Attached files

| file | filename |

|---|---|

| 8-K - GEOKINETICS INC | form8-k.htm |

NYSE

Amex: GOK - A

World of Opportunities, Revealed

NYSE

Amex: GOK - A

World of Opportunities, Revealed

EnerCom’s

The

Oil & Services Conference

February

17, 2010

Investor

Presentation

NYSE

Amex: GOK - A

World of Opportunities, Revealed

NYSE

Amex: GOK - A

World of Opportunities, Revealed

2

Forward-Looking

Statements

u This presentation

contains forward-looking statements.

u All forward-looking

statements speak only as of the date of this presentation or,

in the case of any document incorporated by reference, the date of that

document. All subsequent written and oral forward-looking statements

attributable to the company or any person acting on the company’s behalf are

qualified by the cautionary statements in this section. The company does not

undertake any obligation to update or publicly release any revisions to forward-

looking statements to reflect events, circumstances or changes in expectations

after the date of this report.

in the case of any document incorporated by reference, the date of that

document. All subsequent written and oral forward-looking statements

attributable to the company or any person acting on the company’s behalf are

qualified by the cautionary statements in this section. The company does not

undertake any obligation to update or publicly release any revisions to forward-

looking statements to reflect events, circumstances or changes in expectations

after the date of this report.

u Actual experience

may differ and such differences may be material.

u Backlog consists of

written orders and estimates for our services which we

believe to be firm. In many instances contracts are cancelable by customers so

we may never realize some or all of our backlog, which may lead to lower than

expected financial performance.

believe to be firm. In many instances contracts are cancelable by customers so

we may never realize some or all of our backlog, which may lead to lower than

expected financial performance.

u Forward-looking

statements are subject to uncertainties and risks which are

disclosed in Geokinetics’ Annual Report on Form 10-K and Quarterly Reports on

Form 10-Q.

disclosed in Geokinetics’ Annual Report on Form 10-K and Quarterly Reports on

Form 10-Q.

NYSE

Amex: GOK - A

World of Opportunities, Revealed

NYSE

Amex: GOK - A

World of Opportunities, Revealed

3

GOK

Market Data

u Leading provider of

seismic data acquisition, processing and

interpretation services to the oil & gas industry worldwide

interpretation services to the oil & gas industry worldwide

Market

Data (at

2/8/2010)

• Exchange/Ticker:

NYSE

Amex: GOK

• Market

Capitalization: $132.5

MM

• Enterprise

Value: $253.4

MM*

Trading

Data (at

2/8/2010)

• Common Shares

O/S 15.8

MM

• Avg. Volume (90

day) 184,811

shs/day

• Institutional

Ownership 56%

*Reflects

Debt & Preferred Equity as of 9/30/09, Cash (including $2.0M of Restricted

Cash) as of 9/30/09

adjusted for net proceeds from December Equity Offering, excludes December Bond Offering & Related Cash

Proceeds as these are being held in Escrow pending closing of the PGS Onshore acquisition and will be returned

if this acquisition does not close

adjusted for net proceeds from December Equity Offering, excludes December Bond Offering & Related Cash

Proceeds as these are being held in Escrow pending closing of the PGS Onshore acquisition and will be returned

if this acquisition does not close

Institutional

ownership as reported by Ipreo Bigdough.

NYSE

Amex: GOK - A

World of Opportunities, Revealed

NYSE

Amex: GOK - A

World of Opportunities, Revealed

Industry

Dynamics

u NOC’s control as

much as 94% of world’s oil and gas reserves

(Source: Oil & Gas Journal, February 2, 2009)

(Source: Oil & Gas Journal, February 2, 2009)

u Over 50% of Top 50

oil companies are NOC’s

(Source: Petroleum Intelligence Weekly)

(Source: Petroleum Intelligence Weekly)

u OPEC oil production

is at its highest level since December 2008

u Technical advances

such as 3-D seismic, hydraulic fracturing and horizontal

drilling are bringing new activity in regions with known hydrocarbon systems

drilling are bringing new activity in regions with known hydrocarbon systems

u U.S. shale plays

still active and profitable, E&P expenditures expected to rise by

13% in 2010

13% in 2010

u U.S. projects

generally focused on natural gas, while international projects are

mostly targeting oil prospects

mostly targeting oil prospects

u 45% of companies

surveyed indicated an increase in 2010 exploration spending

u Increasing demand

for seabed seismic data acquisition

(Transition Zone, Ocean Bottom Cable and 4D)

(Transition Zone, Ocean Bottom Cable and 4D)

Source:

Barclays Capital - The Original E&P Spending Survey , December 16,

2009.

