Attached files

| file | filename |

|---|---|

| EX-32.2 - Trident Brands Inc | ex32-2.htm |

| EX-32.1 - Trident Brands Inc | ex32-1.htm |

| EX-31.2 - Trident Brands Inc | ex31-2.htm |

| EX-31.1 - Trident Brands Inc | ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

[X] QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE QUARTERLY PERIOD ENDED FEBRUARY 28, 2018

Commission file number 000-53707

TRIDENT BRANDS INCORPORATED

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation or organization)

200 South Executive Drive, Suite 101

Brookfield, WI 53005

(Address of principal executive offices, including zip code.)

(262) 789-6689

(Telephone number, including area code)

Resident Agents of Nevada

711 S. Carson Street, Suite 4

Carson City, NV 89701

(Name and Address of Agent for Service)

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the last 90 days. YES [X] NO [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES [X] NO [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer, "accelerated filer," "non-accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer [ ]

|

Accelerated filer [ ]

|

|

Non-accelerated filer [ ]

|

Smaller reporting company [X]

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES [ ] NO [X]

The number of the registrant’s common shares outstanding as of April 19, 2018 was 32,311,887.

TRIDENT BRANDS INCORORATED

FORM 10-Q

For the quarterly period ended February 28, 2018

TABLE OF CONTENTS

|

PART I

|

FINANCIAL INFORMATION

|

|

|

Item 1.

|

Financial Statements (Unaudited)

|

7 |

|

Consolidated Balance Sheets as at February 28, 2018 and November 30, 2017

|

8 | |

|

Consolidated Statements of Operations for the three months ended February 28, 2018 and 2017

|

9 | |

|

Consolidated Statements of Cash Flows for the three months ended February 28, 2018 and 2017

|

10 | |

|

Notes to Consolidated Financial Statements

|

11 | |

|

Item 2

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

15 |

|

Item 3

|

Quantitative and Qualitative Disclosures about Market Risk

|

19 |

|

Item 4

|

Controls and Procedures

|

20 |

|

PART II

|

OTHER INFORMATION

|

|

|

Item 6

|

Exhibits

|

21 |

2

Basis of Presentation

Except where the context otherwise requires, all references in this Quarterly Report on Form 10-Q (“Form 10-Q”) to the “Company”, “we”, “us”, “our”, “Trident” and “Trident Brands” or similar words and phrases are to Trident Brands Incorporated and its subsidiaries, taken together.

In this report, all currency amounts are expressed in thousands of United States (“U.S.”) dollars (“$”), except per share data, unless otherwise stated. Amounts expressed in other than U.S. dollars are noted accordingly. For example, amounts if expressed in Canadian dollars are expressed in thousands of Canadian dollars and preceded by the symbol “Cdn $”.

Forward-Looking Statements

This Form 10-Q contains forward-looking statements which are based on our current expectations and assumptions and involve a number of risks and uncertainties. Generally, forward-looking statements do not relate strictly to historical or current facts and are typically accompanied by words such as “anticipate”, “estimate”, “intend”, “project”, “potential”, “continue”, “believe”, “expect”, “could”, “would”, “should”, “might”, “plan”, “will”, “may”, “predict”, the negatives of such terms, and words and phrases of similar impact and include, but are not limited to references to expected increases in revenues and margins, growth opportunities, the success of new product launches and line extensions, our ability to finance our business, potential strategic investments, business strategies, competitive strengths, goals, references to key markets where we operate and the market for our securities. These forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on certain assumptions and analyses we make in light of our experience and our interpretation of current conditions, historical trends and expected future developments, as well as other factors that we believe are appropriate in the circumstance.

Whether actual results and developments will agree with our expectations and predictions is subject to many risks and uncertainties. Accordingly, there are or will be important factors that could cause our actual results to differ materially from our expectations and predictions. We believe these factors include, but are not limited to, the following:

|

·

|

we have a limited operating history with significant losses and expect losses to continue for the foreseeable future;

|

|

·

|

there is doubt about our ability to continue as a going concern due to recurring losses from operations, an accumulated deficit and insufficient cash resources on hand to meet our business objectives, all of which means that we may not be able to continue operations;

|

|

·

|

we could face intense competition, which could result in lower revenues and higher expenditures and could adversely affect our results of operations;

|

|

·

|

we are governed by only three persons serving as directors and officers which may lead to faulty corporate governance;

|

|

·

|

we must attract and maintain key personnel or our business may fail;

|

|

·

|

we may not be able to secure additional financing to meet our future capital needs due to changes in general economic conditions;

|

|

·

|

our business and operating results could be harmed if we fail to manage our growth or change;

|

|

·

|

we have a limited operating history and if we are not successful in growing our business, then we may have to scale back or even cease our ongoing business operations;

|

3

|

·

|

if our intellectual property is not adequately protected, then we may not be able to compete effectively and we may not be profitable;

|

|

·

|

if we are the subject of an intellectual property infringement claim, the cost of participating in any litigation could impact our ability to stay in business;

|

|

·

|

we could lose our competitive advantages if we are not able to protect any of our food and nutritional products and intellectual property rights against infringement, and any related litigation could be time-consuming and costly;

|

|

·

|

if we fail to effectively manage our growth our future business results could be harmed and our managerial and operational resources may be strained;

|

|

·

|

if we fail to effectively manage our growth our future business results could be harmed and our managerial and operational resources may be strained;

|

|

·

|

our services may become obsolete and unmarketable if we are unable to respond adequately to rapidly changing technology and customer demands;

|

|

·

|

our failure to appropriately respond to changing consumer preferences and demand for new products or product enhancements could significantly harm product sales and harm our financial condition and operating results;

|

|

·

|

if we do not introduce new products or make enhancements to adequately meet the changing needs of our customers, some of our products could fail in the marketplace, which could negatively impact our revenues, financial condition and operating results;

