Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Tri-Tech Holding, Inc. | Financial_Report.xls |

| EX-31.1 - EXHIBIT 31.1 - Tri-Tech Holding, Inc. | v312201_ex31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - Tri-Tech Holding, Inc. | v312201_ex32-1.htm |

| EX-21.1 - EXHIBIT 21.1 - Tri-Tech Holding, Inc. | v312201_ex21-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Tri-Tech Holding, Inc. | v312201_ex31-2.htm |

| EX-32.2 - EXHIBIT 32.2 - Tri-Tech Holding, Inc. | v312201_ex32-2.htm |

U. S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

| x | Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended March 31, 2012

| ¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from ___________ to ___________.

Commission File Number 001-34427

Tri-Tech Holding Inc.

(Exact name of registrant as specified in its charter)

| Cayman Islands | Not Applicable | |

| (State or other jurisdiction of | (I.R.S. employer | |

| incorporation or organization) | identification number) |

16th Floor of Tower B, Renji Plaza

101 Jingshun Road, Chaoyang District

Beijing 100102 China

(Address of principal executive offices and zip code)

+86 (10) 5732-3666

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer (Do not check if a smaller reporting company) | ¨ | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ¨

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

The Company is authorized to issue 30,000,000 ordinary shares, $0.001 par value per share. As of May 14, the Company has 8,212,406 ordinary shares outstanding, excluding 21,100 treasury shares.

TRI-TECH HOLDING INC.

FORM 10-Q

INDEX

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | ii | ||

| PART I. | FINANCIAL INFORMATION | I-1 | |

| Item 1. | Financial Statements | I-1 | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | I-1 | |

| Item 3. | Quantitative and Qualitative Disclosures about Market Risk | I-17 | |

| Item 4. | Controls and Procedures | I-17 | |

| PART II. | OTHER INFORMATION | II-1 | |

| Item 1. | Legal Proceedings | II-1 | |

| Item 1A. | Risk Factors | II-1 | |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | II-1 | |

| Item 3. | Defaults Upon Senior Securities | II-1 | |

| Item 4. | Mine Safety Disclosures. | II-1 | |

| Item 5. | Other Information | II-1 | |

| Item 6. | Exhibits | II-1 | |

| FINANCIAL STATEMENTS | F-1 | ||

| i |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This document contains certain statements of a forward-looking nature. Such forward-looking statements, including but not limited to projected growth, trends and strategies, future operating and financial results, financial expectations and current business indicators are based upon current information and expectations and are subject to change based on factors beyond the control of the Company. Forward-looking statements typically are identified by the use of terms such as “look,” “may,” “should,” “might,” “believe,” “plan,” “expect,” “anticipate,” “estimate” and similar words, although some forward-looking statements are expressed differently. The accuracy of such statements may be impacted by a number of business risks and uncertainties that could cause actual results to differ materially from those projected or anticipated, including but not limited to the following:

| • | the timing of the development of future products; |

| • | projections of revenue, earnings, capital structure and other financial items; |

| • | statements of the Company’s plans and objectives; |

| • | statements regarding the capabilities of its business operations; |

| • | statements of expected future economic performance; |

| • | statements regarding competition in its market; and |

| • | assumptions underlying statements regarding the Company or its business. |

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to update this forward-looking information. Nonetheless, the Company reserves the right to make such updates from time to time by press release, periodic report or other method of public disclosure without the need for specific reference to this Report. No such update shall be deemed to indicate that other statements not addressed by such update remain correct or create an obligation to provide any other updates.

| ii |

PART I. FINANCIAL INFORMATION

| Item 1. | Financial Statements |

See the financial statements following the signature page of this report, which are incorporated herein by reference.

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion contains, in addition to historical information, forward-looking statements that involve risks and uncertainties. The actual results could differ materially from those described herein.

Company Overview

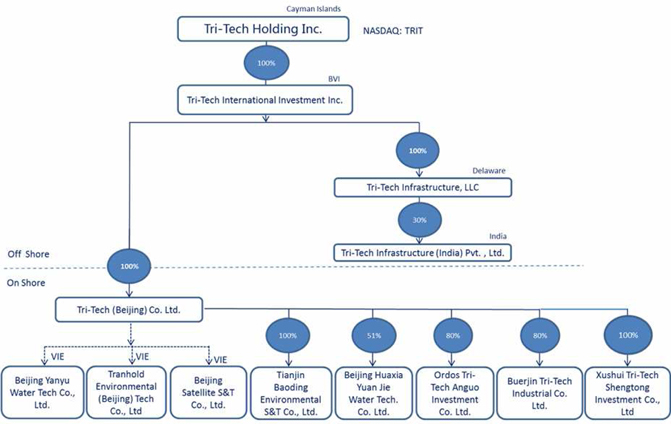

Tri-Tech Holding Inc. (the “Company” or “we”) is a leading provider of integrated solutions, products and technologies to water resource management and environmental protection industries. The Company has successfully implemented projects in both Chinese and overseas markets such as India, the Middle East and North America.

The Company aims to provide tailored solutions to complex environmental challenges faced by both public and private sectors in China and beyond. Its clientele consists of a combination of government agencies, municipalities, and industrial entities located in China, India, the Middle East and North America. To maintain a leading position in its domestic market, the Company’s strategy is to reinforce customer recognition and to offer diversified proprietary products to exceed the expectations of its expanding client base. For its domestic market, the Company incorporated a new wholly-owned subsidiary, Xushui Tri-Tech Sheng Tong Investment Co., Ltd (“Xushui”) in Hebei Province on March 8, 2012. Internationally, the Company continues to further its geographic reach in India, the Middle East and North America in the wastewater treatment and water processing industries.

The Company’s principal executive offices are located at the 16th Floor of Tower B, Renji Plaza, 101 Jingshun Road, Chaoyang District, Beijing 100102 China. The telephone number at this address is +86 (10) 5732-3666. Its ordinary shares are traded on the NASDAQ Capital Market under the symbol “TRIT.”

The Company’s website, www.tri-tech.cn, provides a variety of information. Its annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K filed with the United States Securities and Exchange Commission (the “SEC”) are available, as soon as practicable after filing, under the investor relations tab on its website, or by a direct link to its filings on the SEC’s website.

Principal Products, Services and Their Markets

The Company operates in three segments: (i) Water, Wastewater Treatment and Municipal Infrastructure, (ii) Water Resource Management System and Engineering Services, and (iii) Industrial Pollution Control and Safety. Through its subsidiaries, VIE affiliates and joint venture partnership, the Company provides proprietary and third-party products, integrated systems and other services for the purposes of water resource monitoring, development, utilization and protection. The Company designs water works and customized facilities for reclaiming and reusing water, sewage treatment and solid waste disposal for China’s municipalities. These systems combine process equipment, software, controls and instruments, information management systems, resource planning and local and distant networking hardware that includes sensors, control systems, programmable logic controllers, and supervisory control and data acquisition systems. The Company designs systems that track natural waterway levels for drought control, monitor groundwater quality and manage water resources. It also provides systems for volatile organic compound (“VOC”) abatement, odor control, water and wastewater treatment, water recycling facilities design, project engineering, procurement and construction for petroleum refineries, petrochemical and power plants as well as safe and clean production technologies for oil and gas field exploration and pipelines. With the acquisitions of J&Y and Yuanjie Water, the Company expanded its product lines by adding thermal seawater desalination systems, zero liquid discharge (“ZLD”) systems, and secondary water supply systems targeting high-rise buildings.

