Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DYNEX CAPITAL INC | d8k.htm |

1

FOCUSED ON THE LONG TERM

Dynex Capital, Inc.

Fourth Quarter 2010

Investor Presentation

February 15, 2011

Exhibit 99.1 |

2

Note:

This

presentation

contains

“forward-looking

statements”

within

the

meaning

of

the

Private Securities Litigation Reform Act of 1995, including statements about projected

financial

performance

and

future

investment

opportunities.

The

words

“will,”

“believe,”

“expect,”

“forecast,”

“anticipate,”

“intend,”

“estimate,”

“assume,”

“project,”

“plan,”

“continue,”

and similar expressions also identify forward-looking statements that are

inherently subject to risks and uncertainties, some of which cannot be predicted or

quantified.

Although

these

forward-looking

statements

reflect

our

current

beliefs,

assumptions and expectations based on information currently available to us, the

Company’s actual results and timing of certain events could differ materially from those

projected in or contemplated by these statements. Our forward-looking statements

are subject

to

the

following

principal

risks

and

uncertainties:

availability

of

suitable

reinvestment opportunities; investing in real estate assets including changes in general

economic and market conditions and the general availability of credit; variability in

investment portfolio cash flows; defaults by borrowers and/or guarantors and

foreclosures and related legal proceedings; fluctuations in interest rates;

prepayments of investment portfolio assets; inadequate or improper servicing of our

loans and securities by third-party servicers; general competitive factors;

uncertainty around government policy and the impact of

regulatory

changes;

our

compliance

with

Section

404

of

the

Sarbanes-Oxley

Act;

our

ability

to

maintain

our

qualification

as

a

REIT;

and

our

ability

to

maintain

our

exemption

from registration under the Investment Company Act of 1940. For additional information,

see the Company’s Annual Report on Form 10-K for the year ended December 31,

2009, and other reports filed with and furnished to the Securities and Exchange

Commission. Safe Harbor Statement |

3

DX Snapshot

$328.5 million

Market Capitalization (2/11/2011)

1.1

Price to Book

$10.68

Share Price (2/11/2011)

$0.27

Quarterly Dividend (4Q 2010)

30,762,134

Shares Outstanding (2/11/2011)

DX

NYSE Stock Ticker

Market Highlights

Company Highlights

Internally managed REIT commenced operations in 1988

Significant insider ownership and experienced management team

Hybrid investment strategy investing in residential and commercial mortgage assets

Large NOL carryfoward for unique total return opportunity |

4

2010 Highlights

•

Generated total

return to shareholders of 38% assuming

reinvested dividends (source: Bloomberg)

•

Raised $117 million in new common equity

and earned $1.41

per common share

•

Generated an ROE of 14.5%

•

Increased market value of common stock to $328.5 million

as of 2/11/11

from $119 million as of 12/31/09

(source: SNL)

…..All while maintaining our conservative

risk profile |

5

Management Team

•Thomas B. Akin –

Chairman and Chief Executive Officer

–

32 years of experience in the industry and 7 years at Dynex

–

CEO since 2008

–

Managing General Partner of Talkot Capital, LLC

–

16 years at Merrill Lynch and Salomon Brothers

•Byron L. Boston –

Chief Investment Officer

–

27 years of experience in the industry with 3 years as CIO at Dynex

–

13 years managing levered multi-product portfolios at Freddie Mac and Sunset Financial

Resources –

11 years trading MBS on Wall Street

–

3 years Senior Corporate Lending Officer at Chemical Bank

•Stephen J. Benedetti –

Chief Financial Officer and Chief Operating Officer

–

21 years of experience in the industry and 16 years at Dynex

–

Employed in various capacities at Dynex since 1994

–

Managed Dynex from 2002 –

2007

–

Began career at Deloitte & Touche

•Portfolio Management Team

–

4

member

team

with

a

collective

55

years

of

industry

experience

with

broad

and

deep

skill

sets

in

both

agency and non-agency investment strategies

Experienced team of professionals with a combined 80 years of experience

managing mortgage REITs and mortgage portfolios

5 |

Hybrid Investment

Strategy Hybrid Investment Strategy

that invests in a combination of Agency and non-Agency residential

and commercial assets to maximize risk adjusted total return.

