Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32.2 - Renewable Energy Group, Inc. | regi-20161231xex322.htm |

| EX-32 - EXHIBIT 32.1 - Renewable Energy Group, Inc. | regi-20161231xex321.htm |

| EX-31 - EXHIBIT 31.2 - Renewable Energy Group, Inc. | regi-20161231xex312.htm |

| EX-31 - EXHIBIT 31.1 - Renewable Energy Group, Inc. | regi-20161231xex311.htm |

| EX-23 - EXHIBIT 23.1 - Renewable Energy Group, Inc. | regi-20161231xex231xdeloit.htm |

| EX-21 - EXHIBIT 21.1 - Renewable Energy Group, Inc. | regi-20161231xex211xlistof.htm |

| EX-12 - EXHIBIT 12.1 - Renewable Energy Group, Inc. | regi-20161231xex121stateme.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________________

FORM 10-K

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-35397

______________________________________

RENEWABLE ENERGY GROUP, INC.

(Exact name of registrant as specified in its charter)

Delaware | 26-4785427 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

416 South Bell Avenue, Ames, Iowa | 50010 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (515) 239-8000

Securities registered pursuant to Section 12(b) of the Act:

Title of each class: | Name of each exchange on which registered: |

Common Stock, par value $.0001 per share | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

______________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | x |

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of June 30, 2016, the aggregate market value of Common Stock held by non-affiliates was $337,816,047.

As of February 28, 2017, 38,565,260 shares of Common Stock of the registrant were issued and outstanding.

______________________________________

Documents Incorporated By Reference

All or a portion of Items 10 through 14 in Part III of this Form 10-K are incorporated by reference to the Registrant’s definitive proxy statement on Schedule 14A, which will be filed within 120 days after the close of the fiscal year covered by this report on Form 10-K, or if the Registrant’s Schedule 14A is not filed within such period, will be included in an amendment to this Report on Form 10-K which will be filed within such 120 day period.

TABLE OF CONTENTS

Page | ||

PART I | ||

ITEM 1. | ||

ITEM 1A. | ||

ITEM 1B. | ||

ITEM 2. | ||

ITEM 3. | ||

ITEM 4. | ||

PART II | ||

ITEM 5. | ||

ITEM 6. | ||

ITEM 7. | ||

ITEM 7A. | ||

ITEM 8. | ||

ITEM 9. | ||

ITEM 9A. | ||

ITEM 9B. | ||

PART III | ||

ITEM 10. | ||

ITEM 11. | ||

ITEM 12. | ||

ITEM 13. | ||

ITEM 14. | ||

PART IV | ||

ITEM 15. | ||

ITEM 16. | ||

PART I

Cautionary Statement Regarding Forward-Looking Information

This annual report on Form 10-K contains, in addition to historical information, certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts contained in this report, including statements regarding our future results of operations and financial position, strategy and plans, and our expectations for future operations, are forward-looking statements. The words “believe,” “may,” “will,” “would,” “might,” “could,” “estimate,” “continue,” “anticipate,” “design,” “intend,” “plan,” “seek,” “potential,” “expect” and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, strategy, short-term and long-term business operations and objectives, and financial needs. Forward-looking statements include, but are not limited to, statements about:

• | our financial performance, including revenues, cost of revenues and operating expenses; |

• | government programs, policymaking and mandates relating to renewable fuels; |

• | the availability, future price and volatility of feedstocks; |

• | the future price and volatility of petroleum; |

• | our liquidity and working capital requirements; |

• | anticipated trends and challenges in our business and competition in the markets in which we operate; |

• | our ability to successfully implement our acquisition strategy and integration strategy; |

• | progressing facilities currently under development to the construction and operational stages, including planned capital expenditures and our ability to obtain financing for such construction; |

• | our ability to protect proprietary technology and trade secrets; |

• | the development of competing alternative fuels, energy services and renewable chemicals; |

• | our risk management activities; |

• | product performance, in cold weather or otherwise; |

• | seasonal fluctuations in our business; |

• | our current products as well as products we are developing; |

• | critical accounting policies and estimates, the impact or anticipated impact of recent accounting pronouncements, guidance or changes in accounting principles and future recognition of impairments for the fair value of assets, including goodwill, financial instruments, intangible assets and other assets acquired; and |

• | assumptions underlying or relating to any of the foregoing. |

These statements reflect current views with respect to future events and are based on assumptions and subject to risks and uncertainties. We note that a variety of factors could cause actual results and experience to differ materially from the anticipated results or expectations expressed in our forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Forward-looking statements are also subject to risks and uncertainties that could cause actual results to differ materially from those expected. These risks and uncertainties include, but are not limited to, those risks discussed in Item 1A of this report.

Forward-looking statements contained in this report present management’s views only as of the date of this report. We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise. You are advised, however, to consult any further disclosures we make on related subjects in our 10-Q and 8-K reports filed with the Securities and Exchange Commission.

ITEM 1. | Business |

General

We focus on providing cleaner, lower carbon intensity products and services. We are North America's largest producer of advanced biofuels. We utilize a nationwide production, distribution and logistics system as part of an integrated value chain model designed to convert natural fats, oils and greases into advanced biofuels. During 2016, we sold 567 million gallons and

1

had revenues of $2.0 billion. We are also engaged in research and development efforts focused on the conversion of diverse feedstocks into renewable chemicals.

We own and operate a network of 14 biorefineries. Twelve biorefineries are located in the United States and two in Germany, and 13 of which produce biodiesel or renewable hydrocarbon diesel and have an aggregate nameplate production capacity of 502 million gallons per year, or mmgy. We also operate one microbial fermentation facility in connection with our development of renewable chemicals and one feedstock processing facility. We believe our fully integrated approach, which includes acquiring feedstock, managing biorefinery facility construction and upgrades, operating biorefineries, and distributing through a network of terminals, positions us to serve the market for biomass-based diesel and other advanced biofuels along with other products and services.

We are a lower-cost biomass-based diesel producer. We primarily produce our biomass-based diesel from a wide variety of lower cost feedstocks, including inedible corn oil, used cooking oil and inedible animal fat. We also produce biomass-based diesel from virgin vegetable oils, which are more widely available and tend to be higher in price. We believe our ability to process a wide variety of feedstocks provides us with a cost advantage over many biomass-based diesel producers, particularly those that rely primarily on higher cost virgin vegetable oils, such as soybean oil or canola oil.

We are in the process of developing renewable chemicals through our development-stage industrial biotechnology business, REG Life Sciences, which uses proprietary microbial fermentation processes to produce renewable chemicals, fuels and other products. Fatty acids are one of three product areas REG Life Sciences has focused on, along with esters and alcohols.

We sell petroleum-based heating oil and diesel fuel, which enables us to offer additional biofuel blends, while expanding our customer base. We sell heating oil and ultra-low sulfur diesel, or ULSD, at terminals throughout the northeastern U.S. as well as BioHeat® blended fuel at one of our existing Northeastern terminal locations. We expanded our sales of additional biofuel blends to Midwest terminal locations and look to potentially expand to other areas across North America.

We acquired a 75 mmgy nameplate capacity renewable hydrocarbon diesel biorefinery located in Geismar, Louisiana in June 2014. We began production at the Geismar facility in October 2014 after our completion of certain upgrades. The facility was idle from April 2015 to March 2016 while repairs were made related to the two separate fires that occurred at the facility in April and September 2015. Our Geismar facility has been running at high run rates since early October 2016.

We also expanded our business internationally by acquiring a majority interest in Petrotec AG ("Petrotec"), in December 2014. During 2015 and 2016, we acquired additional shares in Petrotec through cash tender offers and purchases on the open market. At December 31, 2016, we owned approximately 91% of Petrotec's outstanding shares. In January 2017, we completed the acquisition of the remaining minority interest in Petrotec and now own 100% of its outstanding shares. Petrotec is a fully-integrated company utilizing used cooking oil and other waste feedstocks to produce biomass-based diesel at its two biorefineries in Emden and Oeding, Germany. Our production capacity in Europe is approximately 50 mmgy.

In August 2015, we acquired our Grays Harbor facility, a 100 mmgy nameplate biodiesel plant and terminal at the Port of Grays Harbor, Washington. This acquisition expanded our production fleet to the west coast of the United States. The Grays Harbor location includes 18 million gallons of storage capacity and a terminal that can accommodate feedstock intake and fuel delivery on deep-water PANAMAX class vessels as well as possessing significant rail and truck transport capabilities. To date, the production facility's primary feedstock has been canola oil sourced nearby in the Pacific Northwest.

