Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

[x] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2010

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM ___________ TO ___________

COMMISSION FILE NUMBER: 1-11535

|

Exact name of registrant as specified in its charter

Burlington Northern Santa Fe, LLC

|

|

|

State of Organization

Delaware

|

I.R.S. Employer Identification No.

27-1754839

|

|

Address of principal executive offices, including zip code

2650 Lou Menk Drive, Fort Worth, Texas 76131-2830

Registrant’s telephone number, including area code

(800) 795-2673

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class

None

|

Name of each exchange on which registered

None

|

|

Securities registered pursuant to Section 12(g) of the Act:

Limited Liability Company Membership Interest

|

|

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. |

Yes [x] No [ ]

|

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

Yes [ ] No [x]

|

|

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirement for the past 90 days.

|

Yes [x] No [ ]

|

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

Yes [x] No [ ]

|

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

|

[x]

|

|

Indicate by check mark whether the registrant is a large accelerated filer, accelerated filer, non-accelerated filer, or smaller reporting company (as defined in Rule 12b-2 of the Act).

|

|

|

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [x] Smaller reporting company [ ]

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

|

Yes [ ] No [x]

|

|

Burlington Northern Santa Fe, LLC is an indirect, wholly owned subsidiary of Berkshire Hathaway Inc.; as a result, there is no market data with respect to registrant’s membership interests.

|

|

|

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date:

|

|

|

100% of the membership interests of Burlington Northern Santa Fe, LLC outstanding as of February 28, 2011 is held by National Indemnity Company, an indirect, wholly owned subsidiary of Berkshire Hathaway Inc.

|

|

DOCUMENTS INCORPORATED BY REFERENCE

None

REGISTRANT MEETS THE CONDITIONS SET FORTH IN GENERAL INSTRUCTION (I)(1)(a) AND (b) OF FORM 10-K AND IS THEREFORE FILING THIS FORM WITH THE REDUCED DISCLOSURE FORMAT.

i

Part I

Burlington Northern Santa Fe Corporation was incorporated in the State of Delaware on December 16, 1994. On February 12, 2010, Berkshire Hathaway Inc., a Delaware corporation (Berkshire), acquired 100% of the outstanding shares of Burlington Northern Santa Fe Corporation common stock that it did not already own. The acquisition was completed through the merger (the Merger) of Burlington Northern Santa Fe Corporation with and into R Acquisition Company, LLC, a Delaware limited liability company and an indirect wholly-owned subsidiary of Berkshire (Merger Sub), with Merger Sub continuing as the surviving entity. In connection with the Merger, Merger Sub changed its name to “Burlington Northern Santa Fe, LLC” and remains an indirect, wholly-owned subsidiary of Berkshire. Further information about the Merger is incorporated by reference from Note 1 and Note 3 to the Consolidated Financial Statements.

References herein to “BNSF,” “Registrant” or “Company,” with respect to matters occurring prior to completion of the Merger, are references to Burlington Northern Santa Fe Corporation. References herein to “BNSF,” “Registrant” or “Company,” with respect to matters occurring after completion of the Merger, are references to Burlington Northern Santa Fe, LLC.

BNSF is a holding company that conducts no operating activities and owns no significant assets other than through its interests in its subsidiaries. Through its subsidiaries, BNSF is engaged primarily in the freight rail transportation business. At December 31, 2010, BNSF and its subsidiaries had approximately 38,000 employees. The rail operations of BNSF Railway Company (BNSF Railway), the principal operating subsidiary, comprise one of the largest railroad systems in North America.

BNSF’s internet address is www.bnsf.com. Through this internet Web site (under the “About BNSF/Financial Information” link), BNSF makes available, free of charge, its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as well as all amendments to these reports, as soon as reasonably practicable after these reports are electronically filed with or furnished to the Securities and Exchange Commission (the SEC). BNSF makes available on its Web site other previously filed SEC reports, registration statements and exhibits via a link to the SEC’s Web site at www.sec.gov. The Code of Conduct for officers and salaried employees is also made available on the Company’s Web site.

Further discussion of the Company’s business, including equipment and business sectors, is incorporated by reference from Item 2, “Properties.”

Changes in government policy could negatively impact demand for the Company’s services, impair its ability to price its services or increase its costs or liability exposure.

Changes in United States and foreign government policies could change the economic environment and affect demand for the Company’s services. For example, changes in clean air laws or regulation of carbon dioxide emissions could reduce the demand for coal and revenues from the coal transportation services provided by BNSF Railway. Also, United States and foreign government agriculture tariffs or subsidies could affect the demand for grain. Developments and changes in laws and regulations as well as increased economic regulation of the rail industry through legislative action and revised rules and standards applied by the U.S. Surface Transportation Board in various areas, including rates, services and access to facilities could adversely impact the Company’s ability to determine prices for rail services and significantly affect the revenues, costs and profitability of the Company’s business. Additionally, because of the significant costs to maintain its rail network, a reduction in profitability could hinder the Company’s ability to maintain, improve or expand its rail network, facilities and equipment. Federal or state spending on infrastructure improvements or incentives that favor other modes of transportation could also adversely affect the Company’s revenues.

The Company’s success depends on its ability to continue to comply with the significant federal, state and local governmental regulations to which it is subject.

The Company is subject to a significant amount of governmental laws and regulation with respect to its rates and practices, taxes, railroad operations and a variety of health, safety, labor, environmental and other matters. Failure to comply with applicable laws and regulations could have a material adverse effect on the Company. Governments may change the legislative and/or regulatory framework within which the Company operates without providing the Company with any recourse for any adverse effects that the change may have on its business. Federal legislation enacted in 2008 mandates the implementation of positive train control technology by December 31, 2015, on certain mainline track where intercity and commuter passenger railroads operate and where toxic-by-inhalation hazardous materials are transported. This type of technology is new and deploying it across BNSF Railway’s system and other railroads may pose significant operating and implementation risks and will require significant capital expenditures.

As part of its railroad operations, the Company frequently transports chemicals and other hazardous materials, which could expose it to the risk of significant claims, losses and penalties.

BNSF Railway is required to transport these commodities to the extent of its common carrier obligation. An accidental release of these commodities could result in a significant loss of life and extensive property damage as well as environmental remediation obligations. The associated costs could have an adverse effect on the Company’s operating results, financial condition or liquidity as the Company is not insured above a certain threshold. Further, the rates BNSF Railway receives for transporting these commodities do not adequately compensate it should there be some type of accident. In addition, insurance premiums charged for some or all of the coverage currently maintained by the Company could increase dramatically or certain coverage may not be available to the Company in the future if there is a catastrophic event related to rail transportation of these commodities.

The Company faces intense competition from rail carriers and other transportation providers, and its failure to compete effectively could adversely affect its results of operations, financial condition or liquidity.

