Attached files

| file | filename |

|---|---|

| EX-21.1 - EXHIBIT 21.1 - DYNEX CAPITAL INC | a2016form10-kexx211console.htm |

| EX-31.2 - EXHIBIT 31.2 - DYNEX CAPITAL INC | a2016form10-kexx312cfocert.htm |

| EX-32.1 - EXHIBIT 32.1 - DYNEX CAPITAL INC | a2016form10-kexx321soxcert.htm |

| EX-31.1 - EXHIBIT 31.1 - DYNEX CAPITAL INC | a2016form10-kexx311ceocert.htm |

| EX-23.1 - EXHIBIT 23.1 - DYNEX CAPITAL INC | a2016form10-kexx231bdocons.htm |

| EX-10.17 - EXHIBIT 10.17 - DYNEX CAPITAL INC | a2016form10-kexx1017execof.htm |

| EX-3.2 - EXHIBIT 3.2 - DYNEX CAPITAL INC | a2016form10-kexx32bylaws.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2016

or

o | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission File Number: 1-9819

DYNEX CAPITAL, INC.

(Exact name of registrant as specified in its charter)

Virginia | 52-1549373 |

(State or other jurisdiction of | (I.R.S. Employer |

incorporation or organization) | Identification No.) |

4991 Lake Brook Drive, Suite 100, Glen Allen, Virginia | 23060-9245 |

(Address of principal executive offices) | (Zip Code) |

(804) 217-5800 (Registrant’s telephone number, including area code) | |

Securities registered pursuant to Section 12(b) of the Act: | |

Title of each class | Name of each exchange on which registered |

Common Stock, $.01 par value | New York Stock Exchange |

8.50% Series A Cumulative Redeemable Preferred Stock, par value $0.01 per share | New York Stock Exchange |

7.625% Series B Cumulative Redeemable Preferred Stock, par value $0.01 per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | o | Accelerated filer | x |

Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

As of June 30, 2016, the aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $310,217,722 based on the closing sales price on the New York Stock Exchange of $6.94.

On February 28, 2017, the registrant had 49,192,310 shares outstanding of common stock, $0.01 par value, which is the registrant’s only class of common stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Definitive Proxy Statement for the registrant's 2017 annual meeting of shareholders, expected to be filed pursuant to Regulation 14A within 120 days from December 31, 2016, are incorporated by reference into Part III.

DYNEX CAPITAL, INC.

FORM 10-K

TABLE OF CONTENTS

Page | |||

Item 1. | Business | ||

Item 1A. | Risk Factors | ||

Item 1B. | Unresolved Staff Comments | ||

Item 2. | Properties | ||

Item 3. | Legal Proceedings | ||

Item 4. | Mine Safety Disclosures | ||

PART II. | |||

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | ||

Item 6. | Selected Financial Data | ||

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | ||

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | ||

Item 8. | Financial Statements and Supplementary Data | ||

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | ||

Item 9A. | Controls and Procedures | ||

Item 9B. | Other Information | ||

PART III. | |||

Item 10. | Directors, Executive Officers and Corporate Governance | ||

Item 11. | Executive Compensation | ||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | ||

Item 13. | Certain Relationships and Related Transactions, and Director Independence | ||

Item 14. | Principal Accountant Fees and Services | ||

PART IV. | |||

Item 15. | Exhibits, Financial Statement Schedules | ||

Item 16. | Form 10-K Summary | ||

SIGNATURES | |||

i

CAUTIONARY STATEMENT – This Annual Report on Form 10-K may contain “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended (or “1933 Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (or “Exchange Act”). We caution that any such forward-looking statements made by us are not guarantees of future performance, and actual results may differ materially from those expressed or implied in such forward-looking statements. Some of the factors that could cause actual results to differ materially from estimates expressed or implied in our forward-looking statements are set forth in this Annual Report on Form 10-K for the year ended December 31, 2015. See Item 1A. “Risk Factors” as well as “Forward-Looking Statements” set forth in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Annual Report on Form 10-K.

In this Annual Report on Form 10-K, we refer to Dynex Capital, Inc. and its subsidiaries as “the Company,” “we,” “us,” or “our,” unless we specifically state otherwise or the context indicates otherwise.

PART I.

ITEM 1. | BUSINESS |

COMPANY OVERVIEW

We are an internally managed mortgage real estate investment trust, or mortgage REIT, which invests in residential and commercial mortgage-backed securities on a leveraged basis. Our common stock is traded on the New York Stock Exchange ("NYSE") under the symbol "DX". Our objective is to provide attractive risk-adjusted returns to our shareholders over the long term that are reflective of a leveraged, high quality fixed income portfolio with a focus on capital preservation. We seek to provide returns to our shareholders primarily through regular quarterly dividends, and also through capital appreciation.

We also have two series of preferred stock outstanding, our 8.50% Series A Cumulative Redeemable Preferred Stock (the "Series A Preferred Stock") which is traded on the NYSE under the symbol "DXPRA", and our 7.625% Series B Cumulative Redeemable Preferred Stock (the "Series B Preferred Stock") which is traded on the NYSE under the symbol "DXPRB".

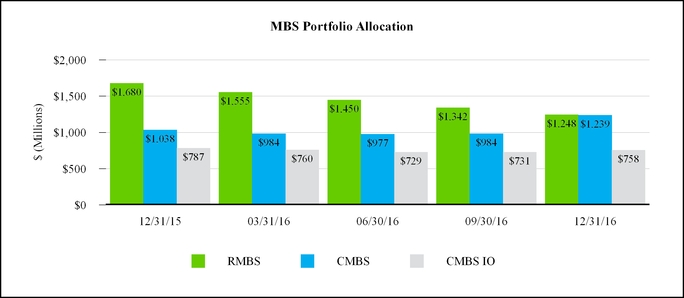

We invest in Agency and non-Agency mortgage-backed securities (“MBS”) consisting of residential MBS (“RMBS”), commercial MBS (“CMBS”) and CMBS interest-only ("IO") securities. Agency MBS have a guaranty of principal payment by an agency of the U.S. government or a U.S. government-sponsored entity ("GSE") such as Fannie Mae and Freddie Mac. Non-Agency MBS have no such guaranty of payment. Our investments in non-Agency MBS are generally higher quality senior or mezzanine classes (typically rated 'A' or better by one or more of the nationally recognized statistical rating organizations) because they are typically more liquid (i.e., they are more easily converted into cash either through sales or pledges as collateral for repurchase agreement borrowings) and have less exposure to credit losses than lower-rated non-Agency MBS.

We invest and manage our capital pursuant to Operating Policies approved by our Board of Directors. We use leverage to enhance the returns on our invested capital by pledging our investments as collateral for borrowings such as repurchase agreements as discussed further below under Financing Strategy. We also use derivative instruments to attempt to mitigate our exposure to adverse changes in interest rates at discussed further below under Hedging Strategy.

Our election to be treated as a REIT for U.S. federal income tax purposes requires us to meet certain investment and operating tests and annual distribution requirements. We generally will not be subject to U.S. federal income taxes on our taxable income to the extent that we annually distribute all of our net taxable income to stockholders (subject to net operating loss carryforwards), do not participate in prohibited transactions, and maintain our intended qualification as a REIT.

RMBS. Our Agency RMBS investments include MBS collateralized by adjustable-rate mortgage loans ("ARMs"), which have interest rates that generally will adjust at least annually to an increment over a specified interest rate index, and hybrid adjustable-rate mortgage loans ("hybrid ARMs"), which are loans that have a fixed rate of interest for a specified period (typically three to ten years) and then adjust their interest rate at least annually to an increment over a specified interest rate index. Agency ARMs also include hybrid Agency ARMs that are past their fixed-rate periods or within twelve months of their initial reset period. We may also invest in fixed-rate Agency RMBS from time to time.