In March 2016, we acquired our 20 mmgy nameplate biodiesel refinery located in DeForest, Wisconsin, REG Madison, LLC, which produces biodiesel from yellow grease, rendered animal fats, and inedible corn oil, in addition to refined vegetable oils using our patented technology currently in use at our Seneca, Illinois plant. The facility has both truck and rail capabilities.

Plant Network

2

Our production network in North America consists of the following owned facilities:

Property | Nameplate1 Production Capacity (mmgy) | Estimated Production Capacity for Current Feedstock Mix as of December 31, 2016 (mmgy) | REG Operations Commenced | Feedstock Capability | ||||

Ralston, Iowa | 12 | 12 | 2002 | Refined Oils and Fats | ||||

Albert Lea, Minnesota | 30 | 30 | 2005 | Crude, High FFA and Refined Oils and Fats | ||||

Newton, Iowa | 30 | 30 | 2007 | Crude, High FFA and Refined Oils and Fats | ||||

Seabrook, Texas | 35 | 35 | 2008 | Refined Oils and Fats | ||||

Danville, Illinois | 45 | 45 | 2009 | Crude, High FFA and Refined Oils and Fats | ||||

Seneca, Illinois | 60 | 60 | 2010 | Crude, High FFA and Refined Oils and Fats | ||||

New Boston, Texas | 15 | 14 | 2013 | Crude, High FFA and Refined Oils and Fats | ||||

Ellenwood, Georgia 2 | 15 | n/a | n/a | N/A | ||||

Mason City, Iowa | 30 | 30 | 2013 | Crude, High FFA and Refined Oils and Fats | ||||

Geismar, Louisiana 3 | 75 | 75 | 2014 | Crude, High FFA and Refined Oils and Fats | ||||

Okeechobee, Florida 4 | n/a | n/a | 2014 | n/a | ||||

Grays Harbor, Washington | 100 | 92 | 2015 | Refined Oils and Fats | ||||

Madison, Wisconsin 5 | 20 | 20 | 2016 | Crude, High FFA and Refined Oils and Fats | ||||

Partially Constructed Facilities | % Complete | |||||||

St. Rose, Louisiana | 60 | n/a | ~45% | Crude, High FFA and Refined Oils and Fats | ||||

Emporia, Kansas | 60 | n/a | ~20% | Crude, High FFA and Refined Oils and Fats | ||||

Clovis, New Mexico | 15 | n/a | ~50% | Crude, High FFA and Refined Oils and Fats | ||||

1 | The nameplate capacity listed above is based on original plant design. |

2 | Idled by prior owner at time of our purchase and remains idled pending repairs or upgrades. We have not yet set a production date. |

3 | Plant commenced operations in March 2016 after being shut down since April 2015 due to two separate fires that occurred in April and September 2015. |

4 | Okeechobee is a demo-scale microbial fermentation facility for the development and production of renewable chemicals, fuels and other products. |

5 | Acquired in March 2016 from Sanimax Energy. |

Our production network in Europe consists of the following facilities:

3

Property | Nameplate Production Capacity1 (million gallons) | Estimated Production Capacity for Current Feedstock Mix as of December 31, 2016 (million gallons) | Operations Commenced | Feedstock Capability | ||||

Emden, Germany | 27 | 27 | 2008 | Crude, High FFA and Refined Oils and Fats | ||||

Oeding, Germany | 23 | 23 | 2001 | Crude, High FFA and Refined Oils and Fats | ||||

1 | The nameplate capacity listed above is based on the output of the original plant design. In Germany, nameplate capacity can be based on input, which is 30 mmgy for Emden and 26 mmgy for Oeding or 185,000 metric tons for these two locations. |

In addition to the production facilities and fermentation facility listed above, we maintain a testing laboratory at our corporate headquarters in Ames, Iowa, which allows us to test various feedstocks for conversion into biomass-based diesel, as well as various manufacturing processes available in the production of biomass-based diesel. We also have a regional office in Tulsa, Oklahoma, focused on maintaining and developing advanced biofuel technologies and renewable chemicals. Our industrial biotechnology research and development activities, conducted in South San Francisco, are dedicated to the development of renewable chemicals, advanced biofuels and other products using our proprietary microbial fermentation technology.

Our Feedstocks and Other Inputs

Our ability to use a wide range of feedstocks gives us the flexibility to respond to changes in feedstock pricing to maintain our feedstock cost advantage. We have the ability to change our processing techniques to accommodate different feedstocks and feedstock mixes. In 2016, approximately 72% of our total feedstock usage was lower cost inedible corn oil, used cooking oil or rendered animal fat feedstock and the remaining 28% was from refined vegetable oils, such as soybean oil or canola oil.

We procure our feedstocks from numerous vendors in quantities ranging from truckload to railcar to water vessel to pipeline. There is no established futures market for lower cost feedstocks. Inedible corn oil is typically purchased in nearby forward positions of one to three months, and occasionally longer, on fixed priced contracts. We generally purchase used cooking oil and rendered animal fats on one to four week forward positions using fixed pricing or an indexed price compared to a published index such as USDA reports or recognized industry price reports such as The Jacobsen or Informa. Soybean and canola oils can be purchased on a spot or forward contract basis from a number of suppliers and pricing for these vegetable oils is compared to the broadly traded Soybean Oil Index of the Chicago Mercantile Exchange (CME).

From time to time, we work with developers of next generation feedstocks, such as algae and camelina, to assist them in bringing these new feedstocks to market. We have converted several of these feedstocks, as well as other second generation feedstocks, into high quality biomass-based diesel in our laboratory and production facilities. We believe we are well positioned to incorporate many new feedstocks into our production process as they become commercially available.

We procure methanol, chemical catalysts used in our production process such as sodium methylate and hydrochloric acid, under fixed-price contracts and formula-indexed contracts based upon competitive bidding. These procurement contracts typically last from three months to one year. The price of methanol is indexed to the monthly reported published price such as the JJ&A Methanol report or Southern Chemical (SSC) report.

Distribution

We have established a national distribution system to supply biomass-based diesel throughout the United States. Each of our biomass-based diesel facilities is equipped with an on-site rail loading system, a truck loading system, or both. Our Seneca biorefinery near the Illinois River has direct barge access supplying customers using the inland waterways system. Our Houston biorefinery has barge and deep-water ship loading capability. Our Grays Harbor biorefinery has deep-water capability for PANAMAX class vessels. We also manage some customers’ biomass-based diesel storage tanks and replenishment process. We lease 484 railcars for transportation and lease biomass-based diesel storage tanks in 49 terminals as of December 31, 2016. In general, the terminals where we lease our biomass-based diesel storage tanks are petroleum fuel terminals so that fuel distributors and other biomass-based diesel customers can create a biomass-based diesel blend at the terminal before further distribution. Terminal leases typically have one- to three-year terms and are generally renewable subject to certain terms and conditions. During 2016, we have sold our various products in 47 states, four provinces in Canada, Peru, as well as Europe.

4

Risk Management

The prices for feedstocks and biomass-based diesel can be volatile and are not always closely correlated. Lower cost feedstocks are particularly difficult to risk manage given that such feedstocks are not traded in any public futures market. To manage feedstock and biomass-based diesel price risks, we utilize forward contracting, hedging and other risk management strategies, including the use of futures, swaps, options and over-the-counter products.

In establishing our risk management strategies, we draw from our own in-house risk management expertise and we consult with industry experts. We utilize research conducted by outside firms to provide additional market information and risk management strategies. We believe combining these sources of knowledge, experience and expertise gives us a more sophisticated and global view of the fluctuating commodity markets for raw materials and energy, which we then can incorporate into our risk management strategies.

Seasonality

Biodiesel producers have experienced seasonal fluctuations in demand for biodiesel. Biodiesel demand has tended to be lower during winter in most states due to blending concentrations being reduced. To mitigate some of these seasonable fluctuations in demand, we have upgraded our Newton and Danville biorefineries to produce distilled biodiesel from lower cost feedstocks, thus allowing that product to have improved cold-weather performance.

