Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CYS Investments, Inc. | d355080d8k.htm |

Investment

Outlook May 2012

2012 Specialty Finance Symposium

Exhibit 99.1 |

Forward Looking Statements

This presentation contains forward-looking statements, within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended, that are based on management’s beliefs and assumptions, current

expectations, estimates and projections. Such statements, including information

relating to the Company’s expectations for future distributions and

market conditions, are not considered historical facts and are considered forward-looking information under the federal securities laws.

This information may contain words such as “believes,”

“plans,”

“expects,”

“intends,”

“estimates”

or similar expressions.

This information is not a guarantee of the Company’s future performance and is

subject to risks, uncertainties and other important factors that could cause

the Company’s actual performance or achievements to differ materially from those expressed or implied by this forward-looking

information and include, without limitation, changes in the Company’s

distribution policy, changes in the Company’s ability to pay distributions,

changes in the market value and yield of our assets, changes in interest rates and

the yield curve, net interest margin, return on equity, availability and

terms of financing and hedging and various other risks and uncertainties related to our business and the economy, some of

which are described in our filings with the SEC. Given these uncertainties,

you should not rely on forward-looking information. The Company

undertakes no obligations to update any forward-looking information, whether as

a result of new information, future events or otherwise. 1

|

CYS:

Overview Focus on Cost

Efficiency

Target Assets

Agency Residential Mortgage Backed Securities

A Real Estate Investment Trust formed in January 2006

Ample Financing

Sources

Currently

financing

lines

with

34

lenders

Swap agreements with 18 counterparties

Dividend Policy

Self managed: highly scalable

Objective

Senior Management

Kevin Grant, CEO, President, Chairman

Frances Spark, CFO

Pay dividends and achieve capital appreciation throughout changing interest

rate and credit cycles

Be the most efficient Agency REIT in the market

Company intends to distribute all or substantially all of its REIT taxable

income 2 |

-1.000

-0.500

0.000

0.500

1.000

1.500

2.000

2.500

3.000

3.500

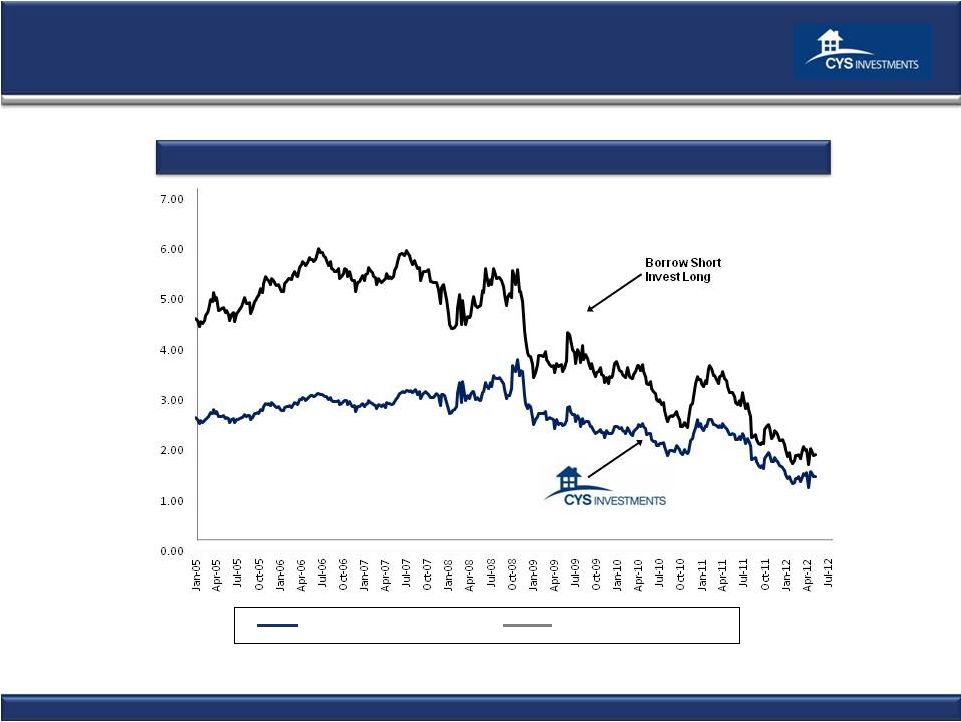

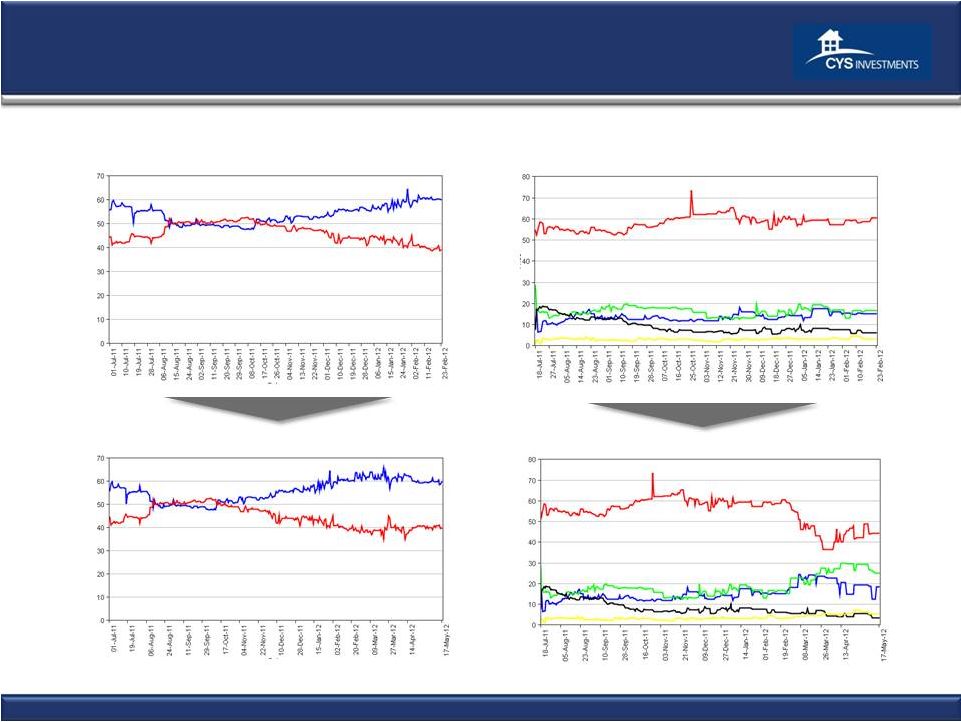

Attractive Environment Likely to Persist

Steep Curve

Creates significant positive carry

Very low cost of financing

Significant ROE

Hedge flexibility very important

Fed still fighting deflation

5

Year

Swap

vs.

1

Month

LIBOR:

1/2005

–

5/2012

5/1

Hybrid

Net

Interest

Margin:

1/2005

–

5/2012

Source; Bloomberg

(1) May 18, 2012

Mortgage Yields Currently Attractive

Par-Priced 7/1 hybrid rates now 1.61%

(1)

30 Year fixed rates now 2.87%

(1)

15 Year fixed rates now 2.27%

(1)

Hedging rates historically low

May 18, 2012

May 18, 2012

3

0.00

1.00

2.00

3.00

4.00

5.00 |

Attractive Investment Environment Remains

Source: Bloomberg.

Note: Spreads

calculated

as:

(i)

15

year

CC

Index

=

50%

4

year

swap,

and

(ii)

15

year

Current

Coupon

Index

15 Year Hedged

(i)

15 Year Unhedged

(ii)

4

May 18, 2012

15

Year

Fixed

Hedged

with

Swaps:

