Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - DTS, INC. | Financial_Report.xls |

| EX-23.2 - EX-23.2 - DTS, INC. | a2223535zex-23_2.htm |

| EX-23.1 - EX-23.1 - DTS, INC. | a2223535zex-23_1.htm |

| EX-31.1 - EX-31.1 - DTS, INC. | a2223535zex-31_1.htm |

| EX-21.1 - EX-21.1 - DTS, INC. | a2223535zex-21_1.htm |

| EX-32.1 - EX-32.1 - DTS, INC. | a2223535zex-32_1.htm |

| EX-31.2 - EX-31.2 - DTS, INC. | a2223535zex-31_2.htm |

| EX-32.2 - EX-32.2 - DTS, INC. | a2223535zex-32_2.htm |

| EX-10.37 - EX-10.37 - DTS, INC. | a2223535zex-10_37.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

Item 8. Financial Statements and Supplementary Data

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2014 |

||

OR |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission File Number 000-50335

DTS, Inc.

(Exact name of Registrant as specified in its charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

77-0467655 (I.R.S. Employer Identification Number) |

|

5220 Las Virgenes Road Calabasas, California 91302 (Address, including zip code, of Registrant's principal executive offices) |

||

Registrant's telephone number, including area code: (818) 436-1000

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| Common Stock, $0.0001 par value | NASDAQ Stock Market LLC |

Securities

registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, as of June 30, 2014 was approximately $243,917,109 (based upon the closing price of shares of the registrant's Common Stock as reported on the NASDAQ Global Select Market for that date). Shares of Common Stock held by each officer and director have been excluded as such persons may be deemed affiliates. The determination of "affiliate" status for purposes of this report on Form 10-K shall not be deemed a determination as to whether an individual is an "affiliate" of the registrant for any other purposes.

As of March 5, 2015, 17,458,154 shares of common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's Definitive Proxy Statement to be filed with the Commission pursuant to Regulation 14A in connection with the registrant's 2015 Annual Meeting of Stockholders, to be filed subsequent to the date hereof within 120 days of the registrant's fiscal year ended December 31, 2014, are incorporated by reference into Part III of this Report, to the extent not set forth herein.

DTS, INC.

FORM 10-K

For the Fiscal Year Ended December 31, 2014

INDEX

This Annual Report on Form 10-K (including, but not limited to, the section titled "Management's Discussion and Analysis of Financial Condition and Results of Operations") and the documents incorporated herein by reference contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended ("Exchange Act"). Words such as "believes," "anticipates," "estimates," "expects," "intends," "projections," "may," "can," "will," "should," "potential," "plans," "continues" and similar expressions are intended to identify those assertions as forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this report. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements, including, but not limited to, statements regarding our future financial performance or position, future economic conditions, our business strategy, plans or expectations, our future effective tax rates, and our objectives for future operations, including relating to our products and services. Although forward-looking statements in this report reflect our good faith judgment, such statements are based on facts and factors currently known by us. We caution readers that forward-looking statements are not guarantees of future performance and our actual results and outcomes may be materially different from those expressed or implied by the forward-looking statements. Important factors that could cause or contribute to such differences in results and outcomes include, without limitation, those discussed under the "Risk Factors" section contained in Part I, Item 1A below in this Annual Report on Form 10-K and in other documents we file with the Securities and Exchange Commission ("SEC"). Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. We undertake no obligation to revise or update these forward-looking statements to reflect future events or circumstances, unless otherwise required by law.

References to "we," "us" and "our" refer to DTS, Inc. and its consolidated subsidiaries.

COMPANY OVERVIEW

We are a premier audio technology solutions provider for high-definition entertainment experiences. Our mission is to make the world sound better—anytime, anywhere, on any device. Our audio solutions are designed to enable recording, delivery and playback of simple, personalized, and immersive high-definition audio and are incorporated by hundreds of licensee customers around the world into an array of consumer electronics devices, including televisions (TVs), personal computers (PCs), smartphones, tablets, digital media players (DMPs), set-top-boxes, soundbars, wireless speakers, video game consoles, Blu-ray Disc players, automotive audio systems, audio/video receivers (AVRs), DVD-based products, and home theater systems.

Sound, long known to be a powerful driver of people's emotional connection with content such as movies, music and games, is emerging as an important product differentiator for a rapidly growing range of consumer electronics devices, especially mobile, small screen devices, as consumers are using these devices to watch and listen to more entertainment than ever before. After years of focus on video quality and usability features, industry professionals and consumers alike are realizing that sound is the next frontier in the technical advancement of the high-definition entertainment experience. Simply put, sound changes the way we see.

We believe that we have industry leading end-to-end audio solutions designed to enhance the entertainment experience for users of consumer electronics devices, particularly those subject to the physical limitations of smaller speakers, such as TVs, PCs and mobile devices. Additionally, we provide products and services to motion picture studios, radio and TV broadcasters, game developers and other

1

content creators to facilitate the inclusion of compelling, realistic DTS-encoded audio within their content.

We are dedicated to making the world sound better, one device at a time, because sound matters. Our goal is to be an essential ingredient in engaging, dynamic and realistic entertainment experiences by incorporating our technology into every connected device that plays or delivers high-definition entertainment.

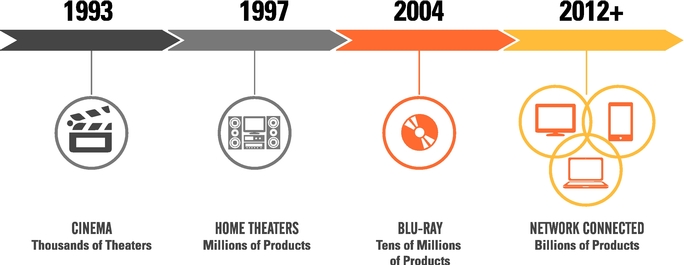

As a premier audio solutions provider to the entertainment industry, our history of innovation has spanned more than 20 years across multiple markets, with the total available market size increasing over time, as shown below:

In the Cinema. We were founded in 1990 and received a key strategic investment in 1993 from a variety of investors, including Universal City Studios, Inc. The first DTS audio soundtrack was created for the release of Steven Spielberg's Jurassic Park in 1993. From this initial release, we established a technical and marketing platform for the development of entertainment technology solutions for the motion picture, home theater, and other consumer markets.

In Home Theaters. In 1996, we launched our technology licensing business, in which we license our technology to consumer electronics manufacturers.

On Blu-ray. We believe the significant growth of our technology licensing business and our position as the quality leader in home theater products led to us attaining a mandatory position in the Blu-ray standard in 2004, which in turn led us to exit our cinema business in 2008. We believe our mandatory position in the Blu-ray standard remains important for our business, as it firmly establishes us as the premier audio solutions provider for high-definition entertainment on optical disc based media.

On Connected Devices. Cloud-based entertainment delivery is growing very rapidly. As content providers and consumer electronics manufacturers seek to deliver a premium audio experience for digital entertainment, we believe this segment will drive the majority of our growth for many years to come. Over the past couple of years, we have significantly broadened our market reach with new customers in the network-connected markets as the trend toward network-connected devices and commercial digital download and streaming of content continues to gain momentum. We are partnering with a growing number of cloud-based content providers to supply consumers with clear, compelling high-definition sound, despite the bandwidth limitations of online and cellular networks and the physical limitations of devices with smaller speakers.

