Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 EARNINGS RELEASE - KITE REALTY GROUP TRUST | exhibit99_1xq22021.htm |

| 8-K - 8-K - KITE REALTY GROUP TRUST | krg-20210802.htm |

| Exhibit 99.2 | ||||||||

QUARTERLY FINANCIAL SUPPLEMENTAL – JUNE 30, 2021 |  | |||||||

| PAGE NO. | TABLE OF CONTENTS | |||||||

| 3 | Earnings Press Release | |||||||

| 7 | Corporate Profile | |||||||

| 8 | Contact Information | |||||||

| 9 | Important Notes Including Non-GAAP Disclosures | |||||||

| 12 | Consolidated Balance Sheets | |||||||

| 13 | Consolidated Statements of Operations for the Three and Six Months Ended June 30, 2021 and 2020 | |||||||

| 14 | Same Property Net Operating Income | |||||||

| 15 | Net Operating Income and EBITDA by Quarter | |||||||

| 16 | Funds from Operations for the Three and Six Months Ended June 30, 2021 and 2020 | |||||||

| 17 | Adjusted Funds From Operations and Other Financial Information for the Three and Six Months Ended June 30, 2021 and 2020 | |||||||

| 18 | Summary Income Statement | |||||||

| 19 | Accounts Receivable Impact of COVID-19 | |||||||

| 20 | Joint Venture Summary as of June 30, 2021 | |||||||

| 21 | Summary of Outstanding Debt as of June 30, 2021 | |||||||

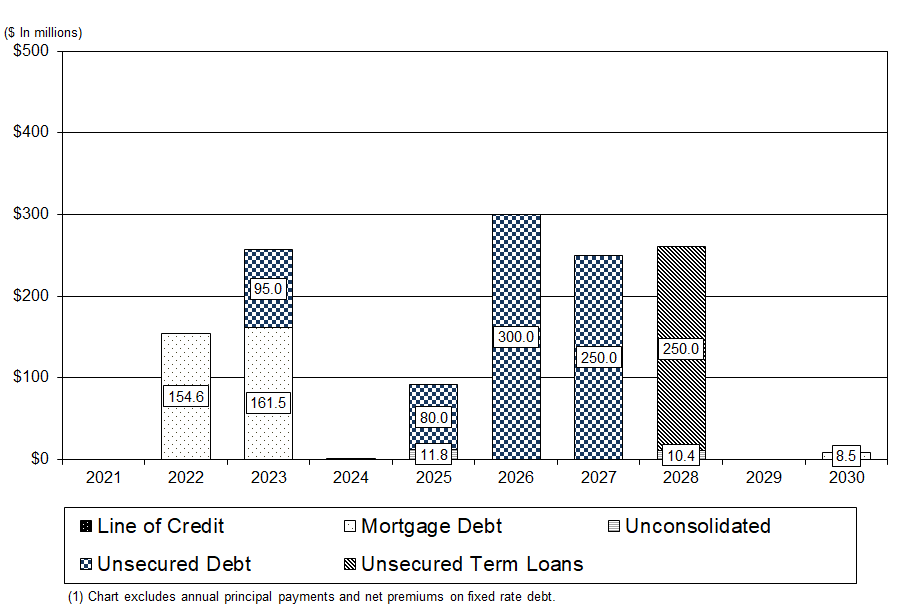

| 22 | Maturity Schedule of Outstanding Debt as of June 30, 2021 | |||||||

| 23 | Key Debt Metrics | |||||||

| 24 | Top 25 Tenants by Annualized Base Rent | |||||||

| 25 | Retail Leasing Spreads | |||||||

| 26 | Lease Expirations | |||||||

| 27 | Development and Redevelopment Projects | |||||||

| 28 | Geographic Diversification – Annualized Base Rent by Region and State | |||||||

| 29 | Operating Retail Portfolio Summary Report | |||||||

| 33 | Operating Office Properties and Other | |||||||

| 34 | Components of Net Asset Value | |||||||

| ||

PRESS RELEASE

Contact Information: Kite Realty Group Trust

Jason Colton

SVP, Capital Markets & Investor Relations

317.713.2762

jcolton@kiterealty.com

Kite Realty Group Trust Reports Second Quarter 2021 Operating Results and Raises Full Year Guidance

Indianapolis, Indiana, August 2, 2021 - Kite Realty Group Trust (NYSE: KRG) reported today its operating results for the second quarter ended June 30, 2021.

“During the second quarter, KRG delivered exceptional operational results as we continue to capitalize on strong retailer demand for our high-quality open-air shopping centers,” said John A. Kite, Chairman and CEO. “Given the continued leasing momentum and reduced tenant fallout, we raised guidance an additional $0.02 at the midpoint.”

Second Quarter Financial Results

•Realized net loss attributable to common shareholders of $0.2 million, or $0.00 per common share, compared to net loss of $4.8 million, or $0.06 per common share, for the three months ending June 30, 2021 and 2020, respectively.

•Generated NAREIT Funds From Operations of the Operating Partnership (FFO) of $29.9 million, or $0.34 per diluted common share.

•Generated Funds From Operations, as adjusted, of the Operating Partnership (FFO) of $29.6 million, or $0.34 per diluted common share.

◦Excludes a positive impact of $1.1 million of 2020 Collection Impact (as defined below).

◦Excludes a negative impact of $0.8 million of merger and acquisition costs.

•Same-Property Net Operating Income (NOI) increased by 10.1%.

•Approximately 98% of second quarter base rent and recoveries have been collected.

•As detailed on page 19 of our supplemental, KRG had a recovery of bad debt of approximately $0.6 million.

Second Quarter Portfolio Operations

•Executed 73 new and renewal leases representing over 637,000 square feet, which more than doubled the year-over-year leasing activity.

◦GAAP leasing spreads of 31.2% (19.7% cash basis) on 11 comparable new leases, 12.1% (7.5% cash basis) on 39 comparable renewals, and 14.7% (9.2% cash basis) on a blended basis.

•Signed significant new anchor leases, including Adidas at Portofino Shopping Center (Houston, TX) and Old Navy at Crossing at Killingly Commons (Willimantic, CT).

•Annualized base rent (ABR) per square foot for the operating retail portfolio was $18.48, a 2.2% increase year-over-year.

•Retail leased percentage was 91.5%, a sequential increase of 100 basis points.

Balance Sheet Overview

•As of June 30, 2021, KRG’s net-debt-to-Adjusted EBITDA was 6.4x.

Merger Update

p. 3 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –6/30/2021 | ||||

•On July 18, 2021, the Company, and KRG Oak, LLC, a wholly-owned subsidiary of the Company, entered into a definitive merger agreement with Retail Properties of America, Inc. (“RPAI”) pursuant to which RPAI will merge with and into a KRG Oak, LLC, and each outstanding share of RPAI common stock will be converted into a right to receive 0.623 common shares of the Company, plus cash in lieu of fractional shares, if any. The merger is subject to customary closing conditions, including approval by RPAI’s stockholders and the Company’s shareholders at special meetings. The Company currently expects that the transaction will close in the fourth quarter of 2021.

2021 Earnings Guidance

KRG is raising 2021 guidance for FFO, as adjusted, by $0.02 at the midpoint to $1.29 to $1.35 per share (previously $1.26 - $1.34).

•Estimated 2021 FFO, as adjusted, excludes the impact of 2020 cash and non-cash bad debt or accounts receivable (“2020 Collection Impact”). In the future, should there continue to be previous bad debt collected (recognized as revenue) or accounts receivable written off (recognized as expense) related to 2020 accounts receivable, KRG will disclose the impact, but exclude it from FFO, as adjusted.

•Estimated 2021 FFO, as adjusted, excludes any future merger and acquisition costs associated with the proposed merger with RPAI. The historical costs incurred through June 30, 2021 are reflected below.

•All estimates exclude the impact from the proposed merger with RPAI, other than Merger and Acquisition Costs incurred during the second quarter of 2021.

| Net Income to FFO, as adjusted, Reconciliation | ||||||||||||||

| Low End | High End | |||||||||||||

| Net Income | $ | (0.08) | $ | (0.02) | ||||||||||

| Depreciation | 1.37 | 1.37 | ||||||||||||

| NAREIT FFO | 1.29 | 1.35 | ||||||||||||

| Less: 2020 Collections Impact | (0.01) | (0.01) | ||||||||||||

| Add: Merger and Acquisition Costs | 0.01 | 0.01 | ||||||||||||

| FFO, as adjusted, Guidance | $ | 1.29 | $ | 1.35 | ||||||||||

Earnings Conference Call

Kite Realty Group Trust will conduct a conference call to discuss its financial results on Tuesday, August 3, 2021, at 11:00 a.m. Eastern Time. A live webcast of the conference call will be available on KRG’s corporate website at www.kiterealty.com. The dial-in numbers are (844) 309-0605 for domestic callers and (574) 990-9933 for international callers (Conference ID: 5090863). In addition, a webcast replay link will be available on the corporate website. As a reminder, this call will focus on second quarter results and we request that you confine your questions and comments to these results and not the previously announced pending merger with RPAI.

About Kite Realty Group Trust

Kite Realty Group Trust is a full-service, vertically integrated real estate investment trust (REIT) that provides communities with convenient and beneficial shopping experiences. We connect consumers to retailers in desirable markets through our portfolio of neighborhood, community, and lifestyle centers. Using operational, development, and redevelopment expertise, we continuously optimize our portfolio to maximize value and return to our shareholders. For more information, please visit our website at kiterealty.com.

Connect with KRG: LinkedIn | Twitter | Instagram | Facebook

Safe Harbor

This release, together with other statements and information publicly disseminated by us, contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934. Such statements are based on assumptions and expectations

p. 4 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –6/30/2021 | ||||

that may not be realized and are inherently subject to risks, uncertainties and other factors, many of which cannot be predicted with accuracy and some of which might not even be anticipated. Future events and actual results, performance, transactions or achievements, financial or otherwise, may differ materially from the results, performance, transactions or achievements, financial or otherwise, expressed or implied by the forward-looking statements.

