Attached files

| file | filename |

|---|---|

| EX-32.2 - 906 CERTIFICATION CFO - INDEPENDENT BANK CORP | indb0331201710-qexx322.htm |

| EX-32.1 - 906 CERTIFICATION CEO - INDEPENDENT BANK CORP | indb0331201710-qexx321.htm |

| EX-31.2 - 302 CERTIFICATION CFO - INDEPENDENT BANK CORP | indb0331201710-qexx312.htm |

| EX-31.1 - 302 CERTIFICATION CEO - INDEPENDENT BANK CORP | indb0331201710-qexx311.htm |

| EX-10.1 - INDEPENDENT BANK CORP. 2017 EXECUTIVE INCENTIVE PLAN - INDEPENDENT BANK CORP | indb0331201710-qex101.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________________________________

FORM 10-Q

___________________________________________________

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2017

Commission File Number: 1-9047

___________________________________________________

Independent Bank Corp.

(Exact name of registrant as specified in its charter)

___________________________________________________

Massachusetts | 04-2870273 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

Office Address: 2036 Washington Street, Hanover Massachusetts 02339

Mailing Address: 288 Union Street, Rockland, Massachusetts 02370

(Address of principal executive offices, including zip code)

(781) 878-6100

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and emerging growth company" in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer | x | Accelerated Filer | o |

Non-accelerated Filer | o | Smaller Reporting Company | o |

Emerging Growth Company | o | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Acts. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of May 1, 2017, there were 27,051,479 shares of the issuer’s common stock outstanding, par value $0.01 per share.

Table of Contents | |

PAGE | |

Exhibit 10.1 - Independent Bank Corp. 2017 Executive Incentive Plan | |

Exhibit 31.1 – Certification 302 | |

Exhibit 31.2 – Certification 302 | |

Exhibit 32.1 – Certification 906 | |

Exhibit 32.2 – Certification 906 | |

3

PART 1. FINANCIAL INFORMATION

Item 1. Financial Statements

INDEPENDENT BANK CORP.

CONSOLIDATED BALANCE SHEETS

(Unaudited—Dollars in thousands)

March 31, 2017 | December 31, 2016 | ||||||

Assets | |||||||

Cash and due from banks | $ | 94,662 | $ | 97,196 | |||

Interest-earning deposits with banks | 125,411 | 191,899 | |||||

Securities | |||||||

Securities - trading | 1,289 | 804 | |||||

Securities - available for sale | 401,837 | 363,644 | |||||

Securities - held to maturity (fair value $500,917 and $485,650) | 502,123 | 487,076 | |||||

Total securities | 905,249 | 851,524 | |||||

Loans held for sale (at fair value) | 3,398 | 6,139 | |||||

Loans | |||||||

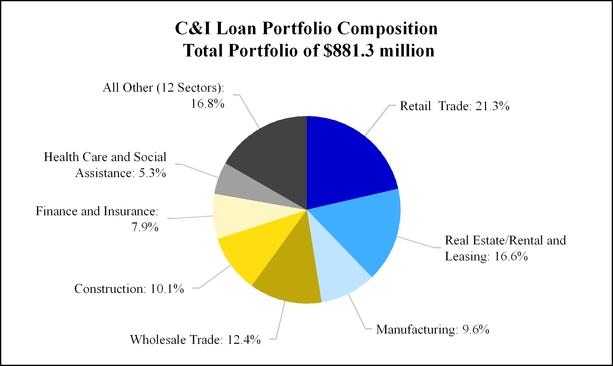

Commercial and industrial | 881,329 | 902,053 | |||||

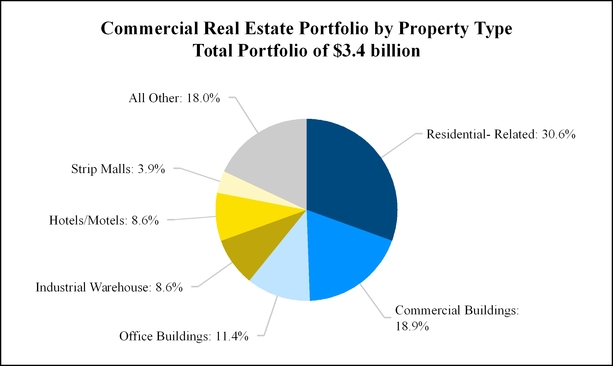

Commercial real estate | 3,027,305 | 3,010,798 | |||||

Commercial construction | 356,173 | 320,391 | |||||

Small business | 126,374 | 122,726 | |||||

Residential real estate | 653,999 | 644,426 | |||||

Home equity - first position | 595,828 | 577,006 | |||||

Home equity - subordinate positions | 412,943 | 411,141 | |||||

Other consumer | 10,415 | 11,064 | |||||

Total loans | 6,064,366 | 5,999,605 | |||||

Less: allowance for loan losses | (62,318 | ) | (61,566 | ) | |||

Net loans | 6,002,048 | 5,938,039 | |||||

Federal Home Loan Bank stock | 11,497 | 11,497 | |||||

Bank premises and equipment, net | 82,027 | 78,480 | |||||

Goodwill | 221,526 | 221,526 | |||||

Other intangible assets | 9,087 | 9,848 | |||||

Cash surrender value of life insurance policies | 145,560 | 144,503 | |||||

Other real estate owned and other foreclosed assets | 3,404 | 4,173 | |||||

Other assets | 134,245 | 154,551 | |||||

Total assets | $ | 7,738,114 | $ | 7,709,375 | |||

Liabilities and Stockholders' Equity | |||||||

Deposits | |||||||

Demand deposits | $ | 2,043,359 | $ | 2,057,086 | |||

Savings and interest checking accounts | 2,542,667 | 2,469,237 | |||||

Money market | 1,268,796 | 1,236,778 | |||||

Time certificates of deposit of $100,000 and over | 242,562 | 266,190 | |||||

Other time certificates of deposits | 373,290 | 382,962 | |||||

Total deposits | 6,470,674 | 6,412,253 | |||||

Borrowings | |||||||

Federal Home Loan Bank borrowings | 50,811 | 50,819 | |||||

4

Customer repurchase agreements | 145,772 | 176,913 | |||||

Junior subordinated debentures (less unamortized debt issuance costs of $131 and $136) | 73,067 | 73,107 | |||||

Subordinated debentures (less unamortized debt issuance costs of $353 and $365) | 34,647 | 34,635 | |||||

Total borrowings | 304,297 | 335,474 | |||||

Other liabilities | 85,663 | 96,958 | |||||

Total liabilities | 6,860,634 | 6,844,685 | |||||

Commitments and contingencies | — | — | |||||

Stockholders' equity | |||||||

Preferred stock, $.01 par value, authorized: 1,000,000 shares, outstanding: none | — | — | |||||

Common stock, $.01 par value, authorized: 75,000,000 shares, issued and outstanding: 27,046,768 shares at March 31, 2017 and 27,005,813 shares at December 31, 2016 (includes 191,181 and 212,698 shares of unvested participating restricted stock awards, respectively) | 269 | 268 | |||||

Value of shares held in rabbi trust at cost: 161,156 shares at March 31, 2017 and 170,036 shares at December 31, 2016 | (4,330 | ) | (4,277 | ) | |||

Deferred compensation and other retirement benefit obligations | 4,330 | 4,277 | |||||

Additional paid in capital | 452,048 | 451,664 | |||||

Retained earnings | 425,802 | 414,095 | |||||

Accumulated other comprehensive loss, net of tax | (639 | ) | (1,337 | ) | |||

Total stockholders’ equity | 877,480 | 864,690 | |||||

Total liabilities and stockholders' equity | $ | 7,738,114 | $ | 7,709,375 | |||

The accompanying condensed notes are an integral part of these unaudited consolidated financial statements.

5

INDEPENDENT BANK CORP.

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited—Dollars in thousands, except per share data)

Three Months Ended | |||||||

March 31 | |||||||

2017 | 2016 | ||||||

Interest income | |||||||

Interest and fees on loans | $ | 58,793 | $ | 54,269 | |||

Taxable interest and dividends on securities | 5,367 | 5,197 | |||||

Nontaxable interest and dividends on securities | 26 | 32 | |||||

Interest on loans held for sale | 14 | 32 | |||||

Interest on federal funds sold and short-term investments | 207 | 211 | |||||

Total interest and dividend income | 64,407 | 59,741 | |||||

Interest expense | |||||||

Interest on deposits | 2,767 | 2,868 | |||||

Interest on borrowings | 1,440 | 1,982 | |||||

Total interest expense | 4,207 | 4,850 | |||||

Net interest income | 60,200 | 54,891 | |||||

Provision for loan losses | 600 | 525 | |||||

Net interest income after provision for loan losses | 59,600 | 54,366 | |||||

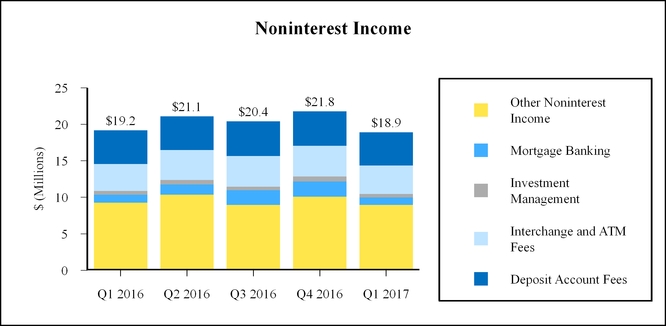

Noninterest income | |||||||

Deposit account fees | 4,544 | 4,595 | |||||

Interchange and ATM fees | 3,922 | 3,724 | |||||

Investment management | 5,614 | 5,003 | |||||

Mortgage banking income | 957 | 1,132 | |||||

Gain on sale of equity securities | 4 | — | |||||

Increase in cash surrender value of life insurance policies | 964 | 1,014 | |||||

