Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 1-33805

OCH-ZIFF CAPITAL MANAGEMENT GROUP LLC

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 26-0354783 | |

| (State of Incorporation) | (I.R.S. Employer Identification Number) |

9 West 57th Street, New York, New York 10019

(Address of Principal Executive Offices)

Registrant’s telephone number: (212) 790-0041

Securities registered pursuant to Section 12(b) of the Act:

| Class A Shares | New York Stock Exchange | |

| (Title of each class) | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer þ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2010 was approximately $1.1 billion. As of February 1, 2011, there were 95,081,389 Class A Shares and 274,666,921 Class B Shares outstanding.

Documents Incorporated by Reference

Portions of the definitive proxy statement for the 2011 annual meeting of Och-Ziff Capital Management Group LLC’s shareholders to be filed pursuant to Regulation 14A are incorporated by reference into Part III of this Form 10-K.

Table of Contents

OCH-ZIFF CAPITAL MANAGEMENT GROUP LLC

| Page | ||||||

| PART I |

||||||

| Item 1. |

3 | |||||

| Item 1A. |

18 | |||||

| Item 1B. |

53 | |||||

| Item 2. |

53 | |||||

| Item 3. |

53 | |||||

| Item 4. |

53 | |||||

| PART II |

||||||

| Item 5. |

54 | |||||

| Item 6. |

56 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

59 | ||||

| Item 7A. |

98 | |||||

| Item 8. |

99 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

99 | ||||

| Item 9A. |

100 | |||||

| Item 9B. |

101 | |||||

| PART III |

||||||

| Item 10. |

103 | |||||

| Item 11. |

103 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

103 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

103 | ||||

| Item 14. |

103 | |||||

| PART IV |

||||||

| Item 15. |

104 | |||||

| 105 | ||||||

| 106 | ||||||

| F-1 | ||||||

i

Table of Contents

Available Information

Och-Ziff Capital Management Group LLC files annual, quarterly and current reports, proxy statements and other information required by the Securities Exchange Act of 1934, as amended (the “Exchange Act”), with the Securities and Exchange Commission (“SEC”). We make available free of charge on our website at http://www.ozcap.com our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and any amendments to those filings as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. Also posted on our website in the “For Shareholders—Corporate Governance” section are charters for our Audit Committee, Compensation Committee, and Nominating, Corporate Governance and Conflicts Committee as well as our Corporate Governance Guidelines and Code of Business Conduct and Ethics governing our directors, officers and employees. Information on, or accessible through, our website is not a part of, and is not incorporated into, this report or any other SEC filing. Requests for copies of Och-Ziff’s SEC filings or the corporate governance materials posted on our website should be directed to: Office of the Secretary, Och-Ziff Capital Management Group LLC, 9 West 57th Street, New York, New York 10019.

Any materials we file with the SEC are also publicly available through the SEC’s website at http://www.sec.gov or may be read and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC, 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.

In this annual report, references to “Och-Ziff,” “our Company,” “the Company,” “we,” “us,” or “our” refer, unless the context requires otherwise, to Och-Ziff Capital Management Group LLC, a Delaware limited liability company, and its consolidated subsidiaries, including the Och-Ziff Operating Group. References to the “Och-Ziff Operating Group” refer, collectively, to OZ Management LP, a Delaware limited partnership, which we refer to as “OZ Management,” OZ Advisors LP, a Delaware limited partnership, which we refer to as “OZ Advisors I,” OZ Advisors II LP, a Delaware limited partnership, which we refer to as “OZ Advisors II,” and their consolidated subsidiaries. References to our “intermediate holding companies” refer, collectively, to Och-Ziff Holding Corporation, a Delaware corporation, which we refer to as “Och-Ziff Corp,” and Och-Ziff Holding LLC, a Delaware limited liability company, which we refer to as “Och-Ziff Holding,” both of which are wholly-owned subsidiaries of Och-Ziff Capital Management Group LLC. References to our “partners” refer to the current limited partners of the Och-Ziff Operating Group entities other than the Ziffs and our intermediate holding companies, including our founder, Mr. Daniel S. Och, except where the context requires otherwise. References to the “Ziffs” refer collectively to Ziff Investors Partnership, L.P. II, Ziff Investors Partnership, L.P. II A and certain of their affiliates and control persons. References to “Class A Shares” refer to our Class A Shares, representing Class A limited liability company interests of Och-Ziff Capital Management Group LLC, which are publicly traded and listed on the New York Stock Exchange. References to “Class B Shares” refer to Class B Shares of Och-Ziff Capital Management Group LLC, which are not publicly traded, are currently held solely by our partners and have no economic rights but entitle the holders thereof to one vote per share together with the holders of our Class A Shares. References to our “IPO” refer to our initial public offering of 36.0 million Class A Shares that occurred in November 2007. References to the “Offerings” refer collectively to our IPO and the concurrent private offering of approximately 38.1 million Class A Shares to DIC Sahir Limited, a wholly-owned subsidiary of Dubai International Capital LLC. References to “DIC” refer to DIC Sahir Limited, Dubai International Capital LLC and its affiliates. References to “our funds” or “Och-Ziff funds” refer to the hedge funds and other alternative investment vehicles for which we provide asset management services. No statements herein, available on our website or in any of the materials we file with the SEC constitute or should be viewed as constituting an offer of any Och-Ziff fund.

1

Table of Contents

Forward-Looking Statements

Some of the statements under “Item 1. Business,” “Item 1A. Risk Factors,” “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Item 7A. Quantitative and Qualitative Disclosures About Market Risk” and elsewhere in this annual report may be forward-looking statements, within the meaning of Section 27A of the Securities Act of 1933, as amended, which we refer to as the “Securities Act,” and Section 21E of the Exchange Act that reflect our current views with respect to, among other things, future events and financial performance. We generally identify forward-looking statements by terminology such as “outlook,” “believe,” “expect,” “potential,” “continue,” “may,” “will,” “should,” “could,” “seek,” “approximately,” “predict,” “intend,” “plan,” “estimate,” “anticipate,” “opportunity,” “comfortable,” “assume,” “remain,” “maintain,” “sustain,” “achieve,” “see,” “think,” “position” or the negative version of those words or other comparable words.

We caution that forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in any forward-looking statement. These factors include but are not limited to those described in “Item 1A. Risk Factors.”

There may be additional risks, uncertainties and factors that we do not currently view as material or that are not known. Any forward-looking statements made by us speak only as of the date they are made, and we assume no duty and do not undertake to update any forward-looking statement.

2

Table of Contents

PART I

| Item 1. | Business |

Business Description

Founded in 1994 by Daniel S. Och, we are one of the largest institutional alternative asset managers in the world with approximately $28.4 billion in assets under management as of February 1, 2011. Our funds seek to generate consistent, positive, risk-adjusted returns across market cycles with low volatility and low correlation to the equity markets. We have always limited our use of leverage to generate investment performance and we emphasize preservation of investor capital. We serve the investment needs of a diversified institutional investor base, providing asset management services through our funds, which pursue a broad range of global investment opportunities.

We have always focused on establishing long-term relationships with a global base of institutional investors, which today includes many of the largest, most sophisticated investors in the world. These include pension funds, fund-of-funds, foundations and endowments, corporations, private banks and family offices.

Our investors value our funds’ consistent performance history, our global investing expertise, our diverse investment strategies and our strong focus on risk management and a robust operational infrastructure. Our funds make investments in many regions around the world with a breadth we believe is offered by few alternative asset management firms.