|

|

·

|

we are affected by laws and governmental regulations with potential penalties or claims, which could harm our financial condition and operating results;

|

|

·

|

since we rely on independent third parties for the manufacture and supply of certain of our products, if these third parties fail to reliably supply products to us at required levels of quality and which are manufactured in compliance with applicable laws, then our financial condition and operating results would be harmed;

|

|

·

|

we may incur material product liability claims, which could increase our costs and harm our financial condition and operating results;

|

|

·

|

unless we can generate sufficient cash from operations or raise additional funds, we may not be able to meet our debt obligations;

|

|

·

|

our customers generally are not obligated to continue purchasing products from us;

|

|

·

|

if we do not manage our supply chain effectively, our operating results may be adversely affected;

|

|

·

|

our stock price may be volatile, which may result in losses to our shareholders;

|

|

·

|

our common shares are thinly traded and our shareholders may be unable to sell at or near ask prices, or at all;

|

|

·

|

the market price for our common stock is particularly volatile given our status as a relatively small and developing company, which could lead to wide fluctuations in our share price. Our shareholders may be unable to sell your common stock at or above their purchase price if at all, which may result in substantial losses;

|

4

|

·

|

we do not anticipate paying any cash dividends to our common shareholders and as a result shareholders may only realize a return when the shares are sold;

|

|

·

|

we are listed on the OTCQB quotation system and our common stock is subject to “penny stock” rules which could negatively impact our liquidity and our shareholders’ ability to sell their shares;

|

|

·

|

volatility in our common share price may subject us to securities litigation;

|

|

·

|

the elimination of monetary liability against our directors, officers and employees under Nevada law and the existence of indemnification rights of our directors, officers and employees may result in substantial expenditures by our company and may discourage lawsuits against our directors, officers and employees; and

|

|

·

|

our business is subject to changing regulations related to corporate governance and public disclosure that have increased both our costs and the risk of noncompliance.

|

Consequently all forward-looking statements made herein are qualified by these cautionary statements and there can be no assurance that our actual results or the developments we anticipate will be realized. The foregoing factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this report.

Corporate Legal Structure and Related Matters

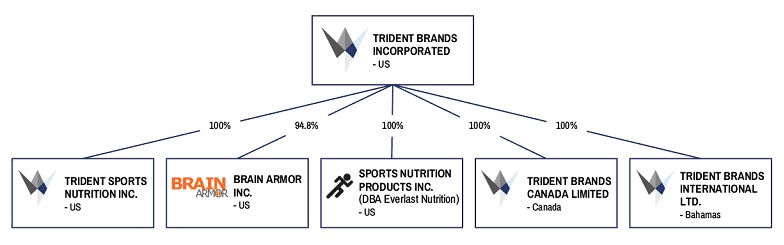

Trident Brands Incorporated has five legal subsidiaries, as detailed below.

Trident Sports Nutrition Inc. is 100% owned by Trident Brands and is organized to deliver shelf ready product solutions in the active nutrition and dietary supplement segment to leading retailers for private label and control brand programs.

Brain Armor Inc. is 94.8% owned by Trident Brands and is organized to develop, market and sell a portfolio of DHA supplements under the Brain Armor® brand targeted at the cognitive health and performance segment.

Sports Nutrition Product Inc. (DBA Everlast Nutrition) is 100% owned by Trident Brands and holds an exclusive license to market and sell products in the nutritional food and supplement category under the Everlast® brand.

Trident Brands Canada Ltd. is 100% owned by Trident Brands Incorporated and holds various banking facilities, and licenses associated with the manufacturing, importation and sale of natural health and nutrition products in Canada.

5

Trident Brands International Ltd. is 100% owned by Trident Brands and was organized to handle the company’s international operations and sub-license trademarks and/or products in international markets.

The Company’s administrative office is located at 200 South Executive Drive, Suite 101, Brookfield, Wisconsin, 53005 and its fiscal year end is November 30th.

The Company has authorized capital of 300,000,000 common shares with a par value of $0.001 per share. 32,311,887 common shares were issued and outstanding as of February 28, 2018 and 32,311,887 as of April 19, 2018.

6

ITEM 1. FINANCIAL STATEMENTS

The unaudited financial statements for the quarter ended February 28, 2018 immediately follow.

7

TRIDENT BRANDS INCORPORATED

Consolidated Balance Sheets

(Unaudited)

|

As of

|

As of

|

|||||||

|

February 28,

|

November 30,

|

|||||||

|

2018

|

2017

|

|||||||

|

ASSETS

|

||||||||

|

Current Assets

|

||||||||

|

Cash and Cash Equivalents

|

$

|

2,621,750

|

$

|

3,143,788

|

||||

|

Accounts Receivable, net of allowance of $69,675 and $29,852, respectively

|

732,386

|

1,071,576

|

||||||

|

Inventory

|

778,306

|

132,951

|

||||||

|

Prepaid and other current assets

|

217,300

|

236,528

|

||||||

|

Total Current Assets

|

4,349,742

|

4,584,843

|

||||||

|

Fixed Assets-Furniture & Fixtures, net

|

37,950

|

40,046

|

||||||

|

Note Receivable

|

612,669

|

617,010

|

||||||

|

Intangible Assets - Licenses, IP net

|

749,800

|

472,875

|

||||||

|

TOTAL ASSETS

|

$

|

5,750,161

|

$

|

5,714,774

|

||||

|

LIABILITIES & STOCKHOLDERS' DEFICIT

|

||||||||

|

Current Liabilities

|

||||||||

|

Accounts Payable

|

$

|

1,958,458

|

$

|

1,388,393

|

||||

|

Accrued Liability

|

1,919,976

|

1,454,770

|

||||||

|

Total Current Liabilities

|

3,878,434

|

2,843,163

|

||||||

|

Convertible Debt, net of discount $1,691,644 and $1,954,594, respectively

|

9,108,356

|

8,845,406

|

||||||

|

Total Liabilities

|

12,986,790

|

11,688,569

|

||||||

|

Stockholders' Deficit

|

||||||||

|

Common stock, $0.001 par value, 300,000,000 shares authorized;