Duration

•

Higher Credit Quality

•

Low Duration

Examples include:

-

Short Duration

Agency ARMs

-

Seasoned non-Agency

RMBS & CMBS

Target Strategy

•

Lower Credit Quality

•

Low Duration

Examples include:

-

Floating Rate Mezzanine

•

Higher Credit Quality

•

Long Duration

Examples include:

-

30 year Agency MBS

Current Coupon

-

Super Senior CMBS

•

Lower Credit Quality

•

Long Duration

Examples include:

-

Credit Sensitive

Securities Rated BBB

and Below

ASSETS:

•

High grade securitized products –

Agency

MBS, non-Agency RMBS and CMBS

•

Target assets with a disciplined capital

allocation framework focused on risk-

adjusted returns and capital preservation

FUNDING:

•

Blend of recourse and non-recourse

•

Conservative leverage

•

Diversified counterparty profile to avoid

concentration risk

•

Active maturity management to ensure

stable financing profile

6 |

7

Disciplined Top-Down Investment Philosophy

Macroeconomic Analysis

Sector Analysis

Security Selection & Funding

Performance & Risk Management |

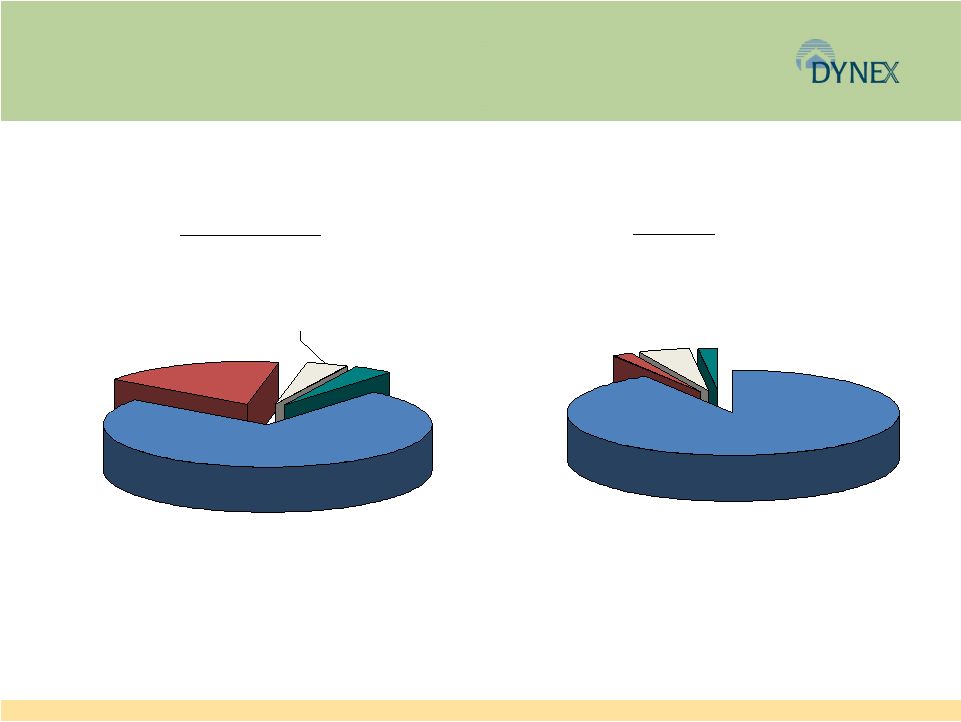

8

Unique Investment Portfolio

(as of 12/31/10)

Agency MBS

74%

Seasoned DX

RMBS/loans

4%

Other

CMBS/RMBS

4%

Seasoned DX

CMBS/loans

18%

AAA

91%

AA

2%

A

5%

Below A

2%

Composition

Ratings |

9

Current Investment Environment

Macro:

–

Fed funds rate at historic lows with a steep yield curve

–

Government policy/regulations to influence investment returns

–

Improved financing environment

–

Competition for high quality assets

–

Securitization markets are healing slowly but unevenly

–

Global risk remains high

Investment thesis:

–

Tighter credit standards have created more predictable mortgage cash flows

and better investment opportunities

–

Agency MBS and highly-rated securities offer stable returns and have low

financing risk

–

Premium risk is manageable

–

Hybrid REIT strategy allocates capital to most compelling investment

opportunities |

10

Return Profile for Prospective Investments as of

12/31/10

100-104

94-103

104-107

102-108

Range of Prices

10%-15%

1.6%-2.4%

4.8%-5.3%

‘AAA’

CMBS

12%-20%

2.8%-3.8%

3.8%-5.0%

‘AAA’

