Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Bonanza Creek Energy, Inc. | tm2115694d8_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Bonanza Creek Energy, Inc. | tm2115694d8_ex99-1.htm |

Exhibit 99.2

Civitas and Crestone Peak Preeminent DJ Basin Pure Play June 7, 2021

Important Disclosures No Offer or Solicitation This communication relates to proposed business combination transactions between Bonanza Creek Energy, Inc. (“BCEI”) and Extr act ion Oil & Gas, Inc. (“XOG”) (the “XOG Merger”) and between BCEI, Crestone Peak Resources LP (“CPR”), CPPIB Crestone Peak Resources America Inc. (“CPPIB”), Crestone Peak Resourc es Management LP (“CPR Management LP,” and, together with CPR and CPPIB, the “Group Companies”) and XOG (the “Crestone Merger,” and together with the XOG Merger, the “Mergers”). Com munications in this document do not constitute an offer to sell or the solicitation of an offer to subscribe for or buy any securities or a solicitation of any vote or approva l w ith respect to the Mergers or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to r egi stration or qualification under the securities laws of any such jurisdiction. Offers of securities with respect to the XOG Merger and offers of securities to certain holders with respect to the Crestone Mer ger shall be made only by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”). BCEI intends to issue the merger co nsideration in connection with the Crestone Merger to certain holders in reliance on the exemptions from the registration requirements under the Securities Act, pursuant to Section 4(a)(2 ) t hereof. Important Additional Information In connection with the Mergers, BCEI and XOG intend to file materials with the U.S. Securities and Exchange Commission (the “ SEC ”), including (1) a joint proxy statement in preliminary and definitive form (the “Joint Proxy Statement”) and (2) a Registration Statement on Form S - 4 with respect to the Mergers (the “Reg istration Statement”), of which the Joint Proxy Statement will be a part. After the Registration Statement is declared effective by the SEC, BCEI and XOG intend to send the definitive form of th e Joint Proxy Statement to the shareholders of BCEI and the shareholders of XOG. These documents are not substitutes for the Joint Proxy Statement or Registration Statement or for any o the r document that BCEI or XOG may file with the SEC and send to BCEI’s shareholders or XOG’s shareholders in connection with the Mergers. INVESTORS AND SECURITY HOLDERS OF BCEI AND XOG ARE URGED TO CAREFULLY AND THOROUGHLY READ THE JOINT PROXY STATEMENT AND THE REGISTRATION STATEMENT, AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND OTHER RELEVANT DOC UMENTS FILED BY BCEI AND XOG WITH THE SEC, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT BCEI, XOG, THE MERGERS, THE RISKS RELAT ED THERETO AND RELATED MATTERS. Investors will be able to obtain free copies of the Registration Statement and Joint Proxy Statement, as each may be amended fro m time to time, and other relevant documents filed by BCEI and XOG with the SEC (when they become available) through the website maintained by the SEC at www.sec.gov. Copies of documen ts filed with the SEC by BCEI will be available free of charge from BCEI’s website at www.bonanzacrk.com under the “Investor Relations” tab or by contacting BCEI’s Investor Relation s D epartment at (720) 225 - 6679 or slandreth@bonanzacrk.com. Copies of documents filed with the SEC by XOG will be available free of charge from XOG’s website at www.extractionog.com und er the “Investor Relations” tab or by contacting XOG’s Investor Relations Department at ir@extractionog.com. Participants in the Solicitation BCEI, XOG and their respective directors and certain of their executive officers and other members of management and employee s m ay be deemed, under SEC rules, to be participants in the solicitation of proxies from BCEI’s shareholders and XOG’s shareholders in connection with the Mergers. Information regarding th e executive officers and directors of BCEI is included in its definitive proxy statement for its 2021 annual meeting filed with the SEC on April 28, 2021. Information regarding the execut ive officers and directors of XOG is included in its amended annual report on Form 10 - K/A filed with the SEC on April 30, 2021. Additional information regarding the persons who may be deemed parti cipants and their direct and indirect interests, by security holdings or otherwise, will be set forth in the Registration Statement, Joint Proxy Statement and other materials when they a re filed with the SEC in connection with the Mergers. Free copies of these documents may be obtained as described in the paragraphs above.

