Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - UNITED INSURANCE HOLDINGS CORP. | d8k.htm |

Exhibit 99.1 |

2 Safe Harbor Statements in this presentation that are not historical facts are

forward-looking statements that are subject to certain risks and uncertainties that could cause actual events and results to differ

materially from those discussed herein. Without limiting the

generality of the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “could,” “would,” “estimate,” “or “continue” or the other negative variations thereof or comparable terminology are

intended to identify forward-looking statements. The

forward-looking statements in this press release include statements regarding the Company’s or management’s plans, objectives, goals, strategies,

expectations, estimates, beliefs or projections, or any other

statements concerning future performance or events. The risks and

uncertainties that could cause our actual results to differ from

those expressed or implied herein include, without limitation, the success of the Company’s marketing initiatives, inflation and other changes in economic conditions (including changes in

interest rates and financial markets); the impact of new regulations adopted in Florida which affect the property and casualty insurance market; the costs of reinsurance and the collectibility of reinsurance, assessments charged by various governmental agencies; pricing

competition and other initiatives by competitors; or ability to

obtain regulatory approval for requested rate changes, and the timing thereof; legislative and regulatory developments; the outcome of litigation pending

against us, including the terms of any settlements; risks related

to the nature of our business; dependence on investment income and the composition of our investment portfolio; the adequacy of our liability for loss and loss adjustment expense; insurance agents; claims experience; ratings by industry services; catastrophe losses; reliance on key

personnel; weather conditions (including the severity and frequency

of storms, hurricanes, tornadoes and hail); changes in loss trends; acts of war and terrorist activities; court decisions and trends in litigation, and health care; and other matters

described from time to time by us in our filings with the SEC,

including, but not limited to, the Company’s Annual Report on Form 10-K/A for the year ended December 31, 2008. In addition, investors should be aware that generally accepted

accounting principles prescribe when a company may reserve for

particular risks, including litigation exposures. Accordingly, results for a given reporting period could be significantly affected if and when a reserve is established for a major

contingency. Reported results may therefore, appear to be volatile

in certain accounting periods. The Company undertakes no obligations to update, change or revise any forward-looking statement, whether as a result of new information,

additional or subsequent developments or otherwise. |

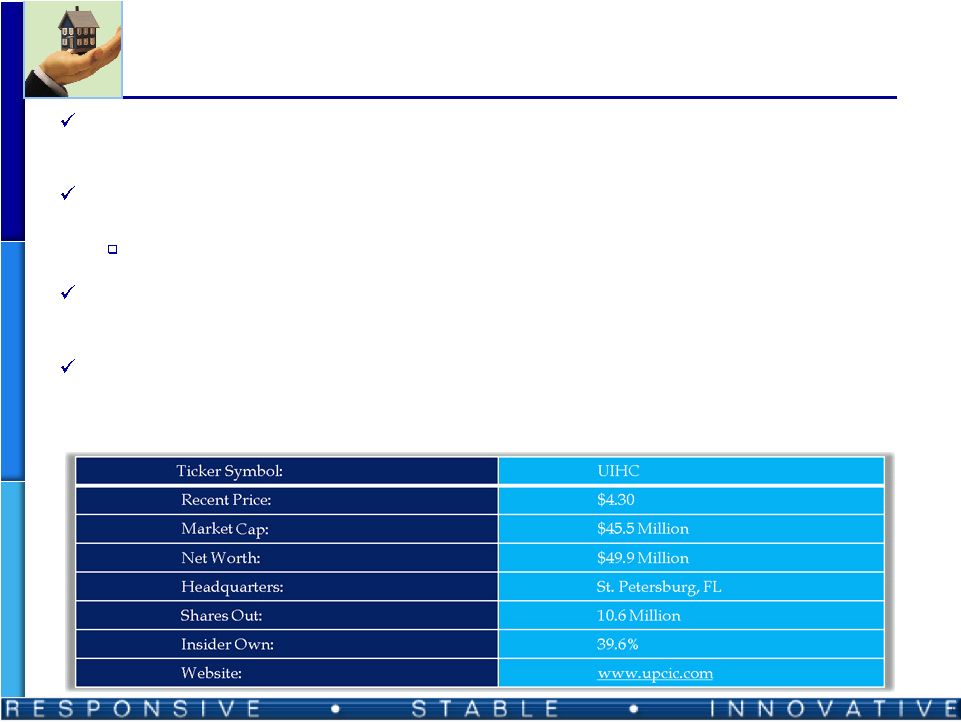

3 United Insurance at a Glance Underwrites homeowners insurance and selected small business insurance in

the state of Florida Founded in 1999 to capitalize on Florida state legislation to promote the

formation of homeowners insurance companies Became public in September 2008 via merger with FMG Acquisition Corp.