RMBS

Non –Agency

13%-20%

1.6%-2.5%

4.2%-4.5%

CMBS

14%-25%

1.7%-2.7%

2.5%-

3.8%

RMBS

Agency

Range of ROEs

Range of net

spread to

funding

Range of

yields

Investment

Note: Ranges noted above reflect estimates based on certain assumptions made by

management and may not be indicative of actual results. |

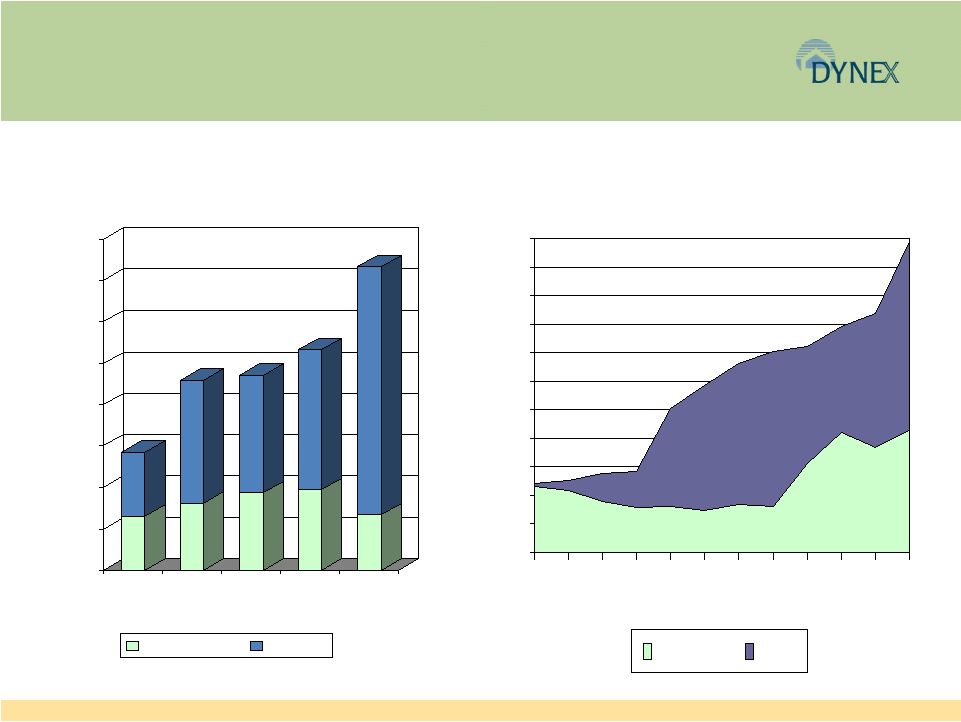

11

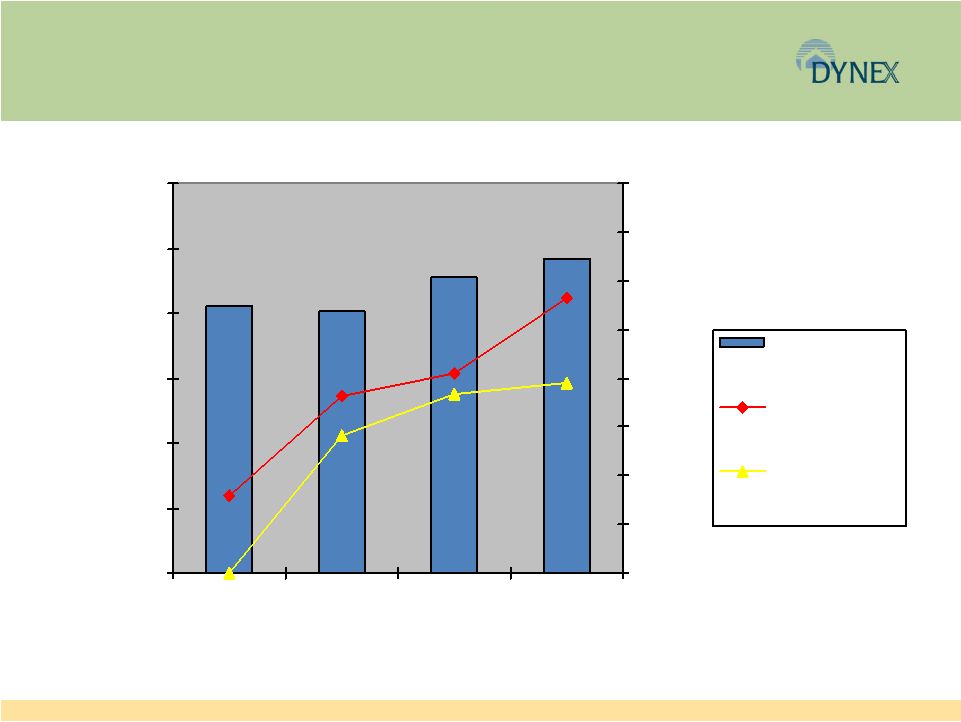

Portfolio Growth and Diversification of Income

Investments

Net Interest Income

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

$10,000

$11,000

1Q08

2Q08

3Q08

4Q08

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

Non-Agency

Agency

$0

$200,000

$400,000

$600,000

$800,000

$1,000,000

$1,200,000

