Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Wesco Aircraft Holdings, Inc | a11-30077_18k.htm |

| EX-99.1 - EX-99.1 - Wesco Aircraft Holdings, Inc | a11-30077_1ex99d1.htm |

Exhibit 99.2

|

|

Fourth Quarter and Full Year 2011 Conference Call November 17, 2011 |

|

|

2 Agenda Introduction Company Highlights Business Update Financial Overview Questions & Answers Richard Zubek Investor Relations Randy Snyder Chairman, Chief Executive Officer and President Hal Weinstein Executive Vice President, Sales and Marketing Greg Hann Executive Vice President, Chief Financial Officer |

|

|

3 Disclaimer Safe Harbor Statement The following information contains, or may be deemed to contain, “forward-looking statements” (as defined in the U.S. Private Securities Litigation Reform Act of 1995). Most forward-looking statements contain words that identify them as forward-looking, such as “may”, “plan”, “seek”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “project”, “opportunity”, “target”, “goal”, “growing” and “continue” or other words that relate to future events, as opposed to past or current events. By their nature, forward-looking statements are not statements of historical facts and involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. These statements give Wesco Aircraft’s current expectation of future events or its future performance and do not relate directly to historical or current events or Wesco Aircraft’s historical or future performance. As such, Wesco Aircraft’s future results may vary from any expectations or goals expressed in, or implied by, the forward-looking statements included in this presentation, possibly to a material degree. Wesco Aircraft cannot assure you that the assumptions made in preparing any of the forward-looking statements will prove accurate or that any long-term financial goals will be realized. All forward-looking statements included in this presentation speak only as of the date made, and Wesco Aircraft undertakes no obligation to update or revise publicly any such forward-looking statements, whether as a result of new information, future events, or otherwise. In particular, Wesco Aircraft cautions you not to place undue weight on certain forward-looking statements pertaining to potential growth opportunities, long-term financial projections or goals, future growth or the value we currently ascribe to certain attributes set forth herein. Actual results may vary significantly from these statements. Wesco Aircraft’s business is subject to numerous risks and uncertainties, which may cause future results of operations to vary significantly from those presented herein, including those highlighted in the section entitled “Risk Factors” in Wesco Aircraft’s registration statement on Form S-1 filed with the Securities and Exchange Commission on July 15, 2011. Wesco Aircraft discloses Adjusted EBITDA and Adjusted Net Income, which are non-GAAP measures its management uses to evaluate its business, because it believes they assist investors and analysts in comparing its performance across reporting periods on a consistent basis by excluding items that Wesco Aircraft does not believe are indicative of its core operating performance. Wesco Aircraft believes these metrics are used in the financial community, and it presents these metrics to enhance investors’ understanding of its operating performance and cash flow. You should not consider Adjusted EBITDA and Adjusted Net Income as an alternative to net income, determined in accordance with GAAP, as an indicator of operating performance, or as an alternative to net cash provided by operating activities, determined in accordance with GAAP, as an indicator of Wesco Aircraft’s cash flow. See the Appendix for reconciliations of Adjusted EBITDA and Adjusted Net Income to GAAP net income. |

|

|

4 Fourth Quarter and Full Year 2011 Highlights Record sales for the fourth quarter and full year 2011 Fourth quarter and full year 2011 revenues of $181.3 million and $710.9 million, respectively Fourth quarter and full year 2011 Adjusted EBITDA of $46.1 million and $179.0 million, respectively Fourth quarter and full year 2011 Adjusted diluted EPS of $0.24 and $0.97, respectively, above previous guidance range Generated $81.2 million of free cash flow during 2011 |

|

|

5 Fourth Quarter 2011 Financial Results Company record Q4 revenue of $181.3 million up 4.2% year over year-Ad hoc increased to 40% of total sales Gross profit margins improved to 40.1% in Q4 2011 vs. 39.2% in Q4 2010 SG&A expenses for the quarter of $34.1 million, including $2.4 million of IPO costs, compared to $25.6 million in Q4 2010 Adjusted EBITDA for Q4 2011 of $46.1 million, compared to $44.7 million in Q4 2010 Net Income and Adjusted Net Income of $18.0 million and $22.4 million, respectively 4.2% 3.1% Revenue Mix Adjusted EBITDA Adjusted EPS $44.7 $46.1 Q4 2010 Q4 2011 31% 25% 31% 35% 38% 40% Q4 2010 Q4 2011 JIT LTA Adhoc $174.0 $181.3 Q4 2010 Q4 2011 $0.24 $0.24 Q4 2010 Q4 2011 |

