Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BATTALION OIL CORP | d340197d8k.htm |

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - BATTALION OIL CORP | d340197dex21.htm |

| EX-10.1 - VOTING AGREEMENT - BATTALION OIL CORP | d340197dex101.htm |

| EX-99.1 - JOINT PRESS RELEASE - BATTALION OIL CORP | d340197dex991.htm |

| EX-10.3 - CONFIDENTIAL INFORMATION - BATTALION OIL CORP | d340197dex103.htm |

| EX-10.2 - VOTING AGREEMENT - BATTALION OIL CORP | d340197dex102.htm |

April 25,

2012 HK to Acquire GEOI

Exhibit 99.2 |

NYSE:

HK Forward-Looking Statements

2

This presentation contains forward-looking information regarding Halcón Resources and

GeoResources that is intended to be covered by the safe harbor for

"forward-looking statements" provided by the Private Securities Litigation Reform Act of 1995. Forward-

looking statements are based on Halcón Resources’ and GeoResources’ current

expectations beliefs, plans, objectives, assumptions and strategies.

Forward-looking statements often, but not always, can be identified by using words such as "expects", "anticipates",

"plans", "estimates", "potential", "possible",

"probable", or "intends", or where Halcón Resources or GeoResources states that

certain actions, events or results "may", "will", "should", or

"could" be taken, occur or be achieved. Forward-looking statements are

subject to risks and uncertainties, which could cause actual results to differ materially from

those reflected in the statements. These risks include, but are not limited to:

anticipated timing for closing the proposed merger, the possibility that the companies may be

unable to obtain stockholder or other approvals required for the acquisition or will not be

able to satisfy the other conditions to closing; that problems will arise in the

integration of the businesses of the two companies; that the acquisition may involve

unexpected costs; operational risks in exploring for, developing and producing crude oil and

natural gas; uncertainties involving geology of oil and natural gas deposits; the

timing of and potential proceeds from planned divestitures; uncertainty of reserve

estimates; uncertainty of estimates and projections relating to future production, costs and

expenses; potential delays or changes in plans with respect to exploration or

development projects or capital expenditures; health, safety and environmental risks and risks

related to weather such as hurricanes and other natural disasters; uncertainties as to the

availability and cost of financing; fluctuations in oil and natural gas prices; risks

associated with derivative positions; inability to timely integrate and realize expected

value from acquisitions, inability of our management team to execute plans to meet our goals;

shortages of drilling equipment, oil field personnel and services; unavailability of

gathering systems, pipelines and processing facilities; and the possibility that laws,

regulations or government policies may change or governmental approvals may be delayed or

withheld. Additional information on these and other factors which could affect

operations or financial results are included in Halcón Resources’ and GeoResources’

reports on file with the SEC. Investors are cautioned that any forward-looking

statements are not guarantees of future performance and actual results or developments

may differ materially from the projections in the forward-looking statements. Forward-looking

statements are based on assumptions, estimates and opinions of management at the time the

statements are made. We do not assume any obligation to update forward-looking

statements should circumstances or such estimates or opinions change. |

NYSE:

HK Additional Information

3

PROPOSED

TRANSACTION.

Investors

and

security

holders

may

obtain

these

documents

free

of

charge

at

the

SEC’s

website

at

www.sec.gov.

In

addition,

the

documents

filed

with

the

SEC

by

Halcón

Resources

can

be

obtained

free

of

charge

from

Halcón

Resources’

website

at

www.halconresources.com.

The

documents

filed

by

GeoResources

can

be

obtained

free

of

charge

from

GeoResources’

website

at

www.georesourcesinc.com.

Halcón Resources and GeoResources intend to file materials relating to the

transaction with the SEC, including a registration statement of Halcón Resources,

which will include a prospectus of Halcón Resources and a joint proxy statement of

Halcón Resources and GeoResources. The definitive joint proxy

statement/prospectus will be mailed to stockholders of Halcón Resources and

GeoResources. INVESTORS AND SECURITY HOLDERS ARE URGED TO CAREFULLY READ THE

REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS FILED WITH THE SEC IN THEIR ENTIRETY

WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT HALCÓN

RESOURCES, GEORESOURCES AND THE Halcón Resources, GeoResources and their respective executive officers and directors may

be deemed to be participants in the solicitation of proxies from the stockholders of

Halcón Resources and GeoResources in respect of the proposed transaction. Information regarding Halcón Resources' directors and executive

officers is available in its annual report on Form 10-K for the year ended December 31,

2011, which was filed with the SEC on March 5, 2012, and its proxy statement for its

2012 annual meeting of stockholders, which was filed with the SEC on April 12, 2012, and information regarding GeoResources' directors and

executive officers is available in its proxy statement for its 2011 annual meeting of

stockholders, which was filed with the SEC on April 29, 2011. Other information

regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be

contained in the joint proxy statement/prospectus and other relevant materials to be filed

with the SEC when they become available. We use the terms “resource potential” and “EURs” per well in this

presentation to describe estimates of potentially recoverable hydrocarbons that the SEC

rules prohibit from being included in filings with the SEC. These are based on the

Company’s internal estimates of hydrocarbon quantities that may be potentially

discovered through exploratory drilling or recovered with additional drilling or recovery techniques. These quantities do not constitute “reserves”

within the meaning of the Society of Petroleum Engineer’s Petroleum Resource Management

System or SEC rules. “EUR,” or Estimated Ultimate Recovery, refers to

our management’s internal estimates based on per well hydrocarbon quantities that may be potentially recovered from a hypothetical future well

completed as a producer in the area. Management estimated these EURs based on publicly

available information relating to the operations of producers who are conducting

operating in these areas. Factors affecting ultimate recovery include our ability to acquire the acreage we are

targeting and the scope of our ongoing drilling program, which will be directly

affected by the availability of capital, drilling and production costs, availability of drilling services and equipment, drilling results, lease expirations,

transportation constraints, regulatory approvals and other factors; and actual drilling

results, including geological and mechanical factors affecting recovery rates.

Estimates of resource potential, per well EUR may change significantly as the Company pursues acquisitions. In addition, our production forecasts and

expectations for future periods are dependent upon many assumptions, including estimates of

production decline rates from existing wells and the undertaking and outcome of future

drilling activity, which may be affected by significant commodity price declines or drilling cost increases.

|

NYSE:

HK Announcing the Acquisition of GEOI by HK

Consideration ($37.97 per GEOI share ):

$20.00 in cash

1.932 HK shares

Total

transaction

value

~$1.0

Billion

GEOI stockholders to own ~18% of HK at closing

Expected to close in 3Q12, subject to customary approvals

4

(1) Based

on

the

closing

price

of

Halcón

Resources’

common

stock

on

April

24,

2012.

(1)

(1) |

NYSE:

HK 5

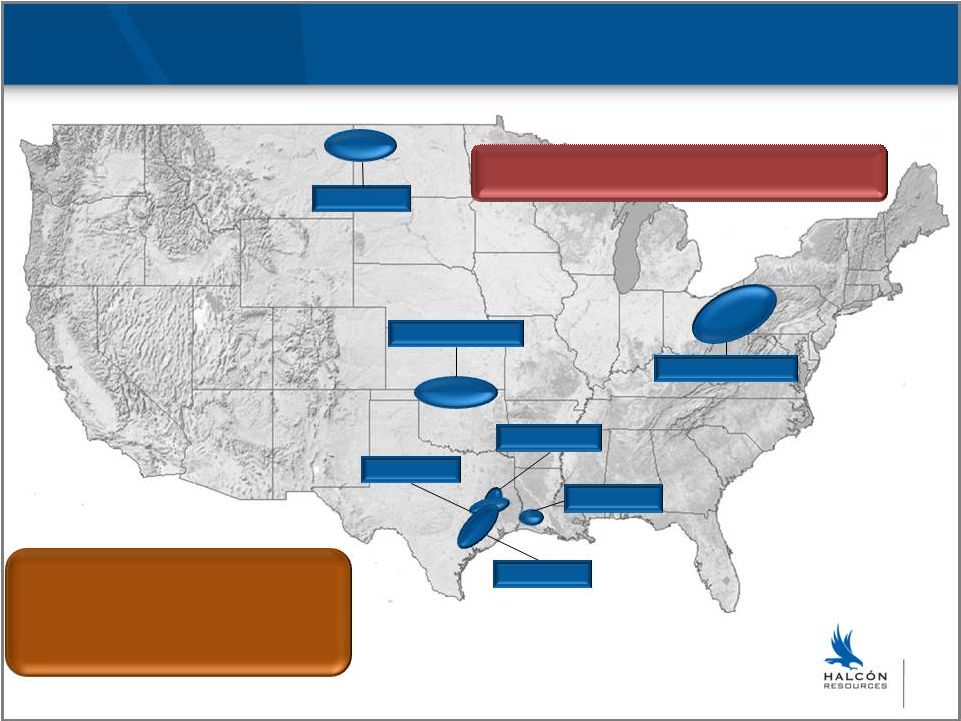

Liquids-Rich Asset Base and Significant Drilling Inventory

Utica/Point Pleasant

Wilcox

Woodbine

Mississippian Lime

Bakken

Austin Chalk

Eagle Ford

3 Exploratory Liquids-Rich Plays Not Shown

Note: Estimated proved reserves and PV10 at 12.31.11 using SEC pricing including

GeoResources’ management estimates of 12.31.11 proved reserves associated with

Brookeland field acquisition using SEC pricing.

