Attached files

Exhibit 10.6

MORTGAGE

Recorder’s Cover Sheet

Preparer Information: (name, address and phone number)

Alex Galyon, 321 E. Walnut, Suite 200, Des Moines, Iowa 50309, (515) 237-1187

Taxpayer Information: (name and complete address)

REG Newton, LLC

c/o Renewable Energy Group, Inc.

416 S. Bell Ave., P.O. Box 888

Ames, IA 50010

Return Document To: (name and complete address)

Gray, Plant, Mooty, Mooty & Bennett, P.A.

c/o George Meinz

1010 West St. Germain

Suite 600

St. Cloud, MN 56301

Grantors:

REG Newton, LLC

Grantees:

AgStar Financial Services, PCA

1921 Premier Drive

Mankato, MN 56002-4249

Legal Description: See Exhibit A

Document or instrument number of previously recorded documents: N/A

MORTGAGE

Open End

THIS MORTGAGE (“Mortgage”) encumbers real property, contains an after-acquired property clause and secures present and future loans and advances.

PARTIES to this Mortgage are:

| Mortgagor: | REG NEWTON, LLC | |

| an Iowa Limited Liability Company | ||

| C/O Renewable Energy Group, Inc. | ||

| 416 S. BELL AVE., P.O. BOX 888 | ||

| AMES, IA 50010 | ||

| Mortgagee: | AGSTAR FINANCIAL SERVICES, PCA | |

| 1921 PREMIER DRIVE | ||

| MANKATO, MN 56002-4249 | ||

NOTICE: This Mortgage secures credit in the amount up to $25,960,731.50. Loans and advances up to this amount, together with interest are senior to indebtedness to other creditors under subsequently recorded or filed mortgages and liens.

1. Grant of Mortgage and Security Interest. Mortgagor hereby sells, conveys and mortgages unto Mortgagee, and grants a security interest to Mortgagee in the following described property:

a. Land and Buildings. All of Mortgagor’s right, title and interest in and to the following described real estate situated in Jasper County, Iowa (the “Land”):

See attached Exhibit A – Legal Description

and all buildings, structures and improvements now standing or at any time hereafter constructed or placed upon the Land (the “Buildings”), including all hereditaments, easements, appurtenances, riparian rights, mineral rights, water rights, rights in and to the lands lying in streets, alleys and roads adjoining the land, estates and other rights and interests now or hereafter belonging to or in any way pertaining to the Land.

b. Personal Property. All fixtures and other personal property integrally belonging to, or hereafter becoming an integral part of the Land or Buildings, whether attached or detached, including equipment and all proceeds, products, increase, issue, accessions, attachments, accessories, parts, additions, repairs, replacements and substitutes of, to, and for the foregoing (the “Personal Property”).

| Mortgage | 2 | |||

| REG Newton, LLC - AgStar Financial Services, PCA | ||||

c. Revenues and Income. All rents, issues, profits, leases, condemnation awards and insurance proceeds now or hereafter arising from the ownership, occupancy or use of the Land, Buildings and Personal Property, or any part thereof (the “Revenues and Income”).

TO HAVE AND TO HOLD the Land, Buildings, Personal Property and Revenues and Income (collectively called the “Mortgaged Property”), together with all privileges, hereditaments thereunto now or hereafter belonging, or in any way appertaining and the products and proceeds thereof, unto Mortgagee, its successors and assigns.

2. Obligations. This Mortgage secures the following (hereinafter collectively referred to as the “Obligations”):

a. The payment of the loan made by Mortgagee to Mortgagor evidenced by a Master Loan Agreement dated the 8th day of March 2010 (the “Master Loan Agreement”) and supplemented with the First Supplement to the Master Loan Agreement and the Second Supplement to the Master Loan Agreement (collectively, the “Supplements”) and the Term Note and the Revolving Line of Credit Note (collectively, the “Notes”), any renewals, extensions, modifications or refinancing thereof and any additional supplements and notes to the Master Loan Agreement issued in substitution therefor; and

b. All other obligations of Mortgagor to Mortgagee, now existing or hereafter arising, whether direct or indirect, contingent or absolute and whether as maker or surety, including, but not limited to, future advances and amounts advanced and expenses incurred by Mortgagee pursuant to this Mortgage.