2

To date, we have entered into licensing agreements with substantially all of the world's major consumer electronics manufacturers. We also license our technology to substantially all relevant integrated circuit (IC) manufacturers. As a result, our technology, trademarks, copyrights and know-how have been incorporated into billions of consumer electronics products worldwide.

INDUSTRY BACKGROUND

Over the past 20 years, the entertainment industry has evolved to take advantage of many technical trends and innovations, including the transition from analog to digital content, growth in broadband speed and subscriber base, an increase in the types of devices supporting content playback, and the transition from physical media to network delivery via streaming and downloading. The mobilization of content consumption allows for entertainment on the go—anytime, anywhere, on any device.

Shift to Network and Cloud-Based Content

Movie, music and other content was historically purchased and consumed primarily via optical disc based media, such as Blu-ray Disc, DVD, and CD. Beginning in 2004, as consumers' demand for high-definition entertainment grew, Blu-ray emerged as the newest form of optical disc based media. Given our mandatory position in this standard, Blu-ray Disc players, including stand-alone players and game consoles, continue to contribute meaningfully to our revenues.

With the growth of PC and mobile usage over the last decade, the shift to network and cloud-based content acquisition continues to occur, including the trend toward full movie and music downloading and streaming services. Furthermore, in this age of convenience, devices are becoming thinner, smaller and more portable than previous models, but as a result, sound quality is commonly sacrificed due to physical limitations. While the smaller, sleeker forms of these devices meet the demand for style or portability, consumers still believe that sound matters, and they demand a higher quality audio experience from these sophisticated devices. A recent 2014 "State of Play" report by CSR (the "2014 CSR Report") shows that a resounding 82% of consumers describe sound quality as critical when selecting a product, and 70% of consumers are prepared to pay more for better sound quality.

In addition, consumer demand for multi-screen playback of content is increasing. As the network connected space continues to expand, consumers now more than ever expect to purchase content once and be able to enjoy such content on all of their devices.

From our success in Blu-ray, we are recognized as a premier audio solutions provider for high-definition entertainment, and as cloud-based service providers look to expand and differentiate their media offerings to multi-screen platforms, such as tablets and smartphones, we are in the unique position to help them deliver high-quality content and new entertainment experiences to consumers across multiple devices.

Wireless Audio Playback

As a result of increased connectivity, portability, and the growing popularity of streaming music services, wireless speakers and multi-room audio products are experiencing rapid growth and are forecasted to continue on this trend for years to come. Wireless audio devices use common wireless audio networking technologies, such as those available under the trademarks Bluetooth, Wi-Fi, Airplay and DLNA, for the wireless streaming of music from audio enabled devices to wireless output systems. With wireless transmissions that can now match the sound quality of direct wire connections, wireless speakers are gaining popularity with consumers. According to the 2014 CSR Report, 68% of respondents would like to see speakers in every room of their home, and two thirds of respondents said it would frustrate them if they couldn't easily link up their smartphone, PC or TV to their home audio system or speakers.

3

Object-Based Audio

The industry is in the early stages of shifting away from purely channel-based audio (stereo, 5.1, 7.1, etc.) to object-based audio, also referred to as "3D audio" or "immersive audio". Development of object-based audio begins at the time of creation of an audio mix where the artist no longer specifies what mix of sounds comes from each speaker, but tells the system where, in space, each sound should come from regardless of speaker positions. When this object-audio is played back, it is rendered in space based on the speakers available in the playback environment resulting in a more accurate and consistent spatial representation. Object-based audio can be used in conjunction with channel-based audio content to produce immersive sound experiences. We believe this area provides a tremendous opportunity to sustain and extend our current codec licensing business, while providing opportunities for new business as our solutions in this space offer a true next-generation, immersive audio experience.

In summary, the proliferation of connected devices, cloud-based content, and the trend towards next-generation audio creates significant opportunities for the deployment of our solutions to deliver high-definition entertainment.

DTS VALUE DRIVERS

To achieve our goal of making the world sound better, our business focus is on several key value drivers, which include:

- •

- Developing and bringing to market a strong pipeline of innovative audio technology solutions

- •

- Driving the proliferation of DTS encoded content

- •

- Actively participating in standards relevant to the audio industry

- •

- Investing in and broadening the IC footprint that supports the inclusion of our technologies

- •

- Elevating the DTS brand among consumers

Innovative Audio Technology Solutions

End-to-End Audio Solutions

At DTS, we combine various technologies and capabilities into what we call "solutions," each designed to address the needs of a particular product, market, or consumer use case and tuned for optimum performance by our technical teams. Our portfolio of advanced audio solutions addresses a broad spectrum of product applications within the markets that we have targeted. Our solutions typically combine several technologies, frequently including both codec and audio processing capabilities, to deliver a comprehensive, easy to deploy package for the enhancement of a product's audio performance. Through the combination of leading edge audio codecs and an unsurpassed portfolio of audio processing technologies, coupled with our device tuning "know how," we are uniquely positioned to fulfill our vision of making the world sound better.

We have a complete range of end-to-end audio solutions—from ingest, through distribution and onto playback—and we continue to expand our offerings through ongoing research and development, targeted acquisitions, and strategic partnerships with IC and consumer electronics manufacturers, content creators and providers, and others within the digital media ecosystem.

4

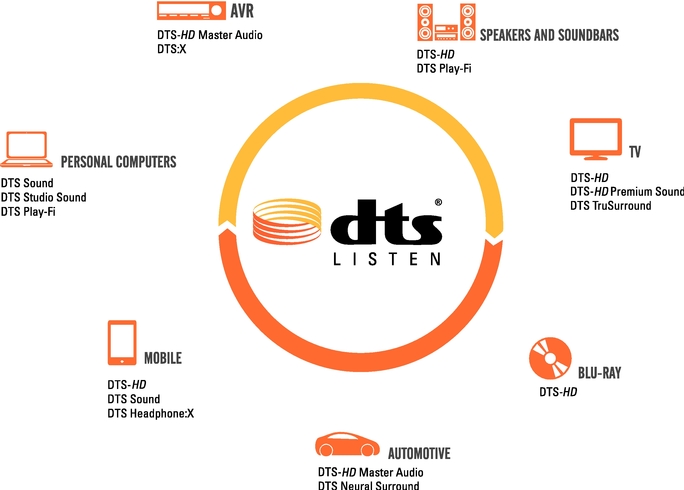

Our solution offerings are tailored specifically for each market. Examples of the range of technologies available for certain markets include:

| DTS-HD® is our core surround sound audio decoder offering high quality audio output for streaming disc and cloud based content. | ||

|

DTS-HD Master Audio™ is our advanced surround sound decoder that utilizes variable bit-rate technology to deliver ultimate audio quality while conserving file size and bandwidth, allowing for an uncompromised audio experience. |

|

|

DTS Sound™ is a tailored, entry level suite of components from both our spatial processing and loudness and dynamics portfolio of technologies that provides a value audio enhancement offering to our customers. |

|

|

DTS Studio Sound™ is our premium audio processing offering that includes a number of our latest sound processing features. Our customers can use this suite to create the ultimate in sound quality. |