The Company operates in a highly competitive business environment. Depending on the specific market, the Company faces intermodal, intramodal, product and geographic competition. This competition from other railroads and motor carriers, as well as barges, ships and pipelines in certain markets, may be reflected in pricing, market share, level of services, reliability and other factors. For example, the Company believes that high service truck lines, due to their ability to deliver non-bulk products on an expedited basis, have had and will continue to have an adverse effect on the Company’s ability to compete for deliveries of non-bulk, time-sensitive freight. While the Company must build or acquire and maintain its rail system, trucks and barges are able to use public rights-of-way maintained by public entities. Any material increase in the capacity and quality of these alternative methods or the passage of legislation granting greater latitude to motor carriers with respect to size and weight restrictions could have an adverse effect on the Company’s results of operations, financial condition or liquidity. In addition, a failure to provide the level of service required by the Company’s customers could result in loss of business to competitors. Changes in the ports used by ocean carriers or the use of all-water routes from the Pacific Rim to the East Coast or other changes in the supply chain could also have an adverse effect on the Company’s volumes and revenues.

Downturns in the economy could adversely affect demand for the Company’s services.

Significant, extended negative changes in domestic and global economic conditions that impact the producers and consumers of the commodities transported by the Company may have an adverse effect on the Company’s operating results, financial condition or liquidity. Declines in or muted manufacturing activity, economic growth and international trade all could result in reduced revenues in one or more business units.

Negative changes in general economic conditions could lead to disruptions in the credit markets, increase credit risks and could adversely affect the Company’s financial condition or liquidity.

Challenging economic conditions may not only affect revenues due to reduced demand for many goods and commodities, but could result in payment delays, increased credit risk and possible bankruptcies of customers. Railroads are capital-intensive and may need to finance a portion of the building and maintenance of infrastructure as well as locomotives and other rail equipment. Economic slowdowns and related credit market disruptions may adversely affect the Company’s cost structure, its timely access to capital to meet financing needs and costs of its financings. The Company could also face increased counterparty risk for its cash investments, its derivative arrangements and access to its credit facility. Adverse economic conditions could also affect the Company’s costs for insurance or its ability to acquire and maintain adequate insurance coverage for risks associated with the railroad business if insurance companies experience credit downgrades or bankruptcies. Declines in the securities and credit markets could also affect the Company’s pension fund and railroad retirement tax rates, which in turn could increase funding requirements.

The Company is subject to stringent environmental laws and regulations, which may impose significant costs on its business operations.

The Company’s operations are subject to extensive federal, state and local environmental laws and regulations concerning, among other things, emissions to the air; discharges to waters; the generation, handling, storage, transportation and disposal of waste and hazardous materials; and the cleanup of hazardous material or petroleum releases. Changes to or limits on carbon dioxide emissions could result in significant capital expenditures to comply with these regulations with respect to BNSF Railway’s diesel locomotives, equipment, vehicles and machinery and its yards and intermodal facilities and the cranes and trucks serving those facilities. Emission regulations could also adversely affect fuel efficiency and increase operating costs. Further, local concerns on emissions and other forms of pollution could inhibit the Company’s ability to build facilities in strategic locations to facilitate growth and efficient operations. In addition, many land holdings are and have been used for industrial or transportation-related purposes or leased to commercial or industrial companies whose activities may have resulted in discharges onto the property. Environmental liability can extend to previously owned or operated properties, leased properties and properties owned by third parties, as well as to properties currently owned and used by the Company’s subsidiaries. Environmental liabilities have arisen and may continue to arise from claims asserted by adjacent landowners or other third parties in toxic tort litigation. The Company’s subsidiaries have been and may continue to be subject to allegations or findings to the effect that they have violated, or are strictly liable under, these laws or regulations. The Company’s operating results, financial condition or liquidity could be adversely affected as a result of any of the foregoing, and it may be required to incur significant expenses to investigate and remediate environmental contamination.

Fuel supply availability and fuel prices may adversely affect the Company’s results of operations, financial condition or liquidity.

Fuel supply availability could be impacted as a result of limitations in refining capacity, disruptions to the supply chain, rising global demand and international political and economic factors. A significant reduction in fuel availability could impact the Company’s ability to provide transportation services at current levels, increase fuel costs and impact the economy. Each of these factors could have an adverse effect on the Company’s operating results, financial condition or liquidity. If the price of fuel increases substantially, the Company expects to be able to offset a significant portion of these higher fuel costs through its fuel surcharge program. However, to the extent that the Company is unable to maintain, expand and ultimately collect under its existing fuel surcharge program, increases in fuel prices could have an adverse effect on the Company’s operating results, financial condition or liquidity.

Severe weather and natural disasters could disrupt normal business operations, which would result in increased costs and liabilities and decreases in revenues.

The Company’s success is dependent on its ability to operate its railroad system efficiently. Severe weather and natural disasters, such as tornados, flooding and earthquakes, could cause significant business interruptions and result in increased costs and liabilities and decreased revenues. In addition, damages to or loss of use of significant aspects of the Company’s infrastructure due to natural or man-made disruptions could have an adverse effect on the Company’s operating results, financial condition or liquidity for an extended period of time until repairs or replacements could be made. Additionally, during natural disasters, the Company’s workforce may be unavailable, which could result in further delays. Extreme swings in weather could also negatively affect the performance of locomotives and rolling stock.

The Company’s operational dependencies may adversely affect results of operations, financial condition or liquidity.

Due to the integrated nature of the United States’ freight transportation infrastructure, the Company’s operations may be negatively affected by service disruptions of other entities such as ports and other railroads which interchange with the Company. A significant prolonged service disruption of one or more of these entities could have an adverse effect on the Company’s results of operations, financial condition or liquidity.

Acts of terrorism or war, as well as the threat of war, may cause significant disruptions in the Company’s business operations.

Terrorist attacks and any government response to those types of attacks and war or risk of war may adversely affect the Company’s results of operations, financial condition or liquidity. The Company’s rail lines and facilities could be direct targets or indirect casualties of an act or acts of terror, which could cause significant business interruption and result in increased costs and liabilities and decreased revenues, which could have an adverse effect on operating results and financial condition. Such effects could be magnified if releases of hazardous materials are involved. Any act of terror, retaliatory strike, sustained military campaign or war or risk of war may have an adverse impact on the Company’s operating results and financial condition by causing unpredictable operating or financial conditions, including disruptions of BNSF Railway or connecting rail lines, loss of critical customers or partners, volatility or sustained increase of fuel prices, fuel shortages, general economic decline and instability or weakness of financial markets. In addition, insurance premiums charged for some or all of the coverage currently maintained by the Company could increase dramatically, the coverage available may not adequately compensate it for certain types of incidents and certain coverages may not be available to the Company in the future.

The Company depends on the stability and availability of its information technology systems.

The Company relies on information technology in all aspects of its business. A significant disruption or failure of its information technology systems could result in service interruptions, safety failures, security violations, regulatory compliance failures and the inability to protect corporate information assets against intruders or other operational difficulties. Although the Company has taken steps to mitigate these risks, including Business Continuity Planning, Disaster Recovery Planning and Business Impact Analysis, a significant disruption could adversely affect the Company’s results of operations, financial condition or liquidity. Additionally, if the Company is unable to acquire or implement new technology, it may suffer a competitive disadvantage, which could also have an adverse effect on the Company’s results of operations, financial condition or liquidity.