1

Non-Agency RMBS are collateralized by non-conforming residential mortgage loans and are tranched into different credit classes of securities with payments to junior classes subordinate to senior classes. We generally invest in senior classes of non-Agency RMBS which may include unrated securities. Some of the non-Agency RMBS that we invest in may be collateralized by loans which are delinquent, the repayment of which is expected to come from foreclosure and liquidation of the underlying real estate. We seek to invest in non-Agency RMBS that we judge to have sufficiently high collateralization to be likely to protect the principal balance of our investment from credit losses on the underlying loans.

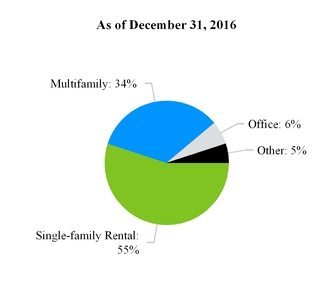

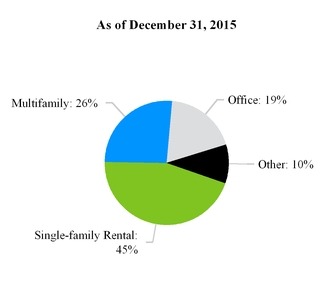

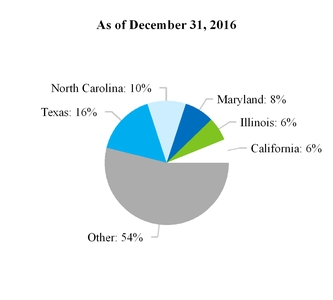

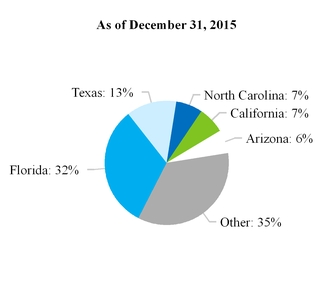

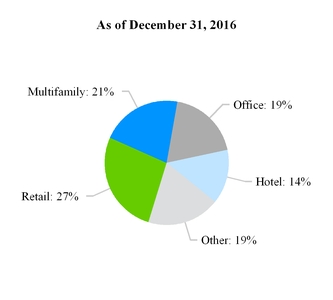

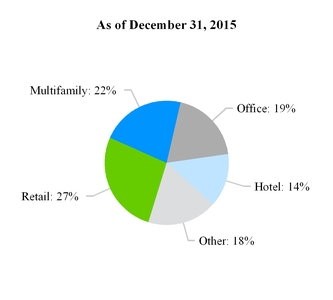

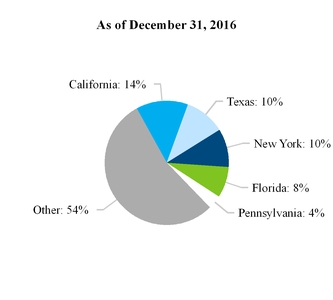

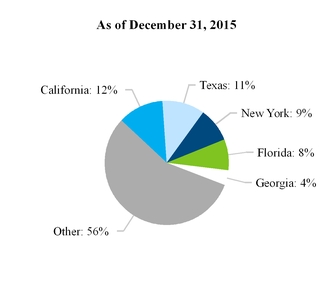

CMBS. The majority of our CMBS investments are primarily fixed-rate Agency-issued securities backed by multifamily housing loans. The remainder of our CMBS portfolio contains both Agency and non-Agency issued securities backed by other commercial real estate property types such as office building, retail, hospitality, and health care. Loans underlying CMBS generally are geographically diverse, are fixed-rate, mature in eight to eighteen years and have amortization terms of up to 30 years. Typically these loans have some form of prepayment protection provisions (such as prepayment lock-out) or prepayment compensation provisions (such as yield maintenance or prepayment penalty). Yield maintenance and prepayment penalty requirements are intended to create an economic disincentive for the loans to prepay. Non-Agency CMBS also includes securities that are backed by pools of single-family rental homes which have variable-rates that reset monthly based on an index rate, such as LIBOR.

CMBS IO. CMBS IO are interest-only securities issued as part of a CMBS securitization and represent the right to receive a portion of the monthly interest payments (but not principal cash flows) on the unpaid principal balance of the underlying pool of commercial mortgage loans. We invest in both Agency-issued and non-Agency issued CMBS IO. The loans collateralizing CMBS IO pools are very similar in composition to the pools of loans that generally collateralize CMBS as discussed above. Since CMBS IO securities have no principal associated with them, the interest payments received are based on the unpaid principal balance of the underlying pool of mortgage loans, which is often referred to as the notional amount. Most loans in these securities have some form of prepayment protection from early repayment including absolute loan prepayment lock-outs, loan prepayment penalties, or yield maintenance requirements similar to CMBS described above. There are no prepayment protections, however, if the loan defaults and is partially or wholly repaid earlier as a result of loss mitigation actions taken by the underlying loan servicer, and therefore yields on CMBS IO investments are dependent upon the underlying loan performance. Because Agency-issued MBS generally contain higher credit quality loans, Agency CMBS IO are expected to have a lower risk of default than non-Agency CMBS IO.

Operating Policies and Risk Management

Our Operating Policies set forth investment and risk limitations as they relate to the Company's investment activities and set parameters for the Company's investment and capital allocation decisions. They require that we manage our operations and investments to comply with various REIT limitations (as discussed further below in “Federal Income Tax Considerations”) and to avoid qualifying as an investment company as such term is defined in the Investment Company Act of 1940 (the "1940 Act") or as a commodity pool operator under the Commodity Exchange Act.

Our Operating Policies limit the overall leverage of the Company (currently limited to a maximum of eight times shareholders’ equity capital) and place limits on certain risks to which we are exposed, such as interest rate and convexity risk, earnings at risk, and shareholders’ equity at risk from changes in fair value of our investment securities as a result of changes in interest rates, prepayment rates, investment prices and spreads, and others items. As part of our risk management process, our Operating Policies require us to perform a variety of stress tests to model the effect of adverse market conditions on our investment portfolio value and our liquidity.

Our Operating Policies limit our investment in non-Agency MBS that are rated BBB+ or lower at the time of purchase by any of the nationally recognized statistical ratings organizations to $250 million in market value and limit our shareholders’ equity at risk to a maximum of $50 million. We also conduct our own independent evaluation of the credit risk on any non-Agency MBS, such that we do not rely solely on the security’s credit rating. In addition, our purchases of non-rated MBS in recent years have been shorter duration securities which we believe to have less credit risk than typical non-rated MBS.

Within the overall limits established by our Operating Policies, our investment and capital allocation decisions depend on prevailing market conditions and other factors and may change over time in response to opportunities available in different

2

economic and capital market environments. The Board may adjust the Operating Policies of the Company from time to time based on macroeconomic expectations, market conditions, and risk tolerances.

Investment Philosophy and Strategy

Our investment philosophy encompasses a macroeconomic, top-down approach that focuses on the expected risk-adjusted outcome of any investment. Key points of our investment philosophy include the following:

• | understanding macroeconomic conditions including the current state of the U.S. and global economies; |

• | understanding the regulatory environment, competition for assets, and the terms and availability of financing; |

• | sector analysis including understanding absolute returns, relative returns and risk-adjusted returns; |

• | security and financing analysis including sensitivity analysis on credit, interest rate volatility, and market value risk; and |

• | managing performance and portfolio risks, including interest rate, credit, prepayment, and liquidity risks. |

Our investment philosophy will dictate our investment strategy. In executing our strategy, we seek to balance the risks of owning various types of mortgage assets with the earnings opportunity on the investments. We believe our investment strategy provides superior diversification of these risks across our investment portfolio and therefore provides ample opportunities to generate attractive risk-adjusted returns while protecting our shareholders’ capital.

