Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GOLUB CAPITAL BDC, Inc. | gbdcip8-kxfy2021q2.htm |

GOLUB CAPITAL BDC, INC. INVESTOR PRESENTATION QUARTER ENDED MARCH 31, 2021

Disclaimer Some of the statements in this presentation constitute forward-looking statements, which relate to future events or our future performance or financial condition. The forward-looking statements contained in this presentation involve risks and uncertainties, including statements as to: our future operating results; our business prospects and the prospects of our portfolio companies including our and their ability to achieve our and their respective objectives as a result of the coronavirus ("COVID-19") pandemic; the effect of investments that we expect to make and the competition for those investments; our contractual arrangements and relationships with third parties; actual and potential conflicts of interest with GC Advisors LLC ("GC Advisors"), our investment adviser, and other affiliates of Golub Capital LLC (collectively, "Golub Capital"); the dependence of our future success on the general economy and its effect on the industries in which we invest; the ability of our portfolio companies to achieve their objectives; the use of borrowed money to finance a portion of our investments and the effect of the COVID-19 pandemic on the availability of equity and debt capital and our use of borrowed funds to finance a portion of our investments; the adequacy of our financing sources and working capital; the timing of cash flows, if any, from the operations of our portfolio companies; general economic and political trends and other external factors, including the COVID-19 pandemic; changes in political, economic or industry conditions, the interest rate environment or conditions affecting the financial and capital markets that could result in changes to the value of our assets, including changes from the impact of the COVID-19 pandemic; the ability of GC Advisors to locate suitable investments for us and to monitor and administer our investments; the ability of GC Advisors or its affiliates to attract and retain highly talented professionals; the ability of GC Advisors to continue to effectively manage our business due to the disruptions caused by the COVID-19 pandemic; our ability to qualify and maintain our qualification as a regulated investment company and as a business development company; general price and volume fluctuations in the stock market; the impact on our business of the Dodd-Frank Wall Street Reform and Consumer Protection Act and the rules and regulations issued thereunder and any actions toward repeal thereof; and the effect of changes to tax legislation and our tax position. Such forward-looking statements may include statements preceded by, followed by or that otherwise include the words “may,” “might,” “will,” “intend,” “should,” “could,” “can,” “would,” “expect,” “believe,” “estimate,” “anticipate,” “predict,” “potential,” “plan” or similar words. We have based the forward-looking statements included in this presentation on information available to us on the date of this presentation. Actual results could differ materially from those anticipated in our forward-looking statements and future results could differ materially from historical performance. We undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise. You are advised to consult any additional disclosures that we may make directly to you or through reports that we have filed or in the future may file with the Securities and Exchange Commission (“SEC”), including annual reports on Form 10-K, registration statements on Form N-2, quarterly reports on Form 10-Q and current reports on Form 8-K. This presentation contains statistics and other data that have been obtained from or compiled from information made available by third-party service providers. We have not independently verified such statistics or data. In evaluating prior performance information in this presentation, you should remember that past performance is not a guarantee, prediction, or projection of future results, and there can be no assurance that we will achieve similar results in the future. 2

Summary of Financial Results 01

Summary of Financial Results vs. Prior Quarter 4 1. On September 16, 2019, Golub Capital BDC, Inc. (“we”, “us”, “our”, the “Company” or “GBDC”) completed the acquisition of Golub Capital Investment Corporation (“GCIC”). Purchase premium refers to the premium paid by GBDC to acquire GCIC in excess of the fair value of the assets acquired. 2. Due to the purchase accounting for the GCIC acquisition, as a supplement to U.S. generally accepted accounting principles (“GAAP”) financial measures, the Company is providing additional non-GAAP measures. See the Endnotes at the end of this presentation for further description on the non-GAAP financial measures. Quarter Ended December 31, 2020 Quarter Ended March 31, 2021 Net Investment Income Per Share Net investment income per share $0.23 $0.24 Amortization of purchase premium per share1 0.06 0.05 Adjusted net investment income per share2 $0.29 $0.29 Net Realized/Unrealized Gain (Loss) Per Share Net realized/unrealized gain (loss) per share $0.33 $0.31 Reversal of unrealized loss resulting from purchase price premium amortization per share1 (0.06) (0.05) Adjusted net realized/unrealized gain (loss) per share2 $0.27 $0.26 Earnings Per Share Earnings (loss) per share $0.56 $0.55 Adjusted earnings (loss) per share2 $0.56 $0.55 Net Asset Value Per Share $14.60 $14.86 A B A B

GBDC Performance Drivers 02

GBDC’s Strong Earnings in Quarter Ended March 31, 2021 Were Driven by a Continuation of Themes from the Prior Quarter 6 GBDC portfolio companies generally continued to perform well ‒ Improved internal performance ratings2 ‒ Decline in non-accruals3 ‒ No net realized losses4 ‒ Solid net unrealized gains, reversing a portion of the unrealized losses incurred in the March 31, 2020 quarter4 Execution of second unsecured bond issuance and corporate revolver Solid originations offset by elevated repayments driving modest decline in funds growth Key Themes from Quarter Ended March 31, 2021 Impact on GBDC Earnings growth year-over-year across middle market private companies in Golub Capital portfolios was a record 16.3%1, as the U.S. economy continued to show signs of an impending rebound from the initial impact of the COVID-19 pandemic Further optimization of GBDC’s balance sheet Middle market deal activity was strong (though not as strong as the prior quarter) 1. Please see March 31, 2021 Golub Capital Middle Market Report for additional details. 2. Please see page titled, “Strong Borrower Performance – GBDC’s Performance Ratings Are Back to 2018 Levels”. 3. Please see page titled, “Portfolio Highlights – Credit Quality”. 4. Please see page titled, “Strong Unrealized Gains Drove a NAV Per Share Increase from December 31, 2020”.