From its headquarters in St. Petersburg, FL, 32 employees manage all business aspects including sales, underwriting, policy owner service and claims

Distributes its products through 200 independent agency groups

|

4 Compelling Investment Highlights Fragmented market provides significant growth opportunities Expansion in Florida (United currently has only 1.8% market share) Safe and sustainable business model due to underwriting discipline Profitable in each year of Company’s history, including storm laden years

of 2004 and 2005 $490.6 million in reinsurance protects United from

low probability, high-cost storms Strong growth and

profitability in 2009 Gross premiums written increased 20% YOY in

the first nine months of 2009 to $128.5 million Homeowner

policies-in-force increased 19.8% to 96,300 at September 30, 2009 from 80,400 at December 31, 2008 2009 nine month net income of $5.2 million, or $0.50 per diluted share 2009 nine month revenue of $69.0 million Company slowed premium writing in Q3 2009 as a risk exposure measure due to

faster than expected growth Dividend paying stock with favorable

industry multiples* Quarterly dividend of $0.05 per share

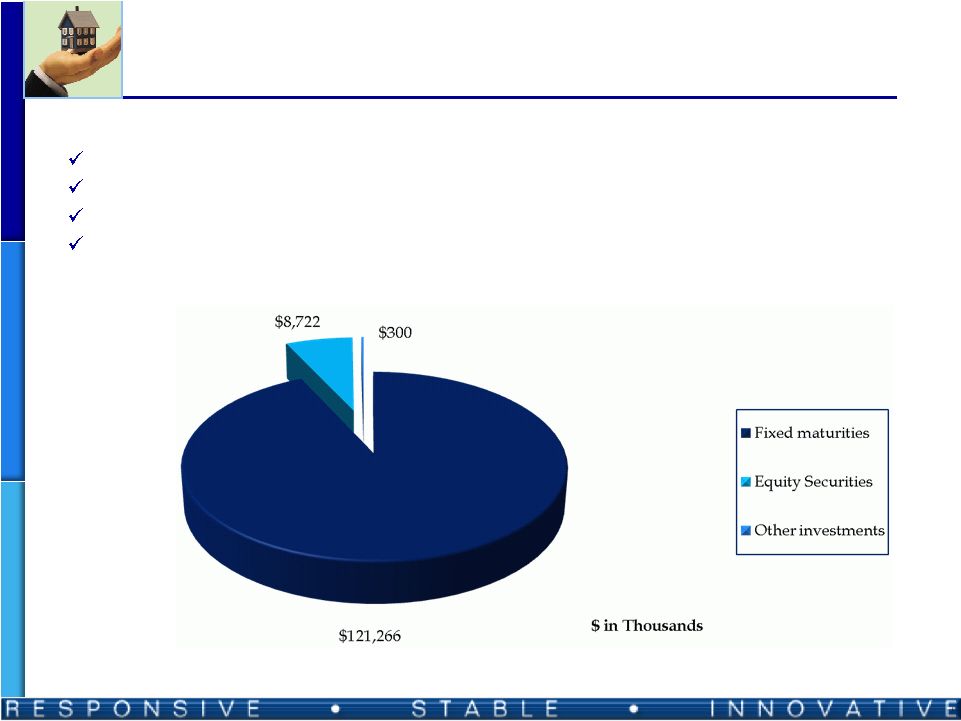

(represents a TTM dividend yield of 2.5%) Book Value of $4.77 per share (trading at approximately 0.90X) P/E of 2X Strong balance sheet and stable investment portfolio Cash and investment holdings of $194.7 million at 9/30/2009 Total investments of $130 million consist primarily of conservative

fixed-income securities * Based on 9/30/2009 stock price of

$4.30 |

5 Fragmented Florida Market Creation of the Florida Hurricane Catastrophe Fund in early 1990s A reinsurance-like entity (Citizens Insurance) funded by a portion of