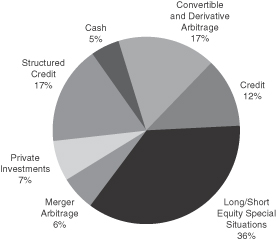

Our assets under management are generally invested on a multi-strategy basis, across multiple geographies, although certain funds are focused on specific sectors, strategies or geographies. Our primary investment strategies are: convertible and derivative arbitrage, credit, long/short equity special situations, merger arbitrage, private investments and structured credit.

We have built an experienced investment management team around the world. As of December 31, 2010, we had 405 employees worldwide, including 130 investment professionals and 19 partners, working from our headquarters in New York City and offices in London, Hong Kong, Mumbai and Beijing. Our London office houses our European investment team and our Hong Kong office houses the majority of our Asian investment team.

We conduct substantially all of our operations through our one reportable segment, the Och-Ziff Funds segment, which provides asset management services to our funds. Our Other Operations are currently comprised of our real estate business, which manages and provides asset management services to our real estate funds, and investments in new businesses established to expand our private investment platforms.

Our primary sources of revenues are management fees, which are based on the amount of our assets under management, and incentive income, which is based on the investment performance we generate for our fund investors. Accordingly, for any given period, our revenues will be driven by the combination of assets under management and the investment performance of our funds.

Funds Overview

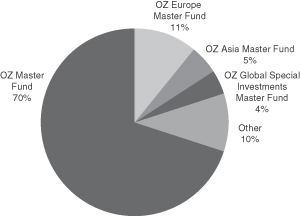

We currently manage four main investment funds on a multi-strategy basis, across multiple geographies. As of December 31, 2010, these four funds comprised approximately 90% of our total assets under management. The following is a description of these funds:

| Ÿ | OZ Master Fund, which is our flagship, global, multi-strategy fund. The OZ Master Fund opportunistically allocates capital between the underlying investment strategies described below in North America, Europe and Asia. The OZ Master Fund’s European and Asian investments mirror those made in the OZ Europe Master Fund and the OZ Asia Master Fund. As of January 1, 2011, the OZ Master Fund’s geographic allocation was 55% in North America, 31% in Europe and 14% in Asia. |

| Ÿ | OZ Europe Master Fund, which is a multi-strategy fund that opportunistically allocates capital between the underlying investment strategies described below in Europe. |

3

Table of Contents

| Ÿ | OZ Asia Master Fund, which is a multi-strategy fund that opportunistically allocates capital between the underlying investment strategies described below in Asia. |

| Ÿ | OZ Global Special Investments Master Fund, which allocates capital globally to private investments and to the private investment platforms we are developing, as well as to many of the other strategies described below. This fund has a higher concentration of investments that tend to be longer term than the investments we make in our other funds. The majority of the capital in this fund belongs to the partners of our firm. |

The remaining 10% of our assets under management as of December 31, 2010 is related to our real estate funds and certain other alternative investment vehicles we manage. Our real estate funds generally make investments in commercial and residential real estate in North America, including real property, multi-property portfolios, real estate related joint ventures, real estate operating companies and other real estate related assets.

The following chart presents the composition of our assets under management by fund as of December 31, 2010:

Multi-Strategy Approach

Our funds invest across multiple strategies and geographies without any pre-determined commitments. Portfolio composition is determined by evaluating what we believe are the best market opportunities, consistent with our goals of diversification and capital preservation. The primary investment strategies we employ in our funds include:

| Ÿ | Convertible and derivative arbitrage, which takes advantage of price discrepancies between convertible and derivative securities and the underlying equity or other security. These investments may be made at multiple levels of an entity’s capital structure to profit from valuation or other pricing discrepancies; |

| Ÿ | Credit, which includes a variety of credit-based strategies, such as high-yield debt investments in distressed businesses and investments in bank loans and senior secured debt. Credit also includes providing mezzanine financing and structuring creative capital solutions; |

| Ÿ | Long/short equity special situations, which consists of long/short and event-driven investing. Fundamental long/short investing involves analyzing companies and assets to profit where we believe mispricing or undervaluation exists. Event-driven investing attempts to realize gain from corporate events such as spin-offs, recapitalizations and other corporate restructurings, whether company specific or as a result of industry or economic conditions; |

| Ÿ | Merger arbitrage, which is an event-driven strategy involving multiple investments in entities contemplating a merger or similar business combination. This strategy seeks to realize a profit from pricing discrepancies among the securities of the entities involved in the event; |

4

Table of Contents

| Ÿ | Private investments, which encompasses investments in a variety of special situations which seek to realize value through strategic sales or initial public offerings; and |

| Ÿ | Structured credit, which involves investments in residential and commercial mortgage-backed securities and other asset-backed securities. This strategy also includes investments in collateralized loan obligations (CLOs) and collateralized debt obligations (CDOs). |

Our ability to invest across multiple strategies and geographies enables us to adjust our portfolio allocations as market conditions change and as we identify new investment opportunities. The following chart presents the composition, by strategy (excluding residual assets attributable to redeeming investors), of the OZ Master Fund as of January 1, 2011:

Investment Management Process

Our approach to asset management today is based on the same fundamental elements that we have employed since we were founded in 1994. Our objectives are to create long-term value for our fund investors by generating consistent, positive, risk-adjusted returns while protecting investor capital, and to develop new, carefully considered investment opportunities. Our extensive experience, combined with the consistency of our approach to investing and risk management, has been integral to extending our performance history. Our investment and risk management processes benefit from our dedicated and experienced industry specialists and private investment teams operating out of our offices worldwide. Our portfolio managers, who are senior partners of the firm, combine qualitative judgment gained from their extensive experience with quantitative analysis in order to effectively manage our investment process. In all of our strategies, our approach is defined by certain common elements:

| Ÿ | Consistent, positive, risk-adjusted returns. Our investment process focuses on generating consistent, positive, risk-adjusted returns across market cycles with low volatility and low correlation to the equity markets. Our goal is to preserve capital during periods of market decline and produce competitive investment performance in rising markets. We seek to generate fund returns without relying on asset concentration or market direction. |

| Ÿ | Multi-strategy approach. Our funds invest across multiple strategies and geographies without any pre-determined commitments. Portfolio composition is determined by evaluating what we believe are the best market opportunities, consistent with our goals of diversification and capital preservation. Our primary investment strategies are convertible and derivative arbitrage, credit, long/short equity special situations, merger arbitrage, private investments and structured credit. Our ability to invest across strategies and geographies enables us to be nimble in adjusting our portfolio allocations as market conditions change. |

5

Table of Contents

| Ÿ | Focus on fundamentals. We approach investments in each of our strategies through rigorous fundamental analysis of the drivers of potential investment risk and return. We look at both qualitative and quantitative factors in assessing the risk/reward parameters and perform extensive due diligence. |

| Ÿ | Limited use of leverage. Our funds generally do not rely on extensive leverage to generate investment returns. Our approach to risk management limits the amount of leverage we employ on a portfolio-wide basis. |

| Ÿ | Disciplined investment and risk management processes. Our investment and risk management processes are central to the way we allocate capital. We focus on hedging and actively managing the exposures of our portfolios. Our risk management practices are based on both quantitative and qualitative analyses implemented at the individual position and total portfolio levels, and they have been integrated into our daily investment process. |

Portfolio Risk Management

Risk management is central to the operation of our business. We use both quantitative and qualitative analyses to monitor financial and event risk and manage volatility. We may seek to hedge credit, interest rate, currency and market exposures; however, there can be no assurances that appropriate hedges will be available or in place to successfully limit losses. We place substantial emphasis on portfolio diversification by asset class, industry sector and geography. The active management of positions in our funds allows for timely reallocation of capital in response to changes in business, market or economic conditions.