The Company is subject to various claims and lawsuits, and increases in the amount or severity of these claims and lawsuits could adversely affect the Company’s operating results, financial condition and liquidity.

As part of its railroad operations, the Company is exposed to various claims and litigation related to commercial disputes, personal injury, property damage, environmental liability and other matters. Personal injury claims by BNSF Railway employees are subject to the Federal Employees’ Liability Act (FELA), rather than state workers’ compensation laws. The Company believes that the FELA system, which includes unscheduled awards and a reliance on the jury system, can contribute to increased expenses. Other proceedings include claims by third parties for punitive as well as compensatory damages, and a few proceedings purport to be class actions. Developments in legislative and judicial standards, material changes to litigation trends, or a catastrophic rail accident or series of accidents involving any or all of property damage, personal injury, and environmental liability could have a material adverse effect on the Company’s operating results, financial condition and liquidity.

Most of the Company’s employees are represented by unions, and failure to negotiate reasonable collective bargaining agreements may result in strikes, work stoppages or substantially higher ongoing labor costs.

A significant majority of BNSF Railway’s employees are union-represented. BNSF Railway’s union employees work under collective bargaining agreements with various labor organizations. Wages, health and welfare benefits, work rules and other issues have traditionally been addressed through industry-wide negotiations. These negotiations have generally taken place over an extended period of time and have previously not resulted in any extended work stoppages. The existing agreements have remained in effect and will continue to remain in effect until new agreements are reached or the Railway Labor Act’s procedures (which include mediation, cooling-off periods and the possibility of presidential intervention) are exhausted. While the negotiations have not yet resulted in any extended work stoppages, if BNSF Railway is unable to negotiate acceptable new agreements, it could result in strikes by the affected workers, loss of business and increased operating costs as a result of higher wages or benefits paid to union members, any of which could have an adverse effect on the Company’s operating results, financial condition or liquidity.

The unavailability of qualified personnel could adversely affect the Company’s operations.

Changes in demographics, training requirements and the unavailability of qualified personnel, particularly engineers and trainmen, could negatively impact the Company’s ability to meet demand for rail service. Recruiting and retaining qualified personnel, particularly those with expertise in the railroad industry, are vital to operations. Although the Company has adequate personnel for the current business environment, unpredictable increases in demand for rail services may exacerbate the risk of not having sufficient numbers of trained personnel, which could have a negative impact on operational efficiency and otherwise have a material adverse effect on the Company’s operating results, financial condition or liquidity.

None.

Track Configuration

BNSF Railway operates one of the largest railroad networks in North America with approximately 32,000 route miles of track, excluding multiple main tracks, yard tracks and sidings, approximately 23,000 miles of which are owned route miles, including easements, in 28 states and two Canadian provinces as of December 31, 2010. Approximately 9,000 route miles of BNSF Railway’s system consist of trackage rights that permit BNSF Railway to operate its trains with its crews over other railroads’ tracks.

As of December 31, 2010, the total BNSF Railway system, including single and multiple main tracks, yard tracks and sidings, consisted of approximately 50,000 operated miles of track, all of which are owned by or held under easement by BNSF Railway except for approximately 10,000 route miles operated under trackage rights.

Property and Facilities

BNSF Railway operates various facilities and equipment to support its transportation system, including its infrastructure and locomotives and freight cars. It also owns or leases other equipment to support rail operations, including containers, chassis and vehicles. Support facilities for rail operations include yards and terminals throughout its rail network, system locomotive shops to perform locomotive servicing and maintenance, a centralized network operations center for train dispatching and network operations monitoring and management in Fort Worth, Texas, regional dispatching centers, computers, telecommunications equipment, signal systems and other support systems. Transfer facilities are maintained for rail-to-rail as well as intermodal transfer of containers, trailers and other freight traffic. These facilities include 31 major international hubs located across the system.

As of December 31, 2010, BNSF Railway owned or held under non-cancelable leases exceeding one year approximately 6,700 locomotives, 76,800 freight cars, and 7,700 chassis and containers, in addition to maintenance of way and other equipment.

In the ordinary course of business, BNSF incurs significant costs in repairing and maintaining the properties described above. In 2010, BNSF recorded approximately $2 billion in repairs and maintenance expense in the Consolidated Statements of Income.

Business Mix

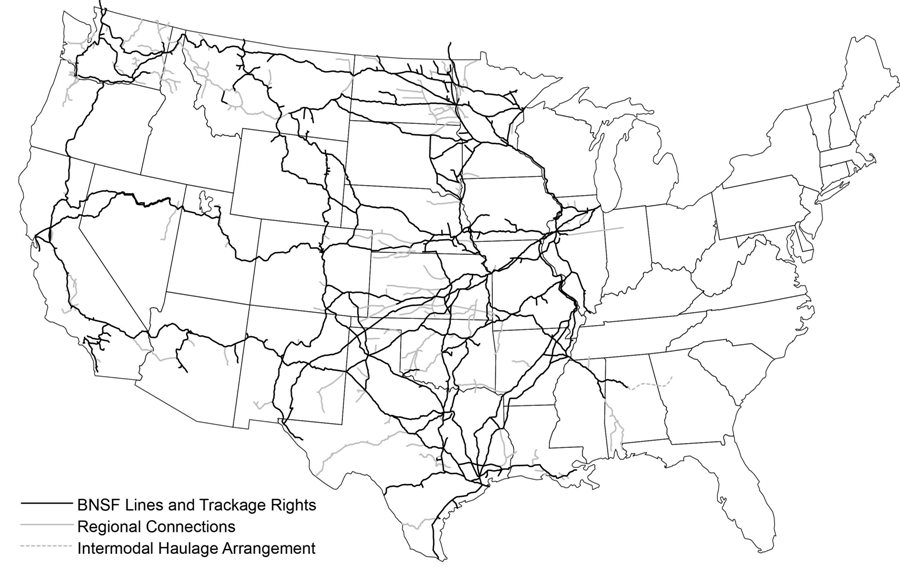

In serving the Midwest, Pacific Northwest, Western, Southwestern and Southeastern regions and ports of the country, BNSF transports, through one operating transportation services segment, a range of products and commodities derived from manufacturing, agricultural and natural resource industries. Over half of the freight revenues of the Company are covered by contractual agreements of varying durations,while the balance is subject to common carrier, published prices or quotations offered by the Company. BNSF’s financial performance is influenced by, among other things, general and industry economic conditions at the international, national and regional levels. The following map illustrates the Company’s primary routes, including trackage rights, which allow BNSF to access major cities and ports in the western and southern United States as well as Canadian and Mexican traffic. In addition to major cities and ports, BNSF efficiently serves many smaller markets by working closely with approximately 200 shortline partners. BNSF has also entered into marketing agreements with other rail carriers, expanding the marketing reach for each railroad and their customers.