Renewable Identification Number, or RIN, prices may also be subject to seasonal fluctuations. The RIN is dated for the calendar year in which it is generated. Since 20% of an Obligated Party's annual Renewable Volume Obligation, or RVO, can be satisfied by prior year RINs, most RINs must come from biofuel produced or imported during the RVO year. As a result, RIN prices can be expected to increase as the calendar year progresses if the RIN market is undersupplied compared to that year's RVO and decrease if it is oversupplied. For further discussion and background on RINs, see "Government Programs Favoring Biomass-based Diesel Production and Use" below.

Competition

We face competition from producers and suppliers of petroleum-based diesel fuel, from other biomass-based diesel producers, marketers, traders and distributors. The size of the biomass-based diesel industry is small compared to the size of the petroleum-based diesel fuel industry and large petroleum companies have greater resources than we do. Our principal competitive differentiators are product quality, both biomass-based diesel and RIN quality, supply reliability and price. We also face competition in the biomass-based diesel RIN compliance market from producers of renewable hydrocarbon diesel and in the advanced biofuel RIN compliance market from producers of other advanced biofuels. In the United States and Canadian biomass-based diesel markets, we compete with large, multi-product companies that have greater resources than we do. Archer Daniels Midland Company, Cargill Incorporated, Louis Dreyfus Commodities Group and Ag Processing Inc. are major international agribusiness corporations and biodiesel producers with the financial sourcing and marketing resources to be formidable competitors in the biodiesel industry. These agribusiness competitors tend to make biodiesel from higher cost virgin vegetable oils such as soybean or canola oil, which they produce as part of their integrated agribusinesses. We are also in competition with producers of renewable hydrocarbon diesel, such as Neste Oil, which has approximately 882 million gallons of renewable hydrocarbon diesel production capacity in Asia and Europe and Diamond Green Diesel, LLC, the joint venture between Valero Energy Corp. and Darling International with approximately 160 million gallons of production capacity and plans to grow its capacity to 275 million gallons by end of 2017. Renewable hydrocarbon diesel can also satisfy the RFS2 biomass-based diesel requirement if the renewable hydrocarbon diesel meets the greenhouse gas reduction requirements and may satisfy Canadian renewable fuel requirements. Neste Oil has greater financial resources than we do.

In the RFS2 advanced biofuel market, we also compete with other producers and importers of advanced biofuels, such as Brazilian sugarcane ethanol producers and producers of biogas used in transportation. We face increasing competition from imported biomass-based diesel and expect this to continue. In January 2015, the EPA announced the approval of a plan submitted by CARBIO, a consortium of Argentinean renewable fuel producers, which allows for Argentinian biodiesel made from soybean oil to generate RINs. Imported biomass-based diesel that does not qualify under RFS2, also competes in jurisdictions where there are biomass-based diesel blending requirements.

We also face competition from independent biodiesel producers. Most of these competitors own only one biodiesel plant and thus, do not enjoy the benefits of scale that we do. Many of these competitors own biodiesel plants that can process only higher cost virgin vegetable oils. Furthermore, in our marketing and distribution, we face competition from biomass-based diesel traders such as US Oil, NGL, Noble, Shell, Tenaska, Vitol and others. These trading companies may have greater financial resources than we do and are able to take significant biomass-based diesel positions in the marketplace. These competitors are often customers and/or suppliers of ours as well.

Segment and Geographic Information

5

We re-assess our reportable segments on an annual basis. Prior to 2015, our business was organized into two reportable segments - the Biomass-based Diesel segment and the Services segment. As a result of the increased activities surrounding our renewable chemicals business, in 2015 we began reporting a new segment, Renewable Chemicals, which was previously included in the Biomass-based Diesel segment. Financial and geographic information regarding our segments can be found in Note 18 to our consolidated financial statements included under Part II, Item 8 of this report.

Government Programs Favoring Biomass-Based Diesel Production and Use

The biomass-based diesel industry benefits from numerous federal and state government programs, the most important of which is RFS2.

Renewable Fuel Standard

On July 1, 2010, RFS2’s biomass-based diesel requirement became effective, requiring for the first time that a certain percentage of the diesel fuel consumed in the United States be made from renewable sources. The biomass-based diesel requirement can be satisfied by two primary fuels, biodiesel and renewable hydrocarbon diesel. RFS2 required the use of one billion gallons of biomass-based diesel in 2012, required 1.28 billion gallons in 2013 and at least one billion gallons each year thereafter, with such higher amounts to be determined by the United States Environmental Protection Agency, or EPA, subject to the Office of Management and Budget, or OMB, approval. On November 30, 2015, the EPA issued the final 2014 through 2016 RVO rules whereby the biomass-based diesel volumes were set at 1.63 billion, 1.73 billion, 1.90 billion gallons for 2014, 2015 and 2016, respectively. In November 2016, the EPA issued the final 2017 biomass-based diesel volume at 2 billion gallons and additionally set the 2018 target at 2.1 billion gallons.

The biomass-based diesel requirement is one of four separate renewable fuel requirements under RFS2. The RFS2 requirements are based on two primary categories and two subcategories. The two primary categories are conventional renewable fuel, which is primarily satisfied by corn ethanol, and advanced biofuel, which is defined as a biofuel that reduces lifecycle greenhouse gas emissions by at least 50% compared to the petroleum-based fuel the biofuel is replacing. The advanced biofuel category has two subcategories, cellulosic biofuel, to be satisfied by newly developed cellulosic biofuels, such as ethanol made from woody biomass, and biomass-based diesel, which is satisfied by biodiesel and renewable hydrocarbon diesel, or RHD. RFS2’s total advanced biofuel requirement is larger than the combined cellulosic fuel and biomass-based diesel requirements, thus requiring the use of additional volumes of advanced biofuels.

The RFS2 requirement for advanced biofuels can be satisfied by any advanced biofuel, including biodiesel, renewable hydrocarbon diesel, biogas used in transportation, biobutanol, cellulosic ethanol or sugarcane-based ethanol, so long as it meets the 50% greenhouse gas reduction requirement. The advanced biofuel requirement was 2.88 billion gallons in 2015, 3.61 billion gallons in 2016, and 4.28 billion gallons in 2017.

The advanced biofuel RVO is expressed in terms of ethanol equivalent volumes, or EEV, which is based on the fuel’s renewable energy content compared to ethanol. Biodiesel has an EEV of 1.5 and RHD has an EEV of 1.5-1.7, compared to 1.0 for sugarcane-based ethanol. Accordingly, it requires less biomass-based diesel than sugarcane-based ethanol to meet the required volumes as each gallon of biomass-based diesel counts as more gallons for purposes of fulfilling the advanced biofuel RVO, providing an incentive for Obligated Parties to purchase biomass-based diesel to meet their advanced biofuel RVO.

The RFS2 volume requirements apply to petroleum refiners and petroleum fuel importers in the 48 contiguous states and Hawaii, who are defined as “Obligated Parties” in the RFS2 regulations, and requires these Obligated Parties to incorporate into their petroleum-based fuel a certain percentage of renewable fuel or purchase credits in the form of RINs from those who do. An Obligated Party’s RVO is based on the volume of petroleum-based fuel they produce or import. The largest United States petroleum refining companies, such as Valero, Phillips 66, ExxonMobil, British Petroleum, Chevron and Shell, represent the majority of the total RVO, with the remainder made up of smaller refiners and importers.

Renewable Identification Numbers

The EPA created the renewable identification number, or RIN, system to track renewable fuel production and compliance with the renewable fuel standard. EPA registered producers of renewable fuel may generate RINs for each gallon of renewable fuel they produce. In the case of biomass-based diesel, generally 1.5 to 1.7 biomass-based diesel RINs may be generated for each gallon of biomass-based diesel produced, based upon the fuel's renewable energy content. Renewable fuel, including biomass-based diesel, can then be sold with associated RINs attached. RINs may also be separated from the gallons of renewable fuel they represent and once separated they may be sold as a separate commodity. RINs are ultimately used by Obligated Parties to demonstrate compliance with the RFS2. Obligated Parties must obtain and retire the required number of RINs to satisfy their RVO during a particular compliance period. An Obligated Party can obtain RINs by buying renewable fuels with RINs attached, buying RINs that have been separated, or producing renewable fuels themselves. All RIN activity under RFS2 must be entered

6

into the EPA’s moderated transaction system, which tracks RIN generation, transfer and retirement. RINs are retired when used for compliance with the RFS2 requirements.