Currently, one of the most significant factors that could cause actual outcomes to differ significantly from our forward-looking statements is the potential adverse effect of the current pandemic of the novel coronavirus, or COVID-19, including possible resurgences and mutations, on the financial condition, results of operations, cash flows and performance of the Company and its tenants, the real estate market and the global economy and financial markets. The effects of COVID-19 have caused and may continue to cause many of our tenants to close stores, reduce hours or significantly limit service, making it difficult for them to meet their rent obligations, and therefore has and will continue to impact us significantly for the foreseeable future. COVID-19 has impacted us significantly, and the extent to which it will continue to impact us and our tenants will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the scope, severity and duration of the pandemic, the continued speed of the vaccine distribution, the efficacy of vaccines, including against variants of COVID-19, acceptance and availability of vaccines, the actions taken to contain the pandemic or mitigate its impact, and the direct and indirect economic effects of the pandemic and containment measures, among others. Moreover, investors are cautioned to interpret many of the risks identified under the section titled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 as being heightened as a result of the ongoing and numerous adverse impacts of the COVID-19 pandemic.

Additional risks, uncertainties and other factors that might cause such differences, some of which could be material, include but are not limited to: the ability to complete the merger with RPAI, including the satisfaction of the conditions necessary to close the proposed transaction (such as approval by the shareholders of both companies), on the terms or timeline currently contemplated, or at all; the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement relating to the proposed transaction with RPAI; risks associated with acquisitions generally, including the integration of the Company’s and RPAI’s businesses and the ability to achieve expected synergies or costs savings; the risk that disruptions caused by or relating to the proposed transaction will harm the Company’s business, including current plans and operations; national and local economic, business, real estate and other market conditions, particularly in connection with low or negative growth in the U.S. economy as well as economic uncertainty; financing risks, including the availability of, and costs associated with, sources of liquidity; the Company’s ability to refinance, or extend the maturity dates of, the Company’s indebtedness; the level and volatility of interest rates; the financial stability of tenants, including their ability to pay rent or request rent concessions, and the risk of tenant insolvency and bankruptcy; the competitive environment in which the Company operates, including potential oversupplies of and reduction in demand for rental space; acquisition, disposition, development and joint venture risks; property ownership and management risks, including the relative illiquidity of real estate investments, periodic costs to repair, renovate and re-lease spaces, operating costs and expenses, vacancies or the inability to rent space on favorable terms or at all; the Company’s ability to maintain the Company’s status as a real estate investment trust for U.S. federal income tax purposes; potential environmental and other liabilities; impairment in the value of real estate property the Company owns; the attractiveness of our properties to tenants, the actual and perceived impact of e-commerce on the value of shopping center assets and changing demographics and customer traffic patterns; risks related to our current geographical concentration of the Company’s properties in Florida, Indiana, Texas, North Carolina and Nevada; civil unrest, acts of terrorism or war, acts of God, climate change, epidemics, pandemics (including COVID-19), natural disasters and severe weather conditions such as hurricanes, tropical storms, tornadoes, earthquakes, droughts, floods and fires, including such events or conditions that may result in underinsured or uninsured losses or other increased costs and expenses; changes in laws and government regulations including governmental orders affecting the use of the Company’s properties or the ability of its tenants to operate, and the costs of complying with such changed laws and government regulations; possible short-term or long-term changes in consumer behavior due to COVID-19 and the fear of future pandemics; insurance costs and coverage; risks associated with cybersecurity attacks and the loss of confidential information and other business disruptions; other factors affecting the real estate industry generally; and

p. 5 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –6/30/2021 | ||||

other risks identified in reports the Company files with the Securities and Exchange Commission (“the SEC”) or in other documents that it publicly disseminates, including, in particular, the section titled “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020, and in the Company’s quarterly reports on Form 10-Q. The Company undertakes no obligation to publicly update or revise these forward-looking statements, whether as a result of new information, future events or otherwise.

This Earnings Release also includes certain forward-looking non-GAAP information. Due to high variability and difficulty in making accurate forecasts and projections of some of the information excluded from these estimates, together with some of the excluded information not being ascertainable or accessible, the Company is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable efforts.

p. 6 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –6/30/2021 | ||||

CORPORATE PROFILE |  | |||||||

General Description

Kite Realty Group Trust is a full-service, vertically integrated real estate investment trust (REIT) engaged primarily in the ownership and operation, acquisition, development and redevelopment of high-quality neighborhood and community shopping centers in certain select markets in the United States. As of June 30, 2021, we owned interests in 87 operating properties totaling approximately 16.8 million square feet and five development and redevelopment projects.

Our strategy is to maximize the cash flow of our operating properties, successfully complete the construction and lease-up of our redevelopment and development portfolio, and continue to gain scale in our target markets. New investments are focused in the shopping center sector primarily in markets that are benefiting from existing and accelerating migration patterns and where we believe we can leverage our existing infrastructure and relationships to generate attractive risk-adjusted returns. Dispositions are generally designed to increase the quality of our portfolio and exit non-target markets. The proceeds of dispositions will generally be used to acquire assets in our target markets, strengthen the Company’s balance sheet, or otherwise allocated so as to generate attractive risk-adjusted returns.

Company Highlights as of June 30, 2021

| # of Properties | Total GLA /NRA | Owned GLA /NRA1 | ||||||||||||

| Operating Retail Properties | 83 | 16,262,602 | 11,659,098 | |||||||||||

| Operating Office Properties and Other | 4 | 498,242 | 498,242 | |||||||||||

| Total Operating Properties | 87 | 16,760,844 | 12,157,340 | |||||||||||

Development and Redevelopment Projects2 | 5 | 866,493 | 368,890 | |||||||||||

| Total All Properties | 92 | 17,627,337 | 12,526,230 | |||||||||||

| Retail | Non-Retail | Total | ||||||||||||

| Operating Properties – Leased Percentage | 91.5% | 96.9% | 91.7% | |||||||||||

| States | 16 | |||||||||||||

Stock Listing: New York Stock Exchange symbol: KRG

| ____________________ | |||||

| 1 | Excludes square footage of structures located on land owned by the company and ground leased to tenants and adjacent non-owned anchors. | ||||

| 2 | Includes square footage of planned space upon completion. | ||||

p. 7 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –6/30/2021 | ||||

CONTACT INFORMATION |  | |||||||

Corporate Office

30 South Meridian Street, Suite 1100

Indianapolis, IN 46204

(888) 577-5600

(317) 577-5600

www.kiterealty.com

| Investor Relations Contact: | Analyst Coverage: | Analyst Coverage: | ||||||||||||

| Jason Colton | Robert W. Baird & Co. | Compass Point Research & Trading, LLC | ||||||||||||

| Senior Vice President, Capital Markets and IR | Mr. Wes Golladay | Mr. Floris van Dijkum | ||||||||||||

| Kite Realty Group Trust | (216) 737-7510 | (646) 757-2621 | ||||||||||||

| 30 South Meridian Street, Suite 1100 | wgolladay@rwbaird.com | fvandijkum@compasspointllc.com | ||||||||||||

| Indianapolis, IN 46204 | ||||||||||||||

| (317) 713-2762 | Bank of America/Merrill Lynch | KeyBanc Capital Markets | ||||||||||||

| jcolton@kiterealty.com | Mr. Jeffrey Spector/Mr. Craig Schmidt | Mr. Jordan Sadler/Mr. Todd Thomas | ||||||||||||

| (646) 855-1363/(646) 855-3640 | (917) 368-2280/(917) 368-2286 | |||||||||||||

| Transfer Agent: | jeff.spector@bofa.com | tthomas@keybanccm.com | ||||||||||||

| craig.schmidt@bofa.com | jsadler@keybanccm.com | |||||||||||||

| Broadridge Financial Solutions | ||||||||||||||

| Ms. Kristen Tartaglione | BTIG | Raymond James | ||||||||||||

2 Journal Square, 7th Floor | Mr. Michael Gorman | Mr. RJ Milligan | ||||||||||||

| Jersey City, NJ 07306 | (212) 738-6138 | (727) 567-2585 | ||||||||||||

| (201) 714-8094 | mgorman@btig.com | rjmilligann@raymondjames.com | ||||||||||||

| Stock Specialist: | Capital One Securities, Inc. | Piper Sandler | ||||||||||||

| Mr. Christopher Lucas | Mr. Alexander Goldfarb | |||||||||||||

| GTS | (571) 633-8151 | (212) 466-7937 | ||||||||||||

| 545 Madison Avenue | christopher.lucas@capitalone.com | alexander.goldfarb@psc.com | ||||||||||||

| 15th Floor | ||||||||||||||

| New York, NY 10022 | Citigroup Global Markets | Wells Fargo Securities, LLC | ||||||||||||

| (212) 715-2830 | Mr. Michael Bilerman/Ms. Katy McConnell | Ms. Tamara Fique | ||||||||||||

| (212) 816-1383/(212) 816-6981 | (617) 603-4262/(443) 263-6568 | |||||||||||||

| michael.bilerman@citigroup.com | tamara.fique@wellsfargo.com | |||||||||||||

| katy.mcconnell@citigroup.com | ||||||||||||||

p. 8 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –6/30/2021 | ||||

IMPORTANT NOTES INCLUDING NON-GAAP DISCLOSURES |  | |||||||

Interim Information

This Quarterly Financial Supplemental contains historical information of Kite Realty Group Trust (“the Company” or “KRG”) and is intended to supplement the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2021, to be filed on or about August 6, 2021, which should be read in conjunction with this supplement. The supplemental information is unaudited, although it reflects all adjustments that, in the opinion of management, are necessary for a fair presentation of operating results for the interim periods.

Forward-Looking Statements

This supplemental information package, together with other statements and information publicly disseminated by us, contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such statements are based on assumptions and expectations that may not be realized and are inherently subject to risks, uncertainties and other factors, many of which cannot be predicted with accuracy and some of which might not even be anticipated. Future events and actual results, performance, transactions or achievements, financial or otherwise, may differ materially from the results, performance, transactions or achievements, financial or otherwise, expressed or implied by the forward-looking statements.