The performance of our investment portfolio will depend on many factors including but not limited to interest rates, trends of interest rates, the steepness of interest rate curves, prepayment rates on our investments, demand for our investments, general market liquidity, and economic conditions and their impact on the credit performance of our investments. In addition, our business model may be impacted by other factors such as the state of the overall credit markets, which could impact the availability and costs of financing. See “Factors that Affect Our Results of Operations and Financial Condition” below and "Risk Factors-Risks Related to Our Business" in Item 1A of Part I of this Annual Report on Form 10-K for further discussion.

Financing Strategy

We finance our investment activities primarily by pledging investment securities to lending counterparties under short-term recourse repurchase agreements. These repurchase agreements generally have original terms to maturity of overnight to six months, though in some instances we may enter into longer-dated maturities depending on market conditions. We pay interest on our repurchase agreement borrowings at a rate usually based on a spread to LIBOR and fixed for the term of the borrowing. Borrowings under these repurchase agreements are renewable at the discretion of our lenders and do not contain guaranteed roll-over terms. One of our repurchase agreement lenders provides a committed repurchase agreement financing facility to us with an aggregate borrowing capacity of $350.0 million that expires on August 6, 2018.

The amount borrowed under a repurchase agreement is limited by the lender to a percentage of the lender's estimated market value of the pledged collateral, which is generally up to 95% of the estimated market value for Agency MBS, up to 90% for higher credit quality non-Agency MBS, and up to 85% for CMBS IO and for non-rated or lower credit quality non-Agency MBS. The difference between the lender's estimated market value of the pledged MBS collateral and the amount of the repurchase agreement is the amount of equity we have in the position (or "haircut") and is intended to provide the lender some protection against fluctuations of value in the collateral and/or the failure by us to repay the borrowing at maturity. If the estimated fair value of the MBS pledged as collateral declines below the lender's required haircut, the lender has the right to initiate a margin call which requires us to pledge additional assets to collateralize the outstanding repurchase agreement borrowings. If we fail to meet any margin call, our lenders also have the right to terminate the repurchase agreement and sell any collateral pledged. Therefore, we attempt to maintain cash and other liquid securities in sufficient amounts to manage our exposure to margin calls by lenders. The lender also has the right to change the required haircut at maturity of the repurchase agreement (if the term is renewed) which would require us to post additional collateral to the lender.

Repurchase agreement financing is provided principally by major financial institutions and broker-dealers acting as financial intermediaries for money market funds and securities lenders that provide funds for the repurchase agreement markets. Repurchase agreement financing exposes us to counterparty risk to such financial intermediaries, principally related to the excess of our collateral pledged over the amount borrowed. To mitigate this risk, we enter into repurchase agreement financings with

3

multiple lenders. In limited instances, a money market fund or securities lender has directly provided funds to us without the involvement of a financial intermediary typically at a lower cost than we would incur borrowing from the financial intermediary. Borrowing directly from these sources also reduces our risk to the financial intermediaries.

Please refer to "Risk Factors-Risks Related to Our Business" in Item 1A of Part 1 of this Annual Report on Form 10-K for additional information regarding significant risks related to our repurchase agreement financing.

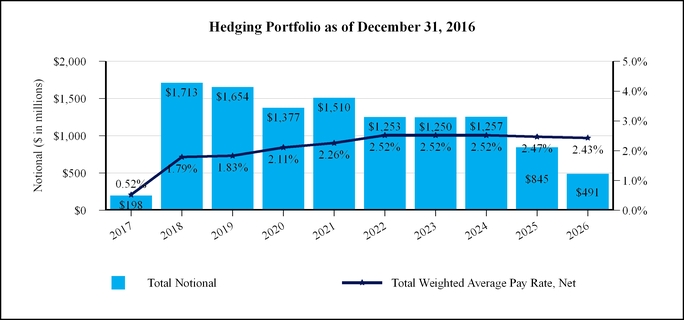

Hedging Strategy

We use derivative instruments to hedge our exposure to changes in interest rates. Such exposure results from our ownership of investments which are primarily fixed rate and which are financed with repurchase agreements which have significantly shorter maturities than the weighted average life of our investments. Changes in interest rates can impact the market value of our investments (and therefore book value per common share), net interest income, and net income. In a period of rising interest rates, our earnings and cash flow may be negatively impacted by borrowing costs increasing faster than interest income from our assets, and our book value may decline as a result of declining market values of our MBS. We attempt to mitigate our exposure to changes in interest rates by utilizing interest rate swap agreements to hedge interest rate risk, but may also utilize Eurodollar futures, interest rate cap or floor agreements, put and call options on securities or securities underlying futures contracts, forward rate agreements, or swaptions. Our hedging activity is in large part driven by our views of macroeconomic fundamentals, though we may occasionally manage our hedging instruments based on market activities.

In conducting our hedging activities, we intend to comply with REIT and tax limitations on our hedging instruments which could limit our activities and the instruments that we may use. We also intend to enter into derivative contracts only with the counterparties that we believe have a strong credit rating to help mitigate the risk of counterparty default or insolvency.

Factors that Affect Our Results of Operations and Financial Condition

Our financial performance is driven by the performance of our investment portfolio and related funding and derivative hedging activity. Our financial performance is measured by net interest income, net income, comprehensive income, book value per common share and core net operating income (a non-GAAP measure). Our financial performance may be impacted by multiple factors, many of which are related to macroeconomic conditions, geopolitical conditions, central bank and government policy, and other factors beyond our control. These factors include, but are not limited to, the absolute level of interest rates, the relative slope of interest rate curves, changes in market expectations of future interest rates, actual and estimated future prepayment rates on our investments, competition for investments, economic conditions and their impact on the credit performance of our investments, and market required yields as reflected by market credit spreads. All of these factors are influenced by market forces and generally are exacerbated during periods of market volatility.

The performance of our investment portfolio, the cost and availability of financing and the availability of investments at acceptable risk-adjusted returns could also be influenced by regulatory actions and regulatory policy measures of the U.S. government including, but not limited to, the Federal Housing Finance Administration ("FHFA"), the U. S. Department of the Treasury (the "Treasury"), and the Board of Governors of the Federal Reserve System (the "Federal Reserve") and could also be influenced by reactions in U.S. markets from activities of central banks around the world.

Our business model may also be impacted by other factors such as the availability and cost of financing and the state of the overall credit markets. Reductions in the availability of financing for our investments could significantly impact our business and force us to sell assets that we otherwise would not sell, potentially at losses depending on market conditions. Regulatory developments since the 2008 financial crisis have impacted large U.S. domiciled banks and their broker dealer subsidiaries by requiring such entities to hold more capital against their assets, including reverse repurchase agreements. In general, this has led to reduced lending capacity in the repurchase agreement market and higher costs. Other factors that could also impact our business include changes in regulatory requirements, including requirements to qualify for registration under the 1940 Act, and REIT requirements.

We believe that regulatory impacts on financial institutions, many of which are our trading and financing counterparties, continue to pose a threat to the overall liquidity in the capital markets. In particular, higher capital requirements under U.S. banking regulations and limitations on the proprietary trading activities of large U.S. financial institutions under the Dodd-Frank

4

Wall Street Reform and Consumer Protection Act ("the "Dodd-Frank Act") could result in reduced liquidity in times of market stress. While the Federal Reserve continues to reinvest principal payments received on its Agency RMBS portfolio, it is unlikely that this activity will provide enough liquidity to the market in times of stress, which could result in volatile asset prices. Further, the impact on market liquidity of our investments and the financing markets could be negatively impacted if the Federal Reserve's Federal Open Market Committee (or "FOMC") suddenly changes market expectations of the targeted Federal Funds Rate or takes other actions which have the effect of tightening monetary policy.

