Attached files

| file | filename |

|---|---|

| EX-32.2 - CREATIVE VISTAS INC | v216524_ex32-2.htm |

| EX-31.2 - CREATIVE VISTAS INC | v216524_ex31-2.htm |

| EX-32.1 - CREATIVE VISTAS INC | v216524_ex32-1.htm |

| EX-31.1 - CREATIVE VISTAS INC | v216524_ex31-1.htm |

| EX-21.1 - CREATIVE VISTAS INC | v216524_ex21-1.htm |

| EX-10.16 - CREATIVE VISTAS INC | v216524_ex10-16.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark one)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission File Number: 0 - 16819

CREATIVE VISTAS, INC.

(Exact name of registrant as specified in its charter)

|

Arizona

(State or Other Jurisdiction of

Incorporation or Organization)

2100 Forbes Street

Unit 8-10

Whitby, Ontario, Canada

(Address of Principal Executive Offices)

|

86-0464104

(I.R.S. Employer

Identification No.)

L1N 9T3

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: 905-666-8676

Securities registered pursuant to Section 12(b) of the Exchange Act:

None

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common Stock, No Par Value

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ¨ No¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in the definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to the Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one): Yes x No¨

|

Large Accelerated Filer ¨

|

Accelerated Filer ¨

|

|

|

Non-Accelerated Filer ¨

|

Smaller Reporting Company x

|

|

|

(Do not check if a smaller reporting company)

|

||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

¨ Yes x No

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter was approximately $629,798 (8,991,121 Shares at $0.07).

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes ¨ No¨

At March 31, 2011, the number of shares outstanding of the registrant’s common stock, no par value (the only class of common stock), was 37,488,714.

|

PART I

|

||||

|

Item 1.

|

Business

|

1

|

||

|

Item 1A.

|

Risk Factors

|

13

|

||

|

Item 1B.

|

Unresolved Staff Comments

|

18 | ||

|

Item 2.

|

Properties

|

18

|

||

|

Item 3.

|

Legal Proceedings

|

18

|

||

|

Item 4.

|

Removed and Reserved

|

18

|

||

|

PART II

|

||||

|

Item 5.

|

Market for the Registrant's Common Equity Related Stockholder Matters and Issuer Purchases of Equity Securities

|

19

|

||

|

Item 6.

|

Selected Financial Data

|

19

|

||

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

19

|

||

|

Item 7a.

|

Quantitative and Qualitative Disclosures about Market Risk

|

26

|

||

|

Item 8.

|

Financial Statements and Supplementary Data

|

F-1 - F-27

|

||

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

27

|

||

|

Item 9a.

|

Controls and Procedures

|

27

|

||

|

Item 9b.

|

Other Information

|

27

|

||

|

PART III

|

||||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

27

|

||

|

Item 11.

|

Executive Compensation

|

29

|

||

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

30

|

||

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

33

|

||

|

Item 14.

|

Principle Accountant Fees and Services

|

33

|

||

|

Item 15.

|

|

Exhibits and Financial Statement Schedules

|

|

34

|

Forward-Looking Statements

Certain statements within this Form 10-K constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of Creative Vistas, Inc. to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These forward-looking statements are based on our current expectations and are subject to a number of risks, uncertainties and assumptions relating to our operations, financial condition and results of operations, including, among others, rapid technological and other changes in the market we serve, our numerous competitors and the few barriers to entry for potential competitors, the seasonality and quarterly variations we experience in our revenue, our customer concentration, our uncertain revenue growth, our ability to attract and retain qualified personnel, our ability to expand our infrastructure and manage our growth, and our ability to identify, finance and integrate acquisitions, among others. If any of these risks or uncertainties materializes, or if any of the underlying assumptions prove incorrect, actual results may differ significantly from results expressed or implied in any forward-looking statements made by us. These and other risks are detailed in this Annual Report on Form 10-K and in other documents filed by us with the Securities and Exchange Commission. Creative Vistas, Inc. undertakes no obligation to update publicly any forward-looking statements for any reason, even if new information becomes available or other events occur in the future.

PART I

|

Item 1.

|

Business

|

Corporate Background and Overview

Creative Vistas, Inc. was incorporated in the state of Arizona on July 18, 1983. We are a leading provider of security-related technologies and systems. We also provide the deployment of broadband services to the commercial and residential market. We primarily operate through our subsidiaries AC Technical Systems Ltd. (“AC Technical Systems”) and Iview Digital Video Solutions Inc. (“Iview DVSI”), to provide integrated electronic security-related technologies and systems. AC Technical Systems is responsible for all of our revenues in the security sector for 2010. It provides its systems to various high profile clients including: government, school boards, retail outlets, banks, and hospitals. Iview DVSI is responsible for providing video surveillance products and technologies to the market.

On December 31, 2005, we acquired Cancable Inc. (“Cancable”) through our wholly owned Delaware subsidiary, Cancable Holding Corp. Cancable is in the business of providing the deployment and servicing of broadband technologies in both residential and commercial markets. Cancable has offices in Ontario, Canada. All related documents were disclosed in Form 8-K/A filed on January 6, 2006. In October 2007, we entered into an agreement, through our wholly owned newly formed Ontario subsidiary, Cancable XL Inc. (“Cancable XL”), to acquire all of the issued and outstanding shares of capital stock and any other equity interests of XL Digital Services Inc. (“XL Digital”), an Ontario corporation. All related documents were disclosed in Form 8K filed on October 17, 2007. In October 2009, we incorporated OSS-IM View Inc. which is responsible for providing BI software. The current version of BI software manages data from over a million multi-faceted transactions for large field-services customers. Wireless and web enabled, the software provides automated intelligent decision-making for managing customer transactions, vehicles, technicians, supply chains, HR-related functions and other activities.

Today, our operations are divided into two distinct operating segments: (a) security and surveillance products and services, and (b) broadband deployment and provisioning services. Through AC Technical Systems we provide integrated security solutions to our commercial customer base. Through Cancable, and XL Digital, we provide broadband deployment and provisioning services to residential and commercial markets.