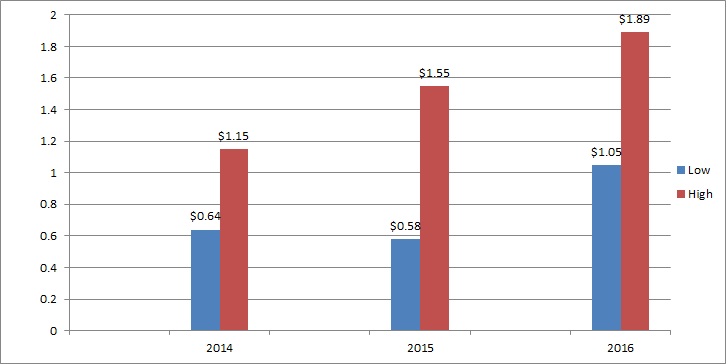

The value of RINs is significant to the price of biomass-based diesel. In 2015, RIN prices as a percentage contribution to the average B100 spot price, as reported by OPIS fluctuated significantly throughout the year and range from a low of $0.58 per gallon, or 23%, in September to a high of $1.55 per gallon, or 53%, in January. In 2016, RIN prices as a percentage contribution to the average B100 spot price, as reported by OPIS fluctuated significantly throughout the year and range from a low of $1.05 per gallon, or 37%, in September to a high of $1.89 per gallon, or 54%, in January.

Biodiesel Tax Credit

The federal biodiesel mixture excise tax credit, or BTC, when in effect, provides a $1.00 per gallon excise tax credit to the first blender of biomass-based diesel with at least 0.1% petroleum-based diesel fuel. The BTC can then be credited against such biodiesel federal excise tax liability or the blender can obtain a cash refund from the United States Treasury for the value of the credit. The BTC became effective January 1, 2005 and then lapsed January 1, 2010 before being reinstated retroactively on December 17, 2010. The BTC again lapsed as of December 31, 2011 and on January 2, 2013, it was again reinstated, retroactively for 2012 and through December 31, 2013. The BTC lapsed again on December 31, 2013 and was retroactively reinstated for 2014 on December 19, 2014. On December 18, 2015, the BTC was reinstated for 2015 and was in effect until December 31, 2016. The BTC is best thought of as an incentive shared across the entire value chain through routine, daily trading and negotiation. The BTC lapsed again on January 1, 2017, but is generally expected to return even though timing and form of the incentive, if reinstated, are uncertain.

California Low Carbon Fuel Standard Credits

The California Low Carbon Fuel Standard, or LCFS, regulation is a rule designed to reduce greenhouse gas emissions associated with transportation fuels used in California. The regulation quantifies lifecycle greenhouse gas emissions by assigning a “carbon intensity” (CI) score to each transportation fuel based on that fuel’s lifecycle assessment. Each fuel provider (generally the fuel’s producer or importer, or “regulated party”) is required to ensure that the overall CI score for its fuel pool meets the annual carbon intensity target for a given year. A regulated party’s fuel pool can include gasoline, diesel, and their blendstocks and substitutes. In other words, excess CI reductions from one type of fuel (e.g. diesel) can be used to offset insufficient reductions in another fuel (e.g. gasoline).

We get CI credits when we sell qualified biomass-based diesel into California. CI credits ranged from $56 per metric ton to $129 per metric ton in 2016.

Other State Programs

According to the U.S. Department of Energy, more than 40 states have implemented various programs that encourage the use of biomass-based diesel through blending requirements as well as various tax incentives. For example, Illinois offers an exemption from the generally applicable 6.25% sales tax on fuel for biomass-based diesel blends that incentivizes blending at 11% biomass-based diesel, or B11, through December 31, 2018. Illinois’ program has made that state one of the largest biomass-based diesel markets in the country. Since 2006, Iowa has had in place a retailer’s incentive for blended fuel which has been modified over time. For 2013 through 2017, retailers earn $0.045 per gallon of B5. Iowa also has a biomass-based diesel production incentive that provides $0.02 per gallon of production capped after the first 25 million gallons per production plant. Iowa recently enacted an increase in its excise tax on fuel, which is three cents per gallon less for B11 or higher blends than the diesel fuel tax. In Texas, the biomass-based diesel portion of biomass-based diesel blends are exempt from state excise tax, which results in a $0.20 per gallon incentive for B100.

Currently, Minnesota law requires a B5 biodiesel blend throughout the entire year. In 2014, the law required the state to increase blends to a B10 blend in the summer months. Oregon has implemented a B5 biodiesel blend requirement. New Mexico, Pennsylvania and Washington have all adopted legislation requiring biomass-based diesel blends beginning at B2 (and B5 in New Mexico) with incremental increases, provided certain feedstock or production minimums are met. Several northeast states, including Connecticut and Vermont, have adopted legislation requiring biomass-based diesel blends in home heating oil. In October 2016, the City of New York has adopted legislation requiring biomass-based diesel blends at a 5% rate for heating oil starting on October 1, 2017 and the blend level then moves to 10% in 2025, 15% in 2030 and 20% in 2034. In addition, Oregon and Washington State have been in the process of developing and implementing their own low carbon fuel programs. Oregon is currently engaged in the rulemaking process.

Although we believe that state requirements for the use of biofuels increase demand for our biomass-based diesel within such states, they may not increase overall demand in excess of RFS2 requirements. Rather, existing demand for our biofuel from

7

Obligated Parties in connection with federal requirements may shift to states that have use requirements or tax incentive programs.

Environmental Matters

Our manufacturing facilities, like other fuel and chemical production facilities, are subject to various federal, state and local environmental laws and regulations, including those relating to the discharge of materials into the air, water and ground; the generation, storage, handling, use, transportation and disposal of hazardous materials; ecological and natural resources; and the health and safety of our employees, contractors and the public. These laws and regulations require us to obtain and comply with numerous environmental permits to construct and operate each facility. They can require expensive pollution control equipment or operational changes to limit actual or potential impacts to human health and the environment. A violation of these laws, regulations or permit conditions could result in substantial fines, natural resource damage, criminal sanctions, permit revocations and or facility shutdowns. We do not currently have any environmental proceedings either pending or threatened against our facilities that would materially affect our business or financial condition. Furthermore, we do not anticipate a material adverse effect on our business or financial condition as a result of our efforts to comply with these requirements as presently in effect.

History

Our predecessor, REG Biofuels, LLC, formerly named REG Biofuels Inc., which was formerly named Renewable Energy Group, Inc., was formed under the laws of the State of Delaware in August 2006 upon acquiring the assets and operations of the biodiesel division of West Central Cooperative, or West Central, and two of West Central’s affiliated companies, InterWest, L.C. and REG, LLC. Set forth below is a summary of the significant events of our company since June 2008.

8

Date | Events | Description | ||

June 2008 | Houston facility | We acquired our Houston facility from U.S. Biodiesel Group, Inc., or USBG, through a transaction which included an equity investment in us by USBG. | ||

February through April 2010 | Danville, Newton and Seneca facilities | We acquired our Danville facility by merger from Blackhawk Biofuels, LLC. We acquired our Newton Facility, through the purchase of substantially all of the assets and liabilities of Central Iowa Energy, LLC. We closed a transaction in which we agreed to lease and operate the Seneca facility and certain related assets. | ||

July 2010 | Tellurian Biodiesel, Inc. and American BDF, LLC | We acquired certain assets of Tellurian Biodiesel, Inc., or Tellurian, and American BDF, LLC, or ABDF. Tellurian was a California-based biodiesel company and marketer. ABDF was a joint venture owned by Golden State Service Industries, Restaurant Technologies, Inc., or RTI, and Tellurian. The purchase connects RTI’s national used cooking oil collection system with our national network of biodiesel manufacturing facilities. | ||

September 2010 | Clovis facility | We acquired for stock the partially constructed Clovis facility. | ||

July 2011 | Albert Lea facility | We acquired for stock all the assets and certain liabilities of SoyMor cooperative and SoyMor Biodiesel, LLC. | ||

January 2012 | REG IPO | We completed our initial public offering in which we sold 6.8 million shares of our Common Stock at a price to the public of $10.00 per share. | ||

January 2012 | Seneca facility | We exercised an option to purchase our Seneca facility, which we previously operated under lease. | ||

October 2012 | New Boston facility | We acquired substantially all the assets of North Texas Bio Energy, LLC, or NTBE, including a 15 mmgy nameplate capacity biorefinery in New Boston, Texas. | ||

