Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HERITAGE FINANCIAL CORP /WA/ | d8k.htm |

1

Exhibit 99.1 |

Forward

Looking Statements 2

“Safe

Harbor”

statement

under

the

Private

Securities

Litigation

Reform

Act

of

1995:

This

presentation

contains

forward-looking

statements

that

are

subject

to risks and uncertainties, including, but not limited to: the credit risks of lending

activities, including changes in the level and trend of loan delinquencies and

write-offs and changes in our allowance for loan losses and provision for loan losses that

may be impacted by deterioration in the housing and commercial real estate markets;

changes in general economic conditions, either nationally or in our market areas; changes in the levels of general interest rates, and the

relative

differences

between

short

and

long

term

interest

rates,

deposit

interest

rates,

our

net

interest

margin

and

funding

sources;

fluctuations

in

the

demand for loans, the number of unsold homes and other properties and fluctuations in real

estate values in our market areas; results of examinations of us by the Board of

Governors of the Federal Reserve System (the “Federal Reserve Board”) and of our bank subsidiaries by the Federal Deposit Insurance

Corporation (the “FDIC”), the Washington State Department of Financial Institutions,

Division of Banks (the “Washington DFI”) or other regulatory authorities,

including the possibility that any such regulatory authority may, among other things, require us to increase our reserve for loan losses, write-

down assets, change our regulatory capital position or affect our ability to borrow funds or

maintain or increase deposits, which could adversely affect our liquidity and earnings;

legislative or regulatory changes that adversely affect our business including changes in regulatory policies and principles, including

the interpretation of regulatory capital or other rules; our ability to control operating

costs and expenses; the use of estimates in determining fair value of certain

of

our

assets,

which

estimates

may

prove

to

be

incorrect

and

result

in

significant

declines

in

valuation;

difficulties

in

reducing

risk

associated

with

the

loans

on

our

balance

sheet;

staffing

fluctuations

in

response

to

product

demand

or

the

implementation

of

corporate

strategies

that

affect

our

workforce

and

potential associated charges; computer systems on which we depend could fail or experience a

security breach; our ability to retain key members of our senior management team; costs

and effects of litigation, including settlements and judgments; our ability to implement our branch expansion strategy; our

ability to successfully integrate any assets, liabilities, customers, systems, and management

personnel we have acquired or may in the future acquire into our operations and our

ability to realize related revenue synergies and cost savings within expected time frames and any goodwill charges related thereto;

changes in consumer spending, borrowing and savings habits; the availability of resources to

address changes in laws, rules, or regulations or to respond to regulatory actions;

adverse changes in the securities markets; inability of key third-party providers to perform their obligations to us; changes in accounting

policies

and

practices,

as

may

be

adopted

by

the

financial

institution

regulatory

agencies

or

the

Financial

Accounting

Standards

Board,

including

additional

guidance and interpretation on accounting issues and details of the implementation of new

accounting methods; other economic, competitive, governmental,

regulatory,

and

technological

factors

affecting

our

operations,

pricing,

products

and

services;

future

legislative

changes

in

the

United

States

Department

of

Treasury

Troubled

Asset

Relief

Program

Capital

Purchase

Program;

and

other

risks

detailed

from

time

to

time

in

our

filings

with

the

Securities

and Exchange Commission.

The Company cautions readers not to place undue reliance on any forward-looking

statements. Moreover, you should treat these statements as speaking only as of the date

they are made and based only on information then actually known to the Company. The Company does not undertake and specifically

disclaims any obligation to revise any forward-looking statements to reflect the

occurrence of anticipated or unanticipated events or circumstances after the date of

such statements. These risks could cause our actual results for 2010 and beyond to differ materially from those expressed in any forward-looking

statements by, or on behalf of, us, and could negatively affect the Company’s operating

and stock price performance. |

Overview

•

Company & Economic Information

•

Financial Performance

•

Credit Risk Management

•

Peer Group Analysis

•

Strategic Focus

3 |

4

|

Corporate

Structure 5

Total assets: $856 million

Branches: 14

Total assets: $155 million

Branches: 6

Financial Highlights

Total Assets

$1.01 billion

Net Loans

$733 million

Total Deposits

$836 million

Tangible Common Equity

$123 million

TARP Preferred

$ 24 million

Loan/Deposit Ratio

87.7%

Coverage Ratio (1)

