Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ORACLE CORP | d224360d8k.htm |

August 27, 2021 Investor Summary Exhibit 99.1

Copyright © 2021, Oracle and/or its affiliates Returning Value to Stockholders in Fiscal 2021 We are committed to returning value to our stockholders through technical innovations, strategic acquisitions, stock repurchases, prudent use of debt, and dividends $24.1 billion returned to stockholders $21 billion in repurchases of common stock $3.1 billion in dividends paid Under our stock repurchase program, we bought back 1.7 billion shares at an average price of $53 and reduced our total shares outstanding by 32% from the start of FY18 to the end of FY21 Fiscal 2021 GAAP Performance Earnings per share of $4.55 Up 48% from FY20 Operating margin of 38% Up 2% from FY20 Operating income of $15.2 billion Up 9% from FY20 Cloud services and license support revenues plus cloud license and on-premise license revenues of $34.1 billion Up 5% from FY20 Delivering Results and Returning Value to Stockholders in Fiscal 2021

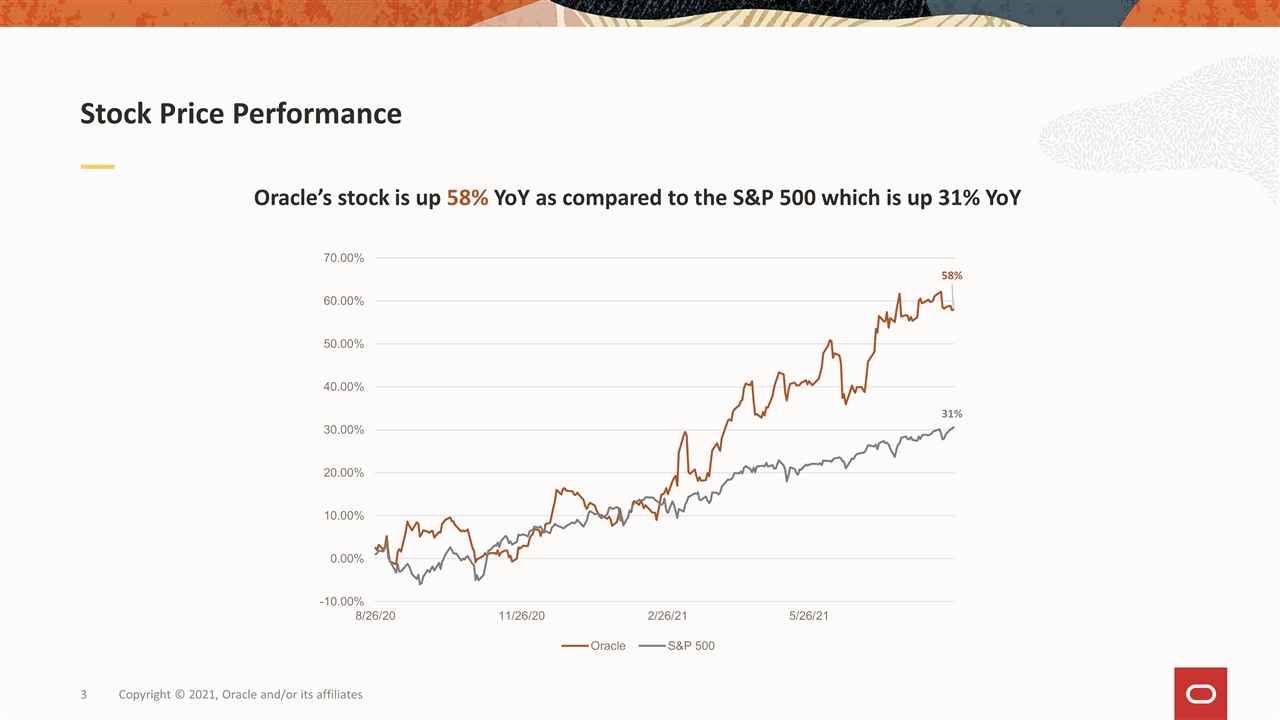

Copyright © 2021, Oracle and/or its affiliates Stock Price Performance Oracle’s stock is up 58% YoY as compared to the S&P 500 which is up 31% YoY

