Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BURLINGTON NORTHERN SANTA FE, LLC | d8k.htm |

Investor

Contact: Linda

Hurt

(817) 352-6452

Media

Contact: John

Ambler

(817)

867-6407

Burlington

Northern Santa Fe Reports

Fourth

Quarter/Full Year 2009 Results

|

·

|

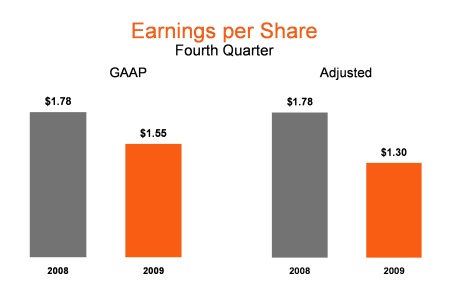

Quarterly

earnings were $1.55 per diluted share, which included a tax benefit of

$0.25 per share related to a fourth-quarter

donation.

|

|

·

|

Compared to

fourth-quarter 2008 earnings of $1.78 per diluted

share

|

|

·

|

Quarterly

freight revenues were $3.57 billion, which included a decrease in fuel

surcharges of $388 million.

|

|

·

|

Compared to

fourth-quarter 2008 freight revenues of $4.25

billion

|

|

·

|

Loads handled

decreased 12 percent

|

|

·

|

Quarterly

operating expenses were $2.79 billion, which included a decrease of $138

million related to lower fuel

prices.

|

|

·

|

Compared to

fourth-quarter 2008 operating expenses of $3.26

billion

|

|

·

|

Strong cost

controls

|

|

·

|

Decreased

unit volumes

|

|

·

|

Full-year

2009 earnings per diluted share were

$5.01.

|

|

·

|

Compared to

full-year 2008 earnings of $6.06 per diluted

share

|

FORT WORTH,

Texas, January 21, 2010 - Burlington

Northern Santa Fe Corporation (BNSF) (NYSE: BNI) today reported quarterly

earnings of $1.55 per diluted share, which included a tax benefit of $0.25 per

share related to the fourth-quarter donation of a portion of a line segment

located in Washington State. This compared to fourth-quarter 2008

earnings of $1.78 per diluted share, which included a fuel surcharge lag benefit

of about $200 million.

“We have seen some improvement in

volumes during the second half of 2009 and expect this gradual improvement to

continue,” said Matthew K. Rose, BNSF Chairman, President and Chief Executive

Officer. “BNSF will continue to position itself to meet demand

consistent with the pace of the economic recovery. And as we look

forward into 2010, we are preparing to become part of the Berkshire Hathaway

family, pending shareholder approval in February.”

1

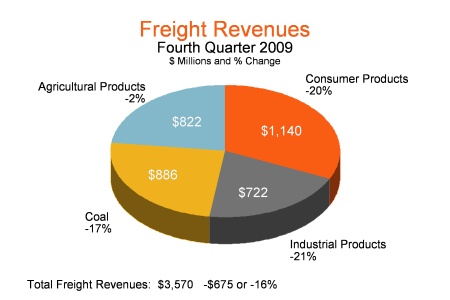

Fourth-quarter 2009 freight

revenues decreased $675 million, or 16 percent, to $3.57 billion compared with

$4.25 billion in the prior year. The 16-percent decrease in revenues included a

decrease in fuel surcharges of $388 million primarily driven by the unfavorable

change in the fuel surcharge lag effect. The remaining variance was due to unit

volumes, which were 12 percent lower as a result of the economic downturn,

partially offset by improved yields.

Coal revenues decreased $181

million, or 17 percent, to $886 million on lower unit volumes driven by soft

demand primarily due to economic conditions, low seasonal burn and

weather-related challenges, partially offset by approximately $30 million for

contract settlements and adjustments with specific customers. Agricultural

Products revenues of $822 million were down $16 million, or 2 percent. Improved

unit volumes, primarily driven by strong soybean exports, and improved yields

were more than offset by a decrease in fuel surcharges. Industrial Products

revenues fell $197 million, or 21 percent, to $722 million, which included a

decline in unit volumes driven primarily by lower demand for construction and

building products, partially offset by improved yields. Consumer Products

revenues declined $281 million, or 20 percent, to $1.14 billion, on lower

volumes due to economic conditions, partially offset by improved

yields. Lower fuel surcharges impacted revenues in each of the

business units.

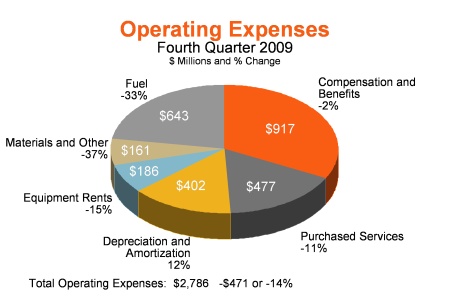

Operating expenses for the

fourth quarter of 2009 were $2.79 billion, a 14-percent reduction compared with

fourth-quarter 2008 operating expenses of $3.26 billion. The $471 million

decrease in operating expenses was principally due to strong cost controls,

decreased unit volumes and lower fuel prices.

Full-year 2009 operating

revenues were $14.0 billion compared to $18.0 billion for 2008. The

decrease in operating revenues included lower fuel surcharges of $2.0

billion. Operating expenses for 2009 declined $3.4 billion, or 24

percent, over the prior year to $10.8 billion. Approximately half of

the $3.4 billion reduction was due to lower fuel prices. The

remaining decrease was due to strong cost controls and lower unit

volumes.

Subsequent

Event

On January 11, 2010, BNSF

transferred operations which completed the sale of a line segment in the State

of Washington, which will result in a gain of $74 million, or

$0.13 per diluted share in the first quarter of

2010.

2

Burlington Northern Santa

Fe Corporation’s subsidiary BNSF Railway Company operates one of the largest

North American rail networks, with about 32,000 route miles in 28 states and two

Canadian provinces. BNSF Railway Company is among the world's top transporters

of intermodal traffic, moves more grain than any other American railroad,

carries the components of many of the products we depend on daily, and hauls

enough low-sulfur coal to generate about ten percent of the electricity produced

in the United States. BNSF Railway Company is an industry leader in Web-enabling

a variety of customer transactions at www.bnsf.com.

BNSF will not be conducting

a fourth quarter earnings conference call.

Financial

information follows:

3

|

Quarterly

earnings were $1.55 per diluted share, which included a tax benefit of

$0.25 per share related to a donation.

· Compared to

fourth-quarter 2008 earnings of $1.78 per

diluted share, which

included a fuel surcharge lag benefit of

about $200

million.

|

|

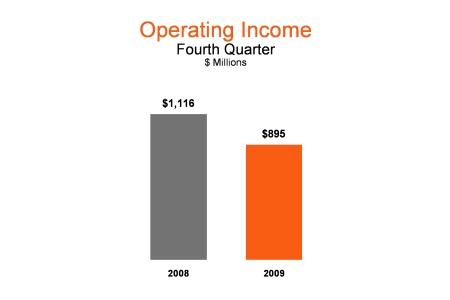

Fourth-quarter

operating income for 2009 was $895 million.

· Compared to

fourth-quarter 2008 operating income of $1.12 billion.

|

|

Freight

revenues decreased $675 million, or 16 percent, to $3.57 billion compared

with the fourth quarter of 2008.

