Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ADVANCED DRAINAGE SYSTEMS, INC. | wms-8k_20210609.htm |

Advanced Drainage Systems Investor Presentation Morgan Stanley 6th Annual Sustainable Futures Conference June 2021

Forward Looking Statements Certain statements in this presentation may be deemed to be forward-looking statements. These statements are not historical facts but rather are based on the Company’s current expectations, estimates and projections regarding the Company’s business, operations and other factors relating thereto. Words such as “may,” “will,” “could,” “would,” “should,” “anticipate,” “predict,” “potential,” “continue,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” “confident” and similar expressions are used to identify these forward-looking statements. Factors that could cause actual results to differ from those reflected in forward-looking statements relating to our operations and business include: fluctuations in the price and availability of resins and other raw materials and our ability to pass any increased costs of raw materials on to our customers in a timely manner; volatility in general business and economic conditions in the markets in which we operate, including the adverse impact on the U.S. and global economy of the COVID-19 global pandemic, and the impact of COVID-19 in the near, medium and long-term on our business, results of operations, financial position, liquidity or cash flows, and other factors relating to availability of credit, interest rates, fluctuations in capital and business and consumer confidence; cyclicality and seasonality of the non-residential and residential construction markets and infrastructure spending; the risks of increasing competition in our existing and future markets, including competition from both manufacturers of high performance thermoplastic corrugated pipe and manufacturers of products using alternative materials; uncertainties surrounding the integration of acquisitions and similar transactions, including the acquisition of Infiltrator Water Technologies and the integration of Infiltrator Water Technologies; our ability to realize the anticipated benefits from the acquisition of Infiltrator Water Technologies; risks that the acquisition of Infiltrator Water Technologies and related transactions may involve unexpected costs, liabilities or delays; our ability to continue to convert current demand for concrete, steel and polyvinyl chloride (“PVC”) pipe products into demand for our high performance thermoplastic corrugated pipe and Allied Products; the effect of any claims, litigation, investigations or proceedings; the effect of weather or seasonality; the loss of any of our significant customers; the risks of doing business internationally; our ability to remediate the material weakness in our internal control over financial reporting, including remediation of the control environment for our joint venture affiliate ADS Mexicana, S.A. de C.V.; the risks of conducting a portion of our operations through joint ventures; our ability to expand into new geographic or product markets, including risks associated with new markets and products associated with our recent acquisition of Infiltrator Water Technologies; our ability to achieve the acquisition component of our growth strategy; the risk associated with manufacturing processes; our ability to manage our assets; the risks associated with our product warranties; our ability to manage our supply purchasing and customer credit policies; the risks associated with our self-insured programs; our ability to control labor costs and to attract, train and retain highly-qualified employees and key personnel; our ability to protect our intellectual property rights; changes in laws and regulations, including environmental laws and regulations; our ability to project product mix; the risks associated with our current levels of indebtedness, including borrowings under our existing credit agreement and outstanding indebtedness under our existing senior notes; fluctuations in our effective tax rate; our ability to meet future capital requirements and fund our liquidity needs; the risk that additional information may arise that would require the Company to make additional adjustments or revisions or to restate the financial statements and other financial data for certain prior periods and any future periods; any delay in the filing of any filings with the Securities and Exchange Commission (“SEC”); the review of potential weaknesses or deficiencies in the Company’s disclosure controls and procedures, and discovering weaknesses of which we are not currently aware or which have not been detected; additional uncertainties related to accounting issues generally; and the other risks and uncertainties described in the Company’s filings with the SEC. New risks and uncertainties emerge from time to time and it is not possible for the Company to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this press release. In light of the significant uncertainties inherent in the forward-looking information included herein, the inclusion of such information should not be regarded as a representation by the Company or any other person that the Company’s expectations, objectives or plans will be achieved in the timeframe anticipated or at all. Investors are cautioned not to place undue reliance on the Company’s forward-looking statements and the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

PUT SIMPLY /// OUR PROMISE To protect and manage water, the world’s most precious resource, safeguarding our environment and communities.

Capture Conveyance Storage Treatment Innovative Water Management Solutions Advancing quality of life through sustainable solutions to water management challenges. Precipitation River

Environmental 2nd largest plastic recycler in North America 510M+ pounds of plastic diverted from landfills every year 670M pounds of Greenhouse Gas avoided annually, which amounts to taking 64,000 cars off the road Operational Focus on safety: Reduce our TRIR to 2.5 by FY 2025 Driving continuous improvement and lean manufacturing throughout our network to reduce our environmental impact 21% decrease in scrap rate in FY21 9% decrease in downtime rate in FY21 ADS is one of few pureplay water companies worldwide with a substantial amount of revenue derived from sustainable water products Our reason is water.TM Social & Governance Established ESG subcommittee of the Board of Directors Recently hired head of Diversity, Equity and Inclusion Established The ADS Foundation to better engage with communities $2 million inaugural funding We are committed to incorporating Sustainability into our everyday business