|

||||||||

|

32,311,887 shares issued and outstanding as of February 28, 2018 and November 30, 2017

|

32,312 | 32,312 | ||||||

|

Additional paid-in capital

|

8,657,952

|

7,869,962

|

||||||

|

Non-Controlling Interest in Subsidiary

|

(138,278

|

)

|

(124,649

|

)

|

||||

|

Accumulated Deficit

|

(15,788,615

|

)

|

(13,751,420

|

)

|

||||

|

Total Stockholders' Deficit

|

(7,236,629

|

)

|

(5,973,795

|

)

|

||||

|

TOTAL LIABILITIES & STOCKHOLDERS' DEFICIT

|

$

|

5,750,161

|

$

|

5,714,774

|

||||

See Notes to Unaudited Consolidated Financial Statements

8

TRIDENT BRANDS INCORPORATED

Consolidated Statements of Operations (unaudited)

|

Three Months

|

Three Months

|

|||||||

|

Ended

|

Ended

|

|||||||

|

February 28,

|

February 28,

|

|||||||

|

2018

|

2017

|

|||||||

|

Revenues

|

$

|

1,861,700

|

$

|

16,686

|

||||

|

Cost of Sales

|

1,804,795

|

9,204

|

||||||

|

Gross Profit

|

56,905

|

7,482

|

||||||

|

General & Administrative Expenses

|

(1,644,141

|

)

|

(726,200

|

)

|

||||

|

Loss from Operations

|

(1,587,236

|

)

|

(718,718

|

)

|

||||

|

Other Income (Expenses)

|

||||||||

|

Interest Expense, net

|

(463,588

|

)

|

(253,732

|

)

|

||||

|

Total Other Income (Expenses)

|

(463,588

|

)

|

(253,732

|

)

|

||||

|

Net Loss

|

$

|

(2,050,824

|

)

|

$

|

(972,450

|

)

|

||

|

Net loss attributable to Trident

|

(2,037,195

|

)

|

(963,158

|

)

|

||||

|

Net loss attributable to Non-Controlling Interests

|

(13,629

|

)

|

(9,292

|

)

|

||||

|

Loss per share - Basic and diluted

|

$

|

(0.06

|

)

|

$

|

(0.03

|

)

|

||

|

Weighted average number of common shares outstanding - Basic and diluted

|

32,311,887

|

31,000,000

|

||||||

See Notes to Unaudited Consolidated Financial Statements

9

TRIDENT BRANDS INCORPORATED

Consolidated Statements of Cash Flows (unaudited)

|

Three Months

|

Three Months

|

|||||||

|

Ended

|

Ended

|

|||||||

|

February 28,

|

February 28,

|

|||||||

|

2018

|

2017

|

|||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

||||||||

|

Net loss

|

$

|

(2,050,824

|

)

|

$

|

(972,450

|

)

|

||

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

||||||||

|

Amortization of debt discount

|

262,950

|

120,732

|

||||||

|

Amortization of license, IP

|

12,125

|

75,000

|

||||||

|

Depreciation expense

|

2,096

|

-

|

||||||

|

Stock options expense

|

787,990

|

15,835

|

||||||

|

Changes in operating assets and liabilities:

|

||||||||

|

Accounts Receivable

|

360,856

|

1,833

|

||||||

|

Interest Receivable

|

4,341

|

-

|

||||||

|

Prepaid expenses

|

(2,438

|

)

|

(100,879

|

)

|

||||

|

Inventory

|

(645,355

|

)

|

23,283

|

|||||

|

Accounts payable and accrued liabilities

|

835,271

|

132,615

|

||||||

|

Cash used in operating activities

|

(432,988

|

)

|

(704,031

|

)

|

||||

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

||||||||

|

Purchase of Fixed Assets

|

-

|

-

|

||||||

|

Purchase of Intangible Assets

|

(89,050

|

)

|

-

|

|||||

|

Cash provided by investing activities

|

(89,050

|

)

|

-

|

|||||

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

||||||||

|

Proceeds on loan payable - related party

|

-

|

-

|

||||||

|

Principal payments on loan payable - third party

|

-

|

-

|

||||||

|

Proceeds on loan payable - third party

|

-

|

-

|

||||||

|

Proceeds on convertible debt

|

-

|

-

|

||||||

|

Cash provided by financing activities

|

-

|

-

|

||||||

|

Net change in cash

|

(522,038

|

)

|

(704,031

|

)

|

||||

|

Cash at beginning of period

|

3,143,788

|

1,527,624

|

||||||

|

Cash at end of period

|

$

|

2,621,750

|

$

|

823,593

|

||||

| Non-Cash Transactions | ||||||||

|

Unpaid intangible asset acquired

|

$ | 200,000 | $ | - | ||||

|

Supplemental disclosure of cash flow information:

|

||||||||

|

Cash paid for:

|

||||||||

|

Income taxes

|

$

|

-

|

$

|

-

|

||||

|

Interest

|

$

|

-

|

$

|

-

|

||||

See Notes to Unaudited Consolidated Financial Statements

10

TRIDENT BRANDS INCORPORATED

Notes to Consolidated Financial Statements

February 28, 2018

(Unaudited)

NOTE 1. ORGANIZATION AND DESCRIPTION OF BUSINESS

Trident Brands Incorporated (f/k/a Sandfield Ventures Corp.) (“we”, “our”, “the Company”) was incorporated under the laws of the State of Nevada on November 5, 2007. The Company was formed to engage in the acquisition, exploration and development of natural resource properties.