Core Technologies and Solutions

ZLD Solution for Industrial Wastewater Treatment. The ZLD systems provide an optimal solution for wastewater treatment as no liquid pollutants are discharged into environment and water is completely recycled. Solid by-products can be produced by treating wastewater with liquid evaporation concentration (mechanical vapor compression- horizontal spraying film evaporator) and crystallization (forced circulation crystallization system), which are key components of the ZLD solution. The Company can tailor ZLD solutions to its customers’ individual needs and requirements, and ensure reliability of technology and stability of system operation. Besides desalination, the technologies can also be used to treat high-concentration wastewater such as landfill leachate and high-salinity wastewater. The industries and companies served by the technologies include oil and gas exploration companies, petrochemical refineries and fertilizer plants, coal-fired and thermal power plants, pulp and paper mills, municipal water treatment facilities, and pharmaceutical and food-processing companies.

| I-1 |

Seawater Desalination Solution. There is a growing market for the business of seawater desalination due to fresh water resource shortage. The Company is capable of providing tailored seawater desalination solutions for different types of customers. These solutions include the thermal seawater desalination technology featuring low temperature multi-effect evaporation and multi-flash evaporation, typically for projects with easy access to low-cost heat source such as superheated vapor and hot liquid, and the membrane seawater desalination technology for projects with easy access to cheap electrical power. The Company also specializes in small skid-mounted seawater desalination units such as the mechanical vapor compression-spraying film evaporator.

VOC Treatment. In the industrial production process, some plants produce large volumes of volatile organic gases that are hazardous to the environment if discharged untreated. The Company’s thermal oxidation technology thoroughly treats these toxic, harmful and non-recyclable organic waste gases. The Company developed different thermal oxidation technologies such as regenerative thermal oxidizer (“RTO”), thermal oxidizer (“TO”), regenerative catalytic oxidizer (“RCO”) and catalytic oxidizer (“CO”) based on specific parameters for different waste gases.

Forward Osmosis Technology. The forward osmosis technology can turn muddy contaminated water into pure and potable water. It can also be used to treat industrial wastewater which contains toxic wastes that are not readily degradable. The Company’s products do not have the clogging or fouling problems seen in the reverse osmosis technology.

Flash Flood Disaster Warning Information Dissemination System. The disaster warning information dissemination platform is a part of the flash flood monitoring and warning system. As the center of information distribution, it is the most important part of the integrated system. The platform accurately and timely transmits disaster warning information to areas threatened by flash flood through early warning programs and channels which receive instructions from county-level flood control offices, allowing them to take necessary precautionary measures to minimize casualties and property losses. The platform can be used to receive feedback from early warning stations to monitor the effectiveness of information dissemination.

Business Segments

The Company’s business segments are grouped according to the types of services provided and the types of clients served. The total sales and costs are accordingly divided into three segments. The Company assesses each segment’s performance based on net revenue and gross profit on contribution margin. More detailed descriptions of the three reportable operating segments follow:

Segment 1: Water, Wastewater Treatment and Municipal Infrastructure

This segment focuses on municipal water supply and distribution, wastewater treatment and gray water recycling, through the procurement and construction of proprietary build-transfer processing equipment and processing control systems. The Company also provides municipal facilities engineering and operation management services for related infrastructure construction projects. This segment has historically provided the majority of its contract revenues. Representative projects in the China market include the expansion phase of the water treatment plant for the City of Ordos valued at approximately $20 million, which started in June 2011 and is expected to be completed by June 30, 2012, and the recycled water quality upgrade project for Tianjin Airport Economic Zone with a total contract value of $1.46 million, which started in June 2011 and is expected to be operational by July 2012. Representative international projects include three Indian engineering-procurement-construction (“EPC”) contracts for sewage collection and treatment plants in three municipalities with a total contract value of $39 million, which started in November 2011 and are expected to be completed by the end of 2013.

Segment 2: Water Resource Management System and Engineering Service

This segment involves projects relating to water resource management, flood control and forecasting, irrigation systems, and similar ventures through system integration of proprietary and third-party hardware and software products. For government agencies, the Company designs systems that track natural waterway levels for drought control, monitor groundwater quality, and generally manage water resources. Representative projects include flash flood early warning and hydrologic monitoring projects for multiple counties of Hubei, Liaoning, Fujian, Hunan, Henan and Hebei provinces, with a total contract value of $7.92 million, which commenced in the first quarter of 2012 and is expected to be completed at different points in time from June to September, 2012.

| I-2 |

Segment 3: Industrial Pollution Control and Safety

This segment focuses on industrial wastewater treatment for industrial safety and emergency response in the petroleum and power industries using a variety of technologies such as ZLD, seawater desalination, and air pollution and odor control. Projects in this segment include traditional engineering, procurement and construction of equipment and modules, and operation and maintenance of wastewater treatment plant. For petroleum refineries, petrochemical factories and power plants, the Company provides systematic solutions for volatile organic compound abatement, odor control, water and wastewater treatment, and water recycling. The Company also provides safe and clean production technologies for oil and gas field exploration and pipeline transportation. Representative projects include the Dawangdian Industrial Park wastewater plant and pipeline project in Xushui County of Hebei Province, with a total contract value of $7.9 million, which is expected to be delivered by November 2012; the seawater desalination project for the Utility Plant of Qatar Petrochemical Co. Ltd. in Qatar, with a contract value of $8.3 million, which started in December 2011 and is expected to be delivered by November 2012; the Wuhan natural gas distribution network control system project, with a contract value of $1.5 million, which began in January 2012 and is expected to be completed by May 2013; and the water processing unit project for a steel plant in Mexico to be completed and delivered by early April 2013.

Revenues by Segment

In the three months ended March 31, 2012, our total revenues were $19.2 million, including $8.4 million from Segment 1, $6.2 million from Segment 2, and $4.6 million from Segment 3. The table below shows the performance of each business segment for the first quarter of 2012. Segment 1 contributed 43.7% of the total revenues; Segment 2 contributed 32.5%; and Segment 3 contributed the remaining 23.8%.

| Three Months Ended March 31, 2012 | ||||||||||||||||||||||||||||||||

| Segment 1 | % | Segment 2 | % | Segment 3 | % | Total | % | |||||||||||||||||||||||||

| System Integration | $ | 8,406,973 | 100.0 | % | $ | 5,953,277 | 95.2 | % | $ | 4,172,412 | 91.5 | % | $ | 18,532,662 | 96.4 | % | ||||||||||||||||

| Hardware Products | $ | — | — | % | $ | 301,313 | 4.8 | % | $ | 387,337 | 8.5 | % | $ | 688,650 | 3.6 | % | ||||||||||||||||

| Software Products | $ | — | — | % | $ | — | — | % | $ | — | — | % | $ | — | — | % | ||||||||||||||||

| Total Revenues | $ | 8,406,973 | 43.7 | % | $ | 6,254,590 | 32.5 | % | $ | 4,559,749 | 23.8 | % | $ | 19,221,312 | 100 | % | ||||||||||||||||

Backlog and Pipeline for 2012

The Company’s backlog represents the amount of contract work remaining to be completed, that is, revenues from existing contracts and work in progress expected to be recorded in 2012 and onwards, based on the assumption that these projects will be completed on time according to the project schedules. As of March 31, 2012, the Company had a total backlog of $86.7 million, including $49.3 million in Segment 1, $14.2 million in Segment 2 and $23.2 million in Segment 3.

As of March 31, 2012, we expected potential projects in the pipeline with a total contract value of $150.2 million, of which approximately $80.2 million is in Segment 1, $11.1 million in Segment 2, and $58.9 million in Segment 3.

With a strong backlog, the Company anticipates that its revenues will reach a range between $103 million and $128 million, and its net income between $9.7 million and $12.1 million, in 2012.

Macro-Economic Factors and Business Trends

China’s gross domestic product (“GDP”) maintained moderate but steady growth in the first quarter of 2012. According to the China State Bureau of Statistics, China’s GDP for the three months ended March 31, 2012 reached RMB 10.8 trillion (or $1.7 trillion), an increase of 8.1% over the same period in 2011 and an increase of 1.8% over the fourth quarter in 2011. Even though the growth rate continued to slow, the economy is still growing and the growth rate of the first quarter of 2012 did exceed the GDP target of 7.5% the Chinese government previously set for 2012.

In addition, industrial production growth (“IPG”) and fixed asset investment (“FAI”) in China remained robust during the first three months of 2012. IPG rate was 11.6% for the three months ended March 31, 2012. The paid-in FAI for the same period totaled RMB 4.8 trillion (or $759.8 billion), an increase of 20.9% over the same period in 2011. In particular, FAI in infrastructure involving the production and distribution of electricity, gas and water reached RMB 211.9 billion (or $33.6 billion), an increase of 18.4%, and FAI in other infrastructure reached RMB 671.9 billion (or $106.7 billion), a decrease of 2.1%. By region, FAI for East China, Central China and West China were 18.9%, 27.1% and 26.9%, respectively, for the first quarter in 2012. The total budget for 61,778 new projects was RMB 3.6 trillion (or $576.8 billion), an increase of 23% over the same period in 2011.