Copyright © 2021, Oracle and/or its affiliates We have supported, donated to, partnered and engaged with organizations globally that provide critical medicines, research, goods and services to combat the COVID-19 pandemic, including: The U.S. federal government as well as state and local government agencies Medical research organizations, hospitals and pharmaceutical companies The national governments of several African countries, which are receiving systems and services to manage public health vaccination programs through our work with the Tony Blair Institute At the onset of the COVID-19 pandemic, we also permitted enterprises, at no additional charge, to access Oracle Fusion Cloud Human Capital Management options for employee health and safety programs in order to proactively manage and respond to COVID-19 implications on their workforces Response to the COVID-19 Pandemic

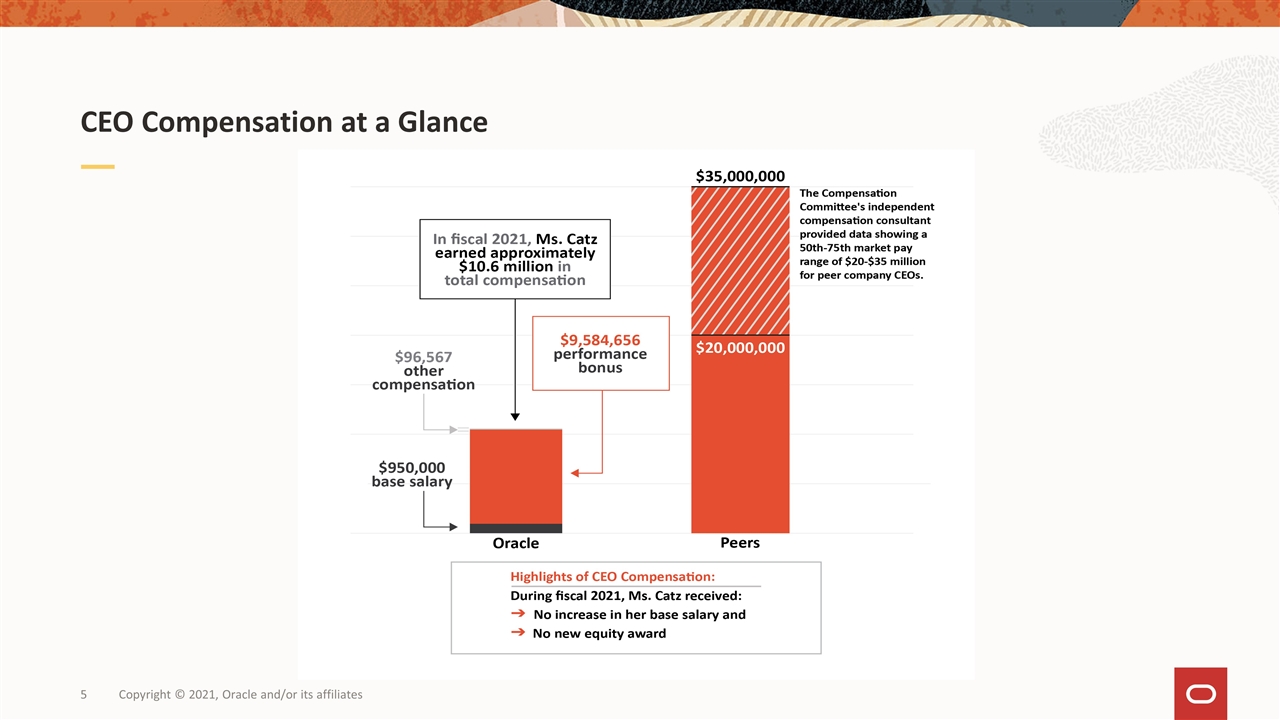

Copyright © 2021, Oracle and/or its affiliates CEO Compensation at a Glance

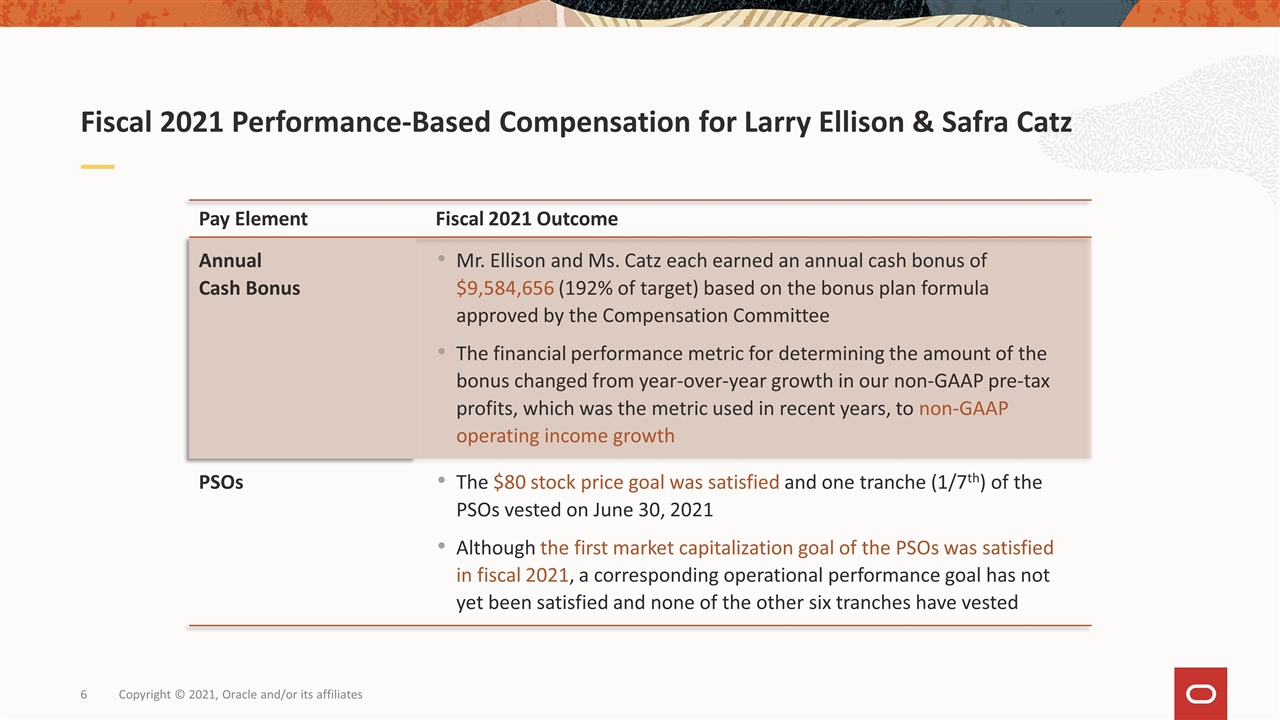

Copyright © 2021, Oracle and/or its affiliates Fiscal 2021 Performance-Based Compensation for Larry Ellison & Safra Catz Pay Element Fiscal 2021 Outcome Annual Cash Bonus Mr. Ellison and Ms. Catz each earned an annual cash bonus of $9,584,656 (192% of target) based on the bonus plan formula approved by the Compensation Committee The financial performance metric for determining the amount of the bonus changed from year-over-year growth in our non-GAAP pre-tax profits, which was the metric used in recent years, to non-GAAP operating income growth PSOs The $80 stock price goal was satisfied and one tranche (1/7th) of the PSOs vested on June 30, 2021 Although the first market capitalization goal of the PSOs was satisfied in fiscal 2021, a corresponding operational performance goal has not yet been satisfied and none of the other six tranches have vested

Copyright © 2021, Oracle and/or its affiliates Extension of PSO Performance Period The Compensation Committee extended the PSO performance period by three fiscal years from May 31, 2022 to May 31, 2025 The Compensation Committee responded to stockholder feedback by extending the PSO performance period while maintaining the other existing terms applicable to the PSOs. The Compensation Committee believes that the goals associated with the PSOs are tailored to focus our executives on Oracle’s most important long-term strategy. The PSO goals remain very challenging. The matching of operational performance goals with market capitalization goals ensures that stockholders will benefit from the achievement of the goals in the future.

