Attached files

| file | filename |

|---|---|

| 10-K - FORM 10-K - JAGGED PEAK, INC. | d263744d10k.htm |

| EX-32.2 - CERTIFICATION - JAGGED PEAK, INC. | d263744dex322.htm |

| EX-31.1 - CERTIFICATION - JAGGED PEAK, INC. | d263744dex311.htm |

| EX-31.2 - CERTIFICATION - JAGGED PEAK, INC. | d263744dex312.htm |

| EX-10.20 - EMPLOYMENT AGREEMENT - JAGGED PEAK, INC. | d263744dex1020.htm |

| EX-32.1 - CERTIFICATION - JAGGED PEAK, INC. | d263744dex321.htm |

| EX-10.22 - LOAN AGREEMENT - JAGGED PEAK, INC. | d263744dex1022.htm |

Exhibit 10.21

LEASE AGREEMENT

RIDGE ROCK PARTNERS, LLC

Landlord

AND

JAGGED PEAK, INC

Tenant

AT

1701 3rd Avenue, St. Petersburg, FL33712

LEASE AGREEMENT

INDEX

| § |

Section |

Page | ||||

| 1. | Basic Lease Terms and Definitions |

1 | ||||

| 2. | Premises |

2 | ||||

| 3. | Use |

2 | ||||

| 4. | Term; Possession |

2 | ||||

| 5. | Rent; Taxes |

2 | ||||

| 6. | Real Estate Taxes & Insurance |

2 | ||||

| 7. | Utilities |

2 | ||||

| 8. | Insurance; Waivers; Indemnification |

2 | ||||

| 9. | Maintenance and Repairs |

3 | ||||

| 10. | Compliance |

4 | ||||

| 11. | Signs |

4 | ||||

| 12. | Alterations |

4 | ||||

| 13. | Construction Liens |

5 | ||||

| 14. | Landlord’s Right of Entry |

5 | ||||

| 15. | Damage by Fire or Other Casualty |

5 | ||||

| 16. | Condemnation |

5 | ||||

| 17. | Quiet Enjoyment |

5 | ||||

| 18. | Assignment and Subletting |

6 | ||||

| 19. | Subordination; Mortgagee’s Rights |

6 | ||||

| Tenant’s Certificate; Financial Information |

||||||

| 20. | Surrender |

7 | ||||

| 21. | Defaults - Remedies |

7 | ||||

| 22. | Tenant’s Authority |

8 | ||||

| 23. | Liability of Landlord |

8 | ||||

| 24. | Miscellaneous |

8 | ||||

| 25. | Notices |

9 | ||||

| 26. | Security Deposit |

9 | ||||

| 27. | Radon Gas |

9 | ||||

| No Offer |

||||||

| 29. | Electrical |

10 | ||||

| 31. | Tenant Improvements |

10 | ||||

Additional Provisions:

i

THIS LEASE AGREEMENT is made by and between RIDGE ROCK PARTNERS, LLC.,, a Florida Limited Liability Company (“Landlord”) and JAGGED PEAK, INC., a Nevada Corporation (“Tenant”), and is dated as of the date on which this Lease has been fully executed by Landlord and Tenant.

1. Basic Lease Terms and Definitions.

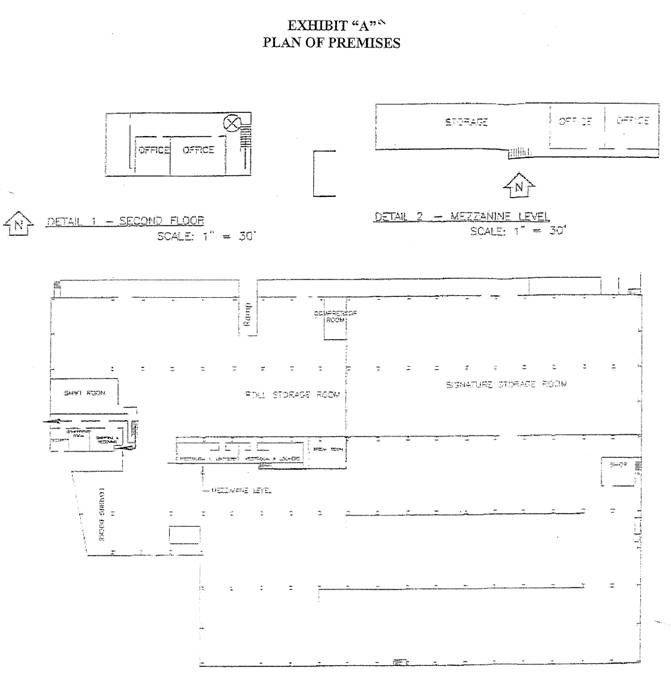

(a) Premises: Entire Building 93,000 rentable square feet as shown on Exhibit “A”.

(b) Building: Approximate rentable square feet: 93,000 Address: 1701 3rd Avenue, St. Petersburg, FL 33712

(c) Term: One hundred twenty (120) months (plus any partial month from the Commencement Date until the first day of the next full calendar month during the Term).

(d) Commencement Date: August 1, 2011

(e) Expiration Date: July 31, 2021

(f) Minimum Annual Rent: Payable in monthly installments as follows:

| Lease Year |

Annual | Monthly | Lease Year |

Annual | Monthly | |||||||||||||

| 1 |

$ | 367,350 | $ | 30,612.50 | 7 | $ | 417,761 | $ | 34,813.46 | |||||||||

| 2 |

$ | 376,533 | $ | 31,377.81 | 8 | $ | 426,116 | $ | 35,509.73 | |||||||||

| 3 |

$ | 385,947 | $ | 32,162.26 | 9 | $ | 434,639 | $ | 36,219.93 | |||||||||

| 4 |

$ | 393,666 | $ | 32,805.50 | 10 | $ | 443,331 | $ | 36,944.32 | |||||||||

| 5 |

$ | 401,539 | $ | 33,461.61 | ||||||||||||||

| 6 |

$ | 409,570 | $ | 34,130.85 | ||||||||||||||

(g) Annual Real Estate Taxes & Insurance: Estimated at $ for Calendar Year 2011, payable in monthly installments of $ , subject to adjustment as provided in this Lease.

(h) Tenant’s Share: 100% (also see Definitions)

(i) Use: Industrial Warehouse, shipping, receiving, light assembly and administrative offices

(j) Security Deposit: $50,000.00

(k) Addresses For Notices:

Landlord: Tenant:

(l) Guarantor: N/A

(m) Additional Defined Terms: See Rider 1 for the definitions of other capitalized terms.