International

Exploration and Production Expenditures ($B)

NYSE

Amex: GOK - A

World of Opportunities, Revealed

NYSE

Amex: GOK - A

World of Opportunities, Revealed

5

Expanding

Capital Budgets

Source:

Barclays Capital - The Original E&P Spending Survey , December 16,

2009.

NYSE

Amex: GOK - A

World of Opportunities, Revealed

NYSE

Amex: GOK - A

World of Opportunities, Revealed

6

Global

Seismic Crew Count

Seismic

Crew Data Source: IHS Energy.

1.

Source: Barclays Capital - The Original E&P Spending Survey

12/16/2009

u International

markets grew

to 79% of total market from 77%,

driven by NOCs and IOCs

primarily targeting oil

to 79% of total market from 77%,

driven by NOCs and IOCs

primarily targeting oil

u U.S. and Canadian

markets

declined to 21% of total market

from 23%

declined to 21% of total market

from 23%

u U.S. E&P

spending in 2010

expected to increase 12%;

international E&P expected to

increase 10%, mostly due to

higher capital spending from

NOCs(1)

expected to increase 12%;

international E&P expected to

increase 10%, mostly due to

higher capital spending from

NOCs(1)

u E&P companies

announcing

increase in percent of budget

allocated to exploration(1)

increase in percent of budget

allocated to exploration(1)

u Global presence

provides

ability to redeploy assets

to best markets

ability to redeploy assets

to best markets

|

Region

|

Feb-2009

|

Feb-2010

|

Change

|

|

U.S.

|

75

|

65

|

-10

|

|

Canada

|

15

|

14

|

-1

|

|

U.S.

& Canada

|

90

|

79

|

-11

|

|

Europe

|

36

|

32

|

-4

|

|

CIS

|

47

|

46

|

-1

|

|

Latin

America

|

36

|

35

|

-1

|

|

Africa

|

74

|

72

|

-2

|

|

Middle

East

|

35

|

35

|

-

|

|

Far

East

|

73

|

70

|

-3

|

|

Outside

U.S. & Canada

|

301

|

290

|

-11

|

|

World

Total

|

391

|

369

|

-22

|

NYSE

Amex: GOK - A

World of Opportunities, Revealed

NYSE

Amex: GOK - A

World of Opportunities, Revealed

7

Geophysical

Market - Competitive Landscape

|

Company

|

Data

Acquisition

|

M-C

Data

Library |

Data

Proc

& Interp |

Eqpmt. |

Land

Seismic

Crews |

||||

|

Marine

Streamer

|

Land

|

TZ

|

OBC

|

Intl

|

North

Amer. |

||||

|

Geokinetics

(Pro Forma)

|

|

ü

|

ü

|

ü

|

ü

|

ü

|

|

ü

|

ü

|

|

Dawson

|

|

ü

|

|

|

|

ü

|

|

|

ü

|

|

Tidelands

|

|

ü

|

ü

|

|

|

|

|

|

ü

|

|

PGS

(Pro Forma)

|

ü

|

|

|

|

ü

|

ü

|

|

|

|

|

BGP

|

ü

|

ü

|

ü

|

|

|

ü

|

ü

|

ü

|

|

|

CGGVeritas

(Sercel)

|

ü

|

ü

|

ü

|

ü

|

ü

|

ü

|

ü

|

ü

|

ü

|

|

WesternGeco

(Schlumberger) |

ü

|

ü

|

ü

|

ü

|

ü

|

ü

|

ü

|

ü

|

|

|

Global

Geophysical

|

|

ü

|

ü

|

ü

|

ü

|

ü

|

|

ü

|

ü

|

|

Seitel

|

|

|

|

|

ü

|

|

|

|

|

|

Mitcham

|

|

|

|

|

|

|

ü

|

|

|

|

ION

Geophysical

|

|

|

|

|

ü

|

ü

|

ü

|

|

|

|

Bolt

Technologies

|

|

|

|

|

|

|

ü

|

|

|

|

OYO

Geospace

|

|

|

|

|

|

|

ü

|

|

|

NYSE

Amex: GOK - A

World of Opportunities, Revealed

NYSE

Amex: GOK - A

World of Opportunities, Revealed

8

Geokinetics

Overview

u Leading provider of

seismic data acquisition, processing and interpretation services to the oil

& gas

industry worldwide

industry worldwide

u Provides seismic

data acquisition services by collecting two-dimensional (2D),

three-dimensional

(3D), and multi-component seismic data in land, marsh and swamp, and shallow water environments

