Attached files

Exhibit 10.2

EXECUTION COPY

FUNDING, INVESTOR FEE AND PUT/CALL AGREEMENT

This Funding, Investor Fee and Put/Call Agreement (“Agreement”) is made and entered into as of the 8 th day of April, 2010 (the “Effective Date”), by and among Seneca Biodiesel Holdco, LLC, a Delaware limited liability company (“Holdco”), Seneca Landlord, LLC, an Iowa limited liability company formerly known as REG Seneca, LLC (“Landlord”), Renewable Energy Group, Inc., a Delaware corporation (“REG”), REG Intermediate Holdco, Inc., a Delaware corporation (“REGIH”) and REG Seneca, LLC, an Iowa limited liability company (“Opco”) (each of Holdco, Landlord, REG, REGIH and Opco, a “Party” and collectively, the “Parties”).

RECITALS

| A. | Holdco is an entity jointly owned by Bunge North America, Inc., a New York corporation (“Bunge”), USRG Holdco IX, LLC, a Delaware limited liability company (“USRG”) and West Central Cooperative, Inc., an Iowa corporation (“West Central,” and together with Bunge and USRG, the “Members”). |

| B. | Pursuant to a Membership Interest Purchase Agreement dated as of the date hereof (the “MIPA”) between Holdco and REG, Holdco is acquiring all of the outstanding equity membership interests (“Membership Interests”) of Landlord, which is acquiring a biodiesel production facility located at Seneca, Illinois (the “Biodiesel Facility”) pursuant to the terms of an Asset Purchase Agreement dated as of September 23, 2009 by and among Nova Biofuels Seneca, LLC and Nova Biosource Technologies, LLC and Landlord (the “APA”). |

| C. | In connection with the acquisition of the Biodiesel Facility pursuant to the terms of the APA, Landlord has entered into an Amended and Restated Credit Agreement dated of even date herewith among Landlord, WestLB AG, New York Branch, (“WestLB”) and those certain lenders referred to therein (the “Credit Agreement”), pursuant to which Landlord will assume certain indebtedness of Nova Biofuels Seneca, LLC and certain of its affiliates (capitalized terms used but not defined herein shall have the meanings assigned thereto in the Credit Agreement), and REG and certain affiliates of REG have entered into a Revolving Credit Agreement dated of even date herewith among REG, REG’s affiliates, WestLB, and those certain lenders referred to therein (the “LOC Agreement”). |

| D. | As required by the Credit Agreement, Holdco has granted a security interest in the Membership Interests to WestLB in its capacity as collateral agent (the “Collateral Agent”) pursuant to the Pledge and Security Agreement, dated of even date herewith, among Landlord, Holdco and the Collateral Agent (the “Pledge Agreement”). |

| E. | Opco and Landlord are parties to that certain Lease Agreement of even date herewith pursuant to which Opco shall lease and operate the Biodiesel Facility (the “Lease”). |

| F. | In connection with the transactions contemplated by the MIPA, the Credit Agreement, the LOC Agreement and the Lease, the Parties hereto desire to make certain agreements among themselves, as more fully set forth herein. |

NOW THEREFORE, in consideration of the mutual agreements set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

| 1. | Funding of Landlord. Holdco shall contribute $4,000,000 as an additional capital contribution to Landlord in connection with the transactions contemplated by the APA, the MIPA, the Credit Agreement and the LOC Agreement on or before the date hereof (together with such additional amounts which may be added thereto pursuant to Section 2.C., the “Investment”). The proceeds from the Investment shall be used by Landlord to pay the reasonable out-of-pocket fees and expenses of the transaction apportioned in the manner set forth on Exhibit A attached hereto up to a maximum amount of $300,000, and to pay such other expenses in accordance with the terms of the Capital Improvement Budget (as defined in the Credit Agreement) which has been approved by Holdco prior to the execution hereof. During the Term, Holdco (a) shall operate Landlord in accordance with the Amended and Restated Operating Agreement of Landlord, and (b) subject to the terms of the Financing Documents (as defined in the Credit Agreement) may sell, assign or otherwise transfer the Membership Interests of Landlord in one transaction or any series of transactions without the prior written consent or approval of REG, provided that the transferee takes assignment of this Agreement and assumes and agrees to be bound by the terms of this Agreement. During the Term, Landlord shall not sell, assign, lease, license or otherwise transfer all or any part of the right, title and interest in the property and assets of Landlord, and Holdco shall not authorize, approve or permit any such action, without the prior written consent of REG. Holdco shall not, without the prior written consent of REG, amend the Certificate of Organization or Amended and Restated Operating Agreement of Landlord in a manner which adversely affects the rights and obligations of REG hereunder. |

| 2. | Investor Fee. |

| A. | As a material inducement for Holdco to enter into the MIPA and to further cause Landlord to enter into the Lease, Holdco shall receive an amount equal to $600,000 per year, payable in arrears in equal quarterly cash installments of $150,000 on the 1st day of each November, February, May and August (collectively, the “Investor Fee”). Except as provided in Section 2.C., the first payment of the Investor Fee will be made on the first scheduled payment date following the Effective Date, with such first payment pro-rated if it is for a partial quarter. Payments of the Investor Fee shall be received by Holdco from the Borrower Revenue Account (as defined in the Credit Agreement) in accordance with the terms of Section 3.03 of the Accounts Agreement (as defined in the Credit Agreement). Except as provided in Section 2.C., if Holdco does not receive an Investor Fee payment on the applicable payment date and any such failure remains unremedied for more than three (3) business days after written notice thereof from Holdco to REG, then Opco agrees that Landlord may in |

