Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NTELOS HOLDINGS CORP. | d253623d8k.htm |

Investor

Presentation November 2011

Exhibit 99.1 |

Use of

Non-GAAP Financial Measures Included

in

this

presentation

are

certain

non-GAAP

financial

measures

that

are

not

determined

in

accordance

with

US

generally

accepted

accounting

principles.

These

financial

performance

measures

are

not

indicative

of

cash

provided

or

used

by

operating

activities

and

exclude

the

effects

of

certain

operating,

capital

and

financing

costs

and

may

differ

from

comparable

information

provided

by

other

companies,

and

they

should

not

be

considered

in

isolation,

as

an

alternative

to,

or

more

meaningful

than

measures

of

financial

performance

determined

in

accordance

with

US

generally

accepted

accounting

principles.

These

financial

performance

measures

are

commonly

used

in

the

industry

and

are

presented

because

NTELOS

believes

they

provide

relevant

and

useful

information

to

investors.

NTELOS

utilizes

these

financial

performance

measures

to

assess

its

ability

to

meet

future

capital

expenditure

and

working

capital

requirements,

to

incur

indebtedness

if

necessary,

and

to

fund

continued

growth.

NTELOS

also

uses

these

financial

performance

measures

to

evaluate

the

performance

of

its

business,

for

budget

planning

purposes

and

as

factors

in

its

employee

compensation

programs.

Please

review

the

reconciliations

of

non-GAAP

financial

measures

contained

in

the

press

release

filed

by

the

Company

with

the

SEC

on

Form

8-K

on

November

7,

2011.

Any

statements

contained

in

this

presentation

that

are

not

statements

of

historical

fact,

including

statements

about

our

beliefs

and

expectations,

are

forward-

looking

statements

and

should

be

evaluated

as

such.

The

words

“anticipates,”

“believes,”

“expects,”

“intends,”

“plans,”

“estimates,”

“targets,”

“projects,”

“should,”

“may,”

“will”

and

similar

words

and

expressions

are

intended

to

identify

forward-looking

statements.

Such

forward-looking

statements

reflect,

among

other

things,

our

current

expectations,

plans

and

strategies,

and

anticipated

financial

results,

all

of

which

are

subject

to

known

and

unknown

risks,

uncertainties

and

factors

that

may

cause

our

actual

results

to

differ

materially

from

those

expressed

or

implied

by

these

forward-looking

statements.

Many

of

these

risks

are

beyond

our

ability

to

control

or

predict.

Because

of

these

risks,

uncertainties

and

assumptions,

you

should

not

place

undue

reliance

on

these

forward-looking

statements.

Furthermore,

forward-looking

statements

speak

only

as

of

the

date

they

are

made.

We

do

not

undertake

any

obligation

to

update

or

review

any

forward-looking

information,

whether

as

a

result

of

new

information,

future

events

or

otherwise.

Important

factors

with

respect

to

any

such

forward-looking

statements,

including

certain

risks

and

uncertainties

that

could

cause

actual

results

to

differ

from

those

contained

in

the

forward-looking

statements,

include,

but

are

not

limited

to:

rapid

development

and

intense

competition

in

the

telecommunications

industry;

adverse

economic

conditions;

operating

and

financial

restrictions

imposed

by

our

senior

credit

facility;

our

cash

and

capital

requirements;

declining

prices

for

our

services;

the

potential

to

experience

a

high

rate

of

customer

turnover;

our

dependence

on

our

affiliation

with

Sprint

Nextel

(“Sprint”);

a

potential

increase

in

our

roaming

rates

and

wireless

handset

subsidy

costs;

increased

costs

to

support

continued

growth

of

data

usage

on

our

network;

the

potential

for

Sprint

to

build

networks

in

our

markets;

federal

and

state

regulatory

fees,

requirements

and

developments;

loss

of

our

cell

sites;

the

rates

of

penetration

in

the

wireless

telecommunications

industry;

and

our

reliance

on

certain

suppliers

and

vendors.