1/1/2005

–

5/18/2012 |

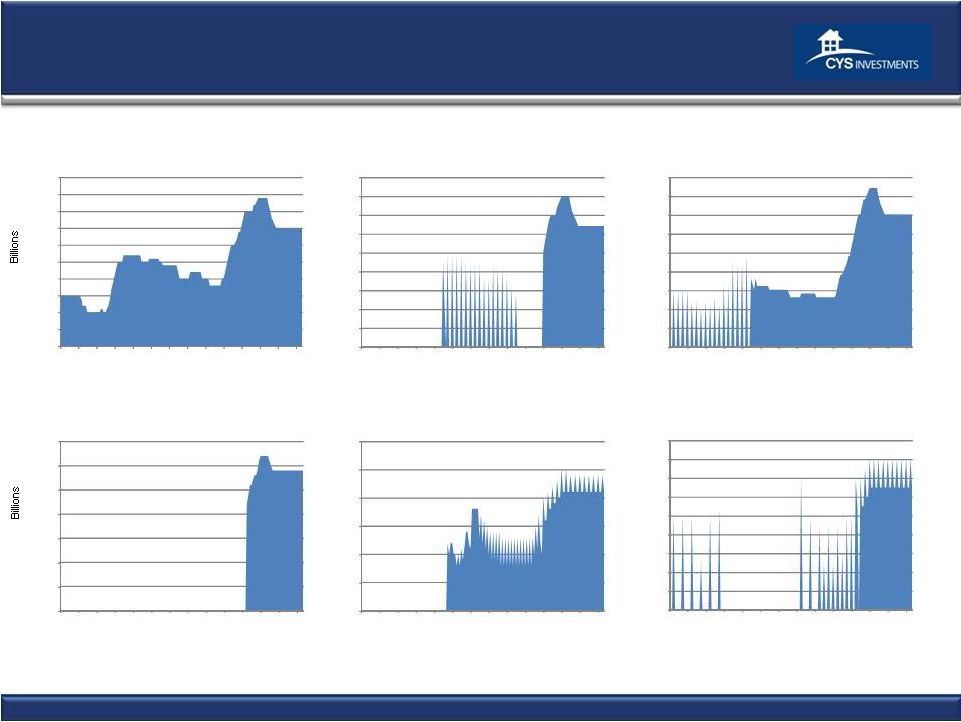

Treasury Auction Volume

10 Year Treasury Note Auctions

11/98 –

4/12

2 Year Treasury Note Auctions

2/98 –

4/12

3 Year Treasury Note Auctions

10/98 –

4/12

Source: Bloomberg, US Treasury

5 Year Treasury Note Auctions

2/98 –

4/12

7 Year Treasury Note Auctions

2/00 –

4/12

30 Year Treasury Note Auctions

2/00–

4/12

0

5

10

15

20

25

30

35

40

45

50

Nov

'98

Nov

'99

Nov

'00

Nov

'01

Nov

'02

Nov

'03

Nov

'04

Nov

'05

Nov

'06

Nov

'07

Nov

'08

Nov

'09

Nov

'10

Nov

'11

0

5

10

15

20

25

30

35

40

45

Nov

'98

Nov

'99

Nov

'00

Nov

'01

Nov

'02

Nov

'03

Nov

'04

Nov

'05

Nov

'06

Nov

'07

Nov

'08

Nov

'09

Nov

'10

Nov

'11

0

5

10

15

20

25

30

35

40

45

Nov

'98

Nov

'99

Nov

'00

Nov

'01

Nov

'02

Nov

'03

Nov

'04

Nov

'05

Nov

'06

Nov

'07

Nov

'08

Nov

'09

Nov

'10

Nov

'11

0

5

10

15

20

25

30

35

Nov

'98

Nov

'99

Nov

