Attached files

| file | filename |

|---|---|

| EX-32.2 - CERTIFICATION - Trident Brands Inc | tdnt_ex322.htm |

| EX-32.1 - CERTIFICATION - Trident Brands Inc | tdnt_ex321.htm |

| EX-31.2 - CERTIFICATION - Trident Brands Inc | tdnt_ex312.htm |

| EX-31.1 - CERTIFICATION - Trident Brands Inc | tdnt_ex311.htm |

| EX-10.4 - FOURTH AMENDMENT TO CONVERTIBLE PROMISSORY NOTES - Trident Brands Inc | tdnt_ex104.htm |

| EX-10.3 - THIRD AMENDMENT TO CONVERTIBLE PROMISSORY NOTES - Trident Brands Inc | tdnt_ex103.htm |

| EX-10.2 - AMENDMENT NO. 2 TO CONVERTIBLE PROMISSORY NOTE - Trident Brands Inc | tdnt_ex102.htm |

| EX-10.1 - AMENDMENT TO CONVERTIBLE PROMISSORY NOTE - Trident Brands Inc | tdnt_ex101.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURUTIES EXCHANGE ACT OF 1934

For the fiscal year ended November 30, 2020

Commission file number 000-53707

| TRIDENT BRANDS INCORPORATED |

| (Exact Name of Registrant as Specified in Its Charter) |

| Nevada |

| 26-1367322 |

| (State or Other Jurisdiction of Incorporation or Organization) |

| (I.R.S. Employer Identification No.) |

200 South Executive Drive, Suite 101

Brookfield, WI 53005

(Address of Principal Executive Offices & Zip Code)

(262) 789-6689

(Telephone Number)

Resident Agents of Nevada

711 S. Carson Street, Suite 4

Carson City, NV 89701

(Name and Address of Agent for Service)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to section 12(g) of the Act:

Common Stock, $.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Smaller reporting company | ☒ |

| Accelerated filer | ☐ | Non-accelerated filer | ☒ |

| Emerging Growth Company | ☒ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of March 16, 2021, the registrant had 32,311,887 shares of common stock issued and outstanding. The Company had a market value of $1,050,136 based on the closing stock price of $0.0325 on November 30, 2020.

TRIDENT BRANDS INCORPORATED

FORM 10-K

For the year ended November 30, 2020

| 2 |

| Table of Contents |

Except where the context otherwise requires, all references in this Annual Report on Form 10-K for the fiscal year ended November 30, 2020 (“Form 10-K”) to the “Company”, “we”, “us”, “our”, “Trident” and “Trident Brands” or similar words and phrases are to Trident Brands Incorporated and its subsidiaries, taken together.

In this report, all currency amounts are expressed in thousands of United States (“U.S.”) dollars (“$”), except per share data, unless otherwise stated. Amounts expressed in other than U.S. dollars are noted accordingly. For example, amounts if expressed in Canadian dollars are expressed in thousands of Canadian dollars and preceded by the symbol “Cdn $”.

This Form 10-K contains forward-looking statements which are based on our current expectations and assumptions and involve a number of risks and uncertainties. Generally, forward-looking statements do not relate strictly to historical or current facts and are typically accompanied by words such as “anticipate”, “estimate”, “intend”, “project”, “potential”, “continue”, “believe”, “expect”, “could”, “would”, “should”, “might”, “plan”, “will”, “may”, “predict”, the negatives of such terms, and words and phrases of similar impact and include, but are not limited to references to expected increases in revenues and margins, growth opportunities, the success of new product launches and line extensions, our ability to finance our business, potential strategic investments, business strategies, competitive strengths, goals, references to key markets where we operate and the market for our securities. These forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on certain assumptions and analyses we make in light of our experience and our interpretation of current conditions, historical trends and expected future developments, as well as other factors that we believe are appropriate in the circumstance.

Whether actual results and developments will agree with our expectations and predictions is subject to many risks and uncertainties. Accordingly, there are or will be important factors that could cause our actual results to differ materially from our expectations and predictions. We believe these factors include, but are not limited to, the following:

|

| · | we have a limited operating history with significant losses and expect losses to continue for the foreseeable future; |

|

|

|

|

|

| · | we could face intense competition, which could result in lower revenues and higher expenditures and could adversely affect our results of operations; |

|

|

|

|

|

| · | we are governed by only three persons serving as directors and officers which may lead to faulty corporate governance; |

|

|

|

|

|

| · | we must attract and maintain key personnel or our business may fail; |

| 3 |

| Table of Contents |

|

| · | We have an immediate and urgent need for capital - we may not be able to secure the financing we need to meet our future capital need; |

|

|

|

|

|

| · | our business and operating results could be harmed if we fail to manage our growth or change; |

|

|

|

|

|

| · | we have a limited operating history and if we are not successful in growing our business, then we may have to scale back or even cease our ongoing business operations; |

|

|

|

|

|

| · | if our intellectual property is not adequately protected, then we may not be able to compete effectively and we may not be profitable; |

|

|

|

|

|

| · | if we are the subject of an intellectual property infringement claim, the cost of participating in any litigation could impact our ability to stay in business; |

|

|

|

|

|

| · | we could lose our competitive advantages if we are not able to protect any of our food and nutritional products and intellectual property rights against infringement, and any related litigation could be time-consuming and costly; |

|

|

|

|

|

| · | if we fail to effectively manage our growth our future business results could be harmed and our managerial and operational resources may be strained; |

|

|

|

|

|

| · | our services may become obsolete and unmarketable if we are unable to respond adequately to rapidly changing technology and customer demands; |

|

|

|

|

|

| · | our failure to appropriately respond to changing consumer preferences and demand for new products or product enhancements could significantly harm product sales and harm our financial condition and operating results; |

|

|

|

|

|

| · | if we do not introduce new products or make enhancements to adequately meet the changing needs of our customers, some of our products could fail in the marketplace, which could negatively impact our revenues, financial condition and operating results. |

|

|

|

|

|

| · | we are affected by laws and governmental regulations with potential penalties or claims, which could harm our financial condition and operating results; |

|

|

|

|

|

| · | since we rely on independent third parties for the manufacture and supply of certain of our products, if these third parties fail to reliably supply products to us at required levels of quality and which are manufactured in compliance with applicable laws, then our financial condition and operating results would be harmed; |

| 4 |

| Table of Contents |

|

| · | we may incur material product liability claims, which could increase our costs and harm our financial condition and operating results; |

|

|

|

|

|

| · | unless we can generate sufficient cash from operations or additional raise funds, we may not be able to meet our debt obligations and continue as a going concern; |

|

|

|

|

|

| · | our customers generally are not obligated to continue purchasing products from us; |

|

|

|

|

|

| · | if we do not manage our supply chain effectively, our operating results may be adversely affected; |

|

|

|

|

|

| · | our stock price may be volatile, which may result in losses to our shareholders; |

|

|

|

|

|

| · | our common shares are thinly traded and our shareholders may be unable to sell at or near ask prices, or at all; |

|

|

|

|

|

| · | the market price for our common stock is particularly volatile given our status as a relatively small and developing company, which could lead to wide fluctuations in our share price. Our shareholders may be unable to sell their common stock at or above their purchase price if at all, which may result in substantial losses to you; |

|

|

|

|

|

| · | we do not anticipate paying any cash dividends to our common shareholders and as a result shareholders may only realize a return when the shares are sold; |

|

|

|

|

|

| · | we are quoted on the OTCQB quotation system and our common stock is subject to “penny stock” rules which could negatively impact our liquidity and our shareholders’ ability to sell their shares; |

|

|

|

|

|

| · | volatility in our common share price may subject us to securities litigation; |

|

|

|

|

|

| · | the elimination of monetary liability against our directors, officers and employees under Nevada law and the existence of indemnification rights of our directors, officers and employees may result in substantial expenditures by our company and may discourage lawsuits against our directors, officers and employees; |

|

|

|

|

|

| · | our business is subject to changing regulations related to corporate governance and public disclosure that have increased both our costs and the risk of noncompliance. |