Loan level derivative income | 606 | 1,722 | |||||

Other noninterest income | 2,301 | 1,965 | |||||

Total noninterest income | 18,912 | 19,155 | |||||

Noninterest expenses | |||||||

Salaries and employee benefits | 28,324 | 27,189 | |||||

Occupancy and equipment expenses | 6,158 | 5,827 | |||||

Data processing and facilities management | 1,272 | 1,206 | |||||

FDIC assessment | 783 | 1,010 | |||||

Advertising expense | 1,294 | 1,257 | |||||

Loss on extinguishment of debt | — | 437 | |||||

Loss on sale of equity securities | 3 | 29 | |||||

Merger and acquisition expense | 484 | 334 | |||||

Software maintenance | 930 | 754 | |||||

Other noninterest expenses | 9,525 | 8,439 | |||||

Total noninterest expenses | 48,773 | 46,482 | |||||

Income before income taxes | 29,739 | 27,039 | |||||

Provision for income taxes | 9,014 | 8,428 | |||||

Net income | $ | 20,725 | $ | 18,611 | |||

Basic earnings per share | $ | 0.77 | $ | 0.71 | |||

Diluted earnings per share | $ | 0.76 | $ | 0.71 | |||

Weighted average common shares (basic) | 27,029,640 | 26,275,323 | |||||

Common share equivalents | 81,283 | 43,409 | |||||

Weighted average common shares (diluted) | 27,110,923 | 26,318,732 | |||||

Cash dividends declared per common share | $ | 0.32 | $ | 0.29 | |||

The accompanying condensed notes are an integral part of these unaudited consolidated financial statements.

6

INDEPENDENT BANK CORP.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited—Dollars in thousands)

Three Months Ended | ||||||||

March 31 | ||||||||

2017 | 2016 | |||||||

Net income | $ | 20,725 | $ | 18,611 | ||||

Other comprehensive income, net of tax | ||||||||

Net change in fair value of securities available for sale | 531 | 4,081 | ||||||

Net change in fair value of cash flow hedges | 89 | 123 | ||||||

Net change in other comprehensive income for defined benefit postretirement plans | 78 | 60 | ||||||

Total other comprehensive income | 698 | 4,264 | ||||||

Total comprehensive income | $ | 21,423 | $ | 22,875 | ||||

The accompanying condensed notes are an integral part of these unaudited consolidated financial statements.

7

INDEPENDENT BANK CORP.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(Unaudited—Dollars in thousands, except per share data)

Common Stock Outstanding | Common Stock | Value of Shares Held in Rabbi Trust at Cost | Deferred Compensation and Other Retirement Benefit Obligations | Additional Paid in Capital | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | Total | |||||||||||||||||||||||

Balance December 31, 2016 | 27,005,813 | $ | 268 | $ | (4,277 | ) | $ | 4,277 | $ | 451,664 | $ | 414,095 | $ | (1,337 | ) | $ | 864,690 | |||||||||||||

Cumulative effect accounting adjustment (1) | — | — | — | — | 542 | (365 | ) | — | 177 | |||||||||||||||||||||

Net income | — | — | — | — | — | 20,725 | — | 20,725 | ||||||||||||||||||||||

Other comprehensive income | — | — | — | — | — | — | 698 | 698 | ||||||||||||||||||||||

Common dividend declared ($0.32 per share) | — | — | — | — | — | (8,653 | ) | — | (8,653 | ) | ||||||||||||||||||||

Proceeds from exercise of stock options, net of cash paid | 7,688 | — | — | — | 143 | — | — | 143 | ||||||||||||||||||||||

Stock based compensation | — | — | — | — | 643 | — | — | 643 | ||||||||||||||||||||||

Restricted stock awards issued, net of awards surrendered | 27,534 | 1 | — | — | (1,337 | ) | — | — | (1,336 | ) | ||||||||||||||||||||

Shares issued under direct stock purchase plan | 5,733 | — | — | — | 393 | — | — | 393 | ||||||||||||||||||||||

Deferred compensation and other retirement benefit obligations | — | — | (53 | ) | 53 | — | — | — | — | |||||||||||||||||||||

Balance March 31, 2017 | 27,046,768 | $ | 269 | $ | (4,330 | ) | $ | 4,330 | $ | 452,048 | $ | 425,802 | $ | (639 | ) | $ | 877,480 | |||||||||||||

Balance December 31, 2015 | 26,236,352 | $ | 260 | $ | (3,958 | ) | $ | 3,958 | $ | 405,486 | $ | 368,169 | $ | (2,452 | ) | $ | 771,463 | |||||||||||||

Net income | — | — | — | — | — | 18,611 | — | 18,611 | ||||||||||||||||||||||

Other comprehensive income | — | — | — | — | — | — | 4,264 | 4,264 | ||||||||||||||||||||||

Common dividend declared ($0.29 per share) | — | — | — | — | — | (7,627 | ) | — | (7,627 | ) | ||||||||||||||||||||

Proceeds from exercise of stock options, net of cash paid | 5,000 | — | — | — | 149 | — | — | 149 | ||||||||||||||||||||||

Tax benefit related to equity award activity | — | — | — | — | 235 | — | — | 235 | ||||||||||||||||||||||

Stock based compensation | — | — | — | — | 865 | — | — | 865 | ||||||||||||||||||||||

Restricted stock awards issued, net of awards surrendered | 36,887 | 1 | — | — | (672 | ) | — | — | (671 | ) | ||||||||||||||||||||

Shares issued under direct stock purchase plan | 15,326 | — | — | — | 679 | — | — | 679 | ||||||||||||||||||||||

Deferred compensation and other retirement benefit obligations | — | — | (73 | ) | 73 | — | — | — | — | |||||||||||||||||||||

Tax benefit related to deferred compensation distributions | — | — | — | — | 179 | — | — | 179 | ||||||||||||||||||||||

Balance March 31, 2016 | 26,293,565 | $ | 261 | $ | (4,031 | ) | $ | 4,031 | $ | 406,921 | $ | 379,153 | $ | 1,812 | $ | 788,147 | ||||||||||||||

(1) | Represents adjustment needed to reflect the cumulative impact on retained earnings for previously recognized stock based compensation, which included an adjustment for estimated forfeitures. Pursuant to the Company's adoption of Accounting Standards Update 2016-09, the Company has elected to recognize stock based compensation without inclusion of a forfeiture estimate, and as such has recognized this adjustment to present retained earnings consistent with this election. |

The accompanying condensed notes are an integral part of these unaudited consolidated financial statements.

8

INDEPENDENT BANK CORP.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited—Dollars in thousands)

Three Months Ended | |||||||

March 31 | |||||||

2017 | 2016 | ||||||

Cash flow from operating activities | |||||||

Net income | $ | 20,725 | $ | 18,611 | |||

Adjustments to reconcile net income to net cash provided by operating activities | |||||||

Depreciation and amortization | 3,557 | 2,905 | |||||

Provision for loan losses | 600 | 525 | |||||

Deferred income tax expense | 709 | 462 | |||||

Net (gain) loss on sale of securities | (1 | ) | 29 | ||||

Net loss on bank premises and equipment | 4 | — | |||||

Loss on extinguishment of debt | — | 437 | |||||

Net gain on other real estate owned and foreclosed assets | (29 | ) | (86 | ) | |||

Realized gain on sale leaseback transaction | (258 | ) | (258 | ) | |||

Stock based compensation | 643 | 865 | |||||

Excess tax benefit related to equity award activity | — | (235 | ) | ||||

Increase in cash surrender value of life insurance policies | (964 | ) | (1,014 | ) | |||

Change in fair value on loans held for sale | 147 | (54 | ) | ||||

Net change in: | |||||||

Trading assets | (485 | ) | (407 | ) | |||

Loans held for sale | 2,594 | (1,544 | ) | ||||

Other assets | 18,384 | (30,455 | ) | ||||

Other liabilities | (8,192 | ) | 11,762 | ||||

Total adjustments | 16,709 | (17,068 | ) | ||||

Net cash provided by operating activities | 37,434 | 1,543 | |||||

Cash flows used in investing activities | |||||||

Proceeds from sales of securities available for sale | 16 | 266 | |||||

Proceeds from maturities and principal repayments of securities available for sale | 12,107 | 11,575 | |||||

Purchases of securities available for sale | (49,617 | ) | (16,469 | ) | |||

Proceeds from maturities and principal repayments of securities held to maturity | 19,101 | 19,942 | |||||

Purchases of securities held to maturity | (34,090 | ) | — | ||||

Redemption of Federal Home Loan Bank stock | — | 2,624 | |||||

Investments in low income housing projects | (3,437 | ) | (2,648 | ) | |||

Purchases of life insurance policies | (93 | ) | (93 | ) | |||

Net increase in loans | (64,997 | ) | (40,895 | ) | |||

Purchases of bank premises and equipment | (5,457 | ) | (2,750 | ) | |||

Proceeds from the sale of bank premises and equipment | 27 | — | |||||

Proceeds from the sale of other real estate owned and foreclosed assets | 1,255 | 724 | |||||