Consumer Products:

The Consumer Products’ freight business provided approximately 31 percent of freight revenues for the 12 months ended December 31, 2010, and consisted of the following business sectors: International Intermodal, Domestic Intermodal (including Truckload/Intermodal Marketing Companies, Expedited Truckload/Less-than-Truckload/Parcel) and Automotive.

Coal:

The transportation of coal contributed approximately 27 percent of freight revenues for the 12 months ended December 31, 2010, with more than 90 percent of all BNSF’s coal tons originating from the Powder River Basin of Wyoming and Montana.

Industrial Products:

The Industrial Products’ freight business provided approximately 21 percent of freight revenues for the 12 months ended December 31, 2010, and consisted of the following five business areas: Construction Products, Building Products, Petroleum Products, Chemicals & Plastics Products and Food & Beverages.

Agricultural Products:

The transportation of Agricultural Products provided approximately 21 percent of freight revenues for the 12 months ended December 31, 2010. These products include wheat, corn, bulk foods, soybeans, oil seeds and meals, feeds, barley, oats and rye, flour and mill products, milo, oils, specialty grains, malt, ethanol and fertilizer.

Government Regulation and Legislation

The Company’s rail operations are subject to the regulatory jurisdiction of the Surface Transportation Board (STB) of the United States Department of Transportation (DOT), the Federal Railroad Administration of the DOT, the Occupational Safety and Health Administration (OSHA), as well as other federal and state regulatory agencies and Canadian regulatory agencies for operations in Canada. The STB has jurisdiction over disputes and complaints involving certain rates, routes and services, the sale or abandonment of rail lines, applications for line extensions and construction and consolidation or merger with, or acquisition of control of, rail common carriers. The outcome of STB proceedings can affect the profitability of BNSF’s business.

DOT and OSHA have jurisdiction under several federal statutes over a number of safety and health aspects of rail operations, including the transportation of hazardous materials. State agencies regulate some aspects of rail operations with respect to health and safety in areas not otherwise preempted by federal law.

Further discussion is incorporated by reference from Note 12 to the Consolidated Financial Statements.

Competition

The business environment in which BNSF Railway operates is highly competitive. Depending on the specific market, deregulated motor carriers and other railroads, as well as river barges, ships and pipelines in certain markets, may exert pressure on price and service levels. The presence of advanced, high service truck lines with expedited delivery, subsidized infrastructure and minimal empty mileage continues to affect the market for non-bulk, time-sensitive freight. The potential expansion of longer combination vehicles could further encroach upon markets traditionally served by railroads. In order to remain competitive, BNSF Railway and other railroads continue to develop and implement operating efficiencies to improve productivity.

As railroads streamline, rationalize and otherwise enhance their franchises, competition among rail carriers intensifies. BNSF Railway’s primary rail competitor in the Western region of the United States is the Union Pacific Railroad Company. Other Class I railroads and numerous regional railroads and motor carriers also operate in parts of the same territories served by BNSF Railway.

Based on weekly reporting by the Association of American Railroads, BNSF Railway’s share of the western United States rail traffic in 2010 was approximately 48 percent.

Beginning May 14, 2007, some 30 similar class action complaints were filed in six federal district courts around the country by rail shippers against BNSF Railway and other Class I railroads alleging that they have conspired to fix fuel surcharges with respect to unregulated freight transportation services in violation of the antitrust laws and seeking injunctive relief and unspecified treble damages. These cases have been consolidated and are currently pending in the federal district court of the District of Columbia for coordinated or consolidated pretrial proceedings. (In re: Rail Freight Fuel Surcharge Antitrust Litigation, MDL No. 1869). Consolidated amended class action complaints were filed against BNSF Railway and three other Class I railroads in April 2008. The Company believes that these claims are without merit and continues to defend against the allegations vigorously. The Company does not believe that the outcome of these proceedings will have a material effect on its financial condition, results of operations or liquidity.

Information concerning certain pending tax-related administrative or adjudicative state proceedings or appeals is incorporated by reference from Note 5 to the Consolidated Financial Statements, and information concerning other claims and litigation is incorporated by reference from Note 12 to the Consolidated Financial Statements.

Part II

All of the membership interests in Burlington Northern Santa Fe, LLC are owned by a subsidiary of Berkshire Hathaway Inc. and therefore are not traded on any market.

Management’s narrative analysis relates to the results of operations of Burlington Northern Santa Fe, LLC and its majority-owned subsidiaries (collectively BNSF, Registrant or Company). The principal operating subsidiary of BNSF is BNSF Railway Company (BNSF Railway) through which BNSF derives substantially all of its revenues. The following narrative analysis should be read in conjunction with the Consolidated Financial Statements and the accompanying notes.

Berkshire’s cost of acquiring BNSF has been pushed-down to establish a new accounting basis for BNSF. Accordingly, the accompanying consolidated financial statements are presented for two periods, Predecessor and Successor, which relate to the accounting periods preceding and succeeding the completion of the Merger. The Predecessor and Successor periods have been separated by a vertical line on the face of the consolidated financial statements to highlight the fact that the financial information for such periods has been prepared under two different historical-cost bases of accounting. The following narrative analysis of results of operations includes a brief discussion of the factors that materially affected the Company’s operating results in the Predecessor period of January 1 – February 12, 2010, and a comparative analysis of the Successor period of February 13 – December 31, 2010, and the Predecessor period of the year ended December 31, 2009.

Results of Operations

Revenues Summary

The following table presents BNSF’s revenue information by business group:

|

Revenues (in millions)

|

Cars / Units (in thousands)

|

||||||||||||||

|

Successor

|

Predecessor

|

Successor

|

Predecessor

|

||||||||||||

|

February 13 –

December 31,

2010

|

January 1 –

February 12,

2010

|

Year ended

December 31,

2009

|

February 13 –

December 31,

2010

|

January 1 –

February 12,

2010

|

Year ended

December 31,

2009

|

||||||||||

|

Consumer Products

|

$

|

4,516

|

$

|

515

|

$

|

4,316

|

3,834

|

453

|

3,911

|

||||||

|

Coal

|

3,906

|

442

|

3,564

|

2,156

|

259

|

2,390

|

|||||||||

|

Industrial Products

|

3,108

|

352

|

2,874

|

1,258

|

139

|

1,172

|

|||||||||

|

Agricultural Products

|

3,076

|

417

|

2,834

|

932

|

126

|

945

|

|||||||||

|

Total freight revenues

|

14,606

|

1,726

|

13,588

|

8,180

|

977

|

8,418

|

|||||||||

|

Other revenues

|

453

|

65

|

428

|

||||||||||||

|

Total operating revenues

|

$

|

15,059

|

$

|

1,791

|

$

|

14,016

|

|||||||||

|

Average Revenue Per Car / Unit

|

|||||||||

|

Successor

|

Predecessor

|

||||||||

|

February 13 –

December 31,

2010

|

January 1 –

February 12,

2010

|

Year ended

December 31,

2009

|

|||||||

|

Consumer Products

|

$

|

1,178

|

$

|

1,137

|

$

|

1,104

|

|||

|

Coal

|

1,812

|

1,707

|

1,491

|

||||||

|

Industrial Products

|

2,471

|

2,532

|

2,452

|

||||||

|

Agricultural Products

|

3,300

|

3,310

|

2,999

|

||||||

|

Total freight revenues

|

$

|

1,786

|

$

|

1,767

|

$

|

1,614

|

|||

Fuel Surcharges

Freight revenues include both revenue for transportation services and fuel surcharges. BNSF’s fuel surcharge program is intended to recover its incremental fuel costs when fuel prices exceed a threshold fuel price. Fuel surcharges are calculated differently depending on the type of commodity transported. In certain commodities, fuel surcharge is calculated using a fuel price from a time period that can be up to 60 days earlier. In a period of volatile fuel prices or changing customer business mix, changes in fuel expense and fuel surcharge may significantly differ.