THIS PARAGRAPH SHALL NOT CONSTITUTE A COMMITMENT TO MAKE ADDITIONAL LOANS IN ANY AMOUNT.

3. Representations and Warranties of Mortgagor. Mortgagor represents, warrants and covenants to Mortgagee that (i) Mortgagor holds clear title to the Mortgaged Property and title in fee simple in the Land; (ii) Mortgagor has the right, power and authority to execute this Mortgage and to mortgage, and grant a security interest in the Mortgaged Property; (iii) the Mortgaged Property is free and clear of all liens and encumbrances, except for real estate taxes not yet delinquent, except for the Permitted Encumbrances set forth on Exhibit B attached hereto and except as otherwise stated in paragraph 1.a. of this Mortgage; (iv) Mortgagor will warrant and defend title to the Mortgaged Property and the lien and priority of this Mortgage against all claims and demands of all persons, whether now existing or hereafter arising; (v) that the real property identified in paragraph 1.a. of this Mortgage is not agricultural land as defined in Iowa Code section 9H.1 or as agricultural property as defined in Iowa Code 654A.1; and (vi) all buildings and improvements now or hereafter located on the Land are, or will be, located entirely within the boundaries of the Land.

4. Payment and Performance of the Obligations. Mortgagor will pay all amounts payable under the Obligations in accordance with the terms of the Obligations when and as due and will timely perform all other obligations of Mortgagor under the

| Mortgage | 3 | |||

| REG Newton, LLC - AgStar Financial Services, PCA | ||||

Obligations. The provisions of the Obligations are hereby incorporated by reference into this Mortgage as if fully set forth herein.

5. Taxes. Subject to Section 8 hereof, Mortgagor shall pay each installment of all taxes and special assessments of every kind, now or hereafter levied against the Mortgaged Property before the same become delinquent, without notice or demand, and shall deliver to Mortgagee proof of such payment within fifteen (15) days after the date on which such tax or assessment becomes delinquent.

6. Liens. Mortgagor shall not create, incur or suffer to exist any lien, encumbrance, security interest or charge on the Mortgaged Property or any part thereof which might or could be held to be equal or prior to the lien of this Mortgage, other than the lien of current real estate taxes and installments of special assessments with respect to which no penalty is yet payable. Mortgagor shall pay, when due, the lawful claims of all persons supplying labor or materials to or in connection with the Mortgaged Property.

7. Compliance with Laws. Mortgagor shall comply with all present and future statutes, laws, rules, orders, regulations and ordinances affecting the Mortgaged Property, any part thereof or the use thereof.

8. Permitted Contests. Mortgagor shall not be required to (I) pay any tax, assessment or other charge referred to in paragraph 5 hereof, (ii) discharge or remove any lien, encumbrance or charge referred to in paragraph 6 hereof, or (iii) comply with any statute, law, rule, regulation or ordinance referred to in paragraph 7 hereof, so long as Mortgagor shall contest, in good faith, the existence, amount or the validity thereof, the amount of damages caused thereby or the extent of Mortgagor’s liability therefor, by appropriate proceedings which shall operate during the pendency thereof to prevent (A) the collection of, or other realization upon the tax, assessment, charge or lien, encumbrances or charge so contested, (B) the sale, forfeiture or loss of the Mortgaged Property or any part thereof, and (C) any interference with the use or occupancy of the Mortgaged Property or any part thereof. Mortgagor shall give prompt written notice to Mortgagee of the commencement of any contest referred to in this paragraph 8.

9. Care of Property. Mortgagor shall take good care of the Mortgaged Property; shall keep the Buildings and Personal Property now or later placed upon the Mortgaged Property in good and reasonable repair and shall not injure, destroy or remove either the Buildings or Personal Property during the term of this Mortgage except in the ordinary course of business. Except for upgrades or improvements permitted by the Master Loan Agreement and Supplements. Mortgagor shall not make any material alteration to the Mortgaged Property without the prior written consent of Mortgagee.