Our risk management processes are overseen by our Risk Committee. The Risk Committee meets regularly to review, among other information, sophisticated risk analysis, including the results of stress testing our portfolios under numerous scenarios. The Risk Committee also discusses other general risks, including, but not limited to, global economic, geopolitical, counterparty and operational risks. Additionally, our portfolio managers meet with our analysts daily to review inherent risks associated with the positions in each fund.

Investment Performance

We believe one of the principal drivers of our ability to increase assets under management is the investment performance track record of our funds. Our historical ability to generate consistent, positive, risk-adjusted returns with limited use of leverage and with little equity-market correlation, combined with our ability to preserve fund capital when markets decline, are hallmarks of our investment approach. We also believe that our performance history is a key point of competitive differentiation for us.

The historical and potential future returns of the funds we manage are not directly linked to returns on our Class A Shares; therefore, positive investment performance of the funds we manage may not necessarily correspond to positive returns on an investment in our Class A Shares. Poor performance of the funds that we manage, however, would cause a decline in our revenues from those funds, which may have a negative effect on the returns on an investment in our Class A Shares. An investment in our Class A Shares is not an investment in any of the Och-Ziff funds. See “Item 1A. Risk Factors—Risks Related to Our Business—An investment in our Class A Shares is not an alternative to an investment in any of our funds, and the returns of our funds should not be considered as indicative of any returns expected on our Class A Shares, although poor investment performance of, or lack of capital flows into the funds we manage could have a material adverse impact on our revenues and, therefore, the returns on our Class A Shares.”

Additionally, our funds’ historical returns reflect investment opportunities and general global economic and market conditions that may not repeat themselves. The rates of return also reflect our funds’ historical expenses, which may vary in the future due to factors beyond our control, including changes in applicable law. See “Item 1A. Risk Factors—Risks Related to Our Funds—The historical returns attributable to our funds should not be considered as indicative of the future results of our funds or any future funds we may raise.”

6

Table of Contents

The table below presents, as of December 31, 2010, the net annualized return, correlation to the S&P 500 Index, volatility and Sharpe Ratio of the OZ Master Fund, and is provided for illustrative purposes only. The OZ Master Fund includes every strategy and geography in which the Och-Ziff funds invest and constituted approximately 70% of our assets under management as of December 31, 2010. Our other funds generally implement geographical or strategy focused investment programs. The investment performance results for our other funds vary from those of OZ Master Fund, and that variance may be material. The performance reflected in the table below is not necessarily indicative of the future results of OZ Master Fund. There can be no assurance that any Och-Ziff fund will achieve comparable results.

| Net Annualized Return through December 31, 20101 |

1 Year | 3 Years | 5 Years | Strategy Inception |

||||||||||||

| OZ Master Fund2 |

8.5 | % | 4.0 | % | 7.5 | % | 14.2 | % | ||||||||

| S&P 500 Index3 |

15.1 | % | -2.9 | % | 2.3 | % | 8.4 | % | ||||||||

| Correlation of OZ Master Fund to S&P 500 Index4 |

0.74 | 0.65 | 0.65 | 0.52 | ||||||||||||

| Volatility |

||||||||||||||||

| OZ Master Fund Standard Deviation (Annualized)5 |

3.6 | % | 7.3 | % | 6.0 | % | 5.6 | % | ||||||||

| S&P 500 Index Standard Deviation (Annualized)5 |

19.3 | % | 22.2 | % | 17.8 | % | 15.7 | % | ||||||||

| Sharpe Ratio6 |

||||||||||||||||

| OZ Master Fund |

2.30 | 0.40 | 0.79 | 1.84 | ||||||||||||

| S&P 500 Index |

0.77 | (0.18 | ) | (0.03 | ) | 0.29 | ||||||||||

| 1 | Net annualized return represents a composite of the average return of the feeder funds that comprise the OZ Master Fund, Ltd. (the “Fund”). Net annualized return is presented on a total return basis, net of all fees and expenses (except incentive income on certain unrealized private investments that could reduce returns on these investments at the time of realization) and includes the reinvestment of all dividends and other income. Performance includes realized and unrealized gains and losses attributable to certain private and initial public offering investments that are not allocated to all investors in the Fund. Investors that do not participate in such investments or that pay different fees may experience materially different returns. |

| 2 | Performance from inception includes actual total return for the partial year beginning in April 1994. For the period from April 1994 through December 1997, performance represents the performance of Och-Ziff Capital Management, L.P., a Delaware limited partnership that was managed by Daniel S. Och following an investment strategy that is substantially similar to that of the Fund. In addition, during this period, performance was calculated by deducting management fees on a quarterly basis and incentive income on a monthly basis. Starting from January 1998, performance has been calculated by deducting both management fees and incentive income on a monthly basis from the composite returns of the Fund. |

| 3 | Readers should not assume that there is any material overlap between those securities in the portfolio of the Fund and those that comprise the S&P 500 Index. It is not possible to invest directly in the S&P 500 Index. Returns of the S&P 500 Index have not been reduced by fees and expenses associated with investing in securities and include the reinvestment of dividends. The S&P 500 Index is an equity index owned and maintained by Standard & Poor’s, a division of McGraw-Hill, whose value is calculated as the free float-weighted average of the share prices of 500 large-capitalization corporations listed on the NYSE and Nasdaq. |

| 4 | Correlation to the returns of the S&P 500 Index represents a statistical measure of the degree to which the return of one portfolio is correlated to the return of another. It is expressed as a factor that ranges from -1.0 (perfectly inversely correlated) to +1.0 (perfectly positively correlated). |

| 5 | Standard deviation is a statistical measure of the degree to which an individual value in a distribution tends to vary from the mean of the distribution. |

| 6 | Sharpe Ratio represents a measure of the investment returns as adjusted for risk. The Sharpe Ratio is calculated by subtracting a “risk-free” rate from the composite returns, and dividing that amount by the standard deviation of the returns. |

Past performance is no guarantee of future results.

7

Table of Contents

Assets Under Management

Our assets under management are a function of the capital that is placed with us by fund investors globally, which we invest on their behalf based on the fund or funds they have selected, and the investment performance we generate for them. We typically accept capital from new and existing investors into our funds on a monthly basis on the first day of each month. Investors in our funds (other than investors in private investments, our real estate funds and certain other funds we manage) have the right to redeem their interests in a fund following an initial lock-up period of one to three years. Following the expiration of these lock-up periods (subject to certain limitations), investors may redeem capital generally on a quarterly or annual basis upon giving 30 to 45 days prior written notice. However, upon the payment of a redemption fee to the funds and upon giving 30 days prior written notice, certain investors may redeem capital during the lock-up period. The lock-up requirements for the funds may generally be waived or modified in the sole discretion of the fund’s general partner or board of directors, as applicable.

The ability of investors to contribute capital to and redeem capital from our funds causes our assets under management to fluctuate from period to period. Fluctuations in assets under management also result from our funds’ investment performance. Both of these factors directly impact the revenues we earn from management fees and incentive income.

Our financial results are primarily driven by the combination of assets under management and the investment performance of our funds. Competitive investment performance in rising markets and preservation of fund investor capital during periods of market volatility or decline are key determinants of the long-term success of our business. These factors enable us to attract additional assets under management from both existing and new fund investors, as well as minimize redemptions of capital from our funds. Growth in assets under management and positive investment performance drive growth in our revenues and earnings. Conversely, poor investment performance slows our growth by decreasing our assets under management and increases the potential for redemptions from our funds which would reduce our assets under management and have a negative effect on our revenues and earnings.

