Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Consolidated Water Co. Ltd. | Financial_Report.xls |

| EX-23.1 - EXHIBIT 23.1 - Consolidated Water Co. Ltd. | v304433_ex23-1.htm |

| EX-23.2 - EXHIBIT 23.2 - Consolidated Water Co. Ltd. | v304433_ex23-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Consolidated Water Co. Ltd. | v304433_ex31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Consolidated Water Co. Ltd. | v304433_ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Consolidated Water Co. Ltd. | v304433_ex32-1.htm |

| EX-32.2 - EXHIBIT 32.2 - Consolidated Water Co. Ltd. | v304433_ex32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(Mark One)

| £ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2011 | |

| OR | |

| £ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transaction period from __________________ to __________________

| |

Commission File Number: 0-25248

CONSOLIDATED WATER CO. LTD.

(Exact name of Registrant as specified in its charter)

| CAYMAN ISLANDS | 98-0619652 | |

| (State or other jurisdiction of | (I.R.S. Employer Identification No.) | |

| incorporation or organization) | ||

| Regatta Office Park | ||

| Windward Three, 4th Floor, West Bay Road | ||

| P.O. Box 1114 | ||

| Grand Cayman, KY1-1102, Cayman Islands | N/A | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s Telephone number, including area code: (345) 945-4277

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Name of each exchange on which registered: | |

| Common Stock, $.60 Par Value | The NASDAQ Stock Market LLC (NASDAQ Global Select Market) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes £ No R

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes £ No R

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes R No £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Sec. 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes R No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this 10-K or any amendments to this Form 10-K. [Not Applicable]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer £ | Accelerated filer R | Non-accelerated filer £ | Smaller reporting company £ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes £ No R

The aggregate market value of common stock held by non-affiliates of the registrant, based on the closing sales price for the registrant’s common shares, as reported on the NASDAQ Global Select Market on June 30, 2011, was $132,171,491.

As of March 9, 2012, 14,568,696 shares of the registrant’s common shares were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: None

TABLE OF CONTENTS

| Section | Description | Page | ||

| Cautionary Note Regarding Forward-Looking Statements | 3 | |||

| PART I | 4 | |||

| Item 1. | Business | 4 | ||

| Item 1A. | Risk Factors | 21 | ||

| Item 1B. | Unresolved Staff Comments | 29 | ||

| Item 2. | Properties | 29 | ||

| Item 3. | Legal Proceedings | 32 | ||

| PART II | 32 | |||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 32 | ||

| Item 6. | Selected Financial Data | 35 | ||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 35 | ||

| Item 7A. | Quantitative and Qualitative Disclosure about Market Risk | 52 | ||

| Item 8. | Financial Statements and Supplementary Data | 53 | ||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 97 | ||

| Item 9A. | Controls and Procedures | 97 | ||

| PART III | 98 | |||

| Item 10. | Directors, Executive Officers and Corporate Governance | 98 | ||

| Item 11. | Executive Compensation | 103 | ||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 122 | ||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 125 | ||

| Item 14. | Principal Accounting Fees and Services | 125 | ||

| PART IV | 126 | |||

| Item 15. | Exhibits, Financial Statement Schedules | 126 | ||

| SIGNATURES | 127 | |||

| 2 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements, including but not limited to, statements regarding our future revenues, future plans, objectives, expectations and events, assumptions and estimates. Forward-looking statements can be identified by use of the words or phrases “will”, “will likely result”, “are expected to”, “will continue”, “estimate”, “project”, “potential”, “believe”, “plan”, “anticipate”, “expect”, “intend”, “may,” “believe, “ or similar expressions and variations of such words. Statements that are not historical facts are based on our current expectations, beliefs, assumptions, estimates, forecasts and projections for our business and the industry and markets related to our business.

The forward-looking statements contained in this report are not guarantees of future performance and involve certain risks, uncertainties and assumptions which are difficult to predict. Actual outcomes and results may differ materially from what is expressed in such forward-looking statements. Important factors which may affect these actual outcomes and results include, without limitation, tourism and weather conditions in the areas we service, scheduled new construction within our operating areas, the economies of the U.S. and the areas we service, regulatory matters, availability of capital to repay debt and for expansion of our operations, and other factors, including those set forth under Part I, Item 1A. “Risk Factors” in this Annual Report.

The forward-looking statements in this Annual Report speak as of its date. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained in this Annual Report to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any forward-looking statement is based, except as may be required by law.

Unless otherwise indicated, references to “we,” “our,” “ours” and “us” refer to Consolidated Water Co. Ltd. and its subsidiaries.

Note Regarding Currency and Exchange Rates

Unless otherwise indicated, all references to “$” or “US$” are to United States dollars.

The exchange rate for conversion of Cayman Island dollars (CI$) into US$, as determined by the Cayman Islands Monetary Authority, has been fixed since April 1974 at US$1.20 per CI$1.00.

The exchange rate for conversion of Belize dollars (BZE$) into US$, as determined by the Central Bank of Belize, has been fixed since 1976 at US $0.50 per BZE$1.00.

The exchange rate for conversion of Bahamas dollars (B$) into US$, as determined by the Central Bank of The Bahamas, has been fixed since 1973 at US$1.00 per B$1.00.

The official currency of the British Virgin Islands is the United States dollar.

The exchange rate for conversion of Bermuda dollars (BMD$) into US$ as determined by the Bermuda Monetary Authority, has been fixed since 1970 at US$1.00 per BMD$1.00.

Our Netherlands subsidiary conducts business in U.S. dollars and Euros and our Mexico affiliate conducts business in U.S. dollars and Mexican pesos.

| 3 |

PART I

ITEM 1. BUSINESS

Overview

We develop and operate seawater desalination plants and water distribution systems in areas where naturally occurring supplies of potable water are scarce or nonexistent. Through our subsidiaries and affiliates, we operate 14 reverse osmosis desalination plants and provide the following services to our customers in the Cayman Islands, the Bahamas, Belize, and the British Virgin Islands:

| • | Retail Water Operations. We produce and supply water to end-users, including residential, commercial and government customers in the Cayman Islands under an exclusive retail license issued by the government to provide water in two of the most populated and rapidly developing areas in the Cayman Islands. In 2011, our retail water operations generated approximately 42% of our consolidated revenues. |

| • | Bulk Water Operations. We produce and supply water to government-owned distributors in the Cayman Islands, Belize and the Bahamas. In 2011, our bulk water operations generated approximately 56% of our consolidated revenues. | |

| • | Services Operations. We provide engineering and management services for desalination projects, including designing and constructing desalination plants and managing and operating desalination plants owned by other companies. In 2011, our services operations generated approximately 2% of our consolidated revenues. |

