Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CAPSTEAD MORTGAGE CORP | d350665d8k.htm |

| EX-99.1 - INVESTOR PRESENTATION WITH INFORMATION AS OF MARCH 31, 2012 - CAPSTEAD MORTGAGE CORP | d350665dex991.htm |

Exhibit 99.2

ABOUT US

Capstead is based in Dallas, Texas and is listed on the New York Stock Exchange (symbol CMO). Having been formed in 1985, we hold the distinction of being the oldest of the publicly-traded mortgage REITs.

Proven Strategy

We invest in a leveraged portfolio of residential adjustable-rate mortgage (“ARM”) securities issued and guaranteed by Fannie Mae, Freddie Mac or Ginnie Mae.

Our investment strategy differentiates us from our peers because ARM securities reset to more current interest rates within a relatively short period of time allowing for:

| • | the recovery of financing spreads diminished during periods of rising interest rates, and |

| • | smaller fluctuations in portfolio values from changes in interest rates compared to fixed-rate mortgage securities. |

Quality Assets

Agency-guaranteed residential mortgage securities are considered to have little, if any, credit risk, particularly given federal government support for Fannie Mae and Freddie Mac. These mortgage investments are highly liquid and can be financed with multiple funding providers through standard repurchase arrangements.

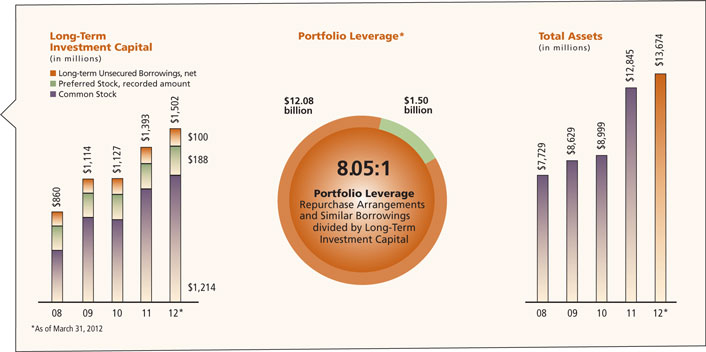

Conservatively Financed

We prudently leverage our portfolio to provide financial flexibility needed to successfully manage through periods of changing market conditions, and we have long-standing relationships with numerous lending counterparties. Further, our use of interest rate swap agreements helps mitigate the effects of rising short-term interest rates.

Experienced Management in a Stockholder Friendly Structure

Our management team has nearly 85 years of combined mortgage finance industry experience. We are self-managed with low operating costs and rely heavily on performance-based compensation. This structure greatly enhances the alignment of management interests with those of our stockholders.

FIRST QUARTER HIGHLIGHTS

QUARTERLY RESULTS

| (In thousands, except per share data) |

March 31, 2012 |

Dec. 31, 2011 |

Sept. 30, 2011 |

June 30, 2011 |

March 31, 2011 |

|||||||||||||||

| Interest income |

$ | 65,883 | $ | 63,981 | $ | 62,949 | $ | 63,194 | $ | 53,254 | ||||||||||

| Interest expense* |

(16,290 | ) | (17,743 | ) | (17,930 | ) | (15,894 | ) | (14,513 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net interest margin |

49,593 | 46,238 | 45,019 | 47,300 | 38,741 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Miscellaneous other revenue (expense) |

(104 | ) | (32 | ) | (45 | ) | (534 | ) | (153 | ) | ||||||||||

| Incentive compensation |

(1,538 | ) | (1,548 | ) | (1,429 | ) | (1,487 | ) | (1,233 | ) | ||||||||||

| Salaries and benefits |

(1,827 | ) | (1,698 | ) | (1,631 | ) | (1,672 | ) | (1,700 | ) | ||||||||||

| Other general and administrative expense |

(954 | ) | (992 | ) | (911 | ) | (1,066 | ) | (963 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (4,423 | ) | (4,270 | ) | (4,016 | ) | (4,759 | ) | (4,049 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

45,170 | 41,968 | 41,003 | 42,541 | 34,692 | |||||||||||||||

| Diluted earnings per common share |

0.4 4 | 0.43 | 0.43 | 0.48 | 0.41 | |||||||||||||||

| Common dividends per share |

0.4 3 | 0.43 | 0.44 | 0.48 | 0.41 | |||||||||||||||

| New equity capital |

63,333 | 39,159 | 54,197 | 83,453 | 60,071 | |||||||||||||||

| Common shares outstanding (EOQ) |

92,951 | 88,287 | 85,256 | 81,311 | 74,994 | |||||||||||||||

| * | Including $2.2 million of interest charges on unsecured borrowings for each period presented. |

| * | As of May 4, 2012 |

| ** | % based on available filings as of May 4, 2012 and shares outstanding as of March 31, 2012. |