Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ASSOCIATED BANC-CORP | d337398d8k.htm |

| EX-99.1 - EX-99.1 - ASSOCIATED BANC-CORP | d337398dex991.htm |

EXHIBIT 99.2

Associated Banc-Corp 1Q 2012 Earnings Presentation April 19, 20129

Forward-Looking Statements

Important note regarding forward-looking statements:

Statements made in this presentation which are not purely historical are forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. This includes any statements regarding management’s plans, objectives, or goals for future operations, products or services, and forecasts of its revenues, earnings, or other measures of performance. Forward-looking statements are based on current management expectations and, by their nature, are subject to risks and uncertainties. These statements may be identified by the use of words such as “believe”, “expect”, “anticipate”, “plan”, “estimate”, “should”, “will”, “intend”, “outlook”, or similar expressions. Outcomes related to such statements are subject to numerous risk factors and uncertainties including those listed in the company’s most recent Form 10-K and any subsequent Form10-Q.

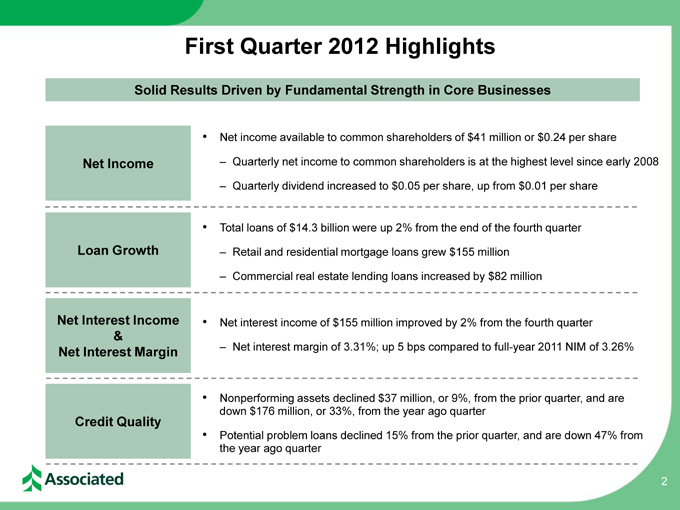

First Quarter 2012 Highlights

Net income available to common shareholders of $41 million or $0.24 per share

–Quarterly net income to common shareholders is at the highest level since early 2008

–Quarterly dividend increased to $0.05 per share, up from $0.01 per share

2 Solid Results Driven by Fundamental Strength in Core Businesses Net Income Loan Growth Net Interest Income & Net Interest Margin

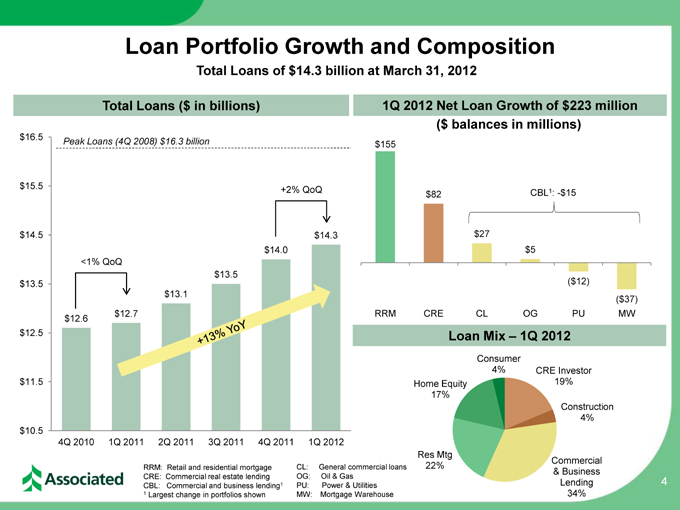

Total loans of $14.3 billion were up 2% from the end of the fourth quarter

–Retail and residential mortgage loans grew $155 million

–Commercial real estate lending loans increased by $82 million

Net interest income of $155 million improved by 2% from the fourth quarter

–Net interest margin of 3.31%; up 5 bps compared to full-year 2011 NIM of 3.26%

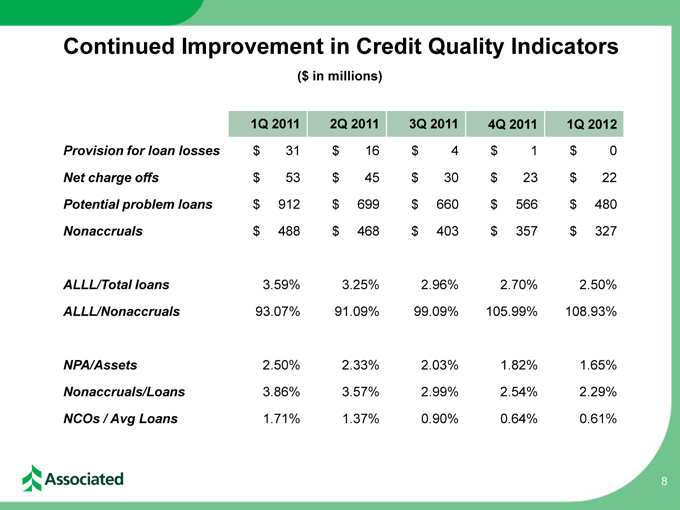

Credit Quality

Nonperforming assets declined $37 million, or 9%, from the prior quarter, and are down $176 million, or 33%, from the year ago quarter