insurance premiums and managed by the Florida State Board of

Administration. Designed to mitigate losses to the industry and

promote the formation of homeowners insurance companies Ability of

Fund to raise capital in this credit environment in the event of a major hurricane hitting the state is a concern for homeowners Market remains highly fragmented Largest non-state owned competitor is State Farm at only 18.2% United began operations to capitalize on these market conditions by underwriting homeowners insurance and selected small business insurance through a broad

distribution network across the state of Florida United provides a definitive “Value Proposition” to Florida homeowners Safe and secure insurance due to strong balance sheet and reinsurance

backing Agents prefer working with companies like United Superior to most non-state owned competitors More efficient customer service than state run insurance Faster claims |

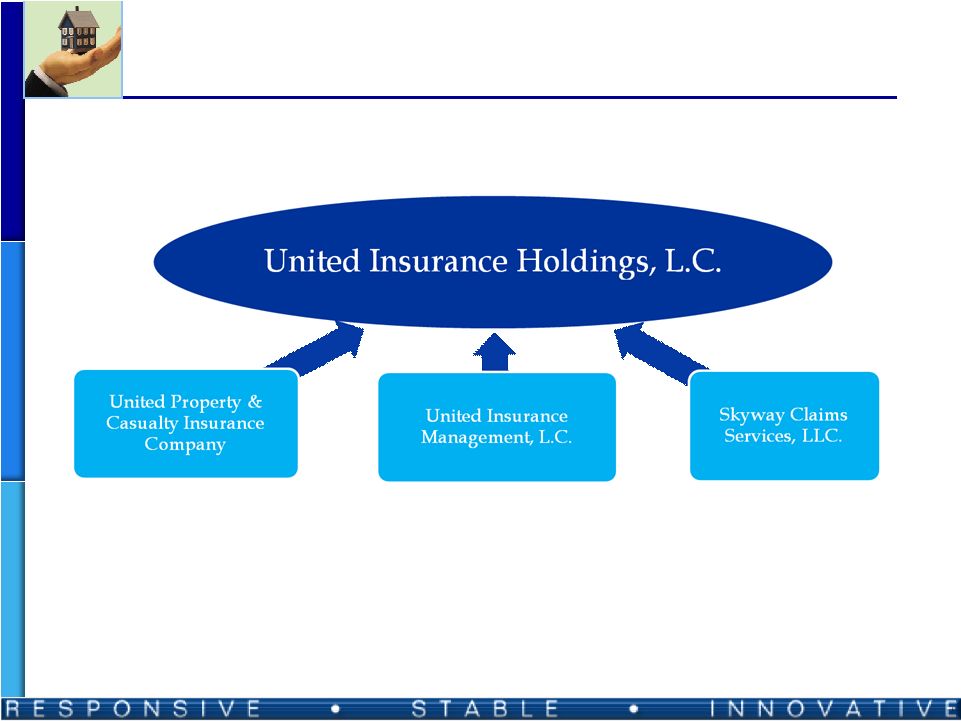

6 United Overview United conducts business through three wholly-owned subsidiaries Licensed insurer that writes all policies, conducts policy assumptions, collects premiums, pays losses and manages investments and contracts with reinsurers Licensed managing general agent that is responsible for all other insurance-related operations Provides claims adjusting services |

7 United’s Subsidiaries and Services United Insurance Management Licensed MGA providing all insurance-related operations Employs all United personnel Sells policies through retail agents (93% of premium) Designs and manages commercial lines programs (7% of premium) Conducts policy and claim administration Contains United’s “intellectual capital” Product and program design; modeling and analytics team Underwriting and geographic management Risk retention and reinsurance program design United Property and Casualty Insurance Company Financially responsible for United’s insurance policies Location of United’s capital for bearing insurance risk Executes reinsurance contracts to manage retained insurance risk Skyway Claims Services Provides claim handling services to United |