|

|

6 Full Year 2011 Financial Results Company record full year 2011 revenue of $710.9 million up 8.4% year over year–Ad hoc increased to 39% of total sales Gross profit margins essentially flat from 38.8% in 2010 to 38.7% in 2011 SG&A expenses were $113.8 million, including $4.9 million of IPO costs, compared to $99.9 million in 2010 Adjusted EBITDA of $179.0 million (25.2% of sales) for the full year grew 7.5% in 2011 Adjusted Net Income and Adjusted Diluted EPS of $90.1 million and $0.97, respectively, came in higher than previous guidance Generated $81.2 million of free cash flow and repaid $64.2 million of debt during 2011–No outstanding borrowings on our revolver 8.4% 7.5% 9.0% Revenue Revenue Mix Adjusted EBITDA Adjusted EPS $0.89 $0.97 FY 2010 FY 2011 $656.0 $710.9 FY 2010 FY 2011 31% 29% 32% 32% 37% 39% FY 2010 FY 2011 JIT LTA Adhoc $166.5 $179.0 FY 2010 FY 2011 |

|

|

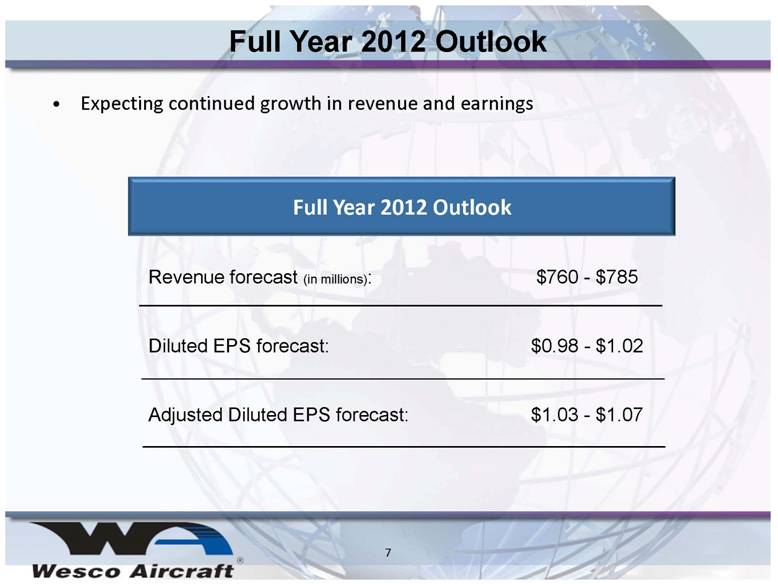

7 Full Year 2012 Outlook Expecting continued growth in revenue and earnings Revenue forecast (in millions): $760 - $785 Diluted EPS forecast: $0.98 - $1.02 Adjusted Diluted EPS forecast: $1.03 - $1.07 Full Year 2012 Outlook |