(n) Contents: The following are attached to and made a part of this Lease:

| Rider 1 – Additional Definitions |

Exhibits: | “A” – Plan showing Premises | ||||

| “B” – Building Rules | ||||||

| “C” – Estoppel Certificate Form | ||||||

| “D” – JDMU Parcel No. 6 |

2. Premises. Landlord leases to Tenant and Tenant leases from Landlord the Premises, together with the right in common with others to use the Common Areas. Tenant accepts the Premises, Building and Common Areas “AS IS”, without relying on any representation, covenant or warranty by Landlord other than as expressly set forth in this Lease. Landlord and Tenant stipulate and agree to the rentable square footage set forth in Section 1(a) above without regard to actual measurement.

3. Use. Tenant shall occupy and use the Premises only for the Use specified in Section l above. Tenant shall not permit any conduct or condition which may endanger, disturb or otherwise interfere with any other Building occupant’s normal operations or with the management of the Building. Tenant shall not use or permit the use of any portion of the Property for outdoor storage or installations outside of the Premises.

4. Term; Possession. The Term of this Lease shall commence on the “COMMENCEMENT DATE” set forth in Section 1(d) above and shall end at 11:59 p.m. on the last day of the Term the “EXPIRATION DATE”, without the necessity for notice from either party, unless sooner terminated in accordance with the terms hereof.

5. Rent; Taxes. Tenant agrees to pay to Landlord, without demand, deduction or offset, Minimum Annual Rent for the Term. Tenant shall pay the Monthly Rent, in advance, on the first day of each calendar month during the Term, together with monthly installments of the Real Estate Taxes & Insurance as set forth in Section 6 below, to Landlord. In addition, the Monthly Rent for the first full month shall be paid at the signing of this Lease. If the Commencement Date is not the first day of the month, the Monthly Rent for that partial month shall be apportioned on a per diem basis and shall be paid on or before the Commencement Date. Tenant shall pay Landlord a service and handling charge equal to 5% of any Rent not paid within 10 days after the date due. In addition, any Rent, including such charge, not paid within 10 days after the due date will bear interest at the Interest Rate from the date due to the date paid. Tenant shall pay before delinquent all taxes levied or assessed upon, measured by, or arising from: (a) the conduct of Tenant’s business; (b) Tenant’s leasehold estate; or (c) Tenant’s property. Additionally, Tenant shall pay to Landlord all sales, use, transaction privilege, or other excise tax that may at any time be levied or imposed upon, or measured by, any amount payable by Tenant under this Lease.

6. Real Estate Taxes & Insurance. For each year during the term of this lease, Tenant shall pay in equal monthly installments, due on the first day of each month, Tenant’s Share of: (i) Cost of insurance relating to the Building, including the cost of property, casualty and liability insurance applicable to the Building and Landlord’s personal property used in connection therewith and “Loss of Rental Income” insurance; (ii) All taxes, excises, assessments, levies, fees or charges, general and special, ordinary and extraordinary, of any kind which are assessed, levied, charged, confirmed or imposed by any public authority upon the Building or the Land, its operations, or the rent provided for in this Lease. Tenant will be responsible for all taxes on its personal property, if any.

7. Utilities. Tenant shall pay for water, sewer, gas, electricity, heat, power, telephone and other communication services and any other utilities supplied to the Premises. Tenant shall obtain service in its own name and timely pay all charges directly to the provider. Landlord shall not be responsible or liable for any interruption in such services, nor shall such interruption affect the continuation or validity of this Lease. Any wiring, cabling or other equipment necessary to connect Tenant’s telecommunications equipment shall be Tenant’s responsibility, and shall be installed in a manner approved by Landlord.

8. Insurance; Waivers; Indemnification.

(a) Landlord shall maintain insurance against loss or damage to the Building or the Property with coverage for perils as set forth under the “Causes of Loss-Special Form” or equivalent property insurance policy in an amount equal to the full insurable replacement cost of the Building (excluding coverage of Tenant’s personal property and any Alterations by Tenant), and such other insurance, including rent loss coverage, as Landlord may reasonably deem appropriate or as any Mortgagee may require.

2

(b) Tenant, at its expense, shall keep in effect commercial general liability insurance, including blanket contractual liability insurance, covering Tenant’s use of the Property, with such coverages and limits of liability as Landlord may reasonably require, but not less than a $2,000,000 combined single limit with a $2,000,000 general aggregate limit (which general aggregate limit may be satisfied by an umbrella liability policy) for bodily injury or property damage; however, such limits shall not limit Tenant’s liability hereunder. The policy shall name Landlord, and any other associated or affiliated entity as their interests may appear and at Landlord’s request, any Mortgagee(s), as additional insureds, shall be written on an “occurrence” basis and not on a “claims made” basis and shall be endorsed to provide that it is primary to and not contributory to any policies carried by Landlord and to provide that it shall not be cancelable or reduced without at least 30 days prior notice to Landlord. The insurer shall be authorized to issue such insurance, licensed to do business and admitted in the state in which the Property is located. Tenant shall deliver to Landlord on or before the Commencement Date or any earlier date on which Tenant accesses the Premises, and at least 30 days prior to the date of each policy renewal, a certificate of insurance evidencing such coverage.

(c) Landlord and Tenant each waive, and release each other from and against, all claims for recovery against the other for any loss or damage to the property of such party arising out of fire or other casualty coverable by a standard “Causes of Loss-Special Form” property insurance policy with, in the case of Tenant, such endorsements and additional coverages as are considered good business practice in Tenant’s business, even if such loss or damage shall be brought about by the fault or negligence of the other party or its Agents; provided, however, such waiver by Landlord shall not be effective with respect to Tenant’s liability described in Sections 9(b) and 10(d) below. This waiver and release is effective regardless of whether the releasing party actually maintains the insurance described above in this subsection and is not limited to the amount of insurance actually carried, or to the actual proceeds received after a loss. Each party shall have its insurance company that issues its property coverage waive any rights of subrogation, and shall have the insurance company include an endorsement acknowledging this waiver, if necessary. Tenant assumes all risk of damage of Tenant’s property within the Property, including any loss or damage caused by water leakage, fire, windstorm, explosion, theft, act of any other tenant, or other cause.

(d) Tenant shall not be permitted to satisfy any of its insurance obligations set forth in this Lease through any self-insurance or self-insured retention in excess of $25,000.

(e) Subject to subsection (c) above, and except to the extent caused by the negligence or willful misconduct of Landlord or its Agents, Tenant will indemnify, defend, and hold harmless Landlord and its Agents from and against any and all claims, actions, damages, liability and expense (including fees of attorneys, investigators and experts) which may be asserted against, imposed upon, or incurred by Landlord or its Agents and arising out of or in connection with loss of life, personal injury or damage to property in or about the Premises or arising out of the occupancy or use of the Property by Tenant or its Agents or occasioned wholly or in part by any act or omission of Tenant or its Agents, whether prior to, during or after the Term. Tenant’s obligations pursuant to this subsection shall survive the expiration or termination of this Lease.

