Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Sculptor Capital Management, Inc. | scu-20210505.htm |

Sculptor Capital Management: 1Q 2021 Earnings Presentation May 5, 2021

| Sculptor Capital Management Reports First Quarter of 2021 Results NEW YORK, May 5, 2021 - Sculptor Capital Management, Inc. (NYSE: SCU) today reported results for the first quarter of 2021. DIVIDEND A cash dividend of $0.30 was declared for the first quarter of 2021, payable on May 25, 2021, to holders of record as of May 18, 2021. CONFERENCE CALL Jimmy Levin, Wayne Cohen, President and Chief Operating Officer, and Dava Ritchea, Chief Financial Officer will host a conference call Thursday, May 6, 2021, 8:30 a.m. Eastern Time to discuss the Company's first quarter 2021 results. The call can be accessed by dialing +877-407-0312 (in the U.S.) or +201-389-0899 (international), passcode 13718672. A simultaneous webcast of the call will be available on the Investor Relations page of the Company's website (www.sculptor.com). For those unable to listen to the live broadcast, a webcast replay will also be available on the Company's website. ABOUT SCULPTOR CAPITAL MANAGEMENT Sculptor Capital Management, Inc. is a leading global alternative asset management firm providing investment products in a range of areas including multi-strategy, credit and real estate. With offices in New York, London, Hong Kong and Shanghai, the Company serves global clients through commingled funds, separate accounts and specialized products. Sculptor Capital’s distinct investment process seeks to generate attractive and consistent risk-adjusted returns across market cycles through a combination of fundamental bottom-up research, a high degree of flexibility, a collaborative team and integrated risk management. The Company’s capabilities span all major geographies, in strategies including fundamental equities, corporate credit, real estate debt and equity, merger arbitrage and structured credit. As of May 1, 2021, Sculptor Capital had approximately $36.8 billion in assets under management. For more information, please visit the Company's website (www.sculptor.com). FORWARD LOOKING STATEMENTS: PLEASE SEE PAGE 27 OF THIS PRESENTATION FOR DISCLOSURES ON FORWARD-LOOKING STATEMENTS CONTAINED HEREIN. (1) Distributable Earnings is a non-GAAP measure. For information on and reconciliations of the Company's non-GAAP measures to the most directly comparable respective financial measures presented in accordance with GAAP, please see pages 20 through 23. —JIMMY LEVIN CHIEF INVESTMENT OFFICER AND CHIEF EXECUTIVE OFFICER We begin a new era at our Firm, stronger and more focused than ever before. We have a great core business built on the back of consistency in generating exceptional returns. I firmly believe that if we continue to execute on our core mission, our clients, shareholders, and employees should all be delighted with the results. FINANCIAL HIGHLIGHTS ▪ GAAP Net Loss for the first quarter of 2021 was $20.3 million, or $0.85 per basic and $0.99 per diluted Class A Share, compared to a GAAP Net Loss of $28.3 million, or $1.27 per basic and diluted Class A Share, for the first quarter of 2020 ▪ Distributable Earnings(1) for the first quarter of 2021 were $36.5 million, or $0.62 per Fully Diluted Share, compared to Distributable Earnings loss of $0.3 million, or $0.01 per Fully Diluted Share, for the first quarter of 2020 ▪ A cash dividend of $0.30 was declared for the first quarter of 2021, payable on May 25, 2021, to holders of record as of May 18, 2021 ASSETS UNDER MANAGEMENT & PERFORMANCE ▪ Our multi-strategy funds had their first quarter of net inflows since 2Q 2014 ▪ As of May 1, 2021, estimated AUM was $36.8 billion ▪ Sculptor Master Fund was up 3.6% net for the first quarter of 2021 and up 6.3% net year-to-date through April 30, 2021 ▪ Sculptor Credit Opportunities Master Fund was up 7.2% net for the first quarter of 2021 and up 8.4% net year-to-date through April 30, 2021 SHAREHOLDER COMMUNICATIONS ▪ A letter to our shareholders from Jimmy Levin, our Chief Investment Officer and Chief Executive Officer, focusing on our business strategy can be found on our website (www.sculptor.com) ▪ Jimmy Levin, Wayne Cohen (President and COO) and Dava Ritchea (CFO) will host a conference call Thursday, May 6, 2021, 8:30 a.m. Eastern Time to answer questions regarding Sculptor's first quarter 2021 results – The call can be accessed by dialing +877-407-0312 (in the U.S.) or +201-389-0899 (international), passcode 13718672 – A simultaneous webcast and replay will be available on the Investor Relations page of our website NEW YORK - May 5, 2021 "We begin a new era at our Firm, stronger and more focused than ever before. We do so with a terrific core business built on the back of consistency in generating exceptional returns. We are passionate about maintaining the highest standard of excellence across all aspects of our business, continuing to generate best-in-class returns for our investors, and doing so with a reinvigorated focus on creating shareholder value." — Jimmy Levin Chief Investment Officer and Chief Executive Officer 2 – Net inflows of $403.8 million, primarily in multi-strategy funds and Institutional Credit Strategies and performance- related appreciation of $726.1 million, primarily in opportunistic credit and multi-strategy funds

