Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - Tri-Tech Holding, Inc. | v222033_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Tri-Tech Holding, Inc. | v222033_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Tri-Tech Holding, Inc. | v222033_ex31-1.htm |

| EX-32.2 - EXHIBIT 32.2 - Tri-Tech Holding, Inc. | v222033_ex32-2.htm |

|

U. S. SECURITIES AND EXCHANGE COMMISSION

|

WASHINGTON, DC 20549

FORM 10-Q

|

x

|

Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

For the quarterly period ended June 30, 2011

|

¨

|

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

For the transition period from ___________ to ___________.

Commission File Number 001-34427

|

Tri-Tech Holding Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Cayman Islands

|

Not Applicable

|

|

|

(State or other jurisdiction of

|

(I.R.S. employer

|

|

|

incorporation or organization)

|

identification number)

|

|

16th Floor of Tower B, Renji Plaza No. 101

|

|

Jingshun Road, Chaoyang District

|

|

Beijing, People’s Republic of China 100102

|

|

(Address of principal executive offices and zip code)

|

+86 (10) 5732-3666

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

|

Large accelerated filer

|

¨

|

Accelerated filer

|

¨

|

|

Non-accelerated filer (Do not check if a smaller reporting company)

|

¨

|

Smaller reporting company

|

x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date. The Company is authorized to issue 30,000,000 ordinary shares, $0.001 par value per share. As of the date of this report, the Company has 8,160,407 outstanding ordinary shares, excluding 21,100 treasury shares.

TRI-TECH HOLDING INC.

FORM 10-Q

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

ii

|

||||

|

PART I.

|

FINANCIAL INFORMATION

|

1 | |||

|

Item 1.

|

Financial Statements

|

1 | |||

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

1 | |||

|

Item 3.

|

Quantitative and Qualitative Disclosures about Market Risk

|

24 | |||

|

Item 4.

|

Controls and Procedures

|

24 | |||

|

PART II.

|

OTHER INFORMATION

|

26 | |||

|

Item 1.

|

Legal Proceedings

|

26 | |||

|

Item 1A.

|

Risk Factors

|

26 | |||

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

26 | |||

|

Item 3.

|

Defaults Upon Senior Securities

|

26 | |||

|

Item 4.

|

(Removed and Reserved)

|

26 | |||

|

Item 5.

|

Other Information

|

26 | |||

|

Item 6.

|

Exhibits

|

26 | |||

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This document contains certain statements of a forward-looking nature. Such forward-looking statements, including but not limited to projected growth, trends and strategies, future operating and financial results, financial expectations and current business indicators are based upon current information and expectations and are subject to change based on factors beyond the control of the Company. Forward-looking statements typically are identified by the use of terms such as “look,” “may,” “should,” “might,” “believe,” “plan,” “expect,” “anticipate,” “estimate” and similar words, although some forward-looking statements are expressed differently. The accuracy of such statements may be impacted by a number of business risks and uncertainties that could cause actual results to differ materially from those projected or anticipated, including but not limited to the following:

|

|

•

|

the timing of the development of future products;

|

|

|

•

|

projections of revenue, earnings, capital structure and other financial items;

|

|

|

•

|

statements of the Company’s plans and objectives;

|

|

|

•

|

statements regarding the capabilities of its business operations;

|

|

|

•

|

statements of expected future economic performance;

|

|

|

•

|

statements regarding competition in its market; and

|

|

|

•

|

assumptions underlying statements regarding the Company or its business.

|

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to update this forward-looking information. Nonetheless, the Company reserves the right to make such updates from time to time by press release, periodic report or other method of public disclosure without the need for specific reference to this Report. No such update shall be deemed to indicate that other statements not addressed by such update remain correct or create an obligation to provide any other updates.

ii

PART I. FINANCIAL INFORMATION

|

Item 1.

|

Financial Statements

|

See the financial statements following the signature page of this report, which are incorporated herein by reference.

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

The following discussion contains, in addition to historical information, forward-looking statements that involve risks and uncertainties. The actual results could differ materially from those described herein.

Company Overview

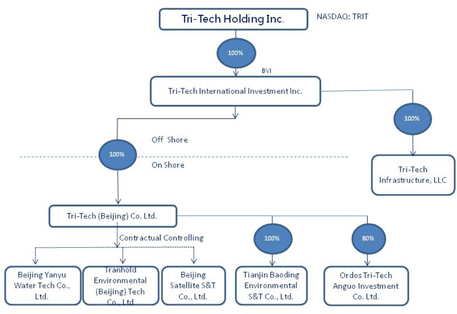

We (“Tri-Tech Holding Inc.,” “TRIT,” “our” or “us”) are a leading provider of integrated solutions to China’s water resource management and environmental protection industries. Headquartered in Beijing, China, we have 302 employees among our eight subsidiaries and controlled companies as of June 30, 2011: (1) Tri-Tech International Investment, Inc. (“TTII”), (2) Tri-Tech (Beijing) Co., Ltd. (“TTB”), (3) Beijing Satellite Science & Technology Co. (“BSST”), (4) Ordos Tri-Tech Anguo Investment Co., Ltd. (“TTA”), (5) Tianjin Baoding Environmental Technology Co., Ltd. (“Baoding”), (6) Tranhold Environmental (Beijing) Tech Co., Ltd. (“Tranhold”), (7) Beijing Yanyu Water Tech Co., Ltd. (“Yanyu”) and (8) Tri-Tech Infrastructure LLC, a Delaware limited liability company located in the United States (“TIS”). Since our incorporation in 2002, we have successfully implemented more than 800 projects throughout China.

We aim to provide reliable, workable solutions to complex environmental challenges faced by governments and large state-owned enterprises. Our major clients are a combination of government agencies, municipalities, and industrial companies located throughout China. Our strategy for maintaining a leading position in the market is to earn positive customer recognition, to continually improve our reputation in the industry and to strengthen our customer relations with government agencies and industrial clients by providing diverse products and services based on proprietary technology, tailored projects and turnkey solutions to our diversified customer base.

Our principal executive offices are located at 16th Floor of Tower B, Renji Plaza, 101 Jingshun Road, Chaoyang District, Beijing 100102 China. The telephone number at this address is +86 (10) 5732-3666. Our ordinary shares are traded on the NASDAQ Capital Market under the symbol “TRIT.”

Our Internet website, www.tri-tech.cn, provides a variety of information about us. Our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K filed with the United States Securities and Exchange Commission (the “SEC”) are available, as soon as practicable after filing, under the investor relations tab on our website, or by a direct link to our filings on the SEC’s free website.

Principal Products or Services and Their Markets

Tri-Tech operates in three segments: (i) water, wastewater treatment and municipal infrastructure, (ii) water resource management system and engineering services, and (iii) industrial pollution control and safety. Through our subsidiaries and contractual controlled companies, we provide self-manufactured and proprietary, as well as third-party, products, system integration and other services in the fields of environmental protection, and water resource monitoring, development, utilization and protection. We design water works and customized facilities for reclaiming and reusing water, treating sewage and disposing of solid waste for China’s municipalities and larger cities. These systems combine process equipment, controls and instruments, information management systems, resource allocation, local and distant networking hardware, and software. They include sensors, control systems, programmable logic controllers, and supervisory control and data acquisition systems. For government agencies, we design systems that track natural waterway levels for drought control, monitor groundwater quality, and generally manage water resources. For petroleum refineries, petrochemical factories and power plants, we provide systems for volatile organic compound (“VOC”) abatement, odor control, water and wastewater treatment, and water recycling through project engineering, procurement and construction. We also provide safety and clean production technologies for oil and gas field exploration and pipelines.

1

Our business is divided into three segments according to the types of services provided and the clients served. We assess the performance of each segment based on the segment net revenue and gross profit on contribution margin. More detailed descriptions of the three reportable operating segments follow:

Segment 1: Water, Wastewater Treatment and Municipal Infrastructure

This segment includes projects involving municipal water supply and distribution, wastewater treatment and gray water reuse engineering, procurement and construction; build-and-transfer; proprietary process control systems; process equipment integration, and proprietary odor control systems; and other municipal facilities engineering, operation management and related infrastructure construction projects.