The Company is now focused on the development of high growth branded and private label consumer products and ingredients within the nutritional supplement, life sciences and food and beverage categories. The Company is in its early growth stage and has transitioned out of its shell status with the Super-8 filing at the end of August, 2014. Activities to date have focused on capital formation, organizational development and execution of its branded and private label consumer products and ingredients business plan.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying unaudited interim financial statements of Trident Brands Incorporated have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules of the Securities and Exchange Commission, and should be read in conjunction with the audited financial statements and notes thereto contained in Trident’s Form 10-K filed with SEC. In the opinion of management, all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of financial position and the results of operations for the interim periods presented have been reflected herein. The results of operations for interim periods are not necessarily indicative of the results to be expected for the full year. Notes to the financial statements which would substantially duplicate the disclosure contained in the audited financial statements for fiscal 2017 as reported in the Form 10-K have been omitted.

Customer Concentration

The Company has one major customer that accounted for approximately 97.6% and $1,817,683 of sales for the three month period ended February 28, 2018 and 92.2% of the accounts receivable compared to 98.7% and $1,416,326 of sales and 98.7% of the accounts receivable for the prior period ended November 30, 2017.

Reclassification

Certain prior period amounts have been reclassified to conform with current period presentation. These reclassifications have no impact on net loss.

NOTE 3. LIQUIDITY

On September 26, 2016, the Company completed a long term financing with a non-US institutional investor, receiving proceeds of $4,100,000 and subsequently $4,400,000 on May 9, 2017 through the issuance of secured convertible promissory notes. The investor has agreed to make additional investments at the Company’s request of up to $1,500,000 ($10,000,000 in the aggregate). As of February 28, 2018, the Company had $2,621,750 in cash and has access to $1,500,000 available from the investor. We believe that our present financial resources including access to available financing will be sufficient to meet the Company’s obligations and fund our operations at least through the next twelve months from the date these financial statements are issued.

11

TRIDENT BRANDS INCORPORATED

Notes to Consolidated Financial Statements

February 28, 2018

(Unaudited)

NOTE 4. WARRANTS AND OPTIONS

On December 6, 2017, our Board of Directors authorized the issuance to its members and management stock options to purchase up to 2,615,000 share of our common stock. 1,307,500 of the options vest upon issuance and are exercisable for up to five years at $0.85 per share, while the remaining 1,307,500 will vest 12 months following issuance and be exercisable for up to five years at $1.00 per share. The Options were issued pursuant to the Company’s 2013 Stock Option Plan, which was registered with the Securities and Exchange Commission on Form S-8 in January, 2015. The 2013 Stock Option Plan authorizes Trident to issue incentive and non-qualified stock options to employees and consultants of the Company to purchase a number of shares not to exceed 15% of the Company’s currently issued and outstanding securities.

The total outstanding stock options as of February 28, 2018 are 4,640,000. The Company used the Black-Scholes model to value the stock options at $1,107,836. For the period ended February 28, 2018, the Company expensed $787,990 as compensation expense compared to $15,835 in the previous comparable year. Following are the assumptions used for the shares vested immediately and 12 months from the date of issuance: Discount rate 1.60% and 2.10%; Volatility 85.51% and 79.75%; and Term 2.5 and 3.0 years.

The following table represents stock option activity for the period ended February 28, 2018:

|

Number of

Options

|

Weighted

Average

Exercise Price

|

Contractual Life

in Years

|

Intrinsic

Value

|

|||||||||||

|

Outstanding - November 30, 2017

|

2,025,000

|

$

|

0.96

|

1.43

|

||||||||||

|

Exercisable - November 30, 2017

|

2,025,000

|

$

|

0.96

|

1.43

|

||||||||||

|

Granted

|

2,615,000

|

$

|

1.08

|

4.77

|

||||||||||

|

Exercised or Vested

|

-0-

|

|||||||||||||

|

Cancelled or Expired

|

-0-

|

|||||||||||||

|

Outstanding - February 28, 2018

|

4,640,000

|

$

|

1.02

|

3.21

|

||||||||||

|

Exercisable - February 28, 2018

|

3,332,500

|

$

|

1.03

|

2.59

|

$191,625

|

|||||||||

On December 6, 2017, the Board of Directors authorized the issuance of 250,000 stock options of Brain Armor to Sanitas, LLC, a consultant and founding shareholder of Brain Armor. The options vest immediately and are exercisable for a period of five (5) years to purchase common shares of Brain Armor at $0.75 per share. The total outstanding Brain Armor stock options as of February 28, 2018 are 250,000. The Company used the Black-Scholes model to value the stock options at $95,814. The assumption used was a discount rate of 1.60%, volatility of 85.51% and term of 2.5 years.

The total outstanding warrants as of February 28, 2018 are 225,000. The exercise price of the warrants are $1.35 with a term of 3 years and vested immediately. The Company used the Black-Scholes model to value the warrants. Following are the assumptions used: Discount rate .9%; Volatility 76.25% and 77.30% respectively.

The following table represents warrant activity for the period ended February 28, 2018:

|

Number of

Warrants

|

Weighted

Average

Exercise Price

|

Contractual Life

in Years

|

Intrinsic

Value

|

|||||||||||

|

Outstanding – November 30, 2017

|

225,000

|

$

|

1.35

|

1.20

|

||||||||||

|

Exercisable - November 30, 2017

|

-0-

|

|||||||||||||

|

Granted

|

-0-

|

|||||||||||||

|

Exercised or Vested

|

-0-

|

|||||||||||||

|

Cancelled or Expired

|

-0-

|

|||||||||||||

|

Outstanding – February 28, 2018

|

225,000

|

$

|

1.35

|

0.95

|

- | |||||||||

12

TRIDENT BRANDS INCORPORATED

Notes to Consolidated Financial Statements

February 28, 2018

(Unaudited)

NOTE 5. RELATED PARTY TRANSACTIONS

The Company neither owns nor leases any real or personal property. The Company is paying a director $750 per month rent for use of office space and services.