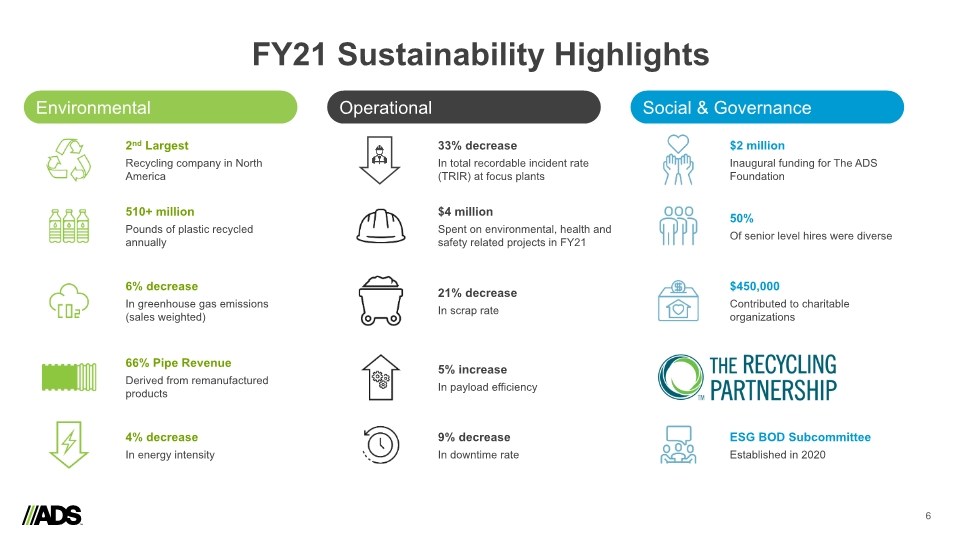

FY21 Sustainability Highlights Environmental Operational Social & Governance

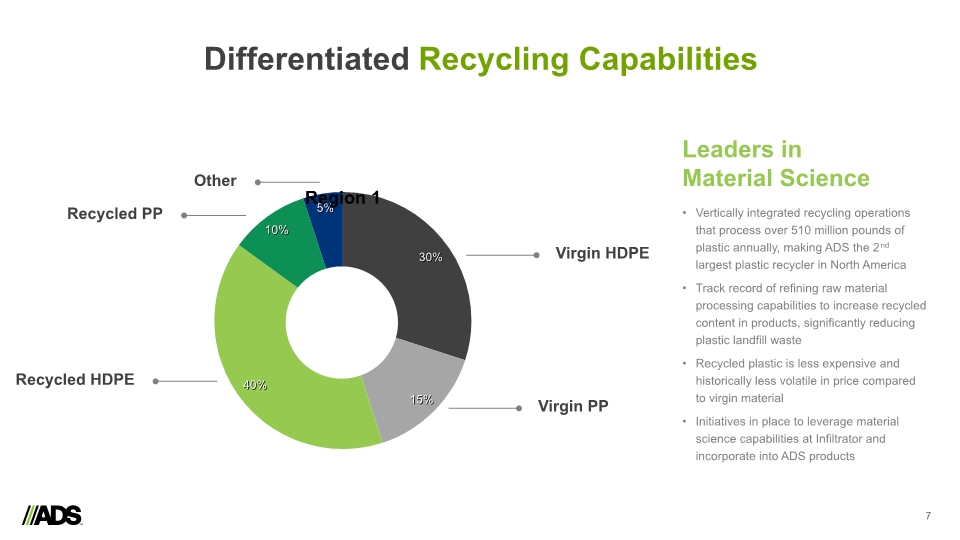

Differentiated Recycling Capabilities Virgin HDPE Recycled HDPE Virgin PP Recycled PP Other Vertically integrated recycling operations that process over 510 million pounds of plastic annually, making ADS the 2nd largest plastic recycler in North America Track record of refining raw material processing capabilities to increase recycled content in products, significantly reducing plastic landfill waste Recycled plastic is less expensive and historically less volatile in price compared to virgin material Initiatives in place to leverage material science capabilities at Infiltrator and incorporate into ADS products Leaders in Material Science

Distinct Market Leader Leading player in the stormwater and onsite-septic wastewater management industry with a track record of gaining market share. Consistent above-market growth driven by material conversion strategy and complete solutions package. Best-in-class sales force, technical expertise and distribution & logistics network creates barriers to entry and positions ADS as the supplier of choice. Large and growing end-markets with favorable tailwinds from regulatory changes and increased focus on sustainability.

Key Themes ADS is an industrial growth story with a large market opportunity and long runway for growth Sales Growth Margin Expansion ADS has significant margin upside potential and action plans in place to achieve superior results Cash Flow Generation Successful execution will result in significant cash generation over the next several years