9. Maintenance and Repairs.

(a) During the term of this lease, Tenant shall, at its sole expense, Maintain, keep in good condition, order and repair, and replace when necessary: (i) Building Systems; and (ii) Common Areas, which include any exclusive parking areas and shipping/receiving areas. Landlord, at its sole expense, shall maintain the Building’s roof, footings, foundations, structural steel columns and girders, and exterior walls. If Tenant becomes aware of any condition that is Landlord’s responsibility to repair, Tenant shall promptly notify Landlord of the condition. In the event that the Building Systems require replacement, and such replacement occurrs with less than 5 years remaining in Tenant’s term, Landlord shall pay to Tenant a sum equal to the cost of such replacement incurred by Tenant multiplied by a fraction, the numerator of which is the number of additional months which the Tenant would have had to occupy the Premises in order to have the use of the replaced component for a full 60 months and the denominator is 60. As an example, Tenant incurs a cost of $10,000 to replace a component with 36 months remaining in the lease. The Landlord would reimburse Tenant as follows: $10,000 x (24/60) = $4,000.

(b) Except as provided in subsection (a) above, Tenant at its sole expense shall maintain the Premises and all fixtures and equipment in the Premises. The Tenant also agrees to keep the Premises, including the common areas of the Building, and sidewalks free of rubbish and in such condition as the Board of Health may require. During the term of this lease, Tenant agrees to pay for and keep in effect an HVAC maintenance agreement (the “HVAC Maintenance Agreement”) with a licensed HVAC contractor. All repairs and replacements by Tenant shall utilize materials and equipment which are comparable to those already existing in the Building and Premises. Alterations, repairs and replacements to the Property, including the Premises, made necessary because of Tenant’s Alterations or installations, any use or circumstances special or particular to Tenant, or any act or omission of Tenant or its Agents shall be made by Landlord or Tenant as set forth above, but at the sole expense of Tenant to the extent not covered by any applicable insurance proceeds paid to Landlord.

3

10. Compliance with Public Lawse.

(a) Tenant further agrees to perform, fully obey and comply with all ordinances, rules, regulations and laws of all public authorities, boards and officers relating to said Premises, or any part thereof, for Tenant’s unique and particular use thereof and shall not use the same in violation of any law, statute or ordinance, whether federal, state or municipal, during the term of said lease or any renewal thereof., at its expense, promptly comply with all Laws now or subsequently pertaining to the Premises or Tenant’s use or occupancy. Tenant will pay any taxes or other charges by any authority on Tenant’s property or trade fixtures or relating to Tenant’s use of the Premises. Neither Tenant nor its Agents shall use the Premises in any manner that under any Law would require Landlord to make any Alteration to or in the Building or Common Areas (without limiting the foregoing, Tenant shall not use the Premises in any manner that would cause the Premises or the Property to be deemed a “place of public accommodation” under the ADA if such use would require any such Alteration). Tenant shall be responsible for compliance with the ADA, and any other Laws regarding accessibility, with respect to the Premises, hereby enacted after the Commencement Date.

(b) Tenant will comply, and will cause its Agents to comply, with the Building Rules.

(c) Tenant agrees not to intentionally do anything or fail to do anything which will increase the cost of Landlord’s insurance or which will prevent Landlord from procuring policies (including public liability) from companies and in a form satisfactory to Landlord. If any breach of the preceding sentence by Tenant causes the rate of fire or other insurance to be increased, Tenant shall pay the amount of such increase as additional Rent within 30 days after being billed.

(d) Tenant agrees that (i) no activity will be conducted on the Premises that will use or produce any Hazardous Materials, except for activities which are part of the ordinary course of Tenant’s business and are conducted in accordance with all Environmental Laws (“Permitted Activities”); (ii) the Premises will not be used for storage of any Hazardous Materials, except for materials used in the Permitted Activities which are properly stored in a manner and location complying with all Environmental Laws; (iii) no portion of the Premises or Property will be used by Tenant or Tenant’s Agents for disposal of Hazardous Materials; (iv) Tenant will deliver to Landlord copies of all Material Safety Data Sheets and other written information prepared by manufacturers, importers or suppliers of any chemical; and (v) Tenant will immediately notify Landlord of any violation by Tenant or Tenant’s Agents of any Environmental Laws or the release or suspected release of Hazardous Materials in, under or about the Premises, and Tenant shall immediately deliver to Landlord a copy of any notice, filing or permit sent or received by Tenant with respect to the foregoing. If at any time during or after the Term, any portion of the Property is found to be contaminated by Tenant or Tenant’s Agents or subject to conditions prohibited in this Lease caused by Tenant or Tenant’s Agents, Tenant will indemnify, defend and hold Landlord harmless from all claims, demands, actions, liabilities, costs, expenses, attorneys’ fees, damages and obligations of any nature arising from or as a result thereof, and Landlord shall have the right to direct remediation activities, all of which shall be performed at Tenant’s cost. Tenant’s obligations pursuant to this subsection shall survive the expiration or termination of this Lease.

11. Signs. Tenant shall have the right throughout the term of this lease and any extensions thereof, at its sole cost and expense, to install external signage on the building where the Premises are located, subject to all applicable codes and Landlord’s approval, such approval not to be unreasonably withheld.

12. Alterations. Except for non-structural Alterations that do not exceed $20,000 in the aggregate per occurrence, Tenant shall not make or permit any Alterations in or to the Premises without first obtaining Landlord’s consent, which consent shall not be unreasonably withheld. With respect to any Alterations made by or on behalf of Tenant (whether or not the Alteration requires Landlord’s consent): (i) not less than 10 days prior to commencing any Alteration, Tenant shall deliver to Landlord the plans, specifications and necessary permits for the Alteration, together with certificates evidencing that Tenant’s contractors and subcontractors have adequate insurance coverage naming Landlord, and any other associated or affiliated entity as their interests may appear as additional insureds, (ii) Tenant shall obtain Landlord’s prior written approval of any contractor or subcontractor, (iii) the Alteration shall be constructed with new materials, in a good and workmanlike manner, and in compliance with all Laws and the plans and specifications delivered to, and, if required above, approved by Landlord, and (iv) upon Landlord’s request Tenant shall, prior to commencing any Alteration, provide Landlord reasonable security against liens arising out of such construction.