NOTE 6. ACQUISITION OF STREAMPAK

On September 12, 2017 we entered into a Share Purchase Agreement dated September 6, 2017 among our wholly owned subsidiary, Trident Brands International Ltd. (“Trident International”), a Bahamas corporation, StreamPak Ltd. (“StreamPak”), an Anguilla corporation, and the sole shareholder of StreamPak, pursuant to which, in consideration for the payment of $125,000 in cash and 500,000 of our common shares valued at $360,000 based on our stock price on September 6, 2017, Trident International purchased 100% of the issued and outstanding common shares of StreamPak. As a result of the share purchase StreamPak became a wholly owned subsidiary of Trident International. The acquisition was not deemed an acquisition of a business but rather an acquisition of a finite-lived intangible asset. The total consideration of $485,000 was recognized as an intangible asset related to intellectual property with an estimated useful life of 10 years. As of February 28, 2018, $24,250 was amortized of which $12,125 was amortized during the current 3 month period and $12,125 in the prior year. The unamortized amount is $460,750.

NOTE 7. NOTE RECEIVABLE

On September 12, 2017 the Company entered into a note purchase agreement with Fengate Trident LP (“Fengate”) pursuant to which, in consideration for the issuance of 811,887 of our common shares to Fengate, we purchased outstanding secured convertible promissory notes of Mycell Technologies LLC ("Mycell") having an aggregate balance due and payable of $511,141 in principal and $94,526 in interest accrued as at September 12, 2017. The purchased notes, which were originally issued to LPF (MCTECH) Investment Corp. on January 27, 2016, February 5, 2016, and May 19, 2016, bear simple interest on unpaid principal at the rate of ten percent per annum. The outstanding principal and accrued interest is convertible at the option of the note holder into securities of Mycell. The accrued interest as at February 28, 2018 is $101,528.

NOTE 8. CONVERTIBLE NOTE

On January 29, 2015, the Company entered into a securities purchase agreement with a non-US institutional investor whereby it agreed to sell an aggregate principal amount of $2,300,000 of senior secured convertible debentures, convertible into shares of the company’s common stock.

The Company received $1,800,000 of the funds from the transaction on February 5, 2015. The balance of $500,000 was received on May 14, 2015.

The convertible debentures are convertible into shares of the Company’s common stock at an initial conversion price of $0.71 per share, for an aggregate of up to 3,239,437 shares. The debentures originally accrued interest at 6% per annum. On September 26, 2016 the Company entered into an amendment agreement related to these convertible debentures whereby the applicable interest rate was increased from 6% to 8% and provisions added to allow the investor to transfer, sell or hypothecate the convertible notes subject to applicable securities laws. The maturity date of the notes was also extended through September 30, 2019. We considered ASC Topic 470-50, Debt Modifications and Extinguishments, and determined that the modification was not deemed substantial, consequently, extinguishment accounting does not apply.

13

TRIDENT BRANDS INCORPORATED

Notes to Consolidated Financial Statements

February 28, 2018

(Unaudited)

Due to the note being convertible to common shares of the Company, a beneficial conversion feature analysis was performed. The intrinsic value of the conversion feature was $647,888 which was recognized as debt discount. As of February 28, 2018, the full amount of the debt discount has been amortized.

On September 26, 2016, the Company entered into a securities purchase agreement with a non-US institutional investor, pursuant to which, in consideration for proceeds of $4,100,000, the Company issued a secured convertible promissory note in the amount of $4,100,000. Pursuant to the securities purchase agreement, the investor has agreed, from time to time after January 1, 2017, to make additional investments at the Company’s request of up to $5,900,000 ($10,000,000 in the aggregate) in one or more tranches of not less than one tranche during any 60 day period. The funding of any tranche under the agreement (other than the first $4,100,000 which has been funded) is subject to the mutual agreement of the parties as to the use of funds.

On May 9, 2017, the Company received the second tranche of funding with proceeds of $4,400,000 for a total investment by the investor of $8,500,000. Under the terms of the securities purchase agreement, the Company has an additional $1,500,000 of available funding.

The Company intends to use the proceeds of the secured convertible note for general working capital purposes including, without limitation, settlement of accounts payable and repayment of mature loans.

In consideration of each advance made by the investor pursuant to the securities purchase agreement, the Company issued to the investor a convertible promissory note of equal value, maturing three years after issuance, and bearing interest at the rate of 8% per annum. Each note will be secured in first priority against the present and after acquired assets of the Company and is convertible in whole or in part at the option of the holder into common shares of the Company at a conversion price of $0.60 per share, for an aggregate of up to 14,166,667 shares.

Due to the notes being convertible to common shares of the Company, a beneficial conversion feature analysis was performed. The intrinsic value of the conversion feature of the notes amounted to $2,833,334 and was recognized as a debt discount. As of February 28, 2018, $1,141,690 of the debt discount was amortized to interest of which $262,950 was amortized during the current three month period and $878,740 in prior years. The unamortized discount is $1,691,644.

The Company analyzed the embedded conversion option for derivative accounting consideration under ASC 815-15 “Derivatives and Hedging” and determined that the conversion option should be classified as equity.