Currently, one of the most significant factors that could cause actual outcomes to differ materially from the forward-looking statements is the potential adverse effect of the current pandemic of the novel coronavirus ("COVID-19"), including possible resurgences and mutations, on the financial condition, results of operations, cash flows and performance of the Company and its tenants, the real estate market and the global economy and financial markets. The effects of COVID-19 have caused and may continue to cause many of the Company’s tenants to close stores, reduce hours or significantly limit service, making it difficult for them to meet their rental obligations, and therefore has and will continue to impact us significantly for the foreseeable future. COVID-19 has impacted the Company significantly, and the extent to which it will continue to impact the Company and its tenants will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the scope, severity and duration of the pandemic, the continued speed of the vaccine distribution, the efficacy of vaccines, including against variants of COVID-19, acceptance and availability of vaccines, the actions taken to contain the pandemic or mitigate its impact, and the direct and indirect economic effects of the pandemic and containment measures, and possible short-term and long-term effects of the pandemic on consumer behavior, among others.

In addition, risks, uncertainties and factors that might cause such differences from the results, performance, transactions or achievements, financial or otherwise, expressed or implied by the forward-looking statements, some of which could be material, include but are not limited to:

•The ability to complete the Merger with RPAI, including the satisfaction of the conditions necessary to close the proposed transaction (such as approval by the shareholders of both companies), on the terms or timeline currently contemplated, or at all;

•the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement relating to the proposed transaction with RPAI;

•risks associated with acquisitions generally, including the integration of the Company’s and RPAI’s businesses and the ability to achieve expected synergies or cost savings;

•the risk that disruptions caused by or relating to the proposed transaction will harm the Company’s business, including current plans and operations;

•national and local economic, business, real estate and other market conditions, particularly in connection with low or negative growth in the U.S. economy as well as economic uncertainty;

•financing risks, including the availability of, and costs associated with, sources of liquidity;

•our ability to refinance, or extend the maturity dates of, our indebtedness;

•the level and volatility of interest rates;

•the financial stability of tenants, including their ability to pay rent or request rent concessions, and the risk of tenant insolvency and bankruptcy;

•the competitive environment in which the Company operates, including potential oversupplies of and reduction in demand for rental space;

•acquisition, disposition, development and joint venture risks;

•property ownership and management risks, including the relative illiquidity of real estate investments, period costs to repair, renovate and re-lease spaces, oeprating costs and expense, vacancies or the inability to rent space on favorable terms or at all;

•our ability to maintain our status as a real estate investment trust for federal income tax purposes;

•potential environmental and other liabilities;

•impairment in the value of real estate property the Company owns;

•the attractiveness of our properties to tenants, the actual and perceived impact of e-commerce on the value of shopping center assets and changing demographics and customer traffic patterns;

•risks related to our current geographical concentration of our properties in Florida, Indiana, Texas, Nevada and North Carolina;

•civil unrest, acts of terrorism or water, acts of God, climate change, epidemics, pandemics (including COVID-19), natural disasters and severe weather conditions such as hurricanes, tropical storms, tornadoes, earthquakes, droughts, floods and fires, including such events or conditions that may result in underinsured or uninsured losses, or other increased costs and expenses;

•changes in laws and government regulations including governmental orders affecting the use of our properties or the ability of our tenants to operate, and the costs of complying with such changed laws and government regulations;

•possible short-term or long-term changes in consumer behavior due to COVID-19 and the fear of future pandemics;

•insurance costs and coverage;

•risks associated with cybersecurity attacks and the loss of confidential information and other business disruptions;

p. 9 | Kite Realty Group Trust Supplemental Financial and Operating Statistics 6/30/2021 | ||||

IMPORTANT NOTES INCLUDING NON-GAAP DISCLOSURES (CONTINUED) |  | |||||||

•other factors affecting the real estate industry generally; and

•other risks identified in reports the Company files with the Securities and Exchange Commission (“the SEC”) or in other documents that it publicly disseminates, including, in particular, the section titled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, and in our quarterly reports on Form 10-Q.

The Company undertakes no obligation to publicly update or revise these forward-looking statements, whether as a result of new information, future events or otherwise.

Non-GAAP Disclosures

Funds from Operations

Funds from Operations (FFO) is a widely used performance measure for real estate companies and is provided here as a supplemental measure of operating performance. The Company calculates FFO, a non-GAAP financial measure, in accordance with the best practices described in the April 2002 National Policy Bulletin of the National Association of Real Estate Investment Trusts ("NAREIT"), as restated in 2018. The NAREIT white paper defines FFO as net income (calculated in accordance with GAAP), excluding depreciation and amortization related to real estate, gains and losses from the sale of certain real estate assets, gains and losses from change in control, and impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity.

Considering the nature of our business as a real estate owner and operator, the Company believes that FFO is helpful to investors in measuring our operational performance because it excludes various items included in net income that do not relate to or are not indicative of our operating performance, such as gains or losses from sales of depreciated property and depreciation and amortization, which can make periodic and peer analyses of operating performance more difficult. FFO excludes the gain on the sale of the ground lease portfolio as this sale was part of our capital strategy distinct from our ongoing operating strategy of selling individual land parcels, from time to time. FFO (a) should not be considered as an alternative to net income (calculated in accordance with GAAP) for the purpose of measuring our financial performance, (b) is not an alternative to cash flow from operating activities (calculated in accordance with GAAP) as a measure of our liquidity, and (c) is not indicative of funds available to satisfy our cash needs, including our ability to make distributions. Our computation of FFO may not be comparable to FFO reported by other REITs that do not define the term in accordance with the current NAREIT definition or that interpret the current NAREIT definition differently than we do. A reconciliation of net income (calculated in accordance with GAAP) to FFO is included elsewhere in this Financial Supplement.

From time to time, the Company may report or provide guidance with respect to “FFO as adjusted” which starts with FFO, as defined by NAREIT, and then removes the impact of certain non-recurring and non-operating transactions or other items the Company does not consider to be representative of its core operating results including without limitation, gains or losses associated with the early extinguishment of debt, gains or losses associated with litigation involving the Company that is not in the normal course of business, merger and acquisition costs, the impact on earnings from employee severance, the excess of redemption value over carrying value of preferred stock redemption, and the impact of 2020 bad debt or 2020 accounts receivable ("2020 Collection Impact"), which are not otherwise adjusted in the Company’s calculation of FFO.

Adjusted Funds from Operations

Adjusted Funds from Operations (“AFFO”) is a non-GAAP financial measure of operating performance used by many companies in the REIT industry. AFFO modifies FFO, as adjusted for certain cash and non-cash transactions not included in FFO. AFFO should not be considered an alternative to net income as an indication of the company's performance or as an alternative to cash flow as a measure of liquidity or ability to make distributions. Management considers AFFO a useful supplemental measure of the company’s performance. The Company’s computation of AFFO may differ from the methodology for calculating AFFO used by other REITs, and therefore, may not be comparable to such other REITs. A reconciliation of net income (calculcated in accordance with GAAP) to AFFO is included elsewhere in this Financial Supplement.

Net Operating Income and Same Property Net Operating Income

The Company uses property net operating income (“NOI”), a non-GAAP financial measure, to evaluate the performance of our properties. The Company defines NOI as income from our real estate, including lease termination fees received from tenants, less our property operating expenses. NOI excludes amortization of capitalized tenant improvement costs and leasing commissions and certain corporate level expenses, including merger and acquisition costs. The Company believes that NOI is helpful to investors as a measure of our operating performance because it excludes various items included in net income that do not relate to or are not indicative of our operating performance, such as depreciation and amortization, interest expense, and impairment, if any.

The Company also uses same property NOI ("Same Property NOI"), a non-GAAP financial measure, to evaluate the performance of our properties. Same Property NOI excludes properties that have not been owned for the full period presented. It also excludes net gains from outlot sales, straight-line rent revenue, lease termination income in excess of lost rent, amortization of lease intangibles and significant prior period expense recoveries and adjustments, if any. When the Company receives payments in excess of any accounts receivable for terminating a lease, Same Property NOI will include such excess payments as monthly rent until the earlier of the following: the expiration of 12 months or the start date of a replacement tenant. The Company believes that Same Property NOI is helpful to investors as a measure of our operating performance because it includes only the NOI of properties that have been owned for the full quarters presented. The Company believes such presentation eliminates disparities in net income due to the acquisition or disposition of properties during the particular periods

p. 10 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –6/30/2021 | ||||

IMPORTANT NOTES INCLUDING NON-GAAP DISCLOSURES (CONTINUED) |  | |||||||

presented and thus provides a more consistent metric for the comparison of our properties. Same Property NOI includes the results of properties that have been owned for the entire current and prior year reporting periods.

NOI and Same Property NOI should not, however, be considered as alternatives to net income (calculated in accordance with GAAP) as indicators of our financial performance. Our computation of NOI and Same Property NOI may differ from the methodology used by other REITs, and therefore may not be comparable to such other REITs.

When evaluating the properties that are included in the same property pool, the Company has established specific criteria for determining the inclusion of properties acquired or those recently under development. An acquired property is included in the same property pool when there is a full quarter of operations in both years subsequent to the acquisition date. Development and redevelopment properties are included in the same property pool four full quarters after the properties have been transferred to the operating portfolio. A redevelopment property is first excluded from the same property pool when the execution of a redevelopment plan is likely and the Company a) begins recapturing space from tenants or b) the contemplated plan significantly impacts the operations of the property. For the quarter ended June 30, 2021, the Company excluded three redevelopment properties from the same property pool that met these criteria and were owned in both comparable periods. In addition, the Company excluded one recently acquired property from the same property pool.