5

|

DTS-HD Premium Sound™ couples our DTS Sound or DTS Studio Sound offerings with our DTS-HD surround sound decoder to provide best in class solutions to the consumer electronics industry and consumers. | |

|

DTS TruSurround® is an audio processing technology delivering surround sound over multi-channel configurations, offering rich bass, dialog clarity and high frequency definition. |

|

|

DTS Neural Surround™ offers seamless conversion between stereo and surround sound audio, enabling stereo and surround audio to be presented in a consistent, rich surround environment. |

|

|

DTS Headphone:X™ includes our integrated surround headphone technology and DTS-HD surround sound decoder, coupled with user-driven, headphone specific tuning and personalization features for output over headphones and earbuds. |

|

|

DTS Play-Fi® allows the synchronized streaming of music directly from a mobile device or PC over a standard Wi-Fi network to anywhere in the home. Play-Fi is currently available for mobile devices that utilize the Android, Kindle Fire or iOS operating systems, as well as the Windows PC platform. |

|

|

DTS:X™ is our state of the art object-based audio format designed for bringing enhanced realism through more accurate spatial rendering, height audio elements, and customizations that adapt to any speaker layout. |

DTS Headphone:X—Surround Sound Now Available on the Go

The rapid growth in usage of smartphones, tablets, portable computers and gaming devices for entertainment consumption has led to significant growth in the use of headphones and earbuds by consumers. The introduction of DTS Headphone:X in 2013 raised the bar for immersive, realistic high-definition audio in the headphones space, as it allows mobile devices to turn an ordinary pair of headphones or earbuds into an impressive personal surround sound system capable of delivering immersive sound where listeners can accurately hear sounds in a multidimensional space. Sound comes from above, below, beside and in front of listeners when content and technologies are enabled with DTS Headphone:X.

6

DTS Headphone:X technology externalizes sound, so instead of the listener hearing the sound "inside their heads," as is typical for traditional headphone listening, they perceive it as coming from speakers located some distance around them. In addition to delivering immersive listening, DTS Headphone:X also improves stereo listening. Moreover, this experience can be achieved through one's favorite pair of headphones or earbuds, as the technology is typically embedded in the playback device rather than in the headphones or earbuds themselves.

We all hear differently and our ears have different physical characteristics that affect how we experience content. DTS Headphone:X provides consumers with a way to personalize their listening experience and enables them to simply create and store a personal "sonic profile," which then enhances the playback of all content on the device according to the personalized preferences. This, in turn, creates a truly unique and unparalleled listening experience. Similarly, product manufacturers can use this customization capability to create a unique, signature sound for their products.

Simply put, DTS Headphone:X dramatically improves the mobile entertainment experience.

DTS Play-Fi—Hi-Fi over Wi-Fi

Our Play-Fi solution targets the booming wireless audio space. Our wireless streaming technology allows Wi-Fi enabled sources, such as PCs, smartphones, and tablets, to stream to Play-Fi enabled products, such as speakers, soundbars, TVs, and home theater systems.

Importantly, DTS Play-Fi enables the synchronized streaming of music across multiple speakers directly from a smartphone, tablet, PC or other Play-Fi enabled device over a standard Wi-Fi network to anywhere the Wi-Fi reaches. Play-Fi leverages Wi-Fi's extensive range and capacity to stream audio with bit-for-bit accuracy for a higher quality audio experience. This solution allows the consumer to play music uninterrupted without the various alerts that plague Bluetooth audio playback, while still being able to use the mobile device for calls, text messages, internet, etc. In addition, Play-Fi provides seamless multi-room, multi-zone audio synchronization, again utilizing standard Wi-Fi capabilities that

7

are built into most mobile devices and an increasing number of homes. With two or more Play-Fi enabled-speakers in a home, a consumer has the option to play different content in different rooms or the same content throughout the house.

Currently, Play-Fi is available for mobile devices that utilize the Android, Kindle Fire or iOS operating systems and is also available for the Windows PC platform. Additionally, this solution is licensed to customers in the PC market and will expand into the Home AV and Mobile markets. Play-Fi enabled speakers and receivers are available online and at select retailers through the Phorus, Wren, Polk and Definitive Technology brands. More recently, the ecosystem has been further expanded with the announcement of support from additional leading consumer electronics brands, including McIntosh, Sonus Faber, Wadia, MartinLogan, Paradigm and Anthem.

Combined, Headphone:X and Play-Fi are designed to make a uniquely compelling use case for the modern connected lifestyle. Historically, making the connection between mobile and whole-home entertainment has been challenging, due to physical connections, wires, and less-than-ideal point-to-point streaming that has limited consumer enjoyment and expectations for what the home audio experience should be. Today's consumers frequently listen to their favorite music and music services on mobile devices through their favorite pair of headphones or earbuds, and when they get home, they typically want to remove the headphones or earbuds and listen to their music out loud. With our Headphone:X and Play-Fi technologies, consumers can walk into their house, disconnect their headphones or earbuds, and seamlessly send their audio entertainment throughout the home wirelessly over their existing Wi-Fi network. We believe this is how consumers want to enjoy their entertainment today, and our technologies represent unique, integrated solutions capable of providing this end-to-end capability.

DTS:X—Object-Based Audio

Looking beyond today's channel-based audio paradigm is DTS:X, our first open, object-based audio format designed for consumer delivery. The DTS:X audio decoder enables soundbar, home theater system and AVR manufacturers to bring the advanced features of object-based audio to the consumer market, and gives content creators a new approach for the creation of ever more compelling soundtracks.

Object-based audio brings enhanced realism through more accurate spatial rendering, height audio elements and customizations that adapt to any speaker layout. In addition to rendering object-based audio content, DTS:X supports complete compatibility for playback of DTS channel based content, providing the best audio experience from any content encoded in DTS audio.

The benefits of DTS:X include:

- •

- Environmentally compensated audio rendering allows consumers to hear audio directionality and dimensionality with more precision than

ever before.

- •

- Object control enables consumers to interact with key objects within the audio mix and adjust them to their preference.

- •

- Customized rendering designed for arbitrary speaker layouts enables consumers to adapt their AV system to their own home environment, rather than have to use pre-determined speaker layouts as is the case with competing offerings.

In summary, we have a complete range of advanced audio solutions, including leading edge audio codecs, audio processing technologies, industry leading wireless speaker playback technology, and forward-thinking object-based audio. Our advanced audio solutions are specifically engineered to meet the unique needs of the markets we support, and we believe that our unsurpassed, industry-leading portfolio of solutions uniquely positions us to drive meaningful growth going forward.

8

Intellectual Property

We have developed and maintain a sizeable library of copyrighted technologies and other technical materials, both printed and digitized, as well as numerous trade secrets. We also have many individual patent families resulting in hundreds of individual patents and patent applications throughout the world.

As a provider of high-definition audio technologies to markets worldwide, we believe it is extremely important to protect our technology through the use of copyrights, trademarks, patents, and trade secrets in many countries. We have targeted our intellectual property coverage to provide protection in the major manufacturing and commercial markets of the world.

Our audio solutions are embodied in the form of proprietary technology to which we retain the copyrights. Accordingly, copyrights are an important component of our intellectual property.