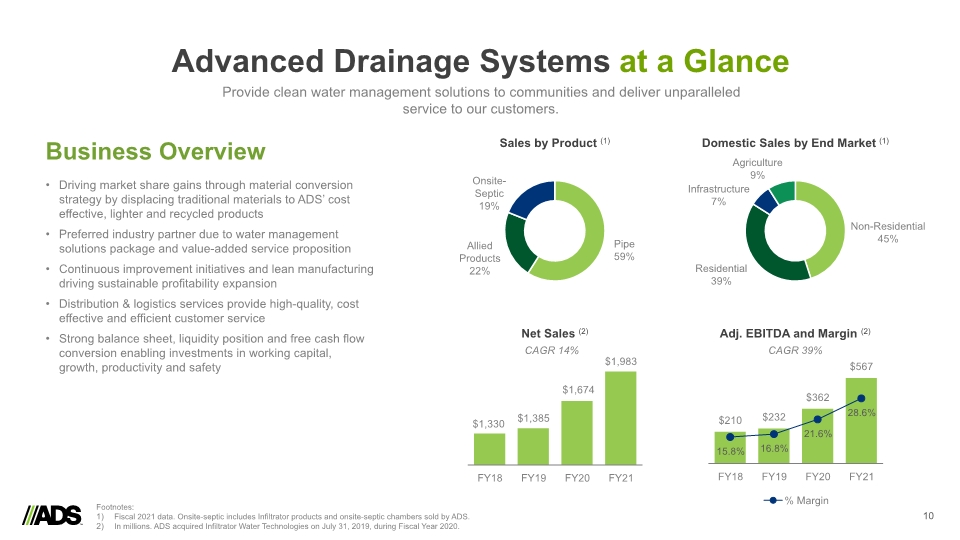

Advanced Drainage Systems at a Glance Provide clean water management solutions to communities and deliver unparalleled service to our customers. Driving market share gains through material conversion strategy by displacing traditional materials to ADS’ cost effective, lighter and recycled products Preferred industry partner due to water management solutions package and value-added service proposition Continuous improvement initiatives and lean manufacturing driving sustainable profitability expansion Distribution & logistics services provide high-quality, cost effective and efficient customer service Strong balance sheet, liquidity position and free cash flow conversion enabling investments in working capital, growth, productivity and safety Business Overview Pipe 59% Allied Products 22% Onsite-Septic 19% Non-Residential 45% Residential 39% Agriculture 9% Infrastructure 7% Sales by Product (1) Domestic Sales by End Market (1) Footnotes: Fiscal 2021 data. Onsite-septic includes Infiltrator products and onsite-septic chambers sold by ADS. In millions. ADS acquired Infiltrator Water Technologies on July 31, 2019, during Fiscal Year 2020. Net Sales (2) Adj. EBITDA and Margin (2) CAGR 14% CAGR 39%

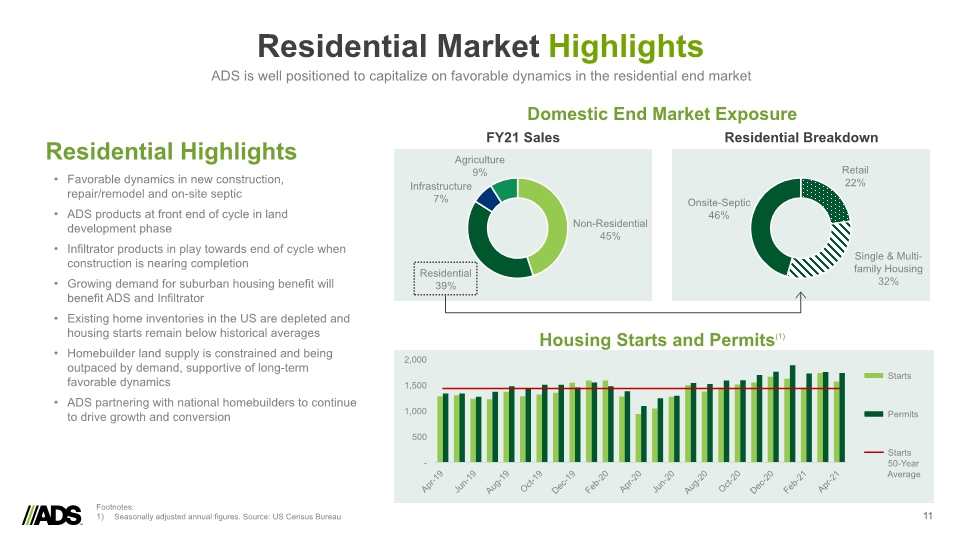

ADS is well positioned to capitalize on favorable dynamics in the residential end market Domestic End Market Exposure Non-Residential 45% Residential 39% Agriculture 9% Infrastructure 7% FY21 Sales Retail 22% Single & Multi-family Housing 32% Onsite-Septic 46% Favorable dynamics in new construction, repair/remodel and on-site septic ADS products at front end of cycle in land development phase Infiltrator products in play towards end of cycle when construction is nearing completion Growing demand for suburban housing benefit will benefit ADS and Infiltrator Existing home inventories in the US are depleted and housing starts remain below historical averages Homebuilder land supply is constrained and being outpaced by demand, supportive of long-term favorable dynamics ADS partnering with national homebuilders to continue to drive growth and conversion Residential Market Highlights Residential Breakdown Housing Starts and Permits(1) Footnotes: Seasonally adjusted annual figures. Source: US Census Bureau Residential Highlights

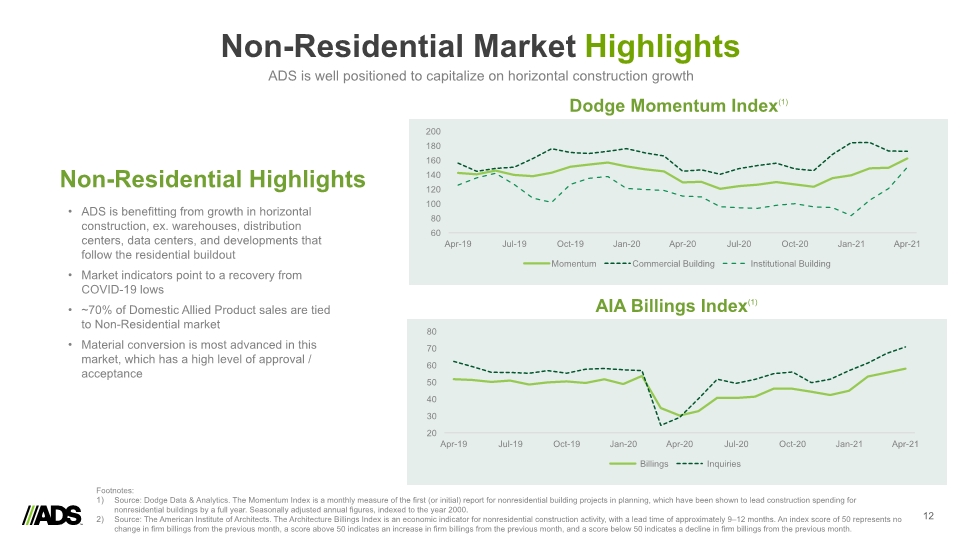

ADS is well positioned to capitalize on horizontal construction growth ADS is benefitting from growth in horizontal construction, ex. warehouses, distribution centers, data centers, and developments that follow the residential buildout Market indicators point to a recovery from COVID-19 lows ~70% of Domestic Allied Product sales are tied to Non-Residential market Material conversion is most advanced in this market, which has a high level of approval / acceptance Non-Residential Market Highlights Non-Residential Highlights Dodge Momentum Index(1) Footnotes: Source: Dodge Data & Analytics. The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. Seasonally adjusted annual figures, indexed to the year 2000. Source: The American Institute of Architects. The Architecture Billings Index is an economic indicator for nonresidential construction activity, with a lead time of approximately 9–12 months. An index score of 50 represents no change in firm billings from the previous month, a score above 50 indicates an increase in firm billings from the previous month, and a score below 50 indicates a decline in firm billings from the previous month. AIA Billings Index(1)