'00

Nov

'01

Nov

'02

Nov

'03

Nov

'04

Nov

'05

Nov

'06

Nov

'07

Nov

'08

Nov

'09

Nov

'10

Nov

'11

0

5

10

15

20

25

30

Nov

'98

Nov

'99

Nov

'00

Nov

'01

Nov

'02

Nov

'03

Nov

'04

Nov

'05

Nov

'06

Nov

'07

Nov

'08

Nov

'09

Nov

'10

Nov

'11

0

2

4

6

8

10

12

14

16

18

Nov

'98

Nov

'99

Nov

'00

Nov

'01

Nov

'02

Nov

'03

Nov

'04

Nov

'05

Nov

'06

Nov

'07

Nov

'08

Nov

'09

Nov

'10

Nov

'11

5 |

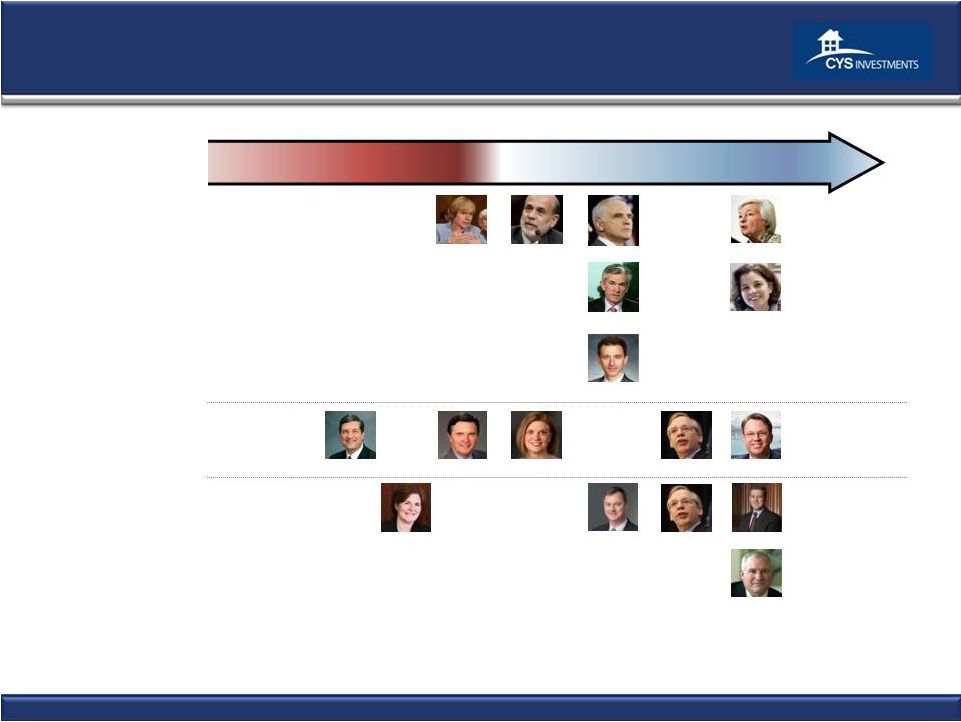

Hawkish

Dovish

Neutral

Lacker

Duke

Tarullo

Lockhart

Pianalto

Yellen

Raskin

Bernanke

Governors

2012 Voters

Fed Voters Moving To Be Even More Dovish in 2012

Williams

2013 Voters

Dudley

Evans

Rosengren

Bullard

Powell

Stein

Sources: federalreserve.gov, Macroeconomic Advisers, LLC, Bank of America

Merrill Lynch, Bloomberg, Wall Street Journal, Indiana University, Marketwatch, Thomson Reuters, Federal Reserve Bank of Atlanta, Federal Reserve Bank of Chicago, Federal