10. Insurance. The Mortgagor shall obtain and keep in full force and effect during the term of this Mortgage at its sole cost and expense, the following policies of insurance:

| Mortgage | 4 | |||

| REG Newton, LLC - AgStar Financial Services, PCA | ||||

a. Property insurance, in broad form covering causes of loss customarily covered in the industry of Mortgagor’s business, including the cost of debris removal, together with a vandalism and malicious mischief endorsement, all in the amounts of not less than the full insurable value or full replacement cost, without deduction for depreciation, of the improvements on the Premises, whichever is greater, covering all buildings, structures, fixtures, personal property and other improvements now existing or hereafter erected or placed on the Premises, which insurance shall at all times be in an amount at least equal to the unpaid Secured Indebtedness at any given time.

b. If the Mortgaged Premises are now or hereafter located in a flood plain as defined by the Federal Insurance Administration, the Mortgagor shall obtain flood insurance in the maximum obtainable amount.

c. If steam boilers or similar equipment for the generation of steam are located in, on or about the Mortgaged Premises, the Mortgagor shall maintain insurance against loss or damage by explosion, rupture or bursting of such equipment and appurtenances thereto, without a co-insurance clause, in an amount satisfactory to the Mortgagee.

d. Comprehensive general public liability insurance covering the legal liability of the Mortgagor against claims for bodily injury, death or property damage occurring on, in or about the Mortgaged Premises in such amounts and with such limits as the Mortgagee may reasonably require.

e. Business interruption insurance in an amount at least equal to coverage over one year’s debt service and required escrow account.

f. Any other insurance covering other losses as required by the Mortgagee.

All such insurance shall be written on forms and with companies reasonably satisfactory to the Mortgagee, shall name as the insured parties the Mortgagor and the Mortgagee as their interests may appear, shall be in amounts sufficient to prevent the Mortgagor from becoming a co-insurer of any loss thereunder, shall name the Mortgagee as a named insured or lender loss payee, shall bear a satisfactory mortgagee clause in favor of the Mortgagee, and shall contain an agreement of the insurer that the coverage shall not be terminated or materially modified without providing to the Mortgagee thirty (30) days’ prior written notice of such termination or modification. All required policies of insurance or acceptable certificates thereof, together with evidence of the payment of current premiums therefor shall be delivered to the Mortgagee. The Mortgagor shall, within thirty (30) days prior to the expiration of any such policy, deliver other original policies or certificates of the insurer evidencing the renewal of such insurance together with evidence of the payment of current premiums therefor. In the event of a foreclosure of this Mortgage or any acquisition of the Mortgaged Premises by the Mortgagee, all such policies and any proceeds payable therefrom, whether payable before or after a foreclosure sale, or during the period of redemption, if any, shall become the absolute property of the Mortgagee to be utilized at its discretion. In the event of foreclosure or the failure to obtain and keep any required insurance, the Mortgagor empowers the Mortgagee to effect insurance upon the Mortgaged Premises at the Mortgagor’s expense and for the benefit of the Mortgagee in the amounts and types aforesaid for a period of time covering the time of redemption from a foreclosure

| Mortgage | 5 | |||

| REG Newton, LLC - AgStar Financial Services, PCA | ||||

sale, and if necessary therefore, to cancel any or all existing insurance policies. The Mortgagor agrees to furnish the Mortgagee with copies of all inspection reports and insurance recommendations received by the Mortgagor from any insurer.

11. Inspection. Mortgagee, and its agents, shall have the right at all reasonable times, to enter upon the Mortgaged Property for the purpose of inspecting the Mortgaged Property or any part thereof. Mortgagee shall, however, have no duty to make such inspection. Any inspection of the Mortgaged Property by Mortgagee shall be entirely for its benefit and Mortgagor shall in no way rely or claim reliance thereon.

12. Protection of Mortgagee’s Security. Subject to the rights of Mortgagor under paragraph 8 hereof, if Mortgagor fails to perform any of the covenants and agreements contained in this Mortgage or if any action or proceeding is commenced which affects the Mortgaged Property or the interest of the Mortgagee therein, or the title thereto, then Mortgagee, at Mortgagee’s option, may perform such covenants and agreements, defend against or investigate such action or proceeding, and take such other lawful action as Mortgagee reasonably deems necessary to protect Mortgagee’s interest. Any amounts or expenses disbursed or incurred by Mortgagee in good faith pursuant to this paragraph 12 with interest thereon at the highest rate specified in the Master Loan Agreement, shall become an Obligation of Mortgagor secured by this Mortgage. Such amounts advanced or disbursed by Mortgagee hereunder shall be immediately due and payable by Mortgagor unless Mortgagor and Mortgagee agree in writing to other terms of repayment. Mortgagee shall, at its option, be subrogated to the lien of any mortgage or other lien discharged in whole or in part by the Obligations or by Mortgagee under the provisions hereof, and any such subrogation rights shall be additional and cumulative security for this Mortgage. Nothing contained in this paragraph shall require Mortgagee to incur any expense or do any act hereunder, and Mortgagee shall not be liable to Mortgagor for any damage or claims arising out of action taken by Mortgagee pursuant to this paragraph.