Strong Borrower Performance – GBDC’s Performance Ratings Are Back to 2018 Levels 7 Internal Performance Rating Migration % of Portfolio at Fair Value 1.0% 1.2% 2.0% 1.7% 1.4% 1.1% 1.1% 11.0% 7.9% 26.5% 22.3% 19.7% 17.9% 12.0% 88.0% 90.9% 71.5% 76.0% 78.9% 81.0% 86.9% 2018 2019 March 31, 2020 June 30, 2020 September 30, 2020 December 31, 2020 March 31, 2021 Internal Performance Ratings 4-5 (Performing At or Above Expectations) Internal Performance Rating 3 (Performing Below Expectations) Internal Performance Ratings 1 and 2 (Performing Materially Below Expectations) − Percentage of portfolio investments at fair value with internal performance ratings 1-2 remained small and has declined to pre-COVID 2018/2019 levels. -1.8%-2.6% -4.2% -5.9% -3.1% At Fiscal Year End

$14.60 $14.86 $0.24 $0.05 $0.00 * $0.31 ($0.29) ($0.05) 12/31/20 NAV Net Investment Income Reversal of Amortization of Purchase Premium² Dividend Paid During March 31, 2021 Quarter Net Realized Gain on Investments Net Change in Unrealized Appreciation on Investments Net Reversal of Realized/ Unrealized Loss Resulting from the Purchase Premium² 3/31/21 NAV Note: Footnotes located in the Endnotes at the end of this presentation. * Rounds to less than $0.01. Strong Unrealized Gains Drove a NAV Per Share Increase from December 31, 2020 8 NAV Per Share Bridge Adjusted NII: $0.291 Adjusted Net Realized & Unrealized Gain: $0.261

Summary of Financial Results for the Quarter Ended March 31, 2021 03

1. Purchase premium refers to the premium paid by GBDC to acquire GCIC in excess of the fair value of the assets acquired. 2. Due to the purchase accounting for the GCIC acquisition and the retroactive adjustment to the weighted average share calculation to recognize the bonus element associated with the rights offering, as a supplement to U.S. generally accepted accounting principles (“GAAP”) financial measures, the Company is providing additional non-GAAP measures. See the Endnotes at the end of this presentation for further description of the non- GAAP financial measures. 3. The weighted average shares of the Company's common stock outstanding used in computing basic and diluted earnings per share for periods ended on or before June 30, 2020 (FQ3 2020) have been adjusted retroactively by a factor of approximately 1.03% to recognize the bonus element associated with rights to acquire shares of the Company's common stock that were issued to stockholders of record as of April 8, 2020. 10 FY 2020 FY 2021 Quarter Ended Quarter Ended 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 Net Investment Income Per Share Net investment income per share $0.24 $0.23 $0.23 $0.23 $0.24 Amortization of purchase premium per share1 0.09 0.05 0.05 0.06 0.05 Adjusted net investment income per share2 $0.33 $0.28 $0.28 $0.29 $0.29 Net Realized/Unrealized Gain (Loss) Per Share Net realized/unrealized gain (loss) per share ($1.95) $0.71 $0.34 $0.33 $0.31 Net reversal of realized/unrealized loss resulting from the purchase premium per share1 (0.09) (0.05) (0.05) (0.06) (0.05) Adjusted net realized/unrealized gain (loss) per share2 ($2.04) $0.66 $0.29 $0.27 $0.26 00 00 00 Earnings (Loss) Per Share Earnings (loss) per share3 ($1.66) $0.93 $0.57 $0.56 $0.55 Retroactive adjustment to per share data resulting from the rights offering3 (0.05) 0.01 - - - Adjusted earnings (loss) per share2 ($1.71) $0.94 $0.57 $0.56 $0.55 Net Asset Value Per Share $14.62 $14.05 $14.33 $14.60 $14.86 Distributions paid per share $0.33 $0.29 $0.29 $0.29 $0.29 A B B A Summary of Quarterly Results

FY2020 FY2021 Quarter Ended Quarter Ended Select Portfolio Funds Roll Data (in millions) 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 New Investment Commitments $167.0 $15.7 $141.2 $526.8 $234.7 Exits and Sales of Investments 290.9 88.4 172.4 278.7 347.5 Net Funds Growth1 (238.1) 40.2 (12.2) 269.0 (112.0) Asset Mix of New Investments Senior Secured 33% 1% 27% 22% 24% One Stop 66% 98% 71% 75% 75% Junior Debt2 0% 0% 0% 2% 0% Equity and Other Investments 1% 1% 2% 1% 1% Portfolio Rotation – Debt Investments Weighted average rate on new investments3 7.1% 7.5% 7.6% 7.1% 6.6% Weighted average spread over LIBOR of new floating rate investments 5.2% 6.3% 6.5% 6.1% 5.5% Weighted average interest rate on investments that paid-off 7.7% 6.1% 7.3% 7.1% 6.5% Weighted average fees on new investments 1.1% 0.4% 1.9% 1.3% 1.2% 1. Net funds growth includes the impact of new investments and exits of investments as noted in the table above, as well as other variables such as net fundings on revolvers, net change in unamortized fees, net change in unrealized appreciation (depreciation), etc. 2. Junior debt is comprised of subordinated debt and second lien loans. 3. Weighted Average interest rate on new investments is based on the contractual interest rate at the time of funding. For variable rate loans that have a London Interbank Offered Rate “LIBOR” or Prime rate option, the contractual rate is calculated using current LIBOR at the time of funding, the spread over LIBOR and the impact of any LIBOR floor. For variable rate loans that only have a Prime rate option, the contractual rate is calculated using current Prime at the time of funding, the spread over Prime and the impact of any Prime floor. For fixed rate loans, the contract rate is the stated fixed rate. 11 New Originations Data and Net Funds Growth − Total investments at fair value decreased by approximately 2.5%, or $112.0 million, during the quarter ended March 31, 2021 as strong originations were offset by elevated repayments. − As of March 31, 2021, we had $44.7 million of undrawn revolver commitments to portfolio companies. Portfolio Highlights – New Originations

