with our cash flow from operations and borrowings; |

• | the effect of rising interest rates on unemployment, inflation and mortgage supply and demand; |

• | our liquidity; |

• | our asset valuation policies, and |

• | our dividend distribution policy. |

Forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. These beliefs, assumptions and expectations are subject to risks and uncertainties and can change as a result of many possible events or factors, not all of which are known to us. If a change

1

occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. The following factors could cause actual results to vary from our forward-looking statements:

• | the factors referenced in this Annual Report on Form 10-K, including those set forth under the section captioned “Risk Factors;” |

• | changes in our investment, financing and hedging strategies; |

• | the adequacy of our cash flow from operations and borrowings to meet our short-term liquidity requirements; |

• | the liquidity of our portfolio; |

• | unanticipated changes in our industry, interest rates, the credit markets, the general economy or the real estate market; |

• | changes in interest rates and the market value of our Agency RMBS; |

• | changes in the prepayment rates on the mortgage loans underlying our Agency RMBS; |

• | our ability to borrow to finance our assets; |

• | actions by the U.S. government or the Fed that impact the value of our Agency RMBS or interest rates; |

• | changes in government regulations affecting our business; |

• | changes in the U.S. government's credit rating or ability to pay its debts; |

• | our ability to maintain our qualification as a REIT for federal income tax purposes; |

• | our ability to maintain our exemption from registration under the Investment Company Act and the availability of such exemption in the future; and |

• | risks associated with investing in real estate assets, including changes in business conditions and the general economy. |

These and other risks, uncertainties and factors, including those described elsewhere in this report, could cause our actual results to differ materially from those projected in any forward-looking statements we make. All forward-looking statements speak only as of the date on which they are made. New risks and uncertainties arise over time and it is not possible to predict those events or how they may affect us. Except as required by law, we are not obligated to, and do not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Our Company

We are a specialty finance company created with the objective of achieving consistent risk-adjusted investment income. We have elected to be taxed as a REIT for federal income tax purposes. We were formed as a Maryland corporation on January 3, 2006, commenced operations in February 2006 and completed the initial public offering of our common stock in June 2009. We conduct all of our business through and hold all of our assets in CYS Investments, Inc.

Investment Strategy

We invest in Agency RMBS collateralized by fixed rate single-family residential mortgage loans (primarily 10, 15, 20

or 30 years), ARMs, which have coupon rates that reset monthly, or Hybrid ARMs, which have a coupon rate that is fixed for an

initial period (typically three, five, seven or 10 years) and thereafter resets at regular intervals. In addition, our investment

guidelines permit investments in collateralized mortgage obligations issued by a government agency or government-sponsored

entity that are collateralized by Agency RMBS (“CMOs”), although we had not invested in any CMOs as of December 31,

2014. In addition, we invest in debt securities issued by the U.S. Department of the Treasury (the "U.S. Treasury") or a government-sponsored entity that are not backed by collateral but, in the case of government agencies, are backed by the full faith and credit of the U.S. government ("U.S. Treasuries"), and, in the case of government sponsored entities, are backed by the integrity and creditworthiness of the issuer (“U.S. Agency Debentures”).

We make investment decisions based on various factors, including, but not limited to, relative value, expected cash

yield, supply and demand, costs of hedging, costs of financing, liquidity, expected future interest rate volatility and the overall

shape of the U.S. Treasury and interest rate swap yield curves. We do not attribute any particular quantitative significance to

any of these factors, and the weight given to these factors varies depending on market conditions and economic trends. We believe that this strategy enables us to pay dividends and increase our book value throughout changing interest rate and

credit cycles, and provide attractive long-term returns to investors.

Our investment strategy is designed to:

2

• | maintain an investment portfolio consisting primarily of Agency RMBS that generates risk-adjusted investment income; |

• | manage financing, interest and prepayment rate risks; |

• | capitalize on discrepancies in the relative valuations in the Agency RMBS market; |

• | manage cash flow to provide for regular quarterly distributions to stockholders; |

• | limit credit risk; |

• | minimize the impact that changing interest rates have on our net income and book value, or stockholders' equity; |

• | invest opportunistically in assets within our investment guidelines; |

• | maintain our qualification as a REIT; and |

• | exempt us from the registration requirements of the Investment Company Act. |

Our income is generated primarily from the difference, or net spread, between the interest income we earn on our investment portfolio and the cost of our borrowings and hedging activities. We believe the most prudent approach to generating a positive net spread is to manage our liabilities to mitigate the interest rate risks of our investments. To seek to achieve this result, we employ short-term financing for our Agency RMBS portfolio in combination with interest rate swaps and caps to hedge the interest rate risk associated with the financing of our portfolio. In the future, we may also employ other hedging techniques from time to time, including interest rate floors, collars and Eurodollar and U.S. Treasury futures, to protect against adverse interest rate movements.

Because our investments vary in interest rate, prepayment speed and maturity, the leverage or borrowings that we employ to fund our asset purchases cannot be precisely matched to the terms or performance of our assets. Based on our experience, because our assets are not match funded, changes in interest rates may impact our net income and the market value of our assets. Our approach to managing our investment portfolio is to take a longer term view of assets and liabilities, such that our net income and mark-to-market valuations at the end of a financial reporting period will not significantly influence our strategy of maximizing cash distributions to stockholders and achieving capital appreciation over the long-term.

Investment Sourcing

We source the majority of our investments through relationships with a large and diverse group of financial intermediaries, ranging from major commercial and investment banks to specialty investment dealers and brokerage firms.

Investment Process

Management evaluates each one of our investment opportunities based on its expected risk-adjusted investment income relative to the investment income available from other comparable investments. In addition, management evaluates new opportunities based on their relative expected returns compared to the securities held in our portfolio. The terms of any leverage available to us for use in funding an investment purchase are also taken into consideration, as are any risks posed by illiquidity or correlations with other securities in the portfolio.

The key steps of our investment process are:

• | allocation of our capital to the attractive types of Agency RMBS; |

• | review of asset allocation plan for overall risk management and diversification; |

• | research and selection of individual securities and financing strategies; |

• | active portfolio monitoring within asset classes, together with ongoing risk management and periodic rebalancing, to maximize long-term income with capital stability; and |

• | consideration of the impact on maintaining our REIT qualification and our exemption from registration under the Investment Company Act. |

3

Financing Strategy

We use leverage to finance a portion of our Agency RMBS portfolio and to seek to increase potential returns to our stockholders. Our use of leverage may, however, have the effect of increasing losses when securities in our portfolio decline in value. Generally, we expect our leverage to be between five and 10 times. Given recent actions and guidance provided by the Fed about the future path of the Federal Funds Target Rate ("Fed Funds Rate"), its goal of reducing asset purchases, the heightened interest-rate volatility that these policy changes have created, and may likely continue to create, and current market conditions, we currently expect our leverage to remain in the lower end of this range. Our leverage varies from time to time depending on many factors and conditions, including short-term changes in our book value, and other factors management assesses, analyzes and deems relevant. At December 31, 2014, our leverage ratio, calculated by dividing our (i) borrowings under repurchase agreements ("repo borrowings") balance plus payable for securities purchased minus receivable for securities sold by (ii) stockholders' equity, was approximately 6.44 to 1, down from 6.97 to 1 at December 31, 2013.