86.0%

Core Deposit Ratio (2)

79.4%

Net Interest Margin

4.58% (Q1’10) 4.57% (FY2009)

Cost of Funds

1.22% (Q1’10) 1.60% (FY2009)

PTPP ROAA (3)

1.90% (Q1’10) 1.99% (FY2009)

(1) Allowance for loan loss/nonperforming loans

(2) All deposits less brokered CDs and CDs over $100,000

(3) Pre-tax, pre-provision return on average assets

Note: Numbers rounded for presentation purposes only

Financial data as of March 31, 2010 |

6

Market Share with

Significant Growth Potential

WA State

County

# of

Branches

Deposits

(in millions)

Market

Share %

Market

Rank

Thurston

(Olympia)

5

$370

12.43%

1

Pierce

(Tacoma)

7

$243

2.48%

12

Mason

1

$ 68

17.76%

2

King

(Seattle)

1

$ 36

0.07%

44

Yakima

5

$115

4.91%

8

Kittitas

1

$ 19

3.42%

9

Source: SNL Financial |

Economic

Outlook •

We have not yet achieved measurable and

sustainable growth in the Pacific Northwest

•

Our local economy will continue to struggle

until unemployment and real estate values

improve

•

However, we are seeing signs of improvement

7 |

8

|

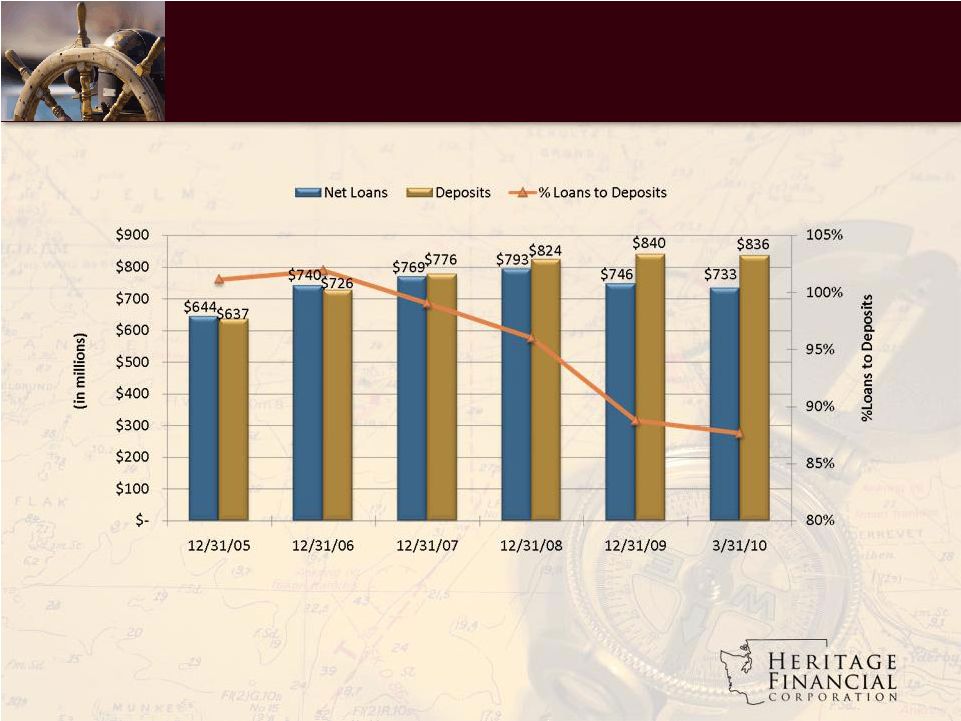

Loan and

Deposit Growth 9

Note: Of the $60 million decrease in loans since 12/31/08, $43 million were in the