To complement the performance of our investment portfolio, we regularly review our existing operations to determine whether our investment strategy or business model should change, including through a change in our investment portfolio, our targeted investments, and our risk position. We may also consider merger, acquisition, or divestiture opportunities and whether we should reallocate our capital resources to other assets or portfolios that better align with our long-term strategy. We analyze and evaluate potential business opportunities that we identify or are presented to us, including possible merger, acquisition, or divestiture transactions, that are a strategic fit for our investment strategy or asset allocation or otherwise maximize value for our shareholders. Pursuing such an opportunity or transaction could require us to issue additional equity or debt securities.

As discussed above, investing in mortgage-related securities on a leveraged basis subjects us to a number of risks including interest rate risk, prepayment and reinvestment risk, credit risk, market value risk and liquidity risk. Please refer to Part I, Item 1A, "Risk Factors" as well as Part II, Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" and Item 7A, "Quantitative and Qualitative Disclosures about Market Risk" of this Annual Report on Form 10-K for a detailed discussion of these factors and others that have the potential to impact our results of operations and financial condition.

INDUSTRY OVERVIEW

Mortgage REITs provide liquidity to the U.S. real estate markets through the purchase of RMBS and CMBS and through the origination or purchase of mortgage loans. The business models of mortgage REITs range from investing only in Agency MBS to investing substantially in non-investment grade MBS and originating and securitizing mortgage loans and investing in mortgage servicing rights. Some mortgage REITs will invest in RMBS and related investments only, some in CMBS and related investments only, and some in a mix. Each mortgage REIT will assume risks in its investment strategy. We invest in a mix of high quality MBS to mitigate credit risk, and our investments in hybrid Agency RMBS and CMBS IO help mitigate interest rate risk. In addition, our hybrid Agency RMBS and CMBS help mitigate extension risk in an increasing interest rate environment while CMBS and CMBS IO help mitigate prepayment risk in a decreasing interest rate environment.

As a continuing consequence of the 2008 financial crisis, the U.S. Congress is exploring ways to reform the housing finance system, and in particular the roles of Fannie Mae and Freddie Mac (together, the GSEs), and to move toward a housing finance system with larger participation by private entities. Given the uncertainty of federal housing policy with the new administration of President Trump, we believe that an immediate or near-term reform of the GSEs is unlikely. As Fannie Mae and Freddie Mac remain under federal conservatorship, they must continue to reduce their investment portfolios of mortgage assets but may continue issuing guarantees on pools of qualified loans. Moreover, in order to reduce exposure to the U.S. taxpayer, their regulator, the Federal Housing Finance Administration, continues to pressure the GSEs to develop credit risk transfer structures to share or outright transfer credit risk in their portfolios to the private markets, and the GSEs have issued securities with credit risk transfer features. Over the longer term, we believe the GSE's role in the housing finance system will change and could evolve in such a way that will present opportunities for industry participants who understand and are willing to hold long-term credit and assume interest rate risk of the U.S. housing market. Ultimately, we believe the cost of credit to the U.S. housing market may increase which will improve yields on investments in RMBS and CMBS.

Uncertainty around regulation of financial institutions under the Dodd-Frank Act, minimum capital standards implemented under the Basel III Accord (and associated implementing regulations) and related regulatory reform initiatives, increased risk-weightings for certain types of mortgage loans held by depository institutions, increased regulatory requirements related to origination of certain types of residential mortgage loans, and other potential regulatory changes, may further impact capital formation in the U.S. mortgage market in ways that could favor mortgage REITs. There are potential negative consequences to increased regulation of financial institutions, however, including increasing borrowing costs or reduced availability of repurchase agreement financing and the need to post more capital to leverage our investments and/or enter into derivative instruments.

5

COMPETITION

The financial services industry in which we compete is a highly competitive market. In purchasing investments and obtaining financing, we compete with other mortgage REITs, broker dealers and investment banking firms, mutual funds, banks, hedge funds, mortgage bankers, insurance companies, governmental bodies, and other entities, many of which have greater financial resources and a lower cost of capital than we do. Increased competition in the market may reduce the available supply of investments and may drive prices of investments to unacceptable levels which would negatively impact our ability to earn an acceptable amount of income from these investments. Competition can also reduce the availability of borrowing capacity at our repurchase agreement counterparties as such capacity is not unlimited, and many of our repurchase agreement counterparties limit the amount of financing they offer to the mortgage REIT industry.

FEDERAL INCOME TAX CONSIDERATIONS

As a REIT, we are required to abide by certain requirements for qualification as a REIT under the Internal Revenue Code of 1986, as amended (the “Code”). To retain our REIT status, the REIT rules generally require that we invest primarily in real estate-related assets, that our activities be passive rather than active and that we distribute annually to our shareholders substantially all of our taxable income, after certain deductions, including deductions for our tax net operating loss (“NOL”) carryforward. We could be subject to income tax if we failed to satisfy those requirements. We use the calendar year for both tax and financial reporting purposes.

We may utilize our NOL carryforward to offset our taxable earnings after taking the REIT distribution requirements into account. As a result of our public offering of common stock in February 2012, we incurred an "ownership change" as such term is defined in Section 382 of the Code. Because of this ownership change, the amount of the NOL carryforward that we may use each year is limited to approximately $13.5 million, and portions of this amount not utilized are accumulated and rolled forward to the following year. Our NOL carryforward begins to expire substantially in 2020. The following table provides a rollforward of our NOL carryforward for the periods indicated:

NOL Available for Use | Total NOL | ||||||

As of December 31, 2013: | $ | 24,700 | $ | 116,187 | |||

NOL limitation release for the years ended: | |||||||

December 31, 2014 | 13,451 | ||||||

December 31, 2015 | 13,451 | ||||||

December 31, 2016 | 13,451 | ||||||

NOL used for the years ended: | |||||||

December 31, 2014 | (26,412 | ) | (26,412 | ) | |||

December 31, 2015 | — | — | |||||

December 31, 2016 (1) | — | — | |||||

As of December 31, 2016 | $ | 38,641 | $ | 89,775 | |||

(1) Subject to completion of our 2016 federal income tax return.

There may be differences between taxable income and net income computed in accordance with U.S. generally accepted accounting principles (“GAAP”). These differences primarily arise from timing differences in the recognition of revenue and expense for tax and GAAP purposes.

Failure to satisfy certain Code requirements could cause us to lose our status as a REIT. If we failed to qualify as a REIT for any taxable year, we may be subject to federal income tax (including any applicable alternative minimum tax) at regular corporate rates and would not receive deductions for dividends paid to shareholders. We could, however, utilize our NOL carryforward to offset all or part of our taxable income to the extent the NOL is available to us based on the limitations described above. If we lost or otherwise surrendered our status as a REIT, we could not elect REIT status again for five years. Several of

6

our investments in securitized mortgage loans have ownership restrictions limiting their ownership to REITs. Therefore, if we fail to maintain our REIT status, we would have to sell these investments or otherwise provide for REIT ownership of these investments. In addition, many of our repurchase agreement lenders and interest rate swap counterparties require us to maintain our REIT status. If we were to lose our REIT status, these lenders would have the right to terminate any repurchase agreement borrowings and interest rate swaps outstanding at that time.

Qualification as a REIT

Qualification as a REIT requires that we satisfy a variety of tests relating to our income, assets, distributions and ownership. The significant tests are summarized below.

Sources of Income. To continue qualifying as a REIT, we must satisfy two distinct tests with respect to the sources of our income: the “75% income test” and the “95% income test.” The 75% income test requires that we derive at least 75% of our gross income (excluding gross income from prohibited transactions) from certain real estate-related sources. In order to satisfy the 95% income test, 95% of our gross income for the taxable year must consist of either income that qualifies under the 75% income test or certain other types of passive income.