These

risks

and

uncertainties

are

not

intended

to

represent

a

complete

list

of

all

risks

and

uncertainties

inherent

in

our

business,

and

should

be

read

in

conjunction

with

the

more

detailed

cautionary

statements

and

risk

factors

included

in

our

SEC

filings,

including

our

Annual

Reports

filed

on

Forms

10-K.

Special Note Regarding Forward-Looking Statements

Presentation of Financial and Other Important Information

2 |

NASDAQ

National Markets “NTLS” Headquartered in Waynesboro, VA

Spin-off of legacy wireline operations

Completed on October 31, 2011

Wireline operations now operate as Lumos Networks (NASDAQ: “LMOS”)

Who We Are

3 |

Company

Overview Wireless

(both

postpay

and

prepaid)

subscribers

of

approximately

415,000

8.1

million

licensed

POPs;

covered

POPs

of

5.9

million

Wholesale

network

provider

to

Sprint

in

a

significant

portion

of

territory

86%

of

network

is

CDMA

3G

EVDO

Market

Cap

of

approximately

$470

million

(as

of

November

4,

2011)

Pro

Forma

LTM

Financials

as

of

September

30,

2011

Revenue

of

$419

million

Adjusted

EBITDA

of

$142

million

Net

Debt

of

$403

million

with

Net

Debt

Leverage

of

2.8X

Who We Are

4

Notes:

“Adjusted

EBITDA”

is

defined

as

EBITDA

plus

ARO

accretion,

equity

based

compensation

charges,

acquisition

related

and

business

segment

charges.

“Net

Debt”

is

defined

as

total

debt

less

cash.

“Net

Debt

Leverage”

is

defined

as

Net

Debt

divided

by

Adjusted

EBITDA. |

Leading

“pure-play” regional wireless company

Platform for organic and strategic growth

Unique growth and income investment opportunity

Wholesale revenue continues to grow

NTELOS declared $0.42/share dividend on 11/3/11, payable on 1/12/12

Strong Free Cash Flow characteristics

Attractive strategic asset set

Exclusive network provider to Sprint in region

Unique network footprint in Mid-Atlantic region

Experienced senior management team

Investment Rationale

5

Note: “Free Cash Flow”

is defined as Adjusted EBITDA less capital expenditures.

|

6

NTELOS Covered Network

Sprint Wholesale Markets

Strategic Network Assets

Where We Operate |

Poised for

Growth Wholesale revenue from Sprint up 22% YOY (Sprint calculated revenue

excluding support from the $9 million minimum is up 33% YOY)

Postpay Data ARPU up 22% YOY

Profitable

5 years of minimum 35% Adjusted EBITDA margin

21% 5 year FCF margin

Stable

Diverse revenue stream from postpaid, prepaid and wholesale customers

Strategic

Exclusive relationship with Sprint through July 2015

Unique network footprint in Mid-Atlantic region

7

Note: Results for the nine months ending September 30, 2011.

Poised for Growth. Profitable. Stable. Strategic |

NTELOS

Retail Wireless Strategy 8

Mission

Mission

Vision

Vision

Strategic

Strategic

Differentiators

Differentiators

We

We

Inspire

Inspire

Loyalty

Loyalty

Highest in revenue

Highest in revenue

and subscriber

and subscriber

market share growth

market share growth

of all carriers in our

of all carriers in our

markets

markets

through 2016

through 2016

Value

Value

Unlimited nationwide

Unlimited nationwide

plans always less

plans always less

expensive than AT&T and

expensive than AT&T and

Verizon Wireless

Verizon Wireless

Simplicity

Simplicity

Cutting through the

Cutting through the

complexity with simple,

complexity with simple,

customer friendly

customer friendly

products and plans

products and plans

Service

Service

Creating “raving fans,”