In June 2011, we entered into an agreement with Beijing Huaxia Yuanjie Water Technology Co., Ltd (“Yuanjie Water”) to acquire a majority stake in Yuanjie Water. According to the terms of the agreement, Yuanjie became a subsidiary of TRIT for majority control of the ownership, effective on July 22, 2011.Directly targeting the consumer use market, Yuanjie Water is engaged in water system integration for large high-rise buildings, through research and development, manufacturing, installation and sales and operation of water treatment equipment systems. Under the terms of the agreement, TTB will invest approximately RMB 11 million (approximately $1.69 million) into Yuanjie Water. This includes RMB 10 million (approximately $1.55 million) in cash and intellectual property valued at RMB 1 million (approximately $0.15 million). In return, TTB will receive 51% of the equity of Yuanjie Water.

Segment 2: Water Resource Management System and Engineering Services

This segment involves projects relating to water resource protection and allocation, flood control and forecasting, irrigation systems, related system integration, proprietary hardware and software products and similar ventures.

Segment 3: Industrial Pollution Control and Safety

This segment focuses on industrial wastewater treatment using zero liquid discharge technology, seawater desalination, air pollution and odor control, and industrial safety and emergency response for the oil, gas, petrochemical and power industries. Business models in this segment include the traditional engineering, procurement and construction, and construction and operation of wastewater treatment plant.

In June 2011, we acquired the operating assets of J&Y International Inc. (“J&Y”) for a total consideration of approximately $1.5 million. Based in Wisconsin, USA, J&Y is a water treatment company that designs and manufactures industrial chemical water recovery systems, desalination plants, domestic and industrial wastewater treatment systems and reverse osmosis filtration systems. J&Y formulates innovative solutions to solve water treatment and chemical concentration problems. It uses various treatment technologies such as evaporators, reverse osmosis, filtration, and ion exchange, among other biological, physical and chemical methods and processes, to meet customers’ demands.

Revenues by Segment

In the quarter ended June 30, 2011, our total revenue was $20.2 million, including $16.8 million in Segment 1, $2.3 million in Segment 2, and $1.1 million in Segment 3. The tables presented below show the performance of each of the business segments for the third-month and six-month periods ended June 30, 2011. For the quarter ended June 30, 2011, Segment 1 contributed 83% of the total revenues; Segment 2 contributed 11.5%; and Segment 3 contributed the remaining 5.5%.

2

|

Three Months Ended June 30, 2011

|

||||||||||||||||||||||||||||||||

|

Segment 1:

|

%

|

Segment 2:

|

%

|

Segment 3:

|

%

|

Total

|

%

|

|||||||||||||||||||||||||

|

System Integration

|

$ | 16,769,633 | 100.0 | % | $ | 2,057,254 | 88.9 | % | $ | 1,056,666 | 94.5 | % | $ | 19,883,553 | 98.4 | % | ||||||||||||||||

|

Hardware Products

|

— | — | % | 257,216 | 11.1 | % | 61,118 | 5.5 | % | 318,334 | 1.6 | % | ||||||||||||||||||||

|

Software Products

|

— | — | % | — | — | % | — | — | % | — | — | % | ||||||||||||||||||||

|

Total Revenues

|

$ | 16,769,633 | 83.0 | % | $ | 2,314,470 | 11.5 | % | $ | 1,117,784 | 5.5 | % | $ | 20,201,887 | 100.0 | % | ||||||||||||||||

The following table provides revenue percentage for each segment and category for the six months ended June 30, 2011. Total revenue has reached 55% of the expected guideline for 2011.

|

Six Months Ended June 30, 2011

|

||||||||||||||||||||||||||||||||

|

Segment 1:

|

%

|

Segment 2:

|

%

|

Segment 3:

|

%

|

Total

|

%

|

|||||||||||||||||||||||||

|

System Integration

|

$ | 29,674,019 | 100.0 | % | $ | 2,183,221 | 55.2 | % | $ | 3,896,807 | 94.5 | % | $ | 35,754,047 | 94.7 | % | ||||||||||||||||

|

Hardware Products

|

— | — | % | 1,772,308 | 44.8 | % | 228,743 | 5.5 | % | 2,001,051 | 5.3 | % | ||||||||||||||||||||

|

Software Products

|

— | — | % | — | % | — | — | % | — | — | % | |||||||||||||||||||||

|

Total Revenues

|

$ | 29,674,019 | 78.6 | % | $ | 3,955,529 | 10.5 | % | $ | 4,125,550 | 10.9 | % | $ | 37,755,098 | 100.0 | % | ||||||||||||||||

Backlog and Pipeline for 2011

For the remaining two quarters of 2011, we anticipate that our revenues will reach a range of $75 million to $80 million. Net income for this period will likely be between $11 million and $12.8 million. Assuming the number of total outstanding shares remains at 8,160,407, excluding the 21,100 shares held in treasury, we expect our earnings-per-share to range from $1.35 to $1.58. The fully diluted earnings-per-share for the second quarter of 2011 was $0.21. The earnings-per-share for the six months ended June 30, 2011 was $0.42.

Our backlog represents the amount of contract work remaining to be completed, including revenues from existing contracts and work in progress expected to be recognized in 2011, based on the assumption that these projects will be completed on time according to the project schedules. As of June 30, 2011, we had a total backlog of $48.3 million, including $39.3 million in Segment 1, $2.3 million in Segment 2, and the remaining $6.7 in Segment 3.

We are currently expecting potential projects in the pipeline with a total expected value of $147.2 million, of which approximately $95.1 million is for Segment 1, $21.8 million for Segment 2, and $30.3 million for Segment 3.

Macro-Economic Factors and Business Trends

China’s gross domestic product (“GDP”) maintained steady growth in the second quarter of 2011. According to the China State Bureau of Statistics, China’s GDP for the six months ended June 30, 2011 reached RMB 20.4 trillion (or $3.2 trillion), an increase of 9.6% over the same period in 2010. The increase for the second quarter was 9.5% compared to the same period last year. The GDP for the second quarter increased by 2.2% compared to the first quarter in 2011. It is believed that the moderate slowdown in the Chinese economy will reduce China’s domestic inflation pressure and that the Chinese economic growth will continue in the upcoming quarters.

In addition, the industrial production growth (“IPG”) and fixed asset investment (“FAI”) in China also saw stable growth as enterprises revenue continue to grow during the first six months of 2011. The industrial production growth rate was 14.3% for the six months ended June 30, 2011. By region, the IPG rates for East China, Central China and West China in the six months ended June 30, 2011 were 12.4%, 17.8% and 17.3%, respectively. The FAI reached RMB 12.5 trillion (or $1.9 trillion) in the six months ended June 30, 2011, an increase of 25.6% over the same period in 2010. By region, urban FAI for East China, Central China and West China in the six months ended June 30, 2011 were 22.6%, 31% and 29.2%, respectively. The relatively higher IPG and FAI growth rates in Central and West China helped stimulate our expansion in these areas.

Finally, local investments have been active in the first year of the 12th Five-Year Plan, with a growth rate of 28.1% during the first six months of 2011.

3

Based on the data shown above, we believe we are likely to continue our rapid growth during the remaining quarters of 2011 and beyond.

New Opportunities in Business

According to the Guidelines to the Environmental Industry Development Program issued recently, during the 12th Five-Year Plan the government will give top priority in developing environmental industry to the retrofit and construction of wastewater treatment infrastructure in small- to medium-sized cities, high concentration and non-biodegradable industrial wastewater treatment, and sludge disposal. During the 12th Five-Year Plan, the government plans to further its efforts in water conservation and the use of recycled water. Compared to the 70% utilization ratio of recycled water for developed countries, China’s water reuse is still in its infancy. Recycled water as a resource has tremendous potential in China, as most cities in China are in need of water. Over 400 out of 655 cities are in water shortage, and 200 of these 400 cities are in severe water shortage.