If we fail to meet either the 75% income test or the 95% income test, or both, in a taxable year, we might nonetheless continue to qualify as a REIT, if our failure was due to reasonable cause and not willful neglect and the nature and amounts of our items of gross income were properly disclosed to the Internal Revenue Service. However, in such a case we would be required to pay a tax equal to 100% of any excess non-qualifying income.

Nature and Diversification of Assets. At the end of each calendar quarter, we must meet multiple asset tests. Under the “75% asset test”, at least 75% of the value of our total assets must represent cash or cash items (including receivables), government securities or real estate assets. Under the “10% asset test,” we may not own more than 10% of the outstanding voting power or value of securities of any single non-governmental issuer, provided such securities do not qualify under the 75% asset test or relate to taxable REIT subsidiaries. Under the “5% asset test,” ownership of any stocks or securities that do not qualify under the 75% asset test must be limited, in respect of any single non-governmental issuer, to an amount not greater than 5% of the value of our total assets (excluding ownership of any taxable REIT subsidiaries).

If we inadvertently fail to satisfy one or more of the asset tests at the end of a calendar quarter, such failure would not cause us to lose our REIT status, provided that (i) we satisfied all of the asset tests at the close of the preceding calendar quarter and (ii) the discrepancy between the values of our assets and the standards imposed by the asset tests either did not exist immediately after the acquisition of any particular asset or was not wholly or partially caused by such an acquisition. If the condition described in clause (ii) of the preceding sentence was not satisfied, we still could avoid disqualification by eliminating any discrepancy within 30 days after the close of the calendar quarter in which it arose.

Ownership. In order to maintain our REIT status, we must not be deemed to be closely held and must have more than 100 shareholders. The closely held prohibition requires that not more than 50% of the value of our outstanding shares be owned by five or fewer persons at any time during the last half of our taxable year. The "more than 100 shareholders" rule requires that we have at least 100 shareholders for 335 days of a twelve-month taxable year. In the event that we failed to satisfy the ownership requirements we would be subject to fines and be required to take curative action to meet the ownership requirements in order to maintain our REIT status.

EMPLOYEES

As of December 31, 2016, we have 18 employees and one corporate office in Glen Allen, Virginia. None of our employees are covered by any collective bargaining agreements, and we are not aware of any union organizing activity relating to our employees.

7

Executive Officers of the Company

Name (Age) | Current Title | Business Experience | ||

Byron L. Boston (58) | Chief Executive Officer, President, Co-Chief Investment Officer, and Director | Chief Executive Officer and Co-Chief Investment Officer effective January 1, 2014; President and Director since 2012; Chief Investment Officer since 2008. | ||

Stephen J. Benedetti (54) | Executive Vice President, Chief Financial Officer, and Chief Operating Officer | Executive Vice President and Chief Operating Officer since 2005; Executive Vice President and Chief Financial Officer from 2001 to 2005 and beginning again in 2008. | ||

Smriti L. Popenoe (48) | Executive Vice President and Co-Chief Investment Officer | Executive Vice President and Co-Chief Investment Officer effective January 1, 2014; Chief Risk Officer of PHH Corporation between 2010 and 2013; Senior Vice President, Balance Sheet Management, of Wachovia Bank, from 2006 to 2009. | ||

AVAILABLE INFORMATION

We are subject to the reporting requirements of the Exchange Act and its rules and regulations. The Exchange Act requires us to file reports, proxy statements, and other information with the SEC. Copies of these reports, proxy statements, and other information can be read and copied at:

SEC Public Reference Room

100 F Street, N.E.

Washington, D.C. 20549

Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC maintains a website that contains reports, proxy statements, and other information regarding issuers that file electronically with the SEC. These materials may be obtained electronically by accessing the SEC’s home page at www.sec.gov.

Our website can be found at www.dynexcapital.com. Our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K, and amendments to those reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, are made available free of charge through our website as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC.

We have adopted a Code of Business Conduct and Ethics (“Code of Conduct”) that applies to all of our employees, officers and directors. Our Code of Conduct is also available free of charge on our website, along with our Audit Committee Charter, our Nominating and Corporate Governance Committee Charter, and our Compensation Committee Charter. We will post on our website amendments to the Code of Conduct or waivers from its provisions, if any, which are applicable to any of our directors or executive officers in accordance with SEC or NYSE requirements.

ITEM 1A. RISK FACTORS

The following is a summary of the risk factors that we believe are most relevant to our business. These are factors which, individually or in the aggregate, we think could cause our actual results to differ significantly from anticipated or historical results. In addition to understanding the key risks described below, investors should understand that it is not possible to predict or identify all risk factors, and consequently, the following is not a complete discussion of all potential risks or uncertainties.

8

RISKS RELATED TO OUR BUSINESS

We use leverage in order to enhance returns to our shareholders which increases the risk of volatility in our results and could lead to material decreases in net interest income, dividends, book value per common share, and liquidity.

The use of leverage in our business increases the risk of volatility in returns to our shareholders and increases the risk of a material decline in our book value and liquidity. Leverage increases returns on our invested capital if we can earn a greater return on investments than our cost of borrowing, but can decrease returns if borrowing costs increase and we have not adequately hedged against such an increase. In addition, using leverage magnifies the potential losses to shareholders' equity (and book value per common share) when the market value of our investments, net of hedges, declines. We also have increased liquidity risk stemming from the potential for margin calls by our lenders for fluctuations in investment collateral values, or if the lender fails to renew or roll over the financing.

Our ability to access leverage sufficient to generate acceptable returns to our shareholders is impacted by the following:

• | market conditions and overall market volatility and liquidity; |

• | regulation of our lenders; |

• | the liquidity of our investments; |

• | the market value of our investments; |

• | the advance rates by our lenders on investment collateral pledged, and; |

• | the willingness of our lenders to finance the types of investments we choose. |

Many of these factors are beyond our control and are difficult to predict, which could lead to sudden and material adverse effects on our results of operations, financial condition, business, liquidity, and ability to make distributions to shareholders, and could force us to sell assets at significantly depressed prices to maintain adequate liquidity.

For more information about our operating policies regarding leverage and historic leverage levels, please see “Liquidity and Capital Resources” within Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operation.”

Repurchase agreements are generally uncommitted short-term financings and changes to terms of such financing may adversely affect our profitability and our liquidity.

The majority of our repurchase agreements are uncommitted financings from lenders with an average term of ninety days or less. Because repurchase agreements are short-term financing commitments, changes in conditions in the repurchase markets may make it more difficult for us to secure continued financing particularly in periods of high volatility. Additionally, regulatory capital requirements imposed on our lenders by financial and banking regulators have changed significantly in recent years, and as a result, the cost of financing has increased and may continue to increase. In addition, many lenders may find it unprofitable to lend against certain collateral types due to higher regulatory costs and regulatory capital requirements, and thus restrict their lending against such collateral. Because we rely heavily on borrowings under repurchase agreements to finance our investments, our ability to achieve our investment and profitability objectives can depend on our ability to access repurchase agreement financing in sufficient amounts and on favorable terms, and to renew or replace maturing financings on a continuing basis. If the terms on which we borrow change in a meaningful way, or if borrowings are not available, we may be forced to sell assets or our borrowing costs could increase, potentially reducing our profitability and dividends to our shareholders.

We invest in assets that are traded in over-the-counter (OTC) markets which are less liquid and have less price transparency than securities exchanges. Owning securities that are traded in OTC markets may increase our liquidity risk, particularly in a volatile market environment, because our assets may be more difficult to borrow against or sell in a prompt manner and on terms acceptable to us, and we may not realize the full value at which we previously recorded the investments and/or may incur additional losses upon sale.