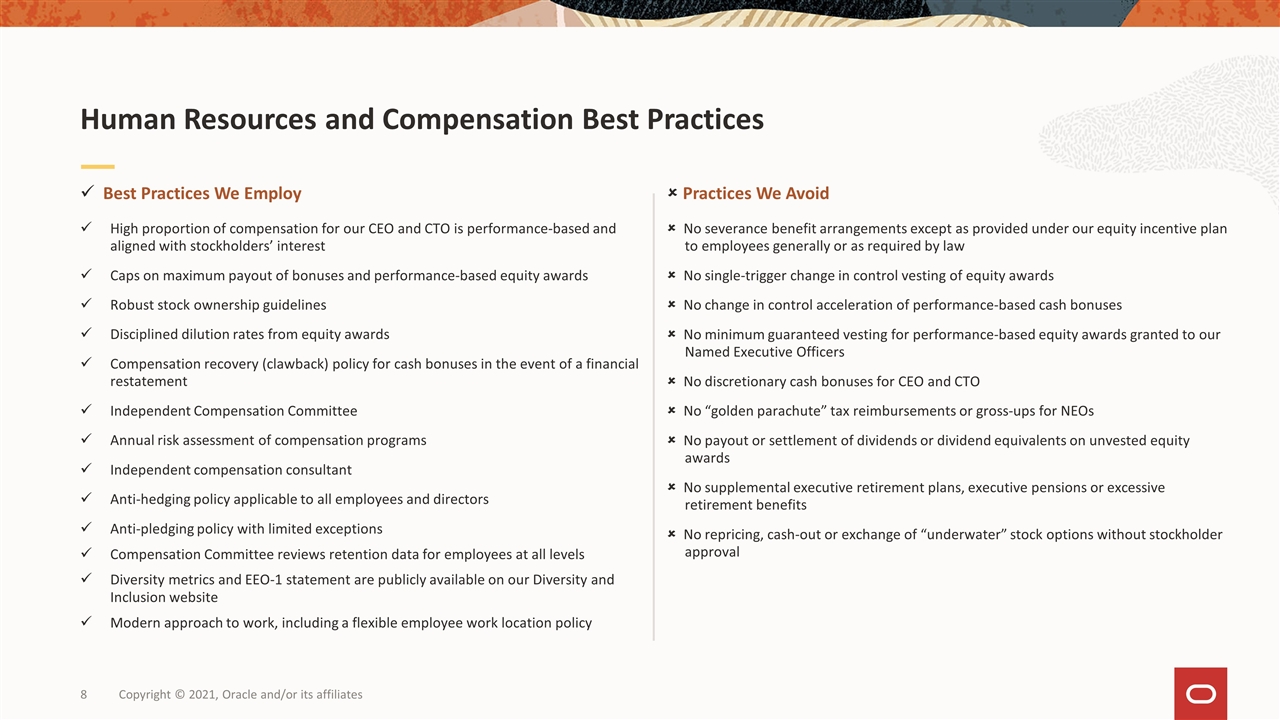

Copyright © 2021, Oracle and/or its affiliates û Practices We Avoid û No severance benefit arrangements except as provided under our equity incentive plan to employees generally or as required by law û No single-trigger change in control vesting of equity awards û No change in control acceleration of performance-based cash bonuses û No minimum guaranteed vesting for performance-based equity awards granted to our Named Executive Officers û No discretionary cash bonuses for CEO and CTO û No “golden parachute” tax reimbursements or gross-ups for NEOs û No payout or settlement of dividends or dividend equivalents on unvested equity awards û No supplemental executive retirement plans, executive pensions or excessive retirement benefits û No repricing, cash-out or exchange of “underwater” stock options without stockholder approval ü Best Practices We Employ High proportion of compensation for our CEO and CTO is performance-based and aligned with stockholders’ interest Caps on maximum payout of bonuses and performance-based equity awards Robust stock ownership guidelines Disciplined dilution rates from equity awards Compensation recovery (clawback) policy for cash bonuses in the event of a financial restatement Independent Compensation Committee Annual risk assessment of compensation programs Independent compensation consultant Anti-hedging policy applicable to all employees and directors Anti-pledging policy with limited exceptions Compensation Committee reviews retention data for employees at all levels Diversity metrics and EEO-1 statement are publicly available on our Diversity and Inclusion website Modern approach to work, including a flexible employee work location policy Human Resources and Compensation Best Practices