2

| Landlord’s sole discretion terminate the Lease upon notice to Opco, provided however that no termination of the Lease shall affect, release or discharge any obligations accruing under this Section or under the Lease up to and including such time of termination. |

| B. | REG hereby irrevocably and unconditionally guarantees to Holdco the complete and punctual payment of the Investor Fees (the “Payment Obligations”). Holdco may recover from REG as a principal debtor the Payment Obligations if Holdco may not recover from REG as guarantor under the immediately preceding sentence, and REG agrees to pay such Payment Obligations not recovered pursuant to the immediately preceding sentence to Holdco as principal debtor. Any Payment Obligations which are not paid when due (as set forth in Section 2.A.) shall, for purposes of REG’s obligations in this Section 2.B., bear interest at the rate of fifteen percent (15%) per annum. For the avoidance of doubt, any interest accruing on any unpaid Investor Fee shall not be paid out of the Borrower Revenue Account, but shall be paid by REG to Holdco. |

| C. | Notwithstanding the foregoing provisions of this Section 2, (a) if Holdco does not receive the first payment of the Investor Fee (which is due May 1, 2010) on or before August 1, 2010 (either through payment from the Borrower Account or through payment by REG), then on August 1, 2010, the amount of such Investor Fee payment, together with all accrued but unpaid interest thereon, shall be added to the amount of the Investment for purposes of Sections 4 and 5, and REG shall not be obligated to pay such Investor Fee payment to Holdco, and (b) if Holdco does not receive the second payment of the Investor Fee (which is due August 1, 2010) on or before November 1, 2010 (either through payment from the Borrower Account or through payment by REG), then on November 1, 2010, the amount of such Investor Fee payment, together with all accrued but unpaid interest thereon, shall be added to the amount of the Investment for purposes of Sections 4 and 5, and REG shall not be obligated to pay such Investor Fee payment to Holdco. The provisions of this Section 2.C. shall not apply to any payment of the Investor Fee due after November 1, 2010. |

| D. | Upon the purchase by REG of any corn oil product from Bunge North America, Inc. pursuant to that certain Bunge/REGIH Corn Oil Sale Agreement dated December 4, 2009 (the “Corn Oil Agreement”), REG shall sell to Opco all or any part of such corn oil product for use as feedstock only at the Biodiesel Facility at the price paid by REG for such corn oil product under the Corn Oil Agreement plus transportation costs to the Biodiesel Facility (“Cost Plus Transportation Price”); provided, however, if REG proposes to sell corn oil product to another purchaser or proposes to sell corn oil product at a price higher than the Cost Plus Transportation Price (either to another purchaser or to the Biodiesel Facility), then REG shall notify Holdco in writing of the quantity to be sold, the purchaser and the higher price to be paid (the “Sale Notice”). Holdco shall have the right to either consent to the new terms of the sale proposed by REG in the Sale Notice, or instead require REG to sell to Opco all or any part of the corn oil product for use as feedstock only at the Biodiesel Facility at the Cost Plus Transportation Price. |

3

| If Holdco does not require REG to sell to Opco all or any part of the corn oil product for use as feedstock at the Biodiesel Facility at the Cost Plus Transportation Price by written notice given to REG within thirty-six (36) hours after Holdco’s receipt of the Sale Notice, REG shall be free to dispose of such corn oil upon the terms set forth in the Sale Notice. The provisions of this Section 2.D. shall survive termination of this Agreement until the earlier of (i) payment of the Purchase Price (as defined below) pursuant to Sections 4 or 5 and (ii) payment in full or cancellation of the Holdco Note (as defined below). |

| 3. | Additional Distribution Provisions. Any distributions of cash or property by Landlord to Holdco shall be made in compliance with the terms of the Credit Agreement and the Amended and Restated Operating Agreement of Landlord (“Distributions”) and shall be credited to the Investor Fee to the extent expressly set forth elsewhere in this Agreement. |

| 4. | REG Call Rights. |

| A. | At any time during the Term, REG shall have a right to cause Holdco to sell to REG all of the Membership Interests (“Call Sale”) by delivering a written notice to Holdco and the Members (“Call Notice”); provided, that the Membership Interests shall remain subject to the lien of the Pledge Agreement following such Call Sale. REG shall pay to Holdco as the purchase price for the Membership Interests an amount (the “Purchase Price”) equal to the greater of (i) the amount required to result in an XIRR on the Investment equal to 35% (the “XIRR Price”), or (ii) an amount equal to three times the Investment (the “Fixed Price”). REG shall also issue to Holdco as additional consideration for the Membership Interests (but not included in the definition of Purchase Price for purposes of this Agreement), certificates representing One Hundred Fifty Thousand (150,000) Shares of REG Common Stock (the “Shares”). If REG exercises its rights under this Section on or before the third (3rd) anniversary of the Effective Date, all Investor Fees and Distributions received by Holdco shall be credited toward the Purchase Price, such that they shall be considered as cash flow for purposes of calculating XIRR on the Investment and shall reduce the amount of the Fixed Price. If REG exercises its rights under this Section after the third (3rd) anniversary of the Effective Date, only those Investor Fees and Distributions received by Holdco subsequent to the third (3rd) anniversary of the Effective Date shall be credited toward the Purchase Price, such that they shall be considered as cash flow for purposes of calculating XIRR on the Investment and shall reduce the amount of the Fixed Price. The closing of the sale of the Membership Interests shall occur no later than 15 days following the date of the Call Notice. In connection with the Call Sale, neither Holdco nor any Member shall be required to provide to REG any representations, warranties or indemnities with respect to the Membership Interests or Landlord other than related to Holdco’s authority, ownership and ability to sell the Membership Interests, free of liens, claims and encumbrances, except the lien of the Pledge Agreement. Upon such Call Sale, REG shall assume all of Holdco’s obligations under the terms of the Pledge Agreement and any other documents executed by Holdco pursuant to the requirements of the Credit Agreement. The term “XIRR” shall mean the internal |