Cautionary Statement Regarding Forward - Looking Statements Forward - Looking Statements and Cautionary Statements Certain statements in this document concerning the Mergers, including any statements regarding the expected timetable for com ple ting the Mergers, the results, effects, benefits and synergies of the Mergers, future opportunities for the combined company, future financial performance and condition, guidance an d any other statements regarding BCEI’s , XOG’s or Crestone Peak’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or perfor man ce that are not historical facts are “forward - looking” statements based on assumptions currently believed to be valid. Forward - looking statements are all statements other than statements of hist orical facts. The words “anticipate,” “believe,” “ensure,” “expect,” “if,” “intend,” “estimate,” “probable,” “project,” “forecasts,” “predict,” “outlook,” “aim,” “will,” “could,” “shou ld, ” “would,” “potential,” “may,” “might,” “anticipate,” “likely,” “plan,” “positioned,” “strategy,” and similar expressions or other words of similar meaning, and the negatives thereof, are intended to identify forward - looking statements. Specific forward - looking statements include statements regarding BCEI’s , XOG’s or Crestone Peak’s plans and expectations with respect to the Mergers and the anticipated impact of the Mergers on the combin ed company’s results of operations, financial position, growth opportunities and competitive position. The forward - looking statemen ts are intended to be subject to the safe harbor provided by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Liti gat ion Reform Act of 1995. These forward - looking statements involve significant risks and uncertainties that could cause actual results to differ materiall y from those anticipated, including, but not limited to, the possibility that shareholders of BCEI may not approve the issuance of new shares of BCEI common stock in the Mergers or that shareholders of XOG may not approve the XOG Merger Agreement; the risk that a condition to closing of the Mergers may not be satisfied, that either party may terminate the XOG Merger Agreemen t o r Crestone Peak Merger Agreement or that the closing of the Mergers might be delayed or not occur at all; potential adverse reactions or changes to business or employee relationships, i ncl uding those resulting from the announcement or completion of the Mergers; the diversion of management time on merger - related issues; the ultimate timing, outcome and results of integrating the operations of BCEI, XOG or Crestone Peak; the effects of the business combination of BCEI, XOG and Crestone Peak, including the combined company’s future financial condition, results of operations, strategy and plans; the ability of the combined company to realize anticipated synergies in the timeframe expected or at all; changes in capital markets and the ability of t he combined company to finance operations in the manner expected; regulatory approval of the Mergers; the effects of commodity prices; the risks of oil and gas activities; and the f act that operating costs and business disruption may be greater than expected following the public announcement or consummation of the Mergers. Expectations regarding business outlook, including ch anges in revenue, pricing, capital expenditures, cash flow generation, strategies for our operations, oil and natural gas market conditions, legal, economic and regulatory conditi ons , and environmental matters are only forecasts regarding these matters. Additional factors that could cause results to differ materially from those described above can be found in BCEI’s Annual Rep ort on Form 10 - K for the year ended December 31, 2020 and in its subsequently filed Quarterly Report on Form 10 - Q, each of which is on file with the SEC and available from BCEI’s website at www .bonanzacrk.com under the “Investor Relations” tab, and in other documents BCEI files with the SEC, and in XOG’s Annual Report on Form 10 - K for the year ended December 31, 2020 and in its subsequently filed Annual Report on Form 10 - K/A and Quarterly Report on Form 10 - Q, each of which is on file with the SEC and available from XOG’s website at www.extractionog.com un der the “Investor Relations” tab, and in other documents XOG files with the SEC. All forward - looking statements speak only as of the date they are made and are based on information available at that time. Neit her BCEI nor XOG assumes any obligation to update forward - looking statements to reflect circumstances or events that occur after the date the forward - looking statements were made or to r eflect the occurrence of unanticipated events except as required by federal securities laws. As forward - looking statements involve significant risks and uncertainties, caution should b e exercised against placing undue reliance on such statements.