The following table presents fuel surcharge and fuel expense information (in millions):

|

Successor

|

Predecessor

|

||||||||

|

February 13 –

December 31,

2010

|

January 1 –

February 12,

2010

|

Year ended

December 31,

2009

|

|||||||

|

Total fuel expense a

|

$

|

2,687

|

$

|

329

|

$

|

2,372

|

|||

|

BNSF fuel surcharges

|

$

|

1,774

|

$

|

192

|

$

|

1,226

|

|||

a Total fuel expense includes locomotive and non-locomotive fuel as well as gains and losses from fuel derivatives, which do not impact the fuel surcharge program.

Expense Table

The following table presents BNSF’s expense information (in millions):

|

Successor

|

Predecessor

|

||||||||

|

February 13 –

December 31,

2010

|

January 1 –

February 12,

2010

|

Year ended

December 31,

2009

|

|||||||

|

Compensation and benefits

|

$

|

3,562

|

$

|

442

|

$

|

3,481

|

|||

|

Fuel

|

2,687

|

329

|

2,372

|

||||||

|

Purchased services

|

1,890

|

279

|

1,873

|

||||||

|

Depreciation and amortization

|

1,532

|

192

|

1,537

|

||||||

|

Equipment rents

|

670

|

97

|

777

|

||||||

|

Materials and other

|

665

|

1

|

714

|

||||||

|

Total operating expenses

|

$

|

11,006

|

$

|

1,340

|

$

|

10,754

|

|||

|

Interest expense

|

$

|

435

|

$

|

72

|

$

|

613

|

|||

|

Other expense, net

|

$

|

7

|

$

|

2

|

$

|

8

|

|||

|

Income tax expense

|

$

|

1,376

|

$

|

153

|

$

|

920

|

|||

Predecessor Period of January 1 – February 12, 2010

Significant changes in the underlying trends affecting the Company’s revenues and expenses during the Predecessor period of January 1 – February 12, 2010, were as follows:

|

•

|

Purchased services expenses included Merger-related legal and consulting fees. See Note 3 to the Consolidated Financial Statements for more information.

|

|

•

|

Sale of a line segment in the State of Washington was completed, resulting in a gain to materials and other expenses of $74 million.

|

Successor Period of February 13 – December 31, 2010 vs Predecessor Period of the Year Ended December 31, 2009

Revenues

Revenues for the period of February 13 – December 31, 2010, were $15,059 million, up 7 percent compared with the year ended December 31, 2009. The increase in revenues was partially offset due to comparing operating results for a 322-day period to one consisting of 365 days, which primarily caused the 3-percent decrease in unit volumes. The following changes in underlying trends, based on a comparable number of days, also impacted the change in revenues:

|

•

|

Consumer Products revenues included increased unit volumes within international intermodal, domestic intermodal and automotive, as well as improved yields.

|

|

•

|

Coal revenues reflected improved yields, as well as a slight increase in volumes due to strength in coal-fired electricity generation during 2010 which was partially offset by customer stockpiles. 2009 included a $66 million loss in excess of amounts previously accrued related to an unfavorable coal rate case decision during the first quarter of 2009 (see Note 12 to the Consolidated Financial Statements under the heading "Coal Rate Case Decision"), partially offset by approximately $30 million for contract settlements and adjustments with specific customers.

|

|

•

|

Industrial Products revenues included increased unit volumes primarily due to increased demand in construction products.

|

|

•

|

Agricultural Products revenues reflected higher unit volumes due to increased grain shipments and improved fertilizer and ethanol loadings, as well as improved yields.

|

|

•

|

Increased fuel surcharges per unit, primarily due to increased fuel prices, impacted revenue in each of the business units.

|

Expenses

Operating expenses for the period of February 13 – December 31, 2010, were $11,006 million, an increase of $252 million, or 2 percent, from the year ended December 31, 2009. The increase in operating expenses was partially offset by a decrease in expenses due to comparing operating results for a 322-day period to one consisting of 365 days. The following changes in underlying trends, based on a comparable number of days, also impacted the change in operating expenses:

|

•

|

Increased unit volumes, wage inflation, higher health and welfare expenses, merger-related stock-based compensation adjustments and improved performance against targets related to incentive compensation and profit sharing, which cover all non-union and about one quarter of union employees, all contributed to increased compensation and benefits expenses.

|

|

•

|

Higher fuel prices increased fuel expenses, partially offset by a higher loss from closed fuel derivatives in 2009. Higher locomotive fuel consumption due to improved unit volumes also impacted fuel expenses.

|

|

•

|

New intangible asset amortization resulting from the application of acquisition method accounting and continuing capital expenditures increased depreciation and amortization expenses.

|

|

•

|

Increased ramping, drayage and other volume-related costs including purchased transportation for BNSF Logistics, a wholly owned, third-party logistics company, increased purchased services expenses. Higher locomotive maintenance costs also increased purchased services expenses.

|

|

•

|

Materials and other expenses included higher environmental costs due to changes in estimates at certain of BNSF’s more complex sites and lower personal injury costs. See Note 12 to the Consolidated Financial Statements for further information.

|

|

•

|

There were no significant changes in the underlying trends for equipment rents expenses.

|

|

•

|

Interest expense included increased interest related to a higher average debt balance, offset by the impact of merger-related adjustments resulting from the application of acquisition method accounting. During 2009, interest expense included a net $32 million loss for the termination of hedge accounting related to certain interest rate hedges as well as an additional $8 million of expense related to an unfavorable coal rate case decision (see Note 12 to the Consolidated Financial Statements under the heading "Coal Rate Case Decision.") Favorable tax settlements also impacted interest expense for 2009.

|

|

•

|

The effective tax rate for the period of February 13 – December 31, 2010, was 38.1 percent, compared with 34.8 percent for 2009. The increase in the effective tax rate is due to the 2009 tax benefit resulting from the donation of a portion of a line segment located in the State of Washington and to the enactment of the Patient Protection and Affordable Care Act in March 2010, which eliminated the tax deductibility of retiree health care costs to the extent of federal subsidies received by plan sponsors that provide retiree prescription drug benefits equivalent to Medicare Part D coverage.

|

Forward-Looking Information

To the extent that statements made by the Company relate to the Company’s future economic performance or business outlook, projections or expectations of financial or operational results, or refer to matters that are not historical facts, such statements are “forward-looking” statements within the meaning of the federal securities laws.