NOTE 9. INTANGIBLE ASSETS

On December 22, 2017, Trident exercised its option under our Exclusive License & Supply Agreement (dated March 1, 2015) to purchase the Brain Armor® brand from DSM Nutrition Products LLC (“DSM”). Subsequently, the parties have executed applicable trademark assignment and purchase agreements necessary to transfer all global intellectual property rights in the Brain Armor brand to Trident. In lieu of a $400,000USD cash payment to DSM for the value of the Brain Armor® brand as initially intended, the Company agreed to meet certain conditions, that when satisfied will have an equivalent value of $400,000USD. The costs incurred to meet these conditions are being charged to intangible assets. As of February 28, 2018, the Company has recorded $289,050 of costs to the asset account. Of this amount $200,000 will be paid over time as the Company purchases omega-3 oil from DSM pursuant to its exclusive supply agreement.

14

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITIONS AND RESULTS OF OPERATIONS

Forward Looking Statements

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) should be read in conjunction with the interim consolidated financial statements, and notes thereto, for the quarter ended February 28, 2018 contained under Item 1 of this Quarterly Report on Form 10-Q (“Form 10-Q”) and in conjunction with the annual consolidated financial statements, and notes thereto, contained in the Annual Report on Form 10-K for the fiscal year ended November 30, 2017 (“Form 10-K”). Unless otherwise indicated herein, the discussion and analysis contained in this MD&A includes information available to April 19, 2018.

Certain statements contained in this MD&A may constitute forward-looking statements as defined under securities laws. Forward-looking statements may relate to our future outlook and anticipated events or results and may include statements regarding our future financial position, business strategy, budgets, litigation, projected costs, capital expenditures, financial results, taxes, plans and objectives. In some cases, forward-looking statements can be identified by terms such as “anticipate”, “estimate”, “intend”, “project”, “potential”, “continue”, “believe”, “expect”, “could”, “would”, “should”, “might”, “plan”, “will”, “may”, “predict”, the negatives of such terms, and other similar expressions concerning matters that are not historical facts. To the extent any forward-looking statements contain future-oriented financial information or financial outlooks, such information is being provided to enable a reader to assess our financial condition, material changes in our financial condition, our results of operations, and our liquidity and capital resources. Readers are cautioned that this information may not be appropriate for any other purpose, including investment decisions.

Forward-looking statements contained in this MD&A are based on certain factors and assumptions regarding expected growth, results of operations, performance, and business prospects and opportunities. While we consider these assumptions to be reasonable, based on information currently available, they may prove to be incorrect. Forward-looking statements are also subject to certain factors, including risks and uncertainties that could cause actual results to differ materially from what we currently expect. These factors are more fully described in the “Risk Factors” section at Item 1A of the Form 10-K.

Forward-looking statements contained in this commentary are based on our current estimates, expectations and projections, which we believe are reasonable as of the date of this report. You should not place undue importance on forward-looking statements and should not rely upon this information as of any other date. Other than as required under securities laws, we do not undertake to update any forward-looking information at any particular time.

All dollar amounts in this MD&A are expressed in thousands of U.S. dollars, except per share amounts, unless otherwise noted.

Business Developments

On December 6, 2017 Mr. Michael Browne resigned as Chief Financial Officer and Treasurer of the Company. Mr. Browne’s resignation did not result from any disagreement with the Company regarding our operations, policies, practices, or otherwise. In light of the resignation, Mark Holcombe, our President and Director, was appointed to serve as Chief Financial Officer.

On December 1, 2017 our Board of Directors appointed Mr. Brian Rola as Vice-President of Trident and General Manager of our wholly owned subsidiary, Trident Sports Nutrition Inc., and Mr. Nick Pili as Vice-President of Trident and General Manager of our wholly owned subsidiary, Brain Armor Inc.

During fiscal 2016 and 2017, Trident advanced approximately $478,539 and $886,999, respectively, in working capital loans with an interest rate of 6% per annum to its 85% owned and controlled subsidiary, Bran Armor Inc. As at December 1st 2017 Brain Armor owed an aggregate of approximately $1,394,251 to the Company in respect of the advances. On December 1, 2017, the boards of directors of Trident and Brain Armor approved the settlement of the inter-company debt by the issuance to Trident of 1,859,001 common shares of Brain Armor at the price of $0.75 per share. As a result of the settlement, Trident now owns approximately 94.82% of Brain Armor’s issued and outstanding securities.

15

On December 6, 2017, our Board of Directors authorized the issuance to its members and management stock options to purchase up to 2,615,000 share of our common stock. 1,307,500 of the options vest upon issuance and are exercisable for up to five years at $0.85 per share, while the remaining 1,307,500 will vest 12 months following issuance and be exercisable for up to five years at $1.00 per share. The Options were issued pursuant to the Company’s 2013 Stock Option Plan, which was registered with the Securities and Exchange Commission on Form S-8 in January, 2015. The 2013 Stock Option Plan authorizes Trident to issue incentive and non-qualified stock options to employees and consultants of the Company to purchase a number of shares not to exceed 15% of the Company’s currently issued and outstanding securities.

Also on December 6, 2017, the Board of Directors authorized the issuance of 250,000 stock options to Sanitas, LLC, a consultant and founding shareholder of Brain Armor. The options vest immediately and are exercisable for a period of five (5) years to purchase common shares of Brain armor at $0.75 per share. The options were issued to one US person, relying on Rule 506 under Regulation D and/or Section 4(2) of the Securities Act of 1933.

Effective December 22, 2017, Trident exercised its option under our Exclusive License Agreement (dated March 1, 2015) to purchase the Brain Armor® brand from DSM Nutrition Products LLC. Subsequently, the parties have executed applicable trademark assignment and purchase agreements necessary to transfer all global intellectual property rights in the Brain Armor brand to Trident.

Effective December 31, 2017, Trident exercised an option to terminate the Trademark License Agreement with Everlast World’s Boxing Headquarters Corp. and International Brand Management Limited (IBML). This strategic decision will allow Trident to focus resources on higher-potential portfolio opportunities. Subsequently, both parties have actively engaged to explore alternative frameworks that may or may not leverage Everlast® brand equity in the sports and active nutrition category.