|

|

Appendix 8 |

|

|

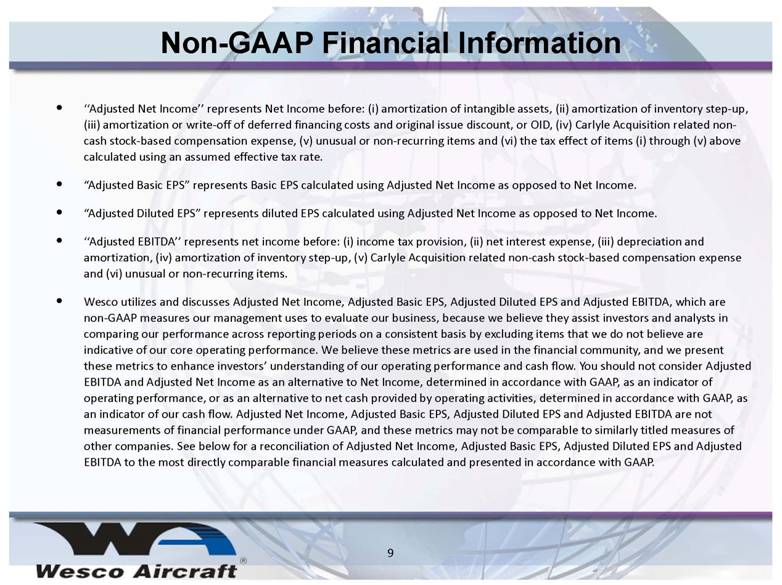

9 Non-GAAP Financial Information ‘‘Adjusted Net Income’’ represents Net Income before: (i) amortization of intangible assets, (ii) amortization of inventory step-up, (iii) amortization or write-off of deferred financing costs and original issue discount, or OID, (iv) Carlyle Acquisition related non-cash stock-based compensation expense, (v) unusual or non-recurring items and (vi) the tax effect of items (i) through (v) above calculated using an assumed effective tax rate. “Adjusted Basic EPS” represents Basic EPS calculated using Adjusted Net Income as opposed to Net Income. “Adjusted Diluted EPS” represents diluted EPS calculated using Adjusted Net Income as opposed to Net Income. ‘‘Adjusted EBITDA’’ represents net income before: (i) income tax provision, (ii) net interest expense, (iii) depreciation and amortization, (iv) amortization of inventory step-up, (v) Carlyle Acquisition related non-cash stock-based compensation expense and (vi) unusual or non-recurring items. Wesco utilizes and discusses Adjusted Net Income, Adjusted Basic EPS, Adjusted Diluted EPS and Adjusted EBITDA, which are non-GAAP measures our management uses to evaluate our business, because we believe they assist investors and analysts in comparing our performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance. We believe these metrics are used in the financial community, and we present these metrics to enhance investors’ understanding of our operating performance and cash flow. You should not consider Adjusted EBITDA and Adjusted Net Income as an alternative to Net Income, determined in accordance with GAAP, as an indicator of operating performance, or as an alternative to net cash provided by operating activities, determined in accordance with GAAP, as an indicator of our cash flow. Adjusted Net Income, Adjusted Basic EPS, Adjusted Diluted EPS and Adjusted EBITDA are not measurements of financial performance under GAAP, and these metrics may not be comparable to similarly titled measures of other companies. See below for a reconciliation of Adjusted Net Income, Adjusted Basic EPS, Adjusted Diluted EPS and Adjusted EBITDA to the most directly comparable financial measures calculated and presented in accordance with GAAP. |

|

|

10 Non-GAAP Financial Information Wesco Aircraft Holdings, Inc. Non-GAAP Financial Information (UNAUDITED) (In thousands, except for per share data) Three Months Ended Fiscal Year Ended September 30, 2011 September 30, 2010 September 30, 2011 September 30, 2010 EBITDA & Adjusted EBITDA Net income $18,029 $20,032 $75,598 $73,674 Income tax expense 14,732 12,620 52,526 43,913 Interest and other, net 6,939 8,857 34,491 36,270 Depreciation and amortization 2,599 2,110 9,558 8,821 EBITDA 42,299 43,619 172,173 162,678 Amortization of inventory step-up - 652 - 2,200 Carlyle Acquisition related non-cash stock-based compensation expense 1,332 397 1,859 1,589 Unusual or non-recurring items 2,426 - 4,931 - Adjusted EBITDA $46,057 $44,668 $178,963 $166,467 Adjusted Net Income Net income $18,029 $20,032 $75,598 $73,674 Amortization of intangible assets 925 921 3,699 4,119 Amortization of inventory step-up - 652 - 2,200 Amortization of deferred financing costs 1,135 1,349 11,416 4,814 Carlyle Acquisition related non-cash stock-based compensation expense 1,332 397 1,859 1,589 Unusual or non-recurring items 2,426 - 4,931 - Adjustments for tax effect (@ 40%) (1,482) (1,328) (7,359) (5,089) Adjusted Net Income $22,365 $22,023 $90,144 $81,307 Adjusted Basic Earnings Per Share Weighted-average number of basic shares outstanding 90,989 90,569 90,697 90,569 Adjusted Net Income Per Basic Shares $0.25 $0.24 $0.99 $0.90 Adjusted Diluted Earnings Per Share Weighted-average number of diluted shares outstanding 94,725 92,541 93,182 91,068 Adjusted Net Income Per Diluted Shares $0.24 $0.24 $0.97 $0.89 |