Attached files

| file | filename |

|---|---|

| 8-K - DYNEX CAPITAL INC | form8-kinvestorpresentatio.htm |

Investor Presentation June 11, 2012

2 Safe Harbor Statement NOTE: This presentation contains certain statements that are not historical facts and that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements in this presentation addressing expectations, assumptions, beliefs, projections, future plans, strategies, and events, developments that we expect or anticipate will occur in the future, and future operating results are forward-looking statements. Forward-looking statements in this presentation may include, but are not limited to statements about projected future investment strategies and leverage ratios, future financial performance, the projected impact of NOL carryforwards, future dividends paid to shareholders, and future investment opportunities and capital raising activities. The words “will,” “believe,” “expect,” “forecast,” “anticipate,” “intend,” “estimate,” “assume,” “project,” “plan,” “continue,” and similar expressions also identify forward-looking statements. These forward-looking statements reflect our current beliefs, assumptions and expectations based on information currently available to us, and are applicable only as of the date of this presentation. Forward-looking statements are inherently subject to risks, uncertainties, and other factors, some of which cannot be predicted or quantified and any of which could cause the Company’s actual results and timing of certain events to differ materially from those projected in or contemplated by these forward-looking statements. Not all of these risks, uncertainties and other factors are known to us. New risks and uncertainties arise over time, and it is not possible to predict those risks or uncertainties or how they may affect us. The projections, assumptions, expectations or beliefs upon which the forward-looking statements are based can also change as a result of these risks and uncertainties or other factors. If such a risk, uncertainty, or other factor materializes in future periods, our business, financial condition, liquidity and results of operations may differ materially from those expressed or implied in our forward-looking statements. While it is not possible to identify all factors, some of the factors that may cause actual results to differ from historical results or from any results expressed or implied by our forward-looking statements, or that may cause our projections, assumptions, expectations or beliefs to change, include the following: the risks and uncertainties referenced in our Annual Report on Form 10-K for the year ended December 31, 2011 and subsequent filings with the Securities and Exchange Commission, particularly those set forth under the caption “Risk Factors”; our ability to find suitable reinvestment opportunities; changes in economic conditions; changes in interest rates and interest rate spreads, including the repricing of interest-earnings assets and interest-bearing liabilities; our investment portfolio performance particularly as it relates to cash flow, prepayment rates and credit performance; the cost and availability of financing; the cost and availability of new equity capital; changes in our use of leverage; the quality of performance of third-party service providers of our loans and loans underlying our securities; the level of defaults by borrowers on loans we have securitized; changes in our industry; increased competition; changes in government regulations affecting our business; regulatory actions, if any, taken in connection with an SEC review of certain sections of the Investment Company Act of 1940; government initiatives to support the U.S financial system and U.S. housing and real estate markets; financial condition and future operations of the GSEs; GSE reform or other government policies and actions; an ownership shift under Section 382 of the Internal Revenue Code that impacts the use of our tax NOL carry forward; and our continued eligibility for inclusion in Russell Indexes and the materiality of the income taxes which may be due to the Company’s ownership of securities which generate excess inclusion income.

3 DX Snapshot Internally managed REIT commenced operations in 1988 Diversified investment strategy Large tax NOL carryforward Significant inside ownership Market Highlights: (as of 6/6/12 unless indicated) NYSE Stock Ticker: DX Shares Outstanding: 54,365,834 Q1 2012 Dividend: $0.28 Share Price/Dividend Yield: $9.62/11.64% Price to Book: (based on BV per share as of 3/31/12) 1.0x Market Capitalization: $523 million

4 Recent Highlights ROE of 14.7% for Q1 2012 Raised market capitalization above $500 million Annualized dividend rate of $1.12 per share up from $1.09 per share declared in 2011 Book Value increased $0.42 in Q1 2012 to $9.62 from $9.20 at the end of 2011 Byron Boston promoted to President and elected to the Board of Directors Total annualized return of 12.2% since 2008 assuming reinvested dividends