Potential problem loans declined 15% from the prior quarter, and are down 47% from the year ago quarter

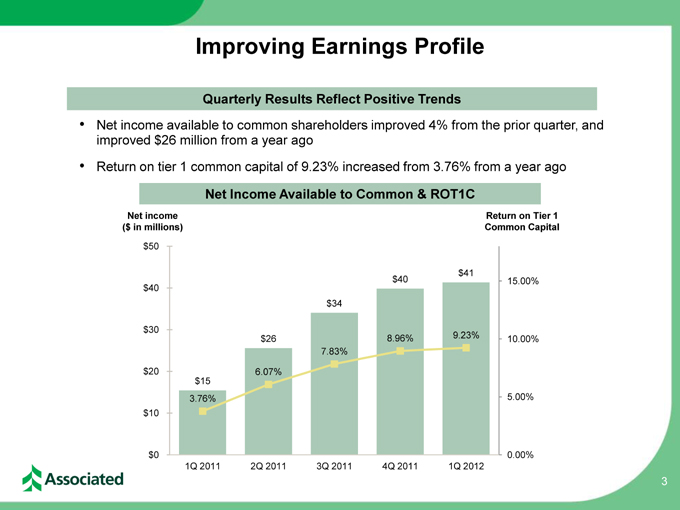

Improving Earnings Profile 3 Quarterly Results Reflect Positive Trends

Net income available to common shareholders improved 4% from the prior quarter, and improved $26 million from a year ago

Return on tier 1 common capital of 9.23% increased from 3.76% from a year ago

$15 $26 $34 $40 $41 3.76% 6.07% 7.83%

8.96% 9.23% 0.00% 5.00% 10.00% 15.00% $0

$10 $20 $30 $40 $50 1Q 2011 2Q 2011 3Q 2011 4Q 2011

1Q 2012 Net Income Available to Common & ROT1C Net income ($ in millions) Return on Tier 1 Common Capital

$155 $82 $27 $5 ($12) ($37) RRM CRE CL OG PU MW $12.6 $12.7 $13.1

$13.5 $14.0 $14.3 $10.5 $11.5 $12.5 $13.5

$14.5 $15.5 $16.5 4Q 2010 1Q 2011 2Q 2011 3Q 2011 4Q 2011 1Q 2012

Loan Portfolio Growth and Composition 4 Total Loans of $14.3 billion at March 31, 2012 1Q 2012 Net Loan Growth of $223 million Total Loans ($ in billions) + 2% QoQ

Peak Loans (4Q 2008) $16.3 billion Loan Mix – 1Q 2012 CRE Investor 19%

Construction 4% Commercial & Business Lending 34% Res Mtg 22% Home Equity 17% Consumer 4% <1% QoQ ($ balances in millions) RRM: Retail and residential mortgage CRE: Commercial real estate lending CBL: Commercial and business lending1 1 Largest change in portfolios shown CL: General commercial loans OG: Oil & Gas PU: Power & Utilities MW: Mortgage Warehouse CBL1: -$15

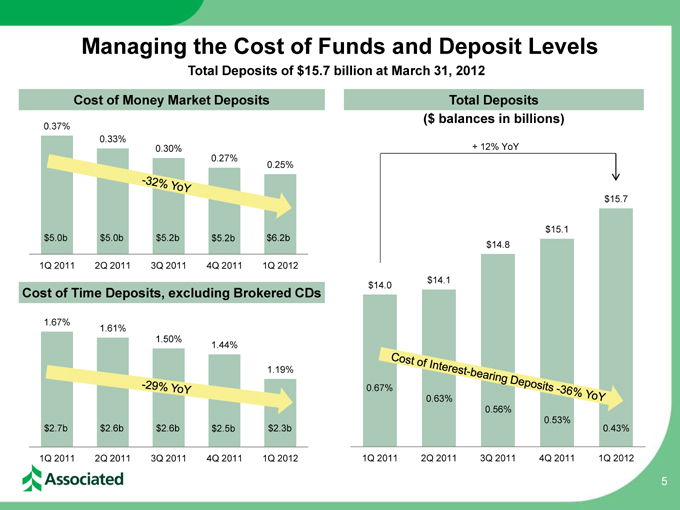

1.67% 1.61% 1.50% 1.44% 1.19% 1Q 2011 2Q 2011 3Q 2011 4Q 2011 1Q 2012 0.37% 0.33% 0.30% 0.27% 0.25%

1Q 2011 2Q 2011 3Q 2011 4Q 2011 1Q 2012

$14.0 $14.1 $14.8 $15.1 $15.7 1Q 2011

2Q 2011 3Q 2011 4Q 2011 1Q 2012 Managing the Cost of Funds and Deposit Levels 5 Cost of Money Market Deposits Cost of Time Deposits, excluding Brokered CDs