Net DJ Basin Acres x PDP PV10 3 x 2022E EBITDA 2 x 2022E Production x Enterprise Value 1 x Annual Synergies x Gross Locations 4 x Preeminent Pure - play DJ Basin Operator (1) Based on the equity market capitalization of Civitas as of June 4, 2021. Balance sheet data as of March 31, 2021, pro forma for recent transactions. (2) Wall Street consensus outlook is sourced from Refinitiv (formerly Thomson Reuters). Crestone Peak figures based on risked pro fo rma model inclusive of synergies. (3) Based on 3 rd party - audited reports as of January 1, 2021, rolled forward to April 1, 2021. Assumes NYMEX strip pricing as of May 5, 2021. (4) Average lateral length of ~9,700’. 2022E FCF 2 x Pro Forma Metrics Civitas | Civitas+CPR ~$3.2 Bn ~$4.5 Bn ~$900 MM $1.3+ Bn ~115 MBoe /d ~160 MBoe /d ~405,000 ~525,000 ~$2.9 Bn ~$3.6 Bn ~750 ~1,200 ~$25 MM ~$70 MM ~$470 MM $575+ MM Boulder Denver Jefferson Adams Arapahoe Elbert Morgan Weld Larimer Douglas Broomfield Laramie Kimball Civitas Crestone Peak

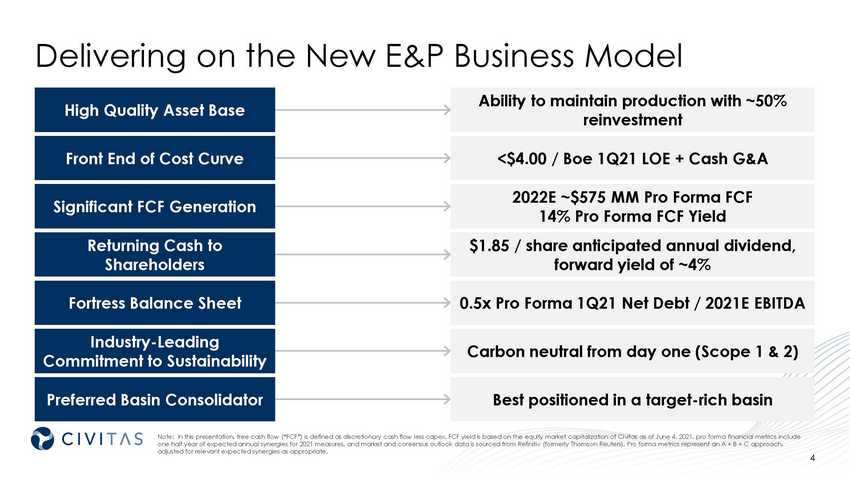

High Quality Asset Base Ability to maintain production with ~50% reinvestment Delivering on the New E&P Business Model Front End of Cost Curve <$4.00 / Boe 1Q21 LOE + Cash G&A Fortress Balance Sheet 0.5x Pro Forma 1Q21 Net Debt / 2021E EBITDA Significant FCF Generation 2022E ~$575 MM Pro Forma FCF 14% Pro Forma FCF Yield Returning Cash to Shareholders $1.85 / share anticipated annual dividend, forward yield of ~4% Industry - Leading Commitment to Sustainability Carbon neutral from day one (Scope 1 & 2) Preferred Basin Consolidator Best positioned in a target - rich basin Note: In this presentation, free cash flow (“FCF”) is defined as discretionary cash flow less capex, FCF yield is based on t he equity market capitalization of Civitas as of June 4, 2021, pro forma financial metrics include one half year of expected annual synergies for 2021 measures, and market and consensus outlook data is sourced from Refinitiv (f ormerly Thomson Reuters). Pro forma metrics represent an A + B + C approach, adjusted for relevant expected synergies as appropriate.