4

13. Construction Liens. The Property shall not be subject in any way to any liens, including construction liens, for improvements to or other work performed with respect to the Property by or on behalf of Tenant. Tenant shall pay timely any contractors and materialmen who supply labor, work or materials to Tenant at the Property and shall take all steps permitted by law in order to avoid the imposition of any construction lien upon all or any portion of the Property. Should any such lien or notice of lien be filed for work performed for Tenant other than by Landlord, Tenant shall bond against or discharge the same within 5 days after Tenant has notice that the lien or claim is filed regardless of the validity of such lien or claim. Nothing in this Lease is intended to authorize Tenant to do or cause any work to be done or materials to be supplied for the account of Landlord, all of the same to be solely for Tenant’s account and at Tenant’s risk and expense. Throughout this Lease the term “construction lien or mechanic’s lien” is used to include any lien, encumbrance or charge levied or imposed upon all or any portion of, interest in or income from the Property on account of any mechanic’s, laborer’s, materialman’s, contractor’s, subcontractor’s or construction lien or arising out of any debt or liability to or any claim of any contractor, subcontractor, mechanic, supplier, materialman, laborer or other person or entity providing services, materials or supplies to, for, upon or with respect to the Premises, and shall include any contractor’s notice of intention to file a lien given to Landlord or Tenant, any stop order given to Landlord or Tenant, any notice of refusal to pay naming Landlord or Tenant and any injunctive or equitable action brought by any person claiming to be entitled to any construction lien.

14. Landlord’s Right of Entry. Tenant shall permit Landlord and its Agents to enter the Premises at all reasonable times following reasonable notice (except in an emergency) to inspect, Maintain, or make Alterations to the Premises or Property, to exhibit the Premises for the purpose of sale or financing, and, during the last 12 months of the Term, to exhibit the Premises to any prospective tenant. Landlord will make reasonable efforts not to inconvenience Tenant in exercising such rights, but Landlord shall not be liable for any interference with Tenant’s occupancy resulting from Landlord’s entry.

15. Damage by Fire or Other Casualty. If the Premises or Common Areas shall be damaged or destroyed by fire or other casualty, Tenant shall promptly notify Landlord, and Landlord, subject to the conditions set forth in this Section, shall repair such damage and restore the Premises or Common Areas to substantially the same condition in which they were immediately prior to such damage or destruction, but not including the repair, restoration or replacement of the fixtures, equipment, or Alterations installed by or on behalf of Tenant. Landlord shall notify Tenant, within 30 days after the date of the casualty, if Landlord anticipates that the restoration will take more than 90 days from the date of the casualty to complete; in such event, either Landlord or Tenant (unless the damage was caused by the negligence of Tenant) may terminate this Lease effective as of the date of casualty by giving notice to the other within 10 days after Landlord’s notice. If a casualty occurs during the last 12 months of the Term, Landlord may terminate this Lease unless Tenant has the right to extend the Term for at least 3 more years and does so within 30 days after the date of the casualty. Moreover, Landlord may terminate this Lease if the loss is not covered by the insurance required to be maintained by Landlord under this Lease. Tenant will receive an abatement of Minimum Annual Rent and Real Estate Taxes & Insurance to the extent the Premises are rendered untenantable as a result of the casualty.

16. Condemnation. If (a) all of the Premises are Taken, (b) any part of the Premises is Taken and the remainder is insufficient in Tenant’s opinion for the reasonable operation of Tenant’s business, or (c) any of the Property is Taken, and, in Tenant’s opinion, it would be impractical or the condemnation proceeds are insufficient to restore the remainder, then this Lease shall terminate as of the date the condemning authority takes possession. If this Lease is not terminated, Landlord shall restore the Building to a condition as near as reasonably possible to the condition prior to the Taking, the Minimum Annual Rent shall be abated for the period of time all or a part of the Premises is untenantable in proportion to the square foot area untenantable, and this Lease shall be amended appropriately. The compensation awarded for a Taking shall belong to Landlord with Landlord remitting a portion of the compensation to Tenant for reasonable moving expenses and relocation. Except for any relocation benefits to which Tenant may be entitled, Tenant hereby assigns all claims against the condemning authority to Landlord, including, but not limited to, any claim relating to Tenant’s leasehold estate.

17. Quiet Enjoyment. Landlord covenants that Tenant, upon performing all of its covenants, agreements and conditions of this Lease, shall have quiet and peaceful possession of the Premises as against anyone claiming by or through Landlord, subject, however, to the terms of this Lease.

5

18. Assignment and Subletting.

(a) Except as provided in Section (b) below, Tenant shall not enter into nor permit any Transfer voluntarily or by operation of law, without the prior consent of Landlord, which consent shall not be unreasonably withheld, conditioned or delayed. A consent to one Transfer shall not be deemed to be a consent to any subsequent Transfer. In no event shall any Transfer relieve Tenant from any obligation under this Lease. Landlord’s acceptance of Rent from any person shall not be deemed to be a waiver by Landlord of any provision of this Lease or to be a consent to any Transfer. Any Transfer not in conformity with this Section 18 shall be void at the option of Landlord.

(b) Landlord’s consent shall not be required in the event of any Transfer by Tenant to an Affiliate provided that (i) the Affiliate has a tangible net worth at least equal to that of Tenant as of the date of this Lease, (ii) Tenant provides Landlord notice of the Transfer at least 15 days prior to the effective date, together with current financial statements of the Affiliate certified by an executive officer of the Affiliate, and (iii) in the case of an assignment or sublease, Tenant delivers to Landlord an assumption agreement reasonably acceptable to Landlord executed by Tenant and the Affiliate, together with a certificate of insurance evidencing the Affiliate’s compliance with the insurance requirements of Tenant under this Lease.

(c) The provisions of subsection (a) above notwithstanding, if Tenant proposes to Transfer all of the Premises (other than to an Affiliate), Landlord may terminate this Lease, either conditioned on execution of a new lease between Landlord and the proposed transferee or without that condition. If Tenant proposes to enter into a Transfer of less than all of the Premises (other than to an Affiliate), Landlord may amend this Lease to remove the portion of the Premises to be transferred, either conditioned on execution of a new lease between Landlord and the proposed transferee or without that condition. If this Lease is not so terminated or amended, Tenant shall pay to Landlord, immediately upon receipt, the excess of (i) all compensation received by Tenant for the Transfer over (ii) the Rent allocable to the Premises transferred.