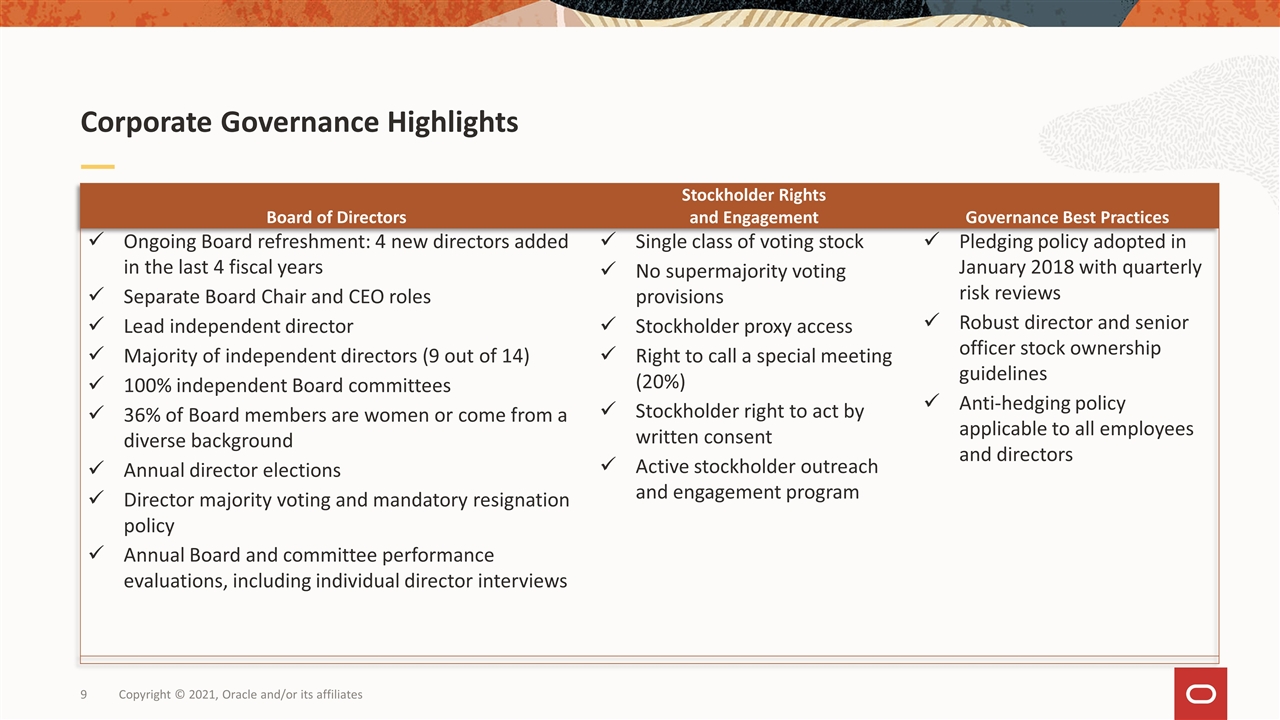

Copyright © 2021, Oracle and/or its affiliates Corporate Governance Highlights Board of Directors Stockholder Rights and Engagement Governance Best Practices Ongoing Board refreshment: 4 new directors added in the last 4 fiscal years Separate Board Chair and CEO roles Lead independent director Majority of independent directors (9 out of 14) 100% independent Board committees 36% of Board members are women or come from a diverse background Annual director elections Director majority voting and mandatory resignation policy Annual Board and committee performance evaluations, including individual director interviews Single class of voting stock No supermajority voting provisions Stockholder proxy access Right to call a special meeting (20%) Stockholder right to act by written consent Active stockholder outreach and engagement program Pledging policy adopted in January 2018 with quarterly risk reviews Robust director and senior officer stock ownership guidelines Anti-hedging policy applicable to all employees and directors

