Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DTS, INC. | a2208913z8-k.htm |

| EX-2.2 - EX-2.2 - DTS, INC. | a2208913zex-2_2.htm |

| EX-2.1 - EX-2.1 - DTS, INC. | a2208913zex-2_1.htm |

| EX-99.1 - EX-99.1 - DTS, INC. | a2208913zex-99_1.htm |

| EX-99.3 - EX-99.3 - DTS, INC. | a2208913zex-99_3.htm |

| EX-99.4 - EX-99.4 - DTS, INC. | a2208913zex-99_4.htm |

|

|

1 DTS, INC. TO ACQUIRE SRS LABS, INC. Accelerates Growth in Rapidly Growing Mobile and Other Network-Connected Markets 04/2012 |

|

|

FORWARD-LOOKING STATEMENTS This document contains forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. These forward-looking statements, which are based on current expectations, estimates and projections about the industry and markets in which DTS and SRS Labs operate and beliefs of and assumptions made by DTS, SRS Labs and their respective management teams, involve uncertainties that could significantly affect the financial results of DTS or SRS Labs or the combined company. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words and similar expressions are intended to identify such forward-looking statements, which generally are not historical in nature. Such forward-looking statements include, but are not limited to, statements about the benefits of the transaction involving DTS and SRS Labs, including future financial and operating results, the combined company’s plans, objectives, expectations and intentions. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future – including statements relating to creating value for stockholders, integrating our companies, and the expected timetable for completing the proposed transaction – are forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Although we believe the expectations reflected in any forward-looking statements are based on reasonable assumptions, we can give no assurance that our expectations will be attained and therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. For example, these forward-looking statements could be affected by factors including, without limitation: • the ability of the parties to satisfy conditions to the closing of the transaction, including obtaining required regulatory approvals and the approval of SRS Labs stockholders; • the possibility that SRS Labs or DTS may be adversely affected by economic, business and/or competitive factors before or after closing of the transaction; • the ability to successfully complete the integration of acquired businesses, including the businesses being acquired from SRS Labs by, among other things, realizing revenue, expense and other synergies, renewing contracts on competitive terms, successfully leveraging the information technology platform of the acquired business, and retaining key personnel; and • any adverse effect to DTS’ business or the business being acquired from SRS Labs due to uncertainty relating to the transaction. This list of important factors is not intended to be exhaustive. Additional risks and factors are discussed in reports filed with the Securities and Exchange Commission (“SEC”) by DTS and SRS Labs from time to time, including those discussed under the heading “Risk Factors” in their respective most recently filed reports on Form 10-K and 10-Q. Neither DTS nor SRS Labs assume any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. |

|

|

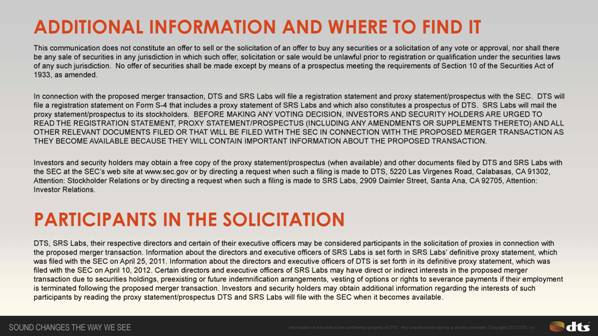

ADDITIONAL INFORMATION AND WHERE TO FIND IT This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. In connection with the proposed merger transaction, DTS and SRS Labs will file a registration statement and proxy statement/prospectus with the SEC. DTS will file a registration statement on Form S-4 that includes a proxy statement of SRS Labs and which also constitutes a prospectus of DTS. SRS Labs will mail the proxy statement/prospectus to its stockholders. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER TRANSACTION AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain a free copy of the proxy statement/prospectus (when available) and other documents filed by DTS and SRS Labs with the SEC at the SEC’s web site at www.sec.gov or by directing a request when such a filing is made to DTS, 5220 Las Virgenes Road, Calabasas, CA 91302, Attention: Stockholder Relations or by directing a request when such a filing is made to SRS Labs, 2909 Daimler Street, Santa Ana, CA 92705, Attention: Investor Relations. DTS, SRS Labs, their respective directors and certain of their executive officers may be considered participants in the solicitation of proxies in connection with the proposed merger transaction. Information about the directors and executive officers of SRS Labs is set forth in SRS Labs’ definitive proxy statement, which was filed with the SEC on April 25, 2011. Information about the directors and executive officers of DTS is set forth in its definitive proxy statement, which was filed with the SEC on April 10, 2012. Certain directors and executive officers of SRS Labs may have direct or indirect interests in the proposed merger transaction due to securities holdings, preexisting or future indemnification arrangements, vesting of options or rights to severance payments if their employment is terminated following the proposed merger transaction. Investors and security holders may obtain additional information regarding the interests of such participants by reading the proxy statement/prospectus DTS and SRS Labs will file with the SEC when it becomes available. PARTICIPANTS IN THE SOLICITATION |