China Association of Environmental Protection Industry estimates investment in industrial wastewater treatment plants and municipal wastewater treatment plants to be over RMB 1 trillion during the 12th Five-Year Plan period. The wastewater treatment market is likely to maintain a high growth rate in the next 10 years also due to the accelerated industrialization process. It is estimated that the waste water treatment capacity in China will increase by 63% from 2011 to 2015, a compound annual growth rate (“CAGR”) of 10%. In light of the high market demand on wastewater treatment solutions, we believe that opportunities abound for up-stream wastewater pipeline manufacturers and mid-stream wastewater treatment plant builders.

China’s most stringent water resources management regulation was published earlier this year, which combines a series of documents such as the State Council Circular No. 1 and Action Program on Implementation of the Most Stringent Water Resources Management Work Plan. We believe that the strict regulations bring opportunities for the water recycle industry. In recent years, local governments and large industrial enterprises have started their water recycle projects. Gradually, such projects become less dominated by government investment and function more as market-oriented operations, especially in cities in water shortage such as Beijing and Tianjin. Residential water prices have risen significantly due to higher cost. Therefore, recycled water is becoming increasingly competitive for the low cost. The Ministry of Industry and Information Technology has also set the target that industrial water consumption shall be reduced by 30% by 2015.

China’s seawater desalination has made remarkable progress in technology and in equipment. According to the State Oceanic Administration, China’s seawater desalination capacity increased to 600,000 tons daily from 30,000 tons daily 10 years ago, an increase of 20 times. It is estimated that the capacity will further quadruple in the next 10 years. According to the target set forth in Seawater Desalination Special Plan issued by the government, China’s seawater desalination capacity will reach 2.5 million tons to 3 million tons daily by 2020.

Government financial support is the primary driving force behind the development of water resource infrastructure construction. According to the Ministry of Water Resources, the Ministry of Finance has invested RMB 3.8 billion ($587 million) in 1,100 counties across the country. The newly built projects in Hunan, Jiangxi and Yunnan Provinces have proven to be instrumental in reducing casualties and property damages during this year’s flood season. The Office of State Flood Control and Drought Relief recently held a flood prevention conference to encourage acceleration of construction progress in every province. Special water resource funds are anticipated for various stages with different focus. By 2013, the fund will be allocated in favor of bottleneck projects such as small- to medium-sized river improvements.

Strategies for Growth

Segment 1: Water, Wastewater Treatment and Municipal Infrastructure

We are continuously working on expanding our geographical reach from the existing bases of operations in Beijing, Tianjin, Hubei, Hunan, Ningxia, Inner Mongolia, Xinjiang, Shaanxi, Sichuan, and Heilongjiang Municipalities, Provinces and Autonomous Regions. Recently, the expansion has reached Anhui, Shanxi and Shandong Provinces.

4

The recent investment in Yuanjie Water was a part of our strategic growth plan in this segment. Founded in 2007, Yuanjie Water is a systems integrator specializing in water equipment sales and installation for high-rise building, and management and operation of water treatment facilities. With its headquarters and production based in Beijing, the company has a corporate advisory team composed of water industry experts from prestigious universities in China, the United States and Taiwan. Its main business includes water system integration services, and the manufacturing and maintenance of water treatment facilities. The company has six major product lines, including residential building secondary water supply products, drinking water treatment products, wastewater treatment and water recycle products, tanks, disinfectors and membrane treatment products. It has altogether more than 20 products and 10 patents. Yuanjie Water’s core technology includes integrated pressurized purification, and dissolved oxygen biochemical technology. Its products have obtained international certifications from quality control, environmental control and occupational health safety management institutes. It also has obtained China Compulsory Certificate and seven hygiene licenses for drinking water equipment and supplies. Yuanjie’s products are widely used in universities, hospitals, government buildings, hotels, shopping malls, office buildings and residences. They have also received a number of awards. Yuanjie is strategically focused on becoming an industry leader in water system integration, providing know-how, technology and service to customers.

We are building up our capacity to transform from a sub-contractor to a general contractor. We have grown from a provider of hardware and system integration to a full-service company capable of the engineering, procurement and construction of municipal wastewater and solid waste disposal facilities. As we continue to grow, we intend to expand through winning larger contracts and higher-level build-and-transfer projects.

In addition to the traditional engineering, procurement and construction business, we started to engage in the build-and-transfer business model, for instance, through our current project of the Ordos drinking water treatment plant. The build-and-transfer model is a contractual arrangement where the project proponent undertakes the financing and construction of a given facility and after its completion turns it over to a government agency or a local government department, which pays the proponent its total investment on the project plus a reasonable rate of return thereon on an agreed schedule. Under a build-and-transfer contract, a developer or project company provides the financing for the project and receives in turn a medium- to long-term municipal payment obligation, typically of two to three years in the case of our projects. As the Ordos project progresses, we are gaining experience in the build-and-transfer project process, which enables us to help cities create better environmental and financial strategies, to deliver value-added solutions to government agencies, and to better position ourselves in exploring further business opportunities under this business model.

In June 2011, we were awarded a contract for the expansion phase of the water treatment plant for the City of Ordos valued at approximately RMB 130 million ($20 million). The expansion project is a follow-up contract to the initial phase project ($40 million) we won in 2010. We are to provide services including design optimization, procurement, installation, pilot testing and commissioning, owner’s personnel training, operation and maintenance manual preparation, and other services as needed. The expansion phase of the project is scheduled for initial test runs no later than June 30, 2012.

Segment 2: Water Resources Management Systems and Engineering Services

In this segment, we are gradually transforming from a specialty solution provider to a full-service solution provider for larger scale river basin projects. The Chinese government’s decision to initiate new programs and allocate significant investment to these projects offers us significant business opportunities. We have been investing resources to developing water quantity and quality monitoring technologies and upgrading our proprietary products. To ensure our leading position in the water sector in China, we recently introduced state-of-the-art water quantity and quality monitoring instruments to our application development.

Segment 3: Industrial Pollution Control and Safety

In this segment, we are strengthening our industrial pollution services for the energy sector such as the oil and petrochemical industry. While we have previously implemented the air pollution control systems for the petrochemical industry, we believe that there are significant business opportunities, such as water and wastewater treatment and safety, in related industries. Through BSST, our subsidiary, we have set up a new business unit in the first quarter of 2011 to focus on the business of water and wastewater treatment specifically for the oil and petrochemical industry.

5

With the recent acquisition of J&Y, we are aggressively expanding our business reach into seawater desalination and industrial water treatment businesses overseas. J&Y contributes to us its cutting edge technologies, including desalination, zero liquid discharge technology, evaporators, reverse osmosis, filtration, and ion exchange, among other biological, physical and chemical methods.

Potential Acquisitions of Complementary Businesses

During the past quarter, we have been active in acquisitions and business investments. During the remaining quarters of 2011, we continue to look for acquisition targets to further our growth. The markets in which we operate are highly fragmented with small competitors. We are aiming for targets believed to add significant value to our business. These potential targets may have strong customer relations but limited market access, or may possess specialized technologies but their business size might not allow them to fully utilize their specialties. When evaluating potential acquisition targets, the management team uses a disciplined, conservative approach to ensure the acquisitions are strategic and beneficial to our business.

Competition

We operate in a highly competitive industry characterized by rapid technological development and evolving industrial standards. Given the stimulus initiatives in China, we expect the competition to intensify as more companies enter the market, notwithstanding relatively high barriers to entry in terms of technical expertise and financial investment.