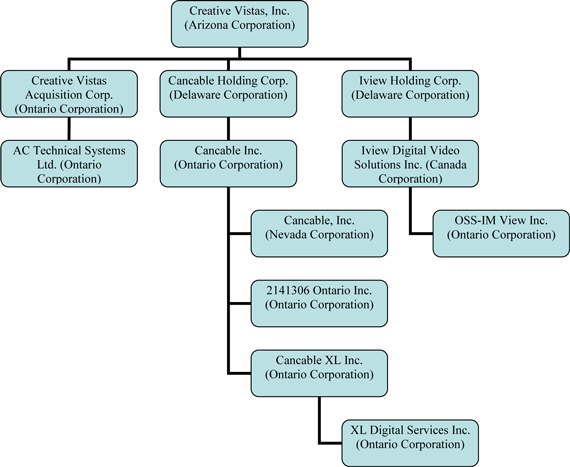

The current corporate structure is as follows:

2

Security and Surveillance Products and Services

AC Technical Systems is focused on the electronic security segment of the security industry. Through our technology integration team of engineers, we integrate various security related products to provide single source solutions to our growing customer base. Our design, engineering and integration facilities are located in Ontario, Canada. We operate through our Iview DVSI subsidiary to build out Digital Video Management Systems (DVMS) to provide PC based video management systems to the surveillance market. Iview is a product company and sells to distributors and integrators in North America. Iview is in the early stages of building a strong consistent sales and marketing team to begin contributing revenues to us.

Industry Overview

We believe that the security industry is growing at a steady pace. There has been renewed focus on our industry since the events of September 11, 2001. The growth is spurred by the continuous evolution of new technologies and processes. We believe that the industry is growing for the following reasons:

|

|

·

|

Increased global awareness due to the increased threats of terrorism;

|

|

|

·

|

Older security devices such as the VCR have become obsolete and new technologies have provided much more efficient systems at a better price;

|

|

|

·

|

Evolving digital technologies have started to replace antiquated analog technologies in the market space;

|

|

|

·

|

Expansion of budgets due to increased awareness of the need for security;

|

|

|

·

|

Increase in crime rates and shrinkage in the industry;

|

|

|

·

|

Integration of multiple devices has expanded the market for technically advanced integrators such as our firm; and

|

|

|

·

|

Growing public concern about crime.

|

|

|

·

|

Decreased cost of security technology.

|

The security industry is highly fragmented with a large number of manufacturers, dealers, distributors, integrators and service groups. All of these parties provide part of the entire solution to the customer. Customers prefer a one-stop shop that provides them with the entire solution and also designs and customizes a solution that fits their needs. This solution may include custom design of hardware, software, along with highly sophisticated integration work. In most cases the cost to the customer is higher when using a large number of parties as opposed to one efficient integrator. We believe that when many parties are involved in providing a solution to the customer, many needs of the customer may not be addressed. The amount of time a customer has to devote to build multiple relationships as opposed to one relationship is substantial. There are also tendencies for different parties to “pass the blame” to the other party when it comes to technical and service issues with the project. As a result, the customer prefers dealing with one source that can handle all issues and be accountable for an entire project. There are a limited number of companies besides us that are capable of providing this entire integrated solution. Providing such a solution requires years of experience, infrastructure for performing all six core functions that we provide, access to technologies and a significant commitment to maintaining a satisfied customer.

A company that is implementing a new security system or enhancing an old system usually has to go through the following steps:

|

|

·

|

Retain a consultant to appropriately outline its needs and design a system that satisfies those needs;

|

|

|

·

|

Once the design is complete, a tender is released whereby a number of invited system integrators bid on the required system;

|

|

|

·

|

System integrators work with various suppliers of hardware and software to meet the system requirements. They also engage these suppliers to complete subcomponents of the system;

|

|

|

·

|

When security systems have to be installed in multiple locations, the company may have to tender the system requirements to different system integrators from various regions; and

|

|

|

·

|

The customer, based on price and qualifications of the system integrator, will award the project to one or more system integrators.

|

3

The process described above can cause a number of issues for clients including client frustrations with project delays, cost inefficiencies, incompatible systems and lack of vendor accountability. It also makes it very difficult for the customer to make changes to the system. In addition, a customer looking to implement security systems in multiple locations may have to hire multiple integrators and suppliers to integrate systems. This usually results in systems that are not consistent with each other. These systems may also not communicate efficiently with a central system. In addition, as security systems become more technologically advanced, an experienced engineering team is required to understand the needs of the customer and satisfy those needs by incorporating the most efficient technologies available into the security system. This may also include some development of hardware and software to customize and integrate the system. Most system integrators are not capable of development, as they do not have a research and development department. Also, the manufacturers of different subsystems are usually not willing to provide custom solutions on a project basis. Customers are realizing the sophistication required in order to provide a good security system and recognizing that their in-house personnel lack the skills and time necessary to coordinate their security projects.

Our Strategy

We have identified four key markets to target with our solution described below. These are 1) government, 2) education 3) healthcare and 4) retail. We offer a one-stop-shop that provides a fully integrated technology based security system to meet the needs of the customer. We understand the needs of the customer and provide a custom solution to meet their needs. We expedite project completion, reduce costs to the customer, reduce manpower requirements of the customer and improve systems consistency in multiple locations.

We provide the following services:

|

|

·

|

Consulting, audit, review and planning;

|

|

|

·

|

Engineering and design;

|

|

|

·

|

Customization, software development and interfacing;

|

|

|

·

|

System integration, installation and project management;

|

|

|

·

|

System training, technical support and maintenance; and

|

|

|

·

|

Ongoing maintenance, preventative maintenance and service and upgrades.

|

We believe that the following key attributes provide us with a sustainable competitive advantage including:

|

|

·

|

Experience and expertise in the security industry;

|

|

|

·

|

In-house research and development departments;

|

|

|

·

|

Dedicated service team;

|

|

|

·

|

Access to and experience in a variety of product mix;

|

|

|

·

|

Customized software and hardware products;

|

|

|

·

|

Strong references; and

|

|

|

·

|

Strong partnerships with suppliers and integrators.

|

Our strategy for growth and expansion is to:

|

|

·

|

Expand our network of technology partners;

|

|

|

·

|

Develop and maintain long-term relationships with clients;

|

|

|

·

|

Open regional offices in key areas to expand revenue and service;

|

|

|

·

|

Capitalize on our position as a leading provider of technologically advanced security systems; and

|

|

|

·

|

Expand our marketing and sales program within our key vertical markets.

|

At the beginning of each new client relationship, we designate an account manager as the client service contact. This individual is the point person for communications between the client and us. The account manager usually has a number of years of experience in the industry and a good understanding of technologies and solutions that we provide. This person is also a trained salesperson who is able to build a long-term relationship with the customer. The account manager works with our project department, engineering department, marketing department, finance department and research and development department to provide an effective solution for the customer. Once the customer has engaged us to provide a solution, the engagement usually goes through one or more of the stages outlined below:

4

Consulting, audit, review and planning

We identify the client’s objectives and security system requirements. We then audit and review the client’s existing system. This audit of the existing system evaluates inventory counts and the existing infrastructure. Then we provide an audit report to outline current deficiencies and vulnerabilities. At this point we design a system alternative to meet the needs of the customer. The alternative system is prioritized based on the needs of the customer. We also include an efficient cost model to ensure that the customer understands the cost of the system. We provide a Return On Investment (ROI) model where applicable. We also provide a preliminary project implementation plan that contains a graphical model of the client’s premises with exact outlines of equipment locations. Our comprehensive planning process helps the customer to properly budget for its needs on a long-term basis.