Net payments relating to other real estate owned and foreclosed assets | — | (113 | ) | ||||

Net cash used in investing activities | (125,185 | ) | (27,837 | ) | |||

Cash flows provided by (used in) financing activities | |||||||

Net decrease in time deposits | (33,219 | ) | (27,633 | ) | |||

Net increase in other deposits | 91,721 | 32,177 | |||||

9

Repayments of long-term Federal Home Loan Bank borrowings | — | (51,641 | ) | ||||

Net increase (decrease) in customer repurchase agreements | (31,141 | ) | 610 | ||||

Net proceeds from exercise of stock options | 143 | 149 | |||||

Restricted stock awards issued, net of awards surrendered | (1,336 | ) | (671 | ) | |||

Excess tax benefit from stock based compensation | — | 235 | |||||

Tax benefit from deferred compensation distribution | — | 179 | |||||

Proceeds from shares issued under direct stock purchase plan | 393 | 679 | |||||

Common dividends paid | (7,832 | ) | (6,823 | ) | |||

Net cash provided by (used in) financing activities | 18,729 | (52,739 | ) | ||||

Net decrease in cash and cash equivalents | (69,022 | ) | (79,033 | ) | |||

Cash and cash equivalents at beginning of year | 289,095 | 275,765 | |||||

Cash and cash equivalents at end of period | $ | 220,073 | $ | 196,732 | |||

Supplemental schedule of noncash investing and financing activities | |||||||

Transfer of loans to other real estate owned & foreclosed assets | $ | 457 | $ | 86 | |||

Net increase in capital commitments relating to low income housing project investments | $ | 60 | $ | 37 | |||

The accompanying condensed notes are an integral part of these unaudited consolidated financial statements.

10

CONDENSED NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1 - BASIS OF PRESENTATION

Independent Bank Corp. (the “Company”) is a state chartered, federally registered bank holding company, incorporated in 1985. The Company is the sole stockholder of Rockland Trust Company (“Rockland Trust” or the “Bank”), a Massachusetts trust company chartered in 1907.

All material intercompany balances and transactions have been eliminated in consolidation. Certain previously reported amounts may have been reclassified to conform to the current year’s presentation.

The accompanying unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP") for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and notes required by GAAP for complete financial statements. In the opinion of management, all adjustments considered necessary for a fair presentation of the financial statements, primarily consisting of normal recurring adjustments, have been included. Results for the quarter ended March 31, 2017 are not necessarily indicative of the results that may be expected for the year ending December 31, 2017 or any other interim period.

For further information, refer to the consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2016, filed with the Securities and Exchange Commission.

NOTE 2 - RECENT ACCOUNTING STANDARDS UPDATES

Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") Topic 718 "Compensation - Stock Compensation" Update No. 2016-09. Update No. 2016-09 was issued in March 2016 and affects all entities that issue share-based awards to their employees. This update was issued as part of the FASB’s simplification initiative. The areas for simplification in this update involve several aspects of the accounting for share-based payment transactions, including the income tax consequences, classification of awards as either equity or liabilities, and classification on the statement of cash flows. The amendments in this update are effective for fiscal years beginning after December 15, 2016, including interim periods within those fiscal years. The Company adopted this standard effective January 1, 2017. Upon adoption, the Company elected to no longer estimate forfeitures on stock compensation and instead recognize forfeitures when they occur. The election required a cumulative effect adjustment to retained earnings which did not materially impact the Company's consolidated financial position. Additionally, the disclosure requirements of this standard will be applied on a prospective basis.

FASB ASC Topic 310-20 "Receivables - Nonrefundable fees and Other Costs" Update No. 2017-08. Update No. 2017-08 was issued in March 2017 to shorten the amortization period for certain callable debt securities held at a premium. Specifically, the amendments require the premium to be amortized to the earliest call date. The amendments do not require an accounting change for securities held at a discount; the discount continues to be amortized to maturity. The amendments in this update are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018. Early adoption is permitted, including adoption in an interim period. The Company early adopted this standard effective January 1, 2017 and the impact on the Company's consolidated financial position was immaterial.

FASB ASC Topic 715 "Compensation - Retirement Benefits" Update No. 2017-07. Update No. 2017-07 was issued in March 2017 to improve the presentation of net periodic pension cost and net periodic postretirement benefit costs. This update requires that an employer report the service cost component in the same line item or items as other compensation costs arising from services rendered by the pertinent employees during the period. The other components of net benefit cost are required to be presented in the income statement separately from the service cost component and outside a subtotal of income from operations, if one is presented. If a separate line item or items are used to present the other components of net benefit cost, that line item or items must be appropriately described. If a separate line item or items are not used, the line item or items used in the income statement to present the other components of net benefit cost must be disclosed. The amendments in this update also allow only the service cost component to be eligible for capitalization when applicable. The amendments in this update are effective for annual periods beginning after December 15, 2017, including interim periods within those annual periods. Early adoption is permitted as of the beginning of an annual period for which the financial statements (interim or annual) have not been issued or made available for issuance. That is, early adoption should be within the first interim period if an employer issues interim financial statements. Disclosures of the nature of and reason for the change in accounting principle are required in the first interim and annual periods of adoption. The adoption of this standard is not expected to have a material impact on the Company's consolidated financial position.

11

FASB ASC Subtopic 610-20 "Other Income - Gains and Losses from the Derecognition of Nonfinancial Assets" Update No. 2017-05. Update No. 2017-05 was issued in February 2017 to clarify that a financial asset is within the scope of Subtopic 610-20 if it meets the definition of an in substance nonfinancial asset. The amendments define the term in substance nonfinancial asset, in part, as a financial asset promised to a counterparty in a contract if substantially all of the fair value of the assets (recognized and unrecognized) that are promised to the counterparty in the contract is concentrated in nonfinancial assets. The amendments in this update also clarify that nonfinancial assets within the scope of Subtopic 610-20 may include nonfinancial assets transferred within a legal entity to a counterparty. A contract that includes the transfer of ownership interests in one or more consolidated subsidiaries is within the scope of Subtopic 610-20 if substantially all of the fair value of the assets that are promised to the counterparty in a contract is concentrated in nonfinancial assets. For purposes of that evaluation, the amendments require an entity to evaluate the underlying assets in consolidated subsidiaries to determine whether those assets are within the scope of Subtopic 610-20. The amendments are effective for annual reporting periods beginning after December 15, 2017, including interim reporting periods within that reporting period. The guidance may be applied earlier but only as of annual reporting periods beginning after December 15, 2016, including interim reporting periods in that reporting period. The adoption of this standard is not expected to have a material impact on the Company's consolidated financial position.

FASB ASC Topic 350 "Intangibles - Goodwill and Other " Update No. 2017-04. Update No. 2017-04 was issued in January 2017 to simplify the subsequent measurement of goodwill, by eliminating Step 2 for the goodwill impairment test. The amendments in this update modify the concept of impairment from the condition that exists when the carrying amount of a reporting unit exceeds its fair value. An entity is no longer required to determine goodwill impairment by calculating the implied fair value of goodwill by assigning the fair value of a reporting unit to all of its assets and liabilities as if that reporting unit has been acquired in a business combination. An entity should apply the amendments in this update on a prospective basis. An entity is required to disclose the nature of and reason for the change in accounting principle upon transition. That disclosure should be provided in the first annual period and in the interim period within the first annual period when the entity initially adopts the amendments in this update. Early adoption is permitted for interim or annual goodwill impairment tests performed on testing dates after January 1, 2017. The adoption of this standard is not expected to have a material impact on the Company's consolidated financial position.

FASB ASC Topic 606 "Revenue from Contracts with Customers" Update No. 2014-09. Update No. 2014-09 was issued in May 2014 to address the previous revenue recognition requirements in GAAP that differ from those in International Financial Reporting Standards (IFRS). Accordingly, the FASB and the International Accounting Standards Board (IASB) initiated a joint project to clarify the principles for recognizing revenue and to develop a common revenue standard for U.S. GAAP and IFRS. The largely converged revenue recognition standards will supersede virtually all revenue recognition guidance in GAAP and IFRS. The core principle of the guidance is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. Since the issuance of Update 2014-09, the FASB has finalized various amendments to the standard as summarized below:

FASB ASC Topic 606 "Revenue from Contracts with Customers" Update No. 2016-20

FASB ASC Topic 606 "Revenue from Contracts with Customers" Update No. 2016-12

FASB ASC Topic 606 "Revenue from Contracts with Customers" Update No. 2016-10

FASB ASC Topic 606 "Revenue from Contracts with Customers" Update No. 2016-08.

FASB ASC Topic 606 "Revenue from Contracts with Customers" Update No. 2015-14.

The amendments in Update 2016-20 make minor corrections or minor improvements to the codification that are not expected to have a significant effect on current accounting practice or create a significant administrative cost to most entities.

Through Updates 2016-12, 2016-10 and 2016-08, the FASB amended its new revenue guidance on licenses of intellectual property, identification of performance obligations, collectability, noncash consideration and the presentation of sales and other similar taxes. The FASB also clarified the definition of a completed contract at transition and added a practical expedient to ease transition for contracts that were modified prior to adoption. The FASB also amended the new revenue recognition guidance on determining whether an entity is a principal or an agent in an arrangement which affects whether revenue should be reported gross or net.