Reserve Bank of Cleveland, Maryland Consumer Rights Coalition, Boston Globe,

Businessweek, Newsweek, Washington Post, CNBC. Dudley

George

6 |

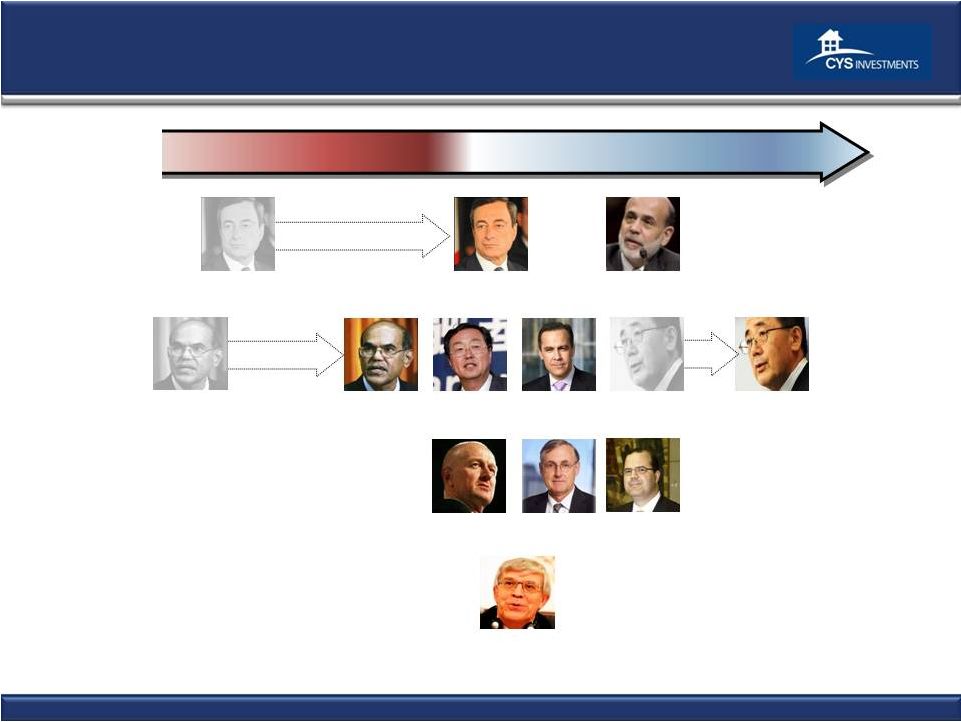

The

Brief Hawkish Interlude Appears Over Xiaochuan

China

Bernanke

USA

Shirakawa

Japan

Canada

Carney

Australia

Stevens

New Zealand

Bollard

Draghi

EU

Tombini

Brazil

Subbarao

India

Global Accommodation has Reluctantly Restarted

Hawkish

Dovish

Neutral

Draghi

EU

Ignatiev

Russia

Shirakawa

Japan

Subbarao

India

7 |

The

Iowa Electronic Futures Market: Obama re-elected and a Republican

Congress Democrat

Republican

Republican House/

Republican Senate

Republican House/

Democrat Senate

Democrat House/

Democrat Senate

Democrat House/

Republican Senate

Source: The Iowa Electronic Markets

2012 US Presidential Election Winner Takes All Market

2012 Congressional Control Winner-Takes-All Market

As of March 1

As of March 1

As of May 17

As of May 17

Republican House/

Democrat Senate

Democrat House/

Democrat Senate

Democrat House/

Republican Senate

Republican House/

Republican Senate

Democrat

Republican

8 |

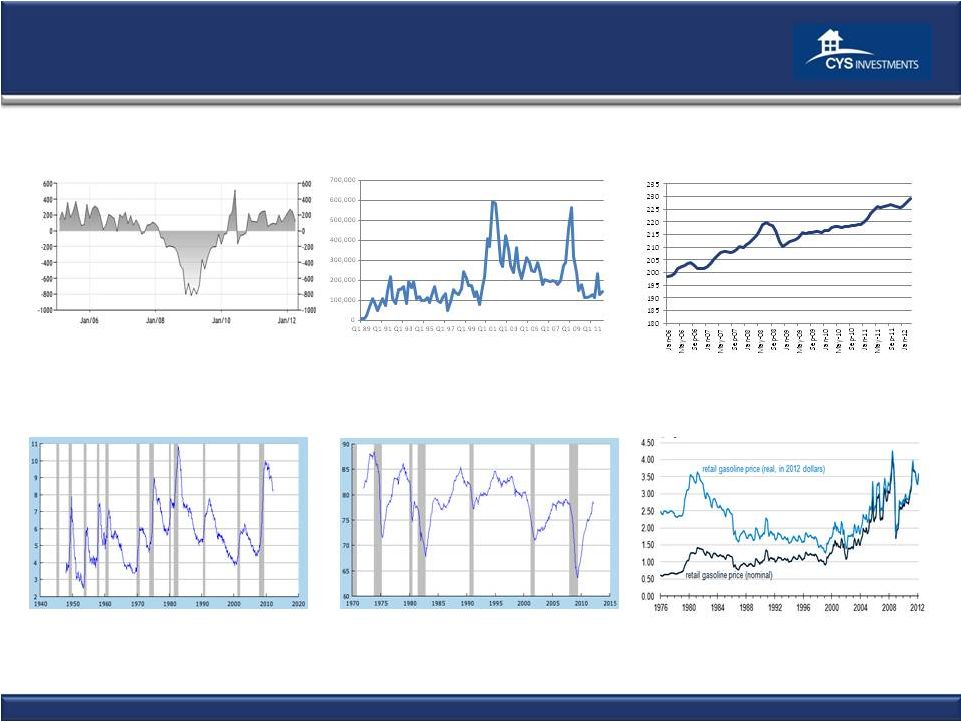

Source: S&P, Fiserv, and Macromarkets LLC / Haver Analytics, BLS, Challenger,

Gray & Christmas, US Dept. of Energy, NYMEX U.S. Retail Gasoline Price, Regular

Grade 1976 –

Present

Capacity Utilization: Manufacturing

1972 –

Present

%

Civilian Unemployment Rate

1947 -

present

%

Economic Recovery Below Normal Pace

CPI-U All Items, Core

2006 –

Present

% Change -

Year to Year

Total Nonfarm Private Payroll Employment

2005-present

000’s

Challenger, Gray & Christmas, Inc.

