Attached files

| file | filename |

|---|---|

| 8-K - 8-K - INDEPENDENT BANK CORP | indb-20210505.htm |

2021 D.A. Davidson 23rd Annual Financial Institutions Virtual Conference May 5 Chris Oddleifson - Chief Executive Officer Rob Cozzone - Executive Vice President and Chief Operating Officer Mark Ruggiero - Chief Financial Officer and Chief Accounting Officer

(2) Who We Are • Independent Bank Corp. (Nasdaq: INDB) ◦ Main Banking Sub: Rockland Trust •Market Cap: $2.7B (as of May 3, 2021) *Excludes impact of pending EBSB merger Loans: $9.2B Deposits: $11.6B Wealth Mgmt: AUA $5.2B Market: Eastern Massachusetts 99 Branches*

(3) Key Messages - Core Franchise • Extensive history of strong financial performance • Demonstrated resiliency in prior crises • Expanding footprint in growth markets • Healthy loan and core deposit originations • Diversified fee income business lines • Strong capital levels • Strong operating efficiency • Proven integrator of acquired banks • Tangible book value steadily growing* • Disciplined risk management culture *See appendix A for reconciliation

(4) Recent Accomplishments • East Boston Savings Bank (assets $6.5B) • Strong new business generation despite pandemic • Solid growth in business and consumer households • Growing presence in Worcester County • Growth initiatives – online account opening, credit card launch, de novo branches, expanded digital offerings, enhanced mortgage capabilities, senior talent adds • Seven consecutive years of record operating earnings through 2019** **See appendix B for reconciliation

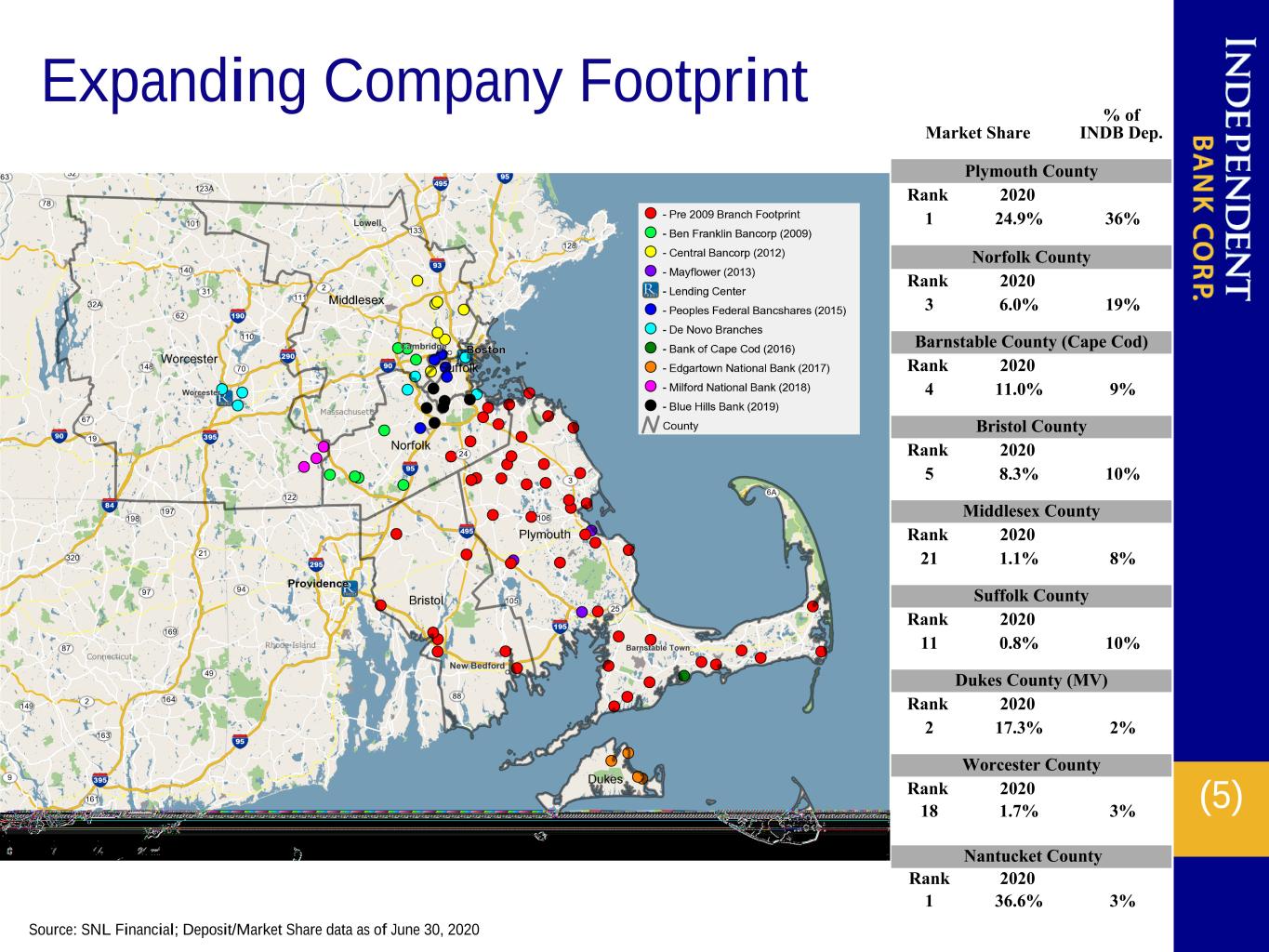

(5) Source: SNL Financial; Deposit/Market Share data as of June 30, 2020 Expanding Company Footprint Market Share % of INDB Dep. Plymouth County Rank 2020 1 24.9% 36% Norfolk County Rank 2020 3 6.0% 19% Barnstable County (Cape Cod) Rank 2020 4 11.0% 9% Bristol County Rank 2020 5 8.3% 10% Middlesex County Rank 2020 21 1.1% 8% Suffolk County Rank 2020 11 0.8% 10% Dukes County (MV) Rank 2020 2 17.3% 2% Worcester County Rank 2020 18 1.7% 3% Nantucket County Rank 2020 1 36.6% 3%

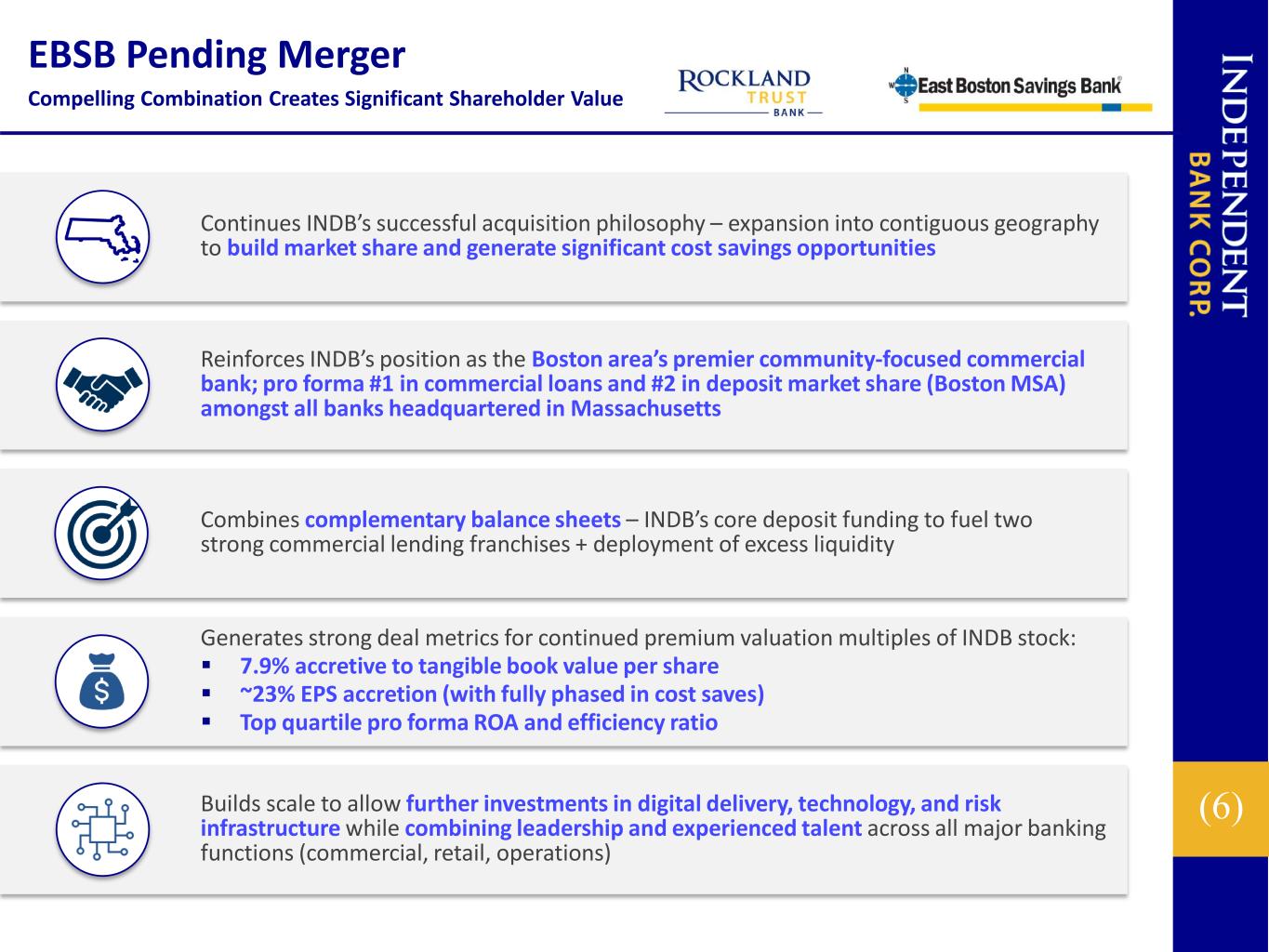

(6) EBSB Pending Merger Compelling Combination Creates Significant Shareholder Value Reinforces INDB’s position as the Boston area’s premier community-focused commercial bank; pro forma #1 in commercial loans and #2 in deposit market share (Boston MSA) amongst all banks headquartered in Massachusetts Generates strong deal metrics for continued premium valuation multiples of INDB stock: 7.9% accretive to tangible book value per share ~23% EPS accretion (with fully phased in cost saves) Top quartile pro forma ROA and efficiency ratio Builds scale to allow further investments in digital delivery, technology, and risk infrastructure while combining leadership and experienced talent across all major banking functions (commercial, retail, operations) Combines complementary balance sheets – INDB’s core deposit funding to fuel two strong commercial lending franchises + deployment of excess liquidity Continues INDB’s successful acquisition philosophy – expansion into contiguous geography to build market share and generate significant cost savings opportunities