Earnings Before Interest Expense, Income Tax Expense, Depreciation and Amortization (EBITDA) and Net Debt to EBITDA

The Company defines EBITDA, a non-GAAP financial measure, as net income before depreciation and amortization, interest expense and income tax expense of taxable REIT subsidiary. For informational purposes, the Company has also provided Adjusted EBITDA, which the Company defines as EBITDA less (i) EBITDA from unconsolidated entities, (ii) gains on sales of properties or impairment charges, (iii) other income and expense, (iv) noncontrolling interest EBITDA and (v) other non-recurring activity or items impacting comparability from period to period. Annualized Adjusted EBITDA is Adjusted EBITDA for the most recent quarter multiplied by four. Net Debt to Adjusted EBITDA is the Company's share of net debt divided by Annualized Adjusted EBITDA. EBITDA, Adjusted EBITDA, Annualized Adjusted EBITDA and Net Debt to Adjusted EBITDA, as calculated by us, are not comparable to EBITDA and EBITDA-related measures reported by other REITs that do not define EBITDA and EBITDA-related measures exactly as we do. EBITDA, Adjusted EBITDA and Annualized Adjusted EBITDA do not represent cash generated from operating activities in accordance with GAAP, and should not be considered alternatives to net income as an indicator of performance or as alternatives to cash flows from operating activities as an indicator of liquidity.

Considering the nature of our business as a real estate owner and operator, the Company believes that EBITDA, Adjusted EBITDA and the ratio of Net Debt to Adjusted EBITDA are helpful to investors in measuring our operational performance because they exclude various items included in net income that do not relate to or are not indicative of our operating performance, such as gains or losses from sales of depreciated property and depreciation and amortization, which can make periodic and peer analyses of operating performance more difficult. For informational purposes, the Company has also provided Annualized Adjusted EBITDA, adjusted as described above. The Company believes this supplemental information provides a meaningful measure of our operating performance. The Company believes presenting EBITDA and the related measures in this manner allows investors and other interested parties to form a more meaningful assessment of our operating results.

p. 11 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –6/30/2021 | ||||

CONSOLIDATED BALANCE SHEETS (UNAUDITED) |  | |||||||

| ($ in thousands) | ||||||||||||||

| June 30, 2021 | December 31, 2020 | |||||||||||||

| Assets: | ||||||||||||||

| Investment properties, at cost | $ | 3,147,133 | $ | 3,143,961 | ||||||||||

| Less: accumulated depreciation | (803,437) | (755,100) | ||||||||||||

| 2,343,696 | 2,388,861 | |||||||||||||

| Cash and cash equivalents | 89,894 | 43,648 | ||||||||||||

| Tenant and other receivables, including accrued straight-line rent of $24,802 and $24,783, respectively | 46,678 | 57,154 | ||||||||||||

| Restricted cash and escrow deposits | 4,186 | 2,938 | ||||||||||||

| Deferred costs and intangibles, net | 57,239 | 63,171 | ||||||||||||

| Short-term deposits and other assets | 164,489 | 39,975 | ||||||||||||

| Investments in unconsolidated subsidiaries | 13,023 | 12,792 | ||||||||||||

| Total Assets | $ | 2,719,205 | $ | 2,608,539 | ||||||||||

| Liabilities and Shareholders’ Equity: | ||||||||||||||

| Mortgage and other indebtedness, net | $ | 1,289,369 | $ | 1,170,794 | ||||||||||

| Accounts payable and accrued expenses | 74,440 | 77,469 | ||||||||||||

| Deferred revenue and other liabilities | 83,856 | 85,649 | ||||||||||||

| Total Liabilities | 1,447,665 | 1,333,912 | ||||||||||||

| Commitments and contingencies | ||||||||||||||

| Limited Partners’ interests in the Operating Partnership and other redeemable noncontrolling interests | 57,367 | 43,275 | ||||||||||||

| Shareholders’ Equity: | ||||||||||||||

| Kite Realty Group Trust Shareholders’ Equity: | ||||||||||||||

| Common Shares, $.01 par value, 225,000,000 shares authorized, 84,546,649 and 84,187,999 shares issued and outstanding at June 30, 2021 and December 31, 2020, respectively | 845 | 842 | ||||||||||||

| Additional paid in capital | 2,064,310 | 2,085,003 | ||||||||||||

| Accumulated other comprehensive loss | (24,354) | (30,885) | ||||||||||||

| Accumulated deficit | (827,326) | (824,306) | ||||||||||||

| Total Kite Realty Group Trust Shareholders’ Equity | 1,213,475 | 1,230,654 | ||||||||||||

| Noncontrolling Interests | 698 | 698 | ||||||||||||

| Total Equity | 1,214,173 | 1,231,352 | ||||||||||||

| Total Liabilities and Equity | $ | 2,719,205 | $ | 2,608,539 | ||||||||||

p. 12 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –6/30/2021 | ||||

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) |  | |||||||

| ($ in thousands, except per share data) | ||||||||||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||||||

| Revenue: | ||||||||||||||||||||||||||

| Rental income | $ | 67,990 | $ | 61,538 | $ | 135,880 | $ | 127,066 | ||||||||||||||||||

| Other property related revenue | 1,027 | 1,676 | 2,078 | 5,956 | ||||||||||||||||||||||

| Fee income | 515 | 91 | 948 | 195 | ||||||||||||||||||||||

| Total revenue | 69,532 | 63,305 | 138,906 | 133,217 | ||||||||||||||||||||||

| Expenses: | ||||||||||||||||||||||||||

| Property operating | 10,227 | 9,319 | 20,496 | 20,120 | ||||||||||||||||||||||

| Real estate taxes | 8,550 | 8,254 | 17,950 | 17,188 | ||||||||||||||||||||||

| General, administrative, and other | 8,159 | 6,578 | 15,435 | 13,504 | ||||||||||||||||||||||

| Merger and acquisition costs | 760 | — | 760 | — | ||||||||||||||||||||||

| Depreciation and amortization | 29,798 | 31,409 | 60,431 | 62,877 | ||||||||||||||||||||||

| Total expenses | 57,494 | 55,560 | 115,072 | 113,689 | ||||||||||||||||||||||

| Gain on sale of properties, net | 50 | 623 | 26,258 | 1,666 | ||||||||||||||||||||||

| Operating income | 12,088 | 8,368 | 50,092 | 21,194 | ||||||||||||||||||||||

| Interest expense | (12,266) | (13,271) | (24,508) | (25,564) | ||||||||||||||||||||||

| Income tax benefit of taxable REIT subsidiary | 100 | 202 | 218 | 306 | ||||||||||||||||||||||

| Equity in loss of unconsolidated subsidiaries | (244) | (436) | (562) | (839) | ||||||||||||||||||||||

| Other income, net | 227 | 351 | 19 | 249 | ||||||||||||||||||||||

| Net (loss) income | (95) | (4,786) | 25,259 | (4,654) | ||||||||||||||||||||||

| Net (income) loss attributable to noncontrolling interests | (147) | 17 | (926) | (188) | ||||||||||||||||||||||

| Net (loss) income attributable to Kite Realty Group Trust common shareholders | $ | (242) | $ | (4,769) | $ | 24,333 | $ | (4,842) | ||||||||||||||||||

| Net income (loss) per common share - basic and diluted | $ | 0.00 | $ | (0.06) | $ | 0.29 | $ | (0.06) | ||||||||||||||||||

| Weighted average common shares outstanding - basic | 84,509,871 | 84,157,541 | 84,423,703 | 84,090,316 | ||||||||||||||||||||||

| Weighted average common shares outstanding - diluted | 84,509,871 | 84,157,541 | 85,280,156 | 84,090,316 | ||||||||||||||||||||||

| Dividends per common share | $ | 0.1700 | $ | 0.0000 | $ | 0.3200 | $ | 0.3175 | ||||||||||||||||||

p. 13 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –6/30/2021 | ||||

SAME PROPERTY NET OPERATING INCOME (NOI) |  | |||||||

| ($ in thousands) | |||||||||||||||||||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||||||||||||||

| 2021 | 2020 | % Change | 2021 | 2020 | % Change | ||||||||||||||||||||||||||||||

Number of properties for the period1 | 83 | 83 | |||||||||||||||||||||||||||||||||

| Leased percentage at period end | 91.6 | % | 94.6 | % | 91.6 | % | 94.6 | % | |||||||||||||||||||||||||||

Economic Occupancy percentage2 | 89.2 | % | 92.4 | % | 89.0 | % | 92.7 | % | |||||||||||||||||||||||||||

| Minimum rent | $ | 49,407 | $ | 49,787 | $ | 99,278 | $ | 100,735 | |||||||||||||||||||||||||||

| Tenant recoveries | 14,864 | 14,944 | 29,864 | 30,701 | |||||||||||||||||||||||||||||||

| Bad debt recovery (provision) | 73 | (5,439) | (568) | (6,090) | |||||||||||||||||||||||||||||||

| Other income | 343 | 82 | 514 | 322 | |||||||||||||||||||||||||||||||

| 64,687 | 59,374 | 129,088 | 125,668 | ||||||||||||||||||||||||||||||||

| Property operating expenses | (8,705) | (7,718) | (17,411) | (16,842) | |||||||||||||||||||||||||||||||

| Real estate taxes | (8,679) | (8,693) | (17,497) | (17,610) | |||||||||||||||||||||||||||||||

| (17,384) | (16,411) | (34,908) | (34,452) | ||||||||||||||||||||||||||||||||

| Same Property NOI | $ | 47,303 | $ | 42,963 | 10.1% | $ | 94,180 | $ | 91,216 | 3.2% | |||||||||||||||||||||||||

| Reconciliation of Same Property NOI to Most Directly Comparable GAAP Measure: | |||||||||||||||||||||||||||||||||||

| Net operating income - same properties | $ | 47,303 | $ | 42,963 | $ | 94,180 | $ | 91,216 | |||||||||||||||||||||||||||