The government gradually focuses on the quality improvement of economic growth and the adaptation to a sustainable economic development. According to the National Bureau of Statistics, the overall Chinese economy will stay healthy and maintain a moderate momentum during the upcoming quarters. The economic sentiment indicators and other leading indicators in March showed the Chinese economy is firming up, and March was a turning point which saw new issuance of loans and the rebound of production activities. The investment in new projects in Central and West China is likely to maintain a rapid increase in 2012.

The China’s water industry will continue to be impacted by the government’s monetary and fiscal policies. As local governments continue to exercise fiscal restraint, funding from the central government and demand from the private sector will be the main driving force behind the growth of water infrastructure construction. As China continues to focus on environmental protection, demands for better products and services increase and opportunities abound for the water industry.

| I-3 |

We believe our business is well positioned to meet and capture the market demand driven by government’s environmental protection policies, and we are likely to continue our stable growth during the remaining quarters of 2012 and beyond.

New Business Opportunities

Segment 1: Water, Wastewater Treatment and Municipal Infrastructure

According to the 12th Five Year Plan for Environmental Protection, the infrastructure investment in environmental protection will be RMB3.4 trillion during the plan period. The central government will continue to increase spending in the treatment of urban wastewater and solid waste according to the Draft Plan of 2012 National Economy and Social Development submitted by the National Development and Reform Commission to the National People’s Congress in early March, 2012. The central government will budget RMB14.5 billion in 2012, an increase of 230% over RMB4.39 billion in 2011, to fund sewage and solid waste treatment infrastructure and sewage pipeline construction for counties and townships. The pollution-free treatment rates for urban sewage and solid waste will increase to 83% and 79%, respectively, by the end of 2012.

Recently, the Ministry of Environmental Protection proposed a series of technical specifications to retrofit and upgrade wastewater treatment plants, as a result of which the minimum wastewater treatment rate needs to be 75%, forcing all existing wastewater treatment plants to upgrade. These regulations will be officially issued after a period of public opinion solicitation. According to the 12th Five Year Plan, the daily treatment capacity of wastewater treatment plants will need to be 50 million tons after the upgrade by the end of 2015. In addition, the new National Sanitary Standards for Drinking Water will begin to be imposed on all drinking water facilities starting July 1, 2012, which demands that all drinking water must meet 106 points of specifications.

We believe these regulations impose standards higher than the existing capacity of many wastewater treatment plants and waste processing plants, which will need equipment and technology upgrades to satisfy the new regulations. The gap between the increasing demands of the regulations and the plants’ existing capacity and capability gives us tremendous opportunities during the 12th Five Year Plan period in the wastewater treatment and water processing segment.

Segment 2: Water Resources Management Systems and Engineering Services

In March 2012, seven ministries of the Chinese central government jointly issued a Proposal on Further Financial Services to China’s Water Conservancy Development (the “Proposal”). According to the Proposal, multiple funding channels, including government financial aid, bank credit, capital markets and private capital, will be available to water conservancy projects. The Proposal demonstrates the government’s initiative in implementing the Circular 1 on Water Conservancy promulgated last year. With the multiple funding channels, the number of water conservancy construction projects in the next several years will probably be higher than previously expected.

Following the Proposal, the Ministry of Water Resources recently released a notice to push forward water conservancy construction projects nationwide. We believe this will accelerate the launching speed of projects. According to Circular 1 issued in 2011, RMB4 trillion will be spent in the next 10 years, as the policy specifies.

The government has expedited the review and approval process for water conservancy projects. The budget from the central government for water conservancy projects is RMB68.3 billion in 2012, an increase of 87% over 2011. The NDRC has approved 46 key projects in 2011 with a total value of RMB184.2 billion, an increase of 175% year-over-year. The construction of these projects has commenced in 2012.

With continued government policy support and fund allocation to water conservancy demonstrate, we believe China’s water conservation industry will witness a boom in 2012. As a leading solution provider in the industry, we are seeing unprecedented growth in this segment of our business.

Segment 3: Industrial Pollution Control and Safety

During the 12th Five Year Plan period, $536 billion is projected to be invested in environmental protection, of which $69 billion will be invested in industrial wastewater treatment. According to the Five Year Plan, the Chinese government is surveying the implementation of the ZLD standard for industrial wastewater treatment and expects to issue policies to encourage compliance with the ZLD standard. In anticipation of such policies, we see tremendous potential for industrial pollution treatment in the coal chemical industry. Chinese government has set the goal of oil self-sufficiency at 80% by 2030, for which more efficient coal consumption and reduced reliance on oil will be important component parts. The projected fast growth of the coal chemical industry will intensify the demand for ZLD and drive the wastewater treatment industry, particularly in North and Northwest China. In addition, we also see opportunities of ZLD application to industrial wastewater treatment in oversea markets such as Mexico and Canada.

| I-4 |

According to government statistics, the daily capacity of seawater desalination is growing at a rate between 10% to 30% per annum. Presently, the annual sales of seawater desalination units have amounted to billions of dollars. The Middle East holds 50% of the world capacity with daily output of 11 million cubic meters of fresh water. The Middle East and the U.S. are the regions where desalination enjoys the fastest growth. The Company expects to play a role in this potentially vast market by leveraging its existing technologies in industrial water treatment. The Company is continuing to expand its business reach in seawater desalination and industrial water treatment businesses in several overseas markets.

Strategies for Growth

Segment 1: Water, Wastewater Treatment and Municipal Infrastructure

We continue to expand our geographic reach beyond China and into other overseas regions including North America, South Asia and the Middle East. We also expect our diversification into multiple type of customers, partnerships with large multinationals and contract with favorable terms, which we believe will be a primary source of growth in revenues over the next several years.

We have evolved from simply providing construction services for wastewater plants to being capable of implementing complete municipal wastewater treatment facility systems such as treatment plants, wastewater piping and pump stations. The extended capability will further ensure our competitive edge in the market.

Following the successful bid for municipal sewage system projects in India, and as the projects implementation progresses, we have been strategically focusing on the municipal wastewater treatment market and are pursuing broader business initiatives in municipal water supply, municipal solid waste disposal, and industrial water and wastewater treatment. We believe there are ample opportunities to generate substantial revenues from this region over the next three to five years.

We are also leveraging our technology such as high-rising building water system for use in residential communities, hotels, and office buildings which are in need of water purification and treatment systems. These types of modular water treatment systems are in high demand throughout the PRC, India and the Middle East.

Segment 2: Water Resources Management Systems and Engineering Services

In this segment, we are gradually transforming into a full-service solution provider for large-scale river basin projects. Based on the general direction of water conservancy in China, the PRC government’s decision to initiate new programs and to allocate significant investment to water resource management systems particularly to the flash flood monitoring and forecasting program presents us with significant business opportunities in the next several years.

With a good track record for winning projects during 2011, we continued our strong momentum and recorded a dramatic growth rate in the first quarter of 2012. The total contract value for this segment we secured in the first quarter exceeded that awarded in all quarters of 2011 combined. We expect to stay competitive in this segment and continue our growth of market share and increased backlog in the upcoming quarters in the PRC as we actively seek to participate in new project bids.

In addition, we are actively implementing a market survey and valuation as several national programs, including National Drought and Flood Control Command System Phase II, National Small River Hydrologic Monitoring and Forecasting Project and National Water Resources Monitoring Capability Project, are about to be launched, and we intend to participate in these projects.

At the same time, we continue to invest resources to the development of water quantity- and quality-monitoring technologies and to upgrade our proprietary products. We also actively develop partnerships with manufacturers of hydrological instruments and sensors, in preparation of our water resource monitoring network projects.