We finance our Agency RMBS investments using repo borrowings with a diversified group of broker dealers and commercial and investment banks. Using repo borrowings, we are able to borrow against the value of our assets. Under repurchase agreements, we sell our assets to a counterparty and agree to repurchase the same assets from the counterparty at a price equal to the original sales price plus an interest factor. As a borrower, we are subject to margin calls from counterparties if the value of the collateral that we have posted has declined below the applicable haircut level, which may occur due to prepayments of the mortgages causing the face value of the mortgage pool provided as collateral to the counterparty to decline or when the value of the mortgage pool provided as collateral declines as a result of interest rate movements or spread widening. Currently, the percentage amounts by which the collateral value must exceed the amount borrowed, which we refer to as the haircut, are between 3% and 7%. Our repo borrowings are accounted for as debt for purposes of U.S. generally accepted accounting principles (“GAAP”) and secured by the underlying assets. During the period of a repo borrowing, we are entitled to and receive the principal and interest payments on the related assets.

We maintain formal relationships with multiple counterparties that are broker dealers and commercial and investment banks for the purpose of obtaining financing on favorable terms and to manage counterparty credit risk. As of December 31, 2014, we had repurchase agreements in place with 45 counterparties and indebtedness outstanding with 32 counterparties in an aggregate amount of approximately $11,289.6 million, or approximately 77% of the fair value of our portfolio, and a weighted-average borrowing rate of 0.35%.

In the future, we may utilize other financing techniques, which may include, but not necessarily be limited to, the issuance of common stock, secured or unsecured debt, or preferred stock.

Hedging Strategy

We utilize derivative financial instruments to hedge the interest rate risk associated with the financing of our investment portfolio. Our most common method of financing Agency RMBS is through repo borrowings, which generally have maturities between 30 and 90 days, but may be longer. The weighted-average life of the Agency RMBS we own is generally much longer than the maturities of our repo borrowings. The difference in maturities, in addition to prepayments, adjustable-rate features of ARMs and other potential changes in timing and amount of cash flows, creates potential interest rate risk. We engage in hedging activities intended to manage changes in interest rates that we expect would impair our ability to continue to finance assets we own at favorable rates. Our hedging techniques are also used in an attempt to protect us against declines in the market value of our assets that result from general trends in debt markets. Our hedging methods have historically consisted of interest rate swaps (a contract exchanging a variable rate for a fixed rate, or vice versa), including cancelable interest rate swaps (swaps that may be canceled at one party’s option before expiry), and interest rate caps (a contract protecting against a rise in interest rates above a fixed level). In the future, our hedging methods are likely to continue to consist of interest rate swaps, including cancelable interest rate swaps, and interest rate caps, but may also include interest rate floors (a contract protecting against a decline in interest rates below a fixed level), interest rate collars (a combination of caps and floors), Eurodollar and U.S. Treasury futures and other interest rate and non-interest rate derivative instruments or contracts.

We enter into interest rate swaps to offset the potential adverse effects of rising interest rates on certain repo borrowings. Our repo borrowings generally carry interest rates that correspond to the London Interbank Offered Rate (“LIBOR”) for the borrowing periods. Historically, we have sought to enter into interest rate swaps structured such that we receive payments based on a variable interest rate and make payments based on a fixed interest rate. The variable interest rate on which payments are received is calculated based on various reset mechanisms for LIBOR. Additionally, we have entered into interest rate caps structured such that we receive payments based on a variable interest rate being above a fixed cap interest rate. The variable interest rate on which payments are received on interest rate caps is also calculated based on various reset mechanisms for LIBOR. Our interest rate swaps and caps effectively fix or cap our borrowing costs and are not held for speculative or trading purposes. As of December 31, 2014, we had established interest rate swaps and caps of approximately$10,150.0 million, covering approximately 79% of the aggregate fair value of our investment portfolio, that has been financed under repo borrowings and payable for securities purchased, or covering approximately 90% of our repo borrowings.

4

Our Portfolio

We invest principally in Agency RMBS, which are residential mortgage pass-through securities, the principal and interest of which are guaranteed by Fannie Mae, Freddie Mac or Ginnie Mae. Our current portfolio of Agency RMBS is backed by fixed-rate mortgages and Hybrid ARMs that typically have a fixed coupon for three, five, seven or 10 years, and then pay an adjustable coupon that generally resets annually over a predetermined interest rate index. As of December 31, 2014, our Agency RMBS portfolio consisted of 10.1% forward settling transactions that will be 2015 production when settled; 42.0% 2014 production; 25.4% 2013 production; 11.9% 2012 production; 7.1% 2011 production; 2.1% 2010 production and 0.2% 2009 production. In addition to Agency RMBS, from time-to-time we invest in U.S. Treasuries. As of December 31, 2014, our Agency RMBS and U.S. Treasuries (collectively, "Debt Securities") portfolio consisted of the following:

Face Value | Fair Value | Weighted-Average | ||||||||||||||||||||||

Asset Type | (in thousands) | Cost/Face | Fair Value/Face | Yield(1) | Coupon | CPR(2) | ||||||||||||||||||

15-Year Fixed Rate | $ | 6,986,686 | $ | 7,305,921 | $ | 103.09 | $ | 104.57 | 1.95 | % | 3.15 | % | 8.0 | % | ||||||||||

20-Year Fixed Rate | 67,839 | 74,216 | 102.94 | 109.40 | 1.85 | % | 4.50 | % | 15.5 | % | ||||||||||||||

30-Year Fixed Rate | 4,990,743 | 5,341,699 | 105.56 | 107.03 | 2.30 | % | 4.03 | % | 5.4 | % | ||||||||||||||

Hybrid ARMs(3) | 1,685,685 | 1,730,620 | 103.41 | 102.67 | 1.88 | % | 2.59 | % | 13.6 | % | ||||||||||||||

U.S. Treasuries | 150,000 | 149,051 | 99.72 | 99.37 | 1.63 | % | 1.50 | % | n/a | |||||||||||||||

Total/Weighted-Average | $ | 13,880,953 | $ | 14,601,507 | $ | 103.98 | $ | 105.19 | 2.06 | % | 3.39 | % | 8.1 | % | ||||||||||