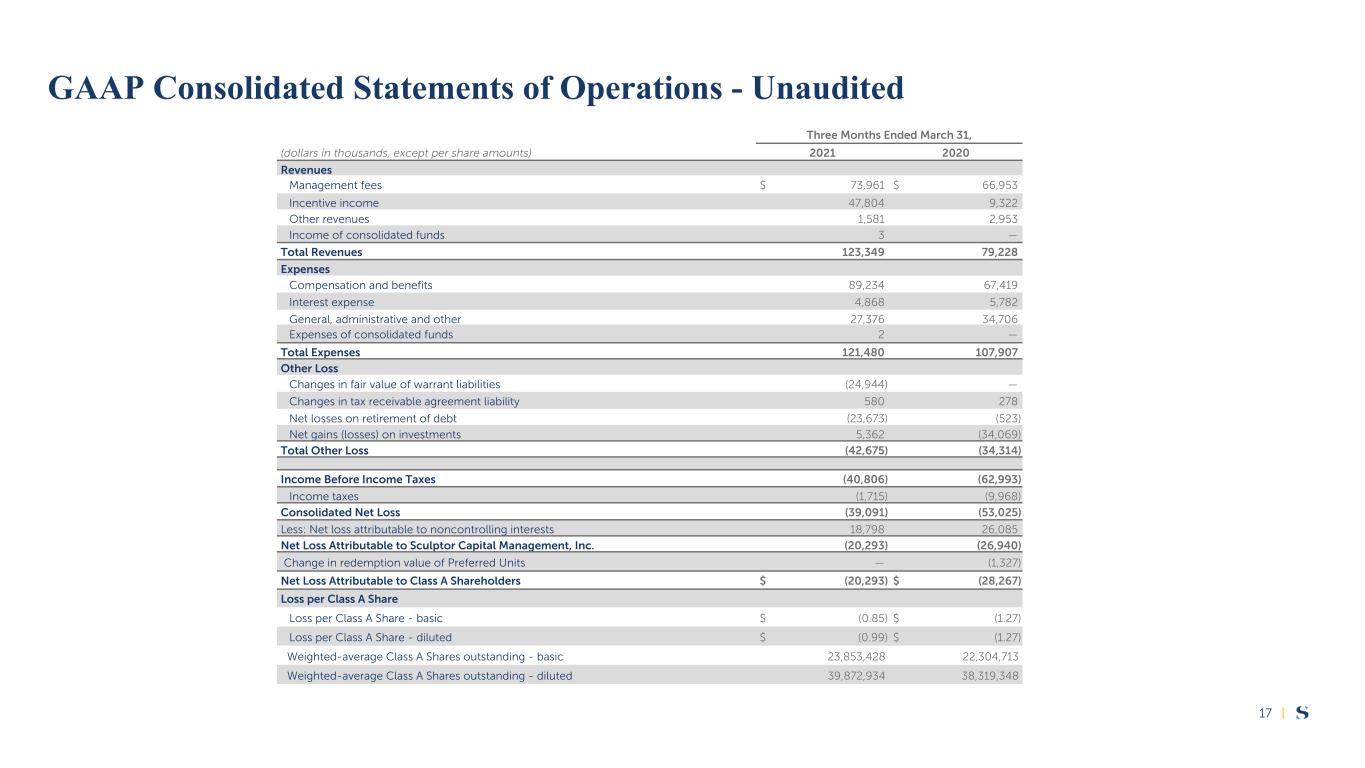

| 1Q 2021 GAAP Financial Highlights (dollars in millions, except per share amounts) 1Q '21 4Q '20 1Q '20 Revenues $ 123.3 $ 604.8 $ 79.2 Management fees 74.0 75.4 67.0 Incentive income 47.8 527.9 9.3 Other revenues 1.5 1.5 2.9 Expenses 121.5 246.0 107.9 Compensation and benefits 89.2 211.4 67.4 Interest expense 4.9 6.2 5.8 General, administrative and other 27.4 28.4 34.7 Other Loss (42.6) (7.4) (34.3) Income taxes (1.7) 93.3 (10.0) Consolidated (Loss) Income (39.1) 258.1 (53.0) Net Loss (Income) Attributable to Noncontrolling Interests 18.8 (40.5) 26.0 Net (Loss) Income Attributable to Sculptor Capital Management (20.3) 217.6 (27.0) Change in redemption value of Preferred Units — (1.4) (1.3) GAAP Net (Loss) Income Attributable to Class A Shareholders $ (20.3) $ 216.2 $ (28.3) (Loss) Earnings per Class A Share - basic $ (0.85) $ 9.50 $ (1.27) (Loss) Earnings per Class A Share - diluted $ (0.99) $ 5.05 $ (1.27) 3 ▪ The decrease in net loss attributable to Class A Shareholders for the first quarter of 2021 was primarily due to higher incentive income and management fees, higher gains on investments and lower operating expenses, partially offset by changes in fair value of warrant liabilities, losses on retirement of debt, higher bonus expense, and higher income tax expense ▪ For details on the underlying drivers of our revenues and expenses, see the Economic Income analysis on the following page Quarterly Drivers

| Quarterly Drivers(dollars in millions) 1Q '21 4Q '20 1Q '20 Revenues $ 118.4 $ 599.7 $ 72.1 Management fees 69.1 70.2 59.9 Incentive income 47.8 527.9 9.3 Other revenues 1.5 1.6 2.9 Expenses $ 77.5 $ 254.1 $ 69.9 Total compensation and benefits 52.5 227.3 40.3 Salaries and benefits 17.4 15.4 20.3 Bonus 35.1 211.9 20.0 General, administrative and other 20.6 21.4 25.7 Interest expense 4.4 5.4 3.9 ▪ Management fees across the platform: – Steady increase in AUM from net flows and appreciation has increased management fee revenue year over year – Impact of deferred CLO fees largely reversed course – $0.6 million net recovery of deferred CLO fees realized in 1Q – Total deferral remaining as of March 31, 2021, of $5.1 million – 2 CLOs in active recovery, 1 remains in full deferral as of April 30th ▪ Incentive income for the quarter driven from the following: – Select multi-strategy annual investors that crystallize at quarter end; bulk of incentive income for these funds typically recognized in 4Q – Investment realizations in Real Estate Fund II resulting in incentive income ▪ Key drivers to compensation and benefits for the quarter include: – Salaries and benefits and fixed bonus expenses that are in-line with guidance – Bonus expense reflects a pull forward of departing executive compensation of $6.7 million; this will not impact full year fixed bonus guidance – Bonuses associated with crystallizing $10.5 million of incentive recognized in Real Estate Fund II Economic Income(1) was $40.9 million for the first quarter of 2021. Distributable Earnings(1) were $36.5 million for the first quarter of 2021. (1)Economic Income, Distributable Earnings and their components are non-GAAP measures. For more information on and reconciliations of the Company's non-GAAP measures to the most directly comparable respective financial measures presented in accordance with GAAP, please see pages 20 through 23. Distributable Earnings Adjustments 1Q '21 4Q '20 1Q '20 Excluded expenses: Legal settlements and provisions and related professional services expenses — 1.3 4.0 Payable for taxes and tax receivable agreement (4.4) (4.5) (1.2) Preferred Units dividends — 0.5 (1.4) 1Q 2021 Economic Income Financial Highlights 4

| ▪ Since inception, the Multi-Strategy Composite has generated an 11.8% net return with less than half the volatility of equity markets, achieving a Sharpe Ratio of 1.5 ▪ Sculptor Master Fund was up 6.3% net year-to-date through April 30, 2021 See page 24 of this presentation for important information related to the footnotes referenced on this slide. Fund Performance - Multi-Strategy 5 (4)(3) (3) (3) (3) Sculptor Multi-Strategy Composite Net Returns(1)(2)

|See pages 24 to 25 of this presentation for important information related to the footnotes referenced on this slide. (*)For the twelve month period of April 1, 2020 through March 31, 2021. Fund Performance - Opportunistic Credit & Real Estate 6 7.2% (1.5)% 10.0% (0.1)% 8.0% 6.6% 8.2% 11.8% 5.8% Sculptor Credit Opportunities Master Fund Net BAML Global High Yield HFRI Distressed Restructuring Index 1Q'21 2020 Since Inception (November 1, 2011) 25.5% 16.1% 32.8% 21.6% 27.8% 18.2% 18.1% 12.6% Real Estate Fund I Gross Real Estate Fund I Net Real Estate Fund II Gross Real Estate Fund II Net Real Estate Fund III Gross Real Estate Fund III Net REC I Gross REC I Net Vintage Year: 2005 Vintage Year: 2010 Vintage Year: 2014 Credit - Vintage Year: 2015 ▪ Since the trough of the market drawdown in 2020 the fund has delivered a net return of 32.1%(*) and was up 8.4% net year-to-date through April 30, 2021 (6) (6) (Real Estate Funds as of March 31, 2021) Sculptor Real Estate Fund Performance(7)(8) Sculptor Credit Opportunities Master Fund Net Performance(1)(5)

| Assets Under Management 7 $32.4 $32.5 $34.5 $36.8 $37.4 $36.8 $13.7 $10.4 $9.3 $10.5 $10.9 $11.2 $5.5 $5.8 $6.0 $6.3 $6.6 $6.3 $10.1 $13.5 $15.7 $15.7 $15.7 $15.0 $2.5 $2.6 $3.5 $4.3 $4.2 $4.3 Multi-strategy Opportunistic credit Institutional Credit Strategies Real estate Other December 31, 2017 December 31, 2018 December 31, 2019 December 31, 2020 March 31, 2021 May 1, 2021 (dollars in billions) Sculptor may determine that the characteristics of a particular investment (i.e., risk, exposure, asset classes, or other characteristics) are best represented by more than one strategy. In these situations, an investment may be divided into more than one strategy for purposes of this presentation. The information contained herein is estimated based on unaudited data. Numbers are subject to rounding.

| Includes amounts invested by the Company, its Executive Managing Directors, employees and certain other related parties for which the Company charged no management fees and received no incentive income for the periods presented. Amounts presented in this table are not the amounts used to calculate management fees and incentive income for the respective periods. See page 25 of this presentation for important information related to the footnotes referenced on this slide. Multi-Strategy Opportunistic Institutional Real Estate (dollars in millions) Funds Credit Funds Credit Strategies Funds Total December 31, 2020 $ 10,504 $ 6,288 $ 15,698 $ 4,308 $ 36,798 Inflows / (Outflows) 78 (117) 304 139 404 Distributions / Other Reductions — (6) (42) (198) (246) Appreciation / (Depreciation)(9) 337 387 — 2 726 Other(10) — — (308) — (308) March 31, 2021 $ 10,919 $ 6,552 $ 15,652 $ 4,251 $ 37,374 Summary Changes to AUM 8 ▪ ICS distributions related to paydowns in our CLOs ▪ Real Estate distributions from investment realizations in Real Estate Credit Fund I and Real Estate Fund III Inflows & Outflows ▪ Multi-strategy funds had first quarter of net inflows since 2Q 2014 ▪ ICS inflows from launch of U.S. CLO 25 on February 25th ▪ Real Estate inflows related to a new co-investment vehicle ▪ Multi-strategy and opportunistic credit funds appreciated due to performance as exhibited by: – Sculptor Master Fund 3.6% 1Q net return – Sculptor Credit Opportunities Master Fund: 7.2% 1Q net return Distributions & Other Reductions Appreciation & Depreciation ▪ ICS decrease includes the effects of changes in the par value of the underlying collateral of the CLOs and foreign currency translation changes in the measurement of AUM of our European CLOs Other Quarterly Total AUM Rollforward

