Attached files

| file | filename |

|---|---|

| EX-4 - Consolidated Water Co. Ltd. | v177335_ex4.htm |

| EX-7 - Consolidated Water Co. Ltd. | v177335_ex7.htm |

| EX-2 - Consolidated Water Co. Ltd. | v177335_ex2.htm |

| EX-5 - Consolidated Water Co. Ltd. | v177335_ex5.htm |

| EX-8 - Consolidated Water Co. Ltd. | v177335_ex8.htm |

| EX-99.6 - Consolidated Water Co. Ltd. | v177335_ex6.htm |

| EX-31.2 - Consolidated Water Co. Ltd. | v177335_ex31-2.htm |

| EX-32.2 - Consolidated Water Co. Ltd. | v177335_ex32-2.htm |

| EX-23.1 - Consolidated Water Co. Ltd. | v177335_ex23-1.htm |

| EX-31.1 - Consolidated Water Co. Ltd. | v177335_ex31-1.htm |

| EX-23.2 - Consolidated Water Co. Ltd. | v177335_ex23-2.htm |

| EX-32.1 - Consolidated Water Co. Ltd. | v177335_ex32-1.htm |

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

10-K

(Mark One)

|

þ

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

|

For

the fiscal year ended December 31, 2009

|

|

|

OR

|

|

|

¨

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

|

For

the transaction period from __________________ to

__________________

|

|

Commission

File Number: 0-25248

CONSOLIDATED

WATER CO. LTD.

(Exact

name of Registrant as specified in its charter)

|

CAYMAN ISLANDS

|

N/A

|

|

|

(State

or other jurisdiction of

|

(I.R.S.

Employer Identification No.)

|

|

|

incorporation

or organization)

|

||

|

Regatta

Office Park

|

||

|

Windward

Three, 4th Floor, West Bay Road

|

||

|

P.O.

Box 1114

|

||

|

Grand Cayman, KY1-1102, Cayman

Islands

|

N/A

|

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

Registrant’s

Telephone number, including area code: (345) 945-4277

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class:

|

Name

of each exchange on which registered:

|

|

|

Common

Stock, $.60 Par Value

|

The

NASDAQ Stock Market LLC (NASDAQ Global Select

Market)

|

Securities

registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes ¨ No

þ

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Act.

Yes ¨ No

þ

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes þ No

¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this 10-K or any amendments to this

Form 10-K. [Not Applicable]

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definition of “large accelerated filer”, “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large

accelerated filer ¨

|

Accelerated

filer þ

|

Non-accelerated

filer ¨

|

Smaller

reporting company ¨

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes ¨ No

þ

The

aggregate market value of common stock held by non-affiliates of the registrant,

based on the closing sales price for the registrant’s common shares, as reported

on the NASDAQ Global Select Market on June 30, 2009, was

$230,334,831.

As of

March 10, 2010,

14,541,878 shares of the registrant’s common shares were

outstanding.

DOCUMENTS

INCORPORATED BY REFERENCE: None

TABLE

OF CONTENTS

|

Section

|

Description

|

Page

|

||

|

Cautionary

Note Regarding Forward-Looking Statements

|

3

|

|||

|

PART

I

|

4

|

|||

|

Item

1.

|

Business

|

4

|

||

|

Item

1A.

|

Risk

Factors

|

21

|

||

|

Item

1B.

|

Unresolved

Staff Comments

|

28

|

||

|

Item

2.

|

Properties

|

28

|

||

|

Item

3.

|

Legal

Proceedings

|

31

|

||

|

Item

4.

|

Submission

of Matters to a Vote of Security Holders

|

31

|

||

|

PART

II

|

31

|

|||

|

Item

5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

31

|

||

|

Item

6.

|

Selected

Financial Data

|

34

|

||

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

34

|

||

|

Item

7A.

|

Quantitative

and Qualitative Disclosure about Market Risk

|

48

|

||

|

Item

8.

|

Financial

Statements and Supplementary Data

|

49

|

||

|

Item

9.

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure

|

87

|

||

|

Item

9A.

|

Controls

and Procedures

|

87

|

||

|

PART

III

|

88

|

|||

|

Item

10.

|

Directors,

Executive Officers and Corporate Governance

|

88

|

||

|

Item

11.

|

Executive

Compensation

|

94

|

||

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

115

|

||

|

Item

13.

|

Certain

Relationships and Related Transactions, and Director

Independence

|

118

|

||

|

Item

14.

|

Principal

Accounting Fees and Services

|

118

|

||

|

PART

IV

|

119

|

|||

|

Item

15.

|

Exhibits,

Financial Statement Schedules

|

119

|

||

|

SIGNATURES

|

120

|

|||

2

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Annual Report on Form 10-K contains forward-looking statements, including but

not limited to, statements regarding our future revenues, future plans,

objectives, expectations and events, assumptions and estimates. Forward-looking

statements can be identified by use of the words or phrases “will”, “will likely

result”, “are expected to”, “will continue”, “estimate”, “project”, “potential”,

“believe”, “plan”, “anticipate”, “expect”, “intend”, or similar expressions and

variations of such words. Statements that are not historical facts are based on

our current expectations, beliefs, assumptions, estimates, forecasts and

projections for our business and the industry and markets related to our

business.

The

forward-looking statements contained in this report are not guarantees of future

performance and involve certain risks, uncertainties and assumptions which are

difficult to predict. Actual outcomes and results may differ materially from

what is expressed in such forward-looking statements. Important factors which

may affect these actual outcomes and results include, without limitation,

tourism and weather conditions in the areas we service, scheduled new

construction within our operating areas, the economies of the U.S. and the areas

we service, regulatory matters, availability of capital to repay debt and for

expansion of our operations, and other factors, including those set forth under

Part I, Item 1A. “Risk Factors” in this Annual Report.

The

forward-looking statements in this Annual Report speak as of its date. We

expressly disclaim any obligation or undertaking to update or revise any

forward-looking statement contained in this Annual Report to reflect any change

in our expectations with regard thereto or any change in events, conditions or

circumstances on which any forward-looking statement is based, except as may be

required by law.

Unless

otherwise indicated, references to “we,” “our,” “ours” and “us” refer to

Consolidated Water Co. Ltd. and its subsidiaries.

Note Regarding Currency and Exchange

Rates.

Unless

otherwise indicated, all references to “$” or “US$” are to United States

dollars.

The

exchange rate for conversion of Cayman Island dollars (CI$) into US$, as

determined by the Cayman Islands Monetary Authority, has been fixed since April

1974 at US$1.20 per CI$1.00.

The

exchange rate for conversion of Belize dollars (BZE$) into US$, as determined by

the Central Bank of Belize, has been fixed since 1976 at US $0.50 per

BZE$1.00.

The

exchange rate for conversion of Bahamas dollars (B$) into US$, as determined by

the Central Bank of The Bahamas, has been fixed since 1973 at US$1.00 per

B$1.00.

The

official currency of the British Virgin Islands is the United States

dollar.

The

exchange rate for conversion of Bermuda dollars (BMD$) into US$ as determined by

the Bermuda Monetary Authority, has been fixed since 1970 at US$1.00 per

BMD$1.00.