Expanded Merger of Peers Leadership & Governance Approvals & Timing Merger Overview • All - stock transaction • Crestone Peak is ~96% owned by CPP Investments • 37% BCEI, 37% XOG and 26% CPR stakeholders • Pro forma enterprise value ~$4.5 Bn 1 • Ben Dell – Chair of the Board • Board of Directors: four BCEI, four XOG and one CPR • Eric Greager – CEO • Unanimously approved by BCEI, XOG and CPR Boards • Subject to approval of BCEI shareholders and consummation of BCEI/XOG merger • CPR shareholders have already approved • Expected closing in Fall 2021 (1) Based on the equity market capitalization of Civitas as of June 4, 2021. Balance sheet data as of March 31, 2021, pro forma for recent transactions.

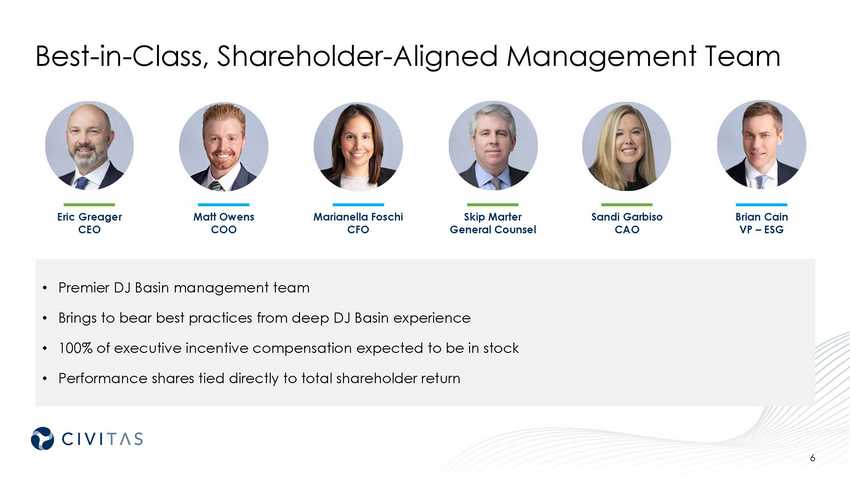

Best - in - Class, Shareholder - Aligned Management Team • Premier DJ Basin management team • Brings to bear best practices from deep DJ Basin experience • 100% of executive incentive compensation expected to be in stock • Performance shares tied directly to total shareholder return Marianella Foschi CFO Brian Cain VP – ESG Matt Owens COO Eric Greager CEO Sandi Garbiso CAO Skip Marter General Counsel

Accretive to 2022E Key Metrics Inventory quality and depth Credit profile and cost of capital Cash flow per share x Dividends per share Pro Forma for Synergies x x x

Strategy, Values, Priorities Maximize Shareholder Return Fortress Balance Sheet ESG Leadership Highest Return Opportunities Return Cash to Shareholders • Distinctive competencies in operations, consolidation, sustainability and regulation • Highly energized management team • Best - in - class corporate governance • Operational flexibility and optionality across the DJ • Committed to all stakeholders • Partnering with / respecting local communities Strategy and Culture • Front end of the North American cost curve • Generating FCF and returning cash to shareholders • Disciplined capital allocation • Maximizing corporate - level returns • Aggressive commitment to sustainability • Committed to maintaining low leverage Priorities

Free Cash Flow Generation & Capital Allocation Priorities 2022E Full Year Pro Forma FCF Generation 1 Disciplined Business Principles Pay Dividend Protect Balance Sheet x Prioritize Highest Return Opportunities for FCF Cash Returns 1 Return - Focused Operations 2 Consolidation Opportunities x 3 $0 $1,500 2022E Levered Sources of Cash 2022E Capex 2022E Levered Free Cash Flow $MM (1) Wall Street consensus outlook is sourced from Refinitiv (formerly Thomson Reuters). ~$24 MM cost of synergies in 2021. • Anticipated to pay $1.85 per share annual dividend • Maintain financial flexibility across commodity and development scenarios • Target leverage to ~0.5x or less (net debt - to - LTM EBITDA) • Grow dividend • Potential for share repurchases and special dividends • Production level is an output • Value - accretive M&A opportunities • Consolidation of working interests