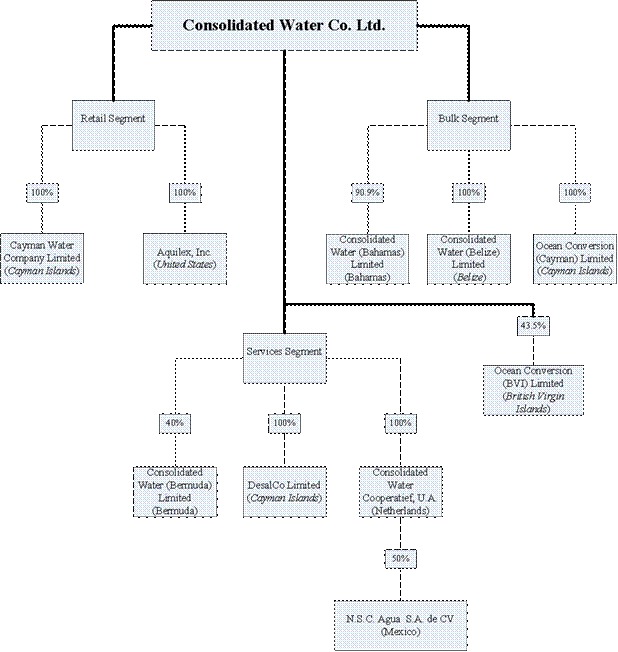

| • | Affiliate Operations. We have three affiliates. (1) We own 50% of the voting rights and 43.5% of the equity rights of Ocean Conversion (BVI) Ltd. (“OC-BVI”), which produces and supplies bulk water to the British Virgin Islands Water and Sewerage Department. (2) We own 40% of the voting rights of Consolidated Water (Bermuda) Limited, which constructed and sold a plant to the Bermuda government and operated the plant on the government’s behalf from the second quarter of 2009 through the termination of the agreement on June 30, 2011. As a result of the termination of the agreement with the Bermuda government, we do not expect to receive any future fees or revenues from CW-Bermuda. (3) In May 2010, we acquired, through our wholly-owned Netherlands subsidiary, Consolidated Water Cooperatief, U.A., a 50% interest in N.S.C. Agua, S.A. de C.V., (“NSC”) a Mexican company. NSC has been formed to pursue a project encompassing the construction, ownership and operation of a 100 million gallon per day seawater reverse osmosis desalination plant to be located in northern Baja California, Mexico and an accompanying pipeline to deliver water to the U.S. border. The project is in the development stage and NSC does not presently generate any operating revenues. |

As of December 31, 2011, the number of plants we, or our affiliates, operate in each country and the production capacities of these plants are as follows:

| Location | Plants | Capacity(1) | ||||||

| Cayman Islands | 8 | 10.2 | ||||||

| Bahamas | 3 | 15.2 | ||||||

| Belize | 1 | 0.6 | ||||||

| British Virgin Islands | 2 | 0.8 | ||||||

| Total | 14 | 26.8 | ||||||

| (1) | In millions of U.S. gallons per day. |

Strategy

Our strategy is to provide water services in areas where the supply of potable water is scarce and we believe the production of potable water by reverse osmosis desalination is, or will be, profitable. We have focused on the Caribbean basin and adjacent areas as our principal markets because they possess the following characteristics which make them attractive for our business:

| • | little or no naturally occurring fresh water; | |

| • | limited regulations and taxes allowing for higher returns; |

| • | a large proportion of tourist properties, which historically have generated higher volume sales than residential properties; | |

| • | growing populations and tourism levels. |

| 4 |

Although we are currently focused primarily on these areas, we believe that our potential market includes any location with a demand for, but a limited supply of, potable water. The desalination of seawater is the most widely used process for producing fresh water in areas with an insufficient natural supply. In addition, in many locations, desalination is the only commercially viable means to expand the existing water supply. We believe that our experience in the development and operation of reverse osmosis desalination plants provides us with the capabilities to successfully expand our operations and we expect to expand our operations beyond our existing Caribbean markets in the future.

Key elements of our strategy include:

• Maximizing the benefits of our exclusive retail license on Grand Cayman. We plan to continue to increase operations within our exclusive retail license service area through organic growth and possible further investments, if opportunities become available.

• Expanding our existing operations in the Cayman Islands, Belize and The Bahamas. We plan to continue to seek new water supply agreements and licenses and will also focus on renewing our existing service contracts with extended terms and greater production levels.

• Penetrating new markets. We plan to continue to seek opportunities to profitably expand our operations into new markets that have significant unfulfilled demands for potable water. These markets include the rest of the Caribbean, North, Central and South America, Mexico, Asia and elsewhere that we can provide water on a profitable basis and in favorable regulatory environments. We may pursue these opportunities either on our own or through joint ventures and strategic alliances.

• Broadening our existing and future operations into complementary services. We continue to consider and pursue opportunities to leverage our water-related expertise to enter complementary service industries, such as wastewater management.

Our Company

We conduct our operations in the Cayman Islands, The Bahamas, the British Virgin Islands, Belize, and the United States through the following principal operating subsidiaries and affiliates:

| 5 |

| • | Cayman Water Company Limited (“Cayman Water”). Cayman Water operates under an exclusive retail license granted by the Cayman Islands government to provide water to customers within a prescribed service area on Grand Cayman that includes the Seven Mile Beach and West Bay areas, two of the three most populated areas in the Cayman Islands. The only non-government owned public water utility on Grand Cayman, Cayman Water owns and operates four desalination plants. |

| 6 |

| • | Ocean Conversion (Cayman) Limited (“OC-Cayman”). OC-Cayman provides bulk water under various licenses and agreements to the Water Authority-Cayman, a government-owned utility and regulatory agency, which distributes the water to properties located outside our exclusive retail license service area in Grand Cayman. OC-Cayman operates four desalination plants owned by the Water Authority-Cayman. |

| • | Consolidated Water (Bahamas) Limited (“CW-Bahamas”). We own a 90.9% equity interest in CW-Bahamas, which provides bulk water under long-term contracts to the Water and Sewerage Corporation of The Bahamas, a government agency. CW-Bahamas owns and operates our largest desalination plant and two other desalination plants. CW-Bahamas pays fees to two of our other subsidiaries for certain administrative services. |

| • | Consolidated Water (Belize) Limited (“CW-Belize”). CW-Belize, (formerly Belize Water Limited), owns and operates one desalination plant and has an exclusive contract to provide bulk water to Belize Water Services Ltd., a water distributor that serves residential, commercial and tourist properties in Ambergris Caye, Belize. |

| • | Aquilex, Inc. This subsidiary, a United States company, provides financial, engineering and supply chain management support services to our subsidiaries and affiliates. |

| • | Ocean Conversion (BVI) Ltd. (“OC-BVI”). We own 50% of the voting stock of our affiliate, OC-BVI, a British Virgin Islands company, which sells bulk water to the Government of The British Virgin Islands Water and Sewerage Department. We own an overall 43.5% equity interest in OC-BVI’s profits and certain profit sharing rights that raise our effective interest in OC-BVI’s profits to approximately 45%. OC-BVI also pays our subsidiary DesalCo Limited fees for certain engineering and administrative services. We account for our investment in OC-BVI under the equity method of accounting. |

| • | DesalCo Limited (“DesalCo”). A Cayman Islands company, DesalCo provides management, engineering and construction services for desalination projects. |

| • | Consolidated Water (Bermuda) Limited (“CW-Bermuda”). In January 2007, our affiliate, Consolidated Water (Bermuda) Limited (“CW-Bermuda”) entered into a design, build, sale and operating agreement with the Government of Bermuda for a desalination plant to be built in two phases at Tynes Bay along the northern coast of Bermuda. Under the agreement, CW-Bermuda constructed and operated the plant from the second quarter of 2009 through the termination of the agreement on June 30, 2011. We entered into a management services agreement with CW-Bermuda for the design, construction and operation of the Tynes Bay plant, under which we received fees for direct services, purchasing activities and proprietary technology. Although we own only 40% of the common shares of CW-Bermuda, we consolidate its results in our consolidated financial statements as we are its primary financial beneficiary. As a result of the termination of our agreement with the Bermuda government, we do not expect to receive any future fees or revenues from CW-Bermuda. |

| • |

Consolidated Water Cooperatief, U.A. (“CW-Coop”). CW-Coop is a wholly-owned Netherlands subsidiary organized in 2010. In May 2010, CW-Coop acquired a 50% interest in N.S.C. Agua, S.A. de C.V., (“NSC”) a Mexican company. NSC has been formed to pursue a project encompassing the construction, ownership and operation of a 100 million gallon per day seawater reverse osmosis desalination plant to be located in northern Baja California, Mexico and accompanying pipeline to deliver water to the U.S. border. The project is currently in the development stage and NSC does not generate any operating revenues. As we have provided and will continue to provide all of NSC’s development funding we consolidate its results in our consolidated financial statements. |

Our Operations

We have three principal business segments: retail water operations, bulk water operations and services operations. Our retail water operations supply water to end-users, including residential, commercial and government customers. Through our bulk water operations we supply water to government owned distributors. Our retail and bulk operations serve customers in the Cayman Islands, Belize, the British Virgin Islands and The Bahamas. Our services operations provide engineering and management services, which include designing and constructing desalination plants, and managing and operating plants owned by other companies.