3

PART

I

ITEM 1. BUSINESS

Overview

We

develop and operate seawater desalination plants and water distribution systems

in areas where naturally occurring supplies of potable water are scarce or

nonexistent. Through our subsidiaries and affiliates, we operate 16 reverse

osmosis desalination plants and provide the following services to our customers

in the Cayman Islands, the Bahamas, Belize, the British Virgin Islands and

Bermuda:

|

|

•

|

Retail Water Operations.

We produce and supply water to end-users, including residential,

commercial and government customers in the Cayman Islands under an

exclusive retail license issued by the government to provide water in two

of the most populated and rapidly developing areas in the Cayman Islands.

In 2009, our retail water operations generated approximately 40% of our

consolidated revenues.

|

|

|

•

|

Bulk Water Operations.

We produce and supply water to government-owned distributors in the

Cayman Islands, Belize and the Bahamas. In 2009, our bulk water operations

generated approximately 45% of our consolidated

revenues.

|

|

|

•

|

Services Operations. We

provide engineering and management services for desalination projects,

including designing and constructing desalination plants and managing and

operating desalination plants owned by other companies. In 2009, our

services operations generated approximately 15% of our consolidated

revenues.

|

|

|

•

|

Affiliate Operations.

Our affiliate, Ocean Conversion (BVI) Ltd. (“OC-BVI”), produces and

supplies bulk water to the British Virgin Islands Water and Sewerage

Department. We account for our interests in OC-BVI using the equity method

of accounting and do not consolidate OC-BVI’s operating results in our

consolidated financial statements. Our affiliate, Consolidated Water

(Bermuda) Limited, has constructed and sold a plant to the Bermuda

government and is presently operating this plant on behalf of the Bermuda

government. We expect to continue to manage the plant on behalf

of the Bermuda government into mid

2011.

|

As of

December 31, 2009, the number of plants we, or our affiliates, manage in each

country and the production capacities of these plants are as

follows:

|

Location

|

Plants

|

Capacity

(1)

|

||||||

|

Cayman

Islands

|

8 | 10.2 | ||||||

|

Bahamas

|

3 | 10.4 | ||||||

|

Belize

|

1 | 0.6 | ||||||

|

British

Virgin Islands

|

3 | 2.5 |

|

|||||

|

Bermuda

|

1 | 0.6 | ||||||

|

Total

|

16 | 24.3 | ||||||

|

(1)

|

In

millions of U.S. gallons per day.

|

Strategy

Our

strategy is to provide water services in areas where the supply of potable water

is scarce and we believe the production of potable water by reverse osmosis

desalination is, or will be, profitable. We have focused on the Caribbean basin

and adjacent areas as our principal market because they possess the following

characteristics which make them attractive for our business:

|

|

•

|

little

or no naturally occurring fresh

water;

|

|

|

•

|

limited

regulations and taxes allowing for higher

returns;

|

4

|

|

•

|

a

large proportion of tourist properties, which historically have generated

higher volume sales than residential properties;

and

|

|

|

•

|

growing

population and tourism levels.

|

Although

we are currently focused primarily on these areas, we believe that our potential

market includes any location with a demand for, but a limited supply of, potable

water. The desalination of seawater is the most widely used process for

producing fresh water in areas with an insufficient natural supply. In addition,

in many locations, desalination is the only commercially viable means to expand

the existing water supply. We believe that our experience in the development and

operation of reverse osmosis desalination plants provides us with the

capabilities to successfully expand our operations.

Key

elements of our strategy include:

• Maximizing the benefits of our

exclusive retail license on Grand Cayman. We plan to continue to increase

operations within our exclusive retail license service area through organic

growth and possible further investments, if opportunities become

available.

• Expanding our existing operations

in the Cayman Islands, Belize and The Bahamas. We plan to continue

to seek new water supply agreements and licenses and focus on renewing our

existing service contracts with extended terms and greater production

levels.

• Penetrating new markets where there

is demand for potable water and where we believe production would be

profitable. We plan to continue to seek opportunities to expand our

operations into new markets including, but not limited to, markets throughout

the Caribbean basin, Central America and South America. We may pursue these

opportunities either on our own or through joint ventures and strategic

alliances.

• Broadening our existing and future

operations into complementary services. We continue to consider and

pursue opportunities to leverage our water-related expertise to enter

complementary service industries, such as wastewater management.

Our

Company

We

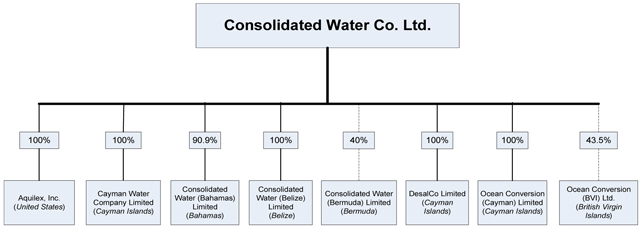

conduct our operations in the Cayman Islands, The Bahamas, the British Virgin

Islands, Belize, Bermuda and the United States through the following principal

operating subsidiaries and affiliates:

|

|

•

|

Cayman

Water Company Limited (“Cayman Water”). In 1998, we

established Cayman Water, which operates under an exclusive retail license

granted by the Cayman Islands government to provide water to customers

within a prescribed service area on Grand Cayman that includes the Seven

Mile Beach and West Bay areas, two of the three most populated areas in

the Cayman Islands. The only non-government owned public water utility on

Grand Cayman, Cayman Water owns and operates four desalination plants on

Grand Cayman.

|

5

|

|

•

|

Ocean

Conversion (Cayman) Limited (“OC-Cayman”). OC-Cayman provides bulk

water under various licenses and agreements to the Water Authority-Cayman,

a government-owned utility and regulatory agency, which distributes the

water to properties located outside our exclusive retail license service

area in Grand Cayman. OC-Cayman operates four desalination plants owned by

the Water Authority-Cayman.

|

|

|

•

|

Consolidated

Water (Bahamas) Limited (“CW-Bahamas”). We own a 90.9% equity

interest in CW-Bahamas, which provides bulk water under long-term

contracts to the Water and Sewerage Corporation of The Bahamas, a

government agency. CW-Bahamas’ operates our largest desalination plant.

CW-Bahamas pays fees to two of our other subsidiaries for certain

administrative services.

|

|

|

•

|

Consolidated

Water (Belize) Limited (“CW-Belize”). CW-Belize, (formerly Belize

Water Limited), has an exclusive contract to provide bulk water to Belize

Water Services Ltd., a water distributor that serves residential,

commercial and tourist properties in Ambergris Caye,

Belize.

|

|

|

•

|

Aquilex,

Inc. This subsidiary, a United States company, provides financial,

engineering and supply chain management support services to our

subsidiaries and affiliates.

|

|

|

•

|

Ocean

Conversion (BVI) Ltd. (“OC-BVI”). We own 50% of the voting stock of

our affiliate, OC-BVI, a British Virgin Islands company, which sells bulk

water on a month-to-month basis to the Government of The British Virgin

Islands Water and Sewage Department. We own an overall 43.5% equity

interest in OC-BVI’s profits and certain profit sharing rights that raise

our effective interest in OC-BVI’s profits to approximately 45%. OC-BVI

also pays our subsidiary DesalCo Limited fees for certain engineering and

administrative services.

|

|

|

•

|

DesalCo

Limited (“DesalCo”). A Cayman Islands company, DesalCo provides

management, engineering and construction services for desalination

projects.

