Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Mattersight Corp | d8k.htm |

| EX-99.1 - PRESS RELEASE, DATED AUGUST 10, 2011 - Mattersight Corp | dex991.htm |

Mattersight

Q2 2011 Earnings Webinar

August 10, 2011

Exhibit 99.2 |

2

Safe Harbor Language

During today’s call we will be making both historical and

forward-looking statements in order to help you better

understand our business. These forward-looking statements

include references to our plans, intentions, expectations,

beliefs, strategies and objectives. Any forward-looking

statements speak only as of today’s date. In addition, these

forward-looking statements are subject to risks and

uncertainties that could cause actual results to differ

materially from those stated or implied by the forward-

looking statements. The risks and uncertainties associated

with our business are highlighted in our filings with the SEC,

including our Annual Report filed on Form 10-K for the year

ended January 1, 2011, our quarterly reports on Form 10-Q,

as well as our press release issued earlier today.

Mattersight undertakes no obligation to publicly update or

revise any forward-looking statements in this call. Also, be

advised that this call is being recorded and is copyrighted by

Mattersight Corporation. |

Discussion

Topics •

Q2 Overview

•

Business Strategy Discussion

•

Q3 Guidance

3 |

4

Q2 Overview |

Highlights

•

Contracts and Backlog

Signed $26.7 million in Managed Services contracts

Grew Backlog to a record $100.0 million

Increased Backlog 69% year/year

•

New Products and New Projects

Closed first production deployment of our predictive analytics

Signed sales pilot at one of our existing accounts

•

Operating Performance

Grew subscription revenues 6% sequentially

•

Other Highlights

Grew sales team from 13 to 18

Completed divestiture of our ICS business unit

5 |

ICS

Divestiture •

Completed ICS divestiture on May 28

•

Proceeds

Received initial proceeds of $34.1 million (prior to ~$3.8

million of transaction costs and taxes)

We expect to receive an additional $1.8 million related to the

final Working Capital adjustment late in Q3

There is also $1.5 million held in escrow that expires on

November 28

•

Taxes

We recorded a $3.8 million tax liability in Q2

We expect to use losses to reduce the tax liability over the

balance of the year

We estimate taxes will be less than $400k

6 |

Revenues

Revenue

Type

Q2

Actual

Subscription

Revenues

$4,863

6%

Amortized

Deployments Fees

and Add On

Consulting Revenues

1,290

3%

Total Behavioral

Analytics Revenues

6,153

5%

Other Revenues

474

(33%)