For fiscal year 2011, our retail water, bulk water and service operations generated approximately 42%, 56% and 2%, respectively, of our consolidated revenues. For information about our business segments and geographical information about our operating revenues and long-lived assets, see Note 16 to our consolidated financial statements at Item 8 of this Annual Report.

Retail Water Operations

For fiscal years 2011, 2010 and 2009, our retail water operations accounted for approximately 42%, 43% and 40%, respectively, of our consolidated revenues. This business in the Cayman Islands produces and supplies water to end-users, including residential, commercial and government customers.

| 7 |

We sell water through our retail operations to a variety of residential and commercial customers through our wholly-owned subsidiary Cayman Water, which operates under an exclusive license issued to us by the Cayman Islands government under The Water Production and Supply Law of 1979. As discussed below, this license was set to expire in July 2010 but has since been extended while negotiations for a new license take place. Pursuant to the license, we have the exclusive right to produce potable water and distribute it by pipeline to our licensed service area which consists of the Seven Mile Beach and West Bay areas of Grand Cayman, two of the three most populated areas in the Cayman Islands.

Under our license, we pay a royalty to the government of 7.5% of our gross retail water sales revenues (excluding energy adjustments). The selling prices of water sold to our customers are determined by license and vary depending upon the type and location of the customer and the monthly volume of water purchased. The license provides for an automatic adjustment for inflation or deflation on an annual basis, subject to temporary limited exceptions, and an automatic adjustment for the cost of electricity on a monthly basis. The Water Authority-Cayman, on behalf of the government, reviews and confirms the calculations of the price adjustments for inflation and electricity costs. If we want to adjust our prices for any reason other than inflation or electricity costs, we have to request prior approval of the Cabinet of the Cayman Islands government. Disputes regarding price adjustments are referred to arbitration. Our last price increase, requested in June 1985, was granted in full.

This license was set to expire on July 10, 2010; however, the Company and the Cayman Islands government have agreed in correspondence to extend the license seven times in order to provide sufficient time to negotiate the terms of a new license agreement. We were advised by a letter dated February 16, 2012 from Water Authority-Cayman that the government had approved an extension of the license until June 30, 2012. We are currently waiting for the government to execute such license extension.

On February 14, 2011, the Water Production and Supply Law, 2011 (which replaces the Water (Production and Supply) Law (1996 Revision) under which the Company is licensed) and the Water Authority (Amendment) Law, 2011 (the “New Laws”) were published on terms that they would come into force on such date as may be appointed by Order made by the Governor in Cabinet. Such Order was subsequently made by Cabinet and the New Laws are now in full force and effect. Under the New Laws, the Water Authority-Cayman would issue any new license which could include a rate of return on invested capital model described below.

We have been informed during our retail license renewal negotiations conducted with representatives of the Cayman Islands government that the Cayman Islands government seeks to restructure the terms of our license to employ a “rate of return on invested capital model” similar to that governing the sale of water to many U.S. municipalities. We have formally objected to the implementation of a “rate of return on invested capital model” on the basis that we believe that such a model would not promote the efficient operation of our water utility and could ultimately increase water rates to our customers. We believe such a model, if ultimately implemented, could significantly reduce the operating income and cash flows we have historically generated from our retail license and could require us to record an impairment loss to reduce the $1.2 million carrying value of our retail segment’s goodwill.

If a new long-term license agreement is not entered into with the government, we would retain a right of first refusal to renew the license on terms that are no less favorable than those that the government might offer in the future to a third party. See further discussion of this matter at Item 1.A. “Risk Factors.”

Facilities

Our retail operations in the Cayman Islands currently produce potable water at four reverse osmosis seawater conversion plants in Grand Cayman located at our Abel Castillo Water Works (“ACWW”, formerly Governor’s Harbour), Britannia and West Bay sites. We own the land for our ACWW and West Bay plants and have entered into a lease for the land for our Britannia plant until January 1, 2027. The current production capacity of the two plants located at ACWW is 2.2 million U.S. gallons of water per day. The production capacity of the Britannia plant is 715,000 U.S. gallons of water per day. The production capacity of the West Bay plant is 910,000 U.S. gallons of water per day.

Electricity to our plants is supplied by Caribbean Utilities Co. Ltd., a publicly traded utility company. At all of our four retail plant sites we maintain diesel driven, standby generators with sufficient capacity to operate our distribution pumps and other essential equipment during any temporary interruptions in electricity supply. Standby generation capacity is also maintained at our West Bay Plant and ACWW plants to operate a portion of the water production capacity as well.

In the event of an emergency, our distribution system is connected to the distribution system of the Water Authority-Cayman. In prior years we have purchased water from the Water Authority-Cayman for brief periods of time. We have also sold potable water to the Water Authority-Cayman from our retail plants.

| 8 |

Our pipeline system in the Cayman Islands covers the Seven Mile Beach and West Bay areas of Grand Cayman and consists of approximately 71 miles of polyvinyl chloride and polyethylene pipeline. We extend our distribution system periodically as demand warrants. We have a main pipe loop covering the Seven Mile Beach and West Bay areas. We place extensions of smaller diameter pipe off our main pipe to service new developments in our service area. This system of building branches from the main pipe keeps construction costs low and allows us to provide service to new areas in a timely manner. During 2011, we completed a number of small pipeline extensions into newly developed properties within our distribution system. Developers are responsible for laying the pipeline within their developments at their own cost, but in accordance with our specifications. When a development is completed, the developer then transfers operation and maintenance of the pipeline to us.

We have a comprehensive layout of our pipeline system, superimposed upon digital aerial photographs, which is maintained using a computer aided design system. This system is interconnected with a computer generated hydraulic model, which allows us to accurately locate pipes and equipment in need of repair and maintenance. It also helps us to plan extensions and upgrades.

Customers

We enter into contracts with hotels, condominiums, residential homes and other properties located in our existing licensed area to provide potable water. In the Seven Mile Beach area, our primary customers are the hotels and condominium complexes that serve the tourist industry. In the West Bay area, our primary customers are residential homes.

| 9 |

Development continues to take place on Grand Cayman, and particularly in our licensed area, to accommodate both the growing local population and the tourism market. Because our license requires us to supply water to developments in our licensed area, the planning department of the Cayman Islands government routinely advises us of proposed developments. This advance notice allows us to manage our production capacity to meet anticipated demand. We believe that we have a sufficient supply of water to meet the foreseeable future demand.

We bill our customers on a monthly basis based on metered consumption and bills are typically collected within 30 to 35 days after the billing date and receivables not collected within 45 days subject the customer to disconnection from water service. In 2011, 2010 and 2009, bad debts represented less than 1% of our total annual retail sales. In addition to their past due invoice balance, customers that have had their service disconnected must pay re-connection charges.

The following table sets forth our approximate total number of customer connections as of, and for the indicated years ended December 31:

Retail Water Customer Connections

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| Number of Customer Connections | 5,200 | 5,100 | 5,000 | 4,600 | 4,600 | |||||||||||||||

The table above does not precisely represent the actual number of customers or facilities that we serve. For example, in hotels and condominiums, we may only have a single customer (e.g. the operator of the hotel or the condominium) while supplying water to all of the units within that hotel or condominium development. Historically, demand on our pipeline distribution has varied throughout the year. Demand depends upon the number of tourists visiting and the amount of rainfall during any particular time of the year. In general, the majority of tourists come from the United States during the winter months.