4

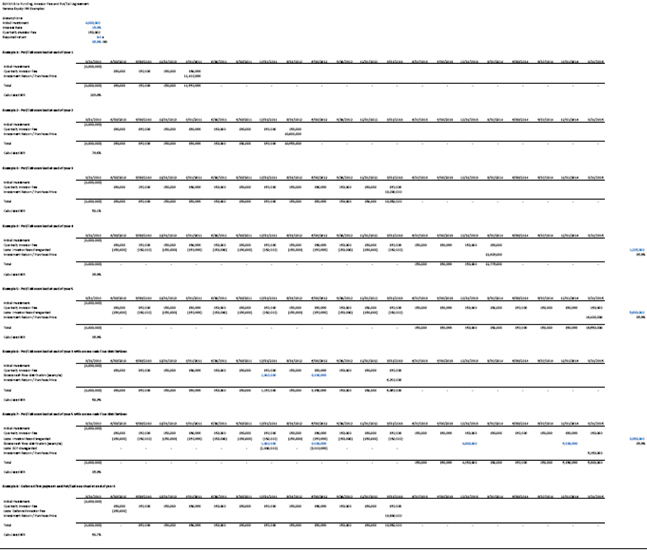

| rate of return calculated using the Microsoft Excel XIRR formula using as cash flows, subject to the provisions of this Section 4 or Section 5, as applicable, pertaining to the treatment of the Investor Fees and Distributions depending on whether a Call Sale or Put Sale occurs on or before, or after, the third anniversary of the Effective Date, (i) all Investor Fees on the dates actually received by Holdco, and (ii) all Distributions on the dates actually received by Holdco from Landlord pursuant to Section 3 above and in compliance with the terms of the Credit Agreement. An example of the calculation of XIRR is set forth on Exhibit B attached hereto. |

| B. | REG represents and warrants to Holdco that the Shares when issued to Holdco pursuant to Sections 4 or 5 hereof will be validly issued, fully paid and nonassessable, and will be free of any liens or encumbrances except as provided in REG’s certificate of incorporation, the Stockholder Agreement dated February 26, 2010 between REG and certain of its stockholders and applicable federal and state securities registration exemptions. The issuance of such Shares is not and will not be subject to any preemptive rights or rights of first refusal that have not been properly waived or complied with. |

| 5. | Holdco Put Rights. |

| A. | At any time after the one year anniversary of the Effective Date, provided that on the date of receipt of the Put Notice (as defined below) Holdco and Landlord have not breached their respective obligations under this Agreement and REG shall have a minimum of “excess net working capital” of more than 1.5 times the Purchase Price (or such lesser amount which Holdco determines to accept as the Purchase Price in its sole discretion), Holdco shall have the right to cause REG to purchase all of the Membership Interests (“Put Sale”) by delivering a written notice to REG (“Put Notice”); provided, that the Membership Interests shall remain subject to the lien of the Pledge Agreement following such Put Sale. For purposes of this Section 5, “excess net working capital,” as of a given date, means the amount calculated in accordance with Exhibit C hereto. REG shall pay to Holdco the Purchase Price as the purchase price for the Membership Interests or such lesser amount as determined by Holdco in its sole discretion. REG shall also issue to Holdco as additional consideration for the Membership Interests (but not included in the definition of Purchase Price for purposes of this Agreement), certificates representing the Shares. If Holdco exercises its rights under this Section on or before the third (3rd) anniversary of the Effective Date, all Investor Fees and Distributions received by Holdco shall be credited toward the Purchase Price, such that they shall be considered as cash flow for purposes of calculating XIRR on the Investment and shall reduce the amount of the Fixed Price. If Holdco exercises its rights under this Section after the third (3rd) anniversary of the Effective Date, only those Investor Fees and Distributions received by Holdco subsequent to the third (3rd) anniversary of the Effective Date shall be credited toward the Purchase Price, such that they shall be considered as cash flow for purposes of calculating XIRR on the Investment and shall reduce the amount of |

5

| the Fixed Price. The closing of the sale of the Membership Interests shall occur no later than thirty (30) days following the date of the Put Notice. In connection with the Put Sale, neither Holdco nor any Member shall be required to provide to REG any representations, warranties or indemnities with respect to the Membership Interests or Landlord other than related to Holdco’s authority, ownership and ability to sell the Membership Interests, free of liens, claims and encumbrances, except the lien of the Pledge Agreement. Upon such Put Sale, REG shall assume all of Holdco’s obligations under the terms of the Pledge Agreement and any other documents executed by Holdco pursuant to the requirements of the Credit Agreement. If REG fails to purchase the Membership Interests as part of a Put Sale in accordance with this Agreement, then in addition to and without limiting any other remedies Holdco may have, Opco agrees that Landlord may, subject to the terms of the Financing Documents, upon delivery of at least 30 days prior written notice to Opco, terminate the Lease. |

| B. | Neither the Call Sale pursuant to Section 4 nor the Put Sale pursuant to Section 5 may be consummated if the purchase pursuant thereto would cause a Default or Event of Default under the Credit Agreement or LOC Agreement. |

| 6. | Term of Agreement; Termination; Effect of Default under Credit Agreement. |