Industry Overview

The asset management business involves investing capital on behalf of institutional and individual investors in exchange for contracted fees and other performance-driven income. The industry invests trillions of dollars of assets and can be broadly divided into two categories: traditional asset management, such as mutual funds, and alternative asset management, such as hedge fund and private equity firms.

Alternative Asset Management / Hedge Funds

Alternative asset management, in general, involves a variety of investment strategies where the common element is the manager’s goal of delivering, within certain risk parameters, investment performance that is typically measured on an absolute return basis, meaning that performance is measured not by how well a fund performs relative to a benchmark index, but by how well the fund performs in absolute terms. Alternative asset managers typically earn management fees based on the value of the assets they manage and incentive income based on the investment performance they generate on those assets. These managers typically run pooled investment vehicles that are not subject to the investment limitations of traditional mutual funds and may employ a wide variety of investment strategies. Alternative asset managers strive to produce investment returns that have a lower correlation to the global capital markets than do traditional asset management strategies.

8

Table of Contents

The term “hedge funds” generally refers to privately held collective investment vehicles managed by alternative asset managers, such as Och-Ziff. Hedge funds differ from traditional investment vehicles, such as mutual funds, by the strategies they employ and the asset classes in which they invest. Asset classes in which hedge funds may invest are very broad and include liquid and illiquid securities, derivative instruments, asset-backed securities and a variety of other non-traditional assets, such as distressed securities and infrastructure investments, among others. Hedge funds have no pre-determined investment parameters and are not precluded from making large investments that are concentrated by asset class, industry sector, geography or market directionality. Hedge funds are also not precluded from employing a variety of instruments, including swaps, options, futures and short sales to mitigate risk or synthetically create investment exposures.

The demand for exposure to alternative asset managers by institutional investors was the main driver of the hedge fund industry’s historical growth. Institutional demand resulted from several factors, including the pursuit of higher returns compared to those generated by traditional equity and fixed income strategies, and the desire to diversify investment portfolios by placing capital with investment managers that generated returns with a low correlation to global equity markets. Alternative investment strategies still account for a relatively small portion of all institutional assets, signifying potential opportunity for future growth.

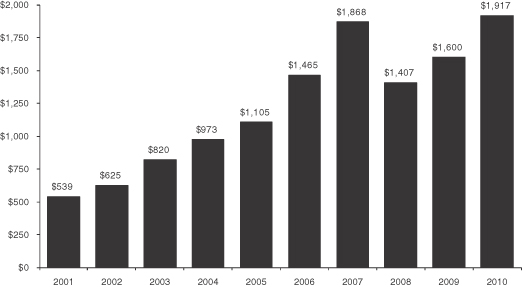

The following table presents the cumulative capital allocated to the hedge fund industry over the last ten years:

Historical Hedge Fund Assets Under Management

(dollars in billions as of December 31)

Source: Hedge Fund Research

9

Table of Contents

During 2010, hedge funds and other alternative asset managers experienced growth in assets under management. Institutional investors increased their allocations to the hedge fund industry to diversify their holdings and increase the proportion of non-correlated returns in their portfolios. Investment performance among alternative asset managers was generally positive for the year.

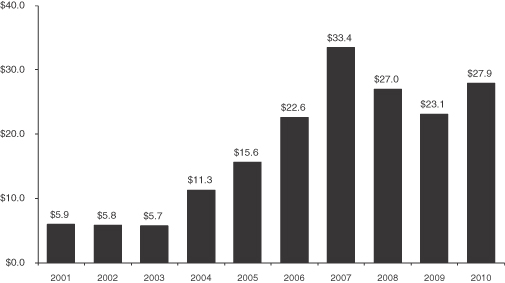

Our Historical Assets Under Management(1)

(dollars in billions as of December 31)

| (1) | Includes investments by us, our partners, employees and certain other related parties. Prior to our IPO, we did not charge management fees or earn incentive income on these investments. Following our IPO, we began charging management fees and earning incentive income on new investments made in our funds by our partners and certain other related parties, including the reinvestment by our partners of the after-tax proceeds from the Offerings. As of December 31, 2010, approximately 9% of our assets under management represented investments by us, our partners and certain other related parties in our funds. As of that date, approximately 35% of these affiliated assets under management are not charged management fees and are not subject to an incentive income calculation. |

Historically, we have achieved or exceeded the historical growth rates in assets under management for hedge funds generally. From December 31, 2001 through December 31, 2010, our compound annual growth rate was approximately 19%, compared to the industry’s compound annual growth rate of 15%.

Competitive Environment

The asset management industry is intensely competitive, and we expect that it will remain so. We face competition in all aspects of our business. Examples include attracting institutional investors and assets under management, pursuing attractive investment opportunities in all of our underlying strategies and in all geographies, and hiring and retaining professionals in all areas of our business. We compete globally for investment opportunities, investor capital and talent. We face competitors that are larger than we are and have greater financial, technical and marketing resources. Certain of these competitors continue to raise capital to pursue investment strategies that may be similar to ours. Some of these competitors may also have access to liquidity sources that are not available to us, which may pose challenges for us with respect to investment opportunities. In addition, some of these competitors may have

10

Table of Contents

higher risk tolerances or make different risk assessments than we do, allowing them to consider a wider variety of investments and establish broader networks of business relationships. Our competitive position depends on our reputation, our investment performance and processes, our ability to continue to offer innovative investment products, the breadth of our infrastructure and our ability to continue to attract and retain qualified employees while managing compensation and other costs. For additional information regarding the competitive risks that we face, see “Item 1A. Risk Factors—Risks Related to Our Business—Competitive pressures in the asset management business could materially adversely affect our business and results of operations.”

Competitive Strengths

Our business was built on certain fundamental elements, which continue to define Och-Ziff today and that we believe are differentiating competitive strengths. As such, we view these elements as important to our ability to retain and attract new assets under management and, over time, increase our market share of new capital flows to the hedge fund industry:

| Ÿ | Alignment of interests. We structure our business to align our firm’s interests with those of the investors in our funds. Investments by our partners and employees comprise a meaningful portion of our total assets under management. Additionally, all of our partners have an ownership interest in the firm and receive distributions which are directly tied to the firm’s profitability. |

| Ÿ | Team-based culture. We evaluate employee contributions and have designed our compensation structure based on a “one-firm” approach, which encourages internal cooperation and the sharing of ideas. We are a global organization and we have fostered a culture that allows us to allocate capital and evaluate investment opportunities on a firm-wide basis, focusing on the best ideas and opportunities available. This collaborative approach emphasizes the success of our firm as a whole. |

| Ÿ | Global presence. Our ability to opportunistically invest worldwide is an important element of diversifying our portfolios and managing risk. We have dedicated and experienced investment professionals operating from our offices globally and have a long history of investing on an international scale. |

| Ÿ | Synergies among investment strategies. Our funds invest across a broad range of asset classes and geographies via our multi-strategy model. Our investment professionals have extensive experience and many are specialized by strategy, industry sector or asset class. This fosters consistent interaction among the investment professionals across our strategies and creates synergies that add to our market insight and ability to identify attractive investment opportunities. |

| Ÿ | Focus on infrastructure. Since our inception we have focused on building a robust infrastructure, with an emphasis on strong financial, operational and compliance-related controls. As a public company, we are required to identify and document key processes and controls, which are subject to independent review. Additionally, we have added a number of independent third party processes to our fund operations which provide continuous verification to our fund investors. |

| Ÿ | Transparency. We believe that our fund investors should be provided with qualitative and quantitative information about our investment process, operational procedures and portfolio exposures which enables them to understand and evaluate our investment performance. We provide our fund investors with comprehensive reporting about each portfolio on a regular basis, and our senior management team and portfolio managers regularly meet with them to address their questions. |

Our Fund Investors

We have always focused on establishing long-term relationships with a global base of institutional investors. Today, we have relationships with many of the largest, most sophisticated investors in the world, which include pension funds, fund-of-funds, foundations and endowments, corporations, private banks and family offices.