Our trademarks consist of many individual word marks, logos and slogans registered and in use throughout the world. The marks cover our various products, technologies, improvements and features as well as the services that we provide. Our trademarks are an integral part of our licensing program and, generally, are required to be used on licensed products to identify the source of the technology in the device, to provide greater consumer awareness and to advance the sales of the licensed products bearing the trademarks. In addition to over one hundred trademark registrations, we also have numerous trademark applications pending worldwide, with additional marks in the pre-application phase.

It is our general practice to file patent applications for our technology in the US and various foreign countries where our customers manufacture, distribute or sell licensed products. We actively pursue new applications to expand our patent portfolio to address new technological innovations. Most of the patents in our patent portfolio have an average life of 20 years from their date of filing. A number of our patents have expiration dates ranging from 2015 to 2032. We have multiple patents covering unique aspects and improvements for many of our technologies. We do not believe that the expiration of any single patent is likely to significantly affect our intellectual property position or our ability to generate licensing revenues.

Presence in Content

The proliferation of connected devices that can support streaming and downloadable content has made presence within the digital ecosystem increasingly important, as the availability of DTS-enabled content drives consumer demand for electronics that support DTS technologies. We have implemented focused efforts in this area with various content partners to help drive the expansion of our presence across the digital ecosystem.

Content Delivery Ecosystem

Adding advanced audio technologies to an existing or new content delivery system requires multifaceted back-end integrations across numerous technology partners. Unlike the optical disc based media distribution business, where only a few parties are involved in the replication and distribution of a disc, the digital content delivery ecosystem can be vast—involving dozens of interrelationships to get entertainment content from the creator to the ultimate consumer. We have spent years developing relationships throughout the ecosystem, and we believe we are now well positioned with relevant industry partners to make DTS-encoded, high-definition content more readily available.

With the increasing popularity of network-connectivity, the fundamental structure of the content ecosystem has now changed to focus not only on accessibility and ease-of-use, but also on higher quality audio and video. This change significantly expands the market for digital media format technologies, such as those provided by DTS.

9

Connected devices with varying content delivery requirements necessitate production tools capable of delivering high volumes of digital content files in multiple formats. We have spent several years bolstering our production tools, which include multiplexers, transcoders and automated quality control tools.

All major North American motion picture studios use the DTS-HD Master Audio Suite, a production tool that has allowed DTS to secure the primary audio tracks on the majority of Blu-ray Disc titles. As content delivery has moved beyond optical disc based media, consumers of production tools now include online services and broadcast facilities. We have provided our digital sound encoding tools to many of the leading home video and music content providers and professional audio facilities, enabling them to create high-definition DTS-enabled content. To date, thousands of Blu-ray Disc and DVD titles have been produced with DTS high-definition audio tracks. According to Nielsen, over 90% of the top 100 Blu-ray titles sold in 2014, including nine out of the top ten movies, were encoded with DTS-HD Master Audio.

Additionally, our recent acquisition of Manzanita Systems was another strategic step to acquire the necessary talent, tools offerings, and know-how in the tools space for us to more rapidly deploy new technologies into the market, broaden our customer support capabilities and accelerate DTS-encoded content creation and support of playback on devices within the network-connected market.

As the transition to digital content delivery accelerates, we continue to pursue strategic partnerships with top streaming technology companies to integrate DTS technologies into content and to be available on as many connected devices as possible, thereby enabling growth in our licensing opportunities. To date, our premium audio technologies have been integrated into thousands of titles, and we are actively pursuing other partnerships to expand the integration of our premium audio technologies into streaming content, including CinemaNow, M-GO, Starz, Encore and Paramount Pictures. This integration of our technology gives major studios, content creators, and retailers turn-key access to digitally distributed content with unparalleled audio quality.

Standards Participation

There are a variety of governmental and industry-related organizations that are responsible for adopting system and product standards. Standards are important in many technology-focused industries as they help to ensure compatibility of technologies across a system or series of products. Generally, standards adoption occurs on either a mandatory basis, requiring the existence of a particular technology or feature, or an optional basis, meaning that a particular technology or feature may be, but is not required to be, utilized.

We believe the market for audio and audio/video products is very standards driven and our active participation with standards organizations is important as we work to include our technology in standards or change our status from optional to mandatory, where possible. We believe our standards involvement also provides us early visibility into future opportunities.

Governmental standards are often operated by non-governmental organizations in cooperation with regional regulatory bodies. These organizations adopt standards by validating and publishing industry standards that are appropriate for various regions and technical requirements. The standards of this nature that we participate in include European Technical Standards Institute (ETSI) which is an affiliated European Standards Organization under the European Union, International Electrotechnical Commission (IEC), and the Moving Pictures Expert Group (MPEG) which is a joint working group under the IEC and International Organization for Standardization (ISO).

The majority of standards we actively participate in are produced by industry-related organizations. These bodies adopt standards based on industry evaluations and discussions across affected constituencies finalizing with consensus voting as to the best solution around which to standardize.

10

More recently, we have joined the Secure Content Storage Association (SCSA), a group of companies working to create storage and transfer solutions for high-definition and premium copyright-protected content on hard drives, flash memory products and solid state drives. SCSA's mission is to increase market opportunities for content owners, content distributors and high-end device manufacturers by delivering a secure solution that allows consumers to enjoy the highest-quality entertainment content across multiple devices.

Some standards bodies are now "open standards" that require all technologies included in the standard be included on non-proprietary and intellectual-property "free" technology platforms in which no company maintains ownership over the dominant technologies. We are actively engaging these bodies to determine how we may participate and the potential impact on our business model and future go-to-market strategies.

Currently, we are actively participating in over 20 standards, including Digital Entertainment Content Ecosystem (DECE), Advanced Television Systems Committee (ATSC) and High-Definition Multimedia Interface (HDMI), amongst others. We anticipate being involved in a number of other standards organizations as appropriate to facilitate the deployment of our technology.

IC Footprint

Traditionally, our technology has resided on an IC chip. We license a defined limited set of rights to incorporate our technology into these IC chips, and the IC manufacturers sell these DTS-enabled chips to our consumer electronics products manufacturer licensees. As such, maintaining a large footprint with the IC manufacturers is critical to drive growth.

Over the past several years, DTS has been working closely with the world's leading IC manufacturers to enable DTS technologies to support the new programmable architectures that fuel innovation and flexibility in today's consumer electronics products. Our partners specialize in key vertical markets and work closely with us to enable our latest technologies for these programmable parts. Together we offer these solutions to DTS licensees. Recently, DTS has gone a step further to develop both decoder and audio processing solutions for ARM-based processors, allowing our partners to quickly integrate DTS technology into their ARM-based processors targeted at popular, high-level operating systems such as Android and iOS, potentially saving their customers months of porting effort and thus providing rapid time-to-market solutions.

We have devoted significant time and resources to develop a broad range of solutions with key partners in certain markets, including Qualcomm, Mediatek, Mstar, Intel, Realtek, Cirrus Logic, Analog Devices, Cadence, Amlogic, and many others.

DTS Branding

Our marketing drives awareness and understanding of the DTS brands and solutions among listeners and customers by creating marketing, advertising, and communications programs that demonstrate the superior sound DTS enables. We envision a DTS-powered future where every sound experience is exciting, engaging, and effortless—in all entertainment, across all devices.

