Attached files

| file | filename |

|---|---|

| EX-10.36 - EXHIBIT 10.36 - East Dubuque Nitrogen Partners, L.P. | d268582dex1036.htm |

| EX-23.1 - EXHIBIT 23.1 - East Dubuque Nitrogen Partners, L.P. | d268582dex231.htm |

| EX-21.1 - EXHIBIT 21.1 - East Dubuque Nitrogen Partners, L.P. | d268582dex211.htm |

| EX-32.2 - EXHIBIT 32.2 - East Dubuque Nitrogen Partners, L.P. | d268582dex322.htm |

| EX-31.1 - EXHIBIT 31.1 - East Dubuque Nitrogen Partners, L.P. | d268582dex311.htm |

| EX-32.1 - EXHIBIT 32.1 - East Dubuque Nitrogen Partners, L.P. | d268582dex321.htm |

| EX-31.2 - EXHIBIT 31.2 - East Dubuque Nitrogen Partners, L.P. | d268582dex312.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended September 30, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to

Commission File No. 001-35334

RENTECH NITROGEN PARTNERS, L.P.

(Exact name of registrant as specified in its charter)

| Delaware | 45-2714747 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 10877 Wilshire Boulevard, Suite 600 Los Angeles, California |

90024 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (310) 571-9800

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Units Representing Limited Partner Interests | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨. No x.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨. No x.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of March 31, 2011, the last business day of the registrant’s most recently completed second fiscal quarter, the registrant’s common units were not publicly traded. The registrant’s common units began trading on the New York Stock Exchange on November 4, 2011.

As of December 14, 2011, the registrant had 38,250,000 common units outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: None

Table of Contents

2

Table of Contents

FORWARD-LOOKING STATEMENTS

Certain statements and information included in this Annual Report on Form 10-K, or this report, and other reports or materials that we have filed or will file with the Securities and Exchange Commission, or the SEC, (as well as information included in oral statements or other written statements made or to be made by us or our management), contain or may contain “forward-looking statements.” Statements that are predictive in nature, that depend upon or refer to future events or conditions or that include the words “will,” “believe,” “expect,” “anticipate,” “intend,” “estimate” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters identify forward-looking statements. Our forward-looking statements include statements about our business strategy, our industry, our future profitability, our expected capital expenditures (including for maintenance or expansion projects and environmental expenditures) and the impact of such expenditures on our performance, and our operating costs. These statements involve known and unknown risks, uncertainties and other factors, that may cause our actual results and performance to be materially different from any future results or performance expressed or implied by these forward-looking statements. Factors that could affect our results include the risk factors detailed in Part I—Item 1A “Risk Factors” and from time to time in our periodic reports and registration statements filed with the SEC. You should not place undue reliance on our forward-looking statements. Although forward-looking statements reflect our good faith beliefs, forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause our actual results, performance or achievements to differ materially from anticipated future results, performance or achievements expressed or implied by such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise, unless required by law.

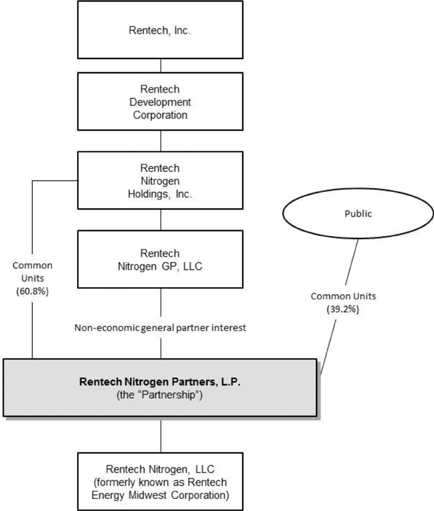

References in this report to “the Partnership,” “we,” “our,” “us” and like terms refer to Rentech Nitrogen Partners, L.P. and our subsidiary, unless the context otherwise requires or where otherwise indicated. References in this report to “Rentech” refer to Rentech, Inc. and its consolidated subsidiaries other than us, unless the context otherwise requires or where otherwise indicated. References to “RDC” refer to Rentech Development Corporation, which is a wholly owned subsidiary of Rentech, references to “RNHI” refer to Rentech Nitrogen Holdings, Inc., which is a wholly owned subsidiary of RDC, and references to “Rentech Nitrogen GP” and “our general partner” refer to Rentech Nitrogen GP, LLC, which is our general partner and a wholly owned subsidiary of RNHI. References to “our operating company” refer to Rentech Nitrogen, LLC, which was formerly known as Rentech Energy Midwest Corporation, or REMC. References to any of our fiscal years mean the fiscal year ending September 30 of that calendar year.

3

Table of Contents

Overview

We are a Delaware limited partnership formed in July 2011 by Rentech, a publicly traded provider of clean energy solutions and nitrogen fertilizer, to own, operate and grow our nitrogen fertilizer business. Our nitrogen fertilizer facility, which is located in East Dubuque, Illinois, has been in operation since 1965, with infrequent unplanned shutdowns. We produce primarily anhydrous ammonia, or ammonia, and urea ammonium nitrate solution, or UAN, at our facility, using natural gas as our primary feedstock. Substantially all of our products are nitrogen-based.

Our facility is located in the center of the Mid Corn Belt, the largest market in the United States for direct application of nitrogen fertilizer products. The Mid Corn Belt includes the States of Illinois, Indiana, Iowa, Missouri, Nebraska and Ohio. We consider our market to be comprised of the States of Illinois, Iowa and Wisconsin.

Our core market consists of the area located within an estimated 200-mile radius of our facility. In most instances, our customers purchase our nitrogen products at our facility and then arrange and pay to transport them to their final destinations by truck. To the extent our products are picked up at our facility, we do not incur shipping costs, in contrast to nitrogen fertilizer producers located outside of our core market that must incur transportation and storage costs to transport their products to, and sell their products in, our core market. In addition, we do not maintain a fleet of trucks and, unlike some of our major competitors, we do not maintain a fleet of rail cars because our customers generally are located close to our facility and prefer to be responsible for transportation. Having no need to maintain a fleet of trucks or rail cars lowers our fixed costs. The combination of our proximity to our customers and our storage capacity at our facility also allows for better timing of the pick-up and application of our products, as nitrogen fertilizer product shipments from more distant locations have a greater risk of missing the short periods of favorable weather conditions during which the application of nitrogen fertilizer may occur.

Our facility can produce up to 830 tons of ammonia per day, with the capacity to upgrade up to 450 tons of ammonia to produce up to 1,100 tons of UAN per day. During the fiscal years ended September 30, 2011 and 2010, we produced approximately 273,000 tons and 267,000 tons, respectively, of ammonia, and approximately 312,000 tons and 287,000 tons, respectively, of UAN. For the fiscal years ended September 30, 2011 and 2010, ammonia and UAN combined accounted for approximately 91% and 89%, respectively, of our total gross profit. Our facility has the flexibility to vary our product mix significantly, which permits us to upgrade our ammonia production into varying amounts of UAN, nitric acid and liquid and granular urea each season, depending on market demand, pricing and storage availability.