leveraging local retail and

customer service

presence |

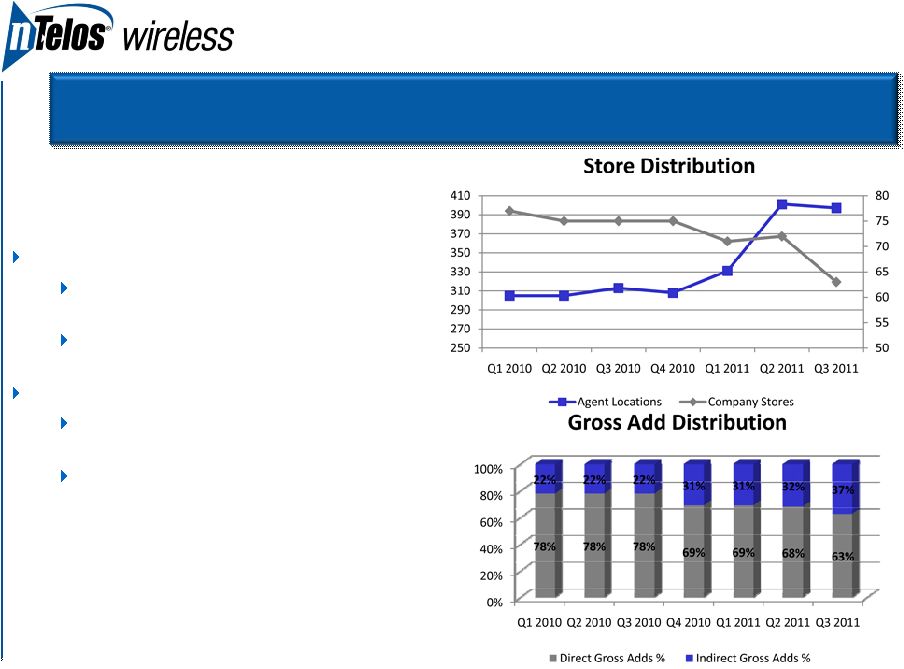

Redefined

distribution strategy NTELOS Owned Retail Stores

55% of NTELOS owned retail stores will

have new look by the end of 2011

A majority of remaining NTELOS owned

retail stores will be retrofitted in 2012

Indirect Distribution Expansions

Significant growth in Indirect channel from

313 doors in 3Q10 to 397 in 3Q 2011.

Grew the number of Exclusive Retail

Partners (ERP’s) from 18 in 3Q 2010 to 52

in 3Q 2011.

9

9

Platform for Organic Growth –

Distribution Strategy |

10

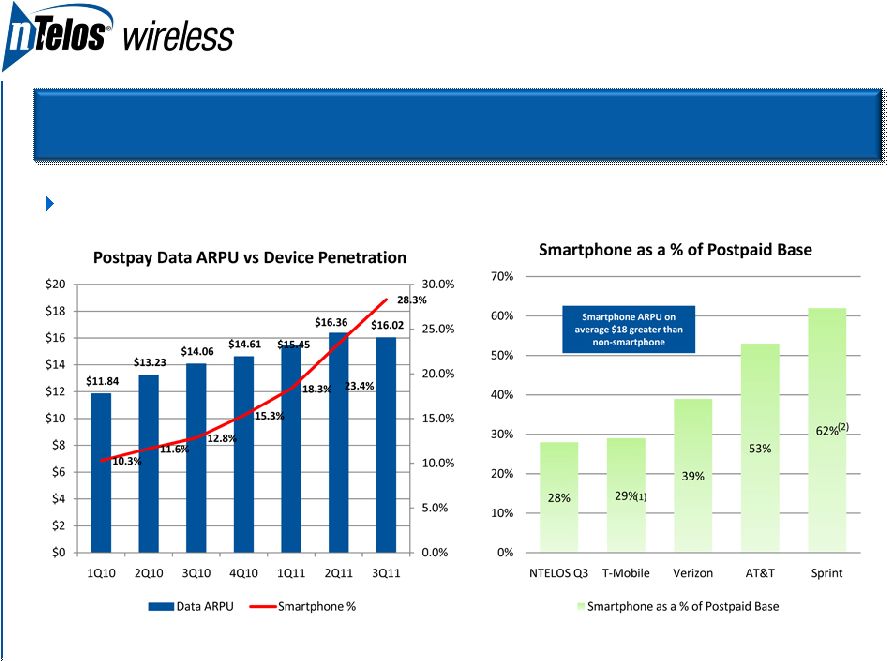

Increased smartphone penetration drives ARPU and lowers churn

10

(1)