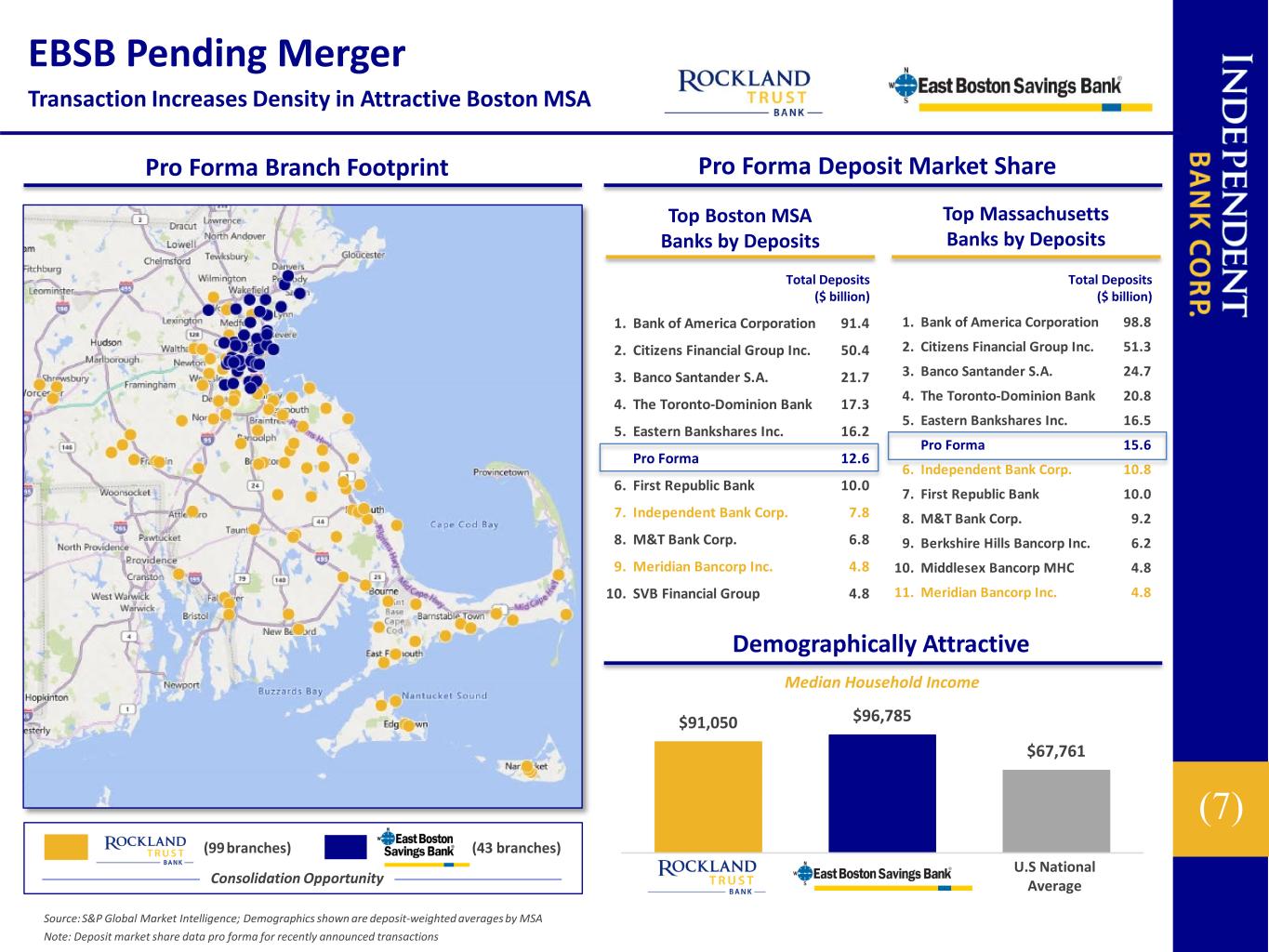

(7) 1. Bank of America Corporation 91.4 2. Citizens Financial Group Inc. 50.4 3. Banco Santander S.A. 21.7 4. The Toronto-Dominion Bank 17.3 5. Eastern Bankshares Inc. 16.2 Pro Forma 12.6 6. First Republic Bank 10.0 7. Independent Bank Corp. 7.8 8. M&T Bank Corp. 6.8 9. Meridian Bancorp Inc. 4.8 10. SVB Financial Group 4.8 $91,050 $96,785 $67,761 INDB EBSB U.S. National Average Source:S&P Global Market Intelligence; Demographics shown are deposit-weighted averages by MSA Note: Deposit market share data pro forma for recently announced transactions (99 branches) (43 branches) Pro Forma Branch Footprint Top Boston MSA Banks by Deposits Pro Forma Deposit Market Share Top Massachusetts Banks by Deposits Demographically Attractive Median Household Income 1. Bank of America Corporation 98.8 2. Citizens Financial Group Inc. 51.3 3. Banco Santander S.A. 24.7 4. The Toronto-Dominion Bank 20.8 5. Eastern Bankshares Inc. 16.5 Pro Forma 15.6 6. Independent Bank Corp. 10.8 7. First Republic Bank 10.0 8. M&T Bank Corp. 9.2 9. Berkshire Hills Bancorp Inc. 6.2 10. Middlesex Bancorp MHC 4.8 11. Meridian Bancorp Inc. 4.8 U.S National Average Total Deposits ($ billion) Total Deposits ($ billion) Consolidation Opportunity EBSB Pending Merger Transaction Increases Density in Attractive Boston MSA

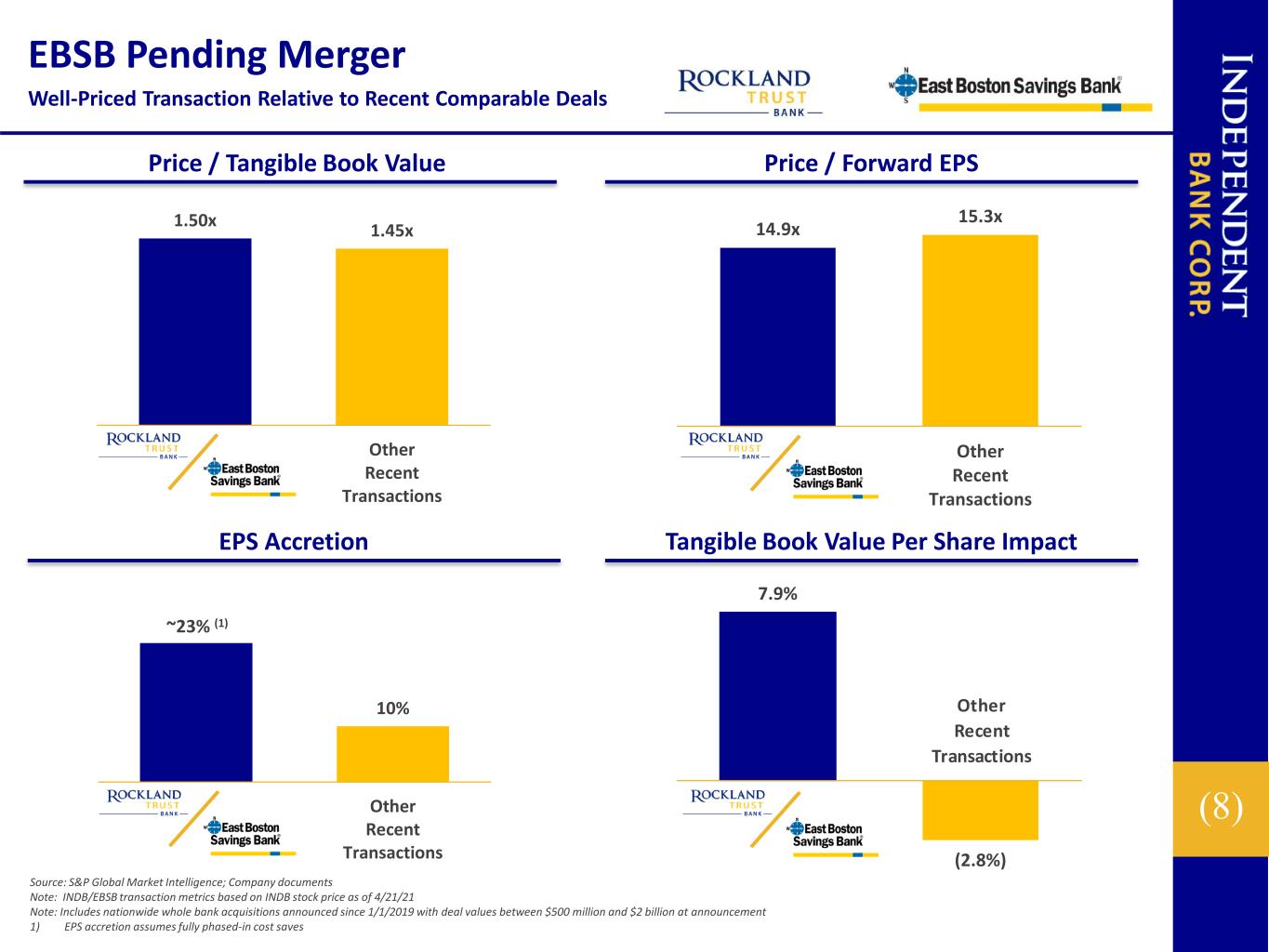

(8) 1.50x 1.45x Other Recent Transactions 25.0% 10% Other Recent Transactions Source: S&P Global Market Intelligence; Company documents Note: INDB/EBSB transaction metrics based on INDB stock price as of 4/21/21 Note: Includes nationwide whole bank acquisitions announced since 1/1/2019 with deal values between $500 million and $2 billion at announcement 1) EPS accretion assumes fully phased-in cost saves Price / Tangible Book Value Price / Forward EPS EPS Accretion Tangible Book Value Per Share Impact 14.9x 15.3x Other Recent Transactions 7.9% (2.8%) Other Recent Transactions ~23% (1) EBSB Pending Merger Well-Priced Transaction Relative to Recent Comparable Deals

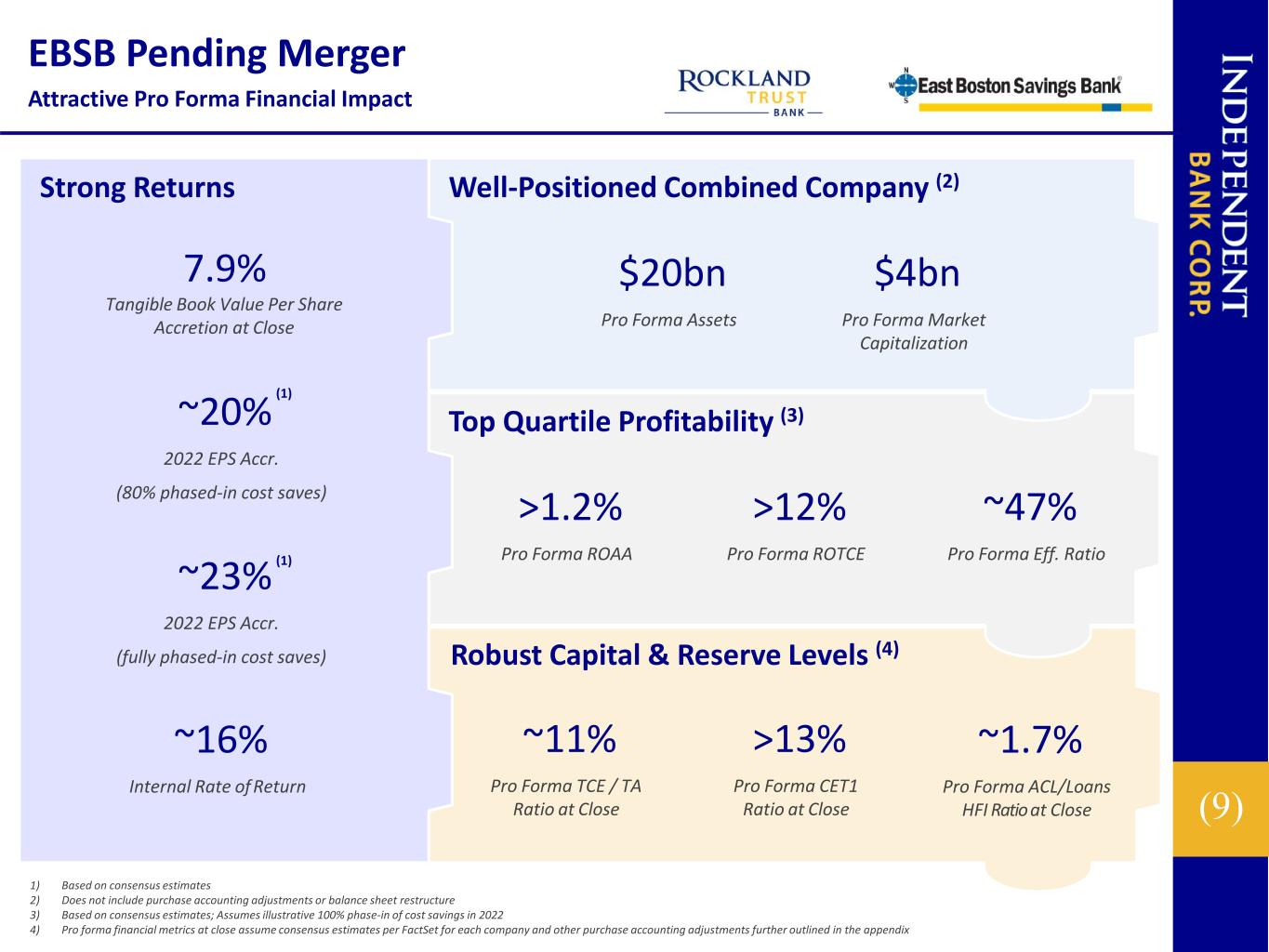

(9) Robust Capital & Reserve Levels (4) >13% Pro Forma CET1 Ratio at Close ~11% Pro Forma TCE / TA Ratio at Close ~1.7% Pro Forma ACL/Loans HFI Ratio at Close 1) Based on consensus estimates 2) Does not include purchase accounting adjustments or balance sheet restructure 3) Based on consensus estimates; Assumes illustrative 100% phase-in of cost savings in 2022 4) Pro forma financial metrics at close assume consensus estimates per FactSet for each company and other purchase accounting adjustments further outlined in the appendix $20bn Pro Forma Assets $4bn Pro Forma Market Capitalization 7.9% ~16% Internal Rate of Return Tangible Book Value Per Share Accretion at Close ~20% 2022 EPS Accr. (80% phased-in cost saves) ~23% 2022 EPS Accr. (fully phased-in cost saves) (1) (1) >1.2% Pro Forma ROAA >12% Pro Forma ROTCE ~47% Pro Forma Eff. Ratio Top Quartile Profitability (3) Well-Positioned Combined Company (2)Strong Returns EBSB Pending Merger Attractive Pro Forma Financial Impact