Engineering and design

The engineering and design process involves preparation of detailed project specifications and working drawings by a team of our design engineers. These drawings lay out the entire property and provide a detailed map of all security equipment and the methodologies used to integrate the system. The specification and drawings also outline any needs for custom software or hardware design services, systems designers and computer-aided design system operators. These specifications and drawings detail areas of high sensitivity, the layout of the main control room, and the placement of cameras, card readers, monitors, switches and other equipment.

Once our system design has been completed, we provide a complete list of components and recommendations. We highly recommend off-the-shelf non-proprietary components in order to ensure that the customer is not tied into one supplier. When off-the-shelf components are not available or are not compatible with each other, we design software or hardware to provide compatibility.

Customization, software development, interface

In many cases, the customer’s needs may not be completely satisfied by the equipment available in the market place. The customer may request features or equipment that are not readily available. For example, a financial institution may request us to take information from their transaction records and an Automatic Teller Machine (ATM), and then integrate that information with a Digital Video Recorder (DVR). This would allow them to review video of an individual who has processed a transaction on an ATM. Normally a financial institution requiring this information would have to go through tapes of data in order to find it. Such a bank would have to search all the transactions that occurred during a period of time and then, based on that information, go over tapes of video. Sometimes the video may not be available if the tapes are only held for a short period of time. Our firm’s integrated system makes this search process instantaneous. Our system allows a bank to search by a number of criteria including time, date, transaction, number and withdrawal amount. A bank can also have video associated with such a search instantly.

Many times we provide an interface to bring multiple technologies together. In one project we integrated eleven different products into one system, thus allowing for a completely integrated system. This integrated system also has a very user-friendly interface that avoids having to deal with multiple monitors and Graphical User Interfaces (GUI).

System integration, installation, project management:

Once we determine that a project has passed through the consulting/audit, design/engineering and customization/software interfacing stage (if required) we can start the implementation of system. During this stage, we provide the following:

|

|

·

|

Detailed schedule of integration

|

|

|

·

|

List of components and labor assignments

|

|

|

·

|

Officially assign the project to one of our project managers

|

|

|

·

|

Production department starts procurement schedules

|

|

|

·

|

Construction draw date schedules

|

|

|

·

|

Progress billings and schedule site visits for quality control

|

|

|

·

|

Tests of final terminations and technology components in-house in order to avoid product failure on site

|

|

|

·

|

Hardware/software and network integration

|

|

|

·

|

Validation and testing

|

|

|

·

|

Final sign off and pass over to service department

|

During this stage the project manager manages the project and the projects are updated weekly to ensure that all components are working efficiently. During certain projects the project manager may opt to use subcontractors to provide services that are not highly advanced technically. These services may include standard wiring and cabling. The customer is updated on the status of the project weekly. These updates may include Gantt charts. During this stage, many customers see the need for additional enhanced equipment, which increases the value of the contract to us.

5

System training, technical support, maintenance

When a project has been completed through system integration, the customer is provided with a complete training program. We train the customer on how to use the system and also provide them with manuals from manufacturers as well as training guides put together by us. Once the training is complete the system will go on line and there is a transfer process to the service department from the projects department. Ongoing technical support and maintenance are provided by our dedicated service team.

Ongoing maintenance, preventative maintenance and service, upgrades:

This is the final stage of our process and it is an ongoing stage. We provide various types of maintenance contracts, which vary depending on the level of response required by the customer. We also provide a service plan suitable to the customer. If the customer does not require a service contract, we provide them with service on an incident by incident basis.

The entire six steps process continues for each customer. Once a project is complete, there are upgrades that are required. Depending on the value of the upgrades, they may initiate a new project. During every stage an account manager is updated on the process. Account managers have regular meetings with the customers after projects are complete in order to help set budgets for the following years and also educate customers on new products and technologies that may be available in the market.

Research and Development

We have our own in-house research and development programs which are supported by the National Research Council of Canada. We may receive grants and tax credits for projects and product development if they qualify for the program. Our product development department develops new products and also enhances existing products. We have the capability to build various forms of hardware and software modules. Once a product is designed, the underlying technologies are used on an ongoing basis to enhance future projects and develop new products. This is one of the differentiating factors between our competitors and us. Our research and development expenses were approximately $860,000 in fiscal year 2010 and $590,000 in fiscal year 2009. Expenses include engineering salaries, costs of development tools and equipment. None of the expenses were borne directly by customers.

Warranties and Maintenance

We offer maintenance and service on all our products, including parts and labor, which range from one year to six years depending upon the type of product concerned and the type of contract signed by the customers. In addition, we provide a one-year warranty on equipment and a 90 day warranty all installation projects completed by us. We receive the same warranty on equipment from our other external suppliers.

On non-warranty items, we perform repair services for our products sold at our main office in Ontario, Canada or at customer locations. For the years ended December 31, 2010 and December 31, 2009, our revenue from such service and maintenance activities was $1,409,400 and $1,471,500 respectively, and is included in service revenue in the accompanying consolidated statements of operations and comprehensive (loss).

Marketing

Our marketing activities are conducted on both national and regional levels. We obtain engagements through direct negotiation with clients, competitive bid processes, referrals and direct sales calls. Our marketing plan is derived with input from all our account managers and senior management. Our plan is to grow vertically within targeted markets where we have a superior level of expertise. Our marketing is very target specific. We market within our four key markets. We also find niche markets where our technologies can provide effective solutions to the customer. Some of our marketing activities include:

|

|

·

|

Trade Shows

|

|

|

·

|

Mailers

|

|

|

·

|

Direct sales calls

|

|

|

·

|

Web promotions

|

|

|

·

|

Seminars

|

|

|

·

|

Collaborations with manufacturers

|

6

|

|

·

|

Collaborations with consultants and architects

|

We also collaborate with providers of complementary technologies and products who are not competitive with us. For example, there is a convergence of IT services and the security industry. We are evaluating the possibility of partnering with an IT services provider in order to provide our existing and potential customers with an expanded scope of services. We are also doing the same within the building automation industry as we see a convergence of building automation technologies and services with the security industry.

We are evaluating several opportunities to expand our operations via joint ventures and partnerships with regional and international companies that can provide us with additional expertise and an expanded presence. In addition we are evaluating the possibility of acquiring similar businesses and expanding our operations.