Following the issuance of Update 2015-14, Update 2014-09, as amended, is effective for the Company for annual reporting periods beginning after December 15, 2017, including interim reporting periods within that reporting period. Earlier adoption is permitted only as of annual reporting periods beginning after December 15, 2016, including interim reporting periods within that reporting period. A full or modified retrospective transition method is required. The Company's revenue is comprised of net interest income on financial assets and liabilities, which is explicitly excluded from the scope of the new guidance, and noninterest income.

12

The Company plans to adopt the revenue recognition guidance in the first quarter of 2018 and is currently evaluating the potential impact on noninterest income on the Company's consolidated financial position, other presentation and disclosure issues. Additionally, the Company anticipates using the modified retrospective transition method upon adoption.

13

NOTE 3 - SECURITIES

Trading Securities

The Company had trading securities of $1.3 million and $804,000 as of March 31, 2017 and December 31, 2016, respectively. These securities are held in a rabbi trust and will be used for future payments associated with the Company’s non-qualified

401(k) Restoration Plan and Non-Qualified Deferred Compensation Plan.

Available for Sale and Held to Maturity Securities

The following table presents a summary of the amortized cost, gross unrealized gains and losses and fair value of securities available for sale and securities held to maturity for the periods indicated:

March 31, 2017 | December 31, 2016 | ||||||||||||||||||||||||||||||

Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | ||||||||||||||||||||||||

(Dollars in thousands) | |||||||||||||||||||||||||||||||

Available for sale securities | |||||||||||||||||||||||||||||||

U.S. government agency securities | $ | 24,007 | $ | 262 | $ | — | $ | 24,269 | $ | 24,006 | $ | 238 | $ | — | $ | 24,244 | |||||||||||||||

Agency mortgage-backed securities | 186,103 | 2,729 | (498 | ) | 188,334 | 173,268 | 2,852 | (736 | ) | 175,384 | |||||||||||||||||||||

Agency collateralized mortgage obligations | 126,017 | 182 | (1,331 | ) | 124,868 | 101,094 | 106 | (1,332 | ) | 99,868 | |||||||||||||||||||||

State, county, and municipal securities | 3,733 | 54 | — | 3,787 | 3,743 | 50 | — | 3,793 | |||||||||||||||||||||||

Single issuer trust preferred securities issued by banks | 2,298 | 22 | — | 2,320 | 2,311 | 3 | (3 | ) | 2,311 | ||||||||||||||||||||||

Pooled trust preferred securities issued by banks and insurers | 2,201 | — | (605 | ) | 1,596 | 2,200 | — | (616 | ) | 1,584 | |||||||||||||||||||||

Small business administration pooled securities | 37,140 | 28 | (166 | ) | 37,002 | 37,561 | — | (372 | ) | 37,189 | |||||||||||||||||||||

Equity securities | 19,166 | 964 | (469 | ) | 19,661 | 19,183 | 641 | (553 | ) | 19,271 | |||||||||||||||||||||

Total available for sale securities | $ | 400,665 | $ | 4,241 | $ | (3,069 | ) | $ | 401,837 | $ | 363,366 | $ | 3,890 | $ | (3,612 | ) | $ | 363,644 | |||||||||||||

Held to maturity securities | |||||||||||||||||||||||||||||||

U.S. Treasury securities | $ | 1,007 | $ | 45 | $ | — | $ | 1,052 | $ | 1,007 | $ | 47 | $ | — | $ | 1,054 | |||||||||||||||

Agency mortgage-backed securities | 184,317 | 2,283 | (1,024 | ) | 185,576 | 156,088 | 2,274 | (858 | ) | 157,504 | |||||||||||||||||||||

Agency collateralized mortgage obligations | 284,716 | 1,065 | (3,657 | ) | 282,124 | 297,445 | 1,002 | (3,797 | ) | 294,650 | |||||||||||||||||||||

Single issuer trust preferred securities issued by banks | 1,500 | 38 | — | 1,538 | 1,500 | 44 | — | 1,544 | |||||||||||||||||||||||

Small business administration pooled securities | 30,583 | 228 | (184 | ) | 30,627 | 31,036 | 189 | (327 | ) | 30,898 | |||||||||||||||||||||

Total held to maturity securities | $ | 502,123 | $ | 3,659 | $ | (4,865 | ) | $ | 500,917 | $ | 487,076 | $ | 3,556 | $ | (4,982 | ) | $ | 485,650 | |||||||||||||

Total | $ | 902,788 | $ | 7,900 | $ | (7,934 | ) | $ | 902,754 | $ | 850,442 | $ | 7,446 | $ | (8,594 | ) | $ | 849,294 | |||||||||||||

When securities are sold, the adjusted cost of the specific security sold is used to compute the gain or loss on the sale.

The actual maturities of certain securities may differ from the contractual maturities because borrowers may have the right to call or prepay obligations with or without call or prepayment penalties. A schedule of the contractual maturities of securities available for sale and securities held to maturity as of March 31, 2017 is presented below:

Available for Sale | Held to Maturity | ||||||||||||||

Amortized Cost | Fair Value | Amortized Cost | Fair Value | ||||||||||||

(Dollars in thousands) | |||||||||||||||

Due in one year or less | $ | 1,232 | $ | 1,239 | $ | — | $ | — | |||||||

Due after one year to five years | 38,912 | 39,410 | 15,915 | 16,092 | |||||||||||

Due after five to ten years | 87,856 | 88,207 | 21,090 | 21,643 | |||||||||||

Due after ten years | 253,499 | 253,320 | 465,118 | 463,182 | |||||||||||

Total debt securities | $ | 381,499 | $ | 382,176 | $ | 502,123 | $ | 500,917 | |||||||

Equity securities | $ | 19,166 | $ | 19,661 | $ | — | $ | — | |||||||

Total | $ | 400,665 | $ | 401,837 | $ | 502,123 | $ | 500,917 | |||||||

14

Inclusive in the table above is $10.9 million of callable securities in the Company’s investment portfolio at March 31, 2017.

The carrying value of securities pledged to secure public funds, trust deposits, repurchase agreements and for other purposes, as required or permitted by law, was $498.6 million and $482.1 million at March 31, 2017 and December 31, 2016, respectively.

At March 31, 2017 and December 31, 2016, the Company had no investments in obligations of individual states, counties, or municipalities which exceeded 10% of stockholders’ equity.

Other-Than-Temporary Impairment ("OTTI")

The Company continually reviews investment securities for the existence of OTTI, taking into consideration current market conditions, the extent and nature of changes in fair value, issuer rating changes and trends, the credit worthiness of the obligor of the security, volatility of earnings, current analysts’ evaluations, the Company’s intent to sell the security, whether it is more likely than not that the Company will be required to sell the debt security before its anticipated recovery, as well as other qualitative factors. The term “other-than-temporary” is not intended to indicate that the decline is permanent, but indicates that the prospects for a near-term recovery of value is not necessarily favorable, or that there is a lack of evidence to support a realizable value equal to or greater than the carrying value of the investment.

The following tables show the gross unrealized losses and fair value of the Company’s investments in an unrealized loss position, which the Company has not deemed to be OTTI, aggregated by investment category and length of time that individual securities have been in a continuous unrealized loss position:

March 31, 2017 | ||||||||||||||||||||||||||

Less than 12 months | 12 months or longer | Total | ||||||||||||||||||||||||

# of holdings | Fair Value | Unrealized Losses | Fair Value | Unrealized Losses | Fair Value | Unrealized Losses | ||||||||||||||||||||

(Dollars in thousands) | ||||||||||||||||||||||||||

Agency mortgage-backed securities | 42 | $ | 145,227 | $ | (1,522 | ) | $ | — | $ | — | $ | 145,227 | $ | (1,522 | ) | |||||||||||

Agency collateralized mortgage obligations | 33 | 247,688 | (3,003 | ) | 45,458 | (1,985 | ) | 293,146 | (4,988 | ) | ||||||||||||||||

Pooled trust preferred securities issued by banks and insurers | 1 | — | — | 1,596 | (605 | ) | 1,596 | (605 | ) | |||||||||||||||||

Small business administration pooled securities | 4 | 46,217 | (350 | ) | — | — | 46,217 | (350 | ) | |||||||||||||||||

Equity securities | 22 | 1,706 | (53 | ) | 5,928 | (416 | ) | 7,634 | (469 | ) | ||||||||||||||||

Total temporarily impaired securities | 102 | $ | 440,838 | $ | (4,928 | ) | $ | 52,982 | $ | (3,006 | ) | $ | 493,820 | $ | (7,934 | ) | ||||||||||

December 31, 2016 | ||||||||||||||||||||||||||

Less than 12 months | 12 months or longer | Total | ||||||||||||||||||||||||

# of holdings | Fair Value | Unrealized Losses | Fair Value | Unrealized Losses | Fair Value | Unrealized Losses | ||||||||||||||||||||

(Dollars in thousands) | ||||||||||||||||||||||||||

Agency mortgage-backed securities | 57 | $ | 137,949 | $ | (1,594 | ) | $ | — | $ | — | $ | 137,949 | $ | (1,594 | ) | |||||||||||

Agency collateralized mortgage obligations | 32 | 243,051 | (3,140 | ) | 47,403 | (1,989 | ) | 290,454 | (5,129 | ) | ||||||||||||||||

Single issuer trust preferred securities issued by banks and insurers | 1 | — | — | 1,036 | (3 | ) | 1,036 | (3 | ) | |||||||||||||||||

Pooled trust preferred securities issued by banks and insurers | 1 | — | — | 1,583 | (616 | ) | 1,583 | (616 | ) | |||||||||||||||||

Small business administration pooled securities | 5 | 59,846 | (699 | ) | — | — | 59,846 | (699 | ) | |||||||||||||||||

Equity securities | 25 | 3,625 | (77 | ) | 6,334 | (476 | ) | 9,959 | (553 | ) | ||||||||||||||||

Total temporarily impaired securities | 121 | $ | 444,471 | $ | (5,510 | ) | $ | 56,356 | $ | (3,084 | ) | $ | 500,827 | $ | (8,594 | ) | ||||||||||

The Company does not intend to sell these investments and has determined based upon available evidence that it is more likely than not that the Company will not be required to sell the security before the recovery of its amortized cost basis. As a result, the Company does not consider these investments to be OTTI. The Company made this determination by reviewing various

15

qualitative and quantitative factors regarding each investment category, such as current market conditions, extent and nature of changes in fair value, issuer rating changes and trends, volatility of earnings, and current analysts’ evaluations.