| A. | The term of this Agreement shall begin as of the Effective Date and end as of April 8, 2017 (the “Term”) (subject to early termination of this Agreement, or one or more provisions of this Agreement, as expressly set forth herein). Upon expiration of the Term or earlier termination of this Agreement as provided in this Agreement, none of the Parties shall have any further rights, obligations or liabilities under or by reason of this Agreement, except as may be accrued through the effective date and except for provisions of this Agreement which are expressly stated to survive termination of this Agreement. |

| B. | This Agreement shall immediately terminate upon payment of the Purchase Price pursuant to either Section 4 or Section 5. This Agreement shall also terminate upon termination of the Lease, including, but not limited to, any termination of Opco’s right to possession under the Lease. If termination of the Lease arose or resulted, wholly or in part, from any action or failure to act by Opco, REG or affiliates of REG (including, without limitation, actions taken by affiliates of REG pursuant to the Management and Operational Services Agreement (as defined in the Credit Agreement)), then REG shall immediately issue to Holdco a promissory note in principal amount equal to the Investment (as adjusted pursuant to Section 2), reduced by the amount of Distributions (but not Investor Fees) received by Holdco as of the date of termination of the Lease, in the form attached hereto as Exhibit D (the “Holdco Note”). If, within the three year period following the issuance of the Holdco Note by REG to Holdco, Holdco shall sell the Membership Interests or the assets of Landlord and receive as consideration therefor an amount equal to at least the outstanding principal and interest of the Holdco Note at the time of completion of such sale, then Holdco shall surrender the Holdco Note for cancellation to REG. The provisions of this Section 6B shall survive termination of this Agreement until payment in full or cancellation of the Holdco Note. |

6

| C. | If REG files any registration statement or filing under the Securities Act of 1933, as amended, or any law of a foreign jurisdiction, covering the registration of REG’s securities in the United States or any foreign jurisdiction (except pursuant to any employee stock incentive plan registered on Form S-8 or its equivalent or in connection with an acquisition transaction registered on Form S-4 or its equivalent), then REG shall promptly give notice of such filing (which notice shall be given no less than 20 days prior to the closing of any sale of securities registered by such registration statement) and, if Holdco and Landlord have not breached their respective obligations under this Agreement, Holdco may exercise its put rights pursuant to Section 5 of this Agreement simultaneous to the closing of the sale of securities registered by such registration statement or filing, without regard to the provisions of Section 5 that restrict exercise of such put right until the first anniversary of the Effective Date and that require that REG have a minimum level of excess net working capital, by giving written notice of such exercise at least ten (10) days prior to closing of such sale; provided that, if not so exercised by Holdco prior to closing of such sale, the one year and excess net working capital requirements in Section 5 shall again apply. |

| D. | REG shall provide Holdco with no less than twenty (20) days prior written notice of any Change of Control of REG to the extent REG has prior notice thereof, and if Holdco and Landlord have not breached their respective obligations under this Agreement, Holdco may exercise its put rights pursuant to Section 5 of this Agreement simultaneous to the closing of the Change of Control without regard to the provisions of Section 5 that restrict exercise of such put right until the first anniversary of the Effective Date and that require that REG have a minimum level of excess net working capital. Holdco shall exercise its put rights by giving written notice of such exercise at least ten (10) days prior to closing of such Change of Control (to the extent REG has provided Holdco at least twenty (20) days prior written notice, and if such written notice has not been so provided by REG, then Holdco’s notice exercising its rights shall be given as promptly as practical after receipt of REG’s notice; provided that if not so exercised by Holdco, the one year excess net working capital requirements in Section 5 shall again apply). To the extent such Change of Control involves a transaction in which the stock of REG is exchanged for the stock of another person, Holdco shall be paid the Purchase Price in stock of such other person, valued in the same manner as set forth in the applicable transaction documents evidencing such Change of Control. To the extent such Change of Control involves a transaction in which the stock of REG is exchanged for either cash, or a combination of both cash and stock of another person, then Holdco shall be paid the Purchase Price in cash. A “Change of Control” of REG means any transaction described in Section (b)(ii) or (b)(iii) of the definition of Change of Control in the Credit Agreement; provided, that the following language in Section (b)(ii) shall be disregarded “other than as a result of an initial public offering of the equity securities of REG,”; |

7

| provided, further that the following language of Section (b)(iii) shall be disregarded “other than as a result of a change in the composition of the board of directors as a result of an initial public offering of the equity securities of REG.” |

| E. | Until the earlier of (i) payment in full to Holdco of the Purchase Price pursuant to either Section 4 or 5, (ii) the cancellation of the Holdco Note pursuant to Section 6B, (iii) REG has listed its common stock on a public securities exchange, or (iv) REG has raised additional capital through a public offering of stock or debt (except pursuant to any employee stock incentive plan) pursuant to a registration statement filed by REG under the Securities Act of 1933, as amended, the existing three (3) Members of Holdco on the date hereof by unanimous vote (or by so many of them as may remain as voting equity holders of Holdco), shall have the right to approve the consolidated annual budget of REG, such approval not to be unreasonably withheld. If Holdco has not approved the annual budget prior to January 1 of any calendar year, the annual budget of REG shall be the budget for the immediately preceding calendar year until such time as the revised budget is approved. If Holdco has unreasonably withheld its approval of the annual budget or any part thereof for a period of at least 30 days, the proposed budget or part thereof as to which Holdco has unreasonably withheld its approval shall be deemed approved. The provisions of this Section 6.E. shall survive termination of this Agreement until the earlier of (i) payment of the Purchase Price pursuant to Sections 4 or 5 or (ii) payment in full or cancellation of the Holdco Note and (iii) at such time as none of the three (3) existing Members remain as members of Holdco. |