Our Track Record $0.71 $0.92 $0.98 $1.09 $1.12 $0.91 $1.02 $1.41 $1.03 $1.32 $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 $1.60 2008 2009 2010 2011 Q1-2012 annualized Dividend per Share EPS $8.07 $9.08 $9.64 $9.20 $9.62 $7.00 $7.50 $8.00 $8.50 $9.00 $9.50 $10.00 2008 2009 2010 2011 Q1-2012 1.51% 3.23% 3.17% 2.45% 2.41% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 2008 2009 2010 2011 Q1-2012 10.7% 11.2% 14.5% 11.0% 14.7% 0% 2% 4% 6% 8% 10% 12% 14% 16% 2008 2009 2010 2011 Q1-2012 Dividends and Earnings Per Share Net Interest Spread Book Value Per Share Return on Average Equity 5

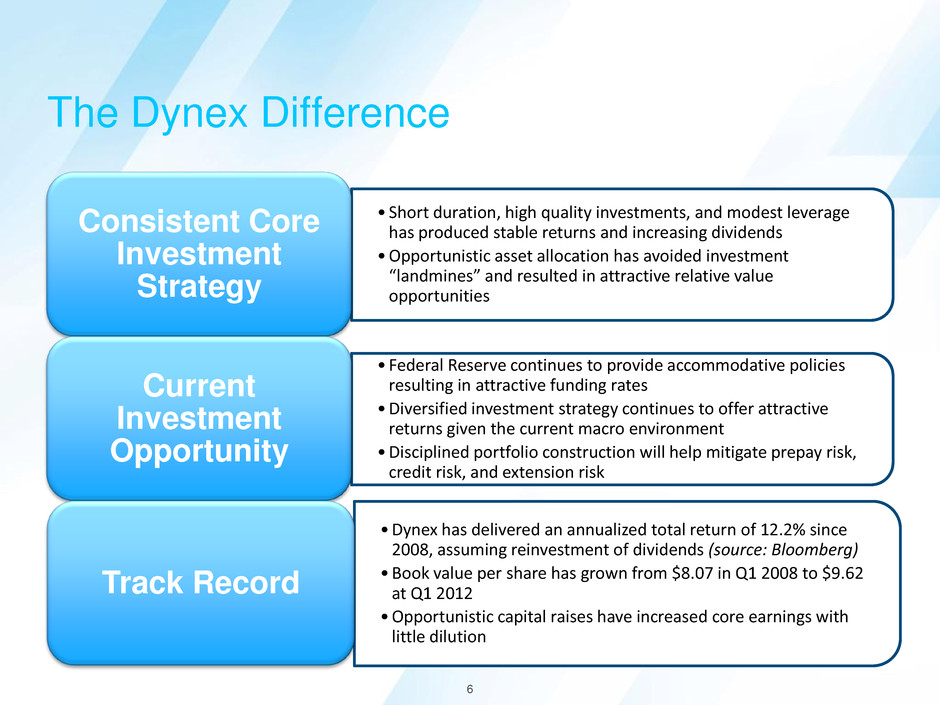

6 The Dynex Difference •Short duration, high quality investments, and modest leverage has produced stable returns and increasing dividends •Opportunistic asset allocation has avoided investment “landmines” and resulted in attractive relative value opportunities Consistent Core Investment Strategy • Federal Reserve continues to provide accommodative policies resulting in attractive funding rates • Diversified investment strategy continues to offer attractive returns given the current macro environment • Disciplined portfolio construction will help mitigate prepay risk, credit risk, and extension risk Current Investment Opportunity •Dynex has delivered an annualized total return of 12.2% since 2008, assuming reinvestment of dividends (source: Bloomberg) •Book value per share has grown from $8.07 in Q1 2008 to $9.62 at Q1 2012 •Opportunistic capital raises have increased core earnings with little dilution Track Record

Disciplined Top-Down Investment Philosophy Macroeconomic Analysis Sector Analysis Security Selection and Funding Performance and Risk Management 7