Segment 3: Industrial Pollution Control and Safety

We expect significant market opportunity for industrial wastewater treatment in industrial parks as these parks promote the low carbon footprint concepts and comply with regulatory pollution control standards.

We recently secured a build-transfer contract for the construction of a wastewater treatment plant and a wastewater pipeline network in Dawangdian Industrial Park in Xushui County, Hebei Province. The aggregate budget of the projects is approximately $7.9 million. We will participate in civil construction, equipment procurement, installation, treatment process calibration, operator training and trial operation for the plant and wastewater pipelines. The projects are scheduled to be completed by November 2012.

| I-5 |

We are also strengthening our industrial pollution services for the energy sector including the oil and petrochemical companies.

We continue to expand our business in safety controls in the fields of oil and natural gas production. Through BSST, one of our affiliates, we recently secured a $1.5 million strategic collaboration agreement with Wuhan Natural Gas High-Pressure Pipeline Co. (“NGHP”). The agreement outlines a framework for an automated control system for natural gas plants, terminal stations and distribution pipelines in the city of Wuhan, Hubei Province. All projects and services stated in the agreement are expected to be completed by May 2013. This also marks BSST’s successful move into the urban natural gas distribution infrastructure market.

The need for desalinated water for energy-producing facilities along the coast of China and throughout Asia represents a large and potentially lucrative market for our technologies. Our J&Y Water Division, serving as a business development platform and technical support source to domestic and overseas projects, ensures the technical feasibility of our global operations. J&Y Water Division also allows us to leverage our technologies such as ZLD and thermal technologies for seawater desalination to explore the Indian, Middle Eastern and North American markets.

We were recently awarded a contract from a Mexican water company to provide a ZLD solution for a Mexican steel plant. The successful bid perfectly fits our strategy of business development in overseas markets as we actively market our technologies such as ZLD for industrial wastewater treatment and seawater desalination.

Funding for Continuous Growth

Funding is critical to maintaining our growth momentum, especially as we explore potential projects using the build-transfer business model. We are actively working with local Chinese banks for possible financial support. In addition to the credit line we renewed with Bank of Hangzhou totaling $12.7 million, we continue to work with other major Chinese banks to secure more lines of credit as we need to finance more project opportunities in the future. In September 2011, we secured a credit line of $9.6 million from CITIC Bank. We secured a credit line of $6.4 million from ICBC Bank in February 2012, which is currently used to fund our operations. The credit lines provide us the liquidity to expand and grow our operations in a non-dilutive manner, to increase our financial flexibility and to optimize the efficiency of our capital structure. We also explore other project financing approaches to dovetail our build-transfer business model.

Competition

We operate in a highly competitive industry characterized by rapid technological development and evolving industrial standards. Given the stimulus initiatives in China, we expect the competition to intensify as more companies enter the market, notwithstanding relatively high barriers to entry in the form of the need for technical expertise and funding.

We compete primarily on the basis of customer recognition, industry reputation, product innovation and a competitive pricing structure. Through mergers and acquisitions, we are able to offer advanced technologies at an attractive price when competing with domestic and international rivals. Due to our nationwide distribution and customer service network and knowledge of the local market, we enjoy an advantage in China over international competitors who typically appoint only one distributor in the Chinese market responsible for selling and servicing their products. In addition, we provide a more comprehensive set of products than most of our international or local competitors. If competition in the industry increases, we could see these advantages decrease or disappear. In order to maintain and enhance our competitive advantage, we must continue to focus on competitive pricing, technological innovation, our leading position in terms of the market trends, as well as the improvement of our proprietary products.

Through Yanyu, one of our VIEs, we were recognized as an AAA-level manufacturer and vendor by the China Water Engineering Association in 2011. The recognition helps us gain reputation and visibility in the marketplace and may make us eligible to compete for projects in locations that have different access thresholds for contract bidders. Presently, only three entities in China have received such recognition.

Although we believe our competitive strengths provide us with advantages over many of our competitors, some of our international competitors have better brand recognition, longer operating histories, longer or more established relationships with their customers, stronger research and development capabilities and greater marketing budgets and other resources. Most of our international competitors are substantially larger and have greater access to capital than we do. Some of our domestic competitors have stronger customer bases, better access to government authorities and stronger industry-based background. In areas such as the ZLD solution and seawater desalination, we anticipate we will face fierce competition from multi-national competitors.

Principal Suppliers

Our suppliers vary from project to project. Often, they are specifically appointed by the clients. Most of the materials or equipment we purchase are not unique and are easily available in the market. The prices for those purchases, although increasing, are relatively consistent and predictable. A specific supplier might constitute a significant percentage of our total purchases at a certain time for a large contract. The dependence on a specific supplier usually ends when the project is completed. We do not rely on any single supplier in the long term.

| I-6 |

As planned, we have deployed ERP modules to centralize our supply chain management for some of our subsidiaries. In addition, we are furthering the deployment of the ERP modules to integrate all subsidiaries.

Customers and Marketing/Distribution Methods

We operate on a project basis, and this particular nature does not usually allow us to create a long-term relationship with our customers. We negotiate with various government agencies, municipalities, industrial enterprises and/or their prime contractors in order to secure and undertake our various contracts. Our major customers usually account for a certain percentage of our total sales. Our top five customers collectively represented approximately 53.0% and 82.9% of our total revenue for the three months ended March 31, 2012 and 2011, respectively. Although we are dependent on our large clients to a certain degree, unlike other commercial businesses, collectability of accounts receivables are relatively secure because our client base consists primarily of government agencies or large state-owned enterprises.

Patents and Proprietary Rights

As of March 31, 2012, we owned 11 product patents and 39 software copyrights.

Government Regulation and Approval

As described in greater detail above in the discussion of our business segments, government policies and initiatives in the various industries we serve have a considerable impact on our potential for growth. We generally undertake projects for government entities and enterprises, and must complete the projects in accordance with the terms of the contracts in which we enter with those entities.

Employees

As of March 31, 2012, we had a total headcount of 390, of which 164 (42%) were in technical support and project management, 86 (22%) in sales, 13 (3%) in research and development, 41 (11%) in finance, and the remaining 86 (22%) in general and administrative functions. The increase of our headcount was mainly in the project management department, which grew by 42, and the general and administrative department, which grew by 21. In the sales department, headcount increased by 8. In the research and development department, headcount decreased by 13. Total headcount increased by 59 from that on December 31, 2011. Our teams are very stable compared to our peers.

Research and Development

We focus our research and development efforts on improving our development efficiency and the quality of our products and services. Some of the technical support team regularly participates in research and development programs. There are five major on-going software research and development projects and one hardware research and development project. The development phase projects are expected to be completed in 2012.

As our research and development base, Tianjin Baoding Environmental Technology Co., Ltd. (“Baoding”) focuses on technology development, software development, pilot testing, manufacturing and pre-installation/pre-assembly of our proprietary products. The Baoding research, development and production facility construction officially started in June 2011. Part I of phase one of the construction is for the odor control system manufacturing and automatic control box assembly workshops, which has been completed. Part II of phase one construction is in process, and is to be completed around August 2012. Phase two and phase three are scheduled to be completed by the end of 2013.

Properties

Our primary office location is the 15th and 16th Floor of Tower B, Renji Plaza, 101 Jingshun Road, Chaoyang District, Beijing 100102 China. The rental space for the two floors is 908 square meters for the 15th floor and 986 square meters for the 16th floor. The lease contract for this location is from September 1, 2010 to August 31, 2013. We also have a 1,300 square meter rental office in Tianjin, located at Huayuan Property Management Zone, 4th Floor, Kaide A Complex, 7 Rongyuan Road, Tianjin, with a rental term that runs until December 2014. In addition, we have three other rental office locations in various areas of Beijing, for which the lease contracts expire at various points in time no later than August 26, 2012.

| I-7 |

Baoding, one of the Company’s subsidiaries, is located at West Tianbao Road, Baodi Economic Development Zone in Tianjin. The subsidiary occupies an area of 158,954 square meters and has a 50-year land use right starting on January 18, 2011.