Job Cut Announcement Report

1/2007 –

3/2012, by Quarter

9 |

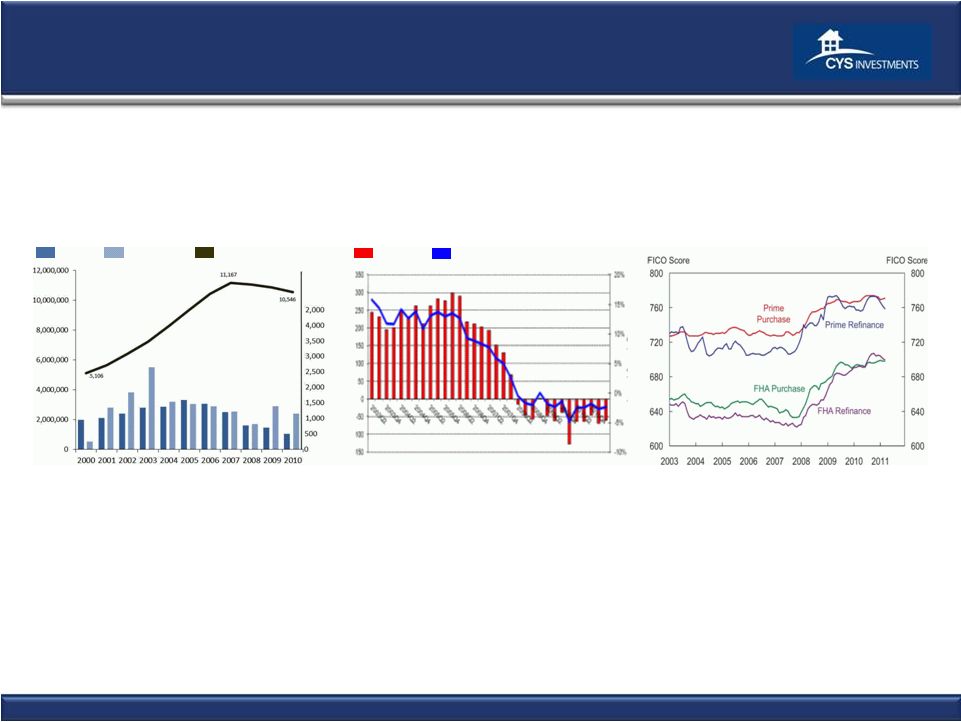

Mortgage Market Shrinkage Likely to Continue

Residential Mortgage Debt Decline Driven By:

1.

Declining home prices

2.

Delevering Consumers/Homeowners

3.

Psychology of lower leverage

4.

Low volume of new and existing home sales

5.

All-cash home purchase transactions, and higher downpayments

6.

Scheduled principal payments

7.

High percentage of cash-in refis versus cash-out refis.

Quarterly Growth in

Residential Mortgage Debt

Q22003

–

Q4

2010

Source: BLS, LPS Applied Analytics, Financial Stability Oversight Council 2011 Annual