| (dollars in millions) 12/31/2018 12/31/2019 12/31/2020 3/31/2021 Summary Assets Cash, cash equivalents and longer-term U.S. government obligations(1)(2) $ 495 $ 388 $ 288 $ 303 Investments in funds, excluding employee-related investments(2) 27 49 51 47 Investments in CLOs, net of financing(2) 22 24 22 24 Summary Liabilities 2020 Term Loan(3) — — (319) (145) 2018 Term Loan(3) (200) (45) — — Preferred Units(3) (400) (200) — — Debt Securities(3) — (200) — — Adjusted Net Assets (56) 16 42 229 (1)These balances include committed cash. (2)These items are non-GAAP measures. For information on and reconciliations of the Company's non-GAAP measures to the most directly comparable respective financial measures presented in accordance with GAAP, please see pages 20 through 23. (3)Represents principal outstanding of the debt obligations and par value of Preferred Units. Balance Sheet Highlights 9 Our Adjusted Net Assets are further strengthened by our Accrued Unrecognized Incentive Income — see next slide for details Balance sheet position continues to strengthen as we have restructured and subsequently reduced liabilities as a result of strong financial performance.

| $14.9 $20.3 $14.9 $62.8 $98.4 $97.4 Multi-strategy funds Opportunistic credit funds Real estate funds December 31, 2020 1Q Recognized Incentive Income 1Q Performance March 31, 2021 $180.5 $128.2 Accrued Unrecognized Incentive Income (ABURI) 10 $97.4 $48.4 $9.4 $5.2 $78.3 $38.0 $8.9 $4.8 Sculptor Master Fund Scuptor Enhanced Master Fund Other Customized Credit Focused Platform Sculptor Credit Opportunties Master Fund Closed-end Opportunstic Credit funds Sculptor Real Esate Multi-strategy Opportunistic Credit Real Estate ▪ Multi-strategy ABURI is derived from clients in the three-year liquidity tranche, where incentive income will be recognized at the end of each client’s three-year period2 ▪ Opportunistic credit ABURI derived from three sources: – Clients in the three-year and four-year liquidity tranches of an open-end opportunistic credit fund, where incentive income will be recognized at the end of each client’s three-year or four-year period2 – Long dated closed-end opportunistic credit funds, where incentive income will be recognized during each fund’s harvest period after invested capital and a preferred return has been distributed to the clients2 – The Customized Credit Focused Platform, where incentive income is recognized at the end of a multi-year term; previously crystallized on December 31, 20202 ▪ Real Estate ABURI is derived from long-dated real estate funds, where incentive income will start to be recognized following the completion of each fund’s investment period as investments are realized and after invested capital and a preferred return has been distributed to the clients2 $65.9 $(13.6) (dollars in millions) 1Q '21 ABURI1 $97.4 $48.4 $9.4 $5.2 $78.3 $38.0 $8.9 $4.8 SRE II SRE III REC I Other Gross ABURI Net ABURI ($ in millions) ABURI M u lt i- S tr a te g y F u n d s Sculptor Master Fund 10.2 Sculptor Enhanced Master Fund 9.5 Other multi-strategy 0.6 Total 20.3 O p p o rt u n is ti c C re d it F u n d s Sculptor Credit Opportunities Master Fund 11.6 Customized Credit Focused Platform 43.9 Other opportunistic credit 7.3 Total 62.8 R e a l E st a te F u n d s SRE II 9.4 SRE III 78.3 REC I 8.9 Other real estate 0.8 Total 97.4 (1)Certain ABURI amounts presented above will generally have compensation expense (on an Economic Income Basis) that will reduce the amount ultimately realized on a net basis. Compensation expense relating to ABURI from our real estate funds is generally recognized at the same time the related incentive income revenue is recognized. Compensation expense relating to ABURI generated from our multi-strategy funds and opportunistic credit funds is generally recognized in the year the underlying fund performance is generated which may not occur at the same time that the related revenues are generated. (2)Other than tax distributions.

| Sculptor Capital Management | Elise King Head of Corporate Strategy and Shareholder Services +1-212-719-7381 investorrelations@sculptor.com INVESTOR RELATIONS & MEDIA CONTACT Sculptor Capital Management, Inc. is a leading global alternative asset management firm providing investment products in a range of areas including multi-strategy, credit and real estate. With offices in New York, London, Hong Kong and Shanghai, the Company serves global clients through commingled funds, separate accounts and specialized products. Sculptor Capital’s distinct investment process seeks to generate attractive and consistent risk-adjusted returns across market cycles through a combination of fundamental bottom-up research, a high degree of flexibility, a collaborative team and integrated risk management. The Company’s capabilities span all major geographies, in strategies including fundamental equities, corporate credit, real estate debt and equity, merger arbitrage and structured credit. As of May 1, 2021, Sculptor Capital had approximately $36.8 billion in assets under management. For more information, please visit the Company's website (www.sculptor.com). ABOUT SCULPTOR CAPITAL MANAGEMENT

| Sculptor Capital Management | Appendix

| Assets Under Management Returns(1) for the Three Months Ended March 31, Annualized Returns Sinceas of March 31, 2021 2020 Inception Through March 31, 2021 (dollars in thousands) 2021 2020 Gross Net Gross Net Gross Net Multi-Strategy Funds Sculptor Master Fund(2) $ 10,016,988 $ 7,776,131 4.8 % 3.6 % -6.5 % -6.6 % 16.9 % 11.8 % Sculptor Enhanced Master Fund 892,589 622,453 1.3 % 0.8 % -7.5 % -7.2 % 15.1 % 10.5 % Other funds 9,156 61,626 n/m n/m n/m n/m n/m n/m $ 10,918,733 $ 8,460,210 Credit Opportunistic credit funds: Sculptor Credit Opportunities Master Fund(5) 2,548,631 1,064,409 8.7 % 7.2 % -19.8 % -20.0 % 14.0 % 10.0 % Customized Credit Focused Platform 3,660,340 2,878,029 See page 14 for information on the Company's Customized Credit Focused Platform. Closed-end opportunistic credit funds 343,528 518,104 See page 14 for information on the Company's closed-end opportunistic credit funds. Other funds — 484,290 n/m n/m n/m n/m n/m n/m 6,552,499 4,944,832 Institutional Credit Strategies 15,652,429 15,994,399 See page 15 for information on the Company's Institutional Credit Strategies. $ 22,204,928 $ 20,939,231 Real estate funds 4,250,757 3,989,821 See page 16 for information on the Company's real estate funds. Other — 1,214 n/m n/m n/m n/m n/m n/m Total $ 37,374,418 $ 33,390,476 n/m - not meaningful See page 24 of this presentation for important information related to the footnotes referenced on this slide. Fund Information 13

| Assets Under Management as of March 31, Inception to Date as of March 31, 2021 Total Commitments Total Invested Capital(11) IRR Gross MOIC(13)(dollars in thousands) 2021 2020 Gross(12) Net(8) Closed-end Opportunistic Credit Funds (Investment Period) Sculptor European Credit Opportunities Fund (2012-2015)(14) $ — $ — $ 459,600 $ 305,487 15.7 % 11.8 % 1.5x Sculptor Structured Products Domestic Fund II (2011-2014)(14) 13,428 46,610 326,850 326,850 19.4 % 15.3 % 2.1x Sculptor Structured Products Offshore Fund II (2011-2014)(14) 11,973 50,480 304,531 304,531 16.8 % 13.2 % 1.9x Sculptor Structured Products Offshore Fund I (2010-2013)(14) 4,721 3,744 155,098 155,098 23.8 % 19.1 % 2.1x Sculptor Structured Products Domestic Fund I (2010-2013)(14) 4,586 3,270 99,986 99,986 22.6 % 18.0 % 2.0x Other funds 308,820 414,000 309,000 132,083 n/m n/m n/m $ 343,528 $ 518,104 $ 1,655,065 $ 1,324,035 n/m - not meaningful See page 25 of this presentation for important information related to the footnotes referenced in this table above. Fund Information (cont.) Customized Credit Focused Platform and Closed-end Opportunistic Credit Funds 14 Weighted Average Return for the Three Months Ended March 31, Inception to Date as of March 31, 2021 2021 2020 IRR Net Invested Capital MultipleGross Net Gross Net Gross Net Customized Credit Focused Platform Opportunistic Credit Performance 8.3 % 6.7 % (18.7) % (15.1) % 15.9 % 12.2 % 2.4x See page 26 of this presentation for important information related to information presented in this table above. Performance presented is for the opportunistic credit strategies in the Customized Credit Focused Platform. As of March 31, 2021, approximately 95% of the invested capital in the Customized Credit Focused Platform is invested in the Platform’s opportunistic credit strategies.