| 7. | Confidentiality. |

| A. | Except for lenders to any Party, including, but not limited to, WestLB, AG, and except as required by law, regulation or legal process, each Party agrees not to disclose the terms of this Agreement to any third party other than such directors, managers, officers, employees, affiliates, consultants and agents (collectively, “Representatives”) as are required to allow a Party to perform under this Agreement. A Party will be responsible for any breach of these confidentiality provisions by any of its Representatives and agrees to take all reasonable measures to restrain its Representatives from prohibited or unauthorized disclosure. Each Party agrees that the actual or threatened disclosure of the information would cause the other Parties immediate and irreparable harm which may not be adequately compensated by money damages. Accordingly, in the event of a breach of these confidentiality provisions by a Party or its Representatives, each Party specifically agrees, that in addition to all other remedies available at law or in equity, the other Parties shall be entitled to equitable relief, including an injunction to limit or prevent such actual or threatened disclosure, together with recovery of costs of litigation from the disclosing Party as a result of breach, including reasonable attorney fees. These obligations of confidentiality shall not apply to any information which: (a) was known to a disclosing Party or its Representatives or was in the public domain prior to disclosure in connection with the negotiation and execution of this |

8

| Agreement; or (b) becomes known to the public from a source other than the disclosing Party; or (c) is disclosed to a disclosing Party or its Representatives by a third party having a legal right to make such disclosure; or (d) is obtained by a disclosing Party or its Representatives in another manner other than pursuant to this Agreement. |

| B. | The Parties acknowledge that in order to comply with certain statutory or regulatory requirements, this Agreement (or portions thereof) may need to be disclosed to the Securities Exchange Commission, state securities bureaus, or other regulators, and agree to allow such disclosure if the Party requesting such disclosure provides the other Parties with at least fifteen (15) days prior written notice and prior agreement on the information to be provided. |

| 8. | Arbitration. Should any controversy, claim, dispute or difference arise between the Parties hereunder out of or relating to this Agreement, including, without limitation, its formation, validity, binding effect, interpretation, performance, breach or termination, then each and every such controversy, claim, dispute or difference shall be submitted and settled by arbitration in accordance with the Commercial Arbitration Rules then in effect of the American Arbitration Association, and shall be conducted in Chicago, Illinois. Judgment upon the award rendered by the arbitrator or arbitrators may be entered in any court of competent jurisdiction. |

| 9. | Representations and Warranties. As a material inducement to the other Parties to enter into this Agreement and with the understanding that the other Parties shall be relying thereon in consummating the transaction contemplated hereunder, each Party hereby represents and warrants to the other Parties as follows: |

| A. | Authorization. The execution of this Agreement has been duly authorized by the appropriate owners and board of governance as may be required for such Party to proceed. |

| B. | Standing. Such Party is duly organized, validly existing and in good standing under the laws of the state of formation and such other states as may be required for this transaction, and has all requisite power and authority to consummate the transactions contemplated hereunder. |

| C. | Consents. No approval or consent is needed from any third party with respect to the performance of obligations hereunder by such Party except as may be provided in the Financing Documents. |

| D. | Breaches. The execution, delivery and performance of this Agreement and the consummation of the transactions contemplated hereby do not and shall not result in any material breach of any terms or conditions of any mortgage, agreement or contract or obligation entered into by such Party except as may be provided in the Credit Agreement or LOC Agreement, nor, to the best of such Party’s knowledge, shall they violate any statute, regulation, judgment or decree of any court by which such Party may be bound. |

9

| 10. | Notices. Any notice or demand desired or required to be given hereunder shall be in writing and deemed given when personally delivered, the next day after delivery to Federal Express or other recognized overnight delivery service with directions for next day delivery, or three (3) days after it is deposited in the United States mail, postage prepaid, sent certified or registered and addressed as follows: |

| To REG or REGIH: | Renewable Energy Group, Inc. | |

| 416 S. Bell Ave | ||

| P.O. Box 888 | ||

| Ames, Iowa 50010 | ||

| Attn: President | ||

| With a copy to: | Wilcox, Polking, Gerken, Schwarzkopf & Copeland, P.C. | |

| 115 E. Lincolnway St., Suite 200 | ||

| Jefferson, IA 50129-2149 | ||

| Attn: John Gerken | ||

| To Opco: | REG Seneca, LLC | |

| 416 S. Bell Ave. | ||

| P.O. Box 888 | ||

| Ames, Iowa 50010 | ||

| Attn: President | ||

| With a copy to: | Wilcox, Polking, Gerken, Schwarzkopf & Copeland, P.C. | |

| 115 E. Lincolnway St., Suite 200 | ||

| Jefferson, IA 50129-2149 | ||

| Attn: John Gerken | ||

| To Holdco or Landlord: | Seneca Biodiesel Holdco, LLC | |

| 2425 Olympic Boulevard, Suite 4050 West | ||

| Santa Monica, California 90404 | ||

| Attn: Jonathan Koch | ||

| With copies to: | Bunge North America | |

| 11720 Borman Drive | ||

| St. Louis, MO 63146 | ||

| Attention: General Manager – Bunge Biofuels | ||

| Bunge North America | ||

| 11720 Borman Drive | ||

| St. Louis, MO 63146 | ||

| Attention: General Counsel | ||

| USRG Holdco V, LLC | ||

| 10 Bank Street, Suite 580 | ||

| White Plains, NY 10606 | ||

| Attention: Jonathan Koch | ||

10

| West Central Cooperative | ||

| 406 First Street | ||

| Ralston, IA 51459 | ||

| Attention: Jeffrey Stroburg |

Any notice or other communications made shall be deemed to have been given when received or refused. A party may change its address for notice by giving notice of such address as provided in this Section.