(d) If Tenant requests Landlord’s consent to a Transfer, Tenant shall provide Landlord, at least 15 days prior to the proposed Transfer, current financial statements of the transferee certified by an executive officer of the transferee, a complete copy of the proposed Transfer documents, and any other information Landlord reasonably requests. Immediately following any approved assignment or sublease, Tenant shall deliver to Landlord an assumption agreement reasonably acceptable to Landlord executed by Tenant and the transferee, together with a certificate of insurance evidencing the transferee’s compliance with the insurance requirements of Tenant under this Lease. Tenant agrees to reimburse Landlord for reasonable administrative and attorneys’ fees, not to exceed $500, in connection with the processing and documentation of any Transfer for which Landlord’s consent is requested.

19. Subordination; Mortgagee’s Rights.

(a) Tenant accepts this Lease subject and subordinate to any Mortgage now or in the future affecting the Premises, provided that Tenant’s right of possession of the Premises shall not be disturbed by the Mortgagee so long as Tenant is not in default under this Lease. This clause shall be self-operative, but within 10 days after request, Tenant shall execute and deliver any further instruments confirming the subordination of this Lease and any further instruments of attornment that the Mortgagee may reasonably request. However, any Mortgagee may at any time subordinate its Mortgage to this Lease, without Tenant’s consent, by giving notice to Tenant, and this Lease shall then be deemed prior to such Mortgage without regard to their respective dates of execution and delivery; provided that such subordination shall not affect any Mortgagee’s rights with respect to condemnation awards, casualty insurance proceeds, intervening liens or any right which shall arise between the recording of such Mortgage and the execution of this Lease.

(b) No Mortgagee shall be (i) liable for any act or omission of a prior landlord, (ii) subject to any rental offsets or defenses against a prior landlord, (iii) bound by any amendment of this Lease made without its written consent, or (iv) bound by payment of Monthly Rent more than one month in advance or liable for any other funds paid by Tenant to Landlord unless such funds actually have been transferred to the Mortgagee by Landlord.

(c) The provisions of Sections 15 and 16 above notwithstanding, Landlord’s obligation to restore the Premises after a casualty or condemnation shall be subject to the consent and prior rights of any Mortgagee.

6

20. Surrender.

(a) On the date on which this Lease expires or terminates, Tenant shall return possession of the Premises to Landlord in good condition, except for ordinary wear and tear, and except for casualty damage or other conditions that Tenant is not required to remedy under this Lease. Prior to the expiration or termination of this Lease, Tenant shall remove from the Property all furniture, trade fixtures, equipment, wiring and cabling (unless Landlord directs Tenant otherwise), and all other personal property installed by Tenant or its assignees or subtenants. Tenant shall repair any damage resulting from such removal and shall restore the Property to good order and condition. Any of Tenant’s personal property not removed as required shall be deemed abandoned, and Landlord, at Tenant’s expense, may remove, store, sell or otherwise dispose of such property in such manner as Landlord may see fit and/or Landlord may retain such property or sale proceeds as its property. If Tenant does not return possession of the Premises to Landlord in the condition required under this Lease, Tenant shall pay Landlord all resulting damages Landlord may suffer.

(b) If Tenant remains in possession of the Premises after the expiration or termination of this Lease, Tenant’s occupancy of the Premises shall be that of a tenancy at will. Tenant’s occupancy during any holdover period shall otherwise be subject to the provisions of this Lease (unless clearly inapplicable), except that the Monthly Rent shall be equal to 125% of the Monthly Rent payable for the last full month immediately preceding the holdover for the first two months, then 150% thereafter. No holdover or payment by Tenant after the expiration or termination of this Lease shall operate to extend the Term or prevent Landlord from immediate recovery of possession of the Premises by summary proceedings or otherwise. Any provision in this Lease to the contrary notwithstanding, any holdover by Tenant shall constitute a default on the part of Tenant under this Lease entitling Landlord to exercise, without obligation to provide Tenant any notice or cure period, all of the remedies available to Landlord in the event of a Tenant default, and Tenant shall be liable for all damages, including consequential damages, that Landlord suffers as a result of the holdover.

21. Defaults - Remedies.

(a) It shall be an Event of Default:

(i) If Tenant does not pay in full when due any and all Rent and, except as provided in Section 22(c) below, Tenant fails to cure such default on or before the date that is 10 days after Landlord gives Tenant notice of default;

(ii) If Tenant enters into or permits any Transfer in violation of Section 18 above;

(iii) If Tenant fails to observe and perform or otherwise breaches any other provision of this Lease, and, except as provided in Section 22(c) below, Tenant fails to cure the default on or before the date that is 10 days after Landlord gives Tenant notice of default; provided, however, if the default cannot reasonably be cured within 10 days following Landlord’s giving of notice, Tenant shall be afforded additional reasonable time (not to exceed 30 days following Landlord’s notice) to cure the default if Tenant begins to cure the default within 10 days following Landlord’s notice and continues diligently in good faith to completely cure the default; or

(iv) If Tenant becomes insolvent or makes a general assignment for the benefit of creditors or offers a settlement to creditors, or if a petition in bankruptcy or for reorganization or for an arrangement with creditors under any federal or state law is filed by or against Tenant, or a bill in equity or other proceeding for the appointment of a receiver for any of Tenant’s assets is commenced, or if any of the real or personal property of Tenant shall be levied upon; provided that any proceeding brought by anyone other than Landlord or Tenant under any bankruptcy, insolvency, receivership or similar law shall not constitute an Event of Default until such proceeding has continued unstayed for more than 60 consecutive days.

(b) If an Event of Default occurs, Landlord shall have the following rights and remedies:

(i) Landlord, without any obligation to do so, may elect to cure the default on behalf of Tenant, in which event Tenant shall reimburse Landlord upon demand for any sums paid or costs incurred by Landlord (together with an administrative fee of 15% thereof) in curing the default, plus interest at the Interest Rate from the respective dates of Landlord’s incurring such costs, which sums and costs together with interest at the Interest Rate shall be deemed additional Rent;

(ii) To enter and repossess the Premises and remove all persons and all or any property, by action at law or otherwise, without being liable for prosecution or damages. Landlord may, at Landlord’s option, make Alterations and repairs in order to relet the Premises and relet all or any part(s) of the Premises for Tenant’s account. Tenant agrees to pay to Landlord on demand any deficiency (taking into account all costs incurred by Landlord) that may arise by reason of such reletting. In the event of reletting without termination of this Lease, Landlord may at any time thereafter elect to terminate this Lease for such

7

previous breach. Notwithstanding any provision to the contrary contained herein, upon an Event of Default by Tenant and a subsequent eviction by Landlord, Landlord shall use commercially reasonable efforts to relet the Premises for a term or terms which may, at Landlord’s option, be less than or exceed the remaining Term hereof. Landlord does not necessarily agree to rent the Premises at its then fair market value if Landlord enters into a new lease agreement with respect to the Premises. The parties understand and agree that Landlord shall not be obligated to lease the Premises in any manner which is not in keeping with the type and caliber of tenants at the Building, nor shall Landlord be obligated to relet the Premises in preference to other vacant space in the Building;

(iii) To accelerate the whole or any part of the Rent for the balance of the Term, and declare the same to be immediately due and payable provided, however, that notwithstanding the foregoing or anything to the contrary contained elsewhere in the Lease, if Landlord obtains a judgment in the amount of the whole or any part of the Rent for the balance of the Term, such judgment shall recite the full lump sum amount but Tenant shall only be obligated under such judgment to pay the amount of Rent reserved under this Lease at the times stipulated for payment of the same in the Lease, less the amount of rental, if any, which Landlord receives during such period from others to whom the Premises may be rented; and

(iv) To terminate this Lease and the Term without any right on the part of Tenant to save the forfeiture by payment of any sum due or by other performance of any condition, term or covenant broken.