| Assets Under Management as of March 31, Most Recent Launch or Refinancing Year(dollars in thousands) Deal Size 2021 2020 Collateralized Loan Obligations 2017 $ 2,763,790 $ 2,075,836 $ 2,079,965 2018 6,920,173 6,433,979 6,520,422 2019 2,985,214 2,886,735 2,841,011 2020 1,868,287 1,726,148 1,401,170 2021 1,242,425 1,163,472 891,936 $ 15,779,889 $ 14,286,170 $ 13,734,504 Aircraft Securitization Vehicles 2018 696,000 475,415 497,611 2019 1,128,000 388,706 1,035,459 2020 472,732 175,710 398,653 $ 2,296,732 $ 1,039,831 $ 1,931,723 Collateralized Bond Obligations 2019 349,550 274,418 274,183 Other Funds n/a n/a 52,010 53,989 $ 18,426,171 $ 15,652,429 $ 15,994,399 Fund Information (cont.) Institutional Credit Strategies 15

| Assets Under Management as of March 31, Inception to Date as of March 31, 2021 Total Investments Realized/Partially Realized Investments(17) Total Commitment s Invested Capital(16) Total Value(17) Gross IRR(7) Net IRR(8) Gross MOIC(18) Invested Capital Total Value Gross IRR(7) Gross MOIC(18)(dollars in thousands) 2021 2020 Real Estate Funds (Investment Period) Sculptor Real Estate Fund I (2005-2010)(14) $ — $ — $ 408,081 $ 386,298 $ 847,612 25.5 % 16.1 % 2.2x $ 386,298 $ 847,612 25.5 % 2.2x Sculptor Real Estate Fund II (2011-2014)(14) 42,040 61,602 839,508 762,588 1,572,431 32.8 % 21.6 % 2.1x 762,588 1,572,431 32.8 % 2.1x Sculptor Real Estate Fund III (2014-2019)(14) 405,775 540,979 1,500,000 1,069,720 1,802,310 27.8 % 18.2 % 1.7x 889,483 1,571,112 31.7 % 1.8x Sculptor Real Estate Fund IV (2019-2023)(19) 2,593,338 2,023,070 2,596,024 335,291 413,753 n/m n/m n/m 65,018 109,514 n/m n/m Sculptor Real Estate Credit Fund I (2015-2020)(14) 259,370 730,738 736,225 483,563 589,355 18.1 % 12.6 % 1.2x 248,333 325,647 19.5 % 1.3x Other funds 950,234 633,432 1,193,944 473,512 654,764 n/m n/m n/m 152,126 276,571 n/m n/m $ 4,250,757 $ 3,989,821 $ 7,273,782 $ 3,510,972 $ 5,880,225 $ 2,503,846 $ 4,702,887 Unrealized Investments as of March 31, 2021 Invested Capital Total Value Gross MOIC(19) Real Estate Funds (Investment Period) Sculptor Real Estate Fund I (2005-2010)(14) $ — $ — — Sculptor Real Estate Fund II (2011-2014)(14) — — — Sculptor Real Estate Fund III (2014-2019)(14) 180,237 231,198 1.3x Sculptor Real Estate Fund IV (2019-2023)(19) 270,273 304,239 n/m Sculptor Real Estate Credit Fund I (2015-2020)(14) 235,230 263,708 1.1x Other funds 321,386 378,193 n/m $ 1,007,126 $ 1,177,338 n/m - not meaningful See page 25 of this presentation for important information related to the footnotes referenced on this slide. Fund Information (cont.) Real Estate Funds 16

| Three Months Ended March 31, (dollars in thousands, except per share amounts) 2021 2020 Revenues Management fees $ 73,961 $ 66,953 Incentive income 47,804 9,322 Other revenues 1,581 2,953 Income of consolidated funds 3 — Total Revenues 123,349 79,228 Expenses Compensation and benefits 89,234 67,419 Interest expense 4,868 5,782 General, administrative and other 27,376 34,706 Expenses of consolidated funds 2 — Total Expenses 121,480 107,907 Other Loss Changes in fair value of warrant liabilities (24,944) — Changes in tax receivable agreement liability 580 278 Net losses on retirement of debt (23,673) (523) Net gains (losses) on investments 5,362 (34,069) Total Other Loss (42,675) (34,314) Income Before Income Taxes (40,806) (62,993) Income taxes (1,715) (9,968) Consolidated Net Loss (39,091) (53,025) Less: Net loss attributable to noncontrolling interests 18,798 26,085 Net Loss Attributable to Sculptor Capital Management, Inc. (20,293) (26,940) Change in redemption value of Preferred Units — (1,327) Net Loss Attributable to Class A Shareholders $ (20,293) $ (28,267) Loss per Class A Share Loss per Class A Share - basic $ (0.85) $ (1.27) Loss per Class A Share - diluted $ (0.99) $ (1.27) Weighted-average Class A Shares outstanding - basic 23,853,428 22,304,713 Weighted-average Class A Shares outstanding - diluted 39,872,934 38,319,348 GAAP Consolidated Statements of Operations - Unaudited 17

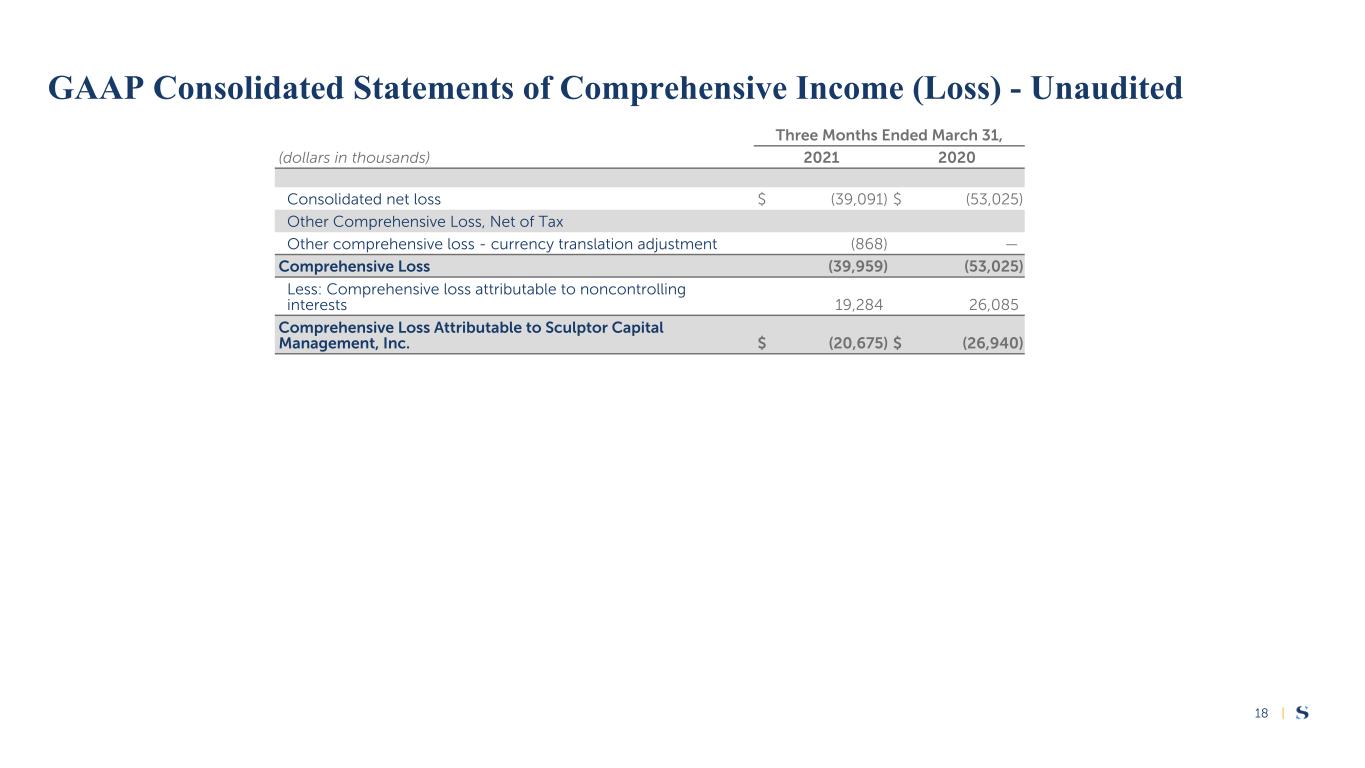

| Three Months Ended March 31, (dollars in thousands) 2021 2020 Consolidated net loss $ (39,091) $ (53,025) Other Comprehensive Loss, Net of Tax Other comprehensive loss - currency translation adjustment (868) — Comprehensive Loss (39,959) (53,025) Less: Comprehensive loss attributable to noncontrolling interests 19,284 26,085 Comprehensive Loss Attributable to Sculptor Capital Management, Inc. $ (20,675) $ (26,940) GAAP Consolidated Statements of Comprehensive Income (Loss) - Unaudited 18