PF Total Proved Reserves: 52.8 MMBoe

PF % Developed: 68%

PF % Oil/NGLs: 69%

PF 4Q11 Avg. Net Daily Production: 11,070 Boe

PF Total Proved PV10: $1,044.9 MM |

NYSE:

HK 6

Numerous “oily”

resource style high growth assets

Multi-decade drilling inventory

Improves commercial opportunity set

Immediately

accretive

to

discretionary

cash

flow,

production

and

reserves

on

a

per

share

basis

More than doubles HK proved reserves and production

Pro forma 52.8 MMBoe of estimated proved reserves

Pro forma 11.1 MBoe/d of 4Q11 production

More than doubles HK estimated 2012 cash flow

Strong balance sheet

Increases public float

Increases debt capacity

Scale

Capital

Access

Resource

Intensity

Accretive

To

Shareholders

Creating a Resource Powerhouse |

NYSE:

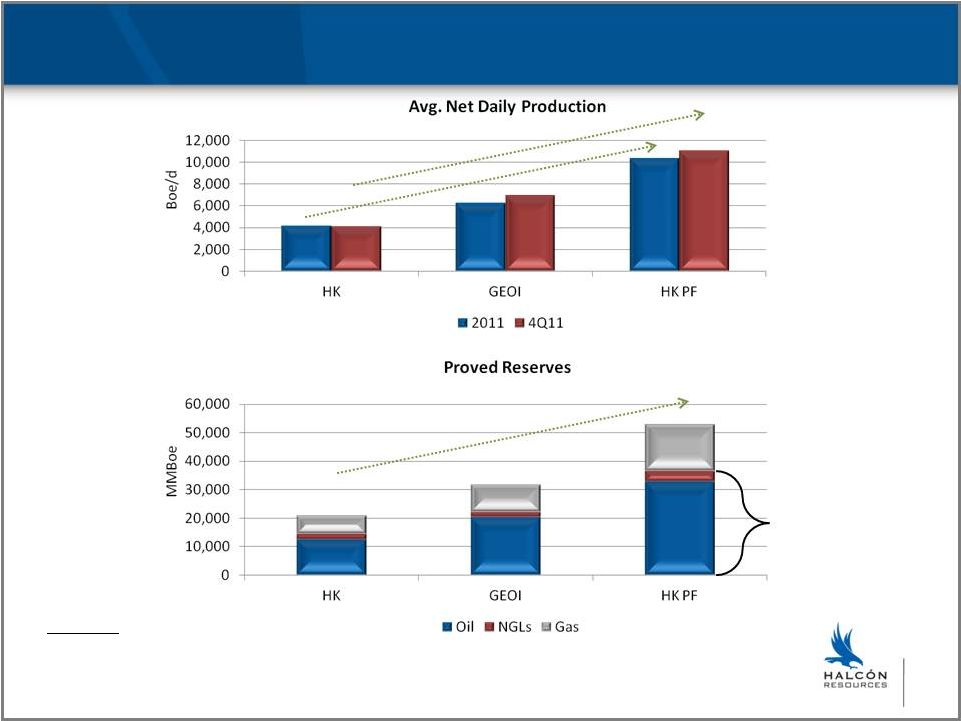

HK Substantial Increase in Production and Reserves

+151%

+171%

+151%

(1)

(1)

(2)

69%

Liquids

(1) Includes GeoResources’ Brookeland field acquisition. (2) Proved

reserves at 12.31.11 using SEC pricing including GeoResources’ management estimates of 12.31.11 proved reserves associated

with Brookeland field acquisition using SEC pricing; proved reserve figures exclude

approximately 1.2 MMBoe (96% gas) of proved reserves and $11 MM of PV10 associated with

GP interest in partnerships with GE. 7 |

NYSE:

HK 48% gas (6:1)

Allows for added focus on growth areas

Expect some sales in 2012

Source of additional liquidity

8

Pro Forma Non-Core Divestiture Candidates

(1) Estimated proved reserves and PV10 at 12.31.11 using SEC pricing.

2011 Average Net

Daily Production

Proved Reserves

(1)

Boe/d

Full Year

4Q11

Oil

MBbls

Gas

MMcf

NGL

MBbls

Equiv.

Mboe

%

Oil/NGLs

% PD

% Total PF

Reserves

PV10

(1)

($MM)

% Total PF

PV10

Permian

322

322

1,205

2,087

44

1,597

78%

72%

3%

$46.3

4%

South Texas

865

732

317

21,246

1,280

5,139

31%

42%

10%

$48.3

5%

South Louisiana

1,146

1,235

3,725

14,499

0

6,141

61%

70%

12%

$142.0

14%

Other

1,364

1,371

3,581

19,765

365

7,240

55%

92%

14%

$131.4

13%

Total

3,697

3,660

8,828

57,597

1,690

20,117

52%

71%

38%

$367.9

35% |

NYSE:

HK 9

Increased Capitalization

(1)

As of 12.31.11 the borrowing base under the revolving credit facility was $150 MM; adjusted

to $225 MM after the 2.8.12 recap and adjusted to estimated $475 MM post GeoResources

acquisition; assumes all outstanding GeoResources borrowings paid off.

(2)

GeoResources

balance

sheet

pro

forma

for

Brookeland

field

($40.4

MM)

and

Bakken

($12.7

MM)

acquisitions

funded

on

revolver.

(3)

Reflects $275 MM five-year convertible Note issued 2.8.12 to HALRES LLC (formerly

Halcón Resources LLC); Note is reflected at fair value.

(4)

Includes 73.3 MM common shares, 4,444 preferred shares automatically converted into 44.4 MM

common shares, issuance costs and change in control payments.

(5)

Reflects equity consideration (51.4 million shares) for GeoResources acquisition at

Halcón’s closing price of $9.30/share on 4.24.12.

HK

Recap

GEOI

Merger

HK + GEOI

($000s)

12.31.11

Adjustments

12.31.11

Adjustments

PF 12.31.11

Debt

Revolving Credit Facility

(1)(2)

127,000

(127,000)

53,100

(53,100)

-

Term Loan

75,000

(75,000)

-

-

-

8.00%

Sr.

Conv.

Note

due

2017

(3)

-

248,961

-

-

248,961

Total Debt

$202,000

$53,100

$248,961

Shareholders’

Equity

(4)

5,948

669,736

368,311

-

1,043,995

New Equity

(5)

-

-

-

478,219

478,219

Total Capitalization

$207,948

$421,411

$1,771,175 |

NYSE:

HK 10

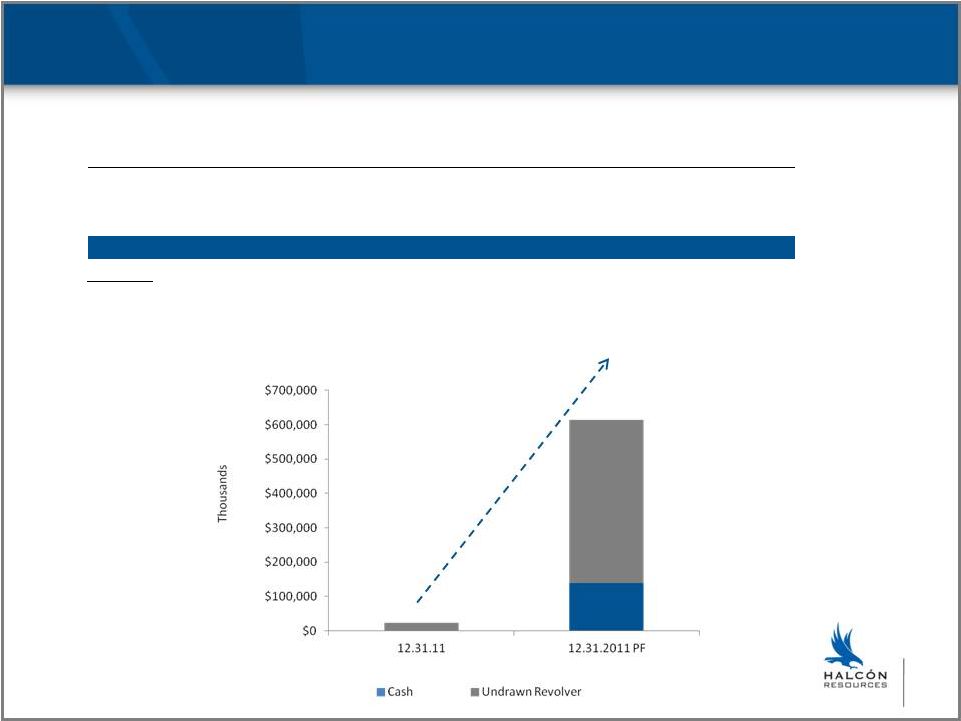

Solid Liquidity to Fund Growth

(1)

Includes cash consideration for acquisition, payoff of outstanding balance on GeoResources

credit facility, change in control payments and estimated transaction

fees/expenses. (2)

Reflects new revolving credit facility with estimated $475 MM borrowing base post

GeoResources acquisition. HK

Recap

GEOI

Merger

HK + GEOI

($000s)

12.31.11

Adjustments

12.31.11

Adjustments

PF 12.31.11

Cash and Cash Equivalents

49

710,342

39,144

(611,391)

(1)

138,144

Revolving Credit Facility

150,000

75,000

180,000

70,000

475,000

(2)

Borrowings

(127,000)

127,000

(53,100)

53,100

-

Total Liquidity

$23,049

$166,044

$613,144 |

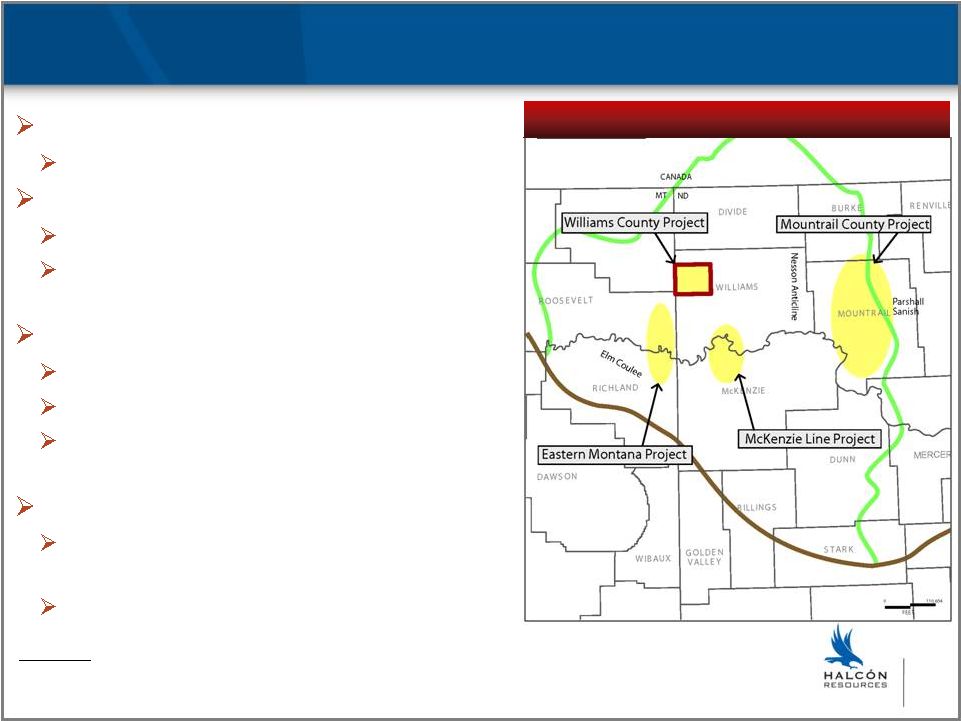

NYSE:

HK 11

Bakken Project Area Overview

55,000 net acres (37,000 operated)

50+ MMBoe of unbooked resource potential

NW Williams County (operated)

2 rigs running

20-24 gross wells planned for 2012

(~30% -

~35% W.I.)