Though Agency MBS are generally deemed to be very liquid securities, turbulent market conditions in the past have at times significantly and negatively impacted the liquidity of these assets, resulting in reductions in their market value. Non-Agency MBS are typically more difficult to value, less liquid, and experience greater price volatility than Agency MBS. In

9

addition, market values for non-Agency MBS are typically more subjective than Agency MBS. As a result of these factors, the number of lenders willing to provide financing for non-Agency MBS or accept them as collateral has generally been limited compared to Agency MBS. Given the trading of our investments in OTC markets, in an extreme case of market stress, a market may not exist for certain of our assets at any price. If the MBS market were to experience a severe or extended period of illiquidity, lenders may refuse to accept our assets as collateral for repurchase agreement financing, which could have a material adverse effect on our results of operations, financial condition and business. A sudden reduction in the liquidity of our investments could limit our ability to finance or could make it difficult to sell investments if the need arises. If we are required to liquidate all or a portion of our portfolio quickly, we may realize significantly less than the fair value at which we have previously recorded our investments which would result in lower than anticipated gains or higher losses.

Risks related to the market value of our investments could negatively impact our net income, comprehensive income, shareholders' equity, book value per common share, and liquidity.

Our investments fluctuate in value due to changes in credit spreads, spot and forward interest rates, actual and anticipated prepayments and other factors. Changes in the market values of our investments are reflected in other comprehensive income, shareholders' equity and book value per common share. Changes in credit spreads represent the market's valuation of the perceived riskiness of assets relative to risk-free rates, and widening credit spreads reduce the market value of our investments as market participants require additional yield to hold riskier assets. Credit spreads could change based on macro-economic or systemic factors specific to a particular security such as prepayment performance or credit performance. Other factors that could impact credit spreads include technical issues such as supply and demand for a particular type of security, market psychology, and FOMC monetary policy. In addition, most of our investments are fixed rate or reset in rate over a period of time, and as interest rates rise, the market value of these investments will decrease. If market values decrease significantly, we may be forced to sell assets at losses in order to maintain liquidity and repay or renew repurchase agreements at maturity.

Fluctuations in interest rates may have various negative effects on us and could lead to reduced net interest income, comprehensive income, and a lower book value per common share.

Fluctuations in interest rates impact us in a number of ways. For example, in a period of rising rates, particularly increases in the targeted Federal Funds Rate, we may experience a decline in our profitability from borrowing rates increasing faster than interest coupons on our investments reset or our investments mature. We may also experience a decline in profitability from our investments adjusting less frequently or relative to a different index (e.g., six month or one-year LIBOR) from our borrowings (repurchase agreements are typically based on short-term rates like one-month or three-month LIBOR). Once the Federal Reserve announces a higher targeted range or if markets determine that the Federal Reserve is likely to announce a higher targeted range for the Federal Funds Rate, our borrowing costs are likely to immediately increase, thereby negatively impacting our results of operations, financial condition, and book value per common share.

The mortgage loans collateralizing ARMs typically have periodic (or interim) and lifetime interest rate caps. Periodic interest rate caps limit the amount interest rates can adjust on a loan during any given period. Lifetime interest rate caps limit the amount interest rates can adjust from inception through maturity of a loan. Because of these caps, the amount of gross interest income earned by ARMs may become limited in a sustained period of rising interest rates or in any period in which interest rates rise rapidly. We may also experience price volatility as ARMs approach their interest rate caps. In addition, we could experience additional declines in net interest income as the repurchase agreements financing ARMs do not have periodic or lifetime interest rate caps.

Fluctuations in interest rates may also negatively affect the market value of our securities. Since our securities are fixed rate or adjust generally over longer-term periods, rising interest rates will reduce the market value of our MBS as a result of higher yield requirements by the market for these types of securities. In some instances, increases in short-term interest rates are rapid enough that short-term interest rates equal or exceed medium/long-term interest rates, resulting in a flat or inverted yield curve. Any fixed-rate or hybrid ARM investment will generally be more negatively affected by these increases than ARMs (which have interest-rates that adjust more frequently). Reductions in the market value of our securities could result in margin calls from our lenders, potentially forcing us to sell securities at a loss. Conversely, while declining interest rates are more favorable for us, we may experience increasing prepayments, resulting in reduced profitability due to reinvestment of our capital in lower yielding investments.

10

A shift in U.S. monetary policy with respect to the reinvestment of principal payments on securities held by the Federal Reserve Bank of New York ("FRBNY") could negatively impact the value of our investments, comprehensive income, and book value per common share.

The FOMC of the Federal Reserve provided in prior years monetary stimulus with large-scale purchases of Treasury securities and Agency RMBS (which the market has referred to as quantitative easing, or "QE"). While the FRBNY, on behalf of the FOMC, is not actively purchasing additional securities under the QE program, it continues to reinvest principal repayments received on the securities which it owns in order to maintain an accommodative monetary policy.

The potential market volatility from the Federal Reserve's withdrawal of its accommodative monetary policy through its reinvestment of principal payments received may be extreme. Further, significant price volatility could occur following large asset sales (or anticipation thereof) by the FRBNY. In such a case, it is likely that prices on our investments would decline which would cause a decline in our book value and also could result in margin calls by our lenders on Agency MBS pledged as collateral for repurchase agreements. If declines in prices are substantial, we could be forced to sell assets at a loss or at an otherwise inopportune time in order to meet margin calls or repay lenders.

Our repurchase agreements and agreements governing certain interest rate swaps may contain financial and non-financial covenants. Our inability to meet these covenants could adversely affect our financial condition, results of operations and cash flows.

In connection with certain of our repurchase agreements and interest rate swap agreements, we are required to maintain certain financial and non-financial covenants. As of February 28, 2017, the most restrictive financial covenants require that we have (i) a minimum of $30 million of liquidity; (ii) maintain a minimum Equity Capital in an amount equal to the greater of 60% of highest historical equity capital level at any time; and (iii) declines in shareholders' equity no greater than 25% in any quarter and 35% in any year. In addition, virtually all of our repurchase agreements and interest rate swap agreements require us to maintain our status as a REIT and to be exempted from the provisions of the 1940 Act. Compliance with these covenants depends on market factors and the strength of our business and operating results. Various risks, uncertainties and events beyond our control, including significant fluctuations in interest rates and changes in market conditions, could affect our ability to comply with these covenants. Failure to comply with these covenants could result in an event of default, termination of an agreement, acceleration of all amounts owed under an agreement, and generally would give the counterparty the right to exercise certain other remedies under the repurchase agreement, including the sale of the asset subject to repurchase at the time of default, unless we were able to negotiate a waiver in connection with any such default related to failure to comply with a covenant. Any such waiver could be conditioned on an amendment to the underlying agreement and any related guaranty agreement on terms that may be unfavorable to us. If we are unable to negotiate a covenant waiver or replace or refinance our assets under a new repurchase facility on favorable terms or at all, our financial condition, results of operations and cash flows could be adversely affected. Further, certain of our repurchase agreements and interest rate swap agreements have cross-default, cross-acceleration or similar provisions, such that if we were to violate a covenant under one agreement, that violation could lead to defaults, accelerations, or other adverse events under other agreements, as well.

Prepayment rates on the mortgage loans underlying our investments may adversely affect our profitability and the market value of our investments. Changes in prepayment rates may also subject us to reinvestment risk.