Consequently all forward-looking statements made herein are qualified by these cautionary statements and there can be no assurance that our actual results or the developments we anticipate will be realized. The foregoing factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this report. For a more detailed discussion of the principal factors that could cause actual results to be materially different, you should read our risk factors in Item 1A, Risk Factors, included elsewhere in this report.

| 5 |

| Table of Contents |

Business Description

Trident Brands Incorporated was incorporated under the laws of the State of Nevada on November 5, 2007. The Company was initially formed to engage in the acquisition, exploration and development of natural resource properties, but has since transitioned and is now focused on branded consumer products and food ingredients. The Company is in the early growth stage and has commenced commercial activities following a period of organization and development of its business plan.

The Company maintains a compelling portfolio of branded consumer products in the functional nutrition and dietary supplement categories under the Brain Armor® and P2N Peak Performance Nutrition® trademarks, and provides a range of private label sports nutrition items to major retailer accounts. Our products are focused on high growth category segments including performance nutrition and brain health, supported by an established contract manufacturing supply chain, strong research and development infrastructure and a solid and proactive management team, board of directors and business advisors with many years of senior experience in related fields.

Corporate Legal Structure and Related Matters

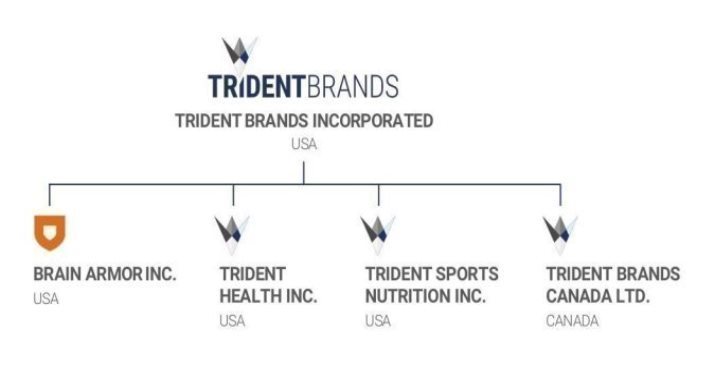

Trident Brands Incorporated has four legal subsidiaries, as detailed below.

Trident Sports Nutrition Inc. is 100% owned by Trident Brands and is organized to deliver shelf ready product solutions in the active nutrition and dietary supplement segment to leading retailers for private label and control brand programs.

Brain Armor Inc. is 94.8% owned by Trident Brands and is organized to develop, market and sell a portfolio of DHA supplements under the Brain Armor® brand, which is targeted at the cognitive health and performance segment.

Trident Health is 100% owned by Trident Brands.

Trident Brands Canada Ltd. is 100% owned by Trident Brands Incorporated and holds various banking facilities, and licenses associated with the manufacturing, importation and sale of natural health and nutrition products in Canada.

The Company’s administrative office is located at 200 South Executive Drive, Suite 101, Brookfield, Wisconsin, 53005 and its fiscal year end is November 30th.

The Company has authorized capital of 300,000,000 common shares with a par value of $0.001 per share. 32,311,887 common shares were issued and outstanding as of November 30, 2020 and 32,311,887 as of March 16, 2021.

| 6 |

| Table of Contents |

Management and Board of Directors

Mr. Anthony Pallante serves as Chairman of the Board and Chief Executive Officer while Mr. Scott Chapman serves as President.

Mr. Peter Salvo, the Vice President, Finance, Corporate Secretary, and Controller of the Company is our Principal Financial Officer and Principal Accounting Officer. Mrs. Pamela Andrews serves as Managing Director of our subsidiary, Brain Armor Inc.

The board is comprised of Mr. Anthony Pallante, Mr. Scott Chapman and Mr. Richard Russell.

Mr. Chapman is a director and Chair of the Corporate Governance Committee. Mr. Russell serves on the Company’s Board of Directors as an “independent director”, as defined under the Nasdaq Stock Market’s corporate governance rules, is Chairman of the Audit Committee and is considered a financial expert.

Evolution of Trident Brands

Brands

On March 1, 2015, we acquired, through a licensing agreement with DSM Nutritional Products LLC (“DNP”), the exclusive global rights to Brain Armor® dietary supplements, a plant-based DHA supplement designed specifically for the needs of athletes. At the same time, a wholly-owned subsidiary, Brain Armor Incorporated was registered to hold the trademark license and all costs and revenue associated with commercial development of the Brain Armor® brand. As per the agreement, DNP shall be the sole source of the Company’s omega-3 oil requirements which will be DNP’s life’s DHATM oil and will supply the soft gel capsules in finished form to us. In order to maintain exclusivity to the license, we are required to meet certain targets with respect to product launches and sales volume. Also under the terms of the agreement we have the opportunity to exercise an option to purchase the Brain Armor(R) dietary supplement brand. The term of the Agreement and the license rights is for five (5) years and shall be subject to successive one (1) year automatic renewal periods, assuming all performance milestones have been met.

On January 28, 2016, we issued 3,000,000 common shares pursuant to a Deed of Assignment dated effective January 20, 2015 among our Company, Oceans Omega LLC, and the assignor 2298107 Ontario Inc., pursuant to which the assignor assigned to our Company the assignor’s non-exclusive rights to purchase, market, sell and distribute certain Omega 3 nutritional emulsions produced by Oceans Omega LLC to the food and beverage industries and exclusive rights to purchase, market, sell and distribute to the global meat industry.

In December 2017, Trident began shipping P2N Peak Performance Nutrition products on an exclusive basis under a Vendor Agreement with Amazon Fulfillment Services Inc.

In April 2019, Trident began shipping Brain Armor dietary supplement products to CVS Health; in July 2020 to Whole Foods Markets through United Natural Foods Inc (UNFI), a national distributor; and in June 2020 to US supplement retailer Vitamin Shoppe. All of these retail listings are under standard vendor trading agreement terms.