Forward-looking statements involve a number of risks and uncertainties, and actual performance or results may differ materially. For a discussion of material risks and uncertainties that the Company faces, see the discussion in Item 1A, “Risk Factors,” of this Annual Report on Form 10-K. Important factors that could cause actual results to differ materially include, but are not limited to, the following:

|

•

|

Economic and industry conditions: material adverse changes in economic or industry conditions, both in the United States and globally; volatility in the capital or credit markets including changes affecting the timely availability and cost of capital; changes in customer demand, effects of adverse economic conditions affecting shippers or BNSF’s supplier base, and effects due to more stringent regulatory policies such as the regulation of carbon dioxide emissions that could reduce the demand for coal or governmental tariffs or subsidies that could affect the demand for grain, changes in fuel prices and other key materials and disruptions in supply chains for these materials; competition and consolidation within the transportation industry; and changes in crew availability, labor and benefits costs and labor difficulties, including stoppages affecting either BNSF’s operations or customers’ abilities to deliver goods to BNSF for shipment;

|

|

•

|

Legal, legislative and regulatory factors: developments and changes in laws and regulations, including those affecting train operations or the marketing of services; the ultimate outcome of shipper and rate claims subject to adjudication or claims; investigations or litigation alleging violations of the antitrust laws; increased economic regulation of the rail industry through legislative action and revised rules and standards applied by the U.S. Surface Transportation Board in various areas including rates and services; developments in environmental investigations or proceedings with respect to rail operations or current or past ownership or control of real property or properties owned by others impacted by BNSF Railway operations; losses resulting from claims and litigation relating to personal injuries, asbestos and other occupational diseases; the release of hazardous materials, environmental contamination and damage to property; regulation, restrictions or caps, or other controls of diesel emissions that could affect operations or increase costs; the availability of adequate insurance to cover the risks associated with operations; and

|

|

•

|

Operating factors: changes in operating conditions and costs; operational and other difficulties in implementing positive train control technology, including increased compliance or operational costs or penalties; restrictions on development and expansion plans due to environmental concerns; constraints due to the nation’s aging infrastructure; disruptions to BNSF’s technology network including computer systems and software, as well as natural events such as severe weather, fires, floods and earthquakes or man-made or other disruptions of BNSF Railway’s or other railroads’ operating systems, structures, or equipment including the effects of acts of terrorism on the Company’s system or other railroads’ systems or other links in the transportation chain.

|

The Company cautions against placing undue reliance on forward-looking statements, which reflect its current beliefs and are based on information currently available to it as of the date a forward-looking statement is made. The Company undertakes no obligation to revise forward-looking statements to reflect future events, changes in circumstances, or changes in beliefs. In the event the Company does update any forward-looking statement, no inference should be made that the Company will make additional updates with respect to that statement, related matters, or any other forward-looking statements.

In the ordinary course of business, BNSF utilizes various financial instruments that inherently have some degree of market risk. The following table summarizes the impact of these derivative activities on the Company’s results of operations (in millions):

|

Successor

|

Predecessor

|

||||||||||

|

February 13 –

December 31,

2010

|

January 1 –

February 12,

2010

|

Year ended

December 31,

2009

|

|||||||||

|

Fuel-derivative gain (loss) (including ineffective portion of unexpired hedges)

|

$

|

49

|

$

|

(13

|

)

|

$

|

(195

|

)

|

|||

|

Interest rate hedge benefit

|

17

|

3

|

22

|

||||||||

|

Interest rate derivative loss

|

−

|

−

|

(32

|

)

|

|||||||

|

Total derivative benefit (loss)

|

66

|

(10

|

)

|

(205

|

)

|

||||||

|

Tax effect

|

(25

|

)

|

4

|

79

|

|||||||

|

Derivative benefit (loss), net of tax

|

$

|

41

|

$

|

(6

|

)

|

$

|

(126

|

)

|

|||

The Company’s fuel-derivative gain or loss was due to fluctuations in average fuel prices subsequent to the initiation of various derivatives. The interest rate hedge benefit is the result of lower interest rates. The interest rate derivative loss in 2009 was related to terminated treasury locks (see Note 4 to the Consolidated Financial Statements). There were no interest rate hedges outstanding at December 31, 2010. The information presented in Note 4 to the Consolidated Financial Statements describes significant aspects of BNSF’s financial instrument activities that have a material market risk.

Commodity Price Sensitivity

BNSF engages in derivative activities to partially mitigate the risk of fluctuations in the price of its diesel fuel purchases. Existing derivative transactions as of December 31, 2010, were based on the front month settlement prices of New York Mercantile Exchange (NYMEX) #2 heating oil (HO), West Texas Intermediate (WTI) crude oil, or the HO refining spread (HO-WTI), which is the difference between HO and WTI. A WTI derivative combined with a HO-WTI derivative will result in the equivalent of a HO derivative. For swaps, BNSF either pays or receives the difference between the derivative price and the actual average price of the derivative commodity during a specified determination period for a specified number of gallons. For costless collars, if the average derivative commodity price for a specified determination period is greater than the cap price, BNSF receives the difference for a specified number of gallons. If the average commodity price is less than the floor price, BNSF pays the difference for a specified number of gallons. If the commodity price is between the floor price and the cap price, BNSF neither makes nor receives a payment. Derivative transactions are generally settled with the counterparty in cash. Based on historical information, BNSF believes there is a significant correlation between the market prices for diesel fuel, HO and WTI.

At December 31, 2010, BNSF had recorded a net fuel-derivative asset of $82 million for fuel derivatives covering 2011 through 2012.

The following table is an estimate of the impact to earnings that could result from hypothetical price changes during the twelve-month period ending December 31, 2011, and the balance sheet impact from the hypothetical price changes on all open derivatives, both based on the Company’s derivative position at December 31, 2010:

|

Sensitivity Analysis

|

||||

|

Derivative Commodity

Price Change

|

Fuel-Derivative Annual

Pre-Tax Earnings Impact

|

Balance Sheet Impact of Change

in Fuel-Derivative Fair Value

|

||

|

10-percent increase

|

$50 million increase

|

$68 million increase

|

||

|

10-percent decrease

|

$52 million decrease

|

$73 million decrease

|

Based on locomotive fuel consumption during the twelve-month period ended December 31, 2010, of 1,295 million gallons and fuel prices during that same period, excluding the impact of the Company’s derivative activities, a 10-percent increase or decrease in the commodity price per gallon would result in an approximate $278 million increase or decrease, respectively, in fuel expense (pre-tax) on an annual basis.

At December 31, 2010, BNSF maintained fuel inventories for use in normal operations, which were not material to BNSF’s overall financial position and, therefore, represent no significant market exposure. The frequency of BNSF’s fuel inventory turnover also reduces market exposure, should fuel inventories become material to BNSF’s overall financial position. Further information on fuel derivatives is incorporated by reference from Note 4 to the Consolidated Financial Statements.