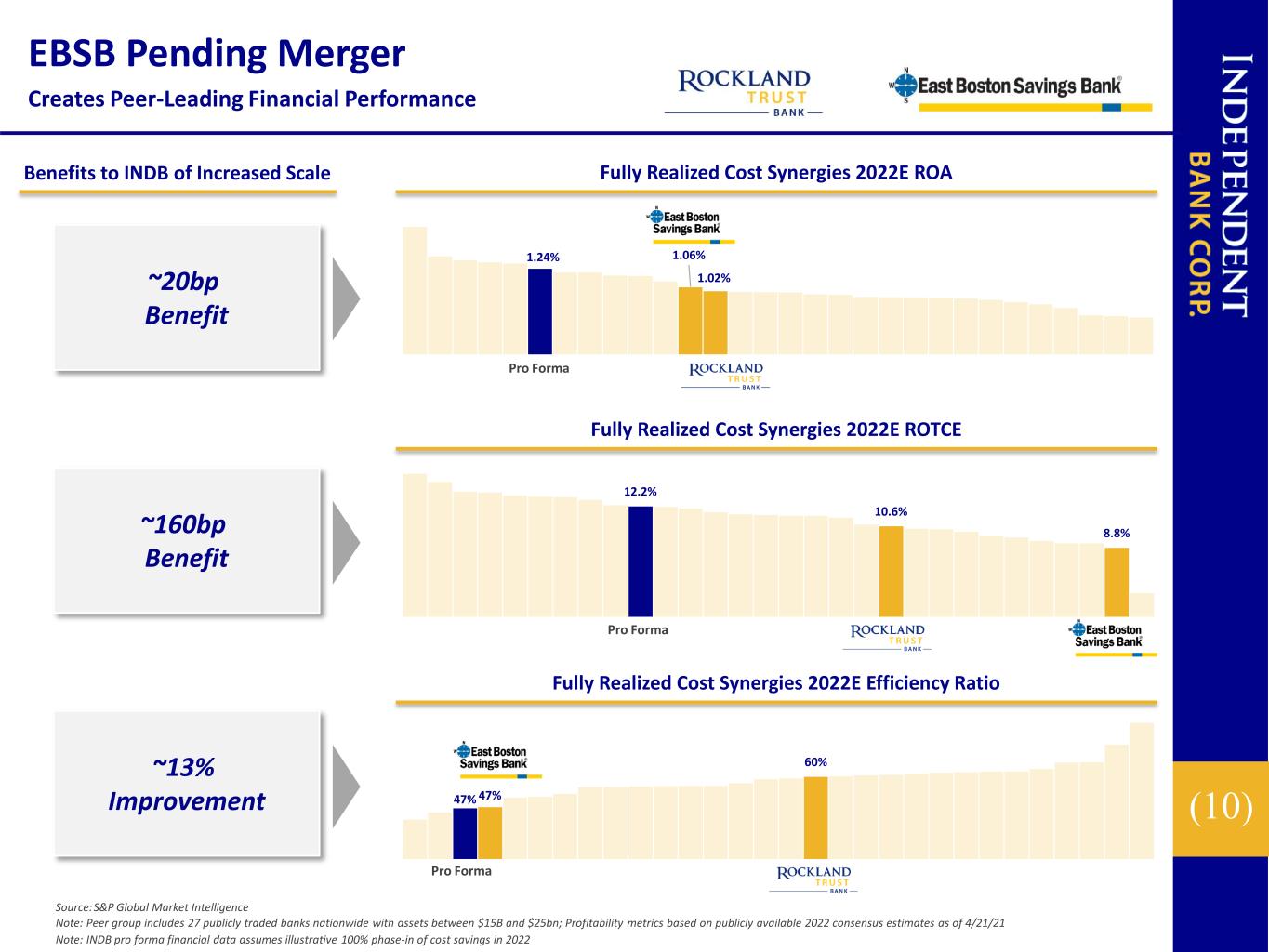

(10) Source:S&P Global Market Intelligence Note: Peer group includes 27 publicly traded banks nationwide with assets between $15B and $25bn; Profitability metrics based on publicly available 2022 consensus estimates as of 4/21/21 Note: INDB pro forma financial data assumes illustrative 100% phase-in of cost savings in 2022 Benefits to INDB of Increased Scale Fully Realized Cost Synergies 2022E ROA Fully Realized Cost Synergies 2022E ROTCE Fully Realized Cost Synergies 2022E Efficiency Ratio ~20bp Benefit ~160bp Benefit ~13% Improvement 1.24% 1.06% 1.02% Pro Forma 12.2% 10.6% 8.8% Pro Forma 47% 47% 60% Pro Forma EBSB Pending Merger Creates Peer-Leading Financial Performance

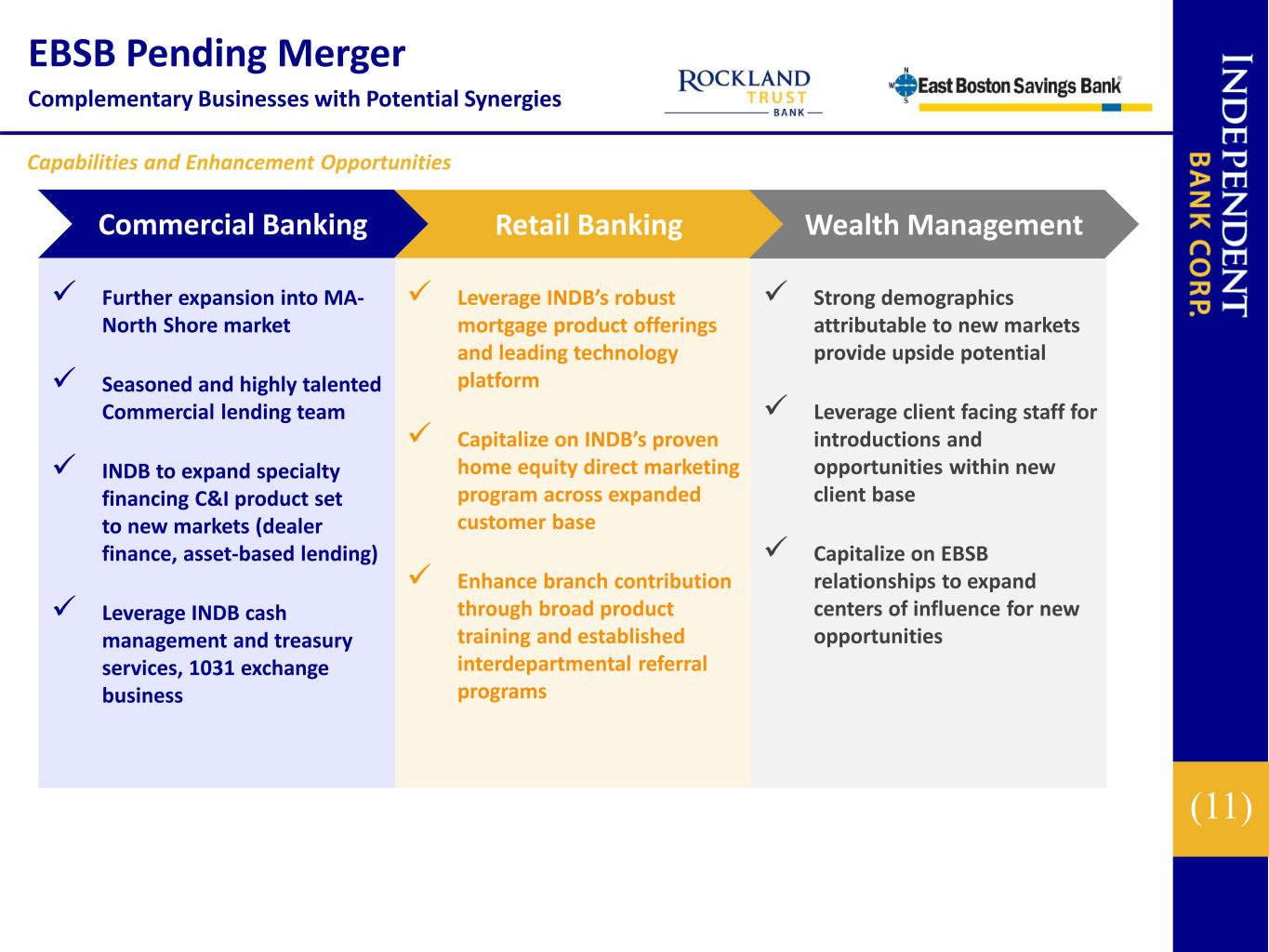

(11) Retail BankingCommercial Banking Strong demographics attributable to new markets provide upside potential Leverage client facing staff for introductions and opportunities within new client base Capitalize on EBSB relationships to expand centers of influence for new opportunities Leverage INDB’s robust mortgage product offerings and leading technology platform Capitalize on INDB’s proven home equity direct marketing program across expanded customer base Enhance branch contribution through broad product training and established interdepartmental referral programs Further expansion into MA- North Shore market Seasoned and highly talented Commercial lending team INDB to expand specialty financing C&I product set to new markets (dealer finance, asset-based lending) Leverage INDB cash management and treasury services, 1031 exchange business Wealth Management Capabilities and Enhancement Opportunities EBSB Pending Merger Complementary Businesses with Potential Synergies

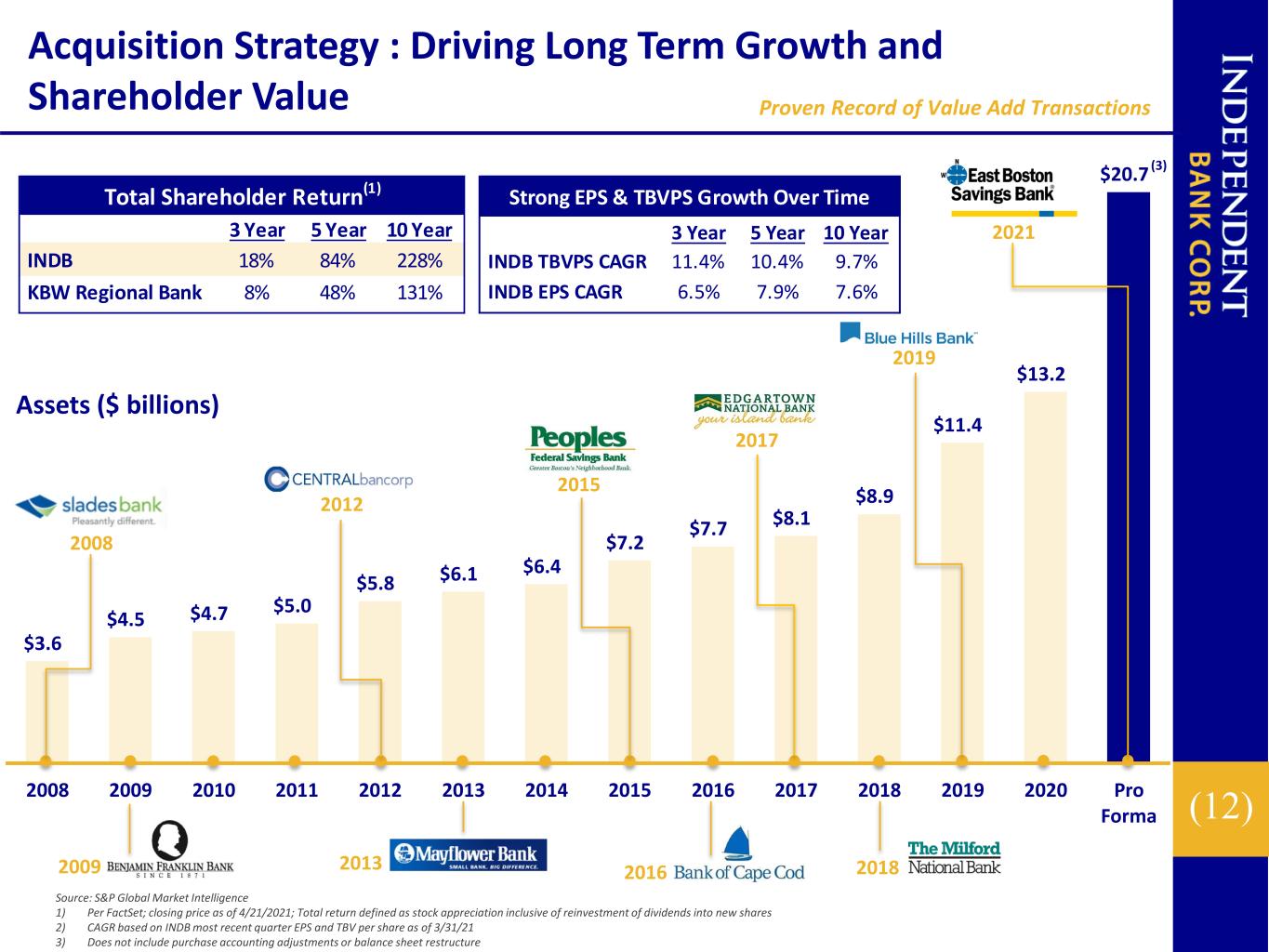

(12) Total Shareholder Return(1) 3 Year 5 Year 10 Year INDB 18% 84% 228% KBW Regional Bank 8% 48% 131% 20182013 Source: S&P Global Market Intelligence 1) Per FactSet; closing price as of 4/21/2021; Total return defined as stock appreciation inclusive of reinvestment of dividends into new shares 2) CAGR based on INDB most recent quarter EPS and TBV per share as of 3/31/21 3) Does not include purchase accounting adjustments or balance sheet restructure Proven Record of Value Add Transactions Assets ($ billions) 2017 2015 2012 2008 2019 2021 20162009 (3) Strong EPS & TBVPS Growth Over Time 3 Year 5 Year 10 Year INDB TBVPS CAGR 11.4% 10.4% 9.7% INDB EPS CAGR 6.5% 7.9% 7.6% (2) $3.6 $4.5 $4.7 $5.0 $5.8 $6.1 $6.4 $7.2 $7.7 $8.1 $8.9 $11.4 $13.2 $20.7 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Pro Forma Acquisition Strategy : Driving Long Term Growth and Shareholder Value