Customers

We provide our products and services to customers in four markets:

|

|

·

|

Government

|

|

|

·

|

Healthcare

|

|

|

·

|

Education

|

|

|

·

|

Retail

|

We also provide our products and services to various other sectors including corporate facilities, mining, entertainment and the automobile industry through direct sales to end-users and through subcontracting agreements.

Backlog

Our backlog consists of written purchase orders and contract, we have received for product deliveries and engineering services that we expect to deliver or complete within 12 months. All of these orders and contracts are subject to cancellation at any time. As of December 31, 2010, our backlog was approximately $2,000,000.

Competition

The security industry is highly fragmented and competitive. We compete with a number of different companies regionally and nationally. We have various different types of competitors including consultants, integrators, and engineering and design firms. Our main competitors include Siemens, ADT, Simplex, Intercon and Diebold. Our competitors also include equipment manufacturers and vendors that provide security services. Some of our competitors have greater name recognition and financial resources than we do. However, we believe that we have a well-respected name and are known for our quality work and technical expertise. We may face future competition from potential new entrants into the security industry and increased competition from existing competitors that may attempt to develop the ability to offer the full range of services offered by us. We cannot assure that we will be able to compete successfully in the future against existing or potential competitors.

Employees

As of December 31, 2010, Cancable has a staff of over 400 employees and A.C. Technical Systems has a staff of 47 employees.

None of our employees are covered by a collective bargaining agreement or represented by a labor union. We consider our relationship with our employees to be satisfactory.

The design and implementation of our equipment and the installation of our systems require substantial technical capabilities in many different disciplines from computer science to electronics with advanced hardware and software development. As a company, we encourage and provide training for new and existing technical personnel. In addition we conduct training courses and also send our technical persons to various technical courses offered by manufacturers of various products. We have various incentive programs for our employees to improve their skills within all departments. These include reimbursements for training fees and raises based on skill sets.

7

Broadband deployment and provisioning services

We operate through our subsidiaries Cancable Inc., XL Digital Services Inc. and Cancable, Inc. (together the “Cancable Group”), located in Canada and the United States to provide and deploy broadband services. Cancable Inc. and XL Digital Services Inc. were subsequent acquisitions. Cancable Group has re-branded its name to Dependable HomeTech in 2007.

Cancable Inc. is a growing Canadian based leader in providing and servicing broadband technologies to both residential and commercial markets. The Cancable service offering, network deployment, IT integration, and support services enable the cable television and telecommunications industries to deliver a high quality broadband experience to their customers. Cancable’s clients rely on Cancable’s knowledge and expertise to rapidly deploy the latest technologies to support advanced cable services, cable broadband Internet access and DSL. Services provisioned include new installations, reconnections, disconnections, service upgrades and downgrades, inbound technical call center sales and trouble resolution for cable Internet subscribers, and network servicing for broadband video, data, and voice services for residential, business, and commercial marketplaces.

Cancable has a long history as a field services organization. It has been successful in developing long-term relationships with its clients and is highly regarded in the industry for quality. This is evidenced by its status as the largest service provider to Rogers Cable Inc., Canada’s largest cable company and the exclusive supplier to Cogeco Cable Inc. in the Windsor, Ontario area. Cancable’s central appeal to its customers is its ability to deliver its quality services and at a cost which they cannot match internally.

XL Digital Services Inc. (“XL Digital”), incorporated in 2007, is a Canadian-based company provisioning the deployment and servicing of broadband technologies in the residential market for Canada’s largest cable television provider, Rogers Cable. XL Digital, with over 70 employees, provides its deployment and provisioning services for Rogers within two territories where the Company currently did not have a presence. The acquisition enables the Company to further expand its services into these two growing territories. XL Digital also brings the Company a number of years of significant management experience within the cable and telecommunications sector.

Senior Management

Cancable Group has a proven team with over 70 years of cable TV contracting/technical deployment and support experience.

Ross Jepson, President and CEO, joined Cancable in December, 2001 after many years of executive management experience in the cable industry most notably as President of Cablenet Canada, Managing Director of Videotron UK, Executive Vice President for Cableworks Communications and Chief Operating Officer of IT Canada. Ross has over 25 years of local, national and international management experience in Operations and Business Development.

Paul Mease, Senior Vice President, Field Services, originally joined the company in August 2005 and now has overall leadership of the Canadian and US field operations. Paul has extensive operational and contracting field services experience having held various senior positions within several large multi trade construction companies including Aecon Inc. and E.S. Fox. Ltd. He has spent almost his entire career within various aspects of field services including operations, procurement, support, fleet and asset management, acquisitions and strategic growth. Paul has both a P. Eng and a MBA.

Cheryl Lewis, Vice-President, Dependable HomeTech Services, leads the Operational and Business Development for Dependable HomeTech's call centre division. Prior to joining Cancable in 1997, Cheryl spent 10 years in the Hospitality industry, gaining a wealth of knowledge in Sales and Customer Service. Throughout her career with Dependable HomeTech she has been involved in the operations of our field services team as well as Customer Service for both Ontario and US Operations. She is currently also responsible for company growth initiatives.

8

Catherine Lewis, P. Eng., MBA, CMA, Chief Financial Officer, joined Cancable in March 2009 and brings over 20 years of accounting and finance experience. She has held senior finance roles in the IT, telecom and technology sectors encompassing the full spectrum of service, product and manufacturing. Companies included CompuCom/CCSI, Telus, AT&T Canada and Nortel. Ms. Lewis is responsible for finance and accounting functions for Cancable.

Cancable believes that there is a large and growing market for its services and the demand for its services are growing as:

|

|

·

|

The increase in popularity of the Internet and in the complexity of Internet sites has increased demand for high-speed Internet access from both residential and commercial consumers;

|

|

|

·

|

Technological advances, including the shift from an analog to a digital network environment and the ability to leverage existing network infrastructure to deploy high-speed services such as IP networking technologies, have accelerated the availability of advanced services such as digital video and high-speed Internet access;

|

|

|

·

|

Cable and telecommunications service providers have made significant investments to build and upgrade their wired and wireless networks, creating a substantial opportunity to deliver advanced services to commercial and residential consumers;

|

|

|

·

|

End-users increasingly demand access to integrated video, voice and data services, advanced set top boxes, high-speed digital modems, telephone lines, voice mail, computer networks, video conferencing and other technologies. Cancable’s clients must rapidly deploy these technologies in order to maximize their revenue per end-user, realize a return on their investments and maintain or gain competitive advantages; and

|

|

|

·

|

The availability of multiple choices for end-users to receive advanced services has led broadband service providers to focus increasingly on end-user satisfaction to control turnover and to rely on technology enabling companies for some of their non-core activities, such as installation, integration, fulfillment, maintenance, warranty and support services.

|

Key Client Relationships

Cancable has three main customer relationships, Rogers Cable Inc., Time Warner Entertainment, and Cogeco Cable. Rogers Cable Inc. is the most significant.

