Attached files

| file | filename |

|---|---|

| EX-14.1 - EXHIBIT 14.1 - AEROFLEX HOLDING CORP. | v233632_ex14-1.htm |

| EX-21 - EXHIBIT 21 - AEROFLEX HOLDING CORP. | v233632_ex21.htm |

| EX-31.2 - EXHIBIT 31.2 - AEROFLEX HOLDING CORP. | v233632_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - AEROFLEX HOLDING CORP. | v233632_ex31-1.htm |

| EX-32.2 - EXHIBIT 32.2 - AEROFLEX HOLDING CORP. | v233632_ex32-2.htm |

| EX-31.3 - EXHIBIT 31.3 - AEROFLEX HOLDING CORP. | v233632_ex31-3.htm |

| EX-32.1 - EXHIBIT 32.1 - AEROFLEX HOLDING CORP. | v233632_ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2011

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File No. 001-34974

|

Aeroflex Holding Corp.

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

01-0899019

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Identification No.)

|

|

35 South Service Road, Plainview, New York

|

11803

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (516) 694-6700

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Class

|

Name of Each Exchange on Which Registered

|

|

|

Common Stock, $.01 par value

|

New York Stock Exchange

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K x.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

|

Non-accelerated filer x

|

(Do not check if a smaller reporting company)

|

Smaller reporting company ¨

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. As of December 31, 2010 – approximately $325,141,000.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. Common Stock, par value $.01 per share; outstanding as of August 30, 2011: 84,789,180 shares.

Documents incorporated by reference: Part III (Items 10, 11, 12, 13 and 14) – registrant’s definitive proxy statement to be filed pursuant to Regulation 14A of the Securities Act of 1934.

TABLE OF CONTENTS

| PAGE | ||

|

PART I

|

||

|

Item 1.

|

Business

|

2

|

|

Item 1A.

|

Risk Factors

|

20

|

|

Item 1B.

|

Unresolved Staff Comments

|

39

|

|

Item 2.

|

Properties

|

40

|

|

Item 3.

|

Legal Proceedings

|

41

|

|

Item 4.

|

(Removed and Reserved)

|

41

|

|

PART II

|

||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

42 |

|

Item 6.

|

Selected Financial Data

|

43

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

49 |

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

74

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

75

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

116 |

|

Item 9A.

|

Controls and Procedures

|

116

|

|

Item 9B.

|

Other Information

|

117

|

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

117

|

|

Item 11.

|

Executive Compensation

|

117

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

117

|

|

Item 13.

|

Certain Relationships and Related Transactions and Director Independence

|

117

|

|

Item 14.

|

Principal Accounting Fees and Services

|

117

|

|

PART IV

|

||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

118

|

- 1 -

PART I

In the Form 10-K, unless the context requires otherwise, (i) “Aeroflex Holding” refers to the issuer, Aeroflex Holding Corp., a holding company that was formerly known as AX Holding Corp., (ii) “Aeroflex” refers to Aeroflex Incorporated, a direct wholly owned subsidiary of Aeroflex Holding, together with its consolidated subsidiaries, (iii) “we”, “our”, or “us” refer to Aeroflex Holding Corp. and its consolidated subsidiaries, including Aeroflex, (iv) the term “parent LLC” refers to VGG Holding LLC, which as of June 30, 2011 owns 76.7% of Aeroflex Holding’s common stock, (v) the term “Veritas Capital” refers to The Veritas Capital Fund III, L.P. and its affiliates, (vi) the term “Golden Gate Capital” refers to Golden Gate Private Equity, Inc. and its affiliates, (vii) the term “GS Direct” refers to GS Direct, L.L.C., (viii) the term “Sponsors” refers collectively to Veritas Capital, Golden Gate Capital and GS Direct, and to affiliates of and funds managed by these entities, (ix) the term “Going Private Transaction” refers to the acquisition of Aeroflex by the Sponsors on August 15, 2007, (x) the term “IPO” refers to the initial public offering of 19,789,180 shares of our common stock at a price of $13.50 per share, which was consummated in November 2010, (xi) the “Sponsor Advisory Agreement” refers to our advisory agreement with affiliates of the Sponsors, under which we paid $2.8 million, $2.5 million and $2.3 million during the years ended June 30, 2011, 2010 and 2009, respectively, prior to it being terminated in connection with the IPO, (xii) the term “senior secured credit facility” refers to the credit facility we entered into on May 9, 2011 in connection with our debt refinancing as of such date and (xiii) any “fiscal” year refers to the twelve months ended June 30 of the applicable year (for example, “fiscal 2011” refers to the twelve months ended June 30, 2011).

Because the Company’s market position and related matters have been determined based on management’s good faith reasonable estimates, statements about such items are noted in this report as a belief or as an estimate.

ITEM 1. BUSINESS

Our Company

We are a leading global provider of radio frequency, or RF, and microwave integrated circuits, components and systems used in the design, development and maintenance of technically demanding, high-performance wireless communication systems. Our solutions include highly specialized microelectronic components and test and measurement equipment used by companies in the (i) space, avionics and defense; (ii) commercial wireless communications; and (iii) medical and other markets. We have targeted customers in these end markets because we believe our solutions address their technically demanding requirements. We were founded in 1937 and have proprietary technology that is based on the extensive know-how of our approximately 700 engineers and experienced management team, and a long history of research and development focused on specialized technologies, often in collaboration with our customers.

In the fourth quarter of fiscal 2011, we changed the way in which we group our sales by product line in order to better align our definition of the wireless business with the rest of the industry. The results of fiscal years 2010 and 2009 have been revised to conform to the current presentation. The change in sales by product line does not have any impact on previously reported consolidated financial results.

We provide a broad range of high margin products for specialized, high-growth end markets. The products we manufacture include a range of RF, microwave and millimeter wave microelectronic components, with a focus on high reliability, or HiRel, and radiation hardened, or RadHard, integrated circuits, or ICs, and analog and mixed-signal devices. We also manufacture a range of RF and microwave wireless radio and avionics test equipment and solutions particularly for the wireless, avionics and radio test markets. We believe that we have a top three global position on the basis of sales in product categories representing the majority of our revenue. These product categories include: HiRel RadHard microelectronics/semiconductors for space; RF and microwave components: attenuation products, including programmables and switch matrices, microwave semiconductors and HiRel diodes; mixed-signal/digital application specific ICs, or ASICs, for medical and security imaging; motion control products; wireless LTE test equipment; military radio and private mobile radio test equipment; avionics test equipment; and synthetic test equipment. Our leadership position is based on estimates of our management, which are primarily based on our management’s knowledge and experience in the markets in which we operate.

- 2 -

We believe that the combination of our leading market positions, broad product portfolio, engineering capabilities, and years of experience enables us to deliver differentiated, high value products to our customers and provides us with a sustainable competitive advantage. We believe most of our market segments have high barriers to entry due to the need for specialized design and development expertise, the differentiation provided by our proprietary technology and the significant switching and requalifying costs that our customers would incur to change vendors. We often design and develop solutions through a collaborative process with our customers whereby our microelectronic products or test solutions are designed, or "spec'd", into our customers' products or test procedures. Our major customers often use our products in multiple systems or programs, sometimes developed by different business units within the customer's organization. We believe, based on our long-term relationships and knowledge of customers' buying patterns, that we were either a primary or the sole source supplier for products representing more than 80% of our total net sales for the fiscal year ended June 30, 2011. If we are a primary supplier, generally the customer will use two to three suppliers to satisfy its requirements for that product.