| 11. | Miscellaneous. |

| A. | Benefits. This Agreement shall bind and benefit the Parties and their permitted successors and assigns. |

| B. | Assignment. Except as set forth in Section 1, no Party may assign any of its rights in or delegate any of its duties under this Agreement without the prior written consent of the other Parties. |

| C. | Governing Law. New York law shall govern the construction and enforcement of this Agreement without regard to conflicts of law principles. |

| D. | Entire Agreement; Beneficiaries; Amendment. This Agreement and the exhibits attached hereto contain the entire agreement of the Parties with respect to the subject matter and supersedes all prior oral or written agreements and understandings. This Agreement may not be amended or modified except in writing signed by the Parties. This Agreement does not, and is not intended to, confer any rights or remedies upon any person other than the Parties, provided, that the Members are third party beneficiaries of this Agreement and may enforce this Agreement. |

| E. | Execution and Delivery. This Agreement may be executed in counterparts and delivered by facsimile, which, taken together, shall be considered one instrument and deemed an original. |

| F. | No Inference from Drafting. The Parties both acknowledge that they have been represented by counsel, and that this Agreement has resulted from extended negotiations between the parties. No inference in favor of or against any Party shall be drawn from the fact that such Party has drafted any portion of this Agreement. |

| G. | Waiver. The waiver by any Party of a breach of any provision of this Agreement will not constitute or be construed as a waiver of any future breach of any provision of this Agreement. |

11

| H. | Survival. The representations, warranties, covenants and indemnities set forth in this Agreement shall survive the expiration or earlier termination of this Agreement. |

| I. | Enforcement and Interpretation. It is the desire and intent of the Parties hereto that this Agreement be enforced to the fullest extent possible under the laws and public policies of the state of New York. Accordingly, if any particular provision of this Agreement is adjudicated to be invalid or unenforceable, such portion shall be deleted, and such deletion shall apply only to such provision with the remainder of the Agreement remaining valid and enforceable, to be construed in conformity with the parties’ initial intent. Further, to the extent any provision hereof is deemed unenforceable by virtue of its scope or terms with respect to geographical area or length of time, but may be enforceable by limitations thereon, the Parties agree that this Agreement shall remain enforceable to the fullest extent possible after the application of such limitations. |

| J. | Rights Not Exclusive. No right, power or remedy conferred by this Agreement will be exclusive of any other right, power or remedy now or hereafter available to a Party at law, in equity, by statute or otherwise. |

| K. | JURY WAIVER. NOTWITHSTANDING ANYTHING HEREIN TO THE CONTRARY, EACH OF THE PARTIES HERETO HEREBY IRREVOCABLY WAIVE ANY RIGHT TO TRIAL BY JURY IN ANY ACTION, PROCEEDING, CLAIM OR COUNTERCLAIM ARISING OUT OF OR RELATING TO THIS AGREEMENT. |

[remainder of page intentionally left blank]

12

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the date first shown above.

| Seneca Biodiesel Holdco, LLC | Renewable Energy Group, Inc. | |||||||

| By: | /s/ Jonathan Koch |

By: | /s/ Daniel J. Oh | |||||

| Name: | Jonathan Koch | Name: | Daniel J. Oh | |||||

| Title: | Co-President | Title: | President | |||||

| By: | /s/ Eric Hakmiller |

|||||||

| Name: | Eric Hakmiller | |||||||

| Title: | Co-President | |||||||

| Seneca Landlord, LLC | REG Intermediate Holdco, Inc. | |||||||

| By: | /s/ Jonathan Koch |

By: | /s/ Daniel J. Oh | |||||

| Name: | Jonathan Koch |

Name: | Daniel J. Oh | |||||

| Title: | Co-President |

Title: | President | |||||

| REG Seneca, LLC | ||||||||

| By: | /s/ Daniel J. Oh | |||||||

| Name: | Daniel J. Oh | |||||||

| Title: | President | |||||||

13

Exhibit A

Fees

1. $150,000 fees and expenses for counsel to WestLB

2. $150,000 fees and expenses for counsel to Holdco

Exhibit B

Example XIRR Calculation

(See attached Excel Spreadsheet as part of Exhibit B)

XIRR (values, dates, guess)

“Values” is a series of cash flows that corresponds to a schedule of payments in dates. The first payment is optional and corresponds to a cost or payment that occurs at the beginning of the investment. If the first value is a cost or payment, it must be a negative value. All succeeding payments are discounted based on a 365-day year. The series of values must contain at least one positive and one negative value.

“Dates” is a schedule of payment dates that corresponds to the cash flow payments. The first payment date indicates the beginning of the schedule of payments. All other dates must be later than this date, but they may occur in any order. Dates should be entered by using the DATE function, or as results of other formulas or functions. For example, use DATE(2008,5,23) for the 23rd day of May, 2008. Problems can occur if dates are entered as text.

“Guess” is a number that you guess is close to the result of XIRR.

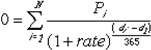

Excel uses an iterative technique for calculating XIRR. Using a changing rate (starting with guess), XIRR cycles through the calculation until the result is accurate within 0.000001 percent. If XIRR can’t find a result that works after 100 tries, the #NUM! error value is returned. The rate is changed until:

where:

di = the ith, or last, payment date.

d1 = the 0th payment date.

Pi = the ith, or last, payment.

Exhibit C

Excess Net Working Capital

Excess net working capital is defined as the average daily ending cash balance (excluding restricted cash and cash held in risk management accounts) measured with respect to the 120 day period prior to the date of receipt of the Put Notice at Renewable Energy Group, Inc., REG Services, LLC and REG Marketing & Logistics, LLC taken together.