November 2012 | Atlanta facility | We acquired substantially all the assets of BullDog Biodiesel, LLC, or BullDog. | ||

July 2013 | Mason City facility | We acquired substantially all of the assets of Soy Energy, LLC's, or the Soy Energy Assets. The Soy Energy Assets consisted of a 30 mmgy nameplate capacity biodiesel facility and related assets located in Mason City, Iowa. We began producing biodiesel at this facility on October 1, 2013. | ||

January 2014 | LS9 | We acquired substantially all of the assets and liabilities of LS9, a development stage company focused on the use of proprietary technologies to make renewable chemicals and other products. | ||

June 2014 | Synthetic Fuels and Geismar facility | We acquired substantially all the assets of Syntroleum, which consisted of a 50% limited liability company membership interest in Dynamic Fuels, a 75 mmgy renewable hydrocarbon diesel production facility in Geismar, LA. Subsequently on June 6, 2014, we acquired the remaining 50% ownership interest in Dynamic Fuels from Tyson Foods. At closing, we renamed Dynamic Fuels, REG Geismar, LLC or REG Geismar. | ||

December 2014 | Petrotec AG | We acquired 69% equity ownership in Petrotec AG from its majority shareholder. As of December 31, 2016, we owned approximately 91% of Petrotec's shares. On January 2, 2017, we completed the acquisition of the remaining minority interest in Petrotec and own 100% of the equity in Petrotec. | ||

August 2015 | Grays Harbor facility | We acquired substantially all of the assets of Imperium Renewables, Inc., or Imperium, including a 100 mmgy nameplate biorefinery and terminal at the Port of Grays Harbor, Washington. | ||

March 2016 | Madison facility | We acquired fixed assets and inventory from Sanimax Energy, including the 20 mmgy nameplate capacity biomass-based diesel refinery in DeForest, Wisconsin. | ||

Employees

As of December 31, 2016, we had 703 full-time employees. None of our employees are represented by a labor organization or under any collective bargaining agreements. We consider our relationship with our employees to be good.

Intellectual Property

We own a significant number of U.S. and international patents and expect to file additional patent applications as we continue to pursue technological innovations. We have also developed trade secrets, and have licensed intellectual property related to our biomass-based diesel and industrial biotechnology businesses. We have developed a patented technology that uses microbes to convert sugars to biodiesel in an one-step fermentation process similar to ethanol manufacturing. Some of the patents issued to us do not expire until 2034 and additional patent applications in prosecution if issued will extend beyond 2034.

Customer concentration

Our sales to one customer, Pilot Travel Centers LLC, or Pilot, were $144.8 million, $114.0 million and $231.8 million, representing approximately 8%, 8% and 18% of our total revenues for 2016, 2015, and 2014, respectively. Our revenues from

9

Pilot generally do not directly include the RINs associated with the gallons of biomass-based diesel sold. The value of those RINs represented approximately an additional 9% and 13% of our total sales in 2016 and 2015, respectively based on the OPIS average RIN price for the year.

Research and development

We devote considerable resources to our research and development programs. Our biomass-based diesel research and development programs have been primarily targeted towards improving the quality and efficiency of the biomass-based diesel production process and developing applications for co-products. Our development stage industrial biotechnology business conducts research and development involving the production of renewable chemicals, additional advanced biofuels and other products from our proprietary microbial fermentation process. In January 2016, ExxonMobil Research and Engineering Company and REG Life Sciences commenced a joint development collaboration to develop technology to produce biodiesel by fermenting renewable cellulosic sugars from sources such as agricultural waste. In October 2016, the Company delivered its first commercial product, a specialty fatty acid. REG developed, produced and delivered approximately one metric ton of the renewable, multi-functional chemical to Aroma Chemical Services International, a leading specialty manufacturer and supplier of flavor and fragrance ingredients. Fatty acids are one of three product areas REG Life Sciences has focused on, along with esters and alcohols.

We expect our research and development expense to decrease in future periods as the business unit generates collaboration revenue. In November 2016, we commenced a strategic review of the life sciences business. We incurred research and development expense of $18.2 million, $16.9 million, and $12.4 million for the years ended December 31, 2016, 2015 and 2014, respectively.

Executive Officers of the Registrant

Daniel J. Oh, age 52, has served as our Chief Executive Officer and as a Director since September 2011 and President since April 2009. Mr. Oh served as our Chief Operating Officer from June 2007 to September 2011, our Chief Financial Officer and Executive Vice President from June 2006 to June 2007 and as Secretary from August 2006 until March 2009. From May 2004 to May 2006, Mr. Oh served at Agri Business Group, Inc., or ABG, an agribusiness management consulting firm, including as Associate Director, Director and Vice President. Prior to joining ABG, Mr. Oh served in several different positions, including Senior Financial Analyst, Financial Team Leader and Manager, in the Corporate Finance and Investment Banking area of the Corporate Strategy and Business Development Group at Eli Lilly and Company, a global pharmaceutical company, from August 2001 to May 2004. From 2000 to August 2001, Mr. Oh served as a consultant with McKinsey & Company, a leading consulting firm, where he focused on the pharmaceutical industry. From 1987 to 1998, Mr. Oh served as an officer in the United States Army, earning the rank of Major. Mr. Oh holds an M.B.A. from the University of Chicago with concentrations in finance, accounting and strategic management as well as a B.S. with a concentration in economics from the United States Military Academy. Mr. Oh serves as a director of Waste Resource Management, Inc. Mr. Oh’s employment agreement with us provides that he will serve as a director.

Chad Stone, age 47, has served as our Chief Financial Officer since August 2009. Prior to joining us from October 2007 to May 2009, he was a Director at Protiviti Inc., a global business consulting and internal audit firm. From August 1997 to September 2007, Mr. Stone served as Director with PricewaterhouseCoopers and worked at Arthur Andersen from July 1992 to August 1997, departing as a manager. Mr. Stone has served on executive Board of the Iowa Biodiesel Board since 2011 and was named chair in September 2014. In October 2015, Mr. Stone began serving on the University of Iowa School of Management's Advisory Committee. In November 2015, Mr. Stone was elected to the Governing Board of the National Biodiesel Board. Mr. Stone has over 20 years of experience in leading financial reporting, strategy, policy and compliance. Mr. Stone holds an M.B.A. with concentrations in finance, economics and accounting from the University of Chicago, Graduate School of Business and a B.B.A in Accounting from the University of Iowa. He is also a Certified Public Accountant.

Brad Albin, age 54, has served as our Vice President, Manufacturing since February 2008. Mr. Albin also served as Vice President of Construction Services from April 2007 through February 2008. From September 2006 through April 2007, Mr. Albin served as Director, Construction. Prior to joining us, Mr. Albin served as General Manager for West Central, one of our predecessors from July 2006 through September 2006. From November 2002 to January 2006, Mr. Albin served as Executive Director of Operations for Material Sciences Corporation, where he directed multi-plant operations that served the automotive and global appliance industries. From 1996 to 2002, Mr. Albin was the Vice President of Operations for Griffin Industries. Mr. Albin has over 25 years of experience in executive operations positions in multi-feedstock biomass-based diesel, chemical, food and automotive supplier companies, such as The Monsanto Company, The NutraSweet Company and Griffin Industries. Mr. Albin was a charter member of the National Biodiesel Accreditation Committee. Mr. Albin serves on the board of the Iowa Renewable Fuels Association and was the President in 2012, as well as, Vice President in 2011. In November 2014, Mr. Albin completed the Advanced Management Program from the University of Chicago Booth School of Business and he holds a B.S. in Chemistry from Eastern Illinois University.

10

Gary Haer, age 63, has served as our Vice President, Sales and Marketing since we commenced operations in August 2006. From October 1998 to August 2006, Mr. Haer served as the National Sales and Marketing Manager for biodiesel for West Central and was responsible for developing the marketing and distribution infrastructure for biomass-based diesel sales in the United States. Mr. Haer has over 15 years of experience in the biomass-based diesel industry. Mr. Haer has been elected to various officer positions of the National Biodiesel Board during his tenure from 1998 to 2015. Mr. Haer holds a M.B.A. from Baker University and a B.S. in accounting from Northwest Missouri State University.

Available Information

Our internet address is http://www.regi.com. Through that address, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports are available free of charge as soon as reasonably practicable after they are filed with the United States Securities and Exchange Commission. The information contained on our website is not included in, or incorporated by reference into, this annual report on Form 10-K.