|

|

|

•

|

Consolidated

Water (Bermuda) Limited (“CW-Bermuda”). In January 2007, our

affiliate, Consolidated Water (Bermuda) Limited (“CW-Bermuda”) entered

into a design, build, sale and operating agreement with the Government of

Bermuda for a desalination plant to be built in two phases at Tynes Bay

along the northern coast of Bermuda. Under the agreement, CW-Bermuda

constructed and has been operating the plant since the second quarter of

2009. We expect CW-Bermuda to operate the plant through

mid-2011. We have entered into a management services agreement

with CW-Bermuda for the design, construction and operation of the Tynes

Bay plant, under which we receive fees for direct services, purchasing

activities and proprietary technology. Although we own only 40% of the

common shares of CW-Bermuda, we consolidate its results in our

consolidated financial statements as we are its primary financial

beneficiary.

|

Our

Operations

We have

three principal business segments: retail water operations, bulk water

operations and services operations. Our retail water operations supply water to

end-users, including residential, commercial and government customers. Through

our bulk water operations we supply water to distributors and commercial

suppliers, including governments and wholesalers. Our retail and bulk operations

serve customers in the Cayman Islands, Belize, the British Virgin Islands and

The Bahamas. Our services operations provide engineering and management

services, which include designing and constructing desalination plants, and

managing and operating plants owned by other companies.

For

fiscal year 2009, our retail water, bulk water and service operations generated

approximately 40%, 45% and 15%, respectively, of our consolidated revenues. For

information about our business segments and geographical information about our

operating revenues and long-lived assets, see Note 17 to our audited

consolidated financial statements at Item 8 of this Annual Report.

Retail

Water Operations

For

fiscal years 2009, 2008 and 2007, our retail water operations accounted for

approximately 40%, 34% and 41%, respectively, of our consolidated revenues. This

business in the Cayman Islands produces and supplies water to end-users,

including residential, commercial and government customers.

6

We sell

water through our retail operations to a variety of residential and commercial

customers through our wholly-owned subsidiary Cayman Water, which operates under

an exclusive license issued to us by the Cayman Islands government under The

Water Production and Supply Law of 1979. Pursuant to the license, we have the

exclusive right to produce potable water and distribute it by pipeline to our

licensed service area which consists of the Seven Mile Beach and West Bay areas

of Grand Cayman, two of the three most populated areas in the Cayman

Islands.

Under our

exclusive license, we pay a royalty to the government of 7.5% of our gross

retail water sales revenues (excluding energy adjustments). The selling prices

of water sold to our customers, except for the prices under our agreements with

the Cayman Beach Suites Hotel, Britannia Golf Course and North Sound Golf Club,

are set out under the license and vary depending upon the type and location of

the customer and the monthly volume of water purchased. The license provides for

an automatic adjustment for inflation or deflation on an annual basis, subject

to temporary limited exceptions, and an automatic adjustment for the cost of

electricity on a monthly basis. The Water Authority-Cayman, on behalf of the

government, reviews and confirms the calculations of the price adjustments for

inflation and electricity costs. If we want to adjust our prices for any reason

other than inflation or electricity costs, we have to request prior approval of

the Cabinet of the Cayman Islands government. Disputes regarding price

adjustments are referred to arbitration. Our last price increase, requested in

June 1985, was granted in full.

Under our

exclusive license, we must provide any requested piped water service within our

exclusive retail license service area that is commercially feasible, as

determined by the Cabinet of the Cayman Islands government. Where service is not

considered commercially feasible, we may require the potential customer to

contribute toward the capital costs of pipe-laying. We then repay these

contributions to the customer, without interest, by way of a 10% discount on

future billings for water sales until this advance in aid of construction has

been repaid.

Unless

renewed, our exclusive license expires in July 2010. We

began negotiations to renew this license in 2008. Unless we are in

default under the license, and upon expiration of the license, the government

may not grant a license to any other party without first offering the license to

us on terms that are no less favorable than those which the government offers to

a third party. We are not, nor have we been in the past, in default under the

retail license.

During

our retail license renewal negotiations conducted with representatives of the

Cayman Island government during the fourth quarter of 2009, we were informed

that the Cayman Island government seeks to restructure the terms of our retail

license to employ a “rate of return on invested capital model’ similar to that

governing the sale of water to most U.S. municipalities. We have

formally objected to the implementation of a “rate of return on invested capital

model” on the basis that we believe that such a model would not promote the

efficient operation of our water utility, and could ultimately increase water

rates to our customers. We believe such a model, if ultimately

implemented, could significantly reduce the operating income we have

historically generated from our retail license.

Facilities

Our

retail operations in the Cayman Islands currently produce potable water at four

reverse osmosis seawater conversion plants in Grand Cayman located at our Abel

Castillo Water Works (“ACWW”, formerly Governor’s Harbour), West Bay and

Britannia sites. We own the land for our ACWW and West Bay plants and have

entered into a lease for the land for our Britannia plant which has more than 18

years remaining. The current production capacity of the two plants located at

ACWW is 2.2 million U.S. gallons of water per day. This production capacity was

expanded on a temporary basis during 2007 from the original capacity of 1.2

million U.S. gallons per day. The temporary capacity was replaced by

permanent production capacity which came online at the end of

2009. The production capacity of the Britannia plant is 715,000 U.S.

gallons of water per day. The Britannia plant was destroyed by Hurricane Ivan in

September 2004 but was rebuilt and placed back in operation in October 2005. The

production capacity of the West Bay plant is 910,000 U.S. gallons of water per

day; we completed an expansion of the production capacity of this plant from

710,000 U.S. gallons of water per day in January 2008. Since the ACWW and West

Bay plants began production of water and the Britannia plant was rebuilt, these

plants have consistently been capable of operating at or near their rated

capacity.

Electricity

to our plants is supplied by Caribbean Utilities Co. Ltd., a publicly traded

utility company. At all four plant sites from which we supply water to our

distribution pipeline, we maintain diesel driven, standby generators with

sufficient capacity to operate our distribution pumps and other essential

equipment during any temporary interruptions in electricity supply. Standby

generation capacity is also maintained at our West Bay Plant and ACWW plant to

operate a portion of the water production capacity as well.

In the

event of an emergency, our distribution system is connected to the distribution

system of the Water Authority-Cayman. In prior years in order to efficiently

maintain our equipment, we have purchased water from the Water Authority-Cayman

for brief periods of time. We have also sold potable water to the Water

Authority-Cayman.

7

Our

pipeline system in the Cayman Islands covers the Seven Mile Beach and West Bay

areas of Grand Cayman and consists of approximately 71 miles of

polyvinylchloride and polyethylene pipeline. We extend our distribution system

periodically as property developments are completed. We have a main pipe loop

covering a major part of the Seven Mile Beach area. We place extensions of

smaller diameter pipe off our main pipe to service new developments in our

service area. This system of building branches from the main pipe keeps

construction costs low and allows us to provide service to new areas in a timely

manner. During 2009, we completed a number of small pipeline extensions into

newly developed properties within our distribution system. Developers are

responsible for laying the pipeline within their developments at their own cost,

but in accordance with our specifications. When a development is completed, the

developer then transfers operation and maintenance of the pipeline to

us.

We have a

comprehensive layout of our pipeline system, superimposed upon digital aerial

photographs, which is maintained using a computer aided design system. This

system is interconnected with a computer generated hydraulic model, which allows

us to accurately locate pipes and equipment in need of repair and maintenance.

It also helps us to plan extensions and upgrades.