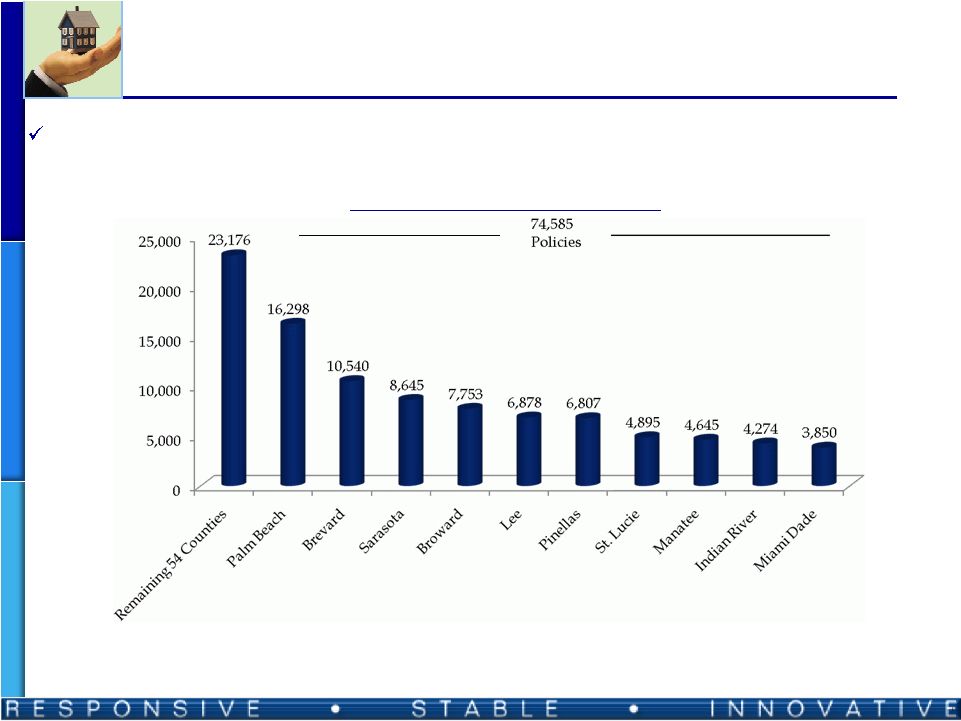

8 Diversified Geographically Policy Concentration by County The United portfolio has a broad distribution across 64 counties in Florida |

9 United Underwriting expertise Underwriting standards aimed at minimizing loss and maximizing premium In-house risk modeling allows for appropriate geographic distribution of

exposures and better capital allocation Zip code analysis is completed monthly to reallocate portfolio exposure

Underwriting guidelines are adjusted periodically to address strategic goals

as well as to improve attritional loss results In-house claims management, adjusting and processing

|

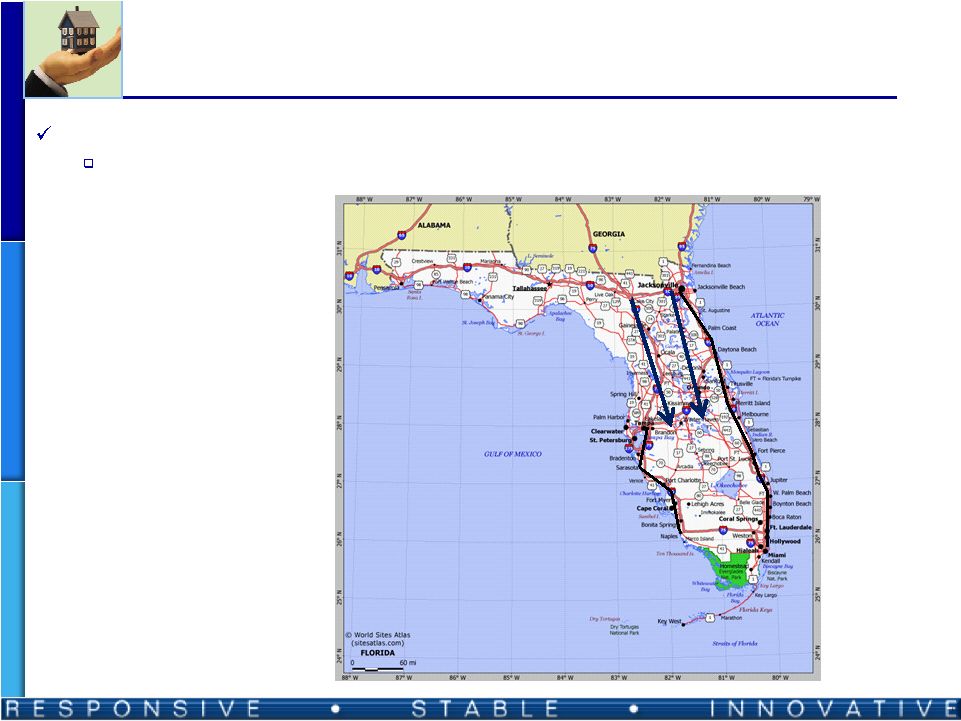

10 Strict Underwriting Focus in Florida Company strives to limit exposure near beach areas Limited coverage west of I-75 and east of I-95