(c) Any provision to the contrary in this Section 22 notwithstanding, (i) Landlord shall not be required to give Tenant the notice and opportunity to cure provided in Section 22(a) above more than three times in any consecutive 12-month period, and thereafter Landlord may declare an Event of Default without affording Tenant any of the notice and cure rights provided under this Lease, and (ii) Landlord shall not be required to give such notice prior to exercising its rights under Section 22(b) if Tenant fails to comply with the provisions of Sections 13 and 20 or in an emergency.

(d) No waiver by Landlord of any breach by Tenant shall be a waiver of any subsequent breach, nor shall any forbearance by Landlord to seek a remedy for any breach by Tenant be a waiver by Landlord of any rights and remedies with respect to such or any subsequent breach. Efforts by Landlord to mitigate the damages caused by Tenant’s default shall not constitute a waiver of Landlord’s right to recover damages hereunder. No right or remedy herein conferred upon or reserved to Landlord is intended to be exclusive of any other right or remedy provided herein or by law, but each shall be cumulative and in addition to every other right or remedy given herein or now or hereafter existing at law or in equity. No payment by Tenant or receipt or acceptance by Landlord of a lesser amount than the total amount due Landlord under this Lease shall be deemed to be other than on account, nor shall any endorsement or statement on any check or payment be deemed an accord and satisfaction, and Landlord may accept such check or payment without prejudice to Landlord’s right to recover the balance of Rent due, or Landlord’s right to pursue any other available remedy.

(e) If either party commences an action against the other party arising out of or in connection with this Lease, the prevailing party shall be entitled to have and recover from the other party attorneys’ fees, costs of suit, investigation expenses and discovery costs, including costs of appeal.

(f) Landlord and Tenant waive the right to a trial by jury in any action or proceeding based upon or related to, the subject matter of this Lease.

22. Tenant’s Authority. Tenant represents and warrants to Landlord that: (a) Tenant is duly formed, validly existing and in good standing under the laws of the state under which Tenant is organized, and qualified to do business in the state in which the Property is located, and (b) the person(s) signing this Lease are duly authorized to execute and deliver this Lease on behalf of Tenant.

23. Liability of Landlord. Notwithstanding anything contained in this Lease to the contrary, the liability of Landlord under this Lease shall be limited to its interest in the Building and Tenant agrees that no judgement against Landlord under this Lease may be satisfied against any property or assets of Landlord other than the interests of Landlord in the Building.

24. Miscellaneous.

(a) The captions in this Lease are for convenience only, are not a part of this Lease and do not in any way define, limit, describe or amplify the terms of this Lease.

8

(b) This Lease represents the entire agreement between the parties hereto and there are no collateral or oral agreements or understandings between Landlord and Tenant with respect to the Premises or the Property. No rights, easements or licenses are acquired in the Property or any land adjacent to the Property by Tenant by implication or otherwise except as expressly set forth in this Lease. This Lease shall not be modified in any manner except by an instrument in writing executed by the parties. The masculine (or neuter) pronoun and the singular number shall include the masculine, feminine and neuter genders and the singular and plural number. The word “including” followed by any specific item(s) is deemed to refer to examples rather than to be words of limitation. The word “person” includes a natural person, a partnership, a corporation, a limited liability company, an association and any other form of business association or entity. Both parties having participated fully and equally in the negotiation and preparation of this Lease, this Lease shall not be more strictly construed, nor any ambiguities in this Lease resolved, against either Landlord or Tenant.

(c) Each covenant, agreement, obligation, term, condition or other provision contained in this Lease shall be deemed and construed as a separate and independent covenant of the party bound by, undertaking or making the same, not dependent on any other provision of this Lease unless otherwise expressly provided. All of the terms and conditions set forth in this Lease shall apply throughout the Term unless otherwise expressly set forth herein.

(d) If any provisions of this Lease shall be declared unenforceable in any respect, such unenforceability shall not affect any other provision of this Lease, and each such provision shall be deemed to be modified, if possible, in such a manner as to render it enforceable and to preserve to the extent possible the intent of the parties as set forth herein. This Lease shall be construed and enforced in accordance with the laws of the state in which the Property is located.

(e) This Lease shall be binding upon and inure to the benefit of Landlord and Tenant and their respective heirs, personal representatives and permitted successors and assigns. All persons liable for the obligations of Tenant under this Lease shall be jointly and severally liable for such obligations.

(f) Tenant shall not record this Lease or any memorandum without Landlord’s prior consent.

25. Notices. Any notice, consent or other communication under this Lease shall be in writing and addressed to Landlord or Tenant at their respective addresses specified in Section 1 above (or to such other address as either may designate by notice to the other) with a copy to any Mortgagee or other party designated by Landlord. Each notice or other communication shall be deemed given if sent by prepaid overnight delivery service or by certified mail, return receipt requested, postage prepaid or in any other manner, with delivery in any case evidenced by a receipt, and shall be deemed to have been given on the day of actual delivery to the intended recipient or on the business day delivery is refused. The giving of notice by Landlord’s attorneys, representatives and agents under this Section shall be deemed to be the acts of Landlord.

26. Security Deposit. At the time of signing this Lease, Tenant shall deposit with Landlord the Security Deposit as set forth in Section 1(j) above, to be retained by Landlord as cash security for the faithful performance and observance by Tenant of the provisions of this Lease. Tenant shall not be entitled to any interest on the Security Deposit. Landlord shall have the right to commingle the Security Deposit with its other funds. Landlord may use the whole or any part of the Security Deposit for the payment of any amount as to which Tenant is in default or to compensate Landlord for any loss or damage it may suffer by reason of Tenant’s default under this Lease. If Landlord uses all or any portion of the Security Deposit as herein provided, within 10 days after demand, Tenant shall pay Landlord cash in an amount equal to that portion of the Security Deposit used by Landlord. If Tenant complies fully and faithfully with all of the provisions of this Lease, the Security Deposit shall be returned to Tenant after the Expiration Date and surrender of the Premises to Landlord.