Our Initial Public Offering

On November 9, 2011, we completed our initial public offering of 15,000,000 common units representing limited partner interests at a public offering price of $20.00 per common unit. The public currently owns 39.2% of our outstanding common units and RNHI owns the remaining 60.8% of our common units. Rentech Nitrogen GP owns 100% of the non-economic general partner interest in us. At the closing of our initial public offering, RNHI contributed its member interests in REMC to us, and REMC converted into a limited liability company named Rentech Nitrogen, LLC, organized under the laws of the State of Delaware.

4

Table of Contents

Organizational Structure

The following diagram depicts our organizational structure as of November 30, 2011 (all percentage ownership interests are 100% unless otherwise noted):

Business

Our Facility

Our facility is located on approximately 210 acres in the northwest corner of Illinois on a 140-foot bluff above Mile Marker 573 on the Upper Mississippi River. Our facility produces ammonia, UAN, liquid and granular urea, nitric acid and food-grade carbon dioxide, or CO2, using natural gas as our primary feedstock. Our facility operates continuously, except for planned shutdowns for maintenance and efficiency improvements and unplanned shutdowns, which are infrequent. Our facility can optimize its product mix according to changes in demand and pricing for its various products. Some of these products, such as UAN, are final products sold to customers, and others, including ammonia, are both final products and feedstocks for other final products, such as nitric acid, liquid urea, granular urea and CO2.

The following table sets forth our facility’s current rated production capacity for the listed products in tons per day and tons per year, and our product storage capacity.

5

Table of Contents

| Product |

Production Capacity |

Product Storage Capacity | ||||

| Tons /Day | Tons /Year | |||||

| Ammonia |

830 | 302,950 | 40,000 tons (2 tanks); 15,000 tons(1) | |||

| UAN |

1,100 | 401,500 | 80,000 tons (2 tanks) | |||

| Urea (liquid / granular) |

400 140 | 146,000 / 51,100 | 12,000 granular ton warehouse | |||

| Nitric acid |

380 | 138,700 | Limited capacity is not a factor | |||

|

CO2(2) |

650 | 237,250 | 1,900 tons | |||

| (1) | Represents 15,000 tons of space at the terminal of Agrium U.S.A., Inc., or Agrium, in Niota, Illinois where we have the right to store ammonia pursuant to our distribution agreement with Agrium. Our right to store ammonia at this terminal expires on June 30, 2016, but automatically renews for successive one year periods, unless we deliver a termination notice to Agrium with respect to such storage rights at least three months prior to an automatic renewal. Notwithstanding the foregoing, our right to use the storage space immediately terminates if the distribution agreement terminates in accordance with its terms. See “—Marketing and Distribution.” |

| (2) | We would expect to reduce our facility’s CO2 production capacity to 350 tons per day and 127,750 tons per year by May 2012 if we complete our ammonia capacity expansion project. See “—Expansion Projects.” |

The following table sets forth the amount of products produced by, and shipped from, our facility for the fiscal years ended September 30, 2011, 2010 and 2009:

| Fiscal Year Ended September 30, |

||||||||||||

| 2011 | 2010 | 2009 | ||||||||||

| (in thousands of tons) | ||||||||||||

| Products Produced |

||||||||||||

| Ammonia |

273 | 267 | 267 | |||||||||

| UAN |

312 | 287 | 274 | |||||||||

| Urea (liquid / granular) |

155 | 145 | 162 | |||||||||

| Nitric acid |

126 | 111 | 104 | |||||||||

|

CO2 |

109 | 107 | 95 | |||||||||

| Products Shipped |

||||||||||||

| Ammonia |

125 | 153 | 126 | |||||||||

| UAN |

315 | 294 | 267 | |||||||||

| Urea (liquid / granular) |

29 | 32 | 36 | |||||||||

| Nitric acid |

15 | 11 | 9 | |||||||||

|

CO2 |

110 | 107 | 95 | |||||||||

Expansion Projects

Since commencing operations in 1965, our facility has undergone various expansion projects that have increased production and product upgrade capabilities. The expansion project we completed in 1998 entailed the construction of a second nitric acid plant at our facility. This project added approximately 150 tons per day of nitric acid capacity to our facility, which, in turn, increased our facility’s UAN capacity from approximately 660 tons per day to approximately 1,100 tons per day.

We are pursuing some, and we intend to continue to evaluate additional, opportunities to increase our profitability by expanding our production capabilities and product offerings, including with the following expansion projects:

| • | Urea Expansion and Diesel Exhaust Fluid Build-Out. We have commenced a project to increase our urea production capacity by approximately 13%, or 50 tons per day. The additional urea could be marketed as liquid urea or upgraded into UAN, both of which sell at a premium to ammonia per nutrient ton. As a part of this project, we have commenced the installation of mixing, storage and load-out equipment that would enable us to produce and sell diesel exhaust fluid, or DEF, from the urea produced at our facility. DEF is a urea-based chemical reactant that is intended to reduce nitrogen oxide emissions in the exhaust systems of certain diesel engines of trucks and off-road farm and construction equipment. As an industrial product, DEF would diversify our product mix and our potential customer base. We believe that there is an expanding market for DEF, with the potential for long-term off-take contracts on favorable terms. We intend to arrange for a third party to sell and distribute our DEF products to customers. We expect the urea expansion and DEF build-out project to cost approximately $5.8 million to complete. We believe the expansion project could be completed by the end of calendar year 2012. We intend to use a portion of the net proceeds from our initial public offering to fund this expansion project. |

6

Table of Contents

| • | Ammonia Capacity Expansion. We have commenced construction of a project that is designed to increase ammonia production at our facility by approximately 70,000 tons annually, for sale or upgrade to additional products, and to increase our ammonia storage capacity by approximately 20,000 tons. We have completed a feasibility study and Front End Engineering and Design, or FEED, obtained the construction permit and commenced construction of certain long lead-time items in order to put the project on a schedule that fits with planned downtime for our 2013 turnaround. Based on the engineering work completed to date including FEED, our preliminary estimate is that this project could be completed in 24 to 30 months without adding significant downtime to that already planned for the 2013 turnaround, and we expect that this project could cost approximately $100 million to complete. We will require additional debt and/or equity financing to complete this project. We currently intend to finance substantially all of the cost of this project with debt financing that we are seeking to obtain. However, there is no guarantee that we will be able to obtain debt financing on acceptable terms or at all. Rentech may provide the initial debt financing for this project in order to enable us to keep the project on schedule as we seek additional debt financing to complete the project. |

Products

Our product sales are heavily weighted toward sales of ammonia and UAN, which together made up 80% or more of our total revenues for the three fiscal years ended September 30, 2011, 2010 and 2009. A majority of our products are sold through our distribution agreement with Agrium as described below under “—Marketing and Distribution,” with the exception of CO2, which we sell directly to customers in the food and beverage market at negotiated contract prices. Although ammonia and UAN may be used interchangeably in some cases, each has its own characteristics, and customer product preferences vary according to the crop planted, soil and weather conditions, regional farming practices, relative prices and the cost and availability of appropriate storage, transportation, handling and application equipment, each of which vary among these two products. During each of the fiscal years ended September 30, 2011, 2010 and 2009, we sold more than 90% of our nitrogen products to customers for agricultural uses, with the remaining portion being sold to customers for industrial uses.