ITEM 1A. | Risk Factors |

Our business, financial condition, results of operations and liquidity are subject to various risks and uncertainties, including those described below. As a result, the trading price of our common stock could decline.

RISKS RELATED TO FEDERAL AND STATE INCENTIVES

RFS2: The elimination or abatement of federal governmental requirements for the use of biofuels could have a material adverse effect on our revenues and operating margins.

The biomass-based diesel industry relies substantially on federal programs requiring the consumption of biofuels. Biomass-based diesel has historically been more expensive to produce than petroleum-based diesel fuel, and governmental programs support a market for biomass-based diesel that might not otherwise exist.

We believe the Renewable Fuel Standard Program is the most important of these government programs in the United States. Under this program, the EPA promulgated a regulation commonly known as RFS2, which became effective on July 1, 2010 and applies through 2022. RFS2 requires consumption of biomass-based diesel fuel, including biodiesel and renewable hydrocarbon diesel, at specified volumes, known as renewable volume obligations, or RVO.

Under RFS2, the EPA is required to set the RVO annually based on a variety of considerations. Over the past several years, the EPA has set the minimum annual consumption volume at increasing levels from 1.28 billion gallons in 2013 to 1.90 billion gallons in 2016. For 2017, the EPA set the minimum annual consumption volume at 2.00 billion gallons and has set 2.10 billion gallons as the minimum annual consumption volume target for 2018.

We believe that much of the increase in demand for our biomass-based diesel since July 2010 is attributable to, and accelerated by, the existence and implementation of RFS2. In addition, we believe that biomass-based diesel prices have received significant support from RFS2 since July 2010.

State requirements and incentives for the use of biofuels increase demand for our biomass-based diesel within such states, but such state requirements and incentives do not increase overall demand for biofuels in excess of RFS2 requirements. Rather, we believe state requirements and tax incentives influence where petroleum refiners and petroleum fuel importers choose to consume the volume requirements established by the EPA under RFS2.

The United States Congress could repeal, curtail or otherwise change RFS2 in a manner adverse to us. Similarly, the EPA could curtail or otherwise change RFS2 in a manner adverse to us, including reducing the RVO to the statutory minimum level of 1 billion gallons. The petroleum industry has generally been opposed to RFS2 and is expected to continue to press for changes that eliminate or reduce its impact. We cannot predict what changes will be instituted by the new administration or the impact, if any, of these changes to our business. It is possible, however, that future government proposals to reduce or eliminate budgetary deficits may include reduced allocations to the EPA and other agencies, or abolish such agencies and any programs thereunder entirely and may adversely affect our business and other businesses within our industry. New legislation, or a significant change in rules, regulations, directives or standards could reduce demand for our products and services, and/or increase expenses, which could have a material adverse effect on our business, financial condition and results of operations.

Any repeal or reduction in the RFS2 requirements or reinterpretation of RFS2 resulting in our biomass-based diesel failing to qualify as a required fuel would materially decrease the demand for and price of our biomass-based diesel, which would materially and adversely affect our revenues and cash flows.

11

Loss of or reductions in tax incentives for biomass-based diesel production or consumption may have a material adverse effect on industry revenues and operating margins.

Federal and state tax incentives have historically aided the biomass-based diesel industry. Prior to the 2010 implementation of RFS2, the biomass-based diesel industry relied principally on tax incentives to make the price of biomass-based diesel more cost competitive with the price of petroleum-based diesel fuel to the end user.

Federal

Biodiesel Tax Credit

The most significant tax incentive program has been the federal biodiesel mixture excise tax credit, referred to as the Biodiesel Tax Credit or BTC. Under the BTC, the entity to first blend pure biomass-based fuel, or B100, with petroleum-based diesel fuel receives a $1.00-per-gallon refundable tax credit.

The BTC was established on January 1, 2005 and has lapsed and been reinstated retroactively and prospectively several times. Most recently, the BTC was reinstated on December 18, 2015, covering 2015 retroactively and 2016 prospectively. But it lapsed again on December 31, 2016, and we are currently operating without the benefit of the BTC. In the past when the BTC has lapsed, we and others in the industry have operated without any assurance that a reinstatement would cover the lapsed period retroactively. There is no assurance that the BTC will be reinstated or, if reinstated, that its application will be retroactive, prospective or both.

Unlike RFS2, the BTC has a direct effect on federal government spending and could be changed or eliminated as a result of changes in the federal budget policy. We cannot predict what action, if any, Congress or the new administration may take with respect to the BTC or whether such action would apply retroactively or prospectively. If the BTC is not reinstated, demand for our biomass-based diesel and the price we are able to charge for our product may decline significantly, harming revenues and profitability.

In addition, uncertainty regarding the extension or reinstatement of the BTC has caused, and may in the future cause, fluctuations in our operating results. Historically, sales have increased shortly before the BTC lapses and then decreased shortly thereafter. For example, when the BTC was scheduled to expire on December 31, 2011, production and sales industry-wide accelerated in the fourth quarter of 2011, but declined in the first quarter of 2012, after the BTC lapsed. We believe reduced demand in the first quarters of 2014 and 2015 also resulted from the lapsing of the BTC at the end of 2013 and 2014, respectively. Similarly, we believe that the lapsing of the BTC on December 31, 2016 caused an acceleration of revenues in the fourth quarter of 2016, which is likely to result in a decline in demand during the first quarter of 2017.

State

Several states have enacted tax incentives for the use of biodiesel and/or biomass-based diesel. For example, we derive a significant portion of our revenues from operations in the State of Illinois. Illinois has a generally applicable 6.25% sales tax, but offers an exemption from this tax for a blend of fuel that consists of 11% biodiesel, or B11, which is set to expire December 31, 2018.

State budget or other considerations could cause the modification or elimination of the tax incentive programs of Illinois and other states. The abatement or elimination of such incentives could materially and adversely affect our revenues and profitability.

Increased industry-wide production of biomass-based diesel, including as a result of existing excess production capacity, could harm our financial results.

If the volume of excess biomass-based diesel RINs exceeds the volume mandated for use under RFS2, the demand for and price of our biomass-based diesel, and biomass-based diesel RINs may be reduced, which could adversely affect our revenues and cash flows.

According to the National Biodiesel Board, or NBB, as of May 6, 2016, 3.0 billion gallons per year of biodiesel production capacity in the United States was registered under the RFS2 program by NBB members. In addition to this amount, several hundred million more gallons of U.S. based biomass-based diesel production capacity was registered by non-NBB members and another 4.5 billion gallons of biomass-based diesel production was registered by foreign producers. The annual production capacity of existing plants and plants under construction far exceeds both historic consumption of biomass-based diesel in the United States and required consumption under RFS2. If this excess production capacity was fully utilized for the U.S. market, it would increase competition for our feedstocks, increase the volume of biomass-based diesel on the market and may reduce biomass-based diesel gross margins, harming our revenues and profitability.

Increased biomass-based diesel production may result in the generation of RINs in excess of the volume of RINs mandated for consumption under RFS2. RIN prices can be expected to decrease as the calendar year progresses if the RIN

12

market is oversupplied compared to that year’s RVO. For example, in 2012, which had a RVO for biomass-based diesel of one billion gallons, biomass-based diesel RIN prices, as reported by OPIS, began to decrease in September when biomass-based diesel RIN generation neared the equivalent of 900 million gallons, as reported by EMTS. Similarly, in September of 2013 when biomass-based diesel RIN generation reached approximately 960 million gallons compared to a 2013 biomass-based diesel RVO of 1.28 billion gallons, biomass-based diesel RIN prices, as reported by OPIS, began to decline.

RISKS RELATED TO OUR BUSINESS OPERATIONS AND THE MARKETS IN WHICH WE OPERATE

Our gross margins are dependent on the spread between biomass-based diesel prices and feedstock costs, each of which are volatile and can cause our results of operations to fluctuate substantially.

Biomass-based diesel has traditionally been marketed primarily as an additive or alternative to petroleum-based diesel fuel, and, as a result, biomass-based diesel prices have been influenced by the price of petroleum-based diesel fuel, adjusted for government incentives supporting renewable fuels, rather than biomass-based diesel production costs. If there is a lack of close correlation between production costs and biomass-based diesel prices, we may be unable to pass increased production costs on to our customers in the form of higher prices. If there is a decrease in the spread between biomass-based diesel prices and feedstock costs, whether as a result of an increase in feedstock prices or a result of a reduction in biomass-based diesel and RIN prices, our gross margins, cash flow and results of operations would be adversely affected.