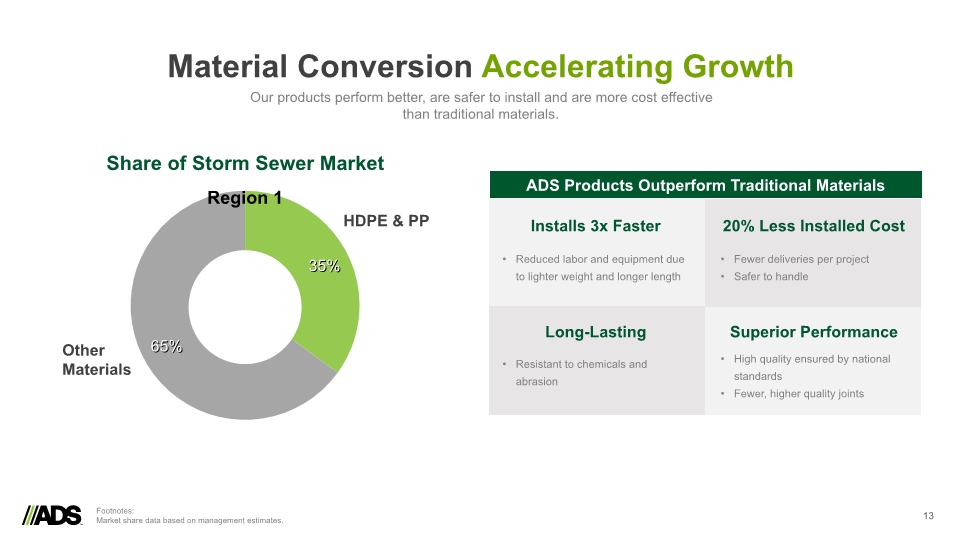

Material Conversion Accelerating Growth HDPE & PP Other Materials Share of Storm Sewer Market Footnotes: Market share data based on management estimates. ADS Products Outperform Traditional Materials Reduced labor and equipment due to lighter weight and longer length Installs 3x Faster Fewer deliveries per project Safer to handle 20% Less Installed Cost Resistant to chemicals and abrasion Long-Lasting High quality ensured by national standards Fewer, higher quality joints Superior Performance Our products perform better, are safer to install and are more cost effective than traditional materials.

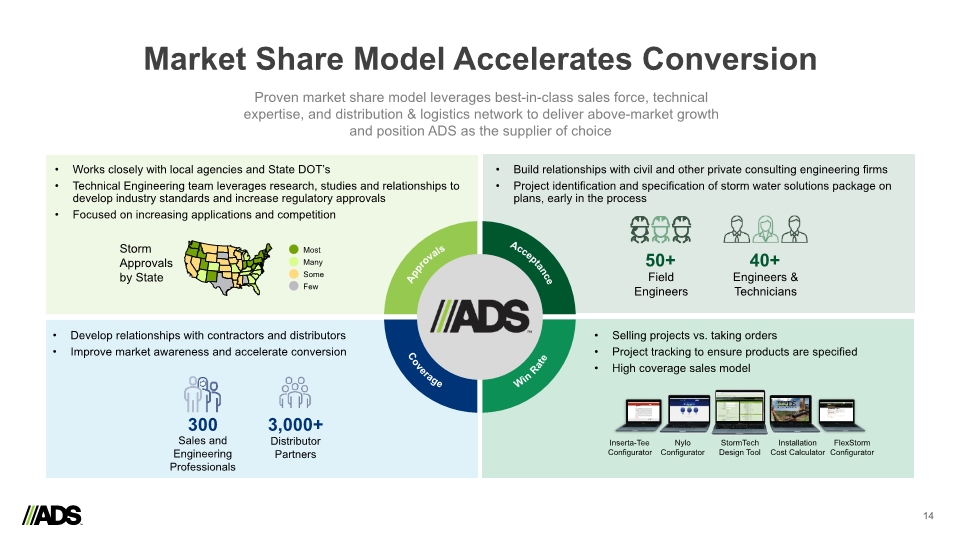

Market Share Model Accelerates Conversion Proven market share model leverages best-in-class sales force, technical expertise, and distribution & logistics network to deliver above-market growth and position ADS as the supplier of choice Win Rate Coverage Acceptance Approvals Works closely with local agencies and State DOT’s Technical Engineering team leverages research, studies and relationships to develop industry standards and increase regulatory approvals Focused on increasing applications and competition Build relationships with civil and other private consulting engineering firms Project identification and specification of storm water solutions package on plans, early in the process Selling projects vs. taking orders Project tracking to ensure products are specified High coverage sales model Inserta-Tee Configurator StormTech Design Tool Installation Cost Calculator FlexStorm Configurator Nylo Configurator Develop relationships with contractors and distributors Improve market awareness and accelerate conversion 50+ Field Engineers 40+ Engineers & Technicians 300 Sales and Engineering Professionals 3,000+ Distributor Partners Storm Approvals by State

On-site Septic Wastewater Solutions Overview On-site septic wastewater industry is an estimated $1.2 billion ~30% of new North American single-family homes utilize on-site septic systems Replacement systems make up ~1/3 of overall demand Plastic leachfield and septic tanks driving conversion from traditional wastewater systems (pipe and stone leachfields and concrete septic tanks) Onsite-Septic Wastewater System 1 2 3 Transfer Wastewater is fed through piping systems into an underground tank located outside of the home Primary Treatment Septic tank stores and treats solids while releasing clarified effluent into the leach field Secondary Treatment Leachfield stores and allows infiltration of effluent into soil; naturally treated and returned to local aquifer

Services More than a product company – we are a solutions provider. We bring our products right to the jobsite and in fewer truckloads. Products From water capture to conveyance, storage and treatment our comprehensive suite of products are designed to meet customer needs for the entire lifecycle of a raindrop. Customer Support We provide everything from design tools to engineering support and delivery notifications. Our Value Proposition The ADS customer value proposition sets us apart from our competition and makes us the partner of choice.