Ammonia. We produce ammonia, the simplest form of nitrogen fertilizer and the feedstock for the production of other nitrogen fertilizers. Our ammonia processing unit has a current rated capacity of 830 tons per day. Our ammonia product storage consists of two 20,000 ton tanks at our facility and 15,000 tons of leased storage in Niota, Illinois. Ammonia is used in the production of all other products produced by our facility, except CO2.

UAN. UAN is a liquid fertilizer that has a slight ammonia odor, and, unlike ammonia, it does not need to be refrigerated or pressurized when transported or stored. Our facility has two UAN storage tanks with a combined capacity of 80,000 tons.

Urea. Our urea solution is sold in its liquid state, processed into granular urea through our urea granulation plant to create dry granular urea (46% nitrogen concentration) or upgraded into UAN. We assess market demand for each of these three end products and allocate our produced urea solution as appropriate. We sell liquid urea primarily to industrial customers in the power, ethanol and diesel emissions markets. Although we believe there is high demand for our granular urea in agricultural markets, we sell granular urea primarily to customers in specialty urea markets where the spherical and consistent size of the granules resulting from our “curtain granulation” technology generally command a premium price. Our facility has a 12,000 ton capacity bulk warehouse that may be used for dry bulk granular urea storage.

Nitric Acid. We produce nitric acid through two separate nitric acid plants at our facility. Nitric acid is either sold to third parties or used within our facility for the production of ammonium nitrate solution, as an intermediate from which UAN is produced. We believe that our facility currently has sufficient storage capacity available for efficient product loading.

Carbon Dioxide. CO2 is a gaseous product that is co-manufactured with ammonia, with approximately 1.1 tons of CO2 produced per ton of ammonia produced. Our facility utilizes CO2 in its urea production and has developed a market for CO2 through conversion to a purified food grade liquid CO2. Our facility has storage capacity for approximately 1,900 tons of CO2. We have multiple CO2 sales agreements that allow for regular shipment of CO2 throughout the year, and our current storage capacity is sufficient to support our CO2 delivery commitments.

7

Table of Contents

Marketing and Distribution

In 2006, we entered into a distribution agreement with Agrium under which a majority of our products, including ammonia and UAN, are sold. Pursuant to the distribution agreement, Agrium is obligated to use its commercially reasonable efforts to promote the sale of, and to solicit and secure orders from its customers for, nitrogen fertilizer products comprising ammonia, liquid and granular urea, UAN, nitric acid and other nitrogen-based products manufactured at our facility. Under the distribution agreement, Agrium bears the credit risk on products sold through Agrium pursuant to the agreement. The distribution agreement has a term that ends in April 2016, but automatically renews for subsequent one-year periods (unless either party delivers a termination notice to the other party at least three months prior to an automatic renewal).

During the three fiscal years ended September 30, 2011, 2010 and 2009, we sold 80% or more of the nitrogen fertilizer products produced at our facility through Agrium pursuant to the distribution agreement, and sold the remaining amounts directly to customers. Our management pre-approves price, quantity and other terms for each sale through Agrium, and we pay Agrium only a commission for its services. Our rights under the distribution agreement include the right to store specified amounts of our ammonia for a monthly fee at Agrium’s ammonia terminal in Niota, Illinois, which serves as another location where our ammonia is sold. Our right to store ammonia at Agrium’s terminal expires on June 30, 2016, but automatically renews for successive one year periods, unless we deliver a termination notice to Agrium with respect to such storage rights at least three months prior to an automatic renewal. Notwithstanding the foregoing, our right to use the storage space immediately terminates if the distribution agreement terminates in accordance with its terms. Outside of the distribution agreement, we also sell our CO2 directly to customers on a contract-by-contract basis.

Under the distribution agreement, we pay commissions to Agrium not to exceed $5 million during each contract year on applicable gross sales during the first 10 years of the agreement. The commission rate was 2% during the first year of the agreement and increased by 1% on each anniversary date of the agreement up to the current rate of 5%, which is the maximum allowable rate under the distribution agreement during the first 10 years of the agreement. For the fiscal years ended September 30, 2011, 2010 and 2009, the effective commission rate associated with sales under the distribution agreement was 4.3%, 4.2% and 2.3%, respectively.

Transportation

In most instances, our customers purchase our nitrogen products freight on board, or FOB, at our facility, and then arrange and pay to transport them to their final destinations by truck according to customary practice in our market. Similarly, under the distribution agreement, neither we nor Agrium is responsible for transportation, and customers that purchase our products through Agrium purchase such products FOB at our facility. When products are purchased FOB at our facility, the customer is responsible for all costs for and bears all risks associated with the transportation of products from our facility.

In certain limited cases, we transport our products by barge or rail, and are responsible for the associated transportation costs. We own a barge dock on the Mississippi River, and we deliver some of our products to customers by barge. We also ship some of our products by barge to our leased storage facility in Niota, Illinois, another location from which our customers may pick up our products by truck. We also own a rail spur that connects to the Burlington Northern Santa Fe Railway, and the Canadian National Railway Company or its predecessors have provided rail service to our facility since 1966.

We believe that having the option to transport our nitrogen products by barge or rail provides us with the flexibility to sell our products to locations that cannot readily be reached by truck. However, transportation by truck generally is not subject to many of the risks and costs associated with transportation by barge or rail. Barge transportation from the Gulf Coast frequently is constrained by unpredictable conditions and limited equipment and storage infrastructure on the Mississippi River. Lock closures on the Upper Mississippi River can be caused by a variety of conditions, including inclement weather or surface conditions, and can unexpectedly delay barge transportation. In addition, in the United States, there are only two towing companies that transport ammonia by barge and only 32 active barges available for ammonia transport, which we believe is only sufficient to transport the current level of produced ammonia. Ammonia storage sites and terminals served by barge on the Mississippi River are controlled primarily by CF Industries Holdings, Inc., or CF Industries, Koch Industries, Inc., or Koch, and Agrium. Because ownership of storage sites and terminals is limited to these competitors, other competitors who rely on barge transportation could encounter storage limitations associated with the seasonal Mississippi River closure that occurs annually from mid-November to early March. Railroads also charge premium prices to ship certain toxic inhalation hazard, or TIH, chemicals, including ammonia, due in part to additional liability insurance costs incurred by the railroads. We believe that railroads are taking other actions, such as requiring indemnification from their customers for liabilities relating to TIH chemicals, to shift the risks they face from shipping TIH chemicals to their customers, which may make transportation of ammonia by rail more costly or less feasible.

8

Table of Contents

Customers

We sell a majority of our nitrogen products to customers located in our core market. We sold over 90% of our nitrogen products to customers for agricultural uses during each of the fiscal years ended September 30, 2011, 2010 and 2009. Given the nature of our business, and consistent with industry practice, we do not have long-term minimum purchase contracts with any of our customers.

In the aggregate, our top five ammonia customers represented approximately 46%, 52% and 49%, respectively, of our ammonia sales for the fiscal years ended September 30, 2011, 2010 and 2009, and our top five UAN customers represented approximately 50% of our UAN sales for each of these fiscal years. In addition, Twin State, Inc., or Twin State, accounted for approximately 6%, 10% and 11%, respectively, of our total product sales for the fiscal years ended September 30, 2011, 2010 and 2009. Growmark, Inc., or Growmark, accounted for approximately 7%, 8% and 11%, respectively, of our total product sales for the fiscal years ended September 30, 2011, 2010 and 2009. For the fiscal years ended September 30, 2011, 2010 and 2009, approximately 3%, 7% and 0%, respectively, of our total product sales were to Agrium as a direct customer (rather than a distributor) and approximately 15%, 11% and 5%, respectively, of our total product sales were to Crop Production Services, Inc., or CPS, a controlled affiliate of Agrium.