We are subject to prepayment risk to the extent that we own investments at premiums to their par value or at yields at a premium to current market yields. Our investment portfolio consists substantially of RMBS and CMBS owned at premiums, and CMBS IO securities which have no principal amounts outstanding and consist only of the right to receive interest payments on the underlying pools of CMBS loans included in the securitization trust. We amortize the premiums we pay on a security using the effective yield method, which is impacted by actual and projected borrower prepayments of principal on the loans. Prepayments on our investments can occur both on a voluntary and involuntary (i.e., a loan default and subsequent foreclosure and liquidation) basis. Voluntary prepayments tend to increase when interest rates are declining or, in the case of ARMs or hybrid ARMs, based on the shape of the yield curve. CMBS and CMBS IO are generally protected from voluntary prepayment for a portion of their expected lives either by an absolute prepayment lock-out on the loan or by yield maintenance or prepayment penalty provisions which serve as full or partial compensation for future lost interest income on the loan. RMBS provide no specific protection from voluntary prepayment. The actual level of prepayments on our investments will be impacted by economic and market conditions, the absolute levels of interest rates and relative levels of interest rates versus our investments, the general

11

availability of mortgage credit, and other factors. We have no protection from involuntary prepayments which tend to increase in periods of economic stress and may occur for any of our investment types. If we experience actual prepayments in excess of our projections or increase our expectations of future prepayment activity, we will amortize investment premiums at an accelerated rate which will reduce our interest income. In addition, we may reinvest prepayments in lower yielding investments which could lead to lower net interest income and reduced profitability.

Increases in actual prepayment rates or market expectations of prepayment rates could also negatively impact the market value of our investments. Faster prepayments generally negatively impact the market value of RMBS due to less predictability of payments on the underlying mortgage loans and will increase the required market yield on such security. Faster prepayments will also negatively impact the market value of CMBS IO, depending on the amount of prepayment protection for a given security. Increasing prepayments will typically reduce the value of our securities owned at premiums which will negatively impact our book value. We are also more likely to experience margin calls from our lenders as a result of the decline in value of our securities.

In certain circumstances, compensation for voluntary prepayment on CMBS IO securities may not be sufficient to compensate us for the loss of future excess interest as a result of the prepayment, thereby adversely affecting our results of operations. Also, the amount of prepayment penalties on loans underlying CMBS and CMBS IO decline over time, and as loans age, interest rates decline, or market values of the collateral supporting the loan increase, prepayment penalties may not serve as a sufficient economic disincentive to prevent the borrower from prepaying.

Prepayments on large balance, single loan Agency CMBS could result in margin calls by lenders in excess of our available liquidity. As such, we may be at risk of defaulting on a repurchase agreement which could force us to sell assets at a loss.

We may own large balance Agency CMBS which are collateralized by a single-loan. While these Agency CMBS have some form of prepayment protection such as yield maintenance which would compensate us for the prepayment, these securities are collateralizing repurchase agreements. If the single loan CMBS prepays, typically there is a 20 day delay between the announcement of such prepayment and the receipt of cash from the prepayment; however, the repurchase agreement lender may initiate a margin call when the prepayment is announced. If the margin call were large enough, we might not be able to meet such margin call from available liquidity, and we could be forced to sell assets quickly and on terms unfavorable to us to meet the margin call. If we cannot meet the margin call, we may be in default under the repurchase agreement until we receive the cash from the prepayment. Because some of our repurchase agreement borrowings contain cross-default provisions, such default could trigger defaults on and margin calls with respect to other of our repurchase agreement borrowings.

Global sovereign credit risk could have a material adverse effect on our business, financial condition and liquidity.

Sovereign credit in recent years, including the United States and Europe, has come under pressure as a result of large budget deficits, fiscal imbalances, political instability and below trend growth or negative growth. While we do not borrow directly from any sovereign, global risk appetite is impacted by changes in actual or perceived credit risk of the United States, Europe,Asia, and other developed and emerging markets. Adverse changes in sovereign credit ratings or credit outlook could have a material adverse impact on financial markets and economic conditions in the United States and worldwide, in some cases causing a material reduction in risk appetite by market participants, which may have a negative effect on the availability of financing as well as the value of securities that we own. Any such adverse impact could have a material adverse effect on our liquidity, financial condition, book value and results of operations.

Provisions requiring yield maintenance charges, prepayment penalties, defeasance, or lock-outs in CMBS IO securities may not be enforceable.

Provisions in loan documents for mortgages in CMBS IO securities in which we invest requiring yield maintenance charges, prepayment penalties, defeasance, or lock-out periods may not be enforceable in some states and under federal bankruptcy law. Provisions in the loan documents requiring yield maintenance charges and prepayment penalties may also be interpreted as constituting the collection of interest for usury purposes. Accordingly, we cannot be assured that the obligation of a borrower to pay any yield maintenance charge or prepayment penalty under a loan document in a CMBS IO security will be enforceable. Also, we cannot be assured that foreclosure proceeds under a loan document in a CMBS IO security will be sufficient to pay an enforceable yield maintenance charge. If yield maintenance charges and prepayment penalties are not collected, or if a lock-out

12

period is not enforced, we may incur losses to write-down the value of the CMBS IO security for the present value of the amounts not collected, and we will experience lower yields and lower interest income. This would also likely cause margin calls from any lender on the CMBS IO impacted which could have a material adverse effect on our liquidity.

We invest in securities guaranteed by Fannie Mae and Freddie Mac which are currently under conservatorship by the FHFA. As conservator, the FHFA has assumed all the powers of the shareholders, directors and officers of the GSEs with the goal of preserving and conserving their assets. Both Fannie Mae's and Freddie Mac's solvency is being supported by the Treasury through their committed purchases of Fannie Mae and Freddie Mac preferred stock. The ultimate impact on the operations of Fannie Mae and Freddie Mac from the conservatorships and the support they receive from the U.S. government is not determinable and could affect Fannie Mae and Freddie Mac in such a way that our business, operations and financial condition may be adversely affected.

In 2008, the FHFA placed Fannie Mae and Freddie Mac under federal conservatorship. As its conservator, the FHFA has broad regulatory powers over Fannie Mae and Freddie Mac and has entered into Preferred Stock Purchase Agreements, as amended, (“PSPAs”) pursuant to which the Treasury ensures that Fannie Mae and Freddie Mac will separately maintain a positive net worth by committing to purchase preferred stock of Fannie Mae and Freddie Mac. The FHFA as the regulator of the GSEs has proposed several reforms including, among other things, building a common, single, securitization platform between the two entities and gradually contracting their presence in the mortgage marketplace. In addition, the U.S. Congress at various times has considered structural changes to the GSEs, including winding down the GSEs and replacing them with a privately capitalized system that is intended to preserve market liquidity and protect taxpayers from future GSE losses due to economic downturns.

The outcome of the conservatorship and the scope and nature of actions that may ultimately be taken by the U.S. Congress to reform the GSEs and the housing finance system, are not predictable at this point. Actions limiting the guarantee on future Agency MBS could impact the amount of Agency MBS available to be purchased which could lead to increased competition and reduced returns from these assets. It could also negatively impact our ability to comply with the provisions of the 1940 Act (see further discussion below regarding the 1940 Act).

Both Fannie Mae and Freddie Mac have returned to profitability as a result of the housing market recovery but their long-term financial viability is highly dependent on governmental support. If the Treasury withdraws its support, the value of Agency MBS could significantly decline, which would make it difficult for us to obtain repurchase agreement financing and could force us to sell assets at substantial losses. In addition, future policies that change the relationship between Fannie Mae and Freddie Mac and the U.S. government, including those that result in their winding down, release from conservatorship, nationalization, privatization, or elimination, may create market uncertainty and have the effect of reducing the actual or perceived credit quality of securities issued or guaranteed by Fannie Mae and Freddie Mac. As a result, such policies could increase the risk of loss on investments in Agency MBS. It also is possible that such policies could adversely impact the market for such securities and spreads at which they trade, and thereby adversely impact the profitability of our investments.

All of the foregoing could materially adversely affect the availability, pricing, liquidity, market value and financing of our assets and materially adversely affect our business, operations and financial condition.