on a contract basis for its customers

(3D), and multi-component seismic data in land, marsh and swamp, and shallow water environments

on a contract basis for its customers

u Provides a suite of

onshore and offshore proprietary seismic data processing and

interpretation

products and services to produce an image of the earth’s subsurface

products and services to produce an image of the earth’s subsurface

u Purpose-built

vessels designed for cost-

effective mobilization by air, land or sea

effective mobilization by air, land or sea

§ Up to 65’ in length,

ultra shallow draft vessels

§ Capable of operating

150 ft. water depth

§ Four active

crews

u Launched OBC

operations Q4 2007

u First operator of

Sercel SeaRay (2 systems)

u Offshore

capabilities up to 500 ft. water depth

u Expanding OBC

capabilities near-term

Leader

in Transition Zone

Emerging

OBC Market

NYSE

Amex: GOK - A

World of Opportunities, Revealed

NYSE

Amex: GOK - A

World of Opportunities, Revealed

9

Investment

Highlights

NYSE

Amex: GOK - A

World of Opportunities, Revealed

NYSE

Amex: GOK - A

World of Opportunities, Revealed

10

Leading

Provider with a Global Market

Presence

Presence

Significant

backlog provides strong visibility for crew utilization into 2010

Geographic

Revenue % Split

Significant

international presence with backlog of ~$455.1 millions as of

9/30/09

*

Backlog

is pro forma for the acquisition of PGS Onshore

Backlog

%

NYSE

Amex: GOK - A

World of Opportunities, Revealed

NYSE

Amex: GOK - A

World of Opportunities, Revealed

Acquisition of PGS Onshore Enhances

Capabilities and International Expertise

PGS

Onshore Capabilities

u PGS Onshore engages

in seismic operations on land, shallow water and

transition zones, including onshore multi-client library

transition zones, including onshore multi-client library

u As of September

2009, PGS Onshore had:

§ 13 crew capacity (9

active) in 10 countries

§ 3,514 data

acquisition employees

§ ~84,000

channels

u Extensive PGS

Onshore geographic capabilities include:

§ Desert - experience

in severe desert conditions in Middle East and Africa

§ Arctic -

environmentally sensitive terrain through its modern equipment

§ Mountain, Jungle and

Swamp

§ Highland - high

channel count capability

§ Transition Zone -

“light tackle” shallow marine, and transition zone surveys

u Multi-client data

library contains over 5,500 square miles of 2D / 3D

seismic information covering the U.S.

seismic information covering the U.S.

11

NYSE

Amex: GOK - A

World of Opportunities, Revealed

NYSE

Amex: GOK - A

World of Opportunities, Revealed

12

Transaction

Overview

Sources

and Uses

u On December 3, 2009,

Geokinetics Inc. (“Geokinetics”) signed a

definitive agreement to acquire the onshore seismic data

acquisition and multi-client data library business of Petroleum Geo

-Services ASA (“PGS Onshore”)

definitive agreement to acquire the onshore seismic data

acquisition and multi-client data library business of Petroleum Geo

-Services ASA (“PGS Onshore”)

u Purchase price of

$210 million consisting of:

§ $183.9 million in

cash consideration

§ $26.1 million common

stock issued directly to the seller (1)

u Financing of the

acquisition and refinancing of current debt

outstanding includes:

outstanding includes:

§ 4.0 million Share

Common Stock Equity Follow-On

§ $300 million Senior

Secured Notes

(1) Reflects stock

consideration based 2.15 million shares at an average price

of $12.11 per share.

of $12.11 per share.

(2) Includes expenses

related to this note offering, the concurrent common

stock offering, the new senior secured revolving credit facility, the bridge

loan and the preferred stock restructuring.

stock offering, the new senior secured revolving credit facility, the bridge

loan and the preferred stock restructuring.

NYSE

Amex: GOK - A

World of Opportunities, Revealed

NYSE

Amex: GOK - A

World of Opportunities, Revealed

Premier

Global Seismic Company

|

|

1

|

Standalone

|

|

Combined

|

||

|

|

|

|

|

PGS

Onshore

|

|

The

New

|

|

Recording

Channels (1) |

|

~120,000

|

|

~84,000

|

|

~204,000

|

|

Vibrator

Equipment |

|

68 (2)

|

|

84 (1)

|

|

152

|

|

Crew

Capacity |

|

25 (1)

|

|

13 (1)

|

|

38

|

|

Multi-Client

Library Area |

|

742 sq.

miles

(3)

|

|

5,500 sq.

miles

|

|

6,242 sq.

miles

|

|

Employees

(1) |

|

4,077

|

|

|||

|

2008

EBITDA

|

|

$65.0

|

|

$71.9

|

|

$136.9 (4)

|

|

YTD

9/30/09

EBITDA |

|

$71.6

|

|

$9.2

|

|

$80.8 (4)

|

|

Total

Assets

|

|

$459.5

|

|

$211.5

|

|

$755.4 (5)

|

|

Backlog

(9/30/09) |

|

$259

|

|

$196

|

|

$455

|

(1) As of September

2009.