8 DX Portfolio Detail (as of March 31, 2012) Agency RMBS 65% Agency CMBS 18% Non- Agency RMBS 2% Non- Agency CMBS 15% RMBS, 67% CMBS, 33% Agency/Non-Agency Residential/Commercial Months to Maturity/Reset Maturity/Reset Distribution

Explicit prepayment protection 76% Post/near reset 5% *Selected specified pools 19% DX Portfolio Detail (as of March 31, 2012) 9 AAA* 91% AA 4% A 4% Below A 1% Credit Quality *Agency MBS are considered AAA rated as of the date presented Dollar Prepayment Premium Exposure *See appendix for details on specified pools

CMBS Portfolio (as of March 31, 2012) 10 AAA 81% AA 6% A 12% Below A 1% Other 33% Multifamily 67% $0 $50,000 $100,000 $150,000 $200,000 $250,000 prior to 2000 2000-2005 2006-2008 2009 or newer Agency CMBS $319.8 Agency CMBS IO $255.0 Non- Agency CMBS $383.0 Non- Agency CMBS IO $69.0 Credit Quality Collateral Non-Agency CMBS Vintage Portfolio CMBS Assets By year of origination $ in millions

Agency CMBS IO Default Sensitivity 11 2.00 2.50 3.00 3.50 4.00 4.50 5.00 5.50 6.00 0% 0.30% 0.60% 1.00% 2.00% 3.00% Asset Yield (%) Expectation Annual Rate of Default *Assumes 20% loss severity

Agency CMBS Historical Credit Performance 12 0.00% 0.05% 0.10% 0.15% 0.20% 0.25% 0.30% 0.35% 0.40% 0.45% % 60+ D a y s Agency Serious Delinquency Rate Source: Freddie Mac

Portfolio Performance *As presented on this slide, Q3-2011 return on average equity is calculated based on a measure that excludes the impact of certain items on earnings per share (EPS Ex-Items). EPS Ex-Items for Q3-2011 was $0.32 and excludes from GAAP earnings per share the impact of litigation settlement and related defense costs of $8.2 million (or $0.20 per diluted common share), a loss of $2.0 million (or $0.05 per diluted common share) on redemption of non-recourse collateralized financings, and $1.3 million (or $0.03 per diluted common share) in net accelerated premium amortization due to an increase in forecasted prepayment speeds during the third quarter of 2011. For Q3-2011, reported diluted EPS was $0.04 and reported annualized ROAE was 1.6%. 17.5% 18.4% 21.2% 21.5% 14.6% 15.4% 17.6% 17.9% 14% 16% 18% 20% 22% 24% 1 mo 3 mo 6 mo 1 year Agency Total portfolio Quarter ended Quarter ended March 31, 2012 December 31, 2011 Agency Non-Agency Portfolio Agency Non-Agency Portfolio 2.98% 6.49% 3.58% 3.11% 6.36% 3.76% (0.91%) (2.52%) (1.17%) (0.91%) (2.73%) (1.20%) 2.07% 3.97% 2.41% 2.20% 3.63% 2.56% Investment Yield Cost of funds Net int r st spread Net Interest Spread Prepayment Performance 5.1x 5.3x 5.5x 6.0x 5.8x 5.4x 16.17% 13.20% 14.10% 13.70% 15.60% 14.70% 3% 6% 9% 12% 15% 18% 4.6 4.8 5 5.2 5.4 5.6 5.8 6 6.2 Q4-2010 Q1-2011 Q2-2011 Q3-2011 Q4-2011 Q1-2012 * Leverage and ROE (as of March 31, 2012)