13. Condemnation. Mortgagor shall give Mortgagee prompt notice of any action, actual or threatened, in condemnation or eminent domain and hereby assign, transfer and set over to Mortgagee the entire proceeds of any award or claim for damages for all or any part of the Mortgaged Property taken or damaged under the power of eminent domain or condemnation. Mortgagee is hereby authorized to intervene in any such action in the name of Mortgagor, to compromise and settle any such action or claim, and to collect and receive from the condemning authorities and give proper receipts and acquittances for such proceeds. Any expenses incurred by Mortgagee in intervening in such action or compromising and settling such action or claim, or collecting such proceeds shall be reimbursed to Mortgagee first out of the proceeds. The remaining proceeds or any part thereof shall be applied to reduction of that portion of the Obligations then most remotely to be paid, whether due or not, or to the restoration or repair of the Mortgaged Property, the choice of application to be solely at the discretion of Mortgagee.

| Mortgage | 6 | |||

| REG Newton, LLC - AgStar Financial Services, PCA | ||||

14. Fixture Filing. From the date of its recording, this Mortgage shall be effective as a financing statement filed as a fixture filing with respect to the Personal Property and for this purpose the name and address of the debtor is the name and address of Mortgagor as set forth in paragraph 20 herein and the name and address of the secured party is the name and address of the Mortgagee as set forth in paragraph 20 herein.

15. Events of Default. Each of the following occurrences, after any notice required by the terms of this Mortgage, the Master Loan Agreement dated the 8th day of March 2010 as supplemented by the First Supplement to the Master Loan Agreement, the Term Note, and the Second Supplement to the Master Loan Agreement, the Revolving Line of Credit Note, any renewals, extensions, modifications or refinancing thereof and any additional supplements and notes to the Master Loan Agreement issued in substitution therefore, shall constitute an event of default hereunder (“Event of Default”):

a. Mortgagor shall default in the due observance or performance of or breach its agreement contained in paragraph 4 hereof or shall default in the due observance or performance of or breach any other covenant, condition or agreement on its part to be observed or performed pursuant to the terms of this Mortgage.

b. An Event of Default, shall occur under the Master Loan Agreement, Supplements, Notes, or any other mortgage, assignment or other security document constituting a lien on the Mortgaged Property or any part thereof.

16. Acceleration; Foreclosure, Receiver. Upon the occurrence of any Event of Default and at any time thereafter while such Event of Default exists, Mortgagee may, at its option, after such notice as may be required by law, exercise one or more of the following rights and remedies (and any other rights and remedies lawfully available to it):

a. Mortgagee may declare immediately due and payable all Obligations secured by this Mortgage, and the same shall thereupon be immediately due and payable, without further notice or demand.

b. Mortgagee shall have and may exercise with respect to the Personal Property, all the rights and remedies accorded upon default to a secured party under the Iowa Uniform Commercial Code. If notice to Mortgagor of intended disposition of such property is required by law in a particular instance, such notice shall be deemed commercially reasonable if given to Mortgagor at least ten (10) days prior to the date of intended disposition.

c. Mortgagee may (and is hereby authorized and empowered to) foreclose this Mortgage in accordance with the law of the State of Iowa, and at any time after the commencement of an action in foreclosure, or during the period of redemption, the court having jurisdiction of the case shall at the request of Mortgagee appoint a receiver to take immediate possession of the Mortgaged Property and of the Revenues and Income accruing therefrom, and to rent or cultivate the same as he may deem best for the interest of all parties concerned, and such receiver shall be liable to account to Mortgagor only for the net profits, after application of rents,

| Mortgage | 7 | |||

| REG Newton, LLC - AgStar Financial Services, PCA | ||||

issues and profits upon the costs and expenses of the receivership and foreclosure and upon the Obligations.