(2) Reflects vibrator

trucks only.

(3) Currently in

process.

(4) Refer to

reconciliation of EBITDA.

US$

millions

13

(5) Total reflects pro

forma adjustments.

NYSE

Amex: GOK - A

World of Opportunities, Revealed

NYSE

Amex: GOK - A

World of Opportunities, Revealed

Extensive

Multi-Client Library

Source: PGS

website.

Multi-Client Data

Library

14

Willow

Bend MC3D

35

square miles

Patrick

Draw

290

square miles

Taloga

102

square miles

Wichita

Mountain Front MC3D

3,000+

square miles

Ultra

Deep Regional 2D

125

square miles

Hearne

East and Flynn 3D

488

square miles

Crockett

3D

455

square miles

Key

Creek North

505

square miles

High

Density Alaska

Foothills

Foothills

500

square miles

Bradford

County

742

square miles (1)

(1) In

progress

PGS

Onshore

Geokinetics

NYSE

Amex: GOK - A

World of Opportunities, Revealed

NYSE

Amex: GOK - A

World of Opportunities, Revealed

15

Strong

Relationships with Diversified

Customer Base

Customer Base

Choice

of Leading Operators - Geokinetics (Pro Forma)

u Long-standing

relationships with major and independent oil and natural gas producers, as well

as

national oil companies throughout the world

national oil companies throughout the world

– Broad distribution

of revenue across customer base

u No one customer

represents more than 16% of total pro forma revenues

NYSE

Amex: GOK - A

World of Opportunities, Revealed

NYSE

Amex: GOK - A

World of Opportunities, Revealed

Execution

of Business Strategy Has Led to

History of Successful Growth

History of Successful Growth

Maintain

focus and specialization in

profitable, high-potential markets

profitable, high-potential markets

16

Prudently

invest in new and

technologically advanced equipment

technologically advanced equipment

Provide

a broad range of services

Diversify

operations geographically, oil

vs. gas, shallow water vs. land and other

services (Multi-Client and Data Process.)

vs. gas, shallow water vs. land and other

services (Multi-Client and Data Process.)

Actively

pursue strategic acquisitions

u In

becoming a leading global seismic provider, Geokinetics has been able

to

execute its business strategy which has resulted in a history of successful growth

execute its business strategy which has resulted in a history of successful growth

Successful

integration of past

acquisitions

acquisitions

Significant

capital investment in assets

and technology

and technology

(Over

$200M over the past three years)

Transition

to more international and

technologically advanced model

technologically advanced model

Significant

growth in revenues and

improvements in profitability

improvements in profitability

Enhanced

asset utilization and

operating efficiency

operating efficiency

NYSE

Amex: GOK - A

World of Opportunities, Revealed

NYSE

Amex: GOK - A

World of Opportunities, Revealed

Financial

Highlights

NYSE

Amex: GOK - A

World of Opportunities, Revealed

NYSE

Amex: GOK - A

World of Opportunities, Revealed

Historical

and Pro Forma Financial

Performance

Performance

Historical

and Pro Forma Revenue & EBITDA Trends

18

Source:

Prospectus Supplement.

$357.7

$474.6

$388.6

$753.4

$530.2

$31.2

$65.0

$71.6

$136.9

$80.8

$0

$100

$200

$300

$400

$500

$600

$700

$800

2007A

2008A

YTD

9/30/09

2008

PF

YTD

9/30/09 PF

Revenues

EBITDA

NYSE

Amex: GOK - A

World of Opportunities, Revealed

NYSE

Amex: GOK - A

World of Opportunities, Revealed

19

Quarterly

Results

Quarterly

earnings can be uneven

u Seasonality

primarily affects second quarter operations due to:

§ Canadian working

season and thaw

§ Colombian rainy

season

u Budgeting cycle of

international companies

u Quarterly volatility

reflects varying crew profitability due to fluctuations in size, job,

location,

utilization of crews and the timing of crew moves

utilization of crews and the timing of crew moves

Quarterly

Revenue ($MM)