___________

(1) | This is a weighted-average forward yield calculated based on the cost basis, coupon and CPR, or “Constant Prepayment Rate” of the securities in the Company's portfolio at December 31, 2014. Because the forward yield is based on a projected CPR and assumes no turnover in the securities in the Company's portfolio, the Company expects the yield it realizes after December 31, 2014 will vary from those included in the table. |

(2) | CPR is a method of expressing the prepayment rate for a mortgage pool that assumes that a constant fraction of the remaining principal is prepaid each month or year. Specifically, the CPR is an annualized version of the prior three month prepayment rate. Securities with no prepayment history are excluded from this calculation. |

(3) | The weighted-average months to reset of our Hybrid ARM portfolio was 59.6 at December 31, 2014. "Months to reset" is the number of months remaining before the fixed rate on a Hybrid ARM becomes a variable rate. At the end of the fixed period, the variable rate will be determined by the margin and the pre-specified caps of the ARM. After the fixed period, 100% of the Hybrid ARMs in the portfolio reset annually. |

We also held $8.0 million of other investments as of December 31, 2014.

Risk Management Strategy

Our board of directors exercises its oversight of risk management in many ways, including overseeing our senior management’s risk-related responsibilities and reviewing management and investment policies and performance against these policies and related benchmarks.

As part of our risk management process, we actively manage the interest rate, liquidity, prepayment and counterparty risks associated with our Agency RMBS portfolio. This process includes monitoring various stress test scenarios on our portfolio. We seek to manage our interest rate risk exposure by entering into various hedging instruments in order to minimize our exposure to potential interest rate mismatches between the interest we earn on our investments and our borrowing costs.

We seek to manage our liquidity risks by monitoring our liquidity position on a daily basis and maintaining a prudent level of leverage based on current market conditions and various other factors, including the health of the financial institutions that lend to us under our repurchase agreements.

We seek to manage our prepayment risk by investing in Agency RMBS with a variety of prepayment characteristics and prepayment protections, as well as by balancing Agency RMBS purchased at a premium with Agency RMBS purchased at a discount, when market conditions permit this.

We seek to manage our counterparty risk by (i) diversifying our exposure across a broad number of counterparties, (ii) limiting our exposure to any one counterparty and (iii) monitoring the financial stability of our counterparties.

Competition

Our success depends, in large part, on our ability to acquire assets at favorable spreads over our borrowing costs. In acquiring Agency RMBS, we compete with other mortgage REITs, specialty finance companies, public and private funds, commercial and investment banks, the Fed, other governmental entities or government sponsored entities, commercial finance companies, and other entities. Our competitors, as well as additional competitors that may emerge in the future, may increase the competition for the acquisition of Agency RMBS, which in turn may result in higher prices and lower yields on our assets.

5

Employees

As of January 31, 2015, we had 16 employees.

Additional Information

We have made available on our website at www.cysinv.com copies of the charters of the committees of our board of directors, our code of business conduct and ethics, our corporate governance guidelines and any materials we file with the SEC. All filings we make with the SEC are also available on our website. Information on our website is not part of this Annual Report on Form 10-K. All reports filed with the SEC may be read and copied at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549. Further information regarding the operation of the public reference room may be obtained by calling 1 (800) SEC-0330. In addition, all of our reports filed with the SEC can be obtained at the SEC’s website at www.sec.gov.

Item 1A. Risk Factors

Investment in our capital stock involves significant risks. Our business, financial condition, liquidity and results of operations could be materially and adversely affected by these risks. The risk factors set forth below are not all of the risks that may affect us. Some statements in this report, including statements in the following risk factors, constitute forward looking statements. Please refer to the section entitled “Forward Looking Statements.”

Risks Related To Our Business

Increases in interest rates and adverse market conditions may negatively affect the value of our investments and increase the cost of our borrowings, which could result in reduced earnings or losses and reduced cash available for distribution to our stockholders.

We invest indirectly in mortgage loans by purchasing Agency RMBS. Under a normal yield curve, an investment in Agency RMBS will decline in value if interest rates increase. In addition, net interest income could decrease if the yield curve becomes inverted or flat. Fannie Mae, Freddie Mac or Ginnie Mae guarantees of the principal and interest payments related to the Agency RMBS we own do not protect us from declines in market value caused by changes in interest rates. Declines in the market value of our investments may ultimately result in losses to us, which may reduce earnings and negatively affect cash available for distribution to our stockholders.

A significant risk associated with our investment in Agency RMBS is that both long-term and short-term interest rates will increase significantly. If long-term rates were to increase significantly, the market value of our Agency RMBS would decline, and the duration and weighted average life of the investments would increase. We could realize a loss if the securities were sold. At the same time, an increase in short-term interest rates would increase the amount of interest owed on our repo borrowings used to finance the purchase of Agency RMBS, which would decrease cash available for distribution to our stockholders.

Market values of our investments may decline without any general increase in interest rates for a number of reasons, such as increases in defaults, increases in voluntary prepayments for those investments that we have that are subject to prepayment risk and widening of credit spreads. If the market values of our investments were to decline for any reason, the value of your investment could also decline.

We leverage our portfolio investments in Debt Securities, which may adversely affect our return on our investments and may reduce cash available for distribution to our stockholders.

We leverage our portfolio investments in Debt Securities through repo borrowings. Leverage can enhance our potential returns, but can also exacerbate losses. As of December 31, 2014, our leverage ratio (calculated by dividing our (i) repo borrowings balance plus payable for securities purchased minus receivable for securities sold by (ii) stockholders' equity) was approximately 6.44 to 1. Our return on investments and cash available for distribution to our stockholders may be reduced if market conditions cause the cost of our financing to increase relative to the income that can be derived from the assets acquired, which could adversely affect the price of our common stock. In addition, our debt service payments will reduce cash flow available for distribution to stockholders. We may not be able to meet our debt service obligations. To the extent that we cannot meet our debt service obligations, we risk the loss of some or all of our assets to foreclosure or sale to satisfy our debt obligations.

6

An increase in our borrowing costs relative to the interest we receive on our assets may impair our profitability and thus our cash available for distribution to our stockholders.

As our repo borrowings mature, we must either enter into new borrowings or liquidate certain of our investments at times when we might not otherwise choose to do so. Lenders may seek to use a maturity date as an opportune time to demand additional terms or increased collateral requirements that could be adverse to us and harm our operations. An increase in short-term interest rates when we seek new borrowings would reduce the spread between our returns on our assets and the cost of our borrowings. This would reduce the returns on our assets, which might reduce earnings and in turn cash available for distribution to our stockholders. We generally expect that the interest rates tied to our borrowings will adjust more rapidly than the interest rates tied to the assets in which we invest.