| (dollars in thousands) March 31, 2021 December 31, 2020 Assets Cash and cash equivalents $ 198,039 $ 183,815 Restricted cash 3,219 3,162 Investments (includes assets measured at fair value of $307,778 and $309,805, including assets sold under agreements to repurchase of $118,926 and $123,616 as of March 31, 2021 and December 31, 2020, respectively) 432,526 414,974 Income and fees receivable 82,298 539,623 Due from related parties 16,936 14,086 Deferred income tax assets 244,012 240,288 Operating lease assets 104,408 104,729 Other assets, net 80,013 82,500 Assets of consolidated funds: Other assets of consolidated funds 3 — Total Assets $ 1,161,454 $ 1,583,177 Liabilities and Shareholders' Equity Liabilities Compensation payable $ 39,355 $ 234,006 Unearned income and fees 57,470 61,880 Due to related parties 184,580 202,225 Operating lease liabilities 114,604 115,237 Debt obligations 185,793 334,972 Warrant liabilities, at fair value 62,771 37,827 Securities sold under agreements to repurchase 117,780 122,638 Other liabilities 32,152 39,512 Liabilities of consolidated funds: Other liabilities of consolidated funds 2 — Total Liabilities $ 794,507 $ 1,148,297 Shareholders' Equity Class A Shares, par value $0.01 per share, 100,000,000 and 100,000,000 shares authorized, 23,899,777 and 22,903,571 shares issued and outstanding as of March 31, 2021 and December 31, 2020, respectively 239 229 Class B Shares, par value $0.01 per share, 75,000,000 and 75,000,000 shares authorized, 32,887,883 and 32,824,538 shares issued and outstanding as of March 31, 2021 and December 31, 2020, respectively 329 328 Additional paid-in capital 185,961 166,917 Accumulated deficit (255,522) (178,674) Accumulated other comprehensive income 350 732 Shareholders’ deficit attributable to Class A Shareholders (68,643) (10,468) Shareholders’ equity attributable to noncontrolling interests 435,590 445,348 Total Shareholders’ Equity 366,947 434,880 Total Liabilities and Shareholders’ Equity $ 1,161,454 $ 1,583,177 GAAP Consolidated Balance Sheets - Unaudited 19

| (dollars in thousands, except per share amounts) 1Q '21 4Q '20 1Q '20 Net (Loss) Income Attributable to Class A Shareholders—GAAP $ (20,293) $ 216,171 $ (28,267) Change in redemption value of Preferred Units — 1,354 1,327 Net (Loss) Income Allocated to Sculptor Capital Management, Inc.—GAAP $ (20,293) $ 217,525 $ (26,940) Net (loss) income allocated to Group A Units (19,253) 39,714 (25,337) Equity-based compensation, net of RSUs settled in cash 30,202 18,302 24,398 Adjustment to recognize deferred cash compensation in the period of grant 8,995 (31,449) 2,179 2020 Term Loan and Debt Securities non-cash discount accretion 434 700 1,865 Income taxes (1,715) 93,243 (9,968) Changes in fair value of warrant liabilities 24,944 7,548 — Net losses on retirement of debt 23,673 4,318 523 Net (gains) losses on investments (5,362) (7,345) 34,068 Adjustment for expenses related to compensation and profit-sharing arrangements based on fund investment performance (2,498) (2,587) 582 Changes in tax receivable agreement liability (580) 2,832 (278) Depreciation, amortization and net gains and losses on fixed assets 1,735 1,745 1,802 Other adjustments 653 1,079 (611) Economic Income—Non-GAAP $ 40,935 $ 345,625 $ 2,283 Payable for taxes and tax receivable agreement—Non-GAAP (4,425) (4,524) (1,227) Preferred Units dividends — 512 (1,402) Distributable Earnings—Non-GAAP $ 36,510 $ 341,613 $ (346) Excluded expenses: Legal settlements and provisions — 426 — Professional services expense related to legal settlements and provisions — 865 3,976 Adjusted Distributable Earnings—Non-GAAP $ 36,510 $ 342,904 $ 3,630 Weighted-average Class A Shares outstanding 23,853,428 22,763,959 22,304,713 Weighted-average Partner Units 29,032,363 28,995,326 29,470,327 Weighted-average Class A Restricted Share Units (RSUs) 3,702,394 3,994,841 4,169,785 Weighted-average warrants 2,237,743 447,089 — Weighted-Average Fully Diluted Shares 58,825,928 56,201,215 55,944,825 Distributable Earnings Per Fully Diluted Share—Non-GAAP $ 0.62 $ 6.08 $ (0.01) Adjusted Distributable Earnings per Fully Diluted Share—Non-GAAP $ 0.62 $ 6.10 $ 0.06 Reconciliation of Non-GAAP Measures to the Respective GAAP Measures - Unaudited 20

| (dollars in thousands) 1Q '21 4Q '20 1Q '20 Management fees $ 73,961 $ 75,364 $ 66,953 Adjustment to management fees(1) (4,891) (5,102) (7,091) Management Fees—Economic Income Basis—Non-GAAP 69,070 70,262 59,862 Incentive Income—Economic Income Basis—GAAP and Non-GAAP 47,804 527,874 9,322 Other Revenues—Economic Income Basis—GAAP and Non-GAAP 1,581 1,525 2,953 Total Revenues—Economic Income Basis—Non-GAAP $ 118,455 $ 599,661 $ 72,137 Compensation and benefits 89,234 211,489 67,419 Adjustment to compensation and benefits(2) (36,699) 15,734 (27,159) Compensation and Benefits—Economic Income Basis—Non-GAAP $ 52,535 $ 227,223 $ 40,260 Interest expense 4,868 6,156 5,782 Adjustment to interest expense(3) (434) (700) (1,865) Interest Expense—Economic Income Basis—Non-GAAP $ 4,434 $ 5,456 $ 3,917 General, administrative and other expenses 27,376 28,401 34,706 Adjustment to general, administrative and other expenses(4) (6,825) (7,045) (9,029) General, administrative and other expenses—Economic Income Basis—Non-GAAP 20,551 21,356 25,677 Excluded expenses (5) — (1,291) (3,976) General, Administrative and Other Expenses Excluding Certain Expenses—Economic Income Basis—Non-GAAP $ 20,551 $ 20,065 $ 21,701 Net (loss) income attributable to noncontrolling interests (18,798) 40,596 (26,085) Adjustment to net (loss) income attributable to noncontrolling interests(6) 18,798 (40,596) 26,085 Net Loss Attributable to Noncontrolling Interests—Economic Income Basis—Non-GAAP $ — $ — $ — See page 23 of this presentation for important information related to the footnotes referenced on this slide. Reconciliation of Non-GAAP Measures to the Respective GAAP Measures - Unaudited (cont'd) 21