· Loads handled

decreased 12 percent.

· Fuel

surcharges declined by $388 million primarily driven

by the

unfavorable

change in the fuel surcharge lag effect.

|

|

Operating

expenses of $2.79 billion were $471 million, or 14 percent, lower than

fourth quarter 2008.

· Strong cost

controls.

· Decreased

unit volumes.

· Lower fuel

prices decreased fuel expense by $138 million.

|

4

|

Burlington

Northern Santa Fe Corporation

|

|||||||||||||||||||||

|

Consolidated

Income Information *

|

|||||||||||||||||||||

|

(Dollars in

millions, except per share data)

|

|||||||||||||||||||||

| Three Months | |||||||||||||||||||||

| Ended December 31, | Year Ended December 31, | ||||||||||||||||||||

|

2009

|

2008 | 2009 | 2008 |

|

2007 |

|

|||||||||||||||

|

Operating

revenues

|

|||||||||||||||||||||

| Freight revenues | $ | 3,570 | $ | 4,245 | $ | 13,588 | (a) | $ | 17,503 | $ | 15,349 | ||||||||||

|

Other

revenues

|

111 | 128 | 428 | 515 | 453 | ||||||||||||||||

|

Total

operating revenues

|

3,681 | 4,373 | 14,016 | 18,018 | 15,802 | ||||||||||||||||

|

Operating

expenses

|

|||||||||||||||||||||

| Compensation and benefits | 917 | 937 | 3,481 | 3,884 | 3,773 | ||||||||||||||||

| Fuel | 643 | 955 | 2,372 | 4,640 | 3,327 | ||||||||||||||||

| Purchased services | 477 | 533 | 1,873 | 2,133 | 2,023 | ||||||||||||||||

| Depreciation and amortization | 402 | 358 | 1,537 | 1,397 | 1,293 | ||||||||||||||||

| Equipment rents | 186 | 219 | 777 | 901 | 942 | ||||||||||||||||

| Materials and other | 161 | 255 | 714 | 1,151 | (b) | 958 | (c) |

|

|||||||||||||

|

Total

operating expenses

|

2,786 | 3,257 | 10,754 | 14,106 | 12,316 | ||||||||||||||||

|

Operating

income

|

895 | 1,116 | 3,262 | 3,912 | 3,486 | ||||||||||||||||

|

Interest

expense

|

151 | 137 | 613 | (d) | 533 | 511 | |||||||||||||||

|

Other expense,

net

|

3 | - | 8 | 11 | 18 | ||||||||||||||||

|

Income before

income taxes

|

741 | 979 | 2,641 | 3,368 | 2,957 | ||||||||||||||||

|

Income tax

expense (e)

|

205 | 364 | 920 | 1,253 | 1,128 | ||||||||||||||||

|

Net

income

|

$ | 536 | $ | 615 | $ | 1,721 | $ | 2,115 | $ | 1,829 | |||||||||||

|

Diluted

earnings per share

|

$ | 1.55 | $ | 1.78 | $ | 5.01 | $ | 6.06 | $ | 5.06 | |||||||||||

|

Operating

ratio (f)

|

74.9 | % | 73.7 | % | 76.0 | % | 77.6 | % | 77.3 | % | |||||||||||

|

*

|

Certain

comparative prior period amounts have been adjusted to conform to the

current period presentation.

|

|

(a)

|

2009

includes a $66 million charge related to an unfavorable coal rate case

decision.

|

|

(b)

|

Second

quarter 2008 includes a $175 million increase in expense related to

environmental matters in Montana.

|

|

(c)

|

2007

includes a first-quarter charge of $81 million for additional

environmental expenses and a technology system

write-off.

|

|

(d)

|

2009

includes a net $32 million loss on interest rate hedges and $8 million

related to an unfavorable coal rate case decision.

|

|

(e)

|

Fourth

quarter 2009 includes a $0.25 per diluted share tax benefit related to a

donation.

|

|

(f)

|

Calculated

as total operating expenses less other revenues divided by freight

revenues.

|

5

|

Burlington Northern

Santa Fe Corporation

|

||||||||||||||||||||

|

Consolidated

Income Information 2009 *

|

||||||||||||||||||||

|

(Dollars in

millions, except per share data)

|

||||||||||||||||||||

|

2009

|

||||||||||||||||||||

|

1st

|

2nd

|

3rd

|

4th

|

Full

|

||||||||||||||||

|

Quarter

|

Quarter

|

Quarter

|

Quarter

|

Year

|

||||||||||||||||

|

Operating

revenues

|

||||||||||||||||||||

| Freight revenues (a) | $ | 3,312 | $ | 3,217 | $ | 3,489 | $ | 3,570 | $ | 13,588 | ||||||||||

|

Other

revenues

|

112 | 99 | 106 | 111 | 428 | |||||||||||||||

|

Total

operating revenues

|

3,424 | 3,316 | 3,595 | 3,681 | 14,016 | |||||||||||||||

|

Operating

expenses

|

||||||||||||||||||||

| Compensation and benefits | 868 | 824 | 872 | 917 | 3,481 | |||||||||||||||

| Fuel | 614 | 509 | 606 | 643 | 2,372 | |||||||||||||||

| Purchased services | 477 | 466 | 453 | 477 | 1,873 | |||||||||||||||

| Depreciation and amortization | 370 | 379 | 386 | 402 | 1,537 | |||||||||||||||

| Equipment rents | 201 | 196 | 194 | 186 | 777 | |||||||||||||||

| Materials and other | 225 | 145 | 183 | 161 | 714 | |||||||||||||||

|

Total

operating expenses

|

2,755 | 2,519 | 2,694 | 2,786 | 10,754 | |||||||||||||||

|

Operating

income

|

669 | 797 | 901 | 895 | 3,262 | |||||||||||||||

|

Interest

expense (b)

|

198 | 137 | 127 | 151 | 613 | |||||||||||||||

|

Other expense,

net

|

3 | 1 | 1 | 3 | 8 | |||||||||||||||

|

Income before

income taxes

|

468 | 659 | 773 | 741 | 2,641 | |||||||||||||||

|

Income tax

expense (c)

|

175 | 255 | 285 | 205 | 920 | |||||||||||||||

|

Net

income

|

$ | 293 | $ | 404 | $ | 488 | $ | 536 | $ | 1,721 | ||||||||||

|

Diluted

earnings per share

|

$ | 0.86 | $ | 1.18 | $ | 1.42 | $ | 1.55 | $ | 5.01 | ||||||||||

|

Operating

ratio (d)

|

79.8 | % | 75.2 | % | 74.2 | % | 74.9 | % | 76.0 | % | ||||||||||

|

*

|

Certain

interim period amounts have been reclassified to conform to the current

period presentation.

|

|

(a)

|

First

quarter includes a $96 million charge related to an unfavorable coal rate

case decision. Third quarter includes a $30 million favorable

adjustment to the charge taken in the first quarter related to the

unfavorable coal rate case decision.

|

|

(b)

|

First

quarter includes a $42 million loss on interest rate hedges and $9 million

related to an unfavorable coal rate case decision. Second

quarter includes a $10 million gain on interest rate hedges and third

quarter includes a $1 million favorable adjustment related to the charge

taken in the first quarter related to the unfavorable coal rate case

decision.