Net operating income - non-same activity3 | 3,452 | 2,769 | 6,280 | 4,693 | |||||||||||||||||||||||||||||||

| Other income (expense), net | 83 | 117 | (325) | (284) | |||||||||||||||||||||||||||||||

| General, administrative and other | (8,159) | (6,578) | (15,435) | (13,504) | |||||||||||||||||||||||||||||||

| Merger and acquisition costs | (760) | — | (760) | — | |||||||||||||||||||||||||||||||

| Depreciation and amortization expense | (29,798) | (31,409) | (60,431) | (62,877) | |||||||||||||||||||||||||||||||

| Interest expense | (12,266) | (13,271) | (24,508) | (25,564) | |||||||||||||||||||||||||||||||

| Gain on sales of properties | 50 | 623 | 26,258 | 1,666 | |||||||||||||||||||||||||||||||

| Net (income) loss attributable to noncontrolling interests | (147) | 17 | (926) | (188) | |||||||||||||||||||||||||||||||

| Net (loss) income attributable to common shareholders | $ | (242) | $ | (4,769) | $ | 24,333 | $ | (4,842) | |||||||||||||||||||||||||||

| ____________________ | |||||

| 1 | Same Property NOI excludes (i) The Corner, Glendale Town Center, and Hamilton Crossing redevelopments, (ii) Eddy Street Commons - Phases II and III developments, (iii) the recently acquired Eastgate Crossing, and (iv) office properties. | ||||

| 2 | Excludes leases that are signed but for which tenants have not yet commenced the payment of cash rent. Calculated as a weighted average based on the timing of cash rent commencement and expiration during the period. | ||||

| 3 | Includes non-cash activity across the portfolio as well as net operating income from properties not included in the same property pool including properties sold during both periods. | ||||

p. 14 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –6/30/2021 | ||||

NET OPERATING INCOME AND EBITDA BY QUARTER |  | |||||||

| ($ in thousands) | ||||||||||||||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||||||||||

| June 30, 2021 | March 31, 2021 | December 31, 2020 | September 30, 2020 | June 30, 2020 | ||||||||||||||||||||||||||||

| Revenue: | ||||||||||||||||||||||||||||||||

Minimum rent1 | $ | 49,097 | $ | 49,801 | $ | 49,506 | $ | 48,669 | $ | 49,265 | ||||||||||||||||||||||

| Minimum rent - ground leases | 3,656 | 4,038 | 4,190 | 4,152 | 4,242 | |||||||||||||||||||||||||||

| Tenant reimbursements | 14,308 | 15,389 | 15,863 | 15,134 | 14,656 | |||||||||||||||||||||||||||

| Bad debt recovery (expense) | 597 | (1,420) | (3,412) | (3,643) | (6,627) | |||||||||||||||||||||||||||

| Other property related revenue | 336 | 549 | 1,675 | 201 | 1,411 | |||||||||||||||||||||||||||

| Overage rent | 332 | 82 | 164 | — | 3 | |||||||||||||||||||||||||||

Parking revenue, net2 | 152 | (1) | (257) | (32) | (102) | |||||||||||||||||||||||||||

| 68,478 | 68,438 | 67,729 | 64,481 | 62,848 | ||||||||||||||||||||||||||||

| Expenses: | ||||||||||||||||||||||||||||||||

Property operating - Recoverable3 | 8,666 | 8,407 | 8,688 | 8,700 | 8,316 | |||||||||||||||||||||||||||

Property operating - Non-Recoverable3 | 1,229 | 1,547 | 1,516 | 1,342 | 725 | |||||||||||||||||||||||||||

| Real estate taxes | 8,343 | 9,212 | 9,122 | 9,168 | 8,165 | |||||||||||||||||||||||||||

| 18,238 | 19,166 | 19,326 | 19,210 | 17,206 | ||||||||||||||||||||||||||||

| Net Operating Income - Properties | 50,240 | 49,272 | 48,403 | 45,271 | 45,642 | |||||||||||||||||||||||||||

| Other (Expenses) Income: | ||||||||||||||||||||||||||||||||

| General, administrative, and other | (8,159) | (7,276) | (7,602) | (6,482) | (6,578) | |||||||||||||||||||||||||||

| Severance charges | — | — | (3,253) | — | — | |||||||||||||||||||||||||||

| Fee income | 515 | 434 | 79 | 104 | 91 | |||||||||||||||||||||||||||

| (7,644) | (6,842) | (10,776) | (6,378) | (6,487) | ||||||||||||||||||||||||||||

| Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization | 42,596 | 42,430 | 37,627 | 38,893 | 39,155 | |||||||||||||||||||||||||||

| Depreciation and amortization | (29,798) | (30,634) | (31,818) | (33,953) | (31,409) | |||||||||||||||||||||||||||

| Merger and acquisition costs | (760) | — | — | — | — | |||||||||||||||||||||||||||

| Interest expense | (12,266) | (12,242) | (12,284) | (12,550) | (13,271) | |||||||||||||||||||||||||||

| Equity in loss of unconsolidated subsidiaries | (244) | (318) | (429) | (417) | (436) | |||||||||||||||||||||||||||

| Income tax benefit of taxable REIT subsidiary | 100 | 118 | 200 | 190 | 202 | |||||||||||||||||||||||||||

| Other income (expense), net | 227 | (206) | 21 | (16) | 350 | |||||||||||||||||||||||||||

| Gain (loss) on sales of properties | 50 | 26,207 | (159) | 3,226 | 623 | |||||||||||||||||||||||||||

| Net income (loss) | (95) | 25,355 | (6,842) | (4,627) | (4,786) | |||||||||||||||||||||||||||

| Less: Net (income) loss attributable to noncontrolling interests | (147) | (778) | 48 | 40 | 17 | |||||||||||||||||||||||||||

| Net (loss) income attributable to Kite Realty Group Trust | $ | (242) | $ | 24,577 | $ | (6,794) | $ | (4,587) | $ | (4,769) | ||||||||||||||||||||||

| NOI/Revenue | 73.4 | % | 72.0 | % | 71.5 | % | 70.2 | % | 72.6 | % | ||||||||||||||||||||||

Recovery Ratios4 | ||||||||||||||||||||||||||||||||

| - Retail Properties | 88.1 | % | 90.6 | % | 92.8 | % | 87.8 | % | 92.3 | % | ||||||||||||||||||||||

| - Consolidated | 84.1 | % | 87.3 | % | 89.1 | % | 84.7 | % | 88.9 | % | ||||||||||||||||||||||

| ____________________ | |||||

| 1 | Minimum rent includes $0.3 million, $1.2 million, $0.6 million, $0.3 million, and $0.6 million of lease termination income for the three months ended June 30, 2021, March 31, 2021, December, 31, 2020, September 30, 2020, and June 30, 2020, respectively. | ||||

| 2 | Parking revenue, net represents the net operating results of the Eddy Street Parking Garage, the Union Station Parking Garage, and the Pan Am Plaza Parking Garage. | ||||

| 3 | Recoverable expenses include recurring G&A expense of $1.4 million allocable to the property operations in the three months ended June 30, 2021, a portion of which is recoverable. Non-recoverable expenses primarily include ground rent, professional fees, and marketing costs. | ||||

| 4 | “Recovery Ratio” is computed by dividing tenant reimbursements by the sum of recoverable property operating expense and real estate tax expense. | ||||

p. 15 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –6/30/2021 | ||||

FUNDS FROM OPERATIONS1, 2 |  | |||||||

| ($ in thousands, except per share data) | ||||||||||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||||||

| Funds From Operations ("FFO") | ||||||||||||||||||||||||||

| Consolidated net (loss) income | $ | (95) | $ | (4,786) | $ | 25,259 | $ | (4,654) | ||||||||||||||||||

| Less: net income attributable to noncontrolling interests in properties | (132) | (132) | (264) | (264) | ||||||||||||||||||||||

| Less: Gain on sales of properties | (50) | (623) | (26,258) | (1,666) | ||||||||||||||||||||||

| Add: depreciation and amortization of consolidated and unconsolidated entities, net of noncontrolling interests | 30,142 | 31,744 | 61,113 | 63,531 | ||||||||||||||||||||||

FFO of the Operating Partnership1 | 29,865 | 26,203 | 59,850 | 56,947 | ||||||||||||||||||||||

| Less: Limited Partners' interests in FFO | (888) | (769) | (1,758) | (1,508) | ||||||||||||||||||||||

FFO attributable to Kite Realty Group Trust common shareholders1 | $ | 28,977 | $ | 25,434 | $ | 58,092 | $ | 55,439 | ||||||||||||||||||

| FFO, as defined by NAREIT, per share of the Operating Partnership - basic | $ | 0.34 | $ | 0.30 | $ | 0.69 | $ | 0.66 | ||||||||||||||||||

| FFO, as defined by NAREIT, per share of the Operating Partnership - diluted | $ | 0.34 | $ | 0.30 | $ | 0.68 | $ | 0.66 | ||||||||||||||||||

| Add: merger and acquisition costs | 760 | — | 760 | — | ||||||||||||||||||||||

| Less: 2020 Collection Impact | (1,057) | — | (1,267) | — | ||||||||||||||||||||||

| FFO, as adjusted, of the Operating Partnership | $ | 29,568 | $ | 26,203 | $ | 59,343 | $ | 56,947 | ||||||||||||||||||

| FFO, as adjusted, per share of the Operating Partnership - basic | $ | 0.34 | $ | 0.30 | $ | 0.68 | $ | 0.66 | ||||||||||||||||||

| FFO, as adjusted, per share of the Operating Partnership - diluted | $ | 0.34 | $ | 0.30 | $ | 0.68 | $ | 0.66 | ||||||||||||||||||

| Weighted average common shares outstanding - basic | 84,509,871 | 84,157,541 | 84,423,703 | 84,090,316 | ||||||||||||||||||||||

| Weighted average common shares outstanding - diluted | 85,684,070 | 84,318,868 | 85,280,156 | 84,247,173 | ||||||||||||||||||||||

| Weighted average common shares and units outstanding - basic | 86,986,054 | 86,392,532 | 86,924,446 | 86,296,471 | ||||||||||||||||||||||

| Weighted average common shares and units outstanding - diluted | 88,160,253 | 86,553,859 | 87,780,899 | 86,453,328 | ||||||||||||||||||||||

| FFO, as defined by NAREIT, per diluted share/unit | ||||||||||||||||||||||||||

| Consolidated net income (loss) | $ | 0.00 | $ | (0.06) | $ | 0.29 | $ | (0.05) | ||||||||||||||||||

| Less: net income attributable to noncontrolling interests in properties | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||||||||||||

| Less: Gain on sales of properties | 0.00 | (0.01) | (0.30) | (0.02) | ||||||||||||||||||||||

| Add: depreciation and amortization of consolidated and unconsolidated entities, net of noncontrolling interests | 0.34 | 0.37 | 0.70 | 0.73 | ||||||||||||||||||||||