We compete primarily on the basis of customer recognition and industry reputation, research and development strengths, comprehensive product offerings and a competitive pricing structure. The low cost we have been striving to achieve provides us with advantages in competing with international competitors. With local rivals, our superior technology ensures top quality services and repeat customers. Our established nationwide distribution and customer service network and our knowledge of local markets allow us an advantage over international competitors who typically appoint only one distributor in the China market responsible for selling and servicing their products. In addition, we provide a more comprehensive offering of products than most of our international or local competitors. In order to maintain and enhance our competitive advantage, we must continue to focus on competitive pricing, technological innovation, staying at the forefront of the market trends, as well as improving our proprietary manufacturing processes.

As a result of our leading position in the industry, we are actively participating in the drafting of industrial standards and guidelines with the state ministries of China. We have participated in drafting technical regulations for automatic hydrologic measurement and reporting systems promulgated by the Ministry of Water Resources, as well as technical guidelines of municipal sewage treatment plant operation, management and safety for the Ministry of Construction. In the first quarter of 2011, we were invited to participate in the Water Information Forum in Fujian Province held by the Disaster Reduction Committee of the China Hydraulic Engineering Society, where we presented our Yanyu mountain torrent monitoring and forecasting products and system platform.

Although we believe that our competitive strengths provide us with advantages over many of our competitors, some of the international competitors have stronger brand names, longer operating histories, more established relationships with their customers, more research and development capabilities and greater marketing budgets, among other resources. Most of our international competitors are substantially larger and have greater access to capital than we do. Some of the domestic competitors have broader customer bases, better access to government authorities and stronger industry-based background.

Principal Suppliers

Our suppliers vary from project to project. Often, they are specifically appointed by the clients. Most of the materials or equipment we purchase are not unique and are easily available in the market. The prices for those purchases, although increasing, are relatively consistent and predictable. A specific supplier might constitute a significant percentage of our total purchase at a certain time for a large contract. The dependence on a specific supplier usually ends when the project is completed. We do not rely on any single supplier in the long term.

6

Customers and Marketing

We operate on a project basis, which do not usually allow us to create a long term relationship with our customers. We negotiate with various government agencies, municipalities, industrial enterprises and/or their prime contractors in order to secure and undertake our various contracts. Our major customers usually account for a high percentage of our total sales. The top customer represented approximately 79.5% of the total revenues of the second quarter of 2011, while in the same period last year our top five customers represented 31% of the total revenue. Although we are dependent on our large clients to a certain degree, unlike other commercial businesses, the collectability for our accounts receivables are relatively secure due to the nature of our client bases, consisting predominantly of government agencies and large nation-owned enterprises.

Patents and Proprietary Rights

In the quarter ended June 30, 2011, we have obtained three new software copyrights in China. Currently, we have a total of 27 software copyrights, two product patents and two registered trademarks.

Government Regulation and Approvals

As described in greater detail above in the discussion of our business segments, government policies and initiatives in the various industries we serve have a considerable impact on our potential for growth. We generally undertake projects for government entities and enterprises and must complete the projects in accordance with the terms of the contracts in which we enter with those entities.

Employees

As of June 30, 2011, our total headcount was 302, of which 120 (40%) are in technical support and project management, 79 (26%) are in sales, 28 (9%) are in research and development, 25 (8%) are in finance, and 50 (17%) are in general and administrative functions. The increase of our headcount is mainly attributable to the project management department, which grew by 19, and in the sales department, which grew by 21. Total headcount increased by 63 compared to the end of March 31, 2011. Our teams are very stable compared to our peers.

Research and Development

We focus our research and development efforts on improving our development efficiency and the quality of our products and services. Currently, our research and development team consists of 28 experienced researchers, engineers, software developers and programmers, 9 headcount increase compared to 19 by the end of the first quarter 2011. In addition, some of the technical support team regularly participates in research and development programs. There are five major on-going software research and development projects and one hardware research and development project. The development phase projects are expected to be completed in the second half of 2011.

As our research and development base, Baoding focuses on technology development, software development, pilot testing, manufacturing and pre-installation/pre-assembly of our proprietary products. The Baoding research, development and production facility construction started officially in June 2011. Part I of phase one of the constructions is for the odor control system fabrication and automatic control box assembly workshop, which is scheduled to be completed towards the end of September 2011. The design for part II of the phase one construction, the main office building and the dormitory, has been submitted for government approval. Phase one is to be completed around May 2012. Phases two and three of the construction are scheduled to be completed by the end of 2013. The total capital budget is $18 million for phases one and two. For the quarter ended June 30, 2011, total spending on the Baoding construction project was approximately $115,894. The total spending on the project as of June 30, 2011 was $5.83 million inclusive of the consideration of $5.3 million for the land use right.

7

In addition to our current research and development projects, we are also pursuing cooperative opportunities with several industrial companies in the U.S. and Europe. The technologies we are pursuing include the membrane bioreactor technology, forward osmosis membrane technology, the latest ecological engineering for wastewater treatment and advanced solid-liquid separation technology.

We entered into a license agreement for the new forward osmosis technology with Hydration Technology Innovations, LLC (“HTI”) in 2010. We will construct and operate one or more forward osmosis pilot units incorporating the licensed technology. We are authorized and licensed to construct and operate such pilot units in both municipal and industrial sites for wastewater treatment testing, demonstration and evaluation. The HTI personal hydration products are at the development stage, and are undergoing design changes for localization.

Properties

Our primary office location is the 15th and 16th Floor of Tower B, Renji Plaza, 101 Jingshun Road, Chaoyang District, Beijing 100102 China. The total rental space for the two floors is 908 square meters for the 15th floor and 986 square meters for the 16th floor. The lease contract for this location is from September 1, 2010 to August 31, 2013. We also have a 1,300 square meter rental office in Tianjin, located at Huayuan Property Management Zone, 4th Floor, Kaide A Complex, 7 Rongyuan Road, Tianjin, with a rental term to expire in December 2014. In addition, we have three other rental office locations in various areas of Beijing, for which the lease contracts expire at various times no later than August 26th, 2012.

TTB entered into a land use right purchase agreement with a local government agency, Tianjin Land Resource Bureau Baodi Branch on November 26, 2010. The agreement was for the land use right of an area of 158,954 square meters in exchange for the consideration of RMB 35 million (US $5.3 million). The consideration has been fully paid as of December 31, 2010. The land is located at West Tianbao Road, Baodi Economic Development Zone in Tianjin. The land use right is for 50 years starting on January 18, 2011. The official land use right application process has been completed in June 2011 and land use right certificated obtained in July 2011. We have confirmed the transfer of the land use right and the acceptance letter was signed on January 18, 2011. Therefore, the amortization of the land use right over the expected duration of 50 years has started since January 2011 with RMB 180,338, or $27,740 per quarter. The first phase of the construction is in progress and expected to be completed by 2012.

Operating Performance Overview for the Three and Six Months Ended June 30, 2011 and 2010

Our operating revenues are primarily derived from system design and integration, hardware product design, manufacturing and sales, and software design and sales. The software sales have been combined into the system integration category. Our 2011 second quarter results reflected stable growth. Highlights of our financial results include:

|

|

·

|

Total revenue increased to $20,201,887 in the second quarter of 2011, an increase of $12,099,109, or 149.3%, from $8,102,778 in the same period 2010. This increase is primarily attributable to the following factors:

|

|

|

o

|

Systems integration revenue increased from $5,587,132 in the second quarter of 2010 to $19,883,553 in the same period in 2011, an increase of $14,296,421, or 255.9%.

|

|

|

o

|

Revenue from hardware products totaled $318,334 in the second quarter of 2011, a decrease of $1,609,426, or 83.5%, from $1,927,760 in the second quarter of 2010.

|

|

|

o

|

Work related to software products development was done as part of system integration projects. Therefore, it has been accounted for in the category of system integration revenue.

|

|

|

·

|

Total cost of revenue increased by $9,799,110 from $5,098,559 in the second quarter of 2010 to $14,897,669 in the second quarter of 2011, a 192.2% increase compared with the same period in 2010. This increase is attributable to the increase in system integration by 325.3%, and the decrease in hardware products by 83.3%.