Energy prices, particularly the market price for crude oil, are volatile. The average price at which we sold our biomass-based diesel increased from $2.97 per gallon in 2015 to $3.17 per gallon in 2016. Petroleum prices are volatile due to global factors, such as the impact of wars, political uprisings, new extraction technologies and techniques, OPEC production quotas, worldwide economic conditions, changes in refining capacity and natural disasters.

In addition, an element of the price of biomass-based diesel that we produce is the value of the associated RINs. RIN prices as reported by OPIS trended higher throughout 2016, starting the year at $0.75 per RIN, climbing to a high of $1.26 in December. RIN prices ended 2016 at $1.05 per RIN. In other years there was more significant volatility in RIN prices. In 2013, RIN prices decreased sharply from $1.09 per RIN on July 1, 2013 to $0.35 per RIN on December 31, 2013. Reductions in RIN values, such as those experienced in prior years, may have a material adverse effect on our revenues and profits as they directly reduce the price we are able to charge for our biomass-based diesel.

A decrease in the availability or an increase in the price, of feedstocks may have a material adverse effect on our financial condition and operating results. The price and availability of feedstocks and other raw materials may be influenced by general economic, market and regulatory factors. These factors include weather conditions, farming decisions, government policies and subsidies with respect to agriculture and international trade and global supply and demand. During periods when the BTC has lapsed, biomass-based diesel producers may elect to continue purchasing feedstock and producing biomass-based diesel at negative margins under the assumption the BTC will be retroactively reinstated, and consequently, the price of feedstocks may not decrease to a level proportionate to current operating margins. The development of alternative fuels and renewable chemicals also puts pressure on feedstock supply and availability to the biomass-based diesel industry. The biomass-based diesel industry may have difficulty in procuring feedstocks at economical prices if these emerging technologies compete with biomass-based diesel for feedstocks, are more profitable or have greater governmental support than biomass-based diesel.

At elevated feedstock price levels, certain feedstocks may be uneconomical to use, as we may be unable to pass feedstock cost increases on to our customers. In addition, we generally are unable to enter into forward contracts at fixed prices for some of our feedstocks, such as animal fat, because markets for these feedstocks are less developed.

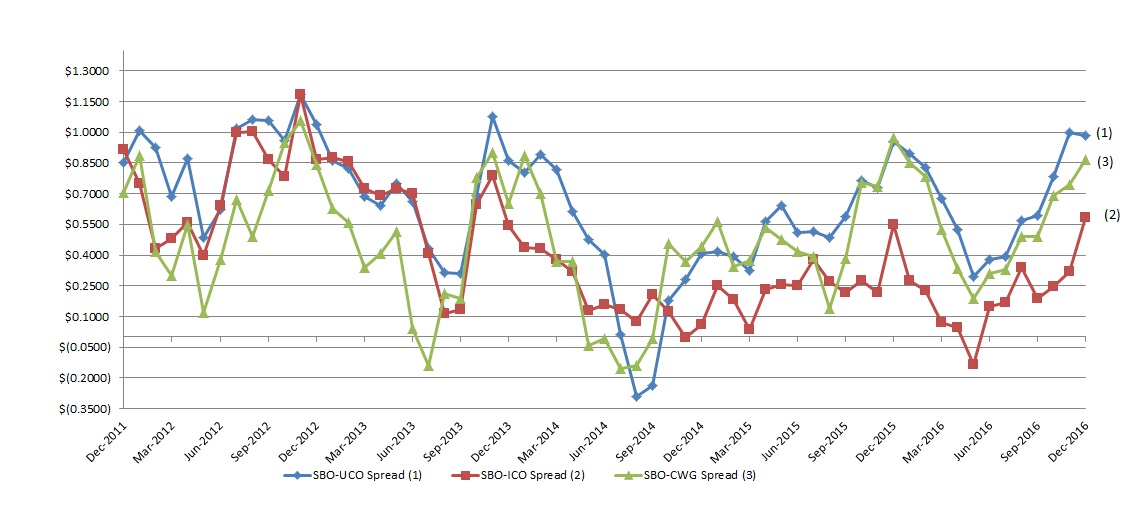

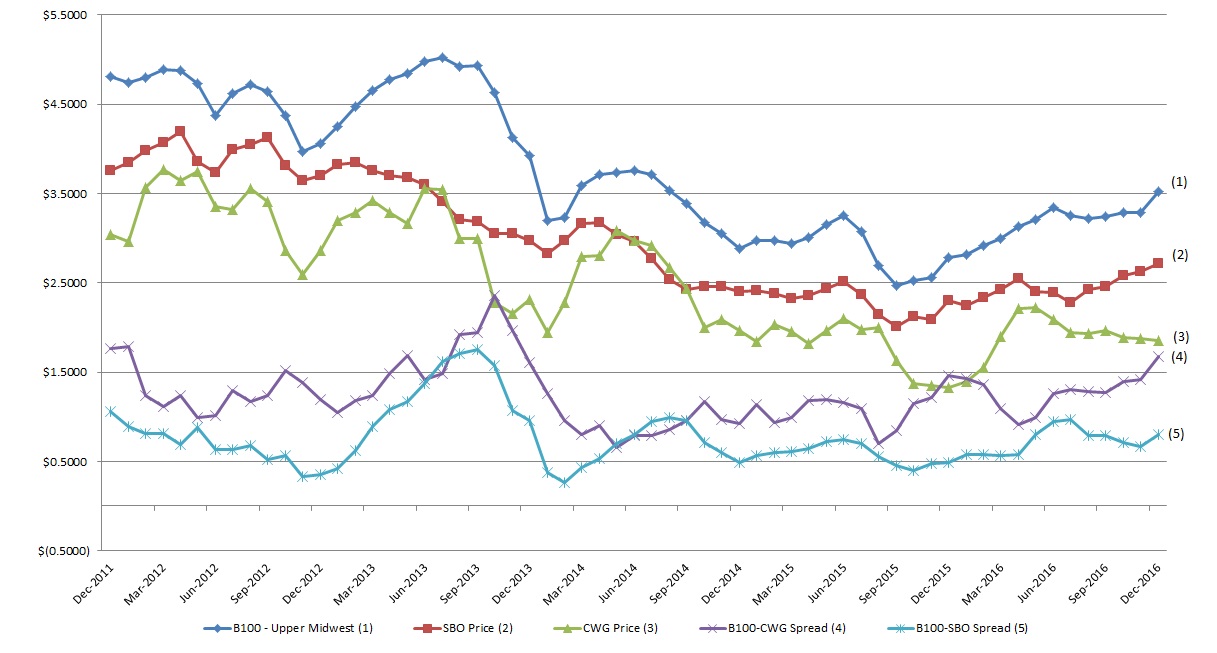

Historically, the spread between biomass-based diesel prices and feedstock costs has varied significantly. Although actual yields vary depending on the feedstock quality, the average monthly spread between the price per gallon of 100% pure biodiesel, or B100, as reported by The Jacobsen Publishing Company, and the price per gallon for the amount of choice white grease, a common inedible animal fat used by us to make biomass-based diesel, was $0.92 in 2014, $1.09 in 2015 and $1.28 in 2016, assuming eight pounds of choice white grease yields one gallon of biomass-based diesel. The average monthly spread for the amount of crude soybean oil required to produce one gallon of biomass-based, based on the nearby futures contract as reported on the Chicago Board of Trade, was $0.65 in 2014, $0.58 in 2015 and $0.73 in 2016, assuming 7.5 pounds of soybean oil yields one gallon of biomass-based. For the periods from 2014 to 2016, approximately 85%, 85% and 72%, respectively, of our annual total feedstock usage was inedible corn oil, used cooking oil or inedible animal fat, and approximately 15%, 15% and 28%, respectively, was virgin vegetable oils.

Risk management transactions could significantly increase our operating costs and may not be effective.

In an attempt to partially offset the effects of volatile feedstock costs and biomass-based diesel fuel prices, we enter into contracts that establish market positions in feedstocks, such as inedible corn oil, used cooking oil, inedible animal fats and soybean oil, along with related commodities, such as heating oil and ultra-low sulfur diesel, or ULSD. The financial impact of

13

such market positions depends on commodity prices at the time that we are required to perform our obligations under these contracts as well as the cumulative sum of the obligations we assume under these contracts.