Customers

We enter

into standard contracts with hotels, condominiums and other properties located

in our existing licensed area to provide potable water. In the Seven Mile Beach

area, our primary customers are the hotels and condominium complexes that serve

the tourist industry. In the West Bay area, our primary customers are

residential homes.

8

Development

continues to take place on Grand Cayman, and particularly in our licensed area,

to accommodate both the growing local population and the tourism market. Because

our license requires us to supply water to developments in our licensed area,

the planning department of the Cayman Islands government routinely advises us of

proposed developments. This advance notice allows us to manage our production

capacity to meet anticipated demand. We believe that we have a sufficient supply

of water to meet the foreseeable future demand.

We bill

our customers on a monthly basis based on metered consumption and bills are

typically collected within 30 to 35 days after the billing date and receivables

not collected within 45 days subject the customer to disconnection from water

service. In 2009, 2008 and 2007, bad debts represented less than 1% of our total

annual retail sales. Customers who have had their service disconnected must pay

re-connection charges.

The

following table sets forth our approximate total number of customer connections

and the volume of water sold in the Cayman Islands as of, and for the indicated

years ended December 31:

Retail

Water Customer Connections and Volume of Water Sold

|

2009

|

2008

|

2007

|

2006

|

2005

|

||||||||||||||||

|

Number

of Customer Connections

|

5,000 | 4,600 | 4,600 | 4,300 | 3,800 | |||||||||||||||

|

Volume

of Water Sold (U.S. Gallons, In Thousands):

|

||||||||||||||||||||

|

Commercial

|

543,658 | 534,614 | 554,087 | 562,702 | 427,439 | |||||||||||||||

|

Residential

|

218,662 | 211,090 | 202,988 | 173,665 | 157,924 | |||||||||||||||

|

Government

|

41,714 | 25,967 | 45,623 | 12,789 | 8,929 | |||||||||||||||

|

Total

|

804,034 | 771,671 | 802,698 | 749,156 | 594,292 | |||||||||||||||

The table

above does not precisely represent our actual number of customers or facilities

that we serve. For example, in hotels and condominiums, we may only have a

single customer who is the operator of the hotel or the condominium while

supplying water to all of the units within that hotel or condominium

development. Historically, demand on our pipeline distribution has varied

throughout the year. Demand depends upon the number of tourists visiting and the

amount of rainfall during any particular time of the year. In general, the

majority of tourists come from the United States during the winter

months.

Before

1991, any owner of property within our licensed area could install water-making

equipment for its own use. Since 1991, that option is only available to private

residences, although water plants in existence prior to 1991 can be maintained

but not replaced or expanded. We know of only one plant that continues to

operate under such exemption at a hotel within our license area and we believe

that the amount of water produced by this plant is insignificant to our

operations.

Retail

Water Demand and Average Sales Prices

The table

below sets forth the total volume of water we supplied to our retail water

customers on a quarterly basis for the indicated years ended December

31:

Retail

Water Total Volume by Quarter

(U.S.

Gallons, In Thousands)

|

2009

|

2008

|

2007

|

2006

|

2005

|

||||||||||||||||

|

First

Quarter

|

217,890 | 203,899 | 215,044 | 207,572 | 145,295 | |||||||||||||||

|

Second

Quarter

|

214,854 | 213,679 | 219,191 | 211,772 | 158,474 | |||||||||||||||

|

Third

Quarter

|

194,076 | 194,971 | 187,796 | 174,490 | 136,784 | |||||||||||||||

|

Fourth

Quarter

|

177,214 | 159,122 | 180,667 | 155,322 | 153,739 | |||||||||||||||

|

Total

|

804,034 | 771,671 | 802,698 | 749,156 | 594,292 | |||||||||||||||

9

Our

average sales prices of potable water sold to our retail water customers for the

indicated years ended December 31 were:

Retail

Water Average Sales Prices

|

2009

|

2008

|

2007

|

||||||||||

|

Average

Sales Price Per 1,000 U.S. Gallons

|

$ | 28.90 | $ | 28.99 | $ | 27.69 | ||||||

Bulk

Water Operations

For

fiscal years 2009, 2008 and 2007, our bulk water operations accounted for

approximately 45%, 46% and 45%, respectively, of our consolidated revenues and

are comprised of businesses in the Cayman Islands, The Bahamas and Belize. These

businesses produce potable water from seawater and sell this water to

governments and private customers.

Bulk

Water Operations in the Cayman Islands

We sell

bulk water in the Cayman Islands through our wholly-owned subsidiary

OC-Cayman.

Facilities

We

operate four reverse osmosis seawater conversion plants in Grand Cayman that are

owned by the Water Authority-Cayman: the Red Gate Road, Lower Valley, North

Sound and North Side Water Works plants, which have production capacities of

approximately 1.3 million, 1.1 million, 1.6 million and 2.4 million U.S. gallons

of water per day, respectively. The North Side Water Works (“NSWW”) plant was

commissioned in June 2009. The North Sound plant operating capacity

was expanded from approximately 0.8 million U.S. gallons to 1.6 million U.S.

gallons of water per day during 2007. The Red Gate plant was temporarily

de-commissioned in December 2009 in order to carry out extensive rehabilitative

and upgrade work to the plant. We expect the Red Gate plant to be

re-commissioned in April 2010. The plants that we operate for the

Water Authority-Cayman are located on land owned by the Cayman Islands

government.

Customers

We

provide bulk water on a take-or-pay basis to the Water Authority-Cayman, a

government owned utility and regulatory agency, under various licenses and

agreements. The Water Authority-Cayman in turn distributes that water to

properties in the parts of Grand Cayman that are outside of our retail licensed

area. During 2009, we supplied the Water Authority-Cayman with approximately 1.1

billion U.S. gallons of water.

In

January 2001, we were granted a 7-year extension, effective December 2001, to

the water supply license by the Cayman Islands government to supply desalinated

water from the Red Gate Road plant through November 2008. Under the terms of the

water production and supply license between OC-Cayman and the government of the

Cayman Islands, we are allowed to use the property and the plant to produce

approximately 1.3 million U.S. gallons of desalinated water per day for sale to

the Water Authority-Cayman. On November 30, 2008, the Water Authority-Cayman

took possession of the plant for no consideration, in accordance with the terms

of the water production and supply license, and the license was also extended

for a period of one year, during which time we are required to operate and

maintain the plant. The plant was originally powered only by electricity, but

was upgraded in 1994 to include diesel driven high-pressure pumps. In August

2008, the Water Authority-Cayman contracted with us to convert the high-pressure

pumps back to electrical power and make other modifications and improvements to

the plant. This work is expected to be completed in April 2010, for which

OC-Cayman will obtain a seven year license and operating agreement for the

plant.

In

December 2001, we were granted a seven-year water supply license, effective

November 2002, by the Cayman Islands government to supply desalinated water from

the North Sound plant through November 2009. Under the terms of this license

OC-Cayman is obligated to deliver to the Water Authority-Cayman the amount of

water it demands or 713,000 U.S. gallons of water per day on average each month,

whichever is less. In January 2007, we were granted an extension to this water

supply license for a period of seven years by the Cayman Island government,

effective on April 1, 2007. Under the terms of this extension, we are obligated

to deliver to the Water Authority-Cayman the amount of water it demands from the

North Sound Plant or 1.43 million U.S. gallons per day, whichever is

less.