Total Revenues

$6,627

1%

7

Sequential

Change |

Bookings

Contract

Type

Q2 2011

Bookings

Last Four Quarter

Bookings

Add On Contracts with

Existing Customers

$26.7m

$40.2m

Renewals

$0

$18.0m

New Customer Contracts

$0

$9.7m

Total

$26.7m

$68.0m

8

Application

Q2 2011

Bookings

Last Four Quarter

Bookings

Call Center

Customer Service

$24.9m

$53.1m

Call Center

Sales and Collections

$0.5m

$10.0m

Other Applications

$1.3m

$4.9m

Total

$26.7m

$68.0m |

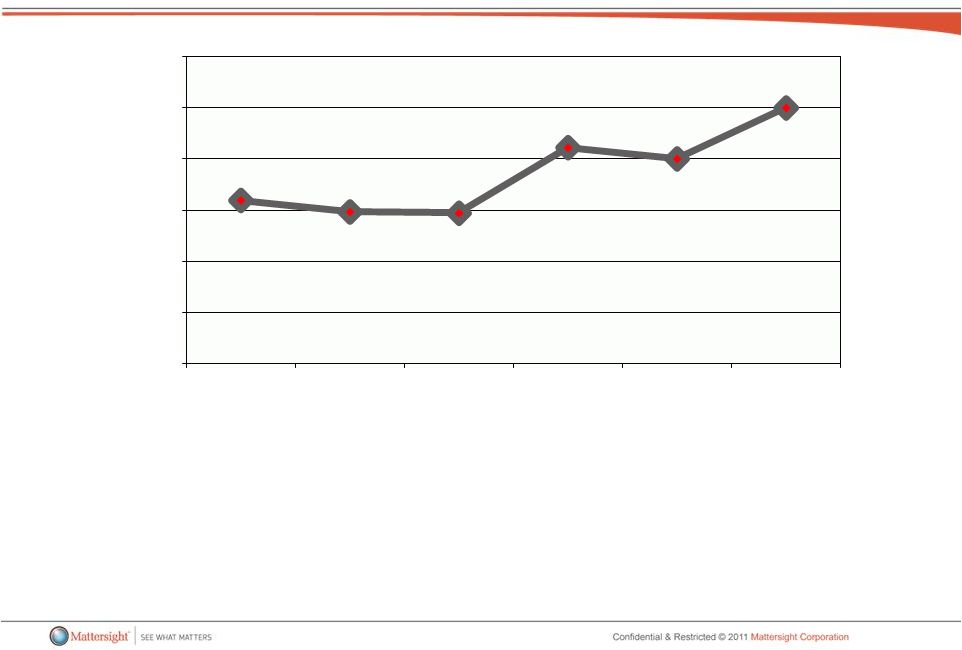

Backlog

9

Notes

Backlog increased 69% year over year

Revenue retention rate of Behavioral Analytics subscriptions is ~95%

Average remaining duration of the backlog is 36 months

Backlog (in Millions)

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

Q2 2011

$120.0

$100.0

$80.0

$60.0

$40.0

$20.0

$-

$63.9

$59.4

$58.9

$84.5

$80.1

$100.0 |

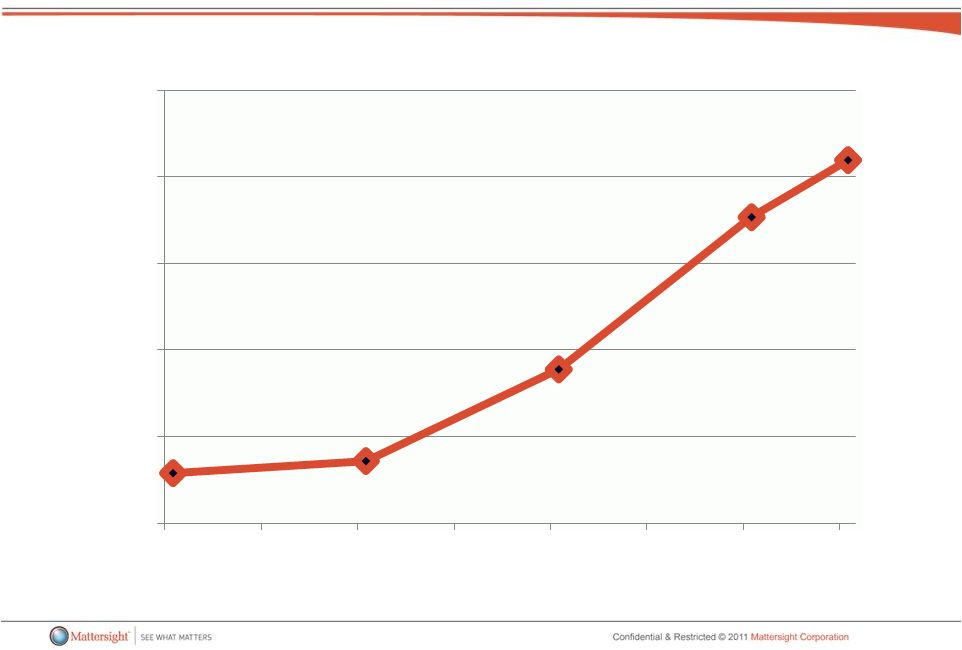

Existing

Account TAM 10

Existing Annual Account TAM (in Millions)