Key Developments in Fiscal 2020 and Fiscal 2021 to the Date of this Report

On January 9, 2020 the Company and Fengate Trident LP entered into an Amendment to Convertible Promissory Notes Agreement to amend the terms of certain convertible promissory notes issued pursuant to a Securities Purchase Agreement by and between the Company and the Purchaser dated September 26, 2016 and previously amended on November 30, 2018 and March 11, 2019. The Amendment affects the convertible notes issued February 5, 2015 (US$1,800,000), May 14, 2015 (US$500,000), September 26, 2016 (US$4,100,000), May 9, 2017 (US$4,400,000) and May 16, 2018 (US$1,500,000), respectively (collectively the “2016 Convertible Notes”). Pursuant to the Amendment, the Purchaser has agreed to convert all of the 2016 Notes on or before the earlier to occur of (i) the Maturity Date of the 2016 Convertible Notes and (ii) the Company raising new equity investment of not less than US$2,000,000, on terms mutually acceptable to the Purchaser and the Company (subject to the Purchaser’s regulatory considerations). Conversion of the 2016 Notes will occur in a single conversion transaction at a price that is equal to a 25% discount to the average closing price of the Company’s common stock for the 10 trading days immediately prior to the conversion date, with the exact structure of the conversion to be determined by the parties.

| 7 |

| Table of Contents |

The Amendment also amends the outstanding convertible notes issued to the Purchaser on November 30, 2018 (US$3,400,780), April 13, 2019 (US$2,804,187) and November 6, 2019 (US$3,795,033) respectively (collectively the “2018 and 2019 Convertible Notes”). Maturity of the 2018 and 2019 Convertible Notes has been extended to December 1, 2021. It was further agreed that interest on the 2018 and 2019 Convertible Notes will accrue as at July 1, 2020 and be payable upon maturity.

On November 30, 2020 (“Effective Date”), the Company entered into that certain Fourth Amendment to Convertible Promissory Notes ( “Fourth Amendment”), with Fengate, the holder of the Notes (the “Note Holder”).

By way of background, immediately prior to the Effective Date, the Company was indebted to the Note Holder in the aggregate principal amount of $22.3 million as follows: $12.3 million (the “2016 Convertible Notes”) and $10 million (the “Amended SPA Notes”). In addition, the Company owed aggregate accrued interest of $5,359,392 on the 2016 Convertible Notes and the Amended SPA Notes.

Conversion of $17.7 million of Indebtedness into Company Equity

In connection with the Fourth Amendment, the Note Holder has agreed to convert aggregate principal and accrued interest of $17,659,392 into equity of the Company, as more fully described below.

As of the Effective Date, the Company and Note Holder have agreed that the Company will issue the Note Holder 29,432,320 shares of Company Preferred Stock in full and complete satisfaction of (i) all amounts owing under the 2016 Convertible Notes through November 30, 2020 (including accrued interest thereon) and (ii) all accrued interest on the Amended SPA Notes through November 30, 2020. This transaction represents the conversion of aggregate principal and accrued interest of $17,659,392 into Preferred Stock at the rate of $.60 per share. The $17,659,392 is comprised of $12.3 million of principal owing under the 2016 Convertible Notes and all accrued interest owing under both the 2016 Convertible Notes and the Amended SPA Notes (an aggregate of $5,359,392).

Under the terms of the Fourth Amendment, the Preferred Stock shall be (i) voting shares, with the same voting rights as common shares, except the Preferred Stock shall have no vote in respect of election of directors, (ii) entitled to such dividends as the Board of Directors of the Company may in its discretion declare (and no dividends may be declared on the Company’s other classes of shares unless a dividend is declared on the Preferred Stock), (iii) have a preference in liquidation ahead of all other classes of Company shares, (iv) be entitled upon a sale of the Company (to be further defined in definitive agreements) to receive the consideration that would be payable in respect of that number of shares of common stock of the Company equal to the number of shares of Preferred Stock (on a one-for one basis with the Company common stock), and (v) otherwise on such other terms and conditions as are mutually agreeable and not inconsistent with the foregoing.

The consummation of the foregoing transaction is subject to (i) authorization and issuance of the Preferred Stock, which is subject to approval of the requisite number of common shares of the Company, in accordance with Nevada law and the Company’s organizational documents, and (ii) Note Holder’s obligation to remain in compliance with regulations governing its ownership of voting shares.

The Company and Note Holder have undertaken to consummate the foregoing transactions no later than June 30 , 2021.The Company expects to consummate this transaction prior to May 30, 2021.

Amendment of Terms of $10 million Amended SPA Notes

The Fourth Amendment also amends the Amended SPA Notes (aggregate principal amount of $10 million) as of the Effective Date, as follows:

|

| 1. | Interest Rate. The interest rate per annum in respect of outstanding principal under the Amended SPA Notes shall be eight (8%) percent computed on a simple interest basis. |

|

|

|

|

|

| 2. | Interest Payments. |

|

| a. | Interest on unpaid principal of the Amended SPA Notes ($10 million) with respect to the period of December 1, 2020 through November 30, 2021 may be paid by the Company in kind by issuing a non-interest bearing note (a “PIK Note”) in the amount of $800,000 on November 30, 2021 with a maturity date of November 30, 2025. If no PIK Note is issued on such date, accrued and unpaid principal shall be payable in cash. |

|

|

|

|

|

| b. | Interest on unpaid principal of the Amended SPA Notes with respect to the period of December 1, 2021 through November 30, 2022 may be paid by the Company in kind by issuing a PIK Note in the amount of $800,000 on November 30, 2022 with a maturity date of November 30, 2025. If no PIK Note is issued on such date, accrued and unpaid principal shall be payable in cash. |

|

|

|

|

|

| c. | The PIK Notes issued by the Company pursuant to the previous two paragraphs shall be in the form attached to the Securities Purchase Agreement dated as of September 26, 2016, as amended, pursuant to the which the Amended SPA Notes were issued, subject to revisions necessary to make such PIK Notes non-convertible and non-interest bearing. |

|

|

|

|

|

| d. | Interest on unpaid principal with respect to the period of December 1, 2022 through November 30, 2025 shall be payable quarterly in arrears commencing February 28, 2023. |

|

| 3. | Termination of Conversion Feature. The convertibility of the Amended SPA Notes is terminated. |

|

|

|

|

|

| 4. | Extension of Maturity Date. The Maturity Date of the Amended SPA Notes is extended to November 30, 2025. |

| 8 |

| Table of Contents |

Except as modified by the Fourth Amendment, the Notes, as previously amended, remain in full force and effect.

On September 24, 2020, the Company appointed Pamela Andrews as Managing Director of Brain Armor Inc.

Business Objectives and Strategies

Our business brings together many years of seasoned expertise in branded consumer and supplement products, supply chain, product development and corporate finance. Our team has experience in developing and commercializing consumer products, in both global companies and specialty markets.

Our objective is to provide our shareholders with solid returns through strategic investments across multiple consumer product and food ingredient platforms. The platforms we are focusing on include:

|

| · | Life science technologies and related products that have applications to a range of consumer products; |

|

|

|

|

|

| · | Nutritional supplements and related consumer goods providing defined benefits to the consumer; and |

|

|

|

|

|

| · | Functional foods and beverages ingredients with defined health and wellness benefits. |

We are building our business through strategic investments in high growth early stage consumer brands and functional ingredients platforms within segment/sectors which we believe offer long term growth potential. We are focused on three core strategies underpinning our objectives:

|

| · | To execute our multi-tier brand and innovation strategy to drive revenue; |

|

|

|

|

|

| · | To aggressively manage our asset light business model to drive a low cost platform; and |

|

|

|

|

|

| · | To drive disciplines leading to increased investor awareness and ability to finance and govern growing operations. |

Once we secure sufficient capital to enable us to fully implement our business plan, we expect revenues and associated margins to increase as we continue to commercialize segments and products within our portfolio. Specifically, Brain Armor®, P2N Peak Performance Nutrition and private label product lines have demonstrated solid potential in the markets where they compete. Further research and development investment is also expected to entrench our position in the market and contribute to current platforms and incremental business potential.