Seasonality and Volatility

The fertilizer business is seasonal, based upon the planting, growing and harvesting cycles. Inventories must be accumulated to allow for customer shipments during the spring and fall fertilizer application seasons, which requires significant storage capacity. The accumulation of inventory to be available for seasonal sales requires us to maintain significant working capital. This seasonality generally results in higher fertilizer prices during peak periods, with prices normally reaching their highest point in the spring, decreasing in the summer, and increasing again in the fall. Fertilizer products are sold both on the spot market for immediate delivery and under product prepayment contracts for future delivery at fixed prices. The terms of the product prepayment contracts, including the percentage of the purchase price paid as a down payment, can vary from season to season. Variations in the proportion of product sold through forward sales and variations in the terms of the product prepayment contracts can increase the seasonal volatility of our cash flows and cause changes in the patterns of seasonal volatility from year-to-year. The cash from product prepayment contracts is included in our operating cash flow in the quarter in which the cash is received, while revenue related to product prepayment contracts is recognized when products are picked-up or delivered and the customer takes title. As a result, the cash received from product prepayment contracts increases our operating cash flow in the quarter in which the cash is received, but may effectively reduce our operating cash flow in a subsequent quarter if the cash was received in a quarter prior to the one in which the revenue is recorded. See Part II—Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Quantitative and Qualitative Disclosure About Market Risk.”

Another seasonal factor affecting our industry is the effect of weather-related conditions on ability to transport products by barge on the Upper Mississippi River. During portions of the winter, the Upper Mississippi River cannot be used for transport due to lock closures, which could preclude the transportation of nitrogen products by barge during this period and may increase transportation costs. However, only approximately 4.4% and 3.7% of the ammonia and UAN tonnage, respectively, that we sold during the three-year period ended September 30, 2011 was transported from our facility by barge.

The following table shows total tons of our products shipped for each quarter during the last three fiscal years:

| For the Fiscal Years Ended September 30, | ||||||||||||

| 2011 | 2010 | 2009 | ||||||||||

| (in thousands of tons) | ||||||||||||

| Ammonia |

||||||||||||

| Quarter ended December 31 |

44 | 45 | 44 | |||||||||

| Quarter ended March 31 |

20 | 22 | 5 | |||||||||

| Quarter ended June 30 |

43 | 51 | 67 | |||||||||

| Quarter ended September 30 |

18 | 35 | 10 | |||||||||

| UAN |

||||||||||||

| Quarter ended December 31 |

79 | 57 | 42 | |||||||||

| Quarter ended March 31 |

30 | 25 | 28 | |||||||||

| Quarter ended June 30 |

129 | 112 | 93 | |||||||||

| Quarter ended September 30 |

77 | 100 | 104 | |||||||||

| Other Nitrogen Products |

||||||||||||

| Quarter ended December 31 |

10 | 7 | 11 | |||||||||

| Quarter ended March 31 |

12 | 14 | 11 | |||||||||

9

Table of Contents

| For the Fiscal Years Ended September 30, | ||||||||||||

| 2011 | 2010 | 2009 | ||||||||||

| (in thousands of tons) | ||||||||||||

| Quarter ended June 30 |

15 | 12 | 15 | |||||||||

| Quarter ended September 30 |

7 | 10 | 8 | |||||||||

|

CO2 |

||||||||||||

| Quarter ended December 31 |

34 | 15 | 18 | |||||||||

| Quarter ended March 31 |

27 | 24 | 22 | |||||||||

| Quarter ended June 30 |

26 | 32 | 28 | |||||||||

| Quarter ended September 30 |

23 | 36 | 27 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Tons Shipped |

594 | 597 | 533 | |||||||||

|

|

|

|

|

|

|

|||||||

We typically ship the highest volume of tons during the spring planting season, which occurs during the quarter ending June 30, and the next highest volume of tons after the fall harvest during the quarter ending December 31. However, as reflected in the table above, the seasonal patterns may change substantially from year-to-year due to various circumstances, including timing of or changes in the weather. These seasonal increases and decreases in demand also can cause fluctuations in sales prices. In more mild winter seasons with warmer weather, early planting may shift significant ammonia sales into the quarter ending March 31.

Raw Materials

The principal raw material used to produce nitrogen fertilizer products is natural gas. We historically have purchased natural gas in the spot market, through the use of forward purchase contracts, or a combination of both. We use forward purchase contracts to lock in pricing for a portion of our facility’s natural gas requirements. These forward purchase contracts are generally either fixed-price or index-priced, short term in nature and for a fixed supply quantity. Our policy is to purchase natural gas under fixed-price forward contracts to produce the products that have been sold under product prepayment contracts for later delivery, effectively fixing a substantial portion of the gross margin on pre-sold product. We are able to purchase natural gas at competitive prices due to our connection to the Northern Natural Gas interstate pipeline system which is within one mile of our facility. The pipeline is connected to Nicor Inc.’s distribution system at the Chicago Citygate receipt point from which natural gas is transported to our facility. Though we do not purchase natural gas for the purpose of resale, we occasionally sell natural gas when contracted quantities received exceed production requirements and storage capacities. The location of our receipt point has allowed us to obtain relatively favorable natural gas prices for our excess natural gas using the Chicago Citygate price point created by the stable residential demand for the commodity in the city of Chicago, Illinois. During the fiscal year ended September 30, 2011, the average price of natural gas on this index exceeded that of the Inside FERC Northern Natural Gas Ventura and Demarcation Indices, which are used to determine the prices for the natural gas we purchase. Natural gas purchased and used in production was approximately 10.3 billion cubic feet, 9.9 billion cubic feet, 10.1 billion cubic feet in the fiscal years ended September 30, 2011, 2010 and 2009, respectively.

Changes in the levels of natural gas prices and market prices of nitrogen-based products can materially affect our financial position and results of operations. Natural gas prices in the United States have experienced significant fluctuations over the last few years, increasing substantially in 2008 and subsequently declining to lower levels in 2009, 2010, and 2011. The price changes have been driven by several factors, including changes in the demand for natural gas from industrial users, which is affected, in part, by the general conditions of the United States economy, and other factors. Several recent discoveries of large natural gas deposits in North America, combined with advances in technology for natural gas production also have caused large increases in the estimates of available natural gas reserves and production in the United States, contributing to significant reductions in the market price of natural gas. One major factor in the recent decrease in natural gas prices has been the use of technologies, including hydraulic fracturing and horizontal drilling, that have substantially increased the amount of natural gas produced in the United States. Hydraulic fracturing is the process of fracturing the underground formation with water, sand and chemicals under high pressure to recover natural gas from coalbeds and shale gas formations that otherwise may have been inaccessible. Horizontal drilling involves drilling a well from the surface to a subsurface location and then proceeding horizontally, which typically exposes significantly more reservoir rock to the well bore and thus results in greater potential natural gas recovery than traditional vertical drilling. Seasonal fluctuations in natural gas prices exist within each year resulting from various supply and demand factors, including, but not limited to, the severity of winter weather and its effect on consumer and industrial demand for heating, the severity of summer weather and its effect on industrial demand by utilities for electrical generation, and hurricane activity in the Gulf of Mexico.