The foundation of our marketing strategy is to increase awareness and understanding of DTS solutions among listeners who highly value experience. When we connect with these influential listeners and demonstrate the sound DTS delivers, our brands become a catalyst for expanding the use of our existing technologies in new markets and in successfully penetrating existing markets with new technologies.

Our marketing campaigns, taken as a whole, aim to establish DTS as the "magic audio ingredient" across all devices—delivering the highest quality sound, unbound from barriers. In 2014, DTS Headphone:X campaigns showed listeners how Headphone:X can create a personalized, immersive

11

experience for their favorite music. We also collaborated with our customers to successfully launch several DTS Play-Fi enabled speaker brands and platforms, in the process demonstrating that awareness drives action and that listeners desire wireless choice and superior quality for their home audio systems. Finally, we continued our compelling innovation with DTS:X—showing off the immersiveness, flexibility, and interactive capabilities of our next-generation codec.

We believe that investments in building the DTS brands, the continued dominance of DTS as the preferred audio format for Blu-ray Disc content, and our further expansion into network-connected devices will result in the proliferation of the DTS brands into expanding categories of consumer electronics, and in turn, grow consumer awareness of and desire for DTS as "the magic audio ingredient."

We remain focused on accelerating these key value drivers as we advance our position in offering high-definition audio experiences, anytime, anywhere, on any device.

KEY MARKETS AND STRATEGIES

Network-Connected Markets

The network-connected markets category has become the largest area of our business and includes consumer electronics devices that are network-capable, including TVs, smartphones, tablets, wireless speakers, and PCs. Our strategy continues to center around further penetrating the various network-connected markets.

TVs

One of our strongest positions in the network-connected space is in the connected TV market. Our key strategy in the connected TV market is joining forces with leading consumer electronics manufacturers like Samsung, LG, Sony, Toshiba, and Vizio, allowing us to play a more significant role in the connected home entertainment market and further ensuring consumer access to high-quality audio when enjoying entertainment content at home. In 2014, we announced a worldwide strategic alliance with LG Electronics to incorporate DTS premium audio technology in LG's complete lineup of home entertainment products, including connected 4K TVs. We have partnerships with nearly every TV manufacturer worldwide, including all of the top 15 brands, and our DTS codec is incorporated into all of the top 10 TV original equipment manufacturers (OEMs).

Mobile

The mobile electronics market is currently, and expected to be for the foreseeable future, the largest single consumer electronics device market in the world in terms of unit volume, and we are currently focused primarily on the high- to mid-tier smartphone and tablet sub-segments of the mobile market.

In years past, mobile product manufacturers had only a few entertainment services to offer their customers over known and predictable networks. However, the explosion of media services, network topographies and device capabilities has caused the range of audio technologies needed by our partners to increase, and we have helped to simplify their businesses by offering simple, scalable solutions to meet their needs.

As smartphones continue to evolve into more feature-rich and sophisticated devices, consumers are seeking similar sound quality that they are accustomed to from their home theater or automobile. We believe that sound matters across all of these platforms; for example, with the integration of DTS Sound and DTS StudioSound into a smartphone, customers can experience uncompromising sound at their fingertips, redefining the quality of the experience. Moreover, with our more recent DTS Headphone:X technology, consumers can receive this same high-quality sound even when using their

12

favorite pair of headphones or earbuds on their mobile devices. Importantly, mobile product manufacturers are beginning to realize that sound, and thus our audio solutions, can be a powerful differentiator for their products.

Today's consumers increasingly expect high-quality sound in all of their electronics. Partnering with key manufacturers, such as Huawei, Sharp, Acer, ZTE and vivo, as well as mobile service providers, such as Nextreaming and Saffron Digital, allows us the opportunity to improve the mobile audio experience through our audio solutions. Notable accomplishments in 2014 within the mobile market include:

- •

- expanding our relationship with Huawei to include DTS Sound within select Huawei smartphone models, starting with the X1 and M1 models

in the MediaPad product line; and

- •

- the integration of DTS-HD into ZTE's new nubia branded smartphones, to decode high-definition audio for videos, music, gaming or streaming content.

As the use of headphones and earbuds and the demand for immersive high-definition audio continues to grow, we have expanded the reach of our Headphone:X technology by:

- •

- incorporating the technology into headphone designs from G-Star Industrial Co. Ltd., a leading global original design

manufacturer (ODM) of headsets and headphones for the PC and gaming industries;

- •

- working with castLabs to integrate the first in-app SDK integration of DTS Headphone:X in the castLabs media player for iOS and

Android;

- •

- teaming up with artists such as Soundgarden and Florida Georgia Line to release new albums specifically mixed in Headphone:X; and

- •

- collaborating with Above Technologies and Deepak Chopra to produce an app allowing users to experience meditative poetry featuring Headphone:X technology over any set of headphones.

We are continuing to pursue relationships to further expand the presence of our Headphone:X technologies in the mobile space.

Wireless Speakers

In the wireless speaker market, over the past year, we have seen significant growth in the adoption of our Play-Fi technology in speaker products. We continue to maintain a Play-Fi Certified ODM Program, which includes many leading audio manufacturers such as Amtran Technology, Anam Electronics, Eastech Electronics Inc., Fenda Technology Co., Ltd., Hansong Technology, LiteOn Technology Corporation, Meiloon Industrial Co. Ltd., Solidex Audio Corporation, Tymphany Corporation, Wistron Corporation, and Zylux Acoustic Corp. Additionally, we have expanded the presence of our Play-Fi technology by:

- •

- collaborating with Aerix to bring DTS Play-Fi technology to its brand of Wi-Fi speakers in the growing European whole-home audio

market;

- •

- working with leading music subscription services, such as Pandora, Songza and SiriusXM, to integrate subscription services into our

Play-Fi app;

- •

- developing a next-generation Phorus PS5 speaker, which features an elegant new design, renowned DTS sound, and is the only speaker in

its class that includes both dual band Wi-Fi streaming and premium Bluetooth options in one affordable, great-sounding, wireless audio speaker; and

- •

- expanding the Play-Fi ecosystem to include support from additional leading consumer electronics brands, including McIntosh, Sonus Faber, Wadia, MartinLogan, Paradigm and Anthem, in

13

addition to existing partnerships with Wren and Sound United's Polk and Definitive Technology products.

We will continue to work with current and new partners to grow the Play-Fi ecosystem.

PCs

The PC market, composed of notebooks, ultrabooks, laptops, desktops, and all-in-one PCs is large, with laptops and notebooks leading the way. Consumers continue to use PCs as multi-media hubs, including Blu-ray Disc drives for high-definition playback. Additionally, with our DTS encoder, consumers can encode their own content into the DTS format and enjoy playback on DTS enabled devices.

The PC market, like the smartphone and tablet markets, is facing shrinking device sizes and decreasing margins. As a result, the market is increasingly turning to audio processing to augment device capabilities. At the same time, the demands of consumers for PCs with improved audio for applications such as movies, music and games continues to rise, creating an increasing demand for advanced audio technologies. We address these demands with solutions tailored to meet both the high and low ends of an OEM's product lines. With DTS Sound and DTS StudioSound, we are meeting the needs of major OEMs, such as HP, LG, Toshiba, and ASUS.