construction loan portfolio |

Diversified

Loan Portfolio 10

Financial data as of March 31, 2010

Total loans: $758 million

Average yield on loans: 6.58% |

Diversified

Loan Portfolio 11

Commercial Loan Portfolio

Commercial Real Estate Portfolio

Financial data as of March 31, 2010

CRE owner occupied: $187 million

CRE non-owner occupied: $219 million

Total CRE portfolio: $406 million

CRE owner occupied: $187 million

CRE non-owner occupied: $219 million

Commercial and industrial: $197 million

Total Commercial Loans: $603 million |

Diversified

Loan Portfolio 12

Construction loans: $83 million

Total loans: $758 million

Loan Portfolio

Construction Portfolio

Total construction portfolio reduced 36.2% since Dec. 31, 2008; represents 11.0% of total

portfolio down from 16.1% at Dec. 31, 2008

Financial data as of March 31, 2010 |

Deposit

Growth 13

Total Avg. Deposits

$616,634 $691,002

$755,252

$787,758 $840,204 $837,719

Compounded Annual Growth Rate since 2005: Certificate of Deposits: 2.9%

Interest-Bearing Transaction Accounts: 11.0%

Non-Interest Bearing Demand Deposits: 9.2% |

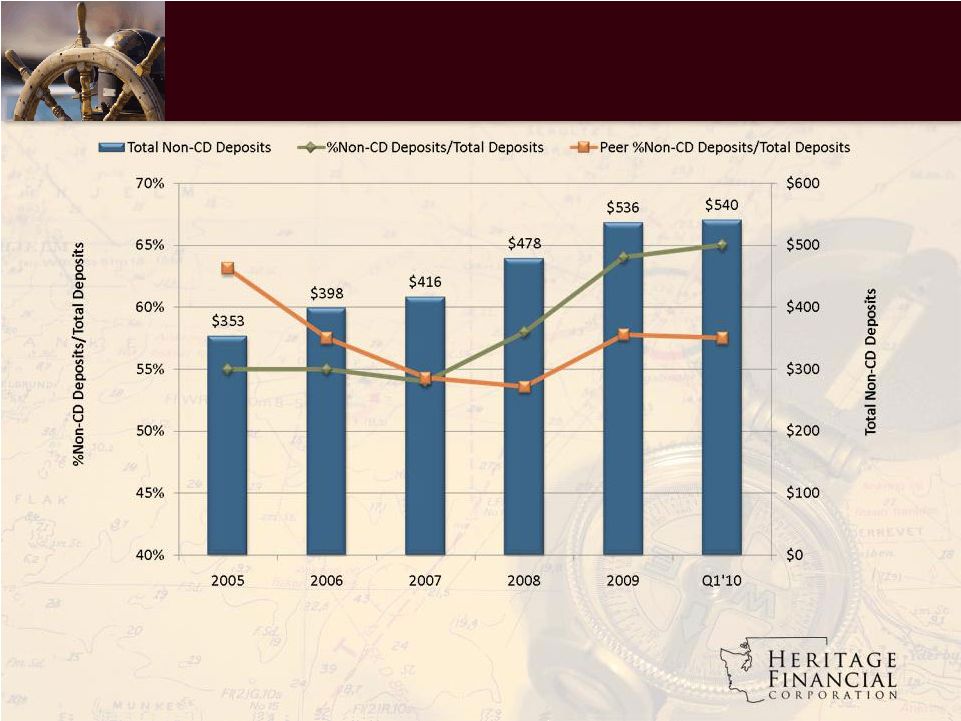

14

Non-CD Deposit Growth

Source: SNL Financial

Regional Peer Group (14) : All NASDAQ banks under $5 billion

in AK, ID, OR, and WA

Ticker Symbols –

BANR, CACB, CASB, COLB, CWLZ, FFNW, HOME, NRIM, PCBK, PRWT, RVSB,

TSBK, WBCO, WCBO |

15

Stable Net Interest Margin

Source: SNL Financial

Regional Peer Group (14)