Q211 –

Have not reported Q311

(2)

% of CDMA Postpay base

Platform for Organic Growth –

Smartphone Explosion |

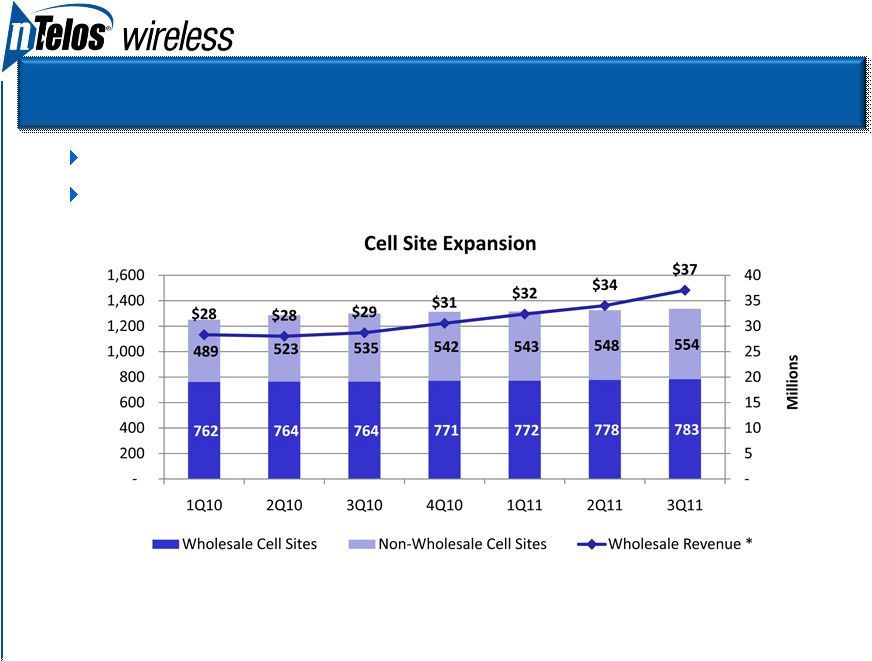

11

Network investments driving wholesale revenue growth

Sprint wholesale revenue up 33% YOY*

Platform for Organic Growth –

Wholesale Revenues

•

Excluding support from the contracted minimums in the prior year. •

Wholesale Revenue shown above is Total Wholesale Revenue, which includes revenue from Sprint. |

