Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ASSOCIATED BANC-CORP | d382367d8k.htm |

| EX-99.1 - EX-99.1 - ASSOCIATED BANC-CORP | d382367dex991.htm |

Associated Banc-Corp

2Q 2012 Earnings Presentation

July 19, 2012

Exhibit 99.2 |

Forward-Looking Statements

Important note regarding forward-looking statements: 1

Statements made in this presentation which are not purely historical are

forward-looking statements, as defined in the Private Securities

Litigation Reform Act of 1995. This

includes any statements regarding management’s plans, objectives, or goals

for future operations,

products

or

services,

and

forecasts

of

its

revenues,

earnings,

or

other

measures of performance.

Such forward-looking statements may be identified by the

use of words such as “believe”,

“expect”, “anticipate”, “plan”, “estimate”, “should”, “will”, “intend”,

“outlook”, or similar expressions.

Forward-looking statements are based on current

management expectations and, by their nature, are subject to risks and

uncertainties. Actual

results

may

differ

materially

from

those

contained

in

the

forward-looking

statements.

Factors which may cause actual results to differ materially from

those contained in such forward-looking

statements include those identified in the company’s most

recent

Form

10-K

and

subsequent

SEC

filings.

Such

factors

are

incorporated

herein

by reference. |

Second Quarter 2012 Highlights

•

Net income available to common shareholders of $42 million or $0.24 per

share –

Quarterly net income to common shareholders is at the highest level since early

2008 •

Return on Tier 1 common equity of 9.26%, compared to 6.07% a year ago

2

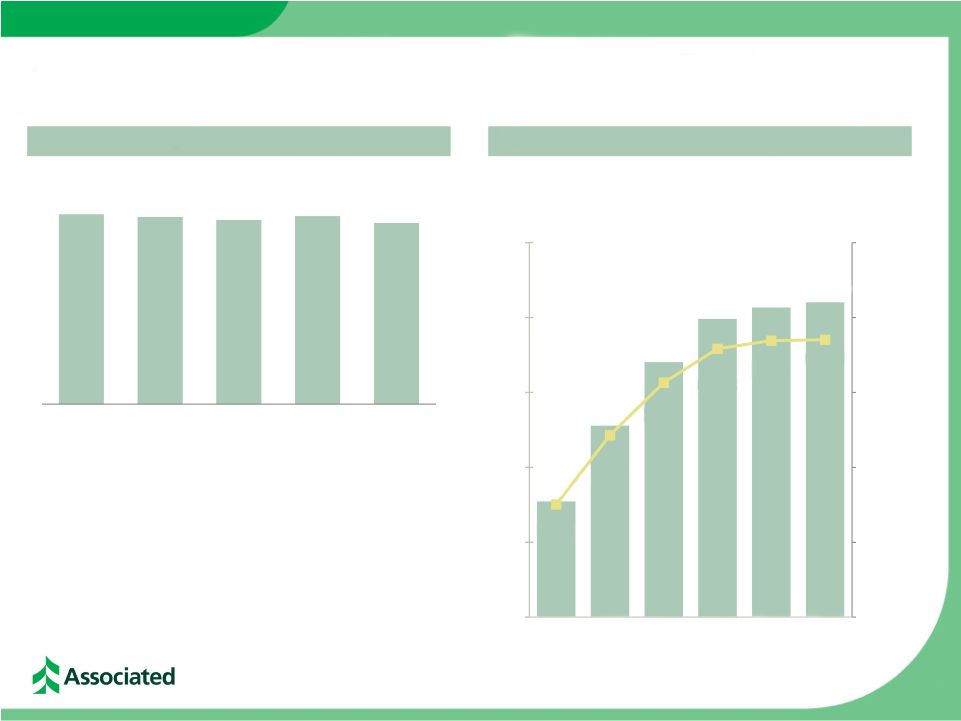

Improving Results & Trends

Net Income

&

ROT1CE

Loan Growth

Net Interest Income

&

Net Interest Margin

•

Total loans of $14.7 billion were up $445 million, or 3% from the end of the first