All ratios based on most recent reported quarter

Annual

Quarterly |

Earnings

16

Quarterly Earnings

Annual Earnings |

Core

Earnings 17

(1) Pre-tax, pre-provision return on average assets |

Core

Earnings 18

(1) Pre-tax, pre-provision return on average assets |

Equity

Growth 19

Note:

2008: TARP $24 million preferred securities sold

2009: $46.6 million net common equity raised |

Strong

Capital Levels 20

Source: SNL Financial

Regional Peer Group (14)

All ratios as of December 31, 2009 |

21

Total investment securities: $109 million

89% of portfolio is guaranteed by US Gov't

or Agencies

Quality Securities Portfolio

Financial data as of March 31, 2010 |

22

|

23

Credit Risk Management

•

Residential construction portfolio decreased

49% since January 2008 and today represents

only 5.5% of total loan portfolio

•

Ongoing CRE loan evaluation and stress

testing shows no measurable weakness

•

A focus to aggressively manage NPA levels

lower as we move through what we believe is

the last half of this credit cycle |

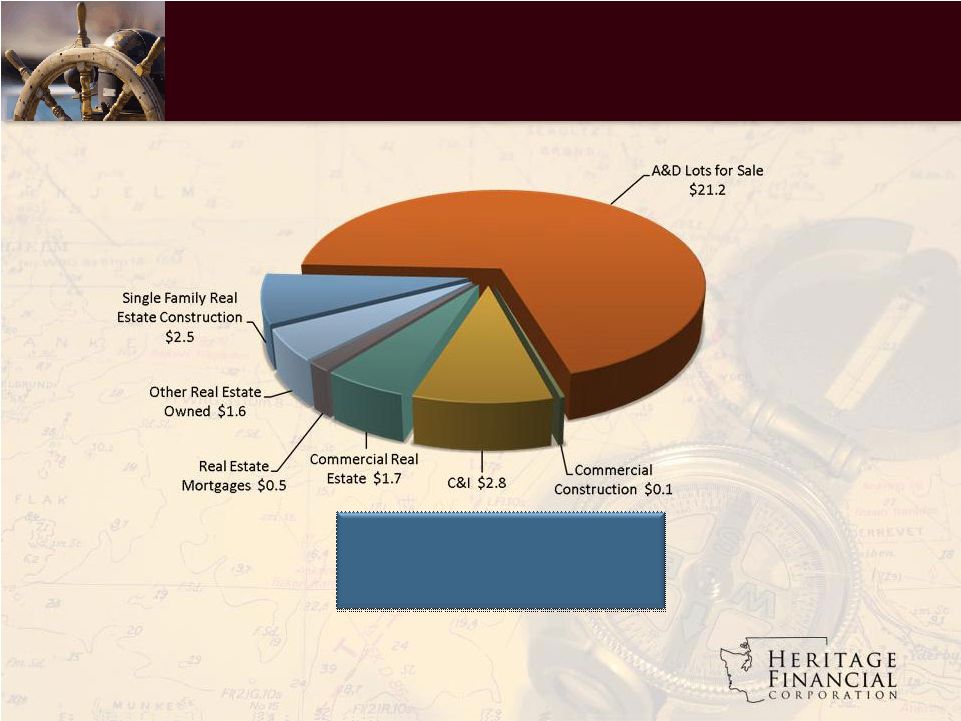

Non-Performing Assets Composition

24

Total nonperforming assets: $30.4 million

Nonperforming assets/total assets: 3.01%

Financial data as of March 31, 2010

Note: Dollars in millions |

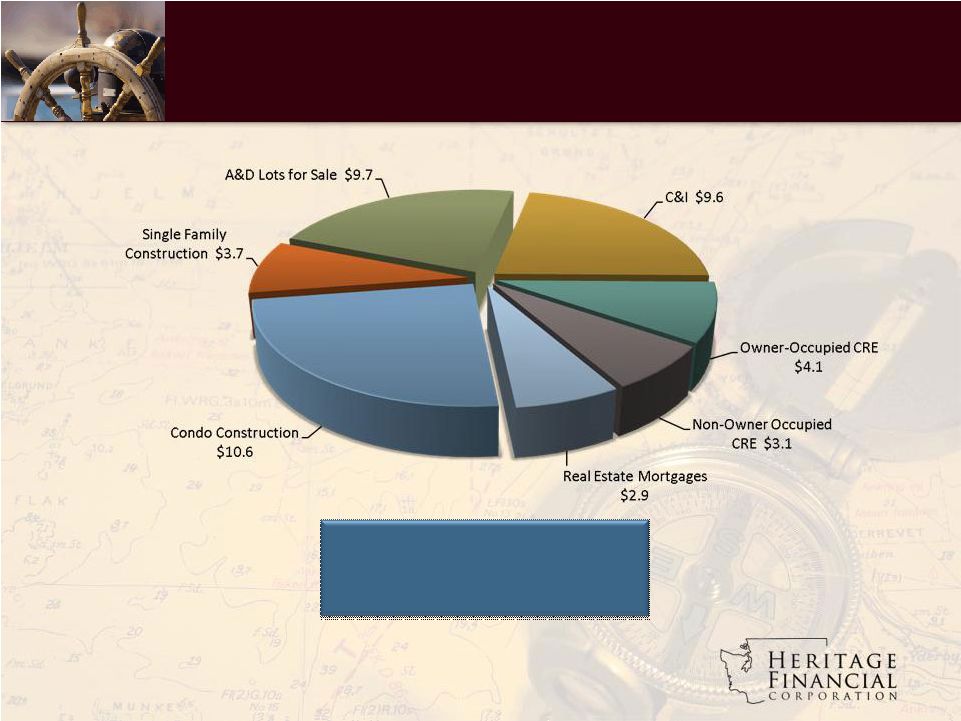

Classified

Loans by Category 25