|

|

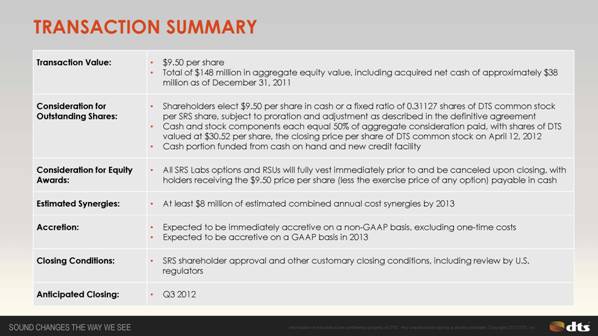

Transaction Value: $9.50 per share Total of $148 million in aggregate equity value, including acquired net cash of approximately $38 million as of December 31, 2011 Consideration for Outstanding Shares: Shareholders elect $9.50 per share in cash or a fixed ratio of 0.31127 shares of DTS common stock per SRS share, subject to proration and adjustment as described in the definitive agreement Cash and stock components each equal 50% of aggregate consideration paid, with shares of DTS valued at $30.52 per share, the closing price per share of DTS common stock on April 12, 2012 Cash portion funded from cash on hand and new credit facility Consideration for Equity Awards: All SRS Labs options and RSUs will fully vest immediately prior to and be canceled upon closing, with holders receiving the $9.50 price per share (less the exercise price of any option) payable in cash Estimated Synergies: At least $8 million of estimated combined annual cost synergies by 2013 Accretion: Expected to be immediately accretive on a non-GAAP basis, excluding one-time costs Expected to be accretive on a GAAP basis in 2013 Closing Conditions: SRS shareholder approval and other customary closing conditions, including review by U.S. regulators Anticipated Closing: Q3 2012 TRANSACTION SUMMARY |

|

|

COMPELLING STRATEGIC AND FINANCIAL ACQUISITION Combines highly complementary product portfolios – DTS’ suite of audio solutions and SRS’ range of audio processing technologies – to extend DTS’ position as a leading audio solutions provider Accelerates DTS’ strategy to provide customers with a best-in-class, comprehensive, integrated suite of audio solutions Fast-tracks DTS’ expansion in the key growth areas of mobile and other network-connected device markets Expands DTS’ already sizeable portfolio of audio-related intellectual property and its footprint with key licensees Enhances DTS’ ability to service its global customer base Expected to provide scale benefits as well as operating, customer and licensing cost efficiencies |

|

|

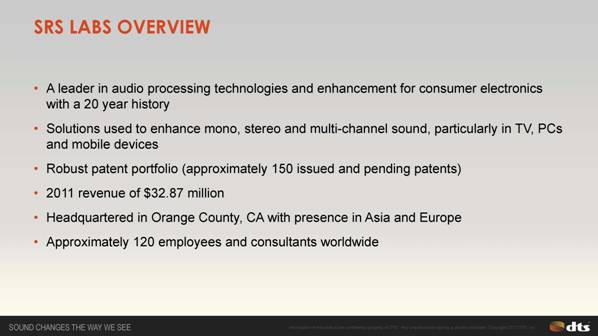

SRS LABS OVERVIEW A leader in audio processing technologies and enhancement for consumer electronics with a 20 year history Solutions used to enhance mono, stereo and multi-channel sound, particularly in TV, PCs and mobile devices Robust patent portfolio (approximately 150 issued and pending patents) 2011 revenue of $32.87 million Headquartered in Orange County, CA with presence in Asia and Europe Approximately 120 employees and consultants worldwide |

|

|

HIGH BIT RATE LOW BIT RATE CODECS Broadcast PRE-PROCESSING POST-PROCESSING AUDIO PROCESSING Mobile Computer Car Home BEST-IN-CLASS COMPREHENSIVE AUDIO SOLUTIONS THE BEST SOUND ON ANY DEVICE, ANYWHERE |

|

|

ACCELERATES MOBILE AND NETWORK-CONNECTED STRATEGY Proliferation of digital content driving increasing demand for high quality sound on a full range of devices Network-connected market expected to grow to as many as 2 billion units sold annually by 2016 SRS’ footprint and technologies will accelerate DTS’ strategy for expansion in rapidly growing network-connected markets: Mobile devices Network-connected TVs PCs |

|

|

ANTICIPATED CUSTOMER SYNERGIES SRS brings strong relationships with a number of key customers Enhances DTS’ well-diversified, global base of customers Accelerates DTS’ delivery of compelling end-to-end audio solutions to a broad base of customers Extends DTS’ ability to provide world class on-the-ground support and service – best-in-class provider |

|

|

EXPANDS FOOTPRINT INTO GLOBAL BASE OF CUSTOMERS |

|

|

FINANCIALLY COMPELLING Transaction expected to be immediately accretive on a non-GAAP basis, excluding one-time costs Transaction expected to be accretive on a GAAP basis in 2013, supported by at least $8 million in estimated annual combined cost synergies Transaction structure designed to ensure DTS maintains a strong balance sheet with relatively low debt Expect to have meaningful cash balance post-transaction DTS expects to resume share repurchase program after acquisition and initial integration |

|

|

MEDIA & INVESTOR CONTACTS SARD VERBINNEN & CO FOR DTS, INC. John Christiansen Andrew Cole jchristiansen@sardverb.com acole@sardverb.com (415) 618-8750 (212) 687-8080 |

|

|

THANK YOU DTS, the Symbol, DTS and the Symbol together, and DTS-HD are registered trademarks of DTS, Inc. Blu-ray and Blu-ray Disc are trademarks of the Blu-ray Disc Association. All other trademarks are the properties of their respective owners. |