We have long standing relationships with a geographically diverse base of leading global companies including Alcatel Lucent, BAE Systems, Boeing, Cisco Systems, Ericsson, General Dynamics, ITT Industries, Lockheed Martin, Motorola, Nokia, Northrop Grumman and Raytheon. For the fiscal year ended June 30, 2011, our largest customer represented approximately 6% of our net sales. In aggregate, for the fiscal year ended June 30, 2011, our top ten customers accounted for approximately 31% of our net sales.

We compete predominantly in the space, avionics, defense and the commercial wireless communications markets. For the fiscal year ended June 30, 2011, approximately 62% of our net sales came from space, avionics and defense, 28% from commercial wireless communications and 10% from medical and other markets. Approximately 30% of sales for the fiscal year ended June 30, 2011 were to agencies of the U.S. government or to prime defense contractors or subcontractors of the U.S. government. Our products are sold primarily to customers in (i) the United States; (ii) Europe and the Middle East; and (iii) Asia, with sales to each of these regions accounting for 54%, 21% and 22%, respectively, of our net sales for fiscal year ended June 30, 2011. The information on sales based on our customers’ geographical location, sales by end markets, and sales and operating profits of our two industry segments for each of the three fiscal years in the period ended June 30, 2011, as well as information regarding total assets, is set forth in Note 20 of the notes to the consolidated financial statements.

After 46 years as a public company, we were acquired on August 15, 2007 in the Going Private Transaction by the Sponsors and certain members of our management. Since the Going Private Transaction, we have implemented significant changes that have improved our business model, and in turn, our financial performance. Since being promoted to CEO upon the consummation of the Going Private Transaction, Leonard Borow has instilled a results-oriented culture where business managers are being encouraged to make strategic decisions to drive growth and margin enhancement. We have made significant investments in new or improved products and technology, streamlined our cost structure to enhance our return on capital, and we believe we have revitalized our organizational culture. In November 2010, we consummated the IPO, in which we sold 19,789,180 shares of our common stock at a price of $13.50 per share.

Over the last seven fiscal years, our business has experienced strong growth in net sales and an increase in backlog, providing improved visibility into future revenue and customer demand. The majority of our backlog is expected to be recognized as revenue within one year. For the period from fiscal 2004 to fiscal 2011, our net sales increased at a compound annual growth rate, or CAGR, of 8.8% and Adjusted EBITDA increased at a CAGR of 18.2%. Our backlog was $294.3 million as of June 30, 2011, compared to $305.6 million as of June 30, 2010.

- 3 -

Our Segments

We operate through two business segments: Aeroflex Microelectronic Solutions, or AMS, and Aeroflex Test Solutions, or ATS. We engineer, manufacture and market a diverse range of products in each of our segments. As evidence of the diversity of our product base, for the fiscal year ended June 30, 2011, our largest product offering, the TM500 test product, represented approximately 10% of our net sales.

|

Aeroflex Microelectronic Solutions

|

Aeroflex Test Solutions

|

|

|

% of Net Sales

in Fiscal 2011

|

50.7%

|

49.3%

|

|

% of Gross Profit

in Fiscal 2011

|

49.1%

|

50.9%

|

|

Products

|

§HiRel microelectronics/semiconductors

|

§Wireless test equipment

|

|

§RF and microwave components

§Mixed-signal/digital ASICs

|

§Military radio and Private Mobile Radio, or PMR, test equipment

|

|

|

§Motion control products

|

§Avionics test equipment

|

|

|

§Synthetic test equipment

|

||

|

§General purpose test equipment and other

|

||

|

Competitive Advantages

|

§Leadership in microelectronic specialty products within our end markets, with a long history and proven track record

§ High-performance, high reliability products optimized for our target markets

§Proprietary technologies in RF, microwave and millimeter wave development

§Established long-term blue chip customer relationships with proven reputation

§High switching costs

§Class K and Class V certified by Defense Supply Center Columbus, or DSCC

§Fabless semiconductor manufacturing model

§State-of-the-art design, test and assembly capabilities

|

§Leadership positions in specialty communications test equipment market segments within our end markets, with a long history and proven track record

§High-performance products and technologies optimized for our target markets

§Integrated hardware/software design focus

§Pioneer in synthetic testing market

§Established long-term blue chip customer relationships with proven reputation

§State-of-the-art manufacturing processes

|

|

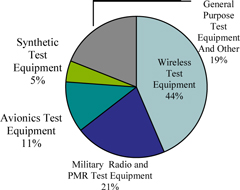

Diverse Product Portfolio (% of Fiscal 2011 Net Sales by Segment)

|

||

|

Aeroflex

|

Aeroflex

|

|

|

Microelectronic

|

Test

|

|

|

Solutions

|

Solutions

|

|

|

|

|

- 4 -

Aeroflex Microelectronic Solutions

AMS offers a broad range of microelectronics products and is a leading provider of high-performance, high reliability specialty products for the space, avionics, defense, commercial wireless communications, medical and other markets. Our strength in these markets stems from our success in the design and development of HiRel and RadHard products. RadHard products are specifically designed to tolerate high radiation level environments, which otherwise can degrade electronic components. The process by which electronic components for these harsh environments are designed, developed and manufactured differs materially from established semiconductor manufacturing practices. As a result, we believe we are among a very limited number of vendors globally who have the expertise, proven history and established relationships to compete and win in our target markets.

We principally operate on a fabless semiconductor manufacturing model, outsourcing virtually all front-end semiconductor fabrication activities to commercial foundries. We believe our fabless semiconductor manufacturing model provides us with a competitive advantage by significantly reducing our capital expenditures and labor costs and enhancing our ability to respond quickly, in scope and scale, to changes in technology and customer needs. We utilize a variety of foundries that incorporate our proprietary design specifications and packaging techniques in the manufacturing of our products.

In order to meet our customers' needs, AMS' Plainview, New York and Colorado Springs, Colorado facilities are space certified and have been manufacturing Class K and Class V products for space, avionics and defense programs for approximately 20 years. Class K device manufacturing utilizes the highest quality and reliability for electronic parts through a number of specifications, standards and test methods. The additional requirements that define Class K address the specific needs of space users and are intended to provide more confidence to the customers that the device is of the highest initial quality and that any defective parts have been removed. To enhance access to customers in the European space market, we acquired Gaisler Technologies, in June 2008. Gaisler Technologies, located in Gothenburg, Sweden, designs and manufactures hi-reliability, high-performance, fault tolerant micro-processors.