Bulk Water Operations

For fiscal years 2011, 2010 and 2009, our bulk water operations accounted for approximately 56%, 50% and 45%, respectively, of our consolidated revenues and are comprised of businesses in the Cayman Islands, The Bahamas and Belize. These businesses produce potable water from seawater and sell this water to governments and private customers.

Bulk Water Operations in the Cayman Islands

We sell bulk water in the Cayman Islands through our wholly-owned subsidiary OC-Cayman.

Facilities

We operate and sell water from four reverse osmosis seawater conversion plants in Grand Cayman that are owned by the Water Authority-Cayman: the Red Gate, Lower Valley, North Sound and North Side Water Works plants, which have production capacities of approximately 1.3 million, 1.1 million, 1.6 million and 2.4 million U.S. gallons of water per day, respectively. The North Side Water Works (“NSWW”) plant was commissioned in June 2009. The Red Gate plant was temporarily de-commissioned in December 2009 in order to carry out extensive rehabilitative and upgrade work to the plant as part of a new seven year operating contract with the Water Authority-Cayman. The refurbished Red Gate plant was re-commissioned in July 2010. The plants that we operate for the Water Authority-Cayman are located on land owned by the Water Authority-Cayman.

Customers

We provide bulk water on a take-or-pay basis to the Water Authority-Cayman, a government owned utility and regulatory agency, under various licenses and agreements. The Water Authority-Cayman in turn distributes that water to properties in the parts of Grand Cayman that are outside of our retail license area.

The current operating agreement for the Red Gate plant began on July 2, 2010 for a period of seven years.

The current operating agreement for the North Sound plant was extended on April 1, 2007 for a period of seven years.

| 10 |

The current operating agreement for the Lower Valley plant was extended on January 12, 2006 for a period of seven years.

On March 11, 2008, we signed a ten-year agreement with the Water Authority-Cayman to finance, design, build and operate a seawater reverse osmosis water production plant at their NSWW site on Grand Cayman. Under the terms of this license, OC-Cayman is obligated to deliver to the Water Authority-Cayman the amount of water it demands or 2.14 million U.S. gallons of water per day on average each month, whichever is less. The NSWW plant was completed in June 2009 and has a production capacity of 2.4 million U.S. gallons per day.

| 11 |

Bulk Water Operations in Belize

In Belize, we sell bulk water through our wholly-owned subsidiary CW-Belize.

Facilities

We own the reverse osmosis seawater conversion plant in Belize and lease the land on which our plant is located from the Belize government at an annual rent of BZE$1.00. The lease, which was entered into in April 1993 and extended in January 2004, expires in April 2026. The production capacity of the plant is 550,000 U.S. gallons of water per day.

Electricity to our plant is supplied by Belize Electricity Limited. At the plant site, we maintain a diesel driven, standby generator with sufficient capacity to operate our water production equipment during any temporary interruption in the electricity supply. Feed water for the reverse osmosis units is drawn from deep wells with associated pumps on the property. Reject water is discharged into a well on the property at a level below that of the feed water intakes.

Customers

We are the exclusive provider of water in Ambergris Caye, Belize to Belize Water Services Ltd. (“BWSL”), a government controlled entity which distributes the water through its own pipeline system to residential, commercial and tourist properties. BWSL distributes our water primarily to residential properties, small hotels, and businesses that serve the tourist market. The base price of water supplied, and adjustments thereto, are determined by the terms of the contract, which provides for annual adjustments based upon the movement in the government price indices specified in the contract, as well as monthly adjustments for changes in the cost of diesel fuel and electricity. Demand is less cyclical than in our other locations due to a higher proportion of residential to tourist demand.

We have an exclusive 23-year contract with BWSL to supply a minimum of 1.75 million U.S. gallons of water per week, or upon demand up to 2.1 million U.S. gallons per week, on a take-or-pay basis. This contract terminates on March 23, 2026. BWSL has the right, with six months advance notice before the termination date, to renew the contract for a further 25-year period on the same terms and conditions. The contract was amended on March 1, 2011 to increase the minimum supply to 290,000 U.S. gallons per day (equal to 2.03 million U.S. gallons per week), or upon demand up to approximately 12.7 million U.S. gallons per month.

Bulk Water Operations in The Bahamas

In The Bahamas, we sell bulk water through our majority-owned subsidiary, CW-Bahamas.

Facilities

We currently supply bulk water in The Bahamas from our Windsor, Blue Hills and Bimini plants. We supply water from our Windsor plant which has a capacity of 3.1 million U.S. gallons per day under the terms of a 15-year water supply agreement with an effective date of March 1998. We supply water from our Blue Hills plant under the terms of a twenty-year water supply agreement dated May 20, 2005, effective July 2006. Prior to 2011, the Blue Hills plant was capable of producing 7.2 million U.S. gallons of potable water per day, and is our largest seawater conversion facility to date. The Blue Hills plant water supply agreement was amended effective January 31, 2011 pursuant to which we increased the production capacity of the Blue Hills plant to 12.0 million U.S. gallons per day during 2011. The term of the water supply agreement will be extended at the date that the expansion is deemed substantially complete for a period of 20-years, or until the plant has delivered approximately 66.9 billion U.S. gallons of water, whichever occurs later. We expect to achieve substantial completion in the first quarter of 2012. The Bimini plant has a capacity of 115,000 U.S gallons per day.

Electricity to our plants is supplied by Bahamas Electricity Corporation. We maintain a standby generator with sufficient capacity to operate essential equipment at our Windsor and Blue Hills plants and are able to produce water with these plants during temporary interruptions in the electricity supply.

Feed water for the reverse osmosis units are drawn from deep wells with associated pumps on the property. Reject water is discharged into wells on the property at a deeper level than the feed water intakes.

| 12 |

Customers

We provide bulk water to the Water and Sewerage Corporation of The Bahamas (“WSC”), which distributes the water through its own pipeline system to residential, commercial and tourist properties on the Island of New Providence.

We are required to provide the WSC with at least 16.8 million U.S. gallons per week of potable water from our Windsor plant, and the WSC has contracted to purchase at least that amount from us on a take-or-pay basis. This water supply agreement expires on March 1, 2013. At the conclusion of the agreement, the WSC has the option to:

| • | extend the agreement for an additional five years at a rate to be negotiated; | |

| • | exercise a right of first refusal to purchase any materials, equipment and facilities that CW-Bahamas intends to remove from the site, and negotiate a purchase price with CW-Bahamas; or | |

| • | require CW-Bahamas to remove all materials, equipment and facilities from the site. |

Prior to 2011 we incurred penalties relating to the Windsor plant for not meeting diesel fuel and electricity efficiencies specified in our water sale agreement with the WSC. These penalties totaled $15,713, and $63,433 in 2010 and 2009, respectively. We believe that programs to replace problematic equipment and improve the feed water source of this plant will to allow us to operate without incurring any material penalties in the future.