10

In August

2005, we were granted a seven-year extension to the water supply license, with

effect from January 2006, by the Cayman Islands government to supply desalinated

water from the Lower Valley plant through January 2013. Under the terms of this

license, we increased the capacity of the Lower Valley plant to 1.1 million U.S.

gallons of water per day in exchange for an increase in the capital component of

the total price we charge for the water produced by the plant.

On March

11, 2008, we signed a ten-year agreement with the Water Authority-Cayman to

finance, design, build and operate a seawater reverse osmosis water production

plant at their NSWW site on Grand Cayman. Under the terms of this license,

OC-Cayman is obligated to deliver to the Water Authority-Cayman the amount of

water it demands or 2.14 million U.S. gallons of water per day on average each

month, whichever is less. The NSWW plant was completed in June 2009 and has a

production capacity of 2.4 million U.S. gallons per day.

11

Bulk

Water Operations in Belize

In

Belize, we sell bulk water through our wholly-owned subsidiary

CW-Belize.

Facilities

We own

the reverse osmosis seawater conversion plant in Belize and lease the land on

which our plant is located from the Belize government at an annual rent of

BZE$1.00. The lease, which was entered into in April 1993 and extended in

January 2004, expires in April 2026. The production capacity of the plant is

550,000 U.S. gallons of water per day.

Electricity

to our plant is supplied by Belize Electricity Limited. At the plant site, we

maintain a diesel driven, standby generator with sufficient capacity to operate

our water production equipment during any temporary interruption in the

electricity supply. Feed water for the reverse osmosis units is drawn from deep

wells with associated pumps on the property. Reject water is discharged into

brine wells on the property at a level below that of the feed water

intakes.

Customers

We are

the exclusive provider of water in Ambergris Caye, Belize to Belize Water

Services Ltd. (“BWSL”), which distributes the water through its own pipeline

system to residential, commercial and tourist properties. BWSL distributes our

water primarily to residential properties, small hotels, and businesses that

serve the tourist market. The base price of water supplied, and adjustments

thereto, are determined by the terms of the contract, which provides for annual

adjustments based upon the movement in the government price indices specified in

the contract, as well as monthly adjustments for changes in the cost of diesel

fuel and electricity. Demand is less cyclical than in our other locations due to

a higher proportion of residential to tourist demand. During 2009, we supplied

BWSL with 151.7 million U.S. gallons of water.

We have

an exclusive 23-year contract with BWSL to supply a minimum of 1.75 million U.S.

gallons of water per week, or upon demand up to 2.1 million U.S. gallons per

week, on a take or pay basis. This contract terminates on March 23, 2026. BWSL

has the right, with six months advance notice to us before the termination date,

to renew the contract for a further 25-year period on the same terms and

conditions.

On

October 3, 2005, a controlling interest in BWSL was sold back to the Belize

government. This transaction effectively reversed the 2001 privatization of

BWSL. This change in control of our customer has not affected our contractual

arrangement with BWSL.

Bulk

Water Operations in The Bahamas

In The

Bahamas, we sell bulk water through our majority-owned subsidiary,

CW-Bahamas.

Facilities

We

currently supply bulk water in The Bahamas from our Windsor, Blue Hills and

Bimini plants. We supply water from our Windsor plant under the terms of a

15-year water supply agreement dated May 7, 1996 effective March 1998. In

October 2005, we temporarily expanded this plant’s capacity from 2.6 to 4.1

million U.S. gallons per day. During August 2006 we relocated some of the

portable reverse osmosis units used to expand our Windsor plant to our retail

water operations in the Cayman Islands, reducing our Windsor plant production

capacity to 3.1 million U.S. gallons per day. We supply water from our Blue

Hills plant under the terms of a twenty-year water supply agreement dated May

20, 2005, effective July 2006. The Blue Hills plant is capable of producing 7.2

million U.S. gallons of potable water per day, and is our largest seawater

conversion facility to date. The Bimini plant has a capacity of

115,000 U.S gallons per day.

Electricity

to our plants is supplied by Bahamas Electricity Corporation. We maintain a

standby generator with sufficient capacity to operate essential equipment at our

Windsor and Blue Hills plants and are able to produce water with these plants

during any temporary interruptions in the electricity supply.

Feed

water for the reverse osmosis unit is drawn from deep wells with associated

pumps on the property. Reject water is discharged into brine wells on the

property at a deeper level than the feed water intakes.

12

Customers

We

provide bulk water to the Water and Sewerage Corporation of The Bahamas (“WSC”),

which distributes the water through its own pipeline system to residential,

commercial and tourist properties on the Island of New Providence. During 2009,

CW-Bahamas supplied WSC with approximately 3.1 billion U.S. gallons of

water.

We are

required to provide the WSC with at least 16.8 million U.S. gallons per week of

potable water from our Windsor plant, and the WSC has contracted to purchase at

least that amount from us on a take-or-pay basis. This water supply agreement

expires on the later of March 1, 2013 or after the plant has produced

approximately 13.1 billion U.S. gallons of water. At the conclusion of the

initial term, the WSC has the option to:

|

|

•

|

extend

the term for an additional five years at a rate to be

negotiated;

|

|

|

•

|

exercise

a right of first refusal to purchase any materials, equipment and

facilities that CW-Bahamas intends to remove from the site, and negotiate

a purchase price with CW-Bahamas;

or

|

|

|

•

|

require

CW-Bahamas to remove all materials, equipment and facilities from the

site.

|

Within

the past three years, we have incurred penalties relating to the Windsor plant

for not meeting diesel fuel and electricity efficiencies specified in our water

sale agreement with the WSC. These penalties totaled $63,433, $112,622, and

$436,184 in 2009, 2008 and 2007, respectively. We have undertaken a program to

replace certain equipment prone to repetitive failure, and in 2008 successfully

completed a program which significantly reduced the adverse impact on our

operations of the fouling tendency of the feed water to the plant.

We are

required to provide the WSC with at least 33.6 million U.S. gallons per week of

potable water from the Blue Hills plant, and the WSC has contracted to purchase

at least that amount from us on a take-or-pay basis. This water supply agreement

expires on the later of July 26, 2026 or after the plant has produced 35.0

billion U.S. gallons of water. At the conclusion of the initial term, the WSC

has the option to:

|

|

•

|

extend

the term for an additional five years at a rate to be

negotiated;

|

|

|

•

|

exercise

a right of first refusal to purchase any materials, equipment and

facilities that CW-Bahamas intends to remove from the site, and negotiate

a purchase price with CW-Bahamas;

or

|

|

|

•

|

require

CW-Bahamas to remove all materials, equipment and facilities from the

site.

|

Bulk

Water Demand and Average Sales Prices

The table

below sets forth the total volume of water we supplied to our bulk water

customers on a quarterly basis for the indicated years ended December

31:

Bulk

Water Total Volume By Quarter

(U.S.