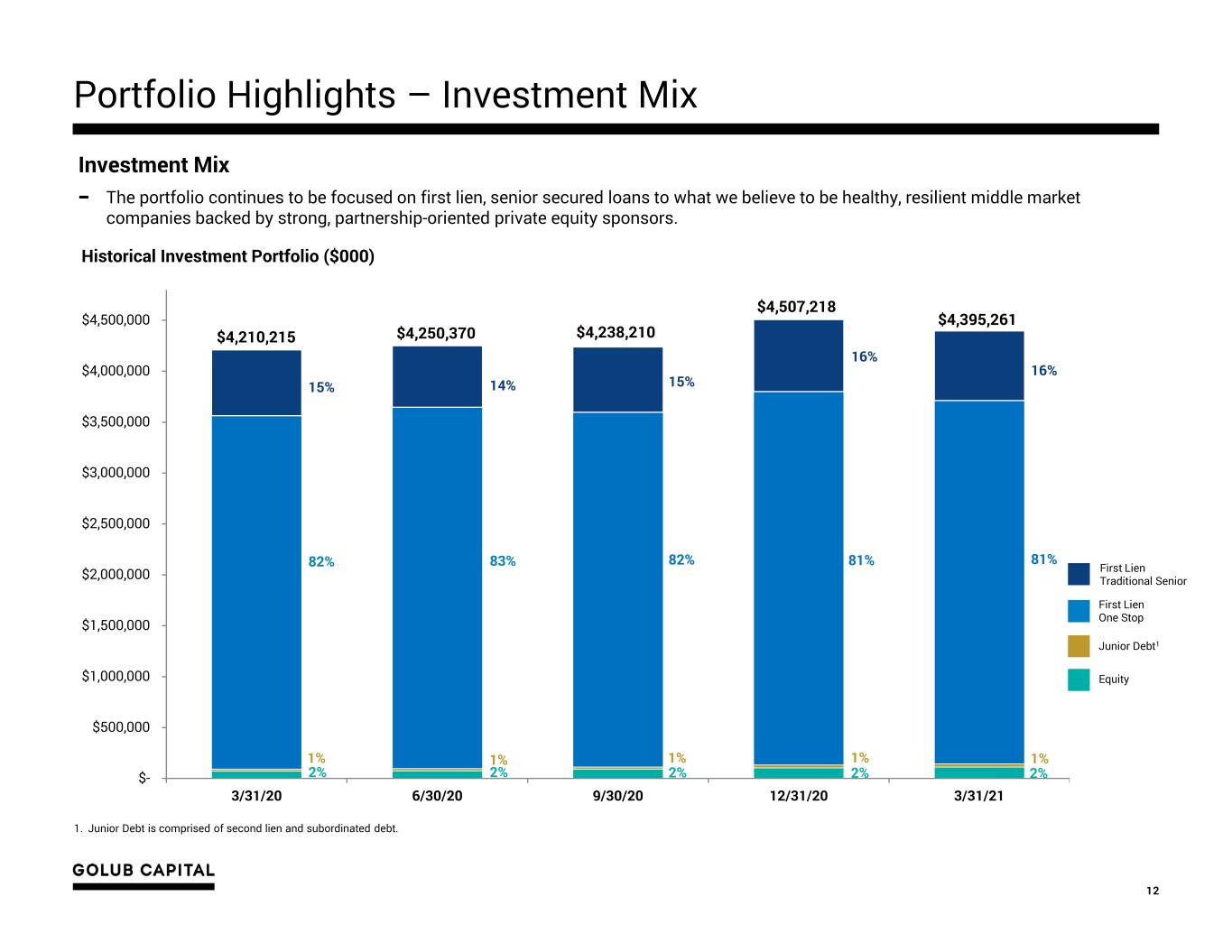

Portfolio Highlights – Investment Mix 12 $- $500,000 $1,000,000 $1,500,000 $2,000,000 $2,500,000 $3,000,000 $3,500,000 $4,000,000 $4,500,000 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 1% 1% Historical Investment Portfolio ($000) 82% 15% 1. Junior Debt is comprised of second lien and subordinated debt. 2% $4,210,215 2% 83% 14% 81% 2% $4,250,370 Equity Junior Debt1 First Lien One Stop First Lien Traditional Senior $4,238,210 82% 15% 2% $4,395,261 1%1% $4,507,218 81% 16% 1% 2% 16% Investment Mix − The portfolio continues to be focused on first lien, senior secured loans to what we believe to be healthy, resilient middle market companies backed by strong, partnership-oriented private equity sponsors.

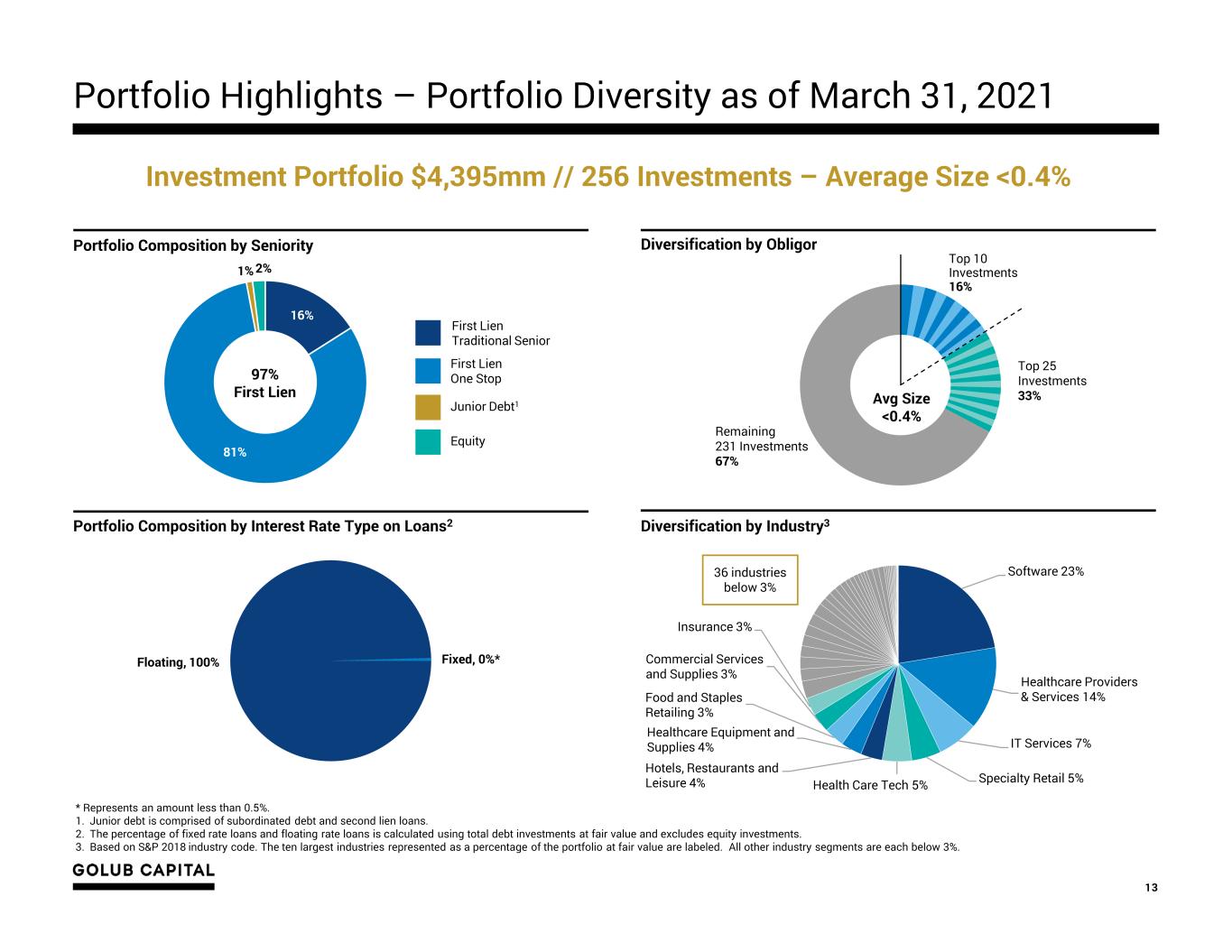

Portfolio Highlights – Portfolio Diversity as of March 31, 2021 13 * Represents an amount less than 0.5%. 1. Junior debt is comprised of subordinated debt and second lien loans. 2. The percentage of fixed rate loans and floating rate loans is calculated using total debt investments at fair value and excludes equity investments. 3. Based on S&P 2018 industry code. The ten largest industries represented as a percentage of the portfolio at fair value are labeled. All other industry segments are each below 3%. Portfolio Composition by Seniority Diversification by Obligor 16% 81% 1% 2% First Lien One Stop First Lien Traditional Senior 97% First Lien Top 25 Investments 33% Remaining 231 Investments 67% Top 10 Investments 16% Avg Size <0.4% Portfolio Composition by Interest Rate Type on Loans2 Floating, 100% Fixed, 0%* Diversification by Industry3 Investment Portfolio $4,395mm // 256 Investments – Average Size <0.4% Software 23% Healthcare Providers & Services 14% IT Services 7% Specialty Retail 5%Health Care Tech 5% Hotels, Restaurants and Leisure 4% Healthcare Equipment and Supplies 4% Food and Staples Retailing 3% Commercial Services and Supplies 3% Insurance 3% 36 industries below 3% Junior Debt1 Equity