250

200

150

100

50

0

Dec-07

Jun-08

Dec-08

Jun-09

Jun-10

Jun-11

Dec-10

Dec-09

29

36

89

177

210 |

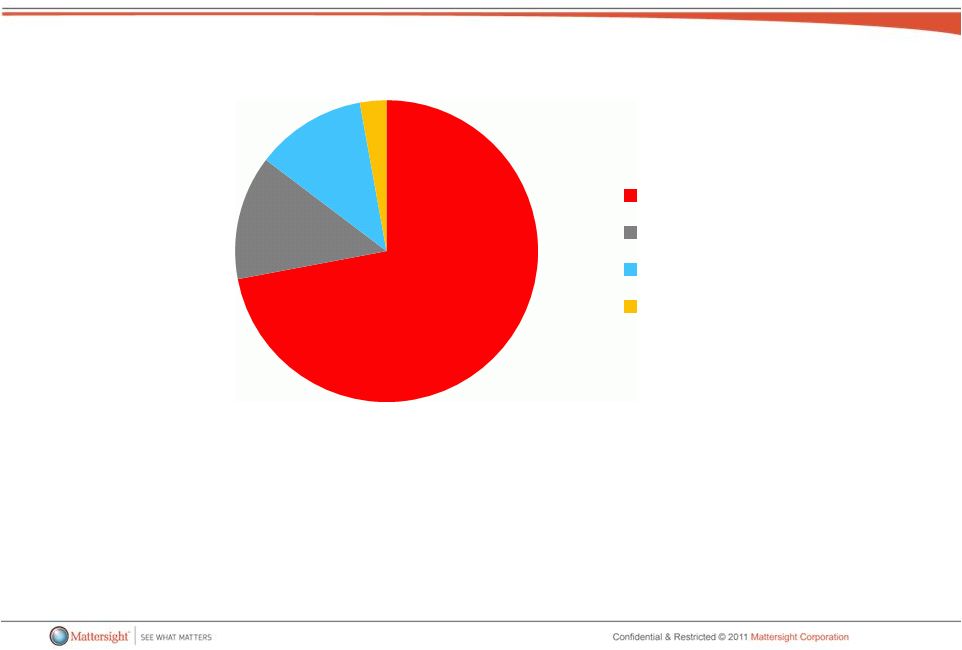

Add On

Sales 11

Add On Sales Metrics

Rolling Four Quarters: 68%

Annualized Current Quarter: 180%

Existing Annual Account TAM (~$210 Million)

Call Center

Informal CC

Back Office

3rd Party |

Headcount

Business

Function

Q2

Headcount

Sequential

Change

Development and

Operations

162

2%

Sales and

Marketing

23

44%

G&A

18

(38%)

Total

203

(1%)

12 |

Discussion of

Operating Results/Income Statement Outlook •

Operating Results

Q2 Operating Results were consistent with our internal forecasts

Cash was less than expected due to the delay in an expected contract

prepayment of ~$4.5 million; this payment is expected to be received

later this year

•

Target Income Statement Model

13

Income Statement

Category

Q2

2011

Comments

Subscription

Revenues As a % of

Total Revenues

73%

90%

Subscription

revenues

will

grow

faster

than other revenue categories

Gross Margin

52%

65%

Core Subscription and Add On

Revenues have higher margins than

other revenues

Sales and Marketing

33%

20%

Driven by Scale

Development

28%

13%

Driven by Scale

G&A

26%

7%

Driven by Scale

Adjusted EBITDA

-35%

25%

Target

Model |

Arbitration

with TCV •

On July 29th Mattersight entered into Arbitration with Technology

Crossover Ventures (TCV)

•

TCV owns 53% of the Series B Preferred and has expressed the

position that the sale of the ICS business triggers the requirement

of a cash payment equal to the full amount of the Series B

liquidation preference

•

The liquidation preference is $5.10 per share of outstanding Series

B Stock (approximately $18 million)