Our lenders may require us to provide additional collateral, especially when the market values for our investments decline, which may restrict us from leveraging our assets as fully as desired and reduce our liquidity, earnings and cash available for distribution to our stockholders.

We currently use repo borrowings to finance our investments in Debt Securities. Our repurchase agreements allow the lenders, to varying degrees, to determine a new market value of the collateral to reflect current market conditions. If the market value of the securities pledged or sold by us to a funding source declines, we may be required by the lender to provide additional collateral or pay down a portion of the funds advanced on minimal notice, which is known as a margin call. Posting additional collateral will reduce our liquidity and limit our ability to leverage our assets, which could adversely affect our business. Additionally, in order to satisfy a margin call, we may be required to liquidate assets at a disadvantageous time, which could cause us to incur further losses and adversely affect our results of operations and financial condition, and may impair our ability to maintain our current level of distributions to our stockholders. We receive margin calls from our repo borrowing counterparties from time to time in the ordinary course of business similar to other entities in the specialty finance business. As of December 31, 2014, we had approximately $1,319.7 million, or 66.8% of our stockholders' equity, in Agency RMBS, U.S. Treasuries, cash and cash equivalents available to satisfy future margin calls. In the event we do not have sufficient liquidity to satisfy these margin calls, lending institutions can accelerate our indebtedness, increase our borrowing rates, liquidate our collateral and terminate our ability to borrow. Such a situation would likely result in a rapid deterioration of our financial condition and possibly necessitate a filing for protection under the U.S. Bankruptcy Code.

Hedging against interest rate exposure may not completely insulate us from interest rate risk and may adversely affect our earnings, which could adversely affect our financial condition and results of operations, reducing cash available for distributions to our stockholders.

We engage in certain hedging transactions to limit our exposure to changes in interest rates and therefore may expose ourselves to risks associated with such transactions. We may utilize instruments such as interest rate swaps, caps, collars and floors and Eurodollar and U.S. Treasury futures to seek to hedge the interest rate risk associated with our portfolio. Hedging against a decline in the values of our portfolio positions does not eliminate the possibility of fluctuations in the values of such positions or prevent losses if the values of such positions decline. However, we may establish other hedging positions designed to gain from those same developments, thereby offsetting the decline in the value of such portfolio positions. Such hedging transactions may also limit the opportunity for gain if the values of the portfolio positions should increase. Moreover, it may not be possible to hedge against certain interest rate fluctuations or to hedge effectively at an acceptable price.

While we may enter into such transactions to seek to reduce interest rate risks, unanticipated changes in interest rates may result in weaker overall investment performance than if we had not engaged in any such hedging transactions. In addition, the degree of correlation between price movements of the instruments used in a hedging strategy and price movements in the portfolio positions being hedged may vary. Moreover, for a variety of reasons, we may not seek to establish a perfect correlation between such hedging instruments and the portfolio holdings being hedged. Any such imperfect correlation may prevent us from achieving the intended hedge and expose us to risk of loss.

We currently hedge against interest rate risk. Our hedging activity varies in scope based on the level and volatility of interest rates, the type of portfolio investments held and other changing market conditions. Interest rate hedging may fail to protect or could adversely affect us because, among other things:

• | interest rate hedging can be expensive, particularly during periods of volatile interest rates; |

• | available interest rate hedging may not correspond directly with the interest rate risk for which protection is sought; |

• | the duration of the hedge may not match the duration of the related liability; |

7

• | the credit quality of the hedging counterparty may be downgraded to such an extent that it impairs our ability to sell or assign our side of the hedging transaction; and |

• | the counterparty in the hedging transaction may default on its obligation to pay. |

Our interest rate hedging activity may adversely affect our financial condition and results of operations, which could reduce cash available for distribution to our stockholders and negatively impact our stock price.

Our use of repo borrowings may give our lenders greater rights in the event that either we or any of our lenders file for bankruptcy, which may make it difficult for us to recover our collateral.

Our repo borrowings may qualify for special treatment under the U.S. Bankruptcy Code, giving our lenders the ability to avoid the automatic stay provisions of the U.S. Bankruptcy Code and take possession of and liquidate our collateral under the repurchase agreements without delay if we file for bankruptcy. Furthermore, the special treatment of repurchase agreements under the U.S. Bankruptcy Code may make it difficult for us to recover our pledged assets in the event that any of our lenders file for bankruptcy. Thus, the terms of repurchase agreements expose our pledged assets to risk in the event of a bankruptcy filing by either our lenders or us. In addition, if the lender is a broker or dealer subject to the Securities Investor Protection Act of 1970 or an insured depository institution subject to the Federal Deposit Insurance Act, our ability to exercise our rights to recover our collateral under a repurchase agreement or to be compensated for any damages resulting from the lender’s insolvency may be further limited by those statutes.

Our use of certain hedging transactions may expose us to counterparty risks.

If an interest rate swap counterparty cannot perform under the terms of the interest rate swap, we may not receive payments due under that swap, and thus, we may lose any unrealized gain associated with the interest rate swap. The hedged liability could cease to be hedged by the interest rate swap. Additionally, we may risk the loss of any collateral we have pledged to secure our obligations under the interest rate swap if the counterparty becomes insolvent or files for bankruptcy. Similarly, if an interest rate cap counterparty fails to perform under the terms of the interest rate cap agreement, we may not receive payments due under that agreement that would offset our interest expense. We could then incur a loss for the then remaining fair market value of the interest rate cap.

If the lending institution under one or more of our repo borrowings defaults on its obligation to resell the underlying security back to us at the end of the borrowing term, we will incur a loss on our repurchase transactions.

When we engage in a repo borrowing, we initially sell securities to the transaction counterparty under a master repurchase agreement in exchange for cash from the counterparty. The counterparty is obligated to resell the same securities back to us at the end of the term of the repo borrowing, which typically is 30 to 90 days but may be longer. If the counterparty in a repurchase transaction defaults on its obligation to resell the securities back to us, we will incur a loss on the transaction equal to the amount of the haircut (assuming no change in the value of the securities). Losses incurred on our repurchase transactions would adversely affect our earnings and our cash available for distribution to our stockholders.

If we default on our obligations under our repurchase agreements, we may be unable to establish a suitable replacement facility on acceptable terms or at all.

If we default on one of our obligations under a repurchase agreement, the counterparty may terminate the agreement and cease entering into any other repurchase agreements with us. In that case, we would likely need to establish a replacement repurchase facility with another financial institution in order to continue to leverage our investment portfolio and carry out our investment strategy. We may be unable to establish a suitable replacement repurchase facility on acceptable terms or at all.