12

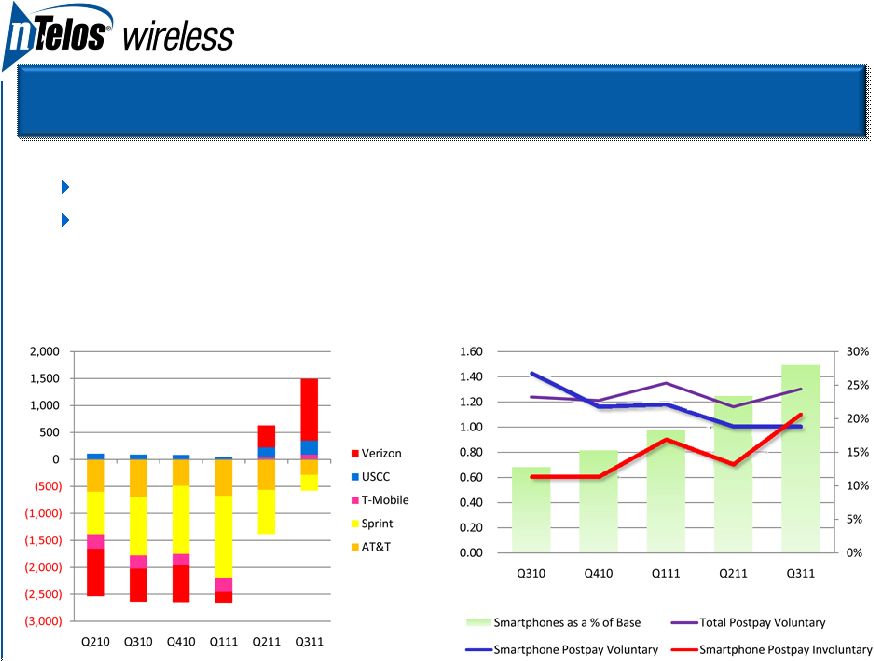

Subscriber ports now net positive for first time since July 2007

Smartphone customers have better churn characteristics

Wireless Number Porting

Postpay Voluntary Churn (%)

Leading Indicators Support Strategy and Execution |

13

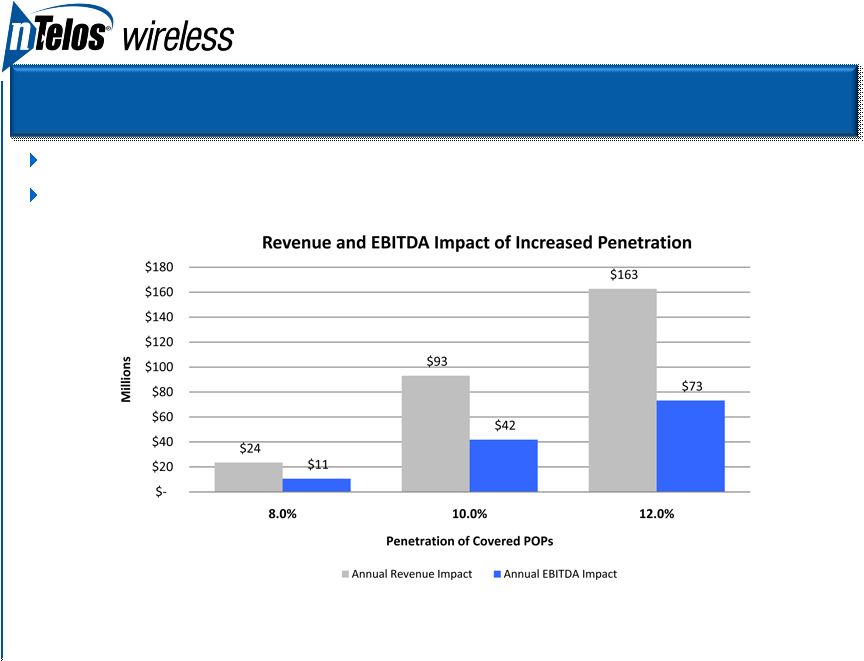

Moderate increases in penetration provide substantial retail revenue and EBITDA growth

1% increase in market share = 58k incremental subs

* Assumes current subscriber base mix at higher penetration and applies operating financial

metrics to illustrate subscriber base. * Assumes 45% incremental EBITDA margin.

* Current NTELOS combined share in all markets is 7.3%.

“Size of the Prize” |

14

Network upgrade to EVDO drove revenue growth

Note: CAPEX numbers exclude IT.