Total classified loans: $ 43.7 million

Excludes nonperforming loans

Financial data as of March 31, 2010

Classified Loans are the regulatory definition of special mention, substandard, or

doubtful Note: Dollars in millions |

Classified

Loans by County 26

Notes: Includes nonperforming loans

Financial data as of March 31, 2010 |

27

Source: SNL Financial

Regional Peer Group (14)

Loan Provisioning |

Credit Cycle

Risk Profile 28

Credit Quality Ratios

3/31/2010

Loan loss allowance

3.27%

Coverage ratio

86.0%

Nonperforming loans to total loans

3.81%

Nonperforming assets to total assets

3.01%

Pre-Tax, Pre-Provision Earnings

Q1’10

Pre-tax, pre-provision ROAA % / $

1.90% / $4,746 |

29

|

Selected Key

Ratios HFWA

Regional Peer

Group Median

HFWA Regional Rank

(out of 14)

National Peer

Group Median

HFWA National Rank

(out of 114)

Coverage Ratio (1)

79.3%

43.2%

#4

65.3%

#38

TCE/TA (2)

12.2%

9.19%

#4

7.43%

#5

PTPP ROAA (3)

1.99%

1.06%

#3

1.24%

#10

Efficiency Ratio

61.3%

64.0%

#4

69.1%

#12

Net Interest Margin

4.57%

4.01%

#4

3.66%

#17

30

(1)

Allowance for loan loss/nonperforming loans

(2)

Tangible common equity/tangible assets

(3) Pre-tax, pre-provision return on average assets

Source: SNL Financial

Ratios as of and for year-ended December 31, 2009

Regional Peer Group (14)