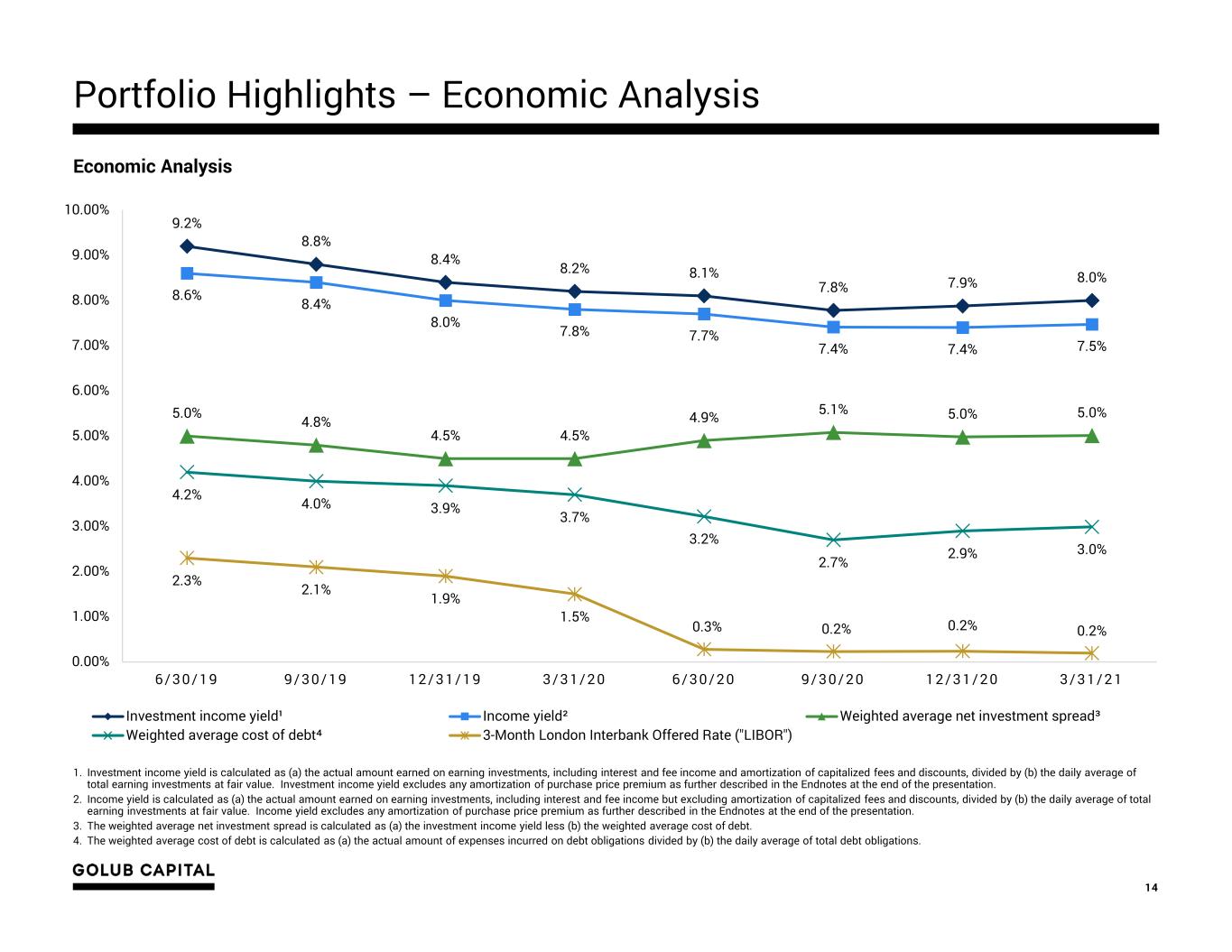

1. Investment income yield is calculated as (a) the actual amount earned on earning investments, including interest and fee income and amortization of capitalized fees and discounts, divided by (b) the daily average of total earning investments at fair value. Investment income yield excludes any amortization of purchase price premium as further described in the Endnotes at the end of the presentation. 2. Income yield is calculated as (a) the actual amount earned on earning investments, including interest and fee income but excluding amortization of capitalized fees and discounts, divided by (b) the daily average of total earning investments at fair value. Income yield excludes any amortization of purchase price premium as further described in the Endnotes at the end of the presentation. 3. The weighted average net investment spread is calculated as (a) the investment income yield less (b) the weighted average cost of debt. 4. The weighted average cost of debt is calculated as (a) the actual amount of expenses incurred on debt obligations divided by (b) the daily average of total debt obligations. 14 Economic Analysis Portfolio Highlights – Economic Analysis 9.2% 8.8% 8.4% 8.2% 8.1% 7.8% 7.9% 8.0% 8.6% 8.4% 8.0% 7.8% 7.7% 7.4% 7.4% 7.5% 5.0% 4.8% 4.5% 4.5% 4.9% 5.1% 5.0% 5.0% 4.2% 4.0% 3.9% 3.7% 3.2% 2.7% 2.9% 3.0% 2.3% 2.1% 1.9% 1.5% 0.3% 0.2% 0.2% 0.2% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% 6 / 3 0 / 1 9 9 / 3 0 / 1 9 1 2 / 3 1 / 1 9 3 / 3 1 / 2 0 6 / 3 0 / 2 0 9 / 3 0 / 2 0 1 2 / 3 1 / 2 0 3 / 3 1 / 2 1 Investment income yield¹ Income yield² Weighted average net investment spread³ Weighted average cost of debt⁴ 3-Month London Interbank Offered Rate ("LIBOR")