Eastern Montana (operated)

Rig to begin drilling in May

3-5 gross wells planned for 2012 (~45% W.I.)

2-3 conventional prospects to be drilled in

2012

Non-operated programs

3-4 rigs running in Mountrail County area

with very strong economics (~8% W.I.)

1 rig running in McKenzie Line area

(~11% W.I.)

Diversified Footprint Across Bakken Trend

(1)

(1) Estimate is based on 320 acre spacing and excludes developed acreage on which proved

reserves are already booked. Excludes Three Forks potential. See Additional

Information on page 3. |

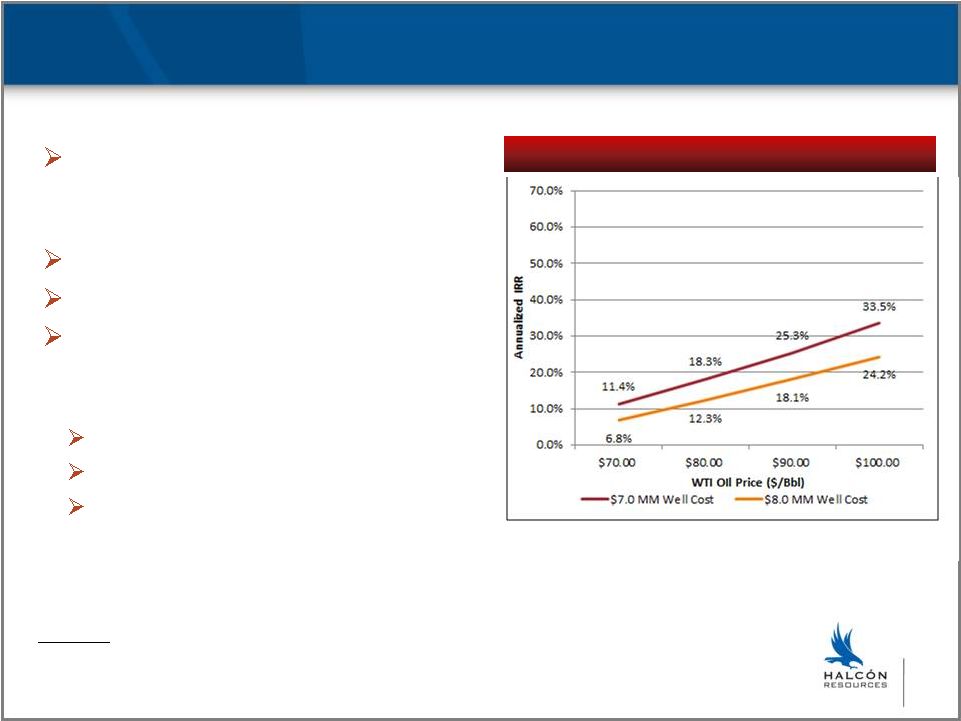

NYSE:

HK 12

Bakken Operated Project Area Economics and Upside

Potential for increased drilling

density (i.e. 4-6 wells per 1280 acre

unit)

Three Forks formation potential

Improved frac efficiency expected

Multiple initiatives underway to

lower D&C, operating costs and

improve recoveries

Pad development, walking rigs

Company owned SWD wells

Infrastructure being developed

Base Case Returns (300 Mboe)

(1)(2)

(1)

Dry gas price held constant at $4.50/Mcf.

(2)

EUR refers to GeoResources’ management internal estimates of reserves potentially

recoverable from successful drilling of wells and may change as more data becomes available as well as our actual results of drilling

and production. See Additional Information on page 3. |

NYSE:

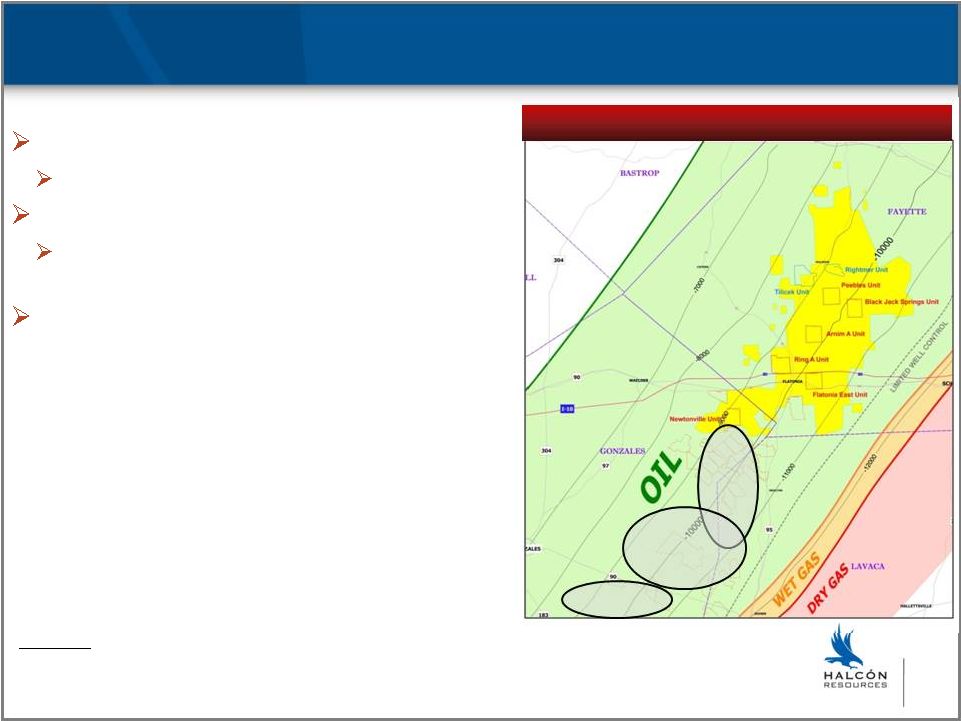

HK 13

Eagle Ford Project Overview

24,000 net acres (operated)

50+ MMBoe of unbooked resource potential

2 rigs running (3 to be added in 2H12)

20-24 gross operated wells planned for 2012

(~45% W.I.)

Geology similar to area being developed by

offset operators to the south

Eagle Ford Acreage Position

EOG

PVA

MHR

(1) Estimate is based on 150 acre spacing and excludes developed acreage on which proved

reserves are already booked. See Additional Information on page 3.

(1)

rd |

NYSE:

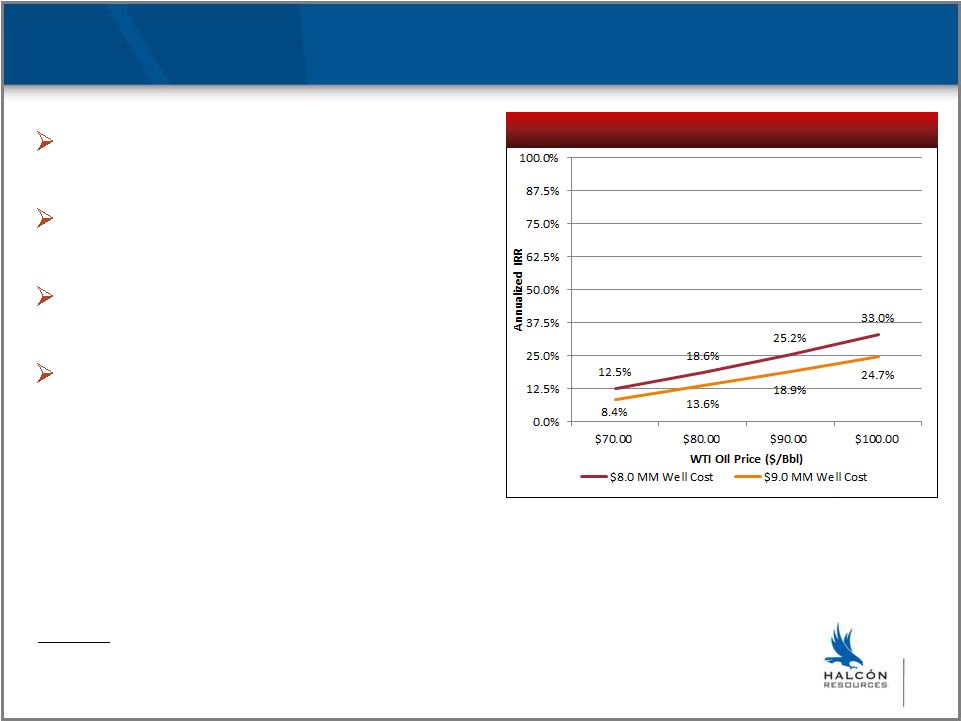

HK 14

Eagle Ford Project Economics and Upside

Continued refinement of optimal

completion methodology

Potential for increased drilling density

(i.e. 80 or 120 acre spacing)

Austin Chalk potential

(unconventional/conventional)

Potential to lower costs and improve

recoveries

Base Case Returns (325 Mboe)

(1)(2)

(1)

Dry gas price held constant at $4.50/Mcf.