| (dollars in thousands) 12/31/2018 12/31/2019 12/31/2020 3/31/2021 Cash and cash equivalents $ 315,808 $ 240,938 $ 183,815 $ 198,039 Long-term U.S. government obligations 179,510 146,565 104,295 104,936 Cash, Cash Equivalents and Long-Term U.S. Government Obligations $ 495,318 $ 387,503 $ 288,110 $ 302,975 Investments in funds 28,519 81,992 105,169 124,748 Investments in funds eliminated in consolidation 20,380 — — — Less: Investments related to employees(7) (22,222) (32,891) (54,002) (77,949) Investments in Funds, Excluding Investments Related to Employees $ 26,677 $ 49,101 $ 51,167 $ 46,799 Investments in CLOs 181,868 182,870 205,510 202,842 Financing related to investments in CLOs(8) (159,692) (159,341) (183,082) (179,068) Investments in CLOs, net of Financing $ 22,176 $ 23,529 $ 22,428 $ 23,774 See page 23 of this presentation for important information related to the footnotes referenced on this slide. Reconciliation of Non-GAAP Measures to the Respective GAAP Measures - Unaudited (cont'd) 22

| Footnotes to Non-GAAP Reconciliations (1) Adjustment to present management fees net of recurring placement and related service fees, as management considers these fees a reduction in management fees, not an expense. The impact of eliminations related to the consolidated funds is also removed. (2) Adjustment to exclude equity-based compensation, as management does not consider these non-cash expenses to be reflective of our operating performance. However, the fair value of RSUs that are settled in cash to employees or executive managing directors is included as an expense at the time of settlement. In addition, expenses related to incentive income profit-sharing arrangements are generally recognized at the same time the related incentive income revenue is recognized, as management reviews the total compensation expense related to these arrangements in relation to any incentive income earned by the relevant fund. Further, deferred cash compensation is expensed in full in the year granted for Economic Income, rather than over the service period for GAAP. (3) Adjustment to exclude amounts related to non-cash interest expense accretion on debt. The 2020 Term Loan and the Debt Securities were each recognized at a significant discount, as proceeds from each borrowing were allocated to warrant liabilities and the 2019 Preferred Units, respectively, resulting in non-cash accretion to par over time through interest expense for GAAP. Management excludes these non-cash expenses from Economic Income, as it does not consider them to be reflective of our economic borrowing costs. (4) Adjustment to exclude depreciation, amortization and losses on fixed assets as management does not consider these items to be reflective of our operating performance. Additionally, recurring placement and related service fees are excluded, as management considers these fees a reduction in management fees, not an expense. (5) Adjustments to exclude legal settlements and provisions and related professional services expenses. (6) Adjustment to exclude amounts attributable to the executive managing directors on their interests in the Sculptor Operating Group, as management reviews the operating performance of the Company at the Sculptor Operating Group level. The Company conducts substantially all of its activities through the Sculptor Operating Group. (7) Adjustment to exclude investments in funds made on behalf of certain employees and executive managing directors, including deferred compensation arrangements. (8) Adjustment to reduce the investments in CLOs by related financing, including CLO investments loans and securities sold under agreements to repurchase. Footnotes to Reconciliations Non-GAAP Financial Measures Distributable Earnings is a measure of operating performance that equals Economic Income less amounts payable for taxes and tax receivable agreement and dividends accrued on the Preferred Units (whether paid or deferred). Economic Income and certain balance sheet measures presented on page 9 exclude the adjustments described above that are required for presentation of the Company's results and financial positions on a GAAP basis. Payable for taxes and tax receivable agreement presents the total estimated GAAP provision for current corporate, local and foreign taxes payable, as well as the current payable under the Company’s tax receivable agreement, assuming that all Economic Income was allocated to Sculptor Capital Management, Inc., which would occur following the exchange of all interests held by current and former executive managing directors in the Sculptor Operating Group (collectively, "Partner Units") for Class A Shares. The current tax provision and current payable under the tax receivable agreement reflect the benefit of tax deductions that are excluded when calculating Distributable Earnings, such as equity-based compensation expenses, legal settlements expenses, tax goodwill and various other items impacting the Company’s taxable income. Management believes that using the estimated current tax provision and current payable under the Company’s tax receivable agreement more accurately reflect earnings that are available to be distributed to shareholders. For purposes of calculating Distributable Earnings per Share, the Company assumes that all Partner Units and Class A Restricted Share Units ("RSUs") have been converted on a one-to-one basis into Class A Shares and warrants are included on a treasury stock basis (collectively, "Fully Diluted Shares"). As of March 31, 2021, there were 3,385,000 Group P Units outstanding and 1,000,000 performance-based restricted share units ("PSUs"). Group P Units and PSUs do not participate in the economics of the Company until certain service and market-performance conditions are met; therefore, the Company will not include the Group P Units or PSUs in Fully Diluted Shares until such conditions are met. As of March 31, 2021, the market-performance conditions had not yet been met. These non-GAAP measures should not be considered as alternatives to the Company's GAAP Net Income or cash flow from operations, or as indicative of liquidity or the cash available to fund operations. You are encouraged to evaluate each of these adjustments and the reasons the Company considers them appropriate for supplemental analysis. In evaluating the Company's non-GAAP measures, you should be aware that in the future the Company may incur expenses that are the same as or similar to some of the adjustments in such presentations. The Company's non-GAAP measures may not be comparable to similarly titled measures used by other companies. Management uses Economic Income and Distributable Earnings, among other financial information, as the basis on which it evaluates the financial performance of the Company and makes resource allocation and other operating decisions, as well as to determine the earnings available to distribute as dividends to holders of the Company's Class A Shares and to the Company's executive managing directors. Management considers it important that investors review the same operating information that it uses. These measures are presented to provide a more comparable view of the Company's operating results year-over-year and the Company believes that providing these measures on a supplemental basis to the Company's GAAP results is helpful to shareholders in assessing the overall performance of the Company's business. 23