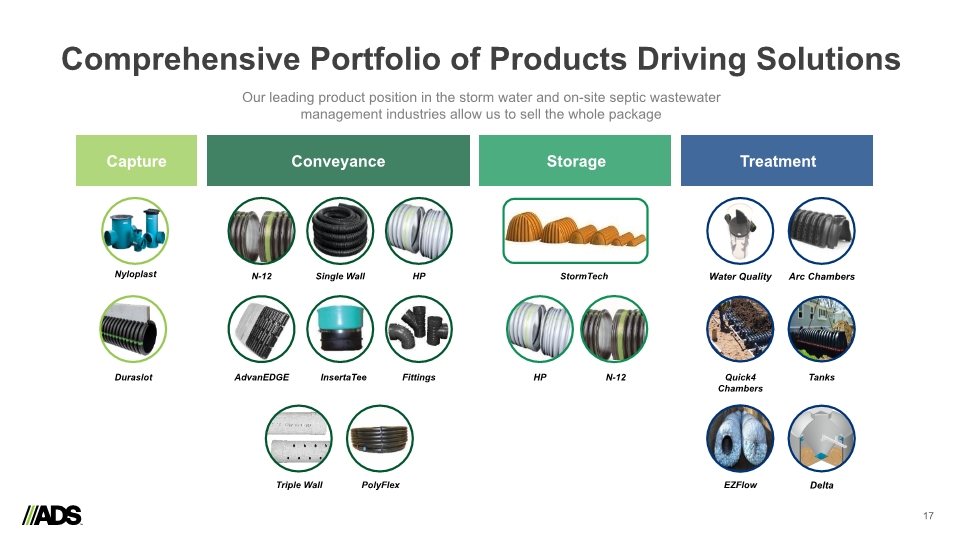

Capture Conveyance Storage Treatment Comprehensive Portfolio of Products Driving Solutions Our leading product position in the storm water and on-site septic wastewater management industries allow us to sell the whole package Nyloplast Duraslot Single Wall Triple Wall PolyFlex AdvanEDGE InsertaTee Fittings HP N-12 HP StormTech N-12 EZFlow Delta Arc Chambers Water Quality Quick4 Chambers Tanks

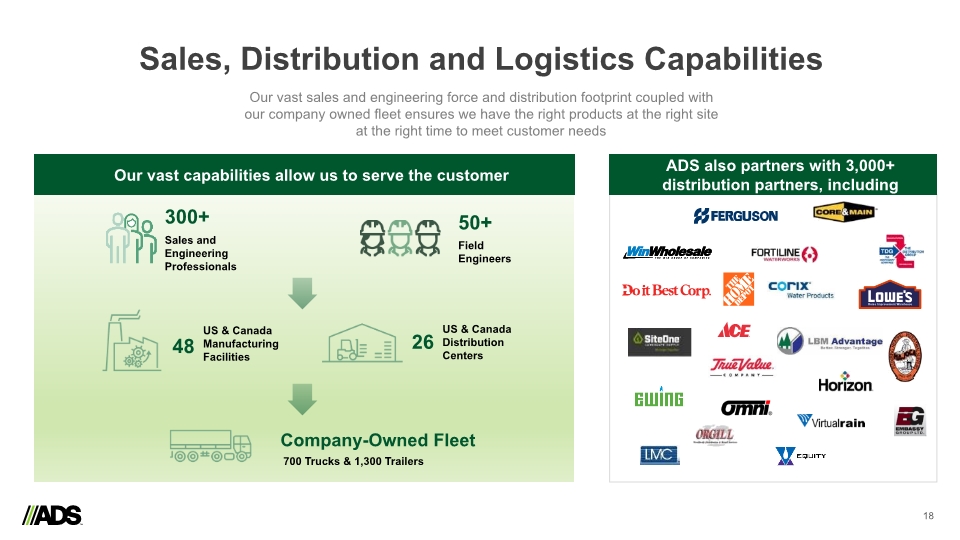

Sales, Distribution and Logistics Capabilities Our vast sales and engineering force and distribution footprint coupled with our company owned fleet ensures we have the right products at the right site at the right time to meet customer needs Our vast capabilities allow us to serve the customer ADS also partners with 3,000+ distribution partners, including

Why Solutions Are Important Providing solutions increases our share of wallet with our customers Pipe Manufacturer Solutions Provider ADSTM Barracuda® Stormwater Separator Opportunity amounts above are for illustrative purposes only and may not be indicative of actual project value.