|

|

|

·

|

Total operating expenses were $2,381,341 for the second quarter of 2011, or 11.8% of the total revenue, compared with $1,231,843, or 15.2% of the total revenue, in the same period of 2010. This represents an increase of $1,149,498, or 93.3%. The following factors contributed to the increase of total operating expenses:

|

8

|

|

o

|

Selling and marketing expenses increased by $172,058, or 57.3%, from $300,092 in the second quarter of 2010 to $472,150 in the same period for 2011. Such expenses represent 2.3% of the total revenue for the second quarter of 2011 and were primarily due to the growth of the sales force and the implementation of strategic growth plans and initiatives.

|

|

|

o

|

General and administrative expenses increased by $1,004,254, or 114.4%, from $878,178 in the second quarter of 2010 to $1,882,432 in the same period for 2011. The general and administrative expenses represent 9.3% and 10.8% of the total revenue in the second quarter of 2011 and 2010, respectively.

|

|

|

·

|

Operating income increased to $2,922,877 in the second quarter of 2011, by 64.9%, from $1,772,376 in the second quarter of 2010, representing 14.5% and 21.9% of the total revenue in the second quarter of 2011 and 2010, respectively.

|

|

|

·

|

Other income (expenses) decreased by $110,580, or 631.4%, from income of $17,513 in the second quarter of 2010 to expense of $93,067 in the second quarter of 2011.

|

|

|

·

|

Net income attributable to TRIT increased to $1,761,688, or $0.21 per diluted share, for the second quarter of 2011, from $1,421,587, or $0.19 per diluted share, for the second quarter of 2010.

|

Performance highlights for the six months ended June 30, 2011 and 2010 include:

|

|

·

|

Total revenue increased to $37,755,098 from $12,340,892, an increase of $25,414,206, or 205.9%.

|

|

|

·

|

Cost of revenue increased to $27,440,700 in the six-month period in 2011 from $7,569,797 for the same period last year, an increase of $19,870,903, or 262.5%.

|

|

|

·

|

Total operating expenses increased to $4,802,293 in the first six months of 2011 from $2,170,987 in the same period 2010, an increase of $2,631,306, or 121.2%. The most significant contributor to this increase is the general and administrative expenses. The increase was $2,329,472, or 143.8%, comparing the six-month periods in 2011 and 2010.

|

|

|

·

|

Operating income for the six months ended June 30 2011 was $5,512,105 or 14.6% of the total revenue. Compared to $2,600,108 for the same period in the prior year, it was an increase of $2,911,997, or 112%.

|

|

|

·

|

Net income attributable to TRIT was $3,460,669, or 9.2% of total revenue, an increase of $1,221,467, or 54.5%, from $2,239,202 for the same period last year.

|

9

Results of Operations

The following are the operating results for the three months ended June 30, 2011 and 2010:

|

Three Months

Ended June 30,

2011 ($)

|

% of

Sales

|

Three Months

Ended June 30,

2010 ($)

|

% of

Sales

|

Change

($)

|

%

Change

|

|||||||||||||||||||

|

Revenue

|

20,201,887 | 100.0 | % | 8,102,778 | 100.0 | % | 12,099,109 | 149.3 | % | |||||||||||||||

|

Cost of Revenues

|

14,897,669 | 73.7 | % | 5,098,559 | 62.9 | % | 9,799,110 | 192.2 | % | |||||||||||||||

|

Selling and Marketing Expenses

|

472,150 | 2.3 | % | 300,092 | 3.7 | % | 172,058 | 57.3 | % | |||||||||||||||

|

General and Administrative Expenses

|

1,882,432 | 9.3 | % | 878,178 | 10.8 | % | 1,004,254 | 114.4 | % | |||||||||||||||

|

Research and Development

|

26,759 | 0.1 | % | 53,573 | 0.7 | % | (26,814 | ) | (50.1 | )% | ||||||||||||||

|

Total Operating Expenses

|

2,381,341 | 11.8 | % | 1,231,843 | 15.2 | % | 1,149,498 | 93.3 | % | |||||||||||||||

|

Operating Income

|

2,922,877 | 14.5 | % | 1,772,376 | 21.9 | % | 1,150,501 | 64.9 | % | |||||||||||||||

|

Other Income (expenses)

|

(93,067 | ) | (0.5 | ) % | 17,513 | 0.2 | % | (110,580 | ) | (631.4 | )% | |||||||||||||

|

Income before Provision for Income Taxes

|

2,829,810 | 14.0 | % | 1,789,889 | 22.1 | % | 1,039,921 | 58.1 | % | |||||||||||||||

|

Provision for Income Taxes

|

439,423 | 2.2 | % | 351,647 | 4.3 | % | 87,776 | 25.0 | % | |||||||||||||||

|

Net Income

|

2,390,387 | 11.8 | % | 1,438,242 | 17.7 | % | 952,145 | 66.2 | % | |||||||||||||||

|

Less: Net Income Attributable to Noncontrolling Interests

|

628,699 | 3.1 | % | 16,655 | 0.2 | % | 612,044 | 3,674.8 | % | |||||||||||||||

|

Net Income Attributable to TRIT

|

1,761,688 | 8.7 | % | 1,421,587 | 17.5 | % | 340,101 | 23.9 | % | |||||||||||||||

The following are the operating results for the six months ended June 30, 2011 and 2010:

|

Six Months

Ended June

30, 2011 ($)

|

% of

Sales

|

Six Months

Ended June

30, 2010 ($)

|

% of

Sales

|

Change ($)

|

%

Change

|

|||||||||||||||||||

|

Revenue

|

37,755,098 | 100.0 | % | 12,340,892 | 100.0 | % | 25,414,206 | 205.9 | % | |||||||||||||||

|

Cost of Revenues

|

27,440,700 | 72.7 | % | 7,569,797 | 61.3 | % | 19,870,903 | 262.5 | % | |||||||||||||||

|

Selling and Marketing Expenses

|

786,323 | 2.1 | % | 438,232 | 3.6 | % | 348,091 | 79.4 | % | |||||||||||||||

|

General and Administrative Expenses

|

3,949,226 | 10.5 | % | 1,619,754 | 13.1 | % | 2,329,472 | 143.8 | % | |||||||||||||||

|

Research and Development

|

66,744 | 0.2 | % | 113,001 | 0.9 | % | (46,257 | ) | (40.9 | )% | ||||||||||||||

|

Total Operating Expenses

|

4,802,293 | 12.7 | % | 2,170,987 | 17.6 | % | 2,631,306 | 121.2 | % | |||||||||||||||

|

Operating Income

|

5,512,105 | 14.6 | % | 2,600,108 | 21.1 | % | 2,911,997 | 112.0 | % | |||||||||||||||

|

Other Income (expenses)

|

(97,134 | ) | (0.3 | )% | 77,694 | 0.6 | % | (174,828 | ) | (225.0 | )% | |||||||||||||

|

Income Before Provision for Income Taxes

|

5,414,971 | 14.3 | % | 2,677,802 | 21.7 | % | 2,737,169 | 102.2 | % | |||||||||||||||

|

Provision for Income Taxes

|

845,059 | 2.2 | % | 419,420 | 3.4 | % | 425,639 | 101.5 | % | |||||||||||||||

|

Net Income

|

4,569,912 | 12.1 | % | 2,258,382 | 18.3 | % | 2,311,530 | 102.4 | % | |||||||||||||||

|

Less: Net Income Attributable to Noncontrolling Interests

|

1,109,243 | 2.9 | % | 19,180 | 0.2 | % | 1,090,063 | 5,683.3 | % | |||||||||||||||

|

Net Income Attributable to TRIT

|

3,460,669 | 9.2 | % | 2,239,202 | 18.1 | % | 1,221,467 | 54.5 | % | |||||||||||||||

10

Our revenues are subject to value added tax (“VAT”), sales tax, urban maintenance and construction tax and additional education fees. Among the above taxes, VAT has already been deducted from the calculation of revenue.