FFO, as defined by NAREIT, of the Operating Partnership per diluted share/unit1, 2 | $ | 0.34 | $ | 0.30 | $ | 0.68 | $ | 0.66 | ||||||||||||||||||

| Add: merger and acquisition costs | 0.01 | — | 0.01 | — | ||||||||||||||||||||||

| Less: 2020 Collection Impact | (0.01) | — | (0.01) | — | ||||||||||||||||||||||

FFO, as adjusted, of the Operating Partnership per diluted share/unit 2 | $ | 0.34 | $ | 0.30 | $ | 0.68 | $ | 0.66 | ||||||||||||||||||

| ____________________ | |||||

| 1 | “FFO of the Operating Partnership" measures 100% of the operating performance of the Operating Partnership’s real estate properties. “FFO attributable to Kite Realty Group Trust common shareholders” reflects a reduction for the redeemable noncontrolling weighted average diluted interest in the Operating Partnership. | ||||

| 2 | Per share/unit amounts of components will not necessarily sum to the total due to rounding to the nearest cent. | ||||

p. 16 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –6/30/2021 | ||||

ADJUSTED FUNDS FROM OPERATIONS AND OTHER FINANCIAL INFORMATION |  | |||||||

| ($ in thousands) | ||||||||||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||||||

| Reconciliation of FFO, as adjusted, to Adjusted Funds from Operations (AFFO) | ||||||||||||||||||||||||||

| FFO, as adjusted, of the Operating Partnership | $ | 29,568 | $ | 26,203 | $ | 59,343 | $ | 56,947 | ||||||||||||||||||

| Add: | ||||||||||||||||||||||||||

| Depreciation of non-real estate assets | 98 | 118 | 202 | 251 | ||||||||||||||||||||||

| Amortization of deferred financing costs | 702 | 590 | 1,230 | 1,172 | ||||||||||||||||||||||

| Non-cash compensation expense | 1,831 | 1,433 | 3,508 | 2,414 | ||||||||||||||||||||||

| Less: | ||||||||||||||||||||||||||

| Straight-line rent - minimum rent | 268 | 213 | 214 | 371 | ||||||||||||||||||||||

| Straight-line rent - common area maintenance | 259 | 180 | 414 | 358 | ||||||||||||||||||||||

| Straight-line rent - reserve for uncollectability | — | (881) | (110) | (3,757) | ||||||||||||||||||||||

| Market rent amortization income | 422 | 768 | 902 | 1,367 | ||||||||||||||||||||||

| Amortization of debt premium | 111 | 111 | 222 | 222 | ||||||||||||||||||||||

Capital expenditures1: | ||||||||||||||||||||||||||

| Maintenance capital expenditures | 194 | 820 | 360 | 981 | ||||||||||||||||||||||

| Revenue enhancing tenant improvements | 606 | 735 | 2,357 | 3,448 | ||||||||||||||||||||||

| External lease commissions | 308 | 102 | 618 | 364 | ||||||||||||||||||||||

| Total Recurring AFFO of the Operating Partnership | 30,031 | $ | 26,296 | $ | 59,306 | $ | 57,430 | |||||||||||||||||||

| Other Financial Information: | ||||||||||||||||||||||||||

| Scheduled debt principal payments | $ | 574 | $ | 554 | $ | 1,141 | $ | 1,103 | ||||||||||||||||||

| ____________________ | |||||

| 1 | Excludes landlord work, tenant improvements and leasing commissions relating to development, redevelopment, and Anchor Acceleration projects. | ||||

p. 17 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –6/30/2021 | ||||

SUMMARY INCOME STATEMENT |  | |||||||

| ($ in thousands) | |||||||||||||||||||||||

| Three Months Ended June 30, | |||||||||||||||||||||||

| 2021 | 2020 | % Change | |||||||||||||||||||||

| Same Property Revenue | $ | 64,687 | $ | 59,374 | 8.9 | % | |||||||||||||||||

| Same Property Expenses | (17,384) | (16,411) | (5.9) | % | |||||||||||||||||||

Same Property Net Operating Income | 47,303 | 42,963 | 10.1 | % | |||||||||||||||||||

| Sold Assets Net Operating Income | — | 573 | |||||||||||||||||||||

| Non-Same Property Net Operating Income | 2,937 | 2,106 | |||||||||||||||||||||

Net Operating Income | 50,240 | 45,642 | 10.1 | % | |||||||||||||||||||

| General and Administrative Expense | (8,159) | (6,578) | (24.0) | % | |||||||||||||||||||

| Fee income | 515 | 91 | 465.9 | % | |||||||||||||||||||

| EBITDA | 42,596 | 39,155 | 8.8 | % | |||||||||||||||||||

| Merger and acquisition costs | (760) | — | |||||||||||||||||||||

| Interest Expense | (12,266) | (13,271) | 7.6 | % | |||||||||||||||||||

| Other income (expense), net | 295 | 319 | 7.5 | % | |||||||||||||||||||

| Funds From Operations | 29,865 | 26,203 | 14.0 | % | |||||||||||||||||||

| 2020 Collection Impact | (1,057) | — | 100.0 | % | |||||||||||||||||||

| Merger and Acquisition Costs | 760 | — | 100.0 | % | |||||||||||||||||||

| Funds From Operations, as adjusted | 29,568 | 26,203 | 12.8 | % | |||||||||||||||||||

| Non-Cash Items | 1,571 | 1,750 | 10.2 | % | |||||||||||||||||||

| Capital Expenditures | (1,108) | (1,657) | 33.1 | % | |||||||||||||||||||

| Recurring Adjusted Funds From Operations | 30,031 | 26,296 | 14.2 | % | |||||||||||||||||||

| FFO per share of the Operating Partnership, as adjusted - diluted | $ | 0.34 | $ | 0.30 | 13.4 | % | |||||||||||||||||

p. 18 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –6/30/2021 | ||||

IMPACT OF COVID-19 |  | |||||||

| ($ in thousands) | ||||||||

| Bad Debt Breakout | ||||||||

| Amount | Supplemental Page No.: | |||||||

| Bad Debt Type | ||||||||

| 2nd Quarter Billed Rent Deemed Uncollectible - Operating Tenants | $ | 722 | ||||||

| 2nd Quarter Cash Impact | 722 | |||||||

| Recovery of Bad Debt Incurred in 1st Quarter 2021 | (149) | |||||||

| Straight-Line Rent Recovery from 1st Quarter 2021 | (113) | |||||||

| 2021 Impact | 460 | |||||||

| Previous Accounts Receivable Balance Accrued in 2020 Now Deemed Uncollectible | 553 | |||||||

| Recovery of Bad Debt Incurred in 2020 | (1,065) | |||||||

| Straight-Line Rent Recovery from 2020 | (545) | |||||||

| Total 2nd Quarter Bad Debt Expense (Recovery) | $ | (597) | 15 | |||||

| Accounts Receivable Impact | ||||||||

| Amount | Supplemental Page No.: | |||||||

| Balance as of March 31, 2021 | $ | 49,080 | ||||||

| Small Business Loans | (158) | |||||||

| Other Activity | 2,069 | |||||||

| 2nd Quarter Billed Rent Outstanding | 1,975 | |||||||

| 2nd Quarter Billed Rent Deemed Uncollectible | (722) | |||||||

| Accounts Receivable Balances Prior to 1st Quarter Deemed Uncollectible | (553) | |||||||

| Amounts Collected Outstanding as of December 31 | (5,013) | |||||||

| Balance as of June 30, 2021 | $ | 46,678 | 12 | |||||

| Revenue Breakdown | ||||||||

| Amount | Supplemental Page No.: | |||||||

| 2nd Quarter Billed Rent | $ | 64,656 | ||||||

| 2nd Quarter Billed Rent Deemed Uncollectible | (722) | |||||||

| Previous Billed Rent Deemed Uncollectible | (553) | |||||||

| Reserved in Previous Quarter, Paid in 2nd Quarter | 1,065 | |||||||

| Other Revenues | 4,032 | |||||||

| 2nd Quarter Total Revenues | $ | 68,478 | 15 | |||||

| 2nd Quarter Total Revenues | 68,478 | |||||||

| Previous Accounts Receivable Balance Now Deemed Uncollectible | 553 | |||||||

| Recovery of Previous Bad Debt | (1,065) | |||||||

| Other Revenues | (4,032) | |||||||

| 2nd Quarter Net Recurring Revenue | $ | 63,934 | ||||||

| Comparison to Q1 2020 | ||||||||

| 1st Quarter 2020 Billed Rent | $ | 67,400 | ||||||

| Difference from 1st Quarter 2020 to 2nd Quarter 2021 in Billed Rent | (4.1) | % | ||||||

| 1st Quarter 2020 Net Recurring Revenues | $ | 68,020 | ||||||

| Difference from 1st Quarter 2020 to 2nd Quarter 2021 in Net Recurring Revenues | (6.0) | % | ||||||

p. 19 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –6/30/2021 | ||||

JOINT VENTURE SUMMARY - JUNE 30, 2021 |  | |||||||

($ in thousands)

| CONSOLIDATED INVESTMENTS | ||||||||||||||||||||||||||

| Investment Partner | Total GLA | Total Assets | Total Debt | Partner Economic Ownership Interest 1 | Partner Share of Debt | Partner Share of Annual Income | ||||||||||||||||||||

| Individual Investors | 466,907 | $ | 138,832 | $ | 29,373 | 2% - 15% | $ | 587 | $ | 528 | ||||||||||||||||