We were required to provide the WSC with at least 33.6 million U.S. gallons per week of potable water from the Blue Hills plant, and the WSC had contracted to purchase at least that amount from us on a take-or-pay basis. This water supply agreement expired on the later of July 26, 2026 or after the plant had produced 35.0 billion U.S. gallons of water. The Blue Hills plant water supply agreement was amended effective January 31, 2011. Under the terms of the amended agreement we increased the production capacity of the Blue Hills plant to 12.0 million U.S. gallons per day. With this expansion, we are required to deliver and the WSC is required to purchase a minimum of 63.0 million U.S. gallons per week. The term of the water supply agreement will be extended at the date that the expansion is deemed substantially complete for a period of 20-years, or until the plant has delivered approximately 65.7 billion U.S. gallons of water, whichever occurs later. We expect to achieve substantial completion in the first quarter of 2012. At the conclusion of the agreement, the WSC has the option to:

| • | extend the agreement for an additional five years at a rate to be negotiated; | |

| • | exercise a right of first refusal to purchase any materials, equipment and facilities that CW-Bahamas intends to remove from the site, and negotiate a purchase price with CW-Bahamas; or | |

| • | require CW-Bahamas to remove all materials, equipment and facilities from the site. |

Services Operations

For fiscal years 2011, 2010 and 2009, our services operations accounted for approximately 2%, 7% and 15%, respectively, of our consolidated revenues and are comprised of businesses providing services in the Cayman Islands, The Bahamas, the British Virgin Islands and (through June 30, 2011) Bermuda. These businesses provide engineering and management services, including designing and constructing desalination plants, and managing and operating plants owned by other companies.

Engineering and Management Services Operations

We provide design, engineering and construction services for desalination projects through DesalCo, which is recognized by suppliers as an original equipment manufacturer of reverse osmosis seawater desalination plants for our Company. DesalCo also provides management services to our affiliates.

Aquilex, Inc., our wholly-owned U.S. subsidiary located in Coral Springs, Florida, provides financial, engineering and supply chain support services to our operating segments.

Affiliate Operations

Our affiliate, OC-BVI, sells water to one government customer in the British Virgin Islands. We own 50% of the voting shares of OC-BVI and have an overall 43.5% equity interest in the profits of OC-BVI. We also own separate profit sharing rights in OC-BVI that raise our effective interest in OC-BVI’s profits from 43.5% to approximately 45%. Sage Water Holdings (BVI) Limited (“Sage”) owns the remaining 50% of the voting shares of OC-BVI and the remaining 55% interest in its profits. Under the Articles of Association of OC-BVI, we have the right to appoint three of the six directors of OC-BVI. Sage is entitled to appoint the remaining three directors. In the event of a tied vote of the Board, the President of the Caribbean Water and Wastewater Association, a regional trade association comprised primarily of government representatives, is entitled to appoint a junior director to cast a deciding vote.

We provide certain engineering and administrative services to OC-BVI for a monthly fee and a bonus arrangement which provides for payment of 4.0% of the net operating income of OC-BVI.

We account for our interests in OC-BVI using the equity method of accounting.

| 13 |

Customer

OC-BVI sells bulk water to the Government of The British Virgin Islands Water and Sewerage Department (“BVIW&S”), which distributes the water through its own pipeline system to residential, commercial and tourist properties on the islands of Tortola and Jost Van Dyke in the British Virgin Islands. During 2011, OC-BVI supplied BVIW&S with 180 million U.S. gallons of water from desalination plants located at Bar Bay, Tortola, and the island of Jost Van Dyke in the British Virgin Islands.

Facilities

Through March 2010, OC-BVI operated a seawater reverse osmosis plant at Baughers Bay, Tortola, in the British Virgin Islands, which had a production capacity of 1.7 million U.S. gallons per day. The plant had an advanced energy recovery system, generated its own electrical power on site using two large diesel driven generator units and also purchased electricity from the BVI Electric Co. to power ancillary equipment and provide building lighting.

| 14 |

In October 2006, we were notified by OC-BVI that the Ministry of Communications and Works of the Government of the British Virgin Islands (the “Ministry”) had asserted a purported right of ownership of OC-BVI’s Baughers Bay desalination plant pursuant to the terms of a Water Supply Agreement dated May 1990 (the “1990 Agreement”). In November 2007, the Ministry commenced litigation against OC-BVI in the Eastern Caribbean Supreme Court seeking ownership of the Baughers Bay plant and was awarded ownership and possession of this plant by the Court in October 2009. As a result of the Court decision, OC-BVI ceased operating the Baughers Bay plant on March 29, 2010. See further discussion at “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Material Commitments, Expenditures and Contingencies.”

In 2007, OC-BVI completed the construction of a 720,000 U.S. gallons per day plant at Bar Bay, Tortola, in the British Virgin Islands. This plant began supplying water to the BVI government in January 2009. The definitive contract for the sale of water from this plant was signed on March 4, 2010. The contract has a term of seven years with a seven year renewal option exercisable by the BVI government. We purchase electrical power to operate this plant from BVI Electric Co. and operate diesel engine driven emergency power generators when BVI Electric Co. is unable to provide power to the plant.

OC-BVI’s plant on the island of Jost Van Dyke has a capacity of 60,000 U.S. gallons per day. This plant operates under a contract with the BVI government that expires July 8, 2013. We purchase electrical power to operate this plant from BVI Electric Co.

| 15 |

Reverse Osmosis Technology

The conversion of seawater to potable water is called desalination. The two primary forms of desalination are distillation and reverse osmosis. Both methods are used throughout the world and technologies are improving to lower the costs of production. Reverse osmosis is a fluid separation process in which the saline water is pressurized and the fresh water is separated from the saline water by passing through a semi-permeable membrane which rejects the salts. The saline water (i.e. seawater) is first passed through a pretreatment system, which generally consists of fine filtration and treatment chemicals, if required. Pre-treatment removes suspended solids and organics which could cause fouling of the membrane surface. Next, a high-pressure pump pressurizes the saline water thus enabling approximately 40% conversion of the saline water to fresh water as it passes through the membrane, while more than 99% of the dissolved salts are rejected and remain in the now concentrated saline water. This remaining feed water which has now been concentrated is discharged without passing through the membrane. The remaining hydraulic energy in the concentrated feed water is transferred to the initial saline feed water with an energy recovery device thus reducing the total energy requirement for the reverse osmosis system. The final step is post-treatment, which consists of stabilizing the produced fresh water, thereby removing undesirable dissolved gases, adjusting the pH and providing chlorination to prepare it for distribution.

We use reverse osmosis technology to convert seawater to potable water at all of the plants we construct and operate. We believe that this technology is the most effective and efficient conversion process for our market. However, we are always seeking ways to maximize efficiencies in our current processes and investigating new, more efficient processes to convert seawater to potable water. The equipment at our plants is among the most energy efficient available and we monitor and maintain the equipment in an efficient manner. As a result of our decades of experience in seawater desalination, we believe that we have an expertise in the development and operation of desalination plants which is easily transferable to locations outside of our current operating areas.

Raw Materials and Sources of Supply

All materials, parts and supplies essential to our business operations are obtained from multiple sources and we use the latest industry technology. We do not manufacture any parts or components for equipment essential to our business. Our access to seawater for processing into potable water is granted through our licenses and contracts with governments of the various jurisdictions in which we have our operations.

Seasonal Variations in Our Business

Our operations are affected by the levels of tourism and are subject to seasonal variations in our service areas. Demand for our water in the Cayman Islands, Belize, and the Bahamas is affected by variations in the level of tourism and local weather, primarily rainfall. Tourism in our service areas is affected by the economies of the tourists’ home countries, primarily the United States and Europe, terrorist activity and perceived threats thereof, and increased costs of fuel and airfares. We normally sell more water during the first and second quarters, when the number of tourists is greater and local rainfall is less, than in the third and fourth quarters.

Government Regulations, Custom Duties and Taxes

Our operations and activities are subject to the governmental regulations and taxes of the countries in which we operate. The following summary of regulatory developments and legislation does not purport to describe all present and proposed regulation and legislation that may affect our businesses. Legislative or regulatory requirements currently applicable to our businesses may change in the future. Any such changes could impose new obligations on us that may adversely affect our businesses and operating results.