Revenue

During the second quarter of 2011, we have announced numerous awards of large contracts including the expansion phase of the Ordos drinking water plant for $20 million. These projects have been launched and large percentage of the subsequent revenue will be recognized in the second half of the year. The software product related businesses are all conducted as part of the system integration. Therefore, they are accounted in the system integration category.

Our total revenue for the second quarter of 2011 was $20,201,887, an increase of $12,099,109, or 149.3%, compared with $8,102,778 in the second quarter of 2010. This increase is primarily attributable to an increase in the system integration category, from $5,587,132 in the second quarter of 2010 to $19,883,553 in the same period for 2011, or an increase of 255.9% as a result of the Ordos project progress. Revenue from Segment 1, water and wastewater treatment and municipal infrastructure, continued to be very strong, constituting 83% of the total revenue. Revenue from Segment 2, water resource management and engineering, totaled $2,314,470, or 11.5% of the total revenue, mostly in the system integration category. Revenue from Segment 3, industrial pollution control and safety, totaled $1,117,784, constituted 5.5% of the total revenue for the second quarter, also mostly in the system integration category.

For the six months ended June 30, 2011, total revenue has reached $37,755,098, among which 78.6%, or $29,674,019 was from Segment 1, 10.5%, or $3,955,529 was from Segment 2, and 10.9%, or $4,125,550, was from Segment 3. The system integration category constituted 94.7% of the total revenue, or $35,754,047. Hardware product sales revenue totaled $2,001,051, constituting the remaining 5.3%.

Cost of Revenue

Total cost of revenue was $14,897,669 for the second quarter of 2011, an increase of $9,799,110, or 192.2%, from $5,098,559 in the second quarter of 2010. The system integration category, which was the largest contributor to the revenue increase, was also the largest contributor to the increase in the cost of revenue, totaling $14,622,576. The cost of revenue increase in the system integration category was $11,184,531, or 325.3%, from $3,438,045 in the second quarter of 2010 to $14,622,576 in the second quarter of 2011. The increase is mainly a result of the Ordos build-and-transfer project, which was at 70% completion by the end of the second quarter. 25% of the Ordos project was completed in the second quarter of 2011 alone. The project design of phase two of the Ordos project has been completed in the second quarter, which constitutes 20% of the contract value for the expansion phase.

Total cost of revenue for the six months ended June 30, 2011 was $27,440,700, an increase of $19,870,903, or 262.5%, compared to $7,569,797 for the same period in 2010. The system integration category, totaling $26,273,325, had an increase of $20,684,065, or 370.1%, from $5,589,260. The cost of revenue for both hardware and software products had a slight decrease.

Cost of revenue is based on total actual costs incurred plus estimated costs to completion applied to percentage of completion as measured at different stages. It includes material costs, equipment costs, transportation costs, processing costs, packaging costs, quality inspection and control, outsourced construction service fees and other costs that directly relate to the execution of the services and delivery of projects. Cost of revenue also includes freight charges, purchasing and receiving costs and inspection costs when they are incurred. In the second quarter of 2011, depending on different projects, about 60-90% of the cost was due to equipment purchases. About 5% to 15% was due to outsourced construction services. The remainder was due to other costs directly associated with each specific project.

11

Our gross margin decreased from 37.1% in the second quarter of 2010 to 26.3% in the second quarter of 2011. The major reason is that most of the revenue for this quarter was for the Ordos project, which, given the scale of the project, has a relatively low gross margin. At the same time, we have been more conservative on the estimates of Ordos project costs. Higher accrued project costs also caused the lower gross margin. Normally, the larger the size of the project, the lower the gross margin will be. Our strategy is to carefully choose more higher-margin build-and-transfer projects, which means the gross margin will remain at the current level. However, in the next two to three years, we will continue to look for ways to minimize the negative impact on our gross margin through optimizing product and system design, leveraging purchasing bargaining power, and exploring supply chain financing and local equipment sourcing.

The gross margin for the six months ended June 30, 2011 and 2010 was 27.3% and 38.7%, respectively.

Selling and Marketing Expenses

Selling and marketing expenses consist primarily of compensation costs, marketing costs, travel expenses and business entertainment expenses. In the second quarter of 2011, total selling and marketing expenses increased by $172,058, or 57.3%, from $300,092 in the second quarter of 2010 to $472,150. This increase was caused by increases in compensation-related expenses of $73,579, or 69.8%, from $105,486 in the second quarter of 2010 to $179,065 for the same period this year, travel expenses of $27,466, or 65.3%, from $42,035 in the second quarter of 2010 to $69,501 for the same period this year, and other selling expenses of $46,750, or 58.7%, from $79,680 in the second quarter of 2010 to $126,430 for the same period this year. The entertainment expenses increased by $24,263, or 33.3%, from $72,891 in the second quarter of 2010 to $97,154 for the same period this year.

The selling and marketing expenses for the six months ended June 30, 2011 totaled $786,323, an increase of $348,091, or 79.4%, from $ 438,232 for the same period last year. This increase was mainly due to the increase of headcount for the sales team and rapid geographic expansion. Compensation-related costs increased from $146,135 for the six-month period ended June 30, 2010 to $294,890 for the same period this year, an increase of $148,755, or 101.8%. Travel expenses increased from $55,149 for the six-month period ended June 30, 2010 to $135,772 for the same period this year, an increase of $80,623, or 146.2%. Other selling expenses increase from $110,275 for the six-month period ended June 30, 2010 to $207,909 for the same period this year, an increase of $97,634, or 88.5%.

Selling and marketing expenses for the quarter and six months ended June 30, 2011 took up approximately 2% of the total revenue. We anticipate it to continue to increase in the second half of 2011.

General and Administrative Expenses

General and administrative expenses consist primarily of compensation costs, rental expenses, professional fees, and other overhead expenses. General and administrative expenses increased by $1,004,254, or 114.4%, from $878,178 in the second quarter of 2010 to $1,882,432 in the second quarter of 2011. Of this increase, $152,381 was for officers’ salaries, which increased from $28,034 in the second quarter of 2010 to $180,415 in the second quarter of 2011. Salaries for mid-level management, technical support team, and other office staff increased by $231,733, or 93.6%, from $247,667 in the second quarter of 2010 to $479,400 in the second quarter of 2011. Other headcount related expenses, such as endowment and social insurance, increased by 64.0% and 26.2%, respectively, to $54,701 and $48,098, in the second quarter of 2011, respectively. Rent increased by $104,887, or 146.8%, from $71,439 in the second quarter of 2010 to $176,326 in the second quarter of 2011 due to office relocation. Professional fees increased by $91,438, or 120.8%, from $75,713 to $167,151, which was mainly for audit services and investor conferences. Amortization of intangible assets and software increased by $104,798 from $20,013 to $124,811. This increase was due to the purchase of some major software and intangible assets in our acquired subsidiaries and the amortization of land use rights for about $9,247 per month. Other general and administrative expenses increased by $242,626, or 69.4%, from $349,700 to $592,326 in the second quarter of 2011. Those are mainly for office expenses, utilities, travel, communication and other services.

In the first half of the year, our administrative support, including human resources and finance functions, grew stronger. Many highly qualified professionals joined us to support the revenue growth. Total general and administrative expenses for the six months ended June 30, 2011 was $3,949,226, an increase of $2,329,472, or 143.8%, from $1,619,754 for the same period last year. Of this increase, $990,038 was for compensation-related costs. Other general and administrative overhead increased by $580,572 for the first half of 2011, or 85.5% compared to the same period last year.

12

General and administrative expenses for the three and six months ended June 30, 2011 took up approximately 10% of the total revenue. We anticipate it to continue to increase but at a lower rate in the second half of 2011.