As PC manufacturers continue to adopt our solutions across various platforms ranging from motherboards to all-in-ones (AIOs), and from notebooks to ultrabooks, there are growing opportunities for us to help these manufacturers differentiate and improve audio experiences on their thinner, smaller and lighter platforms which are in demand by today's consumers.

As devices in the network-connected markets play a more versatile role in the household, consumers are becoming increasingly aware that sound matters. The integration of our solutions into a growing number of TVs, mobile devices, wireless speakers, and PCs further reinforces our prominence in providing manufacturers a means to deliver an immersive, realistic sound experience regardless of the platform.

Base Markets

The base of our business is rooted in certain mature markets, including Blu-ray, Home AV, and Automotive. While these markets do not present the same scale of potential growth as the network-connected markets, they continue to generate a meaningful and relatively stable foundation of revenue, profitability and cash flow.

The Blu-ray market includes standalone players, gaming devices and disc drives included in PCs. As a mandated technology in the Blu-ray standard, our codec is in every product that incorporates a Blu-ray optical disc drive. As such, Blu-ray remains an important contributor to our revenues, most recently driven by the success of the latest gaming cycle launched by Sony and Microsoft. Almost all newly manufactured Blu-ray Disc players are now network-enabled, and a number of models are 3D-capable. We believe our dominant position on Blu-ray Disc content establishes us as the premier audio format for high-definition entertainment and is expected to drive future growth as the industry transitions to 4K video and network-based high-definition content delivery.

The Home AV market includes AVRs, soundbars, DVD players and other home theater equipment. With DVD on the decline, our focus in this market is on the rapidly growing soundbar category. The Home AV market continues to represent an important revenue base, and it continues to present opportunities for growth for our high-definition sound technologies, including our new DTS:X technology. Manufacturers representing nearly 90% of the home AVR and surround processor market, including Anthem, Denon, Integra, Krell, Marantz, McIntosh, Onkyo, Outlaw Audio, Pioneer, Steinway

14

Lyngdorf, Theta Digital, Trinnov Audio, and Yamaha, have already embraced the new technology and have agreed to launch products supporting DTS:X in 2015.

The Automotive market is comprised of infotainment systems, which may include network connectivity. As the trend toward network connectivity transitions into the automotive market, there is opportunity for us to benefit from the increase in demand for our solutions beyond optical disc based infotainment systems. The growing prevalence of using mobile consumer electronics for hosting personal music and movie libraries has prompted automobile manufacturers to enhance their vehicles by allowing mobile devices to interact with automotive infotainment systems. Our strategy in the automotive market is to collaborate with automobile manufacturers and their audio systems suppliers to use and incorporate our audio solutions at the factory level. We partner with key automobile manufacturers such as Acura, Audi, BMW, Cadillac, GM, Honda, Hyundai, Jaguar Land Rover, Lincoln and Mercedes, to incorporate our audio solutions into certain models.

LICENSING TO CUSTOMERS

We have two licensing teams, one headquartered in Ireland and one in California, that market our technology directly to consumer electronics product manufacturers and to IC manufacturers. We also have customer-focused employees located in the US, Europe, China, Japan, South Korea, Taiwan and Singapore. We believe that locating staff near the leading consumer electronics and IC manufacturers is essential to providing the level of customer support necessary in today's rapidly evolving global marketplace.

For the vast majority of our business, we license our technology to consumer electronics product manufacturers primarily through a two-step process:

- •

- IC Manufacturers. First, we license to a substantial

number of major IC manufacturers a limited/restricted set of rights to incorporate our technology in their chips, and to sell these chips supporting DTS technology to our consumer electronics products

manufacturer licensees.

- •

- Consumer Electronics Product Manufacturers. Secondly, we also license hardware manufacturers a limited/restricted set of rights to utilize our technology (incorporated in the IC licensee's chips) in their physical products. Our business model provides for us to receive royalties for products produced by the consumer manufacturer licensees that contain our technologies.

As part of the licensing terms for both IC and hardware manufacturer licensees, we receive fees for access to our technology and for product certification, in addition to royalties received from hardware manufacturer licensees. Generally, we license on a non-exclusive, worldwide basis. We require that all licensees have their chips or hardware devices certified by us prior to distribution, and licensees are generally required to display the appropriate DTS trademark on the products they manufacture. We also reserve the right to audit their books, records and quality standards.

Our licensing business mainly consists of two general types of licensing models: per-unit and minimum guarantee arrangements. Customers with a per-unit arrangement pay us a per-unit license fee for each product manufactured or shipped, as set forth in each license agreement. Such information is reported to us in the subsequent quarter, and consequently, per-unit revenues are recognized on a quarter lag basis when reported. Minimum guarantee arrangements consist of a minimum flat fee paid by the customer for the right to license specified technologies over the contract term. These arrangements stipulate a flat fee that corresponds to a minimum number of units or dollars, with additional per-unit fees for any units or dollars exceeding the minimum. The minimum or flat fee portion of these arrangements is recognized ratably over the contract term, and any overage is recognized on a quarter lag basis when reported.

We have licensed our technologies and our trademarks to substantially all of the major consumer electronics product manufacturers worldwide. Collectively, these manufacturers have sold billions of

15

DTS-licensed consumer electronics products. While our business is not substantially dependent on any single customer agreement, we have entered into several license agreements with the various divisions and companies that comprise Sony Corporation and Samsung Electronics Co., Ltd. and which relate to various types of consumer electronics devices. Each of these significant customers, in the aggregate, accounts for more than 10% of total revenues for the year ended December 31, 2014.

In addition, we sell DTS Play-Fi enabled hardware modules to consumer electronics manufacturers to incorporate our Play-Fi technology into their products. These modules are manufactured by third-party vendors. For 2014, such hardware sales did not represent a material portion of our total consolidated revenue.

SEASONALITY OF BUSINESS

Generally, consumer electronics manufacturing activities are lowest in the first calendar quarter of each year, and increase progressively throughout the remainder of the year. The third and fourth quarters are typically the strongest in terms manufacturing output as our technology licensees increase their manufacturing output to prepare for the holiday selling season. Since recognition of revenues for most arrangements lag manufacturing activity by one quarter due to the timing of licensee reporting to us, part of our revenues and earnings may by impacted by this seasonal trend on a quarter lag basis. However, the seasonal impact to our business is lessened to a certain extent by the growing number of minimum guarantee arrangements with our customers.

In general, the introduction and inclusion of DTS technologies in new and rapidly growing markets can have a material effect on quarterly revenues and profits, and can distort the moderate seasonality described above.

We actively police and enforce our intellectual property and pursue third parties who have under-reported the amount of royalties owed under a license agreement or who utilize our intellectual property without a license. As a result of these activities, from time to time, we may recognize royalty revenues that relate to licensing obligations that occurred in prior periods. These royalty recoveries may cause revenues to be higher than expected during a particular reporting period and may not occur in subsequent periods.

RESEARCH AND DEVELOPMENT

As demonstrated by our portfolio of industry-recognized, advanced technologies, we are centered around strong research and development abilities. We were founded on key research and development that focused on providing unique, cost effective and differentiated audio solutions, and we continue to develop new technologies with this same goal in mind.