(2)

EUR refers to GeoResources’ management internal estimates of reserves potentially

recoverable from successful drilling of wells and may change as more data becomes

available as well as our actual results of drilling and production. See Additional Information

on page 3. |

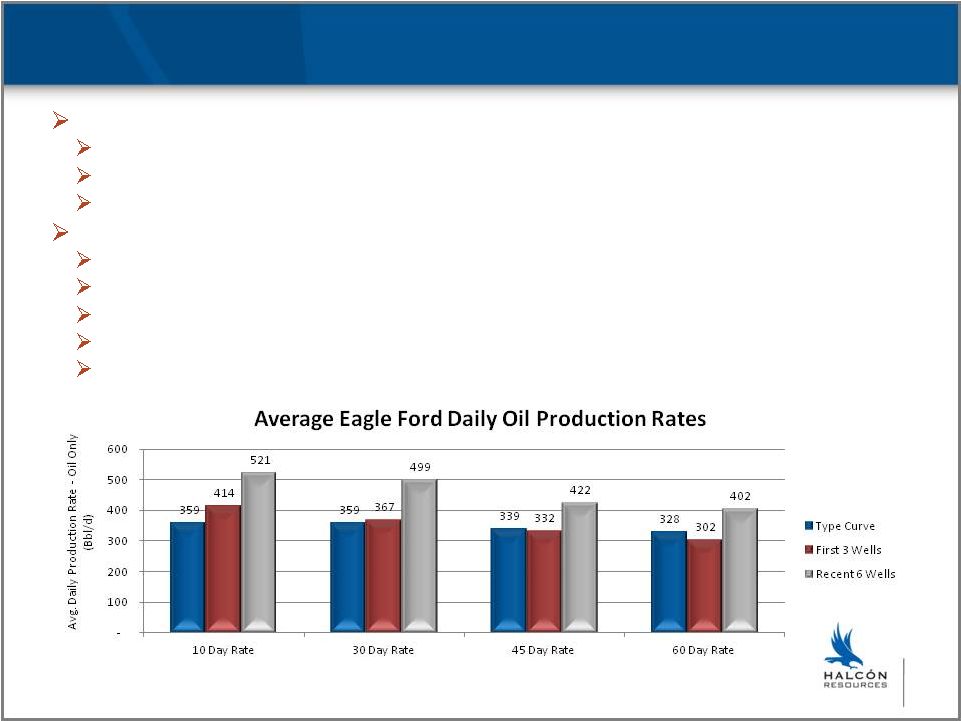

NYSE:

HK 15

Eagle Ford Project Improvements

First three well completions largely ineffective

Laterals 3200’-5900’

with 10-16 frac stages

40/70 white sand (embedment issues)

Slick water, linear gels and cross link frac fluids

Recent six wells

Targeting 5000’

laterals with 20 frac stages

20/40 and 30/50 resin coated and white sand

Cross link gel

All six still flowing up 5.5”

frac string

Performing significantly above 325 Mboe type curve |

NYSE:

HK 16

2012 Pro Forma D&C, Seismic and Infrastructure Estimate

Note:

Capital

budget

subject

to

revision;

property

and

leasehold

acquisitions

not

budgeted.

By Category

By Area

Drilling and Completions

78%

Seismic

9%

Infrastructure

13%

Total

~$620 MM

Utica/Point Pleasant

9%

Woodbine

8%

Wilcox

8%

Mississippi Lime

9%

Bakken

17%

Eagle Ford

16%

Austin Chalk

1%

Exploratory Liquids Plays

11%

Infrastructure

13%

Other

8%

Total

~$620 MM |

NYSE:

HK 17

2012 Operating and Financial Guidance Summary

Note: Pro forma combined guidance under review; guidance is forward-looking information

that is subject to a number of risks and uncertainties, many of which are beyond the

Company’s control. HK

GEOI

Production

Total (Boe/d)

6,161-

6,270

7,300 –

8,300

Percent Oil & NGLs

70%

65-70%

Operating costs and expenses ($ per Boe)

UNDER REVIEW |

NYSE:

HK 18

Building An Oil Company

(1)

Percentage leased, optioned or under contract compared to midpoint of target acreage

range. Targeted Net Acres

Progress

First Spud

Targeted Areas

Utica / Point Pleasant

150,000 -

250,000

~50%

May

Woodbine

150,000 -

250,000

~35%

May

Wilcox

50,000 -

100,000

~30%

June

Mississippian Lime

50,000 -

100,000

~60%

April

Total Targeted Areas

400,000 -

700,000

~42%

3 Exploratory Liquids

Rich Plays

225,000 -

375,000 Not Disclosed

Play 1

25,000 -

75,000

May

Play 2

100,000 -

150,000

June

Play 3

100,000 -

150,000

June

(1)

- |

NYSE:

HK 19

Utica/Point Pleasant Overview

PA

OH

KY

NY

Utica/Point Pleasant

WV

MD

VA

Utica/Point Pleasant

HK Target Acreage Area

Target Acreage: 150,000 –

250,000

Focus –

volatile oil and liquids-rich

window

Access to cores, geochem and logs

3D seismic to optimize completions

and reduce costs

Wells could be as prolific as Eagle

Ford wells

Source: Industry research. |

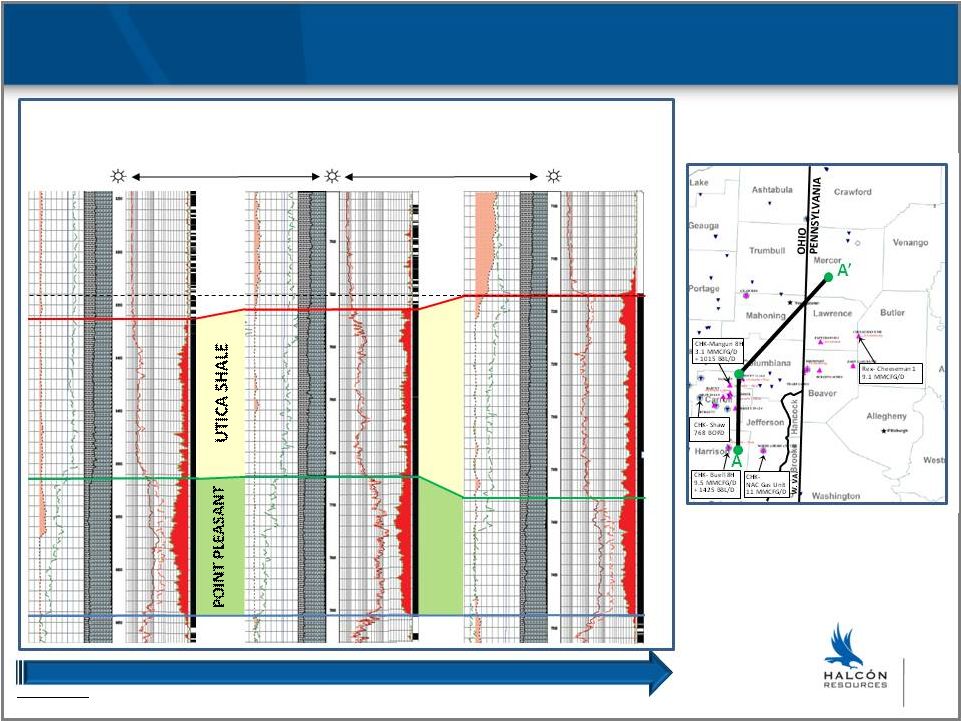

NYSE:

HK 20

Utica/Point Pleasant Thickness and Reservoir Quality Comparison

Source: Citi and

W.D. Von Gonten & Co.

Point Pleasant Thins as Utica Thickens and Reservoir Parameters Improve

-

100’

-

300’

-

200’

-

0’

N. Coast Energy

C. Shaney #1

Harrison Co.

(near Buell 8H Well)

Newstar Energy

Toalston #1

Carroll Co.

(near Mangun 8H Well)

D&M

Lark #1

Mercer Co.

24 miles

48 miles

A

A’

Cross Section |

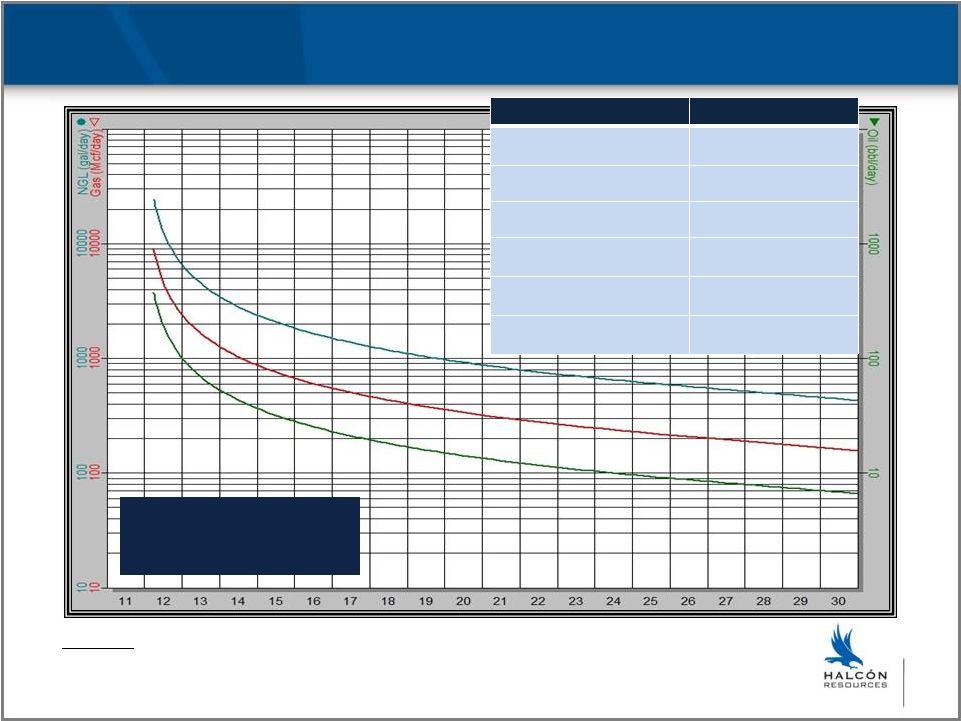

NYSE:

HK 21

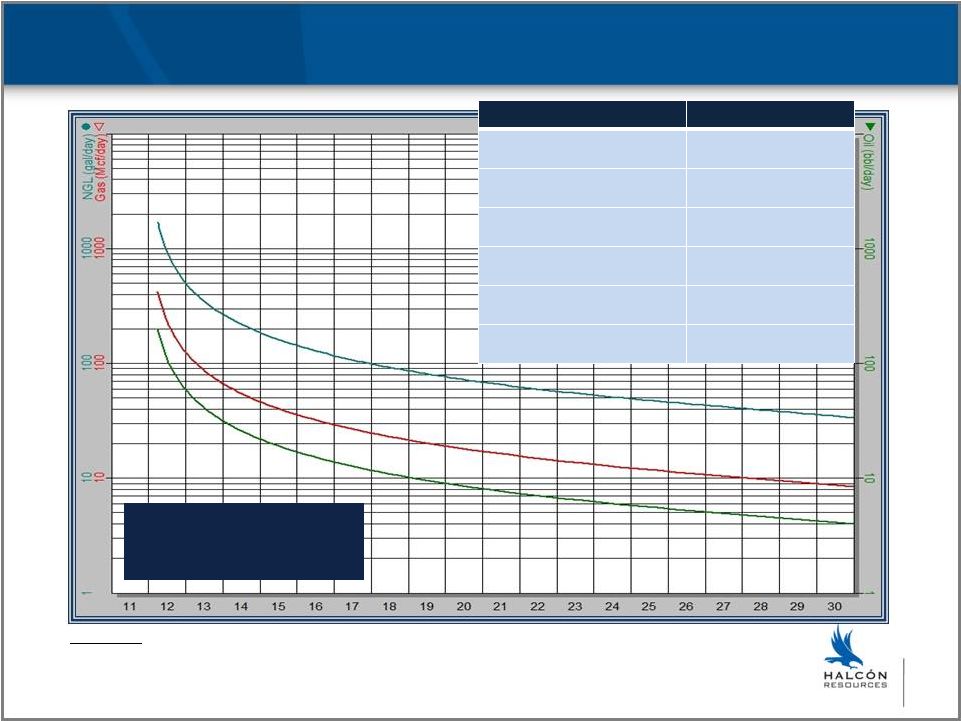

Utica/Point Pleasant Volatile Condensate Single Well Type Curve

Oil: EUR 150-250MBO

NGL: EUR 275-325MBNGL

Gas: EUR 4-5BCF

Play:

Utica/Point Pleasant

Estimated Avg. Well Cost:

$6.5-$7.5 MM

Estimated EUR:

1,250 MBoe

Target Acreage:

150,000-250,000 acres

Est. Spud-to-Production:

90 days

Rig Count Estimate:

2Q12: 1 2H12: 2

Wells Planned:

2012: 8-10

Note: Internal estimates based on third party data. Company has not drilled in this

play. Individual well results will differ. EUR estimate based upon

available data and may change as more data becomes available as well as our actual results of drilling and production.

See Additional Information on page 3. |

NYSE:

HK 22

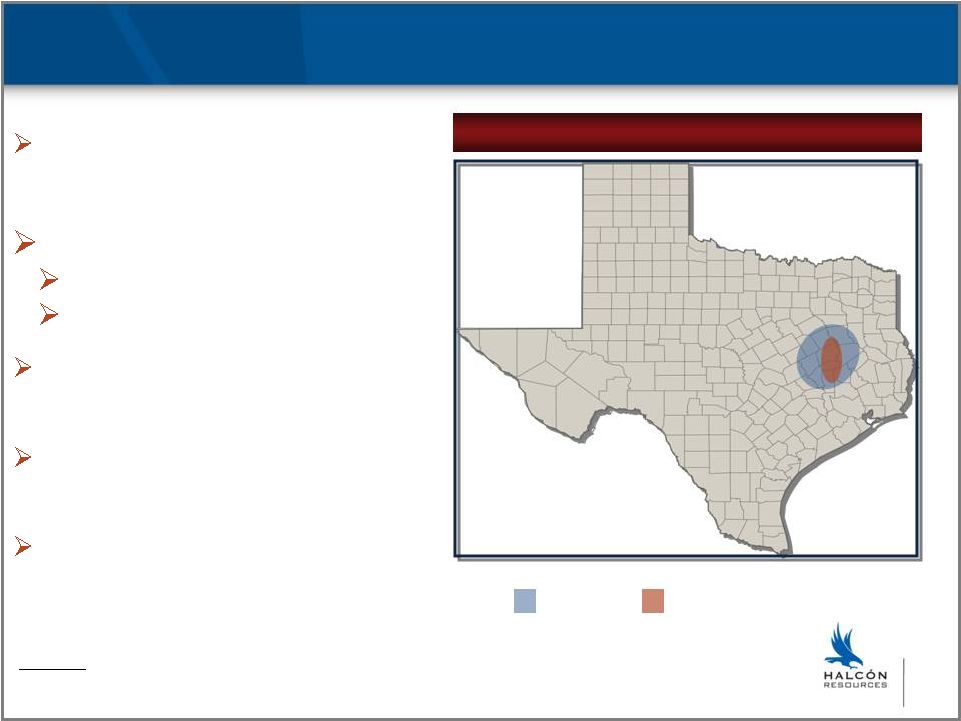

Woodbine Overview

TX

Woodbine

HK Target Acreage Area

Woodbine

Target Acreage: 150,000 –

250,000

Upper Cretaceous section ~40% silica

and clastics = deliverability

Regional studies indicate:

10%+ porosity

Current IP’s 3-4x higher vs. recent past

Geologically analogous to the Eagle

Ford in South Texas

Horizontal drilling and completion

techniques are a game changer

Premium pricing for oil, NGLs and gas

Source: Industry research. |

NYSE:

HK 23

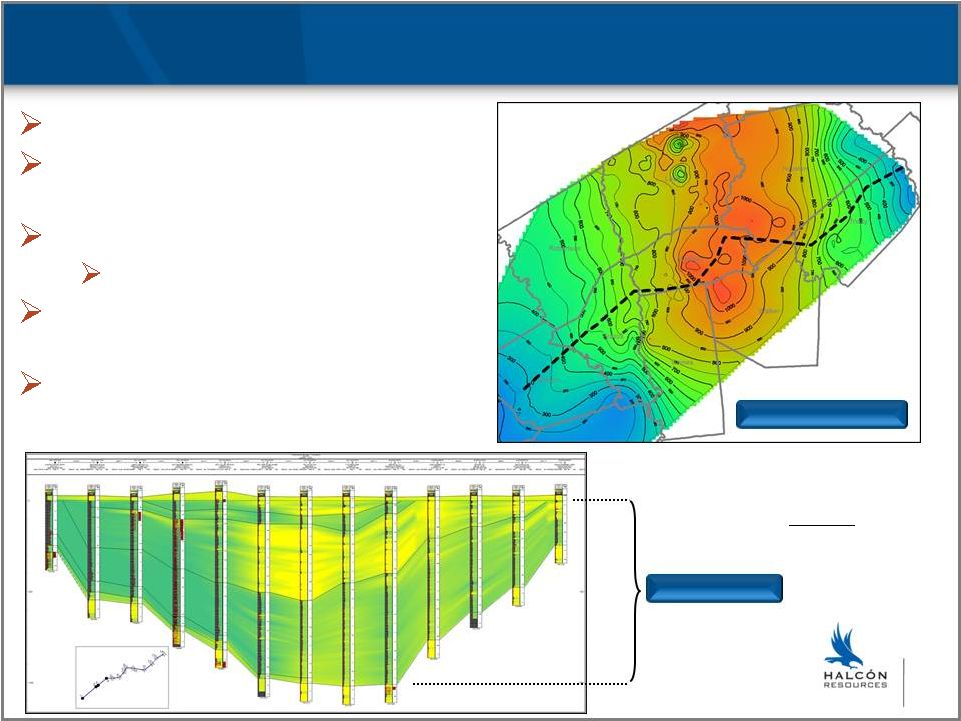

Woodbine Hydrocarbon System

23

Deltaic depositional system

Woodbine sands charged with

Eagle Ford sourced oil

Multiple Woodbine sand lenses

6,500’-

11,500’