Provision for Income Tax

We provide for deferred income taxes using the asset and liability method. Under this method, we recognize deferred income taxes for tax credits, net operating losses available for carry-forwards and significant temporary differences. We classify deferred tax assets and liabilities as current or non-current based upon the classification of the related asset or liability in the financial statements or the expected timing of their reversal if they do not relate to a specific asset or liability. We provide a valuation allowance to reduce the amount of deferred tax assets if it is considered more likely than not that some portion or all of the deferred tax assets will not be realized.

Our operations are subject to income and transaction taxes of the PRC since most of our business activities take place in China. Significant estimates and judgments are required in determining our provision for income taxes. Some of these estimates are based on interpretations of existing tax law or regulations, as well as predictions related to future changes in these law and regulations. The ultimate amount of tax liability may be uncertain as a result. We do not anticipate any events which could change these uncertainties.

We, including our subsidiaries and controlled companies, are subject to income taxes on an entity basis on income arising in or derived from the tax jurisdictions in which each entity is domiciled. According to the New Enterprise Income Tax Law in China, the unified enterprise income tax (“EIT”) rate is 25%. However, two of our subsidiaries are eligible for certain favorable tax policies for being high-tech companies.

|

EIT

|

||||||||

|

Three Months Ended June 30,

|

||||||||

|

2011

|

2010

|

|||||||

|

%

|

%

|

|||||||

|

TTB (effective until the end of 2011)

|

7.5 | 7.5 | ||||||

|

BSST

|

15 | 15 | ||||||

|

Yanyu

|

25 | 25 | ||||||

|

Tranhold

|

25 | 25 | ||||||

|

TTA

|

25 | — | ||||||

|

Baoding

|

25 | 25 | ||||||

|

Consolidated Effective EIT

|

16 | 20 | ||||||

The favorable income tax treatment for TTB at 7.5% is going to expire at the end of 2011. Afterwards, the EIT rate could be either 15% if TTB qualifies as a high-tech company or 25% if it does not so qualify. We believe that TTB will continue to qualify as a high-tech company. The provision for income tax for the second quarter of 2011 was $439,423.

The Company has not recorded tax provision for U.S. tax purposes as they have no assessable profits arising in or derived from the United States and intends to permanently reinvest accumulated earnings in the PRC operations.

Net Income before Income Taxes

In the quarter ended June 30, 2011, our net income before provision for income taxes was $2,829,810, an increase of $1,039,921, or 58.1%, compared to $1,789,889 in the same period in 2010. Our provision for income taxes increased by $87,776, from $351,647 in the second quarter of 2010 to $439,423 in the same period in 2011. The increase in income taxes was primarily driven by an increase in income from ordinary business operations. In the second quarter of 2011, net income attributable to the shareholders of TRIT was $1,761,688, an increase of $340,101, or 23.9%, from $1,421,587 for the same period in 2010.

13

For the six months ended June 30, 2011, our net income before provision for income taxes increased by 102.2%, or $2,737,169, from $2,677,802 for the same period last year to $5,414,971. The provision for income taxes increased at approximately the same rate, from $419,420 to $845,059. The net income attributable to the shareholders of TRIT was $3,460,669, an increase of $1,221,467, or 54.5%, from $2,239,202 for the same period in 2010.

Liquidity and Capital Resources

As highlighted in the consolidated statements of cash flows, our liquidity and available capital resources are impacted by four key components: (i) cash and cash equivalents, (ii) operating activities, (iii) financing activities, and (iv) investing activities.

Consolidated cash flows for the six months ended June 30, 2011 and 2010 were as follow:

|

Six Months Ended June 30,

|

Change

|

|||||||||||

|

2011 ($)

|

2010 ($)

|

($)

|

||||||||||

|

Net Cash Used in Operating Activities

|

(10,926,709 | ) | (6,602,555 | ) | (4,324,154 | ) | ||||||

|

Net Cash Used in Investing Activities

|

(2,373,937 | ) | (428,607 | ) | (1,945,330 | ) | ||||||

|

Net Cash Provided by Financing Activities

|

2,524,703 | 31,507,188 | (28,982,485 | ) | ||||||||

|

Effects of Exchange Rate Changes on Cash and Cash Equivalents

|

499,908 | (36,963 | ) | 536,871 | ||||||||

|

Net Increase (Decrease) in Cash and Cash Equivalents

|

(10,276,035 | ) | 24,439,063 | (34,715,098 | ) | |||||||

|

Cash and Cash Equivalents, Beginning of Period

|

23,394,995 | 7,171,464 | 16,223,531 | |||||||||

|

Cash and Cash Equivalents, End of Period

|

13,118,960 | 31,610,527 | (18,491,567 | ) | ||||||||

Cash and Cash Equivalents

On June 30, 2011, our cash and cash equivalents amounted to $13,118,960. The restricted cash as of June 30, 2011 and December 31, 2010 amounted to $2,289,600 and $1,505,617, respectively, which is not included in the total of cash and cash equivalents. The restricted cash consisted of deposits as collaterals for the issuance of letters of credit. Our subsidiaries that own these deposits do not have material cash obligations to any third parties. Therefore, the restriction does not impact our liquidity.

Operating Activities

Net cash used for operating activities was $10,926,709 for the six months ended June 30, 2011, compared with $6,602,555 in the same period 2010. An increase of $4,324,154 in operating cash outflow was mainly attributable to the lag between revenue recognition and cash collection for the build-and-transfer project in the first half of 2011. This increase is expected, since it is common that most of the cash collection happens in the second half of the year. $4.6 million has been received for the Ordos project initial phase, and it is the client’s intention to pay ahead of the contracted schedule to avoid additional financing charges. This will enhance the Company’s operating cash to a certain extent. As the Company focuses more on its newly adapted build-and-transfer business model, the Company is very likely to face a more critical cash position in the next two quarters. However, the Company is confident that as soon as it passes this rapid takeoff stage, and cash collection for the major projects begins to catch up, this particular tightness of cash will ease substantially.

Investing Activities

Net cash used for investing activities was $2,373,937 in the first half of 2011, compared to $428,607 in the same period of 2010, an increase of $1,945,330. The increase was due to the acquisition of J&Y and the construction in progress for the Baoding research and development center. For the second half of 2011, our investment strategy will remain to focus on capital expenditures for research and development facilities and for new technology and product development.

14

Financing Activities

The cash provided by financing activities was $2,524,703 in the six months ended June 3, 2011, compared to $31,507,188 in the same period of 2010. The large cash inflow last year was due to the second round of capital fund-raising.

Effect of Exchange Rate Changes on Cash and Cash Equivalents

Net cash gain due to currency exchange was $499,908 in the six months ended June 30, 2011, an amelioration of $536,871 compared to a loss of $36,963 in the same period of 2010.

Restricted Net Assets

Our ability to pay dividends is primarily dependent on receiving distributions of funds from our subsidiaries, which is restricted by certain regulatory requirements. Relevant Chinese statutory laws and regulations permit payments of dividends by our Chinese subsidiaries only out of their retained earnings, if any, as determined in accordance with PRC accounting standards and regulations. In addition, our PRC subsidiaries are required to set aside at least 10% of their after-tax profit after deducting any accumulated deficit based on PRC accounting standards each year to our general reserves until the accumulated amount of such reserves reach 50% of our registered capital. These reserves are not distributable as cash dividends. Our off-shore subsidiaries, TIS and TTII, do not have material cash obligations to third parties. Therefore, the dividend restriction does not impact the liquidity of the companies. There is no significant difference between accumulated profit calculated pursuant to PRC accounting standards and that pursuant to U.S. GAAP. As of June 30, 2011 and December 31, 2010, restricted retained earnings were $897,382, and restricted net assets were $3,856,293 and $3,579,295, respectively. Unrestricted retained earnings as of June 30, 2011 and December 31, 2010 were $16,024,293 and $12,563,624, respectively, which were the amounts available for distribution in the form of dividends or for reinvestment.