As we have grown, new technologies have not only been developed internally, but also acquired from outside sources. Our technologies, and the talent and knowledge that created them, are key elements of our research and development base and will continue to be a source of new solutions going forward.

We have a group of over 160 engineers and scientists, including 19 PhDs, focused on research and development. This group oversees our product development efforts and is responsible for implementing our technology into existing and emerging products. We carry out research and development activities in the US, China, Japan, Korea, Northern Ireland, Singapore and Taiwan.

Our research and development expenses totaled $37.3 million during 2014, $31.1 million during 2013 and $25.8 million during 2012. We expect that we will continue to commit resources to research and development efforts in the future, particularly in support of our expansion across a wide variety of digital audio content and playback devices.

16

COMPETITION

We face strong competition in the consumer electronics market and expect competition to continue to intensify in the future. Our primary competitor is Dolby Laboratories, who develops and markets, among other things, high-definition audio products and services. Dolby was founded over 40 years ago and for many years was the only significant provider of audio technologies. Dolby's long-standing market position, brand, business relationships, resources and inclusion in various industry standards provide it with a strong competitive position.

In addition to Dolby, we compete in specific product markets with companies such as Fraunhofer Institut Integrierte Schaltungen and various other consumer electronics product manufacturers. Many of these competitors have a wide variety of strengths that afford them competitive advantages, such as longer operating histories, significantly greater resources, greater name recognition, or the ability to offer their technologies for a lower price or for free.

We believe that the principal competitive factors in each of our markets include some or all of the following:

- •

- technology performance, flexibility, and range of application;

- •

- quality and reliability of technologies, products and services;

- •

- expertise in engineering support and proximity to customers;

- •

- brand recognition and reputation;

- •

- inclusion in industry standards;

- •

- price;

- •

- relationships with IC, consumer electronics manufacturers, and content creators and providers;

- •

- availability of encoding tools that deliver compatible high-definition audio content;

- •

- timeliness and relevance of new product introductions; and

- •

- relationships with, and distribution networks for, production and post-production operators providing content for digital broadcast.

We have been successful in penetrating the consumer electronics markets and building and growing market share. Many top selling Blu-ray Dics and DVDs contain high-definition soundtracks in our format, and a substantial majority of consumer electronics products with high-definition or surround sound audio capability incorporate our technology, trademarks or know-how. Our success has been due in large part to our ability to position our brand as a premium offering that contains superior proprietary technology, the quality of our customer service, our inclusion in industry standards and our industry relationships.

We believe there are significant barriers to entry into the consumer electronics products market, such as our mandatory status in the Blu-ray format. Also, the standards relating to DVD are well established and support a limited number of technologies, including our codecs. Numerous other standards in which we participate support a limited number of technologies, including various DTS technologies.

EMPLOYEES

As of December 31, 2014, we had 372 employees. None of our employees are subject to a collective bargaining agreement, and we have never experienced a work stoppage. We believe our relations with our employees are good.

17

WEBSITE ACCESS TO SEC FILINGS

We file annual, quarterly and current reports, and amendments to those reports, and other information with the SEC. You may access and read our filings without charge through the SEC's website, at www.sec.gov. We also maintain an internet website at www.dts.com. We make available, free of charge through our website, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

18

You should consider each of the following factors as well as the other information in this Annual Report in evaluating our business and our prospects. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently consider immaterial may also impair our business operations. If any of the following risks actually occur, our business, financial condition, or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to Our Business

If we are unable to maintain a sufficient amount of content released in the DTS audio format, demand for the technologies, products, and services that we offer to consumer electronics product manufacturers may significantly decline, which would adversely impact our business and prospects.

We expect to derive a significant percentage of our revenues from the technologies, products, and services that we offer to manufacturers of consumer electronics products. We believe that demand for our audio technologies in growing markets for multi-channel and/or high resolution audio, including TVs, tablets and mobile phones, video game consoles, automobiles, and soundbars, will be based on the amount, quality, and popularity of content (such as movies, TV shows, music, and games) either released in the DTS audio format or capable of being coded and played in the DTS format. In particular, our ability to penetrate the growing markets in the network-connected space depends on the presence of streaming and downloadable content released in the DTS audio format. We generally do not have contracts that require providers of streaming and downloadable content to develop and release such content in a DTS audio format. Accordingly, our revenue could decline if these parties elect not to incorporate DTS audio into their content or if they sell less content that incorporates DTS audio.

In addition, we may not be successful in maintaining existing relationships or developing new relationships with other existing or new content providers. As a result, we cannot assure you that a sufficient amount of content will be released in a DTS audio format to ensure that manufacturers continue offering DTS decoders in the consumer electronics products that they sell.

We may not be able to evolve our technologies, products, and services, or develop new technologies, products, and services, that are acceptable to our customers or the evolving markets.

The markets for our technologies, products, and services is characterized by:

- •

- rapid technological change and product obsolescence;

- •

- new and improved product introductions;

- •

- changing consumer demands;

- •

- increasingly competitive product landscape; and

- •

- evolving industry standards.

Our future success depends upon our ability to enhance our existing technologies, products, and services and to develop acceptable new technologies, products, and services on a timely basis. The development of enhanced and new technologies, products, and services is a complex and uncertain process requiring high levels of innovation, highly-skilled engineering and development personnel, and the accurate anticipation of technological and market trends. We may not be able to identify, develop, market, or support new or enhanced technologies, products, or services on a timely basis, if at all. Furthermore, our new technologies, products, and services may never gain market acceptance, and we may not be able to respond effectively to evolving consumer demands, technological changes, product

19

announcements by competitors, or emerging industry standards. Any failure to respond to these changes or concerns would likely prevent our technologies, products, and services from gaining market acceptance or maintaining market share and could lead to our technologies, products, and services becoming obsolete.

Our ability to develop proprietary technologies in markets in which "open standards" are adopted may be limited, which could adversely affect our ability to generate revenue and growth.

Standards-setting bodies may require the use of open standards, meaning that the technologies necessary to meet those standards are publicly available, free of charge and often on an "open source" basis. These standards are a relatively recent and limited occurrence and have primarily been focused on markets and regions traditionally adverse to the notion of intellectual property ownership and the associated royalties. If the concept of open standards gains industry momentum in the future, the use of open standards may reduce our opportunity to generate revenue, as open standards technologies are based upon non-proprietary technology platforms in which no one company maintains ownership over the dominant technologies.

A loss of one or more of our key customers or licensees in any of our markets could adversely affect our business.

From time to time, one or a small number of our customers or licensees may represent a significant percentage of our revenue. While our business is not substantially dependent on any single customer agreement, we have entered into several license agreements with the various divisions and companies that comprise Sony Corporation and Samsung Electronics Co., Ltd., which relate to various types of consumer electronics devices. Each of these significant customers, in the aggregate, accounted for more than 10% of total revenues for the year ended December 31, 2014. For additional information, refer to "Concentration of Business and Credit Risk" in Note 2 of our consolidated financial statements. Although we have agreements with our customers, many of these agreements do not require any material minimum purchases or minimum royalty fees and typically do not prohibit customers from purchasing or licensing technologies, products, and services from competitors. A decision by any of our major customers or licensees not to use our technologies, or their failure or inability to pay amounts owed to us in a timely manner, or at all, could have a significant adverse effect on our business.