Failure to procure adequate funding and capital would adversely affect our results and may, in turn, negatively affect the value of our common stock and our ability to distribute cash to our stockholders.

We depend upon the availability of adequate funding and capital for our operations. To maintain our status as a REIT, we are required to distribute at least 90% of our REIT taxable income annually, determined without regard to the deduction for dividends paid and excluding net capital gain, to our stockholders and therefore are not able to retain our earnings for new investments. We cannot assure you that any, or sufficient, funding or capital will be available to us in the future on terms that are acceptable to us. In the event that we cannot obtain sufficient funding and capital on acceptable terms, there may be a negative impact on the value of our common stock and our ability to make distributions to our stockholders, and our stockholders may lose part or all of their investment.

8

The Fed ending its monthly purchases pursuant to the third round of quantitative easing ("QE3") could continue to impact the market for and value of the Agency RMBS in which we invest, as well as our book value, or stockholders' equity, and net interest margin.

On September 13, 2012, the Fed announced a third round of quantitative easing, or QE3, which was an open-ended program designed to expand the its' holdings of long-term securities by purchasing an additional $40 billion of Agency RMBS per month until key economic indicators, such as the unemployment rate, showed signs of improvement. In December 2012, the Fed announced that it would begin buying $45 billion of long-term Treasury bonds each month. Beginning in early 2014, the Fed gradually reduced its purchases of both Agency RMBS and Treasury bonds, and in October 2014 ended its purchase program under QE3 (although it is still reinvesting principal and interest it receives on the Agency RMBS and U.S. Treasuries held in its portfolio).

It is unclear what effect, if any, the absence of the Fed’s monthly purchases, other than its reinvestment of principal and interest payments it receives for Agency RMBS in its portfolio, will have on the value of the Agency RMBS in which we invest. However, it is possible that the market for such securities, the price of such securities and, as a result, our book value and/or net interest margin could be negatively affected.

Adoption of the Basel III standards and other proposed supplementary regulatory standards may negatively impact our access to financing or affect the terms of our future financing arrangements.

In response to various financial crises and the volatility of financial markets, the Basel Committee on Banking Supervision adopted the Basel III standards several years ago. The final package of Basel III reforms was approved by the G20 leaders in November 2010. In January 2013, the Basel Committee agreed to delay implementation of the Basel III standards and expanded the scope of assets permitted to be included in a bank’s liquidity measurement. In 2014, the Basel Committee announced that it would propose additional changes to capital requirements for banks over the next few years.

U.S. regulators have elected to implement substantially all of the Basel III standards. Financial institutions will have until 2019 to fully comply with the Basel III standards, which could cause an increase in capital requirements for, and could place constraints on, the financial institutions from which we borrow.

In April 2014, U.S. regulators adopted rules requiring enhanced supplementary leverage ratio standards beginning in January 2018, which would impose capital requirements more stringent than those of the Basel III standards for the most systematically significant banking organizations in the U.S. Adoption and implementation of the Basel III standards and the supplemental regulatory standards adopted by U.S. regulators may negatively impact our access to financing or affect the terms of our future financing arrangements.

Clearing facilities or exchanges upon which some of our hedging instruments are cleared may increase margin requirements on our hedging instruments in the event of adverse economic developments.

In response to events having or expected to have adverse economic consequences or which create market uncertainty, clearing facilities or exchanges upon which some of our hedging instruments, such as interest rate swaps, are traded may require us to post additional collateral. In the event that future adverse economic developments or market uncertainty result in increased margin requirements for our hedging instruments, it could materially adversely affect our liquidity position, business, financial condition and results of operations.

Loss of our exemption from regulation under the Investment Company Act would negatively affect the value of shares of our common stock and our ability to distribute cash to our stockholders.

We have operated and intend to continue to operate our business so as to be exempt from registration under the Investment Company Act because we are “primarily engaged in the business of purchasing or otherwise acquiring mortgages and other liens on and interests in real estate.” Specifically, we invest and intend to continue to invest so that at least 55% of the assets that we own on an unconsolidated basis consist of qualifying mortgages and other liens and interests in real estate, which are collectively referred to as “qualifying real estate assets,” and so that at least 80% of the assets we own on an unconsolidated basis consist of real estate related assets (including our qualifying real estate assets). We treat Fannie Mae, Freddie Mac and Ginnie Mae whole-pool residential mortgage pass-through securities issued with respect to an underlying pool of mortgage loans in which we hold all of the certificates issued by the pool as qualifying real estate assets. Although CMOs are real estate related assets, they are not “qualifying real estate assets” for purposes of the Investment Company Act.

9

If we fail to qualify for this exemption, or the SEC determines that companies that invest in RMBS are no longer able to rely on this exemption, we could be required to restructure our activities in a manner that, or at a time when, we would not otherwise choose to do so, or we may be required to register as an investment company under the Investment Company Act, either of which could negatively affect the value of shares of our common stock and our ability to make distributions to our stockholders.

The federal conservatorship of Fannie Mae and Freddie Mac and related efforts, along with any changes in laws and regulations affecting the relationship between Fannie Mae and Freddie Mac and the U.S. government, may adversely affect our business.

The payments we receive on the Agency RMBS in which we invest depend upon a steady stream of payments on the mortgages underlying the securities and are guaranteed by Ginnie Mae, Fannie Mae or Freddie Mac. Ginnie Mae is part of a U.S. government agency and its guarantees are backed by the full faith and credit of the United States. Fannie Mae and Freddie Mac are U.S. government-sponsored entities (“GSEs”), but their guarantees are not backed by the full faith and credit of the United States.

In 2008, shortly after Fannie Mae and Freddie Mac were placed in federal conservatorship, the Secretary of the U.S. Treasury noted that the guarantee structure of Fannie Mae and Freddie Mac required examination and that changes in the structures of the entities were necessary to reduce risk to the financial system. The future roles of Fannie Mae and Freddie Mac, if any, could be significantly reduced and the nature of their guarantees could be eliminated or considerably limited relative to historical measurements. Any changes to the nature of the guarantees provided by Fannie Mae and Freddie Mac, if any, could redefine what constitutes Agency RMBS and could have broad adverse market implications as well as negatively impact us.

The problems faced by Fannie Mae and Freddie Mac resulting in their being placed into federal conservatorship have resulted in proposed legislation to restructure the U.S. housing finance system and the operations of Fannie Mae and Freddie Mac. If federal policy makers decide that the U.S. government’s role in providing liquidity for the residential mortgage market should be reduced or eliminated, each of Fannie Mae and Freddie Mac could be dissolved and the U.S. government could decide to stop providing liquidity support of any kind to the mortgage market. If Fannie Mae or Freddie Mac were eliminated, or their structures were to change radically, we would not be able to acquire Agency RMBS from these companies, which would drastically reduce the amount and type of Agency RMBS available for investment. As of December 31, 2014, substantially all of our investments had the principal and interest guaranteed by either Fannie Mae, Freddie Mac, or Ginnie Mae, or were U.S. Treasuries.