•

The Company and Sutter Hill Ventures (who owns 38% of the

Series B) disagree with TCV’s position

•

We expect the Arbitration will be decided in approximately 90 days

•

Until the resolution of the Arbitration, we have agreed to hold

$18 million as Restricted Cash

14 |

15

Business Strategy Discussion |

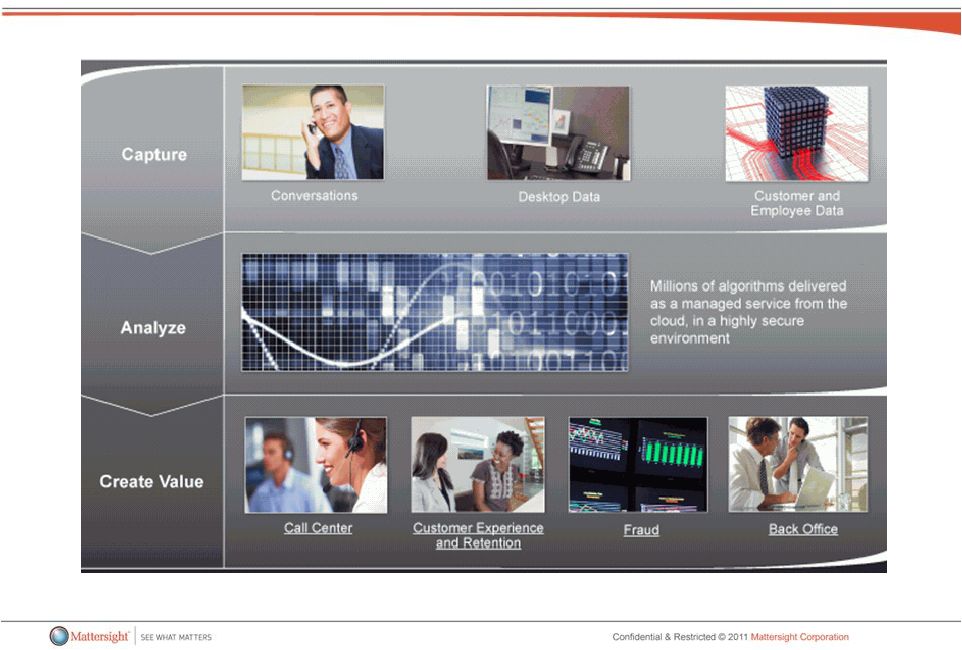

Behavioral

Analytics: Attacking a $10B/Year Market 16 |

Market

Overview Service

Sales

Collections

Fraud

Back Office

Market Size

in Seats

3.5m

.2m

.3m

.5m

10m

Monthly Per

User Price

$125

$150

$200

$100

$50

Economic

Returns

3X

5X

5x

5x

5x

Annual TAM

$5.3b

$.4b

$.7b

$.6b

$6.0b

17 |

Competitive

Strategies and Competitive Proof Points •

Competitive Strategies

Capture more information related to the interactions

Index the captured information in a robust Data Model

Apply powerful Algorithms to create operational transparency

Create Predictive Models to predict future outcomes

Use our Business Monitoring to ensure our clients drive value

with our data

•

Competitive Proof Points

Virtually

all

of

our

accounts

have

Nice,

Verint

or

some

other

Call Recording system

The significant breadth and value of our applications

The size of our Add On revenues

Our 95% revenue retention rate

18 |

Investment

Highlights •

Large, Untapped Market

US TAM of $10+ billion per year

<5% penetrated

•

Significant Opportunity with Existing Customers

Installed base TAM of ~$200 million

~15% penetrated

•

Enterprise

Analytics Footprint Delivered in the Cloud

Analytics for service, sales, and collections calls centers

Mattersight also has analytics applications for fraud, customer retention and the back

office The company’s analytics are delivered in the cloud and virtually all of its

revenues are recurring •

Significant Customer Returns and Impressive Customer List

Mattersight’s unique analytics and delivery model generates significant returns for its

customers •

Large and Sticky Customer Relationships

Average revenue per customer is in excess of $1 million per year

Average initial contract duration of 3 to 5 years

•

Significant Revenue Visibility

Large Contract Backlog

95%+ revenue retention rate

19

Customers include 3 of the top 5 HMOs; 3 of the top 4 Property & Casualty Insurance

companies; 1 of the 3 largest retail banks; and 1 of the 2 largest Prescription

Benefit Management companies |

Q3

Guidance 20 |

Q3

Guidance 21

•

8% to 10% sequential increase in Subscription Revenues

•

5% to 7% sequential increase in Total Revenues |

22

Thank You

•

Kelly Conway

847.582.7200

kelly.conway@mattersight.com

•

Tyson Marian

312.454.3527

tyson.marian@mattersight.com

•

Bill Noon

847.582.7019

bill.noon@mattersight.com |