Supply Chain Overview 20

ADS Business Model

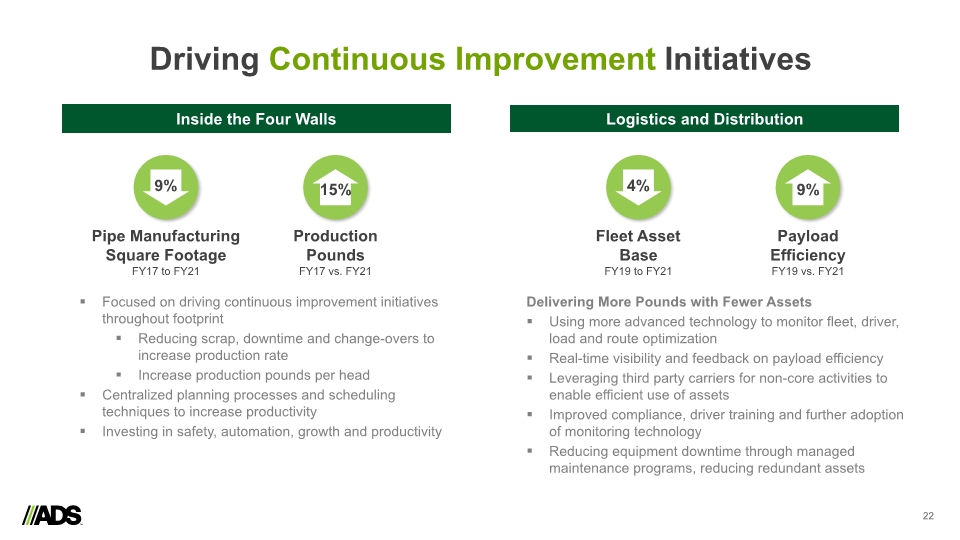

Driving Continuous Improvement Initiatives Focused on driving continuous improvement initiatives throughout footprint Reducing scrap, downtime and change-overs to increase production rate Increase production pounds per head Centralized planning processes and scheduling techniques to increase productivity Investing in safety, automation, growth and productivity Logistics and Distribution Inside the Four Walls Pipe Manufacturing Square Footage FY17 to FY21 Production Pounds FY17 vs. FY21 Delivering More Pounds with Fewer Assets Using more advanced technology to monitor fleet, driver, load and route optimization Real-time visibility and feedback on payload efficiency Leveraging third party carriers for non-core activities to enable efficient use of assets Improved compliance, driver training and further adoption of monitoring technology Reducing equipment downtime through managed maintenance programs, reducing redundant assets Fleet Asset Base FY19 to FY21 Payload Efficiency FY19 vs. FY21

Capacity Expansion Initiatives Invested in new large diameter pipe production line (30” to 60”) to alleviate capacity constraints in South and Midwest Full production capability in 2021 Increases regional production capacity for large diameter pipe Startup with a focus on safety, quality and efficiency ADS Large Diameter Pipe Production in Harrisonville, MO Investments in presses and molds needed to meet strong demand in residential on-site septic market Requires facility expansion at Infiltrator’s Winchester, KY campus Full production capability by the end of 2022 Increases production capacity for chambers Infiltrator Facility and Production Expansion in Winchester, KY

Southeast Capacity Expansion Initiatives New production lines, tooling sets and improved raw material system Investments increase capacity as well as drive labor and productivity efficiencies Full production capability in 2022 Increases regional production capacity in a strong, growing market, with large conversion opportunities ADS Pipe Production in Sebring, FL New production line and downstream automation equipment Downstream automation equipment eliminates manually intensive activities New production line to drive labor and productivity efficiencies Full production capability in 2023 Increases regional production capacity in a strong, growing market, with large conversion opportunities ADS Pipe Production in Perry, GA

Fiscal 2021 Financial Results 25

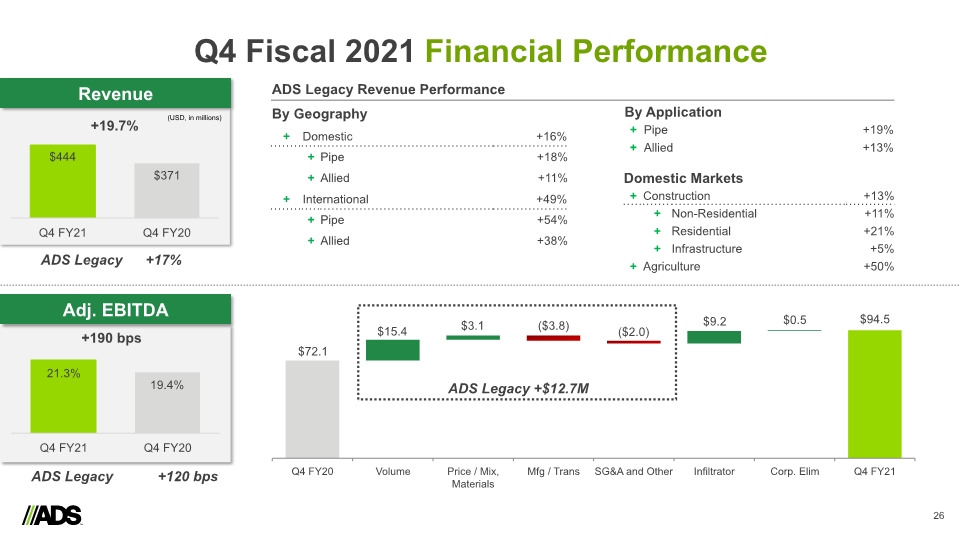

Q4 Fiscal 2021 Financial Performance 26 +190 bps (USD, in millions) +19.7% $72.1 $15.4 $3.1 ($2.0) $9.2 $94.5 Revenue Adj. EBITDA ($3.8) $371 $444 19.4% 21.3% ADS Legacy +$12.7M $0.5