Our income could be negatively affected in a number of ways depending on the manner in which related events unfold. For example, the current credit support provided by the U.S. Treasury to Fannie Mae and Freddie Mac, and any additional credit support it may provide in the future, could have the effect of lowering the interest rate we receive from Agency RMBS, thereby tightening the spread between the interest we earn on our portfolio of targeted investments and our cost of financing that portfolio. A reduction in the supply of Agency RMBS could also increase the prices of Agency RMBS we seek to acquire thereby reducing the spread between the interest we earn on our portfolio of targeted assets and our cost of financing that portfolio.

The effect of these actions taken by the U.S. government remains uncertain. Furthermore, the scope and nature of the actions that the U.S. government will ultimately undertake are unknown and will continue to evolve. Future legislation, if any, could further change the relationship between Fannie Mae and Freddie Mac and the U.S. government, and could also nationalize or eliminate these GSEs entirely. Any law affecting these GSEs, if any, may create market uncertainty and have the effect of reducing the actual or perceived credit quality of securities, either existing or new, issued or guaranteed by Fannie Mae or Freddie Mac. As a result, such laws could increase the risk of loss on investments in Fannie Mae and Freddie Mac Agency RMBS. It is also possible that such laws, if any, could adversely impact the market for such securities and the spreads at which they trade. All of the foregoing could materially adversely affect the pricing, supply, liquidity and value of our target assets and otherwise materially adversely affect our business, operations and financial condition.

We cannot predict the impact, if any, on our earnings or cash available for distributions to our stockholders of the Federal Housing Finance Agency's ("FHFA") proposed revisions to Fannie Mae’s, Freddie Mac’s and Ginnie Mae’s existing infrastructures to align the standards and practices of the three entities.

On February 21, 2012, the FHFA released its Strategic Plan for Enterprise Conservatorships, which set forth three goals for the next phase of the Fannie Mae and Freddie Mac conservatorships. These three goals are: to (i) build a new infrastructure for the secondary mortgage market, (ii) gradually contract Fannie Mae and Freddie Mac’s presence in the marketplace while simplifying and shrinking their operations, and (iii) maintain foreclosure prevention activities and credit availability for new and refinanced mortgages. On October 4, 2012, the FHFA released its white paper entitled Building a New Infrastructure for the Secondary Mortgage Market, which proposes a new infrastructure for Fannie Mae and Freddie Mac that has two basic goals.

10

The first such goal is to replace the current infrastructures of Fannie Mae and Freddie Mac with a common, more efficient infrastructure that aligns the standards and practices of the two entities, beginning with core functions performed by both entities such as issuance, master servicing, bond administration, collateral management and data integration. The FHFA issued a progress report in April 2013 on steps being taken to establish a common securitization platform (“CSP”) for residential mortgage-backed securities reflecting the feedback from a broad cross-section of industry participants. In May 2014, the FHFA issued a progress report on the initiatives outlined in the Strategic Plan for the Enterprise Conservatorships detailing important progress toward the building of a new secondary mortgage market infrastructure. According to the progress report, Fannie Mae and Freddie Mac have made some progress in developing the CSP. While some progress has been made in developing the CSP, the project faces considerable challenges that could undermine its prospects for success, including: (i) the difficulties inherent in developing a large-scale information technology system and (ii) the risks involved with preparing Fannie Mae and Freddie Mac to integrate with the CSP, including modifying internal financial and information systems.

The second goal is to establish an operating framework for Fannie Mae and Freddie Mac that is consistent with the progress of housing finance reform and encourages and accommodates the increased participation of private capital in assuming credit risk associated with the secondary mortgage market.

The FHFA recognizes that there are a number of impediments to their goals which may or may not be surmountable, such as the absence of any significant secondary mortgage market mechanisms beyond Fannie Mae, Freddie Mac and Ginnie Mae, and that their proposals are in the formative stages. As a result, it is unclear if the proposals will be enacted. If such proposals are enacted, it is unclear how closely what is enacted will resemble the proposals from the FHFA White Paper or what the effects of the enactment will be in terms of our book value, earnings or cash available for distribution to our stockholders.

Mortgage loan modification programs and future legislative action may adversely affect the value of, and the returns on, the Agency RMBS in which we invest.

Over the last few years, the U.S. government, through the Federal Housing Administration ("FHA"), the U.S. Treasury and the Federal Deposit Insurance Corporation (“FDIC”), has implemented a variety of programs designed to provide homeowners with assistance in avoiding residential mortgage loan foreclosures. These and any future programs may involve, among other things, the modification of mortgage loans to reduce the principal amount of the loans or the rate of interest payable on the loans, or to extend the payment terms of the loans. It is likely that loan modifications would result in increased prepayments on some Agency RMBS. Prepayment rates could negatively affect the value of our Agency RMBS, which could result in reduced earnings or losses and negatively affect the cash available for distribution to our stockholders,” for information relating to the impact of prepayments on our business. These initiatives, any future loan modification programs and future legislative or regulatory actions, including amendments to the bankruptcy laws, that result in the modification of outstanding mortgage loans may adversely affect the value of, and the returns on, the Agency RMBS, U.S. Treasuries, CMOs and U.S. Agency Debentures in which we may invest.

Prepayment rates could negatively affect the value of our Agency RMBS, which could result in reduced earnings or losses and negatively affect the cash available for distribution to our stockholders.

In the case of residential mortgage loans, there are seldom any restrictions on borrowers’ abilities to prepay their loans. Homeowners tend to prepay mortgage loans faster when applicable mortgage interest rates decline. Consequently, owners of the loans have to reinvest the money received from the prepayments at the lower prevailing interest rates. Conversely, homeowners tend not to prepay mortgage loans when mortgage interest rates remain steady or increase. Consequently, owners of the loans are unable to reinvest money that would have otherwise been received from prepayments at the higher prevailing interest rates. Fannie Mae, Freddie Mac or Ginnie Mae guarantees of principal and interest related to the Agency RMBS we own do not protect us against prepayment risks. This volatility in prepayment rates may affect our ability to maintain targeted amounts of leverage on our Agency RMBS portfolio and may result in reduced earnings or losses for us and negatively affect the cash available for distribution to our stockholders.

Our portfolio investments are recorded at fair value based on market quotations from pricing services and broker dealers. The value of our common stock could be adversely affected if our determinations regarding the fair value of these investments were materially higher than the values that we ultimately realize upon their disposal.