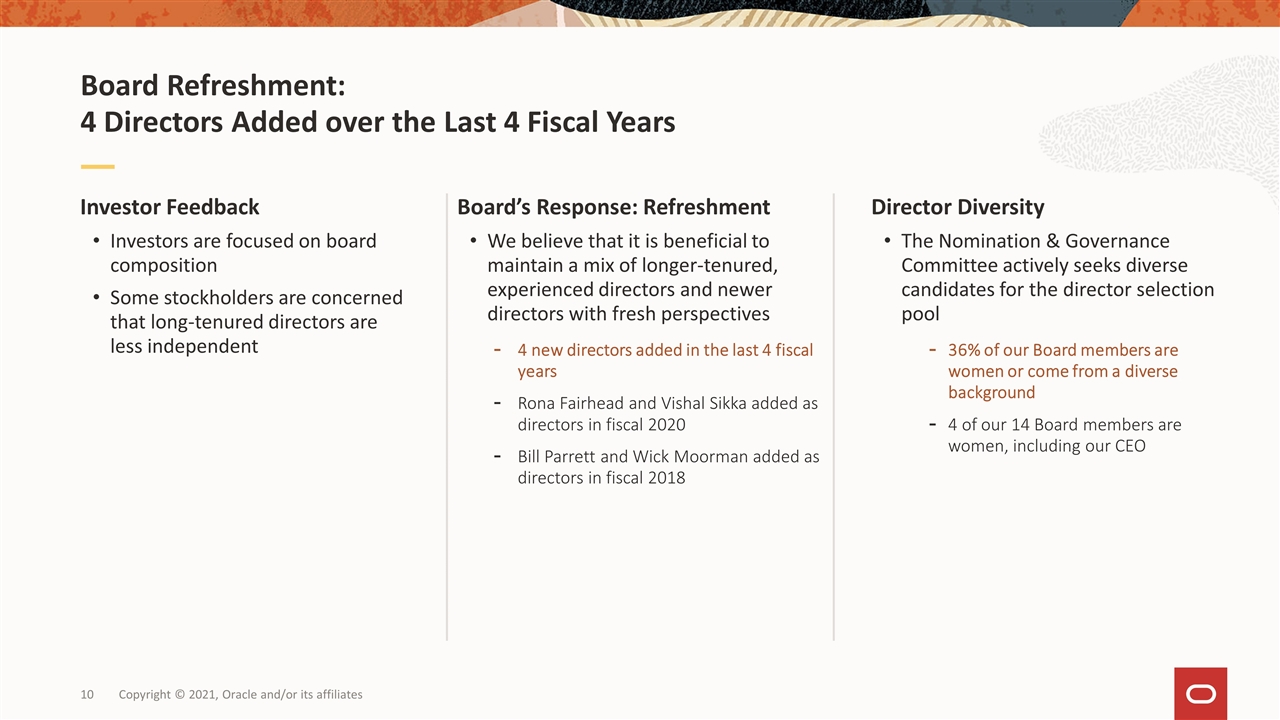

Copyright © 2021, Oracle and/or its affiliates Director Diversity The Nomination & Governance Committee actively seeks diverse candidates for the director selection pool 36% of our Board members are women or come from a diverse background 4 of our 14 Board members are women, including our CEO Board’s Response: Refreshment We believe that it is beneficial to maintain a mix of longer-tenured, experienced directors and newer directors with fresh perspectives 4 new directors added in the last 4 fiscal years Rona Fairhead and Vishal Sikka added as directors in fiscal 2020 Bill Parrett and Wick Moorman added as directors in fiscal 2018 Investor Feedback Investors are focused on board composition Some stockholders are concerned that long-tenured directors are less independent Board Refreshment: 4 Directors Added over the Last 4 Fiscal Years

Copyright © 2021, Oracle and/or its affiliates Statements in this presentation relating to Oracle’s future plans, expectations, beliefs, intentions and prospects are “forward-looking statements” and are subject to material risks and uncertainties. A detailed discussion of these factors and other risks that affect our business is contained in our SEC filings, including our most recent reports on Form 10-K and Form 10-Q, particularly under the heading “Risk Factors.” Copies of these filings are available on the SEC’s website (www.sec.gov), on Oracle’s Investor Relations website (www.oracle.com/investor) or by contacting Oracle Corporation’s Investor Relations Department at (650) 506-4073. All information set forth in this presentation is current as of August 27, 2021. Oracle undertakes no duty to update any statement in light of new information or future events. Safe Harbor Statement