Our investment strategy includes investing in non-Agency MBS with credit risk. Many of these securities have some form of subordinate credit enhancement within the security structure. The performance of these securities is dependent in large part on the performance of the underlying mortgage loans relative to the amount of the subordinate credit enhancement within the security structure. These mortgage loans are subject to defaults, foreclosure timeline extension, fraud, price depreciation, and unfavorable modification of loan principal amount, interest rate, and premium, any of which could result in losses to us.

Non-Agency MBS are secured by mortgage loans (generally single family residential properties for RMBS and pools of commercial mortgage loans for CMBS) that have no guarantee of repayment. Typically, non-Agency MBS have non-rated or low rated tranches or classes that are subordinate to principal payments to higher rated classes and absorb losses on the liquidation of the underlying loans. We own securities that generally have some form of credit subordination to our investment with respect to credit losses on the underlying mortgage loans. We bear a risk of loss of principal on our security to the extent losses experienced on the loans in these securities are in excess of such subordination.

13

Commercial mortgage loans that collateralize CMBS and CMBS IO generally have a higher principal balance, and the ability of a borrower to repay a loan secured by an income-producing property typically is dependent upon the successful operation of the property rather than upon the existence of independent income or assets of the borrower. If the net operating income of a commercial property is reduced, the borrower's ability to repay the loan may be impaired. Net operating income of an income-producing property can be affected by, among other things, economic conditions, tenancy, location and condition, property management decisions, competition, regulations, environmental conditions, occupancy rates, interest rates and real estate tax rates and other operating expenses. Losses on underlying commercial mortgage loans will potentially impact the yield on the CMBS and CMBS IO securities we own and could also negatively impact their market value. Negative impacts on yields will reduce our net income and reductions in market values could lead to margin calls by our lenders which, if significant, could force us to sell assets possibly at losses to meet margin calls.

RMBS securities are generally collateralized by pools of single family mortgage loans which have less idiosyncratic risk than CMBS and CMBS IO. The ability of a borrower to repay a mortgage loan secured by a residential property is dependent upon the income or assets of the borrower. A number of factors may impair borrowers’ abilities to repay their loans, including among other things, their employment situation, economic conditions, and the availability of refinancing. In the event of defaults on the residential mortgage loans that underlie our investments in RMBS and the exhaustion of any underlying or any additional credit support, we may not realize our anticipated return on our investments and we may incur a loss on these investments.

We may change our investment strategy, operating policies, dividend policy, and/or asset allocations without shareholder consent and/or in a manner in which shareholders, analysts, and capital markets may not agree, which could adversely affect our financial condition, results of operations, the market price of our common stock, and our ability to pay dividends to our shareholders.

A change in our investment strategy or asset allocation may materially change our exposure to interest rate and/or credit risk, default risk and real estate market fluctuations. These changes could have a material impact on our ability to continue to pay a dividend at a level that we had previously paid before the change in strategy. Furthermore, if any change in investment strategy, asset allocation, operating or dividend policy is perceived negatively by the markets or analysts covering our stock, our stock price may decline.

Competition may prevent us from acquiring new investments at favorable yields, and we may not be able to achieve our investment objectives which may potentially have a negative impact on our profitability.

Our net income will largely depend on our ability to acquire mortgage-related assets with acceptable risk-return profiles at favorable spreads over our borrowing costs. The availability of mortgage-related assets meeting our investment criteria depends upon, among other things, the level of activity in the real estate market and the quality of and demand for securities in the mortgage securitization and secondary markets. The size and level of activity in real estate lending markets depends on various factors, including interest rates, regional and national economic conditions, and real estate values. In acquiring investments, we may compete with other purchasers of these types of investments, including but not limited to other mortgage REITs, broker-dealers, hedge funds, banks, insurance companies, mutual funds, and other entities that purchase assets similar to ours, many of which have greater financial resources than we do. As a result of all of these factors, we may not be able to acquire sufficient assets at acceptable spreads to our borrowing costs, which would adversely affect our profitability.

In order to maintain our portfolio size and our earnings, we must reinvest the cash flows we receive from our existing investment portfolio, including monthly principal and interest payments and proceeds from sales. If the assets we acquire in the future earn lower yields than the assets we currently own, our reported earnings per share will likely decline over time as the older assets pay down or are sold. In addition, based on market conditions, our leverage, and our liquidity profile, we may decide to not reinvest the cash flows we receive from our investment portfolio. If we retain, rather than reinvest, these cash flows, the size of our investment portfolio and the amount of net interest income generated by our investment portfolio will likely decline.

Our use of hedging strategies to mitigate our interest rate exposure may not be effective and may adversely affect our income and book value.

14

We use interest rate swap agreements, Eurodollar futures, interest rate caps, and other derivative transactions (collectively, “hedging instruments”) to help mitigate increased financing costs and volatility in book value from adverse changes in interest rates. Our hedging activity will vary in scope based on our portfolio construction and objectives, the actual and implied level and volatility of interest rates, our forecast of future interest rates, and financing sources used. No hedging strategy, however, can completely insulate us from the interest rate risks to which we are exposed, and there can be no assurance that the implementation of any hedging strategy will have the desired impact on our results of operations or financial condition. In addition, hedging instruments that we use may adversely affect our results of operations and book value (particularly if interest rates decline) as the fair value of hedging instruments fluctuate with changes in rates (and require us to post margin to counterparties) and also involve an expense that we will incur regardless of the effectiveness of the hedging activity.

Our hedging instruments can be traded on an exchange or administered through a clearing house, or are administered under bilateral agreements between us and a counterparty. Bilateral agreements expose us to increased counterparty risk, and we may be at risk of loss of any collateral held by a hedging counterparty if the counterparty becomes insolvent or files for bankruptcy.

Interest rate hedging may fail to protect or could adversely affect us because, among other things:

• | The performance of instruments used to hedge may not completely correlate with the performance of the assets or liabilities being hedged; |

• | Interest rate hedging can be expensive, particularly during periods of volatile interest rates; |

• | Available hedging instruments may not correspond directly with the interest rate risk from which we seek protection; |

• | The duration of the hedge may not match the duration of the related asset or liability given management's expectation of future changes in interest rates or a result of the inaccuracies of models in forecasting cash flows on the asset being hedged; |

• | The value of derivatives used for hedging will be adjusted from time to time in accordance with GAAP to reflect changes in fair value, and downward adjustments, or “mark-to-market losses,” would reduce our earnings, shareholders’ equity, and book value; |

• | The amount of income that a REIT may earn from hedging transactions (other than through taxable REIT subsidiaries) to offset interest rate losses may be limited by U.S. federal income tax provisions governing REITs; |

• | The credit quality of the party owing money on the hedge may be downgraded to such an extent that it impairs our ability to sell or assign our side of the hedging transaction; and |

• | The party owing money in the hedging transaction may default on its obligation to pay. |

Our hedging transactions, which are intended to limit losses, may actually adversely affect our earnings, which could reduce our ability to pay dividends to our shareholders.

Clearing facilities or exchanges may increase the margin requirements we are required to post when entering into derivative instruments, which may negatively impact our ability to hedge and our liquidity.

We are required to post margin when entering into a hedging instrument which is traded on an exchange or administered through a clearing house. The amount of margin is set for each derivative by the exchange or clearinghouse and in prior periods, exchanges have required additional margin in response to events having or expected to have adverse economic consequences. In the event that future adverse economic developments or market uncertainty (including those due to governmental, regulatory, or legislative action or inaction) result in increased margin requirements for our hedging instruments, it could materially adversely affect our liquidity position, business, financial condition and results of operations.

We may be subject to the risks associated with inadequate or untimely services from third-party service providers, which may negatively impact our results of operations. We also rely on corporate trustees to act on behalf of us and other holders of securities in enforcing our rights.