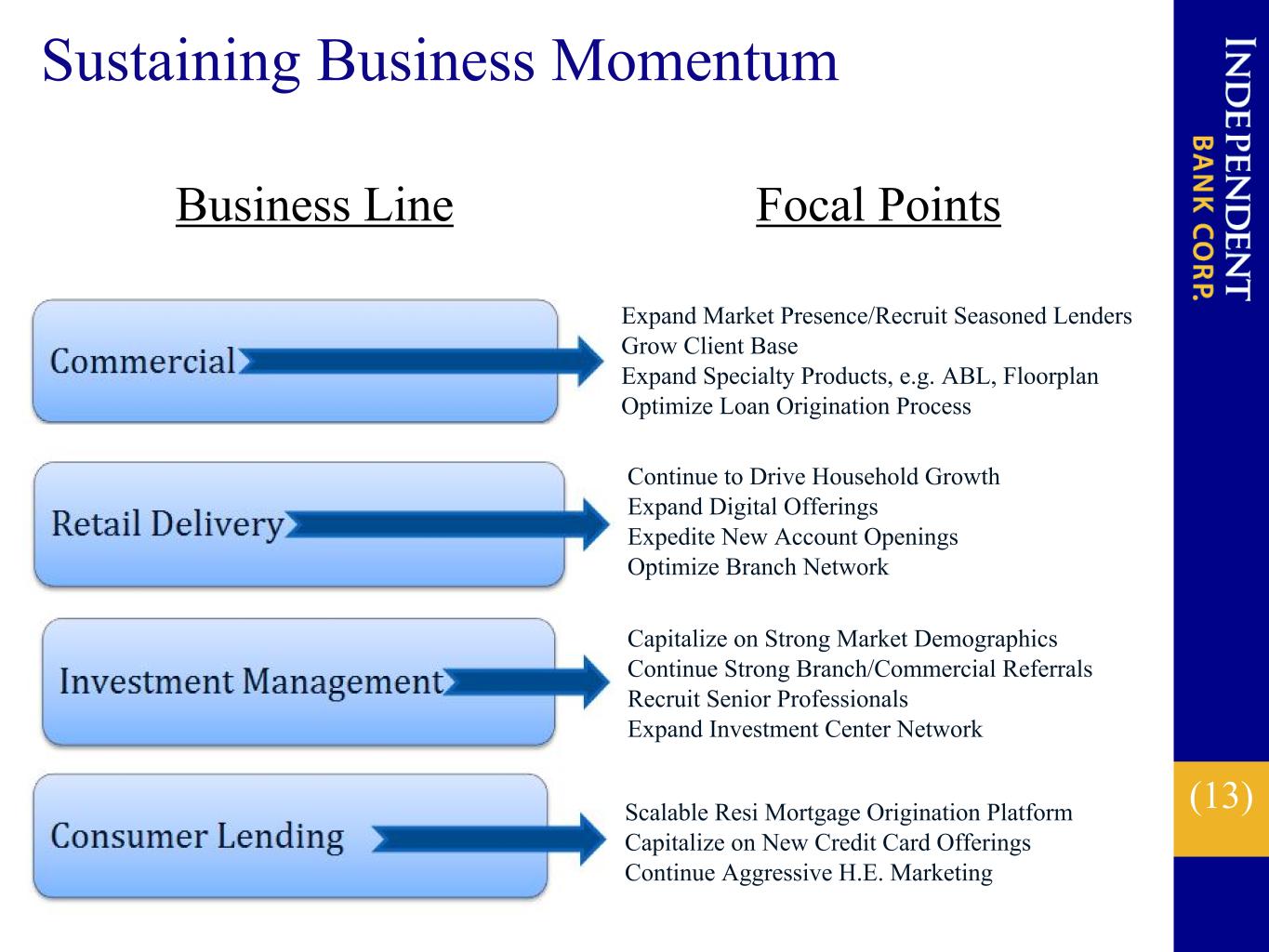

(13) Sustaining Business Momentum Business Line • Expand Market Presence/Recruit Seasoned Lenders • Grow Client Base • Expand Specialty Products, e.g. ABL, Floorplan • Optimize Loan Origination Process • Continue to Drive Household Growth • Expand Digital Offerings • Expedite New Account Openings • Optimize Branch Network • Capitalize on Strong Market Demographics • Continue Strong Branch/Commercial Referrals • Recruit Senior Professionals • Expand Investment Center Network • Scalable Resi Mortgage Origination Platform • Capitalize on New Credit Card Offerings • Continue Aggressive H.E. Marketing Focal Points

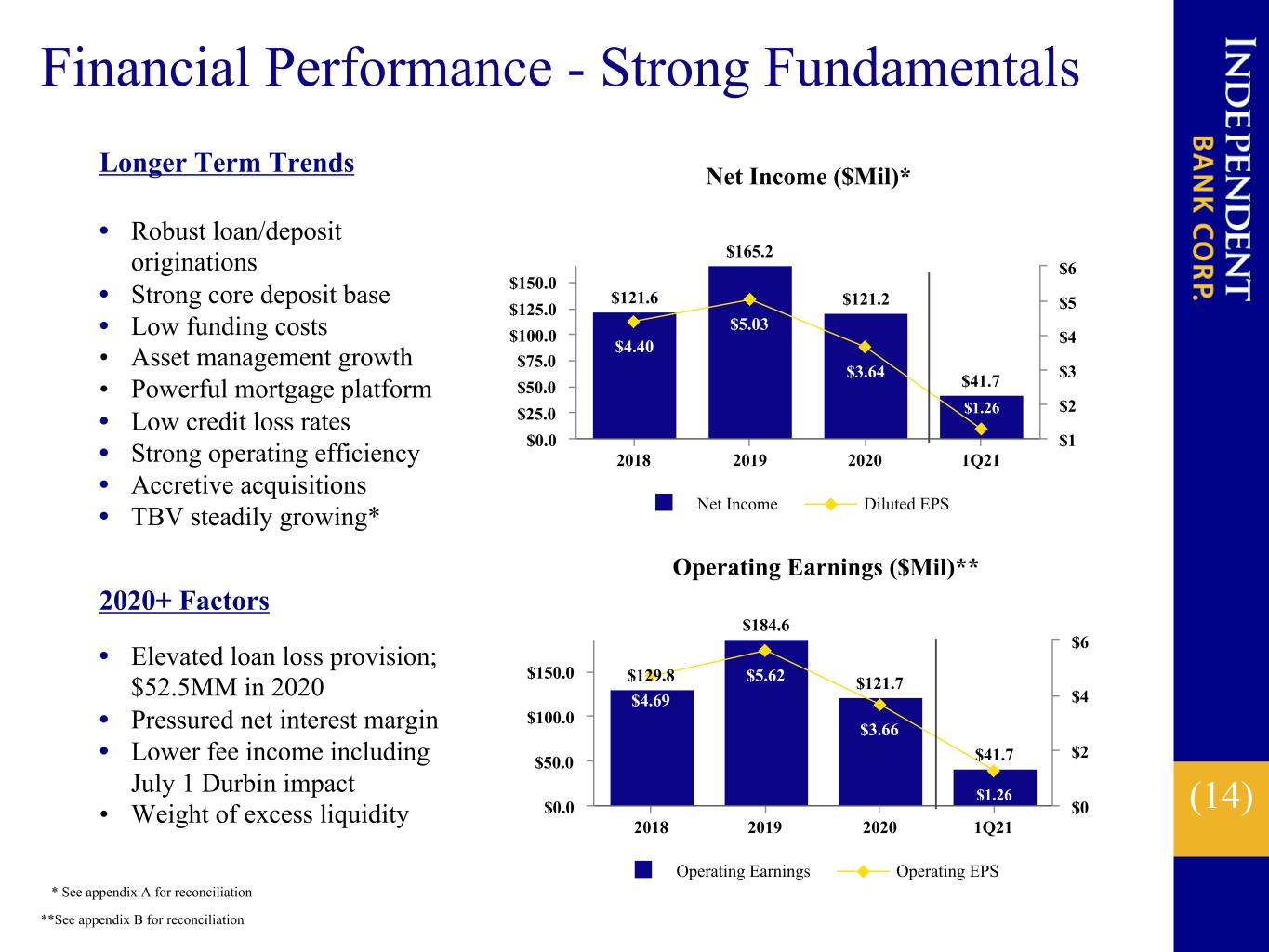

(14) $129.8 $184.6 $121.7 $41.7 $4.69 $5.62 $3.66 $1.26 Operating Earnings Operating EPS 2018 2019 2020 1Q21 $0.0 $50.0 $100.0 $150.0 $0 $2 $4 $6 $121.6 $165.2 $121.2 $41.7 $4.40 $5.03 $3.64 $1.26 Net Income Diluted EPS 2018 2019 2020 1Q21 $0.0 $25.0 $50.0 $75.0 $100.0 $125.0 $150.0 $1 $2 $3 $4 $5 $6 Financial Performance - Strong Fundamentals * See appendix A for reconciliation **See appendix B for reconciliation Longer Term Trends • Robust loan/deposit originations • Strong core deposit base • Low funding costs • Asset management growth • Powerful mortgage platform • Low credit loss rates • Strong operating efficiency • Accretive acquisitions • TBV steadily growing* 2020+ Factors • Elevated loan loss provision; $52.5MM in 2020 • Pressured net interest margin • Lower fee income including July 1 Durbin impact • Weight of excess liquidity Net Income ($Mil)* Operating Earnings ($Mil)**

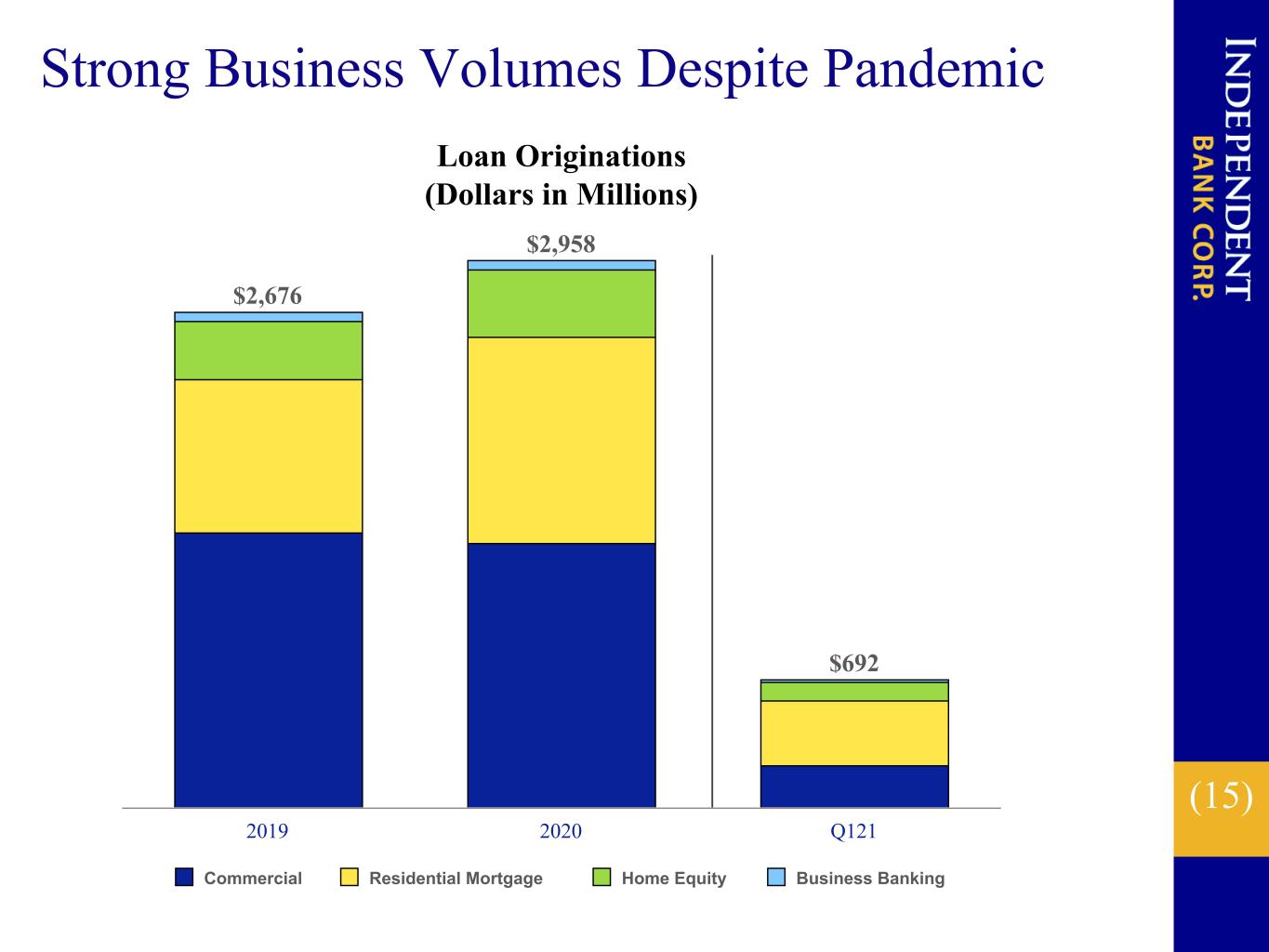

(15) Loan Originations (Dollars in Millions) $2,676 $2,958 $692 Commercial Residential Mortgage Home Equity Business Banking 2019 2020 Q121 Strong Business Volumes Despite Pandemic