14 Potential Investment Returns (as of June 7, 2012) Investment Range of Prices Range of Yields Range of Net Spread to Funding Range of ROEs Agency RMBS 102-109 1.2%- 2.3% .9%-1.8% 8%-16% Agency CMBS 106-113 2.5%-3.0% 1.0%-1.3% 10%-14% Non-Agency ‘A’ - ’AAA’ RMBS 85-104 3.0%-8.5% 1.5%-4.0% 12%-20% Non-Agency ‘A’- ‘AAA’ CMBS 95-110 3.7%-5.0% 2.0%-3.6% 12%-19% The above portfolio is for illustrative purposes only, does not represent or guarantee actual or expected performance and should not be relied upon for any investment decision. The range of returns on equity is based on certain assumptions, including assumptions relating to asset allocation percentages and spreads where mortgage assets can be acquired versus a current cost of funds to finance acquisitions of those assets. Rates used represent a range of asset yields and funding costs based on data available as of the date referenced above. Any change in the assumed yields, funding costs or assumed leverage could materially alter the company’s returns. There can be no assurance that asset yields or funding costs will remain at current levels. For a discussion of risks that may affect our ability to implement strategy and other factors which may affect our potential returns, please see the section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2011.

15 Extension Risk (as of June 7, 2012) 0 2 4 6 8 10 12 14 16 FN 30 year FNCI 15 year FN 5/1 ARM 15 CPR/CPB 2 CPR/CPB Average Life (years) Price Coupon WAC Speed Average Life Average Life Extension FN 30yr $104-31 3.50% 4.01% 15 CPR 2 CPR 5.38 years 14.54 years ~9 years FNCI 15yr $104-22 3.00% 3.44% 15 CPR 2 CPR 4.13 years 7.41 years ~3 years FN 5/1 ARM $103-27 2.35% 2.91% 15 CPB 2 CPB 3.23 years 4.39 years ~1 year Source: Bloomberg

Financing (as of March 31, 2012) Repurchase Agreements Financing Balance WAVG Rate By collateral pledged: Agency $ 2,257,138 0.43% Non-Agency 357,459 1.49% Other 71,601 1.25% Total $ 2,686,198 0.59% By original maturity: (days) 0-30 $ 367,580 0.94% 31-60 1,627,179 0.61% 61-90 373,636 0.34% >90 272,802 0.32% Total $ 2,686,198 0.59% 16 SWAPS Maturity (mos.) Total Notional Balance WAVG Rate 0-12 $ 75,000 1.30% 13-36 565,000 1.44% 37-60 260,000 2.04% >60 190,000 1.81% Total $ 1,090,000 1.65% WAVG Maturity 40 months

17 Portfolio Summary Our portfolio has performed well since 2008 and the earnings power today remains relatively intact Prepayment risk is mitigated by superior portfolio construction and HARP 2.0 should have less impact on Hybrid ARMs. Credit risk is mitigated by highly-rated securities, superior loan origination years and concentration in multifamily collateral. Extension risk is mitigated by the short-duration investment portfolio with 79% of the investments maturing or resetting within seven years (as of March 31, 2012). There continues to be attractive investment opportunities to deploy capital despite the volatile financial markets.

18 Dynex Value Proposition Source: SNL High insider ownership aligns interests and reduces incentives to raise dilutive capital High quality, short duration strategy reduces volatility of results Diversified strategy offers superior capital allocation opportunities Our success since 2008 illustrates our commitment to delivering shareholder value +62.81%