AMS offers a broad range of complementary products that provide connectivity and computing functionality for applications that are characterized by their high-performance, high reliability requirements. Its product portfolio includes RF, microwave and millimeter wave products, including discrete components, ICs, monolithic microwave ICs and multi-chip modules. AMS also designs and manufactures application specific, high-performance analog and mixed-signal devices for use in medical, industrial and intelligent sensors. Our AMS products are used in over 100 space, avionics and defense platforms, including the Wideband Global Satellite Communications satellites, the Geostationary Operational Environmental satellites, the Advanced Extremely High Frequency satellites, the Boeing 777 airliner's databus, the F-16's modular mission computer, the B-1 flight controls upgrade and the Terminal High Altitude Area Defense program. Our AMS products are also widely used in wireless communications platforms, including WCDMA and LTE cellular base station systems, as well as point-to-point broadband radio applications. In the medical area, our products are used by two of the top four manufacturers of CT scan equipment.

For the fiscal year ended June 30, 2011, our AMS segment generated $370.0 million of our net sales and $192.5 million of our gross profit.

Aeroflex Test Solutions

ATS is a leading provider of a broad line of specialized test and measurement hardware and software products, primarily for the space, avionics, defense, commercial wireless communications and other markets. Our strength in testing and measurement stems from our expertise with RF and microwave signals and innovative product design and development to meet the changing needs of our markets. ATS has hardware and software expertise across a number of wireless markets, including the cellular infrastructure, cellular device, mobile radio and satellite markets. ATS' products consist of flexible application software and multifunction hardware that our customers combine with industry-standard computers, networks and other third-party devices to create measurement, automation and embedded systems. This approach gives customers the ability to quickly and cost-effectively design, prototype and deploy unique custom-defined solutions for their design, control and test application needs.

- 5 -

Examples of ATS products and their applications include:

|

|

·

|

wireless test equipment, which is used to develop and test handsets and base stations;

|

|

|

·

|

military radio and PMR test equipment, which is used by radio manufacturers and military, police, fire, and emergency response units to test handheld radios;

|

|

|

·

|

avionics test equipment, which is used in the design, manufacture and maintenance of electronics systems for aircraft;

|

|

|

·

|

synthetic test equipment, which is used to test satellites and transmit / receive modules prior to launch and deployment; and

|

|

|

·

|

general purpose test equipment, including spectrum analyzers and signal generators.

|

As technology continues to evolve and "next generation" communications protocols are introduced, equipment manufacturers and network providers need both test and measurement products that are compatible with the new technologies and products that work with older generation equipment. We have gained significant expertise in advanced RF and new wireless technology and have focused our research and development toward such next generation technologies. One example is the Aeroflex 3000 Series, a modular test suite for mobile phone and general purpose wireless test using the PXI standard, which is a widely accepted standard for module electronic instrumentation platforms. This product is tailored to the testing of wireless handsets and wireless base stations, which are the transmission facilities for wireless networks, where speed, repeatability, and accuracy are critical. Also, as wireless infrastructure has evolved with the advent of 4G networks, ATS has built capabilities around the two main 4G standards, specifically Long Term Evolution or LTE and LTE(A) Long Term Evolution Advanced protocols. In particular, we provide the TM500 product family that targets the 4G LTE market as well as PXI-based products and the 7100 product family that target both the LTE and LTE(A) markets.

For the fiscal year ended June 30, 2011, ATS generated $359.4 million of our net sales and $199.6 million of our gross profit.

Industry Overview

The volume of mobile traffic from multiple data streams is rising rapidly and has resulted in significant technological innovation to address the increasing need for higher rates of data transmission and more efficient use of existing spectrum. This has led to the development of a number of advanced data transmission systems and technologies that use RF, microwave and millimeter wave frequencies that are being used in a broad range of end markets, including space, avionics, defense, commercial wireless communications, medical and other markets. The growing number of applications in these markets, including data transmission, video transmission, control of unmanned aerial vehicles, or UAVs, and a growing number of satellites, generally are driving increased demand for RF, microwave and millimeter wave technologies. Additionally, the creation of a next generation wireless communication network to accommodate the rapidly growing volume of data being transmitted to smart phones and other mobile devices requires new test and measurement equipment for research and development, conformance testing, production testing, installation and commissioning, monitoring and optimization, and service and maintenance.

- 6 -

Our Competitive Strengths

Leading Positions in Multiple Markets. We believe we currently hold a top three position on the basis of sales in eight key product categories in which we compete and a majority of our revenue comes from these categories. Our microelectronics products are key components in over 100 space, avionics and defense platforms. We also have market leading base station and handset testing equipment that targets both the 3G and 4G markets. We believe, based upon our long-term relationships and knowledge of customers' buying patterns, that we were either a primary or the sole source supplier for products representing more than 80% of our total net sales for the fiscal year ended June 30, 2011. We also believe we have achieved the technological capability to succeed in the 4G testing and measurement markets.

We have set out below information about our market leading product categories and information about sales within these categories.

|

Aeroflex Microelectronic Solutions

|

|||||||||||||||

|

% of AMS

|

|||||||||||||||

|

Fiscal

|

Net Sales

|

Estimated

|

|||||||||||||

|

2011

|

in Fiscal

|

Primary/Sole

|

Market

|

||||||||||||

|

Product Category

|

Net Sales

|

2011

|

Source?

|

Position

|

|||||||||||

|

(In millions)

|

|||||||||||||||

|

HiRel RadHard microelectronics semiconductors for space

|

$ | 154 | 42 | % |

Yes

|

#1-2 | |||||||||

|

RF and microwave components:

|

|||||||||||||||

|

attenuation products, including programmables and switch matrices, microwave semiconductors and HiRel diodes

|

$ | 96 | 26 | % |

Yes

|

#2-3 | |||||||||

|

Motion control products

|

$ | 34 | 9 | % |

Yes

|

#2 | |||||||||

|

Mixed-signal/digital ASICs for medical and security imaging

|

$ | 16 | 4 | % |

Yes

|

#1-2 | |||||||||

- 7 -

|

Aeroflex Test Solutions

|

|||||||||||||

|

% of ATS

|

|||||||||||||

|

Fiscal

|

Net Sales

|

Estimated

|

|||||||||||

|

2011

|

in Fiscal

|

Primary/Sole

|

Market

|

||||||||||

|

Product Category

|

Net Sales

|

2011

|

Source?

|

Position

|

|||||||||

|

(In millions)

|

|||||||||||||

|

Wireless LTE test equipment

|

$ | 79 | 22 | % |

Yes

|

#1 | |||||||

|

Military radio and PMR test equipment

|

$ | 76 | 21 | % |

Yes

|

#1 | |||||||

|

Avionics test equipment

|

$ | 37 | 11 | % |

Yes

|

#1 | |||||||

|

Synthetic test equipment

|

$ | 19 | 5 | % |

Yes

|

#1 | |||||||

Proprietary Technology Platforms; Significant Barriers to Entry to our Markets. We have a history of innovation and performance that has made us a leading supplier to our customers. We have proprietary technology that is based on the extensive know-how of our nearly 700 engineers and experienced management team, and a long history of research and development focused on specialized technologies, often in collaboration with customers. We leverage this proprietary technology to design and manufacture a range of RF, microwave and millimeter wave microelectronic components, with a focus on high reliability RadHard ICs. Our strength in the test and measurement market stems from our expertise in RF and microwave signals and innovative product development to meet the changing needs of wireless communications markets.