depth

Play 1: High porosity, high

storage capacity sands

Play 2: Downdip, permeability

trapped sands

Eagle Ford

Buda

Woodbine

Woodbine Isopach

Source: Internal research. |

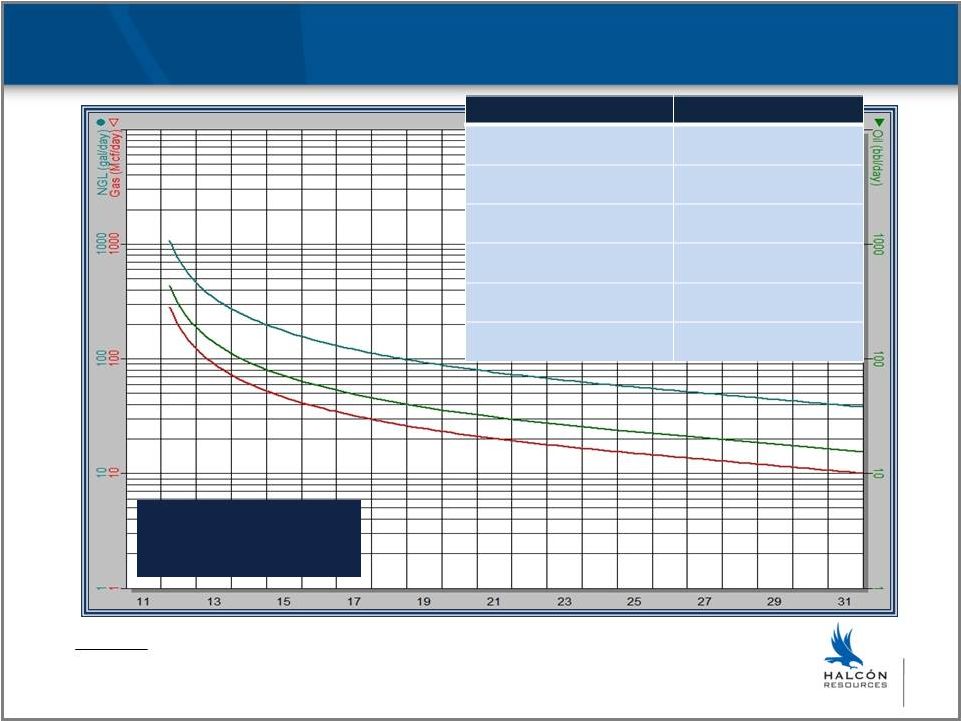

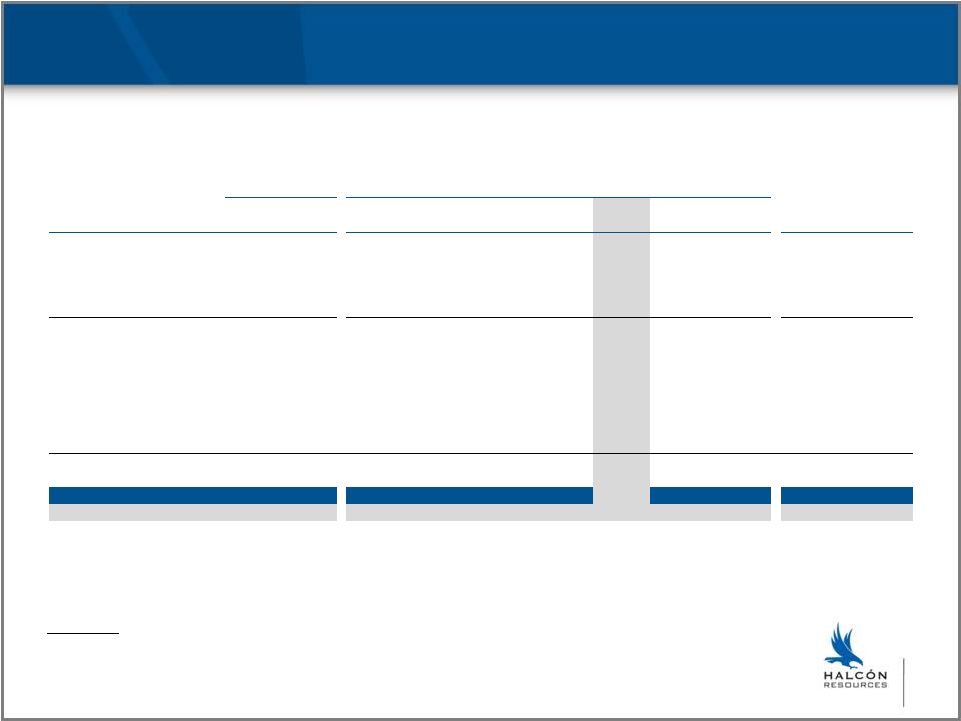

24

Woodbine Single Well Type Curve

Oil: EUR 350-450MBO

NGL: EUR 25-35MBNGL

Gas: EUR 200-300MMCF

NYSE: HK

Play:

Woodbine

Estimated Avg. Well Cost:

$5.5-$6.5 MM

Estimated EUR:

467 MBoe

Target Acreage:

150,000-250,000 acres

Est. Spud-to-Production:

60-90 days

Rig Count Estimate:

2Q12: 1 2H12: 2

Wells Planned:

2012: 10-15

Note: Internal estimates based on third party data. Company has not drilled in this

play. Individual well results will differ. EUR estimate based upon available data

and may change as more data becomes available as well as our actual results of drilling

and production. See Additional Information on page 3. |

NYSE:

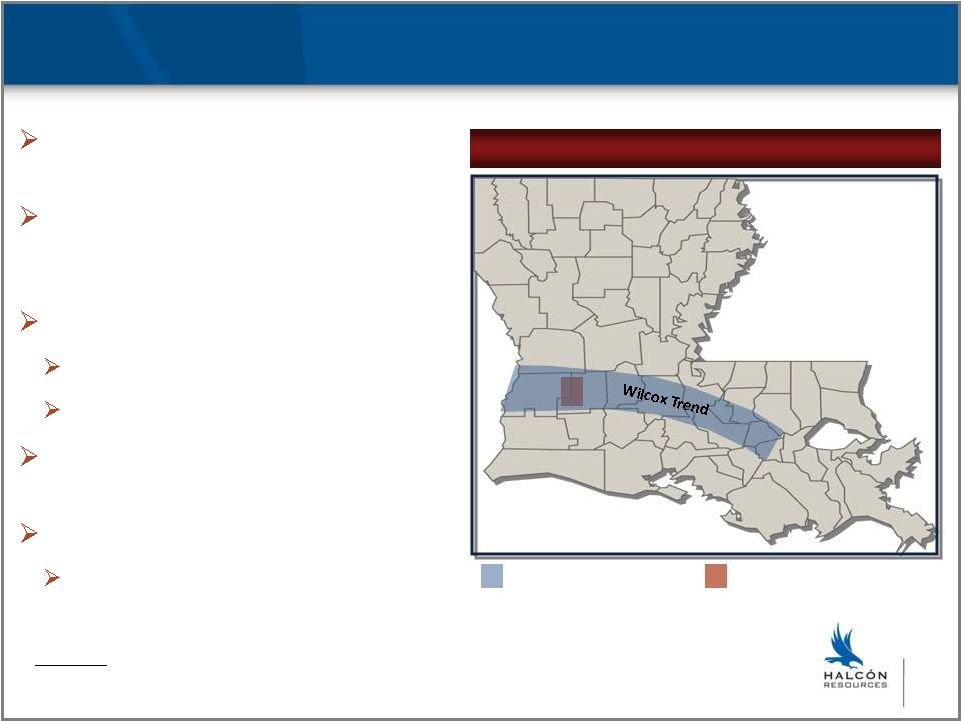

HK 25

Wilcox Overview

LA

Southwest LA Wilcox

HK 3D Shoot in Progress

Source: Industry research.

Oil-prone reservoir with significant

associated gas and NGLs

Production rate limits and

commingling restrictions removed

from Louisiana regulations

3D seismic essential to success

100 sq. mile 3D shoot in progress

36 sq. miles of existing 3D to be merged

Responsive to multi-stage hydraulic

fracturing

Premium pricing

LSS & high BTU gas

Target Acreage: 50,000 –

100,000 |

NYSE:

HK 26

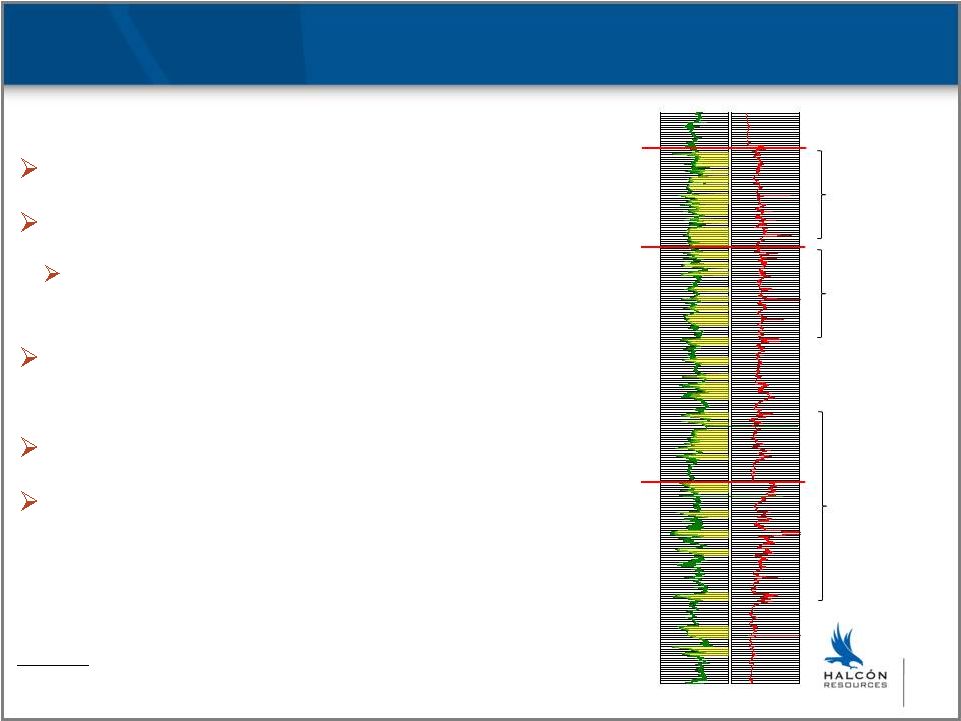

Wilcox Log Section

Source: Industry research.