Results of Operations

Overview for the Three Months Ended March 31, 2012 and 2011

Our operating revenues are primarily derived from system design and integration, hardware product design and manufacturing and sales. Our first quarter results reflected stable growth. Highlights of our financial results during the three months ended March 31, 2012 include:

| · | Total revenues increased to $19,221,312 in the first quarter of 2012, an increase of $1,668,101, or 9.5%, from $17,553,211 in the same period 2011. This increase is primarily attributable to the following factors: |

| o | Systems integration revenue increased from $15,870,494 in the first quarter of 2011 to $18,532,662 in the same period in 2012, an increase of $2,662,168, or 16.8%. |

| o | Hardware products revenue totaled $688,650 in the first quarter of 2012, a decrease of $994,067, or 59.1%, from $1,682,717 in the first quarter of 2011. |

| · | Total cost of revenues increased by $1,460,781 from $12,543,031 in the first quarter of 2011 to $14,003,812 in the first quarter of 2012, an 11.6% increase compared with the same period in 2011. This increase is attributable to the increase of cost in system integration by $1,933,468 and the decrease by $472,687 in hardware product cost. |

| · | Total operating expenses were $3,761,223 for the first quarter of 2012, or 19.6% of total revenues, compared with $2,420,952, or 13.8% of total revenues, in the same period of 2011. This represents an increase of $1,340,271, or 55.4%. |

| · | Operating income decreased to $1,456,277 in the first quarter of 2012, by 43.8%, from $2,589,228 in the first quarter of 2011, representing 7.6% and 14.8% of total revenues in the first quarter of 2012 and 2011, respectively. |

| · | Net income attributable to TRIT decreased to $1,438,125, or by 15.4%, for the first quarter of 2012, from $1,698,981 for the first quarter of 2011. |

The following are the operating results for the three months ended March 31, 2012 and 2011:

| Three Months Ended March 31, 2012($) | % of Sales | Three Months Ended March 31, 2011($) | % of Sales | Change ($) | Change (%) | |||||||||||||||||||

| Revenues | 19,221,312 | 100 | % | 17,553,211 | 100 | % | 1,668,101 | 9.5 | % | |||||||||||||||

| Cost of Revenues | 14,003,812 | 72.9 | % | 12,543,031 | 71.5 | % | 1,460,781 | 11.6 | % | |||||||||||||||

| Selling and Marketing Expenses | 838,993 | 4.4 | % | 314,173 | 1.8 | % | 524,820 | 167 | % | |||||||||||||||

| General and Administrative Expenses | 2,853,360 | 14.8 | % | 2,066,794 | 11.8 | % | 786,566 | 38.1 | % | |||||||||||||||

| Research and Development | 68,870 | 0.4 | % | 39,985 | 0.2 | % | 28,885 | 72.2 | % | |||||||||||||||

| Total Operating Expenses | 3,761,223 | 19.6 | % | 2,420,952 | 13.8 | % | 1,340,271 | 55.4 | % | |||||||||||||||

| Operating Income | 1,456,277 | 7.6 | % | 2,589,228 | 14.8 | % | (1,132,951 | ) | (43.8 | )% | ||||||||||||||

| Other Income (Expenses) | 290,905 | 1.5 | % | (4,067 | ) | 0 | % | 294,972 | (7,252.8 | )% | ||||||||||||||

| Income before Provision for Income Taxes and Noncontrolling Interests Income | 1,747,182 | 9.1 | % | 2,585,161 | 14.7 | % | (837,979 | ) | (32.4 | )% | ||||||||||||||

| Provision for Income Taxes | 314,493 | 1.6 | % | 405,636 | 2.3 | % | (91,143 | ) | (22.5 | )% | ||||||||||||||

| Net Income before Allocation to Noncontrolling Interests | 1,432,689 | 7.5 | % | 2,179,525 | 12.4 | % | (746,836 | ) | (34.3 | )% | ||||||||||||||

| Less: Net Income Attributable to Noncontrolling Interests | (5,436 | ) | 0 | % | 480,544 | 2.7 | % | (485,980 | ) | (101.1 | )% | |||||||||||||

| Net Income Attributable to TRIT | 1,438,125 | 7.5 | % | 1,698,981 | 9.7 | % | (260,856 | ) | (15.4 | )% | ||||||||||||||

Revenues

Our revenues are subject to value added tax (“VAT”), business tax, urban maintenance and construction tax and additional education surcharges. Among the above taxes, VAT has been deducted from the calculation of revenues.

Our total revenues for the first quarter of 2012 were $19,221,312, an increase of $1,668,101, or 9.5%, compared with the same period last year. This increase is primarily attributable to an increase in the system integration category, from $15,870,494 in the first quarter of 2011 to $18,532,662 in the same period for 2012, or an increase of 16.8%. Revenue from Segment 1, water, wastewater treatment and municipal infrastructure, continued to be very strong, constituting 43.7% of total revenues. Revenue from Segment 2, water resource management and engineering, totaled $6,254,590, or 32.5% of total revenues. Revenue from Segment 3, industrial pollution control and safety, totaled $4,559,749, constituting 23.8% of total revenues for the first quarter, mostly in the system integration category.

| I-8 |

Cost of Revenues

Total cost of revenues was $14,003,812 for the first quarter of 2012, an increase of $1,460,781, or 11.6%, from $12,543,031 in the first quarter of 2011. The system integration category, which was the largest contributor to the revenue increase, was also the largest contributor to the increase in the cost of revenues, totaling $13,584,217. The cost of revenues increase in the system integration category was $1,933,468, or 16.6%, from $11,650,749 in the first quarter of 2011 to $13,584,217 in the first quarter of 2012. The increase is mainly a result of the increase in total revenues.

Cost of revenues is based on total actual costs incurred plus estimated costs to completion applied to the percentage of completion as measured at different stages. It includes material costs, equipment costs, transportation costs, processing costs, packaging costs, quality inspection and control, outsourced construction service fees and other costs that directly relate to the execution of the services and delivery of projects. Cost of revenues also includes freight charges, purchasing and receiving costs and inspection costs when they are incurred.

Our gross margin decreased from 28.5% in the first quarter of 2011 to 27.1% in the first quarter of 2012. The most important reason is that 20.7% of our total revenues for this quarter was from the Indian project, which has a relatively low gross margin.

Our strategy is to carefully choose more higher-margin projects. In the next two to three years, we will continue to look for ways to minimize the negative impact on our gross margin through optimizing product and system design, leveraging purchasing bargaining power, and exploring supply chain financing and local equipment sourcing.

Selling and Marketing Expenses

Selling and marketing expenses consist primarily of compensation costs, marketing costs, travel expenses and business entertainment expenses. In the first quarter of 2012, total selling and marketing expenses increased by $524,820, or 167.0%, from $314,173 in the first quarter of 2011 to $838,993 in the same period of 2012. This was a result of increases in compensation-related expenses of $196,675, or 169.8%, from $115,825 in the first quarter of 2011 to $312,500 in the same period of 2012, other selling expenses of $279,899, or 343.5%, from $81,479 in the first quarter of 2011 to $361,378 in the same period of 2012, and a decrease in travel expenses of $9,368, or 14.1%, from $66,271 in the first quarter of 2011 to $56,903 in the same period of 2012, and. The entertainment expenses increased by $57,615, or 113.9%, from $50,597 in the first quarter of 2011 to $108,212 in the same period of 2012.

Selling and marketing expenses for the three months ended March 31, 2012 took up approximately 4.4% of total revenues. We anticipate it to continue to increase during the remaining quarters of the year.