We believe there are significant barriers to entry in most of our markets because our technical expertise enables us to provide innovative solutions and reliable products. For instance, in the space market, customers focus on supplier reputation because the malfunction of a component can lead to the loss of a valuable satellite or missile. In other markets our products are often designed, or "spec'd", into a customer's products or test procedures, which means that customers could incur significant switching and requalifying costs to change vendors, making it more difficult for new vendors to enter the market. Our expertise and product performance in the space market are demonstrated, in part, by our receipt of Class K certification from the DSCC, a distinction we have held for approximately 20 years.

Diverse, Blue Chip Customer Base. We have strong and long standing relationships with blue chip space, avionics, defense, commercial wireless communications, medical and other blue chip customers. Our close customer relationships have enabled us to engage in collaborative product development, build our intellectual property portfolio and develop critical product and end market expertise.

We believe our long track record of successfully supplying our customers with solutions and our recent design win momentum further enhances our ability to:

|

|

·

|

maintain our position as a primary or the sole source supplier of products to customers across a wide array of programs;

|

|

|

·

|

enjoy long multi-year program relationships;

|

|

|

·

|

maximize the effectiveness of our research and development spending; and

|

|

|

·

|

minimize our customers' product development time.

|

We believe that, in addition to our varied customer base, we are well positioned in growth markets and that our geographic and product diversification helps mitigate against volatility in any particular region or market segment.

- 8 -

Compelling Business Model. Our business model emphasizes revenue and earnings growth and robust cash flow conversion and has the following attributes:

High Revenue Growth and Visibility. We have a highly visible sales pipeline because of our backlog and long-term customer relationships. As of June 30, 2011, our backlog was $294.3 million as compared to $305.6 million as of June 30, 2010. Our book-to-bill ratio for the fiscal year ended June 30, 2011 was approximately 1.0 to 1. Our contracted backlog has grown at a compound annual growth rate of 8.3% over the past five fiscal years. The majority of our backlog is recognized as revenue within one year. Our business has also experienced strong growth in net sales. For the period from fiscal 2004 to fiscal 2011, our net sales increased at a CAGR of 8.8%.

Focus on High Margin Products. Our strategy is to design, develop and manufacture products and solutions that address our customers' technically demanding requirements. The sophistication of our products and their differentiation drives our margins. For the fiscal year ended June 30, 2011, we attained a gross margin of 53.8%, and our Adjusted EBITDA margin was 25.2%.

Efficient Research and Development. Our products typically enjoy a long product life cycle, enabling us to generate an attractive return on our research and development efforts. To complement our research and development, we strategically acquire businesses or license certain proven commercial technology to apply to our target markets. As a result, we spent a modest 12.4% of our revenue on research and development for the fiscal year ended June 30, 2011.

Limited Capital Expenditure Requirements. In contrast to certain competitors that have invested in captive semiconductor fabrication facilities, we use third-party foundries to produce space qualified, high reliability RadHard ICs for our AMS segment. This fabless operating model significantly reduces required capital investment and is a key component of our capital efficiency. Capital expenditures as a percentage of sales were 3.6%, 3.2% and 3.1% for fiscal 2011, 2010 and 2009, respectively.

Strong and Experienced Management Team. We are led by an experienced, stable and well-respected management team. Our management team has an average of 28 years in the industry and 19 years with us. Since 1991, the management team has successfully transformed us into a focused, high margin, leading provider of RF and microwave solutions. Over that time period, we have successfully completed 29 acquisitions, divested non-core operations and increased net sales from approximately $63 million in fiscal 1991 to approximately $729 million in fiscal 2011.

Our Growth Strategy

We believe our future success will depend on product innovation, our continued development of existing technology and our ability to continue to build and maintain strong relationships with customers. We are strategically focused on building our product portfolio and market presence in the following ways:

Introducing New Products to Our Existing End Markets. We continue to allocate research and development dollars toward new products serving attractive, growing markets. Our goal is to anticipate movements in our core markets and to design and build compelling solutions to address new opportunities.

In our AMS business, as a result of our long-term customer relationships and extensive knowledge of their system designs, we have early insight and high visibility into our customers' design challenges and requirements. With this insight from our customers, we have developed next generation RadHard Processors, Memory, Data Communication and Power Management Multi-Chip Modules, or MCM's, for the satellite markets. We have also released next generation mixed-signal semiconductor solutions and high-performance photo detectors for the medical-CT and security markets.

- 9 -

In our ATS business, we have focused on developing first-to-market products serving our core wireless test market, including test solutions for the LTE and WiMAX protocols. For example, our TM500 test system emulates a single or multi-handset environment and is used by most global infrastructure development organizations. Additionally, the 7100/7000 products were developed for, and are used by, handset developers. Both the TM500 and 7100/7000 offerings target the research and development market. We have also introduced a PXI-based product that leverages our TM500 and 7100/7000 products, offering a configurable and scalable solution to handset manufacturers and contract manufacturing organizations that support the major handset makers. We continue to invest aggressively in new products for our various wireless test markets, increasingly using a common platform that allows us to bring them to market quickly and at relatively low cost.

We also have become a pioneer in the area of synthetic testing, a market with significant growth potential. In 1999, we used our capabilities in high-speed frequency synthesis and radar cross section measurement and developed a new way to make measurements. Synthetic tests were first used to test and measure satellite payloads, which require many electronic measurements in rapid sequence. Synthetic was a faster and, therefore, more cost effective way to test the satellite payload. The U.S. DoD and U.S. Navy, which instituted a next generation automatic test system program, called NxTest, are responsible for the emergence and growth of synthetic testing. The NxTest initiative aims to minimize the size of the test system, thereby reducing hardware and consequently the cost of the system. Synthetic testing also addresses obsolescence issues and provides additional flexibility for easy upgrades.

Leveraging Existing Technology to Reach New Markets. We have a history of leveraging our technology for use in new markets. For example, our move into CT scanning equipment capitalizes on our expertise in high-performance semiconductors and other electronic components, including mixed-signal ASICs, which are key to producing high quality imaging with reduced doses of radiation per scan. We believe that these benefits, coupled with decreasing production costs, will help drive growth of the overall CT scan market outside of the traditional medical environments and into markets such as security screening and nondestructive test equipment. In addition, our high-performance mixed-signal semiconductor intellectual property capabilities can also target the rapidly growing security scanner marketplace.

Expanding by Acquisition. Acquiring companies opportunistically is a strategic core competency for us. Since 1991, we have successfully completed 29 acquisitions and plan to continue our disciplined approach to acquisitions. Recent strategic acquisitions in both AMS and ATS have broadened and strengthened our product portfolio and expanded our geographic reach.