10

Table of Contents

Competition

We compete with a number of domestic and foreign producers of nitrogen fertilizer products, many of which are larger than we are and have significantly greater financial and other resources than we do. We believe that customers for nitrogen fertilizer products make purchasing decisions principally on the delivered price and availability of the product at the critical application times. Our facility’s proximity to our customers provides us with a competitive advantage over producers located further away from our customers. The nitrogen fertilizer facilities closest to our facility are located in Fort Dodge, Iowa, Creston, Iowa and Port Neal, Iowa, approximately 190 miles, 275 miles and 300 miles, respectively, from our facility, and in Lima, Ohio, approximately 350 miles to the east of our facility. Our physical location in the center of the Mid Corn Belt provides us with a strategic placement and transportation cost advantage, compared to other producers who must ship their products over greater distances to our market area. The combination of our proximity to our customers and our storage capacity at our facility also allows our customers to better time the pick-up and application of our products, as deliveries from more distant locations have a greater risk of missing the short periods of favorable weather conditions during which the application of nitrogen fertilizer and planting may occur.

We plan to continue to operate our facility with natural gas as our primary feedstock. Competitors may have access to cheaper natural gas or other feedstocks that could provide them with a cost advantage. Depending on its magnitude, the amount of this cost advantage could offset the savings we may experience on transportation and storage costs as a result of our location. For the fiscal years ended September 30, 2011, 2010 and 2009, our average prices for natural gas were $4.76 per one million British thermal units, or MMBtu, $4.95 per MMBtu and $5.67 per MMBtu, respectively.

Environmental Matters

Our business is subject to extensive and frequently changing federal, state and local, environmental, health and safety regulations governing the emission and release of hazardous substances into the environment, the treatment and discharge of waste water and the storage, handling, use and transportation of our nitrogen fertilizer products. These laws include the Clean Air Act, or the CAA, the federal Water Pollution Control Act, or the Clean Water Act, the Resource Conservation and Recovery Act, the Comprehensive Environmental Response, Compensation and Liability Act, or CERCLA, the Toxic Substances Control Act, and various other federal, state and local laws and regulations. These laws, their underlying regulatory requirements and the enforcement thereof impact us by imposing:

| • | restrictions on operations or the need to install enhanced or additional controls; |

| • | the need to obtain and comply with permits and authorizations; |

| • | liability for the investigation and remediation of contaminated soil and groundwater at current and former facilities (if any) and off-site waste disposal locations; and |

| • | specifications for the products we market, primarily ammonia and UAN. |

Our operations require numerous permits and authorizations. Failure to comply with these permits or environmental laws generally could result in substantial fines, penalties or other sanctions, court orders to install pollution-control equipment, permit revocations and facility shutdowns. In addition, environmental, health and safety laws may impose joint and several liability, without regard to fault, for cleanup costs on potentially responsible parties who have released or disposed of hazardous substances into the environment. We may experience delays in obtaining or be unable to obtain required permits, which may delay or interrupt our operations and limit our growth and revenue. Private parties, including the owners of properties adjacent to other facilities where our wastes are taken for disposal, also may have the right to pursue legal actions to enforce compliance as well as to seek damages for non-compliance with environmental laws and regulations or for personal injury or property or natural resource damages. In addition, the risk of accidental spills or releases could expose us to significant liabilities that could have a material adverse effect on our business, financial condition or results of operations. During the fiscal years ended September 30, 2011 and 2010, we made $5.6 million and $1.3 million, respectively, of environmental, health and safety-related capital expenditures.

The laws and regulations to which we are subject are complex, change frequently and have tended to become more stringent over time. The ultimate impact on our business of complying with existing laws and regulations is not always clearly known or determinable due in part to the fact that our operations may change over time and certain implementing regulations for laws, such as the CAA, have not yet been finalized, are under governmental or judicial review or are being revised. These laws and regulations could result in increased capital, operating and compliance costs.

11

Table of Contents

Our facility has experienced some level of regulatory scrutiny in the past, and we may be subject to further regulatory inspections, future requests for investigation or assertions of liability relating to environmental issues. In the future, we could incur material liabilities or costs related to environmental matters, and these environmental liabilities or costs (including fines or other sanctions) could have a material adverse effect on our results of operations, financial condition and ability to make cash distributions.

The principal environmental regulations and risks associated with our business are outlined below. We believe that we are in material compliance with all of these environmental regulations.

The Federal Clean Air Act. The CAA and its implementing regulations, as well as the corresponding state laws and regulations that regulate emissions of pollutants into the air, affect us through the CAA’s permitting requirements and emission control requirements relating to specific air pollutants, as well as the requirement to maintain a risk management program to help prevent accidental releases of certain substances. Some or all of the standards promulgated pursuant to the CAA, or any future promulgations of standards, may require the installation of controls or changes to our facility in order to comply. If new controls or changes to operations are needed, the costs could be significant. In addition, failure to comply with the requirements of the CAA and its implementing regulations could result in fines, penalties or other sanctions.

The regulation of air emissions under the CAA requires that we obtain various construction and operating permits, including a Title V air permit issued by the Illinois Environmental Protection Agency, or IEPA, and incur capital expenditures for the installation of certain air pollution control devices at our operations. Various regulations specific to our operations have been implemented, such as National Emission Standard for Hazardous Air Pollutants, New Source Performance Standards and New Source Review. We have incurred, and expect to continue to incur, substantial capital expenditures to maintain compliance with these and other air emission regulations that have been promulgated or may be promulgated or revised in the future, including in connection with the following projects that are designed to comply with our emission limits and requirements of our Title V CAA permit:

| • | Clark Lean Burn Project. We retrofitted three of our 5,500 horsepower Clark compressor engines, which compress the synthesis gas at our facility, with improved combustion control systems and combustion chambers designed to reduce the generation of nitrogen oxides and other pollutants at the source. We completed this project in October 2011. |

| • | Nitric Acid Plant Selective Catalytic Reduction Converter Project. We installed a selective catalytic reduction, or SCR, converter on one of our nitric acid plants as part of a negotiated agreement with the federal Environmental Protection Agency, or the EPA, to resolve alleged violations of the Clear Air Act relating to this plant. The post-installation nitrogen oxide emissions limit represents an 80% decrease from the pre-installation nitrogen oxide emissions limit. Assuming an 80% reduction in nitrogen oxide emissions and the amount of nitric acid produced at the relevant nitric acid plant in 2010, the SCR converter would reduce nitrogen oxide emissions by approximately 88 tons per year. We completed this project in October 2011. |

| • | N2O Catalytic Converter Project. In June 2011, we installed the first tertiary N2O catalytic converter in the United States on one of our nitric acid plants. This converter is designed to convert approximately 90% of the N2O generated in our production of nitric acid into nitrogen and oxygen at that one plant. Assuming this conversion rate and the amount of nitric acid produced at the relevant nitric acid plant in 2010, we expect the converter to reduce N2O emissions at our facility by over 550 tons per year. This converter also will monitor and record its effect on reducing N2O emissions and we expect to be awarded corresponding emission reduction credits for any such reduction. If we do not need the credits, we believe that we could list the credits on an active registry, such as the Climate Registry maintained by the Climate Action Reserve, and sell the credits for a profit. |

Release Reporting. The release of hazardous substances or extremely hazardous substances into the environment is subject to release reporting requirements under federal and state environmental laws, including the Emergency Planning and Community Right-to-Know Act. We occasionally experience minor releases of hazardous or extremely hazardous substances from our equipment. We report such releases to the EPA, the IEPA and other relevant state and local agencies as required by applicable laws and regulations. If we fail to properly report a release, or if the release violates the law or our permits, it could cause us to become the subject of a governmental enforcement action or third-party claims. Government enforcement or third-party claims relating to releases of hazardous or extremely hazardous substances could result in significant expenditures and liability.