Portfolio Highlights – Credit Quality 15 Credit Quality – Investment Portfolio − As of March 31, 2021, non-accrual investments continued to decline to below pre-COVID levels and remained low at 1.4% and 1.0% as a percentage of total investments at cost and fair value, respectively. − During the quarter ended March 31, 2021, the number of non-accrual investments declined from seven to six investments. FY2020 FY 2021 Quarter Ended Quarter Ended Non-Accrual – Debt Investments 3/31/20 6/30/20 9/30/20 12/31/20 3/31/21 Non-accrual investments at amortized cost (000s) $102,189 $124,296 $102,262 $72,422 $62,288 Non-accrual investments / total debt investments at amortized cost 2.3% 2.8% 2.4% 1.6% 1.4% Non-accrual investments at fair value (000s) $66,188 $81,746 $69,315 $52,860 $43,307 Non-accrual investments / total debt investments at fair value 1.6% 2.0% 1.7% 1.2% 1.0% Fair Value of Debt Investments Q2 2020 Q3 2020 Q4 2020 Q4 2020 Fair value of total debt investments as a percentage of principal (loans) 93.0% 95.3% 96.3% 97.4% 98.0%

Portfolio Highlights – Portfolio Ratings 16 Credit Quality – Investment Portfolio − Due to continued improvement in borrower performance, the percentage of risk rated “3” investments decreased to 12.0% of the portfolio at fair value as of March 31, 2021 from 17.9% as of December 31, 2020. * Represents an amount less than 0.1%. Internal Performance Ratings (% of Portfolio at Fair Value) Rating Definition 5 Borrower is performing above expectations and the trends and risk factors are generally favorable 4 Borrower is generally performing as expected and the risk factors are neutral to favorable 3 Borrower may be out of compliance with debt covenants; however, loan payments are generally not past due 2 Borrower is performing materially below expectations and the loan’s risk has increased materially since origination 1 Borrower is performing substantially below expectations and the loan’s risk has substantially increased since origination Internal Performance Rating Definitions At Fiscal Year End At Quarter End Rating 2015 2016 2017 2018 2019 2020 12/31/20 3/31/21 5 8.8% 5.7% 5.5% 6.4% 2.7% 6.1% 7.0% 15.2% 4 84.9% 83.1% 81.8% 81.6% 88.2% 72.8% 74.0% 71.7% 3 5.7% 10.6% 12.6% 11.0% 7.9% 19.7% 17.9% 12.0% 2 0.6% 0.6% 0.0%* 1.0% 1.2% 1.4% 1.1% 1.1% 1 0.0%* 0.0%* 0.1% 0.0%* 0.0%* 0.0%* 0.0%* 0.0%* Grand Total 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%