Report 10

Purchase

Refinance

Total Home Mortgage Debt

Home Mortgage Originations

2000

-

2010

In billions

Home Mortgage Debt

Outstanding

2000 -

2010

In millions

Median Credit Score at

Mortgage Origination

2003-2012

Net Issuance

Growth |

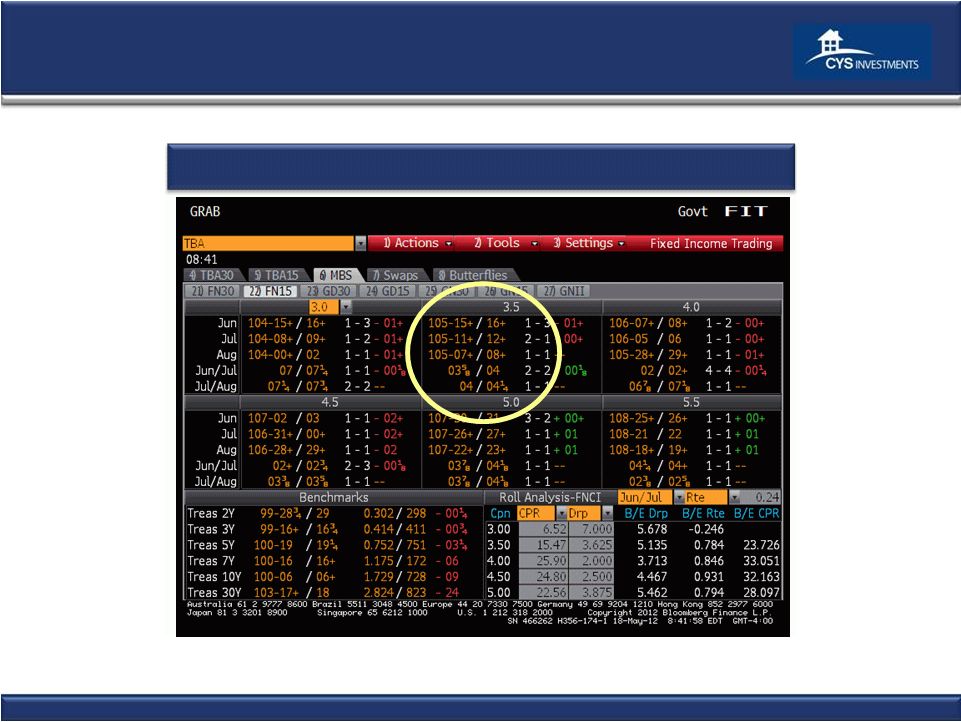

Economics of Forward Purchase

Source: Bloomberg 05/18/12

3 /32

represents

a

discount

to

the

purchase

price

of

the

security

of

approximately

$0.30

per

month

from

trade

date

to

settlement

date.

Economics of Forward Purchase

11

Example: 15 yr. 3½% drop = ~3

5/8

/32 pt. per month

1

5/8

1 |

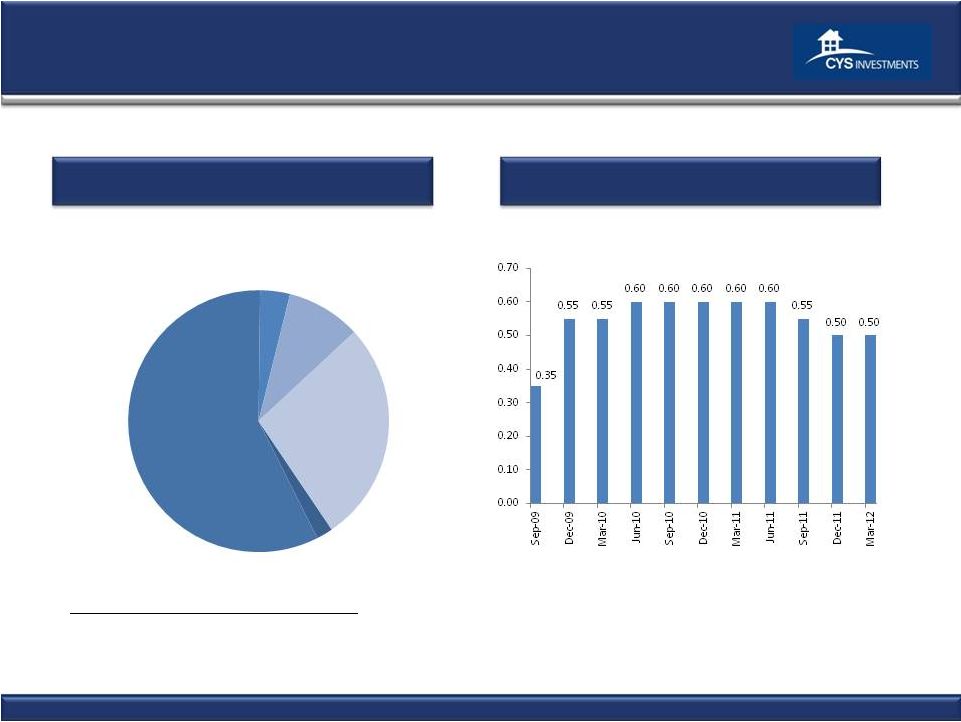

Portfolio Composition and Results

12

1

As of 3/31/12

Total Agency RMBS: $13,307.4 million

10 Year Fixed

Rate, 2%

15 Year Fixed

Rate, 58%

20 Year Fixed

Rate, 4%

30 Year

Fixed Rate,

9%

Hybrid ARMs,

27%

CYS Agency RMBS Portfolio

1

CYS

Dividends:

9/09

–

4/12 |

Portfolio Characteristics

CYS Agency RMBS Portfolio Characteristics*

* As of 3/31/11

(1) MTR,

or

“Months

to

Reset,”

is

the

number

of

months

remaining

before

the

fixed

rate

on

a

hybrid

ARM

becomes

a

variable

rate.

At

the

end

of

the

fixed

period,

the

variable

rate

will

be

determined

by

the

margin

and

the

pre-specified

caps

of

the

ARM.

After

the

fixed

period,

the

interest

rates

on

100% of our hybrid ARMs reset annually.