In AMS, we broadened our portfolio of RF and microwave components with the August 2010 acquisition of Advanced Control Components which designs, manufacturers and markets a wide range of radio frequency and microwave products for the military, civilian radar, scientific and communications markets. In addition, in June 2010, we acquired Radiation Assured Devices which uses commercial and specialty technologies to provide radiation engineering and qualification services, as well as to produce radiation hardened products for commercial and military spaceborne electronics. In June 2009 we purchased Airflyte Electronics which is a leader in custom-engineered slip rings used in pan and tilt cameras, down-hole equipment, and packaging machinery. We also acquired Hi-Rel Components in February 2009, which designs high reliability semiconductors for the aerospace and defense industries. Subsequent to our purchase of Hi-Rel Components, it was awarded U.S. government certification on several key products that are now planned for sale into demanding aerospace applications. Additionally, in June 2008 we bought Gaisler Research. Located in Gothenburg Sweden, Gaisler is a leading European integrated circuit software designer to space-related end markets. Gaisler's radiation tolerant fault LEON3 processor has now been incorporated into several ongoing space missions.

In ATS, in May 2010, we acquired Willtek Communications, or Willtek, which develops test instruments, systems and solutions that test wireless technology, components, infrastructure products, handset products and other consumer wireless products specific to the development, manufacturing and service/support environments. Additionally, we acquired VI Technology in March 2009, which has expanded our test solutions capabilities with a suite of base band test products focusing on audio, video, and multimedia.

We believe our industry relationships allow us to identify specialized companies that are attractive acquisition candidates. We have a track record of successfully integrating acquired businesses into our company. We seek acquisitions that are earnings accretive, give us access to complementary products and services, enhance our customer base, improve our intellectual property position, provide entry into high-growth adjacent markets and, by virtue of their transaction size, bear limited risk.

- 10 -

Broadening Product Offerings Through Licensing. We look to license commercial intellectual property that can be extended to our target markets and customer base in a cost effective and efficient manner. Through third-party technology license agreements, we are able to repurpose or expand the commercial intellectual property of companies that lack RadHard performance or otherwise adapt their technology for use in our markets. This process involves our working with a company to radiation harden its proprietary technology for use in extreme environments. For example, we have entered into technology license agreements with a number of semiconductor companies, including Vicor. The Vicor agreement allows us to deploy highly differentiated RadHard power management technology into the satellite market. We believe agreements such as these will enable us to support ongoing growth by allowing us to introduce new highly-differentiated, high-performance products to our existing customers at reduced cost and risk.

Business Evolution Since Going Private

In August 2007, after 46 years as a public company, we were acquired in the Going Private Transaction by the Sponsors and certain members of our management. Since the Going Private Transaction, we have successfully executed on a number of strategic initiatives that have positioned us for future growth and have expanded our Adjusted EBITDA from $135.1 million in fiscal 2008 to $183.7 million in fiscal 2011 despite the global economic downturn.

Investments in Products and Technology. We have focused on investments, acquisitions, and licensing to enhance our financial performance since the Going Private Transaction.

|

|

·

|

We have successfully brought to market wireless instruments and system solutions that support a vertical market strategy specific to the chipset, product research and development and manufacturing test applications.

|

|

|

·

|

We have been the first to market with a family of next generation LTE handset and infrastructure test products, and have provided popular solutions including the TM500 and 7100.

|

|

|

·

|

We are expanding our wireless instrument and system product offerings leveraging our position in 4G technologies with the addition of a new digital signal generator/analyzer product family, 4G test vector generator/analyzer, multi-standard call box and TM500/7100 fading channel simulator option.

|

We have made eight strategic acquisitions since the Going Private Transaction:

|

|

·

|

October 2007, Test Evolution;

|

|

|

·

|

June 2008, Gaisler Research;

|

|

|

·

|

February 2009, Hi-Rel Components;

|

|

|

·

|

March 2009, VI Technology;

|

|

|

·

|

June 2009, Airflyte Electronics;

|

|

|

·

|

May 2010, Willtek Communications;

|

|

|

·

|

June 2010, Radiation Assured Devices; and

|

|

|

·

|

August 2010, Advanced Control Components.

|

- 11 -

Finally, our increasing focus on licensing agreements has improved our operational and financial profile, allowing us to expand our product offerings efficiently and in a risk-mitigated way with proven technology. Since the Going Private Transaction, we have entered into technology license agreements, including those listed below:

|

|

·

|

March 2008, Vicor and Great Wall;

|

|

|

·

|

July 2009, IceMos;

|

|

|

·

|

December 2009, Mosys;

|

|

|

·

|

May 2010, Everspin; and

|

|

|

·

|

October 2010, Linear Technology.

|

Enhanced Business Model—Managing Costs to Improve Return on Capital. We have continually pursued margin-enhancing cost efficiencies, improving our fixed cost structure by critically examining operations for synergies and expense reduction. In AMS, in fiscal 2009, we down-sized the workforce at our Whippany, New Jersey factory and, in fiscal 2010, implemented a plan to move the resistor product line from this factory to our operations in Ann Arbor, Michigan, which we completed in fiscal 2011. Additionally, in fiscal 2011, we implemented and completed a plan to move the integrated product line from the Whippany factory to our facility in Eatontown, New Jersey. In ATS, we restructured our U.K. operations in 2008 and 2009, divested our radar development business in May 2008, and in July 2009 closed our small ATS operation in France. In May 2010, we acquired Willtek, which develops test instruments, systems and solutions that test wireless technology, components, infrastructure products, handset products and other consumer wireless products specific to the development, manufacturing and service/support environments. In fiscal 2011, we reorganized and integrated Willtek with our European operations. In fiscal 2011, we also completed the reorganization and consolidation of our European operations. As a result of our fixed cost reduction efforts in both AMS and ATS, along with our strategic initiatives, we have significantly enhanced profitability since the Going Private Transaction in August 2007. Specifically, the consolidated Adjusted EBITDA margin increased from 21.0% in fiscal 2008 to 25.2% in fiscal 2011.

Improved Organizational Culture. Since the Going Private Transaction, we have implemented significant changes that have improved our business model and in turn our financial performance. Since being promoted to CEO upon the consummation of the Going Private Transaction, Leonard Borow has instilled a results-oriented culture where business managers are being encouraged to make strategic decisions to drive growth and margin enhancement. We have made significant investments in new or improved products and technology, streamlined our cost structure to enhance our return on capital, and we believe we have revitalized our organizational culture. The financial impact of this new approach has been most apparent in our ability to stabilize and ultimately grow revenue through the recent economic downturn and expand Adjusted EBITDA margins.

Our Products Offered

Aeroflex Microelectronic Solutions

AMS products provide customers with high precision, high reliability, application specific standard products and application specific integrated circuits including databuses, transceivers, microcontrollers, microprocessors and memory products. In addition, AMS also sells sub-assemblies and multichip modules, or MCMs, as well as a diverse portfolio of commercial mixed-signal ICs and RF, microwave and millimeter wave devices. AMS' broad product portfolio has a longstanding, field-tested, history of reliable performance often characterized by long product life cycles and mission-critical functionality. AMS currently provides products in four functional families:

- 12 -

HiRel Microelectronics/Semiconductors. AMS provides HiRel standard and custom integrated circuits and circuit card assembly for the aerospace, high reliability altitude avionics, medical, x-ray cargo scanners, critical transportation systems, nuclear power controls, GPS receivers, networking and telecommunication markets. AMS' HiRel products include transceivers, analog multiplexers, clock management generators, MSI logic products, battery electronics units, voltage regulators, high-speed power controllers, MIL-STD 1553 bus controllers, remote terminals, bus monitors, microcontrollers and microprocessors, RadHard Pulse Width Modulation Controllers, RadHard Resolver-to-Digital and memory modules. HiRel Microelectronics/ Semiconductors have a typical life cycle of 10-20 years, as estimated by management.