Investment in EVDO |

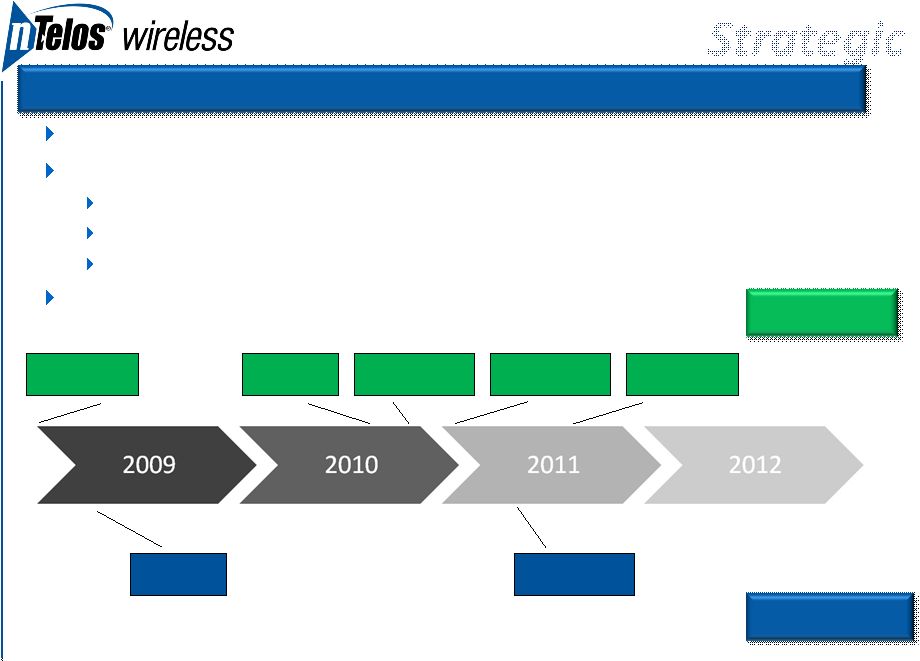

Fast follower

with LTE Well positioned with Sprint for technology upgrade

LightSquared

Clearwire

Stand alone

LTE field trials completed

Industry Milestones

NTELOS Milestones

VZ launch in 30

cities

First LTE Device

Introduced

15

EVDO Build

Completion

Metro PCS

initial Launch

AT&T launch in

10 cities

Sprint WiMAX

in Baltimore

LTE Field Trials

Completed

4G Roadmap |

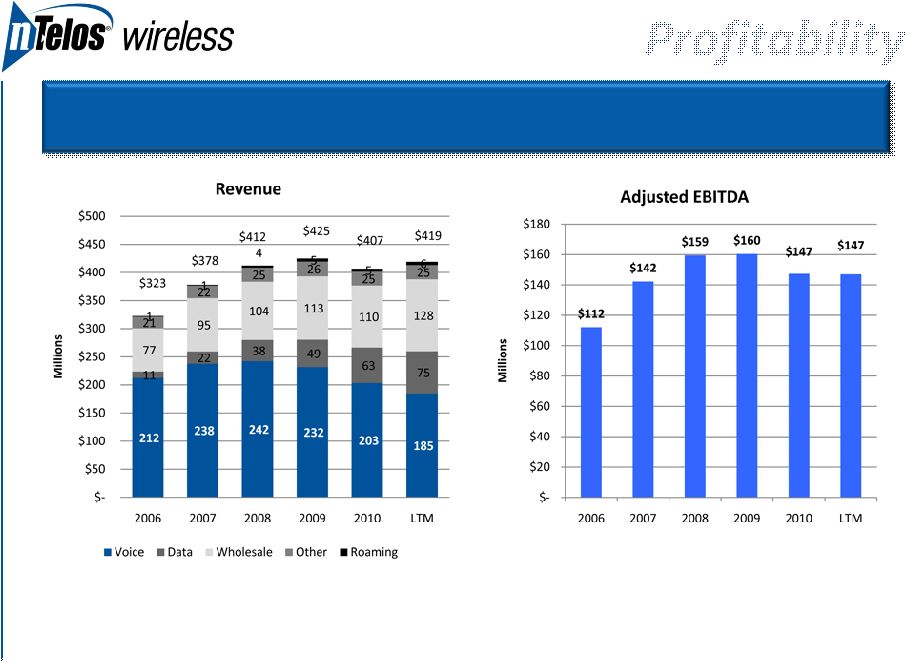

Financial

Summary |

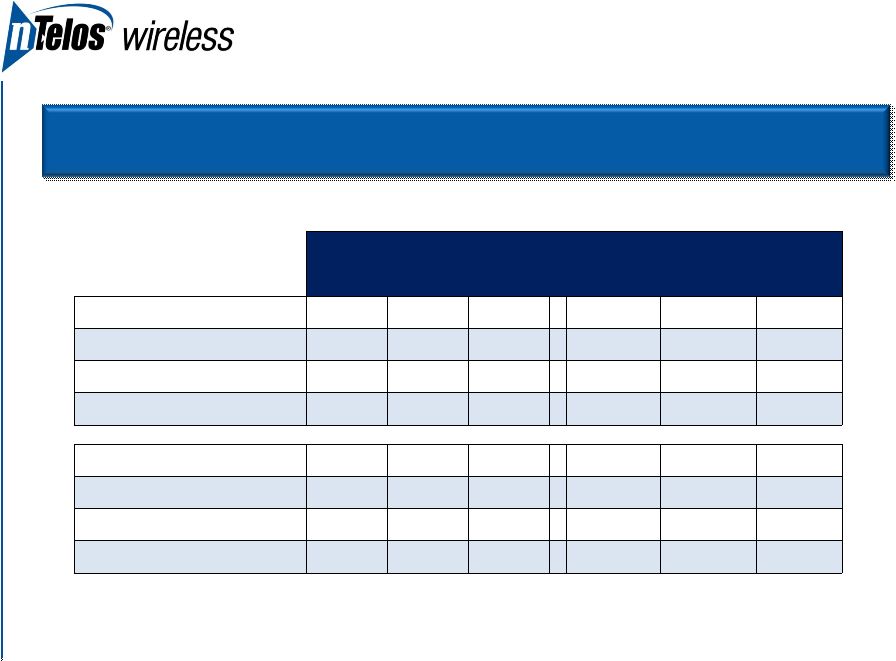

17

Managing to Growth |

18

Financial Overview

2009

2010

LTM

Sept YTD 2010

Sept YTD 2011

YOY Delta

Gross Adds (000s)

176

165

161

120

117

(4)

Ending Subscribers (000s)

439

432

415

434

415

(19)

ARPU -

blended

$53.20

$50.85

$50.54

$50.60

$50.18

($0.42)

Churn -

blended

3.27%

3.25%

3.50%

3.17%

3.50%

-0.33%

Revenue ($mm)

$425

$407

$419

$304

$317

13

Adjusted EBITDA ($mm)

$162

$148

$147

$113

$112

($1)

CAPEX ($mm)

$51

$39

$45

$30

$36

($6)

FCF ($mm)

$111

$109

$102

$83

$77

$7 |

19

Financial Overview

* As of earnings conference call on 11/8/11.

(in millions)

2010

LTM

Pro Forma Results

Pro Forma Revenue

$407

$419