National Peer Group: All publicly traded US commercial banks (114) with assets between $750

million and $1.25 billion |

Total Return

Performance 31

The above chart assumes that the value of the investment in Heritage’s common stock and

each of the two indices was $100 on December 31, 2004, and that all dividends were

reinvested. |

32

|

Strategic

Initiatives 33

•

Organic Growth

–

Renewed effort for organic loan growth

–

Continue focus on Non-CD deposit growth

–

New lender recruitment

–

Acquire/Build 1-2 new branches per year

•

Resume cash dividend payments

•

Continue to pursue FDIC assisted transactions |

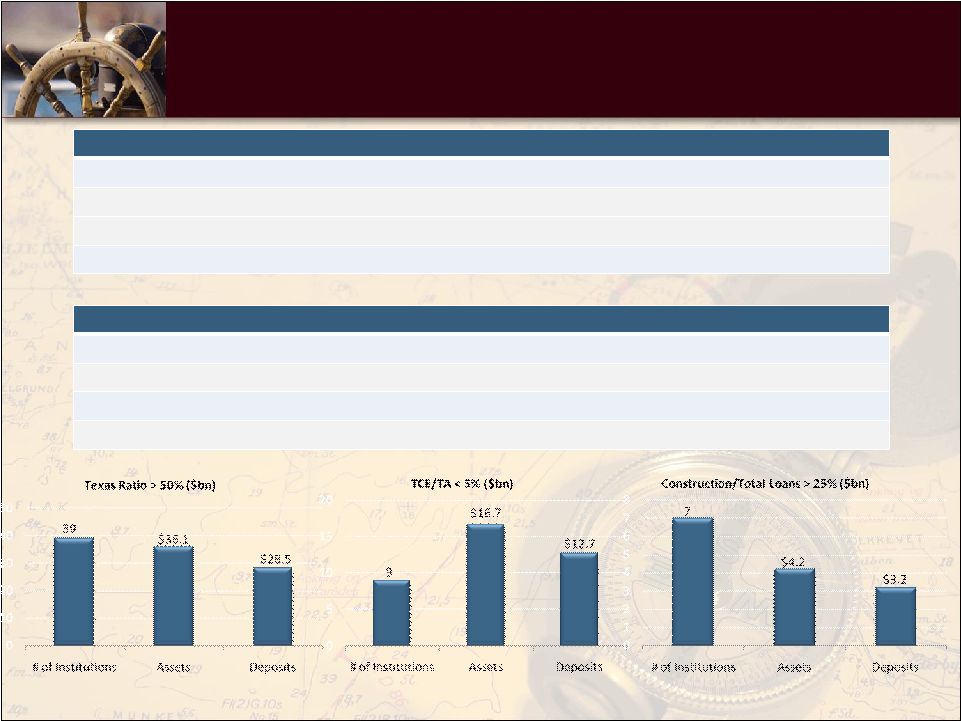

The FDIC

Market Opportunity *Texas Ratio: (NPA + 90 Days PD)/(Tangible Common Equity +

Reserves) 34

Summary of Analysis

19

Washington banks with a Texas Ratio* greater than 100%

14 Washington banks with a Texas Ratio* greater than 100% and assets under $600 million

39 Washington banks with a Texas Ratio* greater than 50%

9 Washington banks with tangible common equity/tangible assets less than 5%

Acquisition Considerations.

Fill-in or expand geographic footprint

Opportunity to take advantage of FDIC loss share agreements

Strengthen market share

Potential to significantly grow our company

Source: SNL Financial data as of March 31, 2010 |

TARP

•

We have previously communicated:

–

We sold preferred securities to Treasury as a

precautionary strategy

–

We currently have the ability to repurchase these

securities today

–

We are hopeful, we will see sufficient local

economic improvement necessary to repurchase

our preferred securities yet this year

35 |

Heritage

Highlights •

Community leader with deep roots in the communities

we serve since 1927

•

Experienced and disciplined management team

•

Strong and diversified balance sheet with no

borrowings

•

Solid loan loss coverage ratios and strong core earnings

•

Strong tangible capital levels

•

Historically stable and strong net interest margin

36 |

37

|