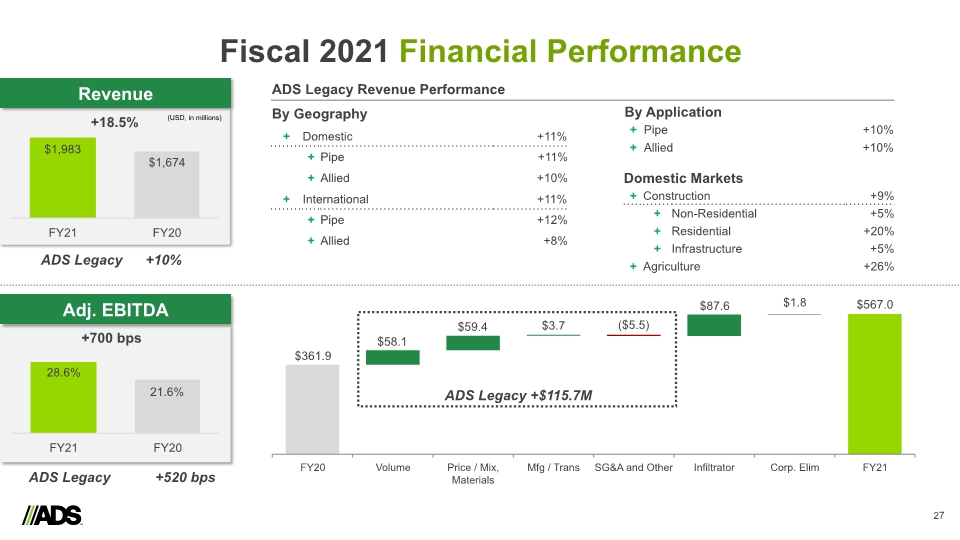

Fiscal 2021 Financial Performance 27 +700 bps (USD, in millions) +18.5% $361.9 $58.1 $59.4 ($5.5) $87.6 $567.0 Revenue Adj. EBITDA $3.7 $1,674 $1,983 21.6% 28.6% ADS Legacy +$115.7M $1.8

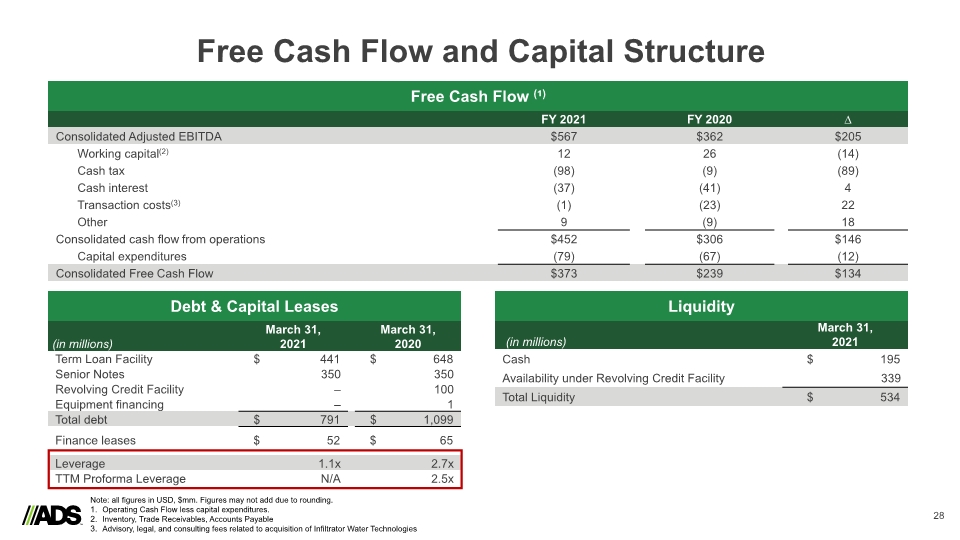

Free Cash Flow and Capital Structure 28 Free Cash Flow (¹) Note: all figures in USD, $mm. Figures may not add due to rounding. Operating Cash Flow less capital expenditures. Inventory, Trade Receivables, Accounts Payable Advisory, legal, and consulting fees related to acquisition of Infiltrator Water Technologies Debt & Capital Leases Liquidity