|

|

(c)

|

Fourth

quarter 2009 includes a $0.25 per diluted share tax benefit related to a

donation.

|

|

(d)

|

Calculated

as total operating expenses less other revenues divided by freight

revenues.

|

6

|

Burlington Northern

Santa Fe Corporation

|

||||||||||||||||||||

|

Consolidated

Income Information 2008 *

|

||||||||||||||||||||

|

(Dollars in

millions, except per share data)

|

||||||||||||||||||||

|

2008

|

||||||||||||||||||||

|

1st

|

2nd

|

3rd

|

4th

|

Full

|

||||||||||||||||

|

Quarter

|

Quarter

|

Quarter

|

Quarter

|

Year

|

||||||||||||||||

|

Operating

revenues

|

||||||||||||||||||||

| Freight revenues | $ | 4,143 | $ | 4,349 | $ | 4,766 | $ | 4,245 | $ | 17,503 | ||||||||||

|

Other

revenues

|

118 | 129 | 140 | 128 | 515 | |||||||||||||||

|

Total

operating revenues

|

4,261 | 4,478 | 4,906 | 4,373 | 18,018 | |||||||||||||||

|

Operating

expenses

|

||||||||||||||||||||

| Compensation and benefits | 983 | 951 | 1,013 | 937 | 3,884 | |||||||||||||||

| Fuel | 1,045 | 1,291 | 1,349 | 955 | 4,640 | |||||||||||||||

| Purchased services | 524 | 539 | 537 | 533 | 2,133 | |||||||||||||||

| Depreciation and amortization | 341 | 349 | 349 | 358 | 1,397 | |||||||||||||||

| Equipment rents | 230 | 223 | 229 | 219 | 901 | |||||||||||||||

| Materials and other (a) | 263 | 411 | 222 | 255 | 1,151 | |||||||||||||||

|

Total

operating expenses

|

3,386 | 3,764 | 3,699 | 3,257 | 14,106 | |||||||||||||||

|

Operating

income

|

875 | 714 | 1,207 | 1,116 | 3,912 | |||||||||||||||

|

Interest

expense

|

134 | 140 | 122 | 137 | 533 | |||||||||||||||

|

Other expense,

net

|

− | 5 | 6 | − | 11 | |||||||||||||||

|

Income before

income taxes

|

741 | 569 | 1,079 | 979 | 3,368 | |||||||||||||||

|

Income tax

expense

|

286 | 219 | 384 | 364 | 1,253 | |||||||||||||||

|

Net

income

|

$ | 455 | $ | 350 | $ | 695 | $ | 615 | $ | 2,115 | ||||||||||

|

Diluted

earnings per share

|

$ | 1.29 | $ | 1.00 | $ | 1.99 | $ | 1.78 | $ | 6.06 | ||||||||||

|

Operating

ratio (b)

|

78.9 | % | 83.6 | % | 74.7 | % | 73.7 | % | 77.6 | % | ||||||||||

|

*

|

Certain

comparative prior period amounts have been adjusted to conform to the

current period presentation.

|

|

(a)

|

Second

quarter includes a $175 million increase in expense related to

environmental matters in Montana.

|

|

(b)

|

Calculated

as total operating expenses less other revenues divided by freight

revenues.

|

7

|

Burlington

Northern Santa Fe Corporation

|

||||||||

|

Consolidated

Balance Sheet Information *

|

||||||||

|

(Dollars in

millions, except per share amounts)

|

||||||||

| December 31, |

|

|||||||

|

2009

|

2008

|

|

||||||

|

Assets

|

||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 1,269 | $ | 633 | ||||

| Accounts receivable, net | 787 | 847 | ||||||

| Materials and supplies | 633 | 525 | ||||||

| Current portion of deferred income taxes | 290 | 442 | ||||||

| Other current assets | 277 | 218 | ||||||

| Total current assets | 3,256 | 2,665 | ||||||

|

Property and

equipment, net

|

32,294 | 30,847 | ||||||

|

Other

assets

|

3,125 | 2,891 | ||||||

|

Total

assets

|

$ | 38,675 | $ | 36,403 | ||||

|

Liabilities

and stockholders' equity

|

||||||||

| Current liabilities: | ||||||||

| Accounts payable and other current liabilities | $ | 2,695 | $ | 3,190 | ||||

| Long-term debt due within one year | 644 | 456 | ||||||

|

Total current

liabilities

|

3,339 | 3,646 | ||||||

|

Long-term

debt

|

9,691 | 9,099 | ||||||

|

Deferred

income taxes

|

9,322 | 8,590 | ||||||

|

Casualty and

environmental liabilities

|

899 | 959 | ||||||

|

Pension and

retiree health and welfare liability

|

783 | 1,047 | ||||||

|

Other

liabilities

|

1,843 | 1,931 | ||||||

|

Total

liabilities

|

25,877 | 25,272 | ||||||

|

Stockholders'

equity:

|

||||||||

| Common stock and additional paid-in capital | 7,781 | 7,636 | ||||||

| Retained earnings | 13,941 | 12,764 | ||||||

| Treasury stock and other | (8,924 | ) | (9,269 | ) | ||||

|

Total

stockholders' equity

|

12,798 | 11,131 | ||||||

|

Total

liabilities and stockholders' equity

|

$ | 38,675 | $ | 36,403 | ||||

|

Book value per

share

|

$ | 37.56 | $ | 32.82 | ||||

|

Common shares

outstanding (in millions)

|

340.7 | 339.2 | ||||||

|

*

|

Certain

comparative prior period amounts have been adjusted to conform to the

current period presentation.

|

8

|

Burlington Northern

Santa Fe Corporation

|

||||||||||||||||||||

|

Consolidated

Cash Flow Information *

|

||||||||||||||||||||

|

(in

millions)

|

||||||||||||||||||||

| Three Months | ||||||||||||||||||||

| Ended December 31, | Year Ended December 31, | |||||||||||||||||||

|

2009

|

2008

|

2009

|

2008

|

2007

|

||||||||||||||||

|

Operating

activities

|

|

|||||||||||||||||||

|

Net

income

|

$ | 536 | $ | 615 | $ | 1,721 | $ | 2,115 | $ | 1,829 | ||||||||||

|

Adjustments to

reconcile net income to net cash

provided by

operating activities:

|

||||||||||||||||||||

|

Depreciation

and amortization

|

402 | 358 | 1,537 | 1,397 | 1,293 | |||||||||||||||

|

Deferred

income taxes

|

154 | 169 | 612 | 417 | 280 | |||||||||||||||

|

Long-term

casualty and environmental

liabilities,

net

|

(59 | ) | (31 | ) | (90 | ) | 150 | 26 | ||||||||||||

|

Other,

net

|

(226 | ) | 27 | (210 | ) | 66 | 162 | |||||||||||||

|

Changes in

accounts receivable sales program

|

− | (528 | ) | (50 | ) | (250 | ) | − | ||||||||||||

|

Other changes

in working capital

|

(32 | ) | 64 | (107 | ) | 82 | (98 | ) | ||||||||||||

|

Net cash

provided by operating activities

|

775 | 674 | 3,413 | 3,977 | 3,492 | |||||||||||||||

|

Investing

activities

|

||||||||||||||||||||

|

Capital

expenditures excluding equipment

|

(322 | ) | (463 | ) | (1,991 | ) | (2,167 | ) | (2,248 | ) | ||||||||||

|

Acquisition of

equipment

|

(118 | ) | (273 | ) | (733 | ) | (949 | ) | (745 | ) | ||||||||||

|

Proceeds from

sale of equipment financed

|

− | 158 | 368 | 348 | 778 | |||||||||||||||

|

Construction

costs for facility financing obligation

|

(1 | ) | (26 | ) | (37 | ) | (64 | ) | (37 | ) | ||||||||||

|

Other,

net

|

(77 | ) | (88 | ) | (244 | ) | (241 | ) | (163 | ) | ||||||||||

|

Net cash used

for investing activities

|

(518 | ) | (692 | ) | (2,637 | ) | (3,073 | ) | (2,415 | ) | ||||||||||

|

Financing

activities

|

||||||||||||||||||||

|

Net (payments)

borrowings

|

(56 | ) | 557 | 296 | 772 | 234 | ||||||||||||||

|

Dividends

paid

|

(137 | ) | (137 | ) | (546 | ) | (471 | ) | (380 | ) | ||||||||||

|

Purchase of

BNSF common stock

|

(1 | ) | (269 | ) | (16 | ) | (1,147 | ) | (1,265 | ) | ||||||||||

|

Proceeds from

stock options exercised

|

33 | 4 | 59 | 91 | 142 | |||||||||||||||

|

Proceeds from

facility financing obligation

|

− | 18 | 51 | 68 | 41 | |||||||||||||||

|

Other,

net

|

12 | 2 | 16 | 86 | 106 | |||||||||||||||

|

Net cash (used

for) provided by financing activities

|

(149 | ) | 175 | (140 | ) | (601 | ) | (1,122 | ) | |||||||||||

|

Increase

(decrease) in cash and cash equivalents

|

108 | 157 | 636 | 303 | (45 | ) | ||||||||||||||

|

Cash and cash

equivalents:

|

||||||||||||||||||||

|

Beginning of

period

|

1,161 | 476 | 633 | 330 | 375 | |||||||||||||||

|

End of

period

|

$ | 1,269 | $ | 633 | $ | 1,269 | $ | 633 | $ | 330 | ||||||||||

|

*

|

Certain

comparative prior period amounts have been adjusted to conform to the

current period presentation.

|

9

|

Burlington Northern Santa Fe

Corporation

|

||||||||||||||||||||

|

Consolidated

Cash Flow Information

|

||||||||||||||||||||

|

(in

millions)

|

||||||||||||||||||||

|

2009

|

||||||||||||||||||||

|

1st

|

2nd

|

3rd

|

4th

|

Full

|

||||||||||||||||

|

Quarter

|

Quarter

|

Quarter

|

Quarter

|

Year

|

||||||||||||||||

|

Operating

activities

|

||||||||||||||||||||

|

Net

income

|

$ | 293 | $ | 404 | $ | 488 | $ | 536 | $ | 1,721 | ||||||||||

|

Adjustments to

reconcile net income to net cash

provided by

operating activities:

|

||||||||||||||||||||

|

Depreciation

and amortization

|

370 | 379 | 386 | 402 | 1,537 | |||||||||||||||

|

Deferred

income taxes

|

90 | 168 | 200 | 154 | 612 | |||||||||||||||

|

Long-term

casualty and environmental

liabilities,

net

|

(1 | ) | (29 | ) | (1 | ) | (59 | ) | (90 | ) | ||||||||||

|

Other,

net

|

49 | (34 | ) | 1 | (226 | ) | (210 | ) | ||||||||||||

|

Changes in

accounts receivable sales program

|

(50 | ) | − | − | − | (50 | ) | |||||||||||||

|

Other changes

in working capital

|

(17 | ) | (100 | ) | 42 | (32 | ) | (107 | ) | |||||||||||

|

Net cash

provided by operating activities

|

734 | 788 | 1,116 | 775 | 3,413 | |||||||||||||||

|

|

||||||||||||||||||||

|

Investing

activities

|

||||||||||||||||||||

|

Capital

expenditures excluding equipment

|

(462 | ) | (620 | ) | (587 | ) | (322 | ) | (1,991 | ) | ||||||||||

|

Acquisition of

equipment

|

(286 | ) | (170 | ) | (159 | ) | (118 | ) | (733 | ) | ||||||||||

|

Proceeds from

sale of equipment financed

|

368 | − | − | − | 368 | |||||||||||||||

|

Construction

costs for facility financing obligation

|

(13 | ) | (18 | ) | (5 | ) | (1 | ) | (37 | ) | ||||||||||

|

Other,

net

|

2 | (98 | ) | (71 | ) | (77 | ) | (244 | ) | |||||||||||

|

Net cash used

for investing activities

|

(391 | ) | (906 | ) | (822 | ) | (518 | ) | (2,637 | ) | ||||||||||

|

Financing

activities

|

||||||||||||||||||||

| Net (payments) borrowings | (251 | ) | 96 | 507 | (56 | ) | 296 | |||||||||||||

|

Dividends

paid

|

(136 | ) | (137 | ) | (136 | ) | (137 | ) | (546 | ) | ||||||||||

|

Purchase of

BNSF common stock

|

(4 | ) | (8 | ) | (3 | ) | (1 | ) | (16 | ) | ||||||||||

|

Proceeds from

stock options exercised

|

8 | 4 | 14 | 33 | 59 | |||||||||||||||

|

Proceeds from

facility financing obligation

|

15 | 36 | − | − | 51 | |||||||||||||||

|

Other,

net

|

2 | 1 | 1 | 12 | 16 | |||||||||||||||

|

Net cash (used

for) provided by financing activities

|

(366 | ) | (8 | ) | 383 | (149 | ) | (140 | ) | |||||||||||

|

(Decrease)

increase in cash and cash equivalents

|

(23 | ) | (126 | ) | 677 | 108 | 636 | |||||||||||||

|

Cash and cash

equivalents:

|

||||||||||||||||||||

|

Beginning of

period

|

633 | 610 | 484 | 1,161 | 633 | |||||||||||||||

|

End of

period

|

$ | 610 | $ | 484 | $ | 1,161 | $ | 1,269 | $ | 1,269 | ||||||||||

10

|

Burlington

Northern Santa Fe Corporation

|

|||||||||||||||||||||||

|

Operating

Statistics *

|

|||||||||||||||||||||||

| Three Months | |||||||||||||||||||||||

| Ended December 31, | Year Ended December 31, | ||||||||||||||||||||||

|

2009

|

2008

|

2009 |

|

2008 |

|

2007 |

|

||||||||||||||||

|

Revenue

Statistics

|

|||||||||||||||||||||||

|

Cars

/ units (in thousands)

|

2,112 | 2,409 | 8,418 | 9,994 | 10,318 | ||||||||||||||||||

|

Average revenue per car / unit

|

$ | 1,690 | $ | 1,762 | $ | 1,622 | (a) |

|

$ | 1,751 | $ | 1,488 | |||||||||||

|

Average length of haul (miles)

|

1,128 | 1,097 | 1,108 | 1,090 | 1,079 | ||||||||||||||||||

|

Revenue ton miles (in millions)