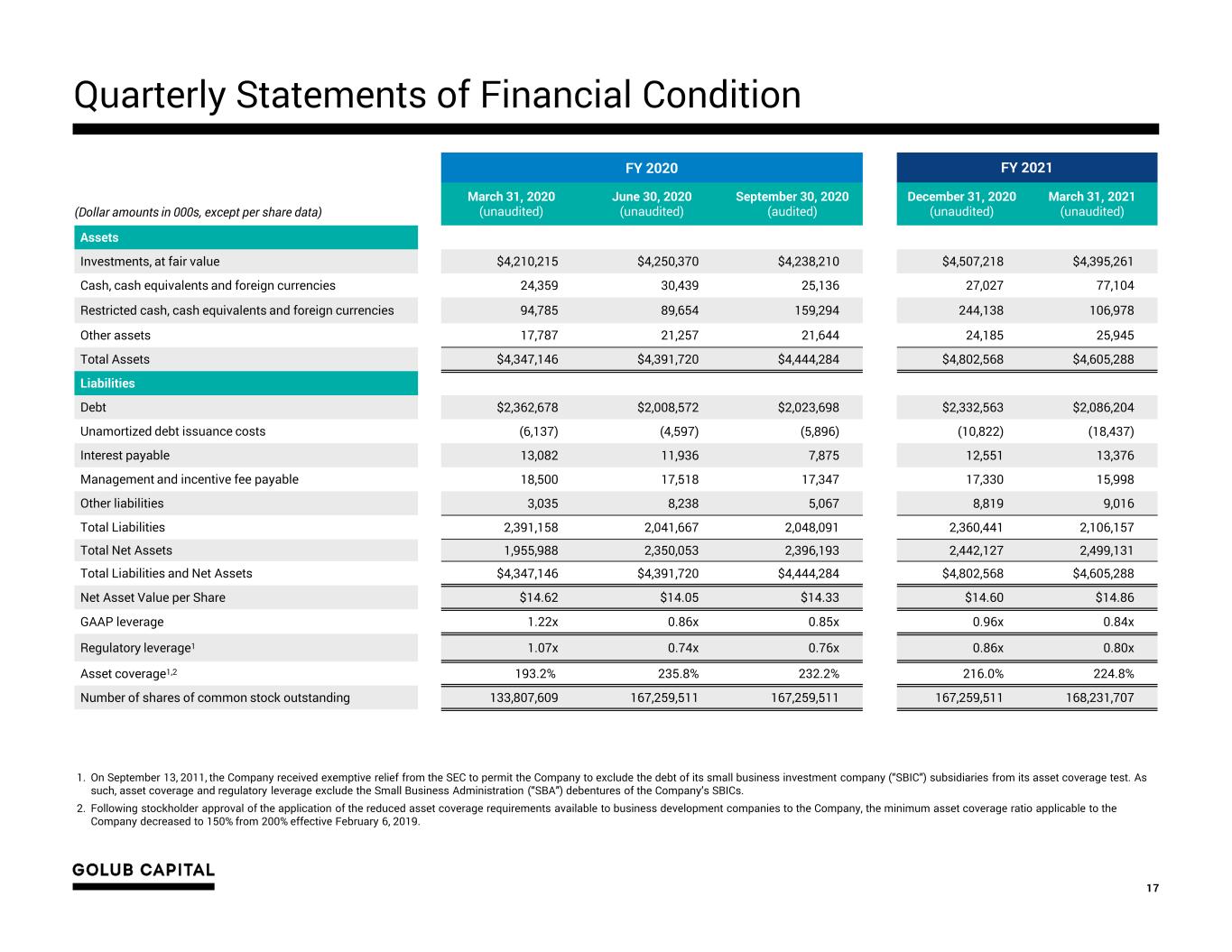

Quarterly Statements of Financial Condition 17 1. On September 13, 2011, the Company received exemptive relief from the SEC to permit the Company to exclude the debt of its small business investment company (“SBIC”) subsidiaries from its asset coverage test. As such, asset coverage and regulatory leverage exclude the Small Business Administration (“SBA”) debentures of the Company’s SBICs. 2. Following stockholder approval of the application of the reduced asset coverage requirements available to business development companies to the Company, the minimum asset coverage ratio applicable to the Company decreased to 150% from 200% effective February 6, 2019. FY 2020 FY 2021 (Dollar amounts in 000s, except per share data) March 31, 2020 (unaudited) June 30, 2020 (unaudited) September 30, 2020 (audited) December 31, 2020 (unaudited) March 31, 2021 (unaudited) Assets Investments, at fair value $4,210,215 $4,250,370 $4,238,210 $4,507,218 $4,395,261 Cash, cash equivalents and foreign currencies 24,359 30,439 25,136 27,027 77,104 Restricted cash, cash equivalents and foreign currencies 94,785 89,654 159,294 244,138 106,978 Other assets 17,787 21,257 21,644 24,185 25,945 Total Assets $4,347,146 $4,391,720 $4,444,284 $4,802,568 $4,605,288 Liabilities Debt $2,362,678 $2,008,572 $2,023,698 $2,332,563 $2,086,204 Unamortized debt issuance costs (6,137) (4,597) (5,896) (10,822) (18,437) Interest payable 13,082 11,936 7,875 12,551 13,376 Management and incentive fee payable 18,500 17,518 17,347 17,330 15,998 Other liabilities 3,035 8,238 5,067 8,819 9,016 Total Liabilities 2,391,158 2,041,667 2,048,091 2,360,441 2,106,157 Total Net Assets 1,955,988 2,350,053 2,396,193 2,442,127 2,499,131 Total Liabilities and Net Assets $4,347,146 $4,391,720 $4,444,284 $4,802,568 $4,605,288 Net Asset Value per Share $14.62 $14.05 $14.33 $14.60 $14.86 GAAP leverage 1.22x 0.86x 0.85x 0.96x 0.84x Regulatory leverage1 1.07x 0.74x 0.76x 0.86x 0.80x Asset coverage1,2 193.2% 235.8% 232.2% 216.0% 224.8% Number of shares of common stock outstanding 133,807,609 167,259,511 167,259,511 167,259,511 168,231,707

Quarterly Operating Results 18 FY 2020 FY 2021 (Dollar amounts in 000s, except share and per share data) March 31, 2020 (unaudited) June 30, 2020 (unaudited) September 30, 2020 (unaudited) December 31, 2020 (unaudited) March 31, 2021 (unaudited) Investment Income Interest income $87,421 $80,100 $79,107 $82,209 $83,728 GCIC acquisition purchase premium amortization (12,600) (7,558) (7,925) (9,230) (8,722) Dividend and fee income 303 668 831 1,067 1,195 Total Investment Income 75,124 73,210 72,013 74,046 76,201 Expenses Interest and other debt financing expenses 21,550 17,516 13,514 15,081 16,190 Base management fee 14,858 14,437 14,742 15,224 15,082 Incentive fee – net investment income 3,847 3,081 999 2,004 942 Incentive fee – capital gains - - - - - Other operating expenses 2,923 3,108 3,444 2,730 3,679 Total Expenses 43,178 38,142 32,699 35,039 35,893 Net Investment Income 31,946 35,068 39,314 39,007 40,308 Net Gain (Loss) on Investments and Foreign Currency Net realized gain (loss) on investments and foreign currency transactions (11,670) (4,925) (4,567) (2,392) 54 Net unrealized appreciation (depreciation) on investments and foreign currency translation (264,150) 104,423 51,961 48,515 42,211 Net unrealized appreciation (depreciation) from the GCIC acquisition purchase premium write-down 14,910 7,577 7,938 9,309 8,742 Net gain (loss) on investments and foreign currency (260,910) 107,075 55,332 55,432 51,007 Net Increase (Decrease) in Net Assets Resulting from Operations ($228,964) $142,143 $94,646 $94,439 $91,315 Per Share Net Investment Income Per Share $0.24 $0.23 $0.23 $0.23 $0.24 Adjusted Net Investment Income Per Share1 $0.33 $0.28 $0.28 $0.29 $0.29 Earnings (Loss) Per Share2 ($1.66) $0.93 $0.57 $0.56 $0.55 Adjusted Earnings (Loss) Per Share1 ($1.71) $0.94 $0.57 $0.56 $0.55 Distributions Paid $0.33 $0.29 $0.29 $0.29 $0.29 Weighted average shares of common stock outstanding2 138,148,963 153,184,678 167,259,511 167,259,511 167,281,115 1. As a supplement to GAAP financial measures, the Company is providing additional non-GAAP measures. See the Endnotes at the end of this presentation for further details on non-GAAP financial measures. 2. The weighted average shares of the Company's common stock outstanding used in computing basic and diluted earnings per share for periods ending on or before June 30, 2020 have been adjusted retroactively by a factor of approximately 1.03% to recognize the bonus element associated with rights to acquire shares of the Company's common stock that were issued to stockholders of record as of April 8, 2020.

Financial Performance Highlights 19 * The quarterly return on equity is calculated as the annualized return on average equity divided by four. The annualized return on average equity for the periods ended through FQ3 2019 are calculated as (a) the net increase in net assets resulting from operations (i.e. net income) for the period presented divided by (b) the daily average of total net assets, then (c) compounded over one year. The annualized return on average equity for quarters FQ4 2019 and after is calculated as (a) adjusted net income, as defined in the Endnotes at the end of this presentation, divided by (b) the daily average of total net assets, then (c) compounded over one year. Adjusted net income is a non-GAAP measure and the Company believes this non-GAAP measure is useful as it excludes the non-cash expense/loss from the purchase premium as further described in the Endnotes at the end of this presentation. These returns do not represent an actual return to any investor in the Company. Quarterly Return on Equity and Quarterly Distributions (Last 5 Years) $0.32 $0.32 $0.32 $0.32 $0.32 $0.32 $0.32 $0.32 $0.32 $0.32 $0.32 $0.32 $0.32 $0.32 $0.33 $0.33 $0.29 $0.29 $0.29 $0.29 $0.57 $0.40 $0.44 $0.46 2.3% 1.9% 2.2% 2.4% 2.2% 2.3% 2.2% 2.4% 2.3% 1.6% 1.9% 1.9% 2.0% 2.2% 2.1% -10.5% 6.7% 4.0% 3.9% 3.8% Regular Distribution Special Distribution Quarterly Return on Equity*