$6 .2 b $5.0b $5.0b $5.2b Total Deposits ($ balances in billions)

$5.2b $2.3b $2.7b $2.6b $2.6b $2.5b Total Deposits of $15.7 billion at March 31, 2012 + 12% YoY 0.43% 0.67%

0.63% 0.56% 0.53%

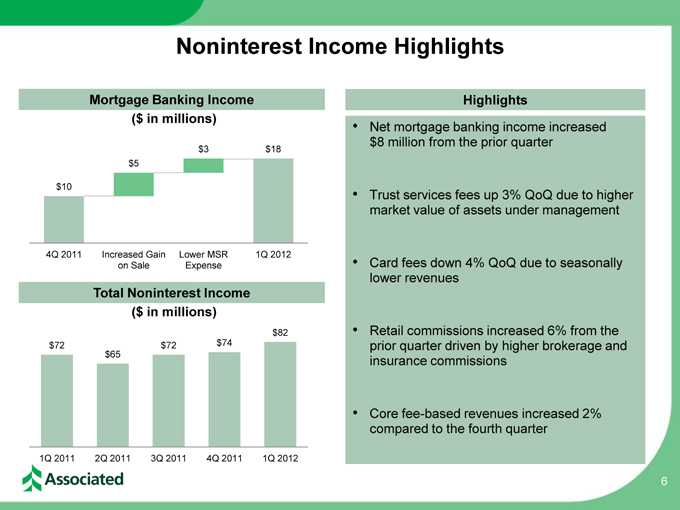

Noninterest Income Highlights 6

Net mortgage banking income increased $8 million from the prior quarter

Trust services fees up 3% QoQ due to higher market value of assets under management

Card fees down 4% QoQ due to seasonally lower revenues

Retail commissions increased 6% from the prior quarter driven by higher brokerage and insurance commissions

Core fee-based revenues increased 2% compared to the fourth quarter

Highlights ($ in millions) ($ in millions)

$72 $65 $72 $74 $82 1Q 2011

2Q 2011 3Q 2011 4Q 2011 1Q 2012 Total Noninterest Income Mortgage Banking Income

$10 $5 $3 $18 4Q 2011 Increased Gain on Sale

Lower MSR Expense 1Q 2012

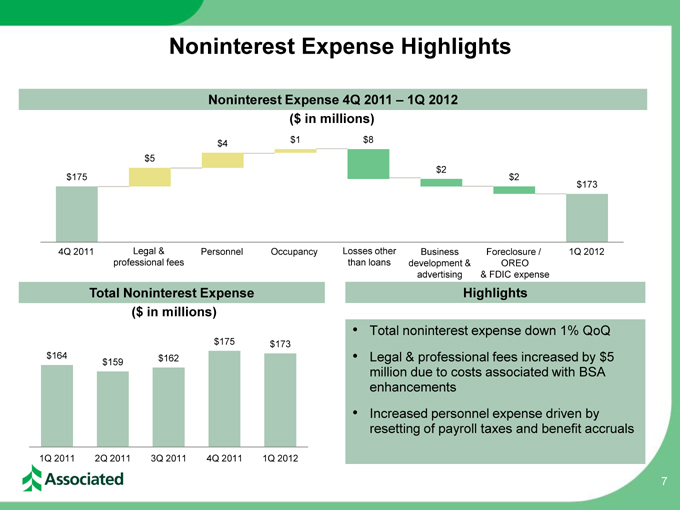

$175 $5 $4 $1 $8 $2 $2 $173 Noninterest Expense Highlights 7

Total noninterest expense down 1% QoQ

Legal & professional fees increased by $5 million due to costs associated with BSA enhancements

Increased personnel expense driven by resetting of payroll taxes and benefit accruals

Highlights ($ in millions) ($ in millions) $164 $159 $162 $175 $173 1Q 2011 2Q 2011 3Q 2011

4Q 2011 1Q 2012 Total Noninterest Expense Noninterest Expense 4Q 2011 – 1Q 2012 Personnel Occupancy