As a result of the Company’s review of these qualitative and quantitative factors, the causes of the impairments listed in the table above by category are as follows at March 31, 2017:

• | Agency Mortgage-Backed Securities, Agency Collateralized Mortgage Obligations and Small Business Administration Pooled Securities: These portfolios have contractual terms that generally do not permit the issuer to settle the securities at a price less than the current par value of the investment. The decline in market value of these securities is attributable to changes in interest rates and not credit quality. Additionally, these securities are either implicitly or explicitly guaranteed by the U.S. Government or one of its agencies. |

• | Pooled Trust Preferred Securities: This portfolio consists of one below investment grade security which is performing. The unrealized loss on this security is attributable to the illiquid nature of the trust preferred market in the current economic and regulatory environment. Management evaluates collateral credit and instrument structure, including current and expected deferral and default rates and timing. In addition, discount rates are determined by evaluating comparable spreads observed currently in the market for similar instruments. |

• | Equity Securities: This portfolio consists of mutual funds and other equity investments. During some periods, the mutual funds in the Company’s investment portfolio may have unrealized losses resulting from market fluctuations, as well as the risk premium associated with that particular asset class. For example, emerging market equities tend to trade at a higher risk premium than U.S. government bonds and thus, will fluctuate to a greater degree on both the upside and the downside. In the context of a well-diversified portfolio, however, the correlation amongst the various asset classes represented by the funds serves to minimize downside risk. The Company evaluates each mutual fund in the portfolio regularly and measures performance on both an absolute and relative basis. A reasonable recovery period for positions with an unrealized loss is based on management’s assessment of general economic data, trends within a particular asset class, valuations, earnings forecasts and bond durations. The Company has the ability and intent to hold these equity securities until a recovery of fair value. |

For the three months ended March 31, 2017 and 2016 there was no OTTI recorded and no cumulative credit related component of OTTI.

16

NOTE 4 - LOANS, ALLOWANCE FOR LOAN LOSSES, AND CREDIT QUALITY

The following tables bifurcate the amount of loans and the allowance allocated to each loan category based on the type of impairment analysis as of the periods indicated:

March 31, 2017 | |||||||||||||||||||||||||||||||||

(Dollars in thousands) | |||||||||||||||||||||||||||||||||

Commercial and Industrial | Commercial Real Estate | Commercial Construction | Small Business | Residential Real Estate | Home Equity | Other Consumer | Total | ||||||||||||||||||||||||||

Financing receivables ending balance: | |||||||||||||||||||||||||||||||||

Collectively evaluated for impairment | $ | 842,891 | $ | 3,002,407 | $ | 356,173 | $ | 125,628 | $ | 632,634 | $ | 1,002,898 | $ | 10,057 | $ | 5,972,688 | |||||||||||||||||

Individually evaluated for impairment | $ | 38,438 | $ | 14,766 | $ | — | $ | 746 | $ | 13,674 | $ | 5,685 | $ | 358 | $ | 73,667 | |||||||||||||||||

Purchased credit impaired loans | $ | — | $ | 10,132 | $ | — | $ | — | $ | 7,691 | $ | 188 | $ | — | $ | 18,011 | |||||||||||||||||

Total loans by group | $ | 881,329 | $ | 3,027,305 | $ | 356,173 | $ | 126,374 | $ | 653,999 | $ | 1,008,771 | $ | 10,415 | $ | 6,064,366 | (1 | ) | |||||||||||||||

December 31, 2016 | |||||||||||||||||||||||||||||||||

(Dollars in thousands) | |||||||||||||||||||||||||||||||||

Commercial and Industrial | Commercial Real Estate | Commercial Construction | Small Business | Residential Real Estate | Home Equity | Other Consumer | Total | ||||||||||||||||||||||||||

Financing receivables ending balance: | |||||||||||||||||||||||||||||||||

Collectively evaluated for impairment | $ | 862,875 | $ | 2,983,642 | $ | 320,391 | $ | 121,855 | $ | 622,392 | $ | 982,095 | $ | 10,666 | $ | 5,903,916 | |||||||||||||||||

Individually evaluated for impairment | $ | 39,178 | $ | 16,813 | $ | — | $ | 871 | $ | 14,175 | $ | 5,863 | $ | 397 | $ | 77,297 | |||||||||||||||||

Purchased credit impaired loans | $ | — | $ | 10,343 | $ | — | $ | — | $ | 7,859 | $ | 189 | $ | 1 | $ | 18,392 | |||||||||||||||||

Total loans by group | $ | 902,053 | $ | 3,010,798 | $ | 320,391 | $ | 122,726 | $ | 644,426 | $ | 988,147 | $ | 11,064 | $ | 5,999,605 | (1 | ) | |||||||||||||||

(1) | The amount of net deferred costs on originated loans included in the ending balance was $5.5 million and $5.1 million at March 31, 2017 and December 31, 2016 respectively. Net unamortized discounts on acquired loans not deemed to be purchased credit impaired ("PCI") included in the ending balance was $8.3 million and $8.6 million at March 31, 2017 and December 31, 2016, respectively. |

17

The following tables summarize changes in allowance for loan losses by loan category for the periods indicated:

Three Months Ended March 31, 2017 | |||||||||||||||||||||||||||||||

(Dollars in thousands) | |||||||||||||||||||||||||||||||

Commercial and Industrial | Commercial Real Estate | Commercial Construction | Small Business | Residential Real Estate | Home Equity | Other Consumer | Total | ||||||||||||||||||||||||

Allowance for loan losses | |||||||||||||||||||||||||||||||

Beginning balance | $ | 16,921 | $ | 30,369 | $ | 4,522 | $ | 1,502 | $ | 2,621 | $ | 5,238 | $ | 393 | $ | 61,566 | |||||||||||||||

Charge-offs | — | — | — | (70 | ) | (23 | ) | (14 | ) | (401 | ) | (508 | ) | ||||||||||||||||||

Recoveries | 187 | 31 | — | 66 | 12 | 76 | 288 | 660 | |||||||||||||||||||||||

Provision (benefit) | (590 | ) | 343 | 501 | 35 | 106 | 45 | 160 | 600 | ||||||||||||||||||||||

Ending balance | $ | 16,518 | $ | 30,743 | $ | 5,023 | $ | 1,533 | $ | 2,716 | $ | 5,345 | $ | 440 | $ | 62,318 | |||||||||||||||

Ending balance: collectively evaluated for impairment | $ | 12,960 | $ | 30,570 | $ | 5,023 | $ | 1,531 | $ | 1,650 | $ | 5,110 | $ | 419 | $ | 57,263 | |||||||||||||||

Ending balance: individually evaluated for impairment | $ | 3,558 | $ | 173 | $ | — | $ | 2 | $ | 1,066 | $ | 235 | $ | 21 | $ | 5,055 | |||||||||||||||

Three Months Ended March 31, 2016 | |||||||||||||||||||||||||||||||

(Dollars in thousands) | |||||||||||||||||||||||||||||||

Commercial and Industrial | Commercial Real Estate | Commercial Construction | Small Business | Residential Real Estate | Home Equity | Other Consumer | Total | ||||||||||||||||||||||||

Allowance for loan losses | |||||||||||||||||||||||||||||||

Beginning balance | $ | 13,802 | $ | 27,327 | $ | 5,366 | $ | 1,264 | $ | 2,590 | $ | 4,889 | $ | 587 | $ | 55,825 | |||||||||||||||

Charge-offs | (2 | ) | — | — | (63 | ) | (19 | ) | (147 | ) | (306 | ) | (537 | ) | |||||||||||||||||

Recoveries | 138 | 189 | — | 21 | — | 27 | 244 | 619 | |||||||||||||||||||||||

Provision (benefit) | (453 | ) | 1,079 | (266 | ) | 119 | (4 | ) | 146 | (96 | ) | 525 | |||||||||||||||||||

Ending balance | $ | 13,485 | $ | 28,595 | $ | 5,100 | $ | 1,341 | $ | 2,567 | $ | 4,915 | $ | 429 | $ | 56,432 | |||||||||||||||

Ending balance: individually evaluated for impairment | $ | 222 | $ | 802 | $ | — | $ | 3 | $ | 1,223 | $ | 231 | $ | 26 | $ | 2,507 | |||||||||||||||