quarter –

Commercial real estate lending loans increased by $193 million

–

General commercial loans increased by $139 million

•

Net interest income of $154 million

–

Net interest margin of 3.30%; down 1 bps compared to first quarter NIM of

3.31% Capital

•

Repurchased $30 million of common stock during the quarter

•

Redeemed $25 million of outstanding 7.625% Trust preferred securities in the

quarter •

Capital ratios remain very strong with a Tier 1 common equity ratio of

12.04% |

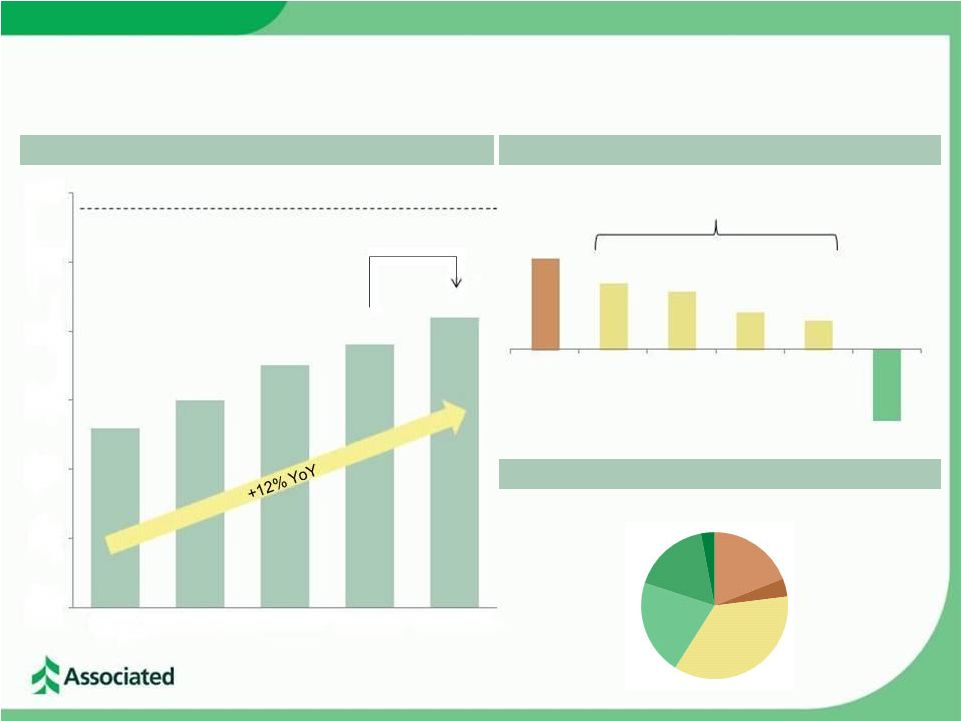

Loan

Portfolio Growth and Composition 3

Total Loans of $14.7 billion at June 30, 2012

2Q 2012 Net Loan Growth of $445 million

Total Loans ($ in billions)

($ balances in millions)

CBL: Commercial and business lending

CRE: Commercial real estate lending

CL: General commercial loans

MW: Mortgage Warehouse

OG: Oil & Gas

PU: Power & Utilities

RRM: Retail and residential mortgage

$193

$139

$122

$79

$61

RRM

($149)