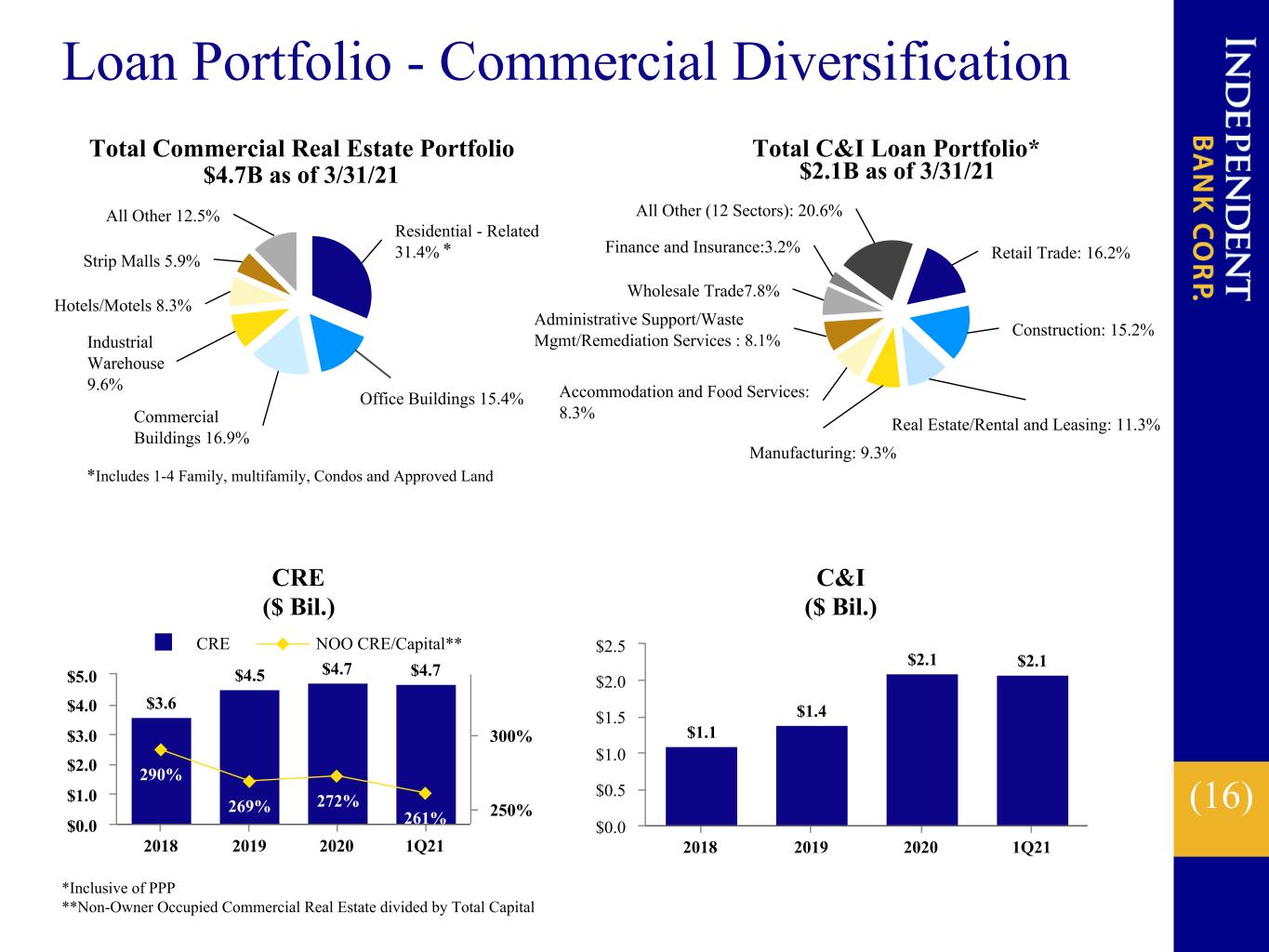

(16) Total Commercial Real Estate Portfolio Residential - Related 31.4% Office Buildings 15.4% Commercial Buildings 16.9% Industrial Warehouse 9.6% Hotels/Motels 8.3% Strip Malls 5.9% All Other 12.5% Loan Portfolio - Commercial Diversification $4.7B as of 3/31/21 Total C&I Loan Portfolio* Retail Trade: 16.2% Construction: 15.2% Real Estate/Rental and Leasing: 11.3% Manufacturing: 9.3% Accommodation and Food Services: 8.3% Administrative Support/Waste Mgmt/Remediation Services : 8.1% Wholesale Trade7.8% Finance and Insurance:3.2% All Other (12 Sectors): 20.6% $2.1B as of 3/31/21 *Includes 1-4 Family, multifamily, Condos and Approved Land CRE ($ Bil.) $3.6 $4.5 $4.7 $4.7 290% 269% 272% 261% CRE NOO CRE/Capital** 2018 2019 2020 1Q21 $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 250% 300% *Inclusive of PPP **Non-Owner Occupied Commercial Real Estate divided by Total Capital C&I ($ Bil.) $1.1 $1.4 $2.1 $2.1 2018 2019 2020 1Q21 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 *

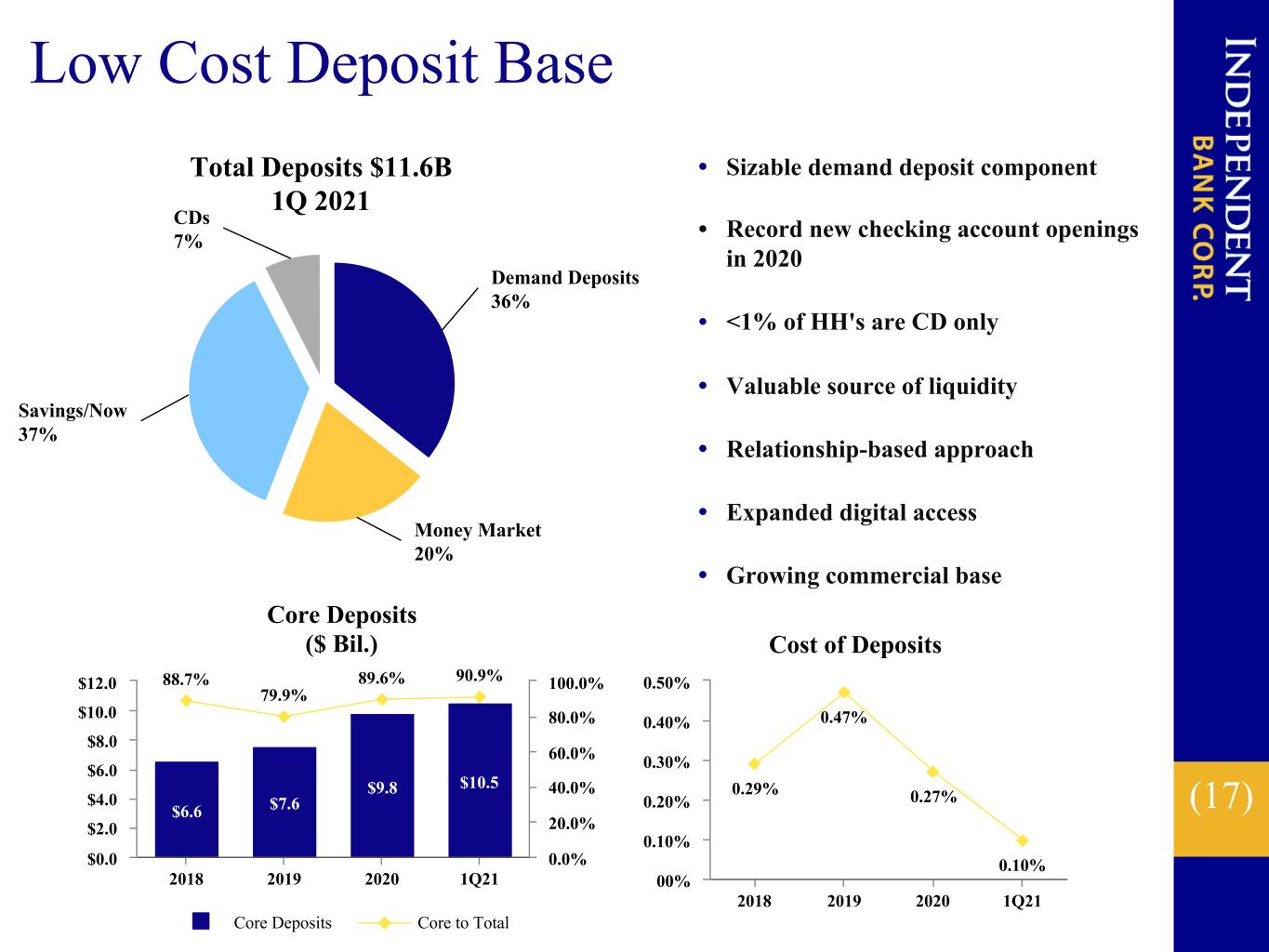

(17) Low Cost Deposit Base Demand Deposits 36% Money Market 20% Savings/Now 37% CDs 7% Total Deposits $11.6B 1Q 2021 Core Deposits ($ Bil.) $6.6 $7.6 $9.8 $10.5 88.7% 79.9% 89.6% 90.9% Core Deposits Core to Total 2018 2019 2020 1Q21 $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 0.0% 20.0% 40.0% 60.0% 80.0% 100.0% Cost of Deposits 0.29% 0.47% 0.27% 0.10% 2018 2019 2020 1Q21 00% 0.10% 0.20% 0.30% 0.40% 0.50% • Sizable demand deposit component • Record new checking account openings in 2020 • <1% of HH's are CD only • Valuable source of liquidity • Relationship-based approach • Expanded digital access • Growing commercial base

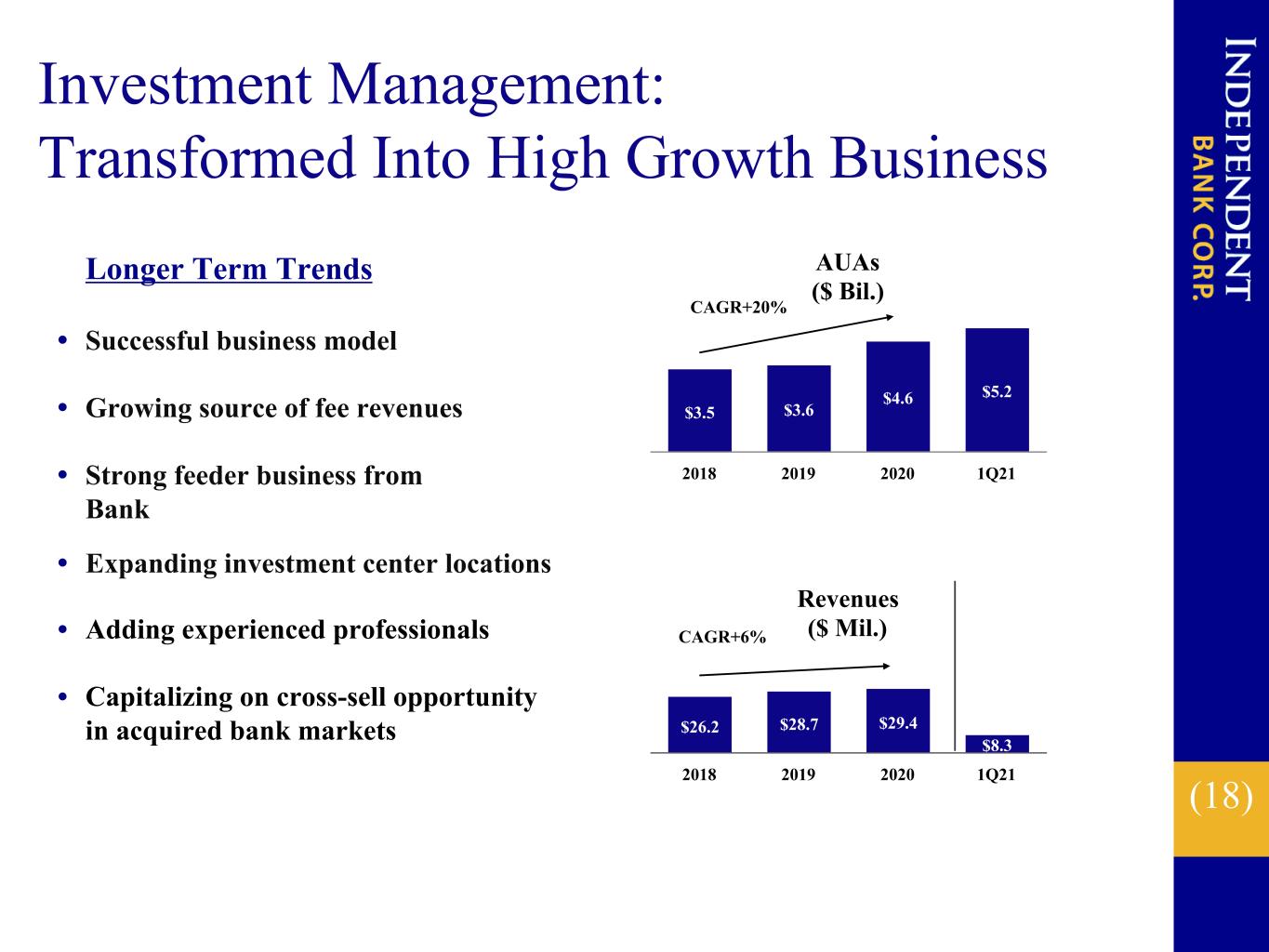

(18) Investment Management: Transformed Into High Growth Business Longer Term Trends • Successful business model • Growing source of fee revenues • Strong feeder business from Bank AUAs ($ Bil.) $3.5 $3.6 $4.6 $5.2 2018 2019 2020 1Q21 • Expanding investment center locations • Adding experienced professionals • Capitalizing on cross-sell opportunity in acquired bank markets • Revenues ($ Mil.) $26.2 $28.7 $29.4 $8.3 2018 2019 2020 1Q21 CAGR+6% CAGR+20%

(19) COVID-19 Pandemic Action Steps • Revised initial CECL assumptions ◦ Leveraging Moody's economic forecasts ◦ Added qualitative analyses of various exposures • Granted relief to customers ◦ Delayed payments, waived fees, etc. • Enhanced credit monitoring of financial statements and cash flows • Participant in PPP program ◦ 2020: Processed over 6,100 loans for approximately $800M ◦ 2021: Received over 3,500 loans for approximately $360M to date while still receiving more applications • Branch strategy balancing customer access and employee safety