General and Administrative Expenses

General and administrative expenses consist primarily of compensation costs, rental expenses, professional fees, and other overhead expenses. General and administrative expenses increased by $786,566, or 38.1%, from $2,066,794 in the first quarter of 2011 to $2,853,360 in the first quarter of 2012. Of this increase, $144,112 was for officers’ salaries, which increased from $167,464 in the first quarter of 2011 to $311,576 in the first quarter of 2012. Salaries for mid-level management, technical support team, and other office staff increased by $99,086, or 18.7%, from $530,917 in the first quarter of 2011 to $630,003 in the first quarter of 2012. Other human resource expenses, such as endowment and social insurance, increased by 71.1% and 69.1%, respectively, to $89,182 and $135,391, in the first quarter of 2012. Rent increased by $64,224, or 35.0%, from $183,287 in the first quarter of 2011 to $ 247,511 in the first quarter of 2012 due to office relocation. Professional fees increased by $69,877, or 38%, from $183,886 to $253,763, which was mainly for audit and legal services. Amortization of intangible assets and software increased by $68,923, from $145,016 in the first quarter of 2011 to $213,939 in the same period of 2012. This increase was due to the purchase of some major software and intangible assets in our acquired subsidiaries and the amortization of land use rights. Depreciation expense increased by $10,712, or 17.6%, from $60,831 in the first quarter of 2011 to $71,543 in the first quarter of 2012. Other general and administrative expenses increased by $237,270, or 35.8%, from $663,182 to $900,452 in the first quarter of 2012. Those are mainly for office expenses, utilities, travel, communication and other services. General and administrative expenses increased by $295,344 in the first quarter of 2012 due to the acquisition of J&Y, and Yuanjie in June 2011 and August 2011, respectively.

General and administrative expenses for the three months ended March 31, 2012 took up approximately 14.8% of total revenues. We anticipate it to continue to increase but at a lower speed in the future.

Provision for Income Tax

We provide for deferred income taxes using the asset and liability method. Under this method, we recognize deferred income taxes for tax credits, net operating losses available for carry-forwards and significant temporary differences. We classify deferred tax assets and liabilities as current or non-current based upon the classification of the related asset or liability in the financial statements or the expected timing of their reversal if they do not relate to a specific asset or liability. We provide a valuation allowance to reduce the amount of deferred tax assets if it is considered more likely than not that some portion or all of the deferred tax assets will not be realized.

| I-9 |

Our operations are subject to income and transaction taxes of the PRC since most of our business activities take place in China. Significant estimates and judgments are required in determining our provision for income taxes. Some of these estimates are based on interpretations of existing tax law or regulations, as well as predictions related to future changes in these law and regulations. The ultimate amount of tax liability may be uncertain as a result. We do not anticipate any events which could change these uncertainties.

We, including our subsidiaries and contractually-controlled affiliates, are subject to income taxes on an entity basis on income arising in or derived from the tax jurisdictions in which each entity is domiciled. According to the New Enterprise Income Tax Law in China, the unified enterprise income tax (“EIT”) rate is 25%. However, five of our subsidiaries are eligible for certain favorable tax policies for being high-tech companies.

| EIT | ||||||||

| Three Months Ended March 31, | ||||||||

| 2012 | 2011 | |||||||

| % | % | |||||||

| TTB (Tax rate is 15% if passing the high-tech enterprise qualification review, the probability of which is very high) | 15 | 7.5 | ||||||

| BSST | 15 | 15 | ||||||

| Yanyu | 15 | 15 | ||||||

| Tranhold | 25 | 25 | ||||||

| TTA | 25 | 25 | ||||||

| Baoding | 15 | 15 | ||||||

| Yuanjie | 15 | — | ||||||

| Buerjin | 25 | — | ||||||

| Xushui | 25 | — | ||||||

| Consolidated Effective EIT | 18 | 16 | ||||||

The favorable income tax treatment for TTB at 7.5% expired at the end of 2011. Afterwards, the EIT rate could be either 15%, if TTB qualifies as a high-tech company, or 25%, if it does not so qualify. We believe TTB will continue to qualify as a high-tech company. The provision for income tax for the first quarter of 2012 was $314,493.

We have not recorded tax provision for U.S. tax purposes as they have no assessable profits arising in or derived from the United States and we intend to permanently reinvest accumulated earnings in the PRC operations.

Net Income before Income Taxes

In the quarter ended March 31, 2012, our net income before provision for income taxes was $1,747,182, a decrease of $837,979, or 32.4%, compared to $2,585,161 in the same period in 2011. Our provision for income taxes decreased by $91,143, from $405,636 in the first quarter of 2011 to $314,493 in the same period in 2012. In the first quarter of 2012, net income attributable to shareholders of TRIT was $1,438,125, a decrease of $260,856, or 15.4%, from $1,698,981 for the same period in 2011.

Liquidity and Capital Resources

As highlighted in the consolidated statements of cash flows, our liquidity and available capital resources are impacted by four key components: (i) cash and cash equivalents, (ii) operating activities, (iii) financing activities, and (iv) investing activities.

Consolidated cash flows for the three months ended March 31, 2012 and 2011 were as follow:

| Three Months Ended March 31, | ||||||||||||

| 2012($) | 2011($) | Change($) | ||||||||||

| Net Cash Used in Operating Activities | 8,012,462 | 196,061 | 7,816,401 | |||||||||

| Net Cash Used in Investing Activities | 94,569 | 888,552 | (793,983 | ) | ||||||||

| Net Cash Provided by Financing Activities | 3,317,057 | 442,696 | 2,874,361 | |||||||||

| Effects of Exchange Rate Changes on Cash and Cash Equivalents | 394,818 | 93,690 | 301,128 | |||||||||

| Net Decrease in Cash and Cash Equivalents | (4,395,156 | ) | (548,227 | ) | (3,846,929 | ) | ||||||

| Cash and Cash Equivalents, Beginning of Period | 11,935,746 | 23,394,995 | (11,459,249 | ) | ||||||||

| Cash and Cash Equivalents, End of Period | 7,540,590 | 22,846,768 | (15,306,178 | ) | ||||||||

| I-10 |

Cash and Cash Equivalents

At March 31, 2012, our cash and cash equivalents amounted to $7,540,590. The restricted cash as of March 31, 2012 and December 31, 2011 amounted to $4,352,776 and $4,629,878, respectively, which are not included in the total of cash and cash equivalents. The restricted cash consisted of deposits as collaterals for the issuance of letters of credit. Our subsidiaries that own these deposits do not have material cash obligations to any third parties. Therefore, the restriction does not impact our liquidity.

Operating Activities

Net cash used for operating activities was $8,012,462 for the three months ended March 31, 2012, compared with $196,061 in the same period 2011. The increase of $7,816,401 in operating cash outflow was mainly attributable to our rapid growth at the infant stage, and aggressive market expansion. This outflow was attributed to the cash outflow in accounts receivables and unbilled receivables. Net accounts receivable increased from $19.9 million on March 31, 2011 to $22.9 million on March 31, 2012, an increase of $3 million. Unbilled receivables increased from $7.3 million on December 31, 2011 to $20.2 million on December 31, 2012, an increase of $12.9 million. There is a lag between revenue recognition and cash collection for the build-and-transfer projects in the first half of 2012. This increase is expected, since it is common that most of the cash collection happens in the second half of the year.

| March 31, 2012 ($) (unaudited) | December 31, 2011 ($) | Change ($) | Change (%) | |||||||||||||

| Cash | 7,540,590 | 11,935,746 | (4,395,156 | ) | (36.8 | ) | ||||||||||

| Restricted cash | 1,804,942 | 2,087,920 | (282,978 | ) | (13.6 | ) | ||||||||||

| Accounts receivable and notes receivable | 23,702,397 | 20,507,146 | 3,195,251 | 15.6 | ||||||||||||

| Allowance for doubtful accounts | (772,746 | ) | (619,062 | ) | (153,684 | ) | 24.8 | |||||||||

| Net Accounts receivable | 22,929,651 | 19,888,084 | 3,041,567 | 15.3 | ||||||||||||

| Unbilled revenue | 20,194,207 | 7,254,830 | 12,939,377 | 178.4 | ||||||||||||

Investing Activities

Net cash used for investing activities was $94,569 during the three months ended March 31, 2012, a decrease of $793,983 from $888,552 in the same period of 2011. This decrease was mainly due to the collection of the restricted cash.

Financing Activities

The cash provided by financing activities was $3,317,057 in the three months ended March 31, 2012, compared to $442,696 in the same period of 2011. The increase was due to increase of the short-term bank borrowing.

Effect of Exchange Rate Changes on Cash and Cash Equivalents

Net cash gain due to currency exchange was $394,818 in the three months ended March 31, 2012, an increase of $301,128 compared to the gain of $93,690 in the same period of 2011.