The Cayman Islands

The Cayman Islands are a British Overseas Territory and have had a stable political climate since 1670, when the Treaty of Madrid ceded the Cayman Islands to England. The Queen of England appoints the Governor of the Cayman Islands to make laws with the advice and consent of the legislative assembly. The legislative assembly consists of 15 elected members and three members appointed by the Governor from the Civil Service. The Cabinet is responsible for day-to-day government operations. The Cabinet consists of five ministers who are chosen by the legislative assembly from its 15 popularly elected members, and the three Civil Service members. The elected members choose from among themselves a leader, who is designated the Premier, and is in effect the leader of the elected government. The Governor has reserved powers and the United Kingdom retains full control over foreign affairs and defense. The Cayman Islands are a common law jurisdiction and have adopted a legal system similar to that of the United Kingdom.

| 16 |

The Cayman Islands have no taxes on profits, income, distributions, capital gains or appreciation. We have exemptions from, or receive concessionaire rates of customs duties on capital expenditures for plant and major consumable spare parts and supplies imported into the Cayman Islands as follows:

| • | We do not pay import duty or taxes on reverse osmosis membranes, electric pumps and motors and chemicals, but we do pay duty at the rate of 10% of the cost, including insurance and transportation to the Cayman Islands, of other plant and associated materials and equipment to manufacture or supply water in the Seven Mile Beach or West Bay areas. We have been advised by the Government of the Cayman Islands that we will not receive any duty concessions in our new retail water license; and |

| • | OC-Cayman pays full customs duties in respect of all plants that it operates for the Water Authority-Cayman. |

The stamp tax on the transfer of ownership of land in the Cayman Islands is a major source of revenue to the Cayman Islands government. To prevent stamp tax avoidance by transfer of ownership of the shares of a company which owns land in the Cayman Islands (as opposed to transfer of the land itself), The Land Holding Companies (Share Transfer Tax) Law was passed in 1976. The effect of this law is to charge a company, which owns land or an interest in land in the Cayman Islands, a tax based on the value of its land or interest in land attributable to each share transferred. The stamp tax calculation does not take into account the proportion which the value of a company’s Cayman land or interest in land bears to its total assets and whether the intention of the transfer is to transfer ownership of part of a company’s entire business or a part of its Cayman land or interest in land.

Prior to our common shares becoming publicly traded in the United States, we paid this tax on private share transfers. We have never paid the tax on transfers of our publicly traded shares and requested an exemption in 1994. On April 10, 2003, we received notice that the Cayman Islands government had granted an exemption from taxation for all transfers of our shares. We believe it is unlikely that government will seek to collect this tax on transfers of our publicly traded shares during 1994 through April 10, 2003.

The Bahamas

The Commonwealth of The Bahamas is an independent nation and a constitutional parliamentary democracy with the Queen of England as the constitutional head of state. The basis of the Bahamian law and legal system is the English common law tradition with a Supreme Court, Court of Appeals, and a Magistrates court.

Under the current laws of the Commonwealth of The Bahamas, no income, corporation, capital gains or other taxes are payable by the Company. The Company is required to pay an annual business license fee (the calculation of which is based on the Company’s preceding year’s financial statements) which to date has not been material to the results of our Bahamas operations.

Belize

Belize (formerly British Honduras) achieved full independence from the United Kingdom in 1981. Today, Belize is a constitutional monarchy with the adoption of a constitution in 1991. Based on the British model with three independent branches, the Queen of England is the constitutional head of state, represented by a Governor General in the government. A Prime Minister and cabinet make up the executive branch, while a 29 member elected House of Representatives and a nine member appointed Senate form a bicameral legislature. The cabinet consists of a prime minister, other ministers and ministers of state who are appointed by the Governor-General on the advice of the Prime Minister, who has the support of the majority party in the House of Representatives. Belize is an English common law jurisdiction with a Supreme Court, Court of Appeals and local Magistrate Courts.

The Government of Belize has exempted CW-Belize from certain customs duties and all revenue replacement duties until April 18, 2026, and had exempted CW-Belize from company taxes until January 28, 2006. Belize levies a gross receipts tax on corporations at a rate varying between 0.75% and 25%, depending on the type of business, and a corporate income tax at a rate of 25% of chargeable income. Gross receipts tax payable amounts are credited towards corporate income tax. The Government of Belize also implemented certain environmental taxes and a general sales tax effective July 1, 2006 and increased certain business and personal taxes and created new taxes effective March 1, 2005. Belize levies import duty on most imported items at rates varying between 0% and 45%, with most items attracting a rate of 20%. In 2008, it was determined that the tax exemption was no longer valid and CW-Belize paid approximately $156,000 of business and corporate income tax for the period 2004 through 2008. Under the terms of our water supply agreement with BWSL we are reimbursed by BWSL for all taxes and customs duties that we are required to pay and we record this reimbursement as an offset to our tax expense.

| 17 |

The British Virgin Islands

The British Virgin Islands (the “BVI”) is a British Overseas Territory, with the Queen as the Head of State and Her Majesty’s representative, the Governor, responsible for external affairs, defense and internal security, the Civil Service and administration of the courts. Since 1967, the BVI has held responsibility for its own internal affairs.

The BVI Constitution provides for the people of the BVI to be represented by a ministerial system of government, led by an elected Premier, a Cabinet of Ministers and the House of Assembly. The House of Assembly consists of 13 elected representatives, the Attorney General, and the Speaker.

The judicial system, based on English law, is under the direction of the Eastern Caribbean Supreme Court, which includes the High Court of Justice and the Court of Appeal. The ultimate appellate court is the Privy Council in London.

Market and Service Area

Although we currently operate in the Cayman Islands, Belize, The British Virgin Islands, and The Bahamas, we believe that our potential market consists of any location where there is a need for potable water. The desalination of seawater, either through distillation or reverse osmosis, is the most widely used process for producing fresh water in areas with an insufficient natural supply. We believe our experience in the development and operation of reverse osmosis desalination plants provides us with a significant opportunity to successfully expand our operations beyond the markets in which we currently operate.

The Cayman Islands Government, through the Water Authority-Cayman, supplies water to parts of Grand Cayman, which are not within our licensed area, as well as to Little Cayman and Cayman Brac. We operate all the reverse osmosis desalination plants owned by the Water Authority-Cayman on Grand Cayman and supply water under licenses and supply agreements held by OC-Cayman with the Water Authority-Cayman.

According to the most recent information published by the Economics and Statistics Office of the Cayman Islands Government, the population of the Cayman Islands was estimated in December 2010 to be approximately 54,397. According to the figures published by the Department of Tourism Statistics Information Center, during the year ended December 31, 2011, tourist air arrivals increased by 7.2% and tourist cruise ship arrivals decreased by 12.0% compared to 2010.

Total visitors for the year decreased from 1.9 million in 2010 to 1.7 million in 2011. We believe that our water sales in the Cayman Islands are more positively impacted by stay-over tourists that arrive by air than by those arriving by cruise ship, since cruise ship tourists generally only remain on the island for one day or less and do not remain on the island overnight. At this time, we believe the stay-over trend will continue through 2012.

| 18 |

Our current operations in Belize are located on Ambergris Caye, which consists of residential, commercial and tourist properties in the town of San Pedro. This town is located on the southern end of Ambergris Caye. Ambergris Caye is one of many islands located east of the Belize mainland and off the southeastern tip of the Yucatan Peninsula. Ambergris Caye is approximately 25 miles long and, according to the Central Statistical Office “Belize: 2010 National Census Overview”, has a population of about 11,510 residents. We provide bulk potable water to BWSL, which distributes this water to this market. BWSL currently has no other source of potable water on Ambergris Caye. Our contract with BWSL makes us their exclusive producer of desalinated water on Ambergris Caye through 2026.