Clean Water Act. The Clean Water Act and analogous state laws impose restrictions and strict controls with respect to the discharge of pollutants, including spills and leaks of oil and other substances, into waters of the United States. The discharge of pollutants into regulated waters is prohibited, except in accordance with the terms of a permit issued by the EPA or an analogous state agency. The Clean Water Act and regulations implemented thereunder also prohibit the discharge of dredge and fill material into regulated waters, including wetlands, unless authorized by an appropriately issued permit. In addition, the Clean Water Act and analogous state laws require individual permits or coverage under general permits for discharges of storm water runoff from certain types of facilities. Spill prevention, control and countermeasure requirements of federal laws require appropriate containment berms

12

Table of Contents

and similar structures to help prevent the contamination of navigable waters by a petroleum hydrocarbon tank spill, rupture or leak. Federal and state regulatory agencies can impose administrative, civil and criminal penalties for non-compliance with discharge permits or other requirements of the Clean Water Act and analogous state laws and regulations.

GHG Emissions. Currently, various legislative and regulatory measures to address greenhouse gas, or GHG, emissions (including CO2, methane and nitrous oxides) are in various phases of discussion or implementation. At the federal legislative level, Congress has previously considered legislation requiring a mandatory reduction of GHG emissions. Although Congressional passage of such legislation does not appear likely at this time, it could be adopted at a future date. It is also possible that Congress may pass alternative climate change bills that do not mandate a nationwide cap-and-trade program and instead focus on promoting renewable energy and energy efficiency.

In the absence of congressional legislation curbing GHG emissions, the EPA is moving ahead administratively under its CAA authority. In October 2009, the EPA finalized a rule requiring certain large emitters of GHGs to inventory and report their GHG emissions to the EPA. In accordance with the rule, we monitor our GHG emissions from our facility and began reporting the emissions to the EPA annually beginning in September 2011. On December 7, 2009, the EPA finalized its “endangerment finding” that GHG emissions, including CO2, pose a threat to human health and welfare. The finding allows the EPA to regulate GHG emissions as air pollutants under the CAA. In May 2010, the EPA finalized the “Greenhouse Gas Tailoring Rule,” which establishes new GHG emissions thresholds that determine when stationary sources, such as our facility, must obtain permits under the Prevention of Significant Deterioration, or PSD, and Title V programs of the CAA. The permitting requirements of the PSD program apply only to newly constructed or modified major sources. Obtaining a PSD permit requires a source to install best available control technology, or BACT, for those regulated pollutants that are emitted in certain quantities. Phase I of the Greenhouse Gas Tailoring Rule, which became effective on January 2, 2011, requires projects already triggering PSD permitting that are also increasing GHG emissions by more than 75,000 tons per year to comply with BACT rules for their GHG emissions. Phase II of the Greenhouse Gas Tailoring Rule, which became effective on July 1, 2011, requires preconstruction permits using BACT for new projects that emit 100,000 tons of GHG emissions per year or existing facilities that make major modifications increasing GHG emissions by more than 75,000 tons per year. The ongoing ammonia capacity expansion project at our facility did not trigger the need to install BACT because actual construction commenced prior to July 1, 2011 and is not considered a major modification with respect to criteria pollutants. However, a future major modification to our facility may require us to install BACT and potentially require us to obtain other CAA permits for our GHG emissions at our facility. The EPA’s endangerment finding, the Greenhouse Gas Tailoring Rule and certain other GHG emission rules have been challenged and will likely be subject to extensive litigation. In addition, a number of Congressional bills to overturn the endangerment finding and bar the EPA from regulating GHG emissions, or at least to defer such action by the EPA under the CAA, have been proposed, although President Obama has announced his intention to veto any such bills if passed.

In addition to federal regulations, a number of states have adopted regional GHG initiatives to reduce CO2 and other GHG emissions. In 2007, a group of Midwest states formed the Midwestern Greenhouse Gas Reduction Accord, which calls for the development of a cap-and-trade system to control GHG emissions and for the inventory of such emissions. However, the individual states that have signed on to the accord must adopt laws or regulations implementing the trading scheme before it becomes effective, and the timing and specific requirements of any such laws or regulations in Illinois are uncertain at this time.

The implementation of additional EPA regulations and/or the passage of federal or state climate change legislation will likely result in increased costs to (i) operate and maintain our facilities, (ii) install new emission controls on our facilities and (iii) administer and manage any GHG emissions program. Increased costs associated with compliance with any future legislation or regulation of GHG emissions, if it occurs, may have a material adverse effect on our results of operations, financial condition and ability to make cash distributions. In addition, climate change legislation and regulations may result in increased costs not only for our business but also for agricultural producers that utilize our fertilizer products, thereby potentially decreasing demand for our nitrogen fertilizer products. Decreased demand for our fertilizer products may have a material adverse effect on our results of operations, financial condition and ability to make cash distributions.

Environmental Remediation. Under CERCLA and related state laws, certain persons may be liable for the release or threatened release of hazardous substances. These persons can include the current owner or operator of property where a release or threatened release occurred, any persons who owned or operated the property when the release occurred, and any persons who disposed of, or arranged for the transportation or disposal of, hazardous substances at a contaminated property. Liability under CERCLA is strict, retroactive and, under certain circumstances, joint and several, so that any responsible party may be held liable for the entire cost of investigating and remediating the release of hazardous substances. As is the case with all companies engaged in similar industries, depending on the underlying facts and circumstances we face potential exposure from future claims and lawsuits involving environmental matters, including soil and water contamination, personal injury or property damage allegedly caused by hazardous substances that we manufactured, handled, used, stored, transported, spilled, disposed of or released. We cannot assure you that we

13

Table of Contents

will not become involved in future proceedings related to our release of hazardous or extremely hazardous substances or that, if we were held responsible for damages in any existing or future proceedings, such costs would be covered by insurance or would not be material.

Environmental Insurance. We have a premises pollution liability insurance policy with an aggregate limit of $25.0 million per pollution condition, subject to a self-insured retention of $250,000. The insurance policy was renewed for a three-year term in September 2011 and will expire on October 1, 2014. Our policy covers claims, remediation costs and associated legal defense expenses for pollution conditions at or migrating from our facility and the transportation risks associated with moving waste from our facility to any location for unloading or depositing waste, but does not cover business interruptions. Our policy contains terms, exclusions, conditions and limitations that could apply to a particular pollution condition claim, and we cannot guarantee that a claim will be adequately insured for all potential damages.