Losses other

than loans Business development & advertising Foreclosure / OREO & FDIC expense 1Q 2012 Legal & professional fees 4Q 2011

1Q 2011

2Q 2011

3Q 2011

4Q 2011

1Q 2012

Provision for loan losses

$ 31

$ 16

$ 4

$ 1

$ 0

Net charge offs

$ 53

$ 45

$ 30

$ 23

$ 22

Potential problem loans

$ 912

$ 699

$ 660

$ 566

$ 480

Nonaccruals

$ 488

$ 468

$ 403

$ 357

$ 327

ALLL/Total loans

3.59%

3.25%

2.96%

2.70%

2.50%

ALLL/Nonaccruals

93.07%

91.09%

99.09%

105.99%

108.93%

NPA/Assets

2.50%

2.33%

2.03%

1.82%

1.65%

Nonaccruals/Loans

3.86%

3.57%

2.99%

2.54%

2.29%

NCOs / Avg Loans

1.71%

1.37%

0.90%

0.64%

0.61%

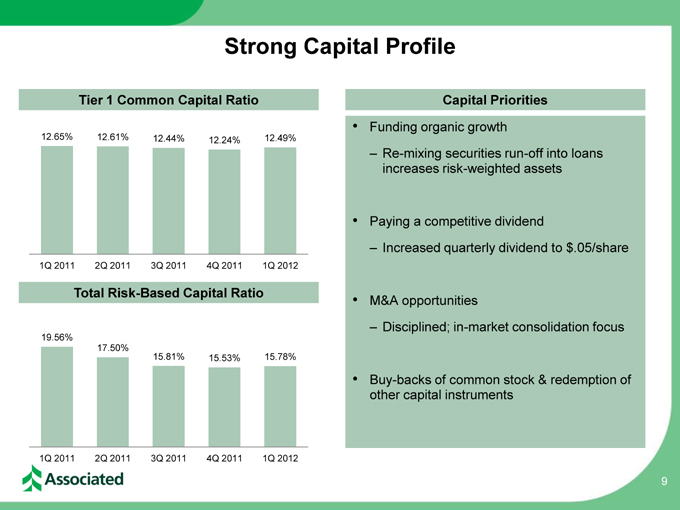

Strong Capital Profile

Funding organic growth

–Re-mixing securities run-off into loans increases risk-weighted assets

Paying a competitive dividend

–Increased quarterly dividend to $.05/share

M&A opportunities

–Disciplined; in-market consolidation focus

Buy-backs of common stock & redemption of other capital instruments

9 19.56% 17.50% 15.81% 15.53% 15.78% 1Q 2011 2Q 2011 3Q 2011 4Q 2011 1Q 2012 12.65% 12.61% 12.44%

12.24% 12.49% 1Q 2011 2Q 2011 3Q 2011 4Q 2011 1Q 2012 Tier 1 Common Capital Ratio Total Risk-Based Capital Ratio Capital Priorities

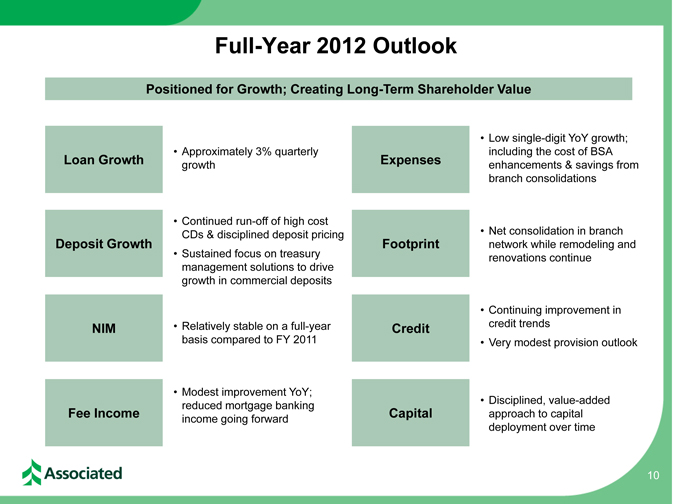

Full-Year 2012 Outlook 10

Positioned for Growth; Creating Long-Term Shareholder Value

Loan Growth

Approximately 3% quarterly growth

Deposit Growth

Continued run-off of high cost CDs & disciplined deposit pricing

Sustained focus on treasury management solutions to drive growth in commercial deposits

NIM

Relatively stable on a full-year basis compared to FY 2011

Fee Income

Modest improvement YoY; reduced mortgage banking income going forward

Expenses

Low single-digit YoY growth; including the cost of BSA enhancements & savings from branch consolidations

Footprint

Net consolidation in branch network while remodeling and renovations continue

Credit

Continuing improvement in credit trends

Very modest provision outlook

Capital

Disciplined, value-added approach to capital deployment over time