|

150,047 | 161,941 | 593,573 | 664,384 | 657,572 | ||||||||||||||||||

|

Freight revenue / thousand GTM

|

$ | 14.31 | $ | 15.65 | $ | 13.87 | (a) |

|

$ | 15.63 | $ | 13.69 | |||||||||||

|

Freight revenue / thousand RTM

|

$ | 23.79 | $ | 26.21 | $ | 23.00 | (a) |

|

$ | 26.34 | $ | 23.34 | |||||||||||

|

Operating

/ Productivity Statistics

|

|||||||||||||||||||||||

|

Operating Expense

|

|||||||||||||||||||||||

|

Gross ton miles (in millions)

|

249,476 | 271,252 | 984,120 | 1,119,616 | 1,121,255 | ||||||||||||||||||

|

Operating expense / thousand GTM

|

$ | 11.17 | $ | 12.01 | $ | 10.93 | $ | 12.60 | (b) |

|

$ | 10.98 | (c) |

|

|||||||||

|

Thousand GTM / average employee

|

6,948 | 6,660 | 26,339 | 27,360 | 27,058 | ||||||||||||||||||

|

Compensation

|

|||||||||||||||||||||||

|

Average

employees

|

35,908 | 40,729 | 37,363 | 40,922 | 41,439 | ||||||||||||||||||

|

Compensation and benefits / average employee

|

$ | 25,542 | $ | 23,025 | $ | 93,153 | $ | 94,923 | $ | 91,054 | |||||||||||||

|

Compensation and benefits / thousand

GTM

|

$ | 3.68 | $ | 3.45 | $ | 3.54 | $ | 3.47 | $ | 3.36 | |||||||||||||

|

Fuel

(d)

|

|||||||||||||||||||||||

|

GTM / gallon of fuel

|

837 | 782 | 821 | 791 | 778 | ||||||||||||||||||

|

Gallons of fuel used (in millions)

|

298 | 347 | 1,198 | 1,415 | 1,442 | ||||||||||||||||||

|

Average price per gallon of fuel (e)

|

$ | 2.07 | $ | 2.63 | $ | 1.89 | $ | 3.16 | $ | 2.22 | |||||||||||||

|

Velocity

|

|||||||||||||||||||||||

|

Locomotive miles per day

|

311.1 | 292.6 | 307.9 | 296.6 | 299.5 | ||||||||||||||||||

|

Car miles per day

|

231.3 | 219.7 | 230.0 | 207.1 | 198.2 | ||||||||||||||||||

|

*

|

Certain

comparative prior period amounts have been adjusted to conform to the

current period presentation.

|

||||||||||||||||||||||

|

(a)

|

Coal

revenues on a GAAP basis were $3,564 million for the year ended December

31, 2009. However, for comparative purposes the table above excludes (from

coal revenues and from the computation of amounts derived therefrom) a $66

million unfavorable impact related to a coal rate case decision for the

year ended December 31, 2009.

|

||||||||||||||||||||||

|

(b)

|

Second

quarter 2008 includes a $175 million increase in expense related to

environmental matters in Montana.

|

||||||||||||||||||||||

|

(c)

|

2007

includes a first-quarter charge of $81 million for additional

environmental expenses and a technology system write-off.

|

||||||||||||||||||||||

|

(d)

|

Fuel

statistics are based on locomotive diesel fuel.

|

||||||||||||||||||||||

|

(e)

|

Includes

handling, taxes and hedge effect.

|

||||||||||||||||||||||

11

|

Burlington Northern

Santa Fe Corporation

|

||||||||||||||||||||

|

Operating

Statistics

|

||||||||||||||||||||

| 2009 |

|

|||||||||||||||||||

|

1st

|

2nd

|

3rd

|

4th

|

Full |

|

|||||||||||||||

|

Quarter

|

Quarter

|

Quarter

|

Quarter

|

Year |

|

|||||||||||||||

|

Revenue

Statistics

|

|

|||||||||||||||||||

|

Cars

/ units (in thousands)

|

2,128 | 2,041 | 2,137 | 2,112 | 8,418 | |||||||||||||||

|

Average

revenue per car / unit (a)

|

$ | 1,602 | $ | 1,576 | $ | 1,619 | $ | 1,690 | $ | 1,622 | ||||||||||

|

Average

length of haul (miles)

|

1,099 | 1,110 | 1,096 | 1,128 | 1,108 | |||||||||||||||

|

Revenue

ton miles (in millions)

|

149,148 | 143,703 | 150,675 | 150,047 | 593,573 | |||||||||||||||

|

Freight

revenue / thousand GTM (a)

|

$ | 13.80 | $ | 13.50 | $ | 13.88 | $ | 14.31 | $ | 13.87 | ||||||||||

|

Freight

revenue / thousand RTM (a)

|

$ | 22.85 | $ | 22.39 | $ | 22.96 | $ | 23.79 | $ | 23.00 | ||||||||||

|

Operating

/ Productivity Statistics

|

||||||||||||||||||||

|

Operating

Expense

|

||||||||||||||||||||

|

Gross

ton miles (in millions)

|

247,008 | 238,376 | 249,260 | 249,476 | 984,120 | |||||||||||||||

|

Operating

expense / thousand GTM

|

$ | 11.15 | $ | 10.57 | $ | 10.81 | $ | 11.17 | $ | 10.93 | ||||||||||

|

Thousand

GTM / average employee

|

6,421 | 6,320 | 6,672 | 6,948 | 26,339 | |||||||||||||||

|

Compensation

|

||||||||||||||||||||

|

Average

employees

|

38,468 | 37,715 | 37,359 | 35,908 | 37,363 | |||||||||||||||

|

Compensation

and benefits / average employee

|

$ | 22,561 | $ | 21,848 | $ | 23,326 | $ | 25,542 | $ | 93,153 | ||||||||||

|

Compensation

and benefits / thousand

GTM

|

$ | 3.51 | $ | 3.46 | $ | 3.49 | $ | 3.68 | $ | 3.54 | ||||||||||

|

Fuel (b)

|

||||||||||||||||||||

|

GTM

/ gallon of fuel

|

777 | 816 | 860 | 837 | 821 | |||||||||||||||

|

Gallons

of fuel used (in millions)

|

318 | 292 | 290 | 298 | 1,198 | |||||||||||||||

|

Average

price per gallon of fuel (c)

|

$ | 1.85 | $ | 1.65 | $ | 1.99 | $ | 2.07 | $ | 1.89 | ||||||||||

|

Velocity

|

||||||||||||||||||||

|

Locomotive

miles per day

|

298.6 | 310.9 | 312.1 | 311.1 | 307.9 | |||||||||||||||

|

Car

miles per day

|

224.0 | 236.1 | 229.2 | 231.3 | 230.0 | |||||||||||||||

|

(a)

|

Coal

revenues on a GAAP basis were $863 million and $940 million for the three

month periods ended March 31, 2009 and September 30, 2009, respectively.