$1,400,000

$1,600,000

2008

2009

2Q10

3Q10

4Q10

Non-Agency

Agency

($ in thousands) |

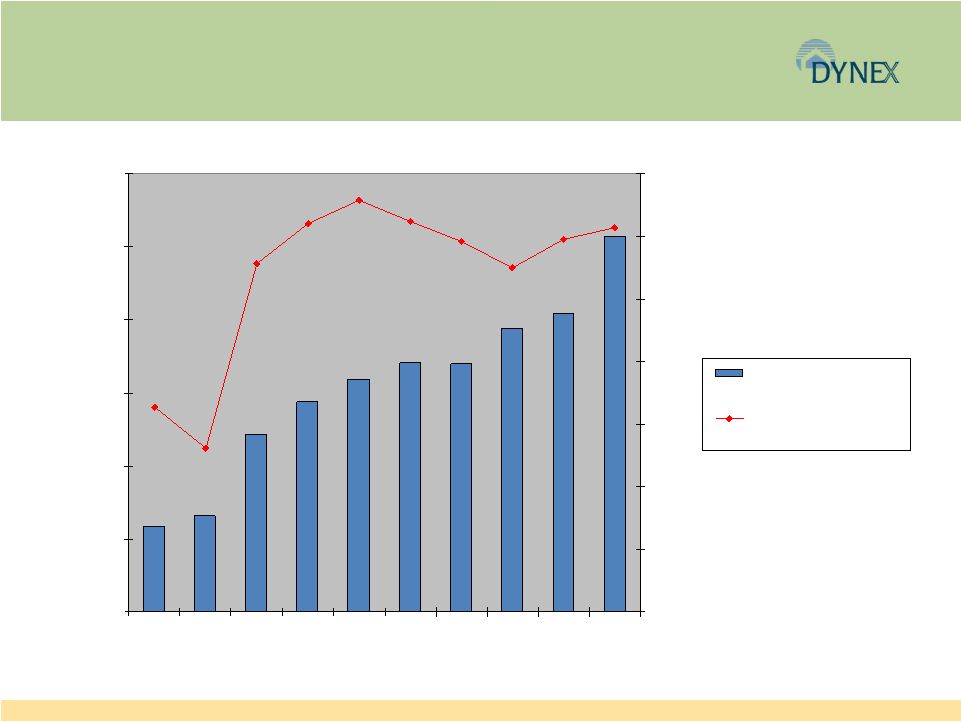

12

Investment Portfolio Income and Spread

$0

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

3Q08

4Q08

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

Net interest income after

provision (LHS)

Net interest spread (RHS)

$ in thousands |

13

Total Return Opportunity

$8.22

$8.07

$9.08

$9.71

$0.40

$0

$0.91

$1.02

$1.41

$0.71

$0.98

$0.92

$0.00

$2.00

$4.00

$6.00

$8.00

$10.00

$12.00

2007

2008

2009

2010

$0.00

$0.25

$0.50

$0.75

$1.00

$1.25

$1.50

$1.75

$2.00

Book value per

common share

(LHS)

Diluted net income

per common share

(RHS)