Exhibit D

TERM LOAN PROMISSORY NOTE

| $ |

, | |

| , 20 |

FOR VALUE RECEIVED, on , 20 , the undersigned, Renewable Energy Group, Inc., a Delaware corporation (“Borrower”), hereby promises to pay to the order of Seneca Biodiesel Holdco, LLC, a Delaware limited liability company (“Lender”), the principal sum of Dollars ($ ), together with interest on the outstanding principal balance of this Note from the date hereof to the maturity date, at the rate of Fifteen Percent (15%) per annum, in Twelve (12) equal consecutive quarterly installments of principal and interest in the amount of Dollars ($ ), with the Twelfth (12th) and final installment due and payable on , 20 . This Note shall be cancelled as and when provided in that certain Funding, Investor Fee and Put/Call Agreement dated April , 2010 by and between Lender, Borrower and certain other parties.

All payments received by Lender under this Note shall be allocated among the principal, interest, fees, collection costs and expenses and other amounts due under this Note in such order and manner as Lender shall elect. The amount of interest accruing under this Note shall be computed on an actual day, 360 day year basis. Lender shall record in its books and records the date and amount of all payments of principal and interest under this Note. Lender’s books and records showing the account between Lender and Borrower shall be admissible in evidence in any action or proceeding and shall constitute prima facie proof of the items therein set forth.

Borrower may prepay all at any time or any portion from time to time of the unpaid principal balance of this Note prior to maturity provided that: (i) partial prepayments shall be applied to the payment of the installments of principal of this Note in the inverse order of their stated maturities and (ii) on each prepayment date, the Borrower shall pay to the order of Lender all accrued and unpaid interest on the principal portion of this Note being prepaid to and including the date of such prepayment.

All payments of principal, interest and other amounts under this Note shall be made in lawful currency of the United States in Federal or other immediately available funds at the office of Lender situated at 2425 Olympic Boulevard, Suite 4050 West, Santa Monica, California 90404 Attn: Jonathan Koch, or at such other place as Lender may from time to time designate in writing. The acceptance by Lender of any payment of principal, interest or other amount due under this Note after the date it is due as described above shall not be held to establish a custom or waive any rights of Lender to enforce prompt payment of any other payments of principal or interest or otherwise.

Borrower represents and warrants to Lender that (a) Borrower is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware, (b) the execution, delivery and performance by Borrower of this Note (i) are within the corporate powers of Borrower, (ii) have been duly authorized by all necessary corporate action on the part of Borrower, (iii) require no action by or in respect of, or filing with, any governmental or regulatory body, agency or official or any other third party and (iv) do not conflict with, or result in a breach of the terms, conditions or provisions of, or constitute a default under or result in any violation of, the terms of the Articles of Incorporation or By-Laws of Borrower, any applicable law, rule, regulation, order, writ, judgment or decree of any court or governmental or regulatory agency or instrumentality or any agreement, document or instrument to which Borrower is a party or by which it is bound or to which it is subject and (c) this Note constitutes the legal, valid and binding obligation of Borrower and is enforceable against Borrower in accordance with its

terms, except as such enforceability may be limited by applicable bankruptcy, insolvency or similar laws affecting the enforcement of creditors’ rights generally and except as limited by general principles of equity (regardless of whether such enforceability is considered in a proceeding in equity or at law).

If any of the following events (“Events of Default”) shall occur: (a) Borrower shall fail to make any payment of any principal of, interest on or other amount with respect to this Note as and when the same shall become due and payable; (b) any representation or warranty of Borrower made in this Note shall prove to have been untrue or incorrect in any material respect when made; (c) Borrower shall (i) voluntarily commence any proceeding or file any petition seeking relief under Title 11 of the United States Code or any other Federal, state or foreign bankruptcy, insolvency, receivership, liquidation or similar law, (ii) consent to the institution of, or fail to contravene in a timely and appropriate manner, any such proceeding or the filing of any such petition, (iii) apply for or consent to the appointment of a receiver, trustee, custodian, sequestrator or similar official of itself or a substantial part of its property or assets, (iv) file an answer admitting the material allegations of a petition filed against itself in any such proceeding, (v) make a general assignment for the benefit of creditors, (vi) become unable, admit in writing its, his or her inability or fail generally to pay its debts as they become due or (vii) take any action for the purpose of effecting any of the foregoing; (d) an involuntary proceeding shall be commenced or an involuntary petition shall be filed in a court of competent jurisdiction seeking (i) relief in respect of Borrower, or of a substantial part of the property or assets of Borrower, under Title 11 of the United States Code or any other Federal, state or foreign bankruptcy, insolvency, receivership, liquidation or similar law, (ii) the appointment of a receiver, trustee, custodian, sequestrator or similar official of Borrower or of a substantial part of the property or assets of Borrower or (iii) the winding up or liquidation of Borrower; and any such proceeding or petition shall continue undismissed for thirty (30) consecutive days or an order or decree approving or ordering any of the foregoing shall continue unstayed and in effect for thirty (30) consecutive days; (e) dissolution, termination of existence or operations, merger, consolidation or transfer of a substantial part of the property or assets of Borrower; (f) an injunction, attachment or judgment shall be issued against any of the property or assets of Borrower; (g) Borrower shall become insolvent in either the equity or bankruptcy sense of the term; (h) Borrower shall have a judgment entered against it by a court having jurisdiction in the premises in an amount exceeding $50,000, and such judgment shall not be appealed in good faith or satisfied by Borrower within thirty (30) days after the entry of such judgment; (i) any default or event of default shall occur under or within the meaning of any agreement, document or instrument evidencing, securing, guaranteeing the payment of or otherwise relating to any outstanding indebtedness of Borrower for borrowed money (other than this Note); or (j) Borrower shall be declared by Lender to be in default on, or pursuant to the terms of, any other present or future obligation to Lender; then, and in each such event (other than an event described in clauses (c) or (d) above), Lender may, at its option, declare the entire outstanding principal balance of this Note and all accrued and unpaid interest thereon to be immediately due and payable, whereupon all of such outstanding principal balance and accrued and unpaid interest shall become and be immediately due and payable, without presentment, demand, protest or further notice of any kind, all of which are hereby expressly waived by Borrower, and Lender may exercise any and all other rights and remedies which it may have, under any agreement, document or instrument securing this Note or at law or in equity; provided, however, that upon the occurrence of any event described in clauses (c) or (d) above, the entire outstanding principal balance of this Note and all accrued and unpaid interest thereon shall automatically become immediately due and payable, without presentment, demand, protest or further notice of any kind, all of which are hereby expressly waived by Borrower, and Lender may exercise any and all other rights and remedies which it may have under any agreement, document or instrument securing this Note or at law or in equity.