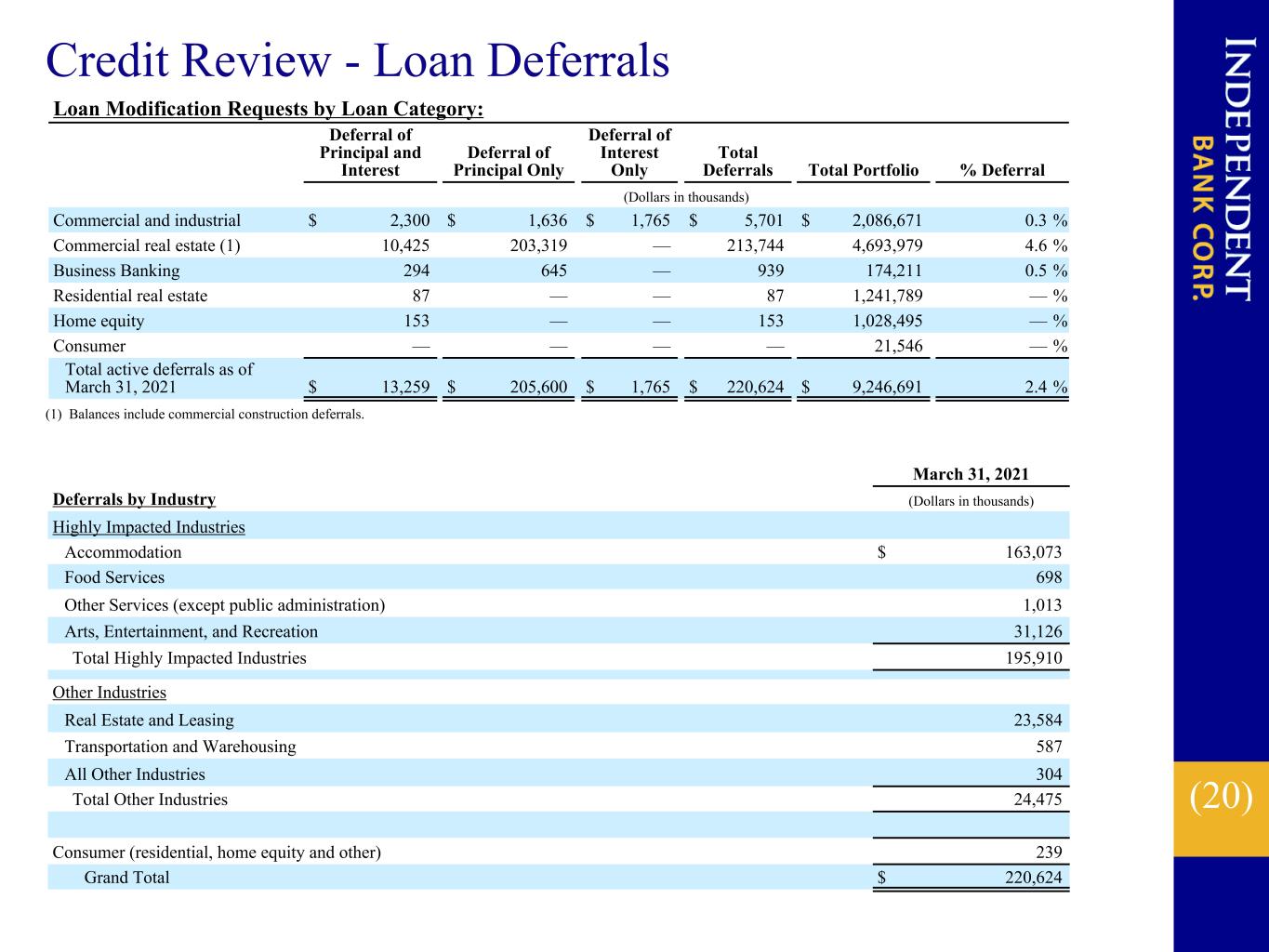

(20) Credit Review - Loan Deferrals March 31, 2021 Deferrals by Industry (Dollars in thousands) Highly Impacted Industries Accommodation $ 163,073 Food Services 698 Other Services (except public administration) 1,013 Arts, Entertainment, and Recreation 31,126 Total Highly Impacted Industries 195,910 Other Industries Real Estate and Leasing 23,584 Transportation and Warehousing 587 All Other Industries 304 Total Other Industries 24,475 Consumer (residential, home equity and other) 239 Grand Total $ 220,624 Loan Modification Requests by Loan Category: Deferral of Principal and Interest Deferral of Principal Only Deferral of Interest Only Total Deferrals Total Portfolio % Deferral (Dollars in thousands) Commercial and industrial $ 2,300 $ 1,636 $ 1,765 $ 5,701 $ 2,086,671 0.3 % Commercial real estate (1) 10,425 203,319 — 213,744 4,693,979 4.6 % Business Banking 294 645 — 939 174,211 0.5 % Residential real estate 87 — — 87 1,241,789 — % Home equity 153 — — 153 1,028,495 — % Consumer — — — — 21,546 — % Total active deferrals as of March 31, 2021 $ 13,259 $ 205,600 $ 1,765 $ 220,624 $ 9,246,691 2.4 % (1) Balances include commercial construction deferrals.

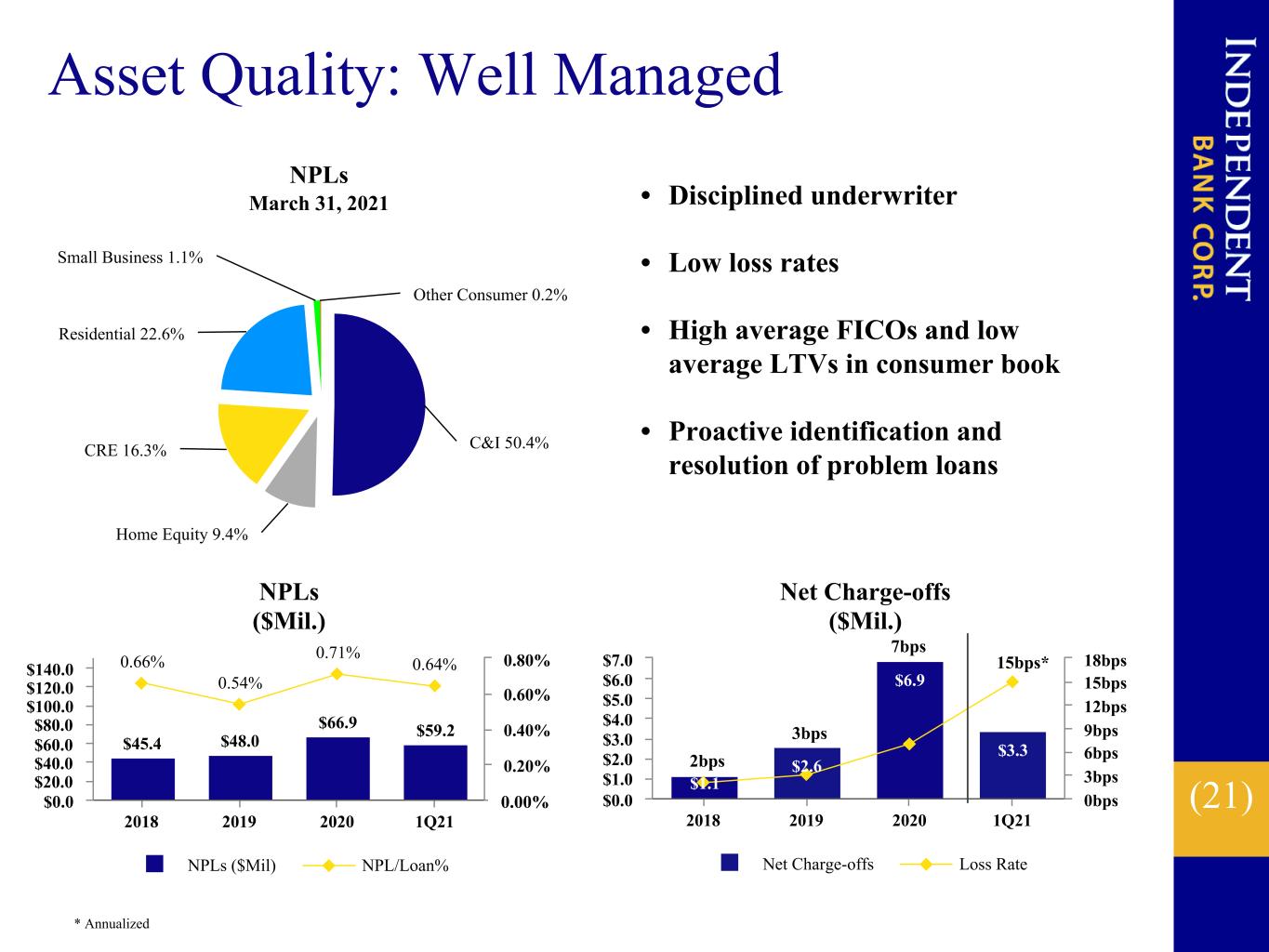

(21) • Disciplined underwriter • Low loss rates • High average FICOs and low average LTVs in consumer book • Proactive identification and resolution of problem loans C&I 50.4% Home Equity 9.4% CRE 16.3% Residential 22.6% Small Business 1.1% Other Consumer 0.2% Asset Quality: Well Managed NPLs ($Mil.) $45.4 $48.0 $66.9 $59.2 0.66% 0.54% 0.71% 0.64% NPLs ($Mil) NPL/Loan% 2018 2019 2020 1Q21 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 00% 0.20% 0.40% 0.60% 0.80% Net Charge-offs ($Mil.) $1.1 $2.6 $6.9 $3.3 Net Charge-offs Loss Rate 2018 2019 2020 1Q21 $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 0bps 3bps 6bps 9bps 12bps 15bps 18bps 2bps 3bps 7bps 15bps* * Annualized NPLs March 31, 2021 . 0%

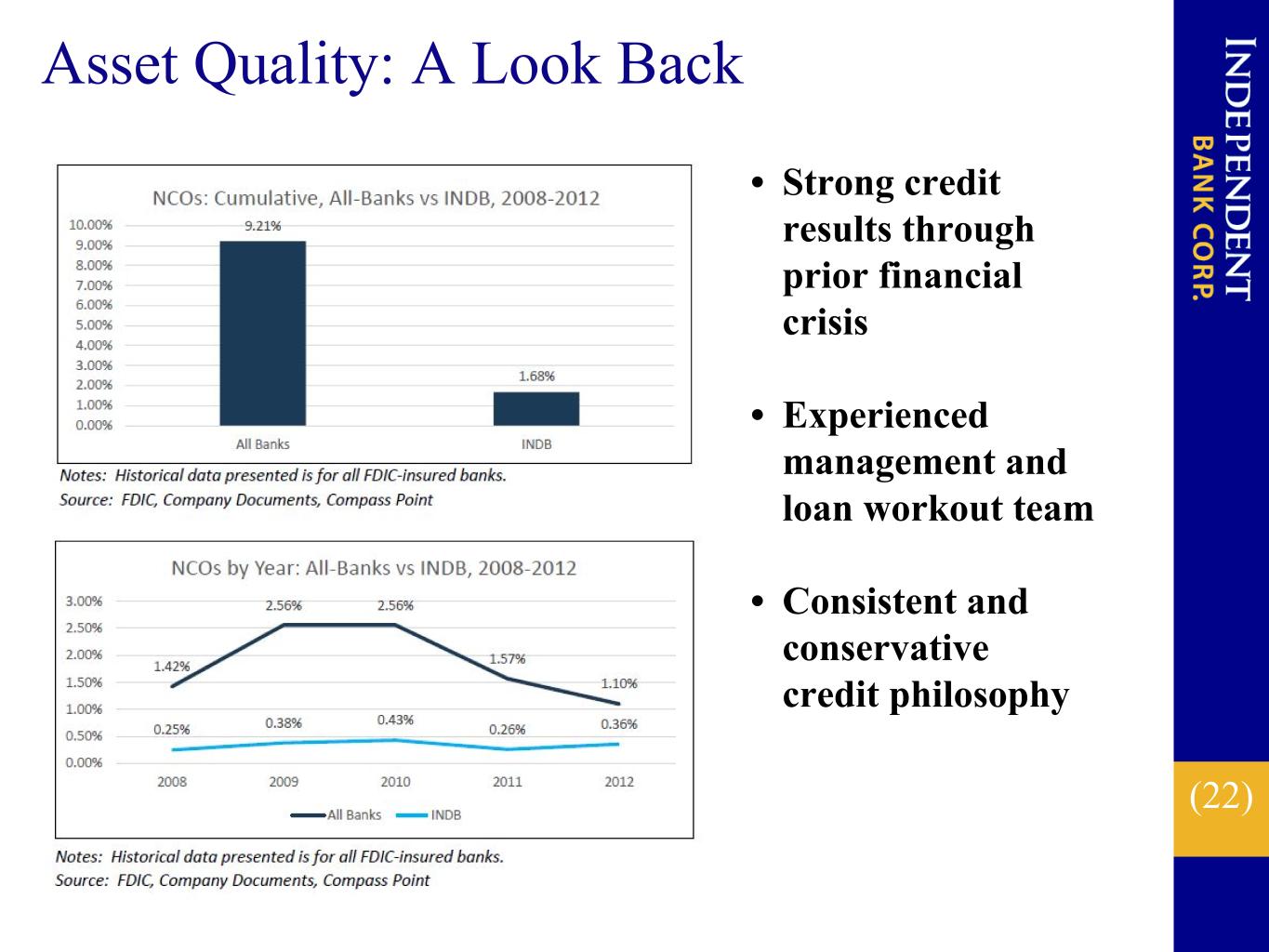

(22) Asset Quality: A Look Back • Strong credit results through prior financial crisis • Experienced management and loan workout team • Consistent and conservative credit philosophy