Our purpose is to apply these capabilities in starting new product lines with specific competitive advantage. Our product development is focused on:

|

| · | Extending established brands with existing equity that can be leveraged; |

|

|

|

|

|

| · | Delivering consumer benefit with unique technology or intellectual properties; and |

|

|

|

|

|

| · | Targeting dynamic growth segments. |

| 9 |

| Table of Contents |

Coupled with strategic capital investment, our focus is on investments within the fast growing nutritional product and functional food segments/sectors. Our goal is to provide our shareholders with outstanding ROI through a portfolio of branded platforms via an asset light business model when and where appropriate.

As part of our long-term strategy we are targeting the following growth opportunities:

|

| · | Brand licenses in fast growing categories; |

|

|

|

|

|

| · | Consumer goods with focus on supplements, functional foods & beverages; |

|

|

|

|

|

| · | Life science technology that has applications in consumer products with a focus on nutritional, brain and heart health products; and |

|

|

|

|

|

| · | Intellectual property and/or licenses in recognized brand platforms. |

In addition to investments in brands and technology, we will seek to acquire positions in businesses to support our strategy through the use of common and/or preferred equity, senior secured, unsecured, and convertible debt in organizations who meet our investment goals. Through our management and directors vast expertise in both the consumer branded segment and strategic investment experience, we seek to provide our shareholders a sound return on their investment.

The Company’s strategic objective is to:

|

| · | Build and grow strategic brands organically; |

|

|

|

|

|

| · | Make strategic investments in high growth companies; |

|

|

|

|

|

| · | Develop and then merge brands/business lines into larger multi-national Companies; and |

|

|

|

|

|

| · | Mitigate risk by creating a diverse portfolio of brands/operations in the growth sectors listed above. |

Brands

Brain Armor®

The Company has a licensing agreement that grants us the exclusive global rights to Brain Armor®, a plant-based Omega-3 dietary supplement formulated to improve cognitive health and well-being. In December 2017, we purchased the Brain Armor® trademark and reformulated Brain Armor® dietary supplements with a proprietary blend of active ingredients clinically-proven to support neuro-nutrition at every stage of life.

P2N Peak Performance Nutrition®

In October 2017, Trident Sports Nutrition developed the P2N Peak Performance Nutrition brand as a control label range for a leading US eCommerce customer. The P2N brand encompasses a full-range of active nutrition products delivering high quality ingredients and proven formulas to support mass-market fitness goals.

| 10 |

| Table of Contents |

Control (or Private) Label

In April 2017, we entered into a vendor agreement to formulate and supply whey protein powder under a private label to a leading mass retail customer.

Product Supply

We procure our products utilizing a series of ingredient suppliers and strategic contract manufacturers. All suppliers are pre-qualified and must meet our stringent quality and performance standards.

All novel product formulations and flavor systems are proprietary and formulated in-house.

Competition

We compete in the branded nutritional products and functional foods market segments. These markets are highly competitive with many companies, large and small, competing for market share.

Compliance with Government Regulation

Our operations, supply chain and products are subject to a wide range of governmental regulations and policies in various regions where we operate, including the U.S. and Canada. These laws, regulations and policies are implemented, as applicable in each jurisdiction, on the national, federal, state, provincial and local levels. We believe we have processes and systems in place throughout our supply chain to meet the requirements of these regulations.

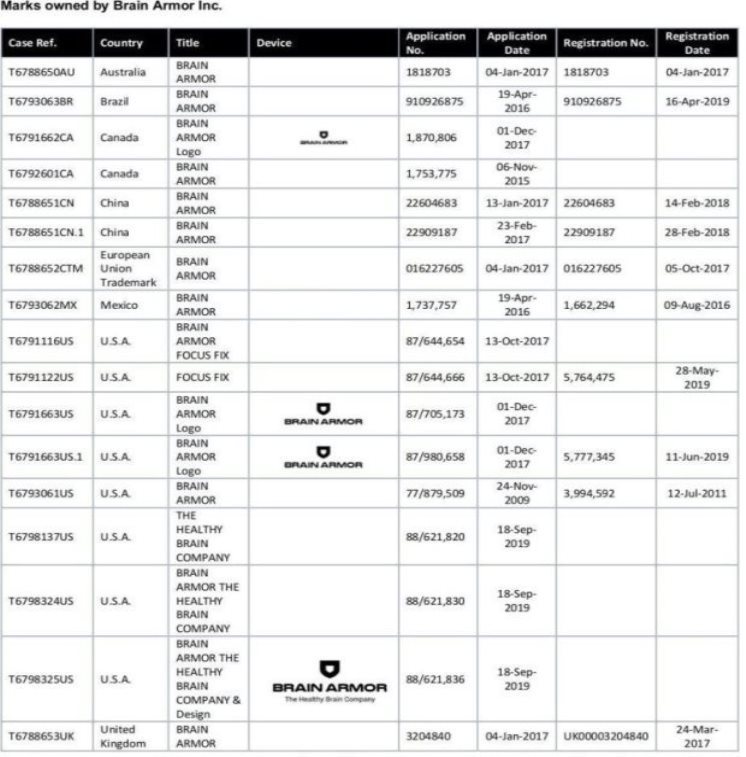

Patents, Trademarks, Franchises, Concessions, Royalty Agreements, or Labor Contracts

As of November 30, 2020 the following trademarks have been registered or applications filed on behalf of Trident Brands Incorporated or operating subsidiaries of Trident Brands Incorporated:

| 11 |

| Table of Contents |

Human Resources, Contract Service Providers, Employees

We operate our business utilizing resources to provide services to the Company on a contractual basis. We feel this is most prudent as we can cost effectively meet our needs and leverage capabilities of talented individuals without employing on a full time basis. As the business grows, we expect to add a number of full-time employees. We presently do not have pension, health, annuity, insurance, profit sharing or similar benefit plans; however, we may adopt such plans in the future. Except for our stock option plan, there are presently no employee benefits available to our officers and directors.

| 12 |

| Table of Contents |

Reports to Securities Holders

We provide an annual report that includes audited financial information to our shareholders. We will make our financial information equally available to any interested parties or investors through compliance with applicable disclosure rules under the Securities Exchange Act of 1934. We are subject to disclosure filing requirements, including filing Form 10K annually and Form 10Q quarterly. In addition, we will file Form 8K and other proxy and information statements from time to time as required. . The public may read and copy any materials that we file with the Securities and Exchange Commission, (“SEC”), at the SEC’s Public Reference Room at 100 F Street NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site (http://www.sec.gov) that contains our reports, proxy and information statements, and other information regarding the Company that we file electronically with the SEC.

RISKS RELATED TO OUR BUSINESS

You should carefully consider the risks described below together with all of the other information included in this report before making an investment decision with regard to our securities. The statements contained in or incorporated into this current report on Form 10-K that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occur, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

We have an immediate and urgent need for capital and may not be able to continue as a going concern.

As of November 30, 2020, we had a working capital deficit of $6.4 million and accumulated deficit of $39,522,278. During the year ended November 30, 2020, we had a net loss of $5.4 million and our operations used $2 million of cash. As of March 15, 2021, we had only minimal cash on hand. We have historically incurred operating losses and may continue to incur operating losses for the foreseeable future. We believe that these conditions raise substantial doubt about our ability to continue as a going concern. This may hinder our future ability to obtain financing or may force us to obtain financing on less favorable terms than would otherwise be available. If we are unable to develop sufficient revenues and additional customers for our products and services, we may not generate enough revenue to sustain our business, and we may fail, in which case our stockholders would suffer a total loss of their investment. There can be no assurance that we will be able to continue as a going concern.