|

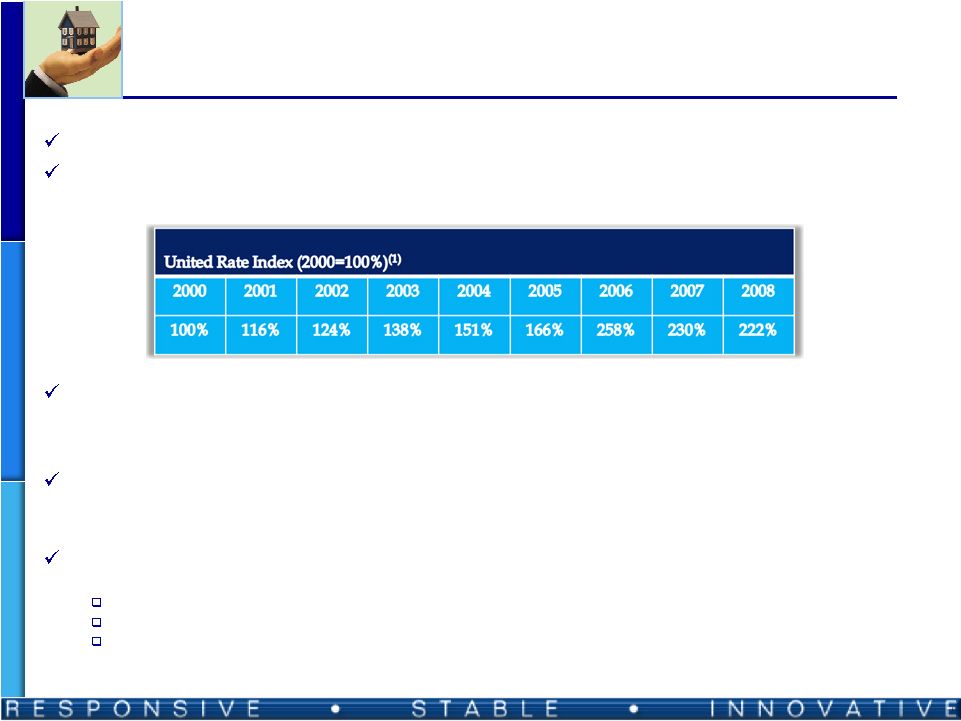

11 Rates and REWARD FOR RISK United’s rates vary across its 108 rating territories United received approval for an overall 12.7% rate increase for its homeowner

product becoming effective September 15, 2009 Received approval for a 15% rate increase for its dwelling/ fire product becoming effective on October 15, 2009 Applied for an overall 14.3% rate adjustment to offset increased reinsurance costs Since 2000, United has obtained rate increases and managed its book to be in a

position: Buy flexible reinsurance to protect its shareholders and policyholders

Offer rate decreases in 2007 and 2008 Provide an appropriate return on capital for shareholders (1) For HO3 policy, most common Florida homeowner policy.

|

12 Reinsurance Protection United purchases substantial reinsurance protection for catastrophic

events Purchase substantial excess-of-loss multi-event

coverage Quality reinsurers with an A.M. Best rating of

A- or better 2009 Retention – 46% of statutory surplus Reinsure up to the 100-year probable maximum loss (PML) For the 2009 storm season (June to November): United effectively retained $25.5 million of exposure for each

event Purchased protection through $516.1 million

|

13 History of Hurricanes in Florida Hurricanes are a fact of life for Florida and the 2004 and 2005 storm seasons were exceptionally active However, during the last 11 storm seasons (1998-2008) there were 9 years with no catastrophic storms for the state Manage Florida risk first through understanding how likely a catastrophic

storm is and second by testing their own portfolios against a

range of possible outcomes Current estimates of a catastrophic storm (defined as a Category 3 or above hurricane) suggest that a catastrophic storm strikes the state about once every four years (1) Not all Cat 3+ storms making landfall cause significant damage in Florida