20 Long History of Strong Shareholder Returns Investors in GBDC’s 2010 IPO have achieved a 9.9% IRR on NAV1 1. Internal rate of return (“IRR”) on NAV is calculated using beginning of period NAV, distributions paid during the period, an incremental investment of $2.29 per share, or the GBDC Rights Offering subscription price of $9.17 per share divided by four (corresponding to the 1:4 issuance ratio in the GBDC Rights Offering, or the "GBDC Rights Offering Investment"), and ending period NAV, multiplied by 1.25x (corresponding to the 1:4 issuance ratio in the GBDC Rights Offering). Period beginning June 30, 2010 and ending March 31, 2021. GBDC made its initial public offering on April 15, 2010. 2. Calculated as (a) the sum of (i) NAV per share for the period presented plus (ii) cumulative regular and special distributions paid per share subsequent to the GBDC Rights Offering (b) divided by four to reflect additional shares purchased at the 1:4 issuance ratio in the GBDC Rights Offering. Note: Amounts presented represent per share amounts for a hypothetical shareholder that purchased one share in GBDC’s initial public offering (“IPO”) on April 15, 2010 and subscribed for its pro rata rights through GBDC’s rights offering, which closed on May 15, 2020 (“GBDC Rights Offering”). For illustrative purposes only; does not reflect the actual returns of a specific GBDC investor. Past performance does not guarantee future results. Sources: SEC filings and Golub Capital analysis. $14.63 $33.33 A pr -1 0 Ju n- 10 S ep -1 0 D ec -1 0 M ar -1 1 Ju n- 11 S ep -1 1 D ec -1 1 M ar -1 2 Ju n- 12 S ep -1 2 D ec -1 2 M ar -1 3 Ju n- 13 S ep -1 3 D ec -1 3 M ar -1 4 Ju n- 14 S ep -1 4 D ec -1 4 M ar -1 5 Ju n- 15 S ep -1 5 D ec -1 5 M ar -1 6 Ju n- 16 S ep -1 6 D ec -1 6 M ar -1 7 Ju n- 17 S ep -1 7 D ec -1 7 M ar -1 8 Ju n- 18 S ep -1 8 D ec -1 8 M ar -1 9 Ju n- 19 S ep -1 9 D ec -1 9 M ar -2 0 Ju n- 20 S ep -2 0 D ec -2 0 M ar -2 1 NAV Per Share Incremental Value Per Share from GBDC Rights Offering Investment² Cumulative Regular Distributions Per Share Cumulative Special Distributions Per Share $14.86 $13.88 $0.58 $4.012

Liquidity and Investment Capacity 21 Cash and Cash Equivalents − Unrestricted cash and cash equivalents and foreign currencies totaled $77.1 million as of March 31, 2021. − Restricted cash, cash equivalents and foreign currencies totaled $107.0 million as of March 31, 2021. Restricted cash is held in our securitization vehicles, SBIC subsidiaries and our revolving credit facilities and is reserved for quarterly interest payments and is also available for new investments that qualify for reinvestment by these entities. Debt Facilities – Availability − Revolving Credit Facilities –As of March 31, 2021, subject to leverage and borrowing base restrictions, we had approximately $499.8 million of remaining commitments and $499.8 million of availability, in the aggregate, on our revolving credit facilities with Morgan Stanley and JP Morgan. − SBIC Debentures – As of March 31, 2021, we had $65.0 million of unfunded debenture commitments available to be drawn, subject to customary SBA regulatory requirements. − GC Advisors Revolver – As of March 31, 2021, we had $100.0 million of remaining commitments and availability on our unsecured line of credit with GC Advisors. JP Morgan Credit Facility − On February 11, 2021, we closed on a $475.0 million revolving credit facility with JP Morgan, which matures on February 11, 2026. The interest rate on the facility ranges from 1 month LIBOR + 1.75% to 1 month LIBOR + 1.875%. 2026 Unsecured Notes − On February 24, 2021, we issued $400.0 million of unsecured notes, which bear a fixed interest rate of 2.50% and mature on August 24, 2026. Debt Facility Amendments − On February 23, 2021, we decreased the borrowing capacity under our revolving credit facility with Morgan Stanley to $75.0 million. On April 13, 2021, we amended the facility to, among other things, extend the reinvestment period to April 12, 2024 from May 3, 2021, extend the maturity date to April 12, 2026 from May 1, 2024, and reduce the interest rate on borrowings to 1 month LIBOR + 2.05% from 1 month LIBOR + 2.45%.

Post-COVID Initiatives Have Enhanced the Flexibility, Term and Durability of GBDC’s Liability Structure 22 Funding Source Debt Commitment Outstanding Par Undrawn Commitment Reinvestment Period Stated Maturity Interest Rate1 Securitizations: 2020 Debt Securitization $ 189,000 $ 189,000 $ - November 5, 2022 November 5, 2032 3 Month LIBOR + 2.44% 2018 Debt Securitization 408,200 408,200 - January 20, 2023 January 20, 2031 3 Month LIBOR + 1.64% GCIC 2018 Debt Securitization 546,500 546,500 - January 20, 2023 January 20, 2031 3 Month LIBOR + 1.51% Unsecured Notes: 2024 Unsecured Notes 400,000 400,000 - N/A April 15, 2024 3.375% 2026 Unsecured Notes 400,000 400,000 - N/A August 24, 2026 2.500% Bank Facilities: Morgan Stanley Credit Facility2 75,000 50,192 24,808 May 3, 2021 May 1, 2024 1 Month LIBOR + 2.45% JP Morgan Credit Facility 475,000 - 475,000 February 11, 2025 February 11, 2026 1 Month LIBOR + 1.75%(3) GC Advisors Revolver 100,000 - 100,000 N/A June 21, 2022 Applicable Federal Rate SBA Debentures: GC SBIC VI, L.P. 162,000 97,000 65,000 N/A 10-year maturity after drawn 2.3% Debt Capital Structure* 3–5 years 22% 5+ years 78% Debt Mix By Vehicle Type – Par Outstanding * Information is presented as of March 31, 2021. 1. Interest rate for securitizations represents the weighted average spread over 3 month LIBOR for the various tranches of issued notes, excluding tranches retained by the Company. The weighted average interest rate for the GCIC 2018 Debt Securitization excludes a $38.5 million note that has a fixed interest rate of 2.50%. For bank facilities, the interest rate represents the interest rate as stated in the applicable credit agreement. For SBA debentures, interest rates are fixed at various pooling dates and the interest rate presented represents the weighted average rate on all outstanding debentures as of March 31, 2021. 2. On April 13, 2021, the reinvestment period was extended to April 12, 2024, the maturity date was extended to April 12, 2026, and the interest rate on borrowings was reduced to 1 month LIBOR + 2.05%. 3. The interest rate on the JPMorgan Credits Facility ranges from 1 month LIBOR + 1.75% to 1 month LIBOR + 1.875%. The rate displayed corresponds to the interest rate incurred on the most recent borrowing. Debt Mix by Remaining Legal Tenor – Par Outstanding Unsecured Notes 38% SBA Debentures 5% Securitizations 55% Bank Facilities 2%