27. Radon Gas. As required by Florida statute, the following notification is provided: “RADON GAS: Radon is a naturally occurring radioactive gas that, when it has accumulated in a building in sufficient quantities, may present health risks to persons who are exposed to it over time. Levels of radon that exceed federal and state guidelines have been found in buildings in Florida. Additional information regarding radon and radon testing may be obtained from your county health department.”

28. Renewal Rights. Tenant shall be provided with two (2) options to renew the Lease for three (3) years by providing notice to Landlord not later than six (6) months prior to the Expiration Date. Terms and conditions shall be subject to market conditions for renewals occurring within 12 months of the date of notice for comparable product occurring in the market in which the Building is located, taking into account rental rates, landlord concessions, brokerage commissions, and improvements allowances. The rental rate shall in no event exceed 3.5% of the then current annual rent.

9

29. Electrical. Tenant shall contact the utility company for electrical service for the Premises and place the account in Tenant’s name, effective upon the Commencement Date.

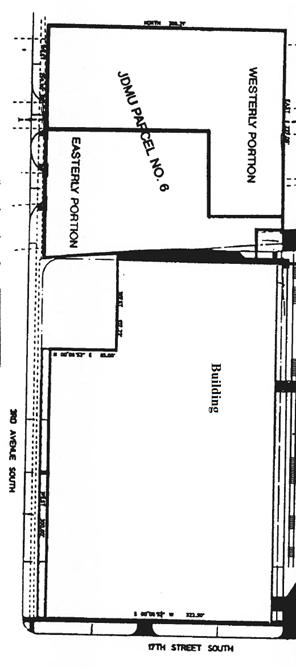

30. Parking. Tenant shall have the exclusive use of the parking area in front of the Premises at any time throughout the Lease. It is understood that the parking is provided via the parcel adjacent to the Building beneath Interstate I-275 which is defined as JDMU Parcel no. 6, depicted as Exhibit D. Tenant acknowledges that Landlord shall have no responsibility in enforcing Tenant’s exclusive parking rights and Tenant shall be wholly responsible in the enforcement and in the making of any improvements necessary for Tenant to maintain its exclusivity.

31. Tenant Improvements.

(a) Allowance: Tenant shall be provided with a Tenant Improvement Allowance (the “TI”) in the amount of $1.00 per rentable square foot ($93,000) in year 6 of this Lease to be utilized by Tenant for improvements to the Premises only. TI must be utilized by Tenant prior to the last day of the 6th lease year or such TI will be forfeited. Improvements to the Premises in connection with Tenant’s TI shall first require Landlord’s review and written approval.

(b) Acceptance of Premises. Tenant has examined and knows the condition of the Property, the streets, sidewalks, parking areas, curbs and access ways adjoining it, visible easements, any surface conditions and the present uses, and Tenant accepts them in the condition in which they now are.

Landlord and Tenant have executed this Lease on the respective date(s) set forth below.

| Date signed: | Landlord: | |||||||

| August 01, 2011 | ||||||||

| RIDGE ROCK PARTNERS, LLC., a Florida Limited Liability Company | ||||||||

| Witness: | By: Ridge Rock Partners, Sole General Partner | |||||||

| /S/ Douglas Jones | ||||||||

| Douglas Jones | ||||||||

| Name (printed): | By: | /S/ Andrew Krusen, JR | ||||||

| Andrew Krusen, JR | ||||||||

| /S/ Travis Luxton | Manager | |||||||

| Name (printed): Travis Luxton | ||||||||

10

| Date signed: | Tenant: | |||||||

| August 01, 2011 | JAGGED PEAK, INC., a Nevada Corporation | |||||||

| Attest/Witness: | By: | /S/ Andrew J Norstrud | ||||||

| /S/ Fay Burgeson | Print Name: Andrew J Norstrud | |||||||

| Title: CFO | ||||||||

| Name (printed): Fay Burgeson | ||||||||

| /S/ Donna Buss | ||||||||

| Name (printed): Donna Buss | ||||||||

11

Rider 1 to Lease Agreement

(Multi-Tenant Industrial)

ADDITIONAL DEFINITIONS

“ADA” means the Americans With Disabilities Act of 1990 (42 U.S.C. § 1201 et seq.), as amended and supplemented from time to time.

“Affiliate” means (i) any entity controlling, controlled by, or under common control of, Tenant, (ii) any successor to Tenant by merger, consolidation or reorganization, and (iii) any purchaser of all or substantially all of the assets of Tenant as a going concern.

“Agents” of a party means such party’s employees, agents, representatives, contractors, licensees or invitees.

“Alteration” means any addition, alteration or improvement to the Premises or Property, as the case may be.

“Building Rules” means the rules and regulations attached to this Lease as Exhibit “B” as they may be amended from time to time.

“Building Systems” means any electrical, mechanical, structural, plumbing, heating, ventilating, air conditioning, sprinkler, life safety or security systems serving the Building.

“Common Areas” means all areas and facilities as provided by Landlord from time to time for the use or enjoyment of all tenants in the Building or Property, including, if applicable, driveways, sidewalks, parking, loading and landscaped areas.

“Environmental Laws” means all present or future federal, state or local laws, ordinances, rules or regulations (including the rules and regulations of the federal Environmental Protection Agency and comparable state agency) relating to the protection of human health or the environment.

“Event of Default” means a default described in Section 22(a) of this Lease.

“Hazardous Materials” means pollutants, contaminants, toxic or hazardous wastes or other materials the removal of which is required or the use of which is regulated, restricted, or prohibited by any Environmental Law.

“Interest Rate” means interest at the rate of 1 1/2% per month.

“Land” means the lot or plot of land on which the Building is situated or the portion thereof allocated by Landlord to the Building.

“Laws” means all laws, ordinances, rules, orders, regulations, guidelines and other requirements of federal, state or local governmental authorities or of any private association or contained in any restrictive covenants or other declarations or agreements, now or subsequently pertaining to the Property or the use and occupation of the Property.

“Lease Year” means the period from the Commencement Date through the succeeding 12 full calendar months (including for the first Lease Year any partial month from the Commencement Date until the first day of the first full calendar month) and each successive 12-month period thereafter during the Term.

“Maintain” means to provide such maintenance, repair and, to the extent necessary and appropriate, replacement, as may be needed to keep the subject property in good condition and repair.