19 APPENDIX

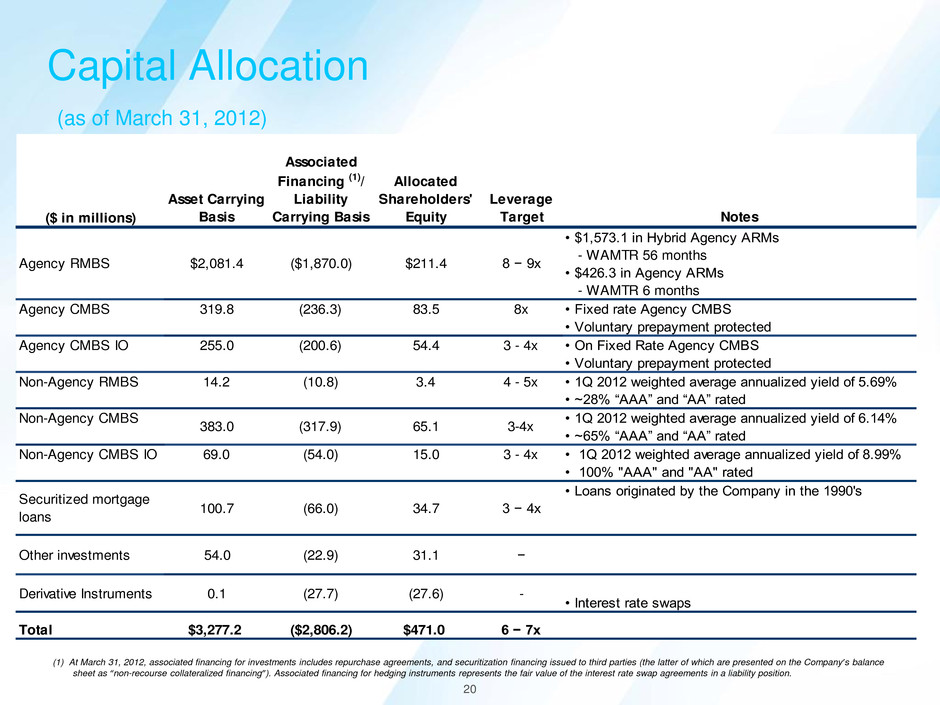

20 Capital Allocation (as of March 31, 2012) (1) At March 31, 2012, associated financing for investments includes repurchase agreements, and securitization financing issued to third parties (the latter of which are presented on the Company’s balance sheet as “non-recourse collateralized financing”). Associated financing for hedging instruments represents the fair value of the interest rate swap agreements in a liability position. ($ in millions) Asset Carrying Basis Associated Financing (1)/ Liability Carrying Basis Allocated Shareholders' Equity Leverage Target Notes • $1,573.1 in Hybrid Agency ARMs - WAMTR 56 months • $426.3 in Agency ARMs - WAMTR 6 months Agency CMBS 319.8 (236.3) 83.5 8x • Fixed rate Agency CMBS • Voluntary prepayment protected Agency CMBS IO 255.0 (200.6) 54.4 3 - 4x • On Fixed Rate Agency CMBS • Voluntary prepayment protected Non-Agency RMBS 14.2 (10.8) 3.4 4 - 5x • 1Q 2012 weighted average annualized yield of 5.69% • ~28% “AAA” and “AA” rated Non-Agency CMBS • 1Q 2012 weighted average annualized yield of 6.14% • ~65% “AAA” and “AA” rated Non-Agency CMBS IO 69.0 (54.0) 15.0 3 - 4x • 1Q 2012 weighted average annualized yield of 8.99% • 100% "AAA" and "AA" rated • Loans originated by the Company in the 1990's Derivative Instruments 0.1 (27.7) (27.6) - • Interest rate swaps Total $3,277.2 ($2,806.2) $471.0 6 − 7x 100.7 54.0 Securitized mortgage loans Other investments 383.0 Agency RMBS ($1,870.0)$2,081.4 (317.9) 65.1 3-4x $211.4 8 − 9x (22.9) 31.1 − (66.0) 34.7 3 − 4x