Dividend per

common share

(RHS) |

14

Why Dynex

Excellent track record with attractive total return opportunity

Strong and defensive balance sheet positioned to weather market

volatility

Experienced management with a track record of disciplined capital

deployment through multiple economic cycles

Alignment of interests with shareholders due to owner-operator

structure

Complementary investment opportunities exist with attractive

return profiles consistent with our investment philosophy

Opportunistic capital raises have increased shareholder value with

minimal book value dilution |

FOCUSED ON

THE LONG TERM APPENDIX |

16

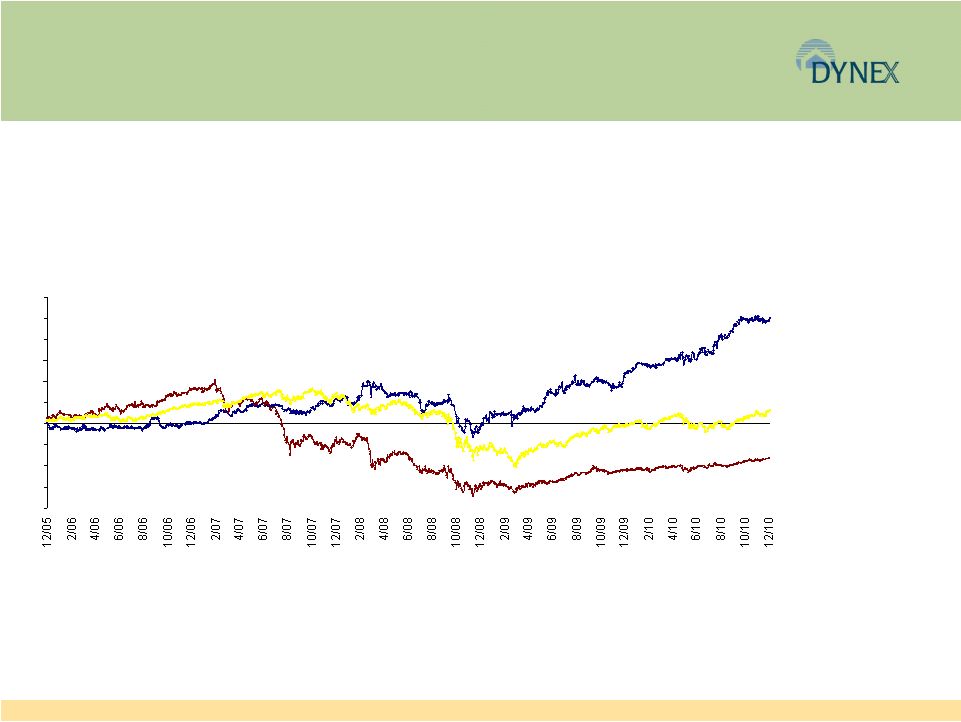

Long-Term Track Record

Demonstrated history of disciplined capital management and producing returns

in excess of market benchmarks.

DX 99.6%

S&P 500 13.3%

SNL Finance REIT*

(32.8%)

-80

-60

-40

-20

0

20

40

60

80

100

120

*SNL Finance REIT: Includes all publicly traded (NYSE, NYSE Amex, NASDAQ, OTC BB,

Pink Sheets) Investment Companies with the following primary focuses: MBS

REIT, Mortgage REIT and Specialty Finance REIT in SNL's coverage universe.

Source: SNL Financial |

17

CMBS Investments Unique to DX

1998 CMBS (12/31/10 balances)

5.3% Non-investment grade

$15.6 million

9%

‘BBB’

8.0%

$6.5 million

13%

‘BBB+’

8.0%

$19.5 million

25%

‘A+’

8.0%

$43.4 million

50%

‘AAA’

8.0%

$83.7 million

Credit Support

Rating

WAC

UPB

1997 CMBS (12/31/10 balances)

7.6% Non-investment grade

$19.8 million

20%

‘A’

7.2%

$23.7 million

44%

‘AAA’

7.0%

$33.1 million

78%

‘AAA’

6.8%

$20.5 million

99%

‘AAA’

1200%

$0.1 million

99%

‘AAA’

6.7%

$0.8 million

Credit Support

Rating

WAC

UPB

We created and sold two CMBS in 1997

and 1998, retaining only the non-

investment grade CMBS in green at

issuance

We redeemed the 1998 CMBS bonds in

blue at par in 12/2009 and 7/2010

We redeemed the 1997 CMBS bonds in

blue at par in 8/2010

We financed all of the redemptions via

resecuritization and repo at a current

effective interest rate of ~1.8% for a

current weighted average “spread”

on the

redeemed CMBS of ~6.4%

Annual net interest income expected

based on the spread earned on the CMBS is

~$12 million based on current rates

DX still owns rights to redeem the CMBS

bonds in red at par |

18

Current Counterparties

Bank of America

Greenwich Capital

Cantor Fitzgerald

BB&T Capital

Morgan Keegan

Deutsche Bank

Morgan Stanley

SunTrust

MF Global

Barclay’s

ING

Guggenheim

Jeffries Securities

Mizuho

South Street Securities

Goldman Sachs

Nomura

LBBW

Credit Suisse

Princeridge

20 |