| UNCONSOLIDATED INVESTMENTS | ||||||||||||||||||||||||||

| Investment Partner | Total GLA | Total Assets | Total Debt | KRG Economic Ownership Interest | KRG Share of Debt | KRG Investment | KRG Share of Quarterly EBITDA | KRG Share of Quarterly EBITDA Annualized | ||||||||||||||||||

| Nuveen | 416,877 | $ | 101,208 | $ | 51,890 | 20% | $ | 10,378 | $ | 9,010 | $ | 328 | $ | 1,312 | ||||||||||||

| Individual Investors | 359,460 | 69,375 | 44,502 | 12% - 35% | 13,022 | 4,013 | 174 | 696 | ||||||||||||||||||

| Total | 776,337 | $ | 170,583 | $ | 96,392 | $ | 23,400 | $ | 13,023 | $ | 502 | $ | 2,008 | |||||||||||||

| ____________________ | |||||||||||||||||||||||

| 1 | Economic ownership % represents the partner's share of cash flow. | ||||||||||||||||||||||

p. 20 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –6/30/2021 | ||||

SUMMARY OF OUTSTANDING DEBT AS OF JUNE 30, 2021 |  | |||||||

| ($ in thousands) | |||||||||||||||||||||||

TOTAL OUTSTANDING DEBT 1 | |||||||||||||||||||||||

| Outstanding Amount | Ratio | Weighted Average Interest Rate | Weighted Average Maturity (in years) | ||||||||||||||||||||

| Fixed Rate Debt | 1,115,185 | 84 | % | 3.59 | % | 4.6 | |||||||||||||||||

| Variable Rate Debt | 184,373 | 14 | % | 3.50 | % | 4.4 | |||||||||||||||||

| Net Debt Premiums and Issuance Costs, Net | (10,189) | N/A | N/A | N/A | |||||||||||||||||||

| Total Consolidated Debt | 1,289,369 | 98 | % | 3.58 | % | 4.6 | |||||||||||||||||

| KRG Share of Unconsolidated Debt | 23,400 | 2 | % | 4.50 | % | 5.3 | |||||||||||||||||

| Total | 1,312,769 | 100 | % | 3.60 | % | 4.6 | |||||||||||||||||

| SCHEDULE OF MATURITIES BY YEAR | ||||||||||||||||||||||||||||||||||||||

| Secured Debt | ||||||||||||||||||||||||||||||||||||||

| Scheduled Principal Payments | Term Maturities | Unsecured Debt 2 | Total Consolidated Debt | Total Unconsolidated Debt | Total Outstanding Debt | |||||||||||||||||||||||||||||||||

| 2021 | 1,162 | — | — | 1,162 | 145 | 1,307 | ||||||||||||||||||||||||||||||||

| 2022 | 1,043 | 153,500 | — | 154,543 | 341 | 154,884 | ||||||||||||||||||||||||||||||||

| 2023 | 806 | 161,517 | 95,000 | 257,323 | 270 | 257,593 | ||||||||||||||||||||||||||||||||

| 2024 | 854 | — | — | 854 | 1,534 | 2,388 | ||||||||||||||||||||||||||||||||

| 2025 | 904 | — | 80,000 | 80,904 | 10,732 | 91,636 | ||||||||||||||||||||||||||||||||

| 2026 | 957 | — | 300,000 | 300,957 | — | 300,957 | ||||||||||||||||||||||||||||||||

| 2027 And Beyond | 3,715 | 100 | 500,000 | 503,815 | 10,378 | 514,193 | ||||||||||||||||||||||||||||||||

| Net Debt Premiums and Issuance Cost, Net | (10,189) | — | — | (10,189) | — | (10,189) | ||||||||||||||||||||||||||||||||

| Total | $ | (748) | $ | 315,117 | $ | 975,000 | $ | 1,289,369 | $ | 23,400 | $ | 1,312,769 | ||||||||||||||||||||||||||

| 1 | Fixed rate debt includes, and variable rate debt excludes, the portion of such debt that has been hedged by interest rate derivatives. As of June 30, 2021, $250 million in variable rate debt is hedged for a weighted average of 4.2 years and $155 million in fixed rate debt is hedged to floating rate for a weighted average of 4.2 years. | ||||

| 2 | This presentation reflects the Company's exercise of its option to extend the maturity date by one year to April 22, 2023 for the Company's unsecured credit facility.The ability to exercise this option is subject to certain conditions, which the Company does not unilaterally control. | ||||

p. 21 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –6/30/2021 | ||||

MATURITY SCHEDULE OF OUTSTANDING DEBT AS OF JUNE 30, 2021 |  | |||||||

| ($ in thousands) | |||||||||||||||||||||||||||||

| Property | Interest Rate1 | Maturity Date | Balance as of June 30, 2021 | % of Total Outstanding | |||||||||||||||||||||||||

| 2021 Debt Maturities | — | — | % | ||||||||||||||||||||||||||

Delray Marketplace 2 | LIBOR + 160 | 2/5/2022 | 29,373 | ||||||||||||||||||||||||||

| Bayonne Crossing | 4.43 | % | 4/1/2022 | 41,686 | |||||||||||||||||||||||||

| Saxon Crossing | 4.65 | % | 7/1/2022 | 11,400 | |||||||||||||||||||||||||

| Shops at Moore | 4.29 | % | 9/1/2022 | 21,300 | |||||||||||||||||||||||||

| Shops at Julington Creek | 4.60 | % | 9/1/2022 | 4,785 | |||||||||||||||||||||||||

| Centre Point Commons | 4.34 | % | 10/1/2022 | 14,410 | |||||||||||||||||||||||||

| Miramar Square | 4.16 | % | 12/1/2022 | 31,625 | |||||||||||||||||||||||||

| 2022 Debt Maturities | 154,579 | 12 | % | ||||||||||||||||||||||||||

| Centennial Gateway | 3.81 | % | 1/1/2023 | 23,962 | |||||||||||||||||||||||||

| Centennial Center | 3.83 | % | 1/6/2023 | 70,455 | |||||||||||||||||||||||||

| Eastern Beltway | 3.83 | % | 1/6/2023 | 34,100 | |||||||||||||||||||||||||

| The Corner (AZ) | 4.10 | % | 3/1/2023 | 14,750 | |||||||||||||||||||||||||

| Chapel Hill | 3.78 | % | 4/1/2023 | 18,250 | |||||||||||||||||||||||||

Unsecured Credit Facility 3 | LIBOR + 115 | 4/22/2023 | — | ||||||||||||||||||||||||||

| Senior Unsecured Note | 4.23 | % | 9/10/2023 | 95,000 | |||||||||||||||||||||||||

| 2023 Debt Maturities | 256,517 | 20 | % | ||||||||||||||||||||||||||

| 2024 Debt Maturities | — | — | % | ||||||||||||||||||||||||||

Senior Unsecured Note 6 | LIBOR + 365 | 9/10/2025 | 80,000 | ||||||||||||||||||||||||||

| 2025 Debt Maturities | 80,000 | 6 | % | ||||||||||||||||||||||||||

| Senior Unsecured Note | 4.00 | % | 10/1/2026 | 300,000 | |||||||||||||||||||||||||

| 2026 Debt Maturities | 300,000 | 23 | % | ||||||||||||||||||||||||||

| Senior Unsecured Exchangeable Note | 0.75 | % | 4/1/2027 | 175,000 | |||||||||||||||||||||||||

Senior Unsecured Note 6 | LIBOR + 375 | 9/10/2027 | 75,000 | ||||||||||||||||||||||||||

Unsecured Term Loan 4 | LIBOR + 200 | 10/24/2028 | 250,000 | ||||||||||||||||||||||||||

| Rampart Commons | 5.73 | % | 6/10/2030 | 8,462 | |||||||||||||||||||||||||

| 2027 And Beyond Debt Maturities | 508,462 | 39 | % | ||||||||||||||||||||||||||

| NET PREMIUMS ON ACQUIRED DEBT & ISSUANCE COSTS | (10,189) | ||||||||||||||||||||||||||||

| TOTAL DEBT PER CONSOLIDATED BALANCE SHEET | $ | 1,289,369 | 98 | % | |||||||||||||||||||||||||

| KRG Share of Unconsolidated Debt | |||||||||||||||||||||||||||||

Embassy Suites at University of Notre Dame 5 | LIBOR + 250 | 7/1/2025 | 11,770 | ||||||||||||||||||||||||||

Glendale Center Apartments 5 | LIBOR + 280 | 5/31/2024 | 1,252 | ||||||||||||||||||||||||||

Nuveen 5 | 4.09% | 7/1/2028 | 10,378 | ||||||||||||||||||||||||||

| TOTAL KRG SHARE OF UNCONSOLIDATED DEBT | 23,400 | 2 | % | ||||||||||||||||||||||||||

| TOTAL CONSOLIDATED AND KRG SHARE OF UNCONSOLIDATED DEBT | $ | 1,312,769 | |||||||||||||||||||||||||||

| 1 | At June 30 2021, one-month LIBOR was 0.10%. | ||||||||||||||||||||||||||||

| 2 | Property is held in a joint venture. The loan is guaranteed by Kite Realty Group, LP. | ||||||||||||||||||||||||||||

| 3 | Assumes Company exercises its option to extend the maturity date by one year. | ||||||||||||||||||||||||||||

| 4 | Assumes Company exercises three one-year options to extend the maturity date. Term loan is hedged to a fixed rate of 4.20% until initial maturity of 2025. | ||||||||||||||||||||||||||||

| 5 | Properties are held in joint ventures. See Joint Venture Summary on page 20 for additional detail. | ||||||||||||||||||||||||||||

| 6 | Notes are hedged to floating rate until 9/10/2025. | ||||||||||||||||||||||||||||

p. 22 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –6/30/2021 | ||||

KEY DEBT METRICS |  | ||||

| UNSECURED PUBLIC DEBT COVENANTS | ||||||||||||||

| June 30, 2021 | Debt Covenant Threshold1 | |||||||||||||

| Total Debt to Undepreciated Assets | 38% | <60% | ||||||||||||

| Secured Debt to Undepreciated Assets | 10% | <40% | ||||||||||||

| Undepreciated Unencumbered Assets to Unsecured Debt | 276% | >150% | ||||||||||||