We have a limited operating history with significant losses and expect losses to continue for the foreseeable future.

We have yet to establish a history of profitable operations and, as at November 30, 2020, have an accumulated deficit of $39,522,278, realized since our inception on November 5, 2007. We have generated only limited revenues since our inception and thus have incurred significant operating losses. Our profitability will require the successful commercialization and sales of our planned products at acceptable margins. We may not be able to successfully achieve any of these requirements.

We could face intense competition, which could result in lower revenues and higher expenditures and could adversely affect our results of operations.

Unless we keep pace with changing market demands, we could lose existing customers and more importantly fail to win new and retain any future customers. In order to compete effectively in the food and nutritional products industry, we must continually design, develop implement and market new and/or enhanced products and strategies. Our future success will depend, in part, upon our ability to address the changing and sophisticated needs of the marketplace. Our strategy of expanding our food and nutrition business may not be successful and could adversely affect our business operations and financial condition.

Further, our plan to pursue sales of our product in international markets may be limited by risks related to conditions in such markets.

| 13 |

| Table of Contents |

We are governed by only three persons serving as directors and two of them act as officers of the company which may lead to faulty corporate governance.

Currently our board includes only one independent director and as a result not all of our committees are independent. This could lead to less than preferable governance practices due to this lack of total independence.

We must attract and maintain key personnel or our business may fail.

Success depends on the acquisition of key personnel. We will have to compete with other companies both within and outside the food and nutritional products industry to recruit and retain competent employees and contract resources. If we cannot maintain qualified resources to meet the needs of our anticipated growth, this could have a material adverse effect on our business and financial condition.

Our business and operating results could be harmed if we fail to manage our growth or change.

Our business may experience periods of rapid change and/or growth that could place significant demands on our personnel, operating and financial resources. To manage possible growth and change, we must continue to locate skilled professionals in the food and nutritional products industries and adequate funds in a timely manner.

We have a limited operating history and if we are not successful in growing our business, then we may have to scale back or even cease our ongoing business operations.

There can be no assurance that we will ever operate profitably. We have a limited operating history. Our success is significantly dependent on the successful marketing and sales of our food and nutritional products, which cannot be guaranteed. Our operations will be subject to all the risks inherent in the uncertainties arising from the absence of a significant operating history. We may be unable to profitably sell our food and nutritional products and thus operate on a profitable basis. Potential investors should be aware of the difficulties normally encountered by enterprises in the development stage. If our business plan is not successful, and we are not able to operate profitably, investors may lose some or all of their investment in our company.

If our intellectual property is not adequately protected, then we may not be able to compete effectively and we may not be profitable.

Our commercial success depends, in part, on obtaining and maintaining patent protection, trade secret protection and regulatory protection of our technologies and products as well as successfully defending third-party challenges to such technologies and products. We will be able to protect our technologies and product from use by third parties only to the extent that valid and enforceable patents, trade secrets or regulatory protection cover them and we have exclusive rights to use them. The ability of our licensors, collaborators and suppliers to maintain their patent rights against third-party challenges to their validity, scope or enforceability will also play an important role in determining our future.

| 14 |

| Table of Contents |

The patent positions of technology related companies can be highly uncertain and involve complex legal and factual questions that include unresolved principles and issues. No consistent policy regarding the breadth of claims allowed regarding such companies’ patents has emerged to date in the United States, and the patent situation outside the United States is even more uncertain. Changes in either the patent laws or in interpretations of patent laws in the United States or other countries may diminish the value of our intellectual property. Accordingly, we cannot predict with any certainty the range of claims that may be allowed or enforced concerning our patents.

We also rely on trade secrets to protect our technologies, especially where we do not believe patent protection is appropriate or obtainable. However, trade secrets are difficult to protect. While we seek to protect confidential information, in part, through confidentiality agreements with our employees, consultants and scientific and other advisors, they may unintentionally or willfully disclose our information to competitors. Enforcing a claim against a third party related to the illegal acquisition and use of trade secrets can be expensive and time consuming, and the outcome is often unpredictable. If we are not able to maintain patent or trade secret protection on our technologies and products, then we may not be able to exclude competitors from developing or marketing competing products, and we may not be able to operate profitability.

If we are the subject of an intellectual property infringement claim, the cost of participating in any litigation could impact our ability to stay in business.

There has been, and we believe that there will continue to be, significant litigation and demands for licenses in our industry regarding patent and other intellectual property rights. Although we anticipate having a valid defense to any allegation that our current products, production methods and other activities infringe the valid and enforceable intellectual property rights of any third parties, we cannot be certain that a third party will not challenge our position in the future. Other parties may own patent rights that we might infringe with our products or other activities, and our competitors or other patent holders may assert that our products and the methods we employ are covered by their patents. These parties could bring claims against us that would cause us to incur substantial litigation expenses and, if successful, may require us to pay substantial damages. Some of our potential competitors may be better able to sustain the costs of complex patent litigation, and depending on the circumstances, we could be forced to stop or delay our research, development, manufacturing or sales activities. The impact of this could impact our ability to stay in business.

We could lose our competitive advantages if we are not able to protect any of our food and nutritional products and intellectual property rights against infringement, and any related litigation could be time-consuming and costly.

Our success and ability to compete depends to a significant degree on our licenses and the ability to use our food and nutritional products. If any of our competitor’s copies or otherwise gains access to any of our competitive advantages or develops similar products independently, our ability to compete would be negatively impacted.

| 15 |

| Table of Contents |

We also consider our assigned trademarks invaluable to our ability to continue to develop and maintain the goodwill and recognition associated with our brands. These and any other measures that we may take to protect our intellectual property rights, which presently are based upon a combination of copyright, trade secret and trademark laws, may not be adequate to prevent their unauthorized use.

Further, the laws of foreign countries may provide inadequate protection of such intellectual property rights. We may need to bring legal claims to enforce or protect such intellectual property rights. Any litigation, whether successful or unsuccessful, could result in substantial costs and diversions of resources. In addition, notwithstanding any rights we have secured in our intellectual property, other persons may bring claims against us that we have infringed on their intellectual property rights, including claims based upon the content we license from third parties or claims that our intellectual property right interests are not valid. Any claims against us, with or without merit, could be time consuming and costly to defend or litigate, divert our attention and resources, result in the loss of goodwill associated with our service marks or require us to make changes to our website or other of our technologies.

If we fail to effectively manage our growth our future business results could be harmed and our managerial and operational resources may be strained.

As we proceed with the commercialization of our portfolio, we expect to experience significant and rapid growth in the scope and complexity of our business. We will need to add resources to market our services, manage operations, handle sales and marketing efforts and perform finance and accounting functions. We will be required to hire a broad range of additional personnel in order to successfully advance our operations. This growth is likely to place a strain on our management and operational resources. The failure to develop and implement effective systems, or to hire and retain sufficient personnel for the performance of all of the functions necessary to effectively service and manage our potential business, or the failure to manage growth effectively, could have a materially adverse effect on our business and financial condition.

Our services may become obsolete and unmarketable if we are unable to respond adequately to rapidly changing technology and customer demands.