Gallons, In Thousands)

|

2009

|

2008

|

2007

|

2006

|

2005

|

||||||||||||||||

|

First

Quarter

|

1,086,979 | 1,066,238 | 1,101,720 | 585,297 | 441,498 | |||||||||||||||

|

Second

Quarter

|

1,087,330 | 1,088,372 | 1,079,858 | 684,452 | 456,625 | |||||||||||||||

|

Third

Quarter

|

1,119,447 | 1,046,255 | 1,070,677 | 1,040,096 | 442,404 | |||||||||||||||

|

Fourth

Quarter

|

1,080,275 | 1,043,686 | 1,112,370 | 1,044,701 | 506,892 | |||||||||||||||

|

Total

|

4,374,031 | 4,244,551 | 4,364,625 | 3,354,546 | 1,847,419 | |||||||||||||||

13

Our

average sales prices of potable water sold to our bulk water customers for the

indicated years ended December 31 were as follows:

Bulk

Water Average Sales Prices

|

2009

|

2008

|

2007

|

||||||||||

|

Average

Sales Price Per 1,000 U.S. Gallons

|

$ | 5.92 | $ | 7.10 | $ | 5.57 | ||||||

Services

Operations

For

fiscal years 2009, 2008 and 2007, our services operations accounted for

approximately 15%, 20%, and, 14%, respectively, of our consolidated revenues and

are comprised of businesses in the Cayman Islands, the British Virgin Islands

and Bermuda. These businesses provide engineering and management services,

including designing and constructing desalination plants, and managing and

operating plants owned by other companies. Through June 2007, we had a service

contract for a plant in Barbados. Revenues recorded from this

contract amounted to $238,000 in 2007.

Engineering

and Management Services Operations

We

provide management, engineering and construction services for desalination

projects through DesalCo, which is recognized by suppliers as an original

equipment manufacturer of reverse osmosis seawater desalination plants for our

Company.

In late

2005, we established Aquilex, Inc., a wholly-owned U.S. subsidiary located in

Deerfield Beach, Florida, to provide financial, engineering and supply chain

support services to our operating segments.

Affiliate

Operations

Our

affiliate, OC-BVI, sells water to one bulk customer in the British Virgin

Islands. We own 50% of the voting shares of OC-BVI and have an overall 43.5%

equity interest in the profits of OC-BVI. We also own separate profit sharing

rights in OC-BVI that raise our effective interest in OC-BVI’s profits from

43.5% to approximately 45%. Sage Water Holdings (BVI) Limited (“Sage”) owns the

remaining 50% of the voting shares of OC-BVI and the remaining 55% interest in

its profits. Under the Articles of Association of OC-BVI, we have the right to

appoint three of the six directors of OC-BVI. Sage is entitled to appoint the

remaining three directors. In the event of a tied vote of the Board, the

President of the Caribbean Water and Wastewater Association, a regional trade

association comprised primarily of government representatives, is entitled to

appoint a junior director to cast a deciding vote.

We

provide certain engineering and administrative services to OC-BVI for a monthly

fee and a bonus arrangement which provides for payment of 4.0% of the net

operating income of OC-BVI.

We

account for our interests in OC-BVI using the equity method of

accounting.

Customer

OC-BVI

sells bulk water to the Government of The British Virgin Islands Water and

Sewerage Department (“BVIW&S”), which distributes the water through its own

pipeline system to residential, commercial and tourist properties on the islands

of Tortola and Jost Van Dyke in the British Virgin Islands. During 2009, OC-BVI

supplied BVIW&S with 576 million U.S. gallons of water from three

desalination plants located at Baughers Bay and Bar Bay, Tortola, and the island

of Jost Van Dyke in the British Virgin Islands.

Facilities

Through

the end of 2009, OC-BVI operated a seawater reverse osmosis plant at Baughers

Bay, Tortola, in the British Virgin Islands, which has a production capacity of

1.7 million U.S. gallons per day. The plant has an advanced energy recovery

system, generates its own electrical power on site using two large diesel driven

generator units and also purchases electricity from the BVI Electric Co. to

power ancillary equipment and provide building lighting.

14

In

October 2006, we were notified by OC-BVI that the Ministry of Communications and

Works of the Government of the British Virgin Islands (the “Ministry”) had

asserted a purported right of ownership of OC-BVI’s Baughers Bay desalination

plant pursuant to the terms of a Water Supply Agreement dated May 1990 (the

“1990 Agreement”) and had invited OC-BVI to submit a proposal for its continued

involvement in the production of water at the Baughers Bay plant in light of the

Ministry’s planned assumption of ownership. In November 2007 the Ministry

commenced litigation against OC-BVI in the Eastern Supreme Court of the

Caribbean seeking ownership of the Baughers Bay plant and was awarded ownership

and possession of this plant by the Court in October 2009. See

further discussion at “Item 7. Management’s Discussion and Analysis of Financial

Condition and Results of Operations — Material Commitments, Expenditures and

Contingencies.”

In 2007,

OC-BVI completed the construction of a 720,000 U.S. gallons per day plant at Bar

Bay, Tortola, in the British Virgin Islands. This plant began supplying water to

the BVI government in January 2009. The definitive contract for the

sale of water from this plant was signed in March 2010. The contract

has a term of seven years with a seven year renewal option exercisable by the

BVI government.

OC-BVI’s

plant on the island of Jost Van Dyke was expanded in 2009 and has a capacity of

60,000 U.S. gallons per day. This plant operates under a contract

with the BVI government that expires July 8, 2013.

15

Reverse

Osmosis Technology

The

conversion of seawater to potable water is called desalination. The two primary

forms of desalination are distillation and reverse osmosis. Both methods are

used throughout the world and technologies are improving to lower the costs of

production. Reverse osmosis is a fluid separation process in which the saline

water is pressurized and the fresh water is separated from the saline water by

passing through a semi-permeable membrane which rejects the salts. The saline

(or seawater) water is first passed through a pretreatment system, which

generally consists of fine filtration and the addition of treatment chemicals if

required. Pre-treatment removes suspended solids and organics which could cause

fouling of the membrane surface. Next, a high-pressure pump pressurizes the

saline water thus enabling a 40% conversion of the saline water to fresh water

as it passes through the membrane, while 99% of the dissolved salts are rejected

and remain the concentrated saline water. This remaining feed water which has

now been concentrated is discharged without passing through the membrane. The

remaining hydraulic energy in the concentrated feed water is transferred to the

initial saline feed water with an energy recovery device thus reducing the total

energy requirement for the reverse osmosis system. The final step is

post-treatment, which consists of stabilizing the produced fresh water, thereby

removing undesirable dissolved gases, adjusting the pH and providing

chlorination to prepare it for distribution.

We use

reverse osmosis technology to convert seawater to potable water at all of the

plants we construct and operate. We believe that this technology is the most

effective and efficient conversion process for our market. However, we are

always seeking ways to maximize efficiencies in our current processes and

investigating new, more efficient processes to convert seawater to potable

water. The equipment at our plants is among the most energy efficient available

and we monitor and maintain the equipment in an efficient manner. As a result of

our decades of experience in seawater desalination, we believe that we have an

expertise in the development and operation of desalination plants which is

easily transferable to locations outside of our current operating

areas.

Raw

Materials and Sources of Supply

All

materials, parts and supplies essential to our business operations are obtained

from multiple sources and we use the latest industry technology. We do not

manufacture any parts or components for equipment essential to our business. Our

access to seawater for processing into potable water is granted through our

licenses and contracts with governments of the various jurisdictions in which we

have our operations.

Seasonal

Variations in Our Business

Our

operations are affected by the levels of tourism and are subject to seasonal

variations in our service areas. Demand for our water in the Cayman Islands,

Belize, the British Virgin Islands and The Bahamas is affected by variations in

the level of tourism and local weather, primarily rainfall. Tourism in our

service areas is affected by the economies of the tourists’ home countries,

primarily the United States and Europe, terrorist activity and perceived threats

thereof, and increased costs of fuel and airfares. We normally sell slightly

more water during the first and second quarters, when the number of tourists is

greater and local rainfall is less, than in the third and fourth quarters. We do

not believe that our operations in Nassau and Tortola are subject to significant

seasonal variations in demand.