Safety, Health and Security Matters

We are subject to a number of federal and state laws and regulations related to safety, including the federal Occupational Safety and Health Act, or OSHA, and comparable state statutes, the purpose of which are to protect the health and safety of workers. We also are subject to OSHA Process Safety Management regulations, which are designed to prevent or minimize the consequences of catastrophic releases of toxic, reactive, flammable or explosive chemicals. These regulations apply to any process that involves a chemical at or above the specified thresholds or any process that involves flammable liquid or gas, pressurized tanks, caverns and wells in excess of 10,000 pounds at various locations. We have an internal safety, health and security program designed to monitor and enforce compliance with worker safety requirements, and we routinely review and consider improvements in our programs. We also are subject to EPA Chemical Accident Prevention Provisions, known as the Risk Management Plan requirements, which are designed to prevent the accidental release of toxic, reactive, flammable or explosive materials, and the United States Coast Guard’s Maritime Security Standards for Facilities, which are designed to regulate the security of high-risk maritime facilities. We believe that we are in material compliance with all applicable laws and regulations related to worker health and safety. Notwithstanding these preventative measures, we cannot guarantee that serious accidents will not occur in the future.

Employees

As of September 30, 2011, we had 55 non-unionized and salaried employees, and 90 unionized employees. We have a collective bargaining agreement, which was renewed for a six year term in October 2006. We have not experienced a work stoppage at our facility since 1991.

Financial Information

We operate in only one business segment. Additionally, all of our properties are located in the United States and all of the related revenues are derived from purchasers located in the United States. Our financial information is included in Part II—Item 8 “Financial Statements and Supplementary Data.”

Properties

We operate our facility on an approximately 210 acre site in East Dubuque, Illinois adjacent to the Mississippi River. We own the land, buildings, several special purpose structures, equipment, storage tanks and specialized truck, rail and river barge loading facilities, and hold easements for the roadways, wells, the rail track and the barge dock. We also have the right to store 15,000 tons of ammonia at Agrium’s terminal in Niota, Illinois. See “—Marketing and Distribution.”

Available Information

Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports are available free of charge as soon as reasonably practical after they are filed or furnished to the SEC, at the “Investor Relations” portion of our website, www.rentechnitrogen.com. Materials we file with the SEC may be read and copied at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet website at www.sec.gov that contains reports, and other information regarding us that we file electronically with the SEC. The information contained on our website does not constitute part of this report.

14

Table of Contents

Set forth below are certain risk factors related to our business. Actual results could differ materially from those anticipated as a result of these and various other factors, including those set forth in our other periodic and current reports filed with the SEC, from time to time. If any of the following risks and uncertainties develops into an actual event, our business, financial condition, cash flow or results of operations could be materially adversely affected. In that case, we might not be able to pay distributions on our common units, the trading price of our common units could decline and you could lose all or part of your investment. Although many of our business risks are comparable to those faced by a corporation engaged in a similar business, limited partner interests are inherently different from the capital stock of a corporation and involve additional risks described below.

Risks Related to Our Business

We may not have sufficient cash available for distribution to pay any quarterly distributions on our common units.

We may not have sufficient cash available for distribution each quarter to enable us to pay any distributions to our common unitholders. Furthermore, our partnership agreement does not require us to pay distributions on a quarterly basis or otherwise. The amount of cash we will be able to distribute on our common units principally depends on the amount of cash we generate from our operations, which is directly dependent upon the operating margins we generate, which have been volatile historically, and cash collections under product prepayment contracts for our products. Our operating margins are significantly affected by the price and availability of natural gas, market-driven product prices we are able to charge our customers and our production costs, as well as seasonality, weather conditions, governmental regulation, unplanned maintenance or shutdowns at our facility and global and domestic demand for nitrogen fertilizer products, among other factors. In addition:

| • | Our partnership agreement does not provide for any minimum quarterly distribution and our quarterly distributions, if any, will be subject to significant fluctuations directly related to the cash we generate after payment of our expenses due to the nature of our business. |

| • | The amount of distributions we make, if any, and the decision to make any distribution at all is determined by the board of directors of our general partner, whose interests may differ from those of our common unitholders. Our general partner has limited fiduciary and contractual duties, which may permit it to favor its own interests or the interests of Rentech to the detriment of our common unitholders. |

| • | Our new revolving credit facility limits, and any credit facility or other debt instruments we enter into in the future may limit, the distributions that we can make. Our new revolving credit facility contains, and any future credit facility or debt instruments we enter into may contain, financial tests and covenants that we must satisfy. Any failure to comply with these tests and covenants could result in the applicable lenders prohibiting distributions by us. |

| • | The amount of cash available to pay any quarterly distribution to our unitholders depends primarily on our cash flow, and not solely on our profitability, which is affected by non-cash items that may be large relative to our reported net income. As a result, we may make distributions during periods when we record losses and may not make distributions during periods when we record net income. |

| • | The actual amount of cash available for distribution will depend on numerous factors, some of which are beyond our control, including the availability and price of natural gas, ammonia and UAN prices, our operating costs, global and domestic demand for nitrogen fertilizer products, fluctuations in our capital expenditures and working capital needs, our product pre-sale and cash collection cycle and the amount of fees and expenses we incur. |

| • | Under Section 17-607 of the Delaware Revised Uniform Limited Partnership Act, or Delaware Act, we are prohibited from making a distribution to our limited partners if the distribution would cause our liabilities to exceed the fair value of our assets. |

The amount of our quarterly cash distributions, if any, will vary significantly both quarterly and annually and will be directly dependent on the performance of our business. Unlike most publicly traded limited partnerships, we do not have a minimum quarterly distribution or employ structures intended to consistently maintain or increase distributions over time.

Investors who are looking for an investment that will pay regular and predictable quarterly distributions should not invest in our common units. We expect our business performance will be more seasonal and volatile, and our cash flow will be less stable, than the business performance and cash flow of most publicly traded limited partnerships. As a result, our quarterly cash distributions will be

15

Table of Contents

volatile and are expected to vary quarterly and annually. Unlike most publicly traded limited partnerships, we do not have a minimum quarterly distribution or employ structures intended to consistently maintain or increase distributions over time. The amount of our quarterly cash distributions will be directly dependent on the performance of our business, which has been volatile historically as a result of volatile nitrogen fertilizer and natural gas prices, unplanned outages, seasonal and global fluctuations in demand for nitrogen fertilizer products and the timing of our product pre-sale and cash collections. Because our quarterly distributions will be subject to significant fluctuations directly related to the cash we generate after payment of our fixed and variable expenses, future quarterly distributions paid to our unitholders will vary significantly from quarter to quarter and may be zero. Given the seasonal nature of our business, we expect that our unitholders will have direct exposure to fluctuations in the margins we realize on sales of nitrogen fertilizers and other products that we produce. In addition, we frequently make product sales pursuant to product prepayment contracts, whereby we receive cash in respect of product to be picked up by or delivered to a customer at a later date, but do not record revenue in respect of such sales until product is picked up or delivered. The cash received from product prepayments increases our operating cash flow in the quarter in which the cash is received, but may effectively reduce our operating cash flow in a subsequent quarter if the cash was received in a quarter prior to the one in which the revenue is recorded.