Restricted Net Assets

Our ability to pay dividends is primarily dependent on receiving distributions of funds from our subsidiaries, which is restricted by certain regulatory requirements. Relevant Chinese statutory laws and regulations permit payments of dividends by our Chinese subsidiaries only out of their retained earnings, if any, as determined in accordance with PRC accounting standards and regulations. In addition, our PRC subsidiaries are required to set aside at least 10% of their after-tax profit after deducting any accumulated deficit based on PRC accounting standards each year to our general reserves until the accumulated amount of such reserves reach 50% of our registered capital. These reserves are not distributable as cash dividends. Our off-shore subsidiaries, TIS and Tri-Tech International Investment, Inc. (“TTII”), do not have material cash obligations to third parties. Therefore, the dividend restriction does not impact our liquidity. There is no significant difference between accumulated profit calculated pursuant to PRC accounting standards and that pursuant to U.S. GAAP. As of March 31, 2012 and December 31, 2011, restricted retained earnings were $1,866,994 for both, and restricted net assets were $4,553,729 and $4,553,729, respectively. Unrestricted retained earnings as of March 31, 2012 and December 31, 2011 were $21,120,511 and $19,682,386, respectively, which were the amounts available for distribution in the form of dividends or for reinvestment.

| I-11 |

Working Capital and Cash Flow Management

As of March 31, 2012, our working capital was $8,290,262, with current assets totaling $70,119,152 and current liabilities totaling $61,828,890. Of the current assets, cash and cash equivalents was $7,540,590.

However, we may require additional cash to undertake larger projects or to complete strategic acquisitions in the future. In the event our current capital is insufficient to fund these and other business plans, we may take the following actions to meet such working capital needs:

| · | We may look into the possibility of optimizing our funding structure by obtaining short- and/or long-term debt through commercial loans. We are actively exploring opportunities with other major Chinese banks, such as ICBC and CITIC Bank, and we expect to acquire additional lines of credit to enable us to gain more project opportunities in the future. Other financing instruments into which we are currently looking include supply chain financing, project financing, trust fund financing and capital leasing. |

| · | We may improve our collection of accounts receivable. Most of our clients are central, provincial and local governments. We believe that our clients are in good financial positions. Therefore, good collectability from relatively high accounts receivables is expected. The accounts receivable collection should catch up with our rapid growth in the near future. Given the interest rates in the long-term contracts, it is possible that some clients might choose to pay the contract fees before the due date. |

Segment Information

We have three reportable operating segments. The segments are grouped with reference to the types of goods and services provided and the types of clients that use such goods and services. Total sales and costs are divided among these three segments. We assess each segment’s performance based on net revenue and gross profit on contribution margin.

Segment 1: Water, Wastewater Treatment and Municipal Infrastructure

The following are the operating results for the three months ended March 31, 2012 and 2011 for Segment 1:

| Three months ended March 31 | ||||||||||||||||

| 2012($) | 2011($) | Change($) | Change (%) | |||||||||||||

| Revenues | 8,406,973 | 12,904,386 | (4,497,413 | ) | (34.9 | )% | ||||||||||

| Cost of Revenues | 5,924,264 | 9,621,997 | (3,697,733 | ) | (38.4 | )% | ||||||||||

| Operating Expenses: | % | |||||||||||||||

| Selling and Marketing Expenses | 225,626 | 109,058 | 116,568 | 106.9 | % | |||||||||||

| General and Administrative Expenses | 1,530,415 | 741,138 | 789,277 | 106.5 | % | |||||||||||

| Research and Development | 5,751 | - | 5,751 | - | % | |||||||||||

| Total Operating Expenses | 1,761,792 | 850,196 | 911,596 | 107.2 | % | |||||||||||

| Other income (expenses) | 347,415 | (5,653 | ) | 353,068 | (6,245.7 | )% | ||||||||||

| Income before Provision for Income Taxes | 1,068,332 | 2,426,540 | (1,358,208 | ) | (56.0 | )% | ||||||||||

Revenues for Segment 1 were $8,406,973 for the three months ended March 31, 2012, a decrease of $4,497,413, or 34.9%, from $12,904,386 in the same period of 2011. This decrease was mainly attributable to the Ordos drinking water plant project. In the first quarter of 2011, we recognized revenue of $12.3 million on Ordos, and we recognized revenue $3.1 million in the first quarter of 2012 on the same project. Although we recognized revenue of $3.99 million on the Indian project in the first quarter of 2012, the revenue increase from the Indian project did not entirely offset the revenue decrease from Ordos.

Cost of revenues for Segment 1 was $5,924,264 in the first quarter of 2012, a decrease of $3,697,733, or 38.4%, from that of $9,621,997 in the first quarter of 2011. Since the Company recognizes revenue following the percentage-of-completion method, measured by different stages of completion, the decrease in cost of revenue was mainly due to the decrease of revenue recognized according to completion stage during the periods.

Total operating expenses in Segment 1 were $1,761,792, an increase of $911,596, or 107.2%, compared with $850,196 in the first quarter of 2011. The selling and marketing expenses increased from $109,058 in the first quarter of 2011 to $225,626 in the same period 2012, an increase of $116,568, or 106.9%. The increase was mainly due to the increase in headcount and travel expenses. The general and administrative expenses for the first quarter of 2012 were $1,530,415, an increase of $789,277, or 106.5%, compared with $741,138 for the same period in 2011. The increase was caused by the increase in salaries, rent and professional service expenses.

| I-12 |

Other income was $347,415 in the first quarter of 2012, a $353,068 increase compared to other expense of $5,653 in the same period of 2011. The increase was mainly due to unrecognized financing income in the first quarter of 2012.

Income before provision for income taxes was $1,068,332 in the quarter ended March 31, 2012, a decrease of $1,358,208, or 56.0%, from that of $2,426,540 in the same period in 2011. The gross margin for this segment was 29.5%.

Segment 2: Water Resource Management System and Engineering Services

The following are the operating results for the three months ended March 31, 2012 and 2011 for Segment 2:

| Three months ended March 31 | ||||||||||||||||

| 2012($) | 2011($) | Change($) | Change (%) | |||||||||||||

| Revenues | 6,254,590 | 1,641,059 | 4,613,531 | 281.1 | % | |||||||||||

| Cost of Revenues | 4,521,154 | 868,608 | 3,652,546 | 420.5 | % | |||||||||||

| Operating Expenses: | % | |||||||||||||||

| Selling and Marketing Expenses | 426,290 | 150,728 | 275,562 | 182.8 | % | |||||||||||

| General and Administrative Expenses | 622,294 | 495,238 | 127,056 | 25.7 | % | |||||||||||

| Research and Development | 63,119 | 39,985 | 23,134 | 57.9 | % | |||||||||||

| Total Operating Expenses | 1,111,703 | 685,951 | 425,752 | 62.1 | % | |||||||||||

| Other expenses | (40,916 | ) | (65 | ) | (40,851 | ) | 62,847.7 | % | ||||||||

| Income before Provision for Income Taxes | 580,817 | 86,435 | 494,382 | 572.0 | % | |||||||||||

In Segment 2, revenues were $6,254,590 for the three months ended March 31, 2012, an increase of $4,613,531, or 281.1%, from $1,640,059 in the same period of 2011. Revenues in this segment increased significantly since Yanyu won a large number of contracts in 2011 and 2012, and the revenue stream from projects awarded in 2011 and 2012 started to be recognized in the first quarter of 2012. Cost of revenues in Segment 2 was $4,521,154 in the quarter ended March 31, 2012, an increase of $3,652,546, or 420.5%, from $868,608 in the same period of 2011. This increase was mainly due to the increase of projects.

Total operating expenses in Segment 2 were $1,111,703, an increase of $425,752, or 62.1%, compared with $685,951 in the first quarter of 2011. The selling and marketing expenses increased from $150,728 in the first quarter of 2011 to $426,690 in the first quarter of 2012, an increase of $275,562, or 182.8%. The increase was mainly due to the increases in headcount and travel expenses. The general and administrative expenses for the first quarter of 2012 were $622,294, an increase of $127,056, or 25.7%, compared with $495,238 for the same period in 2011.