d. Mortgagee may employ a receiver to deal with the aforesaid matter, such receiver’s reasonable salary and remuneration for the account of the Mortgagor. Such receiver shall be regarded as the agent of the Mortgagor and the Mortgagor shall be wholly responsible for the acts and omissions of such receiver.

e. Subject to the provisions of the terms of the Obligations, the Mortgagee shall have the power to dispose of any Mortgaged Property or any part thereof in accordance with the law of the State of Iowa without the consent of the Mortgagor or other persons. The Mortgagee shall have the power to execute all documents relating to the sale and lease of the Mortgaged Property and any loss arising shall not be borne by the Mortgagee.

f. The Mortgagee can dispose of the Mortgaged Property in accordance with this Mortgage Agreement and the laws of the State of Iowa and, subject to the provisions of the Obligations can apply the monies received from the disposition of Mortgaged Property in the following order of priority:

(1) firstly, in payment of all reasonable costs in the disposition of the Mortgaged Property, including (but without limitation) the fees and remuneration of the receiver;

(2) secondly, in payment of all the custom duties and other taxes required by law in connection with the Mortgaged Property;

(3) thirdly, in payment of all necessary costs to maintain the property, including the cost of insurance and any other benefit to the property;

(4) fourthly, in payment of the balance of Mortgagor’s obligations to Mortgagee as defined in the Obligations; and

(5) fifthly, after the indefeasible payment in full of the Obligations, in satisfaction of any junior secured indebtedness; and the remaining balance, after the above deductions, shall be paid to the Mortgagor and other persons entitled to the above sum in full by the Mortgagee.

17. Redemption. It is agreed that if this Mortgage covers less than ten (10) acres of land, and in the event of the foreclosure of this Mortgage and sale of the property by sheriff’s sale in such foreclosure proceedings, the time of one year for redemption from said sale provided by the statues of the State of Iowa shall be reduced to six (6) months provided the Mortgagee, in such action files an election to waive any deficiency judgment against Mortgagor which may arise out of the foreclosure proceedings; all to be consistent with the provisions of Chapter 628 of the Iowa Code. If the redemption period is so reduced, for the first three (3) months after sale such right of redemption shall be exclusive to the Mortgagor, and the time periods in Sections 628.5, 628.15 and 628.16 of the Iowa Code shall be reduced to four (4) months.

It is further agreed that the period of redemption after a foreclosure of this Mortgage shall be reduced to sixty (60) days if all of the three following contingencies develop: (1) The real estate is less than ten (10) acres in size; (2) the Court finds affirmatively that the said real estate has been abandoned by the owners and those persons personally liable under this Mortgage at the time of such foreclosure; and (3) Mortgagee in such action files an election to waive any deficiency judgment against

| Mortgage | 8 | |||

| REG Newton, LLC - AgStar Financial Services, PCA | ||||

Mortgagor or its successors in interest in such action. If the redemption period is so reduced, Mortgagor or its successors in interest or the owner shall have the exclusive right to redeem for the first thirty (30) days after such sale, and the time provided for redemption by creditors as provided in Sections 628.5, 628.15 and 628.16 of the Iowa Code shall be reduced to forty (40) days. Entry of appearance by pleading or docket entry by or on behalf of Mortgagor shall be a presumption that the property is not abandoned. Any such redemption period shall be consistent with all of the provisions of Chapter 628 of the Iowa Code. This paragraph shall not be construed to limit or otherwise affect any other redemption provisions contained in Chapter 628 of the Iowa Code.

18. Attorneys’ Fees. Mortgagor shall pay on demand all lawful costs and expenses incurred by Mortgagee in enforcing or protecting its lawful rights and remedies hereunder, including, but not limited to, reasonable attorneys’ fees and legal expenses allowed by law.

19. Forbearance not a Waiver, Rights and Remedies Cumulative. No delay by Mortgagee in exercising any right or remedy provided herein or otherwise afforded by law or equity shall be deemed a waiver of or preclude the exercise of such right or remedy, and no waiver by Mortgagee of any particular provisions of this Mortgage shall be deemed effective unless in writing signed by Mortgagee. All such rights and remedies provided for herein or which Mortgagee or the holder of the Obligations may have otherwise, at law or in equity, shall be distinct, separate and cumulative and may be exercised concurrently, independently or successively in any order whatsoever, and as often as the occasion therefor arises.