Eocene age tight sandstones

Target depths range from 8,500’-15,000’

Focus -

Middle and Lower Wilcox

(11,000’-15,000’)

Structurally controlled hydrocarbon

accumulation

Vertical wells

Multi-stage fracs

Upper Wilcox

Middle Wilcox

Lower Wilcox

Bivens

N. Bivens

N. Bancroft

18.2 MMBO

6.4 BCFG

Bearhead Creek

S. Bearhead Creek

Fields

W. Gordon

7.7 MMBO

32 BCFG

Neal

Quicksand Creek

Bon Weir

29 MMBO

37 BCFG |

NYSE:

HK 27

Wilcox Single Well Type Curve

Oil: EUR 150-250MBO

NGL: EUR 100-200MBNGL

Gas: EUR 1-2BCF

Play:

Wilcox

Estimated Avg. Well Cost:

$7.5-$8.5 MM

Estimated EUR:

510

MBoe

Target Acreage:

50,000-100,000 acres

Est. Spud-to-Production:

60-90 days

Rig Count Estimate:

2Q12: 1 2H12: 1

Wells Planned:

2012: 4-6

Note: Internal estimates based on third party data. Company has not drilled in this

play. Individual well results will differ. EUR estimate based upon available data

and may change as more data becomes available as well as our actual results of drilling and

production. See Additional Information on page 3.

|

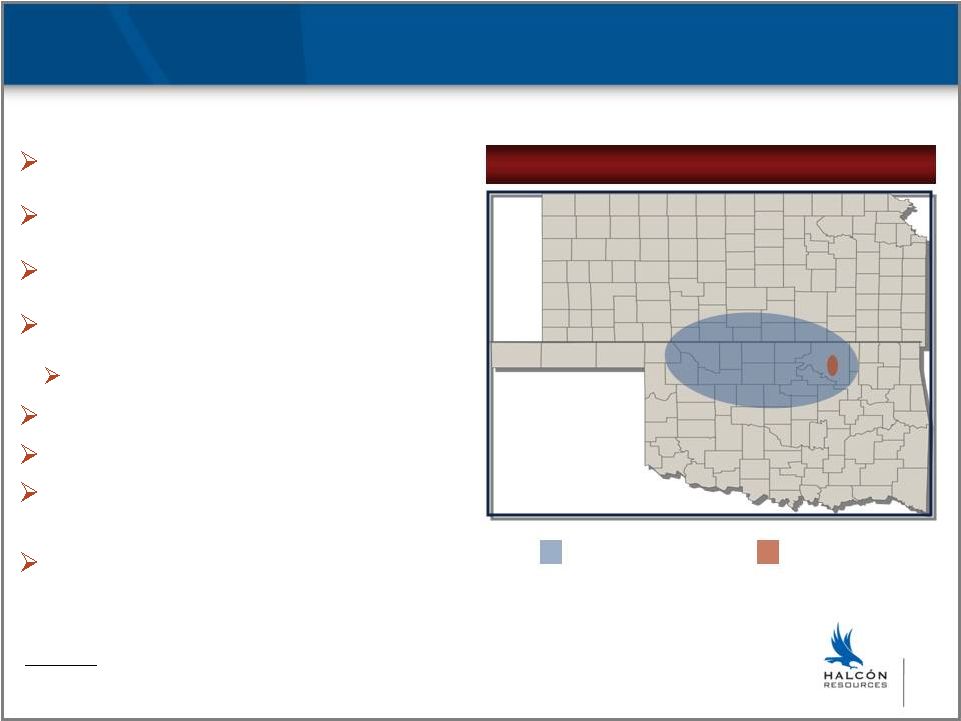

NYSE:

HK 28

Mississippian Lime Overview

KS

OK

Mississippian Lime

HK Acreage

Mississippian Lime

Target Acreage: 50,000 -

100,000

(1)

Initially developed using vertical wells

Carbonate reservoir (high permeability)

Predominately oil production

Shallow drilling depths (4,000’-

6,000’)

200’-

500’

gross thickness

Technology reinvigorating the play

Scalability and repeatability

Commercial results from offset

operators

Recent internal technical evaluation

reinforces enthusiasm for the play

Source: Industry research.

(1) HK currently holds a concession for 45,280 gross/net acres. |

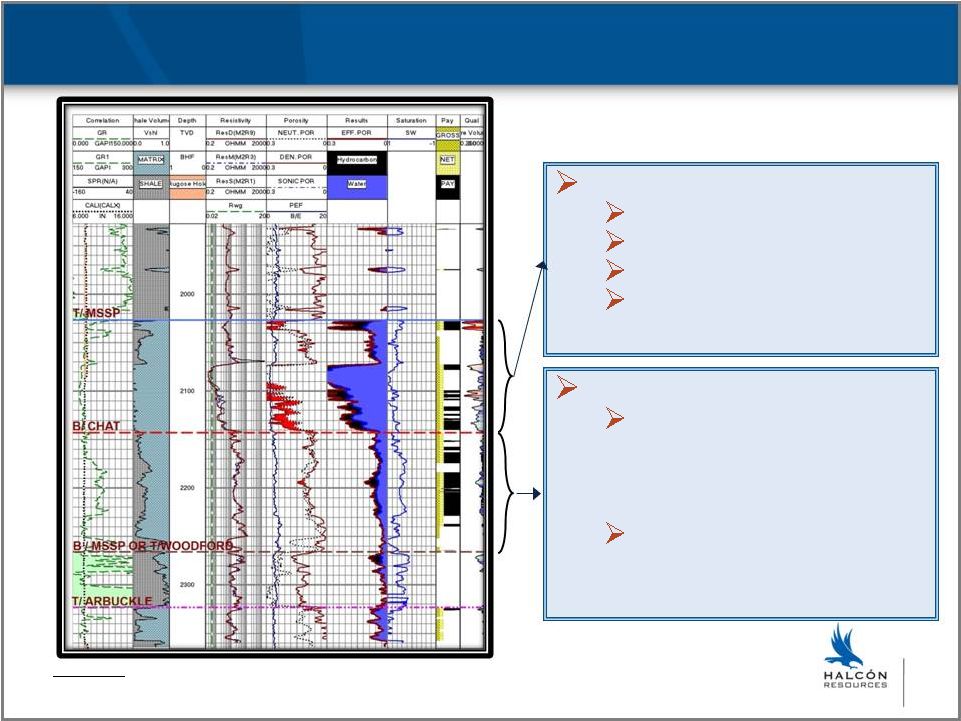

29

Mississippian Lime Log Section

Chat

High porosity (20-30%)

High permeability

Associated with karsting

High fluid volumes

Dense limestone

High porosity tripolitic chert

lenses embedded within the

low porosity/permeability

dense

Horizontal wells with multi-

stage fracs connect high

porosity lenses

Source: W.D. Von Gonten & Co.

NYSE: HK |

NYSE:

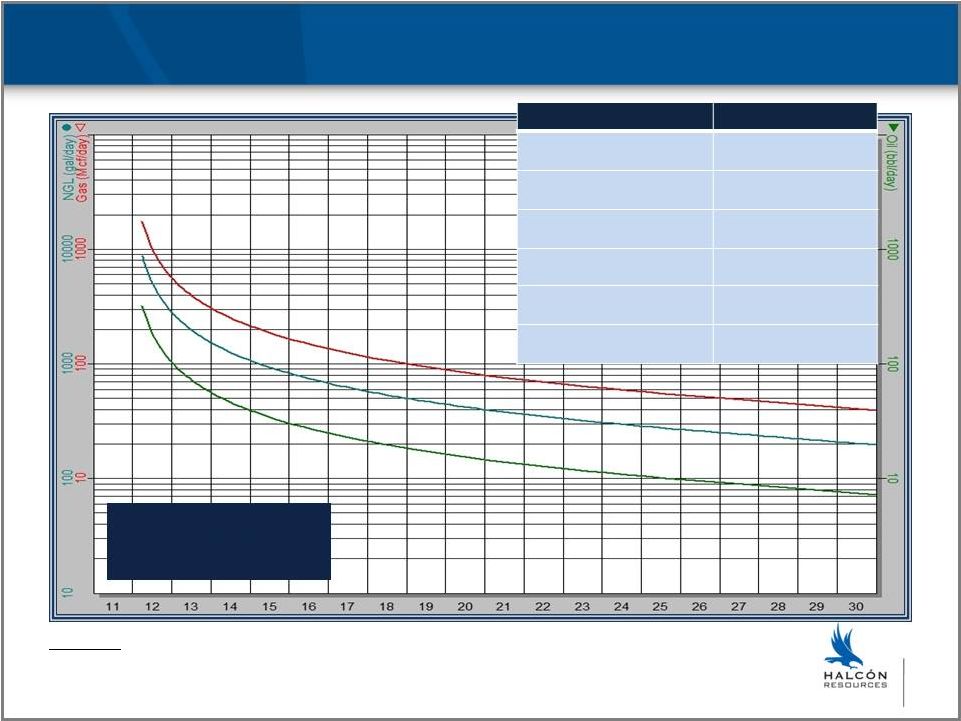

HK 30

Mississippian Lime Single Well Type Curve

Oil: EUR 100-150MBO

NGL: EUR 20-30MBNGL

Gas: EUR 300-350MMCF

Play:

Mississippian Lime

Estimated Avg. Well Cost:

$2.5-$3.5 MM

Estimated EUR

175 MBoe

Target Acreage:

50,000-100,000 acres

Est. Spud-to-Production:

60-90 days

Rig Count Estimate:

2Q12: 1 2H12: 2

Wells Planned:

2012: 8-10

Note: Internal estimates based on third party data. Company has not drilled in this

play. Individual well results will differ. EUR estimate based upon

available data and may change as more data becomes available as well as our actual results of drilling

and production. See Additional Information on page 3. |

NYSE:

HK Exploratory Liquids Rich Plays -

undisclosed

Targeting 225,000 –

375,000 acres in aggregate

Two unconventional plays (100,000 –

150,000 acres each)

One conventional play (25,000 –

75,000 acres)

Will drill in all three plays in 2012

8-12 wells

Oil and liquids-rich targets

Prospect identification driven by technical analysis and experience

Due to competitive concerns, not disclosing details at this time

31 |

NYSE:

HK Investment Highlights

Proven Management Team With Significant Ownership Stake

Proven Management Team With Significant Ownership Stake

Technical Bias With Extensive Resource Play Experience

Technical Bias With Extensive Resource Play Experience

Attractive Liquids-Rich Asset Portfolio With Compelling Economics

Attractive Liquids-Rich Asset Portfolio With Compelling Economics

Positioned For Significant Near-Term Reserve And Production Growth

Positioned For Significant Near-Term Reserve And Production Growth

Excellent Track Record For Managing Cash Margin –

Excellent Track Record For Managing Cash Margin –

The “Best Hedge”