Our industry is characterized by rapid changes in market demands. As a result, our products may quickly become obsolete and unmarketable. Our future success will depend on our ability to adapt to and anticipate market demands, develop new products and enhance our current products on a timely and cost-effective basis. Further, our products must remain competitive with those of other companies with substantially greater resources. We may experience technical or other difficulties that could delay or prevent the development, introduction or marketing of new products or enhanced versions of existing products. Also, we may not be able to adapt new or enhanced services to comply with emerging industry or governmental standards.

| 16 |

| Table of Contents |

Our failure to appropriately respond to changing consumer preferences and demand for new products or product enhancements could significantly harm product sales and harm our financial condition and operating results.

Our business is subject to changing consumer trends and preferences. Our success depends on our ability to anticipate and respond to these changes, and we may not respond in a timely or commercially appropriate manner to such changes. The nutritional supplement industry is characterized by rapid and frequent changes in demand and new product introductions and enhancements. Our failure to predict these trends could negatively impact consumer opinion of our products and thus commercial success.

If we do not introduce new products or make enhancements to adequately meet the changing needs of our customers, some of our products could fail in the marketplace, which could negatively impact our revenues, financial condition and operating results.

The business of marketing of food and nutritional products is highly competitive and sensitive to the introduction of new products, including various prescription drugs, which may rapidly capture a significant share of the market. These market segments include numerous manufacturers, distributors, marketers, retailers and physicians that actively compete for the business of consumers. We must continually adapt to marketplace demands in order to avoid negatively impacting our results.

We are affected by laws and governmental regulations with potential penalties or claims, which could harm our financial condition and operating results.

The formulation, manufacturing, packaging, labeling, distribution, advertising, licensing, sale and storage of our products are affected by laws and governmental regulations.

New regulations or changes in the interpretations of existing regulations may result in significant compliance costs or discontinuation of product sales and may negatively impact the marketing of our products, resulting in loss of revenues. We are subject to FDA rules for current good manufacturing practices, or GMPs, for the manufacture, packing, labeling and holding of nutritional products distributed in the United States. We have retained supply partners that maintain a comprehensive quality assurance program designed to address these regulations.

If these supply partners fail to comply with the GMPs and regulations, this could negatively impact our reputation and ability to sell products even though we are not directly liable under the GMPs and regulations for such compliance.

Since we rely on independent third parties for the manufacture and supply of certain of our products, if these third parties fail to reliably supply products to us at required levels of quality and which are manufactured in compliance with applicable laws, then our financial condition and operating results would be harmed.

We cannot be assured that our outside contract manufacturers will continuously and reliably supply products to us at the levels of quality, or the quantities, we require, and in compliance with applicable laws, including under the FDA’s GMP regulations. Additionally, while we are not presently aware of any current liquidity issues with our suppliers, we cannot be assured we will not experience financial hardship or capacity constraints in the future that could interrupt supply and thus our ability to profitably market our products.

| 17 |

| Table of Contents |

We may incur material product liability claims, which could increase our costs and harm our financial condition and operating results.

We rely upon published and unpublished safety information including clinical studies on ingredients used in our products. Previously unknown adverse reactions resulting from human consumption of these ingredients could occur. As a marketer of dietary and nutritional supplements and other products that are ingested by consumers or applied to their bodies, we may be subjected to various product liability claims, including that the products contain contaminants, the products include inadequate instructions as to their uses, or the products include inadequate warnings concerning side effects and interactions with other substances. It is possible that widespread product liability claims could increase our costs, and adversely affect our revenues and operating income. Moreover, liability claims arising from a serious adverse event may increase our costs through higher insurance premiums and deductibles, and may make it more difficult to secure adequate insurance coverage in the future.

Our customers generally are not obligated to continue purchasing products from us

Many of our customers buy from us under purchase orders, and we generally do not have long-term agreements with or commitments from these customers for the purchase of products. We cannot provide assurance that our customers will maintain or increase their sales volumes or orders for the products supplied by us or that we will be able to maintain or add to our existing customer base. Decreases in our customers’ sales volumes or orders for products supplied by us may have a material adverse effect on our business, financial condition or results of operations.

If we do not manage our supply chain effectively, our operating results may be adversely affected

Our supply chain is complex. We rely on suppliers for our raw materials and for the manufacturing, processing, packaging and distribution of many of our products. The inability of any of these suppliers to deliver or perform for us in a timely or cost-effective manner could cause our operating costs to rise and our margins to fall. We must continuously monitor our inventory and product mix against forecasted demand or risk having inadequate supplies to meet consumer demand as well as having too much inventory that may reach its expiration date. If we are unable to manage our supply chain efficiently and ensure that our products are available to meet consumer demand, our operating costs could increase and our margins could fall.

The COVID-19 pandemic has significantly reduced demand for our products, and has had, and may continue to have, a material adverse impact on our financial condition, results of operations and cash flows.

The effects of the COVID-19 (coronavirus) pandemic, including actions taken by businesses and governments, have resulted in a significant and swift reduction in international and U.S. economic activity. These effects have adversely affected the demand for our products. The decline in our customers’ demand for our products has had, and is likely to continue to have, a material adverse impact on our financial condition, results of operations and cash flows.

RISKS RELATING TO OWNERSHIP OF OUR SECURITIES

Our stock price may be volatile, which may result in losses to our shareholders.

The stock markets have experienced significant price and trading volume fluctuations, and the market prices of companies quoted on the OTC quotation system in which shares of our common stock are quoted, have been volatile in the past and have experienced sharp share price and trading volume changes. The trading price of our common stock is likely to be volatile and could fluctuate widely in response to many factors, including the following, some of which are beyond our control:

|

| · | variations in our operating results; |

|

|

|

|

|

| · | changes in expectations of our future financial performance, including financial estimates by securities analysts and investors; |

|

|

|

|

|

| · | changes in operating and stock price performance of other companies in our industry; |

|

|

|

|

|

| · | additions or departures of key personnel; and |

|

|

|

|

|

| · | future sales of our common stock. |

Domestic and international stock markets often experience significant price and volume fluctuations. These fluctuations, as well as general economic and political conditions unrelated to our performance, may adversely affect the price of our common stock.

| 18 |

| Table of Contents |

Our common shares are thinly traded and our shareholders may be unable to sell at or near ask prices, or at all.

We cannot predict the extent to which an active public market for trading our common stock will be develop or be sustained. Our shares have historically been sporadically or “thinly-traded” meaning that the number of persons interested in purchasing our common shares at or near offered prices at any given time may be relatively small or non-existent.

This situation is attributable to a number of factors, including the fact that we are a small company in its development phase which is relatively unknown to stock analysts, stock brokers, institutional investors and others in the investment community who generate or influence sales volume. Even if we came to the attention of such persons, those persons may be reluctant to follow, purchase, or recommend the purchase of shares of an unproven company such as ours until such time as we become more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous trades without an adverse effect on share price. We cannot be assured that a broader or more active public trading market for our common stock will develop or be sustained, or that current trading levels will be sustained.

The market price for our common stock is particularly volatile given our status as a relatively small and developing company, which could lead to wide fluctuations in our share price. Our shareholders may be unable to sell your common stock at or above your purchase price if at all, which may result in substantial losses to you.

Shareholders should be aware that, according to SEC Release No. 34-29093, the market for penny stock/over the counter stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include (1) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (2) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (3) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (4) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and (5) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. The occurrence of these patterns or practices could increase the volatility of our share price and there can be no assurance that our shares will not be impacted by these practices.