Government

Regulations, Custom Duties and Taxes

Our

operations and activities are subject to the governmental regulations and taxes

of the countries in which we operate. The following summary of regulatory

developments and legislation does not purport to describe all present and

proposed regulation and legislation that may affect our businesses. Legislative

or regulatory requirements currently applicable to our businesses may change in

the future. Any such changes could impose new obligations on us that may

adversely affect our businesses and operating results.

The

Cayman Islands

The

Cayman Islands are a British Overseas Territory and have had a stable political

climate since 1670, when the Treaty of Madrid ceded the Cayman Islands to

England. The Queen of England appoints the Governor of the Cayman Islands to

make laws with the advice and consent of the legislative assembly. There are 15

elected members of the legislative assembly and three members appointed by the

Governor from the Civil Service. The Cabinet is responsible for day-to-day

government operations. The Cabinet consists of five ministers who are chosen by

the legislative assembly from its 15 popularly elected members, and the three

Civil Service members. The elected members choose from among themselves a leader

who is designated the Premier and is in effect the leader of the elected

government. The Governor has reserved powers and the United Kingdom retains full

control over foreign affairs and defense. The Cayman Islands are a common law

jurisdiction and have adopted a legal system similar to that of the United

Kingdom.

16

The

Cayman Islands have no taxes on profits, income, distributions, capital gains or

appreciation. We have exemptions from, or receive concessionaire rates of

customs duties on capital expenditures for plant and major consumable spare

parts and supplies imported into the Cayman Islands as follows:

|

|

•

|

We

do not pay import duty or taxes on reverse osmosis membranes, electric

pumps and motors and chemicals, but we do pay duty at the rate of 10% of

the cost, including insurance and transportation to the Cayman Islands, of

other plant and associated materials and equipment to manufacture or

supply water in the Seven Mile Beach or West Bay areas;

and

|

|

|

•

|

OC-Cayman

pays full customs duties in respect of all plants that it operates for the

Water Authority-Cayman.

|

The stamp

tax on the transfer of ownership of land in the Cayman Islands is a major source

of revenue to the Cayman Islands government. To prevent stamp tax avoidance by

transfer of ownership of the shares of a company which owns land in the Cayman

Islands (as opposed to transfer of the land itself), The Land Holding Companies

(Share Transfer Tax) Law was passed in 1976. The effect of this law is to charge

a company, which owns land or an interest in land in the Cayman Islands, a tax

based on the value of its land or interest in land attributable to each share

transferred. The stamp tax calculation does not take into account the proportion

which the value of a company’s Cayman land or interest in land bears to its

total assets and whether the intention of the transfer is to transfer ownership

of part of a company’s entire business or a part of its Cayman land or interest

in land.

Prior to

our common shares becoming publicly traded in the United States, we paid this

tax on private share transfers. We have never paid the tax on transfers of our

publicly traded shares and requested an exemption in 1994. On April 10, 2003, we

received notice that the Cayman Islands government had granted an exemption from

taxation for all transfers of our shares. We believe it is unlikely that

government will seek to collect this tax on transfers of our publicly traded

shares during 1994 through April 10, 2003.

The

Bahamas

The

Commonwealth of The Bahamas is an independent nation and a constitutional

parliamentary democracy with the Queen of England as the constitutional head of

state. The basis of the Bahamian law and legal system is the English common law

tradition with a Supreme Court, Court of Appeals, and a Magistrates

court.

We have

not been granted any tax exemptions for our Bahamian operations. Bahamian

companies are subject to an annual business license fee ranging from 1% to 2% of

their gross revenues.

Belize

Belize

(formerly British Honduras) achieved full independence from the United Kingdom

in 1981. Today, Belize is a constitutional monarchy with the adoption of a

constitution in 1991. Based on the British model with three independent

branches, the Queen of England is the constitutional head of state, represented

by a Governor General in the government. A Prime Minister and cabinet make up

the executive branch, while a 29 member elected House of Representatives and a

nine member appointed Senate form a bicameral legislature. The cabinet consists

of a prime minister, other ministers and ministers of state who are appointed by

the Governor-General on the advice of the Prime Minister, who has the support of

the majority party in the House of Representatives. Belize is an English common

law jurisdiction with a Supreme Court, Court of Appeals and local Magistrate

Courts.

The

Government of Belize has exempted CW-Belize from certain customs duties and all

revenue replacement duties until April 18, 2026, and had exempted CW-Belize from

company taxes until January 28, 2006. Belize levies a gross receipts tax on

corporations at a rate varying between 0.75% and 25%, depending on the type of

business, and a corporate income tax at a rate of 25% of chargeable income.

Gross receipts tax payable amounts are credited towards corporate income tax.

The Government of Belize also implemented certain environmental taxes and a

general sales tax effective July 1, 2006 and increased certain business and

personal taxes and created new taxes effective March 1, 2005. Belize levies

import duty on most imported items at rates varying between 0% and 45%, with

most items attracting a rate of 20%. In 2008, it was determined that the tax

exemption was no longer valid and CW-Belize paid approximately $156,000 of

business and corporate income tax for the period 2004 through 2008. Under the

terms of our water supply agreement with BWSL we are reimbursed by BWSL for all

taxes and customs duties that we are required to pay and have recorded this

reimbursement as an offset to our tax expense.

17

The

British Virgin Islands

The

British Virgin Islands is a British Overseas Territory that was first settled by

the Dutch in 1648 and annexed by the British in 1672. It adopted a new

constitution in 2007 and is a constitutional democracy with three branches of

government: the Executive Council, the Judiciary and the Legislative Council.

Executive authority is vested in the Queen of England, exercised through her

representative, the Governor. The Governor has responsibility for the courts,

public service, police, and foreign affairs, defense and full policy-making

authority. The Governor is not a member of the Executive Council but receives

assistance with the day-to-day operations of the government. The Executive

Council, comprised of various members of the legislature, is nominated by the

Premier and appointed by the Governor. The Parliament or Legislative Council is

made up of thirteen (13) seats with members elected by popular vote, serving up

to but no more than four-year terms. The British Virgin Islands are an English

common law jurisdiction with a Supreme Court, Court of Appeals and Magistrates

Court.

OC-BVI

received an exemption under the water supply agreement with The British Virgin

Islands government from all taxes, duties, levies and impositions on items which

it imports for the Baughers Bay plant. Under the terms of the March

2010 Bar Bay water sale agreement, OC-BVI must apply to the British Virgin

Islands government for duty and tax concessions relating to the Bar Bay plant’s

construction and operation. In the event that such concessions are

not granted or are partially granted, the British Virgin Islands government has

agreed to allow OC-BVI to increase its water rate to account for any duties and

taxes that are payable by OC-BVI.

Market

and Service Area

Although

we currently operate in the Cayman Islands, Belize, The British Virgin Islands,

The Bahamas and Bermuda, we believe that our potential market consists of any

location where there is a need for potable water. The desalination of seawater,

either through distillation or reverse osmosis, is the most widely used process

for producing fresh water in areas with an insufficient natural supply. We

believe our experience in the development and operation of distillation and

reverse osmosis desalination plants provides us with a significant opportunity

to successfully expand our operations beyond the markets in which we currently

operate.