Pro Forma Adjusted EBITDA

$142

$142

Pro Forma Capitalization (as of 9/30/11)

Cash

$58

Total Debt

$461

Net Debt

$403

Net Debt Leverage

2.8x

Guidance for Fourth Quarter 2011*

Adjusted EBITDA

Between

$33mm -

$35mm

CAPEX

Between

$13mm -

$15mm |

20

Jim Hyde, CEO, President and Director

Former T-Mobile USA / Western Wireless / VoiceStream Sr. Exec

Former CEO, T-Mobile UK

17 years industry experience

Steb Chandor, EVP, CFO and Treasurer

Former CFO, iPCS Wireless

Former CFO, Metro One

16 years industry experience

Conrad Hunter, EVP, COO

Former COO, iPCS Wireless

Former VP of Midwest Operations, U.S. Cellular Corporation

32 years industry experience

Senior Executives –

Wireless Veterans |

Leading

“pure-play” regional wireless company

Platform for organic and strategic growth

Unique growth and income investment opportunity

Wholesale revenue at an all time high and growing

NTELOS declared $0.42/share dividend on 11/3/11 payable on 1/12/12

Strong Free Cash Flow characteristics

Attractive strategic asset set

Exclusive network provider to Sprint in region

Unique network footprint in Mid-Atlantic region

Experienced senior management team

Investment Rationale

21 |

Investor

Presentation November 2011 |