RF and Microwave Components. AMS provides a broad set of standard and application specific RF/microwave diodes and semiconductor devices. Microwave semiconductor products offered include diodes, amplifiers, resistors, inductors, capacitors, switches, and integrated devices. RF and Microwave active components and subsystems offered include PIN diode-based microwave control components, variable attenuators, phase shifters, limiters, time delay units and Multi-Function Microwave assemblies. AMS offers resistor products, which include a variety of low and high reliability power surface mounted passive devices for the wireless infrastructure and defense markets with applications in isolators, circulators, single and multi-carrier power amplifiers and circuits. Passive components offered include high quality, economically priced and Restriction of Hazardous Substances compliant attenuators, terminations, adapters, DC blocks, and other components for commercial, military and laboratory applications. Other products include power amplifiers, up and down converters, mixers, filters and micro-receivers operating to over 40GHz. RF and Microwave components have a typical life cycle of 5-15 years, as estimated by management.

Mixed-Signal/Digital ASICs. AMS provides custom ASICs for demanding environments such as space, medical, screening and industrial applications. RadHard ASICs and Mixed-Signal ASICs include a variety of digital and mixed-signal RadHard ASICs for HiRel applications including 130nHBD, 0.6um to 0.25um processes, QML V and QML Q with total ionizing rates from 100 kilorad to 1 megarad. Mixed-Signal/Digital ASICs have a typical life cycle of 5-15 years, as estimated by management.

Motion Control Products. Our motion control products provide complete and integrated motion control solutions for space (both military and commercial), military, avionics, and strategic industrial customers. AMS' current product line offerings include actuators and mechanisms, electronic controllers, slip rings and twist capsules, DC motors and Gimbal Systems. Motion control products have a typical life cycle of 10-20 years, as estimated by management.

Aeroflex Test Solutions

ATS is a leading provider of a broad line of specialized test and measurement equipment. Our solutions encompass a full spectrum of instrumentation from turnkey systems to standalone test sets to customized modular components and software. We continue to invest aggressively in new products for our various wireless test markets, increasingly using a common platform that allows us to bring them to market quickly and at relatively low cost. ATS currently provides test and measurement equipment across the following five product areas:

Wireless Test Equipment. Wireless Test Equipment is used by wireless service providers and equipment manufacturers to test wireless handsets and base stations. We offer a wide selection of cellular tests across an array of wireless standards and communication frequencies, including 2G and 3G, with particular capability in EDGE protocols, and the new 4G LTE/LTE(A) protocols. Products include a broad range of system, protocol, physical layer and parametric test solutions, such as the TM500 test mobile, RF synthesizers, digitizers and combiners, and application software. In addition, ATS provides PXI-based products which are modular scalable solutions for the handset manufacturing environment. Product applications include research and development, conformance, manufacturing/production, installation and commissioning, field service, and network optimization. ATS' market leading product, the TM500, emulates a single or multi-handset environment and is used by all global infrastructure development organizations. Wireless Test Equipment products have a typical life cycle of 3-5 years, as estimated by management.

- 13 -

Military Radio and PMR Test Equipment. ATS Radio Test Equipment is used by radio manufacturers and military, police, fire and emergency response units to test handheld radio units. ATS provides TErrestrial Trunked RAdio, or TETRA, and Project 25, or P25, radio test equipment, addressing both mobile and repeater test applications. TETRA is a global standard for private mobile radio, or PMR, systems used by emergency services, public transport and utilities. P25 is a standard for digital radio communications for use by federal, state, private, and local public safety agencies in North America. Our military communications testing systems are primarily used by the U.S. military to test complex voice and data frequency hopping radios and accessories. Military radio and PMR test equipment has a typical life cycle of 5-20 years, as estimated by management.

Avionics Test Equipment. Avionics test equipment is used in the design, manufacture, test and maintenance of commercial, civil and military airborne electronic systems, or avionics. ATS equipment provides the stimulus and signals necessary for certification, verification, fault finding and diagnosis of airborne systems on the ground. For civil and commercial aviation, we have test solutions for various transponder modes, communications frequencies, emergency locator transmitters, weather radars and GPS systems. For military aviation, we have test solutions for microwave landing systems, tactical air navigation, enhanced traffic alert and collision avoidance systems, various identification friend or foe, or IFF, transponder/interrogator modes and IFF monopulse antenna simulation. ATS also provides customized avionics test solutions to support manual and automatic test equipment for manufacturing, repair and ground support operations. Avionics test equipment has a typical life cycle of 8-15 years, as estimated by management.

Synthetic Test Equipment. Synthetic test systems test several attributes through one "box" and can take multiple complex measurements simultaneously. ATS provides a highly integrated, turnkey, synthetic test environment that allows digital, analog, RF/microwave and power test of circuits, modules, subsystems and complete systems for commercial, military, and aerospace customers. ATS' STI 1000C+ and TRM 1000C products offer synthetic microwave test systems optimized for testing Transmit/Receive modules and satellite payloads in a factory setting. Our SMART^E and SMART^E 5300 products offer a modular approach for implementing multi-function configurable and reconfigurable test systems. Synthetic test solutions products have a typical life cycle of 10-15 years, as estimated by management.

General Purpose Test Equipment and Other. ATS offers a variety of general purpose test solutions including microwave test solutions, counters and power meters. ATS microwave test solutions cover frequency ranges from 1 MHz to 46GHz, with various tracking, offset, continuous wave, modulated source, fault location, and group delay configuration options provided. ATS power meters are designed for field use, automated test equipment requirements and standard bench applications. General purpose test solutions have a typical life cycle of 4-7 years, as estimated by management.

Our Customers

AMS addresses value-added specialty markets requiring application specific, custom engineered, high-performance microelectronic solutions. The division has strong relationships with the five largest U.S. defense contractors, Boeing, General Dynamics, Lockheed Martin, Northrop Grumman and Raytheon, as well as with several other major defense-related technology companies, such as BAE Systems, Honeywell, ITT Industries and United Technologies. Certain of our customers, such as BAE Systems and Honeywell, are also our competitors due to their in-house capabilities. AMS customers also include communications equipment OEMs such as Cisco Systems and Ericsson. In the fiscal year ended June 30, 2011, AMS had five or more projects with six of its top ten customers by net sales. We believe, based on our long term relationships and knowledge of customers' buying patterns, that in the fiscal year ended June 30, 2011, AMS was also either a primary or the sole source supplier of the types of products that it provides for each of its top ten customers by net sales.