We face intense competition and certain of our competitors have greater resources than we do.

The digital audio, consumer electronics and entertainment markets are intensely competitive, subject to rapid change, and significantly affected by new product introductions and other market activities of industry participants. Our principal competitor is Dolby Laboratories, Inc. (Dolby), who competes with us in most of our markets. We also compete with other companies offering digital audio technology incorporated into consumer electronics product and entertainment mediums, such as Fraunhofer Institut Integrierte Schaltungen.

Certain of our current and potential competitors may enjoy substantial competitive advantages, including:

- •

- greater name recognition;

- •

- a longer operating history;

- •

- a greater global footprint and presence;

- •

- more developed distribution channels and deeper relationships with our common customer base;

- •

- a more extensive customer base;

20

- •

- digital technologies that provide features that ours do not;

- •

- broader product and service offerings;

- •

- greater resources for competitive activities, such as research and development, strategic acquisitions, alliances, joint ventures,

sales and marketing, subsidies and lobbying industry and government standards;

- •

- more technicians and engineers;

- •

- greater technical support;

- •

- the ability to offer open source or free codecs; and

- •

- greater inclusion in government or industry standards.

As a result, these current and potential competitors may be able to respond more quickly and effectively than we can to new or changing opportunities, technologies, standards, or customer requirements.

In addition to the competitive advantages described above, Dolby also enjoys other unique competitive strengths relative to us. For example, it introduced multi-channel audio technology before we did. It has also achieved mandatory standard status in product categories that we have not, including terrestrial digital TV broadcasts in the US. As a result of these factors, Dolby has a competitive advantage in selling its digital multi-channel audio technology.

Our customers, who are also our current or potential competitors, may choose to use their own or competing technologies rather than ours.

We face competitive risks in situations where our customers are also current or potential competitors. For example, certain of our licensee customers maintain in-house audio engineering teams. To the extent that our customers choose to use technologies they have developed or in which they have an interest, rather than use our technologies, our business and operating results could be adversely affected.

Our business and prospects depend upon the strength of our brands, and if we do not maintain and strengthen our brands, our business could be materially harmed.

Establishing, maintaining and strengthening our corporate and product brands is critical to our success. Our brand identity is key to maintaining and expanding our business and entering new markets. Our success depends in large part on our reputation for providing high-quality technologies, products, and services to the consumer electronics and entertainment industries. If we fail to promote and maintain our brands successfully, our business and prospects may suffer. Additionally, we believe that the likelihood that our technologies will be adopted in industry standards depends, in part, upon the strength of our brands, because professional organizations and industry participants are more likely to incorporate technologies developed by well-respected and well-known brands into standards.

Declining retail prices for consumer electronics products could force us to lower the license or other fees we charge our customers or prompt our customers to exclude our audio technologies from their products altogether, which would adversely affect our business and operating results.

The market for consumer electronics products is intensely competitive and price sensitive. Retail prices for consumer electronics products that include our audio technologies have decreased significantly, and we expect prices to continue to decrease for the foreseeable future. Declining prices for consumer electronics products could create downward pressure on the licensing fees we currently charge our customers who integrate our technologies into the consumer electronics products that they

21

sell and distribute. As a result of pricing pressure, consumer electronics product manufacturers who produce products in which our audio technologies are not a mandatory standard could decide to exclude our audio technologies from their products altogether.

Our revenue is dependent upon our customers and licensees incorporating our technologies into their products, and we have limited control over existing and potential customers' and licensees' decisions to include our technologies in their product offerings.

Except for Blu-ray products, where our technology is mandatory, we are dependent upon our customers and licensees—including consumer electronics product manufacturers, semiconductor manufacturers, producers and distributors of content—to incorporate our technologies into their products, purchase our products and services, or release their content in our proprietary DTS audio format. We have contracts and license agreements with many of these companies, which generally are non-exclusive and do not contain any minimum purchase commitments. Furthermore, the decision by a party dominant in the entertainment value chain to provide audio technology at very low or no cost could impact a licensee's decision to use our technology. Our customers, licensees and other manufacturers might not utilize our technologies or services in the future. Accordingly, our revenue could decline if our customers and licensees choose not to incorporate our technologies in their products, or if they sell fewer products incorporating our technologies.

Our licensing revenue depends in large part upon semiconductor manufacturers incorporating our technologies into integrated circuits (ICs), for sale to our consumer electronics product licensees. If our technologies are not incorporated in these ICs, IC production is delayed, or fewer ICs are sold that incorporate our technologies, our operating results would be adversely affected.

Our licensing revenue from consumer electronics product manufacturers depends in large part upon the availability of ICs that implement our technologies. IC manufacturers incorporate our technologies into these ICs, which are then incorporated into consumer electronics products. We do not manufacture these ICs, but rather depend upon IC manufacturers to develop, produce and then sell them to licensed consumer electronics product manufacturers. We do not control the IC manufacturers' decisions whether or not to incorporate our technologies into their ICs, and we do not control their product development or commercialization efforts. If these IC manufacturers are unable or unwilling to implement our technologies into their ICs, production is delayed, or if they sell fewer ICs incorporating our technologies, our operating results could be adversely affected.

If there is a continued decline in optical disc based media consumption and if our ability to further penetrate the streaming and downloadable content delivery markets and adapt our technologies for those markets is limited, our revenues and ability to grow could be adversely impacted.

Video and audio content has historically been purchased and consumed primarily via optical disc based media, such as Blu-ray Disc, DVD, and CD. However, the growth of the internet and network-connected device usage (including PCs, TVs, set-top boxes and DMPs, tablets, and smartphones), along with the rapid advancement of online and mobile content delivery has resulted in the recent trend to entertainment download and streaming services becoming mainstream with consumers in various parts of the world. We expect the shift away from optical disc based media to streaming and downloadable content consumption to continue, which may result in further declines in revenue from Blu-ray Disc and DVD players that incorporate our technologies.

Also, the services that provide content from the cloud are not generally governed by international or national standards and are thus free to choose any media format(s) to deliver their products and services. This freedom of choice on the part of online content providers could limit our ability to grow if such content providers do not incorporate our technologies into their services, which could affect demand for our technologies.

22

Furthermore, our inclusion in mobile and other network-connected devices may be less profitable for us than optical disc players. The online and mobile markets are characterized by intense competition, evolving industry standards and business and distribution models, disruptive software and hardware technology developments, frequent new product and service introductions, short product and service life cycles, and price sensitivity on the part of consumers, all of which may result in downward pressure on pricing. Any of the foregoing could adversely affect our business and operating results.

The licensing of patents constitutes a significant source of our revenue. If we do not replace expiring patents with new patents or proprietary technologies, our revenue could decline.

We hold patents covering a majority of the technologies that we license, and our licensing revenue is tied in large part to the life of those patents. Our right to receive royalties related to our patents terminates with the expiration of the last patent covering the relevant technologies. Accordingly, to the extent that we do not replace licensing revenue from technologies covered by expiring patents with licensing revenue based on new patents and proprietary technologies, our revenue could decline.