In December 2017, Trident began shipping P2N Peak Performance Nutrition products on an exclusive basis under a Vendor Agreement with Amazon Fulfillment Services Inc.

Results of Operations

The following summary of our results of operations should be read in conjunction with our unaudited financial statements for the three month periods ended February 28, 2018 and February 28, 2017.

Our operating results for three month periods ended February 28, 2018 and February 28, 2017 are summarized as follows:

|

Three Months

Ended

|

Three Months

Ended

|

|||||||

|

February 28,

|

February 28,

|

|||||||

|

2018

|

2017

|

|||||||

|

Revenues

|

$

|

1,861,700

|

$

|

16,686

|

||||

|

Gross Profit

|

$

|

56,905

|

$

|

7,482

|

||||

|

Operating Expenses

|

$

|

1,644,141

|

$

|

726,200

|

||||

|

Other Expenses

|

$

|

463,588

|

$

|

253,732

|

||||

|

Net Loss

|

$

|

2,050,824

|

$

|

972,450

|

||||

|

EBITDA

|

$

|

(1,557,654

|

)

|

$

|

(527,577

|

)

|

||

16

Revenues and Gross Profits

Sales in the first quarter of 2018 increased to $1,861,700 versus $16,686 in the prior year primarily driven-by private label sports nutrition product sales associated with an established vendor agreement. Gross profit increased to $56,905 or 3.1% of revenues versus $7,482 or 44.8% of revenues in the prior year. We expect product sales and profit contribution to improve significantly over the course of 2018 as commercial efforts gain traction, private label and control label distribution expansion is realized and branded product innovation enters the market.

Operating Expenses

Our operating expenses for the three month periods ended February 28, 2018 and February 28, 2017 are summarized below:

|

Three Months

Ended

February 28,

|

Three Months

Ended

February 28,

|

|||||||

|

2018

|

2017

|

|||||||

|

Professional Fees

|

$

|

38,524

|

$

|

47,732

|

||||

|

General & Administrative Expenses

|

$

|

1,417,264

|

$

|

447,024

|

||||

|

Marketing, Selling & Warehousing Expenses

|

$

|

108,346

|

$

|

103,270

|

||||

|

Management Salary

|

$

|

26,000

|

$

|

21,000

|

||||

|

Director's Fees

|

$

|

22,500

|

$

|

21,000

|

||||

|

Rent

|

$

|

2,757

|

$

|

2,007

|

||||

|

Royalty

|

$

|

28,750

|

$

|

84,167

|

||||

Operating expenses for the three month period ended February 28, 2018 were $1,644,141 as compared to $726,200 for the comparative period in 2017, an increase of 126.4%. The increase in our operating expenses was primarily due to increased general and administrative costs which included an increase in options expense of $772,155, as well as marketing and promotional expenses as we build out our organization and roll-out our product offering. These costs are expected to continue to increase throughout 2018 as we continue to develop and commercialize our product offerings.

Other Expenses

Other expenses for the three month period ended February 28, 2018 increased to $463,588 versus $253,732 in the comparative period in 2017. The increase was due to an increase in interest expense due to higher debt levels and the impact of certain other items including the beneficial conversion feature related to the convertible note entered into in 2016.

EBITDA

Reported net loss for the three month period February 28, 2018 was $2,050,824 compared to $972,450 in the comparative period in 2017. After deducting interest, depreciation and amortization, EBITDA for the three month period ended February 28, 2018 was ($1,557,654) compared to ($527,577) in 2017. EBITDA included a non-cash option expense of $787,990 for the three month period February 28, 2018 compared to $15,835 in 2017.

Balance Sheet Data

The following table provides selected balance sheets data as at February 28, 2018 and February 28, 2017.

17

Balance Sheet Data:

|

February 28,

2018

|

February 28,

2017

|

|||||||

|

Cash and cash equivalents

|

$

|

2,621,750

|

$

|

823,593

|

||||

|

Total assets

|

$

|

5,570,161

|

$

|

3,600,963

|

||||

|

Total liabilities

|

$

|

12,986,790

|

$

|

6,096,489

|

||||

|

Stockholders' deficit

|

$

|

(7,236,629

|

)

|

$

|

(2,495,526

|

)

|

||

During the first quarter of 2018 total assets increased compared to the comparable period in the prior year as a result of the receipt of additional financing in May 2017. Accounts receivable and inventory were also higher.

Strategic Orientation

Our objective is to provide our shareholders with solid returns through strategic investments across multiple consumer product and ingredient platforms. The platforms we are focusing on include:

|

·

|

Life science technologies and related products that have applications to a range of consumer products;

|

|

·

|

Nutritional supplements and related consumer goods providing defined benefits to the consumer; and

|

|

·

|

Functional foods and beverages ingredients with defined health and wellness benefits.

|

We are building our business through strategic investments in high growth early stage consumer brands and functional ingredient platforms within segment/sectors which we believe offer sustainable commercial potential. We are focused on three core strategies underpinning our objectives:

|

·

|

To execute a multi-tier brand, supply-chain and innovation strategy to drive revenue;

|

|

·

|

To aggressively manage an asset light business model to drive our low cost platform; and

|

|

·

|

To drive disciplines leading to increased investor awareness and ability to finance and govern growing operations.

|

While we have yet to achieve profitability, we are making significant progress against our commercial objectives. We expect revenue and margin to increase as we continue to strengthen distribution partnerships while capitalizing on product innovation, supply-chain optimization and brand equity within our current portfolio.

Liquidity and Capital Resources

Our cash balance at February 28, 2018 was $2,621,750. Management believes the current funds available to the company will be sufficient to fund our operations for the next twelve months.