Ending balance: collectively evaluated for impairment | $ | 13,263 | $ | 27,793 | $ | 5,100 | $ | 1,338 | $ | 1,344 | $ | 4,684 | $ | 403 | $ | 53,925 | |||||||||||||||

For the purpose of estimating the allowance for loan losses, management segregates the loan portfolio into the portfolio segments detailed in the above tables. Each of these loan categories possesses unique risk characteristics that are considered when determining the appropriate level of allowance for each segment. Some of the risk characteristics unique to each loan category include:

Commercial Portfolio

• | Commercial and Industrial: Loans in this category consist of revolving and term loan obligations extended to business and corporate enterprises for the purpose of financing working capital and/or capital investment. Collateral generally consists of pledges of business assets including, but not limited to: accounts receivable, inventory, plant and equipment, or real estate, if applicable. Repayment sources consist of primarily, operating cash flow, and secondarily, liquidation of assets. |

• | Commercial Real Estate: Loans in this category consist of mortgage loans to finance investment in real property such as multi-family residential, commercial/retail, office, industrial, hotels, educational and healthcare facilities and other specific use properties. Loans are typically written with amortizing payment structures. Collateral values are determined based upon third party appraisals and evaluations. Loan to value ratios at origination are governed by established policy and regulatory guidelines. Repayment sources consist of, primarily, cash flow from operating leases and rents and, secondarily, liquidation of assets. |

• | Commercial Construction: Loans in this category consist of short-term construction loans, revolving and nonrevolving credit lines and construction/permanent loans to finance the acquisition, development and construction or rehabilitation of real property. Project types include residential 1-4 family, condominium and multi-family homes, commercial/retail, office, industrial, hotels, educational and healthcare facilities and other specific use properties. Loans may be written with nonamortizing or hybrid payment structures depending upon the type of project. Collateral values are determined based upon third party appraisals and evaluations. Loan to value ratios at origination are governed by established policy and regulatory |

18

guidelines. Repayment sources vary depending upon the type of project and may consist of sale or lease of units, operating cash flows or liquidation of other assets.

• | Small Business: Loans in this category consist of revolving, term loan and mortgage obligations extended to sole proprietors and small businesses for purposes of financing working capital and/or capital investment. Collateral generally consists of pledges of business assets including, but not limited to, accounts receivable, inventory, plant and equipment, or real estate if applicable. Repayment sources consist primarily of operating cash flows and, secondarily, liquidation of assets. |

For the commercial portfolio it is the Company’s policy to obtain personal guarantees for payment from individuals holding material ownership interests of the borrowing entities.

Consumer Portfolio

• | Residential Real Estate: Residential mortgage loans held in the Company’s portfolio are made to borrowers who demonstrate the ability to make scheduled payments with full consideration to underwriting factors such as current and expected income, employment status, current assets, other financial resources, credit history and the value of the collateral. Collateral consists of mortgage liens on 1-4 family residential properties. The Company does not originate or purchase sub-prime loans. |

• | Home Equity: Home equity loans and credit lines are made to qualified individuals and are primarily secured by senior or junior mortgage liens on owner-occupied 1-4 family homes, condominiums or vacation homes. Each home equity loan has a fixed rate and is billed in equal payments comprised of principal and interest. Each home equity line of credit has a variable rate and is billed in interest-only payments during the draw period. At the end of the draw period, each home equity line of credit is billed as a percentage of the principal balance plus all accrued interest. Additionally, the Company has the option of renewing each line of credit for additional draw periods. Borrower qualifications include favorable credit history combined with supportive income requirements and combined loan to value ratios within established policy guidelines. |

• | Other Consumer: Other consumer loan products include personal lines of credit and amortizing loans made to qualified individuals for various purposes such as education, debt consolidation, personal expenses or overdraft protection. Borrower qualifications include favorable credit history combined with supportive income and collateral requirements within established policy guidelines. These loans may be secured or unsecured. |

Credit Quality

The Company continually monitors the asset quality of the loan portfolio using all available information. Based on this information, loans demonstrating certain payment issues or other weaknesses may be categorized as delinquent, impaired, nonperforming and/or put on nonaccrual status. Additionally, in the course of resolving such loans, the Company may choose to restructure the contractual terms of certain loans to match the borrower’s ability to repay the loan based on their current financial condition. If a restructured loan meets certain criteria, it may be categorized as a troubled debt restructuring (“TDR”).

The Company reviews numerous credit quality indicators when assessing the risk in its loan portfolio. For the commercial portfolio, the Company utilizes a 10-point commercial risk-rating system, which assigns a risk-grade to each borrower based on a number of quantitative and qualitative factors associated with a commercial loan transaction. Factors considered include industry and market conditions, position within the industry, earnings trends, operating cash flow, asset/liability values, debt capacity, guarantor strength, management and controls, financial reporting, collateral, and other considerations. The risk-ratings categories are defined as follows:

• | 1- 6 Rating — Pass: Risk-rating grades “1” through “6” comprise those loans ranging from ‘Substantially Risk Free’ which indicates borrowers are of unquestioned credit standing and the pinnacle of credit quality, well established companies with a very strong financial condition, and loans fully secured by cash collateral, through ‘Acceptable Risk’, which indicates borrowers may exhibit declining earnings, strained cash flow, increasing or above average leverage and/or weakening market fundamentals that indicate below average asset quality, margins and market share. Collateral coverage is protective. |

• | 7 Rating — Potential Weakness: Borrowers exhibit potential credit weaknesses or downward trends deserving management’s close attention. If not checked or corrected, these trends will weaken the Company’s asset and position. While potentially weak, currently these borrowers are marginally acceptable; no loss of principal or interest is envisioned. |

• | 8 Rating — Definite Weakness Loss Unlikely: Borrowers exhibit well defined weaknesses that jeopardize the orderly liquidation of debt. Loan may be inadequately protected by the current net worth and paying capacity of the obligor or by the collateral pledged, if any. Normal repayment from the borrower is in jeopardy, although no loss of principal is envisioned. However, there is a distinct possibility that a partial loss of interest and/or principal will occur if the deficiencies are not corrected. Collateral coverage may be inadequate to cover the principal obligation. |

19

• | 9 Rating — Partial Loss Probable: Borrowers exhibit well defined weaknesses that jeopardize the orderly liquidation of debt with the added provision that the weaknesses make collection of the debt in full, on the basis of currently existing facts, conditions, and values, highly questionable and improbable. Serious problems exist to the point where partial loss of principal is likely. |

• | 10 Rating — Definite Loss: Borrowers deemed incapable of repayment. Loans to such borrowers are considered uncollectible and of such little value that continuation as active assets of the Company is not warranted. |

The credit quality of the commercial loan portfolio is actively monitored and any changes in credit quality are reflected in risk-rating changes. Risk-ratings are assigned or reviewed for all new loans, when advancing significant additions to existing relationships (over $50,000), at least quarterly for all actively managed loans, and any time a significant event occurs, including at renewal of the loan.

The Company utilizes a comprehensive strategy for monitoring commercial credit quality. Borrowers are required to provide updated financial information at least annually which is carefully evaluated for any changes in credit quality. Larger loan relationships are subject to a full annual credit review by an experienced credit analysis group. Additionally, the Company retains an independent loan review firm to evaluate the credit quality of the commercial loan portfolio. The independent loan review process achieves significant penetration into the commercial loan portfolio and reports the results of these reviews to the Audit Committee of the Board of Directors on a quarterly basis.

The following table details the amount of outstanding principal balances relative to each of the risk-rating categories for the Company’s commercial portfolio:

March 31, 2017 | |||||||||||||||||||||

Category | Risk Rating | Commercial and Industrial | Commercial Real Estate | Commercial Construction | Small Business | Total | |||||||||||||||

(Dollars in thousands) | |||||||||||||||||||||

Pass | 1 - 6 | $ | 782,142 | $ | 2,900,222 | $ | 354,245 | $ | 123,998 | $ | 4,160,607 | ||||||||||

Potential weakness | 7 | 36,868 | 89,588 | 1,096 | 1,542 | 129,094 | |||||||||||||||

Definite weakness-loss unlikely | 8 | 62,219 | 35,079 | 832 | 828 | 98,958 | |||||||||||||||

Partial loss probable | 9 | 100 | 2,416 | — | 6 | 2,522 | |||||||||||||||

Definite loss | 10 | — | — | — | — | — | |||||||||||||||

Total | $ | 881,329 | $ | 3,027,305 | $ | 356,173 | $ | 126,374 | $ | 4,391,181 | |||||||||||

December 31, 2016 | |||||||||||||||||||||

Category | Risk Rating | Commercial and Industrial | Commercial Real Estate | Commercial Construction | Small Business | Total | |||||||||||||||

(Dollars in thousands) | |||||||||||||||||||||

Pass | 1 - 6 | $ | 783,825 | $ | 2,876,570 | $ | 317,099 | $ | 120,304 | $ | 4,097,798 | ||||||||||

Potential weakness | 7 | 46,176 | 84,641 | 1,363 | 1,859 | 134,039 | |||||||||||||||

Definite weakness-loss unlikely | 8 | 71,991 | 47,164 | 1,929 | 556 | 121,640 | |||||||||||||||

Partial loss probable | 9 | 61 | 2,423 | — | 7 | 2,491 | |||||||||||||||

Definite loss | 10 | — | — | — | — | — | |||||||||||||||

Total | $ | 902,053 | $ | 3,010,798 | $ | 320,391 | $ | 122,726 | $ | 4,355,968 | |||||||||||