20. Notices. All notices required to be given hereunder shall be in writing and deemed given when personally delivered or deposited in the United States mail, postage prepaid, sent certified or registered, addressed as follows:

| a. If to Mortgagor, to: | REG NEWTON, LLC | |||

| c/o Renewable Energy Group, Inc. | ||||

| 416 S. Bell Ave. | ||||

| P.O. Box 888 | ||||

| Ames, IA 50010 | ||||

| Telephone: (515) 239-8000 | ||||

| Fax: (515) 239-8009 | ||||

| Attention: President | ||||

| With a copy to: | Wilcox, Polking, Gerken, Schwarzkopf, | |||

| Copeland, P.C. | ||||

| 115 E. Lincolnway St., Suite 200 | ||||

| Jefferson, IA 50129-2149 | ||||

| Telephone: (515) 386-3158 | ||||

| Fax: (515) 386-8531 | ||||

| Attn. John A. Gerken | ||||

| Mortgage | 9 | |||

| REG Newton, LLC - AgStar Financial Services, PCA | ||||

| b. If to Mortgagee, to: | AgStar Financial Services, PCA | |||

| 1921 Premier Drive | ||||

| P.O. Box 4249 | ||||

| Mankato, MN 56002-4249 | ||||

| Telephone: (507) 386-4242 | ||||

| Facsimile: (507) 344-5088 | ||||

| Attention: Mark Schmidt | ||||

| With copies to: | George Meinz | |||

| Gray Plant Mooty Mooty and Bennett, | ||||

| P.A. | ||||

| 1010 West St. Germain, Suite 600 | ||||

| St. Cloud, MN 56301 | ||||

| Telephone: (320) 252-4414 | ||||

| Facsimile: (320) 252-4482 | ||||

or to such other address or person as hereafter designated in writing by the applicable party in the manner provided in this paragraph for the giving of notices.

21. Severability. In the event any portion of this Mortgage shall, for any reason, be held to be invalid, illegal or unenforceable in whole or in part, the remaining provisions shall not be affected thereby and shall continue to be valid and enforceable and if, for any reason, a court finds that any provision of this Mortgage is invalid, illegal, or unenforceable as written, but that by limiting such provision it would become valid, legal and enforceable then such provision shall be deemed to be written, construed and enforced as so limited.

22. Further Assurances. At any time and from time to time until payment in full of the Obligations, Mortgagor will, at the request of Mortgagee, promptly execute and deliver to Mortgagee such additional instruments as may be reasonably required to further evidence the lien of this Mortgage and to further protect the security interest of Mortgagee with respect to the Mortgaged Property, including, but not limited to, additional security agreements, financing statements and continuation statements. Any expenses incurred by Mortgagee in connection with the recordation of any such instruments shall become additional Obligations of Mortgagor secured by this Mortgage. Such amounts shall be immediately due and payable by Mortgagor to Mortgagee.

23. Successors and Assigns bound; Number; Gender; Agents; Captions. The rights, covenants and agreements contained herein shall be binding upon and inure to the benefit of the respective legal representatives, successors and assigns of the parties. Words and phrases contained herein, including acknowledgment hereof, shall be construed as in the singular or plural number, and as masculine, feminine or neuter gender according to the contexts. The captions and headings of the paragraphs of this

| Mortgage | 10 | |||

| REG Newton, LLC - AgStar Financial Services, PCA | ||||

Mortgage are for convenience only and are not to be used to interpret or define the provisions hereof.

24. Governing Law. This Mortgage shall be governed by and construed in accordance with the laws of the State of Iowa.

25. Waiver of any Exemption. The undersigned hereby waives all rights of exemption as to any of the Mortgaged Property.

26. Acknowledgment of Receipt of Copies of Debt Instrument. Mortgagor hereby acknowledges the receipt of a copy of this Mortgage together with a copy of the Master Loan Agreement and all supplements secured hereby.