11

Table of Contents

Our partners and employees collectively are the single largest investor in our funds, comprising approximately 9% of our total assets under management as of January 1, 2011. No single unaffiliated investor in our funds accounts for more than 4% of our total assets under management as of January 1, 2011, and the top five unaffiliated fund investors accounted for approximately 14%.

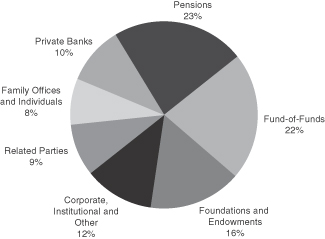

The following chart presents the composition of our fund investor base across all of our funds by the type of investor as of January 1, 2011:

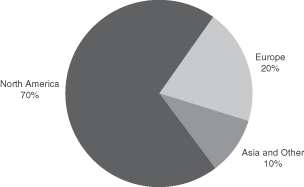

The following chart presents the composition of our fund investor base across all of our funds by region as of January 1, 2011:

12

Table of Contents

Our Structure

Och-Ziff Capital Management Group LLC

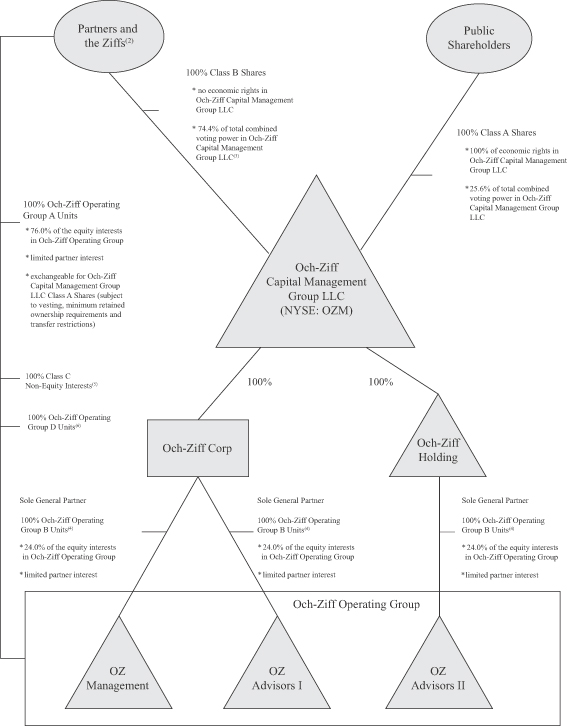

Och-Ziff Capital Management Group LLC is a publicly-traded holding company, and its primary assets are ownership interests in the Och-Ziff Operating Group entities, which are held indirectly through two intermediate holding companies, Och-Ziff Corp and Och-Ziff Holding. We conduct substantially all of our business through the Och-Ziff Operating Group.

Class A Shares

Class A Shares represent Class A limited liability company interests in our Company. The holders of Class A Shares are entitled to one vote per share held of record on all matters submitted to a vote of our shareholders and, as of December 31, 2010, represent 25.6% of our total combined voting power. The holders of Class A Shares are entitled to any distribution declared by our Board of Directors out of funds legally available, subject to any statutory or contractual restrictions on the payment of distributions and to any restrictions on the payment of distributions imposed by the terms of any outstanding preferred shares we may issue in the future. Additional Class A Shares are issuable upon exchange of Och-Ziff Operating Group A Units by our partners and the Ziffs, as described below, and upon vesting of equity awards granted in connection with and after our IPO under our Amended and Restated 2007 Equity Incentive Plan, which we refer to as the “Plan.”

Class B Shares

Class B Shares have no economic rights but entitle the holders of record to one vote per share on all matters submitted to a vote of our shareholders. The Class B Shares are held solely by our partners and provide our partners with a voting interest in Och-Ziff Capital Management Group LLC commensurate with their economic interest in our business. As of December 31, 2010, the Class B Shares represent 74.4% of our total combined voting power. Our partners have granted an irrevocable proxy to vote all of their Class B Shares to the Class B Shareholder Committee, the sole member of which is currently Mr. Och, as it may determine in its sole discretion. This proxy will terminate upon the later of (i) Mr. Och’s withdrawal, death or disability, or (ii) such time as our partners hold less than 40% of our total combined voting power. As a result, Mr. Och is currently able to control all matters requiring the approval of our shareholders. The Ziffs do not hold any of our Class B Shares.

Och-Ziff Operating Group Entities

We conduct substantially all of our business through the Och-Ziff Operating Group. Historically, we have used more than one Och-Ziff Operating Group entity to segregate our operations for business, financial, tax and other reasons. We may increase or decrease the number of our Och-Ziff Operating Group entities and intermediate holding companies based on our views as to the appropriate balance between administrative convenience and business, financial, tax and other considerations.

The Och-Ziff Operating Group currently consists of OZ Management, OZ Advisors I and OZ Advisors II. All of our interests in OZ Management and OZ Advisors I are held through Och-Ziff Corp. All of our interests in OZ Advisors II are held through Och-Ziff Holding. Each intermediate holding company is the sole general partner of the applicable Och-Ziff Operating Group entity and, therefore, generally controls the business and affairs of such entity.

Prior to the Offerings, the interests in the Och-Ziff Operating Group were held by our partners and the Ziffs. In connection with and prior to the Offerings, we completed a reorganization of our business, which we refer to as the “Reorganization.” As part of the Reorganization, interests in the Och-Ziff Operating Group held by our partners and the Ziffs were reclassified as Och-Ziff Operating Group A Units, which we describe below.

We used the net proceeds from the Offerings to acquire a 19.2% interest in the Och-Ziff Operating Group in the form of Och-Ziff Operating Group B Units, which we describe below. The Och-Ziff Operating Group then used the proceeds to acquire from our partners and the Ziffs Och-Ziff Operating Group A Units representing the 19.2%

13

Table of Contents

interest in the Och-Ziff Operating Group, which units were subsequently canceled. The Och-Ziff Operating Group B Units, together with Och-Ziff Operating Group A Units, which we refer to collectively as “Och-Ziff Operating Group Equity Units,” represent all of the equity interests in the Och-Ziff Operating Group.

Och-Ziff Operating Group A Units. As part of the Reorganization, each partner’s and the Ziffs’ interests in an Och-Ziff Operating Group entity was reclassified as a Class A operating group unit, which represents a common equity interest in the respective Och-Ziff Operating Group entity. One Class A operating group unit in each of the Och-Ziff Operating Group entities represents one “Och-Ziff Operating Group A Unit.”

Our partners and the Ziffs continue to own 100% of the Och-Ziff Operating Group A Units, which, as of December 31, 2010, represent a 76.0% ownership interest in the Och-Ziff Operating Group. Och-Ziff Operating Group A Units are exchangeable for our Class A Shares on a one-for-one basis, subject to minimum retained ownership requirements by our partners, transfer restrictions and certain exchange rate adjustments for splits, unit distributions and reclassifications. In addition, Och-Ziff Operating Group A Units granted to our partners in connection with the Reorganization are generally subject to ratable annual vesting through 2012.