Returning Synergy Savings to Shareholders • Combined surface access / extended laterals • Sale and avoided capital of facilities / equipment • Sale of redundant surface holdings • Net of cost of one - time and recurring synergies One - Time Civitas and Crestone Peak Savings $0 $100 One Time Savings $MM BCEI / HPR BCEI / XOG Civitas / Crestone Peak 1 Announced Dividend $1.85 / share $1.60 / share $1.40 / share ~$100 MM Synergies Cumulative Disclosed Recurring Annual Synergies G&A Midstream LOE Capex Recurring Synergies Recurring Civitas and Crestone Peak Synergies Capex • Scale and consistency LOE • Reduced headcount • Field optimization Midstream • Supply agreements / volume commitments G&A • Reduced headcount • Office consolidation $40 – $50 MM • Civitas and Crestone Peak combination generates meaningful one - time benefits and significant recurring synergies • Civitas plans to return approximately half of the recurring synergies to shareholders by increasing the annual dividend further, to $1.85, effective at closing

1Q21 LOE + Cash G&A ($/ Boe ) 1 1Q21 Net Debt / 2021E EBITDA Low Leverage and Low - Cost Note: Market data and consensus outlook data is sourced from Refinitiv (formerly Thomson Reuters). Crestone Peak figures bas ed on risked pro forma model. Peers include BRY, CDEV, CPE, ESTE, LPI, MGY, MTDR, MUR, OAS, PDCE, PVAC and SM. (1) Civitas and Civitas + CPR includes one quarter of related LOE and G&A synergies. Civitas Civitas Civitas + CPR Civitas + CPR

2022E Wall Street Consensus EBITDA ($MM) Scale Leads to Relevance and Liquidity Note: Market data and consensus outlook data is sourced from Refinitiv (formerly Thomson Reuters). Crestone Peak figures based o n risked pro forma model. Peers include BRY, CDEV, CPE, ESTE, LPI, MGY, MTDR, MUR, OAS, PDCE, PVAC and SM. 2022E Wall Street Consensus Production ( MBoe /d) and Liquids Mix (%) Civitas Civitas + CPR Civitas Civitas + CPR

Compelling Valuation Given Peer Leading Free Cash Flow Generation 2022E FCF Yield Enterprise Value 1 / 2022E EBITDA Note: Market data and consensus outlook data is sourced from Refinitiv (formerly Thomson Reuters). Crestone Peak figures bas ed on risked pro forma model. Peers include BRY, CDEV, CPE, ESTE, LPI, MGY, MTDR, MUR, OAS, PDCE, PVAC and SM. (1) Enterprise value calculated as equity market value plus total debt less cash. Civitas Civitas + CPR Civitas Civitas + CPR

DJ Basin Optionality Development Area Approximate DJ Basin Net Acres Geography Western 135,000 Suburban / Rural Eastern 115,000 Rural Southern 125,000 Suburban / Rural Northern 150,000 Rural Net Production Mix (%) Combined Position Facilitates Asset Development Optimization Denver Jefferson Adams Arapahoe Elbert Morgan Weld Larimer Douglas Broomfield Boulder Civitas Leasehold Positions Northern Eastern Southern Western 66% 24% 8% 56% 26% 15% West East South North Inner Ring – April 2021 Outer Ring – 2022 ~160 MBoe /d

Relative Inventory Contribution by Area Note: Single well economics valued at flat $55 WTI / $2.75 HH / 40% NGL differential. Average lateral length of ~9,700’. B - TAX Single Well IRRs at $55 WTI 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 1 201 401 601 801 1,001 West South East Location Counts West ~350 East ~400 South ~450 Total ~1,200

Opportunity - Rich Basin • Civitas is well - positioned to participate in future basin consolidation – Numerous privately held companies – Opportunity to increase efficiencies with scale – Operating expertise across the basin – Captured synergies returned to shareholders • Civitas will continue to be a disciplined transaction partner – FCF and NAV accretion – Focus on offsetting acreage Asset Locator Map Boulder Denver Jefferson Adams Arapahoe Elbert Morgan Weld Larimer Douglas Broomfield Laramie Kimball Civitas + CPR Bayswater Bison Confluence Great Western Mallard Verdad Whiting (Redtail)