A 185 mile long barrier reef, which is the largest barrier reef in the Western Hemisphere, is situated just offshore of Ambergris Caye. This natural attraction is becoming a choice destination for scuba divers and tourists. According to information published by the Belize Trade and Investment Development Service, tourism is Belize’s second largest source of foreign income, next to agriculture.

Our current operations in The Bahamas are located on South Bimini Island and in Nassau on New Providence. The Bimini Islands consist of North Bimini and South Bimini, and are two of 700 islands which comprise The Bahamas. The Bimini Islands are located approximately 50 miles east of Ft. Lauderdale, Florida and are a premier destination for sport fishing enthusiasts. The population of the Bimini Islands is approximately 1,600 persons and the islands have about 200 hotel and guest rooms available for tourists. The total land area of the Bimini Islands is approximately 9 square miles. New Providence, Lyford Caye and Paradise Island, connected by several bridges, are located approximately 150 miles east southeast of the Bimini Islands. With an area of 151 square miles and a population of approximately 211,000, Nassau is the political capital and commercial hub of The Bahamas, and accounts for more than two-thirds of the 4 million tourists who visit The Bahamas annually.

The British Virgin Islands are a British Overseas Territory and are situated east of Puerto Rico. They consist of 16 inhabited and more than 20 uninhabited islands, of which Tortola is the largest and most populated island. The islands are the center for many large yacht-chartering businesses.

Competition

Cayman Islands. Pursuant to our license granted by the Cayman Islands government, we have the exclusive right to provide potable, piped water within our licensed service area on Grand Cayman. At the present time, we are the only non-government-owned public water utility on Grand Cayman. The Cayman Islands government, through the Water Authority-Cayman, supplies water to parts of Grand Cayman located outside of our licensed service area. Although we have no competition within our exclusive retail license service area, our ability to expand our service area is at the discretion of the Cayman Island government. Private residences and commercial multi-unit dwellings up to four units may install water making equipment for their own use. Water plants on premises within our license area and serving only their premises in existence prior to 1991 can be maintained but not replaced or expanded. We are aware of only one such plant currently in operation. The Cayman Islands government, through the Water Authority-Cayman, supplies water to parts of Grand Cayman outside of our licensed service area. We have competed with such companies as GE Water, Veolia, and IDE for bulk water supply contracts with the Water Authority-Cayman.

Belize. On Ambergris Caye in Belize, our water supply contract with Belize Water Services Limited is exclusive, and Belize Water Services Limited can no longer seek contracts with other water suppliers, or produce water themselves, to meet their future needs in San Pedro, Ambergris Caye, Belize.

The Bahamas. On South Bimini Island in The Bahamas, we supply water to a private developer and do not have competitors. GE Water operates a seawater desalination plant on North Bimini Island. We competed with companies such as GE Water, Veolia, IDE, OHL Inima and Biwater for the new contract with the Bahamian government to build and operate a seawater desalination plant at Blue Hills, New Providence, Bahamas. We expect to compete with these companies and others for future water supply contracts in The Bahamas.

British Virgin Islands. In the British Virgin Islands, GE Water operates seawater desalination plants in West End and Sea Cows Bay, Tortola, and on Virgin Gorda and generally bids against OC-BVI for projects. Biwater PLC was recently awarded a 16 year contract to construct and operate a 2.75 million U.S. gallon per day desalination plant in Tortola for the British Virgin Islands government.

| 19 |

To implement our growth strategy outside our existing operating areas, we will have to compete with some of the same companies we competed with for the Blue Hills project in Nassau, Bahamas such as GE Water, Veolia, IDE Technologies, OHL Inima, and Biwater as well as other smaller companies. Some of these companies currently operate in areas in which we would like to expand our operations and already maintain worldwide operations having greater financial, managerial and other resources than our company. We believe that our low overhead costs, knowledge of local markets and conditions and our efficient manner of operating desalinated water production and distribution equipment provide us with the capabilities to effectively compete for new projects in the Caribbean basin and other select markets.

Environmental and Health Regulatory Matters

Cayman Islands. With respect to our Cayman Islands operations, although not required by local government regulations, we operate our water plants in accordance with guidelines of the Cayman Islands Department of Environment. We are licensed by the government to discharge concentrated seawater, which is a byproduct of our desalination process, into deep disposal wells.

Our Cayman Islands license requires that our potable water quality meet the World Health Organization’s Guidelines for Drinking Water Quality and contain less than 200 mg/l of total dissolved solids.

Belize, The Bahamas, British Virgin Islands. With respect to our Belize and Bahamas operations and OC-BVI’s British Virgin Islands operations, we and OC-BVI are required by our water supply contracts to take all reasonable measures to prevent pollution of the environment. We are licensed by the Belize and Bahamian governments to discharge concentrated seawater, which is a byproduct of our desalination process, into deep disposal wells. OC-BVI is licensed by the British Virgin Islands government to discharge concentrated seawater into the sea. We operate our plants in a manner so as to minimize the emission of hydrogen sulfide gas into the environment.

We are not aware of any existing or pending environmental legislation which may affect our operations. To date we have not received any complaints from any regulatory authorities.

Employees

As of March 9, 2012, we employed a total of 123 persons, 69 in the Cayman Islands, 22 in The Bahamas, 25 in the United States and seven in Belize. We also managed the five employees of OC-BVI in the British Virgin Islands. We have 11 management personnel and 36 administrative and clerical employees. The remaining employees are engaged in engineering, purchasing, plant maintenance and operations, pipe laying and repair, leak detection, new customer connections, meter reading and laboratory analysis of water quality. None of our employees is a party to a collective bargaining agreement. We consider our relationships with our employees to be good.

Available Information

Our website address is http://www.cwco.com. Information contained on our website is not incorporated by reference into this Annual Report, and you should not consider information contained on our website as part of this Annual Report.

We have adopted a written code of conduct and ethics that applies to all of our employees and directors, including, but not limited to, our principal executive officer, principal financial officer, and principal accounting officer or controller, or persons performing similar functions. The Code of Conduct and Ethics, the charters of the Audit Committee, Compensation Committee, Nominations and Corporate Governance Committee and the Consolidated Water Co. Ltd. Corporate Governance Guidelines of our Board of Directors, are available at the Investors portion of our website.

You may access, free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, plus amendments to such reports as filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, on our website and on the website of the Securities and Exchange Commission (the “SEC”) as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. In addition, paper copies of these documents may be obtained free of charge by writing us at the following address: Consolidated Water Co. Ltd., Regatta Office Park, Windward Three, 4th Floor, West Bay Road, P.O. Box 1114, Grand Cayman, KY1-1102, Cayman Islands, Attention: Investor Relations; or by calling us at (345) 945-4277.

| 20 |

ITEM 1A. RISK FACTORS

Investing in our common shares involves risks. Prior to making a decision about investing in our common shares, you should consider carefully the factors discussed below and the information contained in this Annual Report. Each of these risks, as well as other risks and uncertainties not presently known to us or that we currently deem immaterial, could adversely affect our business, operating results, cash flows and financial condition, and cause the value of our common shares to decline, which may result in the loss of all or part of your investment.

Our exclusive license to provide water to retail customers in the Cayman Islands may not be renewed in the future.

In the Cayman Islands, we provide water to retail customers under a 20-year license issued to us in July 1990 by the Cayman Islands government that grants us the exclusive right to provide water to retail customers within our licensed service area. Our service area is comprised of an area on Grand Cayman that includes the Seven Mile Beach and West Bay areas, two of the three most populated areas in the Cayman Islands. For the year ended December 31, 2011, we generated approximately 42% of our consolidated revenues and 51% of our consolidated gross profits from the retail water operations conducted pursuant to our exclusive license. If we are not in default of any terms of the license, we have a right of first refusal to renew the license on terms that are no less favorable than those that the government offers to any third party.