Rogers Cable Inc.

Rogers Cable Inc. is Cancable Group’s largest customer employing more than 280 of our field technicians as of December 2010. In addition to its in-house capability, Rogers currently utilizes eight contractors to manage its cable TV activity. This number is down from 22 contractors three years ago. Over the past two years, as a result of the vendor consolidation and its top rated performance, Cancable Group has emerged as Rogers’ primary contractor in Ontario with more than a 25% share of completed work orders.

The Contract Field Technical Support Industry

Overview

In 2004, the cable television industry in Canada served 9.3 million homes of which 2.3 million were subscribers to digital cable. While direct to home satellite service providers have penetrated the video market, cable operators continue to maintain an overall 77% market share.

A significant development for both cable and telecom companies has been the acceptance of the internet as a mass medium for commerce and communications involving both residential and commercial consumers. A recent report stated that, as of 2004, 44% of Canadian homes were connected to high-speed Internet services. Approximately 2.3 million homes connect via cable while 1.9 million connect via telco providers.

At present, Cancable’s management believes that there are approximately 25 providers of contract field technical support serving the Ontario cable television market. Management also believes that this number will be markedly reduced in the near future as evidenced by the vendor consolidation initiative recently completed by Rogers. Management believes that its cable television clients who operate in multiple geographic markets will prefer to align themselves with larger technology enablers, like Cancable, who are able to deploy consistent service on a wider scale and have the expertise and resources to deploy and maintain increasingly complex technologies.

9

Accordingly, management believes that its target market presents substantial growth opportunities due to:

|

|

·

|

the increasingly competitive landscape in the areas of video, internet and telecom delivery, which are requiring cable operators to increase their commitment to quality customer service and strict quality standards;

|

|

|

·

|

a drive for cost reductions on the part of the cable operators, caused by price competition due to “bundling” strategies by them and their competitors;

|

|

|

·

|

the increasing demand by residential and commercial consumers for advanced broadband services such as high-speed internet access, digital video and telephone;

|

|

|

·

|

the need to satisfy the demand for emerging broadband communications technologies such as web-based video conferencing;

|

|

|

·

|

virtual private networks, which are networks run over the internet that provide privacy to the network users;

|

|

|

·

|

Voice-Over-IP (VOIP), which will allow simultaneous two-way voice communication with high-speed data transmission over broadband; and

|

|

|

·

|

the availability of multiple choices for consumers to receive these advanced services, which has led to intensifying competition for subscribers and an increased focus among BSPs on consumer satisfaction, and the need for BSPs to rapidly deploy technology and equipment capable of delivering advanced services to residential and commercial consumers to realize a return on the significant investments they have made to build and upgrade their networks.

|

Over the next three years Cancable’s management expects to see its industry change significantly for the following reasons:

Increasing Technological Complexity

Each of Cancable’s target market segments is experiencing rapid changes in technology. The convergence of previously separate technologies has produced newer, more complex technologies, such as bundled video, voice and data services. Delivering these services requires more highly trained technicians, cross-trained in several technologies, to provide installation, integration, fulfillment, and long-term maintenance and support services than in the past. For example:

|

|

·

|

Cable Internet access. High-speed internet access requires that cable system operators provide initial installation and testing as well as on-going maintenance and support of new technologies, such as cable modems and network cards.

|

|

|

·

|

VOIP. Cable operators are already in the process of utilizing their networks for the provision of local telephone. This area represents a potentially significant source of incremental activity for Cancable.

|

|

|

·

|

Convergence of video and telecom services. Increasingly, traditional telecom carriers are entering the field of entertainment and data delivery, either through strategic investments in alternate technologies (see Direct Broadcast Satellite below) or through the adaptation of the existing telecom infrastructure.

|

|

|

·

|

Direct to home Satellite. Programming services require installation of a satellite receiving antenna or dish and a digital receiver at the consumer premises. In order to facilitate high-speed internet access, additional coordination is required between the satellite technologies and the standard telephone line modem connections that handle outbound communications from the consumer. Although certain DTH equipment may be installed by the consumer, there is a growing trend toward professional installation of satellite equipment.

|

|

|

·

|

Premise networking. Premise networking requires installation, certification and maintenance of high-speed data networks, including LANs/WANs, client/server networks, and video, audio and security networks meeting stringent industry requirements. Substantial resources must be committed to train and retain field technicians in the new technologies. Cancable believes that these increasing knowledge and training requirements present a significant competitive advantage for larger, well-capitalized enabling companies, and provide additional motivation for BSPs to rely on independent technology enablers thereby avoiding costly investments in internal service and fulfillment infrastructures.

|

10

Increased Reliance by BSPs on outsourcing

Technological advances and deregulation in the cable, telecommunications, satellite wireless and premise networking industries have provided residential and commercial consumers with multiple choices for receiving advanced services. The escalating competition for end-users has increased competitive pressures on BSPs, which is requiring them to focus more on consumer satisfaction. The providers' need to rapidly upgrade and expand existing systems, as a result of increased competition and growing demand for advanced services, should lead to a continued increase in the level of reliance on independent technology enablers for non-core activities, such as installation, integration, fulfillment, and long-term maintenance, warranty and support services. Management anticipates that BSPs will increase their reliance on independent technology enablers like Cancable to the extent that the enablers provide services that are of a higher quality and more cost efficient than existing, in-house infrastructure, in the same way that providers historically have relied on outside sources for other ancillary functions, such as design and manufacture of consumer premise equipment. Many emerging BSPs, such as DSL and DTH providers, often enter new markets where they have little or no local presence and limited resources to meet the growing demand for their advanced video, voice and data services. These providers typically have no in-house service infrastructure. Cancable believes these BSPs will continue to rely on independent technology enablers to meet their installation and maintenance needs. Cancable believes there will be an increased need for higher value-added services as the broadband industry continues to evolve and recurring upgrades and value-added improvements become more significant. Historically, large corporations with internal information technology departments have been primary users for such applications. However, the rapidly growing demand for such applications from small to medium-sized businesses and residential end-users, which do not have internal deployment and maintenance capabilities, presents additional growth opportunities for independent technology enablers like Cancable.