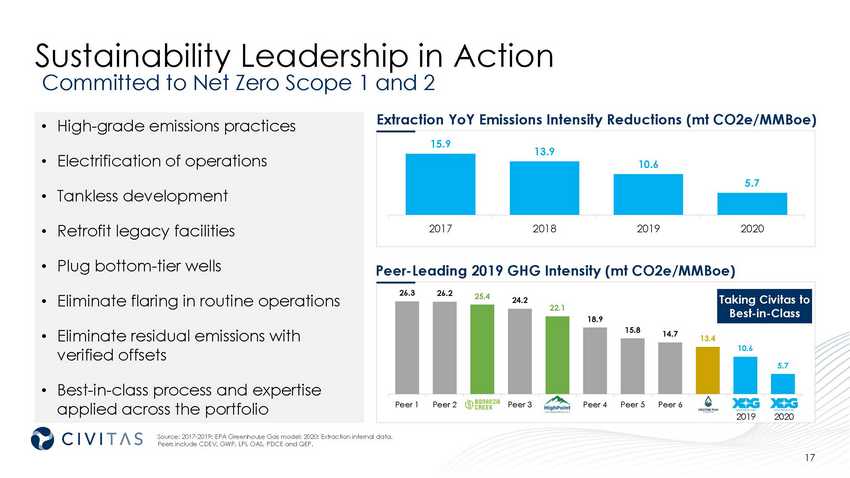

15.9 13.9 10.6 5.7 2017 2018 2019 2020 5.7 10.6 13.4 14.7 15.8 18.9 22.1 24.2 25.4 26.2 26.3 XOG XOG CPR Peer 6 Peer 5 Peer 4 HPR Peer 3 BCEI Peer 2 Peer 1 Sustainability Leadership in Action • High - grade emissions practices • Electrification of operations • Tankless development • Retrofit legacy facilities • Plug bottom - tier wells • Eliminate flaring in routine operations • Eliminate residual emissions with verified offsets • Best - in - class process and expertise applied across the portfolio 2019 2020 Extraction YoY Emissions Intensity Reductions (mt CO2e/ MMBoe ) Peer - Leading 2019 GHG Intensity (mt CO2e/ MMBoe ) Source: 2017 - 2019: EPA Greenhouse Gas model; 2020: Extraction internal data. Peers include CDEV, GWP, LPI, OAS, PDCE and QEP. Taking Civitas to Best - in - Class Committed to Net Zero Scope 1 and 2

• Colorado’s First Carbon Neutral Operator – Aggressive operational emissions - reduction program coupled with a multi - year investment in certified emissions offsets • Project Canary & Payne Institute Partnership – Partnership providing certified, third - party real - time air monitoring – Forward - thinking environmental protection for local communities • Trustwell Facility Certification – Verifies facility engineering to reduce environmental impact • Responsibly Sourced Gas (RSG) – Validates RSG production – Partnership with Xcel Energy demonstrates growing demand for the RSG market • Electric Vehicle Fleet Conversion – Adopting EV fleet this year • Community Solar – Reduces utility costs by up to 20% for neighbors, increases renewable power for the state of Colorado • EV Charging Stations – Identifying locations in our communities • The Civitas Community Fund – Will fund project grants and scholarships for our neighbors – Successful development returns tangible value to our communities Responsible Stewardship Implementing the ESG Vision x x x x x x x x