Working Capital and Cash Flow Management

As of June 30, 2011, our working capital was $15,214,616. Due to the increase in purchase orders, we have experienced tremendous pressure from a shortage in working capital. We received net proceeds from our follow-on offering of $30,251,442 in 2010, of which we have used $23,749,000, or 77.6%, on working capital, product research and development, acquisition and sales and marketing. The percentage allocation is shown below:

| Percentage of | ||||||||||||

|

Proposed

|

Actual Expenditures

|

Proposed Spent

|

||||||||||

|

Expenditure

|

through June 30,

|

through June 30,

|

||||||||||

|

Description of Use

|

Amount

|

2011

|

2011

|

|||||||||

|

Working Capital

|

$ | 18,973,000 | $ | 18,973,000 | 100.0 | % | ||||||

|

Mergers & Acquisitions

|

6,120,000 | 2,081,000 | 34.0 | % | ||||||||

|

New Product Development

|

3,366,000 | 654,000 | 19.4 | % | ||||||||

|

Sales & Marketing

|

2,142,000 | 2,041,000 | 95.3 | % | ||||||||

|

Total

|

$ | 30,601,000 | $ | 23,749,000 | 77.6 | % | ||||||

However, we may require additional cash to undertake larger projects or to complete strategic acquisitions in the future. In the event our current capital is insufficient to fund these and other business plans, we may take the following actions to meet such working capital needs:

|

|

·

|

We may look into the possibility of optimizing our funding structure by obtaining short- and/or long-term debt through commercial loans. We are actively exploring opportunities with other major Chinese banks, such as ICBC and CITIC Bank, and we expect to acquire additional lines of credit to enable us to gain more project opportunities in the future. Other financing instruments into which we are currently looking include supply chain financing, project financing, trust fund financing and capital leasing. As of the time of filing, we have been granted a line of credit loan in the amount of RMB 60 million ($9.32 million) from CITIC Bank. The agreement will be signed by both parties shortly.

|

15

|

|

·

|

We may improve our collection of accounts receivable. Most of our clients are central, provincial and local governments. We believe that our clients are in good financial positions. Therefore, good collectability from relatively high accounts receivables are expected. The accounts receivable collection should catch up with our rapid growth in the near future. Given the interest rates in the long-term contracts, it is possible that some clients might choose to pay the contract fees before the due date. As of the time of filing, $4.6 million has been received ahead of the contracted payment schedule.

|

Contractual Obligations and Commercial Commitments

Operating Leases

As of June 30, 2011, we had commitments under certain operating leases, which require annual minimum rental payments as follows:

|

For the Year Ending December 31,

|

Amount

|

|||

|

2011

|

$ | 342,846 | ||

|

2012

|

643,821 | |||

|

2013

|

452,268 | |||

|

2014

|

111,589 | |||

|

2015

|

– | |||

|

Thereafter

|

– | |||

|

Total

|

$ | 1,550,524 | ||

Our leased properties are principally located in Beijing and are used for administration and research and development purposes. The terms of these operating leases vary from one to five years. Pursuant to the lease terms, when the contracts expire, we have the right to extend them with new negotiated prices. The leases are renewable subject to negotiation. Rental expenses were $176,326 and $71,439 for the quarter ended June 30, 2011 and 2010, respectively.

Product Warranties

Our warranty policy generally is to replace parts at no additional charge if they become defective within one year after deployment. Historically, failure of product parts due to materials used or workmanship has not been significant. We have not incurred any material unexpected costs associated with servicing warranties. We continuously evaluate and estimate our potential warranty obligations, and record the related warranty obligation when the estimated amount becomes material at the time revenue is recorded.

Capital Expenditures

In the past, the capital expenditures were mainly for purchases of computers and other office equipment to support our daily business activities. Our capital expenditures will increase in the near term as our business continues to grow and as the construction of our research and development facilities in Tianjin progresses. The construction of the research and development center consists of three phases. Phase one is to be completed around May 2012. Phase two and three of the construction are planned to be completed by the end 2013. The total capital investment is expected to be $18.2 million.

Seasonality

Our operating revenues normally tend to fluctuate due to different project stages and U.S. GAAP requirements on revenue recognition. As the scope of our business extends to the civil construction activities, certain destructive weather conditions that tend to occur during the winter often impact the progress of our projects. Certain weather conditions, including severe winter storms, may result in temporary suspension of outdoor operations, which can significantly affect the operating results in the affected regions.

Usually, the operating results for the first quarter reflect the business slowdown for the holiday season in China, which usually lasts up to 15 days.

16

As the bidding season starts around March, more contracts start during the second quarter of the year. Revenue recognition criteria are mostly met in the second half of the year, when we typically show our best performances both in revenue and in cash flow.

Off-Balance Sheet Arrangements

We did not have any off-balance sheet arrangements for the quarter ended June 30, 2011 or 2010.

Taxation

According to an approval from the Beijing State Tax Bureau of Xicheng District, TTB received a preferential income tax rate of 7.5% from January 1, 2009 to December 31, 2011.

Pursuant to the new EIT Law and supplementary regulations, only high-tech companies that have been re-certified as such under the new criteria are granted the preferential enterprise income tax rate of 15%. BSST was certified as a high-tech enterprise under the new criteria in September 2010, and it is subject to a 15% income tax rate from January 1, 2010 to December 31, 2012. At that time, BSST will need to re-apply for certification or pay the 25% rate.

Business tax varies from 3% to 5% depending on the nature of the revenue, and VAT is at a rate of 17%. For revenues generated from those parts of our software solutions which are recognized by and registered with government authorities and meet government authorities’ requirements to be treated as software products, we are entitled to receive a refund of 14% on the total VAT paid at a rate of 17%. Revenues from software products other than the above are subject to full VAT at 17%. In addition, we are currently exempted from sales tax for revenues generated from development and transfer of tailor-made software solutions for clients. Further, revenues from consulting services are subject to a 5% sales tax. Qualified to issue VAT invoices, we need to maintain a certain amount of revenue that is taxable by VAT. As such, we may have to refuse some of the tax exemption benefits in our tailor-made software development and transfer business and pay VAT for those parts of the revenue in order to maintain minimum VAT revenue thresholds. This practice may cease to apply if more of the software products become recognized and registered as software products in the PRC.

Segment Information

We have three reportable operating segments. The segments are grouped with reference to the types of services provided and the types of clients that use those services. Total sales and costs are divided among these three segments. We assess each segment’s performance based on net revenue and gross profit on contribution margin.

Segment 1: Water, Wastewater Treatment and Municipal Infrastructure

The following are the operating results for the three months ended June 30, 2011 and 2010 for Segment 1:

|

Three Months Ended June 30,

|

||||||||||||||||

|

2011 ($)

|

2010 ($)

|

Change ($)

|

Change (%)

|

|||||||||||||

|

Revenues

|

16,769,633 | 4,252,524 | 12,517,109 | 294.3 | % | |||||||||||

|

Cost of Revenues

|

12,589,753 | 2,495,414 | 10,094,339 | 404.5 | % | |||||||||||

|

Operating Expenses:

|

||||||||||||||||

|

Selling and Marketing Expenses

|

143,878 | 121,573 | 22,305 | 18.3 | % | |||||||||||

|

General and Administrative Expenses

|

1,196,760 | 446,986 | 749,774 | 167.7 | % | |||||||||||

|

Research and Development

|

7,936 | 53,573 | (45,637 | ) | (85.2 | )% | ||||||||||

|

Total Operating Expenses

|

1,348,574 | 622,132 | 726,442 | 116.8 | % | |||||||||||

|

Other (Expenses) Income, Net

|

(34,363 | ) | 13,531 | (47,894 | ) | (354.0 | )% | |||||||||

|

Income before Provision for Income Taxes

|

2,796,943 | 1,148,509 | 1,648,434 | 143.5 | % | |||||||||||

17