20

For the Company’s consumer portfolio, the quality of the loan is best indicated by the repayment performance of an individual borrower. However, the Company does supplement performance data with current Fair Isaac Corporation (“FICO”) scores and Loan to Value (“LTV”) estimates. Current FICO data is purchased and appended to all consumer loans on a regular basis. In addition, automated valuation services and broker opinions of value are used to supplement original value data for the residential and home equity portfolios, periodically. The following table shows the weighted average FICO scores and the weighted average combined LTV ratios as of the periods indicated below:

March 31, 2017 | December 31, 2016 | ||||

Residential portfolio | |||||

FICO score (re-scored)(1) | 744 | 743 | |||

LTV (re-valued)(2) | 63.4 | % | 63.2 | % | |

Home equity portfolio | |||||

FICO score (re-scored)(1) | 767 | 767 | |||

LTV (re-valued)(2) | 54.9 | % | 55.9 | % | |

(1) | The average FICO scores for March 31, 2017 and December 31, 2016 are based upon rescores available from November 30, 2016 and origination score data for loans booked between December 1, 2016 and the dates indicated. |

(2) | The combined LTV ratios for March 31, 2017 and December 31, 2016 are based upon updated automated valuations as of March 31, 2015 and origination value data for loans booked between April 1, 2015 and through the dates indicated. For home equity loans and lines in a subordinate lien position, the LTV data represents a combined LTV, taking into account the senior lien data for loans and lines. |

Asset Quality

The Company’s philosophy toward managing its loan portfolios is predicated upon careful monitoring, which stresses early detection and response to delinquent and default situations. Delinquent loans are managed by a team of seasoned collection specialists and the Company seeks to make arrangements to resolve any delinquent or default situation over the shortest possible time frame. As a general rule, loans more than 90 days past due with respect to principal or interest are classified as nonaccrual loans. The Company also may use discretion regarding other loans over 90 days delinquent if the loan is well secured and/or in process of collection.

21

The following table shows information regarding nonaccrual loans at the dates indicated:

March 31, 2017 | December 31, 2016 | ||||||

(Dollars in thousands) | |||||||

Commercial and industrial | $ | 36,877 | $ | 37,455 | |||

Commercial real estate | 4,792 | 6,266 | |||||

Small business | 207 | 302 | |||||

Residential real estate | 7,139 | 7,782 | |||||

Home equity | 5,987 | 5,553 | |||||

Other consumer | 48 | 47 | |||||

Total nonaccrual loans (1) | $ | 55,050 | $ | 57,405 | |||

(1) | Included in these amounts were $5.4 million and $5.2 million of nonaccruing TDRs at March 31, 2017 and December 31, 2016, respectively. |

The following table shows information regarding foreclosed residential real estate property at the dates indicated:

March 31, 2017 | December 31, 2016 | ||||||

(Dollars in thousands) | |||||||

Foreclosed residential real estate property held by the creditor | $ | 3,006 | $ | 3,775 | |||

Recorded investment in mortgage loans collateralized by residential real estate property that are in the process of foreclosure | $ | 2,277 | $ | 1,715 | |||

The following table shows the age analysis of past due financing receivables as of the dates indicated:

March 31, 2017 | |||||||||||||||||||||||||||||||||||||||

30-59 days | 60-89 days | 90 days or more | Total Past Due | Total Financing Receivables | Recorded Investment >90 Days and Accruing | ||||||||||||||||||||||||||||||||||

Number of Loans | Principal Balance | Number of Loans | Principal Balance | Number of Loans | Principal Balance | Number of Loans | Principal Balance | Current | |||||||||||||||||||||||||||||||

(Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||

Loan Portfolio | |||||||||||||||||||||||||||||||||||||||

Commercial and industrial | 10 | $ | 3,089 | 6 | $ | 14,666 | 34 | $ | 1,123 | 50 | $ | 18,878 | $ | 862,451 | $ | 881,329 | $ | — | |||||||||||||||||||||

Commercial real estate | 15 | 3,158 | — | — | 9 | 3,141 | 24 | 6,299 | 3,021,006 | 3,027,305 | — | ||||||||||||||||||||||||||||

Commercial construction | — | — | — | — | — | — | — | — | 356,173 | 356,173 | — | ||||||||||||||||||||||||||||

Small business | 9 | 331 | 8 | 108 | 13 | 120 | 30 | 559 | 125,815 | 126,374 | — | ||||||||||||||||||||||||||||

Residential real estate | 11 | 1,867 | 6 | 968 | 23 | 3,258 | 40 | 6,093 | 647,906 | 653,999 | — | ||||||||||||||||||||||||||||

Home equity | 14 | 1,156 | 6 | 460 | 18 | 1,417 | 38 | 3,033 | 1,005,738 | 1,008,771 | — | ||||||||||||||||||||||||||||

Other consumer (1) | 226 | 151 | 14 | 42 | 17 | 16 | 257 | 209 | 10,206 | 10,415 | 2 | ||||||||||||||||||||||||||||

Total | 285 | $ | 9,752 | 40 | $ | 16,244 | 114 | $ | 9,075 | 439 | $ | 35,071 | $ | 6,029,295 | $ | 6,064,366 | $ | 2 | |||||||||||||||||||||

22

December 31, 2016 | |||||||||||||||||||||||||||||||||||||||

30-59 days | 60-89 days | 90 days or more | Total Past Due | Total Financing Receivables | Recorded Investment >90 Days and Accruing | ||||||||||||||||||||||||||||||||||

Number of Loans | Principal Balance | Number of Loans | Principal Balance | Number of Loans | Principal Balance | Number of Loans | Principal Balance | Current | |||||||||||||||||||||||||||||||

(Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||

Loan Portfolio | |||||||||||||||||||||||||||||||||||||||

Commercial and industrial | 8 | $ | 100 | 32 | $ | 253 | 6 | $ | 2,480 | 46 | $ | 2,833 | $ | 899,220 | $ | 902,053 | $ | — | |||||||||||||||||||||

Commercial real estate | 5 | 1,518 | 8 | 1,957 | 8 | 3,105 | 21 | 6,580 | 3,004,218 | 3,010,798 | — | ||||||||||||||||||||||||||||

Commercial construction | — | — | — | — | — | — | — | — | 320,391 | 320,391 | — | ||||||||||||||||||||||||||||

Small business | 9 | 323 | — | — | 19 | 140 | 28 | 463 | 122,263 | 122,726 | — | ||||||||||||||||||||||||||||

Residential real estate | 11 | 1,277 | 9 | 1,950 | 27 | 3,507 | 47 | 6,734 | 637,692 | 644,426 | — | ||||||||||||||||||||||||||||

Home equity | 19 | 1,117 | 11 | 767 | 16 | 1,209 | 46 | 3,093 | 985,054 | 988,147 | — | ||||||||||||||||||||||||||||

Other consumer (1) | 249 | 184 | 12 | 17 | 15 | 7 | 276 | 208 | 10,856 | 11,064 | 2 | ||||||||||||||||||||||||||||

Total | 301 | $ | 4,519 | 72 | $ | 4,944 | 91 | $ | 10,448 | 464 | $ | 19,911 | $ | 5,979,694 | $ | 5,999,605 | $ | 2 | |||||||||||||||||||||

(1) Other consumer portfolio is inclusive of deposit account overdrafts recorded as loan balances.

Troubled Debt Restructurings

In the course of resolving nonperforming loans, the Bank may choose to restructure the contractual terms of certain loans. The Bank attempts to work out an alternative payment schedule with the borrower in order to avoid foreclosure actions. Any loans that are modified are reviewed by the Bank to identify if a TDR has occurred, which is when, for economic or legal reasons related to a borrower’s financial difficulties, the Bank grants a concession to the borrower that it would not otherwise consider. Terms may be modified to fit the ability of the borrower to repay in line with its current financial status and the restructuring of the loan may include the transfer of assets from the borrower to satisfy the debt, a modification of loan terms, or a combination of the two.

The following table shows the Company’s total TDRs and other pertinent information as of the dates indicated:

March 31, 2017 | December 31, 2016 | ||||||

(Dollars in thousands) | |||||||

TDRs on accrual status | $ | 25,575 | $ | 27,093 | |||

TDRs on nonaccrual | 5,439 | 5,199 | |||||

Total TDRs | $ | 31,014 | $ | 32,292 | |||

Amount of specific reserves included in the allowance for loan losses associated with TDRs | $ | 1,439 | $ | 1,417 | |||

Additional commitments to lend to a borrower who has been a party to a TDR | $ | 2,116 | $ | 1,378 | |||

The Company’s policy is to have any restructured loan which is on nonaccrual status prior to being modified remain on nonaccrual status for six months subsequent to being modified before management considers its return to accrual status. If the restructured loan is on accrual status prior to being modified, it is reviewed to determine if the modified loan should remain on accrual status. Additionally, loans classified as TDRs are adjusted to reflect the changes in value of the recorded investment in the loan, if any, resulting from the granting of a concession. For all residential loan modifications, the borrower must perform during a 90 day trial period before the modification is finalized.