Prior to

our acquisition of OC-Cayman in February 2003, the market that we serviced under

our exclusive license in the Cayman Islands consisted of Seven Mile Beach and

West Bay, Grand Cayman, two of the three most populated areas in the Cayman

Islands. The Cayman Islands Government, through the Water Authority-Cayman,

supplies water to parts of Grand Cayman, which are not within our licensed area,

as well as to Little Cayman and Cayman Brac. We operate all the reverse osmosis

desalination plants owned by the Water Authority-Cayman on Grand Cayman and

supply water under licenses and supply agreements held by OC-Cayman with the

Water Authority-Cayman.

According

to the most recent information published by the Economics and Statistics Office

of the Cayman Islands Government, the population of the Cayman Islands was

estimated in December 2005 to be approximately 52,000. According to the figures

published by the Department of Tourism Statistics Information Center, during the

year ended December 31, 2009, tourist air arrivals decreased by 10.2% and

tourist cruise ship arrivals decreased 2.1% over the same period in

2008.

Total

visitors for the year decreased from 1.9 million in 2009 to 1.8 million in 2008.

We believe that our water sales in the Cayman Islands are more positively

impacted by tourists that arrive by air than by those arriving by cruise ship,

since cruise ship tourists generally only remain on island for one day or less

as they do not remain on island overnight.

Tourist

air arrivals increased 6.8% and cruise ship arrivals increased 2.3% in January

2010, compared to the same period in 2009. At this time we are not able to

determine whether these trends will continue through 2010.

In

December 2005, the Ritz-Carlton Hotel, condominiums and golf course development

began operations. This development is required to purchase potable water from us

for the hotel and condominiums under the terms of our exclusive license

agreement, but not for its golf course.

During

2002, the government of the Cayman Islands amended the Development and Planning

Law to permit construction of buildings up to seven stories in certain zones

within our license area, including commercial and hotel zones. Previously,

buildings in these zones were only permitted to be built to three stories. We

believe that this change in the law has and will continue to facilitate the

development of certain properties within our license area that may have

otherwise not developed under the old height restriction, and it has already

facilitated the re-development of a number of existing properties, which have

been demolished re-built under the terms of the new height

restrictions.

18

The Town

of Camana Bay commenced construction in 2005 and will be developed over several

decades. The Camana Bay development is situated on 500 acres stretching from the

Caribbean sea to the North Sound within our retail license area on West Bay

Beach, and is mixed-use masterplanned community, which includes retail,

residential and institutional properties.

Our

current operations in Belize are located on Ambergris Caye, which consists of

residential, commercial and tourist properties in the town of San Pedro. This

town is located on the southern end of Ambergris Caye. Ambergris Caye is one of

many islands located east of the Belize mainland and off the southeastern tip of

the Yucatan Peninsula. Ambergris Caye is approximately 25 miles long and,

according to the Belize National Population Census 2000, has a population of

about 4,500 residents, which has increased approximately 144% over the previous

ten years. We provide bulk potable water to BWSL, which distributes this water

to this market. BWSL currently has no other source of potable water on Ambergris

Caye. Our contract with BWSL makes us their exclusive producer of desalinated

water on Ambergris Caye though 2026.

A 185

mile long barrier reef, which is the largest barrier reef in the Western

Hemisphere, is situated just offshore of Ambergris Caye. This natural attraction

is becoming a choice destination for scuba divers and tourists. According to

information published by the Belize Trade and Investment Development Service,

tourism is Belize’s second largest source of foreign income, next to

agriculture.

Our

current operations in The Bahamas are located on South Bimini Island and in

Nassau on New Providence. The Bimini Islands consist of North Bimini and South

Bimini, and are two of 700 islands which comprise The Bahamas. The Bimini

Islands are located approximately 50 miles east of Ft. Lauderdale, Florida and

are a premier destination for sport fishing enthusiasts. The population of the

Bimini Islands is approximately 1,600 persons and the islands have about 200

hotel and guest rooms available for tourists. The total land area of the Bimini

Islands is approximately 9 square miles. New Providence, Lyford Caye

and Paradise Island, connected by several bridges, are located approximately 150

miles east southeast of the Bimini Islands. With an area of 151 square miles and

a population of approximately 211,000, Nassau is the political capital and the

commercial hub of The Bahamas. As the largest city with its famed Cable Beach,

it accounts for more than two-thirds of the 4.0 million tourists who visit The

Bahamas annually.

The

British Virgin Islands are a British Overseas Territory and are situated east of

Puerto Rico. They consist of 16 inhabited and more than 20 uninhabited islands,

of which Tortola is the largest and most populated island. The islands are the

center for many large yacht-chartering businesses.

Competition

Cayman Islands. Pursuant to

our license granted by the Cayman Islands government, we have the exclusive

right to provide potable, piped water within our licensed service area on Grand

Cayman. At the present time, we are the only non-government-owned public water

utility on Grand Cayman. The Cayman Islands government, through the Water

Authority-Cayman, supplies water to parts of Grand Cayman located outside of our

licensed service area. Although we have no competition within our exclusive

retail license service area, our ability to expand our service area is at the

discretion of the Cayman Island government. Prior to 1991, any owner of property

within our exclusive retail license service area could install water-making

equipment for its own use. Since 1991, that option is only available to private

residences, although water plants in existence prior to 1991 can be maintained

but not replaced or expanded. The Cayman Islands government, through the Water

Authority-Cayman, supplies water to parts of Grand Cayman outside of our

licensed service area. We have competed with such companies as GE Water, Veolia,

and IDE for bulk water supply contracts with the Water

Authority-Cayman.

Belize. On Ambergris Caye in

Belize, our water supply contract with Belize Water Services Limited is

exclusive, and Belize Water Services Limited can no longer seek contracts with

other water suppliers, or produce water themselves, to meet their future needs

in San Pedro, Ambergris Caye, Belize.

The Bahamas. On South Bimini

Island in The Bahamas, we supply water to a private developer and do not have

competitors. GE Water operates a seawater desalination plant on North Bimini

Island. We competed with companies such as GE Water, Veolia,

IDE, Inima and Biwater for the new contract with the Bahamian

government to build and operate a seawater desalination plant at Blue Hills, New

Providence, Bahamas. We expect to compete with these companies and others for

future water supply contracts in The Bahamas.

British Virgin Islands. In

the British Virgin Islands, GE Water operates seawater desalination plants in

West End and Sea Cows Bay, Tortola, and on Virgin Gorda and generally bids

against OC-BVI for projects. Biwater PLC was recently awarded a 16

year contract to construct and operate a 2.75 million US gallon per day

desalination plant in Tortola for the British Virgin Islands

government. This contract was negotiated solely with Biwater and did

not go to competitive tender.

19

To

implement our growth strategy outside our existing operating areas, we will have

to compete with some of the same companies we competed with for the Blue Hills

project in Nassau, Bahamas such as GE Water, Veolia, IDE Technologies,

Inima, and Biwater and as well as other smaller companies like Seven Seas

Water. Some of these companies currently operate in areas in which we would like

to expand our operations and already maintain worldwide operations having

greater financial, managerial and other resources than our company. We believe

that our low overhead costs, knowledge of local markets and conditions and our

efficient manner of operating desalinated water production and distribution

equipment provide us with the capabilities to effectively compete for new