27. Additional Provisions. Add Addendum Page.

Dated this 8th day of March 2010

|

| ||

| REG NEWTON, LLC, | ||

| an Iowa limited liability company | ||

| /s/ Daniel J. Oh | ||

| By: Daniel J. Oh | ||

| Its: President | ||

STATE OF Iowa, COUNTY OF Story

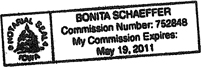

This instrument was acknowledged before me on the 5th day of March 2010 by Dan Oh as President of REG NEWTON, LLC.

| /s/ Bonita Schaeffer |

| Notary Public |

| Mortgage | 11 | |||

| REG Newton, LLC - AgStar Financial Services, PCA | ||||

EXHIBIT A

LEGAL DESCRIPTION

Tract I

Parcel “D” of part of the Southwest Quarter of the Southwest Quarter of Section 13 and part of the Northwest Quarter of the Northwest Quarter of Section 24, all in Township 80 North, Range 19 West of the 5th P.M., Jasper County, Iowa, as appears in Plat of Survey filed in Book 970, Page 321, and also as appears in Plat of Survey Retracement filed in Book 1153, Page 602, in the Office of the Recorder of said County, LESS AND EXCEPT the following: Parcel “G” located in Parcel “D” in the Southwest Quarter of the Southwest Quarter of Section 13, Township 80 North, Range 19 West of the 5th P.M., Jasper County, Iowa, as appears in Plat of Survey filed in Book 1154, Page 475, as Doc ID 001765820001, File No. 2008-00007078.

Tract III

Parcel “E” in the South Half of the Southwest Quarter of Section 13, Township 80 North, Range 19 West of the 5th P.M., Jasper County, Iowa, as appears in plat in Book 1153, Page 571, in the office of the Recorder of said County.

| Mortgage | 12 | |||

| REG Newton, LLC - AgStar Financial Services, PCA | ||||

EXHIBIT B

PERMITTED ENCUMBRANCES

| 1. | Limited Easement in favor of Jasper County Water Association, dated 9/5/80, filed 10/29/80 in Book 818, Page 740, given for the purposes of construction and laying and thereafter using, operating, inspecting, maintaining, repairing, replacing or removing water pipeline and any necessary appurtenances thereto over, across and through the North 30 feet of the SW 1/4 SW 1/4, Sec. 13-80-19. |

| 2. | Easement for road purposes in favor of Jasper County, dated 5/13/96, filed 6/20/96 in Book 1070, Page 477. Conveys for road purposes and for use as a public highway, the West 85.00 feet of the SW 1/4 SW 1/4 of Sec. 13-80-19, containing 1.91 acres exclusive of present established highway. |

This instrument was later re-recorded on 7/17/96 in Book 1072, Page 441, to show the heading of the instrument to be an Easement for Public Purposes.

| 3. | Easement for road purposes in favor of Jasper County, dated 5/13/96, filed 6/20/96 in Book 1070, Page 479. Conveys for road purposes and for use as a public highway Parcel 2480192, described as part of the NW 1/4 of Sec. 24-80-19, beginning at the NW corner of said NW 1/4 NW 1/4; thence East 85.00 feet along the North line of said NW 1/4 NW 1/4; thence South 0°45'35" West, 379.79 feet to the South line of Parcel “D” of said NW 1/4 NW 1/4; thence South 47°11'20" West, 117.32 feet along said South line to the SW corner of said Parcel “D”; thence North 0°45'35" East, 460.65 feet along the West line of said NW 1/4 NW 1/4 to the point of beginning, containing 0.82 acres exclusive of present established highway. |

This instrument was later re-recorded on 7/17/96 in Book 1072, Page 439, to show the heading of the instrument to be an Easement for Public Purposes.

| 4. | Overhang Easement in favor of IES Utilities Inc., dated 8/25/97, filed 9/29/97 in Book 1099, Page 62, for the perpetual right to construct, reconstruct, maintain, operate, repair, patrol and remove electric and telecommunication lines upon, over and across the following property: That portion of Parcel “D” located in the SW 1/4 SW 1/4 of Sec. 13-80-19. This easement is for a 10-foot wide strip of land adjacent to the road right of way through the described land. |

| 5. | Limited Easement in favor of Iowa Regional Utilities Association d/b/a Central Iowa Water Association, dated 2/4/05, filed 2/18/05 as Doc #05-01267, for the purposes of construction and laying and thereafter using, operating, inspecting, maintaining, repairing, replacing or removing water pipeline and any necessary appurtenances thereto over, across and through the following property: A strip of land 30 feet in width, which is coincident with and adjacent to the road right of ways of the property to be insured herein. |

| Mortgage | 13 | |||

| REG Newton, LLC - AgStar Financial Services, PCA | ||||