A storm causing damage with losses of more than $7.0 billion

statewide is much less likely – occurring perhaps once every nine years (2) (1) Robert Hartwig, Insurance Information Institute,

Tallahassee briefing, January 22, 2008. (2) FHCF website, 2007 ratemaking formula report, “Modeled

Adjusted Loss Severity Distributions.” |

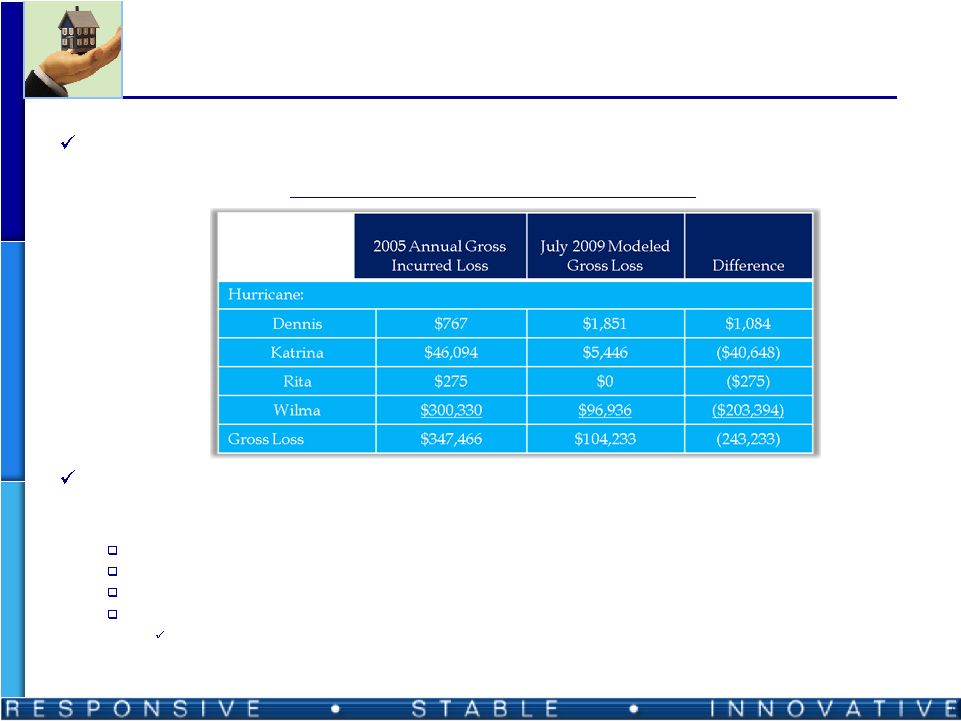

14 CASE STUDY: Repeat of 2005 Hurricanes The 2005 hurricane season in Florida (4 hurricanes) was statistically a highly

improbable event The table above illustrates the actual losses United incurred in 2005 as compared to the losses it would occur today if the exact same set of storms were to occur

again. The main drivers of the different outcomes are:

Shift in business mix away from higher risk areas Premium rate increases statewide (not just in highly exposed areas)

Underwriting better homes with more windstorm mitigation features

Added “pool cage” (enclosure around pools) exclusion on all homeowners policies “Pool cage” losses accounted for approximately 35% of all CAT losses in

2004-2005 1) Simulated results based on AIR Clasic/2

version 11.0 Gross Loss Before Reinsurance Protection ($ in thousands) |

15 SEASONED Management Team Greg C. Branch – Chairman of the Board Founder of United and chairman with previous public market and insurance

experience Chairman of Sunz Insurance Company, a Florida domiciled provider of workers’ compensation insurance Chairman of the Board of Summit Southeast – went public in 1997 and acquired by Liberty Mutual in 1998 Shareholder and Director of Prime Holdings (insurance group focused on excess

and surplus lines products) Florida native, with longstanding

industry and political relationships President and owner of Branch

Properties Donald J. Cronin – President & CEO Named President and CEO in 2002; directed United’s growth, underwriting,

and risk management in the challenging Florida market Experienced marketing, underwriting, and operations executive Previously executive of United Agents Insurance Company of Louisiana;

former advisor to Louisiana State University’s School of

Insurance |

16 Growth Opportunities Florida United has only 1.8% of the Florida market Agents prefer business with well capitalized, experienced company such as