- 14 -

ATS addresses value-added specialty markets requiring application specific, custom engineered, high-performance testing solutions. ATS customers also include wireless handset and infrastructure OEMs, including Nokia Siemens, Ericsson, LG, Huawei, ZTE, Alcatel Lucent and Motorola Mobility. The division also has strong relationships with several major defense-related technology companies, including Lockheed Martin, Boeing, Northrop Grumman and Raytheon. In the fiscal year ended June 30, 2011, ATS had more than five projects with nine of its top ten customers by net sales. We believe, based on our long term relationships and knowledge of customers' buying patterns, that in the fiscal year ended June 30, 2011, ATS was also either a primary or the sole source supplier of the types of products that it provides for each of its top ten customers by net sales.

Government Sales

Approximately 30% of sales for the fiscal year ended June 30, 2011 were to agencies of the U.S. government or to prime defense contractors or subcontractors of the U.S. government. These government contracts have been awarded either on a bid basis or after negotiation. These contracts generally provide for fixed prices and have customary provisions for termination at the convenience of the government without cause.

Competition

We compete primarily on the basis of technology and performance. For certain products, we also compete on the basis of price. Some of our competitors are well-established and have greater market share and manufacturing, financial, research and development and marketing resources than we do. We also compete with emerging companies that are attempting to sell their products in specialized markets, and with the internal capabilities of many of our significant customers, including Honeywell and BAE Systems. In addition, a significant portion of our contracts, including those with the federal government and commercial customers, are subject to commercial bidding, both upon initial issuance and subsequent renewal.

AMS primarily competes with large defense-related technology providers, including BAE Systems and Honeywell. In addition, AMS competes with a number of specialty semiconductor providers, including Hittite Microwave Corporation, ILC / Data Devices Corporation and Microsemi. We believe we are one of the largest providers of specialty microelectronics to our targeted markets and that we are the leading global fabless platform of scale in RadHard semiconductors. Additionally, in the RF and Microwave market segment, AMS competes with companies such as Anaren. However, we believe our specialized expertise in RadHard technology, RF and microwave design and development and fabrication expertise provides us with a differentiated technology and pricing position versus our most direct competitors. We characteristically maintain close and longstanding relationships with our customers and maintain sole source / primary supplier positions with many of our customers.

ATS primarily competes with Agilent and a number of specialty test and measurement providers, including Anite, Anritsu, Rohde & Schwarz and Spirent. We believe our specialized expertise in high-performance RF and wireless testing equipment and our focus on delivery of advanced testing platforms and optimized manufacturing capability sets us apart from our most direct competitors. We believe we continue to maintain the largest installed base of any of our competitors in the specialized test categories in which we compete, including many sole source / primary supplier positions with customers such as Lockheed Martin and Raytheon. In the general purpose test equipment and other markets, our competitors include Agilent Technologies and National Instruments.

As of June 30, 2011, we had approximately 700 engineers conducting research and development activities at 18 of our facilities. Our research and development efforts primarily involve engineering and design relating to:

|

|

·

|

developing new products;

|

|

|

·

|

improving existing products;

|

|

|

·

|

adapting existing products to new applications; and

|

|

|

·

|

developing prototype components to bid on specific programs.

|

- 15 -

We emphasize research and development efforts for products in both the AMS and ATS divisions. In AMS, we have focused our research and development initiatives on the continued enhancement of our high value power management products and subsystems, microwave/RF modules and microreceivers which has enabled us to increase the dollar content of our products embedded into modern satellites. In ATS, we are developing technologies that are used in the next generation of wireless infrastructure. Our research and development consists of self-funded research and development as well as research and development we conduct on behalf of our customers.

Certain product development and similar costs are recoverable under contractual arrangements and those that are not recoverable are expensed in the year incurred. We invested $90.1 million in self-funded research and development for the fiscal year ended June 30, 2011, compared to $76.2 million for the fiscal year ended June 30, 2010. Capital expenditures as a percentage of sales were 3.6%, 3.2% and 3.1% for fiscal 2011, 2010 and 2009, respectively.

We also seek to strategically acquire businesses with proven commercial technology to apply to our target markets. In August 2010, we acquired Advanced Control Components, which designs, manufacturers and markets a wide range of RF and microwave products for the military, civilian radar, scientific and communications markets. In June 2010, we acquired Radiation Assured Devices, which uses commercial and specialty technologies to provide state of the art radiation engineering and qualification services, as well as produce radiation hardened products for commercial and military spaceborne electronics. In June 2009 we broadened our portfolio of motion control products with the purchase of Airflyte Electronics, which is a leader in custom-engineered slip rings used in pan and tilt cameras, down-hole equipment, and packaging machinery. In addition, we acquired Hi-Rel Components in February 2009, which designs high reliability semiconductors for the aerospace and defense industries. In our ATS segment, we acquired Willtek Communications in May 2010, which develops test instruments, systems and solutions that test wireless technology, components, infrastructure products, handset products and other consumer wireless products specific to the development, manufacturing and service/support environments. Also in ATS, we acquired VI Technology in March 2009, which has expanded our test solutions capabilities with a suite of base band test products focusing on audio, video, and multimedia. During fiscal 2011, we also entered into an agreement to acquire certain of the spectrum analyzer assets of LIG-NEX1.

Manufacturing

The AMS division operates under a fabless semiconductor manufacturing model, outsourcing substantially all semiconductor fabrication activities to commercial foundries, which significantly reduces our capital expenditures and labor costs and enhances our ability to respond quickly with scalability to changes in technology and customer demands. We purchase our semiconductors from a variety of foundries, which utilize our proprietary design specifications and packaging techniques to manufacture our RadHard products. We test certain of our RadHard products in our in-house radiation simulation testing chamber.

AMS has 11 primary manufacturing facilities throughout the United States, as well as one in China. In AMS' largest facility, Colorado Springs, Colorado, we design and develop our RadHard solutions in addition to a broad range of products for avionics and space applications. AMS manufactures advanced MCMs for airborne, space, shipboard, ground based and commercial avionics and telecommunications systems in its Plainview, New York, facility. The remaining facilities are used to produce RadHard solutions, RF and microwave products and aerospace motion control solutions.

We manufacture products for aerospace and defense programs in compliance with stringent military specifications. Most of our manufacturing plants are ISO-9001 certified, and our Plainview, New York, Hauppauge, New York, and Colorado Springs, Colorado, facilities are also certified to the more stringent AS9100 standard.

ATS has six primary manufacturing facilities throughout the United States, as well as one each in England and Germany. In ATS' largest facility, Wichita, Kansas, we design and develop a wide range of test instrumentation for military radio and avionics. In ATS' Stevenage, England facility, we produce wireless systems test technologies and also provide test solutions with expertise in signal generators, signal analyzers, microwaves and automatic test equipment. The remaining facilities focus on synthetic testing solutions and other wireless communications and automated testing equipment.

- 16 -

Many of the component parts we use in our products are purchased, including semiconductors, transformers and amplifiers. Although we may obtain certain components and materials from a limited group of suppliers, all the materials and components we use, including those purchased from a sole source, are readily available and are, or can be, purchased in the open market. We have no long-term purchase commitments and no supplier provided more than 10% of our raw materials during fiscal 2011.