All of our current portfolio investments are, and some of our future portfolio investments will be, in the form of securities that are not publicly traded. The fair value of securities and other investments that are not publicly traded may not be readily determinable. We currently value and will continue to value these investments monthly at fair value as determined by our management based on market quotations from pricing services and brokers/dealers. Because such quotations and valuations are inherently uncertain, they may fluctuate over short periods of time and may be based on estimates, and our determinations of fair

11

value may differ materially from the values that would have been used if a public market for these securities existed. The value of our common stock could be adversely affected if our determinations regarding the fair value of these investments were materially higher than the values that we ultimately realize upon their disposal.

Our forward settling transactions, including “to-be-announced” transactions (“TBAs”), subject us to certain risks, including price risks and counterparty risks.

We purchase a substantial portion of our Agency RMBS through forward settling transactions, including TBAs. In a forward settling transaction, we enter into a forward purchase agreement with a counterparty to purchase either (i) an identified Agency RMBS, or (ii) a TBA , or to-be-issued, Agency RMBS with certain terms. As with any forward purchase contract, the value of the underlying Agency RMBS may decrease between the contract date and the settlement date. Furthermore, a transaction counterparty may fail to deliver the underlying Agency RMBS at the settlement date. If any of the above risks were to occur, our financial condition and results of operations may be materially adversely affected.

We are dependent on our key personnel and the loss of such key personnel could materially adversely affect our business, financial condition and results of operations and our ability to pay distributions to our stockholders.

We are dependent on the efforts of our key officers and employees, including Kevin E. Grant, our Chief Executive Officer, President and Chief Investment Officer. Although we have an employment agreement with him, we cannot assure you that he will remain employed with us. The loss of Mr. Grant’s services could have a material adverse effect on our business, financial condition and results of operations and our ability to pay distributions to our stockholders.

We operate in a highly competitive market for investment opportunities.

A number of entities compete with us to make the types of investments that we make. We compete with other mortgage REITs, specialty finance companies, public and private funds, commercial and investment banks, the Fed, other governmental entities or government sponsored entities, commercial finance companies, and other entities. Many of our competitors are substantially larger and have considerably greater financial, technical and marketing resources than we do. Several other REITs may have investment objectives that overlap with ours, which may create competition for investment opportunities. Some competitors may have a lower cost of funds and access to funding sources that are not available to us. In addition, some of our competitors may have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of investments and establish more relationships than us. We provide no assurances that the competitive pressures we face will not have a material adverse effect on our business, financial condition and results of operations. Also, as a result of this competition, we may not be able to take advantage of attractive investment opportunities from time to time, and we can offer no assurance that we will be able to identify and make investments that are consistent with our investment objectives.

Our board of directors does not approve each of our investment decisions, and may change our investment guidelines without notice or stockholder consent, which may result in riskier investments.

Our board of directors periodically reviews our investment guidelines, investment portfolio, and potential investment strategies. However, our directors do not pre-approve individual investments leaving management with day to day discretion over the portfolio composition within the investment guidelines. Within those guidelines, management has discretion to significantly change the composition of the portfolio. In addition, in conducting periodic reviews, the directors may rely primarily on information provided to them by our management. Our board of directors has the authority to change our investment guidelines at any time without notice to or consent from our stockholders. In 2008, our board of directors amended our investment guidelines to require that we invest exclusively in Agency RMBS. In 2010, our board of directors modified our investment guidelines to permit investments in CMOs. In 2012, our board of directors amended our investment guidelines to allow us to invest in U.S. Treasuries and U.S. Agency Debentures. To the extent that our investment guidelines change in the future, we may make investments that are different from, and possibly riskier than, the investments described in this Annual Report on Form 10-K. A change in our investment guidelines may increase our exposure to interest rate and real estate market fluctuations.

We may enter into derivative transactions that could expose us to unexpected economic losses in the future.

We may enter into certain derivative transactions, such as swaps, caps and certain options and other custom instruments, which are subject to the risk of non-performance by the counterparty, and risks relating to the creditworthiness of the counterparty. In addition, we are subject to the risk of the failure of any of the exchanges or clearing houses on which we trade. Interest rate swaps and caps can be individually negotiated and structured to include exposure to a variety of different types of investments or market factors. Depending on their structure, swaps and caps may increase or decrease exposure to long-term or short-term interest

12

rates (in the United States or abroad), foreign currency values, mortgage securities, corporate borrowing rates, or other factors such as security prices, baskets of equity securities or inflation rates.

Swaps and caps tend to shift investment exposure from one type of investment to another. Depending on how they are used, swaps and caps may increase or decrease the overall volatility of our portfolio. The most significant factor in the performance of swaps is the change in the specific interest rate, currency, individual equity values or other factors that determine the amounts of payments due to and from us. If a swap calls for payments or collateral transfers by us, we must be prepared to make such payments and transfers when due.

Part of our investment strategy involves entering into derivative transactions that could require us to fund cash payments in the future under certain circumstances, such as the early termination of the derivative transaction caused by any event of default or other early termination event, or the decision by a counterparty to request margin securities it is contractually owed under the terms of the derivative contract. The amount due would be equal to the unrealized loss of the open derivative positions with the respective counterparty and could also include other fees and charges. These potential payments would be contingent liabilities and therefore may not appear on our balance sheet. The economic losses will be reflected in our financial results of operations, and our ability to fund these obligations will depend on our liquidity and access to capital at the time. The need to fund these obligations could adversely impact our financial condition.

Certain hedging instruments are not traded on regulated exchanges, guaranteed by an exchange or its clearing house, or regulated by any U.S. or foreign governmental authorities and involve risks and costs.

The cost of using hedging instruments increases as the as the duration of the hedge increases and in periods of rising and/or volatile interest rates. Despite this, we may increase our hedging duration and/or enter into hedges during periods when interest rates are volatile or rising, and in such cases our hedging costs will increase.

In addition, hedging instruments typically involve risk because certain of them are not currently traded on regulated exchanges, guaranteed by an exchange or its clearing house, or regulated by any U.S. or foreign governmental authorities. Consequently, there are no requirements with respect to record keeping, financial responsibility or segregation of customer funds and positions. Furthermore, the enforceability of agreements underlying derivative transactions may depend on compliance with applicable statutory and commodity and other regulatory requirements and, depending on the identity of the counterparty, applicable international requirements. The business failure of a hedging counterparty with whom we enter into a hedging transaction most likely will result in a default. Default by a party with whom we enter into a hedging transaction may result in the loss of unrealized profits and force us to cover our resale commitments, if any, at the then current market price. In addition, we may not always be able to dispose of or close out a hedging position without the consent of the hedging counterparty, and we may not be able to enter into an offsetting contract to cover our risk. We cannot assure you that a liquid secondary market will exist for hedging instruments purchased or sold, and we may be required to maintain a position until exercise or expiration, which could result in losses.