23

The following table shows the modifications which occurred during the periods indicated and the change in the recorded investment subsequent to the modifications occurring:

Three Months Ended | ||||||||||

March 31, 2017 | ||||||||||

Number of Contracts | Pre-Modification Outstanding Recorded Investment | Post-Modification Outstanding Recorded Investment (1) | ||||||||

(Dollars in thousands) | ||||||||||

Troubled debt restructurings | ||||||||||

Commercial and industrial | 2 | $ | 80 | $ | 80 | |||||

Commercial real estate | 4 | 934 | 934 | |||||||

Small business | 4 | 143 | 143 | |||||||

Home equity | 2 | 140 | 140 | |||||||

Total | 12 | $ | 1,297 | $ | 1,297 | |||||

Three Months Ended | ||||||||||

March 31, 2016 | ||||||||||

Number of Contracts | Pre-Modification Outstanding Recorded Investment | Post-Modification Outstanding Recorded Investment (1) | ||||||||

(Dollars in thousands) | ||||||||||

Troubled debt restructurings | ||||||||||

Commercial and industrial | 3 | $ | 277 | $ | 277 | |||||

Commercial real estate | 2 | 424 | 424 | |||||||

Residential real estate | 2 | 423 | 465 | |||||||

Home equity | 1 | 182 | 182 | |||||||

Other consumer | 4 | 85 | 85 | |||||||

Total | 12 | $ | 1,391 | $ | 1,433 | |||||

(1) | The post-modification balances represent the legal principal balance of the loan on the date of modification. These amounts may show an increase when modifications include a capitalization of interest. |

The following table shows the Company’s post-modification balance of TDRs listed by type of modification as of the periods indicated:

Three Months Ended March 31 | |||||||

2017 | 2016 | ||||||

(Dollars in thousands) | |||||||

Extended maturity | $ | 1,207 | $ | 1,195 | |||

Combination rate and maturity | — | 238 | |||||

Court ordered concession | 90 | — | |||||

Total | $ | 1,297 | $ | 1,433 | |||

The Company considers a loan to have defaulted when it reaches 90 days past due. There were no loans modified during the past twelve months which have subsequently defaulted during the three months ended March 31, 2017 and 2016.

All TDR loans are considered impaired and therefore are subject to a specific review for impairment. The impairment analysis appropriately discounts the present value of the anticipated cash flows by the loan’s contractual rate of interest in effect prior to the loan’s modification. The amount of impairment, if any, is recorded as a specific loss allocation to each individual loan in the allowance for loan losses. Commercial loans (commercial and industrial, commercial construction, commercial real estate and small business loans), residential loans, and home equity loans that have been classified as TDRs and which subsequently default are reviewed to determine if the loan should be deemed collateral dependent. In such an instance, any shortfall between the value of the collateral and the carrying value of the loan is determined by measuring the recorded investment in the loan against

24

the fair value of the collateral less costs to sell. The Company charges off the amount of any confirmed loan loss in the period when the loans, or portion of loans, are deemed uncollectible. Smaller balance consumer TDR loans are reviewed for performance to determine when a charge-off is appropriate.

Impaired Loans

A loan is considered impaired when, based on current information and events, it is probable that the Company will be unable to collect the scheduled payments of principal or interest when due according to the contractual terms of the loan agreement. Factors considered by management in determining impairment include payment status, collateral value, and the probability of collecting scheduled principal and interest payments when due. Loans that experience insignificant payment delays and payment shortfalls generally are not classified as impaired. Management determines the significance of payment delays and payment shortfalls on a case-by-case basis, taking into consideration all of the circumstances surrounding the loan and the borrower, including the length of the delay, the reasons for the delay, the borrower’s prior payment record, and the amount of the shortfall in relation to the principal and interest owed.

25

The tables below set forth information regarding the Company’s impaired loans by loan portfolio at the dates indicated:

March 31, 2017 | |||||||||||

Recorded Investment | Unpaid Principal Balance | Related Allowance | |||||||||

(Dollars in thousands) | |||||||||||

With no related allowance recorded | |||||||||||

Commercial and industrial | $ | 28,319 | $ | 29,280 | $ | — | |||||

Commercial real estate | 9,596 | 10,742 | — | ||||||||

Small business | 300 | 359 | — | ||||||||

Residential real estate | 3,640 | 3,858 | — | ||||||||

Home equity | 4,289 | 4,378 | — | ||||||||

Other consumer | 117 | 118 | — | ||||||||

Subtotal | 46,261 | 48,735 | — | ||||||||

With an allowance recorded | |||||||||||

Commercial and industrial | $ | 10,119 | $ | 10,220 | $ | 3,558 | |||||

Commercial real estate | 5,170 | 5,516 | 173 | ||||||||

Small business | 446 | 462 | 2 | ||||||||

Residential real estate | 10,034 | 10,626 | 1,066 | ||||||||

Home equity | 1,396 | 1,568 | 235 | ||||||||

Other consumer | 241 | 242 | 21 | ||||||||

Subtotal | 27,406 | 28,634 | 5,055 | ||||||||

Total | $ | 73,667 | $ | 77,369 | $ | 5,055 | |||||

December 31, 2016 | |||||||||||

Recorded Investment | Unpaid Principal Balance | Related Allowance | |||||||||

(Dollars in thousands) | |||||||||||

With no related allowance recorded | |||||||||||

Commercial and industrial | $ | 28,776 | $ | 29,772 | $ | — | |||||

Commercial real estate | 11,628 | 12,891 | — | ||||||||

Commercial construction | — | — | — | ||||||||

Small business | 494 | 569 | — | ||||||||

Residential real estate | 4,216 | 4,427 | — | ||||||||

Home equity | 4,485 | 4,572 | — | ||||||||

Other consumer | 146 | 146 | — | ||||||||

Subtotal | 49,745 | 52,377 | — | ||||||||

With an allowance recorded | |||||||||||

Commercial and industrial | $ | 10,402 | $ | 10,440 | $ | 3,661 | |||||

Commercial real estate | 5,185 | 5,533 | 196 | ||||||||

Small business | 377 | 392 | 8 | ||||||||

Residential real estate | 9,959 | 10,530 | 1,086 | ||||||||

Home equity | 1,378 | 1,547 | 242 | ||||||||

Other consumer | 251 | 252 | 21 | ||||||||

Subtotal | 27,552 | 28,694 | 5,214 | ||||||||

Total | $ | 77,297 | $ | 81,071 | $ | 5,214 | |||||

26

The following tables set forth information regarding interest income recognized on impaired loans, by portfolio, for the periods indicated:

Three Months Ended | |||||||

March 31, 2017 | |||||||

Average Recorded Investment | Interest Income Recognized | ||||||

(Dollars in thousands) | |||||||

With no related allowance recorded | |||||||

Commercial and industrial | $ | 39,193 | $ | 208 | |||

Commercial real estate | 9,678 | 91 | |||||

Small business | 304 | 3 | |||||

Residential real estate | 3,671 | 43 | |||||

Home equity | 4,323 | 44 | |||||

Other consumer | 120 | 2 | |||||

Subtotal | 57,289 | 391 | |||||

With an allowance recorded | |||||||

Commercial and industrial | $ | 10,178 | $ | 4 | |||

Commercial real estate | 5,189 | 50 | |||||

Small business | 457 | 5 | |||||

Residential real estate | 10,057 | 85 | |||||

Home equity | 1,402 | 13 | |||||

Other consumer | 245 | 2 | |||||

Subtotal | 27,528 | 159 | |||||

Total | $ | 84,817 | $ | 550 | |||

27

Three Months Ended | |||||||

March 31, 2016 | |||||||

Average Recorded Investment | Interest Income Recognized | ||||||

(Dollars in thousands) | |||||||

With no related allowance recorded | |||||||

Commercial and industrial | $ | 2,871 | $ | 17 | |||

Commercial real estate | 15,093 | 137 | |||||

Small business | 478 | 4 | |||||

Residential real estate | 3,639 | 43 | |||||

Home equity | 4,718 | 48 | |||||

Other consumer | 146 | 3 | |||||

Subtotal | 26,945 | 252 | |||||

With an allowance recorded | |||||||

Commercial and industrial | $ | 2,090 | $ | 4 | |||

Commercial real estate | 8,024 | 69 | |||||

Small business | 484 | 8 | |||||

Residential real estate | 10,528 | 94 | |||||

Home equity | 1,323 | 10 | |||||

Other consumer | 398 | 3 | |||||

Subtotal | 22,847 | 188 | |||||

Total | $ | 49,792 | $ | 440 | |||

Purchased Credit Impaired Loans

Certain loans acquired by the Company may have shown evidence of deterioration of credit quality since origination and it was therefore deemed unlikely that the Company would be able to collect all contractually required payments. As such, these loans were deemed to be PCI loans and the carrying value and prospective income recognition are predicated upon future cash flows expected to be collected. The following table displays certain information pertaining to PCI loans at the dates indicated:

March 31, 2017 | December 31, 2016 | ||||||

(Dollars in thousands) | |||||||

Outstanding balance | $ | 20,034 | $ | 20,477 | |||

Carrying amount | $ | 18,011 | $ | 18,392 | |||

The following table summarizes activity in the accretable yield for the PCI loan portfolio:

Three Months Ended March 31 | |||||||

2017 | 2016 | ||||||

(Dollars in thousands) | |||||||

Beginning balance | $ | 2,370 | $ | 2,827 | |||

Acquisition | — | — | |||||

Accretion | (307 | ) | (409 | ) | |||

Other change in expected cash flows (1) | 216 | 297 | |||||

Reclassification from nonaccretable difference for loans which have paid off (2) | — | 64 | |||||