Emergence of Preferred Providers of Technology Enabling Services

Cancable believes that because of the increasing geographic scope of and complexity of technology deployed by BSPs, there is a growing trend towards long-term, strategic alliances with technology enabling companies, in contrast to the historic, contractual project-by-project arrangements. Cancable believes that its industry is highly fragmented and characterized by smaller, privately held companies that offer a limited range of industry-specific services to a small number of clients in concentrated geographic areas. In Cancable’s experience, BSPs in its target markets who rely on technology enabling companies prefer to align themselves with larger, better capitalized companies that:

|

|

·

|

have the expertise and resources to deploy and maintain increasingly complex technologies over large networks;

|

|

|

·

|

consistently deliver high quality service;

|

|

|

·

|

provide regional coverage and have the capacity to work on multiple projects simultaneously; and

|

|

|

·

|

have the ability and willingness to invest in infrastructure to enhance the deployment and maintenance of the advanced technologies demanded by residential and commercial customers.

|

Industry Trends Specific to the Contract Field Technical Support Industry

|

|

·

|

Competition at the client level. Some of Cancable’s customers are in a monopolistic industrial environment. Today, these customers are faced with increasing competition which is forcing them to adapt the new reality. Part of this adaptation includes taking an in-depth review of their internal cost structure to determine which services must be performed by employees and which should be contracted out, at lower cost.

|

|

|

·

|

Consolidation at the client level. The cable television industry in particular has been undergoing a trend towards consolidation for many years. This trend has resulted in changes in the manner in which services are contracted for and has changed the relationship between client and service provider. Relationships today are driven less by personal contacts and more by professional qualifications. Also important to industry relationships today are the service provider’s ability to provide a service level that is uniform across its work force and to integrate its management and reporting systems with those of the client.

|

11

|

|

·

|

Trend towards contracting out. The above two drivers are causing cable television and telecommunications service providers to move increasingly towards contracting out services that are perceived to be non-core but are manageable through sophisticated systems and a high level of integration between their own internal systems and those of the support provider. While not a current client of Cancable, Bell Canada is leading the trend in this area with almost all of its field service activities contracted out. Cancable believes that its two largest clients, Rogers Cable and Cogeco Cable, contract out approximately two-thirds of their field installation and service call work. Cancable expects that this percentage will continue to increase and that the outsourcing trend will spread to these clients’ other field activities that are currently not outsourced.

|

|

|

·

|

Consolidation among service providers. As an adjunct to consolidation at the client level, larger clients want to increase efficiency by reducing the number of vendors in each area. This trend tends to favor those service providers that are able to scale up to the demands of increased volumes and are able to meet the system integration requirements of the client.

|

12

|

ITEM 1A.

|

RISK FACTORS

|

Described below are the material risks that we face. Our business, operating results or financial condition could be materially adversely affected by, and the trading price of our common stock could decline due to, any of these risks.

Competitive pressure from larger firms

The security industry is highly competitive. We compete with a number of large international firms, which have more extensive resources than we do. In addition, these competitors may have greater brand recognition, proprietary technologies and superior purchasing power as well as other competitive advantages.

Risks associated with budget constraints and cut back of customer spending:

We are dependent on large institutional and commercial customers and their budgets. If there are cut backs in budgets by its customers it will adversely impact our revenues.

Risks associated with possible delays of construction schedules

We have contracted to provide security systems to a number of new buildings. Delays in construction of these buildings could potentially delay revenues being realized.

Supplier product failures

We do not currently manufacture our own products and must purchase products from others. It could adversely impact our relationships with our customers if there are delays in receiving products from suppliers or if there are defects in these products.

Contracts with government agencies may not be renewed or funded

Contracts with government agencies accounts for some of our revenues. Many of these contracts are subject to annual review and renewal by the agencies and may be terminated at any time or on short notice. Each government contract is only valid if the agency appropriates enough funds for such contracts. Accordingly, we might fail to derive any revenue from sales to government agencies under a contract in any given future period. In addition, if government agencies fail to renew or terminate any of these contracts, it would adversely affect our business and results of operations.

We have a small number of customers from which we receive a large portion of our sales. Our experience has been that some of these substantial customers will be a source of significant sales in the succeeding year and some will not. Consequently, we are often required to replace one customer with one or more other customers in order to generate the same amount of sales. There can be no assurance that we will continue to be able to do so.

Key personnel losses

Competition for highly qualified technical personnel is intense and we may not be successful in attracting and retaining the necessary personnel, which would limit the rate at which we can develop products and generate sales. In particular, the departure of any of our senior management members or other key personnel could harm our business.

13

Intellectual property protection risks

Our intellectual property might not be protected. No new intellectual property has been acquired within the last three years. Despite our precautions, it may be possible for unauthorized third parties to copy our products or obtain and use information that we regard as proprietary to create products that compete against ours. If we fail to protect and preserve our intellectual property, we may lose an important competitive advantage. In addition, we may from time to time be served with claims from third parties asserting that our products or technologies infringe their intellectual property rights. If, as a result of any claims, we were precluded from using technologies or intellectual property rights, licenses to the disputed third-party technology or intellectual property rights might not be available on reasonable commercial terms, or at all. We may initiate claims or litigation against third parties for infringement of our proprietary rights or to establish the validity of our proprietary rights. Litigation, either as plaintiff or defendant, could result in significant expenses or divert the efforts of our technical and management personnel from productive tasks, whether or not the litigation is resolved in our favor. A successful claim against us, coupled with our failure to develop or license a substitute technology, could cause our business, financial condition and results of operations to be adversely affected.

We may not be able to increase our bonding

Many of our government contracts require that we obtain bonding. We may not be able to increase our bonding and, therefore, we may not be able to pursue larger projects as a primary contractor.

Fluctuation in quarterly results

Our quarterly results have varied over the past few years and will likely continue to do so. The results will vary based on the timing of the projects, construction schedules and customer budgets. Such fluctuations may contribute to volatility in the market price for our stock.

Lengthy sales cycle

The sale of our products and services frequently involves a significant commitment of resources to evaluate and propose a project. The approval process for our proposals usually involves multiple departments within our clients and may take several months. Accordingly, depending on the length of recording and processing time, a sale can take a prolonged period of time.

We may not be able to successfully make acquisitions or form partnerships as a means of fostering our growth

Our growth strategy involves successfully acquiring companies that will add value to our firm and also build partnerships with companies who can complement our core competencies. We may not be successful in identifying or consummating transactions with such companies.

Continued need for additional financing

To implement our growth plan, we may need additional financing. We will need additional financing upon, but not limited to, any of the following events:

|

|

·

|

Changes in operating plans

|

|

|

·

|

Lower than anticipated sales

|

|

|

·

|

Increased costs of expansion

|

|

|

·

|

Increase in competition relating to decrease in price

|

|

|

·

|

Increased operating costs

|

|

|

·

|

Potential acquisitions

|

Additional financing may not be available on commercially reasonable terms or may not be available at all.