Other expenses were $40,916 in the quarter ended March 31, 2012, an increase of $40,851 from $65 in the same period of 2011. The increase was mainly due to interest expense in the first quarter of 2012.

Income before provision for income taxes were $580,817 in the quarter ended March 31, 2012, an increase of $494,832 from $86,435 in the same period of 2011. The gross margin for this segment was 27.7%.

Segment 3: Industrial Pollution Control and Safety

The following are the operating results for the three months ended March 31, 2012 and 2011 for Segment 3:

| Three months ended March 31 | ||||||||||||||||

| 2012($) | 2011($) | Change($) | Change (%) | |||||||||||||

| Revenues | 4,559,749 | 3,007,766 | 1,551,983 | 51.6 | % | |||||||||||

| Cost of Revenues | 3,558,394 | 2,052,426 | 1,505,968 | 73.4 | % | |||||||||||

| Operating Expenses: | % | |||||||||||||||

| Selling and Marketing Expenses | 187,077 | 54,387 | 132,690 | 244.0 | % | |||||||||||

| General and Administrative Expenses | 700,651 | 830,418 | (129,767 | ) | (15.6 | )% | ||||||||||

| Research and Development | — | — | — | — | % | |||||||||||

| Total Operating Expenses | 887,728 | 884,805 | 2,923 | 0.3 | % | |||||||||||

| Other (expenses) income | (15,594 | ) | 1,651 | (17,245 | ) | (1.044.5 | )% | |||||||||

| Income before Provision for Income Taxes | 98,033 | 72,186 | 25,847 | 35.8 | % | |||||||||||

Revenues in Segment 3 were $4,559,749 for the three months ended March 31, 2012, an increase of $1,551,983, or 51.6%, from $3,007,766 in the same quarter of 2011. The increase was mainly due to the Qatar project, the Canadian project and the Mexican project. Cost of revenues for the first quarter was $3,558,394, an increase of $1,505,968, or 73.4%, from $2,052,426 in the first quarter of 2011. The increase was mainly due to the increase of projects including the Qatar project, the Canadian project and the Mexican project.

| I-13 |

Total operating expenses were $887,728, an increase of $2,923, or 0.3%, from $884,805 in the first quarter of 2011. Selling and marketing expenses increased by $132,690 compared to the first quarter of 2011. General and administrative expenses decreased from $830,418 in the first quarter of 2011 to $700,651, a decrease of $129,767, or 15.6%. Income before provision for income taxes for the first quarter 2012 was $98,033, compared to $72,186 for the same period of 2011, an increase of $25,847, or 35.8%. The gross margin for this segment was 22.0%.

Assets attributable to each segment as of March 31, 2012 and December 31, 2011 are shown below:

| Segment Assets | Segment 1 | Segment 2 | Segment 3 | Total | ||||||||||||

| As of March 31, 2012 | $ | 87,478,382 | $ | 32,906,620 | $ | 27,048,708 | $ | 147,433,710 | ||||||||

| As of December 31, 2011 | $ | 84,910,147 | $ | 26,081,474 | $ | 27,659,057 | $ | 138,650,678 | ||||||||

Contractual Obligations and Commercial Commitments

Operating Leases

As of March 31, 2012, we had commitments under certain operating leases, which require annual minimum rental payments as follows:

| For the Years Ended December 31, | Amount | |||

| 2012 | $ | 610,384 | ||

| 2013 | 471,053 | |||

| 2014 | 154,535 | |||

| Total | $ | 1,235,972 | ||

Our leased properties are principally located in Beijing and are used for administration and research and development purposes. The terms of these operating leases vary from one to five years. Pursuant to the lease terms, when the contracts expire, we have the right to extend them with new negotiated prices. The leases are renewable subject to negotiation. Rental expenses were $247,511 and $183,287 for the quarter ended March 31, 2012 and 2011, respectively.

Product Warranties

Our warranty policy generally is to replace parts at no additional charge if they become defective within one year after deployment. Historically, failure of product parts due to materials used or workmanship has not been significant. We have not incurred any material unexpected costs associated with servicing warranties. We continuously evaluate and estimate our potential warranty obligations, and record the related warranty obligation when the estimated amount becomes material at the time revenue is recorded.

Capital Expenditures

In the past, the capital expenditures were mainly for purchases of computers and other office equipment to support our daily business activities. Our capital expenditures will increase in the near term as our business continues to grow and as the construction of our research and development facilities in Tianjin progresses. The construction of the research and development center consists of three phases. Phase one has been completed. Phases two and three of the construction are planned to be completed by the end of 2013. The total capital investment is expected to be $20 million.

Seasonality

The Company’s operating revenues normally tend to fluctuate due to different project stages and U.S. GAAP requirements on revenue recognition. As the scope of our business extended to the civil construction activities, certain destructive weather conditions that tend to occur during the winter often impact the progress of our projects. Certain weather conditions, including severe winter storms, may result in the temporary suspension of outdoor operations, which can significantly affect the operating results of the affected regions. The operating results for the first quarter often reflect the business slowdown for the Chinese traditional holidays, the Spring Festival, which could last anywhere from 7 days up to one month.

Off-Balance Sheet Arrangements

We did not have any off-balance sheet arrangements for the quarter ended March 31, 2012 or 2011.

| I-14 |

Taxation

Pursuant to the new EIT Law and supplementary regulations, only high-tech companies that have been re-certified as such under the new criteria are granted the preferential enterprise income tax rate of 15%. According to an approval from the Beijing State Tax Bureau of Xicheng District, TTB received a preferential income tax rate of 7.5% from January 1, 2009 to December 31, 2011. Thereafter, the EIT rate could be either 15%, if TTB qualifies as a high-tech company, or 25%, if it does not so qualify. We believe TTB will continue to qualify as a high-tech company.

Sales tax varies from 3% to 5% depending on the nature of the revenue, and VAT is 17%. For revenues generated from those parts of our software solutions which are recognized by and registered with government authorities and meet government authorities’ requirements to be treated as software products, we are entitled to receive a refund of 14% on the total VAT paid at a rate of 17%. Revenues from software products other than the above are subject to full VAT at 17%. In addition, we are currently exempted from sales tax for revenues generated from development and transfer of tailor-made software solutions for clients. Further, revenues from consulting services are subject to a 5% sales tax. Qualified to issue VAT invoices, we need to maintain a certain amount of revenue that is taxable by VAT. As such, we may have to refuse some of the tax exemption benefits in our tailor-made software development business and pay VAT for those parts of the revenue in order to maintain minimum VAT revenue thresholds. This practice may cease to apply if more of the software products become recognized and registered as software products in the PRC.

Significant Accounting Policies

Estimates and Assumptions

The preparation of financial statements requires management to make numerous estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Changes in these estimates and assumptions may have financial impacts on recognition and disclosure of assets, liabilities, equity, revenues and expenses. However, we believe that these estimates used in preparing our financial statements are based on our best professional judgment, and are reasonable and prudent.

The most complex and subjective estimates and assumptions that present the greatest amount of uncertainty relate to the recognition of revenue under the percentage of completion method recording, business combination, the allowance for doubtful accounts, long term contract collectability, impairment of fixed assets and intangible assets, and income tax. We evaluate all of these estimates and judgments on an on-going basis. Below are the most critical estimates and assumptions we make in preparing the consolidated financial statements.

Revenue Recognition

Our revenues consist primarily of three categories: (i) System Integration, (ii) Hardware Product Sales, and (iii) Software Product Sales. The Company recognizes revenue when the consideration to be received is fixed or determinable, products delivered, or services rendered, and collectability ensured.

For system integration, sales contracts are structured with fixed price. The contract periods range from two months to approximately three years in length. We recognize revenue of these contracts following the percentage-of-completion method, measured by different stages in accordance with ASC 605-35, “Construction-Type and Production-Type Contracts.” Only if the actual implementation status meets the established stages of completion will we recognize the relevant portion of the revenue. There are four major stages for the system integration revenue recognition: (a) the completion of project design, (b) the delivery of products, (c) the completion of debugging, and (d) inspection and acceptance.