The “Best Hedge”

Solid Balance Sheet And Liquidity To Fund Growth

Solid Balance Sheet And Liquidity To Fund Growth

32 |

NYSE:

HK “Oily”

(69% Liquids)

Strong growth profile (+25% in 2012)

Adds two established liquids rich resource plays

Austin Chalk potential

Solid production base

Immediately accretive

New HK shareholders

33

HK to Acquire GEOI |

Appendix |

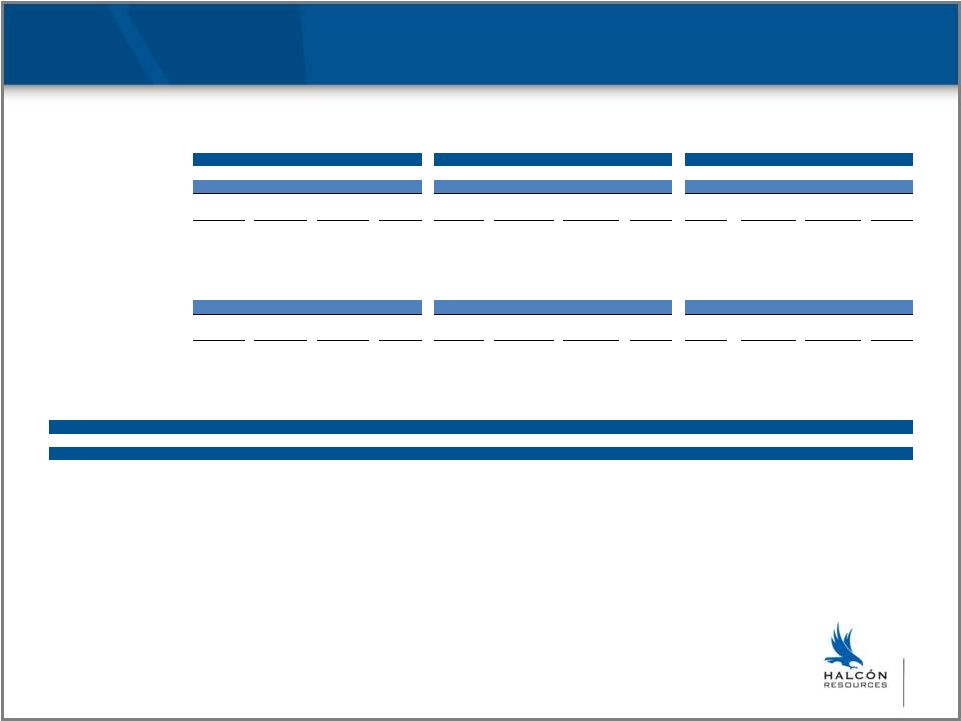

NYSE:

HK 35

Pro Forma Production and Reserves (69% Liquids)

2011 Average Net

Daily Production

Proved Reserves

(1)

Boe/d

Full Year

4Q

Oil

MBbls

Gas

MMcf

NGL

MBbls

Equiv.

Mboe

%

Oil/NGLs

% PD

% Total

Reserves

PV10

(1)

($MM)

% Total

PV10

Resource Style

Bakken

1,560

1,998

6,264

3,040

273

7,044

93%

59%

13%

$183.9

18%

Eagle Ford

106

176

890

349

69

1,017

94%

17%

2%

$16.4

2%

Austin Chalk

2,412

2,581

1,279

34,987

1,293

8,403

31%

68%

16%

$99.0

9%

4,078

4,755

8,433

38,376

1,635

16,464

61%

61%

31%

$299.3

29%

Conventional

Electra/Burkburnett

1,329

1,325

5,889

-

328

6,217

100%

65%

12%

$151.5

15%

Fitts-Allen

826

822

4,916

1,437

79

5,235

95%

74%

10%

$129.4

12%

South Texas

865

732

317

21,246

1,280

5,139

31%

42%

10%

$48.3

5%

South Lousiana

1,146

1,235

3,725

14,499

-

6,141

61%

70%

12%

$142.0

14%

Permian

322

322

1,205

2,087

44

1,597

78%

72%

3%

$46.3

4%

Other

1,793

1,879

8,166

20,852

365

12,007

71%

85%

23%

$228.0

22%

6,282

6,315

24,219

60,121

2,096

36,335

72%

71%

69%

$745.5

71%

Total

10,360

11,070

32,652

98,497

3,731

52,799

69%

68%

100%

$1,044.9

100%

% Increase vs. HK Stand-Alone

151%

171%

164%

146%

86%

151%

1%

6%

167%

(1) Estimated proved reserves and PV10 at 12.31.11 using SEC pricing including

GeoResources’ management estimates of 12.31.11 proved reserves and PV10

associated with Brookeland field acquisition using SEC pricing. Note: Production figures are pro forma to include GeoResources’ Brookeland field

acquisition; proved reserve and PV10 figures exclude approximately 1.2 MMBoe (96%

gas) of proved reserves and $11 MM of PV10 associated with GP interest in partnerships with GE. |

NYSE:

HK 36

Pro Forma Derivative Summary

*Weighted averaged price

FY 2012

FY 2013

FY 2014

OIL

OIL

OIL

Volume

(Bbls)

Ceiling /

Swap Price*

Floor

Purchased*

Floor

Sold*

Volume

(Bbls)

Ceiling / Swap

Price*

Floor

Purchased*

Floor

Sold*

Volume

(Bbls)

Ceiling /

Swap Price*

Floor

Purchased*

Floor

Sold*

Three-Way Collars

400,500

$104.89

$87.11

$70.00

251,075

$100.60

$95.18

$70.00

280,500

$99.59

$95.00

$70.00

Collars

419,300

$105.85

$84.42

350,875

$100.04

$95.00

-

-

-

-

Swaps

660,000

$98.62

-

-

360,000

$102.18

-

-

-

-

-

-

Puts

-

-

-

-

-

-

-

-

-

-

-

-

GAS

GAS

GAS

Volume

(MMBtu)

Ceiling /

Swap Price*

Floor

Purchased*

Floor

Sold*

Volume

(MMBtu)

Ceiling / Swap

Price*

Floor

Purchased*

Floor

Sold*

Volume

(MMBtu)

Ceiling /

Swap Price*

Floor

Purchased*

Floor

Sold*

Three-Way Collars

-

-

-

-

-

-

-

-

-

-

-

-

Collars

915,000

$6.00

$4.00

-

-

-

-

-

-

-

-

-

Swaps

1,720,000

$5.15

-

-

465,000

$4.18

-

-

-

-

-

-

Puts

609,700

-

$4.35

-

-

-

-

-

-

-

-

-

Total (Boe)

1,918,967

1,039,450

280,500

Total (Boe/d)

5,243

2,848

768 |

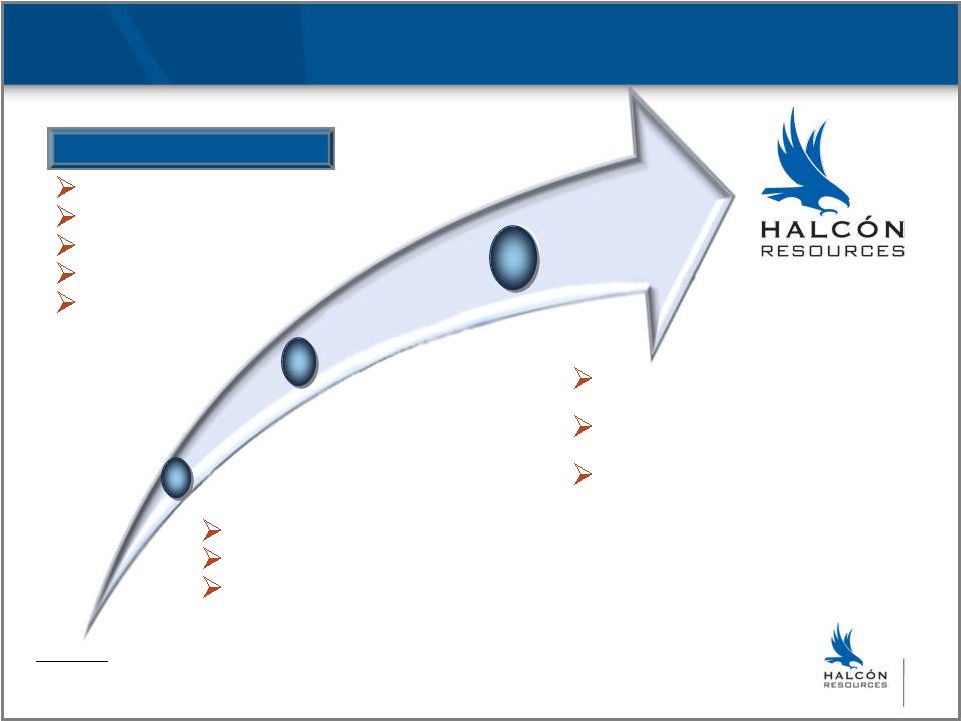

NYSE: HK

$550 Million Recap

(1)

Halcón/RAM Transaction Summary

37

Ticker change to HK

(effective 2.9.12)

Reverse stock split (1:3)

(effective 2.10.12)

New credit facility with

undrawn borrowing base of

$225 million

$275 million common equity

$275 million convertible note

36.7 million warrants

Why RAM Energy Resources?

Solid platform

Concentrated ownership

Oil levered

Simple balance sheet

Attractive valuation

New Senior

Management

and Board

Stock Listing

Modifications

(1) Common equity issued at $3.75 per share; convertible note yields 8% with a 5 year term and

is convertible at $4.50 per share after February 8, 2014; warrants exercisable at

$4.50 per share; Investor group partnering with Halcón management includes EnCap Investments L.P.,

Liberty Energy Holdings LLC, and Mansefeldt Investment Corp.

|

Contact:

Scott

Zuehlke,

Director

of

Investor

Relations

1000 Louisiana St., Suite 6700, Houston, TX 77002

832-538-0314

szuehlke@halconresources.com

www.halconresources.com |