However, for comparative purposes the table above excludes (from coal

revenues and from the computation of amounts derived therefrom) a $96

million unfavorable and $30 million favorable impact related to a coal

rate case decision for the three month periods ended March 31, 2009 and

September 30, 2009, respectively.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(b)

|

Fuel

statistics are based on locomotive diesel fuel.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(c)

|

Includes

handling, taxes and hedge effect.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

12

|

Burlington

Northern Santa Fe Corporation

|

|||||||||||||||||||||||

|

Revenue

Statistics by Commodity

|

|||||||||||||||||||||||

| Three Months | 08-09 | ||||||||||||||||||||||

| Ended December 31, |

Percent

|

Year Ended December 31, | Percent | ||||||||||||||||||||

|

Revenues (in

millions)

|

2009

|

2008

|

Change

|

2009

|

2008

|

2007

|

Change

|

|

|||||||||||||||

|

Domestic

Intermodal

|

$ | 557 | $ | 681 | (18.2 | ) % | $ | 2,110 | $ | 2,830 | $ | 2,541 | (25.4 | ) % |

|

||||||||

|

International

Intermodal

|

486 | 626 | (22.4 | ) | 1,869 | 2,721 | 2,627 | (31.3 | ) | ||||||||||||||

|

Automotive

|

97 | 114 | (14.9 | ) | 337 | 513 | 496 | (34.3 | ) | ||||||||||||||

|

Total Consumer

Products

|

1,140 | 1,421 | (19.8 | ) | 4,316 | 6,064 | 5,664 | (28.8 | ) | ||||||||||||||

|

Coal

(a)

|

886 | 1,067 | (17.0 | ) | 3,630 | 3,970 | 3,279 | (8.6 | ) | ||||||||||||||

|

Industrial

Products

|

722 | 919 | (21.4 | ) | 2,874 | 4,028 | 3,684 | (28.6 | ) | ||||||||||||||

|

Agricultural

Products

|

822 | 838 | (1.9 | ) | 2,834 | 3,441 | 2,722 | (17.6 | ) | ||||||||||||||

|

Total freight

revenue

|

3,570 | 4,245 | (15.9 | ) | 13,654 | 17,503 | 15,349 | (22.0 | ) | ||||||||||||||

|

Other

revenue

|

111 | 128 | (13.3 | ) | 428 | 515 | 453 | (16.9 | ) | ||||||||||||||

|

Total

revenues

|

$ | 3,681 | $ | 4,373 | (15.8 | ) % | $ | 14,082 | $ | 18,018 | $ | 15,802 | (21.8 | ) % |

|

||||||||

|

Cars/units (in

thousands)

|

|||||||||||||||||||||||

|

Domestic

Intermodal

|

478 | 534 | (10.5 | ) % | 1,859 | 2,132 | 2,097 | (12.8 | ) % |

|

|||||||||||||

|

International

Intermodal

|

493 | 599 | (17.7 | ) | 1,954 | 2,542 | 2,886 | (23.1 | ) | ||||||||||||||

|

Automotive

|

28 | 30 | (6.7 | ) | 98 | 144 | 166 | (31.9 | ) | ||||||||||||||

|

Total Consumer

Products

|

999 | 1,163 | (14.1 | ) | 3,911 | 4,818 | 5,149 | (18.8 | ) | ||||||||||||||

|

Coal

|

570 | 648 | (12.0 | ) | 2,390 | 2,516 | 2,472 | (5.0 | ) | ||||||||||||||

|

Industrial

Products

|

284 | 353 | (19.5 | ) | 1,172 | 1,598 | 1,664 | (26.7 | ) | ||||||||||||||

|

Agricultural

Products

|

259 | 245 | 5.7 | 945 | 1,062 | 1,033 | (11.0 | ) | |||||||||||||||

|

Total

cars/units

|

2,112 | 2,409 | (12.3 | ) % | 8,418 | 9,994 | 10,318 | (15.8 | ) % |

|

|||||||||||||

|

Average

revenue per car/unit

|

|||||||||||||||||||||||

|

Domestic

Intermodal

|

$ | 1,165 | $ | 1,275 | (8.6 | ) % | $ | 1,135 | $ | 1,327 | $ | 1,212 | (14.5 | ) % |

|

||||||||

|

International

Intermodal

|

986 | 1,045 | (5.6 | ) | 956 | 1,070 | 910 | (10.7 | ) | ||||||||||||||

|

Automotive

|

3,464 | 3,800 | (8.8 | ) | 3,439 | 3,563 | 2,988 | (3.5 | ) | ||||||||||||||

|

Total Consumer

Products

|

1,141 | 1,222 | (6.6 | ) | 1,104 | 1,259 | 1,100 | (12.3 | ) | ||||||||||||||

|

Coal

(a)

|

1,554 | 1,647 | (5.6 | ) | 1,519 | 1,578 | 1,326 | (3.7 | ) | ||||||||||||||

|

Industrial

Products

|

2,542 | 2,603 | (2.3 | ) | 2,452 | 2,521 | 2,214 | (2.7 | ) | ||||||||||||||

|

Agricultural

Products

|

3,174 | 3,420 | (7.2 | ) | 2,999 | 3,240 | 2,635 | (7.4 | ) | ||||||||||||||

|

Average

revenue per car/unit

|

$ | 1,690 | $ | 1,762 | (4.1 | ) % | $ | 1,622 | $ | 1,751 | $ | 1,488 | (7.4 | ) % |

|

||||||||

|

Revenue

ton miles (in millions)

|

|||||||||||||||||||||||

|

Domestic

Intermodal

|

12,374 | 13,604 | (9.0 | ) % | 48,520 | 54,555 | 52,492 | (11.1 | ) % |

|

|||||||||||||

|

International

Intermodal

|

15,665 | 16,748 | (6.5 | ) | 60,489 | 74,942 | 82,526 | (19.3 | ) | ||||||||||||||

|

Automotive

|

1,040 | 1,068 | (2.6 | ) | 3,733 | 5,304 | 6,123 | (29.6 | ) | ||||||||||||||

|

Total Consumer

Products

|

29,079 | 31,420 | (7.5 | ) | 112,742 | 134,801 | 141,141 | (16.4 | ) | ||||||||||||||

|

Coal

|

66,314 | 75,943 | (12.7 | ) | 280,287 | 291,513 | 280,365 | (3.9 | ) | ||||||||||||||

|

Industrial

Products

|

21,893 | 25,069 | (12.7 | ) | 87,206 | 113,125 | 117,338 | (22.9 | ) | ||||||||||||||

|

Agricultural

Products

|

32,761 | 29,509 | 11.0 | 113,338 | 124,945 | 118,728 | (9.3 | ) | |||||||||||||||

|

Total

revenue ton miles

|

150,047 | 161,941 | (7.3 | ) % | 593,573 | 664,384 | 657,572 | (10.7 | ) % |

|

|||||||||||||

|

Freight

revenue per thousand ton miles

|

|||||||||||||||||||||||

|

Domestic

Intermodal

|

$ | 45.01 | $ | 50.06 | (10.1 | ) % | $ | 43.49 | $ | 51.87 | $ | 48.41 | (16.2 | ) % |

|

||||||||

|

International

Intermodal

|

31.02 | 37.38 | (17.0 | ) | 30.90 | 36.31 | 31.83 | (14.9 | ) | ||||||||||||||

|

Automotive

|

93.27 | 106.74 | (12.6 | ) | 90.28 | 96.72 | 81.01 | (6.7 | ) | ||||||||||||||

|

Total Consumer

Products

|

39.20 | 45.23 | (13.3 | ) | 38.28 | 44.98 | 40.13 | (14.9 | ) | ||||||||||||||

|

Coal

(a)

|

13.36 | 14.05 | (4.9 | ) | 12.95 | 13.62 | 11.70 | (4.9 | ) | ||||||||||||||

|

Industrial

Products

|

32.98 | 36.66 | (10.0 | ) | 32.96 | 35.61 | 31.40 | (7.4 | ) | ||||||||||||||

|

Agricultural

Products

|

25.09 | 28.40 | (11.7 | ) | 25.00 | 27.54 | 22.93 | (9.2 | ) | ||||||||||||||

|

Freight

revenue per thousand ton miles

|

$ | 23.79 | $ | 26.21 | (9.2 | ) % | $ | 23.00 | $ | 26.34 | $ | 23.34 | (12.7 | ) % |

|

||||||||

|

|

|

(a)