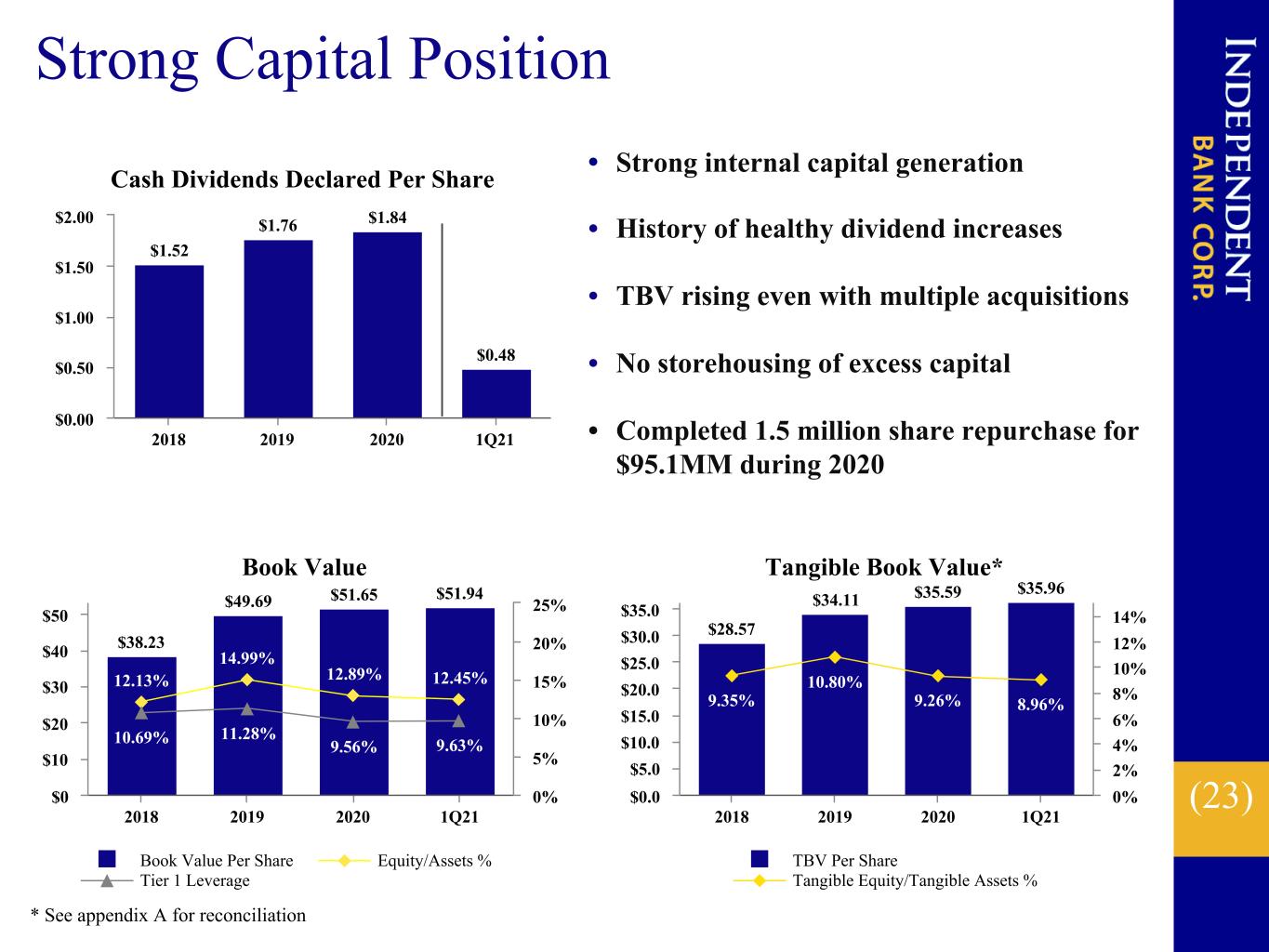

(23) Book Value $38.23 $49.69 $51.65 $51.94 12.13% 14.99% 12.89% 12.45% 10.69% 11.28% 9.56% 9.63% Book Value Per Share Equity/Assets % Tier 1 Leverage 2018 2019 2020 1Q21 $0 $10 $20 $30 $40 $50 0% 5% 10% 15% 20% 25% Strong Capital Position Tangible Book Value* $28.57 $34.11 $35.59 $35.96 9.35% 10.80% 9.26% 8.96% TBV Per Share Tangible Equity/Tangible Assets % 2018 2019 2020 1Q21 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 0% 2% 4% 6% 8% 10% 12% 14% * See appendix A for reconciliation • Strong internal capital generation • History of healthy dividend increases • TBV rising even with multiple acquisitions • No storehousing of excess capital • Completed 1.5 million share repurchase for $95.1MM during 2020 Cash Dividends Declared Per Share $1.52 $1.76 $1.84 $0.48 2018 2019 2020 1Q21 $0.00 $0.50 $1.00 $1.50 $2.00

(24) Near-Term Priorities • Preparing for EBSB closing and integration • Fulfilling demand for current round of PPP • Extending our presence in attractive Worcester market • Branch optimization including select openings and closings • Expansion of dealer floor-plan efforts • Maximizing use of Salesforce platform • Continued investment in digital/mobile technology • Deepening of risk management programs • Reassessment of physical workspace needs

(25) INDB Investment Merits • High quality franchise in attractive markets • Regained momentum following prior crises • Consistent, strong financial performance • Strong organic business volumes • Growing brand recognition • Leverageable operating platform • Capitalizing on in-market consolidation opportunities • Diligent stewards of shareholder capital • Grounded management team

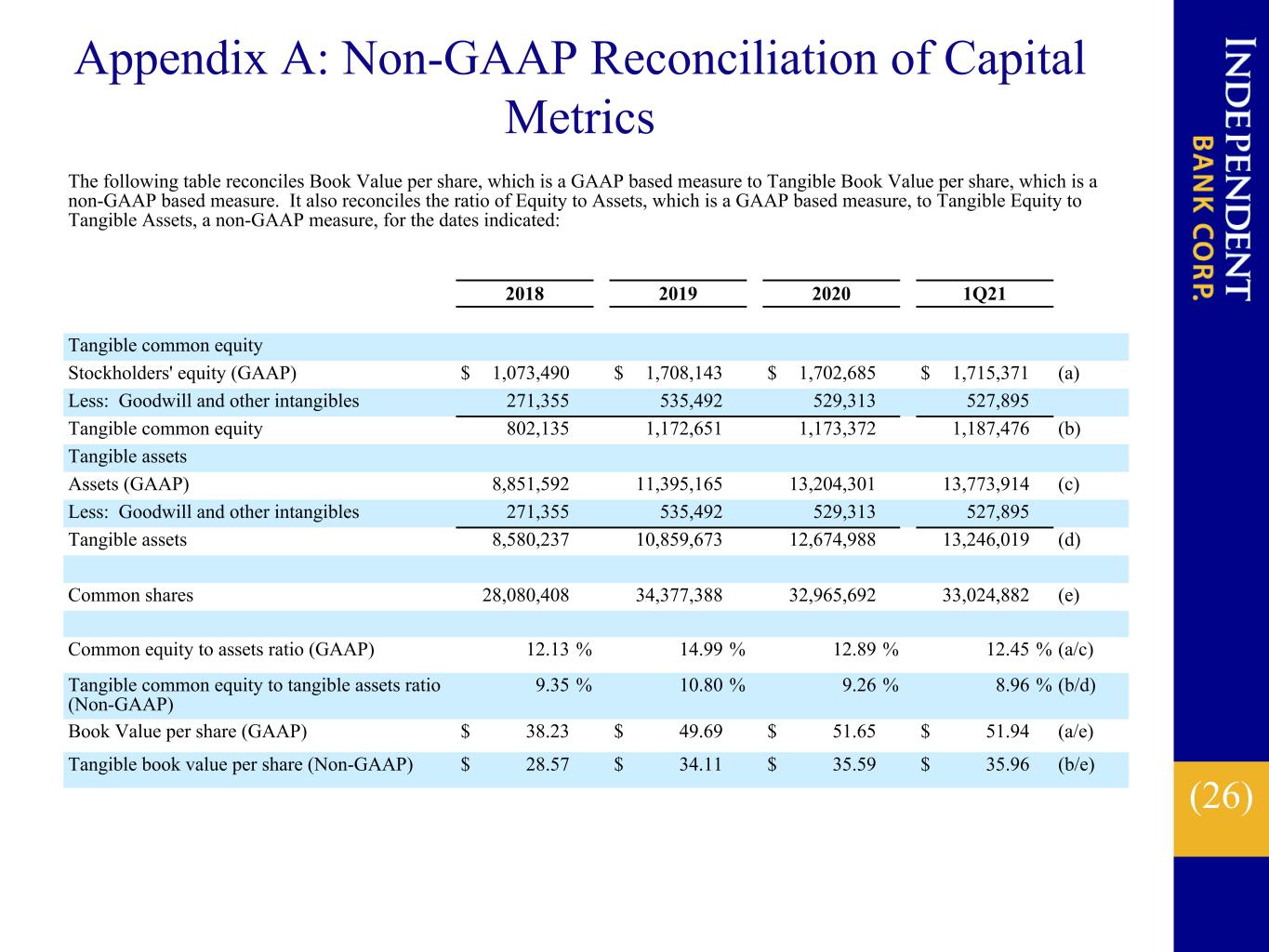

(26) Appendix A: Non-GAAP Reconciliation of Capital Metrics The following table reconciles Book Value per share, which is a GAAP based measure to Tangible Book Value per share, which is a non-GAAP based measure. It also reconciles the ratio of Equity to Assets, which is a GAAP based measure, to Tangible Equity to Tangible Assets, a non-GAAP measure, for the dates indicated: 2018 2019 2020 1Q21 Tangible common equity Stockholders' equity (GAAP) $ 1,073,490 $ 1,708,143 $ 1,702,685 $ 1,715,371 (a) Less: Goodwill and other intangibles 271,355 535,492 529,313 527,895 Tangible common equity 802,135 1,172,651 1,173,372 1,187,476 (b) Tangible assets Assets (GAAP) 8,851,592 11,395,165 13,204,301 13,773,914 (c) Less: Goodwill and other intangibles 271,355 535,492 529,313 527,895 Tangible assets 8,580,237 10,859,673 12,674,988 13,246,019 (d) Common shares 28,080,408 34,377,388 32,965,692 33,024,882 (e) Common equity to assets ratio (GAAP) 12.13 % 14.99 % 12.89 % 12.45 % (a/c) Tangible common equity to tangible assets ratio (Non-GAAP) 9.35 % 10.80 % 9.26 % 8.96 % (b/d) Book Value per share (GAAP) $ 38.23 $ 49.69 $ 51.65 $ 51.94 (a/e) Tangible book value per share (Non-GAAP) $ 28.57 $ 34.11 $ 35.59 $ 35.96 (b/e)