We do not anticipate paying any cash dividends to our common shareholders and as a result shareholders may only realize a return when the shares are sold.

We presently do not anticipate that we will pay dividends on any of our common stock in the foreseeable future. If payment of dividends does occur at some point in the future, it would be contingent upon our revenues and earnings, if any, capital requirements, and general financial condition. The payment of any common stock dividends will be within the discretion of our Board of Directors. We presently intend to retain all earnings to implement our business plan; accordingly, we do not anticipate the declaration of any dividends for common stock in the foreseeable future.

| 19 |

| Table of Contents |

We are quoted on the OTC quotation system and our common stock is subject to “penny stock” rules which could negatively impact our liquidity and our shareholders’ ability to sell their shares.

Our common stock is currently quoted on the OTCQB. We must comply with numerous NASDAQ MarketPlace rules in order to maintain the listing of our common stock on the OTCQB. There can be no assurance that we can continue to meet the requirements to maintain the quotation on the OTC system of our common stock. If we are unable to maintain the quotation of our common stock in the OTC system, the market liquidity of our common stock may be severely limited.

Volatility in our common share price may subject us to securities litigation.

The market for our common stock is characterized by significant price volatility as compared to seasoned issuers, and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may, in the future, be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management’s attention and resources and impact our ability to operate as a going concern.

The elimination of monetary liability against our directors, officers and employees under Nevada law and the existence of indemnification rights of our directors, officers and employees may result in substantial expenditures by our company and may discourage lawsuits against our directors, officers and employees.

Our Articles of Incorporation contains a specific provision that eliminates the liability of our directors and officers for monetary damages to our company and shareholders. Further, we are prepared to give such indemnification to our directors and officers to the extent provided for by Nevada law. We may also have contractual indemnification obligations under our employment agreements with our officers. The foregoing indemnification obligations could result in our company incurring substantial expenditures to cover the cost of settlement or damage awards against directors and officers, which we may be unable to recoup. These provisions and resultant costs may also discourage our company from bringing a lawsuit against directors and officers for breaches of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our shareholders against our directors and officers even though such actions, if successful, might otherwise benefit our company and shareholders.

Our business is subject to changing regulations related to corporate governance and public disclosure that have increased both our costs and the risk of noncompliance.

Because our common stock is publicly traded, we are subject to certain rules and regulations of federal, state and financial market entities charged with the protection of investors and the oversight of companies whose securities are publicly traded. These entities, including the Public Company Accounting Oversight Board, the SEC and FINRA, have issued requirements and regulations and continue to develop additional regulations and requirements in response to corporate scandals and laws enacted by Congress, most notably the Sarbanes-Oxley Act of 2002. Our efforts to comply with these regulations have resulted in, and are likely to continue resulting in, increased general and administrative expenses and diversion of management time and attention from revenue-generating activities to compliance activities. Because new and modified laws, regulations and standards are subject to varying interpretations in many cases due to their lack of specificity, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies. This evolution may result in continuing uncertainty regarding compliance matters and additional costs necessitated by ongoing revisions to our disclosure and governance practices.

Item 1B. Unresolved Staff Comments

None.

| 20 |

| Table of Contents |

We do not currently own any property and we currently have no investment policies as they pertain to real estate, real estate interests or real estate mortgages.

On January 11, 2019, the Company filed a lawsuit against Everlast World’s Boxing Headquarters Corp. (“Everlast”). This action involves Everlast’s attempts to prevent the Company from exercising its right to terminate a License Agreement between the parties pursuant to which Trident had the right to market certain Everlast-branded products.

On January 17, 2019, Everlast World’s Boxing Headquarters Corp. (“Everlast”) filed a counter civil lawsuit against the Company and other defendants. In that lawsuit, Everlast seeks payment from the defendants under a License Agreement dated June 4, 2013, for $425,555 in unpaid royalties allegedly due and owing under the License Agreement and interest on the allegedly unpaid royalties of $96,265, which interest allegedly continues to accrue. Everlast has also sought all costs, expenses, and legal fees incurred by Everlast in collecting monies that it claims are due under the License Agreement. On February 26, 2020, the court in the Everlast matter issued an Opinion and Order granting a motion to dismiss all of the Company’s claims against Everlast and granting a motion for judgment on the pleadings as to liability against the Company. The Court left open the question of damages to be awarded to Everlast. The Company has requested that the parties participate in settlement discussions before a magistrate judge or, in the alternative, that Everlast engage in limited discovery on these matters. No settlement was reached. On October 15, 2020, the Court in the Everlast case ordered, adjudged and decreed that Plaintiff Everlast have judgment and recover a total of $738,946 from the Company as follows:

1. $425,000 representing royalty payments due to Everlast;

2. Interest on royalty payments computed through October 15, 2020, in the sum of $242,920;

3. Costs and attorneys’ fees in the sum of $71,026

The Company has fully accrued the $738,946 liability as of November 30, 2020.

The Clerk of Court was directed to close the case. The Company did not appeal the judgement.

On June 3, 2019, the Company filed a lawsuit against PIT Mycell, LLC, William E. Peterson III, New Age Ventures, LLC, Volker Berl, and Mycell Technologies, LLC (“Mycell”) in the Superior Court in Bergen County, New Jersey, Civil Action No. BER-L-004198-19, in which the Company seeks to require the defendants to perform under and allow the enforcement of certain notes made by Mycell and acquired by the Company in September 2017. The notes are past their stated maturity date of December 31, 2016. The Company also alleges that the parties had entered into a written Settlement Agreement Letter of Intent dated March 14, 2019 (the “Settlement”), but that the defendants repudiated it shortly thereafter. The notes had been the subject of an earlier lawsuit in Virginia in state court in Fairfax County between the Company and PIT Mycell, LLC that the Settlement was intended to resolve. The Company seeks to enforce the notes and the Settlement in the New Jersey lawsuit and requests actual damages in an amount to be proven at trial, attorneys’ fees and litigation costs, specific performance requiring certain defendants to enforce obligations under the notes against Mycell, specific performance requiring the defendants to execute a final Settlement Agreement consistent with the Settlement, an order permitting foreclosure on the collateral for the notes, and declaratory relief. On January 24, 2020, the New Jersey court denied Defendant’s Motions to dismiss the case. The parties have engaged in written discovery and exchanged productions of documents. Mycell filed for bankruptcy on November 25, 2020.

On December 1, 2020, Bank of America Leasing and Capital, LLC filed a legal action against the Company in the Superior Court for the State of California, County of San Mateo (Case NO. 20-CIV-05306), alleging breach of contract. The claim arises out of a software services contract between the Company and Oracle Corporation. Bank of America Leasing and Capital, LLC acquired Oracle’s rights under the agreement. The plaintiff claims the Company is liable for damages in the amount of $217,000 plus interests and costs. The Company has not filed an answer to this complaint. On February 22, 2021, the plaintiff requested that the Court enter a default judgment against the Company. The Company intends to engage counsel and defend against this claim.