“Monthly Rent” means the monthly installment of Minimum Annual Rent plus the monthly installment of Annual Real Estate Taxes & Insurance payable by Tenant under this Lease.

A-1

“Mortgage” means any mortgage, deed of trust or other lien or encumbrance on Landlord’s interest in the Property or any portion thereof, including without limitation any ground or master lease if Landlord’s interest is or becomes a leasehold estate.

“Mortgagee” means the holder of any Mortgage, including any ground or master lessor if Landlord’s interest is or becomes a leasehold estate.

“Property” means the Land, the Building, the Common Areas, and all appurtenances to them.

“Rent” means the Minimum Annual Rent, Annual Real Estate Taxes & Insurance and any other amounts payable by Tenant to Landlord under this Lease.

“Taken” or “Taking” means acquisition by a public authority having the power of eminent domain by condemnation or conveyance in lieu of condemnation.

“Tenant’s Share” means the percentage obtained by dividing the rentable square feet of the Premises by the rentable square feet of the Building, as set forth in Section 1 of this Lease.

“Transfer” means (i) any assignment, transfer, pledge or other encumbrance of all or a portion of Tenant’s interest in this Lease, (ii) any sublease, license or concession of all or a portion of Tenant’s interest in the Premises, or (iii) any transfer of a controlling interest in Tenant.

Page 2 of 2

A-1

EXHIBIT “B”

BUILDING RULES

1. Any sidewalks, lobbies, passages and stairways shall not be obstructed or used by Tenant for any purpose other than ingress and egress from and to the Premises. Landlord shall in all cases retain the right to control or prevent access by all persons whose presence, in the judgment of Landlord, shall be prejudicial to the safety, peace or character of the Property.

2. Tenant shall not impair in any way the fire safety system and shall comply with all safety, fire protection and evacuation procedures and regulations established by Landlord or any governmental agency.

3. Without Landlord’s prior written consent, Tenant shall not hang, install, mount, suspend or attach anything from or to any sprinkler, plumbing, utility or other lines. If Tenant hangs, installs, mounts, suspends or attaches anything from or to any doors, windows, walls, floors or ceilings, Tenant shall spackle and sand all holes and repair any damage caused thereby or by the removal thereof at or prior to the expiration or termination of the Lease. If Tenant elects to seal the floor, Tenant shall seal the entire unfinished floor area within the Premises.

4. Tenant shall not place weights anywhere beyond the safe carrying capacity of the Building.

5. The use of rooms as sleeping quarters is strictly prohibited at all times.

6. If Landlord designates the Building as a non-smoking building, Tenant and its Agents shall not smoke in the Building nor at the Building entrances and exits.

7. Tenant shall comply with any move-in/move-out rules provided by Landlord.

8. Tenant shall cause all of Tenant’s Agents to comply with these Building Rules.

9. These Building Rules are not intended to give Tenant any rights or claims in the event that Landlord does not enforce any of them against any other tenants or if Landlord does not have the right to enforce them against any other tenants and such nonenforcement will not constitute a waiver as to Tenant.

B-1

EXHIBIT “C”

TENANT ESTOPPEL CERTIFICATE

Please refer to the documents described in Schedule 1 hereto, (the “Lease Documents”) including the “Lease” therein described; all defined terms in this Certificate shall have the same meanings as set forth in the Lease unless otherwise expressly set forth herein. The undersigned Tenant hereby certifies that it is the tenant under the Lease. Tenant hereby further acknowledges that it has been advised that the Lease may be collaterally assigned in connection with a proposed financing secured by the Property and/or may be assigned in connection with a sale of the Property and certifies both to Landlord and to any and all prospective mortgagees and purchasers of the Property, including any trustee on behalf of any holders of notes or other similar instruments, any holders from time to time of such notes or other instruments, and their respective successors and assigns (the “Beneficiaries”) that as of the date hereof:

1. The information set forth in attached Schedule 1 is true and correct.

2. Tenant is in occupancy of the Premises and the Lease is in full force and effect, and, except by such writings as are identified on Schedule l, has not been modified, assigned, supplemented or amended since its original execution, nor are there any other agreements between Landlord and Tenant concerning the Premises, whether oral or written.

3. All conditions and agreements under the Lease to be satisfied or performed by Landlord have been satisfied and performed.

4. Tenant is not in default under the Lease Documents, Tenant has not received any notice of default under the Lease Documents, and, to Tenant’s knowledge, there are no events which have occurred that, with the giving of notice and/or the passage of time, would result in a default by Tenant under the Lease Documents.

5. Tenant has not paid any Rent due under the Lease more than 30 days in advance of the date due under the Lease and Tenant has no rights of setoff, counterclaim, concession or other rights of diminution of any Rent due and payable under the Lease except as set forth in Schedule 1.

6. To Tenant’s knowledge, there are no uncured defaults on the part of Landlord under the Lease Documents, Tenant has not sent any notice of default under the Lease Documents to Landlord, and there are no events which have occurred that, with the giving of notice and/or the passage of time, would result in a default by Landlord thereunder, and that at the present time Tenant has no claim against Landlord under the Lease Documents.

7. Except as expressly set forth in Part G of Schedule 1, there are no provisions for any, and Tenant has no, options with respect to the Premises or all or any portion of the Property.

8. No action, voluntary or involuntary, is pending against Tenant under federal or state bankruptcy or insolvency law.

9. The undersigned has the authority to execute and deliver this Certificate on behalf of Tenant and acknowledges that all Beneficiaries will rely upon this Certificate in purchasing the Property or extending credit to Landlord or its successors in interest.

10. This Certificate shall be binding upon the successors, assigns and representatives of Tenant and any party claiming through or under Tenant and shall inure to the benefit of all Beneficiaries.

IN WITNESS WHEREOF, Tenant has executed this Certificate this day of , 2 .

| Name of Tenant | ||

| By: | ||

| Title: | ||

C-1

SCHEDULE 1 TO TENANT ESTOPPEL CERTIFICATE

Lease Documents, Lease Terms and Current Status

| A. | Date of Lease: |

| B. | Parties: |

| 1. | Landlord: |

| 2. | Tenant: |

| C. | Premises: |

| D. | Modifications, Assignments, Supplements or Amendments to Lease: |

| E. | Commencement Date: |

| F. | Expiration of Current Term: |

| G. | Option Rights: |

| H. | Security Deposit Paid to Landlord: $ |

| I. | Current Minimum Annual Rent: $ |

| J. | Current Annual Real Estate Taxes & Insurance: $ |

| K. | Current Total Rent: $ |

| L. | Square Feet Demised: |

C-2

EXHIBIT “D”

D-1