We may modify or revoke our cash distribution policy at any time at our discretion. Our partnership agreement does not require us to make any distributions at all.

Our current cash distribution policy is to distribute all of the cash available for distribution we generate each quarter to unitholders of record on a pro rata basis. However, we may change such policy at any time at our discretion and could elect not to make distributions for one or more quarters. Our partnership agreement does not require us to make any distributions at all. Accordingly, investors are cautioned not to place undue reliance on the permanence of such a policy in making an investment decision. Any modification or revocation of our cash distribution policy could substantially reduce or eliminate the amounts of distributions to our unitholders.

Our operations may become unprofitable and may require substantial working capital financing.

During each of the five fiscal years ended September 30, 2011, 2010, 2009, 2008 and 2007, we generated positive income from operations and positive cash flow from operations. However, during the fiscal year ended September 30, 2006, we operated at a net loss despite the fact that we generated positive cash flow from operations. In prior fiscal years, we sustained losses and negative cash flow from operations. Our profits and cash flow are subject to changes in the prices for our products and our main input, natural gas, which are commodities, and, as such, the prices can be volatile in response to numerous factors outside of our control. Our profits depend on maintaining high rates of production of our products, and interruptions in operations at our facility could materially adversely affect our profitability. If we are not able to operate our facility at a profit or if we are not able to retain cash or access a sufficient amount of additional financing for working capital, our business, financial condition, cash flow, results of operations and ability to pay cash distributions could be materially adversely affected, which could adversely affect the trading price of our common units.

The nitrogen fertilizer business is, and nitrogen fertilizer prices are, seasonal, cyclical and highly volatile and have experienced substantial and sudden downturns in the past. Currently, nitrogen fertilizer demand is at a relative high point and could decrease significantly in the future. Cycles in demand and pricing could potentially expose us to significant fluctuations in our operating and financial results, and expose you to substantial volatility in our quarterly distributions and material reductions in the trading price of our common units.

We are exposed to fluctuations in nitrogen fertilizer demand and prices in the agricultural industry. These fluctuations historically have had, and could in the future have, significant effects on prices across all nitrogen fertilizer products and, in turn, our financial condition, cash flow and results of operations, which could result in significant volatility or material reductions in the price of our common units or an inability to make cash distributions on our common units.

Nitrogen fertilizer products are commodities, the prices of which can be highly volatile. The price of nitrogen fertilizer products depends on a number of factors, including general economic conditions, cyclical trends in end-user markets, supply and demand imbalances, the prices of natural gas and other raw materials, and weather conditions, all of which have a greater relevance because of the seasonal nature of fertilizer application. If seasonal demand exceeds the projections on which we base production, our customers may acquire nitrogen fertilizer products from our competitors, and our profitability will be negatively impacted. If seasonal demand is less than we expect, we will be left with excess inventory that will have to be stored or liquidated, the costs of which could adversely affect our operating margins and our ability to pay cash distributions.

16

Table of Contents

Demand for nitrogen fertilizer products is dependent on demand for crop nutrients by the global agricultural industry. Nitrogen fertilizer products are currently in high demand, driven by a growing world population, changes in dietary habits and an expanded production of corn. Supply is affected by available capacity and operating rates of nitrogen producers, raw material costs, government policies and global trade. A significant or prolonged decrease in nitrogen fertilizer prices would have a material adverse effect on our business, cash flow and ability to make distributions.

Any decline in United States agricultural production or crop prices or limitations on the use of nitrogen fertilizer for agricultural purposes could have a material adverse effect on the market for nitrogen fertilizer, and on our results of operations, financial condition and ability to make cash distributions.

Conditions in the United States agricultural industry significantly impact our operating results. This is particularly the case in the production of corn, which is a major driver of the demand for nitrogen fertilizer products in the United States. The United States agricultural industry in general, and the production and prices of corn in particular, can be affected by a number of factors, including weather patterns and soil conditions, current and projected grain inventories and prices, domestic and international supply of and demand for United States agricultural products and United States and foreign policies regarding trade in agricultural products. Prices for these agricultural products can decrease suddenly and significantly. For example, in June 2011, an unexpectedly large corn crop estimate resulted in an approximately 20% decrease in corn prices from their peak levels earlier in the month, the largest monthly decrease since June 2009.

State and federal governmental regulations and policies, including farm and biofuel subsidies and commodity support programs, as well as the prices of fertilizer products, may also directly or indirectly influence the number of acres planted, the mix of crops planted and the use of fertilizers for particular agricultural applications. Developments in crop technology, such as nitrogen fixation, the conversion of atmospheric nitrogen into compounds that plants can assimilate, could also reduce the use of chemical fertilizers and adversely affect the demand for nitrogen fertilizer. In addition, from time to time various state legislatures have considered limitations on the use and application of chemical fertilizers due to concerns about the impact of these products on the environment. The adoption or enforcement of such regulations could adversely affect the demand for and prices of nitrogen fertilizers, which could adversely affect our results of operations, cash flows and ability to make cash distributions to our unitholders.

A major factor underlying the current high level of demand for our nitrogen-based fertilizer products is the expanding production of ethanol. A decrease in ethanol production, an increase in ethanol imports or a shift away from corn as a principal raw material used to produce ethanol could have a material adverse effect on our results of operations, financial condition and ability to make cash distributions.

A major factor underlying the current level of demand for corn and the use of nitrogen fertilizer products is the current production level of ethanol in the United States. Ethanol production in the United States is dependent in part upon a myriad of federal and state incentives. Such incentive programs may not be renewed, or if renewed, they may be renewed on terms significantly less favorable to ethanol producers than current incentive programs. Studies showing that expanded ethanol production may increase the level of GHGs in the environment, or other factors, may reduce political support for ethanol production. For example, on June 16, 2011, the United States Senate voted to eliminate the Volumetric Ethanol Excise Tax Credit, or VEETC, which provides for a 45 cents per gallon tax credit to blenders and refiners for gasoline that has been blended with ethanol. Even if the VEETC is not ultimately repealed, it is scheduled to expire on December 31, 2011, and we cannot guarantee that it will be renewed or that any other ethanol-related subsidy will be implemented in its place. Furthermore, the current trend in ethanol production research is to develop an efficient method of producing ethanol from cellulose-based biomass. If the VEETC is eliminated or an efficient method of producing ethanol from cellulose-based biomass is developed and commercially deployed at scale, the demand for corn may decrease significantly. Any reduction in the demand for corn and, in turn, for nitrogen fertilizer products could have a material adverse effect on our results of operations, financial condition and ability to make cash distributions to our unitholders.

Nitrogen fertilizer products are global commodities. Any decrease in the price of nitrogen fertilizer products from foreign countries could harm us.

Fertilizers are global commodities, with little or no product differentiation, and customers make their purchasing decisions principally on the basis of delivered price and availability of the product. In recent years, the price of nitrogen fertilizer in the United States has been substantially driven by pricing in the global fertilizer market and favorable prices for natural gas in the United States as compared to those in foreign countries. If foreign natural gas prices become lower than natural gas prices in the United States, competition from foreign businesses will likely increase and this could have a material adverse effect on our results of operations, financial condition and ability to make cash distributions to our unitholders.

17

Table of Contents

We face intense competition from other nitrogen fertilizer producers.