Och-Ziff Operating Group B Units. We contributed our proceeds from the Offerings to our intermediate holding companies, which in turn contributed those proceeds to each of the Och-Ziff Operating Group entities in exchange for Class B operating group units in each such entity. One Class B operating group unit in each of the Och-Ziff Operating Group entities represents one “Och-Ziff Operating Group B Unit.” Each intermediate holding company holds a general partner interest and Och-Ziff Operating Group B Units in each Och-Ziff Operating Group entity that it controls. Our intermediate holding companies continue to own 100% of the Och-Ziff Operating Group B Units, which, as of December 31, 2010, represent a 24.0% ownership interest in the Och-Ziff Operating Group. The Och-Ziff Operating Group B Units are economically identical to the Och-Ziff Operating Group A Units held by our partners and the Ziffs and represent common equity interests in our business, but are not exchangeable for Class A Shares and are not subject to vesting, forfeiture or minimum retained ownership requirements.

Och-Ziff Operating Group D Units. Subsequent to our IPO, we issued Class D operating group units to new partners in connection with their admission to the Och-Ziff Operating Group. One Class D operating group unit in each of the Och-Ziff Operating Group entities represents one “Och-Ziff Operating Group D Unit.” The Och-Ziff Operating Group D Units are non-equity, limited partner profits interests that are only entitled to share in residual assets upon liquidation, dissolution or winding up to the extent that there has been a threshold amount of appreciation or gain in the value of Och-Ziff Operating Group A Units subsequent to issuance of the units. The Och-Ziff Operating Group D Units automatically convert into Och-Ziff Operating Group A Units to the extent we determine that they have become economically equivalent to such units. Allocations to these interests are recorded within compensation and benefits in our consolidated statements of operations.

14

Table of Contents

The diagram below depicts our organizational structure as of December 31, 2010(1):

| (1) | This diagram does not give effect to 14,079,612 Class A restricted share units, or “RSUs”, that were outstanding as of December 31, 2010, and which were granted to our partners, managing directors, other employees and the independent members of our Board of Directors. |

15

Table of Contents

| (2) | Mr. Och, the other partners and the Ziffs hold Och-Ziff Operating Group A Units representing 38.9%, 30.5% and 6.6%, respectively, of the equity in the Och-Ziff Operating Group, excluding the 1,181,601 Class A Shares owned directly by Mr. Och. Our partners also hold Class C Non-Equity Interests and Och-Ziff Operating Group D Units as described below in notes (5) and (6). |

| (3) | Mr. Och holds Class B Shares representing 41.6% of the voting power of our Company and the other partners hold Class B Shares representing 32.7% of the voting power of our Company. Our partners have granted an irrevocable proxy to vote all of their Class B Shares to the Class B Shareholder Committee, the sole member of which is currently Mr. Och, as it may determine in its sole discretion. In addition, Mr. Och controls an additional 0.3% of the combined voting power through his direct ownership of 1,181,601 Class A Shares. The Ziffs do not hold any of our Class B Shares and, therefore, will not have any voting power in our Company except to the extent they exchange their Och-Ziff Operating Group A Units for Class A Shares and retain such Class A Shares. |

| (4) | The Och-Ziff Operating Group Equity Units have no preference or priority over other securities of the Och-Ziff Operating Group (other than the Och-Ziff Operating Group D Units to the extent described above) and, upon liquidation, dissolution or winding up, will be entitled to any assets remaining after payment of all debts and liabilities of the Och-Ziff Operating Group. |

| (5) | Class C Non-Equity Interests represent non-equity interests in the Och-Ziff Operating Group entities. No holder of Class C Non-Equity Interests will have any right to receive distributions on such interests. Our partners hold all of the Class C Non-Equity Interests, which may be used for discretionary income allocations, if any, in the future. |

| (6) | The Och-Ziff Operating Group D Units, which represent an approximately 1.3% profits interest in the Och-Ziff Operating Group, are not considered equity interests for U.S. GAAP purposes. |

Our Fund Structure

Our funds are typically organized using a “master-feeder” structure. This structure is commonly used in the hedge fund industry and calls for the establishment of one or more U.S. or non-U.S. “feeder” funds, which are managed by us but are separate legal entities and have different structures and operations designed for distinct groups of investors. Fund investors, including our partners, managing directors and other employees, invest directly into our feeder funds. These feeder funds hold direct or indirect interests in a “master” fund that, together with its subsidiaries, is the primary investment vehicle for its feeder funds. Our funds are managed by the Och-Ziff Operating Group. Any of our existing or future funds may invest using any alternative structure that is deemed useful or appropriate.

Employees

As of December 31, 2010, our worldwide headcount was 405 (including 65 in the United Kingdom and 42 in Asia), with 130 investment professionals (including 38 in the United Kingdom and 24 in Asia). As of such date, we had 19 partners and 57 managing directors.

Regulatory Matters

Our business is subject to extensive regulation, including periodic examinations and potential regulatory investigations, by governmental and self-regulatory organizations in the jurisdictions in which we operate around the world. As an investment adviser registered under the Investment Advisers Act of 1940, as amended, which we refer to as the “Advisers Act,” and a company subject to the registration and reporting provisions of the Exchange Act, we are subject to regulation and oversight by the SEC. As a company with a class of securities listed on the NYSE, we are subject to the rules and regulations of the NYSE. In addition, we are subject to regulation by the Department of Labor under the U.S. Employee Retirement Income Security Act of 1974, which we refer to as “ERISA.” Our European and Asian operations, and our investment activities around the globe, are subject to a variety of regulatory regimes that vary country by country, including the U.K. Financial Services Authority, the Securities and Futures

16

Table of Contents

Commission in Hong Kong and the Securities and Exchange Board of India. Currently, governmental authorities in the United States and in the other countries in which we operate have proposed additional disclosure requirements and regulation of hedge funds and other alternative asset managers. See “Item 1A. Risk Factors—Risks Related to Our Business—Extensive regulation of our business affects our activities and creates the potential for significant liabilities and penalties. Our reputation, business and operations could be materially affected by regulatory issues” and “Item 1A. Risk Factors—Risks Relating to Our Business—Increased regulatory focus could result in additional burdens on our business.”

Global Compliance Program

We have implemented a global compliance program to address the legal and regulatory requirements that apply to our company-wide operations. We registered as an investment adviser with the SEC in 1999. Since that time our affiliated companies have registered with the U.K. Financial Services Authority, the Securities and Futures Commission in Hong Kong and the Securities and Exchange Board of India. We have structured our global compliance program to address the requirements of each of these regulators as well as the requirements necessary to support our global securities trading operations. Our compliance program includes comprehensive policies and supervisory procedures that have been implemented to monitor compliance with these requirements. All employees attend mandatory compliance training to remain informed of our policies related to matters such as the handling of material non-public information and employee securities trading. In addition to a robust internal compliance framework, we have strong relationships with a global network of local attorneys specializing in compliance matters to help us quickly identify and address compliance issues as they arise.

Our Executive Officers

Set forth below is certain information regarding our executive officers as of the date of this filing.

Daniel S. Och, 50, is the founder of the Och-Ziff Capital Management Group. Mr. Och serves as Och-Ziff’s Chief Executive Officer and Chairman of the Board of Directors. Mr. Och is also chairman of the Partner Management Committee. Prior to founding Och-Ziff in 1994, Mr. Och spent eleven years at Goldman, Sachs & Co. He began his career in the Risk Arbitrage Department and future responsibilities included Head of Proprietary Trading in the Equities Division and Co-Head of U.S. Equities Trading. Mr. Och holds a B.S. in Finance from the Wharton School of the University of Pennsylvania.