Cancable Group, one of our major subsidiaries, relies on certain large clients for a significant portion of our revenues

Cancable Group currently derives a significant portion of its revenues from a limited number of clients. For the fiscal year ended December 31, 2010, Rogers Cable TV Limited accounted for approximately 68.5% of Cancable’s revenues. The services required by any one client can be limited by a number of factors, including industry consolidation, technological developments, economic slowdown and internal budget constraints. Cancable Group’s clients are not obligated to purchase additional services and most of Cancable’s contracts are cancelable on short notice. As a result of these factors, the volume of work performed for specific clients is likely to vary from period to period and a major client in one period may not use Cancable’s services to the same degree in a subsequent period. A temporary or permanent loss of any of Cancable’s key clients could seriously harm its business. If any cancelled contracts were not replaced with contracts from other clients, Cancable’s revenues might decrease and its profitability could be adversely affected.

14

Cancable will be adversely affected by a decline in the growth of the cable and telecom industries

The broadband communications industry has experienced a high rate of growth. If the rate of growth slows, and broadband service providers reduce their capital investments in upgrades or expansion of their systems, Cancable’s clients may not require the same volume of services from Cancable and it may not be able to execute its growth strategy. In that case, Cancable’s profitability and its prospects could be adversely affected.

Our clients may not rely on the Contract Field Technical Support services we provide

Cancable’s success is dependent on the continued reliance by BSPs on independent companies like Cancable for performance of their installation, integration, fulfillment, and long- term maintenance and support services. If these providers elect to perform these services themselves, Cancable’s revenues may decline and its business could be harmed.

Consolidation of broadband service providers could result in fewer and smaller customers for us

The cable, telecommunications, satellite and wireless industries could experience significant consolidation activity. In addition, the consolidation of Cancable’s clients could have the effect of reducing the number of its current or potential clients, which could result in Cancable’s dependence on a smaller number of clients.

Cancable may face reduced customer demand due to new technologies

Cancable’s industry is subject to rapid changes in technology. Existing technologies for transmission of video, voice and data are subject to potential displacement by various new technologies. New technologies may be developed that allow broadband service providers to deliver their services to consumers without a significant upgrade of their existing systems. Furthermore, new technologies may be developed that enable consumers to perform more easily their own installation and maintenance of the equipment required for the delivery of these services at their premises. Cancable will need to be able to enhance its current service offerings to keep pace with technological developments and to address increasingly sophisticated client needs. Cancable may not be successful in developing and marketing service offerings that respond to technological advances in a timely manner, and its services may not adequately or competitively address the needs of the changing marketplace. If Cancable is not successful in responding in a timely manner to technological changes, market conditions and industry developments, it may lose current clients or be unable to obtain new clients and its business, prospects, operating results and financial condition could suffer.

Cancable may not be able to compete on price with our competitors

Cancable’s industry is fragmented and highly competitive. Accordingly, it cannot be assured of being able to maintain or enhance its competitive position. Historically, there have been relatively few barriers to entry into the markets in which Cancable operates. As a result, any organization that has adequate financial resources and access to technical expertise may become one of our competitors. Competition in the industry depends on a number of factors, including price. Cancable’s competitors may have lower cost structures and may, therefore, be able to provide their services at lower rates than it can. Cancable also faces competition from the in-house service organizations of its existing or prospective clients, which often employ personnel who perform some of the same types of services as it does. If Cancable is unable to maintain or enhance its competitive position, its business, prospects, operating results and financial condition may suffer materially.

Cancable may face an inability to attract and retain qualified employees

Cancable’s ability to provide high-quality services on a timely basis requires that it employ an adequate number of field technicians. Accordingly, its ability to meet the demand for its services will be limited by Cancable’s ability to attract, train and retain skilled personnel. Cancable’s industry is characterized by highly competitive labor markets and, like many of its competitors, historically Cancable has experienced high rates of employee turnover. Furthermore, its labor expenses may increase as a result of a shortage in the supply of skilled personnel and its efforts to improve its employee retention, which could adversely impact its profitability. Cancable cannot be certain that it will be able to improve its employee retention rates or maintain an adequate skilled labor force necessary to operate efficiently and to support its growth strategy. Failure to do so could impair its ability to operate efficiently and maintain its reputation for high quality service. This could also impair Cancable’s ability to retain current clients and attract new clients that could cause its financial performance to decline.

15

Mismatch of Staffing Levels and Contract Requirements

Since Cancable’s business is driven by large, and sometimes multi-year contracts, Cancable forecasts its personnel needs for future projected business. If Cancable increases its staffing levels in anticipation of a project that is subsequently delayed, reduced or terminated, it may underutilize these additional personnel, which would increase its expenses and could harm its business.

Cancable relies on key senior employees and management

Cancable’s success is substantially dependent upon the retention of, and the continued performance by, its senior management and other key employees, including key employees of companies that it may acquire in the future. If any member of Cancable’s senior management team becomes unable or unwilling to participate in its business and operations and it is not able to replace them in a timely manner, its business could suffer. Cancable does not maintain "key man" life insurance policies on any member of its senior management or any of its key employees.

Cancable is a growing business and may require additional financing which may not be available to us

Cancable may require additional financing, including access to a bank operating line and lease financing for vehicles, to fully implement its business strategy in a timely manner. Cancable’s future requirements will depend on many factors, including continued progress in its client development and expansion programs. There can be no assurance that additional funding will be available or, if available, that it will be available on acceptable terms. If such funding is not available, Cancable may be forced to reduce or eliminate expenditures for further development of its proposed new initiatives and contemplated acquisitions. There can be no assurance that Cancable will be able raise additional capital if its capital resources are exhausted. Cancable’s ability to arrange such financing in the future will depend in part upon prevailing capital market conditions as well as its business performance. Failure to obtain such financing could delay implementation of Cancable’s strategy and could have a material adverse effect on its ability to successfully develop its business. Such financing, if available, could result in dilution to existing shareholders.

We have issued a substantial number of warrants and options and other convertible securities, which may cause the trading price of our securities to decline and may limit our ability to raise capital from other sources:

As of December 31, 2010, there were 15,212,983 shares of common stock issuable upon the exercise of warrants and 1,729,155 shares issuable upon the exercise of options. If all these warrants and options were exercised by the holders, this will result in a dilution in shareholders’ percentage holdings by approximately 30%. Included in the balance were 1,600,000 shares related to the Employee Stock Options (see Note 13 in the Financial Statements). Also, included in the balance, 15,012,983 shares of common stock issuable upon the exercise of warrants and 129,155 shares issuable upon the exercise of options issued to Laurus Master Fund, Ltd and its related entities, Erato Corporation, Valens Offshore Fund and Valens U.S. Fund, LLC and PSource Structured Debt Limited (“Laurus”). Additionally, there were 49 shares of common stock of Cancable issuable upon the exercise of options and 20 shares of common stock of Iview issuable upon the exercise of options to Laurus and its related entities. While these securities are outstanding, the holders will have the opportunity to profit from a rise in the price of our securities with a resulting dilution (upon exercise or conversion) in the value of the interests of our other security holders. Our ability to obtain additional financing during the period these convertible securities are outstanding may be adversely affected and their existence may have a negative effect on the price of our securities. We may be obligated to issue additional shares in payment of accrued interest on our term notes as a result of adjustments to the conversion or exercise prices of our convertible securities. Additional shares of our common stock may be issued if additional amounts are funded under our existing financing arrangements with Laurus or if we obtain additional financings in the future. The happening of certain events such as stock splits, reverse stock splits, stock dividends or conversion price would trigger an adjustment in the exercise or conversion price (as applicable). The adjustment would be based upon a weighted average formula in the case of below exercise or conversion price issuances. The adjustment will depend on the number of shares issued and the difference between the issuance price and the then effective exercise or conversion price. Since no such transactions are currently contemplated, it is not presently possible to quantify possible future adjustments. The holders of these securities are likely to exercise them at a time when we would, in all likelihood, be able to obtain any needed capital by a new offering of securities on terms more favorable to us than those of the outstanding warrants and options.

16

Because our directors own approximately 76% of our outstanding common shares, they could make and control corporate decisions that may be disadvantageous to minority shareholders

Our directors own approximately 76.0% of the outstanding common shares. Accordingly, they will have a significant influence in determining the outcome of all corporate transactions or other matters, including mergers, consolidations and the sale of all or substantially all of our assets, and also the power to prevent or cause a change in control. The interests of our directors may differ from the interests of the other shareholders and thus result in corporate decisions that are disadvantageous to other shareholders.

Exchange rate fluctuations may have adverse effects on our revenues

A significant portion of our revenues and expenses are denominated in Canadian dollars. As a result, we will be exposed to currency exchange rate risk. Our reported earnings could fluctuate materially as a result of foreign exchange rate fluctuations.

Our substantial debt could adversely affect our financial position

Our substantial indebtedness could have important consequences to you. Our annual debt service requirements related to payments of principal on the net balance of our term notes ($16,551,128 at December 31, 2010) are $14,051,128 and $2,500,000 in 2011 and 2013 respectively. In addition, interest on the notes is payable on a monthly basis. We also have a series of other notes payable totaling $1,500,000 as of December 31, 2010. The $1,500,000 promissory note included in other notes payable, which were issued by Creative Vistas Acquisition to The Burns Trust and The Navaratnam Trust in connection with the acquisition of AC Technical, have no fixed term of repayment. The note payable was transferred to Malar Trust during Fiscal Year 2006 with the same payment term. The term notes are secured by substantially all of our assets. Interest on term notes are settled in cash. We do not currently have the ability to repay the notes in the event of a demand by the holder; accordingly, in the event we are unable to generate sufficient cash flow from our operations, we may face difficulties in servicing our substantial debt load. In such event, we could be forced to seek protection from our creditors, which could cause the liquidation of the Company in order to repay the secured debt. In any liquidation of us, the holders of our debt (including The Malar Trust), and in all likelihood our unsecured creditors would be required to be paid in full before any payments could be made to the holders of our common stock. In addition, our outstanding indebtedness could limit our ability to obtain any additional financing.

There is no active trading market in our securities

Effective February 23, 2011, our common stock became ineligible for quotation on the OTC Bulletin Board due to quoting inactivity pursuant to Rule 15c2-11 under the Securities Exchange Act of 1934, as amended. The Company’s common stock has been moved to OTC Link, which is operated by OTC Markets Group Inc. (formerly known as Pink OTC Markets Inc. or “Pink Sheets”). OTC Link is an electronic quotation system that displays quotes from broker dealers for many over-the-counter securities. Although, our common stock is quoted on OTC Link, there is no active trading in the stock. A trading market may not develop and stockholders may not be able to liquidate their investment without considerable delay. If a market should develop, the price of our stock may be highly volatile.

Penny Stock regulations apply to our securities:

Our securities are subject to the “penny” stock regulation of Rule 15g-9 of the Securities Exchange Act of 1934. Rule 15g-9 of the Exchange Act is commonly referred to as the “penny stock” rule and imposes special sales practice requirements upon broker-dealers who sell such securities to persons other than established customers or accredited investors. A penny stock is any equity security with a market price less than $5.00 per share, subject to certain exceptions. Rule 3a51-1 of the Exchange Act provides that any equity security is considered a penny stock unless that security is: registered and traded on a national securities exchange and meets specified criteria set forth by the SEC; authorized for quotation in the National Association of Securities Dealers’ Automated Quotation System; issued by a registered investment company; issued with a price of five dollars or more; or issued by an issuer with net tangible assets in excess of $2,000,000. This rule may affect the ability of broker-dealers to sell our securities.

17

For transactions covered by Rule 15g-9, a broker-dealer must furnish to all investors in penny stocks a risk disclosure document, make a special suitability determination of the purchaser, and receive the purchaser’s written agreement to the transaction prior to the sale. In order to approve a person’s account for transactions in penny stocks, the broker-dealer must (i) obtain information concerning the person’s financial situation, investment experience, and investment objectives; (ii) reasonably determine, based on that information that transactions in penny stocks are suitable for the person and that the person has sufficient knowledge and experience in financial matters to reasonably be expected to evaluate the transactions in penny stocks; and (iii) deliver to the person a written statement setting forth the basis on which the broker-dealer made the determination of suitability stating that it is unlawful to effect a transaction in a designated security subject to the provisions of Rule 15g-9(a)(2) unless the broker-dealer has received a written agreement from the person prior to the transaction. Such written statement from the broker-dealer must also set forth, in highlighted format immediately preceding the customer signature line, that the broker-dealer is required to provide the person with the written statement and the person should sign and return the written statement to the broker-dealer only if it accurately reflects the person’s financial situation, investment experience and investment objectives.

Losing our status as a Canadian Controlled Private Corporation could adversely affect our financial position:

A Canadian Controlled Private Corporation (“CCPC”) is a corporation that is not controlled by a non-Canadian entity. If, in the future, more than 50% of the voting shares of AC Technical are owned by a non-Canadian entity, such as by Laurus exercising its rights under the Share Pledge Agreement, we would lose our status as a CCPC. Unless a company is a CCPC, it is not eligible for certain Canadian research and development tax credits. As a non-CCPC, the maximum Canadian research and development tax credits are 20% (for both Federal and Provincial Canadian taxes) of total eligible research and development expenditures. AC Technical is presently entitled to claim the maximum credits available to CCPCs of 41.5% (for both Federal and Provincial Canadian taxes) of the total eligible expenditures. During Fiscal Year 2010, this extra 21.5% totaled approximately $200,000.

Available Information