This license was set to expire on July 10, 2010, however we and the Cayman Islands government have agreed in correspondence to extend the license seven times in order to provide sufficient time to negotiate the terms of a new license agreement. We were advised by letter dated February 16, 2012 from Water Authority-Cayman that the government had approved an extension of the License until June 30, 2012. We are currently waiting for the government to execute such license extension.

On February 14, 2011, the Water Production and Supply Law, 2011 (which replaces the Water (Production and Supply) Law (1996 Revision) under which the Company is licensed) and the Water Authority (Amendment) Law, 2011 (the “New Laws”) were published on terms that they would come into force on such date as may be appointed by Order made by the Governor in Cabinet. Such Order was subsequently made by Cabinet and the New Laws are now in full force and effect. Under the New Laws, the Water Authority-Cayman would issue any new license which could include a rate of return on invested capital model described below.

We have been informed during our retail license renewal negotiations conducted with representatives of the Cayman Islands government that the Cayman Islands government seeks to restructure the terms of our license to employ a “rate of return on invested capital model” similar to that governing the sale of water to many U.S. municipalities. We have formally objected to the implementation of a “rate of return on invested capital model” on the basis that we believe that such a model would not promote the efficient operation of our water utility and could ultimately increase water rates to our customers. We believe such a model, if ultimately implemented, could significantly reduce the operating income and cash flows we have historically generated from our retail license and could require us to record an impairment loss to reduce the $1.2 million carrying value of our retail segment’s goodwill. Such impairment loss could be material to our results of operations.

If a new long-term license agreement is not entered into with the government, we would retain a right of first refusal to renew the license on terms that are no less favorable than those that the government might offer in the future to a third party.

If we do not enter into a new license agreement, and no other party is awarded a license, we expect to be permitted to continue to supply water to our service area. However, the terms of such continued supply may not be as favorable to us as the terms in the July 11, 1990 license agreement. It is possible that the government could offer a third party a license to service some or all of our present service area. In such event, we may assume the license offered to the third party by exercising our right of first refusal. The terms of the new license agreement may not be as favorable to us as the terms under which we are presently operating and could reduce the operating income and cash flows we have historically generated from our retail license and could require us to record an impairment loss to reduce the $1.2 million carrying value of our retail segment’s goodwill. Such impairment loss could be material to our results of operations.

| 21 |

The value of our investment in our affiliate OC-BVI is dependent upon the collection of amounts recently awarded by the Eastern Caribbean Supreme Court.

In October 2006, the British Virgin Islands government notified OC-BVI that it was asserting a purported right of ownership of OC-BVI’s desalination plant in Baughers Bay, Tortola pursuant to the terms of a 1990 Agreement. Early in 2007, the British Virgin Islands government unilaterally took the position that until such time as a new agreement is reached on the ownership of the Baughers Bay plant and for the price of the water produced by the plant, the BVI government would only pay that amount of OC-BVI’s invoices that the BVI government purported constituted OC-BVI’s costs of producing the water. Payments made by the BVI government to OC-BVI since the BVI government’s assumption of this reduced price were sporadic. On November 22, 2007, OC-BVI’s management was informed that the BVI government had filed a lawsuit with the Eastern Caribbean Supreme Court (the “Court”) seeking ownership and possession of the Baughers Bay plant. OC-BVI counterclaimed that it was entitled to continued possession and operation of the Baughers Bay plant until the BVI government paid OC-BVI approximately $4.7 million, which it believed represented the value of the Baughers Bay plant at its present expanded production capacity. OC-BVI also took the legal position that since the BVI government never paid the $1.42 million required under the 1990 Agreement to purchase the Baughers Bay plant, the 1990 Agreement terminated on May 31, 1999, which was eight months after the date that the Ministry provided written notice of its intention to purchase the plant.

On July 4, 2008, OC-BVI filed a claim with the Court, and on April 22, 2009 amended and increased this claim, seeking recovery of amounts for water sold and delivered to the BVI government from the Baughers Bay plant through May 31, 2009 based upon the contract prices in effect before the BVI government asserted its purported right of ownership of the plant.

The Court held a trial in July 2009 to address both the Baughers Bay ownership issue and OC-BVI’s claim for payment of amounts owed for water sold and delivered to the BVI government and on September 17, 2009, the Court issued a preliminary ruling with respect to this litigation. The Court determined that the BVI government was entitled to immediate possession of the Baughers Bay plant and dismissed OC-BVI’s claim for compensation of approximately $4.7 million for improvements to the plant. However, the Court determined that OC-BVI was entitled to full payment of water invoices issued up to December 20, 2007, which had been calculated under the terms of the original 1990 water supply agreement, and ordered the BVI government to make an immediate interim payment of $5.0 million to OC-BVI for amounts owed to OC-BVI. The Court deferred deciding the entire dispute between the parties until it could conduct a hearing to determine the reasonable rate for water produced by OC-BVI for the period subsequent to December 20, 2007.

After conducting hearings in October 2009, the Court ordered the BVI government to pay OC-BVI at the rate of $13.91 per thousand imperial gallons for water produced by OC-BVI for the period subsequent to December 20, 2007, which amounted to a total recovery for OC-BVI of $10.4 million as of September 17, 2009. The BVI government made a payment of $2.0 million to OC-BVI under the Court order during the fourth quarter of 2009, a second payment of $2 million under the Court order in July 2010 and a third payment of $1 million under the Court order in February 2011.

On October 28, 2009, OC-BVI filed an appeal with the Eastern Caribbean Court of Appeals (the “Appellate Court”) asking the Appellate Court to review the September 17, 2009 ruling by the Eastern Caribbean Supreme Court as it relates to OC-BVI’s claim for compensation for improvements to the Baughers Bay plant. On October 29, 2009, the BVI government filed an appeal with the Appellate Court seeking the Appellate Court’s review of the September 17, 2009 ruling of the Court that the BVI government pay OC-BVI the reasonable rate for water produced by OC-BVI for the period subsequent to December 20, 2007. The BVI government is requesting a ruling from the Appellate Court that the BVI government should only pay OC-BVI the actual cost of water produced at the plant. In March 2011, the BVI government filed an application with the Appellate Court for a stay of execution of the judgments of the Court in order to defer any further payments of amounts under the Court order until such time as the Appellate Court rules on the appeal. On September 30, 2011, the Appellate Court conducted its hearing of the arguments of both parties under their respective appeals. While we anticipated that the Appellate Court would issue its ruling on these appeals by the end of 2011, no ruling has been issued to date. We have not been informed when to expect the Appellate Court to issue its ruling.

After considering the impact of the September and October 2009 rulings of the Court of the Caribbean relating to the Baughers Bay dispute and the announcement by the BVI government in February 2010 that it had signed a long-term contract with another company for the construction and operation of a new water plant to serve Tortola, we determined that the carrying value of our investment in OC-BVI exceeded the estimated fair value for our investment in OC-BVI and therefore recognized impairment losses aggregating approximately $4.7 million for the year ended December 31, 2009 to reduce our investment in OC-BVI to its estimated fair value. The remaining carrying value of our investment in OC-BVI of $6.6 million as of December 31, 2011 assumes OC-BVI will collect in full the remaining $5.4 million awarded by the Court and will not be required to return any of the $5.0 million paid to date by the BVI government under the Court order. Should the BVI government be successful in its appeal to reduce the $10.4 million award, we will be required to record charges that will reduce our earnings by an amount equal to approximately 44% of any reduction of the $10.4 million previously awarded by the Court. Such charges could have a significant adverse impact on our results of operations, financial condition and cash flows.

The staff of the SEC is presently reviewing our goodwill impairment testing for 2011, and we could ultimately be required to record an impairment charge to reduce the carrying value of this asset.