Risk management activities can themselves result in losses when a position is purchased in a declining market or a position is sold in a rising market. Risk management arrangements expose us to the risk of financial loss in situations where the counterparty defaults on its contract or, in the case of exchange-traded or over-the-counter futures or options contracts, where there is a change in the expected differential between the underlying price in the contract and the actual prices paid or received by us. Changes in the value of these futures instruments are recognized in current income and may result in margin calls. We may also vary the amount of risk management strategies we undertake, or we may choose not to engage in risk management transactions at all. Our results of operation may be negatively impacted if we are not able to manage our risk management strategy effectively.

One customer accounted for a meaningful percentage of revenues and a loss of this customer could have an adverse impact on our total revenues.

One customer, Pilot Travel Centers LLC, or Pilot, accounted for 8%, 8% and 18% of our revenues in 2016, 2015 and 2014, respectively. Our revenues from Pilot generally do not include the RINs associated with the gallons of biomass-based diesel sold to Pilot. The value of those RINs represented approximately an additional 9% and 13% of our total sales in 2016 and 2015, respectively, based on the OPIS average RIN price for the year. In the event we lose Pilot as a customer or Pilot significantly reduces the volume of biomass-based diesel bought from us, it could be difficult to replace the lost revenues from biomass-based diesel and RINs, and our profitability and cash flow could be materially harmed. We do not have a long term contract with Pilot that ensures a continuing level of business from Pilot.

Our facilities and our customers' facilities are subject to risks associated with fire, explosions, leaks, and other natural disasters which may disrupt our business and increase costs and liabilities.

Because biomass-based diesel and some of its inputs and outputs are combustible and/or flammable, a leak, fire or explosion may occur at a plant or customer’s facility which could result in damage to the plant and nearby properties, injury to employees and others, and interruption of operations. For example, in April 2015 and again in September 2015, we experienced fires at our Geismar facility. In the April fire, two employees were injured. In the September fire, one employee and three contractors were injured. Multiple parties and our subsidiary have been named as a defendant in lawsuits filed by contractors injured in the September fire and these suits allege that injuries resulted from, among other things, our negligence. We may be subject to additional litigation in connection with these incidents. In addition, the Occupational Safety and Health Administration, or OSHA, has issued seven "serious" citations to the Geismar facility, which has implemented abatement actions in accordance with those citations. If OSHA becomes dissatisfied with the abatement implementation, there is a possibility that it could impose additional citations or fines.

As a result of the fires, our Geismar facility was shut down from April 2015 through early March 2016 while repairs and upgrades were completed. While we expect a significant portion of the costs associated with the Geismar fires will be covered by insurance, our insurance company may dispute coverage and we may be subject to costs and penalties that are not covered by insurance. Accordingly, as a result of these two incidents at the Geismar facility, we may incur significant additional costs, including potential liability for damages or injuries, legal expenses and loss of profit, which could seriously harm our results of operations and financial condition.

A majority of our facilities are also located in the Midwest, which is subject to tornado activity. REG Life Sciences' research and development center is in South San Francisco, California, which is subject to earthquakes. In addition, our Houston and Geismar facilities, due to their Gulf Coast locations, are vulnerable to hurricanes and flooding, which may cause plant damage, injury to employees and others and interruption of operations. For example, in August 2016 we experienced reduced operating days at our Geismar facility as a result of local area flooding. Each of our plants could incur damage from other natural disasters as well. If any of the foregoing events occur, we may incur significant additional costs including, among other things, loss of profits due to unplanned temporary or permanent shutdowns of our facilities, cleanup costs, liability for damages or injuries, legal expenses and reconstruction expenses, which would harm our results of operations and financial condition.

Our insurance may not protect us against our business and operating risks.

We maintain insurance for some, but not all, of the potential risks and liabilities associated with our business. For some risks, we may not obtain insurance if we believe the cost of available insurance is excessive relative to the risks presented. As a result of market conditions, premiums and deductibles for certain insurance policies can increase substantially and, in some instances, certain insurance policies may become unavailable or available only for reduced amounts of coverage. As a result,

14

we may not be able to renew our existing insurance policies or procure other desirable insurance on commercially reasonable terms, if at all. Although we intend to maintain insurance at levels we believe are appropriate for our business and consistent with industry practice, we will not be fully insured against all risks. In addition, pollution, environmental risks and the risk of natural disasters generally are not fully insurable. Losses and liabilities from uninsured and underinsured events and delay in the payment of insurance proceeds could have a material adverse effect on our financial condition and results of operations.

Our business is primarily dependent upon two similar products. As a consequence, we may not be able to adapt to changing market conditions or endure any decline in the biomass-based diesel industry.

Our revenues are currently generated almost entirely from the production and sale of biodiesel and renewable hydrocarbon diesel, collectively referred to as biomass-based diesel. Our reliance on biomass-based diesel means that we may not be able to adapt to changing market conditions or to withstand any significant decline in the size or profitability of the biomass-based diesel industry. Historically we were required to periodically idle our plants, particularly during the first quarter of the year due to insufficient demand at profitable price points. If we are required to idle our biomass-based diesel plants in the future or are unable to adapt to changing market conditions, our revenues and results of operations may be materially harmed.

We face competition from imported biodiesel and renewable hydrocarbon diesel, which may reduce demand for biomass-based diesel produced by us and cause our revenues and profits to decline.

Biodiesel and renewable hydrocarbon diesel imports into the United States have increased significantly and compete with biodiesel and renewable hydrocarbon diesel produced in the United States. The imported fuels may benefit from production incentives or other financial incentives in foreign countries that offset some of their production costs and enable importers to profitably sell biodiesel or renewable hydrocarbon diesel in the United States at lower prices than United States-based biodiesel and renewable hydrocarbon diesel producers. Under RFS2, imported biodiesel and renewable hydrocarbon diesel is eligible and, therefore, competes to meet the volumetric requirements for biomass-based diesel and advanced biofuels. If imports continue to increase, this could make it more challenging for us to market or sell biomass-based diesel in the United States, which would have a material adverse effect on our revenues. In January 2015, the EPA announced the approval for Argentinian biodiesel made from soybean oil to generate RINs. Imported biomass-based diesel that does not qualify under RFS2, also competes in jurisdictions where there are biomass-based diesel blending requirements.

Technological advances and changes in production methods in the biomass-based diesel industry and renewable chemical industry could render our plants obsolete and adversely affect our ability to compete.

It is expected that technological advances in biomass-based diesel production methods will continue to occur and new technologies for biomass-based diesel production may develop. Advances in the process of converting oils and fats into biodiesel and renewable hydrocarbon diesel could allow our competitors to produce biomass-based diesel faster and more efficiently and at a substantially lower cost. In addition, we currently produce biomass-based diesel to conform to or exceed standards established by the American Society for Testing and Materials ("ASTM"). ASTM standards for biomass-based diesel and biomass-based diesel blends may be modified in response to new technologies from the industries involved with diesel fuel.

New standards or production technologies may require us to make additional capital investments in, or modify, plant operations to meet these standards. If we are unable to adapt or incorporate technological advances into our operations, our production facilities could become less competitive or obsolete. Further, it may be necessary for us to make significant expenditures to acquire any new technology and retrofit our plants in order to incorporate new technologies and remain competitive. In order to execute our strategy to expand into the production of renewable chemicals, additional advanced biofuels, next generation feedstocks and related renewable products, we may need to acquire licenses or other rights to technology from third parties. We can provide no assurance that we will be able to obtain such licenses or rights on favorable terms. If we are unable to obtain, implement or finance new technologies, our production facilities could be less efficient than our competitors, and our ability to sell biomass-based diesel may be harmed, negatively impacting our revenues and profitability.

Our intellectual property is integral to our business. If we are unable to protect our intellectual property, or others assert that our operations violate their intellectual property, our business could be adversely affected.

Our success depends in part upon our ability to protect and prevent others from using our intellectual property. Failure to obtain or maintain adequate intellectual property protection could adversely affect our competitive business position. We rely on a combination of intellectual property rights, including patents, copyrights, trademarks and trade secrets in the United States and in select foreign countries. Effective patent, copyright, trademark and trade secret protection may be unavailable, limited or not applied for in some countries.

15