Interest Rate Sensitivity

At December 31, 2010, the fair value of BNSF’s debt, excluding capital leases and unamortized gains on interest rate swaps, was $10,761 million.

The following table is an estimate of the impact to the fair value of total debt, excluding capital leases and unamortized gains on interest rate swaps, that could result from hypothetical interest rate changes during the twelve-month period ending December 31, 2011, based on debt levels as of December 31, 2010:

|

Sensitivity Analysis

|

|||

|

Hypothetical Change

in Interest Rates

|

Change in Fair Value

|

||

|

Total Debt

|

|||

|

1-percent decrease

|

$1,027 million increase

|

||

|

1-percent increase

|

$871 million decrease

|

||

Further information on interest rate hedges is incorporated by reference from Note 4 to the Consolidated Financial Statements. Information on the Company’s debt, which may be sensitive to interest rate fluctuations, is incorporated by reference from Note 11 to the Consolidated Financial Statements.

The Consolidated Financial Statements of BNSF and subsidiary companies, together with the reports of the Company’s independent registered public accounting firms, are included as part of this filing.

The following documents are filed as a part of this report:

Consolidated Financial Statements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To the Board of Managers and Member of

Burlington Northern Santa Fe, LLC

We have audited the accompanying consolidated balance sheet of Burlington Northern Santa Fe, LLC and subsidiaries (the "Company") as of December 31, 2010, and the related consolidated statements of operations, cash flows, and changes in equity for the periods from February 13, 2010 through December 31, 2010 (Successor) and January 1, 2010 through February 12, 2010 (Predecessor). These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on the financial statements based on our audit.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, such consolidated financial statements present fairly, in all material respects, the financial position of Burlington Northern Santa Fe, LLC and subsidiaries as of December 31, 2010 (Successor) and the results of their operations and their cash flows for the periods from February 13, 2010 through December 31, 2010 (Successor) and January 1, 2010 through February 12, 2010 (Predecessor) in conformity with accounting principles generally accepted in the United States of America.

/s/ DELOITTE & TOUCHE LLP

Fort Worth, Texas

February 28, 2011

Report of Independent Registered Public Accounting Firm

To the Board of Managers and Member of

Burlington Northern Santa Fe, LLC

In our opinion, the consolidated financial statements listed in the accompanying index as of December 31, 2009 and for each of two years in the period ended December 31, 2009 present fairly, in all material respects, the financial position of Burlington Northern Santa Fe Corporation and its subsidiaries (the Company) at December 31, 2009, and the results of their operations and their cash flows for each of the two years in the period ended December 31, 2009, in conformity with accounting principles generally accepted in the United States of America. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

/s/ PricewaterhouseCoopers LLP

Fort Worth, Texas

February 11, 2010

Burlington Northern Santa Fe, LLC and Subsidiaries

In millions

|

Successor

|

Predecessor

|

|||||||||||

|

February 13 –

December 31,

2010

|

January 1 –

February 12,

2010

|

Year ended

December 31,

2009

|

Year ended

December 31,

2008

|

|||||||||

|

Revenues

|

$

|

15,059

|

$

|

1,791

|

$

|

14,016

|

$

|

18,018

|

||||

|

Operating expenses:

|

||||||||||||

|

Compensation and benefits

|

3,562

|

442

|

3,481

|

3,884

|

||||||||

|

Fuel

|

2,687

|

329

|

2,372

|

4,640

|

||||||||

|

Purchased services

|

1,890

|

279

|

1,873

|

2,133

|

||||||||

|

Depreciation and amortization

|

1,532

|

192

|

1,537

|

1,397

|

||||||||

|

Equipment rents

|

670

|

97

|

777

|

901

|

||||||||

|

Materials and other

|

665

|

1

|

714

|

1,151

|

||||||||

|

Total operating expenses

|

11,006

|

1,340

|

10,754

|

14,106

|

||||||||

|

Operating income

|

4,053

|

451

|

3,262

|

3,912

|

||||||||

|

Interest expense

|

435

|

72

|

613

|

533

|

||||||||

|

Other expense, net

|

7

|

2

|

8

|

11

|

||||||||

|

Income before income taxes

|

3,611

|

377

|

2,641

|

3,368

|

||||||||

|

Income tax expense

|

1,376

|

153

|

920

|

1,253

|

||||||||

|

Net income

|

$

|

2,235

|

$

|

224

|

$

|

1,721

|

$

|

2,115

|

||||

See accompanying Notes to Consolidated Financial Statements.

Burlington Northern Santa Fe, LLC and Subsidiaries

Dollars in millions, shares in thousands

|

Successor

|

Predecessor

|

|||||||

|

December 31, 2010

|

December 31, 2009

|

|||||||

|

Assets

|

||||||||

|

Current assets:

|

||||||||

|

Cash and cash equivalents

|

$

|

2,087

|

$

|

1,269

|

||||

|

Accounts receivable, net

|

928

|

787

|

||||||

|

Materials and supplies

|

652

|

633

|

||||||

|

Current portion of deferred income taxes

|

317

|

290

|

||||||

|

Other current assets

|

193

|

277

|

||||||

|

Total current assets

|

4,177

|

3,256

|

||||||

|

Property and equipment, net of accumulated depreciation of $660 and $10,736, respectively

|

45,486

|

32,294

|

||||||

|

Goodwill

|

14,803

|

−

|

||||||

|

Intangible assets, net

|

1,732

|

−

|

||||||

|

Other assets

|

2,449

|

3,125

|

||||||

|

Total assets

|

$

|

68,647

|

$

|

38,675

|

||||

|

Liabilities and Equity

|

||||||||

|

Current liabilities:

|

||||||||

|

Accounts payable and other current liabilities

|

$

|

2,768

|

$

|

2,695

|

||||

|

Long-term debt due within one year

|

699

|

644

|

||||||

|

Total current liabilities

|

3,467

|

3,339

|

||||||

|

Deferred income taxes

|

14,307

|

9,322

|

||||||

|

Long-term debt

|

11,281

|

9,691

|

||||||

|

Intangible liabilities, net

|

1,790

|

−

|

||||||

|

Casualty and environmental liabilities

|

938

|

899

|

||||||

|

Pension and retiree health and welfare liability

|

490

|

783

|

||||||

|

Other liabilities

|

867

|

1,843

|

||||||

|

Total liabilities

|

33,140

|

25,877

|

||||||

|

Commitments and contingencies (see Notes 4, 11 and 12)

|

||||||||

|

Equity:

|

||||||||

|

Additional paid-in-capital

|

34,495

|

7,776

|

||||||

|

Retained earnings

|

985

|

13,941

|

||||||

|

Accumulated other comprehensive income (loss)

|

27

|

(496

|

)

|

|||||

|

Predecessor:

|

||||||||

|

Common stock, $0.01 par value, 600,000 shares authorized; 543,416 shares issued

|

−

|

5

|

||||||

|

Treasury stock, at cost, 202,677 shares

|

−

|

(8,428

|

)

|

|||||

|

Total equity

|

35,507

|

12,798

|

||||||

|

Total liabilities and equity

|

$

|

68,647

|

$

|

38,675

|

||||

See accompanying Notes to Consolidated Financial Statements.