Item 4. Mining Safety Disclosures

None.

| 21 |

| Table of Contents |

Since July 8, 2013 our shares began trading under the symbol “TDNT”. As of the date of this filing, there has been no active trading of our securities.

|

|

| 2020 |

|

| 2019 |

| ||||||||||

|

|

| High |

|

| Low |

|

| High |

|

| Low |

| ||||

| First Quarter |

| $ | 0.500 |

|

| $ | 0.250 |

|

| $ | 0.600 |

|

| $ | 0.310 |

|

| Second Quarter |

| $ | 0.348 |

|

| $ | 0.160 |

|

| $ | 0.468 |

|

| $ | 0.380 |

|

| Third Quarter |

| $ | 0.288 |

|

| $ | 0.031 |

|

| $ | 0.620 |

|

| $ | 0.440 |

|

| Fourth Quarter |

| $ | 0.150 |

|

| $ | 0.033 |

|

| $ | 0.580 |

|

| $ | 0.208 |

|

The foregoing over-the-counter market quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

The OTCQB is a regulated quotation service that displays real-time quotes, last sale prices and volume information in over-the-counter (OTC) securities. The OTC is not an issuer listing service, market or exchange. Although the OTC market does not have any listing requirements per se, to be eligible for quotation on the OTC market, issuers must remain current in their filings with the SEC or applicable regulatory authority. Market Makers are not permitted to begin quotation of a security whose issuer does not meet this filing requirement. Securities already quoted on the OTC market that become delinquent in their required filings will be removed following a grace period if they do not make their required filing during that time.

As of November 30, 2020, we had 32,311,887 Shares of $0.001 par value common stock issued and outstanding held by 48 shareholders of record.

Of the 32,311,887 shares of common stock outstanding as of November 30, 2020, 8,441,724 shares are owned by Anthony Pallante, CEO and director, and may only be resold in compliance with Rule 144 of the Securities Act of 1933.

The stock transfer agent for our securities is Action Stock Transfer.

Dividends

We have never declared or paid any cash dividends on our common stock. For the foreseeable future, we intend to retain any earnings to finance the development and expansion of our business, and we do not anticipate paying any cash dividends on our common stock. Any future determination to pay dividends will be at the discretion of the Board of Directors and will be dependent upon then existing conditions, including our financial condition and results of operations, capital requirements, contractual restrictions, business prospects, and other factors that the Board of Directors considers relevant.

Section Rule 15(g) of the Securities Exchange Act of 1934

The Company’s shares are covered by Section 15(g) of the Securities Exchange Act of 1934, as amended that imposes additional sales practice requirements on broker/dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses). For transactions covered by the Rule, the broker/dealer must make a special suitability determination for the purchase and have received the purchaser’s written agreement to the transaction prior to the sale. Consequently, the Rule may affect the ability of broker/dealers to sell our securities and also may affect your ability to sell your shares in the secondary market.

Section 15(g) also imposes additional sales practice requirements on broker/dealers who sell penny securities. These rules require a one page summary of certain essential items. The items include the risk of investing in penny stocks in both public offerings and secondary marketing; terms important to in understanding of the function of the penny stock market, such as “bid” and “offer” quotes, a dealers “spread” and broker/dealer compensation; the broker/dealer compensation, the broker/dealers duties to its customers, including the disclosures required by any other penny stock disclosure rules; and the customers rights and remedies in causes of fraud in penny stock transactions.

| 22 |

| Table of Contents |

Securities authorized for issuance under equity compensation plans

As of November 30, 2020, we have issued the following securities under our 2013 Stock Option Plan:

| Name and Position | Number of Options | Date of Grant | Exercise price | Expiration | Vesting from date of Grant | |

| 1.

| Scott Chapman Current President, Director, Chair of Corporate Governance Committee |

150,000 150,000 |

Dec 6, 2017 Dec 6, 2017 |

$0.40 $0.40 |

Dec 6, 2022 Dec 6, 2022 |

Immediate 12 months |

| 2. | Mark Holcombe (former President, CFO, Director, Chairman of the Compensation Committee |

150,000 150,000 |

Dec 6, 2017 Dec 6, 2017 |

$0.40 $0.40 |

Dec 6, 2022 Dec 6, 2022 |

Immediate 12 months |

| 3.

| Peter Salvo Controller | 75,000 75,000 | Dec 6, 2017 Dec 6, 2017 | $0.40 $0.40 | Dec 6, 2022 Dec 6, 2022 | Immediate 12 months |

| 4. | Anthony Pallante CEO, Director, Chairman of the Board | 375,000 375,000 | Dec 6, 2017 Dec 6, 2017 | $0.40 $0.40 | Dec 6, 2022 Dec 6, 2022 | Immediate 12 months

|

| 5. | Brad Caistor

| 150,000 150,000 | Dec 6, 2017 Dec 6, 2017 | $0.40 $0.40 | Dec 6, 2022 Dec 6, 2022 | Immediate 12 months |

| 6. | Landon McCluskey

| 16,250 16,250 | Dec 6, 2017 Dec 6, 2017 | $0.40 $0.40 | Dec 6, 2022 Dec 6, 2022 | Immediate 12 months |

|

| Total: | 1,832,500 |

| 23 |

| Table of Contents |

Section 16(a)

Based solely upon a review of Forms 3 and 4 furnished by us under Rule 16a-3(d) of the Securities Exchange Act of 1934, we are not aware of any individual who failed to file a required report on a timely basis required by Section 16(a) of the Securities Exchange Act of 1934.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

There were no shares of common stock or other securities issued to the issuer or affiliated purchasers during the year ended November 30, 2020.

Item 6. Selected Financial Data

As a smaller reporting company we are not required to provide this information.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Financial Information

This Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) section provides analysis of our operations and financial position for the fiscal year ended November 30, 2020 and includes information available up to March 16, 2020, unless otherwise indicated herein. It is supplementary information and should be read in conjunction with the Consolidated Financial Statements included elsewhere in this report.

Certain statements contained in this MD&A may constitute forward-looking statements as defined under securities laws. Forward-looking statements may relate to our future outlook and anticipated events or results and may include statements regarding our future financial position, business strategy, budgets, litigation, projected costs, capital expenditures, financial results, taxes, plans and objectives. In some cases, forward-looking statements can be identified by terms such as “anticipate”, “estimate”, “intend”, “project”, “potential”, “continue”, “believe”, “expect”, “could”, “would”, “should”, “might”, “plan”, “will”, “may”, “predict”, or other similar expressions concerning matters that are not historical facts. To the extent any forward-looking statements contain future-oriented financial information or financial outlooks, such information is being provided to enable a reader to assess our financial condition, material changes in our financial condition, our results of operations, and our liquidity and capital resources. Readers are cautioned that this information may not be appropriate for any other purpose, including investment decisions.

Forward-looking statements contained in this MD&A are based on certain factors and assumptions regarding expected growth, results of operations, performance, and business prospects and opportunities. While we consider these assumptions to be reasonable, based on information currently available, they may prove to be incorrect. Forward-looking statements are also subject to certain factors, including risks and uncertainties that could cause actual results to differ materially from what we currently expect. These factors are more fully described in the “Risk Factors” section at Item 1A of this Form 10-K.

| 24 |

| Table of Contents |

Critical Accounting Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities, related revenues and expenses, and disclosure of gain and loss contingencies at the date of the financial statements. The estimates and assumptions made require us to exercise our judgment and are based on our experience and various other factors that we believe to be reasonable under the circumstances. We continually evaluate the information that forms the basis of our estimates and assumptions as our business and the business environment generally changes. The following are the accounting estimates which we believe to be most important to our business.

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable are recorded at their original invoice amounts. We regularly review collectability and establish an allowance for uncollectible amounts as necessary.

Inventory