| (1) The return information reflected in these tables represents, where applicable, the composite performance of all feeder funds that comprise each of the master funds presented. Gross return information is generally calculated using the total return of all feeder funds, net of all fees and expenses except management fees and incentive income of such feeder funds and master funds and the returns of each feeder fund include the reinvestment of all dividends and other income. Net return information is generally calculated as the gross returns less management fees and incentive income. Return information that includes investments in certain funds that the Company, as investment manager, determines lack a readily ascertainable fair value, are illiquid or should be held until the resolution of a special event or circumstance ("Special Investments") excludes incentive income on unrealized gains attributable to such investments, which could reduce returns on these investments at the time of realization. Special Investments and initial public offering investments are not allocated to all investors in the funds, and investors that were not allocated Special Investments and initial public offering investments may experience materially different returns. The performance calculation for the Sculptor Master Fund excludes realized and unrealized gains and losses attributable to currency hedging specific to certain investors investing in Sculptor Master Fund in currencies other than the U.S. Dollar. (2) The annualized returns since inception are those of the Sculptor Multi-Strategy Composite, which represents the composite performance of all accounts that were managed in accordance with the Company's broad multi-strategy mandate that were not subject to portfolio investment restrictions or other factors that limited the Company's investment discretion since inception on April 1, 1994. Performance is calculated using the total return of all such accounts net of all investment fees and expenses of such accounts, and the returns include the reinvestment of all dividends and other income. The performance calculation for the Sculptor Master Fund excludes realized and unrealized gains and losses attributable to currency hedging specific to certain investors investing in Sculptor Master Fund in currencies other than the U.S. Dollar. For the period from April 1, 1994 through December 31, 1997, the returns are gross of certain overhead expenses that were reimbursed by the accounts. Such reimbursement arrangements were terminated at the inception of the Sculptor Master Fund on January 1, 1998. The size of the accounts comprising the composite during the time period shown vary materially. Such differences impacted the Company's investment decisions and the diversity of the investment strategies followed. Furthermore, the composition of the investment strategies the Company follows is subject to its discretion, has varied materially since inception and is expected to vary materially in the future. As of March 31, 2021, the annualized returns since the Sculptor Master Fund’s inception on January 1, 1998 were 13.7% gross and 9.3% net excluding Special Investments and 13.3% gross and 9.1% net inclusive of Special Investments. (3) The returns for the Sculptor Master Fund exclude Special Investments. Special Investments in the Sculptor Master Fund are held by investors representing a small percentage of assets under management in the fund. Inclusive of these Special Investments, the returns of the Sculptor Master Fund for three months ended March 31, 2021 were 4.8% gross and 3.6% net, respectively, for three months ended March 31, 2020 were (6.8)% gross net, respectively, and annualized since inception through March 31, 2021 were 16.5% gross and 11.6% net. (4) The returns for the Sculptor Credit Opportunities Master Fund exclude Special Investments. Special Investments in the Sculptor Credit Opportunities Master Fund are held by investors representing a small percentage of assets under management in the fund. Inclusive of these Special Investments, the returns of the Sculptor Credit Opportunities Master Fund for three months ended March 31, 2021 were 8.6% gross and 7.3% net, for three months ended March 31, 2020 were (19.9)% gross and (20.2)% net, and annualized since inception through March 31, 2021 were 13.6% gross and 9.7% net. (5) Represents funded capital commitments net of recallable distribution to investors. (6) Gross internal rate of return ("IRR") for the Company's closed-end opportunistic credit funds represents the estimated, unaudited, annualized return based on the timing of cash inflows and outflows for the fund as of March 31, 2021, including the fair value of unrealized investments as of such date, together with any appreciation or depreciation from related hedging activity. Gross IRR does not include the effects of management fees or incentive income, which would reduce the return, and includes the reinvestment of all fund income. (7) Net IRR is calculated as described in footnotes (4) and (11), but is reduced by management fees and for the real estate funds other fund-level fees and expenses not adjusted for in the calculation of gross IRR. Net IRR is further reduced by accrued and paid incentive income, which will be payable upon the distribution of each fund's capital in accordance with the terms of the relevant fund. Accrued incentive income may be higher or lower at such time. The net IRR represents a composite rate of return for a fund and does not reflect the net IRR specific to any individual investor. (8) Gross multiple of invested capital ("MOIC") for the Company's closed-end opportunistic credit funds is calculated by dividing the sum of the net asset value of the fund, accrued incentive income, life-to-date incentive income and management fees paid and any non-recallable distributions made from the fund by the invested capital. (9) These funds have concluded their investment periods, and therefore the Company expects assets under management for these funds to decrease as investments are sold and the related proceeds are distributed to the investors in these funds. (10) An investment is considered partially realized when the total amount of proceeds received, including dividends, interest or other distributions of income and return of capital, represents at least 50% of invested capital. (11) Invested capital represents total aggregate contributions made for investments by the fund. (12) Total value represents the sum of realized distributions and the fair value of unrealized and partially realized investments as of March 31, 2021. Total value will be impacted (either positively or negatively) by future economic and other factors. Accordingly the total value ultimately realized will likely be higher or lower than the amounts presented as of March 31, 2021. (13) Gross IRR for the Company's real estate funds represents the estimated, unaudited, annualized return based on the timing of cash inflows and outflows for the aggregated investments as of March 31, 2021, including the fair value of unrealized and partially realized investments as of such date, together with any unrealized appreciation or depreciation from related hedging activity. Gross IRR is not adjusted for estimated management fees, incentive income or other fees or expenses to be paid by the fund, which would reduce the return. (14) Gross MOIC for the Company's real estate funds is calculated by dividing the value of a fund's investments by the invested capital, prior to adjustments for incentive income, management fees or other expenses to be paid by the fund. (15) This fund has invested less than half of its committed capital; therefore, IRR and MOIC information is not presented, as it is not meaningful. (16) Appreciation (depreciation) reflects the aggregate net capital appreciation (depreciation) for the entire period and is presented on a total return basis, net of all fees and expenses (except incentive income on Special Investments), and includes the reinvestment of all dividends and other income. Management fees and incentive income vary by product. (17) Includes the effects of changes in the par value of the underlying collateral of the CLOs, foreign currency translation changes in the measurement of assets under management of our European CLOs and changes in the portfolio appraisal value for aircraft securitization vehicles. Fund Information - Footnotes Fund Information - Footnotes 24 (1) Past performance is not indicative of future results. The return information reflected in these tables represents, where applicable, the composite performance of all feeder funds that comprise each of the master funds presented. Gross return information is generally calculated using the total return of all feeder funds, net of all fees and expenses except management fees of such feeder funds and master funds and incentive income allocated to the general partner of the funds, and the returns of each feeder fund include the reinvestment of all dividends and other income. Net return information is generally calculated as the gross returns less management fees and incentive income allocated to the general partner of the funds. Return information that includes investments in certain funds that the Company, as investment manager, determines lack a readily ascertainable fair value, are illiquid or should be held until the resolution of a special event or circumstance ("Special Investments") excludes incentive income allocated to the general partner of the funds on unrealized gains attributable to such investments, which could reduce returns on these investments at the time of realization. Special Investments and initial public offering investments are not allocated to all investors in the funds, and investors that were not allocated Special Investments and initial public offering investments may experience materially different returns. The performance calculation for the Sculptor Master Fund excludes realized and unrealized gains and losses attributable to currency hedging specific to certain investors investing in Sculptor Master Fund in currencies other than the U.S. Dollar. (2) The annualized returns since inception are those of the Sculptor Multi-Strategy Composite, which represents the composite performance of all accounts that were managed in accordance with the Company's broad multi-strategy mandate that were not subject to portfolio investment restrictions or other factors that limited the Company's investment discretion since inception on April 1, 1994. Performance is calculated using the total return of all such accounts net of all investment fees and expenses of such accounts, and the returns include the reinvestment of all dividends and other income. The performance calculation for the Sculptor Master Fund excludes realized and unrealized gains and losses attributable to currency hedging specific to certain investors investing in Sculptor Master Fund in currencies other than the U.S. Dollar. For the period from April 1, 1994 through December 31, 1997, the returns are gross of certain overhead expenses that were reimbursed by the accounts. Such reimbursement arrangements were terminated at the inception of the Sculptor Master Fund on January 1, 1998. The size of the accounts comprising the composite during the time period shown vary materially. Such differences impacted the Company's investment decisions and the diversity of the investment strategies followed. Furthermore, the composition of the investment strategies the Company follows is subject to its discretion, has varied materially since inception and is expected to vary materially in the future. As of March 31, 2021, the annualized returns since the Sculptor Master Fund’s inception on January 1, 1998 were 13.7% gross and 9.3% net excluding Special Investments and 13.3% gross and 9.1% net inclusive of Special Investments. The returns for the Sculptor Master Fund exclude Special Investments. Special Investments in the Sculptor Master Fund are held by investors representing a small percentage of assets under management in the fund. Inclusive of these Special Investments, the returns of the Sculptor Master Fund for three months ended March 31, 2021 were 4.8% gross and 3.6% net, for year ended December 31, 2020 were 25.3% gross and 18.6% net, for three months ended March 31, 2020 were (6.8)% gross and net, respectively, and annualized since inception through March 31, 2021 were 16.5% gross and 11.6% net. Sharpe Ratio is a measure of the risk-adjusted return of the Fund, or benchmark, as applicable. The Sharpe Ratio is calculated by subtracting the annualized risk-free rate from the annualized portfolio return, and dividing that amount by the standard deviation of the portfolio's monthly returns in excess of the risk-free rate. The risk-free rate of return used in computing the Sharpe Ratio is the 1-month LIBOR compounded monthly throughout the periods presented. (3) Source: Bloomberg, HFRI. The comparison shows the returns of the MSCI World Gross Local Index (GDDLWI Index), the ICE BofAML Global High Yield Index (HW00) (inception date of January 1, 1998), the Balanced US 60/40 Index (VBINX US Equity) and the HFRI Fund Weighted Composite Index (HFRIFWI Index (the “Broader Market Indices”) against the Multi-Strategy Composite. This comparison is intended solely for illustrative purposes to show a historical comparison of the Master Fund Composite to the broader markets, as represented by the Broader Market Indices, and should not be considered as an indication of how Sculptor Master Fund or the Feeder Funds will perform relative to the Broader Market Indices in the future. There can be no assurance any such trends would persist in the future. Assets and securities contained within the Broader Market Indices are different than the assets held in the Master Fund Composite and will therefore have different risk and reward profiles. (4) Volatility is a statistical measure that measures the fluctuation of the monthly rates of return against the average return. (5) The returns for the Sculptor Credit Opportunities Master Fund exclude Special Investments. Special Investments in the Sculptor Credit Opportunities Master Fund are held by investors representing a small percentage of assets under management in the fund. Inclusive of these Special Investments, the returns of the Sculptor Credit Opportunities Master Fund for three months ended March 31, 2021 were 8.6% gross and 7.3% net, for year ended December 31, 2020 were 0.7% gross and (1.8)% net, for three months ended March 31, 2020 were (19.9)% gross and (20.2)% net, and annualized since inception through March 31, 2021 were 13.6% gross and 9.7% net. (6) Source: Bloomberg, HFRI. The comparison shows the returns of the ICE BofAML Global High Yield Index (HW00) and HFRI Distressed/Restructuring Index (HFRIDSI) (the “Broader Market Indices”) against Sculptor Credit Opportunities Master Fund. This comparison is intended solely for illustrative purposes to show a historical comparison of the Sculptor Credit Opportunities Master Fund to the broader credit markets, as represented by the Broader Market Indices, and should not be considered as an indication of how Sculptor Credit Opportunities Master Fund will perform relative to the Index in the future. There can be no assurance any such trends would persist in the future. Assets and securities contained within the Broader Market Indices are different than the assets held in Sculptor Credit Opportunities Master Fund and will therefore have different risk and reward profiles.