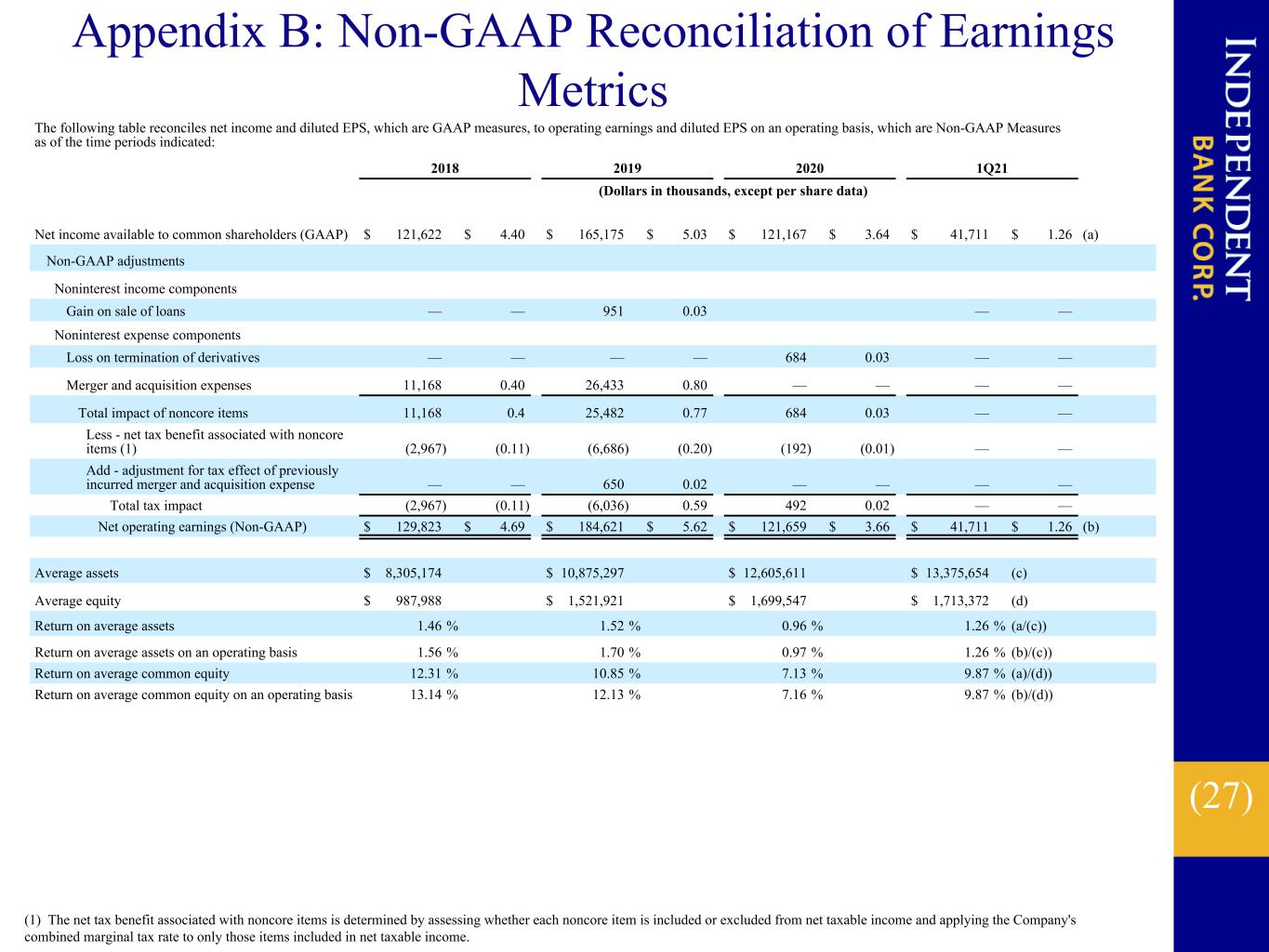

(27) Appendix B: Non-GAAP Reconciliation of Earnings Metrics The following table reconciles net income and diluted EPS, which are GAAP measures, to operating earnings and diluted EPS on an operating basis, which are Non-GAAP Measures as of the time periods indicated: 2018 2019 2020 1Q21 (Dollars in thousands, except per share data) Net income available to common shareholders (GAAP) $ 121,622 $ 4.40 $ 165,175 $ 5.03 $ 121,167 $ 3.64 $ 41,711 $ 1.26 (a) Non-GAAP adjustments Noninterest income components Gain on sale of loans — — 951 0.03 — — Noninterest expense components Loss on termination of derivatives — — — — 684 0.03 — — Merger and acquisition expenses 11,168 0.40 26,433 0.80 — — — — Total impact of noncore items 11,168 0.4 25,482 0.77 684 0.03 — — Less - net tax benefit associated with noncore items (1) (2,967) (0.11) (6,686) (0.20) (192) (0.01) — — Add - adjustment for tax effect of previously incurred merger and acquisition expense — — 650 0.02 — — — — Total tax impact (2,967) (0.11) (6,036) 0.59 492 0.02 — — Net operating earnings (Non-GAAP) $ 129,823 $ 4.69 $ 184,621 $ 5.62 $ 121,659 $ 3.66 $ 41,711 $ 1.26 (b) Average assets $ 8,305,174 $ 10,875,297 $ 12,605,611 $ 13,375,654 (c) Average equity $ 987,988 $ 1,521,921 $ 1,699,547 $ 1,713,372 (d) Return on average assets 1.46 % 1.52 % 0.96 % 1.26 % (a/(c)) Return on average assets on an operating basis 1.56 % 1.70 % 0.97 % 1.26 % (b)/(c)) Return on average common equity 12.31 % 10.85 % 7.13 % 9.87 % (a)/(d)) Return on average common equity on an operating basis 13.14 % 12.13 % 7.16 % 9.87 % (b)/(d)) (1) The net tax benefit associated with noncore items is determined by assessing whether each noncore item is included or excluded from net taxable income and applying the Company's combined marginal tax rate to only those items included in net taxable income.

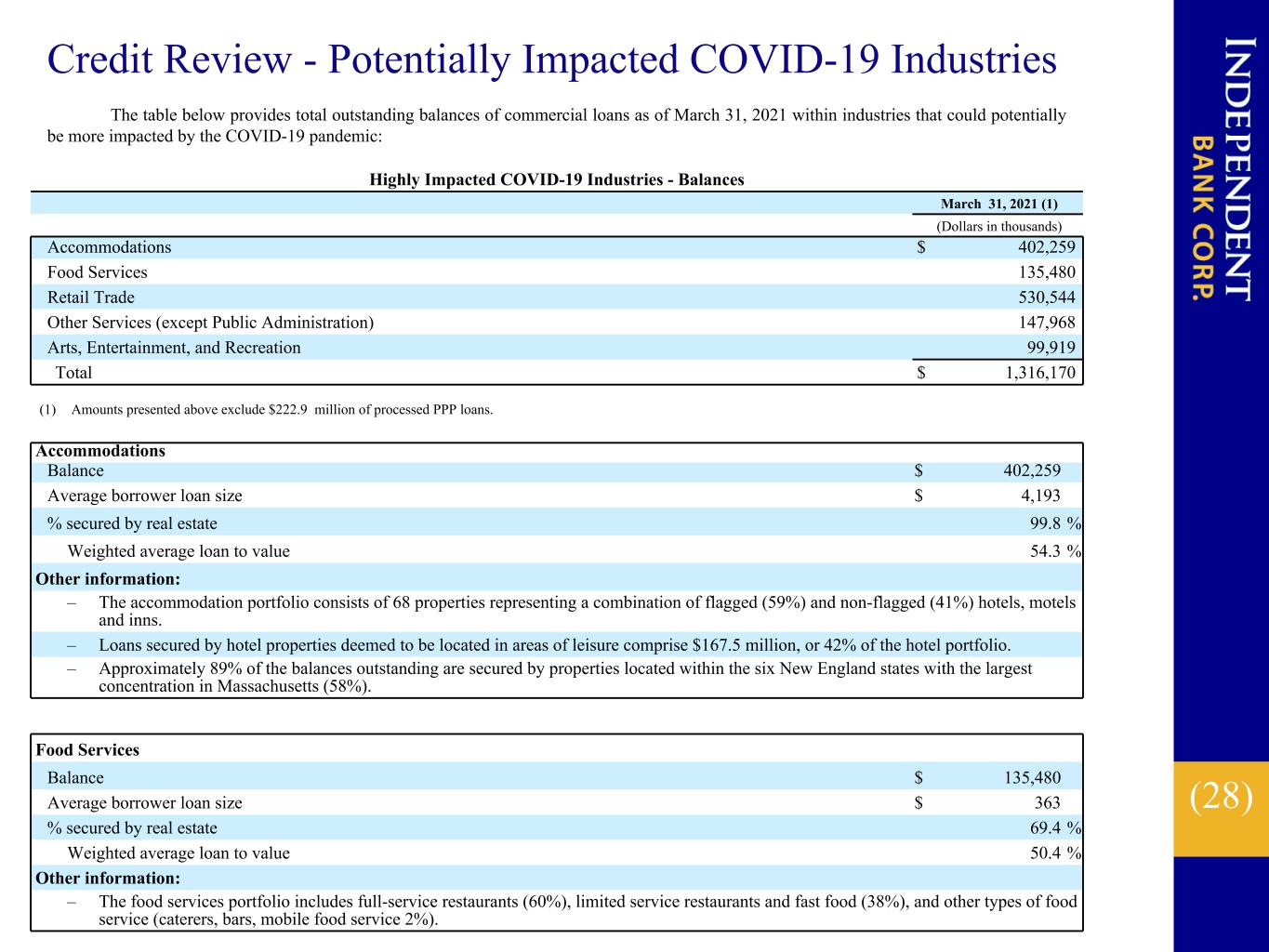

(28) Credit Review - Potentially Impacted COVID-19 Industries Accommodations Balance $ 402,259 Average borrower loan size $ 4,193 % secured by real estate 99.8 % Weighted average loan to value 54.3 % Other information: – The accommodation portfolio consists of 68 properties representing a combination of flagged (59%) and non-flagged (41%) hotels, motels and inns. – Loans secured by hotel properties deemed to be located in areas of leisure comprise $167.5 million, or 42% of the hotel portfolio. – Approximately 89% of the balances outstanding are secured by properties located within the six New England states with the largest concentration in Massachusetts (58%). The table below provides total outstanding balances of commercial loans as of March 31, 2021 within industries that could potentially be more impacted by the COVID-19 pandemic: Food Services Balance $ 135,480 Average borrower loan size $ 363 % secured by real estate 69.4 % Weighted average loan to value 50.4 % Other information: – The food services portfolio includes full-service restaurants (60%), limited service restaurants and fast food (38%), and other types of food service (caterers, bars, mobile food service 2%). Highly Impacted COVID-19 Industries - Balances March 31, 2021 (1) (Dollars in thousands) Accommodations $ 402,259 Food Services 135,480 Retail Trade 530,544 Other Services (except Public Administration) 147,968 Arts, Entertainment, and Recreation 99,919 Total $ 1,316,170 (1) Amounts presented above exclude $222.9 million of processed PPP loans.

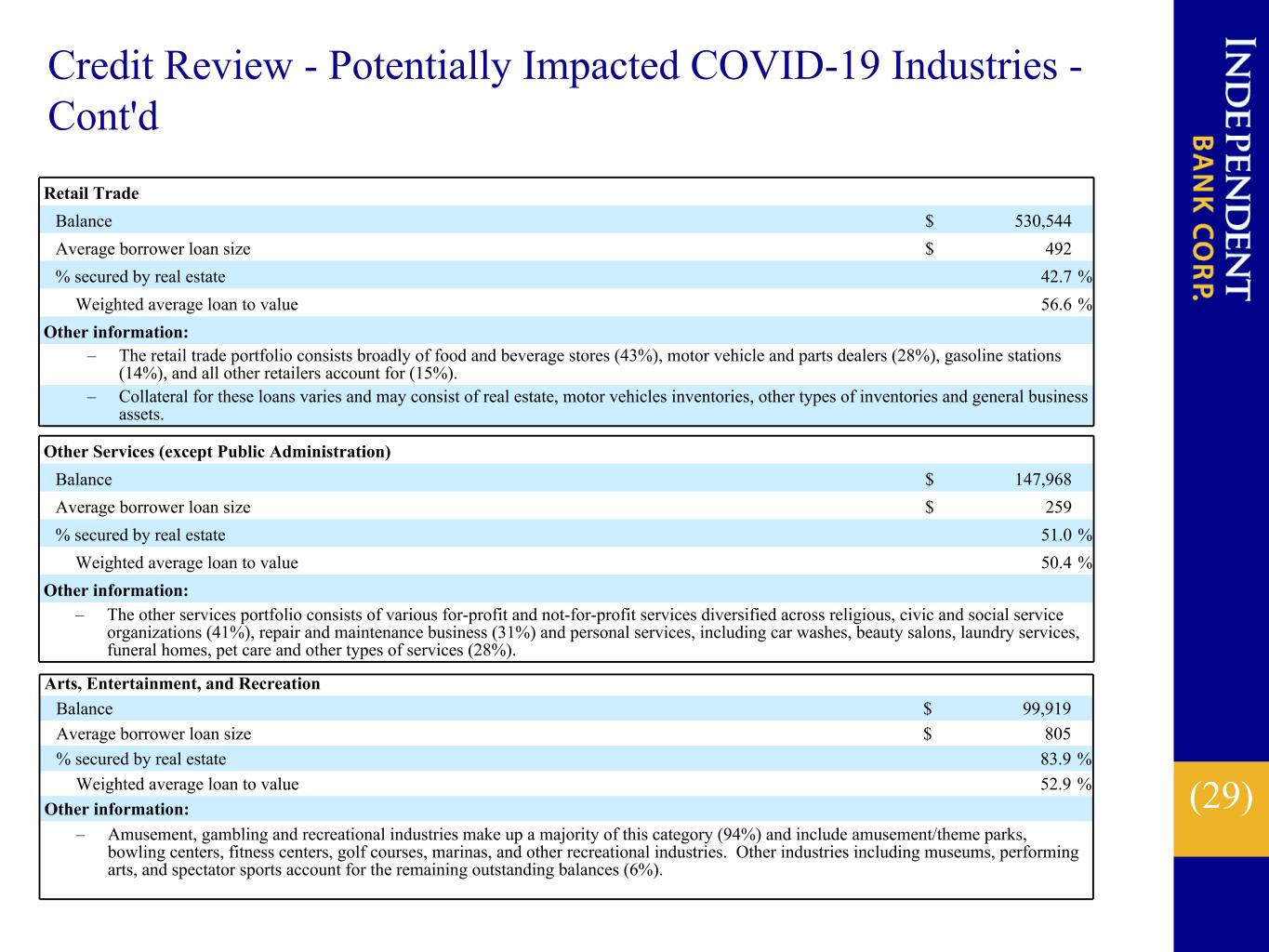

(29) Credit Review - Potentially Impacted COVID-19 Industries - Cont'd Other Services (except Public Administration) Balance $ 147,968 Average borrower loan size $ 259 % secured by real estate 51.0 % Weighted average loan to value 50.4 % Other information: – The other services portfolio consists of various for-profit and not-for-profit services diversified across religious, civic and social service organizations (41%), repair and maintenance business (31%) and personal services, including car washes, beauty salons, laundry services, funeral homes, pet care and other types of services (28%). Arts, Entertainment, and Recreation Balance $ 99,919 Average borrower loan size $ 805 % secured by real estate 83.9 % Weighted average loan to value 52.9 % Other information: – Amusement, gambling and recreational industries make up a majority of this category (94%) and include amusement/theme parks, bowling centers, fitness centers, golf courses, marinas, and other recreational industries. Other industries including museums, performing arts, and spectator sports account for the remaining outstanding balances (6%). Retail Trade Balance $ 530,544 Average borrower loan size $ 492 % secured by real estate 42.7 % Weighted average loan to value 56.6 % Other information: – The retail trade portfolio consists broadly of food and beverage stores (43%), motor vehicle and parts dealers (28%), gasoline stations (14%), and all other retailers account for (15%). – Collateral for these loans varies and may consist of real estate, motor vehicles inventories, other types of inventories and general business assets.

(30) NASDAQ Ticker: INDB www.rocklandtrust.com Mark Ruggiero – CFO & Chief Accounting Officer Shareholder Relations: (781) 982-6737 Statements contained in this presentation that are not historical facts are “forward-looking statements” that are subject to risks and uncertainties which could cause actual results to differ materially from those currently anticipated due to a number of factors, which include, but are not limited to, factors discussed in documents filed by the Company with the Securities and Exchange Commission from time to time.