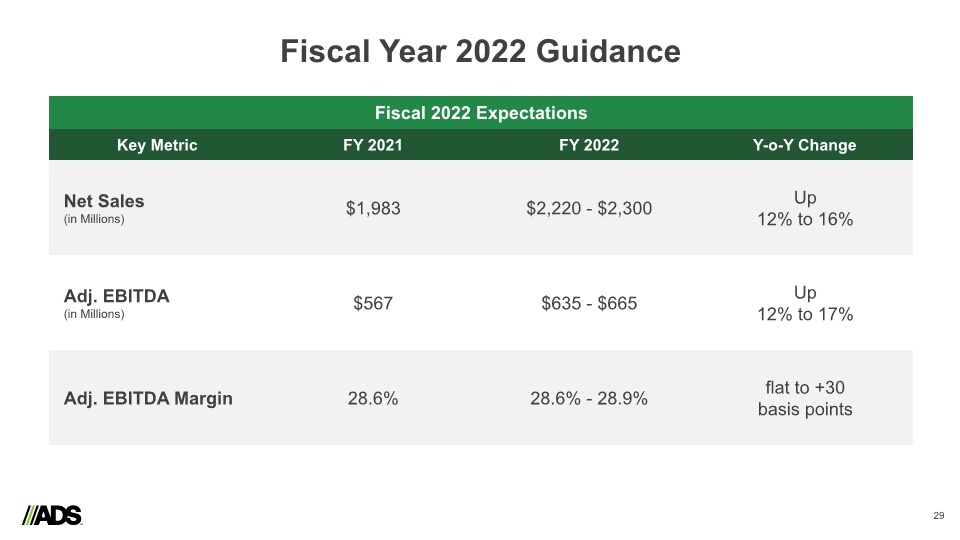

Fiscal Year 2022 Guidance 29 Fiscal 2022 Expectations

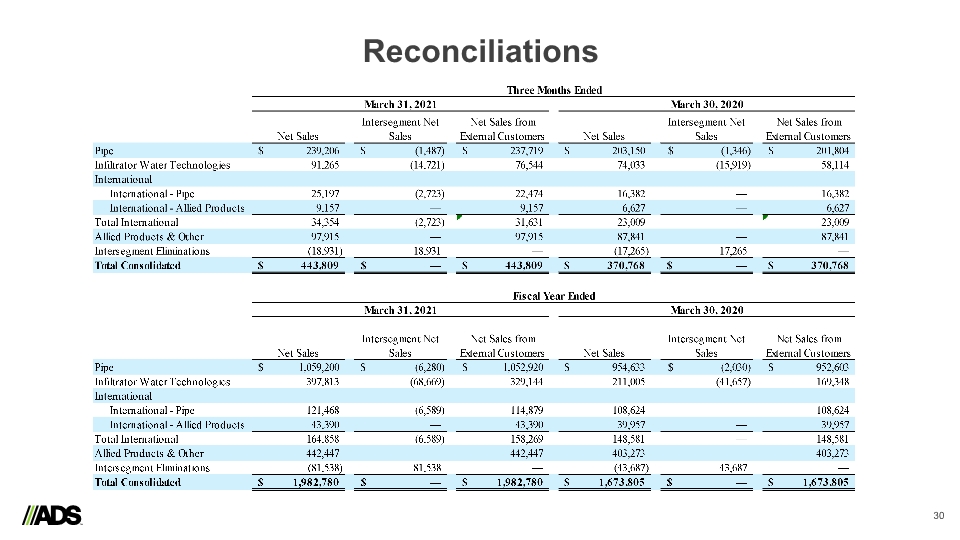

Reconciliations 30

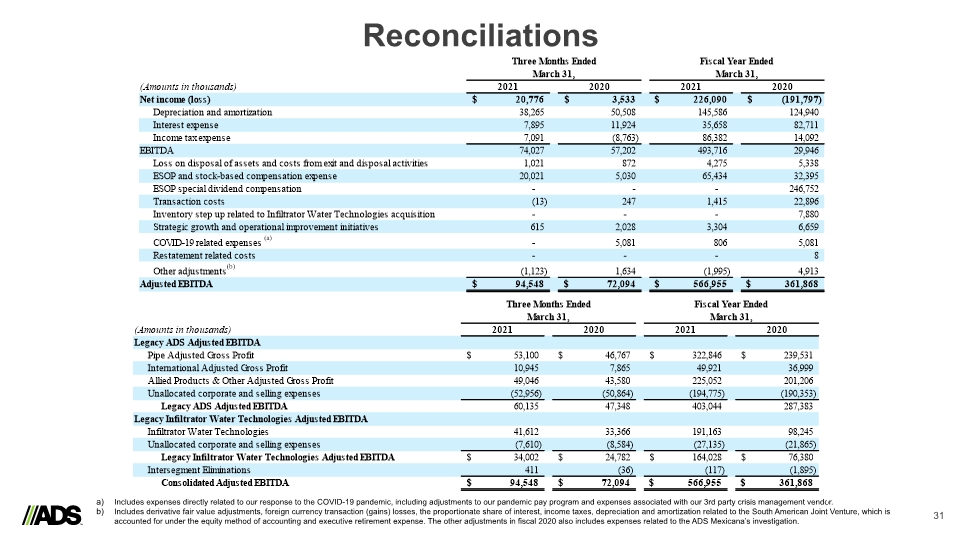

Reconciliations 31 Includes expenses directly related to our response to the COVID-19 pandemic, including adjustments to our pandemic pay program and expenses associated with our 3rd party crisis management vendor. Includes derivative fair value adjustments, foreign currency transaction (gains) losses, the proportionate share of interest, income taxes, depreciation and amortization related to the South American Joint Venture, which is accounted for under the equity method of accounting and executive retirement expense. The other adjustments in fiscal 2020 also includes expenses related to the ADS Mexicana’s investigation.

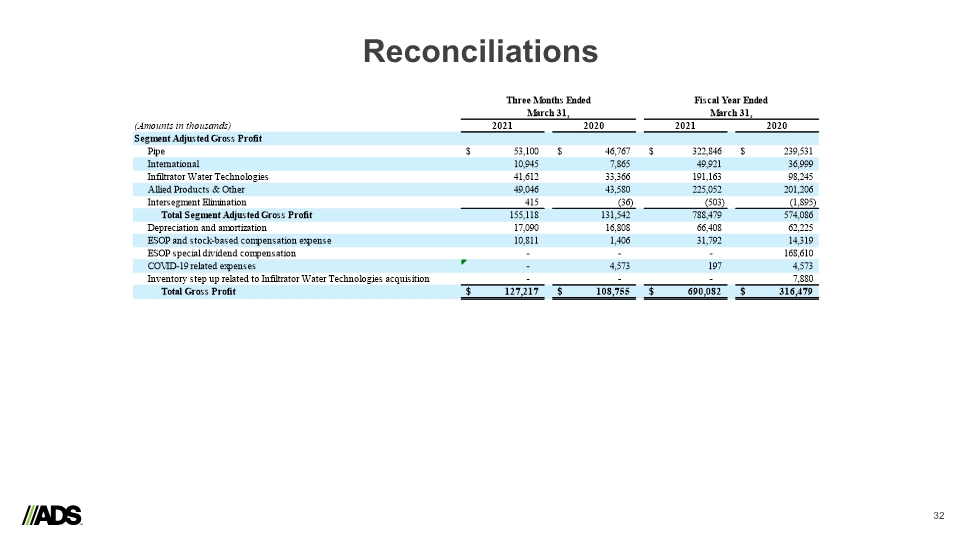

Reconciliations 32