Upon the occurrence and during the continuance of any Event of Default under this Note, Lender is hereby authorized at any time and from time to time, without notice to Borrower (any such notice being expressly waived by Borrower) and to the fullest extent permitted by law, to set-off and apply any and all

other indebtedness at any time owing by Lender to or for the credit or account of Borrower against any and all indebtedness, liabilities and obligations of Borrower to Lender under or in respect of this Note irrespective of whether or not Lender shall have made any demand for payment under this Note and although such indebtedness, liabilities and/or obligations may be contingent or unmatured. Lender agrees to promptly notify Borrower after any such set-off and application made by Lender, provided, however, that the failure to give such notice shall not affect the validity of such set-off and application. The rights of Lender under this paragraph are in addition to any other rights and remedies (including, without limitation, other rights of set-off) which Lender may have. Nothing contained in this Note shall impair the right of Lender to exercise any right of set-off or counterclaim it may have against Borrower and to apply the amount subject to such exercise to the payment of indebtedness of Borrower unrelated to this Note.

In the event that any payment of any principal, interest or other amount due under this Note is not paid when due, whether by reason of maturity, acceleration or otherwise, and this Note is placed in the hands of an attorney or attorneys for collection or for foreclosure or any agreement, document or instrument securing the payment of this Note, or if this Note is placed in the hands of an attorney or attorneys for representation of Lender in connection with bankruptcy or insolvency proceedings relating to this Note, Borrower promises to pay to the order of Lender, in addition to all other amounts otherwise due on or under this Note, the costs and expenses of such collection, foreclosure and representation, including, without limitation, reasonable attorneys’ fees and expenses (whether or not litigation shall be commenced in aid thereof). All parties hereto expressly waive presentment, demand for payment, notice of dishonor, protest and notice of protest.

This Note may not be changed, nor may any term, condition or Event of Default be waived, modified or discharged orally but only by an agreement in writing, signed by Lender. No failure or delay by Lender in exercising any right, remedy, power or privilege under this Note shall operate as a waiver thereof; nor shall any single or partial exercise thereof preclude any other or further exercise thereof or the exercise of any other right, remedy, power or privilege. In addition, Lender may, without notice to and without releasing the liability of Borrower, add or release one or more of such parties or release any collateral or security for this Note in whole or in part. Borrower waives notice of and consent to, and Borrower shall be released from liability under this Note by virtue of, any extension of time for the payment of any principal of or interest on this Note or the renewal of this Note one or more times or any other amendment or modification of this Note.

BORROWER HEREBY IRREVOCABLY (A) SUBMITS TO THE NONEXCLUSIVE JURISDICTION OF ANY DELAWARE STATE COURT OR ANY UNITED STATES OF AMERICA COURT SITTING IN DELAWARE , AS LENDER MAY ELECT, IN ANY SUIT, ACTION OR PROCEEDING ARISING OUT OF OR RELATING TO THIS NOTE, (B) AGREES THAT ALL CLAIMS IN RESPECT TO ANY SUCH SUIT, ACTION OR PROCEEDING MAY BE HELD AND DETERMINED IN ANY OF SUCH COURTS, (C) WAIVES, TO THE FULLEST EXTENT PERMITTED BY LAW, ANY OBJECTION WHICH BORROWER MAY NOW OR HEREAFTER HAVE TO THE LAYING OF VENUE OF ANY SUCH SUIT, ACTION OR PROCEEDING BROUGHT IN ANY SUCH COURT, (D) WAIVES ANY CLAIM THAT SUCH SUIT, ACTION OR PROCEEDING BROUGHT IN ANY SUCH COURT HAS BEEN BROUGHT IN AN INCONVENIENT FORUM AND (E) WAIVES ALL RIGHTS OF ANY OTHER JURISDICTION WHICH BORROWER MAY NOW OR HEREAFTER HAVE BY REASON OF ITS PRESENT OR SUBSEQUENT DOMICILES. BORROWER (AND BY ITS ACCEPTANCE OF THIS NOTE, LENDER) IRREVOCABLY WAIVE THE RIGHT TO TRIAL BY JURY WITH RESPECT TO ANY ACTION IN WHICH BORROWER AND LENDER ARE PARTIES RELATING TO OR ARISING OUT OF OR IN CONNECTION WITH THIS NOTE.

This Note shall be governed by and construed in accordance with the substantive laws of the State of New York (without reference to conflict of law principles).

| Renewable Energy Group, Inc. | ||

| By: |

| |

| Title: |

| |