Sales

We employ a team-based sales approach to closely manage relationships at multiple levels of the customer's organization, including management, engineering and purchasing personnel. This integrated sales approach involves a team consisting of a senior executive, a business development specialist and members of our engineering department. Our use of experienced engineering personnel as part of the sales effort enables close technical collaboration with our customers during the design and qualification phase of new technologies and equipment. We believe that this is critical to the integration of the product into the customer's equipment. Manufacturers' representatives and independent sales representatives are also used as needed. Each of the businesses that comprise the AMS segment has its own sales organization, whereas the ATS segment has a common sales force to service its global market. As of June 30, 2011, we had approximately 240 sales people employed domestically and internationally.

Seasonality

Historically our net sales and earnings increase sequentially from quarter to quarter within a fiscal year, but the first quarter is typically less than the previous year’s fourth quarter.

Our Employees

As of June 30, 2011, we had approximately 2,900 employees, of whom 1,500 were employed in a manufacturing capacity, and 1,400 were employed in engineering, sales or administrative positions. Approximately 100 of our employees are covered by a collective bargaining agreement. The collective bargaining agreement expires September 30, 2013. We believe that our employee relations are satisfactory.

Intellectual Property

In order to protect our intellectual property rights, we rely on a combination of patent, trade secret, copyright and trademark laws and employee and third-party nondisclosure agreements. We believe that while the protection afforded by patent, trade secret, copyright and trademark laws may provide some advantages, the competitive position of participants in our industry is principally determined by such factors as the technical and creative skills of their personnel, the frequency of their new product developments and their ability to anticipate and rapidly respond to evolving market requirements. Therefore, we have focused our efforts principally on developing substantial expertise and know-how in our industry, and protecting that know-how with confidentiality agreements and trade secrets.

We consider the protection of our proprietary technology to be an important element of our business. We limit access to and distribution of our proprietary information. We attempt to protect our intellectual property rights, both in the United States and in foreign countries, through a combination of patent, trademark and trade secret laws, as well as confidentiality agreements. Because of the differences in foreign trademark, patent and other laws concerning proprietary rights, our intellectual property rights may not receive the same degree of protection in foreign countries as they would in the United States.

- 17 -

We have from time to time applied for patent protection relating to certain existing and proposed products, processes and services, but we do not have an active patent application strategy. When we do apply for patents, we generally apply in those countries where we intend to make, have made, use or sell patented products; however, we may not accurately predict all of the countries where patent protection will ultimately be desirable. If we fail to timely file a patent application in any such country, we may be precluded from doing so at a later date. The patents we own could be challenged, invalidated or circumvented by others and may not be of sufficient scope or strength to provide us with any meaningful protection or commercial advantage. To the extent that a competitor effectively uses its intellectual property portfolio, including patents, to prevent us from selling products that allegedly infringe such competitor's products, our results of operations could be materially adversely affected.

Some of our proprietary technology may have been developed under, or in connection with, U.S. government contracts or other federal funding agreements. With respect to technology developed under such agreements, the U.S. government may retain a nonexclusive, non-transferable, irrevocable, paid-up license to use the technology on behalf of the United States throughout the world. In addition, the U.S. government may obtain additional rights to such technology, or our ability to exploit such technology may be limited.

We rely on our trademarks, tradenames and brand names to distinguish our products and services from the products and services of our competitors, and have registered or applied to register many of these trademarks. In the event that our trademarks are successfully challenged, we could be forced to rebrand our products and services, which could result in loss of brand recognition, and could require us to devote resources towards marketing new brands.

We also rely on unpatented proprietary technology. It is possible that others will independently develop the same or similar technology or otherwise obtain access to our unpatented technology. To protect our trade secrets and other proprietary information, we require employees, consultants, advisors and collaborators to enter into confidentiality agreements. We periodically evaluate our confidentiality policies and procedures, and believe that we have adequate protections in place. However, these agreements may not provide meaningful protection for our trade secrets, know-how or other proprietary information in the event of any unauthorized use, misappropriation or disclosure of such trade secrets, know-how or other proprietary information.

We face the risk of claims that we have infringed or misappropriated third parties' intellectual property rights. In general, if we are found to infringe third parties' intellectual property rights, we may be required to enter into licensing agreements in order to obtain the right to use a third party's intellectual property. Any licensing agreements, if required, may not be available to us on acceptable terms or at all. A successful claim of infringement against us could result in our being required to pay significant damages, enter into costly license agreements, or stop the sale of certain products, which could adversely affect our net sales, gross margins and expenses and harm our future prospects.

In addition to our own intellectual property, we have an active program of licensing third-party technologies to be developed into new products. In many cases, we make substantial up-front payments to procure such technology. We generally attempt to license third-party technology for so long as practicable and have acquired six licenses that make the technology acquired available to us for periods of up to twenty years. If we are unable to continue to use or license these technologies on reasonable terms, or if these technologies fail to operate properly, we may not be able to secure alternatives in a timely manner and our ability to make the products that employ these third-party technologies could be harmed. In addition, licensed technology may be subject to claims that it infringes others' technology, and we may lose access to or have restrictions placed on our use of the licensed technology.

Our licenses of third-party technologies have certain requirements that we must meet to maintain the licenses. For instance, if we fail to meet certain minimum royalty or purchase amounts, or meet delivery deadlines, certain licenses may be converted from an exclusive license to a nonexclusive license, thus allowing the licensors to license the technology to our competitors. In addition, breach of confidentiality or the unauthorized use of the technology could render the license agreement void. In the future, we may need to obtain additional licenses, renew existing license agreements or otherwise replace existing technology. We are unable to predict whether these license agreements can be obtained or renewed or the technology can be replaced on acceptable terms, or at all.

- 18 -

Regulation

- Environmental

Our operations are subject to various federal, state, local, and foreign environmental laws, ordinances and regulations that limit discharges into the environment, establish standards for the handling, generation, use, emission, release, discharge, treatment, storage and disposal of, or exposure to, hazardous materials, substances and waste, and require cleanup of contaminated soil and groundwater. These laws, ordinances and regulations are complex, change frequently and have tended to become more stringent over time. Many of them provide for substantial fines and penalties, orders (including orders to cease operations) and criminal sanctions for violations. They may also impose liability for property damage and personal injury stemming from the presence of, or exposure to, hazardous substances.

In March 2005, we sold the net assets of our shock and vibration control device manufacturing business, which we refer to as VMC. Under the terms of the sale agreements, we retained certain liabilities relating to adverse environmental conditions that existed at the premises occupied by VMC as of the date of sale. See Item 3 - "Legal Proceedings" with respect to the accrued liability.

We believe that we are in material compliance with all environmental laws, do not anticipate any material expenditure to meet current or pending environmental requirements, and generally believe that our processes and products do not present any unusual environmental concerns. We are unaware of any existing, pending or threatened contingent liability that may have a material adverse effect on our ongoing business operations.

Our operations are also governed by laws and regulations relating to workplace safety and worker health. We believe we are in material compliance with these laws and regulations and do not believe that future compliance with such laws and regulations will have a material adverse effect on our results of operations or financial condition. We also believe that we are in material compliance with all applicable labor regulations.

- ITAR and Export Controls