| Fund Information - Footnotes (cont'd) Fund Information - Footnotes 25 (7) Gross IRR for the Company's real estate funds represents the estimated, unaudited, annualized return based on the timing of cash inflows and outflows for the aggregated investments as of March 31, 2021, including the fair value of unrealized and partially realized investments as of such date, together with any unrealized appreciation or depreciation from related hedging activity. Gross IRR is not adjusted for estimated management fees, incentive income allocated to the general partner of the fund or other fees or expenses to be paid by the fund, which would reduce the return. (8) Net IRR is calculated as described in footnotes (7) and (13), but is reduced by management fees and for the real estate funds other fund-level fees and expenses not adjusted for in the calculation of gross IRR. Net IRR is further reduced by accrued and paid incentive income allocated to the general partner of the fund, which will be payable upon the distribution of each fund's capital in accordance with the terms of the relevant fund. Accrued incentive income allocated to the general partner of the fund may be higher or lower at such time. The net IRR represents a composite rate of return for a fund and does not reflect the net IRR specific to any individual investor. (9) Appreciation (depreciation) reflects the aggregate net capital appreciation (depreciation) for the entire period and is presented on a total return basis, net of all fees and expenses (except incentive income allocated to the general partner of the fund on unrealized Special Investments), and includes the reinvestment of all dividends and other income. Management fees and incentive income allocated to the general partner of the fund vary by product. (10) Includes the effects of changes in the par value of the underlying collateral of the CLOs, foreign currency translation changes in the measurement of assets under management of our European CLOs and changes in the portfolio appraisal value for aircraft securitization vehicles. (11) Represents funded capital commitments net of recallable distribution to investors. (12) Gross internal rate of return ("IRR") for the Company's closed-end opportunistic credit funds represents the estimated, unaudited, annualized return based on the timing of cash inflows and outflows for the fund as of March 31, 2021, including the fair value of unrealized investments as of such date, together with any appreciation or depreciation from related hedging activity. Gross IRR does not include the effects of management fees or incentive income allocated to the general partner of the fund, which would reduce the return, and includes the reinvestment of all fund income. (13) Gross multiple of invested capital ("MOIC") for the Company's closed-end opportunistic credit funds is calculated by dividing the sum of the net asset value of the fund, accrued incentive income allocated to the general partner of the fund, life-to-date incentive income allocated to the general partner of the fund and management fees paid and any non-recallable distributions made from the fund by the invested capital. (14) These funds have concluded their investment periods, and therefore the Company expects assets under management for these funds to decrease as investments are sold and the related proceeds are distributed to the investors in these funds. (15) An investment is considered partially realized when the total amount of proceeds received, including dividends, interest or other distributions of income and return of capital, represents at least 50% of invested capital. (16) Invested capital represents total aggregate contributions made for investments by the fund. (17) Total value represents the sum of realized distributions and the fair value of unrealized and partially realized investments as of March 31, 2021. Total value will be impacted (either positively or negatively) by future economic and other factors. Accordingly the total value ultimately realized will likely be higher or lower than the amounts presented as of March 31, 2021. (18) Gross MOIC for the Company's real estate funds is calculated by dividing the value of a fund's investments by the invested capital, prior to adjustments for incentive income allocated to the general partner of the fund, management fees or other expenses to be paid by the fund. (19) This fund has invested less than half of its committed capital; therefore, IRR and MOIC information is not presented, as it is not meaningful.

| Weighted Average Returns: Weighted Average Returns reflect the total profit & loss divided by the weighted average capital base for the period. Gross IRR represents estimated, unaudited, annualized pre-tax returns based on the timing of cash inflows and outflows from contributions into and distributions from the Platform to its fee paying investors (excluding management fees incurred by the Platform and incentive income allocated to the general partner of the fund). Net IRR is the gross IRR adjusted to reflect actual management fees incurred by the Platform and incentive income allocated to the general partner of the fund. Net Invested Capital Multiple: Given the Platform has an active liquid investment program, a key element of which includes ramping up and ramping down depending on market conditions - much of which has recently been deployed - this is a multiple measuring the current net asset value over the Net Invested Capital, where Net Invested Capital represents cumulative contributions less cumulative distributions. Customized Credit Focused Platform - Footnotes 26

| This press release and earnings presentation contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that reflect the Company's current views with respect to, among other things, future events, its operations and its financial performance. The Company generally identifies forward-looking statements by terminology such as "outlook," "believe," "expect," "potential," "continue," "may," "will," "should," "could," "seek," "approximately," "predict," "intend," "plan," "estimate," "anticipate," "opportunity," "comfortable," "assume," "remain," "maintain," "sustain," "achieve," "see," "think," "position" or the negative version of those words or other comparable words. Any forward-looking statements contained in this press release are based upon historical information and on the Company's current plans, estimates and expectations. The inclusion of this or other forward-looking information should not be regarded as a representation by the Company or any other person that the future plans, estimates or expectations contemplated by the Company will be achieved. The Company cautions that forward-looking statements are subject to numerous assumptions, estimates, risks and uncertainties including but not limited to the following: global economic, business, market and geopolitical conditions, including the impact of public health crises, such as the ongoing COVID-19 pandemic; U.S. and foreign regulatory developments relating to, among other things, financial institutions and markets, government oversight, fiscal and tax policy; the outcome of third-party litigation involving the Company; the consequences of the Foreign Corrupt Practices Act settlements with the SEC and the U.S. Department of Justice and any claims arising therefrom; whether the Company realizes all or any of the anticipated benefits from the recapitalization and other related transactions; whether the recapitalization and other related transactions result in any increased or unforeseen costs, indemnification obligations or have an impact on the Company's ability to retain or compete for professional talent or investor capital; conditions impacting the alternative asset management industry; the Company's ability to retain existing investor capital; the Company's ability to successfully compete for fund investors, assets, professional talent and investment opportunities; the Company's ability to retain its active executive managing directors, managing directors and other investment professionals; the Company's successful formulation and execution of its business and growth strategies; the Company's ability to appropriately manage conflicts of interest and tax and other regulatory factors relevant to its business; the anticipated benefits of changing the Company's tax classification from a partnership to a corporation and subsequently converting from a limited liability company to a corporation; and assumptions relating to the Company's operations, investment performance, financial results, financial condition, business prospects, growth strategy and liquidity. If one or more of these or other risks or uncertainties materialize, or if the Company’s assumptions or estimates prove to be incorrect, its actual results may vary materially from those indicated in these statements. These factors are not and should not be construed as exhaustive and should be read in conjunction with the other cautionary statements and risks that are included in the Company’s filings with the SEC, including but not limited to the Company’s annual report on Form 10-K for the year ended December 31, 2020, dated February 23, 2021, as well as may be updated from time to time in the Company’s other SEC filings. There may be additional risks, uncertainties and factors that the Company does not currently view as material or that are not known. The forward-looking statements contained in this press release are made only as of the date of this press release. The Company does not undertake to update any forward-looking statement because of new information, future developments or otherwise. This press release does not constitute an offer of any Sculptor Capital fund. The Company files annual, quarterly and current reports, proxy statements and other information required by the Exchange Act of 1934, as amended, with the SEC. The Company makes available free of charge on its website (www.sculptor.com) its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and any amendment to those filings as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. The Company also uses its website to distribute company information, including assets under management by investments strategy, and such information may be deemed material. Accordingly, investors should monitor the Company's website, in addition to its press releases, SEC filings and public conference calls and webcast. Forward-Looking Statements 27