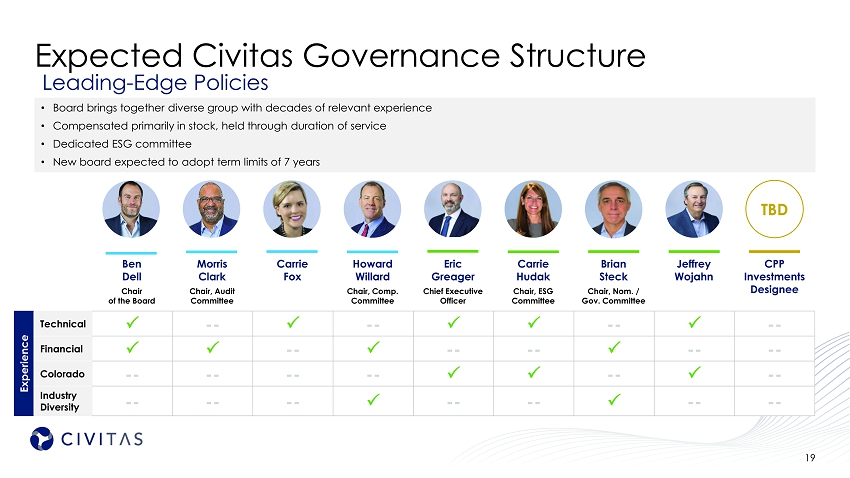

Expected Civitas Governance Structure Experience Technical -- -- -- -- Financial -- -- -- -- -- Colorado -- -- -- -- -- -- Industry Diversity -- -- -- -- -- -- -- Ben Dell Chair of the Board Morris Clark Chair, Audit Committee Carrie Fox Howard Willard Chair, Comp. Committee • Board brings together diverse group with decades of relevant experience • Compensated primarily in stock, held through duration of service • Dedicated ESG committee • New board expected to adopt term limits of 7 years Carrie Hudak Chair, ESG Committee Brian Steck Chair, Nom. / Gov. Committee Eric Greager Chief Executive Officer Jeffrey Wojahn Leading - Edge Policies CPR Designee TBD

Civitas + Crestone Peak = A Value Enhancing Combination Creates the premier pure - play DJ Basin operator Preferred transaction partner in the basin Accelerates cash - return business model Maintain flat production at 50% reinvestment rate and increase dividend Strengthens credit profile and lowers cost of capital Increases financial and operational scale while maintaining ~0.5x leverage Improves existing low - cost operations through tangible cost and operational synergies ~$45 MM annually, equating to over $200 MM of present value Compelling value proposition Implied pro forma valuation at low end of peer group despite ~14% free cash flow yield x x x x x

Appendix

Pro Forma Shareholder Base • High - quality stockholder base • Increased market cap expands investor appeal • Added to the Russell 3000 index • Current index participation may increase • Top 10 holders own ~70%

$51.39 $45.11 $43.85 $44.98 $44.21 $32.78 - $51.19 $38.09 - $67.10 $40.00 - $72.70 $55.08 36,648 22,170 6,655 4,600 3,700 – 10,000 20,000 30,000 40,000 4Q21 2022 2023 2024 2025 Oil Swaps Oil Collars Oil Swaptions Hedge Positions Enhance Financial Strength Hedge position protects balance sheet, dividend and cash flow stability Civitas + CPR Oil Hedges ( Bbl /d) Civitas + CPR Gas Hedges (Mcf/d) $2.83 $2.83 $2.51 $2.57 $2.25 - $2.52 $2.00 - $3.25 $2.00 - $3.25 $2.13 $2.13 $2.15 - $2.75 $2.15 - $2.75 208,785 112,698 47,998 22,350 – – 60,000 120,000 180,000 240,000 4Q21 2022 2023 2024 2025 NYMEX Gas Swaps NYMEX Gas Collars CIG Gas Swaps CIG Gas Collars CIG Basis and NGL OPIS Swaps 50,000 Mcf/d CIG basis swaps at ($0.18)/Mcf in 4Q21, 5,500 Bbl /d OPIS swaps at $22.55/ Bbl in 4Q21 and 4,000 Bbl /d OPIS swaps at $20.22/ Bbl in 2022

Corporate Contact Information Investor Relations John Wren ir@extractionog.com Scott Landreth slandreth@bonanzacrk.com Media & ESG Policy Brian Cain info@extractionog.com