| Debt Service Coverage | 3.2x | >1.5x | ||||||||||||

| UNSECURED CREDIT FACILITY COVENANTS | ||||||||||||||

| June 30, 2021 | Debt Covenant Threshold | |||||||||||||

| Maximum Leverage | 39% | <60% | ||||||||||||

| Minimum Fixed Charge Coverage | 3.3x | >1.50x | ||||||||||||

| Secured Indebtedness | 10.4% | <45% | ||||||||||||

| Unsecured Debt Interest Coverage | 3.9x | >1.75x | ||||||||||||

| Unsecured Leverage | 42% | <60% | ||||||||||||

| Senior Unsecured Debt Ratings: | ||||||||||||||

| Moody's Investors Service | Baa3/Stable | |||||||||||||

| Standard & Poor's Rating Services | BBB-/Stable | |||||||||||||

| Liquidity ($ in thousands) | ||||||||||||||

| Cash, cash equivalents, and short-term deposits | $ | 214,894 | ||||||||||||

| Availability under unsecured credit facility | 422,117 | |||||||||||||

| $ | 637,011 | |||||||||||||

| Unencumbered NOI as a % of Total NOI | 74 | % | ||||||||||||

| 1 | For a complete listing of all Debt Covenants related to the Company's Senior Unsecured Notes, as well as definitions of the terms, refer to the Company's filings with the SEC. | |||||||||||||

| NET DEBT TO EBITDA | |||||||||||

| Company's Consolidated Debt & Share of Unconsolidated Debt | $ | 1,322,371 | |||||||||

| Less: Cash, Cash Equivalents, Restricted Cash, and Short-Term Deposits | (220,589) | ||||||||||

| $ | 1,101,782 | ||||||||||

| Q2 2021 EBITDA, Annualized: | |||||||||||

| - Consolidated EBITDA | $ | 170,384 | |||||||||

- Unconsolidated EBITDA 1 | 2,008 | ||||||||||

- Minority Interest EBITDA 1 | (528) | 171,864 | |||||||||

| Ratio of Company Share of Net Debt to EBITDA | 6.4x | ||||||||||

| ____________________ | |||||||||||||||||||||||

| 1 | See page 20 for details | ||||||||||||||||||||||

p. 23 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –6/30/2021 | ||||

TOP 25 TENANTS BY ANNUALIZED BASE RENT |  | |||||||

As of June 30, 2021

($ in thousands, except per square foot data)

This table includes the following:

•Operating retail properties;

•Operating office properties; and

•Development/Redevelopment property tenants open for business or ground lease tenants who commenced paying rent as of June 30, 2021.

| Number of Stores | Credit Ratings | |||||||||||||||||||||||||||||||||||||||||||||||||

| Tenant | Wholly Owned | JV1 | Total Leased GLA/NRA2 | Annualized Base Rent3,4 | Annualized Base Rent per Sq. Ft.4 | % of Total Portfolio Annualized Base Rent4 | S&P | Moody's | ||||||||||||||||||||||||||||||||||||||||||

| Publix Super Markets, Inc. | 11 | — | 535,466 | $ | 5,455 | $ | 10.19 | 2.51 % | N/A | N/A | ||||||||||||||||||||||||||||||||||||||||

The TJX Companies, Inc.5 | 14 | 2 | 471,684 | 4,862 | 11.26 | 2.24 % | A | A2 | ||||||||||||||||||||||||||||||||||||||||||

| PetSmart, Inc. | 13 | 1 | 291,379 | 4,084 | 14.62 | 1.88 % | B | B2 | ||||||||||||||||||||||||||||||||||||||||||

| Ross Stores, Inc. | 12 | 1 | 364,442 | 4,067 | 11.81 | 1.87 % | BBB+ | A2 | ||||||||||||||||||||||||||||||||||||||||||

Dick's Sporting Goods, Inc.6 | 7 | — | 340,502 | 3,764 | 11.05 | 1.73 % | N/A | N/A | ||||||||||||||||||||||||||||||||||||||||||

| Nordstrom Rack | 5 | 1 | 197,797 | 3,571 | 20.75 | 1.64 % | BB+ | Baa3 | ||||||||||||||||||||||||||||||||||||||||||

| Michaels Stores, Inc. | 11 | 1 | 253,849 | 3,319 | 13.81 | 1.53 % | N/A | N/A | ||||||||||||||||||||||||||||||||||||||||||

| Burlington Stores, Inc. | 5 | — | 310,423 | 3,092 | 9.96 | 1.42 % | BB+ | N/A | ||||||||||||||||||||||||||||||||||||||||||

| Old Navy (11) / Athleta (1) | 12 | — | 188,548 | 3,035 | 16.10 | 1.40 % | BB- | Ba2 | ||||||||||||||||||||||||||||||||||||||||||

| National Amusements | 1 | — | 80,000 | 2,953 | 36.92 | 1.36 % | B- | N/A | ||||||||||||||||||||||||||||||||||||||||||

| Kohl's Corporation | 4 | — | 184,516 | 2,832 | 7.87 | 1.30 % | BBB- | Baa2 | ||||||||||||||||||||||||||||||||||||||||||

Walmart Stores, Inc.7 | 5 | — | — | 2,776 | 3.42 | 1.28 % | AA | Aa2 | ||||||||||||||||||||||||||||||||||||||||||

| Best Buy Co., Inc. | 5 | — | 183,604 | 2,661 | 14.49 | 1.23 % | BBB+ | A3 | ||||||||||||||||||||||||||||||||||||||||||

| Petco Animal Supplies, Inc. | 10 | — | 136,669 | 2,436 | 17.83 | 1.12 % | B | B2 | ||||||||||||||||||||||||||||||||||||||||||

| Lowe's Companies, Inc. | 3 | — | — | 2,375 | 4.91 | 1.09 % | BBB+ | Baa1 | ||||||||||||||||||||||||||||||||||||||||||

| LA Fitness | 3 | — | 125,209 | 2,292 | 18.31 | 1.06 % | CCC+ | Caa1 | ||||||||||||||||||||||||||||||||||||||||||

| Hobby Lobby Stores, Inc. | 5 | — | 271,254 | 2,276 | 8.39 | 1.05 % | N/A | N/A | ||||||||||||||||||||||||||||||||||||||||||

Bed Bath & Beyond, Inc.8 | 8 | 1 | 251,060 | 2,243 | 9.72 | 1.03 % | B+ | Ba3 | ||||||||||||||||||||||||||||||||||||||||||

| Whole Foods Market, Inc. | 4 | — | 139,781 | 2,130 | 15.24 | 0.98 % | AA | A1 | ||||||||||||||||||||||||||||||||||||||||||

Mattress Firm, Inc.9 | 16 | — | 76,408 | 2,129 | 27.86 | 0.98 % | N/A | N/A | ||||||||||||||||||||||||||||||||||||||||||

| Walgreens | 4 | — | 63,462 | 2,104 | 33.15 | 0.97 % | BBB | Baa2 | ||||||||||||||||||||||||||||||||||||||||||

The Kroger Co.10 | 3 | — | 60,268 | 2,099 | 9.19 | 0.97 % | BBB | Baa1 | ||||||||||||||||||||||||||||||||||||||||||

| Total Wine & More | 4 | — | 105,684 | 2,013 | 19.05 | 0.93 % | N/A | N/A | ||||||||||||||||||||||||||||||||||||||||||

| Ulta Beauty | 8 | 2 | 100,086 | 1,760 | 21.10 | 0.81 % | N/A | N/A | ||||||||||||||||||||||||||||||||||||||||||

| Five Below, Inc. | 11 | — | 94,197 | 1,738 | 18.45 | 0.80 % | N/A | N/A | ||||||||||||||||||||||||||||||||||||||||||

| TOTAL | 184 | 9 | 4,826,288 | $ | 72,067 | $ | 11.47 | 33.2 | % | |||||||||||||||||||||||||||||||||||||||||

| 1 | JV Stores represent stores at unconsolidated properties. | ||||

| 2 | Excludes the estimated size of the structures located on land owned by the Company and ground leased to tenants. | ||||

| 3 | Annualized base rent represents the monthly contractual rent for June 30, 2021, for each applicable tenant multiplied by 12. Annualized base rent does not include tenant reimbursements. Annualized base rent represents 100% of the annualized base rent at consolidated properties and our share of the annualized base rent at unconsolidated properties. | ||||

| 4 | Annualized base rent and percent of total portfolio includes ground lease rent. | ||||

| 5 | Includes TJ Maxx (9), Marshalls (5) and HomeGoods (2). | ||||

| 6 | Includes Dick's Sporting Goods (6) and Golf Galaxy (1). | ||||

| 7 | Includes Walmart (3) and Sam's Club (2). | ||||

| 8 | Includes Bed Bath and Beyond (5) and Buy Buy Baby (4). | ||||

| 9 | Includes Mattress Firm (12) and Sleepy's (4). | ||||

| 10 | Includes Kroger (1), Harris Teeter (1), and Smith's (1). | ||||

p. 24 | Kite Realty Group Trust Supplemental Financial and Operating Statistics –6/30/2021 | ||||

RETAIL LEASING SPREADS |  | |||||||

Comparable Space1, 2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Category | Total Leases | Total Sq. Ft. | Leases | Sq. Ft. | Prior Rent PSF3 | New Rent PSF4 | Cash Rent Spread | GAAP Rent Spread5 | TI, LL Work, Lease Commissions PSF6 | |||||||||||||||||||||||||||||||||||||||||||||||

| New Leases - Q2, 2021 | 27 | 159,497 | 11 | 35,612 | $ | 25.86 | $ | 30.95 | 19.7 | % | 31.2 | % | ||||||||||||||||||||||||||||||||||||||||||||

| New Leases - Q1, 2021 | 20 | 100,604 | 16 | 89,791 | 15.20 | 19.06 | 25.3 | % | 34.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||