Joel M. Frank, 55, is Chief Financial Officer and Senior Chief Operating Officer of Och-Ziff and a member of the Board of Directors of Och-Ziff. Mr. Frank is also a member of the Partner Management Committee. Prior to joining Och-Ziff at its inception in 1994, Mr. Frank was with Rho Management Company, Inc. as its Chief Financial Officer from 1988 to 1994. He was previously with Manufacturers Hanover Investment Corporation from 1983 to 1988 as Vice President and Chief Financial Officer and with Manufacturers Hanover Trust from 1977 to 1983. Mr. Frank holds a B.B.A. in Accounting from Hofstra University and an M.B.A. in Finance from Fordham University. He is a C.P.A. certified in the State of New York.

David Windreich, 53, is Head of U.S. Investing for Och-Ziff and is a member of Och-Ziff’s Board of Directors and the Partner Management Committee. Prior to joining Och-Ziff at its inception in 1994, Mr. Windreich was a Vice President in the Equity Derivatives Department of Goldman Sachs & Co. He became a Vice President in 1988 and began his career at Goldman Sachs in 1983. Mr. Windreich holds both a B.A. in Economics and an M.B.A. in Finance from the University of California, Los Angeles.

Michael L. Cohen, 39, is Head of European Investing for Och-Ziff, is a member of the Partner Management Committee and manages Och-Ziff’s London office. Prior to joining Och-Ziff in 1997, Mr. Cohen was with Franklin Mutual Advisory as an Equity Research Analyst and with CS First Boston as an Investment Banking Analyst specializing in the financial services sector. Mr. Cohen holds a B.A. in Economics from Bowdoin College.

17

Table of Contents

Zoltan Varga, 37, is Head of Asian Investing for Och-Ziff, is a member of Och Ziff’s Partner Management Committee and manages Och-Ziff’s Hong Kong office. Prior to joining Och-Ziff in 1998, Mr. Varga was with Goldman, Sachs & Co. as an Investment Banking Analyst in the Mergers and Acquisitions Department. Mr. Varga holds a B.A. in Economics from DePauw University.

Harold A. Kelly, 47, is Head of Global Convertible and Derivative Arbitrage for Och-Ziff and is a member of the Partner Management Committee. Prior to joining Och-Ziff in 1995, Mr. Kelly spent seven years trading various financial instruments and held positions at Cargill Financial Services Corporation, Eagle Capital Management, Merrill Lynch International, Ltd. and Buchanan Partners, Ltd. Mr. Kelly holds a B.B.A. in Finance and also holds an M.B.A. and a Ph.D. in Business Administration from The University of Georgia.

Jeffrey C. Blockinger, 41, is Chief Legal Officer, Chief Compliance Officer and Secretary of Och-Ziff. Prior to joining Och-Ziff in April 2005, Mr. Blockinger was with Schulte, Roth and Zabel LLP from April 2003 to April 2005, Crowell & Moring LLP from January 2002 to April 2003 and Morgan, Lewis & Bockius LLP from September 1996 to January 2002. Mr. Blockinger holds a B.A. in Political Science from Purdue University and a J.D. from the University of Miami School of Law. Mr. Blockinger is admitted to the bars of New York and the District of Columbia.

| Item 1A. | Risk Factors |

Risks Related to Our Business

In the course of conducting our business operations, we are exposed to a variety of risks that are inherent to or otherwise impact the alternative asset management business. Any of the risk factors we describe below have affected or could materially adversely affect our business, results of operations, financial condition and liquidity. The market price of our Class A Shares could decline, possibly significantly or permanently, if one or more of these risks and uncertainties occur. Certain statements in “Risk Factors” are forward-looking statements. See “Forward-Looking Statements.”

Our business has been and may be adversely affected by global economic and market conditions, which can change rapidly and which we cannot predict or control. A recurrence of the adverse conditions that were experienced during the financial crisis in 2008 to 2009 would adversely affect our business and financial condition.

As a global alternative asset manager, we seek to generate consistent, positive, risk-adjusted returns for the investors in our funds. Our ability to do this has been and may be materially impacted by conditions in the global financial markets and economic conditions generally. The financial crisis that began in the second half of 2008 resulted in significant global market turbulence, a lack of liquidity and substantial declines in the values of most asset classes worldwide. While these conditions have generally stabilized and improved since the first quarter of 2009, the global financial markets and economies have not fully recovered, adverse conditions resulting from the crisis continue to persist and certain businesses continue to be negatively impacted by events both leading to and resulting from the crisis. There continues to be broad concern about the trajectory of the global economy, including geopolitical uncertainties, European sovereign debt issues, regulatory uncertainty with respect to the operation of, and certain participants, in the global financial markets, and continued levels of risk averseness within institutional and other investment communities. Conditions affecting global economic and financial conditions are inherently outside of our control, can change rapidly and cannot be predicted, but can adversely impact in a material way our funds’ investment performance and ability to retain and attract new assets under management, which in turn may slow or reduce the long-term growth of our business and adversely impact the price of our Class A Shares. If the prevailing economic, market and business conditions remain uncertain or worsen, we could experience continuing or increased adverse effects on our business, financial condition or results of operations.

The financial crisis, together with widely publicized scandals involving certain financial institutions, had an adverse impact on the hedge fund industry. The industry experienced significant losses in assets under management as a result of these events and, while the industry experienced inflows during 2010, it may not be able to maintain these gains or achieve pre-crisis growth rates, even if market and economic conditions continue to improve. Our business may be adversely impacted by negative trends impacting the hedge fund industry as a whole, even if our business

18

Table of Contents

operations and infrastructure and fund performance can be positively differentiated from other hedge fund industry participants.

Difficult global market, economic or geopolitical conditions may materially adversely affect our business and cause significant volatility in equity and debt prices, interest rates, exchange rates, commodity prices and credit spreads. These factors can materially adversely affect our business in many ways, including by reducing the value or performance of the investments made by our funds and by reducing the ability of our funds to raise or deploy capital, each of which could materially reduce our revenues and cash flows and materially adversely affect our financial condition.

The success and growth of our business are highly dependent upon conditions in the global financial markets and economic and geopolitical conditions throughout the world that are outside of our control and difficult to predict. Factors such as equity prices, equity market volatility, asset or market correlations, interest rates, counterparty risks, availability of credit, inflation rates, economic uncertainty, changes in laws or regulation (including laws relating to the financial markets generally or the taxation or regulation of the hedge fund industry), trade barriers, commodity prices, currency exchange rates and controls, and national and international political circumstances (including governmental instability, wars, terrorist acts or security operations) can have a material impact on the value of our funds’ portfolio investments or our general ability to conduct business. Difficult market, economic and geopolitical conditions can negatively impact those valuations and our business overall, which in turn would reduce or even eliminate our revenues and profitability.

Unpredictable or unstable market, economic or geopolitical conditions have resulted and may in the future result in reduced opportunities to find suitable risk-adjusted investments to deploy capital and make it more difficult to exit and realize value from our existing investments, which could materially adversely affect our ability to raise new funds and increase our assets under management. In addition, during such periods, financing and merger and acquisition activity may be greatly reduced, making it harder and more competitive for asset managers to find suitable investment opportunities and to obtain funding for such opportunities. If we fail to react appropriately to difficult market, economic and geopolitical conditions, our funds could incur material losses.

An investment in our Class A Shares is not an alternative to an investment in any of our funds, and the returns of our funds should not be considered as indicative of any returns expected on our Class A Shares, although poor investment performance of or lack of capital flows into the funds we manage could have a materially adverse impact on our revenues and, therefore, the returns on our Class A Shares.

The returns on our Class A Shares are not directly linked to the performance of the funds we manage or the manager of those funds. Even if our funds experience positive performance and our assets under management increase, holders of our Class A Shares may not experience a corresponding positive return on their Class A Shares.