21 Selected Financial Highlights (as of and for the quarter ended) Financial Highlights: ($000 except per share amounts) Mar 31, 2012 Dec 31, 2011 Sept 30, 2011 Jun 30, 2011 Mar 31, 2011 Total Investments 3,276,170$ 2,500,976$ 2,595,574$ 2,591,097$ 2,279,610$ Total Assets 3,349,056 2,582,193 2,633,686 2,656,703 2,359,816 Total Liabilities 2,826,159 2,210,844 2,264,152 2,269,843 1,976,323 Total Equity 522,897 371,349 369,534 386,860 383,493 Interest Income 26,272 23,704 21,143 21,065 17,465 Interest Expense 7,125 6,732 6,583 6,032 4,734 Net I tere t Income 19,147 16,972 14,560 15,033 12,731 General and Administrative Expenses 3,121 3,249 2,335 2,255 2,118 Net income 16,476$ 14,406$ 1,532$ 13,594$ 10,280$ Diluted EPS 0.33$ 0.36$ $ 0.04* 0.34$ 0.31$ Dividends declared per common share 0.28 0.28 0.27 0.27 0.27 Book Value per share 9.62 9.20 9.15 9.59 9.51 * Diluted EPS Ex-Items was $0.32. EPS Ex-Items, or Dynex’s earnings per share excluding certain items, excludes from GAAP earnings per share the impact of litigation settlement and related defense costs of $8.2 million (or $0.20 per diluted common share), a loss of $2.0 million (or $0.05 per diluted common share) on redemption of non-recourse collateralized financings, and $1.3 million (or $0.03 per diluted common share) in net accelerated premium amortization due to an increase in forecasted prepayment speeds during the third quarter of 2011. See the Company’s press release issued November 1, 2011 for further discussion.

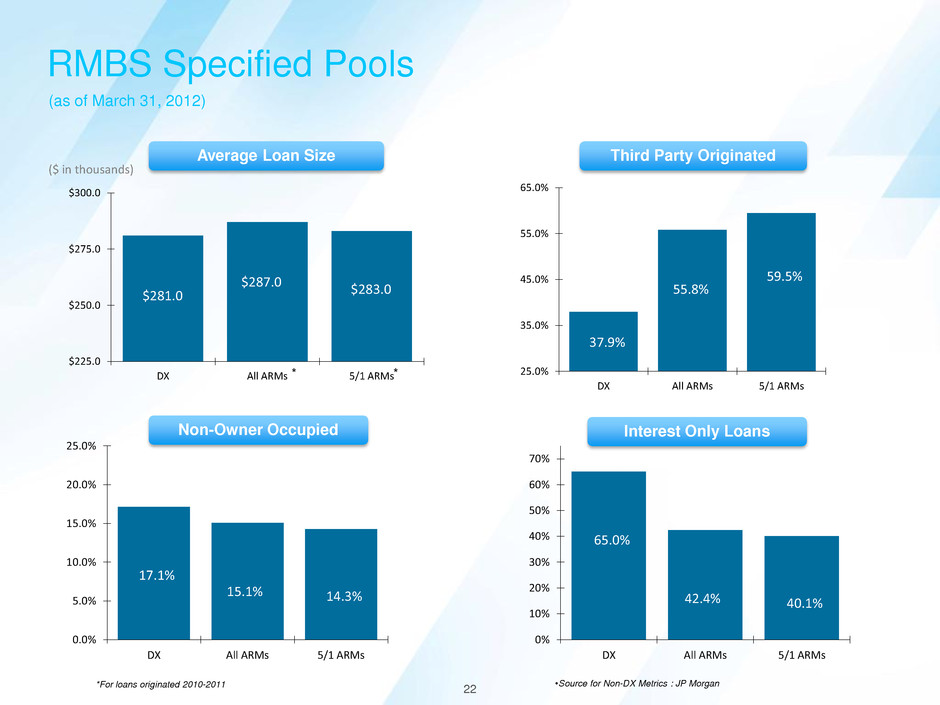

22 RMBS Specified Pools $281.0 $287.0 $283.0 $225.0 $250.0 $275.0 $300.0 DX All ARMs 5/1 ARMs Average Loan Size 37.9% 55.8% 59.5% 25.0% 35.0% 45.0% 55.0% 65.0% DX All ARMs 5/1 ARMs Third Party Originated 17.1% 15.1% 14.3% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% DX All ARMs 5/1 ARMs 65.0% 42.4% 40.1% 0% 10% 20% 30% 40% 50% 60% 70% DX All ARMs 5/1 ARMs Non-Owner Occupied Interest Only Loans *For loans originated 2010-2011 ($ in thousands) (as of March 31, 2012) * * •Source for Non-DX Metrics : JP Morgan