Coal revenues on a GAAP basis were $3,564 million for the year

ended December 31, 2009. For comparative purposes, the table above

excludes the impact related to the coal rate decision (see note (a) on

page

11).

|

13

|

Burlington

Northern Santa Fe Corporation

|

||||||||||||||||||||

| Revenue Statistics by Commodity | ||||||||||||||||||||

|

|

2009

|

|||||||||||||||||||

|

1st

|

2nd

|

3rd

|

4th

|

Full

|

||||||||||||||||

|

Revenues (in

millions)

|

Quarter

|

Quarter

|

Quarter

|

Quarter

|

Year

|

|||||||||||||||

|

Domestic

Intermodal

|

$ | 515 | $ | 512 | $ | 526 | $ | 557 | $ | 2,110 | ||||||||||

|

International

Intermodal

|

462 | 444 | 477 | 486 | 1,869 | |||||||||||||||

|

Automotive

|

74 | 82 | 84 | 97 | 337 | |||||||||||||||

|

Total Consumer

Products

|

1,051 | 1,038 | 1,087 | 1,140 | 4,316 | |||||||||||||||

|

Coal

(a)

|

959 | 875 | 910 | 886 | 3,630 | |||||||||||||||

|

Industrial

Products

|

719 | 686 | 747 | 722 | 2,874 | |||||||||||||||

|

Agricultural

Products

|

679 | 618 | 715 | 822 | 2,834 | |||||||||||||||

|

Total freight

revenue

|

3,408 | 3,217 | 3,459 | 3,570 | 13,654 | |||||||||||||||

|

Other

revenue

|

112 | 99 | 106 | 111 | 428 | |||||||||||||||

|

Total

revenues

|

$ | 3,520 | $ | 3,316 | $ | 3,565 | $ | 3,681 | $ | 14,082 | ||||||||||

|

Cars/units (in

thousands)

|

||||||||||||||||||||

|

Domestic

Intermodal

|

458 | 460 | 463 | 478 | 1,859 | |||||||||||||||

|

International

Intermodal

|

497 | 474 | 490 | 493 | 1,954 | |||||||||||||||

|

Automotive

|

21 | 24 | 25 | 28 | 98 | |||||||||||||||

|

Total Consumer

Products

|

976 | 958 | 978 | 999 | 3,911 | |||||||||||||||

|

Coal

|

627 | 589 | 604 | 570 | 2,390 | |||||||||||||||

|

Industrial

Products

|

298 | 282 | 308 | 284 | 1,172 | |||||||||||||||

|

Agricultural

Products

|

227 | 212 | 247 | 259 | 945 | |||||||||||||||

|

Total

cars/units

|

2,128 | 2,041 | 2,137 | 2,112 | 8,418 | |||||||||||||||

|

Average

revenue per car/unit

|

||||||||||||||||||||

|

Domestic

Intermodal

|

$ | 1,124 | $ | 1,113 | $ | 1,136 | $ | 1,165 | $ | 1,135 | ||||||||||

|

International

Intermodal

|

930 | 937 | 973 | 986 | 956 | |||||||||||||||

|

Automotive

|

3,524 | 3,417 | 3,360 | 3,464 | 3,439 | |||||||||||||||

|

Total Consumer

Products

|

1,077 | 1,084 | 1,111 | 1,141 | 1,104 | |||||||||||||||

|

Coal

(a)

|

1,530 | 1,486 | 1,507 | 1,554 | 1,519 | |||||||||||||||

|

Industrial

Products

|

2,413 | 2,433 | 2,425 | 2,542 | 2,452 | |||||||||||||||

|

Agricultural

Products

|

2,991 | 2,915 | 2,895 | 3,174 | 2,999 | |||||||||||||||

|

Average

revenue per car/unit

|

$ | 1,602 | $ | 1,576 | $ | 1,619 | $ | 1,690 | $ | 1,622 | ||||||||||

|

Revenue

ton miles (in millions)

|

||||||||||||||||||||

|

Domestic

Intermodal

|

11,867 | 12,125 | 12,154 | 12,374 | 48,520 | |||||||||||||||

|

International

Intermodal

|

14,700 | 14,959 | 15,165 | 15,665 | 60,489 | |||||||||||||||

|

Automotive

|

793 | 940 | 960 | 1,040 | 3,733 | |||||||||||||||

|

Total Consumer

Products

|

27,360 | 28,024 | 28,279 | 29,079 | 112,742 | |||||||||||||||

|

Coal

|

73,245 | 69,475 | 71,253 | 66,314 | 280,287 | |||||||||||||||

|

Industrial

Products

|

21,301 | 21,060 | 22,952 | 21,893 | 87,206 | |||||||||||||||

|

Agricultural

Products

|

27,242 | 25,144 | 28,191 | 32,761 | 113,338 | |||||||||||||||

|

Total

revenue ton miles

|

149,148 | 143,703 | 150,675 | 150,047 | 593,573 | |||||||||||||||

|

Freight

revenue per thousand ton miles

|

||||||||||||||||||||

|

Domestic

Intermodal

|

$ | 43.40 | $ | 42.23 | $ | 43.28 | $ | 45.01 | $ | 43.49 | ||||||||||

|

International

Intermodal

|

31.43 | 29.68 | 31.45 | 31.02 | 30.90 | |||||||||||||||

|

Automotive

|

93.32 | 87.23 | 87.50 | 93.27 | 90.28 | |||||||||||||||

|

Total Consumer

Products

|

38.41 | 37.04 | 38.44 | 39.20 | 38.28 | |||||||||||||||

|

Coal

(a)

|

13.09 | 12.59 | 12.77 | 13.36 | 12.95 | |||||||||||||||

|

Industrial

Products

|

33.75 | 32.57 | 32.55 | 32.98 | 32.96 | |||||||||||||||

|

Agricultural

Products

|

24.92 | 24.58 | 25.36 | 25.09 | 25.00 | |||||||||||||||

|

Freight

revenue per thousand ton miles

|

$ | 22.85 | $ | 22.39 | $ | 22.96 | $ | 23.79 | $ | 23.00 | ||||||||||

|

|

||||||||||||||||||||

|

(a)

Coal revenues on a GAAP basis

were $863 million and $940 million for the three month periods ended March

31, 2009 and September 30, 2009, respectively. However, for comparative

purposes the table above excludes (from coal revenues and from the

computation of amounts derived therefrom) a $96 million unfavorable and

$30 million favorable impact related to a coal rate case decision for the

three month periods ended March 31, 2009 and September 30, 2009,

respectively.