However, poor performance of the funds we manage will cause a decline in our revenues from such funds, and will therefore have a negative effect on our performance and the returns on our Class A Shares. Our funds seek to generate consistent, positive, risk-adjusted returns across market cycles, with low volatility and low correlation to the equity markets. If we fail to meet the expectations of our fund investors or otherwise experience poor investment performance, whether due to difficult economic and financial conditions or otherwise, our ability to retain existing assets under management and attract new investors and capital flows could be materially adversely affected. In turn, the management fees and incentive income that we would earn would be reduced and our results would suffer, thus negatively impacting the price of our Class A Shares. Furthermore, even if the investment performance of our funds is positive, our business, results of operations and the price of our Class A Shares could be materially adversely affected if we are unable to attract and retain additional assets under management consistent with our past experience, industry trends or investor and market expectations. The competition for third-party capital is extremely intense and involves increased regulatory scrutiny and disclosures to existing and potential fund investors. If, for any reason, we are unable to attract new capital flows into our funds in amounts that are perceived as sufficient or consistent with our history and industry trends, our revenues will not grow and could decrease and our competitive position could be materially adversely impaired, which could result in a decrease in the price of our Class A Shares.

19

Table of Contents

Investors in our funds have the right to redeem their investments in our funds on a regular basis and could redeem a significant amount of assets under management during any given quarterly period, which would result in significantly decreased revenues.

Subject to any specific redemption provisions applicable to a fund, investors may generally redeem their investments in our funds on an annual or quarterly basis following the expiration of a specified period of time (typically between one and three years), although certain investors generally may redeem capital during such specified period upon the payment of a redemption fee and upon giving proper notice. In a declining market, the pace of redemptions and consequent reduction in our assets under management potentially could accelerate. Furthermore, investors in our funds may also invest in funds managed by other alternative asset managers that have restricted or suspended redemptions or may in the future do so. Such investors may redeem capital from our funds, even if our performance is superior to such other alternative asset managers’ performance if they are restricted or prevented from redeeming capital from those other managers.

The decrease in revenues that would result from significant redemptions in our funds could have a material adverse effect on our results of operations, cash flows and business. In 2009, due to factors related to the financial crisis, investors redeemed approximately $9.9 billion from our funds. If economic and market conditions remain uncertain or worsen, we may once again experience significant redemptions.

Our business and financial condition may be materially adversely impacted by the highly variable nature of our revenues, results of operations and cash flows. In a typical year, a substantial portion of our incentive income and all of our annual discretionary bonus expense is determined and recorded in the fourth quarter each year, which means that our interim results are not expected to be indicative of our results for a full year, causing increased volatility in the price of our Class A Shares.

Our revenues are influenced by the combination of the amount of assets under management and the investment performance of our funds. Asset flows, whether inflows or outflows, can be highly variable from month-to-month and quarter-to-quarter. Furthermore, our funds’ investment performance, which affects the amount of assets under management, can be volatile due to, among other things, general market and economic conditions. Accordingly, our revenues, results of operations and cash flows are all highly variable. This variability is exacerbated during the fourth quarter of each fiscal year, primarily due to the fact that a substantial portion of our revenues historically has been and we expect will continue to be derived from incentive income from our funds. Such incentive income is contingent on the investment performance of the funds’ as of the relevant measurement period, which generally is as of the end of each calendar year; however, as of December 31, 2010 with respect to 13% of assets under management, the measurement period can be three years or longer depending on how the assets are invested. A portion of these assets under management earn incentive income at the end of a three-year measurement period, which may occur on dates other than December 31. Moreover, in a typical year, we determine the amount of our annual discretionary cash bonus during the fourth quarter as we determine our incentive income for that year. Because this bonus is variable and discretionary, it can exacerbate the volatility of our results. We may also experience fluctuations in our results from quarter to quarter due to a number of other factors, including changes in management fees resulting from changes in the values of our funds’ investments, other changes in the amount of assets under management, changes in our operating expenses, unexpected business developments and initiatives and, as discussed above, general economic and market conditions. Such variability and unpredictability may lead to volatility or declines in the price of our Class A Shares and cause our results for a particular period not to be indicative of our performance in a future period or particularly meaningful as a basis of comparison against results for a prior period.

The amount of incentive income that may be generated by our funds is uncertain until it is actually crystallized. We generally do not record incentive income in our interim financial statements other than incentive income earned (i) as a result of investor redemptions during the interim period, (ii) at the end of the three-year investment period for assets under management subject to a three-year measurement period, (iii) upon realization or sale of certain other assets subject to longer-term measurement periods, or (iv) from tax distributions relating to assets with longer term measurement periods. Furthermore, all of our assets under management that have longer-term measurement periods are subject to hurdle rates

20

Table of Contents

which, if not exceeded, could reduce the amount of incentive income that we earn. As a result of these and other factors, our interim results may not be indicative of historical performance or any results that may be expected for a full year.

In addition, as of January 1, 2010, all of our hedge funds have “perpetual high-water marks.” This means that if a fund investor experiences losses in a given year, we will not be able to earn incentive income with respect to such investor’s investment unless and until our investment performance surpasses the perpetual high-water mark. The incentive income we earn is therefore dependent on the net asset value of each fund investor’s investment in the fund. In addition, incentive income distributions from our real estate and certain other funds is subject to clawback obligations generally measured as of the end of the life of a fund, which means that we are required to repay amounts to a fund to the extent we have received excess incentive income distributions during the life of the fund relative to the aggregate performance of the fund. We cannot predict when realization events will occur or whether, upon occurrence, these investments will be profitable.

As a result of quarterly fluctuations in, and the related unpredictability of, our revenues and profits, the price of our Class A Shares can be significantly volatile.

Competitive pressures in the asset management business could materially adversely affect our business and results of operations.

The asset management business remains intensely competitive, with competition based on a variety of factors, including investment performance, the quality of service and level of desired information provided to fund investors, brand recognition and business reputation. We compete for fund investors, highly qualified talent, including investment professionals, and for investment opportunities with a number of hedge funds, private equity firms, specialized funds, traditional asset managers, commercial banks, investment banks and other financial institutions. A number of factors create competitive risks for us:

| Ÿ | We compete in an international arena and, to remain competitive, we may need to further expand our business into new geographic regions or new business areas where our competitors may have a more established presence or greater experience and expertise; |

| Ÿ | A number of our competitors have greater financial, technical, marketing and other resources and more personnel than we do; |

| Ÿ | Several of our competitors have raised and continue to raise significant amounts of capital, and many of them have or may pursue investment objectives that are similar to ours, which would create additional competition for investment opportunities and may reduce the size and duration of pricing inefficiencies that many alternative investment strategies seek to exploit; |

| Ÿ | Some of our competitors may also have access to funding or other liquidity sources that are not available to us, which may create competitive disadvantages for us with respect to investment opportunities; |

| Ÿ | Some of our competitors may have higher risk tolerances or different risk assessments which could allow them to consider a wider variety of investments and to bid more aggressively than us for investments that we may want to make; and |

| Ÿ | Other industry participants will from time to time seek to recruit our partners, investment professionals and other professional talent away from us. |

We may lose investors in the future if we do not match or provide more attractive investment fees, structures and terms than those offered by competitors. However, we may experience decreased revenues if we match or provide more attractive investment fees, structures and terms offered by competitors. In addition, changes in the global capital markets could diminish the attractiveness of our funds relative to investments in other investment products. This competitive pressure could materially adversely affect our ability to make successful investments and limit our ability to raise future successful funds, either of which would materially adversely impact our business, revenues, results of operations and cash flows.

21

Table of Contents