NYSE

Amex: GOK - A

World of Opportunities, Revealed

NYSE

Amex: GOK - A

World of Opportunities, Revealed

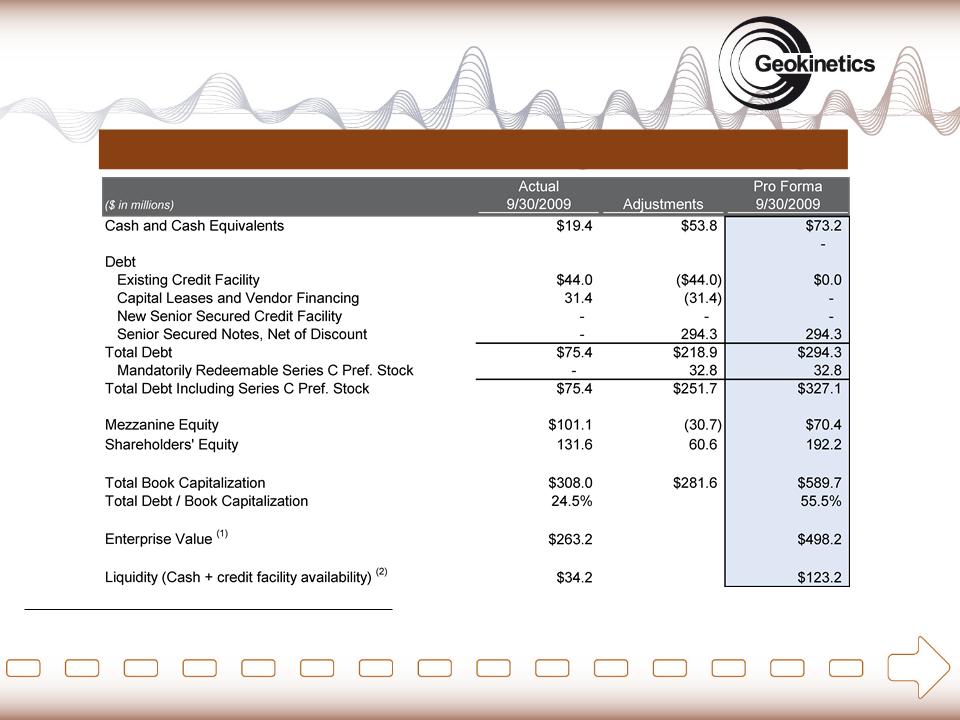

20

Pro

Forma Capitalization and Credit Statistics

Pro

Forma Capitalization (9/30/09)

(1) Enterprise value as

of 12/29/09 based on GOK stock price of $9.81. Stand

alone based on 10.8 million shares outstanding. Pro

forma shares outstanding based on 10.8 million basic shares outstanding +

0.8

million shares issued to Avista + 4.0 million shares issued to the public + 2.2 million shares issued to PGS.

million shares issued to Avista + 4.0 million shares issued to the public + 2.2 million shares issued to PGS.

(2) Represents revolver

availability ($58.8M and $50M on stand alone and PF basis, respectively, less

amount outstanding, plus cash on the balance sheet

NYSE

Amex: GOK - A

World of Opportunities, Revealed

NYSE

Amex: GOK - A

World of Opportunities, Revealed

Geokinetics

and PGS Onshore Capital

Expenditures and Multi-Client Investments

Expenditures and Multi-Client Investments

21

u In

2009, Geokinetics began investment in the Multi-Client data library

u Both

GOK and PGS Onshore capex has fallen in line with drop in oil

prices

u PGS

Onshore has invested heavily over the past several years to develop its

multi-client library in the U.S.

Historical

and Pro Forma Capital Expenditure and Multi-Client Investments

(US$ in

millions)

NYSE

Amex: GOK - A

World of Opportunities, Revealed

NYSE

Amex: GOK - A

World of Opportunities, Revealed

Synergies

Discussion

22

$10

million in

annual

synergies

Cost

Revenue

Growth

Platforms

Platforms

u After

completion of the PGS Onshore acquisition, Geokinetics estimates preliminary

annual synergies of $10

million

million

u Majority

of the synergies to be driven by overlap and cost reductions

u Synergies

will begin to be partially realized in Q2 of 2010

Procurement

Corporate

marketing

Organizational

overlap

Office

overlap

Cross-sell

Market

access

New

technology commercialization

NYSE

Amex: GOK - A

World of Opportunities, Revealed

NYSE

Amex: GOK - A

World of Opportunities, Revealed

Thank

you for your interest.

Investor

Presentation