Common Stock and Distribution Information 23 Common Stock Data1 Distribution Data Date Declared Record Date Payment Date Amount Per Share Frequency Total Amount (in 000s) May 7, 2019 June 7, 2019 June 28, 2019 $0.32 Quarterly $19,388 August 6, 2019 August 19, 2019 September 27, 2019 $0.32 Quarterly $19,429 November 22, 2019 December 12, 2019 December 30, 2019 $0.33 Quarterly $43,777 November 22, 2019 December 12, 2019 December 30, 2019 $0.13 Special $17,246 February 4, 2020 March 6, 2020 March 27, 2020 $0.33 Quarterly $44,156 April 9, 2020 June 9, 2020 June 29, 2020 $0.29 Quarterly $48,505 August 4, 2020 September 8, 2020 September 29, 2020 $0.29 Quarterly $48,505 November 20, 2020 December 11, 2020 December 30, 2020 $0.29 Quarterly $48,505 February 5, 2021 March 5, 2021 March 30, 2021 $0.29 Quarterly $48,505 May 7, 2021 June 11, 2021 June 29, 2021 $0.29 Quarterly $48,7872 Fiscal Year Ending September 30, 2020 High Low End of Period First Quarter $18.56 $17.70 $18.45 Second Quarter $18.14 $9.55 $12.56 Third Quarter $12.65 $9.58 $11.65 Fourth Quarter $13.44 $11.31 $13.24 Fiscal Year Ending September 30, 2021 High Low End of Period First Quarter $14.15 $12.66 $14.14 Second Quarter $15.36 $14.08 $14.62 1. Based on closing stock price on the Nasdaq Global Market Select. On May 15, 2020, we completed a transferable rights offering. The per share data shown has not been adjusted to account for the bonus element associated with the rights issued detailed in the Endnotes at the end of this presentation. 2. Estimated based on 168,231,707 of shares outstanding as of March 31, 2021.

Appendix: Endnotes A

1. On September 16, 2019, the Company completed its acquisition of GCIC. The merger was accounted for under the asset acquisition method of accounting in accordance with Accounting Standards Codification (“ASC”) 805-50, Business Combinations — Related Issues. Under asset acquisition accounting, where the consideration paid to GCIC’s stockholders exceeded the relative fair values of the assets acquired, the premium paid by GBDC was allocated to the cost of the GCIC assets acquired by GBDC pro-rata based on their relative fair value. Immediately following the acquisition of GCIC, GBDC recorded its assets at their respective fair values and, as a result, the purchase premium allocated to the cost basis of the GCIC assets acquired was immediately recognized as unrealized depreciation on the Company's Consolidated Statement of Operations. The purchase premium allocated to investments in loan securities will amortize over the life of the loans through interest income with a corresponding reversal of the unrealized depreciation on the GCIC loans acquired through their ultimate disposition. The purchase premium allocated to investments in equity securities will not amortize over the life of the equity securities through interest income and, assuming no subsequent change to the fair value of the GCIC equity securities acquired and disposition of such equity securities at fair value, the Company will recognize a realized loss with a corresponding reversal of the unrealized depreciation upon disposition of the GCIC equity securities acquired. On May 15, 2020, the Company completed a transferable rights offering, issuing 33,451,902 shares at a subscription price of $9.17 per share. In accordance with ASC 260 – Earnings Per Share, it was determined the Company’s rights offering contained a bonus element as the exercise price at issuance was less than the fair market value of the stock. In accordance with ASC 260, basic and diluted EPS are required to be adjusted retroactively for the bonus element for all periods ending on or before June 30, 2020 by applying an adjustment factor to weighted average shares outstanding. The adjustment factor that was calculated in accordance with ASC 260 was 1.03%. As a supplement to U.S. generally accepted accounting principles (“GAAP”) financial measures, the Company has provided the following non-GAAP financial measures: “Adjusted Net Investment Income” and “Adjusted Net Investment Income Per Share” - excludes the amortization of the purchase premium and the accrual for the capital gain incentive fee required under GAAP (including the portion of such accrual that is not payable under GBDC’s investment advisory agreement) from net investment income calculated in accordance with GAAP. “Adjusted Net Realized and Unrealized Gain/(Loss)” and “Adjusted Net Realized and Unrealized Gain/(Loss) Per Share” - excludes the unrealized loss resulting from the purchase premium write-down and the corresponding reversal of the unrealized loss resulting from the amortization of the premium on loans or from the sale of equity investments from the determination of realized and unrealized gain/(loss) in accordance with GAAP. “Adjusted Net Income” and “Adjusted Earnings/(Loss) Per Share” – calculates net income and earnings per share based on Adjusted Net Investment Income and Adjusted Net Realized and Unrealized Gain/(Loss). “Adjusted Earnings/(Loss) Per Share” also excludes the impact of the retroactive adjustment to the weighted average shares calculation due to the rights offering and the resulting impact on earnings per share. The Company believes that excluding the financial impact of the purchase premium in the above non-GAAP financial measures is useful for investors as this is a non-cash expense/loss and is one method the Company uses to measure its financial condition and results of operations. In addition, the Company believes excluding the accrual of the capital gain incentive fee in the above non-GAAP financial measures is useful as a portion of such accrual is not contractually payable under the terms of either the Company’s current investment advisory agreement with GC Advisors, which was effective September 16, 2019, or its prior investment advisory agreement with GC Advisors, (each an, “Investment Advisory Agreement”). In accordance with GAAP, the Company is required to include aggregate unrealized appreciation on investments in the calculation and accrue a capital gain incentive fee on a quarterly basis as if such unrealized capital appreciation were realized, even though such unrealized capital appreciation is not permitted to be considered in calculating the fee actually payable under either Investment Advisory Agreement. As of each of December 31, 2020, September 30, 2020, June 30, 2020, March 31, 2020, and September 30, 2019, the cumulative capital gain incentive fee accrued by the Company in accordance with GAAP is $0, and none was payable as a capital gain incentive fee pursuant to the current Investment Advisory Agreement as of December 31, 2020. Any payment due under the terms of the current Investment Advisory Agreement is based on the calculation at the end of each calendar year or upon termination of the Investment Advisory Agreement. The Company paid capital gain incentive fees in the amounts of $1.2 million and $1.6 million calculated in accordance with its prior Investment Advisory Agreement as of December 31, 2017 and 2018 , respectively. The Company did not pay any capital gain incentive fee under the Investment Advisory Agreement for any period ended prior to December 31, 2017. Finally, the Company believes excluding the impact of the retroactive adjustment to the weighted average shares calculation due the rights offering and the resulting impact on per share data is useful for investors as it presents per share financial data that is consistent with what was previously reported. Although these non-GAAP financial measures are intended to enhance investors’ understanding of the Company’s business and performance, these non-GAAP financial measures should not be considered an alternative to GAAP. Refer to slide ‘Summary of Quarterly Results’ for a reconciliation to the nearest GAAP measures. 2. Purchase premium refers to the premium paid by GBDC to acquire GCIC in excess of the fair value of the assets acquired. Endnotes – Non-GAAP Financial Measures 25