On January 29, 2015, we entered into a securities purchase agreement with a non-US institutional investor whereby we agreed to sell an aggregate principal amount of $2,300,000 of senior secured convertible debentures, convertible into shares of the company’s common stock. We received $1,800,000 of the funds from the transaction on February 5, 2015 and the balance of $500,000 on May 14, 2015. On September 26, 2016, we entered into a Convertible Promissory Note Amendment Agreement with this investor whereby we agreed to extend the maturity date and amend the interest payable on the senior secured convertible debentures, whereby we extended the term of the notes through September 30, 2019 and interest rate was increased from 6% per annum to 8% per annum. The convertible debentures are convertible into shares of the Company’s common stock at an initial conversion price of $.71 per share for an aggregate of up to 3,239,437 shares.

18

On September 26, 2016, we entered into a Securities Purchase Agreement with a non-US institutional investor pursuant to which, in consideration for proceeds of $4,100,000, we issued a secured convertible promissory note in the amount of $4,100,000. Pursuant to the Securities Purchase Agreement, the investor has agreed, from time to time after January 1, 2017, to make additional investments at our request of up to $5,900,000 ($10,000,000 in the aggregate) in one or more tranches of not less than one tranche during any 60 day period. The funding of any tranche under the agreement (other than the first $4,100,000 which has been funded) is subject to the mutual agreement of the parties as to the use of funds. The parties have agreed to negotiate in good faith to pre-approve use of funds within 120 days following September 26, 2016. On May 9, 2017, the Company received the second tranche of funding with proceeds of $4,400,000 for a total investment by the investor of $8,500,000. Under the terms of the securities purchase agreement, the Company has an additional $1,500,000 of available funding. We intend to use the proceeds of the secured convertible note for general working capital purposes including, without limitation, settlement of accounts payable and repayment of mature loans. In consideration of each advance made by the investor pursuant to the Securities Purchase Agreement, we will issue to the investor a convertible promissory note of equal value, maturing three years after issuance, and bearing interest at the rate of 8% per annum. Each note will be secured in first priority against the present and after acquired assets of the Company, and will be convertible in whole or in part at the option of the holder into common shares of the Company at a conversion price per share of $0.60, equal to a 25% discount to the 10 day average closing price of the Company’s common stock for the period immediately preceding the issuance of the applicable note. Due to the note being convertible to the Company common shares, a beneficial conversion feature analysis was performed. The intrinsic value of the conversion feature was $1,366,667 and $1,466,667 respectively and which was recognized as debt discount. As of February 28, 2018, $1,141,690 of debt discount was amortized of which $262,950 was amortized during the current three month period and $878,740 in the prior years. The unamortized discount is $1,691,644 .

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Contractual Obligations

Except for the transactions noted in Business Developments, there have been no material changes outside the normal course of business in our contractual obligations since January 3, 2015.

Critical Accounting Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities, related revenues and expenses, and disclosure of gain and loss contingencies at the date of the financial statements. The estimates and assumptions made require us to exercise our judgment and are based on historical experience and various other factors that we believe to be reasonable under the circumstances. We continually evaluate the information that forms the basis of our estimates and assumptions as our business and the business environment generally changes. The use of estimates is pervasive throughout our financial statements. There have been no material changes to the critical accounting estimates disclosed under the heading “Critical Accounting Estimates” in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, of the Form 10-K.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

As a smaller reporting company we are not required to provide this information.

19

ITEM 4. CONTROLS AND PROCEDURES.

Evaluation of Disclosure Controls and Procedures

Under the supervision and with the participation of our management, including our principal executive officer and the principal financial officer, we have conducted an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures, as defined in Rules 13a-15(e) and 15d-15(e) under the Securities and Exchange Act of 1934, as of the end of the period covered by this report. Based on this evaluation, our principal executive officer and principal financial officer concluded as of the evaluation date that our disclosure controls and procedures were not effective such that the material information required to be included in our Securities and Exchange Commission reports is accumulated and communicated to our management, including our principal executive and financial officer, recorded, processed, summarized and reported within the time periods specified in SEC rules and forms relating to our company, particularly during the period when this report was being prepared.

Changes in Internal Controls Over Financial Reporting

Our management, with the participation of our principal executive officer and principal financial officer have concluded that there have been no changes in our internal control over financial reporting that occurred during the last fiscal quarter ended February 28, 2018 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

20

PART II. OTHER INFORMATION

ITEM 6. EXHIBITS.

The following exhibits are included with this quarterly filing:

|

Exhibit No.

|

Description

|

|

|

3.1

|

Articles of Incorporation*

|

|

|

3.2

|

Bylaws*

|

|

|

31.1

|

Sec. 302 Certification of Chief Executive Officer

|

|

|

31.2

|

Sec. 302 Certification of Chief Financial Officer

|

|

|

32.1

|

Sec. 906 Certification of Chief Executive Officer

|

|

|

32.2

|

Sec. 906 Certification of Chief Financial Officer

|

|

|

101

|

Interactive data files pursuant to Rule 405 of Regulation S-T.

|

| * |

Document is incorporated by reference and can be found in its entirety in our Registration Statement on Form SB-2, SEC File Number 333-148710, at the Securities and Exchange Commission website at www.sec.gov.

|

21

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

April 19, 2018

|

Trident Brands Incorporated

|

|

|

/s/ Anthony Pallante

|

||

|

By: Anthony Pallante

|

||

|

(Chief Executive Officer & Chair of the Board)

|

||

|

/s/ Mark Holcombe

|

||

|

By: Mark Holcombe

|

||

|

(President, CFO & Director)

|

||

|

/s/ Scott Chapman

|

||

|

By: Scott Chapman

|

||

|

(Director)

|

||

22