(2) CPR,

or

“Constant

Prepayment

Rate,”

is

a

method

of

expressing

the

prepayment

rate

for

a

mortgage

pool

that

assumes

that

a

constant

fraction

of

the remaining principal is prepaid each month or year. Specifically, the CPR is an

annualized version of the prior three month prepayment rate.

Securities with no prepayment history are excluded from this calculation.

(3) Weighted average months to reset of our hybrid ARM portfolio.

Par Value

Fair Value

Asset Type

Cost/Par

Fair

Value/Par

MTR

(1)

Coupon

CPR

(2)

10 Year Fixed Rate

$256,373

$269,227

$103.88

$105.01

N/A

3.50%

13.8%

15 Year Fixed Rate

7,306,193

7,666,261

103.05

104.93

N/A

3.54%

14.8%

20 Year Fixed Rate

460,938

489,662

102.36

106.23

N/A

4.16%

21.8%

30 Year Fixed Rate

1,132,244

1,225,193

106.90

108.21

N/A

5.09%

26.5%

Hybrid ARMs

3,493,632

3,657,100

102.54

104.68

65.9

3.19%

20.1%

Total/Weighted Average

$ 12,649,380

$13,307,443

$103.24

$ 105.20

65.9

(3)

3.61%

17.3%

Weighted Average

(in thousands)

13 |

History of Transparent and Consistent

Financial Reporting

CYS uses Financial Reporting for Investment Companies

CYS financial reporting -

Best in Class

Schedule of investments

NAVs have reflected mark-to-market accounting since inception

No OCI account on balance sheet

Realized and unrealized losses taken through income statement

Losses expensed in period incurred

14 |

Historical Financials

15

3/31/2012

12/31/2011

Income Statement Data (in 000's)

Investment

Income

–

Interest

Income

$65,369

$61,631

Total expenses

11,972

10,510

Net Investment Income

53,397

51,121

Net gain (loss) from investments

33,150

(8,587)

Net gain (loss) from swap and cap contracts

(17,429)

1,559

Net Income

$69,118

$44,093

Net Income Per Common Share (diluted)

$0.66

$0.53

Distributions per Common Share

$0.50

$0.50

Non-GAAP Measure (in 000's)

Core Earnings

(1)

$41,891

$37,836

Non-GAAP

Reconciliation

(in

000’s)

NET INCOME

$69,118

$44,093

Net (gain) loss from investments

(33,150)

8,587

Net (gain) loss on termination of swap contracts

--

1,411

Net unrealized (appreciation) depreciation on swap

and cap contracts

5,923

(16,255)

Core Earnings

$41,891

$37,836

Key Portfolio Statistics*

Average yield on Agency RMBS

(2)

2.78%

2.81%

Average cost of funds and hedge

(3)

0.90%

1.01%

Interest rate spread net of hedge

(4)

1.88%

1.80%

Operating expense ratio

(5)

1.46%

1.53%

Leverage ratio (at period end)

(6)

7.7:1

7.7:1

Balance Sheet Data (in 000's)

3/31/2012

12/31/2011

Cash and Cash Equivalents

$10,643

$11,508

Total Assets

$13,555,905

$9,518,057

Repurchase Agreements

$8,234,669

$7,880,814

Net assets

$1,525,792

$1,077,458

Net assets per common share

$13.14

$13.02

Three Months Ended

As of

(1) Core Earnings is defined as net income (loss) excluding net gain (loss) on investments, net

realized gain (loss) on termination of swap contracts and unrealized appreciation (depreciation) on swap and cap contracts.

(2) Our average yield on Agency RMBS for the period was calculated by dividing our interest income

from Agency RMBS by our average Agency RMBS.

(3) Our average cost of funds and hedge for the period was calculated by dividing our total interest

expense, including our net swap and cap interest income (expense), by our average repurchase agreements.

(4) Our interest rate spread net of hedge for the period was calculated by subtracting our average

cost of funds and hedge from our average yield on Agency RMBS.

(5) Our operating expense ratio is calculated by dividing operating expenses by average net assets. (6) Our leverage ratio was

calculated by dividing (i) the Company’s repurchase agreements balance plus payable for securities purchased minus receivable for securities sold by (ii) net assets.

* All percentages are annualized.

|

Financial Highlights

Steep yield curve and attractive spreads in target assets

Tailwinds likely to continue

Fed Transparency very helpful

Investment Company accounting provides transparency

16 |

2012 Specialty Finance Symposium

Investment Outlook

May 2012 |