United, not Citizens (state-owned insurance company)

Apply underwriting skills and experience to selected additional

states United makes in-house use of storm modeling, portfolio optimization, and dynamic financial analysis Management focuses on “states in need” of homeowner’s insurance capacity receptive to private-market

solutions: Louisiana - South Carolina - Massachusetts Operate on an insurance company or an MGA basis (see next point) Expand United Insurance Management, L.C., a managing general agency Fee-based business that retains no risk Underwriting, policy administration, accounting, reporting and risk modeling

services performed by United Insurance Management, L.C. for other

companies Florida and other “states in need” attract start up capital in need of quality administration

|

17 Q3 2009 VS. Q3 2008 Comparison In thousands, except share numbers and EPS Three Months Ended 9/30/2009 9/30/2008 Amount Amount Y-O-Y% CHANGE Gross premiums written $ 33,350 $ 36,200 (7.9%) Gross premiums ceded $ (1,650) $ (2,963) (44.3%) Net premiums earned $ 18,422 $ 20,089 (8.3%) Total revenue $ 20,715 $ 25,992 (20.3%) Losses and LAE $ 12,193 $ 12,500 (2.5%) Total expenses $ 22,142 $ 19,745 12.1% Net income (loss) $ (734) $ 8,878 (108.3%) Weighted average shares outstanding – basic 10,573,932 10,548,932 0.2% Net income per share – basic $ (0.07) $ 0.84 Weighted average shares outstanding – diluted 10,573,932 11,830,069 (10.6%) Diluted net income per share $ (0.07) $ 0.75 |

September

30, 2009 December 31, 2008 Total Investments $ 130,288 $ 126,218 Cash and Cash Equivalents 64,461 31,689 Total Assets 303,832 233,121 Long-term Notes Payable 36,106 36,682 Total Liabilities 253,360 190,194 Total Shareholders’ Equity $ 50,472 $ 42,927 Balance sheet highlights (2009 period unaudited, $ in thousands) |

19 Stable Investment Portfolio Conservative investment philosophy Consists primarily of fixed-income securities Does not use any swaps, options, futures or forward contracts to hedge Average credit quality of fixed income portfolio AA-/Aa3

|

20 Peer Company Analysis Company Name Ticker Price (1) Market Cap (in millions) (1) Book Value p/s (2) Price / Book Value (1,2) TTM P/E (1,2) ROE (2) Forward Dividend Yield (1,2) United Insurance Holdings Corp UIHC $4.30 $46 $4.77 0.90 1.97 41.00% 2.50% 21 Century Holding Company TCHC $4.38 $35 $9.68 0.47 N/A -1.12% 5.20% Homeowners Choice HCII $8.15 $55 $6.80 1.27 3.81 44.96% N/A Mercer Insurance Group MIGP $18.47 $119 $21.67 0.85 12.83 6.37% 1.70% Safety Insurance Group SAFT $33.89 $462 $39.97 0.85 9.45 9.60% 4.70% Universal Insurance Holdings UVE $5.36 $202 $3.16 1.67 6.19 31.75% 10.60% MEAN 0.86 6.85 18.94% Pure-play Florida homeowners insurance companies include: TCHC, UVE,

HCII (1) Nasdaq Market Surveillance (2) Company Filings At September 30, 2009 st |

21 Investment Conclusions Fragmented Bright Prospects United occupies only 1.8% market share in Florida – presents significant growth opportunities Significant increase in gross written premiums with rates increasing over 2009

- 2010 Safe and Sustainable Growth Business opportunity not fundamentally correlated to interest rates or broader

stock markets Ability to deploy capital directly to high ROE

projects Board will consider initiation a target payout/dividend

policy Strong Financial Results / Favorable Industry

Multiples Right Management Team Possess skills necessary to underwrite and control risk In-house operation of sophisticated risk analysis models Long-standing relationships with the Florida insurance and

regulatory authorities Chairman, CEO and Board of Directors that can optimize public market,

insurance, and reinsurance experience and contacts to the benefit

of United |

December 2009 Investor Presentation |