CRE

CL

MW

OG

PU

$16.5

$15.5

$14.5

$13.5

$12.5

$11.5

$10.5

2Q 2011

3Q 2011

4Q 2011

1Q 2012

2Q 2012

$13.1

$13.5

$14.0

$14.3

$14.7

3% QoQ

Peak Loans (4Q 2008) $16.3 billion

CBL: +$401

Loan Mix

2Q 2012

+

–

+

CRE Investor

19%

Consumer

3%

Home Equity

17%

Res Mtg

21%

Construction

4%

Commercial

& Business

Lending

36% |

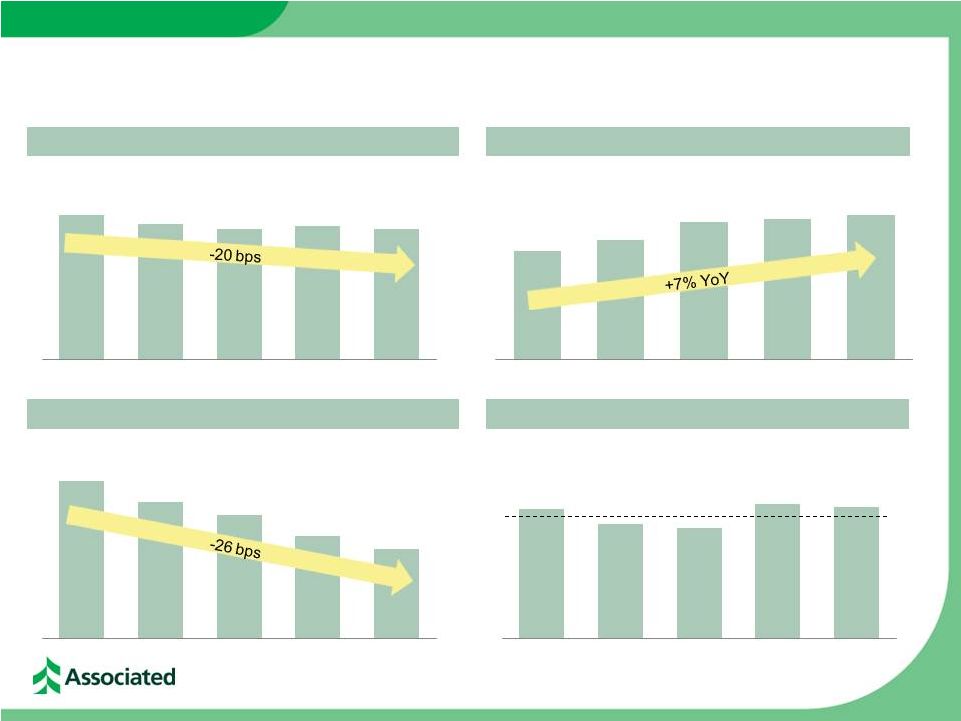

4

FY2011:

3.26%

Yield on Interest-earning Assets

Cost of Interest-bearing Liabilities

Average Deposits

Net Interest Margin

($ balances in billions)

4.00%

3.88%

3.81%

3.85%

3.80%

2Q 2011

3Q

2011 4Q

2011 1Q

2012

2Q

2012

2Q 2011

3Q

2011 4Q

2011 1Q

2012

2Q

2012

2Q 2011 3Q

2011

4Q

2011

1Q

2012

2Q

2012

2Q 2011 3Q

2011

4Q

2011

1Q

2012

2Q

2012

0.91%

0.83%

0.78%

0.70%

0.65%

$14.1

$14.4

$14.9

$15.0

$15.1

3.29%

3.23%

3.21%

3.31%

3.30%

Managing the Cost of Funds & Margin |

Continued Improvement in Credit Quality Indicators

5

($ in millions)

Provision for loan losses

$ 16

$ 4

$ 1

$ 0

$ 0

Net charge offs

$ 45

$ 30

$ 23

$ 22

$ 24

Potential problem loans

$ 699

$ 660

$ 566

$ 480

$ 410

Nonaccruals

$ 468

$ 403

$ 357

$ 327

$ 318

ALLL/Total loans

3.25%

2.96%

2.70%

2.50%

2.26%

ALLL/Nonaccruals

91.09%

99.09%

105.99%

108.93%

104.65%

NPA/Assets

2.33%

2.03%

1.82%

1.65%

1.62%

Nonaccruals/Loans

3.57%

2.99%

2.54%

2.29%

2.16%

NCOs / Avg Loans

1.37%

0.90%

0.64%

0.61%

0.65%

2Q 2011

3Q 2011

2Q 2012

1Q 2012

4Q 2011 |

Strong Capital Profile

& Improving Earnings Tier 1 Common Equity Ratio

Net Income Available to Common & ROT1CE

12.61%

12.44%

12.24%

12.49%

12.04%

2Q 2011

3Q 2011

4Q 2011

1Q 2012

2Q 2012

3.76%

6.07%

7.83%

8.96%

9.23%

9.26%

12.50%

10.00%

7.50%

5.00%

2.50%

0.00%

$50

$40

$30

$20

$10

Net Income

($ in millions)

Return on Tier 1

Common Equity

$0

$15

$26

$34

$40

$41

$42

•

Current capital levels are well in excess of

“well-capitalized”

regulatory benchmarks

–

Existing capital levels are already above

proposed Basel III capital levels

1Q 2011

2Q 2011

3Q 2011

4Q 2011

1Q 2012

2Q 2012

6 |

Outlook

7

Loan Growth

•

Approximately 3% quarterly

growth

Deposit Growth

Fee Income

Expenses

NIM

Positioned for Growth; Creating Long-Term Shareholder Value

Footprint

Credit

Capital

•

Continued disciplined pricing

•

Slowing run-off of high cost CDs

•

Sustained focus on treasury

management solutions to drive

growth in commercial deposits

•

Relatively stable on a full-year

basis compared to full-year 2011

•

Modest improvement quarterly

in core fee-based revenues

with mortgage banking income

likely reduced going forward

•

Low single-digit quarterly growth;

including the cost of continuing

BSA enhancements & footprint

updates

•

Continue to invest in our branches

while optimizing our network

•

Consolidating in downtown

Green Bay

•

Continuing improvement in

credit trends

•

Very modest provision outlook

•

Disciplined, value-added

approach to capital

deployment over time |