Burlington Northern Santa Fe, LLC and Subsidiaries

In millions

|

Successor

|

Predecessor

|

|||||||||||||

|

February 13 –

December 31,

2010

|

January 1 –

February 12,

2010

|

Year ended

December 31,

2009

|

Year ended

December 31,

2008

|

|||||||||||

|

Operating Activities

|

||||||||||||||

|

Net income

|

$

|

2,235

|

$

|

224

|

$

|

1,721

|

$

|

2,115

|

||||||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

||||||||||||||

|

Depreciation and amortization

|

1,532

|

192

|

1,537

|

1,397

|

||||||||||

|

Deferred income taxes

|

710

|

127

|

612

|

417

|

||||||||||

|

Long-term casualty and environmental liabilities, net

|

(25

|

)

|

(2

|

)

|

(90

|

)

|

150

|

|||||||

|

Contributions to qualified pension plan

|

(400

|

)

|

−

|

(255

|

)

|

−

|

||||||||

|

Other, net

|

(204

|

)

|

(78

|

)

|

45

|

66

|

||||||||

|

Changes in current assets and liabilities:

|

||||||||||||||

|

Accounts receivable, net

|

(118

|

)

|

(21

|

)

|

116

|

191

|

||||||||

|

Change in accounts receivable securitization program

|

−

|

−

|

(50

|

)

|

(250

|

)

|

||||||||

|

Materials and supplies

|

(23

|

)

|

3

|

(108

|

)

|

54

|

||||||||

|

Other current assets

|

104

|

(123

|

)

|

(38

|

)

|

(31

|

)

|

|||||||

|

Accounts payable and other current liabilities

|

539

|

(258

|

)

|

(77

|

)

|

(132

|

)

|

|||||||

|

Net cash provided by operating activities

|

4,350

|

64

|

3,413

|

3,977

|

||||||||||

|

Investing Activities

|

||||||||||||||

|

Capital expenditures excluding equipment

|

(1,829

|

)

|

(137

|

)

|

(1,991

|

)

|

(2,167

|

)

|

||||||

|

Acquisition of equipment

|

(445

|

)

|

(67

|

)

|

(733

|

)

|

(949

|

)

|

||||||

|

Proceeds from sale of equipment financed

|

−

|

−

|

368

|

348

|

||||||||||

|

Construction costs for facility financing obligation

|

−

|

−

|

(37

|

)

|

(64

|

)

|

||||||||

|

Partnership investment

|

(443

|

)

|

−

|

−

|

−

|

|||||||||

|

Other, net

|

(255

|

)

|

68

|

(244

|

)

|

(241

|

)

|

|||||||

|

Net cash used for investing activities

|

(2,972

|

)

|

(136

|

)

|

(2,637

|

)

|

(3,073

|

)

|

||||||

|

Financing Activities

|

||||||||||||||

|

Net decrease in commercial paper and bank borrowings

|

−

|

−

|

(100

|

)

|

(161

|

)

|

||||||||

|

Proceeds from issuance of long-term debt

|

1,500

|

−

|

825

|

1,150

|

||||||||||

|

Payments on long-term debt

|

(493

|

)

|

(30

|

)

|

(429

|

)

|

(217

|

)

|

||||||

|

Dividends paid

|

(1,250

|

)

|

(226

|

)

|

(546

|

)

|

(471

|

)

|

||||||

|

Proceeds from stock options exercised

|

−

|

21

|

59

|

91

|

||||||||||

|

Purchase of BNSF common stock

|

−

|

−

|

(16

|

)

|

(1,147

|

)

|

||||||||

|

Excess tax benefits from equity compensation plans

|

−

|

9

|

29

|

96

|

||||||||||

|

Proceeds from facility financing obligation

|

−

|

−

|

51

|

68

|

||||||||||

|

Other, net

|

(19

|

)

|

−

|

(13

|

)

|

(10

|

)

|

|||||||

|

Net cash used for financing activities

|

(262

|

)

|

(226

|

)

|

(140

|

)

|

(601

|

)

|

||||||

|

Increase (decrease) in cash and cash equivalents

|

1,116

|

(298

|

)

|

636

|

303

|

|||||||||

|

Cash and cash equivalents:

|

||||||||||||||

|

Beginning of period

|

971

|

1,269

|

633

|

330

|

||||||||||

|

End of period

|

$

|

2,087

|

$

|

971

|

$

|

1,269

|

$

|

633

|

||||||

|

Supplemental Cash Flow Information

|

||||||||||||||

|

Interest paid, net of amounts capitalized

|

$

|

539

|

$

|

97

|

$

|

587

|

$

|

538

|

||||||

|

Income taxes paid, net of refunds

|

$

|

665

|

$

|

−

|

$

|

264

|

$

|

820

|

||||||

|

Non-cash asset financing

|

$

|

40

|

$

|

8

|

$

|

514

|

$

|

258

|

||||||

See accompanying Notes to Consolidated Financial Statements.

Burlington Northern Santa Fe, LLC and Subsidiaries

Dollars in millions, shares in thousands, except per share data

|

Predecessor

|

Common Shares

|

Treasury

Shares

|

Common Stock

and Paid–in

Capital

|

Retained

Earnings

|

Treasury

Stock

|

Accumulated Other

Comprehensive Loss

|

Total

Equity

|

||||||||||||||

|

Balance at December 31, 2007

|

537,330

|

(189,626

|

)

|

$ |

7,353

|

$ |

11,152

|

$ |

(7,222

|

)

|

$ |

(139

|

)

|

$ |

11,144

|

||||||

|

Comprehensive income:

|

|||||||||||||||||||||

|

Net income

|

–

|

2,115

|

–

|

–

|

2,115

|

||||||||||||||||

|

Change in unrecognized prior service credit and actuarial losses, net of tax benefit of $219

|

–

|

–

|

–

|

(353

|

)

|

(353

|

)

|

||||||||||||||

|

Change in fuel/interest hedge mark-to-market, net of tax benefit of $233

|

–

|

–

|

–

|

(377

|

)

|

(377

|

)

|

||||||||||||||

|

Change in other comprehensive income of equity method investees

|

–

|

–

|

–

|

(5

|

)

|

(5

|

)

|

||||||||||||||

|

Total comprehensive income

|

–

|

2,115

|

–

|

(735

|

)

|

1,380

|

|||||||||||||||

|

Adjustment to change the measurement date pursuant to adoption of authoritative accounting guidance related to defined benefit pension and other postretirement plans, net of tax benefit of $3

|

–

|

(7

|

)

|

–

|

2

|

(5

|

)

|

||||||||||||||

|

Adjustment to initially apply authoritative accounting guidance related to defined benefit pension and other postretirement plans to equity method investees

|

–

|

–

|

–

|

(2

|

)

|

(2

|

)

|

||||||||||||||

|

Common stock dividends, $1.44 per share

|

–

|

(496

|

)

|

–

|

–

|

(496

|