Failure to obtain and maintain an exemption from being regulated as a commodity pool operator could subject us to additional regulation and compliance requirements and may result in fines and other penalties which could materially adversely affect our business, financial condition and results of operations.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) established a comprehensive new regulatory framework for derivative transactions commonly referred to as “swaps.” As a result, any investment fund that trades in swaps may be considered a “commodity pool,” which would cause its operators (and in some cases the fund’s directors) to be regulated as “commodity pool operators” (“CPOs”). Under new rules adopted by the U.S. Commodity Futures Trading Commission (the “CFTC”), those funds that become commodity pools solely because of their use of swaps must register with the National Futures Association (“NFA”). Registration requires compliance with the CFTC’s regulations and the NFA’s rules with respect to capital raising, disclosure, reporting, recordkeeping and other business conduct. However, the CFTC’s Division of Swap Dealer and Intermediary Oversight has issued a no-action letter saying, although it believes that mortgage REITs are properly considered commodity pools, it would not recommend that the CFTC take enforcement action against the operator of a mortgage REIT who does not register as a CPO if, among other things, the mortgage REIT limits the initial margin ("IM") and premiums required to establish its swaps, futures and other commodity interest positions to not more than five percent of its total assets, the mortgage REIT limits the net income derived annually from those commodity interest positions that are not qualifying hedging transactions to less than five percent of its gross income and interests in the mortgage REIT are not marketed to the public as or in a commodity pool or otherwise as or in a vehicle for trading in the commodity futures, commodity options or swaps markets.

We do not currently engage in any speculative derivatives activities or other non-hedging transactions using swaps, futures or options on futures. We do not use these instruments for the purpose of trading in commodity interests, and we do not consider

13

our company or our operations to be a commodity pool as to which CPO registration or compliance is required. We have submitted the required filing to claim the no-action relief afforded by the above-described no-action letter. Consequently, we will be restricted to operating within the parameters discussed in the no-action letter and will not enter into hedging transactions covered by the no-action letter if they would cause us to exceed the limits set forth in the no-action letter.

The CFTC has substantial enforcement power with respect to violations of the laws over which it has jurisdiction, including its anti-fraud and anti-manipulation provisions. For example, the CFTC may suspend or revoke the registration of or the no-action relief afforded to a person who fails to comply with commodities laws and regulations, prohibit such a person from trading or doing business with registered entities, impose civil money penalties, require restitution and seek fines or imprisonment for criminal violations. Additionally, a private right of action exists against those who violate the laws over which the CFTC has jurisdiction or who willfully aid, abet, counsel, induce or procure a violation of those laws. In the event that we fail to comply with statutory requirements relating to derivatives or with the CFTC’s rules thereunder, including the no-action letter described above, we may be subject to significant fines, penalties and other civil or governmental actions or proceedings, any of which could have a materially adverse effect on our business, financial condition and results of operations.

We are highly dependent on communications and information systems operated by third parties, and systems failures could significantly disrupt our business, which may, in turn, negatively affect the market price of our common stock and our ability to pay distributions to our stockholders.reorder

Our business is highly dependent on communications and information systems that allow us to monitor, value, buy, sell, finance and hedge our investments. These systems are primarily operated by third parties and, as a result, we have limited ability to ensure their continued operation. In the event of systems failure or interruption, we will have limited ability to affect the timing and success of systems restoration. Any failure or interruption of our systems could cause delays or other problems in our securities trading activities, including Agency RMBS trading activities, which could have a material adverse effect on our operating results and negatively affect the market price of our common stock and our ability to make distributions to our stockholders

If we issue debt securities or equity securities that are senior to our stock for the purposes of dividend and liquidating distributions, our operations may be restricted, we will be exposed to additional risk and the market price of our common stock could be adverse affected.

If we decide to issue debt securities in the future, it is likely that such securities will be governed by an indenture or other instrument containing covenants restricting our operating flexibility. Additionally, any convertible or exchangeable securities that we issue in the future may have rights, preferences and privileges more favorable than those of our common stock. We have issued and outstanding an aggregate of 3,000,000 shares of our 7.75% Series A Cumulative Redeemable Preferred Stock and 8,000,000 shares of our 7.50% Series B Cumulative Redeemable Preferred Stock. Other classes or series of our preferred stock, if issued, could have a preference on liquidating distributions or a preference on dividend payments that could limit our ability to make a distribution to the holders of our common stock. We, and indirectly our stockholders, will bear the cost of issuing and servicing such securities. Holders of debt securities may be granted specific rights, including but not limited to, the right to hold a perfected security interest in certain of our assets, the right to accelerate payments due under the indenture, rights to restrict dividend payments, and rights to approve the sale of assets. Such additional restrictive covenants, operating restrictions and preferential dividends could have a material adverse effect on our operating results and negatively affect the market price of our common stock and our ability to pay distributions to our stockholders.

A security breach or a cyber-attack could adversely affect our business.

We rely on sophisticated information technology systems, networks and infrastructure in managing our day-to-day business and operations. Despite in-place cyber-security measures, our information technology systems, networks and infrastructure may be vulnerable to deliberate attacks or unintentional events that could interrupt or interfere with their functionality or the confidentiality of our information. Our inability to effectively utilize our information technology systems, networks and infrastructure, and protect our information could adversely affect our business.

CMOs may be subject to greater risks than whole-pool Agency RMBS.

In March 2010, our board of directors amended our investment guidelines to allow us to invest in CMOs. CMOs are securitizations issued by a government agency or a government-sponsored entity that are collateralized by Agency RMBS that are divided into various tranches that have different characteristics (such as different maturities or different coupon payments), and, therefore, may carry greater risk than an investment in whole-pool Agency RMBS. For example, certain CMO tranches, such as interest-only securities, principal-only securities, support securities and securities purchased at a significant premium, are more

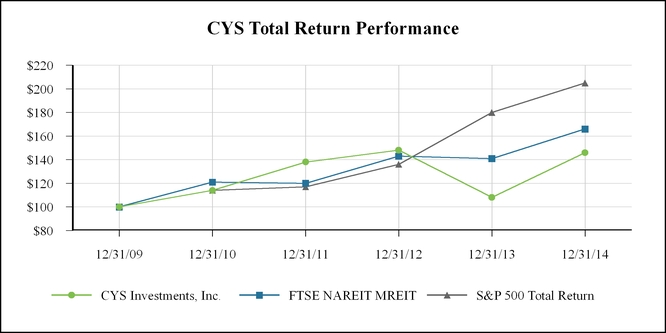

14