|

14

|

Burlington

Northern Santa Fe Corporation

|

||||||||||||||||||||

|

Capital

Expenditures *

|

||||||||||||||||||||

| Three Months | ||||||||||||||||||||

| Ended December 31, | Year Ended December 31, | |||||||||||||||||||

|

2009

|

2008

|

2009

|

2008

|

2007 |

|

|||||||||||||||

|

Capital

expenditures excluding equipment (in

millions)

|

||||||||||||||||||||

|

Engineering

|

|

|||||||||||||||||||

|

Rail

|

$ | 34 | $ | 89 | $ | 416 | $ | 429 | $ | 376 | ||||||||||

|

Ties

|

36 | 69 | 391 | 358 | 316 | |||||||||||||||

|

Surfacing

|

50 | 45 | 252 | 230 | 235 | |||||||||||||||

|

Other

|

127 | 138 | 546 | 544 | 432 | |||||||||||||||

|

Total

engineering

|

247 | 341 | 1,605 | 1,561 | 1,359 | |||||||||||||||

|

Mechanical

|

21 | 52 | 107 | 168 | 141 | |||||||||||||||

|

Other

|

22 | 46 | 110 | 133 | 105 | |||||||||||||||

|

Total

replacement capital

|

290 | 439 | 1,822 | 1,862 | 1,605 | |||||||||||||||

|

Information

services

|

24 | 12 | 83 | 83 | 75 | |||||||||||||||

|

Terminal and

line expansion

|

8 | 12 | 86 | 222 | 568 | |||||||||||||||

|

Total capital

expenditures excluding equipment

|

$ | 322 | $ | 463 | $ | 1,991 | $ | 2,167 | $ | 2,248 | ||||||||||

|

Acquisition

of equipment

|

$ | 118 | $ | 273 | $ | 733 | $ | 949 | $ | 745 | ||||||||||

|

Track miles of

rail laid

|

||||||||||||||||||||

|

Replacement

capital

|

54 | 186 | 904 | 885 | 773 | |||||||||||||||

|

Expansion

projects

|

2 | 5 | 19 | 48 | 183 | |||||||||||||||

|

Total

|

56 | 191 | 923 | 933 | 956 | |||||||||||||||

|

Cross ties

inserted (thousands)

|

||||||||||||||||||||

|

Replacement

capital

|

182 | 651 | 3,284 | 3,038 | 2,708 | |||||||||||||||

|

Expansion

projects

|

4 | 9 | 26 | 129 | 418 | |||||||||||||||

|

Total

|

186 | 660 | 3,310 | 3,167 | 3,126 | |||||||||||||||

|

Track

resurfaced (miles)

|

2,833 | 2,397 | 15,456 | 13,005 | 11,687 | |||||||||||||||

|

*

|

Certain comparative prior period amounts have been adjusted to conform to the current period presentation. | |

15

|

Burlington Northern

Santa Fe Corporation

|

||||||||||||||||||||

|

Capital

Expenditures *

|

||||||||||||||||||||

| 2009 |

|

|||||||||||||||||||

|

1st

|

2nd

|

3rd

|

4th

|

Full |

|

|||||||||||||||

|

Quarter

|

Quarter

|

Quarter

|

Quarter

|

Year |

|

|||||||||||||||

|

Capital

expenditures excluding equipment (in

millions)

|

|

|||||||||||||||||||

|

Engineering

|

||||||||||||||||||||

|

Rail

|

$ | 110 | $ | 138 | $ | 134 | $ | 34 | $ | 416 | ||||||||||

|

Ties

|

87 | 144 | 124 | 36 | 391 | |||||||||||||||

|

Surfacing

|

42 | 78 | 82 | 50 | 252 | |||||||||||||||

|

Other

|

108 | 157 | 154 | 127 | 546 | |||||||||||||||

|

Total

engineering

|

347 | 517 | 494 | 247 | 1,605 | |||||||||||||||

|

Mechanical

|

37 | 25 | 24 | 21 | 107 | |||||||||||||||

|

Other

|

28 | 30 | 30 | 22 | 110 | |||||||||||||||

|

Total

replacement capital

|

412 | 572 | 548 | 290 | 1,822 | |||||||||||||||

|

Information

services

|

19 | 24 | 16 | 24 | 83 | |||||||||||||||

|

Terminal and

line expansion

|

31 | 24 | 23 | 8 | 86 | |||||||||||||||

|

Total capital

expenditures excluding equipment

|

$ | 462 | $ | 620 | $ | 587 | $ | 322 | $ | 1,991 | ||||||||||

|

Acquisition

of equipment

|

$ | 286 | $ | 170 | $ | 159 | $ | 118 | $ | 733 | ||||||||||

|

Track miles of

rail laid

|

||||||||||||||||||||

|

Replacement

capital

|

205 | 318 | 327 | 54 | 904 | |||||||||||||||

|

Expansion

projects

|

12 | - | 5 | 2 | 19 | |||||||||||||||

|

Total

|

217 | 318 | 332 | 56 | 923 | |||||||||||||||

|

Cross ties

inserted (thousands)

|

||||||||||||||||||||

|

Replacement

capital

|

769 | 1,223 | 1,110 | 182 | 3,284 | |||||||||||||||

|

Expansion

projects

|

10 | 3 | 9 | 4 | 26 | |||||||||||||||

|

Total

|

779 | 1,226 | 1,119 | 186 | 3,310 | |||||||||||||||

|

Track

resurfaced (miles)

|

2,351 | 5,015 | 5,257 | 2,833 | 15,456 | |||||||||||||||

|

*

|

Certain

interim period amounts have been reclassified to conform to the current

period presentation.

|

|||||||||||||||||||

16

|

Burlington

Northern Santa Fe Corporation

|

||||||

|

Outstanding

Debt

|

||||||

|

(Dollars in

millions)

|

||||||

| December 31, | ||||||

| 2009 |

|

2008 | ||||

|

Notes and

debentures, weighted average rate of 6.0 percent, due 2010 to 2097

*

|

$

|

8,095

|

$

|

7,593

|

||

|

Equipment

obligations, weighted average rate of 6.2 percent, due 2010 to

2027

|

271

|

244

|

||||

|

Capitalized

lease obligations, weighted average rate of 5.5 percent, due 2010 to

2028

|

1,589

|

1,281

|

||||

|

Mortgage

bonds, weighted average rate of 5.9 percent, due 2010 to

2047

|

94

|

97

|

||||

|

Financing

obligations, weighted average rate of 6.2 percent, due 2010 to

2028

|

323

|

278

|

||||

|

Commercial

paper

|

-

|

100

|

||||

|

Unamortized

discount and other, net

|

(37)

|

(38)

|

||||

| Total outstanding debt |

10,335

|

9,555

|

||||

|

Less: current

portion of long-term debt

|

(644)

|

(456)

|

||||

|

Long-term

debt

|

$

|

9,691

|

$

|

9,099

|

||

|

*

|

Notes

and debentures include a fair value adjustment increase for hedges of $26

million and $73 million at December 31, 2009 and 2008,

respectively.

|

||||||||

17